Attached files

| file | filename |

|---|---|

| EX-32.1 - United States Commodity Index Funds Trust | v215265_ex32-1.htm |

| EX-32.2 - United States Commodity Index Funds Trust | v215265_ex32-2.htm |

| EX-31.1 - United States Commodity Index Funds Trust | v215265_ex31-1.htm |

| EX-14.1 - United States Commodity Index Funds Trust | v215265_ex14-1.htm |

| EX-31.2 - United States Commodity Index Funds Trust | v215265_ex31-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

x

|

Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended December 31, 2010.

|

or

|

¨

|

Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the transition period from to .

|

Commission file number: 001-34833

United States Commodity Index Funds Trust

(Exact name of registrant as specified in its charter)

|

Delaware

|

27-1537655

|

|

|

(State or other jurisdiction of

|

(I.R.S. Employer

|

|

|

incorporation or organization)

|

Identification No.)

|

1320 Harbor Bay Parkway, Suite 145

Alameda, California 94502

(Address of principal executive offices) (Zip code)

(510) 522-9600

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Units of United States Commodity Index Fund

|

NYSE Arca, Inc.

|

|

|

(Title of each class)

|

(Name of exchange on which registered)

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ¨ Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

|

|

Non-accelerated filer x

|

Smaller reporting company ¨

|

|

|

(Do not check if a smaller reporting company)

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes x No

The aggregate market value of the registrant’s units held by non-affiliates of the registrant as of June 30, 2010 was: $0.

The registrant had 5,800,020 outstanding units as of March 29, 2011.

DOCUMENTS INCORPORATED BY REFERENCE:

None.

UNITED STATES COMMODITY INDEX FUNDS TRUST

Table of Contents

|

|

Page

|

|

|

Part I.

|

||

|

Item 1. Business.

|

1

|

|

|

Item 1A. Risk Factors.

|

63

|

|

|

Item 1B. Unresolved Staff Comments.

|

81

|

|

|

Item 2. Properties.

|

82

|

|

|

Item 3. Legal Proceedings.

|

82

|

|

|

Item 4. Reserved.

|

82

|

|

|

Part II.

|

||

|

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

|

82

|

|

|

Item 6. Selected Financial Data.

|

83

|

|

|

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

|

83

|

|

|

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

|

100

|

|

|

Item 8. Financial Statements and Supplementary Data.

|

102

|

|

|

Item 9. Changes in and Disagreements With Accountants on Accounting and Financial Disclosure.

|

135

|

|

|

Item 9A. Controls and Procedures.

|

135

|

|

|

Item 9B. Other Information.

|

135

|

|

|

Part III.

|

||

|

Item 10. Directors, Executive Officers and Corporate Governance.

|

136

|

|

|

Item 11. Executive Compensation.

|

141

|

|

|

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

|

141

|

|

|

Item 13. Certain Relationships and Related Transactions, and Director Independence.

|

141

|

|

|

Item 14. Principal Accountant Fees and Services.

|

142

|

|

|

Part IV.

|

||

|

Item 15. Exhibits and Financial Statement Schedules.

|

143

|

|

|

Exhibit Index.

|

143

|

|

|

Signatures

|

144

|

What is the Trust and USCI?

The United States Commodity Index Funds Trust (the “Trust”) is a Delaware statutory trust formed on December 21, 2009 that is currently organized into four separate series (each series, a “Fund” and collectively, the “Funds”). The United States Commodity Index Fund (“USCI”) is the first series of the Trust and is a commodity pool that issues units representing fractional undivided beneficial interests in USCI (“units”) traded on the NYSE Arca, Inc. (the “NYSE Arca”). The three other series of the Trust, the United States Metals Index Fund (“USMI”), the United States Agriculture Index Fund (“USAI”) and the United States Copper Index Fund (“USCUI”), may be publicly offered in the future, but USCI, which was formed on April 1, 2010, is currently the Trust’s only publicly offered series. The Trust and the Funds maintain their main business office at 1320 Harbor Bay Parkway, Suite 145, Alameda, California 94502. The Trust and the Funds operate pursuant to the terms of the Trust’s Second Amended and Restated Declaration of Trust and Trust Agreement, dated November 10, 2010 (as amended from time to time, the “Trust Agreement”), which grants full management control to their sponsor, United States Commodity Funds LLC (“USCF”).

USCI invests in futures contracts for commodities that are traded on the New York Mercantile Exchange (the “NYMEX”), ICE Futures Exchange (“ICE Futures”), Chicago Board of Trade (“CBOT”), Chicago Mercantile Exchange (“CME”), London Metal Exchange (“LME”), Commodity Exchange, Inc. (“COMEX”) or on other foreign exchanges (such exchanges, collectively, the “Futures Exchanges”) (such futures contracts, collectively, “Futures Contracts”) and, to a lesser extent, in order to comply with regulatory requirements or in view of market conditions, other commodity-based contracts and instruments such as cash-settled options on Futures Contracts, forward contracts relating to commodities, cleared swap contracts and other over-the-counter transactions that are based on the price of commodities and Futures Contracts (collectively, “Other Commodity-Related Investments”). Market conditions that USCF currently anticipates could cause USCI to invest in Other Commodity Related Investments would be those allowing USCI to obtain greater liquidity or to execute transactions with more favorable pricing. Futures Contracts and Other Commodity-Related Investments collectively are referred to as “Commodity Interests” in this annual report on Form 10-K.

The investment objective of USCI is for the daily changes in percentage terms of its units’ net asset value (“NAV”) to reflect the daily changes in percentage terms of the SummerHaven Dynamic Commodity Index Total Return (the “Commodity Index”), less USCI’s expenses. The Commodity Index is comprised of 14 Futures Contracts that are selected on a monthly basis from a list of 27 possible Futures Contracts. The Futures Contracts that at any given time make up the Commodity Index are referred to herein as “Benchmark Component Futures Contracts.” USCI invests first in the current Benchmark Component Futures Contracts and other Futures Contracts intended to replicate the return on the current Benchmark Component Futures Contracts and, thereafter may hold Futures Contracts in a particular commodity other than one specified as the Benchmark Component Futures Contract, or may hold Other Commodity-Related Investments that may fail to closely track the Commodity Index’s total return movements. If USCI increases in size, and due to its obligations to comply with regulatory limits or due to other market pricing or liquidity factors, USCI may invest in Futures Contract months other than the designated month specified as the Benchmark Component Futures Contract, or in Other Commodity-Related Investments, which may have the effect of increasing transaction related expenses and may result in increased tracking error. USCI’s units began trading on August 10, 2010. USCF is the sponsor of USCI and is responsible for the management of USCI.

Who is USCF?

USCF is a single member limited liability company that was formed in the state of Delaware on May 10, 2005. Prior to June 13, 2008, USCF was known as Victoria Bay Asset Management, LLC. It maintains its main business office at 1320 Harbor Bay Parkway, Suite 145, Alameda, California 94502. USCF is a wholly-owned subsidiary of Wainwright Holdings, Inc., a Delaware corporation (“Wainwright”). Mr. Nicholas Gerber (discussed below) controls Wainwright by virtue of his ownership of Wainwright’s shares. Wainwright is a holding company. Wainwright previously owned an insurance company organized under Bermuda law, which has been liquidated, and a registered investment adviser firm named Ameristock Corporation, which has been distributed to Wainwright shareholders. USCF is a member of the National Futures Association (the “NFA”) and registered as a commodity pool operator (“CPO”) with the Commodity Futures Trading Commission (the “CFTC”) on December 1, 2005.

1

On May 12, 2005, USCF formed the United States Oil Fund, LP (“USOF”), a limited partnership that is a commodity pool and issues units traded on the NYSE Arca. The investment objective of USOF is for the changes in percentage terms of its units’ NAV to reflect the changes in percentage terms of the spot price of light, sweet crude oil delivered to Cushing, Oklahoma, as measured by the changes in the price of the futures contract for light, sweet crude oil traded on the NYMEX, that is the near month contract to expire, except when the near month contract is within two weeks of expiration, in which case it will be measured by the futures contract that is the next month contract to expire, less USOF’s expenses. USOF’s units began trading on April 10, 2006. USCF is the general partner of USOF and is responsible for the management of USOF.

On September 11, 2006, USCF formed the United States Natural Gas Fund, LP (“USNG”), also a limited partnership that is a commodity pool and issues units traded on the NYSE Arca. The investment objective of USNG is for the changes in percentage terms of its units’ NAV to reflect the changes in percentage terms of the spot price of natural gas delivered at the Henry Hub, Louisiana, as measured by the changes in the price of the futures contract on natural gas traded on the NYMEX, that is the near month contract to expire, except when the near month contract is within two weeks of expiration, in which case it will be measured by the futures contract that is the next month contract to expire, less USNG’s expenses. USNG’s units began trading on April 18, 2007. USCF is the general partner of USNG and is responsible for the management of USNG.

On June 27, 2007, USCF formed the United States 12 Month Oil Fund, LP (“US12OF”), also a limited partnership that is a commodity pool and issues units traded on the NYSE Arca. The investment objective of US12OF is for the changes in percentage terms of its units’ NAV to reflect the changes in percentage terms of the spot price of light, sweet crude oil delivered to Cushing, Oklahoma, as measured by the changes in the average of the prices of 12 futures contracts on light, sweet crude oil traded on the NYMEX, consisting of the near month contract to expire and the contracts for the following 11 months, for a total of 12 consecutive months’ contracts, except when the near month contract is within two weeks of expiration, in which case it will be measured by the futures contracts that are the next month contract to expire and the contracts for the following 11 consecutive months, less US12OF’s expenses. When calculating the daily movement of the average price of the 12 contracts, each contract month will be equally weighted. US12OF’s units began trading on December 6, 2007. USCF is the general partner of US12OF and is responsible for the management of US12OF.

On April 13, 2007, USCF formed the United States Gasoline Fund, LP (“UGA”), also a limited partnership that is a commodity pool and issues units traded on the NYSE Arca. The investment objective of UGA is for the changes in percentage terms of its units’ NAV to reflect the changes in percentage terms of the spot price of gasoline, as measured by the changes in the price of the futures contract on unleaded gasoline (also known as reformulated gasoline blendstock for oxygen blending, or “RBOB”), for delivery to the New York harbor, traded on the NYMEX, that is the near month contract to expire, except when the near month contract is within two weeks of expiration, in which case it will be measured by the futures contract that is the next month contract to expire, less UGA’s expenses. UGA’s units began trading on February 26, 2008. USCF is the general partner of UGA and is responsible for the management of UGA.

On April 13, 2007, USCF formed the United States Heating Oil Fund, LP (“USHO”), also a limited partnership that is a commodity pool and issues units traded on the NYSE Arca. The investment objective of USHO is for the changes in percentage terms of its units’ NAV to reflect the changes in percentage terms of the spot price of heating oil (also known as No. 2 fuel oil) delivered to the New York harbor, as measured by the changes in the price of the futures contract on heating oil traded on the NYMEX, that is the near month contract to expire, except when the near month contract is within two weeks of expiration, in which case it will be measured by the futures contract that is the next month contract to expire, less USHO’s expenses. USHO’s units began trading on April 9, 2008. USCF is the general partner of USHO and is responsible for the management of USHO.

On June 30, 2008, USCF formed the United States Short Oil Fund, LP (“USSO”), also a limited partnership that is a commodity pool and issues units traded on the NYSE Arca. The investment objective of USSO is for the changes in percentage terms of its units’ NAV to inversely reflect the changes in percentage terms of the spot price of light, sweet crude oil delivered to Cushing, Oklahoma, as measured by the changes in the price of the futures contract on light, sweet crude oil traded on the NYMEX, that is the near month contract to expire, except when the near month contract is within two weeks of expiration, in which case it will be measured by the futures contract that is the next month contract to expire, less USSO’s expenses. USSO’s units began trading on September 24, 2009. USCF is the general partner of USSO and is responsible for the management of USSO.

2

On June 27, 2007, USCF formed the United States 12 Month Natural Gas Fund, LP (“US12NG”), also a limited partnership that is a commodity pool and issues units traded on the NYSE Arca. The investment objective of US12NG is for the changes in percentage terms of its units’ NAV to reflect the changes in percentage terms of the spot price of natural gas delivered at the Henry Hub, Louisiana, as measured by the changes in the average of the prices of 12 futures contracts on natural gas traded on the NYMEX, consisting of the near month contract to expire and the contracts for the following 11 months, for a total of 12 consecutive months’ contracts, except when the near month contract is within two weeks of expiration, in which case it will be measured by the futures contracts that are the next month contract to expire and the contracts for the following 11 consecutive months, less US12NG’s expenses. When calculating the daily movement of the average price of the 12 contracts, each contract month will be equally weighted. US12NG’s units began trading on November 18, 2009. USCF is the general partner of US12NG and is responsible for the management of US12NG.

On September 2, 2009, USCF formed the United States Brent Oil Fund, LP (“USBO”), also a limited partnership that is a commodity pool and issues units traded on the NYSE Arca. The investment objective of USBO is for the daily changes in percentage terms of its units’ NAV to reflect the daily changes in percentage terms of the spot price of Brent crude oil, as measured by the changes in the price of the futures contract on Brent crude oil traded on the ICE Futures, that is the near month contract to expire, except when the near month contract is within two weeks of expiration, in which case it will be measured by the futures contract that is the next month contract to expire, less USBO’s expenses. USBO’s units began trading on June 2, 2010. USCF is the general partner of USBO and is responsible for the management of USBO.

USOF, USNG, US12OF, UGA, USHO, USSO, US12NG and USBO are collectively referred to herein as the “Related Public Funds”. For more information about each of the Related Public Funds, investors in USCI may call 1-800-920-0259 or go online to www.unitedstatescommodityindexfund.com.

USCF has filed a registration statement for three other exchange-traded security funds, USMI, USAI and USCUI, each of which is a series of the Trust. The investment objective of USMI will be for the daily changes in percentage terms of its units’ NAV to reflect the daily changes in percentage terms of the SummerHaven Dynamic Metals Index Total Return (the “Metals Index”), less USMI’s expenses. The investment objective of USAI will be for the daily changes in percentage terms of its units’ NAV to reflect the daily changes in percentage terms of the SummerHaven Dynamic Agriculture Index Total Return (the “Agriculture Index”), less USAI’s expenses. The investment objective of USCUI will be for the daily changes in percentage terms of its units’ NAV to reflect the daily changes in percentage terms of the SummerHaven Copper Index Total Return (the “Copper Index”), less USCUI’s expenses.

USCF is required to evaluate the credit risk of USCI to the futures commission merchant, oversee the purchase and sale of USCI’s units by certain authorized purchasers (“Authorized Purchasers”), review daily positions and margin requirements of USCI and manage USCI’s investments. USCF also pays the fees of ALPS Distributors, Inc., which serves as the marketing agent for USCI (the “Marketing Agent”), Brown Brothers Harriman & Co. (“BBH&Co.”), which serves as the administrator (the “Administrator”) and the custodian (the “Custodian”) for USCI, and SummerHaven Investment Management, LLC (“SummerHaven”), which serves as USCI’s trading advisor.

The business and affairs of USCF are managed by a board of directors (the “Board”), which is comprised of four management directors, some of whom are also its executive officers (the “Management Directors”), and three independent directors who meet the requirements established by the NYSE Arca and the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Management Directors have the authority to manage USCF pursuant to its limited liability company agreement, as amended from time to time. In addition, to satisfy applicable requirements, the Board of USCF acts on behalf of the Related Public Funds, all of which are limited partnerships and for which USCF acts as the general partner. Unlike the Related Public Funds, USCI is not subject to certain independent director and governance requirements. Therefore, USCI does not have any directors nor directors acting on its behalf.

3

How Does USCI Operate?

The net assets of USCI consist primarily of Commodity Interests. USCI invests in Commodity Interests to the fullest extent possible without being leveraged or unable to satisfy its current or potential margin or collateral obligations with respect to its investments in Commodity Interests. The primary focus of USCF is the investment in Commodity Interests and the management of USCI’s investments in short term obligations of the United States of two years or less (“Treasury Securities” or “Treasuries”), cash and/or cash equivalents for margining purposes and as collateral.

The investment objective of USCI is for the daily changes in percentage terms of its units’ NAV to reflect the daily changes in percentage terms of the Commodity Index, less USCI’s expenses. It is not the intent of USCI to be operated in a fashion such that its NAV will equal, in dollar terms, the price of the Commodity Index or the price of any particular commodity Futures Contract.

USCI seeks to achieve its investment objective by investing in a mix of Commodity Interests such that the daily changes in its NAV will closely track the daily changes in the Commodity Index. USCI’s positions in Commodity Interests are rebalanced on a monthly basis in order to track the changing nature of the Commodity Index. The portfolio rebalancing takes place during the last four business days of the month (“Rebalancing Period”). At the end of each of the days in the Rebalancing Period, one fourth of the prior month portfolio positions are replaced by equally-weighted positions reflecting the particular Benchmark Component Futures Contracts determined on the selection date, which is the fifth business day before the end of the month (“Selection Date”). At the end of the Rebalancing Period, the Commodity Index will have an equal-weight position of approximately 7.14% in each of the selected Benchmark Component Futures Contracts which will be reflected in the rebalanced portfolio. After fulfilling the collateral requirements with respect to its Commodity Interests, USCI invests the remainder of its proceeds from the sale of creation baskets in Treasury Securities or cash equivalents, and/or merely hold such assets in cash (generally in interest-bearing accounts).

The anticipated dates on which USCI’s positions in Commodity Interests will be rebalanced on a monthly basis in 2011 are posted on USCI’s website at www.unitedstatescommodityindexfund.com, and are subject to change without notice.

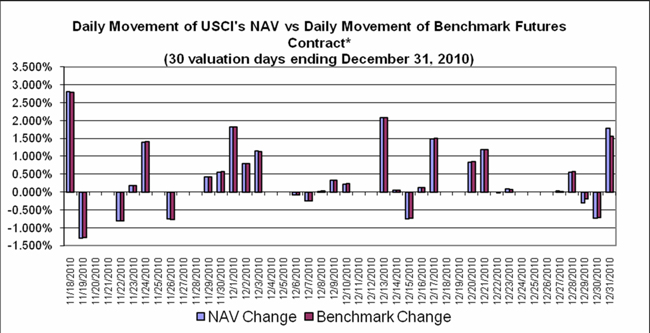

USCF endeavors to place USCI’s trades in Commodity Interests and otherwise manage USCI’s investments so that A will be within plus/minus 10 percent of B, where:

|

|

•

|

A is the average daily percentage change in USCI’s NAV for any period of 30 successive valuation days; i.e., any NYSE Arca trading day as of which USCI calculates its NAV, and

|

|

|

•

|

B is the average daily percentage change in the price of the Commodity Index over the same period.

|

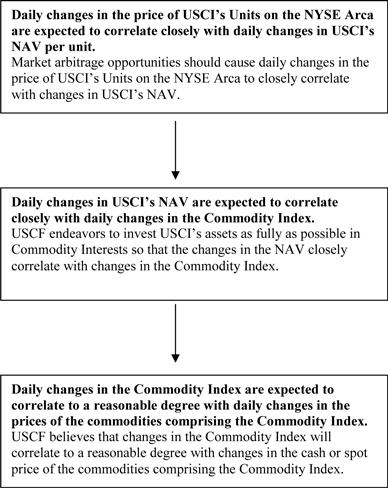

USCF believes that market arbitrage opportunities cause daily changes in USCI’s unit price on the NYSE Arca to closely track the daily changes in USCI’s NAV per unit. USCF believes that the net effect of this expected relationship and the expected relationship described above between USCI’s NAV and the Commodity Index will be that the daily changes in the price of USCI’s units on the NYSE Arca will closely track the daily changes in the Commodity Index, less USCI’s expenses. While the Commodity Index is composed of Futures Contracts and is therefore a measure of the prices of the commodities comprising the Commodity Index for future delivery, there is nonetheless expected to be a reasonable degree of correlation between the Commodity Index and the cash or spot prices of the commodities underlying the Benchmark Component Futures Contracts.

4

These relationships are illustrated in the following diagram:

An investment in the units provides a means for diversifying an investor’s portfolio or hedging exposure to changes in commodities prices. An investment in the units allows both retail and institutional investors to easily gain this exposure to the commodities market in a transparent, cost-effective manner.

USCF employs a “neutral” investment strategy intended to track changes in the Commodity Index regardless of whether the Commodity Index goes up or goes down. USCI’s “neutral” investment strategy is designed to permit investors generally to purchase and sell USCI’s units for the purpose of investing indirectly in the commodities market in a cost-effective manner, and/or to permit participants in the commodities or other industries to hedge the risk of losses in their commodity-related transactions. Accordingly, depending on the investment objective of an individual investor, the risks generally associated with investing in the commodities market and/or the risks involved in hedging may exist. In addition, an investment in USCI involves the risk that the changes in the price of USCI’s units will not accurately track the changes in the Commodity Index, and that changes in the Commodity Index will not closely correlate with changes in the spot prices of the commodities underlying the Benchmark Component Futures Contracts. Furthermore, USCI also holds Treasury Securities, cash and/or cash equivalents to meet its current or potential margin or collateral requirements with respect to its investments in Commodity Interests and to invest cash not required to be used as margin or collateral. USCI does not expect there to be any meaningful correlation between the performance of USCI’s investments in Treasury Securities, cash and/or cash equivalents and the changes in the prices of commodities or Commodity Interests. While the level of interest earned on or the market price of these investments may in some respect correlate to changes in the prices of commodities, this correlation is not anticipated as part of USCI’s efforts to meet its objective.

5

USCI’s total portfolio composition is disclosed each business day that the NYSE Arca is open for trading, on USCI’s website at www.unitedstatescommodityindexfund.com. The website disclosure of portfolio holdings is made daily and includes, as applicable, the name and value of each Futures Contract, the specific types and values of Other Commodity-Related Investments and characteristics of such Other Commodity-Related Investments, the name and value of each Treasury security and cash equivalent, and the amount of cash held in USCI’s portfolio. USCI’s website is publicly accessible at no charge.

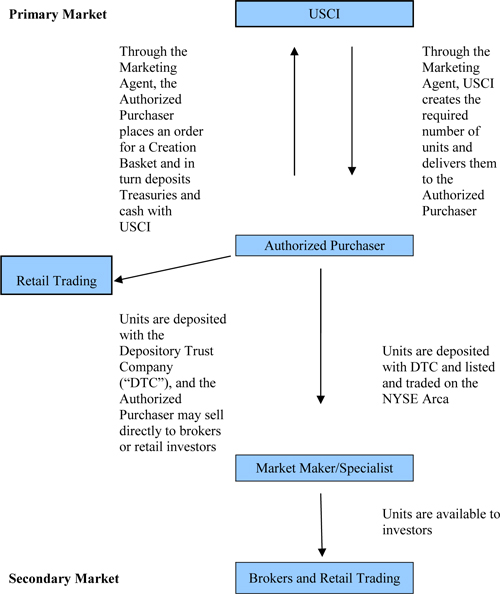

The units issued by USCI may only be purchased by Authorized Purchasers and only in blocks of 100,000 units called Creation Baskets. The amount of the purchase payment for a Creation Basket is equal to the aggregate NAV of the units in the Creation Basket. Similarly, only Authorized Purchasers may redeem units and only in blocks of 100,000 units called Redemption Baskets. The amount of the redemption proceeds for a Redemption Basket is equal to the aggregate NAV of units in the Redemption Basket. The purchase price for Creation Baskets and the redemption price for Redemption Baskets are the actual NAV calculated at the end of the business day when a request for a purchase or redemption is received by USCI. The NYSE Arca publishes an approximate NAV intra-day based on the prior day’s NAV and the current price of the Benchmark Component Futures Contracts, but the price of Creation Baskets and Redemption Baskets is determined based on the actual NAV calculated at the end of each trading day.

While USCI issues units only in Creation Baskets, units may also be purchased and sold in much smaller increments on the NYSE Arca. These transactions, however, are effected at the bid and ask prices established by specialist firm(s). Like any listed security, units can be purchased and sold at any time a secondary market is open.

What is USCI’s Investment Strategy?

Other than to address monthly changes in the Benchmark Component Futures Contacts, in managing USCI’s assets, USCF does not use a technical trading system that automatically issues buy and sell orders. Instead, each time one or more baskets are purchased or redeemed, USCF will purchase or sell Commodity Interests with an aggregate market value that approximates the amount of cash received or paid upon the purchase or redemption of the basket(s).

As an example, assume that a Creation Basket is sold by USCI, and that USCI’s closing NAV per unit is $50.00. In that case, USCI would receive $5,000,000 in proceeds from the sale of the Creation Basket ($50.00 NAV per unit multiplied by 100,000 units, and ignoring the Creation Basket fee of $1,000). If one were to assume further that USCF wants to invest the entire proceeds from the Creation Basket in Benchmark Component Futures Contracts and that the market value of each such Benchmark Component Futures Contract is $16,000, USCI would be unable to buy an exact number of Benchmark Component Futures Contracts with an aggregate market value equal to $5,000,000. Instead, USCI would be able to purchase 103 Benchmark Component Futures Contracts with an aggregate market value of $4,969,750. Assuming a margin requirement equal to 10% of the value of the Benchmark Component Futures Contracts, USCI would be required to deposit $496,975 in Treasury Securities and cash with the futures commission merchant through which the Benchmark Component Futures Contracts were purchased. The remainder of the proceeds from the sale of the Creation Basket, would remain invested in cash, cash equivalents, and Treasury Securities as determined by USCF from time to time based on factors such as potential calls for margin or anticipated redemptions.

The specific Commodity Interests purchased depends on various factors, including a judgment by USCF as to the appropriate diversification of USCI’s investments. While USCF has made significant investments in Benchmark Component Futures Contracts on the Futures Exchanges, for various reasons, including the ability to enter into the precise amount of exposure to the commodities market and position limits on Futures Contracts, it may also invest in economically equivalent Futures Contracts other than those that compose the Benchmark Component Futures Contract and Other Commodity-Related Investments. To the extent that USCI invests in Other Related Investments, it would prioritize investments in contracts and instruments that are economically equivalent to the Benchmark Component Futures Contracts, including cleared swaps that satisfy such criteria, and then to a lesser extent, it would invest in other types of cleared swaps and other contracts, instruments and swaps, including swaps in the over-the-counter market. If USCI is required by law or regulation, or by one of its regulators, including a Futures Exchange, to reduce its position in one or more Benchmark Component Futures Contracts to the applicable position limit or to a specified accountability level, a substantial portion of USCI's assets could be invested in Other Commodity-Related Investments that are intended to replicate the return on the Commodity Index or particular Benchmark Component Futures Contracts. As USCI's assets reach higher levels, USCI is more likely to exceed position limits, accountability levels or other regulatory limits and, as a result, it is more likely that it will invest in Other Commodity-Related Investments at such higher levels. In addition, market conditions that USCF currently anticipates could cause USCI to invest in Other Commodity-Related Investments include those allowing USCI to obtain greater liquidity or to execute transactions with more favorable pricing.

6

USCF may not be able to fully invest USCI’s assets in Futures Contracts having an aggregate notional amount exactly equal to USCI’s NAV. For example, as standardized contracts, the Benchmark Component Futures Contracts included in the Commodity Index are for a specified amount of a particular commodity, and USCI’s NAV and the proceeds from the sale of a Creation Basket is unlikely to be an exact multiple of the amounts of those contracts. As a result, in such circumstances, USCI may be better able to achieve the exact amount of exposure to changes in price of the Benchmark Component Futures Contracts through the use of Other Commodity-Related Investments, such as over-the-counter contracts that have better correlation with changes in price of the Benchmark Component Futures Contracts.

USCI anticipates that, to the extent it invests in Futures Contracts other than the Benchmark Component Futures Contracts and Other Commodity-Related Investments that are not economically equivalent to the Benchmark Component Futures Contracts, it will enter into various non-exchange-traded derivative contracts to hedge the short-term price movements of such Futures Contracts and Other Commodity-Related Investments against the current Benchmark Component Futures Contracts.

USCF does not anticipate letting USCI’s Futures Contracts expire and taking delivery of any commodities. Instead, USCF closes existing positions, e.g., in response to ongoing changes in the Commodity Index or if it otherwise determines it would be appropriate to do so and reinvests the proceeds in new Commodity Interests. Positions may also be closed out to meet orders for Redemption Baskets, in which case the proceeds from closing the positions will not be reinvested.

The Trust Agreement contains no restrictions on the ability of USCF to change the investment objective of USCI. Notwithstanding this, USCF has no intention of changing the investment objective of USCI or the manner in which it intends to achieve the investment objective. Should USCF seek to change the investment objective of USCI, such change would be reflected in an amended prospectus and would provide advance notice to investors.

What are Futures Contracts?

Futures contracts are agreements between two parties. One party agrees to buy a commodity such as natural gas from the other party at a later date at a price and quantity agreed-upon when the contract is made. For example, the futures contracts for natural gas traded on the NYMEX trade in units of 10,000 million British Thermal Units (“mmBtu”). Generally, futures contracts traded on the NYMEX are priced by floor brokers and other exchange members both through an “open outcry” of offers to purchase or sell the contracts and through an electronic, screen-based system that determines the price by matching electronically offers to purchase and sell. Futures contracts may also be based on commodity indices, in that they call for a cash payment based on the change in the value of the specified index during a specified period.

Certain typical and significant characteristics of futures contracts are discussed below. Additional risks of investing in futures contracts are included in “Item 1A. Risk Factors” in this annual report on Form 10-K.

Impact of Accountability Levels, Position Limits and Price Fluctuation Limits. Futures contracts include typical and significant characteristics. Most significantly, the CFTC and U.S. designated contract markets such as the NYMEX, COMEX, CME, and CBOT have established accountability levels and position limits on the maximum net long or net short futures contracts in commodity interests that any person or group of persons under common trading control (other than as a hedge, which an investment by USCI is not) may hold, own or control. The net position is the difference between an individual or firm’s open long contracts and open short contracts in any one commodity. In addition, most U.S.-based futures exchanges limit the daily price fluctuation for futures contracts. Currently, the ICE Futures imposes position and accountability limits that are similar to those imposed by U.S.-based futures exchanges but does not limit the maximum daily price fluctuation, while some other non-U.S. futures exchanges have not adopted such limits.

7

The accountability levels for the commodities comprising the Commodity Index and other futures contracts traded on U.S.-based futures exchanges are not a fixed ceiling, but rather a threshold above which such exchanges may exercise greater scrutiny and control over an investor’s positions. For example, the current accountability level for any one month in natural gas futures contracts traded on NYMEX is 6,000 contracts. In addition, the NYMEX imposes an accountability level for all months of 12,000 net futures contracts in natural gas. If USCI and the Related Public Funds exceed these accountability levels for investments in futures contracts for natural gas, the NYMEX will monitor USCI’s exposure and ask for further information on their activities, including the total size of all positions, investment and trading strategy, and the extent of USCI’s liquidity resources. If deemed necessary by the NYMEX, it could also order USCI to reduce its position back to the accountability level. As of December 31, 2010, USCI and the Related Public Funds held a net of 119,602 Futures Contracts traded on the Futures Exchanges.

Position limits differ from accountability levels in that they represent fixed limits on the maximum number of futures contracts that any person may hold and cannot allow such limits to be exceeded without express CFTC authority to do so. For example, the current position limit for feeder cattle futures contracts on the CME is 1,600 futures contracts in any contract month. USCI will not be able to hold, own or control feeder cattle futures contracts in excess of this limit.

If a Futures Exchange orders USCI to reduce its position in a particular Futures Contract back to the applicable position limit or accountability level, or to an accountability level that the Futures Exchange deems appropriate for USCI, such a level may impact the mix of investments in Commodity Interests made by USCI. To illustrate, assume that the WTI crude oil futures contract traded on the NYMEX and the unit price of USCI are each $100, and that the NYMEX has determined that USCI may not own more than 20,000 WTI crude oil futures contracts. In such case, USCI could invest up to $2 billion of its daily net assets in the WTI crude oil futures contract (i.e., $100 per contract multiplied by 1,000 (the standard size of a WTI crude oil futures contract is 1,000 barrels) multiplied by 20,000 contracts) before reaching the position level imposed by the NYMEX. Once the daily net assets of the portfolio exceed $2 billion in the WTI crude oil futures contract, the portfolio may not be able to take any further positions in the WTI crude oil futures contract, depending on whether the NYMEX imposes limits. If USCI is limited in its investments in any Futures Contracts, USCF anticipates that it will invest the majority of its assets above that level in a mix of other Futures Contracts or other Commodity Interests on other Futures Exchanges or over-the-counter markets. However, the Dodd-Frank Act requires the CFTC to establish position limits that apply to over-the-counter transactions as well as futures contracts and the aggregation of these position limits could further limit USCI’s ability to invest in commodity interests.

See “Item 1A. Risk Factors—Risks Associated With Investing Directly or Indirectly in Commodity Interests—Regulation of the commodities and energy markets is extensive and constantly changing; future regulatory developments are impossible to predict but may significantly and adversely affect USCI” in this annual report on Form 10-K.

In addition to position limits and accountability levels that may apply at any time, the Futures Exchanges may impose position limits on particular contracts held in the last few days of trading in the near month contract prior to the contract expiring. However, it is unlikely that USCI will run up against such position limits. USCI does not typically hold the near month contract in its Benchmark Component Futures Contracts. In addition, USCI’s investment strategy is to close out its positions during each Rebalancing Period in advance of the period right before expiration and purchase new contracts. As such, USCF does not anticipate that position limits that apply to the last few days prior to a contract’s expiration will impact USCI.

U.S.-based futures exchanges also limit the amount of price fluctuation for futures contracts. For example, the NYMEX imposes a $3.00 per mmBtu ($30,000 per contract) price fluctuation limit for natural gas futures contracts. This limit is initially based off the previous trading day’s settlement price. If any natural gas futures contract is traded, bid, or offered at the limit for five minutes, trading is halted for five minutes. When trading resumes it begins at the point where the limit was imposed and the limit is reset to be $3.00 per mmBtu in either direction of that point. If another halt were triggered, the market would continue to be expanded by $3.00 per mmBtu in either direction after each successive five-minute trading halt. There is no maximum price fluctuation limit during any one trading session.

8

Currently, U.S. futures exchanges, including the NYMEX, do not implement fixed position limits for futures contracts held outside of the last few days of trading in the near month contract to expire. However, the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”), which was signed into law on July 21, 2010, requires the CFTC to establish aggregate position limits that apply to both cleared and uncleared commodity swaps in addition to exchange-traded futures contracts held by an entity and certain of its affiliates. Such position limits could limit USCI’s ability to invest in accordance with its investment objective. On January 13, 2011, the CFTC proposed new rules, which if implemented in their proposed form, would establish position limits and limit formulas for certain physical commodity futures, including Futures Contracts and options on Futures Contracts executed pursuant to the rules of designated contract markets (i.e., certain regulated exchanges) and commodity swaps that are economically equivalent to such futures and options contracts. The CFTC has also proposed aggregate position limits that would apply across different trading venues to contracts based on the same underlying commodity. At this time, it is unknown precisely when such position limits would take effect. The CFTC’s position limits for futures contracts held during the last few days of trading in the near month contract to expire, which, under the CFTC’s proposed rule, would be substantially similar to the position limits currently set by the exchanges, could take effect as early as spring 2011. Based on the CFTC’s current proposal, other position limits would not take effect until March 2012 or later. The effect of this future regulatory change on USCI is impossible to predict, but it could be substantial and adverse.

USCI anticipates that to the extent it invests in Futures Contracts other than the Benchmark Component Futures Contracts and Other Commodity-Related Investments, it will enter into various non-exchange-traded derivative contracts to hedge the short-term price movements of such Futures Contracts and Other Commodity-Related Investments against the current Benchmark Component Futures Contracts.

|

Futures Contract

|

Position Accountability

Levels and Limits

|

Maximum Daily Price Fluctuation

|

||

|

ICE-UK Crude (Brent)

|

There are no position accountability levels or limits for this contract. However, the exchange’s daily position management regime requires that any position greater than 500 lots in the nearest two expiry months must be reported to the exchange on a daily basis.

|

There is no maximum daily price fluctuation limit.

|

||

|

NYMEX Light, Sweet Crude Oil

(WTI)

|

Accountability Levels: for any one month: 10,000 net futures / all months: 20,000 net futures.

Position Limits: 3,000 net futures in the last three days of trading in the spot month.

|

$10.00 per barrel ($10,000 per contract) for all months. If any contract is traded, bid, or offered at the limit for five minutes, trading is halted for five minutes. When trading resumes, the limit is expanded by $10.00 per barrel in either direction. If another halt were triggered, the market would continue to be expanded by $10.00 per barrel in either direction after each successive five-minute trading halt. There will be no maximum price fluctuation limits during any one trading session.

|

9

|

ICE-UK Gas Oil

|

There are no position accountability levels or limits for this contract. However, any position greater than 100 lots in the nearest expiry month must be reported to the exchange on a daily basis.

|

There is no maximum daily price fluctuation limit.

|

||

|

NYMEX Heating Oil

|

Accountability Levels: any one month: 5,000 net futures / all months: 7,000 net futures.

Position Limits: 1,000 net futures in the last three days of trading in the spot month.

|

$0.25 per gallon ($10,500 per contract) for all months. If any contract is traded, bid, or offered at the limit for five minutes, trading is halted for five minutes. When trading resumes, the limit is expanded by $0.25 per gallon in either direction. If another halt were triggered, the market would continue to be expanded by $0.25 per gallon in either direction after each successive five-minute trading halt. There will be no maximum price fluctuation limits during any one trading session.

|

||

|

NYMEX Henry Hub Natural Gas

|

Accountability Levels: any one month: 6,000 net futures / all months: 12,000 net futures.

Position Limits: 1,000 net futures in the last three days of trading in the spot month.

|

$3.00 per mmBtu ($30,000 per contract) for all months. If any contract is traded, bid, or offered at the limit for five minutes, trading is halted for five minutes. When trading resumes, the limit is expanded by $3.00 per mmBtu in either direction. If another halt were triggered, the market would continue to be expanded by $3.00 per mmBtu in either direction after each successive five-minute trading halt. There will be no maximum price fluctuation limits during any one trading session.

|

||

|

NYMEX RBOB Gasoline

|

Accountability Levels: any one month: 5,000 net futures / all months: 7,000 net futures.

Position Limits: 1,000 net futures in the last three days of trading in the spot month.

|

$0.25 per gallon ($10,500 per contract) for all months. If any contract is traded, bid, or offered at the limit for five minutes, trading is halted for five minutes. When trading resumes, the limit is expanded by $0.25 per gallon in either direction. If another halt were triggered, the market would continue to be expanded by $0.25 per gallon in either direction after each successive five-minute trading halt. There will be no maximum price fluctuation limits during any one trading session.

|

10

|

CME Feeder Cattle

|

Accountability Limits: none.

Position Limits: non-spot month: 1,950 net futures / spot month: 300 net futures (during the last 10 days of trading).

|

$0.03 per pound above or below the previous day’s settlement price.

|

||

|

CME Lean Hogs

|

Accountability Levels: none.

Position Limits: non-spot month: 4,150 net futures / spot month: 950 net futures (as of the close of business on the fifth business day of the contract month).

|

$0.03 per pound above or below previous day’s settlement price, except that there are no limits in the spot month contract during the in last 2 days of trading.

|

||

|

CME Live Cattle

|

Accountability Levels: none.

|

|||

|

Position Limits: non-spot month: 6,300 net futures / spot month: 450 net futures (300 net futures as of the close of business on the business day immediately preceding the last 5 business days of the contract month).

|

$0.03 per pound above or below the previous day’s settlement price.

|

|||

|

CBOT Bean Oil

|

Accountability Levels: none.

Position Limits: spot month: 540 net futures / any one month: 5,000 net futures / all months: 6,500 net futures.

|

$0.025 cents per pound expandable to $0.035 cents per pound and then to $0.055 cents per pound when the market closes at limit bid or limit offer. There shall be no price limits on the current month contract on or after the second business day preceding the first day of the delivery month.

|

||

|

CBOT Corn

|

Accountability Levels: none.

Position Limits: spot month: 600 net futures / any one month: 13,500 net futures / all months: 22,000 net futures.

|

$0.30 per bushel expandable to $0.45 and then to $0.70 when the market closes at limit bid or limit offer. There shall be no price limits on the current month contract on or after the second business day preceding the first day of the delivery month.

|

||

|

CBOT Soybeans

|

Accountability Levels: none.

Position Limits: spot month: 600 net futures / any one month: 6,500 net futures / all months: 10,000 net futures.

|

$0.70 per bushel expandable to $1.05 and then to $1.60 when the market closes at limit bid or limit offer. There shall be no price limits on the current month contract on or after the second business day preceding the first day of the delivery month.

|

||

|

CBOT Soybean Meal

|

Accountability Levels: none.

Position Limits: spot month: 720 net futures / any one month: 5,000 net futures / all months: 6,500 net futures.

|

$20 per short ton expandable to $30 and then to $45 when the market closes at limit bid or limit offer. There shall be no price limits on the current month contract on or after the second business day preceding the first day of the delivery month.

|

11

|

CBOT Wheat

|

Accountability Levels: none.

Position Limits: spot month: 600 net futures / any one month: 5,000 net futures / all months: 6,500 net futures.

|

$0.60 per bushel expandable to $0.90 and then to $1.35 when the market closes at limit bid or limit offer. There shall be no price limits on the current month contract on or after the second business day preceding the first day of the delivery month.

|

||

|

LME High Grade Primary

Aluminum

|

Accountability Levels: none.

Position Limits: none.

|

There is no maximum daily price fluctuation limit.

|

||

|

COMEX Copper

|

Accountability Levels: any one month: 5,000 net futures / all months: 5,000 net futures.

Position Limits: 1,200 net futures in the expiration month.

|

There is no maximum daily price fluctuation limit.

|

||

|

LME Lead

|

Accountability Levels: none.

Position Limits: none.

|

There is no maximum daily price fluctuation limit.

|

||

|

LME Primary Nickel

|

Accountability Levels: none.

Position Limits: none.

|

There is no maximum daily price fluctuation limit.

|

||

|

LME Tin

|

Accountability Levels: none.

Position Limits: none.

|

There is no maximum daily price fluctuation limit.

|

||

|

LME Special High Grade Zinc

|

Accountability Levels: none.

Position Limits: none.

|

There is no maximum daily price fluctuation limit.

|

||

|

COMEX Gold

|

Accountability Levels: any one month: 6,000 net futures / all months: 6,000 net futures.

Position Limits: 3,000 net futures in the expiration month.

|

There is no maximum daily price fluctuation limit.

|

||

|

NYMEX Platinum

|

Accountability Levels: any one month: 1,500 net futures / all months: 1,500 net futures.

Position Limits: 150 net futures in the expiration month.

|

There is no maximum daily price fluctuation limit.

|

||

|

COMEX Silver

|

Accountability Levels: any one month: 6,000 net futures / all months: 6,000 net futures.

Position Limits: 1,500 net futures in the expiration month.

|

There is no maximum daily price fluctuation limit.

|

12

|

ICE-US Cocoa

|

Accountability Levels: any one month: 6,000 net futures / all months: 6,000 net futures.

Position Limits: 1,000 net futures for any month for which delivery notices have or may be issued.

|

There is no maximum daily price fluctuation limit.

|

||

|

ICE-US Coffee “C”

|

Accountability Levels: any one month: 5,000 net futures / all months: 5,000 net futures.

Position Limits: 500 net futures for any month for which delivery notices have or may be issued.

|

There is no maximum daily price fluctuation limit.

|

||

|

ICE-US Cotton

|

Accountability Levels: none.

Position Limits: spot month: 300 net futures / any one month: 3,500 net futures / all months: 5,000 net futures.

|

$0.03 above or below previous day’s settlement price. Limit is subject to expansion in certain circumstances.

|

||

|

ICE-US Sugar No. 11

|

Accountability Levels: any one month: 10,000 net futures / all months: 15,000 net futures.

Position Limits: 5,000 net futures in the spot month.

|

There is no maximum daily price fluctuation limit.

|

Price Volatility. Despite daily price limits, the price volatility of futures contracts generally has been historically greater than that for traditional securities such as stocks and bonds. Price volatility often is greater day-to-day as opposed to intra-day. Economic factors that may cause volatility in futures contracts include changes in interest rates; governmental, agricultural, trade, fiscal, monetary and exchange control programs and policies; weather and climate conditions; changing supply and demand relationships; changes in balances of payments and trade; U.S. and international rates of inflation; currency devaluations and revaluations; U.S. and international political and economic events; and changes in philosophies and emotions of market participants. Because USCI invests a significant portion of its assets in futures contracts, the assets of USCI, and therefore the price of USCI’s units, may be subject to greater volatility than traditional securities.

Marking-to-Market Futures Positions. Futures contracts are marked to market at the end of each trading day and the margin required with respect to such contracts is adjusted accordingly. This process of marking-to-market is designed to prevent losses from accumulating in any futures account. Therefore, if USCI’s futures positions have declined in value, USCI may be required to post variation margin to cover this decline. Alternatively, if USCI’s futures positions have increased in value, this increase will be credited to USCI’s account.

13

The Commodity Index was developed based upon academic research by Yale University professors Gary B. Gorton and K. Geert Rouwenhorst, and Hitotsubashi University professor Fumio Hayashi. The Commodity Index is designed to reflect the performance of a fully margined or collateralized portfolio of 14 commodity futures contracts with equal weights, selected each month from a universe of 27 eligible commodity futures contracts. The Commodity Index is rules-based and rebalanced monthly based on observable price signals. In this context, the term “rules-based” is meant to indicate that the composition of the Commodity Index in any given month will be determined by quantitative formulas relating to the prices of the futures contracts that relate to the commodities that are eligible to be included in the Commodity Index. Such formulas are not subject to adjustment based on other factors. The overall return on the Commodity Index is generated by two components: (i) uncollateralized returns from the commodity futures contracts comprising the Commodity Index and (ii) a daily fixed income return reflecting the interest earned on a hypothetical 3-month U.S. Treasury Bill collateral portfolio, calculated using the weekly auction rate for the 3-Month U.S. Treasury Bills published by the U.S. Department of the Treasury. SummerHaven Index Management, LLC (“SummerHaven Indexing”) is the owner of the Commodity Index.

The Commodity Index is composed of physical non-financial commodity futures contracts with active and liquid markets traded upon futures exchanges in major industrialized countries. The futures contracts are denominated in U.S. dollars and weighted equally by notional amount. The Commodity Index currently reflects commodities in six commodity sectors: energy (e.g., crude oil, natural gas, heating oil, etc.), precious metals (e.g., gold, silver platinum), industrial metals (e.g., zinc, nickel, aluminum, copper, etc.), grains (e.g., wheat, corn, soybeans, etc.), softs (e.g., sugar, cotton, coffee, cocoa), and livestock (e.g., live cattle, lean hogs, feeder cattle).

Table 1 below lists the eligible commodities, the relevant futures exchange on which the futures contract is listed and quotation details. Table 2 lists the eligible futures contracts, their sector designation and maximum allowable tenor.

TABLE 1

|

Commodity

|

Designated Contract

|

Exchange

|

Units

|

Quote

|

||||

|

Crude (Brent)

|

Crude Oil

|

ICE-UK

|

1,000 barrels

|

USD/barrel

|

||||

|

Crude Oil (WTI)

|

Light, Sweet Crude Oil

|

NYMEX

|

1,000 barrels

|

USD/barrel

|

||||

|

Gas Oil

|

Gas Oil

|

ICE-UK

|

100 metric tons

|

USD/metric ton

|

||||

|

Heating Oil

|

Heating Oil

|

NYMEX

|

42,000 gallons

|

U.S. cents/gallon

|

||||

|

Natural Gas

|

Henry Hub Natural Gas

|

NYMEX

|

10,000 mmbtu

|

USD/mmbtu

|

||||

|

Unleaded Gasoline

|

Reformulated Blendstock for Oxygen Blending “RBOB”

|

NYMEX

|

42,000 gallons

|

U.S. cents/gallon

|

||||

|

Feeder Cattle

|

Feeder Cattle

|

CME

|

50,000 lbs.

|

U.S. cents/pound

|

||||

|

Lean Hogs

|

Lean Hogs

|

CME

|

40,000 lbs.

|

U.S. cents/pound

|

||||

|

Live Cattle

|

Live Cattle

|

CME

|

40,000 lbs.

|

U.S. cents/pound

|

||||

|

Bean Oil

|

Bean Oil

|

CBOT

|

60,000 lbs.

|

U.S. cents/pound

|

||||

|

Corn

|

Corn

|

CBOT

|

5,000 bushels

|

U.S. cents/bushel

|

||||

|

Soybeans

|

Soybeans

|

CBOT

|

5,000 bushels

|

U.S. cents/bushel

|

||||

|

Soybean Meal

|

Soybean Meal

|

CBOT

|

100 tons

|

USD/ton

|

||||

|

Wheat

|

Wheat

|

CBOT

|

5,000 bushels

|

U.S. cents/bushel

|

||||

|

Aluminum

|

High Grade Primary Aluminum

|

LME

|

25 metric tons

|

USD/metric ton

|

||||

|

Copper

|

Copper

|

COMEX

|

25,000 lbs

|

U.S. cents/pound

|

||||

|

Lead

|

Lead

|

LME

|

25 metric tons

|

USD/metric ton

|

||||

|

Nickel

|

Primary Nickel

|

LME

|

6 metric tons

|

USD/metric ton

|

||||

|

Tin

|

Tin

|

LME

|

5 metric tons

|

USD/metric ton

|

||||

|

Zinc

|

Special High Grade Zinc

|

LME

|

25 metric tons

|

USD/metric ton

|

||||

|

Gold

|

Gold

|

COMEX

|

100 troy oz.

|

USD/troy oz.

|

||||

|

Platinum

|

Platinum

|

NYMEX

|

50 troy oz.

|

USD/troy oz.

|

||||

|

Silver

|

Silver

|

COMEX

|

5,000 troy oz.

|

U.S. cents/troy oz.

|

||||

|

Cocoa

|

Cocoa

|

ICE-US

|

10 metric tons

|

USD/metric ton

|

||||

|

Coffee

|

Coffee “C”

|

ICE-US

|

37,500 lbs

|

U.S. cents/pound

|

||||

|

Cotton

|

Cotton

|

ICE-US

|

50,000 lbs

|

U.S. cents/pound

|

||||

|

Sugar

|

Sugar No. 11

|

ICE-US

|

112,000 lbs.

|

U.S. cents/pound

|

14

TABLE 2

|

Commodity

Symbol

|

Commodity

Name

|

Sector

|

Allowed Contracts

|

Max.

tenor

|

||||

|

CO

|

Brent Crude

|

Energy

|

All 12 Calendar Months

|

12

|

||||

|

CL

|

Crude Oil

|

Energy

|

All 12 Calendar Months

|

12

|

||||

|

QS

|

Gas Oil

|

Energy

|

All 12 Calendar Months

|

12

|

||||

|

HO

|

Heating Oil

|

Energy

|

All 12 Calendar Months

|

12

|

||||

|

NG

|

Natural Gas

|

Energy

|

All 12 Calendar Months

|

12

|

||||

|

XB

|

RBOB

|

Energy

|

All 12 Calendar Months

|

12

|

||||

|

FC

|

Feeder Cattle

|

Livestock

|

Jan, Mar, Apr, May, Aug, Sep, Oct, Nov

|

5

|

||||

|

LH

|

Lean Hogs

|

Livestock

|

Feb, Apr, Jun, Jul, Aug, Oct, Dec

|

5

|

||||

|

LC

|

Live Cattle

|

Livestock

|

Feb, Apr, Jun, Aug, Oct, Dec

|

5

|

||||

|

BO

|

Bean Oil

|

Grains

|

Jan, Mar, May, Jul, Aug, Sep, Oct, Dec

|

7

|

||||

|

C

|

Corn

|

Grains

|

Mar, May, Jul, Sep, Dec

|

12

|

||||

|

S

|

Soybeans

|

Grains

|

Jan, Mar, May, Jul, Aug, Sep, Nov

|

12

|

||||

|

SM

|

Soymeal

|

Grains

|

Jan, Mar, May, Jul, Aug, Sep, Oct, Dec

|

7

|

||||

|

W

|

Wheat

|

Grains

|

Mar, May, Jul, Sep, Dec

|

7

|

||||

|

LA

|

Aluminum

|

Industrial Metals

|

All 12 Calendar months

|

12

|

||||

|

HG

|

Copper

|

Industrial Metals

|

All 12 Calendar Months

|

12

|

||||

|

LL

|

Lead

|

Industrial Metals

|

All 12 Calendar Months

|

7

|

||||

|

LN

|

Nickel

|

Industrial Metals

|

All 12 Calendar Months

|

7

|

||||

|

LT

|

Tin

|

Industrial Metals

|

All 12 Calendar Months

|

7

|

||||

|

LX

|

Zinc

|

Industrial Metals

|

All 12 Calendar Months

|

7

|

||||

|

GC

|

Gold

|

Precious Metals

|

Feb, Apr, Jun, Aug, Oct, Dec

|

12

|

||||

|

PL

|

Platinum

|

Precious Metals

|

Jan, Apr, Jul, Oct

|

5

|

||||

|

SI

|

Silver

|

Precious Metals

|

Mar, May, Jul, Sep, Dec

|

5

|

||||

|

CC

|

Cocoa

|

Softs

|

Mar, May, Jul, Sep, Dec

|

7

|

||||

|

KC

|

Coffee

|

Softs

|

Mar, May, Jul, Sep, Dec

|

7

|

||||

|

CT

|

Cotton

|

Softs

|

Mar, May, Jul, Dec

|

7

|

||||

|

SB

|

Sugar

|

Softs

|

Mar, May, Jul, Oct

|

7

|

Prior to the end of each month, SummerHaven Indexing determines the composition of the Commodity Index and provides such information to Bloomberg, L.P. (“Bloomberg”). Values of the Commodity Index are computed by Bloomberg and disseminated approximately every fifteen (15) seconds from 8:00 a.m. to 5:00 p.m., New York City time, which also publishes a daily Commodity Index value at approximately 5:30 p.m., New York City time, under the index ticker symbol “SDCITR:IND”. Only settlement and last-sale prices are used in the Commodity Index’s calculation, bids and offers are not recognized — including limit-bid and limit-offer price quotes. Where no last-sale price exists, typically in the more deferred contract months, the previous days’ settlement price is used. This means that the underlying Commodity Index may lag its theoretical value. This tendency to lag is evident at the end of the day when the Commodity Index value is based on the settlement prices of the component commodities, and explains why the underlying Commodity Index often closes at or near the high or low for the day.

Composition of the Commodity Index

The composition of the Commodity Index on any given day, as determined and published by SummerHaven Indexing, is determinative of the benchmark for USCI. Neither the Summerhaven Dynamic Commodity Index (“SDCI”) index methodology nor any set of procedures, however, are capable of anticipating all possible circumstances and events that may occur with respect to the Commodity Index and the methodology for its composition, weighting and calculation. Accordingly, a number of subjective judgments must be made in connection with the operation of the Commodity Index that cannot be adequately reflected in this description of the Commodity Index. All questions of interpretation with respect to the application of the provisions of the SDCI index methodology, including any determinations that need to be made in the event of a market emergency or other extraordinary circumstances, will be resolved by SummerHaven Indexing.

15

Contract Expirations

Because the Commodity Index is comprised of actively traded contracts with scheduled expirations, it can be calculated only by reference to the prices of contracts for specified expiration, delivery or settlement periods, referred to as contract expirations. The contract expirations included in the Commodity Index for each commodity during a given year are designated by SummerHaven Indexing, provided that each contract must be an active contract. An active contract for this purpose is a liquid, actively-traded contract expiration, as defined or identified by the relevant trading facility or, if no such definition or identification is provided by the relevant trading facility, as defined by standard custom and practice in the industry.

If a trading facility ceases trading in all contract expirations relating to a particular contract, SummerHaven Indexing may designate a replacement contract on the commodity. The replacement contract must satisfy the eligibility criteria for inclusion in the Commodity Index. To the extent practicable, the replacement is effected during the next monthly review of the composition of the Commodity Index. If that timing is not practicable, SummerHaven Indexing determines the date of the replacement based on a number of factors, including the differences between the existing contract and the replacement contract with respect to contractual specifications and contract expirations.

If a contract is eliminated and there is no replacement contract, the underlying commodity will necessarily drop out of the Commodity Index. The designation of a replacement contract, or the elimination of a commodity from the Commodity Index because of the absence of a replacement contract, could affect the value of the Commodity Index, either positively or negatively, depending on the price of the contract that is eliminated and the prices of the remaining contracts. It is impossible, however, to predict the effect of these changes, if they occur, on the value of the Commodity Index.

Commodity Selection

Fourteen of the 27 eligible commodities are selected for inclusion in the Commodity Index for the next month, subject to the constraint that each of the six commodity sectors is represented by at least one commodity. The methodology used to select the 14 commodities is based solely on quantitative data using observable futures prices and is not subject to human bias.

Monthly commodity selection is a two-step process based upon examination of the relevant futures prices for each commodity:

1) The annualized percentage price difference between the closest-to-expiration futures contract and the next closest-to-expiration futures contract is calculated for each of the 27 eligible commodities on the Selection Date. The seven commodities with the highest percentage price difference are selected.

2) For the remaining 20 eligible commodities, the percentage price change of each commodity over the previous year is calculated, as measured by the change in the price of the closest-to-expiration futures contract on the Selection Date from the price of the closest-to-expiration futures contract a year prior to the Selection Date. The seven commodities with the highest percentage price change are selected.

When evaluating the data from the second step, all six commodity sectors must be represented. If the selection of the seven additional commodities with the highest price change fails to meet the overall diversification requirement that all six commodity sectors are represented in the Commodity Index, the commodity with the highest price change among the commodities of the omitted sector(s) would be substituted for the commodity with the lowest price change among the seven additional commodities.

The 14 commodities selected are included in the Commodity Index for the next month on an equally-weighted basis. Due to the dynamic monthly commodity selection, the sector weights will vary from approximately 7% to 43% over time, depending on the price observations each month. The Selection Date is the fifth business day prior to the first business day of the next calendar month.

16

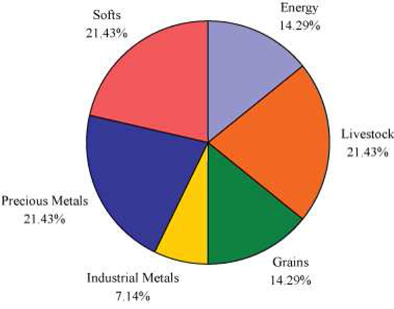

The following graph shows the sector weights of the commodities selected for inclusion in the Commodity Index as of December 31, 2010.

SDCI Sector Weights

as of December 31, 2010

Contract Selection

For each commodity selected for inclusion into the Commodity Index for a particular month, the Commodity Index selects a specific Futures Contract with a tenor (i.e., contract month) among the eligible tenors (the range of contract months) based upon the relative prices of the Futures Contracts within the eligible range of contract months. The previous notwithstanding, the contract expiration is not changed for such month if a contract remains in the Commodity Index, as long as the contract does not expire or enter its notice period in the subsequent month.

Portfolio Construction

The portfolio rebalancing takes place during the Rebalancing Period. At the end of each of the days in the Rebalancing Period, one fourth of the prior month portfolio positions are replaced by an equally-weighted position in the commodity contracts determined on the Selection Date. At the end of the Rebalancing Period, the Commodity Index takes an equal-weight position of approximately 7.14% in each of the selected commodity contracts.

Commodity Index Return Calculation

The percentage excess return equals the percentage change of the market values of the underlying commodity futures. During the Rebalancing Period, the Commodity Index changes its contract holdings during a four day period.

The value of the SDCI Excess Return (“SDCI ER”) at the end of a business day “t” is equal to the SDCI ER value on day “t-1” multiplied by the sum of the daily percentage price changes of each commodity future factoring in each respective commodity future’s notional holding on day “t-1”.

Rebalancing Period

The Commodity Index is rebalanced during the last four business days of each calendar month, when existing positions are replaced by new positions based on the signals used for contract selection as outlined above. At the end of the first day of the Rebalancing Period, the signals are observed and on the second day a new portfolio is constructed that is equally weighted in terms of notional positions in the newly selected contracts.

17

Total Return Calculation

The value of the SDCI Total Return (“SDCI TR”) on any business day is equal to the product of (i) the value of the SDCI TR on the immediately preceding business day multiplied by (ii) one plus the sum of the day’s SDCI ER returns and one business day’s interest from the hypothetical Treasury Bill portfolio. The value of the SDCI TR is calculated and published by Bloomberg.

Commodity Index Base Level

The SDCI TR was set to 100 on January 2, 1991.

2011 Holiday Schedule

The SDCI TR will not be computed on the following weekdays in 2011:

|

January

|

1

|

|

|

January

|

17

|

|

|

February

|

21

|

|

|

April

|

22

|

|

|

May

|

30

|

|

|

July

|

4

|

|

|

September

|

5

|

|

|

November

|

24

|

|

|

December

|

26

|

The holiday schedule is subject to change. USCI will not accept Creation Baskets or Redemption Baskets on these days.

What are Over-the-Counter Derivatives?

In addition to futures contracts and options on futures contracts, derivative contracts that are tied to various commodities are entered into outside of public exchanges. These “over-the-counter” contracts are entered into between two parties in private contracts. Unlike most of the exchange-traded futures contracts or exchange-traded options on futures contracts, each party to such a contract bears the credit risk of the other party, i.e., the risk that the other party will not be able to perform its obligations under its contract.

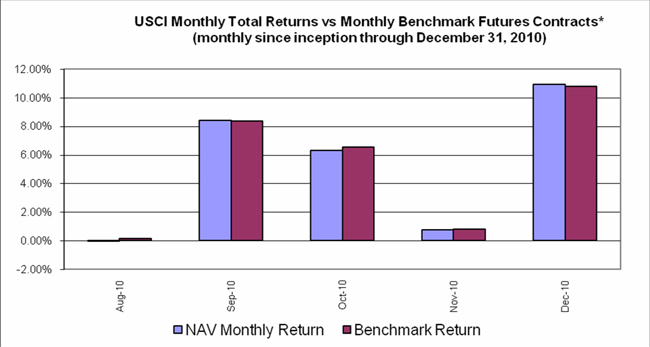

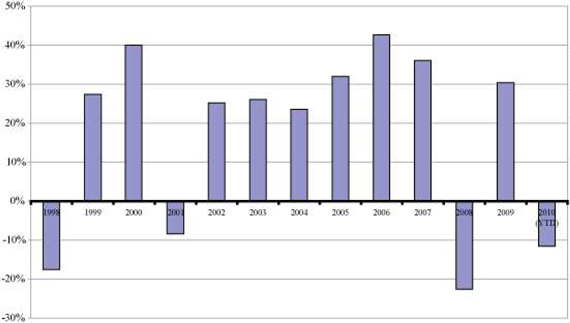

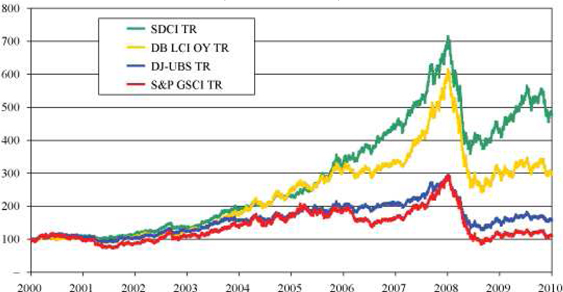

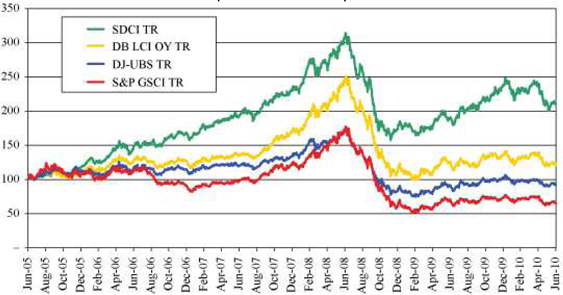

Some derivatives contracts contain fairly standard terms and conditions and are available from a wide range of participants. Others have highly customized terms and conditions and are not as widely available. Many of these over-the-counter contracts are cash-settled forwards for the future delivery of commodities that have terms similar to futures contracts. Others take the form of “swaps” in which a party pays a fixed price per unit and the other pays a variable price based on the average price of futures contracts for a specified period or the price on a specified date, with payments typically made between the parties on a net basis. For example, USCI may enter into over-the-counter derivative contracts the value of which will track changes in the prices of the commodities underlying the Benchmark Component Futures Contract, thereby enabling USCI to track the Commodity Index without investing in Futures Contracts.