Attached files

| file | filename |

|---|---|

| EX-31.2 - CERTIFICATION - LENCO MOBILE INC. | lenco_10k-ex3102.htm |

| EX-14.1 - CODE OF CONDUCT - LENCO MOBILE INC. | lenco_10k-ex1401.htm |

| EX-99.1 - PRESS RELEASE - LENCO MOBILE INC. | lenco_10k-ex9901.htm |

| EX-21.1 - SUBSIDIARIES OF THE REGISTRANT - LENCO MOBILE INC. | lenco_10k-ex2101.htm |

| EX-32.1 - CERTIFICATION - LENCO MOBILE INC. | lenco_10k-ex3201.htm |

| EX-31.1 - CERTIFICATION - LENCO MOBILE INC. | lenco_10k-ex3101.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

þ

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended: December 31, 2010

OR

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Commission File Number: 000-53830

LENCO MOBILE INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

75-3111137

|

|

(State or other jurisdiction of

incorporation or organization

|

(IRS Employer Identification No.)

|

|

345 Chapala Street, Santa Barbara, California

|

93101

|

|

(Address of principal executive offices)

|

(Zip Code)

|

(805) 308-9199

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

Name of Each Exchange on Which Registered

|

|

|

None

|

None

|

Securities registered pursuant to Section 12(g) of the Exchange Act:

Common Stock, Par Value $0.001

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. o Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes o No

Indicate by checkmark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant for Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). o Yes o No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

|

Large accelerated filer o

|

Accelerated filer o

|

Non-accelerated filer o

|

Smaller reporting company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). o Yes x No

The aggregate market value of voting and non-voting common stock held by non-affiliates computed as of the last business day of Lenco Mobile Inc.’s most recently completed second quarter (June 30, 2010) was approximately $244,107,000 (based on the closing sale price of $6.00 on June 30, 2010). Shares of common stock held by executive officers, directors and by persons who own 10% or more of the outstanding common stock of the registrant have been excluded for purposes of the foregoing calculation in that such persons may be deemed to be affiliates. This does not reflect a determination that such persons are affiliates for any other purpose.

As of March 11, 2011, 71,145,659 shares of Lenco Mobile Inc.’s common stock were outstanding.

Documents Incorporated by Reference

Portions of the registrant’s Proxy Statement for the 2011 Annual Meeting of Stockholders are incorporated herein by reference in Part III of this Annual Report on Form 10-K to the extent stated herein. Such proxy statement will be filed with the Securities and Exchange Commission within 120 days of the registrant’s fiscal year ended December 31, 2010.

Lenco Mobile Inc.

Annual Report on Form 10-K

For the Fiscal Year Ended December 31, 2010

Table of Contents

|

Page

|

|||

|

EXPLANATORY NOTES

|

3

|

||

|

SPECIAL NOTE ABOUT FORWARD-LOOKING STATEMENTS

|

3

|

||

|

PART I

|

|||

|

Item 1.

|

Business.

|

4

|

|

|

Item 1A.

|

Risk Factors.

|

20

|

|

|

Item 1B.

|

Unresolved Staff Comments

|

33

|

|

|

Item 2.

|

Properties.

|

33

|

|

|

Item 3.

|

Legal Proceedings.

|

33

|

|

|

Item 4.

|

(Removed and reserved)

|

33

|

|

|

PART II

|

|||

|

Item 5.

|

Market for Our Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

|

34

|

|

|

Item 6.

|

Selected Financial Data.

|

35

|

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operation.

|

36

|

|

|

Item 7A.

|

Quantitative and Qualitative Disclosure About Market Risk.

|

43

|

|

|

Item 8.

|

Financial Statements and Supplementary Data.

|

44

|

|

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

|

74

|

|

|

Item 9A.

|

Controls and Procedures.

|

74

|

|

|

Item 9B.

|

Other Information.

|

76

|

|

|

PART III

|

|||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance.

|

77

|

|

|

Item 11.

|

Executive Compensation.

|

77

|

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

|

77

|

|

|

Item 13.

|

Certain Relationships and Related Transactions and Director Independence.

|

77

|

|

|

Item 14.

|

Principal Accounting Fees and Services.

|

77

|

|

|

PART IV

|

|||

|

Item 15.

|

Exhibits and Financial Statement Schedules.

|

78

|

|

|

SIGNATURES

|

81

|

||

2

EXPLANATORY NOTES

In this annual report on Form 10-K, unless the context indicates otherwise, the terms “Lenco Mobile,” “Company,” “we,” “us” and “our” refer to Lenco Mobile Inc., a Delaware corporation, and its subsidiaries.

Special Note about Forward-Looking Statements

Certain statements in this report are “forward-looking statements.” Forward-looking statements reflect current views about future events and financial performance based on certain assumptions. They include opinions, forecasts, intentions, plans, goals, projections, guidance, expectations, beliefs or other statements that are not statements of historical fact. Words such as “may,” “will,” “should,” “could,” “would,” “expects,” “plans,” “believes,” “anticipates,” “intends,” “estimates,” “approximates,” “predicts,” or “projects,” or the negative or other variation of such words, and similar expressions may identify a statement as a forward-looking statement. Any statements that refer to projections of our future financial performance, our anticipated growth and trends in our business, our goals, strategies, focus and plans, and other characterizations of future events or circumstances, including statements expressing general optimism about future operating results and the development of our products, are forward-looking statements. Forward-looking statements in this report may include statements about:

|

·

|

Our ability to control operating costs and fully implement our current business plan;

|

|

·

|

Our ability to obtain future financing or funds when needed;

|

|

·

|

Our ability to successfully launch our mobile phone and internet services with new mobile telephone network operators (“Wireless Carriers”);

|

|

·

|

Our ability to obtain future financing or funds when needed and the timing and ability of Wireless Carriers to invest in and roll out their next generation mobile networks;

|

|

·

|

Our ability to respond to new developments in technology and new applications of existing technology before our competitors; and

|

|

·

|

Risks associated with acquisitions, business combinations, strategic partnerships, divestures, and other significant transactions which may involve additional uncertainties; and financial risk due to fluctuations in foreign currencies against the U.S. Dollar.

|

The forward-looking statements in this report speak only as of the date of this report and, except to the extent required by law, we do not undertake any obligation to update any forward looking statements. Forward-looking statements are subject to certain events, risks, and uncertainties that may be outside of our control. When considering forward-looking statements, you should carefully review the risks, uncertainties and other cautionary statements in this report as they identify certain important factors that could cause actual results to differ materially from those expressed in or implied by the forward-looking statements. These factors include, among others, the risks described under Item 1A and elsewhere in this report, as well as in other reports and documents we file with the SEC. Caution should be taken not to place undue reliance on any such forward-looking statements.

MARKET DATA AND INDUSTRY INFORMATION

Information regarding market and industry statistics contained in this report is included based on information available to us which we believe is accurate. We have not reviewed or included data from all available sources, and cannot assure stockholders of the accuracy or completeness of the data included in this report.

3

PART I

Item 1. Business.

Overview of Our business

We develop, own and operate mobile phone, internet and internet broadcasting advertising platforms that are used by mobile telephone network operators (“Wireless Carriers”), manufacturers, retailers and commercial enterprises (“Brand Owners”) to attract, monetize and retain relationships with consumers. During 2010, we have broadened our market reach to include mobile and internet monetization of advertising for terrestrial radio and “pure-play” internet broadcasters.

We offer Brand Owners the ability to design, manage and execute mobile and internet-based marketing campaigns, as well as terrestrial radio and “pure-play” advertising, using our proprietary advertising platforms. By using our platforms and proprietary technology, Brand Owners are able to access our state-of-the-art technology to:

|

·

|

Simplify the development and distribution of mobile phone, internet and internet broadcasting advertising;

|

|

·

|

Enhance the quality, appearance and delivery of their advertisements;

|

|

·

|

Reduce the cost of their advertising campaigns;

|

|

·

|

Improve the return on their advertising expenditure; and

|

|

·

|

Measure the level of response on each advertising campaign.

|

During 2010, we also continued to invest time and resources in order to expand our international mobile phone business. Connectivity with international Wireless Carriers forms a key component of our business plan. We have made significant progress in testing connectivity and initiating relationships with international Wireless Carriers in Mexico, Colombia, Singapore, the United Kingdom and the United States. We are currently connected to all the major U.S. Wireless Carriers through an aggregator and have specifically obtained approval from Verizon, AT&T and Sprint for selected mobile messaging campaigns. We have connected with Vodafone in the U.K. In South Africa, we are fully connected and operating with Vodafone SA (through their South African subsidiary “Vodacom”), are connected with MTN, and are currently testing with Telkom, and Cell C. We have signed an agreement to provide one of the leading banks in South Africa with a range of MMS-based marketing solutions and we are currently providing all of the major banks in South Africa with various mobile marketing solutions. Our mobile phone-based financial statement product has been accepted for use by Vodacom and a number of major Brand Owners including several of South Africa’s largest banks. We have received regulatory approval from the local tax authorities regarding compliance with the appropriate tax and communications regulations and have begun to prepare the roll-out the financial statement product to customers. In Mexico, we have successfully connected with Telcel and Iusacell and are currently testing via an aggregator in South Korea. In Singapore, we have successfully tested connectivity with M1 and StarHub, and are testing with SingTel. In Australia we have successfully executed a number of campaigns for Optus, using our server based bulk MMS messaging solution.

We have provided mobile marketing campaigns for Brand Owners such as Mr. Price, Electronic Arts, Alfa Romeo, BMW, First National Bank, Clinique, Vodacom, Vodafone, Makro, LG, Samsung, Nedbank, Ellerines, JD Group, VW, SONY, Nokia, Mitsubishi, Peugeot, Woolworths, Volvo, Virgin Mobile, Toyota, Toshiba, Sun International, Nissan, Land Rover, Ford, Fiat, Estee Lauder, Doritos, SABMiller, BlackBerry, Imperial, Hang Ten, MTN and Nike.

We have also designed, built, integrated and hosted mobi sites, which are internet sites that are accessed via a mobile phone, for many leading, blue chip Brand Owners including Mr. Price, Sasko Flour, Nike, Samsung, Morkels, Joshua Door, Dodos Shoes, Vodafone, MTN, VodaShop, Toyota South Africa, Volkswagen South Africa, Nokia, Makro, Super Sport Television Channel, First National Bank, Ellerine’s and Wetherlys.

Mobile Phone Advertising Platforms and Products

Our mobile phone advertising platform is based on our proprietary technology developed by us. We continually invest in our technical platforms to ensure that we remain market leaders in the mobile messaging sector. These software platforms facilitate the development of advertising content, compression of the advertisement to reduce file size, formatting the message to accommodate the configuration of various mobile phone handset models, and transmission of the advertisement through the Wireless Carrier’s network. During 2010, we have strengthened this platform with our acquisition of a fully integrated technical solution known as the Signaling Gateway (or “SGW”) from Angelos Gateway Limited. We now have the capability to provide MMSC, SMSC, Location-Based Services and USSD solutions using MM7 and SS7 protocols and to deliver high volumes of messages to mobile phones. Our mobile messaging platform is now one of the most advanced, if not the most advanced, in the SMS and MMS sector, with significant throughput capability. Our platform is attractive for both large wireless carriers looking to increase data throughput and smaller wireless carriers seeking to increase or initiate data revenues programs.

4

We provide Wireless Carriers with software and services which they use to manage and track the distribution of Short Message Services (“SMS”) messages and Multimedia Message Services (“MMS”) messages through their MMS Messaging Switch Center (“MMSC”). An SMS message is commonly referred to as a “text message”; it is a text based protocol which enables a mobile phone subscriber to send a text message from one mobile handset to another via a Wireless Carrier. An MMS message is similar, but the message contains multimedia content, such as pictures, audio or video content which is sent via a Wireless Carrier to a subscriber’s mobile handset. By making use of our MMS messaging platforms, a Wireless Carrier is able to enhance the revenue generated from its existing MMS network infrastructure, increase the efficiency of their MMSC, and improve the overall quality of the MMS messages which they deliver to their subscribers.

Wireless Carriers around the world are all looking to increase revenue and profits by growing the volume of data that they sell to their subscribers. Revenue from traditional voice usage is declining when measured by revenue per minute of voice usage and there is now a major drive to identify additional revenue streams from inter alia MMS messaging and solutions delivered via smart mobile phones. Our solutions are well-positioned in the mobile value chain to enhance Average Revenue Per User for the Wireless Carriers. We also believe that our business model offers Wireless Carriers a compelling value proposition which significantly reduces total cost of ownership.

Our MMS messaging platform is unique in that an MMS message compiled and delivered using our platform appears in video format on a mobile subscriber’s handset. In order to view the MMS messages, a mobile phone subscriber simply clicks to open the MMS message as if it was an SMS message, and the MMS runs automatically. Our MMS messages are not streamed, but are compressed and delivered directly into the mobile handset where they are permanently available to be viewed over again. The MMS message can be stored and retrieved at a later date, or forwarded to another mobile subscriber. Our MMS messaging platform is comprised of the following products and services:

|

·

|

FlightDeck: Our proprietary bulk MMS messaging server that is installed at the Wireless Carrier’s network infrastructure. FlightDeck delivers MMS messages in a fully automated, managed environment. FlightDeck can also prioritize an MMS campaign that is time sensitive so that the campaign is delivered at the right time and to the right mobile phone subscribers.

|

|

·

|

FlightPlan: Our mobile marketing campaign design and management system. FlightPlan takes the guesswork out of planning and designing MMS message campaigns, allowing qualified designers to efficiently construct a quality MMS message. FlightPlan offers Brand Owners and advertisers a simple to use graphical user interface that creates MMS messages.

|

|

·

|

Signaling Gateway: Our Signaling Gateway (“SGW”) platform manages the compilation and distribution of MMS and SMS messages for wireless carriers and brands. We are able to compress rich data files by up to 80% and deliver them through the MMSC and SMSC to mobile subscribers. Our MMS messages are fully-automated and delivered to mobile subscribers in full color. The compression technology used to deliver our messaging solutions allows our bulk MMS messaging server to deliver up to 1,000 MMS messages per second, per installation and has the capacity to send over 1 million MMS messages per hour. The SGW platform offers Location-Based Services as well as MM7 and SS7 protocol technology which is instrumental in Wireless Carrier communications processing.

|

|

·

|

The EPS server application: Enables a Wireless Carrier to deliver bulk MMS messaging outside of their core MMSC by uniquely encoding an MMS message. The EPS solution is designed to offer bulk A2P (Application to Person) MMS messaging capability. EPS has been successfully tested and installed at two of our current Wireless Carrier clients.

|

|

·

|

Build.mobi™: We design, build and manage a number of high-traffic mobi sites for our own use and for our clients. Mobi sites are internet sites that are designed for and accessed via a mobile phone. Mobi sites provide a full range of services, which can be used by consumers to access everything from bank accounts to mobile content sites.

|

|

·

|

MMS Greeting Card: MMS cards are digital cards that can be downloaded, customized and delivered by MMS message for special events. We have successfully deployed this solution in partnership with Vodacom, leading toVodacom increasing MMS messaging through put volumes.

|

|

·

|

Mobile Financial Statements: We have developed a unique mobile financial statement application, which delivers consumer statements directly into a mobile phone. The application includes a delivery report option, which proves receipt of the statement by the consumer. Once a mobile phone statement has been delivered into the physical handset, the consumer is able to securely access a mobi site that securely stores all of their relevant account information. We believe this application will have strong appeal to Wireless Carriers in developing countries where mobile subscribers have limited access to postal services or computers. According to the International Telecommunications Union, a specialized agency of the United Nations Organization, responsible for information and communications technology, 73% of mobile subscriptions are in the developing world. This represents a potential market of 3.8 billion mobile subscribers who have access to digitally delivered products on their mobile phones. A further benefit of the mobile phone statement application is the ability to significantly reduce the volume of paper and postage needed to communicate with consumers providing cost-savings and an improved carbon-footprint opportunity to our clients.

|

5

|

·

|

Mobile and internet advertising for terrestrial radio and “pure-play” internet broadcasters: We have broadened our market reach to include monetization of advertising for terrestrial radio and “pure-play” internet broadcasters. Through our Jetcast, Inc. acquisition (now called “Lenco Media Inc.”) and development of our UniveralPlayer™, we have an ad-serving platform which can monetize a listener base that as of January 2011 was ranked the number one in comScore’s Entertainment-Radio category in terms of unique audience, total minutes and total page views in the U.S. Display, pre-roll video and audio in-stream advertising monetized though delivery on our UniveralPlayer™, reaches an audience of approximately 40 million unique visitors per month, which we believe we will be able to monetize at attractive CPM (“cost per thousand”) prices for our customers.

|

|

·

|

Mobile Marketing Campaign and Promotion Management: Wireless Carriers and Brand Owners use our technologies to attract, monetize and retain relationships with consumers. We have significant expertise in managing mobile marketing campaigns to successfully reach consumers in a unique and effective way via mobile phones. Our blend of marketing expertise and a powerful platform provide us with significant advantages over the vast majority of other marketing companies trying to compete in the mobile space.

|

Our MMS messaging platforms are currently being used by Vodacom, one of the leading Wireless Carriers in Africa. Vodacom has approximately 30 million subscribers in Southern Africa and is part of the Vodafone Group which has 341 million proportionate subscribers worldwide. Vodacom accounted for approximately 33% of our total revenues during 2010 and approximately 23% of our revenues for the year ended December 31, 2009. We are currently in discussions to offer our MMS platforms and solutions to other carriers throughout the world. Our business goal is to create relationships with both Brand Owners and Wireless Carriers in as many countries as possible, and increase our appeal and ability to service global Brand Owners with their mobile phone advertising campaigns.

Internet and Internet Broadcasting Advertising Platforms and Products

Our internet advertising platform operates under the Lenco Multimedia Inc. (formerly “AdMax Media Inc.”). We provide Brand Owners with advertising products and services to reach out to consumers online in a highly-focused manner leading to better response rates on advertisements, higher quality leads and the ability to measure the success of each advertising campaign.

|

|

·

|

AdMaximizer Ad Placement. AdMaximizer provides cutting edge technology which is used by Brand Owners to generate consumer leads for their businesses. Our platform is designed to provide the Brand Owner with broad consumer access, better response rates on advertisements, higher quality leads and the ability to measure the success of each advertising campaign.

|

|

|

·

|

Lead Generation. We help our customers secure consumer leads through a number of methods, including opt-in programs (where consumers have elected to receive advertisements), on-line co-registration, display advertisements on third party websites and via our own websites. We have extensive relationships with internet publishers, who publish our advertisements and content on third-party websites. We also publish our own websites. We own approximately 1,157 websites and 2,867 URLs (Uniform Resource Locators or internet domains) that have been developed over many years and have an established history with the major search engines. We have worked over a period of years to drive traffic to our websites, link our sites with key partners, and take other steps designed to improve the ranking of our sites on major search engines and improve their appeal to consumers who view them. We also constantly monitor and perform search engine optimization on our sites to increase the profile of our sites on major search engines such as Google, Yahoo and Bing.

|

|

|

·

|

Consumer Database. We also own and manage a database with approximately 120 million unique names of individual consumers based in the United States. The database contains 50 million unique names where the customer has opted-in to accept offers from Brand Owners in one or more vertical industries owned or managed by us, together with 70 million unique names of consumers who have opted-in to accept offers from our ad-network publishing clients. This database is used to create a pool of prospective customers that we can approach on behalf of Brand Owners. We also track information concerning the consumers in the database to discern information concerning demographics, buying propensities, return rates and purchase defaults.

|

6

|

|

·

|

Internet broadcasting. Mobile and internet advertising for terrestrial radio and “pure-play” internet broadcasters: We have broadened our market reach to include monetization of advertising for terrestrial radio and “pure-play” internet broadcasters. Through our Jetcast, Inc. acquisition (now called “Lenco Media Inc.”) Lenco Media Inc. provides products designed to make internet broadcasting profitable for broadcasters and advertisers. Lenco Media Inc.’s UniversalPlayer™, RadioLoyalty™, ReplaceAds™ and Jetcast® streaming products eliminate costs and increase revenue for broadcasters and increase advertisers’ return on their advertising investment. As recently as January 2011, the Company’s internet radio advertising network was ranked number one by comScore in the “Entertainment-Radio” category with potential reach of 37.9 million unique visitors per month in the United States. Pandora, CBS Radio, AOL Radio, Yahoo Radio, Westwood One and Clear Channel are also included in the category. We view the acquisition as strategic in our efforts to develop an advertising company that provides Brand Owners with global access to new media channels and compelling technology. It also provides a mechanism to create and manage lists of consumers by interest groups. As we continue to expand the use of our UniversalPlayer™ to a large broadcaster base, we expect to see significant increases in revenue with this addition.

|

Our Strategy and Mission

There are approximately 5.3 billion mobile phone subscribers and 1.6 billion internet connections in the world today. We believe that there is a natural convergence between the mobile phone and the internet and that this convergence will take place at a faster and faster rate as the functionality resident in mobile phones increases. More and more mobile phones are being sold with internet browsing capability and a variety of smart applications. While data transfer rates for mobile phones have historically been the fastest in Southeast Asia, Wireless Carriers in the United States are investing in Long Term Evolution technology which will see downlink data rates of up to 100 megabits per second. This is sufficient speed to watch a television broadcast on a mobile phone while traveling in a car. The additional speed and functionality enhances the range of products and services which we are able to offer to our clients.

Brand Owners continuously compete for consumers on the basis of product features, quality and price. As a result, Brand Owners will continue to invest significant resources in developing ways to create, keep and leverage customers. In order to do this they will continue to use technology to improve service levels, delivery channels and the management of data. Our management has an intimate understanding of the mobile phone and internet markets and has developed a framework around which to continue growing our revenue through monetizing our products and services.

We believe that there are four primary reasons why consumers use their mobile phones or access the internet. These are information, communications, entertainment and to transact commerce. Many Brand Owners have failed to recognize the importance of engaging with clients at appropriate times and through appropriate channels. Our mission is to continue to assist our clients to create, keep and leverage their customers in a sustainable and competitive manner using our technology platforms.

Our strategy, based on current market conditions and opportunities, is as follows:

|

·

|

Expand the Wireless Carrier customer base for our mobile platforms: We plan to continue our focus on expanding our mobile phone technology platforms into new markets, using our success in South Africa as a reference for expansion into other territories. Our ultimate goal is to be able to afford Brand Owners global distribution for their online and mobile advertising campaigns.

|

|

·

|

Cross sell our mobile marketing and internet platforms: We believe that the ability to offer Brand Owners services for both internet and mobile advertising will expand the market that we can reach, and provide “single source” convenience that will assist us in retaining Brand Owners as clients.

|

|

·

|

Build and leverage a comprehensive database of consumer information: Starting with our existing database, we intend to build an opted-in database of customers who elect to receive targeted offers from our Brand Owner partners. We intend to expand and leverage our existing database of consumer information to improve the relevance, effectiveness and value of the advertising services we offer to Brand Owners. Because input costs have largely become commoditized, we believe that Brand Owners will increasingly view a well-managed customer relationship management and loyalty program focused on customer retention and driving incremental revenue as the best way to retain market share and ensure ongoing profitability.

|

Customers and Prospective Customers

In our mobile marketing business, we have two primary customers—the Wireless Carrier and the Brand Owner. Historically our mobile operations have been conducted in South Africa and Austraila. We are aggressively working to establish additional relationships with additional Wireless Carriers worldwide. These negotiations are at various stages and on the whole have been positive. We are continuing to expand our reach of mobile messaging products and services. Our business goal is to create relationships with both Brand Owners and Wireless Carriers in as many countries as possible, and increase our appeal and ability to service global Brand Owners in their mobile phone advertising campaigns.

7

|

·

|

South Africa: Our current primary Wireless Carrier customer is Vodacom; one of the leading Wireless Carriers in Africa. Vodacom has approximately 30 million subscribers in Southern Africa and is part of the Vodafone Group which has 341 million proportionate subscribers worldwide. Vodacom accounted for approximately 33% of our total revenues during 2010 and approximately 23% of our revenues for the year ended December 31, 2009. We are connected with MTN, and are currently testing with Telkom, and Cell C. We have signed an agreement to provide one of the leading banks in South Africa with a range of MMS-based marketing solutions and we are currently providing all of the major banks in South Africa with various mobile marketing solutions.

|

|

·

|

Australia: In Australia through our master license agreement in Australia for the mobile sector, which ran successful MMS messaging campaigns with the Wireless Carrier Optus during 2010, we earned our first revenues in Australia and expect to continue to generate revenues from that region. Also during 2011, we obtained another licensee of our mobile messaging platform with the addition of New Zealand.

|

|

·

|

Colombia: We have established offices in Bogota and are in the process of testing connectivity in Colombia.

|

|

·

|

Korea: We are currently testing with SK Telecom via an aggregator in South Korea

|

|

·

|

Mexico: In Mexico, we have successfully connected with Telcel and Iusacell.

|

|

·

|

Singapore: In Singapore, we have successfully connected with M1 and StarHub and are initiating testing with SingTel.

|

|

·

|

United Kingdom: We currently have connectivity with Vodafone in the U.K.

|

|

·

|

United States: In the United States, we entered into a commercial service agreement with OpenMarket, Inc. on September 17, 2009. OpenMarket is one of the largest aggregators of telecom services in the United States. Through OpenMarket we have access to carriers such as Sprint, Verizon and AT&T. We have successfully deployed our MMS messaging platform in initial tests with OpenMarket. We are in the process of setting up a sales and marketing infrastructure to approach Brand Owners in the United States through our Lenco Mobile USA Inc. subsidiary.

|

We have managed mobile marketing campaigns in Africa for Brand Owners of a number of global brands such as Mr. Price, Vodafone, MTN, Nedbank, Ellerines, JD Group, VW, Sony, Nokia, Mitsubishi, Peugeot, Woolworths, Volvo, Virgin Mobile, Toyota, Toshiba, Sun International, Nissan, Landrover, Ford, Fiat, Estee Lauder, Doritos, SABMiller, BlackBerry, Imperial, Hang Ten, Nike, Electronic Arts, Alfa Romeo, Clinique, Makro, LG, First National Bank, BMW and Samsung. Wireless Carriers themselves are Brand Owners and they currently use their own SMS and MMS network infrastructure to promote their products and services. Wireless Carriers are not only faced with declining average revenue per user but also high levels of churn. In order to promote customer retention, Wireless Carriers use MMS messaging to extend retention based offers to their mobile subscribers.

We have signed an agreement to provide one of the leading banks in South Africa with a range of MMS-based marketing solutions and we are currently providing all of the major banks in South Africa with various mobile marketing solutions. Our mobile phone-based financial statement product has been accepted for use by a number of major Brand Owners including several of South Africa’s largest banks. We have received regulatory approval from the local tax authorities regarding compliance with the appropriate tax and communications regulations. We currently experience a high level of repeat business from our clients, which we believe reflects the quality of our products and services.

Our internet and mobile and internet radio businesses sell to Brand Owner and advertising networks using our UniversalPlayer™ and through efforts in various vertical markets such as auto, mixed martial arts, and investing. Some of our customers include Citrix, Google and AOL.

Awards We Have Received

We have been invited to participate in various international mobile marketing competitions by regulatory bodies which oversee the marketing activities of the mobile sector.

In 2008, our campaign for Vodacom’s My Ad Me campaign won double gold and the Inkosi first place award at the 2008 Direct Marketing Association Awards. The awards were open to all Brand Owners who have used mobile marketing in the South African marketplace. More than seventy brands competed for the award.

In 2008, we won I Love Mobile Web awards in the Commerce and Retail Sector (1st place) for the Sasko Flour mobi site and in the Corporate category (3rd place) for the Vodacom Upgrade campaign. The I Love Mobile Web Awards are run under the auspices of the Mobile Marketing Association, based in New York City, New York. The awards are open to organizations that have demonstrated leading edge mobile capability and are judged by independent industry experts. More than one hundred companies and brands competed in the awards for 2008.

8

In 2009, we won the Mobile Marketing Association global award in the display category for the Europe, Middle East & Africa region for the Live Mobile Football soccer portal. The awards are open to all mobile advertising agencies and the more than 700 members of the Mobile Marketing Association.

In 2010, Multimedia Solutions, our wholly-owned South African subsidiary partnered with Mr. Price to win multiple awards at the 6th Annual Mobile Marketing Association Awards Ceremony. The Multimedia Solutions campaign designed and executed for Mr. Price was overall winner in the category for Global Relationship Building and regional winner for Europe, Middle East and Africa in the Products and Services Launch category. The Mobile Marketing Association is the world wide body that represents the interests of the wireless carriers and marketers in promoting use of mobile phones as a technology and marketing platform.

In addition, in 2010 the Multimedia Solutions campaign designed and executed for Mr. Price was also the overall winner in the South African Direct Marketing Association’s 2010 Annual Awards, wining the coveted Inkosi Assegai award. This award recognizes the top direct marketer in South Africa and is testimony to the rise of mobile phones as a marketing channel.

Trends in the Mobile Phone and Online Advertising Sectors

Wireless Carriers worldwide generally use one of two wireless transmission platforms: the Global System for Mobile (“GSM”) technology or the Code Divisible Multiple Access (“CDMA”) technology. There are currently some 800 GSM networks in 219 countries reaching 3 billion subscribers. According to the CDMA Development Group, there are 564 million CDMA subscribers, representing 321 Wireless Carriers in 121 countries using various CDMA technology platforms. Our MMS messaging platform can be integrated into either a GSM or CDMA network.

We believe that the market for our mobile and online advertising products and services will continue to grow dramatically for the foreseeable future. There are various factors driving this growth, including:

|

·

|

Wireless Carrier’s voice revenue, calculated in Average Revenue Per User or “ARPU,” is declining worldwide as a result of intense competition and commoditization of services.

|

|

·

|

Wireless Carriers are investing in data platforms which can be used to deliver services that will be charged for on a per use or per application basis.

|

|

·

|

Data transmission rates over wireless and wired networks are rapidly increasing which will provide the opportunity to deliver more sophisticated products and services to mobile handsets and computers.

|

|

·

|

Mobile phones provide one of the best direct marketing channels available today. Advertisements delivered via a mobile phone can be personalized, which traditional media cannot offer. Mobile phones offer the ability to communicate with consumers anywhere, anytime and at any place.

|

|

·

|

Advertising on mobile phones and online is less expensive to implement and can be rolled out much faster than traditional media. Moreover, Brand Owners are able to measure the response rates and uptake of offers delivered by mobile phones or accepted online.

|

|

·

|

The rapid evolution in the uses, functions and performance of technology-based products has impacted the way in which consumers shop, and, as a result, traditional marketing channels are becoming less effective. Paper coupons, an advertising mainstay for years, have seen declines in use and redemptions since 2006. However, online advertising and shopping has grown during this same period.

|

|

·

|

Both terrestrial and “pure play” internet radio broadcasters continue to seek to additional revenues and expanding audience reach through the use of mobile devices and the internet. Consumers have embraced mobile and internet as a means of transmitting radio programming, thus opening a new means of monetizing advertising spending and reaching consumers on mobile devices.

|

A further factor affecting Brand Owners is the recognition of the disproportionate cost of acquiring new customers as opposed to the cost of retaining existing customers. Mobile and online advertising campaigns can be personalized to meet individual consumer needs and behavior. As a result, strategic focus has moved towards retaining customers and profiling data in a predictive way with the ultimate goal of making better informed marketing decisions.

We believe that both our mobile phone and internet products and services provide Brand Owners of all sizes with the ability to create, keep and leverage customers. In the current economic downturn, businesses are all being forced to find more efficient and more innovative ways of managing and retaining their customers. In particular, almost every business is highly reliant on repeat customers and referrals in order to maintain market share and grow. We believe mobile phones and the internet offer the most cost effective way to reach these audiences.

9

For the year ended December 31, 2010, we generated approximately 75% of our revenues from the sale of mobile phone-related services in South Africa and 25% of our revenues from sales of internet products and services in the United States. For the year ended December 31, 2009, we generated approximately 63% of our revenues from the sale of mobile phone related services in South Africa and 37% of our revenues from sales of internet products and services in the United States. We plan to expand the geographic reach for our mobile and internet broadcast radio advertising products to other parts of the world to take advantage of the trends in the mobile phone and online advertising sectors.

Technology and Operations

Our operations and related infrastructure are located at our facilities in Santa Barbara, California, Johannesburg, South Africa, Mexico City, Mexico, Bogota, Colombia, and Singapore. We operate a data center located at our offices in Santa Barbara, California. This center houses the entire computer and communications infrastructure necessary to operate our business in North America, including our mobile phone as well as our internet and internet broadcasting advertising platforms. We employ onsite technical staff who are able to support our technology and services. We also have equipment for back-up facilities at a co-location facility monitored by a third-party data center operator in Los Angeles, California. We maintain a dedicated OC-48, 2.5 GBPS fiber optic connection between Santa Barbara and the co-location facility in Los Angeles. Both facilities provide video surveillance and access controls, and are serviced by onsite electrical generators, fire detection and suppression systems. Both facilities also have multiple Tier 1 interconnects to the internet.

Our staff manages and maintains our proprietary MMS messaging platform. We operate a number of our own high-speed servers which form the backbone of the FlightDeck, FlightPlan and SGW messaging platforms. We also provide managed servers which are installed at Wireless Carrier’s core network switching centers. These servers are highly secure and cannot be accessed from outside the Wireless Carrier network. We also make use of third-party server facilities to provide connectivity between our MMS messaging platforms and Wireless Carriers. We continually monitor these systems and enter into service level agreements with technology vendors, where necessary.

We build high-performance, availability and reliability into our product offerings. Our infrastructure is designed using load-balanced web server tools, redundant interconnected network switches and firewalls, replicated databases, and fault-tolerant storage devices. We safeguard against the potential for service interruptions at our third-party technology vendors by engineering fail-safe controls into our critical components. Scalability is achieved through use of advanced application partitioning to allow for horizontal scaling across multiple sets of applications. This enables individual applications and operating systems to scale independently as required by volume and usage. Production data is backed up on a daily basis and stored in multiple locations to ensure transactional integrity and restoration capability. Our applications are monitored 24 hours a day, 365 days a year by specialized monitoring systems that aggregate alarms to a human-staffed network operations center. If a problem occurs, appropriate engineers are notified and corrective action is taken. We are presently experimenting with the installation of a cloud computing network through which our products and services can be accessed securely and remotely. We believe that we will be able to deploy our services internationally, far more efficiently, using virtual servers. All client sensitive data will still remain securely stored on our own servers.

We own all of the hardware deployed in our MMS messaging and internet platform production environments. Changes to our production environment are tracked and managed through a formal maintenance request process. Production baseline changes are handled much the same as software product releases and are first tested on a quality control system, then verified in a staging environment, and finally deployed to the production system.

Research and Development

Historically, we have not experienced significant research and development expenses. Since February 2008, we have expanded our business through the selective acquisition of products and services which enhance our overall product offering. Our Multimedia Solutions subsidiary in South Africa has been in operation since 2004 and had completed development of its initial products at the time of our acquisition. We employ software engineers who provide a variety of services, including: customer support, content development, software maintenance and bug fixes, and the development of new features and functions for our products.

We have begun to incur research and development expense and we expect this amount to increase as we continue to develop and acquire unique technologies. Research and development expense for the years ended December 31, 2010 and 2009 were $533,000 and $262,000, respectively.

10

Intellectual Property

We have filed patent applications covering elements of our product and services offering, but no patents have been issued to date. We cannot be certain that current patent applications, or applications that we may file in the future, will result in the issuance of a patent or, even if a patent is issued, that it will provide a meaningful competitive advantage. We have not historically aggressively sought patent or copyright protection for software because of the requirement to publish the specific method or implementation of the technology as part of the application process. In those instances we rely on trade secret protection, including confidentiality agreements and invention contribution agreements with our employees and contractors to protect our rights in that technology.

Much of our technology, and the uniqueness of our solutions, is based upon software we have acquired or developed. This applies to our SGW MMS message technology which encodes, compresses and manages the way in which a MMS message is delivered over a Wireless Carrier’s network, as well as the EPS server technology, our AdMaximizer.com technology, Lenco Media Inc.’s UniversalPlayer™, RadioLoyalty™ and ReplaceAds™.

In some cases we rely on licensed software tools or engines which we use under open source or commercial licenses from third-parties. Some of the basic components that our products come from leading software and hardware providers including Oracle, Sybase, Sun, Dell, EMC, NetApp, Microsoft and Cisco while some components are constructed from leading Open Source software projects such as Apache Web Server, MySQL, Java, Perl and Linux. By striking the proper balance between using commercially available software and Open Source software, our technology expenditures are directed toward maintaining our technology platforms while minimizing third-party technology supplier costs. These licenses have various conditions to their use including payment of royalties, and authorship credit.

From time to time we may receive notices from third parties that we have violated their license, or that our products or services infringe upon their intellectual property rights. If we do not prevail in these disputes, we may lose some or all of our intellectual property protection, be enjoined from further sales of applications determined to infringe the rights of others and/or be forced to pay substantial royalties.

Sales and Marketing

Our mobile phone business is currently focused on developing relationships with both Brand Owners and Wireless Carriers, which will ultimately lead to them using our MMS messaging platform and other products. The relationship with the Wireless Carrier is the initial step to creating an advertising distribution channel that we can use to sell our services to Brand Owners. In many instances the Wireless Carriers also refer Brand Owners to us as potential customers, based on their satisfactory experience in using our products and services.

We sell to Wireless Carriers through both direct and indirect channels. Our Multimedia Solutions operation in South Africa has a dedicated sales team of 12 people which solicits additional business from Brand Owners. Our management team is experienced at selling products and services to both Wireless Carriers and Brand Owners and they are presently as varying stages in development of the markets for our mobile products and services in Singapore, the U.K., Vietnam, Thailand, South Korea, Indonesia, Malaysia, Mexico and China.

Where we can identify a qualified partner, we have entered into channel relationships for certain territories. We have master licensees in Australia, New Zealand and the United Kingdom to sell our products and services into those markets. Under the terms of the master license agreement we provide technology and sales support to these licensees via dedicated business development and technical personnel. These licensees have successfully established connectivity in these markets and are in the process of presenting our MMS products and services to Brand Owners in their respective regions. We have already begun to earn revenue from the Australian and New Zealand master license agreement in 2010. Master licensees will pay us a pre-agreed percentage of revenue for the support and access to our MMS messaging platform and an initial fee. We are exploring discontinuance of our U.K. master license arrangement and instead operate in the U.K. as a majority-controlled subsidiary in 2011. We have opened a subsidiary in the U.K., Lenco Mobile UK Ltd., to effect such a change; however, we cannot guarantee that we will complete such a change until we are further along in negotiations and legal efforts.

Once we have established a relationship with a Wireless Carrier for a particular region, we work with that Wireless Carrier to offer our mobile marketing products and solutions to the Wireless Carrier’s Brand Owner customers. In addition, where appropriate, we might contract with local advertising agencies that have relationships with Brand Owners. Our products and services afford the agency the opportunity to provide unique, effective and measurable campaigns for their Brand Owner clients. We supplement this reach to the Brand Owners with direct advertising that is targeted to the geographic region. In territories where there is high internet penetration we use the internet as a business development channel because the cost of identifying and securing customers is lower than other traditional media channels. In territories where there is less developed infrastructure we use the mobile phone as a business development channel. We believe that there is and will continue to be a logical convergence of the internet and the mobile phone and that as a result Brand Owners will continue to look for organizations who can service both marketing channels for them.

11

Our internet and mobile and internet radio businesses provide products designed to make internet broadcasting profitable for broadcasters and advertisers as well as other lead generation, data sales and list management services. Lenco Media Inc.’s UniversalPlayer™, RadioLoyalty™, ReplaceAds™ and Jetcast® brand streaming products eliminate costs and increase revenue for broadcasters and increase advertisers’ return on their advertising investment. We have five personnel at our Lenco Media Inc. subsidiary that handle direct sales to Brand Owners and sales of lead generation, data and list management services. We also use third-party advertising networks to generate sales for our mobile and internet radio business.

Our U.S. mobile sales team, under our Lenco Mobile USA Inc. subsidiary, consists of three staff members focused on sales of the Build.mobi™ product and deploying our mobile platforms in the United States in order to support our clients’ requests and new Brand Owner relationships.

Competition and Business Strengths

We face intense competition from a variety of organizations in both our mobile as well as our internet business. There are currently numerous organizations which provide various components of the mobile marketing value chain, but very few who provide the integrated range of mobile and online services which we have to offer. We believe that in the future we might compete directly with the Wireless Carriers if they decide to focus on developing platforms similar to our MMS messaging platform and possibly face competition from major online advertisers who wish to expand into the mobile arena.

The market for mobile applications and solutions is dependent on connectivity with a mobile handset through either the internet or via the Wireless Carrier. Browser based connections such as the Apple iPhone’s application are accessed by subscribers on a “pull” basis, as opposed to MMS services which are typically transmitted via the Wireless Carriers on a “push” to the subscriber when an outbound message is sent. We are able to deliver our products and services via both “push” or “pull” channels and as a result we believe that we are well positioned to address the market for both browser based and MMS delivered services. We recently presented a leading carrier in Asia a proposal to provide a mobile “app” solution and we will continue to explore avenues to develop these solutions.

Both Brand Owners and Wireless Carriers evaluate our services on a variety of levels including breadth of product offerings, price, product quality, porting abilities, ease of use, speed of execution, customer support and breadth of distribution relationships. We currently view our competitive position as follows:

|

|

·

|

We compete on the basis that our product offerings are fully-integrated and comprehensive. In this regard, we believe that we offer one of the most compelling end to end solutions available today for both our Wireless Carriers and Brand Owner clients. Our “one-stop” solution for online and mobile advertising allows us to monitor and coordinate the launch of campaigns across these two key digital media, which we believe is a competitive advantage.

|

|

|

·

|

We supply our products and services as a managed solution. This significantly reduces upfront costs for the Wireless Carriers and also allows us to price our products and services to meet new demand. We believe that our total cost of ownership model offers a compelling point of differentiation between us and our competitors, primarily because of our ability to provide reduced upfront capital costs for our Wireless Carrier clients.

|

|

|

·

|

We also compete on the basis of the quality of services that we provide. Our mobile phone platforms, including the FlightDeck, FlightPlan, SGW platform and the EPS server enable Brand Owners and Wireless Carriers to produce better quality mobile content and to efficiently reach the vast majority of handsets currently available.

|

|

|

·

|

Our FlightDeck, FlightPlan and SGW platforms contain porting capability to convert content to reach more than five thousand different operating system and handset model configurations needed to deliver an MMS message. Each handset manufactured by the leading suppliers such as Apple, BlackBerry, Nokia, Sony Ericsson, Motorola, LG and Samsung, and each operating system such as Symbian, Android and Windows Mobile, operate on different technical specifications. We are currently able to send an MMS message to both smart phones and any older handsets that have a color screen. We estimate that we are able to reach up to ninety percent of the handsets that are currently in use today

|

|

|

·

|

Our products and services have been designed to be user friendly. Our FlightPlan platform allows Brand Owners or content developers to assemble MMS messages in standard file formats and port them for distribution to thousands of unique handsets. FlightDeck allows us to connect to a Wireless Carrier’s network via a secure IP connection and manage MMS messaging campaigns remotely. We also provide unique solutions to minimize network bandwidth utilization and improve the speed of delivery of messages through the network. Our mobile phone platforms are tried and tested and can be sold or licensed to almost any of the more than 800 Wireless Carriers in the world today. By making use of our products and services, a Wireless Carrier is able to rapidly begin generating additional revenue. Because we use IP based connectivity interfaces we are able to deploy our services and solutions in far shorter time frames than competitors.

|

12

|

|

·

|

We have made a substantial commitment to providing high levels of customer services and we have been recognized by many of our customers for providing service excellence. We provide free customer support to all our customers. Our online marketing staff maintains contact with our advertisers and publishers to quickly resolve any client queries. Our mobile business staff has a proactive approach to dealing with our customers, and they are constantly in contact during the development phase of a campaign or when the campaign is being executed. Our senior management is on standby 24 hours to deal with major client queries.

|

|

|

·

|

Each of our Brand Owner customers as well as Wireless Carriers look to us as a source of incremental revenue generation. Brand Owners are looking for us to attract consumers for their products and services. Wireless Carriers earn a substantial part of their revenue from data and value-added services such as MMS messaging. Many of the MMS messages that we send out to subscribers are forwarded to other subscribers, thereby creating continuing revenue streams for the Wireless Carrier. By securing Brand Owners as new clients, we generate additional revenue for the Wireless Carriers. The higher the volume of MMS messages we distribute through the Wireless Carrier’s network, the more profit is generated for the Wireless Carrier. Our business goals are firmly aligned with that of our Brand Owner and Wireless Carrier clients.

|

While we compete and expect to continue to compete on the basis set out above, our competitors may have product offerings or other business advantages that Brand Owners or Wireless Carriers may find compelling. We believe that the most effective barrier to entry against competition is to build efficient, stable, secure and user friendly products and solutions that assist our clients to significantly enhance their businesses. Through this proactive approach, we believe that we will be able to achieve economies of scale which in turn will provide barriers to entry against competition and lead to first-mover advantages.

History of our Current Business and Corporate Structure

We were incorporated in 1999 in Delaware under the name of Shochet Holdings Corporation and we have been engaged in our current line of business, mobile and internet marketing, since early 2008. Prior to 2008, Shochet Holdings Corporation completed an initial public offering, underwent several changes of control and were engaged in several different businesses, which included discount brokerage, financial services, mortgage banking and apparel. Ultimately, we were operating as a shell company seeking a combination with another operating company. The following represents a history of our business and significant transactions:

|

|

·

|

In February 2008, we entered into an Exchange Agreement, pursuant to which our subsidiary Lenco International Ltd. acquired 100% of the outstanding shares of Digital Vouchers (Pty) Ltd., from Target Equity Limited, a British Virgin Islands company. Mr. Michael Levinsohn, our Chief Executive Officer, was the founder and principal executive officer of Digital Vouchers. Promptly upon completion of the acquisition, we appointed Mr. Levinsohn as our Chief Executive Officer with the objective of developing our mobile phone and internet marketing businesses internationally.

|

|

|

·

|

In July 2008, Lenco International Ltd. established Omara Investments Limited as a subsidiary corporation in the British Virgin Islands. On August 24, 2009, we changed the name of our subsidiary Omara Investments Limited to Omara Technology Services Ltd. On November 3, 2009 we changed the name of Omara Technology Services Limited to Lenco Technology Group Limited. Lenco Technology Group Limited (“Lenco Technology”) acts as our international licensing and managed services operation.

|

|

|

·

|

In August 2008, we acquired Capital Supreme (Pty) Ltd, a company based in Johannesburg, South Africa, doing business as Multimedia Solutions. Multimedia Solutions has been in operation as a mobile marketing company focused on MMS messaging solutions since 2005, and had ongoing business operations, customer relationships and revenue. Multimedia Solutions had developed several key software platforms and technologies including our FlightDeck and FlightPlan platforms as well as technologies for compressing MMS files and efficiently transmitting them through a Wireless Carrier’s MMSC and network.

|

|

|

·

|

In February 2009, we changed our name to Lenco Mobile Inc.

|

|

|

·

|

In February 2009, we entered into an asset purchase agreement with Superfly Advertising, Inc. (“Superfly”). In connection with the acquisition, Superfly transferred certain online advertising assets and liabilities from its Consumer Loyalty Group and Legacy Media business units to our newly formed subsidiary AdMax Media Inc., a Nevada corporation (“AdMax”). The assets we acquired from Superfly included principally our AdMaximizer™ software platform, advertising contracts with Brand Owners, relationships with a network of web publishers, 1,235 URLS, several hundred websites and content, consumer databases including over 120 million unique consumer records.

|

13

|

|

·

|

In October 2009, our AdMax Media Inc. subsidiary acquired certain assets of Simply Ideas, LLC. The assets acquired included websites, URLs, contracts and software platforms related to online advertising, primarily in the education industry.

|

|

|

·

|

In August 2010, our AdMax Media Inc. subsidiary entered into an asset purchase agreement with G2AA, LLC pursuant to which we acquired assets related to an online and mobile automotive marketing business.

|

|

|

·

|

In September 2010, we completed the acquisition of Jetcast, Inc. as a wholly-owned subsidiary. Pursuant to the merger agreement, we paid $500,000 in cash and issued 4,008,453 unregistered shares of our common stock to the former Jetcast stockholders. In addition, we agreed to pay up to approximately $4.3 million in cash and up to $20.7 million in the form of unregistered shares of our common stock issuable to the former Jetcast stockholders in connection with the achievement of future revenue targets.

|

|

|

·

|

In December 2010, Lenco Technology Group Ltd., (“LTG”) our wholly-owned subsidiary, entered into an asset purchase agreement with Angelos Gateway Limited (“Angelos”). In connection with the purchase and sale agreement, Angelos sold and transferred certain software and IP relating to the deployment of the Signaling Gateway (“SGW”) system.

|

|

|

·

|

In December 2010, AdMax sold the assets used in its educational lead generation service business (“EDU Vertical”) and the name, AdMax Media Inc.

|

|

|

·

|

In February 2011, we formally changed the name of our wholly-owned subsidiary Jetcast, Inc to Lenco Media Inc. In addition, we changed the name of our wholly-owned subsidiary AdMax Media Inc. to Lenco Multimedia Inc.

|

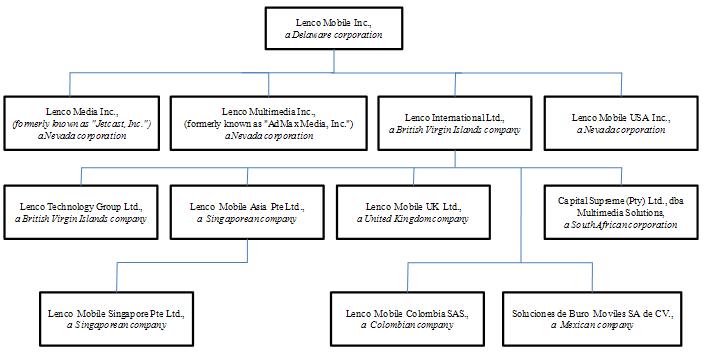

As a result of these transactions and other subsidiary formations, our current corporate structure is as follows:

Seasonality and Cyclical Fluctuations

Our advertising services business is subject to seasonal fluctuations related to the advertising spend by Brand Owners. The calendar third quarter is generally our weakest and the fourth quarter is generally our strongest, but this might vary from year to year. Other factors such as the general economic climate, the addition or loss of large customers will also to affect our business. In many cases Brand Owners plan their advertising campaigns up to one year in advance and we are dependent on their budgets for a significant percentage of our revenue. We are developing product solutions, such as our mobile phone statements, which will be less susceptible to seasonal fluctuations in revenue.

14

On December 30, 2010, we sold a significant portion of our internet business with the sale of the education lead generation business. This business had reached its pinnacle in revenue and profit performance for us in mid-2010 and began to significantly underperform from that point in time. Also, the online education sector garners ever-increasing legislative attention in the context of governmental budget cuts which we believe will hamper the ability of online schools to continue funding significant advertising dollars. We believe that we took the correct decision to sell the education lead generation business, given market circumstances. As such, we enter 2011 without the continuance of revenue in the education lead generation vertical.

Government Regulation

Laws and regulations that apply to internet communications, commerce and advertising are becoming more prevalent. These regulations could affect the costs of communicating on the Web and could adversely affect the demand for our advertising solutions or otherwise harm our business, results of operations and financial condition. The United States Congress has enacted internet legislation regarding children’s privacy, copyrights, sending of commercial email, and taxation. The United States Congress has passed legislation regarding spyware and the New York Attorney General’s office has sued a major internet marketer for alleged violations of legal restrictions against false advertising and deceptive business practices related to spyware.

The Controlling the Assault of Non-Solicited Pornography and Marketing Act of 2003, or CAN-SPAM Act, was adopted by the United States Congress as federal law and establishes requirements for commercial advertisements and specifies penalties for commercial mobile advertisements that violate the Act. In addition, the CAN-SPAM Act gives consumers the right to require advertisers to stop sending them commercial advertisements. The CAN-SPAM Act covers messages sent for the primary purpose of advertising or promoting a commercial product, service, or internet web site. The Federal Trade Commission, a federal consumer protection agency, is primarily responsible for enforcing the CAN-SPAM Act, and the Department of Justice, other federal agencies, State Attorneys General, and Internet Service Providers also have authority to enforce certain of its provisions.

The CAN-SPAM Act’s main provisions include:

|

|

·

|

Prohibiting false or misleading ad header information;

|

|

|

·

|

Prohibiting the use of deceptive subject lines;

|

|

|

·

|

Ensuring that recipients may, for at least 30 days after an ad is sent, opt out of receiving future commercial messages from the sender, with the opt-out effective within 10 days of the request;

|

|

|

·

|

Requiring that commercial ad be identified as a solicitation or advertisement unless the recipient affirmatively permitted the message; and

|

|

|

·

|

Requiring that the sender include a valid postal address in the ad message.

|

The CAN-SPAM Act also prohibits unlawful acquisition of recipients’ addresses, such as through directory harvesting, and transmission of commercial mobiles by unauthorized means, such as through relaying messages with the intent to deceive recipients as to the origin of such messages.

Violations of the CAN-SPAM Act’s provisions can result in criminal and civil penalties, including statutory penalties that can be based in part upon the number of advertisements sent, with enhanced penalties for commercial advertisers who harvest recipients’ addresses, use dictionary attack patterns to generate mobile addresses, and/or relay advertisements through a network without permission.

The CAN-SPAM Act acknowledges that the internet offers unique opportunities for the development and growth of frictionless commerce, and the CAN-SPAM Act was passed, in part, to enhance the likelihood that wanted commercial ad messages would be received. We believe we are a leader in developing policies and practices affecting our industry and that our permission-based mobile marketing model and our anti-spam policy are compatible with current CAN-SPAM Act regulatory requirements. We are a founding member of the Email Sender and Provider Coalition, or ESPC, a cooperative industry organization founded to develop and implement industry-wide improvements in spam protection and solutions to prevent inadvertent blocking of legitimate commercial advertisements. We maintain high standards that apply to all of our customers, including non-profits and political organizations, whether or not they are covered by the CAN-SPAM Act.

The CAN-SPAM Act preempts, or blocks, most state restrictions specific to email, except for rules against falsity or deception in commercial advertisements, fraud and computer crime. The scope of these exceptions, however, is not settled, and some states have adopted email regulations that, if upheld, could impose liabilities and compliance burdens on us and on our customers in addition to those imposed by the CAN-SPAM Act. Moreover, some foreign countries, including the countries of the European Union and Israel, have regulated the distribution of commercial advertisements and the internet collection and disclosure of personal information. Foreign governments may attempt to apply their laws extraterritorially or through treaties or other arrangements with U.S. governmental entities.

15

Our Wireless Carrier and Brand Owner customers may be subject to the requirements of the CAN-SPAM Act, and/or other applicable state or foreign laws and regulations affecting electronic marketing. If our customers’ mobile campaigns are alleged to violate applicable laws or regulations and we are deemed to be responsible for such violations, or if we were deemed to be directly subject to and in violation of these requirements, we could be exposed to liability.

Our standard terms and conditions of sale require our customers to comply with laws and regulations applicable to their mobile marketing campaigns and to implement any required regulatory safeguards. We take additional steps to facilitate our customers’ compliance with the CAN-SPAM Act, including the following:

|

|

·

|

New customers signing up for our services must agree that they will send advertisements through our service only to persons who have given their permission;

|

|

|

·

|

When a contact list or database is uploaded, the customer must certify that it has permission to contact each of the addressees;

|

|

|

·

|

When an individual indicates that they want to be added to a mailing list, they may receive a confirmation email and may be required to confirm their intent to be added to the contact list, through a process called double opt-in; and

|

|

|

·

|

We electronically inspect all of our customers’ contact lists to check for spam traps, dictionary attack patterns and lists that fail to meet our permission standards.

|

Our operations are also subject to general laws related to advertising. The Federal Trade Commission (“FTC”) conducted an investigation into certain segments of the internet advertising industry, which included Commerce Planet, Inc., an entity which sold certain assets to Superfly Advertising Inc. The FTC brought an action against Commerce Planet, Inc., Michael Hill (currently the President of Lenco Multimedia Inc.) and certain officers of Commerce Planet, Inc. The FTC alleged that during the period from 2005 to 2008, Commerce Planet, Inc. used certain billing practices in connection with its online supplier business that were misleading, including (i) the use of “negative option features” where a consumer’s failure to take affirmative action to reject products or services were interpreted as acceptance of an offer, and (ii) the failure to clearly and conspicuously disclose all material terms of an offer and any refund or termination policy. Mr. Hill, without admitting any of the allegations and denying any wrongdoing, entered into a stipulated judgment and order with the FTC to settle this action in November 2009. The monetary judgment against Mr. Hill was suspended based on his transfer to the FTC of cash, promissory notes and other claims with a value of approximately $700,000. The stipulated judgment also imposed certain permanent injunctions against Mr. Hill, and any person or entity in active concert or participation with him, including: (i) prohibitions against misrepresenting any material fact in connection with the advertising, promotion, offering or sale of a product or service, (ii) requirements to clearly and conspicuously disclose all costs and terms of an offer, including any refund policy, and (iii) a requirement to obtain express informed consent from a consumer prior to using any billing information to obtain payment for a product or service. The permanent injunctions proscribed in the stipulated judgment are consistent with recently adopted FTC guidelines for the internet advertising industry as a whole. Compliance with these new FTC guidelines may adversely affect our ability to operate in the lead generation sector.