Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2010

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________ to ________

Commission file number 1-10006

(Exact name of registrant as specified in its charter)

|

TEXAS

(State or other jurisdiction of incorporation or organization)

|

75-1301831

(I.R.S. Employer Identification No.)

|

|

|

1145 EMPIRE CENTRAL PLACE, DALLAS, TEXAS

(Address of principal executive offices)

|

75247-4305

(Zip Code)

|

Registrant's telephone number, including area code: (214) 630-8090

|

Title of Each Class

|

Name of Each Exchange on Which Registered

|

|

|

i) Common Stock $1.50 par value

ii) Rights to purchase Common Stock

|

The NASDAQ Stock Market LLC

(NASDAQ Global Select Market)

|

Securities registered pursuant to Section 12(g) of the Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act: Yes [ ] No [ X ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act: Yes [ ] No [ X ]

Indicate by check mark whether the registrant (l) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ X ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or smaller reporting company. See the definition of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [X] Smaller reporting company [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

The aggregate market value of 15,533,815 shares of the registrant’s $1.50 par value common stock held by non-affiliates as of June 30, 2010 was approximately $54,368,353 (based upon $3.50 per share).

As of March 25, 2011, the number of outstanding shares of the registrant’s common stock was 17,565,467.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's Annual Report to Stockholders for the year ended December 31, 2010 and Proxy Statement for use in connection with its Annual Meeting of Stockholders to be held on May 18, 2011, to be filed with the Securities and Exchange Commission pursuant to Regulation 14A not later than 120 days after December 31, 2010, are incorporated by reference in Part III (Items 10, 11, 12, 13 and 14).

i

TABLE OF CONTENTS

|

PAGE

|

||

|

Business

|

1

|

|

|

Risk Factors

|

9

|

|

|

Unresolved Staff Comments

|

12

|

|

|

Properties

|

12

|

|

|

Legal Proceedings

|

13

|

|

|

Removed and Reserved

|

13

|

|

|

Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

13

|

|

|

Selected Financial Data

|

15

|

|

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

15

|

|

|

Quantitative and Qualitative Disclosures about Market Risk

|

29

|

|

|

Financial Statements and Supplementary Data

|

29

|

|

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

45

|

|

|

Controls and Procedures

|

45

|

|

|

Other Information

|

45

|

|

|

Directors and Executive Officers and Corporate Governance

|

46

|

|

|

Executive Compensation

|

46

|

|

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

47

|

|

|

Certain Relationships and Related Transactions, and Director Independence

|

47

|

|

|

Principal Accountant Fees and Services

|

47

|

|

|

Exhibits and Financial Statement Schedules

|

47

|

|

|

48

|

||

|

49

|

ii

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains information and forward-looking statements that are based on management's current beliefs and expectations and assumptions we made based upon information currently available. Such statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Any statements not of historical fact may be considered forward-looking statements. Forward-looking statements include statements relating to our plans, strategies, objectives, expectations, intentions and adequacy of resources and may be identified by words such as “will”, “could”, “should”, “believe”, “expect”, “intend”, “plan”, “schedule”, “estimate”, “project” or other variations of these or similar words, identify such statements. These statements are based on our current expectations and are subject to uncertainty and change.

Although we believe the expectations reflected in such forward-looking statements are reasonable, actual results could differ materially from the expectations reflected in such forward-looking statements. Should one or more of the risks or uncertainties underlying such expectations not materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those we expect.

Factors that are not within our control that could cause actual results to differ materially from those in such forward-looking statements include demand for our services and products, and our ability to meet that demand, which may be affected by, among other things, competition, weather conditions and the general economy, the availability and cost of labor and owner-operators, our ability to negotiate favorably with lenders and lessors, the effects of terrorism and war, the availability and cost of equipment, fuel and supplies, the market for previously-owned equipment, the impact of changes in the tax and regulatory environment in which we operate, operational risks and insurance, risks associated with the technologies and systems we use and the other risks and uncertainties described in Item 1A, Risk Factors of this report and risks and uncertainties described elsewhere in our filings with the Securities and Exchange Commission (“SEC”). We undertake no obligation to correct or update any forward-looking statements, whether as a result of new information, future events, or otherwise.

References in the Annual Report to “we”, “us”, “our”, or the Company or similar terms refer to Frozen Food Express Industries, Inc. and it’s consolidated subsidiaries unless the context otherwise requires.

ITEM 1. Business

OVERVIEW

Frozen Food Express Industries, Inc. is one of the leading providers of temperature-controlled truckload and less-than-truckload services in the United States with operations in the transport of temperature-controlled products and perishable goods including food, health care and confectionary products. Transportation services are offered in over-the-road and intermodal modes for temperature-controlled truckload and less-than-truckload, as well as dry truckload. We also provide brokerage, or logistics services, including ocean, air, and both domestic and international expedited services, as well as dedicated fleets to our customers.

We were incorporated in Texas in 1969, as successor to a company formed in 1946. Our principal office is located at 1145 Empire Central Place, Dallas, Texas 75247-4305. Our telephone number is (214) 630-8090 and our website is www.ffeinc.com.

Our growth strategy is to expand our business internally by offering shippers a high level of service with flexible shipping capacity. We market our temperature-controlled truckload services primarily to large shippers that require consistent freight capacity within our preferred lanes, desire the high service level we provide and understand the pricing necessary to support these service levels. We market our temperature-controlled less-than-truckload services to shippers who need the flexibility to ship varying quantities based upon scheduled departure and delivery times. Our fleet of company and independent contractor tractors allows us to offer a high quality of service and on-time performance within tight time windows at stringent temperature standards.

1

Our services are further described below:

|

·

|

TRUCKLOAD (“TL”) LINEHAUL SERVICE: This service provides for the shipment of a load, typically weighing between 20,000 and 40,000 pounds and usually from a single shipper, which fills the trailer. Normally, a truckload shipment has a single destination, although we are also able to provide multiple stop deliveries. We are one of the largest temperature-controlled truckload carriers in the United States.

|

|

·

|

DEDICATED FLEETS: This service provides trucks and drivers to handle certain of our customers’ transportation needs, including guaranteed year-round capacity without the capital investment, insurance risks and equipment utilization issues of private fleets. Providing this service allows our customers to eliminate all or a portion of their internal dedicated fleet to lower their customers’ transportation costs and improve the quality of service.

|

|

·

|

LESS-THAN-TRUCKLOAD ("LTL") LINEHAUL SERVICE: This service provides for the shipment of a load, typically consisting of up to 30 shipments, which may weigh as little as 50 pounds or as much as 20,000 pounds, from multiple shippers destined to multiple locations. Our temperature-controlled LTL operation is the largest in the United States and the only one offering regularly scheduled nationwide service. In providing temperature-controlled LTL service, multi-compartment trailers enable us to haul products requiring various levels of temperatures in a single load.

|

|

·

|

BROKERAGE: Our brokerage services help us to balance the level of demand in our core business. Orders for shipments to be transported for which we have no readily available transportation assets are assigned to other unaffiliated motor carriers through our brokerage service. Our services also include ocean, air, and both domestic and international expedited services. We establish the price to be paid by the customer, invoice the customer and pay the service provider. We also assume the credit risk associated with the transaction.

|

|

·

|

EQUIPMENT RENTAL: Revenue from equipment rental includes amounts we charge to independent contractors for the use of trucks we own and lease to them. We also lease refrigerated trailers for the storage and transportation of perishable items as needed by our customers.

|

The following table summarizes and compares the components of our revenue for each of the years in the five-year period ended December 31, 2010:

|

(in thousands)

|

||||||||||||||||||||

|

Revenue from:

|

2010

|

2009

|

2008

|

2007

|

2006

|

|||||||||||||||

|

Truckload linehaul services

|

$

|

171,392

|

$

|

187,234

|

$

|

214,348

|

$

|

212,416

|

$

|

237,464

|

||||||||||

|

Dedicated fleets

|

17,467

|

19,707

|

24,609

|

17,861

|

21,121

|

|||||||||||||||

|

Less-than-truckload linehaul services

|

110,467

|

109,054

|

124,091

|

127,438

|

129,764

|

|||||||||||||||

|

Fuel surcharges

|

57,410

|

44,876

|

109,144

|

73,391

|

75,084

|

|||||||||||||||

|

Brokerage

|

6,798

|

7,266

|

13,142

|

15,586

|

12,506

|

|||||||||||||||

|

Equipment rental

|

5,288

|

4,914

|

5,202

|

5,522

|

7,782

|

|||||||||||||||

|

Total revenue

|

$

|

368,822

|

$

|

373,051

|

$

|

490,536

|

$

|

452,214

|

$

|

483,721

|

||||||||||

Additional information regarding our business is presented in the Notes to Consolidated Financial Statements included in Item 8 and in Management's Discussion and Analysis of Financial Condition and Results of Operations in Item 7 of this Annual Report on Form 10-K.

Temperature-controlled transportation: The products we haul include meat, ice, poultry, seafood, processed foods, candy and other confectionaries, dairy products, pharmaceuticals, medical supplies, fresh and frozen fruits and vegetables, cosmetics, film and Christmas trees. In the temperature-controlled market, it may be necessary to keep freight frozen, as with ice; to keep freight cool, as with candy; or to keep freight from freezing. The common and contract hauling of temperature-sensitive cargo is highly fragmented and comprised primarily of carriers generating less than $70 million in annual revenue. In addition, many major food companies, food distribution firms and grocery chain companies transport a portion of their freight with their own fleets.

2

Non-temperature-controlled transportation: Our non-temperature-controlled (“dry”) trucking services accounted for approximately 28.7% of our full-truckload revenue in 2010. The Company serves the dry truckload market throughout the United States, Mexico and Canada.

Intermodal transportation: In providing our truckload linehaul service, we often engage railroads to transport shipments between major cities. In such an arrangement, loaded trailers are transported to a rail facility and placed on flat rail cars for transport to their destination. Upon arrival, we pick up the trailer and deliver the freight to the consignee. Intermodal service is a cost effective way of providing service in major truckload markets that do not have restrictive service requirements that would limit the ability to rely on intermodal rail service.

MARKETING AND OPERATIONS

Our temperature-controlled and non-temperature-controlled trucking operations serve nearly 4,400 customers in the United States, Mexico and Canada. Revenue from international activities was approximately 2% of total operating revenue during each of the past five years.

Fiscal years 2009 and 2010 provided significant economic challenges for us and the transportation industry as a whole. Due to continuing economic uncertainty, demand for freight services was inconsistent, both month-to-month and quarter-to-quarter, causing mixed financial results. While overall truckload capacity has shrunk, creating an environment for improved freight rates and pricing concessions by shippers remains very much route and seasonally sensitive. We strive to provide high service levels at a value added price to our customers as opposed to competing with low cost, low service providers. Our marketing efforts target shippers requesting premium service, reliable capacity, and value added service options. We market mainly temperature controlled truckload, less-than-truckload, intermodal, and logistics services, but also provide non-temperature controlled truckload, intermodal and logistics services, all focused on value added services and pricing. Due to the decline in industry-wide truckload capacity, pricing for our truckload and intermodal services has been more favorable to us. However, improved pricing for the LTL market continues to be challenging and route specific, as well as more seasonally influenced.

Excluding fuel surcharges, temperature-controlled shipments account for about 83% of our total operating revenue. Our customers are involved in a variety of products including food products, pharmaceuticals, medical supplies and household goods. Our customer base is diverse in that our top 5, 10 and 20 largest customers accounted for 26%, 37% and 48%, respectively, of our total operating revenue during 2010. None of our markets are dominated by any single competitor nor did any customer account for more than 10% of total operating revenue during any of the past five years. We compete with several hundred other trucking companies. The principal methods of competition are price, quality of service and availability of equipment needed to satisfy customer needs.

Our marketing efforts are conducted by a staff of dedicated sales, customer service and support personnel under the supervision of our senior management team. Sales personnel travel within assigned regions to solicit new customers and maintain contact with existing customers. We also have an enterprise sales force team that focuses primarily on large LTL and truckload temperature-controlled shippers. Additionally, we market and sell our brokerage services from our corporate sales and service office in Dallas, Texas. Our brokerage and logistics services include temperature-controlled, dry van and other specialized needs of our customers not typically offered by other carriers, including ocean, air, and expedited domestic and international services.

Our operations personnel strive to improve our asset utilization by seeking freight that allows for efficient and timely use of assets, minimizes empty miles, carries a value added rate structure and allows our drivers to remain within our preferred network of lanes. Once we have established a relationship with a customer, customer service managers work closely with our fleet managers to match the customer’s needs with our capacity. Load planners or dispatchers utilize various optimization solutions to assign loads in ways that meet our customers’ needs and provide the most efficient use of our assets. We attempt to route most of our trucks over preferred lanes, which we believe assists us in meeting our customer’s needs, balancing traffic, reducing empty miles and improving the reliability of our delivery schedules. Within our LTL services, we provide for regularly scheduled pick-up and delivery times so our customers can depend upon a pre-existing schedule.

DRIVERS AND OTHER PERSONNEL

We select drivers using specific guidelines for safety records, background information, driving experience and personal evaluations. We believe that maintaining a safe and professional driver group is essential to providing excellent customer service, safer roads for others and achieving profitability. We maintain stringent screening, training and testing procedures for our drivers to reduce the risk for accidents and thereby controlling our insurance and claims cost. We train our drivers at our service centers in all phases of our policies and operations including safety techniques, fuel-efficient operation of the equipment, and customer service. We also offer computer and audio based training through our website. All drivers must also pass United States Department of Transportation (“DOT”) required tests prior to commencing employment.

3

Toward the end of the first quarter of 2010, we began to experience the tightening of freight capacity as the expected driver shortage began to manifest itself. The loss of independent contractors, closure of small trucking firms, and the layoff of drivers from larger trucking firms has greatly altered the industry landscape compared to that of 2009. The overcapacity created during the economic downturn of 2008 and 2009 has been reversed in the truckload market and carriers are competing to find qualified drivers. As the economy strengthens, the driver shortage will become more critical to the shipping industry, which will drive freight rates up. This occurred to a limited degree in 2010.

At December 31, 2010 we had 1,572 company drivers and 304 independent contractors. Our turnover for company drivers was approximately 84%. We find that if we can retain a driver beyond the first 12 months, we have a much better opportunity to retain that driver for a longer period of time. We pay our company drivers on a fixed rate per mile basis and the independent contractors either a percentage of the earned revenue or on a per mile basis.

We actively seek to expand our fleet with equipment provided by independent contractors. These independent contractors provide tractors to pull our loaded trailers. We generally utilize the independent contractors based upon our existing capacity and the needs of our customers as those needs increase or decrease. At the end of 2010, we had 138 independent contractors providing truckload services and 166 providing LTL services. This compares to December 31, 2009, when we had 192 independent contractors providing truckload services and 197 providing LTL services. Each independent contractor pays for their driver wages, fuel, equipment related expenses and other transportation costs. We bill the customer and pay the independent contractor upon proof of delivery to the destination. The Company assumes the credit risk with the customer and provides all customer support.

At December 31, 2010, we had 2,286 employees. This consists of 1,572 drivers, 503 field and operations personnel and 211 sales, general and administrative employees. This compares to December 31, 2009, when we had 1,505 drivers, 462 field and operations personnel and 220 sales and general and administrative employees. None of our employees are represented by a collective bargaining unit, and we consider relations with our employees to be good. The increase in personnel in 2010 was caused by a focus on driver recruiting and retention in our truckload operations.

FUEL

We are dependent on diesel fuel for our transportation services and our customers and we are impacted by the volatility of fuel prices. The price and availability of diesel fuel can vary significantly and are subject to political, economic and market factors that are beyond our control. While we do not hedge our exposure to volatile energy prices, we attempt to minimize our exposure by buying in bulk in Dallas and at various facilities throughout the country. In addition, we negotiate nationwide volume purchasing arrangements for our drivers in transit. During 2010, approximately 93.1% of our fuel purchases were made within this national network.

We further manage the price volatility through fuel surcharge programs with our customers. Fuel surcharge programs are intended to offset the increased fuel expenses we incur when prices escalate. The Company adjusts fuel surcharge factors on a weekly basis; however, it may not fully recover price increases in the preceding week. We have historically been able to pass through most long-term increases in fuel in the form of surcharges to our customers. Net fuel prices per gallon increased approximately 20% compared to 2009, but not with the volatility we witnessed in 2008. Nevertheless, in the current economy, shippers continued to be resistant to fuel surcharge programs.

Factors that could prevent us from fully recovering fuel cost increases include the competitive environment, empty miles, out-of-route miles, tractor engine idling and fuel to power our trailer refrigeration units. Such fuel consumption often cannot be attributed to a particular load and therefore, there is no incremental revenue to which a fuel surcharge may be applied.

In most years, states increase fuel and road use taxes. Our recovery of future increases or realization of future decreases in fuel prices and fuel taxes, if any, will continue to depend upon competitive freight market conditions.

4

INSURANCE AND CLAIMS

We self-insure for a portion of our claims exposure resulting from workers’ compensation, auto liability, general liability, cargo and property damage claims and employees’ health insurance. We are also responsible for our proportionate share of the legal expenses related to such claims. We reserve currently for anticipated losses and related expenses and periodically evaluate and adjust our insurance and claims reserves to reflect our experience. We are responsible for the first $4.0 million on each auto and general liability claim and $300,000 for employees’ health claims. We are also responsible for the first $1.0 million for workers’ compensation claims generated outside of Texas and for $500,000 on work injury claims filed in Texas. We have a separate policy in the state of New Jersey as required by statute with a $500,000 deductible. We are fully insured for auto and general liability exposures between $4.0 million and $50.0 million. We are fully insured between our retention of $500,000 and $1.5 million for Texas work injury claims and between our retention of $1.0 million and state statutory limits for workers’ compensation claims outside of Texas. We have a $300,000 stop-loss retention on employee health claims. As of March 25, 2011, we have $4.6 million in standby letters of credit to guarantee settlement of claims under agreements with our insurance carriers and regulatory authorities.

Insurance rates have proven to be influenced by events outside of our Company’s control. As a result, our insurance and claims expense could increase, or we could raise our self-insured retention when our policies are renewed in June 2011. Our risk management program is founded on the continual enhancement of safety in our operations. Our safety department conducts programs that include driver education and over-the-road observation and requires that drivers meet or exceed specific safety guidelines, driving experience, drug testing and physical examinations. Up to this point, we have not found the current economic climate to negatively impact our insurance programs as they relate to premiums. However, we have found that some of our insurance providers continue to look for additional opportunities to increase their revenues, which have created additional insurance expense.

Our insurance and claims accruals represent our estimate of ultimate claims outcomes and are established based on the information available at the time of an incident. As additional information regarding the incident becomes available, any necessary adjustments are made to previously recorded amounts, including any expenses related to the incident. We use recommendations from an independent actuary to assist in developing reserve amounts.

INFORMATION TECHNOLOGY

The demanding shipping requirements of today’s world creates a need for continued investment in information technology to maintain a successful temperature-controlled trucking operation. In 2010, we handled approximately 124,000 truckload and 257,000 LTL shipments. These shipments are tracked for quality and service reasons. Our technology continues to advance and provides improved tracking systems, driver communication and routing systems and driver safety systems. Additionally, federal regulations continue to create demand for new systems such as electronic driver log systems.

Our truckload and LTL fleets use computer and satellite technology to enhance efficiency and customer service. The mobile communications system provides automatic position updates of each truckload tractor and permits real-time communication between operations personnel and drivers. Dispatchers relay pick-up, delivery, weather, road conditions and other information to the drivers while shipment status updates. Drivers relay other information to our computers via mobile communications.

The Company has also invested in the following technology that we believe allows us to operate more efficiently:

|

·

|

Freight optimization software that assists us in selecting loads that match our overall criteria, including profitability, repositioning, identifying capacity for expedited loads, driver availability and home time, and other factors;

|

|

·

|

Fuel-routing software that optimizes the fuel stops for each trip to take advantage of volume discounts available in our national fuel network;

|

|

·

|

Electronic data interchange and internet communication with various customers concerning freight tendering, invoices, shipment status and other information;

|

|

·

|

Costing software that allows us to develop the appropriate pricing to our customers and to determine the profitability of specific moves; and

|

|

·

|

Trailer tracking devices utilizing global positioning system technology, which provides product traceability and desktop control of the refrigerated trailers.

|

5

REVENUE EQUIPMENT

We operate premium company-owned tractors in order to help attract and retain qualified employee-drivers, promote safe operations, minimize repair and maintenance costs and ensure dependable service to our customers. We believe the higher initial investment for our equipment is recovered through more efficient vehicle performance offered by such premium tractors and improved resale value. Major repair costs are mostly recovered through manufacturers' warranties, but routine and preventative maintenance is our responsibility.

Changes in the size of our fleet depend upon developments in the nation's economy, demand for our services and the availability of qualified drivers. Continued emphasis will be placed on improving the operating efficiency and increasing the utilization of the fleet through enhanced driver training and retention and reducing the percentage of empty, non-revenue producing miles.

As of December 31, 2010, we operated a fleet of 1,803 tractors, including 1,499 company-owned tractors and 304 tractors supplied by independent contractors. The average age of our tractors was approximately 2.6 years. We typically replace our tractors within 42 months after purchase. As of December 31, 2010, we maintained 3,503 trailers. Our general policy is to retire our refrigerated and dry trailers after seven and ten years of service, respectively. Occasionally, we retain older equipment for use in local delivery operations. The following represents a breakdown of the age of our tractors and trailers at the end of 2010 and 2009:

|

Age in Years

|

||||||||||||||||||||||||||||||||

|

Tractors

|

Less than 1

|

1 through 3

|

More than 3

|

Total

|

||||||||||||||||||||||||||||

|

2010

|

2009

|

2010

|

2009

|

2010

|

2009

|

2010

|

2009

|

|||||||||||||||||||||||||

|

Company-owned and leased

|

205

|

334

|

815

|

743

|

479

|

477

|

1499

|

1,554

|

||||||||||||||||||||||||

|

Owner-operator provided

|

87

|

84

|

134

|

171

|

83

|

134

|

304

|

389

|

||||||||||||||||||||||||

|

292

|

418

|

949

|

914

|

562

|

611

|

1803

|

1,943

|

|||||||||||||||||||||||||

|

Age in Years

|

||||||||||||||||||||||||||||||||

|

Trailers

|

Less than 1

|

1 through 5

|

More than 5

|

Total

|

||||||||||||||||||||||||||||

|

2010

|

2009

|

2010

|

2009

|

2010

|

2009

|

2010

|

2009

|

|||||||||||||||||||||||||

|

Company-owned and leased

|

289

|

99

|

1,484

|

2,211

|

1,730

|

1,476

|

3,503

|

3,786

|

||||||||||||||||||||||||

|

Owner-operator provided

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

||||||||||||||||||||||||

|

289

|

99

|

1,484

|

2,211

|

1,730

|

1,476

|

3,503

|

3,786

|

|||||||||||||||||||||||||

Approximately 83% of our trailers are insulated and equipped with refrigeration units capable of providing the temperature control necessary to maintain perishable freight. Trailers used primarily in LTL operations are equipped with movable partitions permitting the transportation of goods requiring different temperatures. We also operate a fleet of non-refrigerated trailers in our non-temperature-controlled truckload operation. Company-operated trailers are primarily 102 inches wide. Truckload trailers used in dry freight and temperature-controlled linehaul operations are primarily 53 feet long.

Since approximately 2004, the federal government, through the Environmental Protection Agency (the “EPA”), has mandated the phase in of truck engines that reduce particulate matter count, nitrous oxides and sulfur emissions. This new technology serves to reduce emissions from diesel engines but generally also reduces miles per gallon and increases the new cost of the engines, as well as maintenance cost. We have been in full compliance of these programs due to our vehicle replacement programs that replace tractors at a rate that maintains proper ratios as required by the EPA. While the EPA-compliant engines are more costly to purchase and maintain, we are committed to the EPA’s SmartWay Transport Partner Program (“SmartWay”) to minimize the negative environmental impacts of diesel-powered equipment.

6

INTERNATIONAL OPERATIONS

Service to and from Canada is provided using tractors from our fleets. We partner with Mexico-based trucking companies to facilitate freight moving both ways across the southern United States border. Freight moving from Mexico is hauled in our trailers to the border by the Mexico-based carrier, where the trailers are exchanged. Southbound shipments work much the same way. This arrangement has been in place for more than ten years, and we do not expect to change our manner of dealing with freight to or from Mexico. Changes in United States, Canadian, or Mexican government regulations could cause us to change our operations, including border management, taxation, or various transportation and safety practices. Approximately 2% of our total operating revenue during 2010 involved international shipments, all of which was billed and collected in United States currency.

REGULATION

Our trucking operations are regulated by the DOT. The DOT generally governs matters such as safety requirements, registration to engage in motor carrier operations, certain mergers, insurance, consolidations and acquisitions. The DOT conducts periodic on-site audits of our compliance with its safety rules and procedures. Our most recent audit, which was completed in October of 2010, resulted in a rating of "satisfactory", the highest safety rating available.

During 2005, the Federal Motor Carrier Safety Administration ("FMCSA") began to enforce changes to the regulations that govern drivers' hours of service. Hours of Service ("HOS") rules issued by the FMCSA, in effect since 1939, generally limit the number of consecutive hours and consecutive days that a driver may work. The new rules reduced by one hour the number of hours that a driver may work in a shift, but increased by one hour the number of hours that a driver may drive during the same shift. Drivers often are working at a time they are not driving. Duties such as fueling, loading and waiting to load count as part of a driver's shift that are not considered driving. Under the old rules, a driver was required to rest for at least eight hours between shifts. The new rules increased that to ten hours, thereby reducing the amount of time a driver can be "on duty" by two hours. We believe we are well equipped to minimize the economic impact of the current HOS rules on our business. In many cases, we have negotiated time delay charges with our customers. Additionally, we work directly with our customers in an effort to manage our drivers’ non-driving activities such as loading, unloading or waiting and we continue to communicate with our customers regarding these matters. We also are able to assess detention and other charges to offset losses in productivity resulting from the current HOS regulations.

In December 2010, the FMCSA launched the Compliance Safety Accountability (“CSA”) program. The program was created to provide a better view into how well large commercial motor vehicle carriers and drivers are complying with safety rules and regulations. The program will allow FMCSA to reach more carriers earlier and deploy interventions as needed. The CSA Operation Model has three major components: measurement, evaluation and intervention. The impact of this program could reduce the number of available drivers and increase maintenance costs on minor non-safety related repairs. As of the date of this Form 10-K, we are unable to know if the program will have a material impact on our financial statements.

We have experienced higher prices for new tractors over the past few years, partially as a result of government regulations applicable to newly manufactured tractors and diesel engines. The entire linehaul sleeper fleet has either the 2004-EGR (“Exhaust-Gas Recirculation”) or the 2007-EGR EPA-mandated engines. Further restrictions for clean air compliance were mandated by the EPA for all engines manufactured after January 1, 2010. While the 2010 engines will further increase the costs of our equipment, we plan to continue with our normal equipment replacement cycles. We expect to receive tractors with 2010 engines beginning in the second quarter of 2011. Based on our recent replacement history for tractors, this will add approximately $4.3 million to the costs of our replacement tractors in 2011.

In 2010, the state of California enforced stricter carbon emission standards for refrigeration units on temperature-controlled trailers. Currently, approximately 90% of our trailers are C.A.R.B. (“California Air Research Board”) compliant and all of our trailers located in California are C.A.R.B. compliant. We will begin to replace the non-compliant trailers during our 2011 replacement cycle. We do not anticipate a significant increase in cost for these trailers.

7

ENVIRONMENTAL

We are subject to various environmental laws and regulations by various state regulatory agencies with respect to certain aspects of our operations including the operations of fuel storage tanks, air emissions from our trucks and engine idling. We have been committed to environmental quality for many years and joined SmartWay at its inception in 2004. SmartWay is an innovative collaboration between the EPA and the freight sector designed to improve energy efficiency, reduce greenhouse gas and air pollutant emissions, and improve energy security. Currently, every truck of the Company is an EPA 2004 Engine or newer. Constant upgrades are made to replace with environmentally friendly models that have fuel-efficient tires, aerodynamic styling and skirts. We use environmentally friendly refrigerants in our refrigeration units and every truck in our fleet is ULSD (“Ultra Low Sulfur Diesel”). Furthermore, we have reduced our fleet trucks to sixty-two miles per hour to achieve greater fuel efficiency. We utilize a fuel optimizer program to reduce miles and maintain idle management devices on our trucks. We are also diligent in our recycling programs for used oil and other hazardous material by-products.

SEASONALITY

Seasonal changes affect our temperature-controlled operations. The growing seasons for fruits and vegetables in Florida, California and Texas typically create increased demand for trailers equipped to transport cargo that requires refrigeration. LTL shipment volume during the winter is normally lower than the other seasons. Shipping volumes of LTL freight are usually highest during July through October. LTL volumes also tend to increase in the weeks before holidays such as Halloween, Thanksgiving, Christmas, Valentine’s Day and Easter when significant volumes of food and candy are transported.

EFFECT OF CLIMATE CHANGES

Considering 83% of our total operating revenue excluding fuel surcharges is from temperature controlled transport of goods, the climate could affect our customers’ service needs and our service product. As the climate becomes warmer, more refrigerated capacity would be needed. In a cold, harsh winter, we could be required to heat more products and handle freight that would not normally need a temperature controlled environment.

Greenhouse gas emissions have increasingly become the subject of a large amount of international, national, regional, state and local attention. Cap and trade initiatives to limit greenhouse gas emissions have been introduced in the European Union (the “EU”). Similarly, numerous bills related to climate change have been introduced in the United States Congress, which could adversely impact all industries. In addition, future regulation of greenhouse gases could occur pursuant to future U.S. treaty obligations, statutory or regulatory changes under the Clean Air Act or new climate change legislation. It is uncertain whether any of these initiatives will be implemented, although, based on published media reports, we believe it is not likely the current proposed initiatives will be implemented without substantial modification. If such initiatives are implemented, restrictions, caps, taxes, or other controls on emissions of greenhouse gases, including diesel exhaust, could significantly increase our operating costs. Restrictions on emissions could also affect our customers that use significant amounts of energy or burn fossil fuels in producing or delivering the products we carry including, but not limited to, food producers and distributors. Although significant cost increases, government regulation, and changes of consumer needs or preferences for goods or services relating to alternative sources of energy or emissions reductions or changes in our customers' shipping needs could materially affect the markets for the products we carry, which in turn could have a material adverse effect on our results of operations, financial condition, and liquidity, or, in the alternative, could result in increased demand for our transportation services, we are currently unable to predict the manner or extent of such effect.

INTERNET WEB SITE

We maintain a web site, www.ffeinc.com, on the Internet where additional information about our company is available. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, press releases, earnings releases and other reports filed with and furnished to the SEC, pursuant to Section 13 or 15(d) of the Exchange Act are available, free of charge, on our web site as soon as practical after they are filed.

We have adopted a Code of Business Conduct and Ethics for our Board of Directors, our Chief Executive Officer, principal financial and accounting officer and other persons responsible for financial management and our employees generally. We also have charters for the Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee of our Board of Directors. Copies of the foregoing documents may be obtained on our web site, and such information is available in print to any shareholder who requests it. Such requests should be made to the Senior Vice President and Chief Financial Officer at 1145 Empire Central Place, Dallas, Texas 75247.

SEC FILINGS

The annual, quarterly, special and other reports we file with and furnish to the SEC are available at the SEC's Public Reference Room, located at 100 F Street, NE, Room 1580, Washington, D.C. 20549. Information may be obtained on the operation of the Public Reference Room by calling the SEC at 1-800-732-0330. The SEC also maintains a web site at www.sec.gov. The SEC site also contains information we file with and furnish to the agency.

8

ITEM 1A. Risk Factors

The following factors are important and should be considered carefully in connection with any evaluation of our business, financial condition, results of operations, prospects, or an investment in our common stock. The risks and uncertainties described below are those we currently believe may materially affect our company or our financial results. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business operations or affect our financial results.

Our business is subject to general economic factors and business risks that are largely out of our control, any of which could have a material adverse effect on our operating results. Our business is subject to general economic factors and business factors that may have a material adverse effect on our results of operations, many of which are beyond our control. These factors include excess capacity in the trucking and temperature-controlled industry, strikes, or other work stoppages, significant increases in interest rates, fuel costs, taxes and license and registration fees. Recessionary economic cycles, changes in customers' business activities and excess tractor or trailer capacity in comparison with shipping demands could materially affect our operations. Economic conditions that decrease shipping demand or an increase in the supply of tractors and trailers generally available in the transportation sector of the economy can exert downward pressure on our pricing programs and equipment utilization, thereby decreasing asset profitability. Economic conditions also may adversely influence our customers and their ability to pay for our services.

Financial institutions may continue to consolidate or cease to do business, which could result in tightening in the credit markets, lower levels of liquidity in many financial markets, and increased volatility in fixed income, credit, currency and equity markets. A credit crisis could negatively impact our business, including through the impaired credit availability and financial stability of our customers, including our distribution partners and channels. A disruption in the financial markets may also have an effect on our banking partners on which we rely for operating cash management.

We may need to incur indebtedness or issue debt or equity securities in the future to fund working capital requirements, make investments in revenue generating equipment, or for general operating purposes. If we are not successful in obtaining sufficient financing because we are unable to access the capital markets on financially economical or feasible terms, it could impact our ability to provide services to our customers and may materially and adversely affect our business, financial results, current operations, results of operations and potential investments.

It is not possible to predict the effects on the economy or consumer confidence of actual or threatened armed conflicts or terrorist attacks, efforts to combat terrorism, military action against a foreign state or group located in a foreign state, or heightened security requirements.

We operate in a highly competitive and fragmented industry and numerous competitive factors could impair our growth and profitability. Some of these factors include:

|

·

|

We compete with many other transportation carriers of varying sizes, some of which have more equipment and greater capital resources than we do or have other competitive advantages;

|

|

·

|

Some of our competitors periodically reduce their freight rates to gain business, especially during times of reduced growth rates in the economy, which may limit our ability to maintain or increase freight rates or maintain our profitability levels;

|

|

·

|

Many customers reduce the number of carriers they use by selecting so-called “core carriers” as approved transportation service providers or current bids from multiple carriers, and in some instances we may not be selected;

|

|

·

|

Many customers periodically accept bids from multiple carriers for their shipping needs, and this process may depress freight rates or result in the loss of some business to competitors as a core carrier;

|

|

·

|

Certain of our customers that operate private fleets to transport their own freight could decide to expand their operations;

|

|

·

|

Competition from freight logistics and brokerage companies may negatively impact our customer relationships and freight rates; and

|

|

·

|

Economies of scale that may be passed onto smaller carriers by procurement aggregation providers may improve such carriers’ ability to compete with us.

|

We derive a significant portion of our revenue from our major customers, the loss of one or more of which could have a material adverse effect on our business. A significant portion of our revenue is generated from our major customers. For 2010, our top 20 customers accounted for approximately 48% of our revenue; our top ten customers accounted for 37% of our revenue; and our top five customers accounted for approximately 26% of our revenue. Generally, we enter into one-year agreements with our major customers, which generally do not contain minimum shipment volumes with us. We cannot ensure that, upon expiration of existing contracts, these customers will continue to utilize our services at the current levels. Many of our customers periodically solicit bids from multiple carriers for their shipping needs, and this process may depress freight rates or result in a loss of business to one of our competitors. Some of our customers also operate their own private fleets and the expansion of those fleets may result in lowering the demand for our services with such customers.

9

Future insurance and claims expense could reduce our earnings. Our future insurance and claims expense might exceed historical levels, which could reduce our earnings. We self-insure significant portions of our claims exposure resulting from work-related injuries, auto liability, general liability, cargo and property damage claims, as well as employees' health insurance. We currently reserve for anticipated losses and expenses. We periodically evaluate and adjust our claims reserves to reflect our experience. However, ultimate results usually differ from our estimates, which could result in losses in excess of our reserved amounts.

We maintain insurance above the amounts for which we self-insure. Although we believe the aggregate insurance limits should be sufficient to cover reasonably expected claims, it is possible that one or more claims could exceed our aggregate coverage limits. Insurance carriers have raised premiums for many businesses, including transportation companies. As a result, our insurance and claims expense could increase, or we could raise our self-insured retention when our policies are renewed. If these expenses increase, if we experience a claim in excess of our coverage limits, or if we experience a claim for which coverage is not provided, results of our operations and financial condition could be materially affected.

Fluctuations in the price or availability of fuel may increase our cost of operations, which could materially affect our profitability. We are subject to risk with respect to purchases of fuel for use in our tractors and refrigerated trailers. Fuel prices are influenced by many factors that are not within our control.

Because our operations are dependent upon diesel fuel, significant increases in diesel fuel costs could materially and adversely affect our results of operations and financial condition unless we are able to pass increased costs on to customers through rate increases or fuel surcharges. Historically, we have sought to recover increases in fuel prices from customers through fuel surcharges. Fuel surcharges that can be collected have not always fully offset the increase in the cost of diesel fuel in the past, and there can be no assurance that fuel surcharges that can be collected will offset the increase in the cost of diesel fuel in the future.

Seasonality and the impact of weather can affect our profitability. Our tractor productivity generally decreases during the winter season because inclement weather impedes operations and some shippers reduce their shipments. At the same time, operating expenses generally increase, with fuel efficiency declining because of engine idling and harsh weather creating higher accident frequency, increased claims and more equipment repairs. We can also suffer short-term impacts from weather-related events, such as hurricanes, blizzards, ice-storms and floods, which may increase in severity or frequency due to the physical effects of climate change that could harm our results or make our results more volatile.

We will have significant ongoing capital requirements that could negatively affect our growth and profitability. The trucking industry is capital intensive, and replacing older equipment requires significant investment. If we elect to expand our fleet in future periods, our capital needs would increase. We expect to pay for our capital expenditures with cash flows from operations, borrowings under our revolving credit facility and leasing arrangements. If we are unable to generate sufficient cash from operations and obtain financing on favorable terms, we may need to limit our growth, enter into less favorable financing arrangements or operate our revenue equipment for longer periods, any of which could affect our profitability.

We rely on our key management and other employees and depend on recruitment and retention of qualified personnel. Difficulty in attracting or retaining qualified employee-drivers and independent contractors who provide tractors for use in our business could impede our growth and profitability. A limited number of key executives manage our business. Their departure could have a material effect on our operations. In addition, our performance is primarily dependent upon our ability to attract and retain qualified drivers. Our independent contractors are responsible for paying for their own equipment, labor, fuel, and other operating costs. Significant increases in these costs could cause them to seek higher compensation from us or other opportunities. Competition for employee-drivers continues to increase. If a shortage of employee-drivers occurs, or if we were unable to continue to sufficiently contract with independent contractors, we could be forced to limit our growth or experience an increase in the number of our tractors without drivers, which would lower our profitability.

Service instability in the railroad industry could increase our operating costs and reduce our ability to offer intermodal services, which could adversely affect our revenue, results of operations and customer relationships. Our intermodal operations are dependent on railroads, and our dependence on railroads may increase if we expand our intermodal services. In most markets, rail service is limited to a few railroads or even a single railroad. Any reduction in service by the railroads may increase the cost of the rail-based services we provide and reduce the reliability, timeliness and overall attractiveness of our rail-based services. Railroads are relatively free to adjust their rates as market conditions change. That could result in higher costs to our customers and influence our ability to offer intermodal services. There is no assurance that we will be able to negotiate replacement of or additional contracts with railroads, which could limit our ability to provide this service and may affect our profitability.

10

Interruptions in the operation of our computer and communications systems could reduce our income. We depend on the efficient and uninterrupted operation of our computer and communications systems and infrastructure. Our operations and those of our technology and communications service providers are vulnerable to interruption by fire, earthquake, power loss, telecommunications failure, terrorist attacks, internet failures, computer viruses and other events beyond our control. In the event of a system failure, our business could experience significant disruption. We have established an off-site facility where our data and processing functions are replicated; however, there can be no assurances that the business recovery plan will work as intended or may not prevent significant interruptions of our operations.

Changes in the availability of or the demand for new and used trucks could reduce our growth and negatively affect our income. More restrictive federal emissions standards require new technology diesel engines. As a result, we expect to continue to pay increased prices for equipment and incur additional expenses and related financing costs for the foreseeable future.

We have a conditional commitment from our principal tractor vendor regarding the amount we will be paid on the disposal of most of our tractors as part of a trade-in program. We could incur a financial loss upon disposition of our equipment if the vendor cannot meet its obligations under these agreements.

If we are unable to obtain favorable prices for our used equipment, or if the cost of new equipment continues to increase, we will increase our depreciation expense or recognize less gain (or a loss) on the disposition of our tractors and trailers. This may affect our earnings and cash flows.

We operate in a highly regulated industry, and increased costs of compliance with, or liability for violation of, existing or future regulations could have a material adverse effect on our business. The DOT and various state and local agencies exercise broad powers over our business, generally governing such activities as authorization to engage in motor carrier operations, safety and insurance requirements. Our company drivers and independent contractors must also comply with the safety and fitness regulations promulgated by the DOT, including those relating to drug and alcohol testing and hours-of-service. We may also become subject to new or more restrictive regulations relating to fuel emissions, drivers’ hours-of-service, ergonomics, or other matters affecting our safety or operating methods. Other agencies, such as the EPA, FMCSA and the Department of Homeland Security, also regulate our equipment, operations, and drivers. Future laws and regulations may be more stringent and require changes in our operating practices, influence the demand for transportation services, or require us to incur significant additional costs: see Part I, Item 1. Business - Regulation.

Our operations are subject to various environmental laws and regulations, the violation of which could result in substantial fines or penalties. We are subject to various environmental laws and regulations dealing with the handling of hazardous materials, fuel storage tanks, air emissions from our vehicles and facilities, engine idling, and discharge and retention of storm water. We operate in industrial areas, where truck terminals and other industrial activities are located and where groundwater or other forms of environmental contamination have occurred. Our operations involve the risks of fuel spillage or seepage, environmental damage, and hazardous waste disposal, among others. Although we have instituted programs to monitor and control environmental risks and promote compliance with applicable environmental laws and regulations, if we are involved in a spill or other accident involving hazardous substances or if we are found to be in violation of applicable laws or regulations, we could be subject to liabilities, including substantial fines or penalties or civil and criminal liability, any of which could have a material adverse effect on our business and operating results.

We may not be able to improve our operating efficiency rapidly enough to meet market conditions. Because the markets in which we operate are highly competitive, we must continue to improve our operating efficiency in order to maintain or improve our profitability. Although we have been able to improve efficiency and reduce costs in the past, there is no assurance we will continue to do so in the future. In addition, the need to reduce ongoing operating costs may result in significant up-front costs to reduce workforce, close or consolidate facilities, or upgrade equipment and technology.

Our operations could be affected by a work stoppage at locations of our customers. Although none of our employees are covered by a collective bargaining agreement, a strike or other work stoppage at a customer location could negatively affect our revenue and earnings and could cause us to incur unexpected costs to redeploy or deactivate assets and personnel.

We are subject to anticipated future increases in the statutory federal tax rate. An increase in the statutory tax rate would increase our tax expense. In addition, our net deferred tax liability is stated net of offsetting deferred tax assets. The assets consist of anticipated future tax deductions for items such as personal and work-related injuries and bad debt expenses, which have been reflected on our financial statements but which are not yet tax deductible. We will need to generate sufficient future taxable income in order to fully realize our deferred tax assets. Should we not realize sufficient future taxable income, we may be required to write-off a portion or all of our deferred tax assets, which could materially affect our results of operations and financial condition. Due to probable tax rate increases in the future, we would be required to adjust our deferred tax liabilities at that time to reflect higher federal tax rates.

11

Changes in market demand may have an unfavorable impact on our operating efficiency. We provide transportation services to a number of customers that ship a variety of products including, but not limited to, food, health care, and confectionary products. Should the demand for our customers’ products decline, our revenues could be negatively affected. Should those conditions arise, there is no assurance that we will be able to adjust our operating costs sufficiently to offset the decline in revenue.

We are subject to potential litigation and claims. We are exposed to litigation involving personal injury, property damage, work-related injuries, cargo losses, Equal Employment Opportunity Commission (“EEOC”), unemployment claims and general liability during the normal course of operating our business, any of which could affect our results depending on the severity and resolution of the aforementioned exposures.

A negative economic impact on our customers’ businesses may adversely affect our credit risk. Certain customers may not be able to meet their financial obligations due to deterioration of their own financial condition, credit ratings, or bankruptcy. While we do record an allowance for doubtful accounts, a considerable amount of judgment is required in assessing the realization of these receivables which could affect our cash collections and operating results.

We are dependent on our customers’ product safety and quality control procedures to ensure product integrity. As most shipments tendered to us are packaged in such a way to prevent inspection and testing, we are dependent upon our customers’ quality control to ensure our other customers’ products are not subject to chemicals, bacteria, or other harmful agents that could contaminate their products. Such contamination could result in loss of business, consumer confidence in our Company, and possibly cause public health concerns resulting in fines, costly litigation, and/or loss of operating authority.

None.

At December 31, 2010, we maintained service centers or office facilities of 10,000 square feet or more in or near the cities listed below. We also occupy a number of smaller rented recruiting and sales offices around the country. Remaining lease terms range from one month to approximately thirteen years. We expect our present facilities are sufficient to support our operations.

The following table sets forth certain information regarding our properties at December 31, 2010:

|

Approximate

Square Footage

|

Approximate

Acreage

|

Owned

or Leased

|

Lease Expiration Date

|

|||||

|

Dallas, TX

|

||||||||

|

Maintenance, service center and freight handling

|

100,000

|

80

|

Owned

|

NA

|

||||

|

Corporate office

|

34,000

|

2

|

Owned

|

NA

|

||||

|

Burlington, NJ

|

84,000

|

10

|

Leased

|

May 2024

|

||||

|

Ft. Worth, TX

|

34,000

|

7

|

Owned

|

NA

|

||||

|

Chicago, IL

|

37,000

|

5

|

Owned

|

NA

|

||||

|

Lakeland, FL

|

26,000

|

15

|

Owned

|

NA

|

||||

|

Atlanta, GA

|

50,000

|

13

|

Owned

|

NA

|

||||

|

Ontario, CA

|

92,000

|

*

|

Leased

|

October 2020

|

||||

|

Salt Lake City, UT

|

12,500

|

*

|

Leased

|

November 2011

|

||||

|

Miami, FL

|

17,500

|

*

|

Leased

|

January 2014

|

||||

|

Olive Branch, MS

|

16,000

|

*

|

Leased

|

September 2017

|

||||

|

Stockton, CA

|

11,000

|

*

|

Leased

|

January 2015

|

*Facilities are part of an industrial park in which we share acreage with other tenants.

We previously leased a facility near Los Angeles, CA. The city informed the property owner and us that it plans to construct a maintenance facility on the property. As a result, we relocated to Ontario, CA in October 2010. During the early fall of 2010, we moved the operations previously located in Memphis, TN to Olive Branch, MS. We signed a lease that expires in September 2017.

12

ITEM 3. Legal Proceedings

We are involved in litigation incidental to our operations, primarily involving claims for personal injury, property damage, work-related injuries and cargo losses incurred in the ordinary and routine transportation of freight. We believe that the routine litigation is adequately covered by our insurance reserves and adverse effects arising from these events will not have a material impact on our financial statements.

On January 14, 2009, a plaintiff filed a lawsuit against us titled James Bradshaw vs. FFE Transportation Service, Inc. and James A. Booker, Sr. in the United States District Court for the Western District of Arkansas, Hot Springs Division, alleging negligence against the Defendant Booker as an employee of the Defendant FFE Transportation Services, Inc. The Plaintiff also asserts that the Defendant FFE Transportation Services, Inc. is vicariously liable under the doctrine of respondeat superior. The case went to trial February 15, 2011 and the jury found in favor of the Plaintiff. The Court entered a judgment of $1,000,000 on March 3, 2011. Because the Company and its counsel believe there were errors in the initial trial court process, the Company intends to seek reconsideration of the verdict or appeal the verdict to a higher court. As a result, we cannot determine the amount or range of the related loss, if any.

ITEM 4. Removed and Reserved.

ITEM 5. Market for Registrant's Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities

Market for Registrant's Common Equity and Related Shareholder Matters

Our common stock is listed on the NASDAQ Global Select Market under the symbol “FFEX”. The table below shows the range of high and low bid prices for the quarters indicated on the NASDAQ Global Select Market. Such quotations reflect inter-dealer prices, without retail markups, markdowns or commissions and therefore, may not necessarily represent actual transactions. The following table sets forth the high and low prices of our stock within each quarter of the previous two years:

|

Price Range

|

||||||||

|

Year Ended December 31, 2010

|

High

|

Low

|

||||||

|

Fourth Quarter

|

$

|

4.96

|

$

|

2.78

|

||||

|

Third Quarter

|

3.91

|

2.68

|

||||||

|

Second Quarter

|

4.99

|

3.50

|

||||||

|

First Quarter

|

4.42

|

3.09

|

||||||

|

Year Ended December 31, 2009

|

||||||||

|

Fourth Quarter

|

$

|

3.71

|

$

|

2.71

|

||||

|

Third Quarter

|

4.10

|

2.93

|

||||||

|

Second Quarter

|

4.73

|

2.51

|

||||||

|

First Quarter

|

5.81

|

2.56

|

||||||

On March 23, 2011, we had approximately 2,470 beneficial shareholders of our common stock.

During 2010, there were no cash dividend payments. Due to the continued uncertainty of the industry economic environment, management and the Board of Directors determined it imprudent to continue the payment of dividends until such time that the economy has improved and the Company has reflected this in improved results.

13

Repurchase of Equity Securities

In November 2007, our Board of Directors renewed our authorization to purchase up to 1,357,900 shares of our common stock. The authorization does not specify an expiration date. Shares may be purchased from time to time on the open market or through private transactions at such times as management deems appropriate. Purchases may be increased, decreased or discontinued by our Board of Directors at any time. In the fourth quarter of 2010, 1,600 shares were repurchased. At December 31, 2010, there were a total of 915,000 remaining authorized shares that could be repurchased.

|

Period

|

Total Number of Shares Purchased

(a)

|

Average Price Paid per Share

(b)

|

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs

(c)

|

Maximum Number (or Approximate Dollar Value) of Shares (or Units) that May Yet Be Purchased Under the Plans or Programs

(d)

|

|||||||

|

October 2010

|

1,600

|

$ |

3.23

|

1,600

|

$ |

915,000

|

|||||

|

November 2010

|

-

|

-

|

-

|

-

|

|||||||

|

December 2010

|

-

|

-

|

-

|

-

|

|||||||

|

Total

|

1,600

|

$ |

3.23

|

1,600

|

$ |

915,000

|

|||||

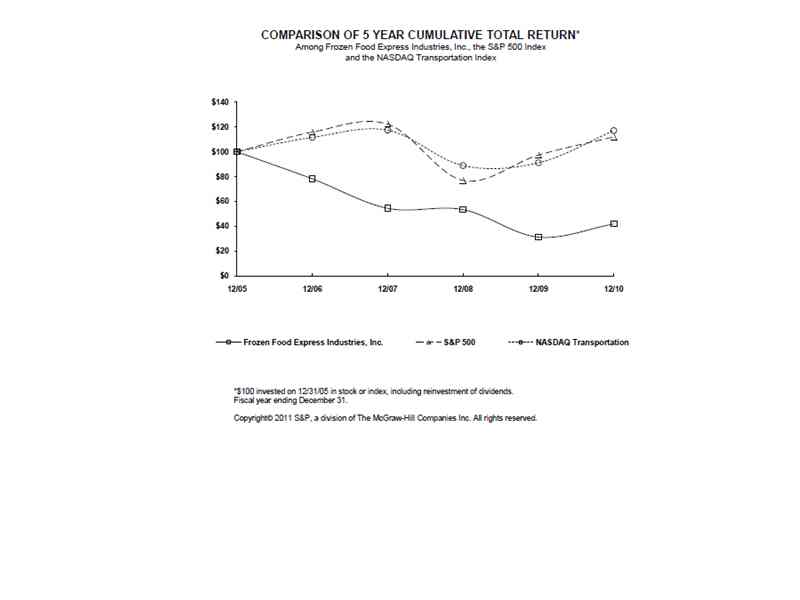

Comparative Stock Performance

The graph below compares the cumulative total stockholder return on our common stock with the NASDAQ Transportation Index and the S&P 500 Index for the last five years. The graph assumes $100 is invested in our common stock, the NASDAQ Transportation Index and the S&P 500 Index on December 31, 2005, with reinvestment of dividends. The comparisons in the graph are based on historical data and are not intended to predict future performance of our stock. The information in the graph shall be deemed “furnished” and not “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section.

14

ITEM 6. Selected Financial Data

The following unaudited data for each of the years in the five-year period ended December 31, 2010 should be read in conjunction with our Consolidated Financial Statements and Notes thereto included under Item 8 of this report and "Management's Discussion and Analysis of Financial Condition and Results of Operations" contained in Item 7.

|

(dollars in thousands, except per share data)

|

||||||||||||||||||||

|

Summary of Operations

|

2010

|

2009

|

2008

|

2007

|

2006

|

|||||||||||||||

|

Statement of Operations Data

|

||||||||||||||||||||

|

Total operating revenue

|

$

|

368,822

|

$

|

373,051

|

$

|

490,536

|

$

|

452,214

|

$

|

483,721

|

||||||||||

|

Net (loss) income

|

$

|

(11,930

|

)

|

$

|

(16,415

|

)

|

$

|

605

|

$

|

(7,670

|

)

|

$

|

11,226

|

|||||||

|

Operating expenses

|

$

|

386,492

|

$

|

397,964

|

$

|

488,482

|

$

|

462,743

|

$

|

472,162

|

||||||||||

|

Operating ratio (a)

|

104.8

|

%

|

106.7

|

%

|

99.6

|

%

|

102.3

|

%

|

97.6

|

%

|

||||||||||

|

Balance Sheet Data

|

||||||||||||||||||||

|

Total assets

|

$

|

134,905

|

$

|

145,800

|

$

|

162,186

|

$

|

173,669

|

$

|

191,762

|

||||||||||

|

Long-term debt

|

$

|

5,689

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

4,900

|

||||||||||

|

Shareholders' equity

|

$

|

78,809

|

$

|

89,735

|

$

|

106,451

|

$

|

107,259

|

$

|

122,531

|

||||||||||

|

Per Share Data

|

||||||||||||||||||||

|

Net (loss) income per common share, diluted

|

$

|

(0.69

|

)

|

$

|

(0.96

|

)

|

$

|

0.04

|

$

|

(0.45

|

)

|

$

|

0.61

|

|||||||

|

Book value per share (b)

|

$

|

4.50

|

$

|

5.22

|

$

|

6.32

|

$

|

6.41

|

$

|

6.99

|

||||||||||

|

Cash dividends per share

|

$

|

-

|

$

|

0.03

|

$

|

0.12

|

$

|

0.12

|

$

|

0.03

|

||||||||||

|

Weighted average diluted shares

|

17,275

|

17,080

|

16,997

|

17,187

|

18,517

|

|||||||||||||||

|

Revenue From

|

||||||||||||||||||||

|

Truckload linehaul services

|

$

|

171,392

|

$

|

187,234

|

$

|

214,348

|

$

|

212,416

|

$

|

237,464

|

||||||||||

|

Dedicated fleets

|

17,467

|

19,707

|

24,609

|

17,861

|

21,121

|

|||||||||||||||

|

Less-than-truckload linehaul services

|

110,467

|

109,054

|

124,091

|

127,438

|

129,764

|

|||||||||||||||

|