Attached files

Exhibit 10.32

SECURED PROMISSORY NOTE

(Commercial Note)

| PRINCIPAL AMOUNT: | Edwardsville, IL |

|

$682,500.00

|

October 21, 2010 |

FOR VALUE RECEIVED, YTB International, Inc., a Delaware corporation having an office and place of business at 1901 E. Edwardsville Rd., Wood River, IL 62095 (the "Borrower" or "Maker"), unconditionally promises to pay to the order of Normandy Corporation, a New York corporation having an office and place of business at 46 Prince Street, Rochester, NY 14607 (the "Lender"), or such other place as the Lender shall designate, the principal sum of Six Hundred Eighty-Two Thousand Five Hundred and 00/100 Dollars ($682,500.00) with interest thereon from the date hereof payable as follows:

A payment of Fifty-Eight Thousand and 00/100 Dollars ($58,000.00) shall be due and payable on the first day of each month of the term hereof commencing with the November 1, 2010 payment. Monthly payments will be applied first to accrued and unpaid interest, then to late charges, and other charges, if any, with the balance of said payment applied to the outstanding principle due under the Note.

The "Interest Rate" payable under the Note shall be fixed at fourteen and one half percent (14,5%) per annum. Interest shall be calculated at the Interest Rate and based upon the outstanding balance hereunder, for the actual number of calendar days in each month, and upon a 360 day year.

The outstanding principal balance together with any accrued and unpaid interest shall be due and payable in full on the September 1, 2011 ("the Maturity Date"),

BORROWER may prepay this Note, in whole or in part, at any time without incurring any prepayment penalty.

BORROWER REPRESENTS to Lender that the proceeds of this Note shall be used only for business purposes. Borrower acknowledges that Lender has made this loan in reliance upon the foregoing representation of Borrower.

REPAYMENT of this Note is secured by a Mortgage encumbering certain real property (the "Real Property") being situated in the County of Madison, State of Illinois, commonly known as 1 Country Club View, Edwardsville, IL 62025, and described as follows:

See Exhibit "A" attached hereto and made part hereof

1

The terms, conditions and provisions of the Mortgage are by this reference made a part hereof to the extent and with the same force and effect as if fully set forth herein and any default under any of said documents shall be an event of default under this Note.

ALL RIGHTS and remedies herein specified are intended to be cumulative and not in substitution for any right or remedy otherwise available_ In any action or proceeding to recover any sum herein provided for, to the extent permitted by applicable law, no defense of adequacy of security, or' that resort must first be bad to security or to any other person, shall be asserted by Borrower. Borrower hereby waives all rights of exemption of property from levy or sale under execution or other process for the collection of this Note to the extent permitted under the laws of the United States or any state thereof. If a financial statement has been delivered to Lender, Borrower represents that such financial statement is true, correct, and complete as of the date of such statement, and that there has been no material or adverse change in the statement from the date thereof to the date hereof, and that so long as Borrower has any loans outstanding with Lender, it will at once notify Lender of any material adverse change in its financial condition.

THE FOLLOWING EVENTS shall, in addition to the terms set forth herein and in the Mortgage, constitute Defaults hereunder and under' the Mortgage:

|

a.

|

Borrower's failure to perform or observe any term, condition, covenant, or obligation set forth in the Note or Mortgage (or in any other documents executed by Borrower in connection with the loan transaction evidenced by this Note);

|

|

b.

|

Borrower's failure to pay any installment of principal and/or interest due hereunder when due, or real estate taxes or insurance premiums within thirty (30) days of when due;

|

|

e.

|

Borrower's failure to perform or observe any term, condition, covenant, or obligation contained in any promissory note or mortgage (or in any other loan instrument of any kind or nature) pertaining to any other loan transactions by and between Borrower and Lender;

|

|

d.

|

Any sale (or other transfer of any kind) of all or any portion of the Real Property without Borrower's prior written consent, or any change in the use of the Real Property without Lender's prior written consent, and any transfer of all or any portion of the Real Property in violation of the Mortgage;

|

|

e.

|

any warranty, representation or statement of Borrower in the Mortgage, or otherwise made or furnished to Lender by or on behalf of Borrower, proves to have been false or misleading in any material respect when made or furnished;

|

|

f.

|

dissolution of, termination of the existence of, insolvency of, business failure of, appointment of a receiver for any part of the property (including, without limitation, the Real Property) of, assignment for the benefit of creditors by, or the commencement of any proceeding under any bankruptcy or insolvency laws by or against Borrower;

|

2

|

g.

|

good faith belief by Lender that the obligations of the Mortgage, the Note, or any other obligation referenced herein are inadequately secured or that the prospect for payment or performance of any of same is impaired;

|

|

h,

|

Borrower's failure to remove (or bond over) any lien filed on the Real Property within twenty (20) days from the date of its filing; or

|

|

i.

|

Borrower's failure to provide to Lender a letter together with each monthly payment due hereunder stating that there are no homeowners assessments due and unpaid with respect to any of the Real Property.

|

IF ANY DEFAULT shall occur, Lender shall provide to Borrower a written notice of default, if such default shall not be cured within ten (10) days from the date of such notice in respect of a monetary default, and within twenty (20) days from the date of such notice in respect of a non monetary default, then the remaining unpaid principal, any accrued and unpaid interest, plus any applicable prepayment penalties, shall, at the option of the Lender and without further notice immediately become due and payable in full. Any payment of interest due hereunder made ten (10) or more days after its due date must be accompanied by a late charge in the amount of six percent (6%) of the payment Any payment of principal made ten (1 0) or more days after its due date shall be accompanied by a late charge in the amount of six percent (6%) of the payment. From and after the date of any Default or in the event this Note is not paid in full on Maturity, the principal sum and all interest or other charges then accrued, shall bear interest at the rate equal to the greater of: (i) eighteen percent (18%) per annum; or (ii) the maximum allowable by law.

IN TILE EVENT OF ANY DEFAULT not cured in a timely manner as provided for herein above, Lender shall also be entitled to recover all costs of collection with or without lawsuit or foreclosure including reasonable attorney fees; and if the Mortgage securing this Note is foreclosed, Lender shall also be entitled to recover all costs and reasonable attorney fees in connection therewith, "Reasonable attorney fees" are defined to include, but not be limited to, all reasonable fees incurred in all matters of collection, foreclosure, redemption, receivership, enforcement, construction and interpretation, whether or not suit is instituted and if so instituted such costs and fees incurred before, during and after suit, trial, other proceedings and appeals, as well as appearances in connection with any bankruptcy proceedings or creditor's reorganization or similar proceedings,

BORROWER, to the extent permitted by law, hereby waives notice of demand, presentment for payment, notice of nonpayment and protest, notice of dishonor, and any and all notices of whatever kind or nature, the exhaustion of legal remedies herein and any homestead rights. "Presentment" means the right to require the Note Holder to demand payment of any amounts due. "Notice of dishonor" means the right to require the Note Holder to give notice to other persons that the amounts due have not been

paid. The terms, conditions and obligations under this Note cannot be changed, modified, or terminated except by a writing signed by the Lender.,

3

BORROWER REPRESENTS that it is duly authorized and empowered to enter into, deliver, perform and be fully bound by all the terms, provisions and conditions of this Note, Borrower also represents that the making and delivery of this Note, and the performance of any agreement or instrument made in connection herewith, does not conflict with or violate any other agreement to which Borrower is a party.

IT IS THE INTENTION of the parties hereto to comply with applicable federal and state usury laws. Accordingly, it is agreed that notwithstanding any provisions to the contrary in this Note, no provision of this Note shall require the payment by or permit the collection of interest from the Borrower or any other person in excess of the maximum permitted by law to be so charged and collected_ If any excess of interest in such respect is provided for, or shall be adjudicated to be so provided for in this Note, then in such event: (a) the provisions herein shall govern and control, (b) neither the Borrower nor any other person shall be obligated to pay the amount of such interest to the extent that it is in excess of that permitted by law to be charged and collected, (c) any such excess which may have been collected shall be applied as a credit against the then-unpaid principal balance of this Note, or if such excess interest exceeds the unpaid balance of principal, the excess shall be refunded to Borrower, and (d) the effective rate of interest for which any party shall be liable under this Note shall be automatically subject to reduction to the maximum lawful rate allowed to be charged and collected from such party under applicable federal and state usury laws as now or hereafter construed by any court..

LENDER MAY TRANSFER THIS NOTE to any person, firm or corporation and deliver any security given herewith, or any part thereof, to such transferee who shall thereupon become vested with all the rights and powers herein given to Lender, and Lender shall thereafter be forever relieved and discharged from any liability to Borrower with respect to such security or otherwise as to any matters arising subsequent to the date of such transfer.

BORROWER HEREBY KNOWINGLY, voluntarily and intentionally waives any right it may have to a trail by jury in respect of any litigation arising out of under or in connection with this Note, any other loan document or the transactions contemplated herein. Further, Borrower hereby certifies that no representative or agency of the Lender nor the Lender's counsel has represented, expressly or otherwise, that the Lender would not, in the event of such litigation, seek to enforce this waiver of right to jury trial provision. Finally, Borrower acknowledges that the Lender has been induced to make the loan evidenced by this Note by, among other things, the provisions of this section_

THIS NOTE IS and shall be deemed entered into in the State of Illinois and shall be governed by and construed in accordance with the laws of the State of Illinois and no defense given or allowed by the laws of any state or country shall be interposed in any action or proceeding hereof unless such defense is also given or allowed by the laws of the State of Illinois_ In the event that any word, phrase, clause, sentence, or other provision thereof shall violate any applicable statute, ordinance or rule of law in any jurisdiction in which it is used, such provision shall be ineffective to the extent of such violation without invalidating any other provision hereof:.

4

WITH RESPECT TO any claim arising out of this Note or the Mortgage, Borrower (a) irrevocably submits, for itself and its property, to the exclusive jurisdiction of the courts of the State of Illinois, and any appellate courts therefrom, (b) irrevocably waives any objection which it may have at any time to venue of any suit, action or proceeding arising out of or relating to this Note or any other document securing this Note brought in any such court, (c) irrevocably waives any claim that any such suit, action or proceeding brought in any such court has been brought in an inconvenient forum, and (d) further irrevocably waives the right to object with respect to such claim, suit, action or proceeding brought in any such court that such court does not have jurisdiction over it. Borrower irrevocably and unconditionally consents to the service of process in any such suit, action or proceeding in the aforesaid court by the mailing of-copies of such process by certified mailing to the last known address of Borrower, or to such address that Borrower may notify Lender of in writing.

IN WITNESS WHEREOF. the Borrower has caused this Note to be duly executed as of the day and year first written above.

YTI3 INTERNATIONAL, INC.

/s/ Robert M. Van Patten

Robert M. Van Patten, Director

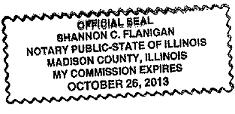

STATE OF )

) ss,

COUNTY OF )

On this 21st day of October, in the year 2010, before me, the undersigned, personally appeared Robert M, Van Patten, personally known to me, or proved to me on the basis of satisfactory evidence, to be the individual whose name is subscribed to the within instrument and acknowledged to me that she executed the same in her capacity, and that by her signature on the instrument, the individual, the person or entity upon behalf of which the individual acted, executed this instrument.

|

|

5

EXHIBIT "A"

Lot 1 in Country Club View-Third Addition, a part of the Southeast Quarter of Section 21, Township 4 North, Range 8 West of the Third Principal Meridian, City of Edwardsville, Madison County, Illinois, as recorded in Plat Cabinet 62 Page 173, (excepting therefrom that part conveyed to One 157 Center LLC, a Limited Liability Company by Quit Claim Deed recorded July 29, 2003 in Book 4592 Page 5474, more particularly described as follows: Beginning at the most Easterly corner of said Lot 1; thence on an assumed bearing of South 42 degrees 04 minutes 50 seconds West on the Southeasterly line of said Lot 1, a distance of 20.35 feet; thence Northwesterly 31.76 feet on a curve to the left, having a radius of 20,00 feet, the chord of said curve beats North 03 degrees 25 minutes 07 seconds West, 28.53 feet to the Northeasterly line of said Lot 1; thence South 48 degrees 55 minutes 05 seconds East of said Northeasterly line 20.35 feet to the point of beginning; also except coal, gas and other mineral rights conveyed, excepted or reserved in prior conveyances), in Madison County, Illinois.

Permanent Parcel No. 14-2-15-21-19-401-001

NOTE: The Permanent Parcel No.is given for information

purposes and is not warranted or insured herein,