Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - Neutron Energy, Inc. | a2203031zex-23_1.htm |

| EX-23.3 - EX-23.3 - Neutron Energy, Inc. | a2203031zex-23_3.htm |

| EX-21.1 - EX-21.1 - Neutron Energy, Inc. | a2203031zex-21_1.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS Neutron Energy, Inc. and Subsidiaries

As filed with the Securities and Exchange Commission on March 30, 2011

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

Form S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Neutron Energy, Inc.

(Exact name of registrant as specified in its charter)

| Nevada (State or other jurisdiction of incorporation or organization) |

1090 (Primary Standard Industrial Classification Code Number) |

73-1734293 (I.R.S. Employer Identification Number) |

9000 E. Nichols Avenue, Suite 225

Englewood, Colorado 80112

(303) 531-0470

(Address, including zip code and telephone number,

including area code, of registrant's principal executive offices)

Edward M. Topham

Chief Financial Officer

9000 E. Nichols Avenue

Englewood, Colorado 80112

Telephone: (303) 531-0470

(Name, address, including zip code and telephone number,

including area code, of agent for service)

Copies to:

| Richard J. Mattera Hogan Lovells US LLP 1200 Seventeenth Street, Suite 1500 Denver, Colorado 80202 Telephone: (303) 899-7300 |

David F. Marx Christopher L. Doerksen Dorsey & Whitney LLP 136 South Main Street, Suite 1000 Salt Lake City, Utah 84101 Telephone: (801) 933-7360 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated , an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (do not check if a smaller reporting company) |

Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

|

|||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1) |

Amount of Registration Fee |

|||

|---|---|---|---|---|---|

Common Stock, par value $0.001 per share(2) |

$57,500,000 | $6,676 | |||

Underwriters' Warrants(3) |

— | — | |||

Common Stock underlying Underwriters' Warrants(4)(5) |

$3,450,000 | $401 | |||

TOTAL |

$60,950,000 | $7,077 | |||

|

|||||

- (1)

- Estimated

solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as

amended.

- (2)

- Includes

the offering price attributable to shares that the underwriters have the option to purchase solely to cover over-allotments, if any.

- (3)

- No

separate registration fee is required pursuant to Rule 457(g) promulgated under the Securities Act of 1933.

- (4)

- Pursuant

to Rule 416 promulgated under the Securities Act of 1933, there are also being registered such additional shares of common stock as may

become issuable pursuant to anti-dilution provisions of the underwriter's warrants.

- (5)

- Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(g) promulgated under the Securities Act of 1933. We have agreed to issue warrants to purchase a number of shares of common stock equal to 5% of the number of shares of common stock offered hereby (including any over-allotment), at an exercise price per share equal to 120% of the price of the common stock offered hereby.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to such Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MARCH 30, 2011

Prospectus

Shares of Common Stock

This is an initial public offering of shares of common stock by Neutron Energy, Inc. Neutron Energy is selling a maximum of shares of common stock. The estimated initial public offering price is between $ and $ per share.

No public market exists for our shares. We have applied for a listing of our common stock on under the symbol " ."

Investing in our common stock involves risks. See "Risk Factors" beginning on page 6.

| |

Per Share | Total | |||||

|---|---|---|---|---|---|---|---|

Initial public offering price |

$ | $ | |||||

Underwriting discounts and commissions(1) |

$ | $ | |||||

Proceeds to Neutron Energy, before expenses |

$ | $ | |||||

- (1)

- The underwriters will receive compensation in addition to the discounts and commissions and as set forth under "Underwriting."

To the extent the underwriters sell more than shares of common stock, we have granted the underwriters an option for a period of 30 days to purchase up to additional shares of common stock, at the initial public offering price less the underwriting discounts and commissions.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares against payment on , 2011.

| |

|

|

|---|---|---|

| Roth Capital Partners | Cormark Securities (U.S.A.) Limited |

The date of this prospectus is , 2011

As used in this prospectus, unless the context otherwise requires, the terms "Neutron," "Neutron Energy," "NEI," "the Company," "we," "our" and "us" refer to Neutron Energy, Inc. and its consolidated subsidiaries.

Except as otherwise indicated, all information in this prospectus assumes that the underwriters' over-allotment option will not be exercised.

You should rely only on the information contained in this prospectus that we authorize to be distributed to you. We have not, and the underwriters have not, authorized anyone to provide you with information different from or in addition to that contained in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. We are offering to sell and are seeking offers to buy shares of common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the common stock.

i

Our business, financial conditions, results of operations and prospects may have changed since that date.

We obtained the market, competitive position and similar data used throughout this prospectus from our own research and from surveys or studies conducted by third parties and industry or general publications. This market, competitive position and similar data include, among other things, statements regarding the global market for uranium and nuclear energy, uranium supply deficits, sources of uranium, and the historical and projected growth rate of our industry. While we believe that each of these surveys, studies and publications is reliable, we have not independently verified such data. Similarly, we believe our internal research is reliable, but it has not been verified by any independent sources.

Through and including , 2011, all dealers that buy, sell or trade our common stock, whether or not participating in this offering, may be required to deliver a prospectus. This delivery requirement is in addition to the obligation of dealers to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

ii

The following summary highlights information contained elsewhere in this prospectus. Before deciding whether to buy shares of our common stock, you should read this summary and the more detailed information in this prospectus, including our consolidated financial statements and related notes and the discussion of the risks of investing in our common stock in the section entitled "Risk Factors" starting on page 6.

Our Company

We began operations as an unincorporated entity on March 25, 2005 and were incorporated on March 29, 2005 under the laws of the State of Wyoming. On April 26, 2007, we transferred our state of domicile from Wyoming to Nevada. We were formed to capitalize on our management's extensive knowledge and experience in uranium exploration, development and production, as well as our geologic and engineering data bases covering several uranium districts that historically have been uranium producers.

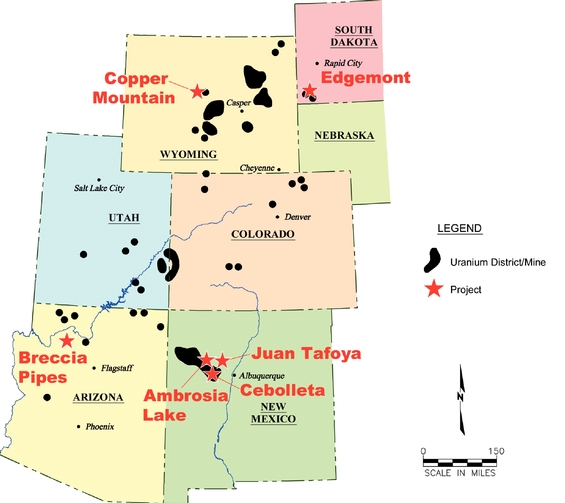

We are a natural resource company engaged in the acquisition and exploration of uranium properties in the United States. Our strategy is to acquire properties that (i) have undergone some degree of historical uranium exploration and on which uranium mineralized material, but not reserves, have been located, and (ii) are located in mineralized districts that have undergone some degree of historical uranium exploration and are thought to be prospective for further uranium exploration, but on which no uranium mineralized material has been located. We have acquired interests in 63,312 net acres of leased or staked mineral properties in New Mexico, South Dakota and Wyoming.

We also hold residual mineral interests that we received in the disposition of properties in Arizona and South Dakota. These residual interests were received in consideration of the sale of our ownership interests in the properties and are primarily comprised of royalty interest, net proceeds interest and our ability to convert the royalty interest into a working interest in the properties.

All of our mineral properties are exploration stage properties. Some of our mineral properties have been the subject of historical exploration and/or development, and in one case production, by other mining companies, that provides indications that further uranium exploration is warranted. Our view that these properties are prospective for mineral exploration is based on prior exploration and/or development conducted by other companies, management information and work product derived from various reports, maps, radiometric assay from down-hole radiometric logging, exploratory drill logs, state organization reports, consultants, geological study and other exploratory information. If we are able to locate economic uranium reserves that are commercially viable, we intend to develop the mine site, including mill facilities, and extract uranium for production.

We are an exploration stage company and all of our projects are in the exploration stage and do not have any known proven or probable reserves in accordance with the definitions of reserves under Industry Guide 7 issued by the Securities and Exchange Commission (the "SEC"). There can be no assurance that a commercially viable mineral deposit, or reserve, exists on any of our properties until appropriate exploratory work is completed and a comprehensive evaluation based on such work concludes legal and economic feasibility. Further exploration and permitting beyond the scope of our planned activities will be required before a final evaluation as to the economic and legal feasibility of mining of any of our properties is determined. There is no assurance that further exploration will result in a final evaluation that a commercially viable mineral deposit exists on any of our mineral properties. We will require additional financing in order to pursue full exploration and permitting of these properties.

As of March 24, 2011, we had 58,204,141 shares of common stock outstanding. On that date, there were 195 holders of record.

1

Corporate Information

Our executive offices are located at 9000 E. Nichols Avenue, Suite 225, Englewood, Colorado 80112. Our telephone number is (303) 531-0470. We have a field office in Albuquerque, New Mexico.

Employees

We have 13 full-time and three part-time employees and have engaged geological and technical consultants for additional day-to-day services. Other services are provided by outsourcing consultants and special purpose contracts.

Business and Growth Strategy

We are an exploration stage company engaged in the exploration of uranium. We do not engage in any development activities at this time, but may engage in development activities should uranium reserves be located on any of our properties. The key elements of our business and growth strategy are as follows:

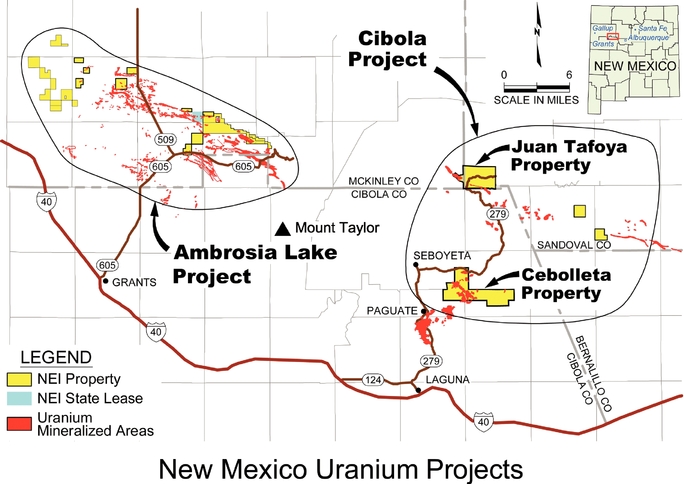

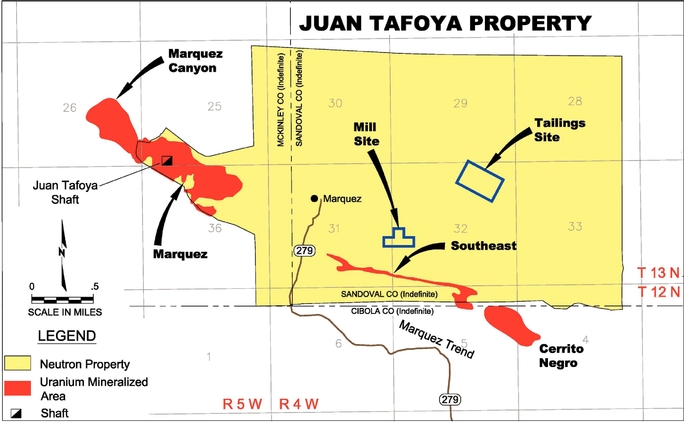

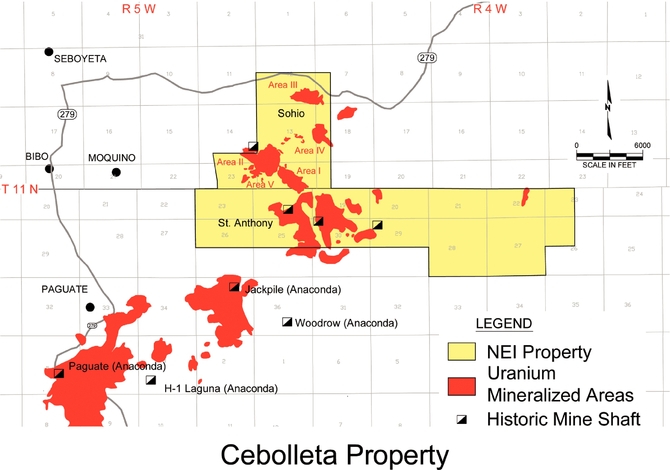

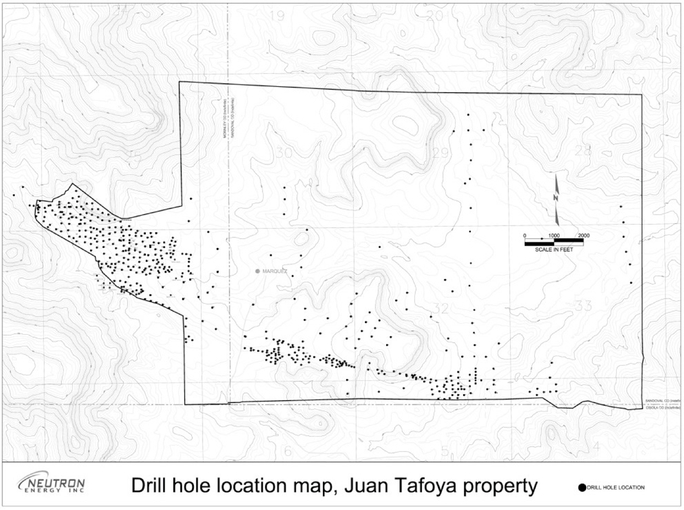

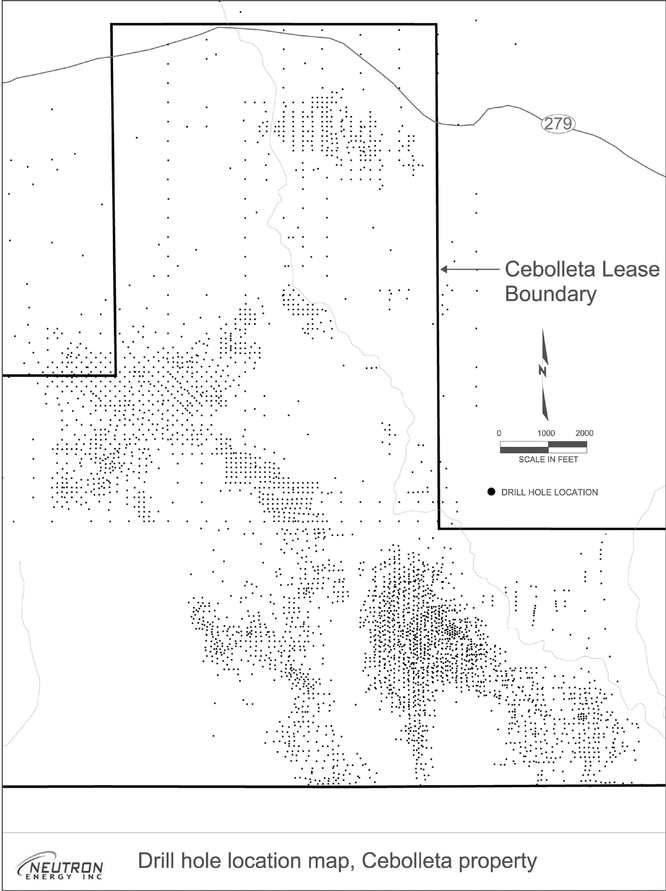

Cibola Project. Based on historical exploration and development data, we believe our wholly-owned Cibola Project may have future uranium reserve potential. We have received the required exploration permits on our Juan Tafoya property and Cebolleta property (together our "Cibola Project") which will allow us to commence confirmation drilling programs to confirm the uranium mineralized material identified by previous operators. We have substantially completed resource modeling on each of the Juan Tafoya and Cebolleta properties, based on historical data we have in our possession. We have received an independent technical report completed in accordance with the provisions of National Instrument 43-101, Standards of Disclosure for Mineral Projects, of the Canadian Securities Administrators ("NI 43-101"), which is authored by G. S. Carter, P. Eng., a qualified person.

Because of the long lead times for environmental permitting of mining operations in North America, we have commenced the permitting process with the U.S. Nuclear Regulatory Commission ("NRC") on our Cibola Project, primarily through initial planning sessions with the NRC and the collection of environmental baseline data. We believe that commencing the permitting process at this early stage will allow us to expeditiously commence development of our properties if we move to that stage.

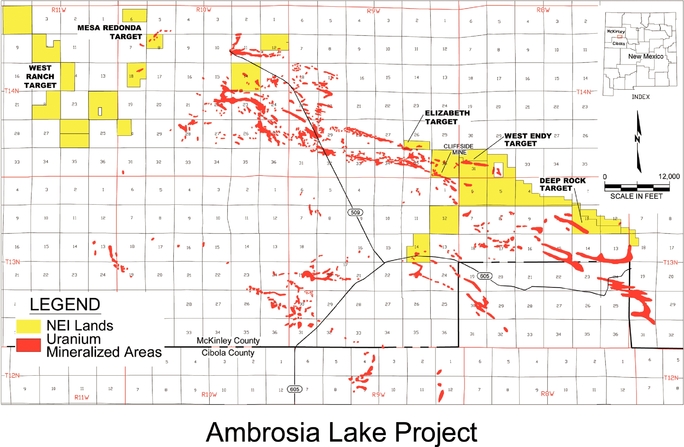

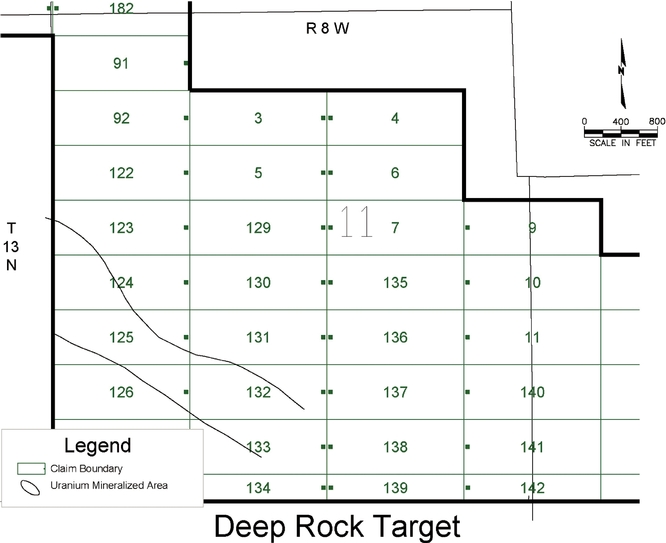

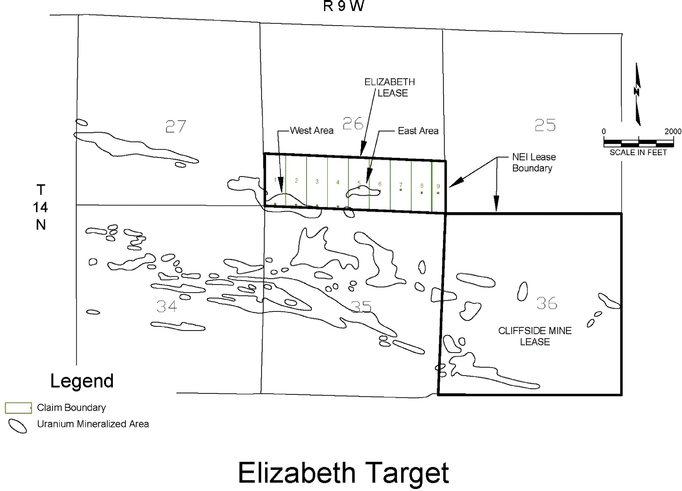

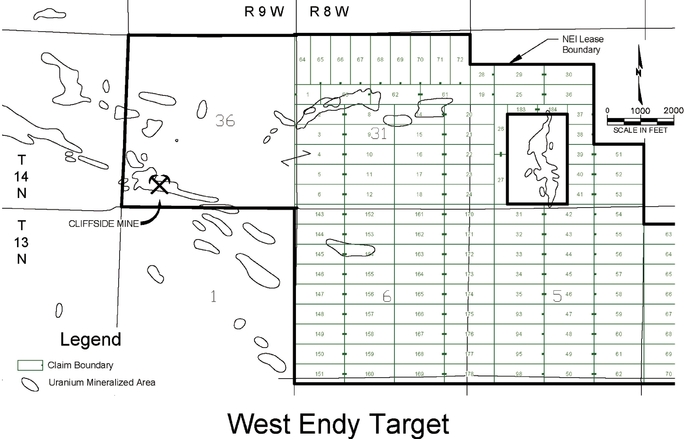

Ambrosia Lake Project. We have received the required exploration permit on our Elizabeth Target, included in the Ambrosia Lake Project, which will allow us to commence confirmation drilling programs to confirm the uranium mineralized material identified by previous operators. We believe our Elizabeth, Deep Rock, Mesa Redonda, West Endy and West Ranch targets represent long-term uranium reserve potential. We seek to complete the analysis and digitization of historic geologic data, mapping, and other geophysic and geologic activities on our Ambrosia Lake Project targets and to commence exploration permitting and exploration programs on selected targets.

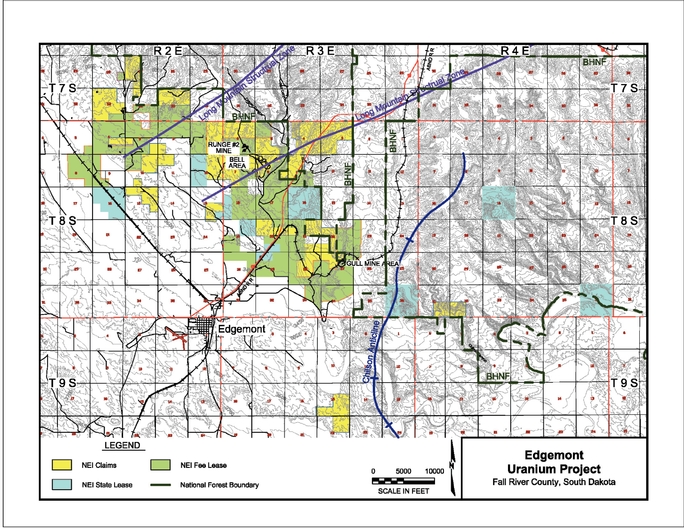

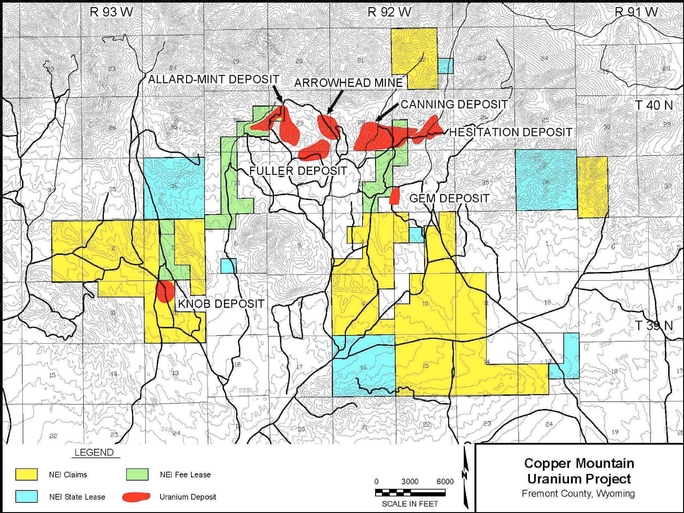

Edgemont Project, Copper Mountain Project and Other Wyoming Properties. We do not anticipate any significant exploration activities during the next twelve months on our other properties. We may seek to sell or enter into joint-venture arrangements on these properties with other exploration companies.

Extensive Due Diligence of Properties. Our exploration activities are divided into phases dependent on the nature of historical exploration and development activities on the property. Our initial phase of exploration includes extensive due diligence and analysis of all historical exploration data available to us or in our possession. Furthermore, we probe existing and newly drilled holes with gamma probes

2

with the goal of confirming historical drill results and planning for future development. We will proceed to our second phase if we are able to confirm historical data and drill results.

Pursue Strategic Acquisitions of Exploration Stage Properties. We are also engaged in the continual review of opportunities to acquire properties in the exploration stage that are thought to contain uranium mineralization and have undergone some degree of historical exploration or development.

Financing. Historically, we have financed our operations primarily by (i) private placements of convertible subordinated notes convertible for either (a) shares of our common stock, or (b) shares of our common stock and warrants to purchase additional shares of our common stock; (ii) private placement of shares of our common stock to certain individuals and institutional investors; and (iii) senior secured debt credit facilities.

We will require additional funding to implement our business and growth strategy.

The Offering

| Common stock offered by us | shares | |

Common stock outstanding immediately after the offering |

shares |

|

Use of proceeds |

We expect the net proceeds to us from this offering (after deducting underwriting discounts and commissions payable to the underwriters and our estimated offering expenses) to be approximately $ . We intend to use the net proceeds (i) to discharge our senior indebtedness in the aggregate principal amount of $24,000,000 plus accrued interest; (ii) to finance our exploration and permitting activities, design and engineering activities and deposit confirmation drilling activities; and (iii) for general corporate purposes, including the possible acquisition of additional properties. |

|

Dividend policy |

The holders of our common stock are entitled to receive dividends, if any, as may be declared by our Board of Directors, in its discretion. We currently intend to retain any future earnings to fund the development and growth of our business. Therefore, we do not currently anticipate paying cash dividends. |

|

Risk factors |

See "Risk Factors" starting on page 6 and other information included in this prospectus for a discussion of factors you should carefully consider before deciding whether to invest in shares of our common stock. |

|

Proposed symbol |

The number of shares of common stock to be outstanding immediately after the offering is based upon 58,204,141 shares of common stock outstanding as of March 24, 2011 and the offering of shares of common stock pursuant to this offering and excludes:

- •

- 6,291,666 shares of common stock issuable upon the exercise of stock options outstanding at March 24, 2011 under our 2006 Stock Option and Restricted Stock Plan (the "2006 Plan"), 2007 Omnibus Incentive Plan (the "2007 Plan") and 2011 Equity Incentive Plan (the "2011 Plan") at a weighted average exercise price of $0.75 per share;

3

- •

- 3,000 shares of common stock reserved for future issuance under our 2006 Plan;

- •

- 155,334 shares of common stock reserved for future issuance under our 2007 Plan;

- •

- Up to 2,600,000 shares of common stock reserved for future issuance under our 2011 Plan (the 2011 Plan authorizes

us to issue the greater of (A) 1,000,000 shares of common stock or (B) the number of shares of common stock, up to a maximum of 3,000,000 shares, that when added together with the number

of shares authorized under the 2006 Plan and 2007 Plan equals 10% of our total issued and outstanding shares of common stock. As of March 24, 2011, 1,000,000 shares are authorized

under the 2011 Plan and stock options to purchase 400,000 shares of common stock have been issued under the 2011 Plan leaving 600,000 reserved for future issuance.);

- •

- 3,051,744 shares of common stock underlying outstanding warrants;

- •

- Up to 4,262,541 shares of common stock underlying future warrants that the Company is obligated to issue as is necessary

for the holder of the warrants described above to own, upon exercise of its warrants, 5% of the outstanding common stock of the Company, calculated on a partially diluted basis, of which the Company

expects to issue a warrant to purchase shares of common stock as a result of this offering;

- •

- shares of common stock underlying warrants that the Company will issue to the underwriters in connection

with this offering; and

- •

- shares of common stock issuable pursuant to the underwriters' over-allotment option.

4

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL DATA

The following table shows our summary consolidated statements of operations, balance sheets and other financial and operating data as of, and for each of the years ended, December 31, 2010, 2009, 2008, 2007 and 2006. The summary financial and operating data set forth below are derived from our audited consolidated financial statements prepared in accordance with United States generally accepted accounting principles ("GAAP"). Our historical results are not necessarily indicative of our results for any future period.

The following summary historical consolidated financial and other data should be read in conjunction with, and are qualified in their entirety by reference to, the section of this prospectus entitled "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our audited consolidated financial statements and related notes included elsewhere in this prospectus.

Summary Annual Financial Information (audited)

(In thousands except for per share amounts)

| |

As of December 31, | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2010 | 2009 | 2008 | 2007 | 2006 | ||||||||||||

Consolidated Balance Sheet Data |

|||||||||||||||||

Cash and cash equivalents |

$ | 174 | $ | 1,024 | $ | 7,095 | $ | 14,740 | $ | 3,309 | |||||||

Restricted cash and marketable securities |

7,255 | 235 | — | — | — | ||||||||||||

Working capital (deficit) |

(17,261 | ) | 1,119 | 6,931 | 14,271 | (3,756 | ) | ||||||||||

Net property and equipment |

20,093 | (1) | 8,571 | 8,366 | 7,395 | 1,539 | |||||||||||

Total assets |

28,141 | 10,182 | 15,670 | 22,283 | 5,278 | ||||||||||||

Total liabilities |

26,750 | (2) | 559 | 325 | 506 | 7,110 | |||||||||||

Deficit accumulated during the exploration stage |

(36,835 | ) | (28,405 | ) | (21,672 | ) | (13,352 | ) | (5,572 | ) | |||||||

Total stockholders' equity (deficit) |

1,391 | 9,623 | 15,346 | 21,777 | (1,832 | ) | |||||||||||

| |

Years Ended December 31, | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2010 | 2009 | 2008 | 2007 | 2006 | ||||||||||||

Consolidated Operating Data |

|||||||||||||||||

Revenues |

$ | — | $ | — | $ | — | $ | — | $ | — | |||||||

Mineral property maintenance |

1,142 | 1,036 | 1,220 | 1,664 | 817 | ||||||||||||

Mineral exploration |

1,835 | 3,528 | 4,366 | 2,543 | 519 | ||||||||||||

General and administrative |

2,228 | 2,821 | 3,501 | 2,279 | 1,013 | ||||||||||||

Other income (expense) |

(3,544 | ) | 56 | 324 | (1,550 | ) | (1,607 | ) | |||||||||

Operating loss |

(8,749 | ) | (7,328 | ) | (8,762 | ) | (8,036 | ) | (3,957 | ) | |||||||

Net loss attributable to the company |

(8,429 | ) | (6,733 | ) | (8,319 | ) | (7,780 | ) | (3,957 | ) | |||||||

Net loss per basic and diluted share of common stock |

(0.14 | ) | (0.12 | ) | (0.15 | ) | (0.22 | ) | (0.17 | ) | |||||||

Consolidated Cash Flow Data |

|||||||||||||||||

Net cash used by operations |

$ | (4,694 | ) | $ | (6,455 | ) | $ | (8,027 | ) | $ | (5,394 | ) | $ | (1,979 | ) | ||

Net cash used by investing activities |

(7,568 | ) | (350 | ) | (632 | ) | (4,847 | ) | (1,376 | ) | |||||||

Net cash provided by financing activities |

11,413 | 734 | 1,014 | 21,672 | 6,513 | ||||||||||||

Net increase (decrease) in cash and cash equivalents |

(850 | ) | (6,071 | ) | (7,645 | ) | 11,431 | 3,157 | |||||||||

- (1)

- Includes

our April 2010 acquisition of the 49% non-controlling interest in Cibola Resources LLC. See the section of this prospectus

entitled "Management's Discussion and Analysis of Financial Condition and Results of Operations—Material Commitments—Significant Mineral

Properties—Cebolleta Mineral Property" and our audited consolidated financial statements and related notes included elsewhere in this prospectus.

- (2)

- Includes (a) current liabilities consisting of accounts payable and accrued expenses of $240,437 and senior debt, net, of $24,844,874 and (b) long-term liabilities consisting of long-term payable, net, of $325,539 and warrant liability of $1,339,402. For a description of our senior debt, see the section of this prospectus entitled "Management's Discussion and Analysis of Financial Condition and Results of Operations—Material Commitments—Senior Debt Credit Facility" and our audited consolidated financial statements and related notes included elsewhere in this prospectus.

5

Investing in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with the other information in this prospectus, before making an investment decision. If any of the risks described below occurs, our business and financial condition would suffer. As a result, the trading price of our common stock could decline and you may lose all or part of your investment. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business and operations.

Risks Related to Our Business

We have a limited operating history as an uranium exploration and mining company, and our business and prospects should be considered in light of the risks and difficulties typically encountered by a company with a limited operating history.

We have had no revenue generating operations since our incorporation in 2005 and our operating cash flow needs have been financed solely through offerings of our common stock or other securities and debt. As a result, we have limited historical financial and operating information relating to our ability to generate revenue in the future available to help you evaluate our performance or an investment in our common stock.

All of our properties are in the exploration stage and require the capital to be obtained from this offering in order to continue with the implementation of our business plan. Until the commencement of operations, we will not generate any operating revenues. We expect to continue to incur operating deficits as we implement our business plan.

Our estimates of capital, personnel, equipment, and facilities required for our proposed operations are based on certain other existing businesses operating under similar business conditions and plans. We believe that our estimates are reasonable, but, until our operations have been established, it is not possible to determine the accuracy of such estimates. We have not had any direct operating experience and therefore have no basis for our projections, other than the experience of other similar businesses from which limited financial histories are available. As a result, there is no assurance that we will be able to generate profits from operations.

We may not be able to implement our business plan.

Our business plan requires substantial capital in order to succeed. We will require capital to complete our exploration efforts and substantial additional capital for mine and mill development. We presently do not have sufficient working capital to pursue our business plan through the various exploration efforts described in this prospectus. In formulating our business plan, we have relied on the judgment of our officers and their experience in the industry. There can be no assurance that we will be able to obtain sufficient financing or implement the business plan we have devised. Further, even with sufficient financing, there can be no assurance that we will be able to expand on a regional or national basis or operate our business on a profitable basis. Our plans are based upon the assumptions that we will identify commercially viable uranium deposits, that the demand for uranium will continue for prolonged periods, that the proceeds of this offering will be applied efficiently and that the risks described in this prospectus will be dealt with successfully. There can be no assurance that such plans will be realized or that any of the assumptions will prove to be correct.

All of our mineral properties are in the exploration stage and we have not yet identified, and may never identify, commercially viable mineral deposits that would generate revenues.

We are considered an exploration stage company and will continue to be until we identify commercially viable reserves on our properties and develop our properties. We have no uranium

6

producing properties and have never generated any revenue from our operations. All our mineral properties are in the exploration stage and do not contain any known reserves in accordance with the definitions adopted by the SEC and we have not confirmed that a commercially viable mineral deposit exists on any of our properties and we may never discover uranium in commercially exploitable quantities. Because the probability of an individual prospect having reserves is uncertain, our properties may not contain any reserves, and any funds spent on exploration may be lost. Further exploration will be required before a final evaluation as to the economic and legal feasibility. There is no guarantee that we will be able to identify commercially viable mineral deposits on any of our current or future acquired mineral properties or that if commercially viable mineral deposits are identified, that we will be able to extract deposits profitably. While discovery of commercially viable mineral deposits may result in substantial rewards, few properties which are explored are ultimately developed into producing mines. If we are not able to identify commercially viable mineral deposits or profitably extract mineral from such deposits, our business would be materially adversely affected and our investors could lose all or a substantial portion of their investment.

Our mineral properties may be subject to defects in title and we are at risk of loss of ownership.

Our mineral properties consist of private mineral rights, leases covering state and private lands, leases of patented mining claims, and unpatented mining claims. Many of our mining properties are unpatented mining claims to which we have only possessory title. The validity of unpatented mining claims is often uncertain and such validity is always subject to contest. Unpatented mining claims are generally considered subject to greater title risk than patented mining claims or other real property interests that are owned in fee simple. Because unpatented mining claims are self-initiated and self-maintained, they possess some unique vulnerabilities not associated with other types of property interests. It is impossible to ascertain the validity of unpatented mining claims from public real property records, and therefore it can be difficult or impossible to confirm that all of the requisite steps have been followed for location, perfection and maintenance of an unpatented mining claim. The present status of our unpatented mining claims located on public lands allows us the exclusive right to mine and remove locatable minerals, such as uranium. We also are allowed to use the surface of the land solely for purposes related to mining and processing the mineral-bearing ores. However, legal ownership of the public land remains with the federal government. We remain at risk that the mining claims may be lost either to the federal government or to rival private claimants due to failure to comply with statutory requirements. In addition, we may not have, or may not be able to obtain, all necessary surface rights to develop a property.

We cannot guarantee that title to properties leased by us will not be challenged. Title insurance is generally not available for mineral properties and our ability to ensure that we have obtained secure title to individual mineral properties or mining claims may be severely constrained. Our mineral properties may be subject to prior unrecorded agreements, transfers or claims, and title may be affected by, among other things, conflictual title rights and undetected defects. While we believe that the lessor of our Juan Tafoya property has valid title, our title searches have revealed conflictual title rights to portions of such property. We may incur significant costs related to defending the title to our properties. A successful claim contesting our title to a property may cause us to compensate other persons or perhaps reduce our interest in the affected property or lose our rights to explore and develop that property. This could result in us not being compensated for our prior expenditures relating to the property.

We will be subject to operating hazards and risks which may result in personal injury or death, environmental damage, delays in mining, monetary losses and possible legal liability.

Mineral exploration involves many hazards and risks, which even a combination of experience, knowledge and careful evaluation may not be able to overcome. Our operations are subject to the

7

hazards and risks normally incidental to exploration and, if applicable, development and production, of metals, including, but not limited, to environmental hazards, flooding, fire, periodic or seasonal hazardous climate and weather conditions, unexpected rock formations, industrial accidents and metallurgical and other processing problems. These risks could result in damage to, or destruction of, mineral properties, production facilities or other properties; personal injury; environmental damage; work stoppages; delays in mining; increased production costs; monetary losses; and possible legal liability. We may become subject to liability which we cannot insure against or which we may elect not to insure due to high premium costs or other reasons. Where considered practical to do so we maintain insurance against risks in the operation of our business in amounts which we believe to be reasonable. Such insurance, however, contains exclusions and limitations on coverage. We cannot provide any assurance that such insurance will continue to be available, will be available at economically acceptable premiums or will be adequate to cover any resulting liability. In some cases, coverage is not available or considered too expensive relative to the perceived risk. The potential costs which could be associated with any liabilities not covered by insurance, or in excess of insurance coverage, could have a material adverse effect upon our financial condition.

We have a history of losses, deficits and negative operating cash flows and will likely continue to incur losses in the future. Such losses may impair our ability to pursue our business plan.

We have incurred losses and negative operating cash flows since our inception in 2005 and expect to continue to incur operating losses and negative cash flows from operations for the foreseeable future. We have made, and will continue to make, substantial capital and other expenditures before we will have sufficient operating income and cash flow to recover our investments. We are not able to accurately estimate when, if ever, our operating income will be sufficient to cover these investments. Further, we may not achieve or maintain profitability or generate cash from operations in future periods. We have been dependent on sales of our equity securities and debt financing to meet our cash requirements and such financing may not continue to be available. We have incurred losses totaling approximately $36,834,600 from our inception on March 25, 2005 to December 31, 2010. As of December 31, 2010, we had total stockholders' equity of $1,390,817. We do not expect positive cash flow from operations in the near term. There is no assurance that actual cash requirements will not exceed our estimates.

We have substantial capital requirements and do not have operating income. As a result, we have been and continue to be dependent on sales of our equity securities and debt financing to fund our operating costs.

Our current plans require us to make significant capital expenditures for the exploration and potential development of our minerals exploration properties. Based upon our historical losses from operations and projected future expenditures, we require substantial additional financing in order to pursue our business plan. We have funded our operations through the issuance of equity and short term debt financing arrangements and we may not be able to continue to obtain all of the financing we require. If we cannot obtain additional funds through equity or debt financings or otherwise, our ability to execute our plans and achieve production levels will be greatly limited. Depending on our future operations, the market for uranium and the conditions of the equity capital and debt markets, we may not be able to continue to raise additional equity capital or borrow money on terms acceptable to us or at all. A lack of adequate financing may adversely affect our ability to pursue our business strategy, respond to changing business and economic conditions and competitive pressures, absorb negative operating results and fund our continuing operations, capital expenditures or increased working capital requirements. If we are not able to secure financing, we may be forced to change our business plans or our business may fail.

8

Our level of indebtedness may make it more difficult for us to pay our debts as they become due.

Our aggregate principal indebtedness under our senior credit facility was approximately $24,000,000 as of December 31, 2010. This entire amount, including accrued interest, matures and becomes due and payable in full on June 30, 2011. Our ability to repay this debt depends on our ability to raise sufficient capital through the sale of our equity securities or to refinance such indebtedness. If we are unable to generate sufficient funds from the sale of our securities or are unable to refinance or restructure our indebtedness prior to maturity, we will be in default, which could require us to pursue a restructuring of our indebtedness or file for protection under the U.S. Bankruptcy Code. Additionally, the obligation to repay this debt restricts our ability to use the proceeds of the sale of our securities for other purposes, including for operations.

Our acquisition activities may not be successful.

As part of our growth strategy, we may acquire additional uranium exploration properties. Such acquisitions may pose substantial risks to our business, financial condition, and results of operations. In pursuing acquisitions, we will compete with other companies, many of which have greater financial and other resources to acquire attractive properties. Even if we are successful in acquiring additional properties, some of the properties may not contain commercially viable uranium deposits. Furthermore, in some cases, the failure to develop such prospects within specified time periods may cause the forfeiture of the lease in that prospect. Further, acquisitions could disrupt ongoing business operations and exploration activities or use capital that could be used in more productive activities. If any of these events occur, it would have a material adverse effect upon our business.

We may not be able to compete effectively in the market for uranium.

We operate in a highly competitive industry, competing with other mining and exploration companies, and institutional and individual investors, which are actively seeking uranium exploration properties throughout the world together with the equipment, labor and materials required to exploit such properties. The principal area of competition is encountered in the financial ability to acquire prime minerals properties and then exploit such properties. Competition for the acquisition of uranium exploration properties is intense, with many properties available in a competitive bidding process in which we may lack technological information, financial resources or expertise available to other bidders. Many of our competitors have financial resources, staff and facilities substantially greater than ours and our limited resources may put us at a disadvantage in bidding for uranium exploration properties. Further, we may not be able to secure financing for acquisitions on terms satisfactory to us or at all. Therefore, we may not be successful in acquiring and developing profitable properties in the face of this competition. Furthermore, we have not commenced mining operations and therefore do not have experience in mining or milling commercial amounts of uranium. Our actual costs of production may exceed those of our competitors.

We rely on key personnel and if we are unable to retain or attract qualified personnel, we may not be able to execute our business plan.

We are highly dependent on the services of Messrs. Kelsey L. Boltz, our Executive Chairman, Gary C. Huber, our President and Chief Executive Officer, and Edward M. Topham, our Chief Financial Officer. The loss of the services of these individuals could harm our business. We do not have key man life insurance on any of these individuals and may not have the financial resources to hire a replacement if we were to lose any of our officers. Our future success also depends on our ability to attract, train, retain and motivate other highly qualified technical and managerial personnel. Competition for such personnel is intense and we may not be able to attract, train, retain or motivate such persons in the future.

9

Some of our officers and directors do not have technical training or experience in the acquisition and exploration of uranium properties and we may have to hire qualified personnel.

Some of our officers and directors have experience with the acquisition, exploration and development of uranium properties but others do not. Therefore, we may have to hire qualified persons to perform surveying, exploration and, if we find commercially exploitable reserves of uranium, development of our properties. There can be no assurance that we will have available to us the necessary expertise to explore and develop our uranium properties. Some of our officers and directors have no direct training or experience in these areas and as a result may not be fully aware of many of the specific requirements related to working within the industry. As a result, their decisions and choices may not take into account standard engineering or managerial approaches mineral exploration companies commonly use, and our exploration activities, earnings and ultimate financial success could suffer irreparable harm due to certain of management's decisions.

Our directors and executive management beneficially own a significant interest in us in the aggregate and can exercise significant influence over us.

Our directors and executive officers beneficially own 19.23% of our issued and outstanding shares of common stock (including shares subject to options held by such individuals that are exercisable within 60 days). These stockholders may, if they act together, exercise significant influence over all matters requiring stockholder approval, including the election of directors and the determination of significant corporate actions, as well as control our management, policies and operations. This concentration of ownership could depress our stock price or value or delay or prevent a change in control that could otherwise be beneficial to our stockholders.

Our directors may be subject to conflicts of interest.

All of our directors, except for Gary C. Huber, our President and Chief Executive Officer, serve only part time and may be subject to conflicts of interest. Each may devote part of his or her working time to other business endeavors, including consulting relationships with other business entities, and may have responsibilities to these other entities. Such conflicts may include deciding how much time to devote to our affairs, as well as what business opportunities should be presented to us. Because of these relationships, our directors may be subject to conflicts of interest.

Risks Related to Our Industry

The profitable mining of uranium is subject to conditions and events beyond our control, which could result in higher operating expenses and/or decreased production and sales and adversely affect our operating results and cash flows.

The business of minerals exploration is subject to many risks and uncertainties, including those described in this section. The potential profitability of mining uranium properties, if commercially viable deposits of uranium are found, is dependent upon many factors and risks beyond our control, including, but not limited to:

- •

- unanticipated ground and water conditions and adverse claims to water rights and to land;

- •

- assertions that water rights have not been perfected by the application of water to beneficial use or have been

intentionally abandoned;

- •

- geological problems;

- •

- metallurgical and other processing problems;

- •

- the occurrence of unusual weather or operating conditions and other force majeure events;

10

- •

- lower than expected ore grades;

- •

- accidents;

- •

- delays in the receipt of or failure to receive necessary government permits;

- •

- delays in transportation;

- •

- labor disputes;

- •

- government permit restrictions and regulation restrictions;

- •

- unavailability of materials and equipment; and

- •

- the failure of equipment or processes to operate in accordance with specifications or expectations.

The occurrence of any of these conditions or events in the future may adversely affect our ability to profitably mine uranium, which would adversely affect our operating results and cash flow. Cost effective insurance contains exclusions and limitations on coverage and may be unavailable in some circumstances.

Our future profitability and ability to raise capital will be dependent on uranium prices.

Because a significant portion of our anticipated revenues are expected to be derived from the sale of uranium, our net earnings, if any, can be affected by the long and short-term market price of uranium. Uranium prices are subject to wide fluctuation. The price of uranium is affected by numerous factors beyond our control, including the demand for nuclear power, accidents at nuclear power facilities, worldwide political and economic conditions, uranium supply from secondary sources, legislation, uranium production levels and costs of production.

Future price of uranium may be impacted by secondary sources of supply.

Uranium is supplied from primary production (the mining of uranium ores) and secondary sources such as the drawdown of excess inventories and uranium made available from decommissioning of nuclear weapons, re-enriched depleted uranium tails, and used reactor fuel that has been reprocessed. The price of uranium may be adversely affected by secondary sources of supply being introduced into the market.

The only significant market for uranium is nuclear power plants worldwide, and there are only a few customers.

Uranium producers are dependent on a small number of electric utilities that buy uranium for nuclear power plants. Because of the limited market for uranium, a reduction in purchases of newly-produced uranium by electric utilities for any reason (such as plant closings) would adversely affect the viability of our business.

The price of alternative energy sources affects the demand for and price of uranium.

The attractiveness of uranium as an alternative fuel to generate electricity is to some degree dependent on the prices of oil, gas, coal and hydro-electricity and the possibility of developing other low cost sources for energy. If the price of alternative energy sources decreases or new low-cost alternative energy sources are developed, the demand for uranium could decrease, which may result in the decrease in the price of uranium.

11

Public acceptance of nuclear energy is uncertain.

Maintaining the demand for uranium at current levels and future growth in demand will depend upon acceptance of nuclear technology as a means of generating electricity. Incidents involving nuclear energy production, such as overheating reactors, radiation leaks and reactor melt-downs, can cause a significant decrease in public acceptance of nuclear technology and uranium prices. Lack of public acceptance of nuclear technology would adversely affect the demand for nuclear power and likely increase the regulation of the nuclear power industry.

Government regulation of uranium mining and processing may adversely affect our ability to commence and expand our operations.

Exploration, mining and processing operations are subject to federal, state, and local laws relating to prospecting, development, production, exports, taxes, labor standards, occupational health, waste disposal, protection and remediation of the environment, including the removal of natural resources from the ground and the discharge of materials into the environment, protection of endangered and protected species, protection of cultural properties, mine safety, toxic substances and other matters. Uranium mining operations are also subject to federal, state, and local laws and regulations which seek to maintain health and safety standards by regulating the design and use of mining methods and equipment. Various permits from government bodies are required for mining operations to be conducted; no assurance can be given that such permits will be received. Environmental standards imposed by federal, state, or local authorities may be changed and any such changes may have material adverse effects on our activities. Moreover, compliance with such laws may cause substantial delays or require capital outlays in excess of those anticipated, thus resulting in an adverse effect on us. Additionally, we may be subject to liability for pollution or other environmental damages which we may elect not to insure against due to prohibitive premium costs and other reasons. To date, we have not been required to spend material amounts on compliance with environmental regulations because our exploration activities to date have been minimal. As we continue to proceed with our exploration activities, and if we move into development and production, however, we will be required to spend material amounts on compliance with environmental regulations in the future and this may affect our ability to commence or maintain our operations. Compliance with these laws and regulations will impose substantial costs on us and will subject us to significant potential liabilities.

Compliance with environmental laws and regulations may increase our costs and reduce our revenues.

Uranium exploration and development and future potential uranium mining and processing operations are or will likely be subject to stringent federal, state and local laws and regulations relating to improving or maintaining environmental quality. Failure to comply with these laws and regulations may trigger a variety of administrative, civil and criminal enforcement measures, including the assessment of monetary penalties, the imposition of remedial requirements, and the issuance of orders enjoining future operations. Certain environmental statutes impose strict, joint and several liabilities for costs required to clean up and restore sites where hazardous substances have been disposed or otherwise released. Environmental laws also may impose liability with respect to divested or terminated operations, even if the operations were terminated or divested of many years ago. In addition, certain types of operations require the preparation of environmental assessments and environmental impact statements in conjunction with governmental decision-making. Compliance with environmental laws and regulations will impose substantial costs on us and will subject us to significant potential liabilities. Further, environmental legislation is evolving in a manner which means stricter standards and enforcement, and more stringent fines and penalties for non-compliance. This recent trend includes, without limitation, laws and regulations relating to air and water quality, mine reclamation, waste handling and disposal, the protection of certain species and the preservation of certain lands. These regulations may require the acquisition of permits or other authorizations for certain activities. These

12

laws and regulations may also limit or prohibit activities on certain lands. Compliance with more stringent laws and regulations, as well as potentially more vigorous enforcement policies or stricter interpretation of existing laws, may necessitate significant capital outlays, may materially affect our results of operations and business, or may cause material changes or delays in our intended activities. Costs associated with environmental liabilities and compliance are expected to increase with the increasing scale and scope of our current and planned future activities. We expect these costs may increase in the future. We are not fully insured at the current date against possible environmental risks.

Future changes in the law may adversely affect our ability to profitably extract uranium deposits.

The laws, regulations, policies or current administrative practices of any government body, organization or regulatory agency in the United States or any other applicable jurisdiction, may be changed, applied or interpreted in a manner which will fundamentally alter our ability to carry on our business. We cannot predict what legislation, regulation or policy will be enacted or adopted in the future or how future laws or regulations will be administered or interpreted. The actions, policies or regulations, or changes thereto, of any government body or regulatory agency, or other special interest groups, may have a detrimental effect on us and our ability to operate.

Members of the U.S. Congress have repeatedly introduced bills which would supplant or alter the provisions of the Mining Law of 1872. Several proposals would, if enacted, impose a royalty payable to the U.S. Government on existing and future production of minerals from unpatented mining claims in the United States. If enacted, such legislation could change the cost of holding and conducting operations on unpatented mining claims and could significantly impact our ability to develop mineralized material on unpatented mining claims. Such bills have also proposed, among other things, to either eliminate or greatly limit the right to a mineral patent. Enactment of any of such bills could adversely affect the potential for development of such mining claims and the economics of existing operating mines on federal unpatented mining claims. Passage of such legislation could adversely affect our financial performance.

Members of the State of New Mexico legislature have repeatedly introduced bills which would impose strict liability on landowners and operators, including successor liability, for environmental contamination resulting from uranium mining activities. If enacted, such legislation could greatly affect our ability to secure mining properties and we may be responsible for all or part of the costs to clean up contaminated facilities or properties.

We may not be able to obtain all permits and licenses necessary to operate and expand our business.

Various permits and licenses from government bodies are required for exploration, mining and processing operations to be conducted. There can be no assurance that we will be able to obtain or maintain all necessary permits and licenses that may be required to continue the exploration of our properties or to commence development, construction or operation of mining and processing facilities at such properties on terms which enable operations to be conducted at economically justifiable costs. The failure to obtain necessary permits and licenses would impair our ability to pursue our business plan. For example, an NRC license is required to build and operate a mill. In order to obtain such a license, we must demonstrate that we can deed a fee interest in the relevant property to the NRC. However, we hold only a leasehold interest on a significant portion of our mineral properties without the right to purchase such properties. There is no guarantee that we will be able to obtain a fee interest in such properties and therefore we may not be able to obtain the required licensing to build and operate a mill if commercially viable mineral deposits are identified.

Various permits and licenses from federal, state and local government bodies are required for exploration, mining and milling operations to be conducted. Certain governmental agencies may have

13

limited personnel with experience permitting uranium exploration, mining and milling operations, which may result in delays in issuing the permits required for the Company to conduct its operations.

Energy and mineral development on Native American lands or activities otherwise deemed to be located within areas known as Indian country, may be subject to principles of Indian law or tribal law. The legal environment in Indian country can be materially different with respect to law and regulations relating to how development rights must be acquired and the legal standards applicable to performance under agreements. For example, by Resolution dated April 21, 2005, the Navajo Nation Council adopted the Diné Natural Resources Protection Act of 2005 which provides, in summary, that "no person shall engage in uranium mining and uranium processing on any sites within Navajo Indian Country." Generally speaking, primary jurisdiction over land that is Indian country rests with the Federal government and the Indian tribe inhabiting it and not with the States. Application of Indian law or tribal law may result in significantly longer permitting processes, unique approval requirements and restrictions involving the use of Native American lands.

Risks Related to Our Common Stock

There has been no prior public market for our common stock and an active market may not develop or be maintained, which could limit your ability to sell our common stock. Even if a market does develop, the stock prices in the market may not exceed the offering price.

Prior to this initial public offering, there has not been a public market for our common stock. Although we are applying for listing on and the Toronto Stock Exchange ("TSX"), an active public market for shares of our common stock may not develop or continue. We cannot predict the extent to which investor interest in our company will lead to the development of an active trading market on , TSX or otherwise, or how liquid that market may become. If an active trading market does not develop, you may have difficulty selling shares of common stock that you buy.

The initial public offering price will be determined by negotiations between us and the underwriters and may not be representative of the market price at which our common stock will trade after this offering. In particular, we cannot assure you that you will be able to resell our common stock at or above the initial public offering price.

The market price and volume of our common stock may be volatile, which could cause the value of your investment to decline.

The market price and volume of our common stock may fluctuate as a result of our performance or events pertaining to the industry as well as factors unrelated to us or our industry. Many of these factors are outside of our control. Fluctuations in the market price of our common stock may be caused a number of factors, including (i) disappointing results from our discovery or development efforts; (ii) failure to meet our revenue or profit goals or operating budget; (iii) a decline in demand for our common stock; (iv) downward revisions in securities analysts' estimates or changes in general market conditions; (v) technological innovations by competitors or in competing technologies; (vi) a lack of funding generated for operations; (vii) investor perception of our industry or our prospects; (viii) general economic trends; (ix) the market for uranium; (x) the demand for nuclear energy; (xi) governmental regulation that may materially adversely affect the attractiveness of nuclear energy; (xii) public acceptance of nuclear energy; and (xiii) other factors described in this prospectus. Variations in any of these factors could cause significant fluctuations in the market price of our common stock. In recent years, the securities markets in the United States have experienced a high level of price and volume volatility, and the market price of securities of many companies, particularly small-capitalization companies, have experienced wide fluctuations that have not necessarily been related to the operations, performances, underlying asset values, or prospects of such companies.

14

If securities or industry analysts do not publish research or reports about us, our business or our market, or if they adversely change their recommendations regarding our common stock, our common stock price and trading volume could decline.

The trading market for our common stock is influenced by the research and reports that industry and securities analysts publish about us, our business and our market. If one or more of the analysts who cover us change their recommendation regarding our common stock adversely, our common stock price would likely decline. If one or more of these analysts cease coverage of our company or fail to regularly publish reports on us, we could lose visibility in the financial markets, which in turn could cause our common stock price or trading volume to decline.

A decline in the price of our common stock could affect our ability to raise further working capital and adversely impact our operations.

A decline in the price of our common stock could result in a reduction in the liquidity of our common stock and a reduction in our ability to raise additional capital for our operations. Because our operations to date have been principally financed through the sale of equity securities, a decline in the price of our common stock could have an adverse effect upon our liquidity and our continued operations. Any reduction in our ability to raise equity capital in the future would have a material adverse effect upon our business plan and operations, including our ability to continue our current operations. If our stock price declines, we may not be able to raise additional capital or generate funds from operations sufficient to meet our obligations.

The issuance of additional securities could adversely affect the rights of our stock holders

Our articles of incorporation authorize the issuance of 200,000,000 shares of common stock. We are also authorized to issue 10,000,000 shares of preferred stock. Our Board of Directors has the authority to issue additional shares of our capital stock without stockholder approval to provide additional financing in the future and the issuance of any such shares may result in a reduction of the book value or market price of the outstanding shares of our common stock. Our preferred stock is blank check in that our Board of Directors can set the terms and conditions of the preferred stock without stockholder approval. The issuance by us of additional equity securities of equal or senior rank to our common stock may have the following effects: decrease our stockholders' proportionate ownership interest in us, diminish the relative voting strength of each previously issued and outstanding share of common stock or cause the market price of our common stock to decline. In addition, an issuance of additional stock could have a negative impact on the trading price of our shares of common stock.

The issuance of additional securities, including common stock pursuant to options and warrants, would dilute the interest of stockholders

We have authorized an aggregate of between 7,300,000 and 9,300,000 shares of common stock under our 2006 Plan, 2007 Plan and 2011 Plan. As of March 24, 2011, we have granted (i) options to purchase an aggregate 6,291,666 shares of our common stock that are currently outstanding, and (ii) 250,000 shares of common stock as unrestricted stock awards under our 2006 Plan, 2007 Plan and 2011 Plan. We have outstanding warrants to purchase 3,051,744 shares of common stock and are obligated to issue such additional warrants as is necessary for the warrant holder to own 5%, calculated on a partially diluted basis, of our issued and outstanding common stock, up to a maximum of 4,262,541 additional shares, of which we expect to issue an additional warrant to purchase approximately shares of our common stock as a result of this offering. We also expect to issue warrants to the underwriters to purchase an aggregate of shares of our common stock in connection with this offering. Furthermore, our management's plans to finance our exploration and development costs and acquisition activities include financing through future sales of our equity or debt

15

securities. To the extent that we issue any additional securities or outstanding stock options and warrants are exercised, dilution to the interests of our stockholders would occur.

Purchasers in this offering will experience immediate and substantial dilution in net tangible book value per share of common stock.

The initial public offering price per share of common stock is expected to be substantially higher than the net tangible book value per share of our outstanding common stock. Purchasers of shares of common stock in this offering will experience immediate dilution in the net tangible book value of their shares. Based on an assumed initial public offering price of $ per share, dilution per share in this offering will be $ per share (or % of the initial public offering price). See the section of this prospectus entitled "Dilution" for additional information.

You may lose your entire investment in our shares.

An investment in our common stock is highly speculative and may result in the loss of your entire investment. Only investors who are experienced investors in high risk investments and who can afford to lose their entire investment should consider an investment in us.

We have not paid cash dividends on our common stock and do not anticipate paying any dividends on our common stock in the foreseeable future.

We anticipate that we will retain all future earnings and other cash resources for the future operation and development of our business. Accordingly, we do not intend to declare or pay any cash dividends on our common stock in the foreseeable future. Payment of any future dividends will be at the discretion of our Board of Directors after taking into account many factors, including our financial conditions, current and anticipated cash needs and plans for exploration and development of our uranium properties.

The Financial Industry Regulatory Authority, or FINRA, sales practice requirements may limit a stockholder's ability to buy and sell our stock.

The FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer's financial status, tax status, investment objectives and other information. Under interpretations of these rules, the FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. The FINRA requirements may make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares.

Gain recognized by non-U.S. stockholders on the sale or other disposition of shares of our common stock may be subject to U.S. federal income tax.

We believe that we are currently a "U.S. real property holding corporation" under section 897(c) of the Internal Revenue Code ("USRPHC") and there is a substantial likelihood that we will continue to be a USRPHC. Generally, gain recognized by a non-U.S. holder on the sale or other disposition of our common stock will be subject to U.S. federal income tax on a net income basis at normal graduated U.S. federal income tax rates if we are a USRPHC at any time during the 5-year period ending on the date of the sale or disposition of the common stock (or the non-US holder's holding period for the common stock if shorter). Under an exception to these USRPHC rules, if the common stock is "regularly traded" on an "established securities market," the common stock will not be treated

16

as a USRPHC. This exception is not available, however, to a non-U.S. holder that held or was deemed to hold, directly or under certain constructive ownership rules, more than 5% of the common stock at any time during the 5-year period ending on the date of the sale or other disposition (or the non-U.S. holder's holding period of the common stock if shorter).

We will incur increased costs as a result of being a publicly-traded company.

We have no history of operating as a publicly-traded company. As a publicly-traded company, we will incur significant legal, accounting and other expenses that we would not incur as a private company. We will become subject to the Sarbanes-Oxley Act of 2002, as well as related rules implemented by the SEC, and TSX, which will increase our legal and financial compliance costs and require us to devote additional management time and resources to these compliance matters. For example, as a result of becoming a publicly-traded company, we will be required to have at least three independent directors, create additional board committees and adopt policies regarding internal controls and disclosure controls and procedures, including the preparation of reports on internal control over financial reporting. In addition, we will incur additional costs associated with our publicly-traded company reporting requirements.

We will not be fully subject to the requirements of Section 404 of the Sarbanes-Oxley Act of 2002 until the end of 2012. If we fail to maintain an effective system of internal controls, we may not be able to accurately report our financial results or prevent fraud and, as a result, our business could be harmed and current and potential stockholders could lose confidence in us, which could cause our stock price to fall.

We will be required to document our system and process evaluation and testing (and any necessary remediation) to comply with the management certification and auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, which we expect will first apply to us for our fiscal year ended December 31, 2012. As a result, we expect to incur substantial additional expenses and diversion of management's time. We cannot be certain as to the timing of completion of our evaluation, testing and remediation actions or their effect on our operations. If we are not able to implement the requirements of Section 404 in a timely manner or with adequate compliance, we may not be able to accurately report our financial results or prevent fraud and might be subject to sanctions or investigation by regulatory authorities, such as the SEC, or TSX. Any such action could harm our business or investors' confidence in us, and could cause our stock price to fall.

Certain regulations and legislation associated with being a publicly-traded company, including the Sarbanes-Oxley Act of 2002, may make it difficult for us to retain or attract officers and directors.

We may be unable to attract and retain qualified officers, directors and members of board committees required to provide for our effective management as a result of the recent and currently proposed changes in the rules and regulations which govern publicly-held companies. The Sarbanes-Oxley Act of 2002 has resulted in a series of rules and regulations by the SEC that increased responsibilities and liabilities of directors and executive officers. The increased personal risk associated with these changes may deter qualified individuals from accepting these roles. As a public company, we expect that it will be more difficult and expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified persons to serve on our Board of Directors or as executive officers. We will incur significant incremental costs per year associated with being a publicly-traded company.

17

Provisions in our Articles of Incorporation, Bylaws and Nevada law may make it more difficult to effect a change in control, which could adversely affect the price of our common stock.

Provisions of our Articles of Incorporation, Bylaws and Nevada law could make it more difficult for a third party to acquire us, even if doing so would be beneficial to our stockholders. We may issue shares of preferred stock in the future without stockholder approval and upon such terms as our Board of Directors may determine. Our issuance of this preferred stock could have the effect of making it more difficult for a third party to acquire, or of discouraging a third party from acquiring a majority of our outstanding stock and potentially prevent the payment of a premium to stockholders in an acquisition.

Furthermore, our Bylaws include provisions that exclude stockholders from parties entitled to call special meetings, give the Board of Directors the exclusive right to fill all Board of Director vacancies, and require advance notice of stockholder proposals and specific information regarding director nominees. These provisions could discourage proxy contests and make it more difficult for stockholders to elect directors and take other corporate actions. As a result, these provisions could make it more difficult for a third party to acquire us, even if doing so would benefit our stockholders, and may limit the price that investors are willing to pay in the future for shares of our common stock.

We are also subject to Title 7, Chapter 78 of the Nevada Revised Statutes (the "Nevada Corporations Act") that, subject to certain exceptions, prohibits business combinations with persons owning 10% or more of the voting shares of a corporation's outstanding stock for three years following the date that person became an interested stockholder, unless the combination is approved by the Board of Directors prior to the person owning 10% or more of the stock and after the expiration of the three year period, any such business combination would be subject to special stockholder approval requirements or various fair price criteria. This provision could deprive our stockholders of an opportunity to receive a premium for their common stock as part of a sale of our company or may otherwise discourage a potential acquirer from attempting to obtain control from us, which in turn could have a material adverse effect on the market price of our common stock.

Nevada law and our Articles of Incorporation and Bylaws may protect our directors from certain types of lawsuits.

Nevada law and our Articles of Incorporation provide that our officers and directors will not be liable to us or our stockholders for monetary damages for all but certain types of conduct as officers and directors. Our Bylaws generally provide for indemnification of directors, officers, employees, agents and certain other individuals against all damages incurred in connection with our business to the fullest extent permitted by law. While we currently maintain director and officer liability insurance, such insurance contains exclusions and limitations on coverage and we may be required to use our limited assets to defend or indemnify such individuals on any amounts that fall outside of such insurance coverage.

18

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS