Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2010

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 000-52646

GEOVIC MINING CORP.

(Exact name of registrant as specified in its charter)

| Delaware | 20-5919886 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 1200 17th Street, Suite 980 Denver, Colorado |

80202 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (303) 476-6455

Securities registered pursuant to Section 12(b) of the Exchange Act:

None

Securities registered pursuant to Section 12(g) of the Exchange Act:

Common Stock, par value $0.0001 per share

Title of each class to be so registered

Indicate by check mark whether the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K x

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company

Large Accelerated Filer ¨ Accelerated Filer ¨ Non-accelerated Filer ¨ Smaller Reporting Company. x

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act) Yes ¨ No x

The aggregate market value of the Registrant’s common stock held by non-affiliates, computed by reference to the closing price of the common stock as of June 30, 2010, the last business day of the Registrant’s most recently completed second fiscal quarter, was approximately $45,743,720.

At March 24, 2010, there were 104,577,512 shares of the Registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Part III is incorporated by reference from the Registrant’s definitive Proxy Statement for its 2011 Annual Meeting of Stockholders to be filed pursuant to Regulation 14A, no later than 120 days after the end of the Registrant’s fiscal year.

Table of Contents

GEOVIC MINING CORP.

2010 ANNUAL REPORT ON FORM 10-K

In this Annual Report on Form 10-K, all dollar amounts are in thousands of United States Dollars unless otherwise indicated.

1

Table of Contents

CAUTIONARY LANGUAGE ABOUT FORWARD-LOOKING STATEMENTS

Certain statements in this report constitute “forwarding-looking statements” within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities and Exchange Act of 1934 and applicable Canadian securities laws. Certain, but not necessarily all, of such forward-looking statements can be identified by the use of forward-looking terminology such as “believes,” “expects,” “may,” “will,” “should,” or “anticipates” or the negative thereof or other variations thereon or comparable terminology, or by discussions of strategy that involve risks and uncertainties. All statements other than statements of historical fact, included in this report regarding our financial position, business and plans or objectives for future operations are forward-looking statements. Without limiting the broader description of forward-looking statements above, we specifically note that statements regarding exploration and mine development, construction and expansion plans, costs, grade, production and recovery rates, permitting, financing needs, the availability of financing on acceptable terms or other sources of funding, if needed, and the timing of additional tests, feasibility studies and environmental permitting are all forward-looking in nature.

Statements contained in this annual report that are not historical facts are forward-looking statements that involve risks and uncertainties. Forward-looking statements include, but are not limited to, statements with respect to the expected completion of the feasibility study for the Nkamouna Project; the estimation of mineral reserves and mineralized material and the timing of completion of such estimations; our expectations regarding the amount of capital required prior to production at the Nkamouna Project and our ability to source the required capital; success of exploration activities; permitting time lines; construction and capital costs; operating expenses; currency fluctuations; requirements for additional capital; our expectations regarding processing and marketing of future production from the Nkamouna Project; ability to enter into off-take arrangements; government regulation of mining operations; environmental risks; unanticipated reclamation expenses; title disputes or claims; limitations on insurance coverage; commencement of mine production, anticipated expenditures in 2011; and our plans with respect to future debt and equity financing. Forward-looking statements involve known and unknown risks, uncertainties, and other factors which may cause the actual results, performance, or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such risks and other factors include, among others, the risk factors discussed below in Item 1A—“Risk Factors,” and other factors described herein and in other filings with the U.S. Securities and Exchange Commission (the “SEC”) and Canadian securities regulatory authorities. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The forward-looking statements in this annual report speak only as of the date hereof. The Company does not undertake any obligation to release publicly any revisions to these forward-looking statements to reflect events or circumstances after the date hereof to reflect the occurrence of unanticipated events.

CAUTIONARY NOTE REGARDING DISCLOSURE OF MINERAL PROPERTIES

Geovic Mining Corp. is subject to the reporting requirements of the Securities Exchange Act of 1934, as amended (“Exchange Act”), and applicable Canadian securities laws, and as a result we report our mineral reserves according to two different standards. Canadian reporting requirements for disclosure of mineral properties are governed by National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”). The definitions of NI 43-101 are adopted from those given by the Canadian Institute of Mining, Metallurgy and Petroleum. U.S. reporting requirements are governed by the SEC Industry Guide 7 (“Guide 7”). These reporting standards have similar goals in terms of conveying an appropriate level of confidence in the disclosures being reported, but embody different approaches and definitions. Under Guide 7, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made.

2

Table of Contents

We disclose mineral reserves and mineral resources according to the definitions set forth in NI 43-101 and modify them as appropriate to confirm to Guide 7 for reporting in the U.S. In this Form 10-K, we use the term “mineralized material” to describe the amount of mineralization in mineral deposits that do not constitute “reserves” by United States standards. This is substantially equivalent to the total measured mineral resources and indicated mineral resources (disclosed as exclusive of reserves), which we disclose for reporting purposes in Canada. U.S. investors are cautioned that, while the terms “measured mineral resources,” “indicated mineral resources” and “inferred mineral resources” are recognized and required by Canadian securities laws, rules adopted by the SEC do not recognize them. U.S. investors are also cautioned not to assume that all or any part of measured or indicated resources will ever be converted into Guide 7 compliant reserves.

3

Table of Contents

| ITEM 1. | BUSINESS |

Geovic Mining Corp. was incorporated under the Business Corporations Act (Alberta) on August 27, 1984 and was continued into Ontario on November 8, 2001. On November 21, 2006, we became domesticated as a Delaware corporation and changed our name to “Geovic Mining Corp.” In this Form 10-K, the “Company,” “Geovic Mining,” “we,” “our” and “us” refer to Geovic Mining Corp. and one or more of its subsidiaries as indicated by the context.

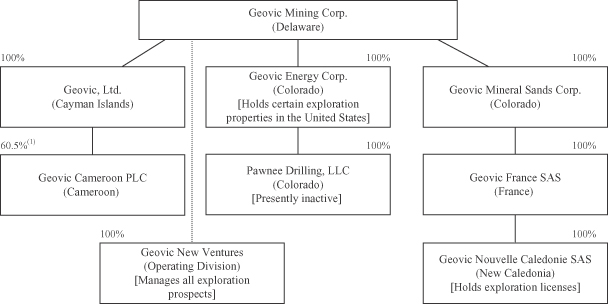

We completed a reverse take-over transaction (the “RTO”) on December 1, 2006, with the result that we hold 100% of the issued and outstanding shares of Geovic, Ltd., a Cayman Islands corporation (“Geovic”). Geovic owns 60.5% of Geovic Cameroon PLC (“GeoCam”), a private corporation existing under the laws of the Republic of Cameroon which holds our mining prospect in Cameroon.

Intercorporate Relationships

Geovic is our principal operating subsidiary, and employs all our employees. The following chart illustrates the inter-corporate relationships among the Company and its subsidiaries as of March 24, 2011.

| (1) | GeoCam minority interest owners are described below under “GeoCam Shareholder and other Agreements.” |

Our principal business is conducted through Geovic by which we hold rights to several cobalt-nickel-manganese deposits in the Republic of Cameroon in Africa through its ownership interest in GeoCam. Our principal business focus since 1994 has been to advance our interest in the deposits. GeoCam’s Mining Permit (the “Mining Permit”) establishes exclusive mining rights to develop the Nkamouna, Mada and other cobalt-nickel-manganese deposits within a 1,250 square kilometer area in southeastern Cameroon (the “Cameroon Properties”). The Cameroon Properties are described in Item 2. Properties. GeoCam plans to develop and mine the Nkamouna and Mada deposits (together, the “Nkamouna Project”) before the other deposits are developed.

Business Operations

Qualified independent consulting firms identified and retained by either Geovic or GeoCam completed engineering pre-feasibility studies and technical reports on the Nkamouna deposit in 2006, a feasibility study in

4

Table of Contents

November 2007, a NI 43-101compliant technical report in January 2008, a feasibility optimization study in September 2008 (“2008 OS”), and an updated NI 43-101 compliant technical report on the Nkamouna Project in November 2009 (the “Nkamouna Technical Report”). A final, independent feasibility study including a NI 43-101 technical report is expected in April 2011.

Beginning in late 2008 and continuing through early 2011, several process improvement programs were initiated to enhance the Nkamouna Project’s economics and reduce technical and financial risks, including adopting conventional leaching technology using readily available pilot scale laboratory tests completed in 2010 by independent third parties validated the improvements and planned production.

In mid-2009 GeoCam retained three well-known, highly qualified and experienced metallurgical and chemical engineers to serve as its Technical Advisory Panel (“TAP”). The TAP was engaged to provide high-level metallurgical processing input to the Geovic technical design team as well as provide independent expert feedback to GeoCam and its shareholders. Based on recommendations of the TAP and the results of preliminary marketing performed, we intend to produce two intermediate products (a mixed cobalt and nickel sulfide product, referred to as MSP, and manganese carbonate) at the mine site. These intermediate products would be sold in the international marketplace or shipped offshore for processing into finished products. These decisions were made to try to limit initial process plant capital costs and process risk at the remote mine site, and to address product preferences learned from potential off-take customers.

In December 2009 GeoCam engaged Lycopodium Pty Ltd. (“Lycopodium”), an international engineering firm based in Perth, Australia to prepare an independent feasibility study for the Nkamouna Project. The feasibility study, first expected in late 2010 is now expected to be completed in April 2011. This feasibility study will include updated reserves, estimated construction and capital costs, operating expenses and future net cash flow from mining operations for the Nkamouna Project. Once the pending feasibility study is completed and accepted, we will continue to work with GeoCam to obtain project financing.

During 2010, GeoCam undertook the following activities to advance the Nkamouna Project:

| • | Appointed a new General Manager of GeoCam with significant mine development and operating experience in rural areas of Africa; |

| • | Improved the field compound at Kongo camp near the Nkamouna Project; |

| • | Progressed, tested and finalized the metallurgical processing to be utilized at the Nkamouna Project; |

| • | Conducted metallurgical testing and engineering design for a possible refinery at Nkamouna Project site; |

| • | Advanced the engineering design of the storage facility to receive tailings from the physical upgrading of ore and the leaching of concentrates; |

| • | Completed an interim update to the Project Environmental and Social Assessment (“ESA”) and progressed the final ESA update which is due for completion in April 2011; |

| • | Formed a Steering committee of local stakeholders to guide and focus community development initiatives; |

| • | Continued to support socio-humanitarian programs in the local communities in the health, education, agriculture and animal husbandry disciplines; |

| • | Assisted Lycopodium and other consultants in working toward completion of the feasibility study. |

Please refer to Item 2. Properties for more detailed information on the Nkamouna Project and other deposits held by GeoCam, and by other subsidiaries of the Company.

5

Table of Contents

GeoCam Shareholder and Other Agreements

Geovic is party to a shareholders agreement with the other GeoCam shareholders, Societe Nationale d’Investissement du Cameroun (“SNI”) (the owner of a 20% interest in GeoCam), and four Cameroonian individuals (collectively, the owners of a 19.5% interest in GeoCam and represented by SNI) (the “Shareholders Agreement”). The Shareholders Agreement reflects the historic ownership and management arrangements among the shareholders and sets forth the terms, conditions and fiscal arrangement for continued participation by the shareholders in GeoCam. The Shareholders Agreement includes provisions in accordance with Cameroon business laws for all shareholders to contribute their proportionate share of future GeoCam capital required to meet its annual operating expenditures, as approved periodically by the GeoCam Board of Directors.

As provided in the Shareholders Agreement, in 2007 GeoCam began to operate autonomously from Geovic. Geovic and GeoCam also have entered into annual Technical Services Contracts under which Geovic provides certain staff, services and management to assist GeoCam to carry out its budgeted work program at rates set forth in the Technical Services Contracts. SNI also provides services to GeoCam under similar annual agreements.

By exercising an option we held, in 2010 we acquired the 0.5% ownership interest in GeoCam previously held by William A. Buckovic, the founder of Geovic, in exchange for 139,000 shares of our stock with an estimated fair value of approximately $85.

All the Cameroon Properties are held by GeoCam, and the Mining Convention and Mining Permit are issued to GeoCam. Pursuant to the Shareholders Agreement, the GeoCam Board of Directors consists of five directors, three of whom are selected by Geovic and two by the other Cameroonian shareholders. Under the Shareholders Agreement, Geovic is entitled to nominate the General Manager/Managing Director and one Deputy General Manager while other shareholders are entitled to nominate the other Deputy General Manager. It is the GeoCam Board of Directors that appoints these positions. Although we are a majority shareholder and our representatives form a majority of the Board of Directors of GeoCam, we generally seek concurrence from the other shareholders for material policy and operational decisions.

Nkamouna Project Financing Activities

In December 2009, we engaged Standard Chartered Bank as the Company’s financial advisor in connection with preparing and planning for project financing, reviewing documentation, considering early-stage efforts to locate potential purchasers of the MSP and manganese carbonate products we expect to produce, and related activities. In August 2010, GeoCam assumed the engagement with Standard Chartered Bank. During 2010 we began meeting with various large international businesses that have indicated an interest in the future off-take from the Nkamouna Project.

Cameroon Properties

Our business plan is to use our available management, technical expertise and talent to develop our interests in the Cameroon Properties into a high quality mining and mineral production operation. Assuming external financing in sufficient amounts to complete construction and start-up activities is available on a timely basis, we will continue to focus on the Nkamouna Project where our plan is to begin initial mine production by late 2014. The remaining steps to production include completing the final feasibility study to support the construction of mining and processing facilities at the Nkamouna Project, securing project debt and equity financing, negotiating product off-take sales agreements and completing the mine and plant construction. We will complete construction of the initial mine and facilities in a socially and environmentally responsible manner.

When in full production, we believe that the Nkamouna Project will be the largest primary cobalt producing mine in the world.

6

Table of Contents

We presently have no current revenue from operations and we expect to continue to generate losses and negative cash flows until after mine and milling operations begin on the Nkamouna Project. See Item7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Other Activities

We are also evaluating other mineral properties and prospects in the United States and elsewhere to diversify our business activities. We believe that opportunities exist to acquire interests suitable for mineral exploration and development.

Through our subsidiary Geovic Energy Corp. we acquired uranium leases, exploration permits and claims in Colorado and Wyoming during 2007, 2008 and 2010. During 2010 we mapped and analyzed these and nearby properties using existing data.

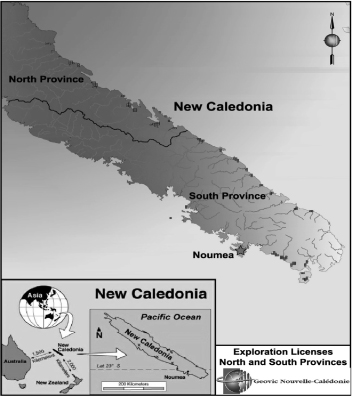

Through our subsidiary Geovic Mineral Sands Corp. we identified chromite deposits in New Caledonia, a French overseas territory (collectivity) northeast of Australia in the South Pacific in 2009. In 2010 we applied for exploration licenses covering approximately 100 square kilometers on and offshore. These licenses were granted in early 2011. After completion of the required environmental surveys, we plan to explore these areas in 2011 and 2012.

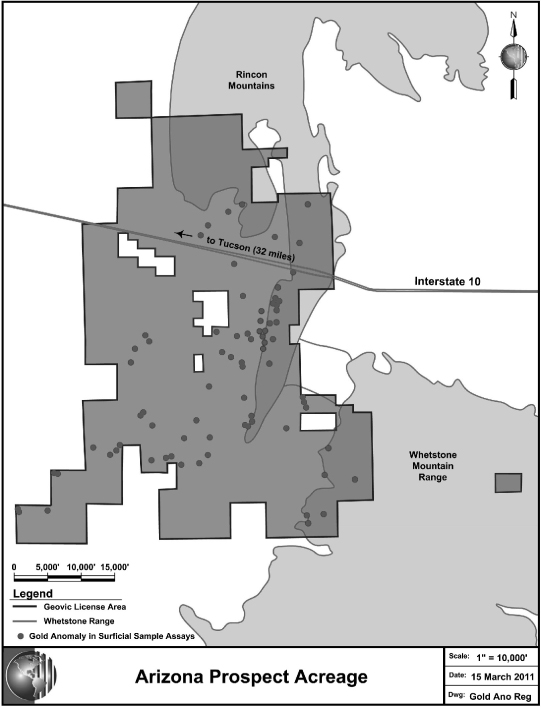

Also in 2010 we conducted additional prospecting in southeastern Arizona near our existing state permits and federal mining claims. We leased additional tracts and filed additional mining claims. By year-end 2010 we held about 68 square miles of surface prospects for further exploration for gold under leases, exploration permits or claims.

In late 2010 and early 2011 we filed mining claims on federal land in southeastern New Mexico where our prospecting activities during the year showed possible deposits of certain rare earth minerals and zirconium. Additional claims are being staked to fill out the exploration prospect area.

Please refer to Item 2. Properties for more information on these other mineral prospects.

Competitive Conditions

We expect that GeoCam will compete with other cobalt and nickel producers around the world, including those with projects now under development. Other producers with ongoing operations have established production and demonstrated feasibility and have greater financial strength than we do. These competitors include such current producers as Xstrata Nickel, Vale, Tenke Fungurume (Freeport McMoRan-Lundin Mining Corp.-Gecamines), Sherritt and Murrin Murrin (Minara-Glencore). Significant mines expected to produce cobalt as a by-product during the next few years include Ambatovy (Sherritt, Sumitomo, Korea Resources and SNC Lavalin), Weda Bay (Eramet), Goro Nouvelle-Calédonie (Vale), and Boleo (Baja Mining Corp.). Operating expenses, reserve quantities and qualities, operating efficiencies, and location may affect the long-term success of all competing producers, including GeoCam.

Social and Environmental Policies

Geovic Mining Corp is committed to sustainable development and social responsibility. We understand that our long-term business security is directly related to the welfare of the people and communities in the areas where we operate. In the end, these are the people who should be the main beneficiaries of our activities. We are also committed to excellence in stewardship of the environment. We believe that a strong sense of corporate social and environmental responsibility is essential for our success.

Applicable environmental protection requirements will affect the financial condition, operating performance and earnings of the Company as a result of capital expenditures and operating costs required to meet or exceed these requirements. These expenditures and costs may also have an impact on our competitive position to the extent that our competitors are subject to less rigorous requirements. Through 2010 the effect of these

7

Table of Contents

requirements was limited due to the early stage of the Nkamouna Project. While these costs are expected to have a larger effect in future years as we move toward and commence production at the Project, we are providing for them to the best of our knowledge in the upcoming feasibility study.

GeoCam is subject to ongoing obligations under its mining and environmental permits in Cameroon to provide social and educational assistance to persons and in areas impacted by the mining activities. These obligations will be handled both directly and by engaging third parties, such as GeoAid International (“GeoAid”), to provide specified services.

An ESA, comprised of an Environmental and Social Impact Assessment (“ESIA”) and an Environmental and Social Action Plan (“ESAP”), has been prepared to document the existing environmental and social conditions, describe the proposed operation, identify potential impacts, develop mitigation measures to reduce or minimize the impact of the operation, and the actions needed to assure the measures are undertaken at the Nkamouna Project. Knight Piésold and Co. (“Knight Piésold”) and Rainbow Environment Consult (“REC”) were retained by Geovic Ltd. in 2004 to develop the ESA, which was completed and submitted to the Ministry of Environment and Protection of Nature in 2006 and approved by the Ministry in May 2007. Both Knight Piésold and REC continue to provide environmental and social program services to the Project today.

Since approval of the ESA, GeoCam has been diligently moving the Project forward toward construction. As part of that process, a number of Project elements have been modified and optimized since finalizing the ESA in 2006. Consequently, Knight Piésold and REC prepared the “Geovic Cameroon PLC, Nkamouna Project, Environmental and Social Assessment 2010 Update” dated March 31, 2010 based on more recent Project plans. This update was presented to the Ministry in May 2010.

The Ministry notified GeoCam in September 2010 that the ESA 2010 Update report provides an appropriate demonstration that the Project continues to move forward and therefore remains in conformity with regulatory requirements. However, the Ministry required that GeoCam consolidate the 2007 ESA, the ESA 2010 Update, and any other Project modifications that may be put forward in the final feasibility study into a single document. GeoCam intends to consolidate and reissue the approved ESA, with updates, to provide consistency with the content of the feasibility study and furnish it to the Ministry in the first half of 2011. Given that the Ministry has already acknowledged that the Project remains in full conformity with the regulatory requirements, the review process for this ESA update is expected to be routine.

Geovic collaborates with GeoAid, an IRS-recognized 501(c)(3) non-profit humanitarian corporation. GeoAid has domestic operations in Oregon and on-going humanitarian and social programs in Cameroon. Its mission is focused on reducing poverty by meeting the needs of people and communities impacted by mining and extractive operations in the developing nations of the world. Originally conceived and fully funded by the Company, GeoAid now is an independent entity that partners with Geovic and other private donors to further its mission. This collaboration, along with services from other contractors, satisfies certain ESAP commitments, but Geovic has been committed to GeoAid and its social and humanitarian initiatives since well before there was a regulatory requirement to do so, and GeoAid’s activities with the Nkamouna Project area go beyond GeoCam’s regulatory commitments.

GeoAid operates in Cameroon through its implementing partner, GeoAid Cameroon. GeoCam has retained GeoAid Cameroon under a service contract to assist with the planning, management, implementation, monitoring and reporting on certain of its community development commitments. The Company also supports GeoAid at the corporate level. Corporate grants made to GeoAid are coupled with other private contributions such that GeoAid has successfully solicited significant gift-in-kind donations from several external donors. This resulted in significant added value for the people of Cameroon, in that for every dollar donated by the Company in 2009, GeoAid was able to raise an additional two dollars in in-kind donations of medical equipment, supplies, and medicines that were shipped to and distributed within Cameroon in 2009 and 2010. That leveraged value ratio nearly doubled to about four dollars for each dollar we contributed in 2010, and is currently expected at six to one ratio for 2011.

8

Table of Contents

This unique model of development and the partnership between Geovic and GeoAid achieves significant humanitarian and social assistance to beneficiaries in the Nkamouna Project area and throughout Cameroon at important cost-savings. Moreover, we continue to enjoy increasing goodwill at community and national levels for the Company and its subsidiaries.

Employees

All of our employees are employees of Geovic and our executive officers are also officers of Geovic. Geovic has 16 full time employees in its offices in the United States, and at year-end 2010, GeoCam had 31 full time employees and 6 contract workers in its administrative offices in Yaoundé and 94 contract workers at the Nkamouna Project operations location in the East Province in the Republic of Cameroon.

Offices

Our principal corporate head office is located at 1200 17th Street, Suite 980, Denver, Colorado 80202, Telephone (303) 476-6455. We also maintain an exploration office in Grand Junction, Colorado. GeoCam maintains its head office in the capital city of Yaoundé and a mine area office at Kongo Camp in the East Province, both in the Republic of Cameroon.

Available Information

Our website address is www.geovic.net. Available on this website under “Investor Relations” free of charge, are links to our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, Forms 3, 4 and 5 filed on behalf of directors and executive officers and amendments to those reports after such materials are electronically filed with or furnished to the SEC.

Also posted on our website, and available in print upon request made by any stockholder to the Secretary, are charters for the Board’s Audit Committee, Human Resources and Compensation Committee, and Nominating and Corporate Governance Committee. Copies of the Code of Business Conduct and Ethics (“Code”) and our Whistleblower’s Policy are also posted on our website under the “About Geovic-Committee Charters” section. Within the time period required by the SEC, we will post on our website any modifications to the Code and any waivers applicable to senior officers as defined in the Code, as required by the Sarbanes-Oxley Act of 2002.

9

Table of Contents

| ITEM 1A. | RISK FACTORS |

We consider the risks set out below to be the most significant risks facing the Company, although these risks should not be considered to be comprehensive. If any of these risks materialize into actual events or circumstances or other possible additional risks and uncertainties of which we are currently unaware or which we consider not to be material in relation to our business, actually occur, our assets, liabilities, financial condition, results of operations (including future results of operations), business and business prospects, are likely to be materially and adversely affected, and as a result, the trading price of our common stock and warrants could be materially and adversely impacted. These risk factors should be read in conjunction with other information set forth in this report, including our Consolidated Financial Statements and the related Notes.

We are an exploration stage company and have no history as an operating company. Any future revenues and profits are uncertain.

We have no history of mining or refining any mineral products or metals and none of our properties is currently producing. There can be no assurance that the Nkamouna Project will be successfully placed into production, produce minerals in commercial and processing quantities or otherwise generate operating earnings. We will continue to incur losses at least until mining activities have successfully reached commercial production levels and generate sufficient revenue to fund continuing operations, which is currently estimated to be late 2014. There is no certainty that we will produce revenue from any source, operate profitably or provide a return on investment in the future. If we are unable to generate revenues or profits, our stockholders might not be able to realize returns on their investment in our common stock. Even if we do achieve profitability, we may not be able to sustain or increase profitability on a quarterly, annual or sustaining basis.

The development of the Nkamouna Project will require the commitment of substantial financial resources. The amount and timing of these costs will depend on a number of factors, some of which are beyond the Company’s control.

We will be subject to all of the risks associated with establishing new mining operations and business enterprises including: the availability of funds to finance construction and development activities; timing and cost of the construction of mining and processing facilities; the efficacy of planned mineral processing; the availability and costs of skilled labor and mining equipment; the availability and cost of appropriate processing materials and equipment; the need to obtain in a timely manner additional governmental approvals and permits; the likely terms of off-take agreements or metal sales contracts; potential opposition from non-governmental organizations, environmental groups or local groups in Cameroon which may delay or prevent development activities; and potential increases in construction and operating costs due to changes in the cost of fuel, power, equipment, materials and supplies. Further, the costs, timing and complexities of mine construction and development are increased by the remote location of the Cameroon Properties. Accordingly, our activities may not result in profitable mining operations and we may fail to successfully establish or maintain mining operations or profitably produce metals at any of our properties.

The actual capital costs and mine operating costs to be incurred in connection with opening the Nkamouna Project may be significantly higher than anticipated.

We expect that estimated initial projected capital costs in the final feasibility study expected in April 2011 will be more than $650 million, which is significantly higher than was estimated in earlier studies. Estimated future operating expenses are also expected to be higher than estimates made in 2008. These and similar cost and expense increases are beyond our control, and will require significantly more capital to bring the Nkamouna Project into production and could result in a decrease in our anticipated future return from operations. Our actual capital costs and operating costs may be higher than we presently anticipate.

10

Table of Contents

Market events and conditions may adversely affect our business and the mining industry.

International credit markets or Canadian, United States and global economic conditions, could, among other things, impede access to capital or increase the cost of capital, which would have an adverse effect on our ability to fund the working capital and other capital requirements of GeoCam. Unprecedented disruptions in credit and financial markets in 2008 and 2009 had a significant material adverse impact on a number of financial institutions and limited access to capital and credit for many companies, particularly resource companies such as the Company. While these disruptions have mostly been overcome, it could be more difficult or more expensive for GeoCam to obtain capital and financing for construction and for operations. Access to capital and financing may not be available on terms acceptable to the Company or at all. Nkamouna Project development modifications may be necessary or desirable to secure lending commitments which would also delay the completion of any financing. All delays in completing financing for the Project will delay mine construction, anticipated production activities and future revenue.

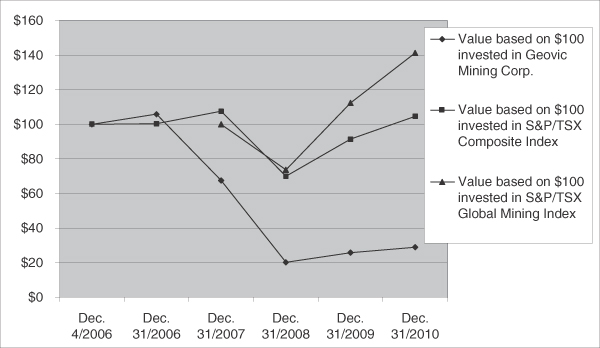

The share prices of junior natural resource companies, including Geovic Mining experienced large declines in value from 2008 into 2010. Market forces may render it difficult or impossible for the Company to raise equity capital except on terms which results in severe dilution to existing stockholders, or at all. Therefore, there can be no assurance that significant fluctuations in the trading price of the Company’s common stock will not continue, or that such fluctuations will not materially adversely impact the Company’s ability to raise equity.

General economic conditions may adversely effect our growth and profitability.

A worsened slowdown in the economy and other economic conditions, including but not limited to, consumer spending, employment rates, business conditions, continued inflation, increases in fuel and energy costs, consumer debt levels, interest rates, and tax rates may adversely affect our growth and profitability. Specifically:

| • | the global economic slow down could impact the cost and availability of financing and our overall liquidity; |

| • | the volatility of commodity prices could impact our future revenues, profits, losses and cash flow; |

| • | increasing energy prices, commodity and consumables prices and adverse currency exchange rates could impact our production costs; |

| • | volatility of global stock markets could impact the valuation of our equity and other securities; and |

| • | construction related costs could increase and adversely affect economics of the Nkamouna Project. |

These factors, among others, could have a material adverse effect on our financial condition and results of operations.

GeoCam may fail to secure Nkamouna Project financing if lenders or their advisors conclude that changes to the ore processing techniques being considered in the feasibility study are too risky or are otherwise not feasible.

In response to observations that raised questions about the efficacy of a few aspects of planned ore processing considered in previous feasibility studies, we modified certain of the metallurgical processes planned to be utilized and decided that GeoCam will not refine final metal products from the Nkamouna Project ore at the project site. If potential lenders are not ultimately assured that the modified metallurgical processes will allow the processing facilities to operate successfully as designed, Nkamouna Project debt financing may be delayed until further enhancement testing is performed or funding could be unavailable altogether.

11

Table of Contents

If we lose key personnel or are unable to attract and retain additional experienced personnel, we may be unable to establish and develop our business.

Our development in the future will be highly dependent on the efforts of our key management employees, namely, Michael Mason, Barbara Filas, William A. Buckovic, Timothy Arnold, Gary Morris, Greg Hill, John Sherborne, and Brian Briggs (currently Chief Executive Officer, President, Executive Vice President, Chief Operating Officer, Senior Vice President, Chief Financial Officer, President, New Ventures division and Vice President, Technical Operations, respectively), and Phillip Mason, General Manager of GeoCam and other key employees that we or GeoCam may hire in the future. Loss of any of these executives could have a material adverse effect on our operations and future success. We do not have and currently have no plans to obtain key man insurance with respect to any of our key employees.

The other shareholders of GeoCam may fail to pay their share of future GeoCam capital.

Under the Shareholders Agreement, all shareholders agreed to fund their share of capital and operating costs. However, it is possible that the minority shareholders will be unable or unwilling to provide their respective share of future GeoCam funding, and we may be required to delay the project or advance all the shareholder funds necessary to place the Nkamouna Project into production, pursuant to a loan agreement or other arrangement between Geovic and GeoCam.

Our lack of operating experience may cause us difficulty in managing our growth.

Geovic has owned a majority interest in GeoCam since its inception more than a decade ago. Geovic employees have managed the exploration of the GeoCam deposits and negotiated the terms of the required Cameroon government approvals and permits and financings we have completed. We will continue to provide many of such services under Technical Services Contracts with GeoCam. Our ability to manage our continued growth will require us to improve and expand our management and our operational and financial systems and controls. If our management is unable to manage our growth and the development of the Cameroon Properties effectively, our business and financial condition could be adversely affected.

GeoCam’s dependence on many outside service providers to place the Nkamouna Project into production may delay mine opening or operation.

GeoCam’s ability to place the Nkamouna Project into production will be dependent to a large part upon using the services of appropriately experienced employees, consultants and contractors working under our supervision and agreements with other major resource companies that can provide required expertise or equipment. In 2010 we recruited and hired a new General Manager for GeoCam with senior level mining and operating experience. Also, a significant local work force will be trained, few of whom currently have any related experience. We may not have available to us, or we may be unable to retain on satisfactory terms, the necessary expertise, equipment or local workers to build the GeoCam facilities and place the Nkamouna Project into production.

Our development activities in Cameroon may not be commercially successful.

We currently have no producing properties. Substantial expenditures are required to develop the Nkamouna Project, to drill and analyze for additional ore reserves, to construct facilities to implement the metallurgical processes to extract metal from the mined ore and to develop the mining and processing facilities and infrastructure at each deposit site chosen for mining. Our existing cobalt-nickel-manganese deposits may prove not to be in sufficient quantities to justify commercial operations, and future financing required to commence mining operations may not be obtained on a timely or cost-effective basis or on terms acceptable to us.

12

Table of Contents

The prices of cobalt, nickel and manganese are subject to fluctuations which could adversely affect the realizable value of our assets, future results of operations and cash flow.

Our principal assets are deposits of cobalt, nickel and manganese in the Nkamouna and other six deposits. All of these rights are held by GeoCam. Our potential future revenue is expected to be, in large part, derived from the mining, processing and sale of cobalt, nickel and related mineral products from the Cameroon Properties or from the outright sale or joint venture of some or all of these properties. The value of these reserves and deposits, and the value of any potential production therefrom, will vary in proportion to significant changes in cobalt, nickel and manganese prices. The prices of these commodities have fluctuated widely, peaked and declined significantly in 2008 and only partially recovered through 2010. These commodity prices are affected by numerous factors beyond our control, including, but not limited to, worldwide economic conditions, international economic and political trends, realized or expected levels of inflation, currency exchange fluctuations, central bank activities, interest rates, global or regional consumption patterns and speculative activities. The effect of these factors on the prices of cobalt and nickel, and therefore the economic viability of our Project, cannot accurately be predicted. Significant decreases in the prices of cobalt and nickel, and to a lesser extent, manganese, would adversely affect asset values, cash flows, potential revenues and profits of the Cameroon Properties if they are placed into production.

GeoCam may not be able to produce and sell mineral products at profitable prices. Our future operations are, therefore, more exposed to the impact of future decreases in commodity prices. Conversely, forward sales contracts would limit potential upside market swings. Such upside price swings could have a significant benefit to companies that take added market risk and sell produced mineral product on the open spot metals market. There are no central markets for the intermediate cobalt, nickel and manganese products we intend to produce and sell, and these products will reflect current metal prices of the contained metals. If cobalt or nickel prices decrease significantly at a time when our properties are producing, we would realize reduced revenue. GeoCam may enter into metal sales agreements for process plant off-take with one or more companies. If we contract to sell our planned intermediate products, the selling price would be related to prevailing market prices at time of delivery. Selling intermediate products produced at mine site, while reducing process risk and required capital expense, will also likely result in lower operating profit and cash flow from the mining and processing operations. There may be reduced demand or no market for intermediate products that are expected to be produced at the Nkamouna Project site which could adversely affect prices for such products and operating results.

Our mining exploration, planned development and operating activities are inherently hazardous and may not be insured or insurable.

Mineral exploration involves many risks and hazards that even a combination of experience, knowledge and careful evaluation may not be able to overcome. The business of mining is subject to certain types of risks and hazards, including reserve and resource estimates, processing risks, environmental hazards, metallurgical and process risks, industrial accidents, flooding, fire, metal theft, personal injuries, accidents, and periodic disruptions due to force majeure events and inclement weather. Workers are subject to risks associated with large mining equipment operations, slope instability, exposure to indigenous disease, steam and hazardous chemicals, as well as local social unrest. Disruption of exploration, development and production operations may occur. Operations in which we have direct or indirect interests will be subject to all the hazards and risks normally incidental to exploration, development and production of minerals, any of which could result in work stoppages, damage to property and possible environmental damage. The nature of these risks is such that liabilities might exceed any liability insurance policy limits. It is also possible that the liabilities and hazards might not be insurable, or, that we could elect not to insure Geovic Mining or GeoCam against such liabilities due to high premium costs or other reasons, in which event, we could incur significant costs that could have a material adverse effect on our financial condition.

13

Table of Contents

Our present mineralized material and future reserve estimates may be inaccurate which could adversely affect the estimated value of our future mining activities.

There is a high degree of uncertainty attributable to the calculation of mineralized material and future reserves and ore grades dedicated to future production because such estimates are expressions of judgment based on knowledge, experience and industry practice, and estimates of reserves may prove to have been inaccurate. Estimates which were valid when made may change significantly when new information becomes available. Accordingly, development and mining plans may have to be altered in a way that adversely affects the Company’s operation and profitability. An historical 2008 estimation of reserves and future production from the Nkamouna Project, prepared before the 2008 and 2009 drilling program was completed and analyzed, is included as Table 1 in Item 2. Properties. These estimated reserves were changed to mineralized material reflected in Table 2. Metallurgical testing on mineralization at the Cameroon Properties performed by the independent consultants and the Company in late 2009 concluded that revisions to planned processing methods assumed in the 2008 estimate should be made to reduce risk. These revisions are expected to affect the calculations of the Nkamouna Project reserves. There is a risk that full scale production activities may indicate technical and commercial shortcomings to whatever processing methodology is installed. Consequently, actual results may vary materially and adversely affect projected values given to reserves.

Until reserves are actually mined and processed, the quantity of ore and grades must be considered as an estimate only. In addition, the quantity of reserves and ore may vary depending on metal prices. Any material change in the quantity of reserves, grade or overburden stripping ratio or price of cobalt and nickel may affect the economic viability of our properties. In addition, cobalt and nickel recoveries or other metal recoveries in pilot-scale tests may not be duplicated during production.

Our previously reported historical 2008 estimated reserves were based on assumptions and drilling data that are different from our 2009 estimate of mineralized material and are likely to be revised.

The estimated proven and probable reserves at the Nkamouna deposit that were previously announced and which are presented in this Annual Report on a historical basis were prepared by independent consultants in January 2008 using drill data obtained before 2008, then-current cost estimates and other information and assumptions described in the Technical Report, Nkamouna Cobalt Project, Feasibility Study dated January 18, 2008 (the “2008 PAH Report”). In November 2009, a different consultant, SRK, completed an estimate of mineralized material at the Nkamouna and Mada deposits, also prepared in compliance with NI 43-101 (the “Nkamouna Technical Report”). This estimate relied on additional information from 2,045 drill holes and over 48,000 additional assay samples that were completed after the 2008 reserve estimate was completed and reflected only mineralized material, with no estimate of reserves.

We expect that SRK will prepare estimates of proven and probable reserves for the Nkamouna and Mada deposits in connection with completion of the pending feasibility study. Because we expect to use a higher cut-off grade for cobalt when we mine the deposits than was used in completing the 2008 PAH Report, and because other project parameters and assumptions have changed, the estimated reserves for the Nkamouna and Mada deposits will likely be different than the historic estimate included in the 2008 PAH Report and previously reported.

We face intense competition in the mining industry.

The mining industry in general, and cobalt and nickel mining in particular, are intensely competitive in all phases. A significant number of new cobalt and nickel projects have been announced in recent years and if placed in production, the resulting increased supplies of those commodities could adversely affect prices available for our expected production. Competitors include large established mining companies with experience and expertise and with greater financial and technical resources, and as a result we may be unable to obtain financing, or sell mined and processed products on terms we consider acceptable. We compete with other mining companies in the

14

Table of Contents

recruitment and retention of qualified managerial and technical employees and in the raising of capital. If we are unable to raise sufficient capital, our exploration and development programs may be jeopardized or we may not be able to develop or operate our projects. Also, our decision to produce and sell intermediate products is likely to reduce significantly the number of customers for our metals produced.

There presently is a lack of required infrastructure in Cameroon which could delay or prevent completion of our mine development activities or increase operating costs.

Completion of the development of the Nkamouna Project is subject to various infrastructure requirements, including the availability and timing of acceptable arrangements for site access, power, water, housing, transportation, air services and other facilities at the project site. The lack of availability on acceptable terms or the delay in the availability of any one or more of these items could prevent or delay development. There can be no assurance that construction will be commenced or completed on a timely basis, if at all, that the resulting operations will achieve the anticipated production or that the construction costs and ongoing operating costs associated with the development will not be higher than anticipated.

Unless we obtain significant additional external financing, enter into a strategic alliance or sell a property interest, we will be unable to develop the Nkamouna Project.

The Nkamouna Project requires capital, start up and financing expenditures in excess of $650 million to construct mining and processing facilities and related infrastructure. We likely will require external debt and equity financing to fund development and construction of mining and processing facilities. The expected sources of external financing for these purposes include secured project debt incurred by GeoCam, convertible debt of the Company or GeoCam and equity placements by GeoCam or the Company. In addition, the Company may consider the sale of some or all of its interest in GeoCam and/or GeoCam may consider a sale of an interest in GeoCam or in one or more of the other Cameroon Properties, GeoCam could enter into a strategic alliance with another company or we may utilize some combination of these alternatives. We intend that GeoCam will seek financing from international institutions with significant experience in financing large natural resource ventures in remote locations such as southeastern Cameroon. Such financiers will likely require GeoCam and its owners to comply with costly conditions as a requirement to completion of project financing, including significant additional equity contributions to GeoCam. The financing options chosen may not be available on acceptable terms, or at all. The failure to obtain adequate financing on a timely basis will have a material adverse effect on development of the Nkamouna Project, our growth strategy, results of operations and future financial condition.

Challenges to our title to mineral properties in which we may have an interest could affect our exploration or development rights.

GeoCam could be deemed noncompliant with terms or conditions of its Cameroon mining and other permits and authorizations. There may be challenges to title to other mineral properties that we currently control or which we may acquire in the future. Our exploration activities in New Caledonia may not lead to other required permits from the government. If there are title defects with respect to any of our properties, we might be required to satisfy additional government requirements, compensate other persons or perhaps reduce our interest in the affected property or lose our interest completely. Also, in any such case, the investigation and resolution of title issues would divert our management’s time from ongoing exploration and development programs.

Our exploration and development operations are subject to continuously evolving environmental regulations, which could result in incurrence of additional costs and operational delays.

All phases of our operations are subject to environmental regulation. Environmental legislation is evolving in countries and local jurisdictions in a manner which will likely require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects, and a heightened degree of responsibility for companies and their officers, directors and employees. Future changes in environmental regulation, if any, could adversely affect our projects.

15

Table of Contents

Acquisition of mineral rights from governmental agencies in the United States requires compliance with applicable regulations and could add costs and delays to future development.

We intend to continue to acquire properties or mineral rights in the United States. All mineral development in the United States is subject to regulation and compliance regardless of land tenure. Development projects are regulated at the state level, and in some states, also at the county level, and we must comply with the regulations relating to mining; land use; air quality; water quality, quantity and supply; and solid and hazardous wastes in the state within which the properties are located. If a state does not have an established program for regulating air, water and waste (pursuant to the federal Clean Air Act, Clean Water Act and the Resource Conservation and Recovery Act), then the U.S. Environmental Protection Agency will have direct regulatory jurisdiction. Depending on the state, there may be other applicable federal regulatory programs that also apply beyond those enacted by the state.

Mineral development (and other) actions on public lands managed by federal land management agencies such as the Bureau of Land Management (“BLM”) or the United States Forest Service (“USFS”) are obliged to file an acceptable plan of operations which is then subject to an environmental impact evaluation under the National Environmental Policy Act (“NEPA”). The NEPA process requires the completion of either an environmental assessment or an environmental impact statement prior to approval of the plan of operations. Whether on public or private land, mining companies must comply with all relevant federal, state and county requirements and will be required to post a bond or other surety to guarantee the cost of post-mining reclamation.

Federal, state, and local regulatory requirements including public disclosure processes and opportunities for stakeholders to appeal regulatory decisions, or changes to these requirements, could add significant additional cost and delays to any mining project we undertake in the United States. Permitting rules and/or discharge limits established at the federal, state, or local level may impose limitations on our production levels warranting additional capital expenditures in order to comply with the rules.

Provisions of the Comprehensive Environmental Response, Compensation, and Liability Act (“CERCLA”) impose strict joint and several liability on parties associated with releases or threats of releases of hazardous substances. Our future United States mining operations may use or produce hazardous substances which could accidentally be released to the environment, and in the United States may be subject to the provisions and attendant liabilities of CERCLA. Such liabilities could include the cost of removal or remediation of the release of the hazardous substance and damages for injury to the surrounding property.

We may develop conflicts of interest with other natural resource companies with which one of our directors may be affiliated.

Certain of our directors are also directors and officers of other natural resource companies. Consequently, there exists the possibility for such directors to be in a position of conflict. We expect that decisions made by any of such directors relating to the Company will be made in accordance with their duties and obligations to deal fairly and in good faith with the Company and such other companies.

Many factors beyond our control could adversely affect our future profitability.

The cost, timing and complexities of mine construction and development are increased by the remote location of the Cameroon Properties. It is common in new mining operations to experience unexpected problems and delays during construction, development, mine start-up and ramp-up to full commercial production. Also, ongoing cost and expense increases being faced throughout the mining and natural resources industries are beyond our control. Accordingly, our activities may not result in timely or profitable mining operations, and we may fail to successfully establish mining operations or profitably produce metals at any of our properties. In addition, the progress of ongoing exploration and development, the results of consultants’ analysis and recommendations, the rate at which operating losses are incurred, and the Company’s acquisition of additional properties will also impact the magnitude of the cost and timing of Company expenditures.

16

Table of Contents

If we are unable to comply readily with present or future laws and regulations of the Republic of Cameroon, development activities could be delayed and profitability not achieved or reduced.

The current and future development of the GeoCam Properties requires permits from various Cameroon governing authorities. Future operations will be subject to a number of existing laws and regulations such as labor standards, environmental reclamation, land use and safety. GeoCam must receive a land lease for that portion of the mine permit area to be used for the Nkamouna Project. It is also in the process of updating its ESA and several discipline specific implementation plans. These and other permits required to construct and operate a mining and processing facility may contain terms and conditions that are difficult or expensive to meet. Such laws and regulations may adversely affect the profitability of GeoCam’s operations.

General and Cameroon economic conditions could adversely affect our future results.

Cameroon, as well as United States and world economic conditions may affect the future performance of the Company. Inflation or deflation, changing tax laws, and fluctuating interest rates may make mineral resource development more difficult. These factors have had a significant effect on Cameroon’s economy in recent years. Economic conditions may have an adverse effect on the overall performance of the Company. In addition, various economic conditions could increase the risk that financial projections for the Nkamouna Project may not be realized as expected.

Political unrest or changes in Cameroon or nearby countries could interfere with our operating or financing activities.

The political risk in sub-Saharan Africa is significant. GeoCam’s rights to explore and develop mineral deposits in Cameroon are always subject to the continued political stability of the Republic of Cameroon and its government. In March 2008 Cameroon experienced some domestic strikes and political unrest that subsided within weeks. An election for the Presidency in Cameroon will be held in 2011. Also, political unrest or upheaval in adjoining countries could adversely affect our mining and development activities, and, if significant, would likely increase the costs of long term financing of the mining and processing activities. Further, GeoCam may not be able to finance or operate the Nkamouna Project at all if future state or regional political upheavals occur in Cameroon.

Potential violations of the Foreign Corrupt Practices Act (“FCPA”) by GeoCam, its agents or representatives could have a material adverse impact on our financial condition and results of operations.

The FCPA prohibits payments of, promises to pay, or authorizations to pay, money, gifts or anything of value to officials of foreign governments, in order to “obtain or retain” business. Payments or gifts to a third party, such as an agent or sales representative, while knowing (or having reason to know) that all or part of the money or gift will be offered or given to such an official, are also prohibited. If employees violate the FCPA, the violation creates severe potential criminal and civil liability for themselves and the affiliated U.S. company. The types of conduct prohibited by the FCPA are not always clear. As a result, caution is required when doing business through foreign consultants, commercial representatives or agents, or with businesses that are owned, in whole or in part, by foreign governments or that have personal or family ties to government officials. We do not oversee the day to day operations of employees or representatives of GeoCam. Although we emphasize compliance with the FCPA to all our employees and representatives and those of GeoCam, there remains a risk of violation in Cameroon or in the other countries where we may have operations.

We may fail to maintain the adequacy of internal control over financial reporting as required by the Sarbanes-Oxley Act.

In 2008 we documented and tested our internal controls and procedures in order to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act of 2002 (“SOX”). SOX requires an annual report by management of

17

Table of Contents

the effectiveness of the Company’s internal control over financial reporting. Management evaluated the Company’s disclosure controls and procedures and concluded that they were not effective as of December 31, 2008. Also, the Company’s Chief Executive Officer and Chief Financial Officer evaluated our internal control over financial reporting and determined that material weaknesses existed of December 31, 2008.

We implemented a number of activities during 2009 to remediate the weaknesses and improve our internal control over financial reporting. Our management evaluated our disclosure controls and procedures and our internal controls over financial reporting as of December 31, 2009 and concluded that disclosure controls and procedures were effective and that internal control over financial reporting was effective to provide reasonable assurance regarding the reliability of our financial reporting and the preparation of our financial statements in accordance with US GAAP. Our management reached similar conclusions as of December 31, 2010.

We may be unable to ensure in the future that we have effective internal controls over financial reporting or effective disclosure controls and procedures as defined by applicable rules. Because the financial statements of GeoCam are consolidated, GeoCam financial reporting is also subject to SOX. Our failure to satisfy the requirements of Section 404 of SOX on an ongoing, timely basis could result in the loss of investor confidence in the reliability of our financial reporting and disclosure, which in turn could harm our business and negatively impact the trading price of our common shares. In addition, difficulties in maintaining satisfactory controls and procedures could harm our future reported operating results or cause us to fail to meet our reporting obligations. Any future acquisitions of other businesses may provide us with challenges in implementing the required internal processes, procedures and controls in the acquired operations. Acquired companies may not have effective disclosure control and procedures or internal control over financial reporting that are as thorough or effective as those required by securities laws currently applicable to us.

No evaluation can provide complete assurance that our internal control over financial reporting will detect or uncover all failures of our personnel to disclose material information otherwise required to be reported. The effectiveness of our controls and procedures could also be limited by simple errors or faulty judgments. In addition, should we expand in the future, the challenges involved in implementing appropriate internal controls over financial reporting will increase and will require that we continue to improve our internal controls over financial reporting. Although we intend to devote substantial time and incur substantial costs, as necessary, to ensure compliance, we cannot be certain that we will be successful in complying with Section 404 of SOX on an ongoing basis.

Risks related to ownership of our stock

The market price of our common stock and warrants may be adversely affected by market volatility due in part to the current instability in the financial markets.

Our common stock price and warrant prices have decreased significantly since 2007. We cannot predict if or when current adverse economic conditions will be resolved or what the affect such instability may be on the price of our common stock and warrants.

Conditions beyond our control may cause wide price fluctuations in the market price of our common stock and warrants.

The market price of our common stock and warrants may be subject to wide fluctuations in response to many factors, including worldwide economic conditions and commodities prices, variations in our operating results, divergence in financial results from investors’ expectations, changes in performance estimates, changes in our business prospects, changes in mineral reserve or resource estimates, results of exploration, changes in results of mining operations, legislative changes, our liquidity and likely ability to achieve financing for the Nkamouna Project and other events and factors outside our control.

18

Table of Contents

Future sales of our securities in the public or private markets could adversely affect the trading price of our common stock and warrants and our ability to continue to raise funds in new stock offerings.

Future sales of substantial amounts of our securities in the public or private markets, or the perception that such sales could occur, could adversely affect prevailing trading prices of our common stock and warrants and could impair our ability to raise capital through future offerings of securities.

We do not intend to pay cash dividends in the near future.

Our Board of Directors determines whether to pay cash dividends on our issued and outstanding shares. The declaration of dividends would depend upon our future earnings, our capital requirements, our financial condition and other relevant factors. Our Board does not intend to declare any dividends on our shares for the foreseeable future. We anticipate that we will retain any future earnings to finance the growth of our business and for general corporate purposes.

Provisions of our Certificate of Incorporation, By-laws and Delaware law could defer a change of our management which could discourage or delay offers to acquire us.

Provisions of our Certificate of Incorporation, By-laws and Delaware law may make it more difficult for someone to acquire control of us or for our stockholders to remove existing management, and might discourage a third party from offering to acquire us, even if a change in control or in management might be beneficial to our stockholders. For example, our Certificate of Incorporation allows us to issue different series of shares of preferred stock without any vote or further action by our stockholders and our Board of Directors has the authority to fix and determine the relative rights and preferences of each series of preferred stock. As a result, our Board of Directors could authorize the issuance of a series of preferred stock with holders having the preferred right to our assets upon liquidation, preferred voting rights, preferred dividends before dividends are paid on common stock and/or redemption preferences or other preferred rights.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None

19

Table of Contents

| ITEM 2. | PROPERTIES |

Glossary of Certain Terms

Ferralite. Limonitic laterite, sometimes pulverulent, mottled, with varied shades of black, yellow, brown and red. Often foliated, reflecting relict serpentinite textures. Thickness varies from a few meters to tens of meters, averaging near 8 meters. Main ore unit, consistently mineralized with good metal grades near the top where black manganese zones occur, moderate to low cobalt grades lower in the unit.

Ferricrete breccia. Beneath the upper laterite is a nearly ubiquitous horizon of iron-rich concretions, ranging in size from one or two centimeters across, to blocks larger than a meter across. The ferricrete breccia averages 6 to 8 meters thick, and was often divided into two or three units by project geologists. A unit can contain very high cobalt grades, particularly at the base.

Hectare. A land measurement. One hectare is equal to 100 square meters, or approximately 2.47 acres.

Hydrometallurgical processing. One of several metallurgical processes that uses water and other liquids for the leaching and recovery of soluble metals from ore.

Lateritic soil. A soil containing laterite, or any reddish tropical soil developed by intense tropical weathering.

Manganese precipitate. Manganese compounds produced by precipitation from leach solutions.

Mine Permit. Republic of Cameroon Mining Permit Decree, dated April 11, 2003.

Mining Convention. Mining Convention between The Republic of Cameroon and Geovic Cameroon, S.A., dated July 31, 2002.

Nickeliferous laterite deposit. A nickel-bearing laterite deposit, occurring beneath the cobalt-nickel deposit at the Nkamouna Project.

Serpentinite. Bedrock, olive green to dark green, may be fractured and fissile, with silica-filled fractures. Uniformly low metals grades except in rare cases where garnierite-like nickeliferous silicates fill fractures.

Tailings facility. A containment system comprised of a compacted, earthen structure or dike and a prepared basin area that is used to contain solid tailings and water from the mineral beneficiation process.

Tailings disposal. A method for disposing of tailings, waste rejects, and water from a processing operation into the tailings facility.

Terrain or terrane. A term applied to a general geologic unit or grouping with no specific definition or formal designation.

Tonne. One metric tonne is 1000 kilograms, or 2,204.6 pounds.

Upper laterite. A purplish-red, highly magnetic, powdery clay-like soil. Ubiquitous, normally 4 to 8 m thick, except where removed by erosion at the borders of laterite plateaus.

Water table. The sub-surface level below which the host rock is water saturated. Geovic recorded a water table depth in several test drill holes which varied from approximately 12 to approximately 25 meters below surface at the Nkamouna Project site.

20

Table of Contents

Description of Mineral Projects

THE NKAMOUNA PROJECT

Much of the information in this section is summarized, compiled or extracted from the NI 43-101 Technical Report, Nkamouna and Mada Deposits, East Province of Cameroon, Africa, dated November 30, 2009 (the “Nkamouna Technical Report”) prepared for Geovic Mining by SRK Consulting (U.S.), Inc. (“SRK”). Information related to the historical estimated reserves is summarized and extracted from the Technical Report, Nkamouna Cobalt Project, Feasibility Study dated January 18, 2008 (the 2008 PAH Report”) prepared for Geovic Mining by Pincock Allen & Holt (“PAH”). SRK is independent from the Company. These Reports were prepared in accordance with the requirements of NI 43-101.

Portions of the following information are based on assumptions, qualifications and procedures which are set out only in the full Nkamouna Technical Report or the 2008 PAH Report as the case may be. We have omitted much of the background information that is included in the Reports. For a complete description of assumptions, qualifications and procedures associated with the following information and for additional details about the findings of SRK, reference should be made to the full text of the Nkamouna Technical Report which is available electronically from the Company’s website at www.geovic.net and on SEDAR at www.sedar.com. References to “Geovic” in this Item 2 “Properties” include the Company and GeoCam, where applicable.

The Company and GeoCam are currently reviewing and completing an independent feasibility study of the Nkamouna Project. The Company expects the feasibility study to be completed by the end of April 2011. The feasibility study will include an updated mine plan, ore reserve estimate, ore benefication and tailings storage designs, estimated construction and capital costs, operating expenses and future cash flow from mining operations at the Nkamouna Project.

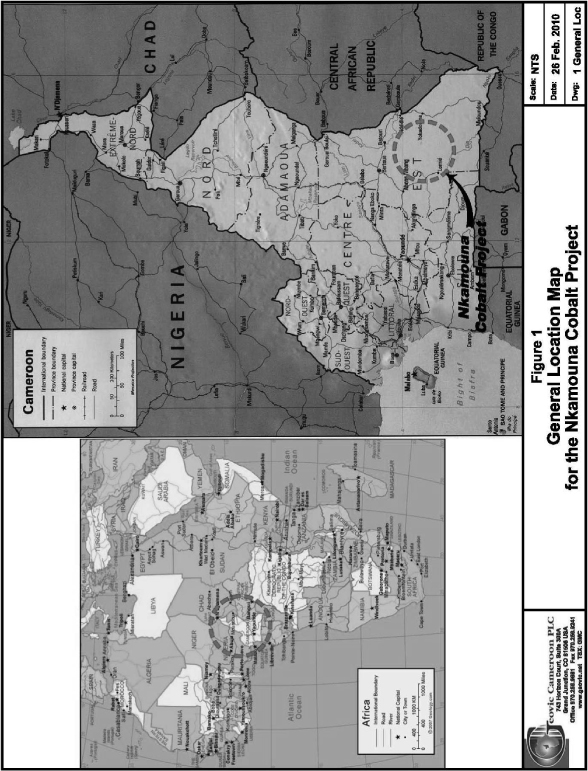

Project Description and Location

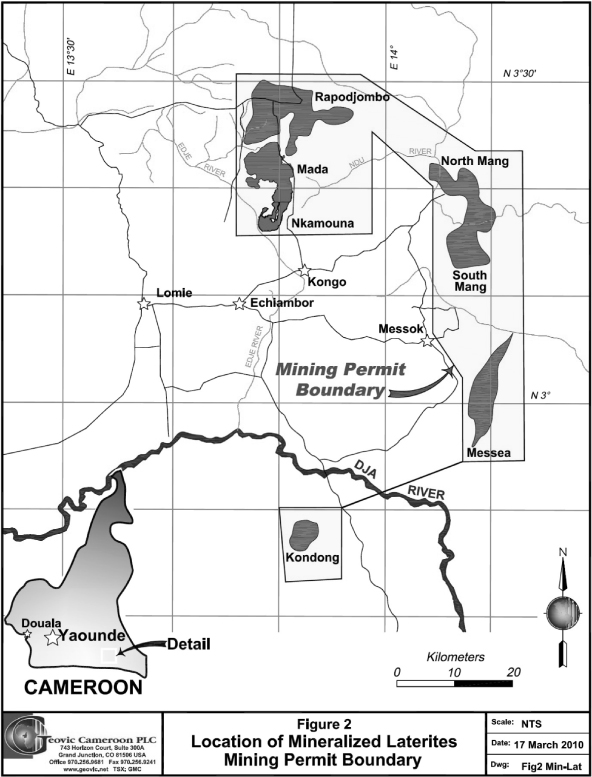

Geovic, through its 60.5% owned subsidiary GeoCam, has exclusive rights to several large cobalt-nickel laterite deposits in Cameroon (the “Cameroon Properties”) (Figure 1). There are seven laterite plateaus included in the Cameroon Properties (collectively, the “Plateaus”). The seven Plateaus aggregate approximately 337 square kilometers within the 1,250 square kilometer Mine Permit area. The Plateaus are (clockwise) Nkamouna, Mada, Rapodjombo, North Mang, South Mang, Messea and Kondong, and form a crescent-shaped array extending 80 kilometers north-south and 45 kilometers east-west (Figure 2).

The mineral rights are held by GeoCam under the Mine Permit and administered under the Mining Convention. The Mine Permit boundary is shown in Figure 2. The Plateaus within the Cameroon Properties constitute the known mineralized terrain within the Mine Permit, which is designated as “mineral exclusive lands.” The Nkamouna and Mada areas are the subject of the Reports. The Nkamouna (pronounced Ka-moon-ah) and Mada deposits (together the “Nkamouna Project”), will be mined first, and are located in southeastern Cameroon, (Figure 1), approximately 640 road kilometers east of the port city of Douala and 400 road kilometers east of the capital of Yaounde. The Mada deposit is contiguous and north of the Nkamouna deposit.

The Cameroon Properties are located in the Haut Nyong Division of the East Province. Nkamouna, Mada and the other laterite plateaus (except Kondong) lie within the Lomie Subdivision. The irregular 18-corner polygon-shaped Mine Permit area is monumented and is described in the Presidential Decree authorizing the Mining Permit.

Populations living near the site of the project are mainly made up of Nzimé (Bantu group) and indigenous Baka. Most inhabitants of the region practice subsistence agriculture (cassava, yams, plantains, bananas, some maize and taro) and supplement their diets with animal protein either domestically raised or from bush meat procured by hunters. The Nzimé people mainly live in villages along the existing network of unimproved roads. Baka are semi-nomadic forest people who live in shifting settlements in the forest, in roadside encampments and also in established villages. All generally speak languages of the Bantu linguistic family. The dominant languages in the project area are Dzime and Baka. French is nearly universal among adults, and some speak a little English since Cameroon is officially bilingual in French and English.

21

Table of Contents