Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2010

OR

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from_______to_______

Commission file number 333-156383

China Chemical Corp.

(Exact name of registrant as specified in its charter)

|

Delaware

(State or other jurisdiction of incorporation or organization)

|

26-3018106

(I.R.S. Employer Identification No.)

|

|

|

1, Electric Power Road

Zhou Cun District

Zibo, P.R. China

(Address of principal executive offices)

|

255330

(Zip Code)

|

Registrant’s telephone number, including area code +86 0533-6168699

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or such shorter period that the registrant was required to submit and post such files). Yes No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer Accelerated filer

Non-accelerated filer (Do not check if a smaller reporting company) Smaller reporting company

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes No

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common stock was last sold as of the last business day of the registrant’s most recently completed fiscal year was $66,011,295.

As of March 28, 2011, there were 30,015,000 shares of Common Stock, par value $0.0001 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE: NONE

1

CHINA CHEMICAL CORP.

Table of Contents

|

Page

|

||

|

PART I

|

||

|

Item 1.

|

Business.

|

3 |

|

Item 1A.

|

Risk Factors.

|

15 |

|

Item 1B.

|

Unresolved Staff Comments.

|

29 |

|

Item 2.

|

Properties.

|

29 |

|

Item 3.

|

Legal Proceedings.

|

30 |

|

Item 4.

|

Reserved.

|

30 |

|

PART II

|

||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

|

31 |

|

Item 6.

|

Selected Financial Data.

|

31 |

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations.

|

32 |

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk.

|

32 |

|

Item 8.

|

Financial Statements and Supplementary Data.

|

43 |

|

Item 9.

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure.

|

44 |

|

Item 9A(T).

|

Controls and Procedures.

|

44 |

|

Item 9B.

|

Other Information.

|

44 |

|

PART III

|

||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance.

|

45 |

|

Item 11.

|

Executive Compensation.

|

48 |

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

|

49 |

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence.

|

50 |

|

Item 14.

|

Principal Accountant Fees and Services.

|

55 |

|

PART IV

|

||

|

Item 15.

|

Exhibits and Financial Statement Schedules.

|

56 |

2

PART I

Forward-Looking Statements

Forward-looking statements in this report, including without limitation, statements related to China Chemical Corp.’s plans, strategies, objectives, expectations, intentions and adequacy of resources, are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Investors are cautioned that such forward-looking statements involve risks and uncertainties including without limitation the following: (i) China Chemical Corp.’s plans, strategies, objectives, expectations and intentions are subject to change at any time at the discretion of China Chemical Corp.; (ii) China Chemical Corp.’s plans and results of operations will be affected by China Chemical Corp.’s ability to manage growth; and (iii) other risks and uncertainties indicated from time to time in China Chemical Corp.’s filings with the Securities and Exchange Commission (“SEC”).

In some cases, you can identify forward-looking statements by terminology such as ‘‘may,’’ ‘‘will,’’ ‘‘should,’’ ‘‘could,’’ ‘‘expects,’’ ‘‘plans,’’ ‘‘intends,’’ ‘‘anticipates,’’ ‘‘believes,’’ ‘‘estimates,’’ ‘‘predicts,’’ ‘‘potential,’’ or ‘‘continue’’ or the negative of such terms or other comparable terminology. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness of such statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. We are under no duty to update any of the forward-looking statements after the date of this report.

Factors that might affect our forward-looking statements include, among other things:

|

●

|

overall economic and business conditions;

|

|

|

●

|

the demand for our goods and services;

|

|

|

●

|

competitive factors in the industries in which we compete;

|

|

|

●

|

changes in tax requirements (including tax rate changes, new tax laws and revised tax law interpretations);

|

|

|

●

|

the outcome of litigation and governmental proceedings;

|

|

|

●

|

interest rate fluctuations and other changes in borrowing costs;

|

|

|

●

|

other capital market conditions, including availability of funding sources;

|

|

|

●

|

potential further impairment of our indefinite-lived intangible assets and/or our long-lived assets; and

|

|

|

●

|

changes in government regulations related to the broadband and Internet protocol industries.

|

China Chemical Corp. (the “Company”, “we”, “us” or “our”) was incorporated in the State of Delaware on July 16, 2008 under the name Bomps Mining, Inc.

On September 24, 2010, the Company entered into an Agreement and Plan of Merger and Reorganization with its newly formed wholly-owned subsidiary, China Chemical Corp. (the “Merger Sub”), pursuant to which the Merger Sub was merged into and with the Company. In connection with the merger, the Company changed its name from Bomps Mining, Inc. to China Chemical Corp. In accordance with §253 of the Delaware General Corporation Law (the “DGCL”), the Company was not required to obtain shareholder approval of the merger with its wholly-owned subsidiary. Pursuant to §253 of the DGCL, in any case in which at least 90% of the outstanding shares of each class of the stock of a corporation or corporations, of which class there are outstanding shares that, absent this subsection, would be entitled to vote on such merger, is owned by another corporation and one of the corporations is a corporation of the State of Delaware and the other or others are corporations of the State of Delaware, or any other state or states, or the District of Columbia and the laws of the other state or states, or the District permit a corporation of such jurisdiction to merge with a corporation of another jurisdiction, the corporation having such stock ownership may either merge the other corporation or corporations into itself and assume all of its or their obligations, or merge itself, or itself and 1 or more of such other corporations, into 1 of the other corporations by executing, acknowledging and filing a certificate of such ownership and merger setting forth a copy of the resolution of its board of directors to so merge and the date of the adoption. Further, if the surviving corporation is a Delaware corporation, it may change its corporate name by inclusion of a provision to that effect in the resolution of merger adopted by the directors of the parent corporation and set forth in the certificate of ownership and merger.

3

In addition, on September 24, 2010, the Company effected a nine-to-one stock dividend whereby each stockholder of record of the Company as of October 7, 2010 (the “Record Date”) was issued 9 shares of common stock for each 1 share of common stock which they hold as of the Record Date (the “Stock Dividend”), unless otherwise indicated in this Annual Report, all share amounts reflect the Stock Dividend.

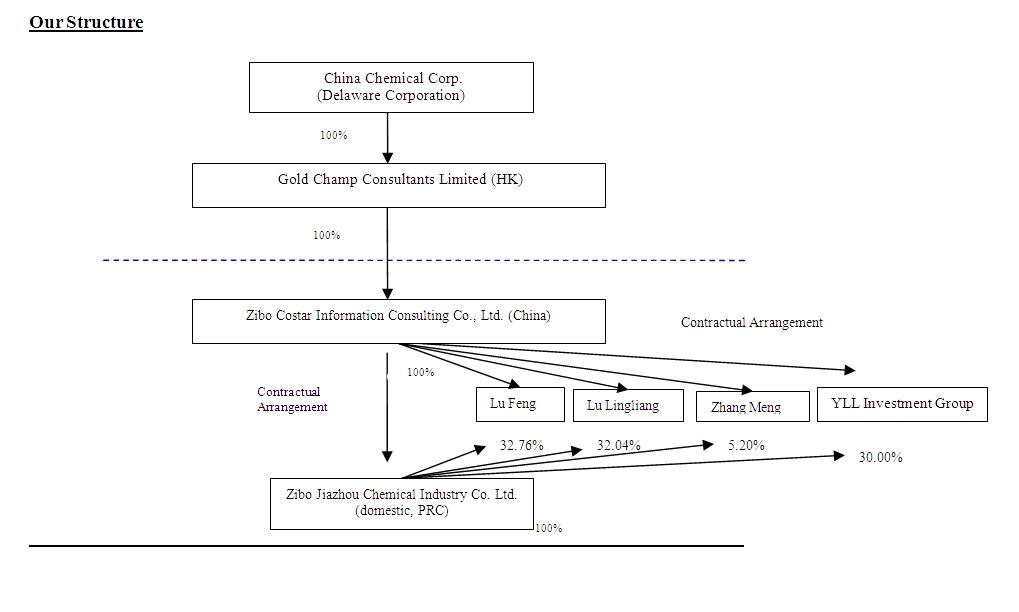

On September 30, 2010, the Company entered into a Share Exchange Agreement with Gold Champ Consultants Limited, a Hong Kong corporation (“Gold Champ”) and the shareholders of Gold Champ, pursuant to which the Company acquired 100% of the issued and outstanding capital of Gold Champ in exchange for 19,861,700 shares of the Company’s common stock, par value $0.0001 (the “Share Exchange”). Prior to the Share Exchange, the Company adopted the China Chemical Corp. 2010 Incentive Stock Plan (the “2010 Plan”) and reserved for issuance 500,000 shares of common stock for issuance as awards to officers, directors, employees, consultants and others. Upon the closing of the Share Exchange, the Company issued an aggregate of 38,300 shares of common stock to certain eligible individuals under the 2010 Plan. In addition, the Company issued 100,000 shares of common stock to its investor relations firm. Gold Champ is a holding company whose asset is 100% of the registered capital of Zibo Costar Information Consulting Co., Ltd. (“Zibo Costar Information Consulting”), a Wholly-Owned Foreign Enterprise ("WOFE") organized under the laws of the People’s Republic of China (“PRC”). All of Gold Champ's operations are conducted in China through Zibo Costar Information Consulting, and through contractual arrangements with Zibo Jiazhou Chemical Industry Co., Ltd., a limited liability enterprise organized under the laws of the People’s Republic of China (“Zibo Jiazhou Chemical”). Zibo Jiazhou Chemical is a manufacturing company that is based in Shandong, China. It is principally engaged in the manufacturing of organic chemical compounds. At the time of the Share Exchange, the Company was not engaged in any active business. Following the Share Exchange, we intend to carry on the business of Zibo Jiazhou Chemical, our PRC operating entity, as our sole line of business.

In connection with the Share Exchange, the following transactions took place:

|

·

|

Doug Cole resigned as the Company’s President, Secretary, Treasurer on September 30, 2010. Following the Share Exchange, he will retain his position as a member of the Company’s Board of Directors.

|

|

·

|

Lu Feng, Chairman of Gold Champ, Zibo Costar Information and Zibo Jiazhou Chemical, was elected to serve on the Company’s Board of Directors as Chairman, and was appointed as Chief Executive Officer and President of the Company.

|

|

·

|

Lu Lingliang, Vice-Chairman of Zibo Jiazhou Chemical was elected to serve on the Company’s Board of Directors as Vice-Chairman.

|

|

·

|

Yan Kai, Chief Operating and Administration Officer of Zibo Jiazhou Chemical, was appointed as Chief Operating and Administration Officer of the Company.

|

|

·

|

Dean Huge was appointed as Chief Financial Officer and Treasurer of the Company.

|

|

·

|

Zhang Lianjun, Chief Marketing Officer of Zibo Jiazhou Chemical, was appointed as Chief Marketing Officer of the Company.

|

|

·

|

Li Bin, Chief Accounting Officer of Zibo Jiazhou Chemical, was appointed as Chief Accounting Officer of the Company.

|

|

·

|

Chen Hui was elected to serve on the Company’s Board of Directors.

|

|

·

|

Jared Wang was elected to serve on the Company’s Board of Directors.

|

|

·

|

Immediately following the closing of the Share Exchange, under an Agreement of Conveyance, Transfer and Assignment of Assets and Assumption of Liabilities (the “Conveyance Agreement”), the Company transferred all of its pre-Share Exchange assets and liabilities to its wholly-owned subsidiary, Bomps Mining Holdings, Inc. (“SplitCo”). Thereafter, pursuant to a stock purchase agreement (the “Stock Purchase Agreement”), the Company transferred all of the outstanding capital of SplitCo to one of its shareholders in exchange for the cancellation of 30,000,000 shares of the Company’s common stock (the “Split-Off Transaction”). Following the Share Exchange and the Split-Off Transaction, the Company discontinued its former business and is now engaged in the chemical manufacturing business.

|

4

As a result of these transactions, the former shareholders of Gold Champ now own securities that in the aggregate represent approximately 66% of the equity in the Company.

Overview

Following the Share Exchange, we intend to carry on the business of Zibo Jiazhou Chemical, our PRC operating entity, as our sole line of business through certain contractual arrangements between Zibo Jiazhou Chemical and Zibo Costar Information Consulting as more fully described below. Zibo Jiazhou Chemical is a manufacturer of organic chemical compounds and other high-value fine chemicals. These chemicals are pure, single chemical substances that are commercially produced with chemical reactions into highly specialized applications which are custom-produced in smaller quantities for special uses. Gold Champ was incorporated in Hong Kong under Chapter 32 Companies Ordinance on July 15, 2010 as a limited company. The Company is a holding company whose primary asset is 100% of the registered capital of Zibo Costar Information Consulting, a company organized under the laws of the PRC.

To comply with the PRC laws and regulations while operating our chemical business in the PRC, Gold Champ, through its subsidiary, Zibo Costar Information Consulting, which is a WOFE in the PRC, entered into contractual agreements (known as a “variable interest entity” (VIE) arrangement) with Zibo Jiazhou Chemical on September 30, 2010, under which Zibo Costar Information Consulting provides exclusive management consulting services and exclusive technology consulting services (collectively, the “Service Agreements”) to Zibo Jiazhou Chemical in exchange for substantially all of the net income of Zibo Jiazhou Chemical. As collateral to ensure Zibo Jiazhou Chemical’s payments under the Service Agreements, the shareholders of Zibo Jiazhou Chemical, through an equity pledge agreement, pledged all of their rights and interests in Zibo Jiazhou Chemical, including voting rights and dividend rights, to Zibo Costar Information Consulting. In addition, the shareholders of Zibo Jiazhou Chemical, through an exclusive option agreement, granted to Zibo Costar Information Consulting an exclusive, irrevocable and unconditional right to purchase part or all of the equity interests in Zibo Jiazhou Chemical when the purchase becomes permissible under the relevant PRC Law.

5

We need to use the following contractual arrangements to exercise effective control.

As further described below, Zibo Costar Information Consulting has entered into the following contractual arrangements with Zibo Jiazhou Chemical and the shareholders of Zibo Jiazhou Chemical, pursuant to which it exercises effective control over Zibo Jiazhou Chemical:

|

·

|

Exclusive Management Consulting Services Agreement;

|

|

·

|

Exclusive Technology Consulting Agreement;

|

|

·

|

Proxy Letter;

|

|

·

|

Purchase Option Agreement; and

|

|

·

|

Equity Pledge Agreement.

|

Agreements that Transfer Economic Benefits to Us

Pursuant to our contractual arrangements with Zibo Jiazhou Chemical and its shareholders, Lu Feng, Lu Lingliang, Zhang Meng and YLL Investment Group Limited, Zibo Costar Information Consulting provides exclusive management consulting services and exclusive technology consulting services to Zibo Jiazhou Chemical in exchange for service fees. The service fees shall equal to 50% of the net profit of Zibo Jiazhou Chemical under the exclusive management consulting services agreement and 50% of the net profit of Zibo Jiazhou Chemical under the exclusive technology consulting agreement.

6

Agreements that Provide Effective Control over Zibo Jiazhou Chemical

Gold Champ’s wholly-owned subsidiary, Zibo Costar Information Consulting entered into the following agreements with Zibo Jiazhou Chemical and its shareholders, Lu Feng, Lu Lingliang, Zhang Meng and YLL Investment Group Limited that provide it with effective control over Zibo Jiazhou Chemical:

|

·

|

An exclusive management consulting services agreement, pursuant to which Zibo Jiazhou Chemical irrevocably entrusts to Zibo Costar Information Consulting the right of management and operation of Zibo Jiazhou Chemical and the responsibilities and authorities of their shareholders and directors of Zibo Jiazhou Chemical;

|

|

·

|

An exclusive technology consulting agreement, pursuant to which Zibo Jiazhou Chemical irrevocably entrusts to Zibo Costar Information Consulting the right to maintain the facilities and provide technical support to the operations of Zibo Jiazhou Chemical;

|

|

·

|

A proxy letter, pursuant to which the shareholders of Zibo Jiazhou Chemical has granted the personnel designated by Zibo Costar Information Consulting the right to appoint directors and senior management of Zibo Jiazhou Chemical and to exercise all of their other voting rights as shareholders of Zibo Jiazhou Chemical, as the case may be, as provided under the articles of association of each such entity;

|

|

·

|

A purchase option agreement, pursuant to which, among other things, Zibo Jiazhou Chemical:

|

|

·

|

May not sell, transfer, pledge or through any other method dispose of any asset, business or rights and benefits of legal or beneficial income, or permit selling other guarantee rights concerning the same, without the prior written consent of Zibo Costar Information Consulting;

|

|

·

|

Shall not engage in any transactions which materially affect the assets, responsibility, operation, shares and other legal rights, without the prior written consent of Zibo Costar Information Consulting;

|

|

·

|

Shall not pay a dividend without the prior written consent of Zibo Costar Information Consulting; and

|

|

·

|

Granted Zibo Costar Information Consulting or its designee an exclusive option to purchase all or part of the equity interests in Zibo Jiazhou Chemical, all or part of the equity interests in Zibo Jiazhou Chemical, or all or part of the assets of Zibo Jiazhou Chemical, in each case when and to the extent permitted by PRC law. In case of Zibo Costar Information Consulting exercising the purchase option in its sole discretion upon the occurrence of the situation in which such call option exercise become feasible under the relevant laws in PRC, any additional consideration paid other than the $1.00 which may be required under the laws of the PRC to effect such purchase to comply with such legal formalities shall be either cancelled or returned to the Company immediately with no additional compensation to the owners; and

|

|

·

|

An equity pledge agreement pursuant to which each of shareholders of Zibo Jiazhou Chemical has pledged his or its equity interest in Zibo Jiazhou Chemical to Zibo Costar Information Consulting to secure their obligations under the relevant contractual control agreements, including but not limited to, the obligations of Zibo Jiazhou Chemical under the exclusive management consulting services agreement, the exclusive technology consulting agreement, the purchase option agreement, the voting rights proxy agreement described above, and each of them has agreed not to transfer, sell, pledge, dispose of or create any encumbrance on their equity interest in Zibo Jiazhou Chemical without the prior written consent of Zibo Costar Information Consulting.

|

See “Related Party Transactions” for further information on our contractual arrangements with these parties.

In the opinion of Grandall Legal Group, our PRC legal counsel:

7

|

·

|

The ownership structures of Zibo Costar Information Consulting and Zibo Jiazhou Chemical, both currently and after giving effect to this Share Exchange, are in compliance with existing PRC laws and regulations;

|

|

·

|

The contractual arrangements among Zibo Costar Information, Zibo Jiazhou Chemical governed by PRC law are valid, binding and enforceable, and will not result in any violation of PRC laws or regulations currently in effect; and

|

|

·

|

The business operations of Zibo Costar Information Consulting and Zibo Jiazhou Chemical, as described in this Form 10-K, are in compliance with existing PRC laws and regulations in all material respects.

|

However, in spite of the above, there are substantial uncertainties regarding the interpretation and application of current and future PRC laws and regulations. Accordingly, there can be no assurance that the PRC regulatory authorities will not in the future take a view that is contrary to the above opinion of our PRC legal counsel. If the PRC government finds that the agreements that establish the structure for operating our PRC chemical business do not comply with PRC government restrictions on foreign investment in the chemical businesses, we could be subject to severe penalties.

Business of Zibo Jiazhou Chemical

We are a Zibo City, China-based manufacturer of organic chemical compounds used in high-performance plastics, PVC, electric fibers, paints, tires, insulation, flooring, adhesives, medicines, food processing, ink and paper. Our primary products are Phthalic Anhydride (PA) and Maleic Anhydride (MAH), which have a wide variety of applications in the construction, automotive, aviation, marine, and consumer goods industries. We currently have the capacity to produce 60,000 tons of MAH and 50,000 tons of PA annually. In addition, we began site development in October 2010 for a 50,000-ton-capacity 1,4 butanediol (BDO) co-generation plant. The Company actually produced 30,175 tons of PA and 22,142 tons of MAH over the last 12 months ending in December 31, 2010. Actual full operations of the expanded 30,000 metric tons of MAH were not fully operational until January of 2011.

We primarily sell our products through a “cash and carry” system whereby customers notify us of their anticipated requirements one month prior to pick-up. Prices are negotiated between Zibo Jiazhou Chemical and the customer based upon prevailing market prices. Customers are responsible for the pick-up and transport of their product orders.

We are an upstream chemical manufacturer that does not sell products to the retail marketplace. We currently sell PA and MAH to other chemical processing companies that add additional chemicals in their processes that create both retail and industrial uses in their manufacturing process for items we see in everyday life. Many products have automotive, construction, aviation, transportation, marine and medical industry applications.

The following table summarizes our top 5 customers for the years ended December 31, 2010 and 2009:

|

Customers

|

Sales

|

Accounts Receivable

|

||||||||||||||

|

2010

|

2009

|

December 31, 2010

|

December 31, 2009

|

|||||||||||||

|

Zibo Xinghua Resin Co., Ltd.

|

22% | 25% | 41% | 39% | ||||||||||||

|

Zouping Erkeri Chemical Co., Ltd

|

6% | - | 21% | - | ||||||||||||

|

Dongying Shenli Zhongya Chemecial Co., Ltd

|

16% | 4% | 1% | - | ||||||||||||

|

Kaifeng Taihua Chemical Co., Ltd

|

6% | 4% | 1% | - | ||||||||||||

|

Pingmei Group Kaifeng Xinghua Fine Chemical Factory

|

9% | 25% | - | - | ||||||||||||

Current Product Offerings

MAH is an organic chemical used primarily in the production of unsaturated polyester and polyurethane resins. The primary MAH applications produced by us are unsaturated polyester resins. Unsaturated polyester resins are used to produce fiberglass reinforced high quality adhesives and paint for the automotive, construction, aviation, transportation and marine applications.

8

PA is an organic chemical used primarily in the production of polyvinyl chloride (PVC). It is used as a high volume “commodity plastic” for packaging, film, magnetic tape, tires, pipes, hoses, containers, and other everyday products. The primary advantages of PA are:

|

·

|

High strength / weight ratio

|

|

·

|

Ideal for high volume product manufacturing;

|

|

·

|

Low scrap and recyclability; and

|

|

·

|

Diversified use across numerous industries.

|

Planned Product Offerings

We began site development in October 2010 for a 50,000-ton capacity BDO co-generation facility. Construction is subject to financing. Accordingly, based upon current estimates, production of BDO will begin in 18 months after the BDO site specifications are completed. BDO is used primarily in the production of elastic fibers such as Spandex. It is also used in the production of soft and rigid foam used in dashboards, seating and insulation panels. Additional uses include durable wheels, tires and bumpers, artificial leather, flooring, insulation and high performance paints. In addition, it is used in the production of drugs, cosmetics and herbicides. The primary advantages of BDO include the following:

|

·

|

Durability, elasticity, flexibility, and heat resistance;

|

|

·

|

High demand engineered products;

|

|

·

|

Low scrap and recyclability; and

|

|

·

|

Diversified use across numerous industries.

|

9

We believe that BDO will produce higher margins than MAH, which is used as a feedstock in the production of BDO. In addition, we believe that the introduction of BDO will widen our geographic distribution and sales networks into new domestic markets.

The following table summarizes our current and planned product offerings:

|

Chemical Compound

|

Capacity (Tons/Year)

|

Status

|

||

|

Phthalic Anhydride

|

50,000

|

No additional capacity is currently contemplated.

|

||

|

Maleic Anhydride

|

60,000

|

30,000 tons/year expansion began startup in October 2010.

|

||

|

Fumaric Acid

|

3,500

|

Byproduct of Phthalic Anhydride and Maleic Anhydride production. No additional capacity is currently contemplated.

|

||

|

Acidic (Electrolyzed Water)

|

15,200

|

Byproduct of Phthalic Anhydride and Maleic Anhydride production. No additional capacity is currently contemplated.

|

||

|

1,4-butanediol

|

(50,000 planned)

|

Planning and permitting completed. Site development began in October 2010.

|

||

|

Tetrahydrofuran

|

(3,000 planned)

|

Downstream byproduct of 1,4-butanediol production. High-value polyurethane resin precursor.

|

||

|

y-Butyrolactone

|

(2,000 planned)

|

Downstream byproduct of 1,4-butanediol production. High-value water soluble solvent.

|

||

|

Steam

|

Variable

|

Byproduct of Phthalic Anhydride, Maleic Anhydride and 1,4-butanediol. Sold to local power generator.

|

Raw Materials and Byproducts

Benzene is the raw material used in the chemical processes at Zibo Jiazhou Chemical.

|

·

|

o-Xylene Benzene is used in the process for making phthalic anhydride.

|

|

·

|

Coking Benzene is used in the process of making maleic anhydride.

|

Benzene is introduced to catalysts which create 2 byproducts. Zibo Jiazhou Chemical has 2 processes which change the molecular structure of phthalic anhydride and maleic anhydride without having to introduce heat (cracking). These chemical reactions create the byproducts of vapor (steam) and acidic (electrolyzed water) “acid water”. They are sold in gigajoules and tons; respectively.

Acid water is a byproduct used by many industries inclusive of many industrial, health, fitness products, etc. It has the capabilities of killing bacteria and has many functions. The current capacity is only 11,000 tons/year. The acid water produced by both phthalic anhydride and maleic anhydride-plants are expected to be used in 2012 for the production of 1,4-butanediol when the plant is operational.

Steam is a byproduct which is sold to the electrical generating plant adjacent to the property, which is controlled by our Vice-Chairman and is purchased on an avoided cost calculation per gigajoule. The plant typically purchases all steam that is generated.

10

Fumaric Acid is an additional process which is created by the introduction of another catalyst to acid water. Fumaric acid is only created when it is economically feasible to do so. Zibo Jiazhou Chemical sells either acid water and/or fumaric acid based on the spot market pricing.

Processing Fees are referred to the raw material processing for third parties for a net fixed fee. Zibo Jiazhou Chemical’s benefits from processing the raw materials of third parties are net revenue, free steam and free acid water.

Product Sales Distribution and Marketing

Zibo Jiazhou Chemical primarily sells its products through a “cash and carry” system whereby customers notify Zibo Jiazhou Chemical of their anticipated requirements one month prior to pick-up. Prices are negotiated between Zibo Jiazhou Chemical and the customer based upon prevailing market prices. Customers are responsible for the pick-up and transport of their product orders.

During the year ended December 31, 2010, Zibo Jiazhou Chemical had sales of $75,673,839, of which $55,770,402 or 73.7% were paid for in cash or by check by customers prior to pick-up and $19,903,437 or 26.3% were paid for by customers subsequent to pick-up.

Sales by Product

The following table summarizes Zibo Jiazhou Chemical’s sales by product for the years ended December 31, 2010 and 2009:

|

For the Year Ended

|

For the Year Ended

|

||||||||||||||

|

December 31, 2010

|

December 31, 2009

|

Comparisons

|

|||||||||||||

|

Product

|

Amount

|

Percentage of Revenues

|

Amount

|

Percentage of Revenues

|

Change in Amount

|

Increase (Decrease) in Percentage

|

|||||||||

|

Phthalic Anhydride

|

$

|

33,944,237

|

44.86%

|

$

|

27,296,046

|

47.95%

|

$

|

6,648,191

|

24.36%

|

||||||

|

Maleic Anhydride

|

$

|

26,842,072

|

35.47%

|

$

|

17,114,630

|

30.07%

|

$

|

9,727,442

|

56.84%

|

||||||

|

Steam

|

$

|

6,026,436

|

7.96%

|

$

|

6,223,324

|

10.93%

|

$

|

(196,888)

|

(3.16)%

|

||||||

|

Acid Water

|

$

|

4,347,718

|

5.75%

|

$

|

3,134,331

|

5.51%

|

$

|

1,213,387

|

38.71%

|

||||||

|

Fumeric Acid

|

$

|

1,366,858

|

1.81%

|

$

|

305,184

|

0.54%

|

$

|

1,061,674

|

347.88%

|

||||||

|

Processing Fee

|

$

|

2,267,602

|

3.00%

|

$

|

1,504,479

|

2.64%

|

$

|

763,123

|

50.72%

|

||||||

|

Raw Material

|

$

|

878,916

|

1.16%

|

$

|

1,342,748

|

2.36%

|

$

|

(463,832)

|

(34.54)%

|

||||||

|

Total

|

$

|

75,673,839

|

100.00%

|

$

|

56,920,742

|

100.00%

|

$

|

18,753,097

|

32.95%

|

||||||

Intellectual Property

Zibo Jiazhou Chemical owns one registered trademark. The trademark is registered with the Trademark Bureau of State Administration for Industry and Commerce. It is valid until December 27, 2019.

On February 16, 2009, Zibo Jiazhou Chemical entered into an agreement with Davy Process Technology Limited, a British company (“Davy”), pursuant to which Davy licensed certain technology and know-how, technical documentation, contract equipment, contract catalyst, technical service and technical training to be supplied by Davy for the construction of a plant for Zibo Jiazhou Chemical to manufacture products, up to a maximum of 55,000 metric tons of 1,4-butanediol equivalent, on an annual basis (the “Davy Contract”).

11

The total contract price is Euro16,650,000 or $20,326,320 as of December 31, 2010 and is fixed, including (i) a fee for license of technology and know-how of Euro 7,700,000 or $ 9,400,160 as of December 31, 2010 ; (ii) a fee for contract equipment and contract catalyst of Euro 4,750,000 or $5,798,800 as of June 30, 2010; (iii) a fee for technical documentation of Euro 3,600,000 or $4,394,880 as of December 31, 2010; (iv) a fee for technical service at Euro 471,240 or $575,290 as of December 31, 2010; and (v) a fee for technical training at Euro 128,760 or $157,190 as of December 31, 2010. According to the payment schedule provided in the Davy Contract, the initial payment (20%) of the fees for the license of technology and know-how and the fee for technical documentation of Euro 2,260,000 or $3,190,888 as of July 17, 2009 (the “Initial Software Fee”) shall be made within 20 days after receipt of corresponding invoice issued by Davy; the initial payment (50%) of fee for contract equipment and contract catalyst of Euro2,375,000 or $3,353,257 as of July 27, 2009 (the “Initial Equipment Fee”) shall be made within 20 days after receipt of corresponding invoice issued by Davy; payments of subsequent installments and/or other fees shall be made after corresponding technical documentation, services and/or training been delivered. Zibo Jiazhou Chemical fully paid the initial software fee and the initial equipment fee on July 17, 2009 and July 27, 2009, respectively. The designing work is still in process within Davy’s office and Zibo Jiazhou Chemical has not received any technical documentation as of the date of this filing. The total amount paid to the Davy Contract as of December 31, 2010 was $7,642,487.

According to relevant PRC laws and regulations, a foreign entity cannot provide architecture or construction designing services directly in China, which means it has to set up a company in China to apply for necessary licenses or cooperate with a Chinese company having all necessary licenses. For the 1,4-butanediol project, Davy cooperated with Hua Lu Engineering Technology Co., Ltd. (the “Hua Lu”), a Chinese engineering company having Level I of PRC national standard engineering designing qualification. Zibo Jiazhou Chemical entered into a contract with Hua Lu on July 25, 2009. The total contract price is RMB5,750,000 or $846,975 as of December 31, 2010, in which RMB860,000 or $126,683 as of July 29, 2009 shall be paid as deposit within 10 days after execution of the contract and the other installments shall be paid within 10 days after delivery of corresponding designing documentation. It is reflected in a bank sheet that Zibo Jiazhou Chemical paid the deposit on July 29, 2009. As of the date of this Current Report, Zibo Jiazhou Chemical has not received any designing documentation from Hua Lu.

On January 11, 2006, Zibo Jiazhou Chemical entered into a licensing agreement with the Institute of Coal Chemistry, Chinese Academy of Sciences (the “Licensor”), pursuant to which the Licensor granted Zibo Jiazhou Chemical an exclusive license to certain technology utilized in the production of maleic anhydride. The license is valid until June 8, 2026.

Competition

Zibo Jiazhou Chemical's customer base is currently predominantly based in the Shandong Province. The Company does not believe that it currently faces any significant direct competition for the sale of its products in the Shandong Province. The chemical manufacturing industry in the PRC, however, is highly competitive. Larger, more well capitalized companies may emerge that may be able to satisfy Zibo Jiazhou Chemical’s customer requirements more readily than it is currently able to.

Zibo Jiazhou Chemical's primary competitors are as follows:

Shandong Hongxin Chemical Industry Co., Ltd Shandong Hongxin Chemical, located in Zibo City, which is approximately 100 km from the Zibo Jiazhou Chemical facilities, currently has the capacity to produce 13,000 tons/year of maleic anhydride and 80,000 tons/year of phthalic anhydride. The Company is not aware of any plans by Shandong Hongxin Chemical to expand its operations to include the production of 1,4-butanediol.

Dongying Lihuyi Chemical Industry Co., Ltd Dongying Lihuyi Chemical, located in Dongying City, which is approximately 100 km from the Zibo Jiazhou Chemical facilities, currently has the capacity to produce 20,000 tons/year of phthalic anhydride. The Company is not aware of any plans by Dongying Lihuyi Chemical to expand its operations to include the production of 1,4-butanediol. Pursuant to the Davy Contract, Davy may not transfer the 1,4-butanediol technology to another company in the Shandong Province.

Zibo Qifeng Chemical Industry Co., Ltd Zibo Qifeng Chemical, located in Zibo Linzi, which is approximately 100 km from the Zibo Jiazhou Chemical facilities, currently has the capacity to produce 8,000 tons/year of maleic anhydride. The Company is not aware of any plans by Zibo Qifeng Chemical to expand its operations to include the production of 1,4-butanediol.

Shijiazhuang Bailong Chemical Industry Co., Ltd Shijiazhuang Bailong Chemical, located in Shijiazhuang, which is approximately 400 km from the Zibo Jiazhou Chemical facilities, currently has the capacity to produce 20,000 tons/year of maleic anhydride and 50,000 tons/year of phthalic anhydride. The Company is not aware of any plans by Shijiazhuang Bailong Chemical to expand its operations to include the production of 1,4-butanediol.

Tianjin Taisen Chemical Industry Co., Ltd Tianjin Taisen Chemical, located in Tianjin, which is approximately 300 km from the Zibo Jiazhou Chemical facilities, currently has the capacity to produce 20,000 tons/year of phthalic anhydride. The Company is not aware of any plans by Tainjin Taisen Chemical to expand its operations to include the production of 1,4-butanediol.

12

Employees

As of March 28, 2011, we have a total of approximately 176 employees and skilled labor working in our offices and production facilities in the PRC. However, there can be no assurance that we will be able to maintain a prolonged good relationship with our existing or ex-employees and that no labor disruptions will occur in the future. Should any industrial action or labor unrest occur, our business operations could be adversely affected. The following table outlines the breakdown of the 176 employees:

|

Departments

|

Employee Amount

|

|

|

Management

|

8

|

|

|

Sales

|

5

|

|

|

Plant operations

|

106

|

|

|

Plant maintenance

|

7

|

|

|

Accounting

|

5

|

|

|

Employee support

|

16

|

|

|

Security

|

8

|

|

|

Other

|

21

|

|

|

Total

|

176

|

Government and Environmental Regulation

Industrial Products Production License

The Administration Rules on Industrial Products Production License was promulgated by the State Council on July 9, 2005, according to which enterprises intending to engage in production of important industrial product, including dangerous chemicals, shall meet with certain requirements and obtain a license from governmental quality supervision authority.

Zibo Jiazhou Chemical obtained its License of Producing Industrial Products on April 10, 2006, which has information registered therein as follows:

Certificate No.: XK13-216-00149

Scope of products: phthalic anhydride (PA)

Issued by: the State Bureau of Quality and Technical Supervision

Issuing Date: April 10, 2006

Valid Until: April 9, 2011

Although Zibo Jiazhou Chemical began to produce maleic anhydride in April 2007, maleic anhydride is not registered in the scope of products of its current Industrial Products Production License. If Zibo Jiazhou Chemical fails to do the filing, the relevant government authority may order Zibo Jiazhou Chemical to suspend production of the unregistered product and impose fines. Zibo Jiazhou Chemical recently applied with the relevant authority for the registration of maleic anhydride in this license and expects to obtain approval within a reasonable time.

Registration Certificate of Enterprise Producing Dangerous Chemicals

According to the Administration Rules on Registration of Dangerous Chemicals promulgated on October 8, 2002, enterprises producing dangerous chemicals shall file documents in relation to production, products’ specifications, safety management system, accident handling measures, etc. to the governmental registration centre for registration.

13

The Company obtained its initial registration certificate required under the said regulation on April 28, 2007 and renewed it on August 12, 2010. The information registered on the current certificate are as follows:

Certificate No.: 370312114

Registered Chemicals: phthalic anhydride (PA) and o-xylene(邻二甲苯)

Issued by: the Registration Centre of Dangerous Chemicals of the State Bureau of Work Safety

Issuing Date: August 12, 2010

Valid Until: August 11, 2013

Registration Certificate of Chemicals Subject to Supervision and Control

The Registration Certificate of Chemicals Subject to Supervision and Control promulgated by the State Council on December 27, 1995 provides that the activities of production, trading and using of chemicals which could be used to produce chemical weapons are under supervision and control of the government and every person intending to engage in such activities shall be registered with and approved by competent government authority before acting.

Zibo Jiazhou Chemical obtained its first Registration Certificate of Chemicals Subject to Supervision on December 19, 2003, which was renewed several times thereafter. The information in the current registration certificate is as follows:

Certificate No.: HW37C(001)号

Registered Chemicals: phthalic anhydride (PA) and maleic anhydride (MAH)

Issued by: Chemical Industry Administration Office of Zibo City

Issuing Date: November 10, 2010

Valid Until: November 9, 2011

Registration Certificate of Standardization

The information in the current registration certificate is as follows:

National Standard Registration Certificate (山东省企业产品执行标准登记证书)

Certificate No.: 370300-0510

Standard in Conformance: GB/T 3676-2008 for maleic anhydride (MAH); GB/T 15336-2006 for phthalic anhydride (PA)

Issued by: Quality and Technical Supervision Bureau of Shandong Province

Issuing Date: April 22, 2010

Valid Until: April 22, 2013

License of Heating Supply

Zibo Jiazhou Chemical is engaged in the sale of steam, which is produced as a byproduct of phthalic anhydride and maleic anhydride. According to the Administration Rules of Shandong Province on Heating Supply Permit and the Administration Rules of Shandong Province on Heating Supply promulgated by Shandong Provincial Government on February 27, 2006 and October 31, 2007 respectively, Zibo Jiazhou Chemical registered with the government authority for being in the business relating to public utility and obtained a license with information set forth as follows:

Certificate No.: 鲁淄热许字第10018号

Issued by: Public Utility Administration Bureau of Shandong Province

Issuing Date: June 7, 2010

Valid Until: June 7, 2013

Project Investment Approvals

According to relevant PRC regulations, for each project having fixed assets construction or enlargement, as a precondition for applying for other necessary approvals from various government authorities (such as land, layout, construction, fire control, etc.), the approval in regard of investment scale, capital sources, production capacity, profit prediction, resources consumption, etc. from competent level of governmental authority in charge of macro-economic control of this area shall be firstly obtained (the “Project Investment Approval”).

14

Zibo Jiazhou Chemical has three projects been built or in building:

|

(1)

|

Project of phthalic anhydride (“Project A”)

|

The construction of Project A was divided into two phases. Phase I, having annual production capability of 30,000 tons phthalic anhydride, began in February 2004 and completed in August 2006. Phase II, having annual production capability of 20,000 tons phthalic anhydride, began in October 2007 and completed in February 2008. The Company obtained the Project Investment Approval from the Economic and Trade Administration Committee of Zibo Municipal on June 3, 2004.

|

(2)

|

Project of maleic anhydride (“Project B”)

|

The construction of Project B was divided into three phases. Phase I, having annual production capability of 10,000 tons maleic anhydride, began in November 2004 and completed in April 2007. Phase II, having annual production capability of 20,000 tons maleic anhydride, began in October 2007 and completed in June 2008. Construction of Phase III, having the production capability of 30,000 tons maleic anhydride has already begun and operations will commence in October, 2010.

Zibo Jiazhou Chemical obtained the Project Investment Approval from the Economic and Trade Administration Committee of Zibo Municipal on March 11, 2006 for Phase I of Project B and obtained the Project Investment Approval from the Economic and Trade Administration Committee of Shandong Province on March 5, 2009 for Phase III of Project B.

|

(3)

|

Project of 1,4-butanediol (“Project C”)

|

Zibo Jiazhou Chemical obtained the Project Investment Approval for Project C, having annual production capacity of 50,000 tons/year 1,4-butanediol, from the Economic and Trade Administration Committee of Shandong Province on March 5, 2009. Construction of Project C is expected to begin in October 2010. Construction is expected to be completed within 18 months of the commencement of construction. Accordingly, based upon current estimates, production of 1,4-butanediol will begin in April 2012.

Our Strategies, Risks and Uncertainties

In order to enhance our position as one of the top chemical manufacturers in the PRC, we intend to expand our 1,4-butanediol production, expand our toll processing business to maximize capacity utilization and gain no-cost by-product revenues for acid water and steam sales, widen our geographic distribution and sales networks into new domestic and international markets, and further integrate Westerns management best practices and techniques to maximize profitability and financial controls.

These risks and uncertainties, along with others, are also described in the Risk Factors section of this Annual Report on Form 10-K.

ITEM 1A. RISK FACTORS

There are numerous and varied risks, known and unknown, that may prevent us from achieving our goals. If any of these risks actually occur, our business, financial condition or results of operation may be materially adversely affected. In such case, the trading price of our common stock could decline and investors could lose all or part of their investment.

Risks Associated with our Business

We have a relatively limited operating history.

We have a relatively limited operating history with respect to our current business strategy. Zibo Jiazhou Chemical, our PRC operating entity, through which we currently operate our business, commenced production of phthalic anhydride in 2001 and maleic anhydride in 2007. We have expanded MAH production from 30,000 to 60,000 tons with startup commencing operations on October of 2010. Our action was to insure that the Company would have enough internally generated feedstock, MAH, for producing the full capacity of the BDO plant without having to seek MAH from outside sources. In 2013 it is intended that the Company will sell only two chemicals, PA and BDO.

15

We are an upstream chemical manufacturer that does not sell products to the retail marketplace. We currently sell PA and MAH to other chemical processing companies that add additional chemicals in their processes that create both retail and industrial uses in their manufacturing process for items we see in everyday life. Many products have automotive, construction, aviation, transportation, marine and medical industry applications.

You should consider our future prospects in light of the risks and uncertainties typically experienced by companies such as ours in evolving industries such as the chemical industries in China and the Asia-Pacific region. Some of these risks and uncertainties relate to our ability to:

|

●

|

Offer new and innovative products to attract and retain a larger customer base;

|

|

●

|

Attract additional customers and increase spending per customer;

|

|

|

●

|

Increase awareness of our products and brands and continue to develop user and customer loyalty;

|

|

|

●

|

Raise sufficient capital to sustain and expand our business;

|

|

●

|

Maintain effective control of our costs and expenses;

|

|

|

●

|

Respond to changes in our regulatory environment;

|

|

|

●

|

Respond to competitive market conditions;

|

|

|

●

|

Manage risks associated with intellectual property rights;

|

|

|

●

|

Integrate any business acquisition properly;

|

|

|

●

|

Attract, retain and motivate qualified personnel; and

|

|

|

●

|

Upgrade our technology to support additional research and development of new products.

|

Because our contracts are individual purchase orders and not long-term agreements, the results of our operations can vary significantly from quarter to quarter.

We currently do not have any long-term contracts with our customers for our chemical products. We have been dependent in each year on a small number of customers who generate a significant portion of our business related to our chemical products, and these customers have changed from year to year. For the fiscal year ended December 31, 2010, 5 customers accounted for approximately 59% of our total revenues related to our chemical products.

The following table summarizes our top 5 customers for the years ended December 31, 2010 and 2009:

|

Customers

|

Sales

|

Accounts Receivable

|

|||||||||

|

2010

|

2009

|

December 31, 2010

|

December 31, 2009

|

||||||||

|

Zibo Xinghua Resin Co., Ltd.

|

22% | 25% | 41% | 39% | |||||||

|

Zouping Erkeri Chemical Co., Ltd

|

6% | - | 21% | - | |||||||

|

Dongying Shenli Zhongya Chemecial Co., Ltd

|

16% | 4% | 1% | - | |||||||

|

Kaifeng Taihua Chemical Co., Ltd

|

6% | 4% | 1% | - | |||||||

|

Pingmei Group Kaifeng Xinghua Fine Chemical Factory

|

9% | 25% | - | - | |||||||

16

We are looking to diversify our customers to become less dependent on large customers. In 2010 and 2009 we sold Zibo Xinghua Resin Co.,Ltd. 22% and 25%, respectively. We also sold products in 2010 and 2009 to Fine Chemical Factory 9% and 25%, respectively. Dongying Shenli Zhongya Chemecial Co., Ltd actually increased sales for 2010 and 2009 to 16% and 4%, respectively. The next two customers have 6% for sales each. Thus our actions of decreasing the amount of larger customers is being implemented but may not completely diversify for the foreseeable future.

For the fiscal years ended December 31, 2010 and 2009, 74.77% and 69.07% of revenue, respectively, was derived from the Shandong Province. We anticipate that our dependence on a limited number of customers in any given fiscal year will continue to decrease for the foreseeable future. There is a risk that existing customers will elect not to do business with us in the future or will experience financial difficulties. There is also a risk that our customers will attempt to impose new or additional requirements on us that reduce the profitability of those customers for us. If we do not develop relationships with new customers, we may not be able to increase, or even maintain, our revenue, and our financial condition, results of operations, business and/or prospects may be materially adversely affected.

Possible shortage in supply or price fluctuations of raw materials may have a detrimental effect on our profitability.

We have not entered into any long-term supply contracts with suppliers of major raw materials and cannot guarantee that we will be able to pass any future increases in raw material purchase prices on to consumers.

For the years ended December 31, 2010, 3 suppliers provided approximately 89% of our raw materials. For the year ended December 31, 2009, 4 suppliers provided approximately 91% of our raw materials that are used in our processes of approximately 55,000 metric tons annually prior to the MAH expansion. Within a 200km parameter of Zibo Jiazhou Chemical, there is an additional excess capacity of 150,000 metric tons annually or 273% of additional supply of raw materials. In the event that our relationships deteriorate with such suppliers, we may be unable to fulfill our customers’ needs. In the event that there is a significant shortage or change in the purchase price of raw materials in the future and we are unable to transfer resulting cost increases to our customers, our business operations and profitability may be adversely affected.

We face competition from other chemical producers and sellers. Therefore, the business and prospects may be adversely effected if we are not able to compete effectively.

We operate in markets where we compete with organic chemical producers and sellers of similar or larger size and scale in the PRC. In addition, a number of foreign companies have established chemical manufacturing enterprises in the PRC, and other foreign manufacturers may do so in the future. Such domestic and foreign competitors may have greater access to financial resources, higher levels of vertical integration, better operating efficiency and longer operating histories. Zibo Jiazhou Chemical produces over 50% of the supply of MAH currently, and 70% when the 30,000 metric ton expansion becomes fully operational in January, 2011. At current production level for PA it is an estimated 20% of the PA supply. If we are unable to improve product quality, performance and price competitiveness or if we are unable to anticipate and respond to changing market demand, maintain operating efficiency and economies of scale, and control costs in connection with the planned expansion, raw materials and energy, our business and prospects may be adversely affected and we may not be able to compete effectively.

The majority shareholder of Zibo Jiazhou Heat and Power Co., Ltd. has potential conflicts of interest with us, which may adversely affect our business.

Lu Lingliang, our Vice-Chairman, is the majority shareholder of Zibo Jiazhou Heat and Power Co., Ltd. Conflicts of interests between his duties to our company and Zibo Jiazhou Heat and Power Co., Ltd. may arise. As Lu Lingliang is a director of our company, he has a duty of loyalty and care to us under Delaware State law when there are any potential conflicts of interests between our company and Zibo Jiazhou Heat and Power Co., Ltd.. Zibo Jiazhou Heat and Power Co., Ltd. is indebted to our company in excess of $20 million with no fixed repayment term. We cannot assure, however, that when conflicts of interest arise, Lin Lingliang will act completely in our interests or that conflicts of interests will be resolved in our favor. If we cannot resolve any conflicts of interest between us and Lin Liagliang, we would have to rely on legal proceedings, which could result in the disruption of our business.

Our substantial amount of debt could adversely affect our financial health, which could adversely affect our results of operations.

We are highly leveraged. Our substantial indebtedness could have a material adverse effect on us by: making it more difficult for us to satisfy our payment obligations under our bank loans; limiting our ability to borrow money for working capital, restructurings, capital expenditures, research and development, investments, acquisitions or other purposes, if needed, and increasing the cost of any of these borrowings; requiring us to dedicate a substantial portion of our cash flow from operations to service our debt, which reduces the funds available for operations and future business opportunities; limiting our flexibility in responding to changing business and economic conditions, including increased competition and demand for new services; placing us at a disadvantage when compared to those of our competitors that have less debt; and making us more vulnerable than those of our competitors who have less debt to a downturn in our business, industry or the economy in general. Despite our substantial indebtedness, we may still incur significantly more debt, which could further exacerbate the risks described above.

17

Our business and operations require capital investment. Failure to raise sufficient capital in a timely manner may adversely effect the business and results of operations.

In accordance with our development plan, including the contemplated construction of the 1,4-butanediol production line, we intend to expand our operations in the Shandong Province of the PRC. Management may from time to time have other business expansion plans that require further capital. If we are unable to obtain such additional funding, we may not be able to pay for the necessary capital expenditures needed for expansion, or to implement proposed business strategies or at all. Any of the above could impede the implementation of our business strategies or prevent us from entering into transactions that would otherwise benefit business on commercially reasonable terms or at all and adversely effect its financial condition and results of operations.

Our ability to obtain additional capital on acceptable terms is subject to a variety of uncertainties, including:

·Investors’ perception of, and demand for, securities of alternative chemical companies;

·Conditions of the U.S. and other capital markets in which we may seek to raise funds;

·Our future results of operations, financial condition and cash flows;

·PRC governmental regulation of foreign investment in chemical companies in China;

·Economic, political and other conditions in China; and

·PRC governmental policies relating to foreign currency borrowings.

We cannot assure you that financing will be available in amounts or on terms acceptable to us, if at all. Any failure by us to raise additional funds on terms favorable to us could have a material adverse effect on our liquidity and financial condition.

Our business is subject to operation risks beyond our control and could have a detrimental effect on our profitability.

Our financial performance is at all times subject to operational risks which may include factors that are beyond our control. The production process could face unforeseen operating problems and therefore production could be delayed and financial performance would be adversely affected. Unanticipated additional major maintenance of the plant would also impact upon production capacity and revenue projections. This potential downtime would impact upon our results. More specifically an example could be; if a catalyst fails on site and not during a normal maintenance period it would take time to have the new catalyst shipped by boat and the production would be down during this time period. Catalysts should last up to 3 years of operations.

Operations are subject to hazards and natural disasters that may not be fully covered by our insurance policies.

We make substantial investments in complex manufacturing and production facilities. Many of the production processes, raw materials and certain finished products are potentially destructive and dangerous in uncontrolled or catastrophic circumstances, including operating hazards, fires and explosions, and natural disasters such as typhoons, floods, earthquakes and major equipment failures for which insurance may not be obtainable at a reasonable cost or at all. Should an accident or natural disaster occur, it may cause significant property damage, disruption to operations and personal injuries and our insurance coverage may be inadequate to cover such loss. Should an uninsured loss or a loss in excess of insured limits occur, we could suffer from damage to our reputation or lose all or a portion of production capacity as well as future revenues anticipated to derive from the relevant facilities. Any material loss not covered by our insurance policies could materially and adversely effect our business, financial condition and operations.

18

We do not currently maintain any business interruption insurance policies.

We have not yet taken out a business interruption insurance policy. Our operations could be interrupted by fire, flood, earthquake and other events beyond our control for which we do not carry adequate insurance. While we have property damage insurance, we do not carry business disruption insurance, which is not readily available in China. Any disruption of the operations in our factories would have a significant negative impact on our ability to manufacture and deliver products, which would cause a potential diminution in sales, the cancellation of orders, damage to our reputation and potential lawsuits.

Furthermore, any defects in our chemical products could result in economic loss, adverse customer reaction, negative publicity, and additional expenditure to rectify the problems and/or legal proceedings instituted against us. We have not maintained any insurance policy against losses that may arise from such claims. Any litigation relating to such liability may be expensive and time consuming, and successful claims against us could result in substantial monetary liability or damage to our business reputation and disruption to our business operations.

We are dependent upon key personnel and the loss of key personnel, or the inability to hire or retain qualified personnel, could have an adverse effect on our business and operations.

Our success is heavily dependent on the continued active participation of Lu Feng, our Chief Executive Officer, President and Chairman, Yan Kai, our Chief Operating and Administration Officer, Zhang Lianjun, our Chief Marketing Officer, Li Bin, our Chief Accounting Officer. Loss of the services of Mr./Ms. Lu, Yan, Li or Zhang could have a material adverse effect upon our business, financial condition or results of operations. Further, our success and achievement of our growth plans depend on our ability to recruit, hire, train and retain other highly qualified technical and managerial personnel. Competition for qualified employees among companies in the chemical industry is intense, and the loss of any of such persons, or an inability to attract, retain and motivate any additional highly skilled employees required for the expansion of our activities, could have a materially adverse effect on us. The inability on our part to attract and retain the necessary personnel and consultants and advisors could have a material adverse effect on our business, financial condition or results of operations.

There are differences between PRC and U.S. Generally Accepted Accounting Principles.

Our profits are derived from our PRC operating entity. The profits available for distribution for companies established in the PRC are determined in accordance with PRC accounting standards, which may differ from the amounts, arrived at under US GAAP. In the event that the amount of the profits determined under the PRC accounting standard in a given year is less than that determined under the US GAAP, we may not have funds to allow distribution of profits to our stockholders.

We may fail to achieve our outline business objectives.

The future plans as set out in this document have been formulated on the basis of a number of assumptions in relation to future events, which by their nature are subject to changes and uncertainties and may not materialize. Although we will endeavor to execute such plans there is no assurance that our plans will materialize or be executed in accordance with the stated timeframe or that our objectives will be fully accomplished.

There is a risk of infringement of our intellectual property rights in the PRC.

Zibo Jiazhou Chemical owns one registered trademark in the PRC. There can be no assurance that the existing legal protection in the PRC will effectively prevent unauthorized use of our trademarks or the misappropriation by third parties of the technology associated with our applied/registered patents.

Policing unauthorized use of our trademarks and the proprietary technology may be difficult, costly and ineffective, and there can be no assurance that any steps taken by us will effectively prevent any such misappropriation or infringement from occurring. Unauthorized use of our trademarks and patented technology could adversely effect our performance and business reputation. Failure to renew our trademarks could also adversely effect our performance and business reputation.

Potential claims alleging infringement of third party’s intellectual property by us could harm our ability to compete and result in significant expense to us and loss of significant rights.

From time to time, third parties may assert patent, copyright, trademark and other intellectual property rights to technologies that are important to our business. Any claims that our products or processes, whether in relation to the specific circumstances set out above or otherwise, infringe the intellectual property rights of others, regardless of the merit or resolution of such claims, could cause us to incur significant costs in responding to, defending, and resolving such claims, and may divert the efforts and attention of our management and technical personnel away from the business. As a result of such intellectual property infringement claims, we could be required or otherwise decide it is appropriate to pay third-party infringement claims; discontinue manufacturing, using, or selling particular products subject to infringement claims; discontinue using the technology or processes subject to infringement claims; develop other technology not subject to infringement claims, which could be time-consuming and costly or may not be possible; and/or license technology from the third-party claiming infringement, which license may not be available on commercially reasonable terms. The occurrence of any of the foregoing could result in unexpected expenses or require us to recognize an impairment of our assets, which would reduce the value of the assets and increase expenses. In addition, if we alter or discontinue the production of affected items, our revenue could be negatively impacted.

19

Pursuant to relevant regulations issued by the State government, land collectively owned by peasants can only be used for agriculture, building utilities for the inhabiting community or be used to build commercial or industrial facilities by business entities owned by the inhabiting community. Zibo Jiazhou Chemical is not an entity owned by the inhabiting community of the land, therefore it is not legal for Zibo Jiazhou Chemical to use the land in the current status. Zibo Jiazhou Chemical needs to apply with the local government for the using of this land and, if approved, the government will compensate the inhabiting community for transforming the nature of the land to “State-owned” and then grant the land use right to Zibo Jiazhou Chemical through appropriate procedure. Zibo Jiazhou Chemical received notification from the State Land Bureau of Zibo Municipal on August 10, 2010 that the land leasing relationship between Jiazhou Community and Zibo Jiazhou Chemical will be kept in its current status before the land being granted to Zibo Jiazhou Chemical in the nature of a State-owned land, which is undertaken to be happened within five years.

We depend on only one factory to manufacture our products and any disruption of the operations in this factory would damage our business.

All of our products are manufactured in our factory in the PRC which we depend on to produce the products that we sell. Our operations could be interrupted by fire, flood, earthquake and other events beyond our control. Any disruption of the operations in this factory would have a significant negative impact on our ability to deliver products, which would cause a potential diminution on sales, the cancellation of orders, damage to our reputation and potential lawsuits.

RISKS RELATING TO THE CHEMICAL INDUSTRY IN THE PRC

Our failure to comply with ongoing governmental regulations could hurt our operations and reduce our market share.

In China, the chemical industry is undergoing increasing regulations as environmental awareness increases in China. The trend is that the Chinese government toughens its regulations and penalties for violations of environmental regulations. New regulatory actions are constantly changing our industry. Although we believe we have complied with applicable government regulations, there is no assurance that we will be able to do so in the future.

RISKS RELATING TO DOING BUSINESS IN CHINA

Governmental control of currency conversion may affect the value of your investment.

The PRC government imposes controls on the convertibility of RMB into foreign currencies and, in certain cases, the remittance of currency out of China. We receive substantially all of our revenues in RMB. Shortages in the availability of foreign currency may restrict the ability of our PRC subsidiaries and our affiliated entity to remit sufficient foreign currency to pay dividends or other payments to us, or otherwise satisfy their foreign currency denominated obligations. Under existing PRC foreign exchange regulations, payments of current account items, including profit distributions, interest payments and expenditures from trade-related transactions, can be made in foreign currencies without prior approval from China State Administration of Foreign Exchange by complying with certain procedural requirements. However, approval from appropriate government authorities is required where RMB is to be converted into foreign currency and remitted out of China to pay capital expenses such as the repayment of bank loans denominated in foreign currencies, repatriation of funds and direct investment. The PRC government may also at its discretion restrict access in the future to foreign currencies for current account transactions. If the foreign exchange control system prevents us from obtaining sufficient foreign currency to satisfy our currency demands, we may not be able to pay dividends in foreign currencies to our stockholders.

Failure to comply with the United States Foreign Corrupt Practices Act could subject us to penalties and other adverse consequences.

We are subject to the United States Foreign Corrupt Practices Act (“FCPA”), which generally prohibits United States companies from engaging in bribery or other prohibited payments to foreign officials for the purpose of obtaining or retaining business. Foreign companies, including some that may compete with us, are not subject to these prohibitions. Corruption, extortion, bribery, pay-offs, theft and other fraudulent practices occur from time-to-time in the PRC. We can make no assurance, however, that our employees or other agents will not engage in such conduct for which we might be held responsible. While our code of ethics have been adopted to ensure compliance with the FCPA and Chinese anti-corruption laws by all individuals involved with our company, our employees or other agents may engage in such conduct for which we might be held responsible. If our employees or other agents are found to have engaged in such practices, we could suffer severe penalties and other consequences that may have a material adverse effect on our business, financial condition and results of operations.

20

The PRC economy may experience inflationary pressure, which may lead to an increase in interest rates and a slowdown in economic growth.

In response to concerns regarding the PRC’s high rate of growth, the PRC Government has taken measures to slow down economic growth to a more manageable level. Among the measures that the PRC Government has taken are restrictions on bank loans in certain sectors. These measures have contributed to a slowdown in economic growth in the PRC and a reduction in demand for consumer goods. Consequently, these measures and any additional measures, including a possible increase in interest rates, could contribute to a further slowdown in the PRC economy, which in turn could adversely affect the future demand of the our products and our operating results. If prices for our products rise at a rate that is insufficient to compensate for the rise in our costs, it may have an adverse effect on profitability.

Fluctuations in the exchange rate could have a material adverse effect upon our business.

We conduct our business in RMB. To the extent our future revenue are denominated in currencies other than the United States dollars, we would be subject to increased risks relating to foreign currency exchange rate fluctuations which could have a material adverse effect on our financial condition and operating results since our operating results are reported in United States dollars and significant changes in the exchange rate could materially impact our reported earnings.