Attached files

| file | filename |

|---|---|

| EX-32.1 - China Intelligence Information Systems Inc. | v215900_ex32-1.htm |

| EX-31.1 - China Intelligence Information Systems Inc. | v215900_ex31-1.htm |

| EX-21.1 - China Intelligence Information Systems Inc. | v215900_ex21-1.htm |

`

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended: December 31, 2010

OR

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from __________ to ____________

Commission File Number: 333-131017

CHINA INTELLIGENCE INFORMATION SYSTEMS, INC.

(Exact name of small business issuer in its charter)

|

Nevada

|

98-0509797

|

|

(State or other jurisdiction of incorporation or organization)

|

(IRS Employer Identification No.)

|

11th Floor Tower B1, Yike Industrial Base, Shunhua Rd,

High-tech Industrial Development Zone, Jinan, China 250101

(Address of principal executive offices)

86-(531) 55585742

(Issuer's telephone number)

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under Section 12(g) of the Exchange Act: Common Stock, par value $0.001

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (section 229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

As of March 25, 2011, the aggregate market value of the shares of the registrant’s common stock held by non-affiliates (based upon the closing price of such shares as reported on the Over-the-Counter Bulletin Board and OTCQB) was $31,413,658.5. Shares of the registrant’s common stock held by each executive officer and director and by each person who owns 10 percent or more of the outstanding common stock have been excluded in that such persons may be deemed to be affiliates of the registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of March 25, 2011, there were 68,791,489 shares of the registrant’s common stock outstanding.

FORM 10-K

For the Fiscal Year Ended December 31, 2010

|

Page

|

||

|

PART I

|

||

|

Special Note Regarding Forward-Looking Statements

|

||

|

Item 1. Business

|

4

|

|

|

Item 1A. Risk Factors

|

17

|

|

|

Item 2. Properties

|

21

|

|

|

Item 3. Legal Proceedings

|

21

|

|

|

Item 4. Submission of Matters to a Vote of Security Holders

|

22

|

|

|

PART II

|

||

|

Item 5. Market for Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

|

22

|

|

|

Item 6. Selected Financial Data

|

23

|

|

|

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

23

|

|

|

Item 8. Financial Statements and Supplementary Data

|

29

|

|

|

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

29

|

|

|

Item 9A. Controls and Procedures

|

29

|

|

|

Item 9B. Other Information

|

30

|

|

|

PART III

|

||

|

Item10. Directors, Executive Officers and Corporate Governance

|

31

|

|

|

Item11. Executive Compensation

|

34

|

|

|

Item12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

36

|

|

|

Item13. Certain Relationships and Related Transactions, and Director Independence

|

37

|

|

|

Item14. Principal Accountant Fees and Services

|

37

|

|

|

PART IV

|

||

|

Item15. Exhibits and Financial Statement Schedules

|

37

|

|

|

SIGNATURES

|

39

|

|

2

USE OF CERTAIN DEFINED TERMS

Except as otherwise indicated by the context, all references in this annual report to (i) “CIISI,” the “Company,” “we,” “us” or “our” are to China Intelligence Information Systems, Inc., a Nevada corporation, and its direct and indirect subsidiaries; (ii) “Jinan Yinquan” are to our subsidiary Jinan Yinquan Technology Co. Ltd., a corporation incorporated in the People’s Republic of China; (iii) “BPUT” are to our subsidiary Beijing PowerUnique Technologies Co., Ltd., a corporation incorporated in the People’s Republic of China; (iv) “Securities Act” are to the Securities Act of 1933, as amended; (v) “Exchange Act” means the Securities Exchange Act of 1934, as amended; (vi) “RMB” are to Renminbi, the legal currency of China; (vii) “U.S. dollar,” “$” and “US$” are to the legal currency of the United States; (viii) “China” and “PRC” are to the People’s Republic of China; and (ix) “SEC” are to the United States Securities and Exchange Commission.

FACTORS THAT MAY AFFECT FUTURE RESULTS

This Annual Report on Form 10-K contains forward-looking statements, within the meaning of the federal securities laws, about our business and prospects. The forward-looking statements do not include the potential impact of future events, including any mergers, acquisitions, divestitures, securities offerings or business combinations or other developments in our business that may be announced or consummated after the date of this Annual Report. Any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, the words “outlook”, “believes,” “plans,” “intends,” “expects,” “goals,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “predicts,” “estimates,” “anticipates,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these words. Our future results may differ materially from our past results and from those projected in the forward-looking statements due to various uncertainties and risks, including those described in Item 1A of Part I (Risk Factors). The forward-looking statements speak only as of the date of this Annual Report and undue reliance should not be placed on these statements. We disclaim any obligation to update any forward-looking statements contained herein after the date of this Annual Report.

3

PART I

ITEM 1. BUSINESS

Overview

China Intelligence Information Systems, Inc. (the “Company”), formerly known as China VoIP & Digital Telecom Inc., develops and provides virtualization and cloud computing solutions and services. The Company owns several virtualization-based products with independent intellectual property rights for education, info-security and cloud computing.

On August 17, 2006, we acquired all of the outstanding capital stock of Jinan Yinquan Technology Co. Ltd. (“Jinan Yinquan”) in exchange for the issuance of 40,000,000 shares of our common stock to the Jinan Yinquan’s shareholders and $200,000 as the cost of going public. Such shares are restricted in accordance with Rule 144 of the Securities Act. In addition, as further consideration for the acquisition, Apollo Corporation, the principal shareholder of the Company, agreed to cancel 11,750,000 post-split shares of its outstanding common stock. As a result, Jinan Yinquan became our wholly-owned subsidiary.

Jinan Yinquan is an equity joint venture established in Jinan in the People’s Republic of China (“the PRC”) in 2001. The exchange of shares with Jinan Yinquan has been accounted for as a reverse acquisition under the purchase method of accounting since the stockholders of Jinan Yinquan obtained control of the consolidated entity. Accordingly, the merger of the two companies has been recorded as a recapitalization of Jinan Yinquan, with Jinan Yinquan being treated as the continuing entity. The historical financial statements presented are those of Jinan Yinquan.

On May 7, 2008 (the “Closing Date”), Jinan Yinquan completed the acquisition of Beijing PowerUnique Technologies Co., Ltd. (“BPUT”), a company incorporated under the laws of the PRC, in accordance with an Investment Agreement. On the Closing Date, Jinan Yinquan invested RMB4,000,000 into BPUT; and BPUT issued 80% of the shares of BPUT to Jinan Yinquan. On the Closing Date, Jinan Yinquan became the controlling shareholder of BPUT. BPUT is a software company located in Beijing specializing in enterprise application software research and development. It creates reliable, secure as well as efficient information technology platforms for enterprise clients. BPUT is committed to providing the highest quality solutions to enterprises in both information security and virtual technology.

On July 5, 2008, Jinan Yinquan acquired the remaining 20% ownership of BPUT by paying another RMB4,000,000 to BPUT’s original shareholders. BPUT therefore became a 100% owned subsidiary of Jinan Yinquan.

Before July 2009, the Company was focused on the Voice Over Internet Phone (“VOIP”) technology related business. In July 2009, following political riots in Urumqi, the capital of the Xinjiang Uygur Autonomous region, the Chinese government issued an order to block VoIP business. The Company’s telecom service business suffered tremendously. We did not anticipate this order, nor did the Company expect such a long duration of the suspension of VoIP services. As a result, the Company discontinued its VOIP business in October 2009

The virtualization business is primarily conducted through BPUT outside of the Shandong area, while Jinan Yinquan primarily focuses on the Shangdong area. Jinan Yinquan and BPUT are the leaders in the applied virtual technology field in China. In May 2008, BPUT became an official Technology Alliance Partner (TAP) of VMware (NYSE: VMW). In addition, BPUT also obtained VMware Community Source and VMware VAC qualifications and is a VMware Premier Partner. VMware is the global leader in virtualization solutions from the desktop to the data center. Customers of all sizes rely on VMware to reduce capital and operating expenses, ensure business continuity, strengthen security and go green. VMware has more than 160,000 customers worldwide and all Fortune 100 enterprises are using the mature virtual technology of VMware. The alliance partnership allows BPUT to leverage VMware’s advanced virtual technology in the information security products marketplace in order to broaden its product offerings and strengthen its competitive advantage.

After Jinan Yinquan launched both the virtualization application technology and IBCC service platform in 2008, its virtualization technology and its IBCC service platform have been endorsed as the designated virtualization application technology product and the designated communications service platform for the 11th National Games of the PRC (the “National Games”), respectively. Jinan Yinquan implemented the virtualization technology in the National Games dedicated data center. The virtualization technology significantly reduced system purchases and operating costs. It also improved the reliability and manageability of the system and safeguarded the information used during the National Games. In addition, the IBCC service platform was run as the sub-website of the National Games’ official website for athletes, coaches, staff, volunteers and sponsors so they may enjoy unified communication services including an online office system, telephone, SMS, Email, fax, conference call and video conference.

4

Reorganization

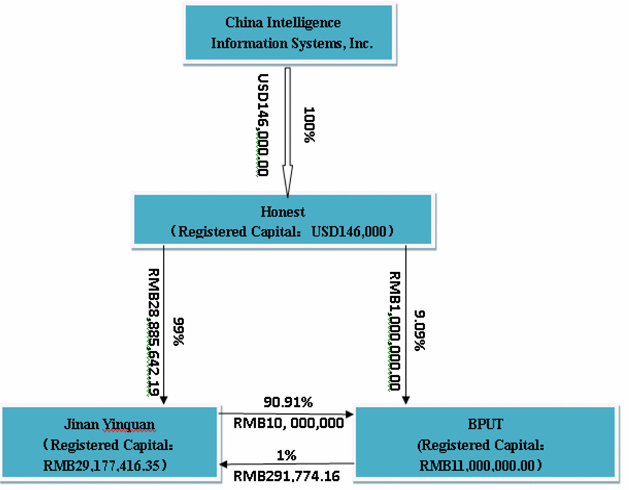

In 2010, we consummated a series of transaction which resulted in us becoming the sole shareholder of Shandong Honest Management Consulting Co., Ltd., (“Honest”), which, in turn, is the sole shareholder of Jinan Yinquan and BPUT. The purpose of these transactions is for the Company to enjoy preferential policies provided by the Chinese Government to the local hi-tech and software companies.

On December 31, 2009, our Board of Directors authorized our acquisition of 100% of the shares of Honest, a company incorporated and operated under the laws of the People’s Republic of China, for a purchase price of RMB35,464,934 (Approx. $5,187,055). After the acquisition, which was effective on August 3, 2010, Honest became the wholly-owned subsidiary of the Company.

On December 31, 2009, our Board of Directors authorized our sale of our 100% ownership in Jinan Yinquan to Honest for a price of RMB34,464,934.21 (Approx. $5,040,797). After the transfer, which was effective on August 24, 2010, Jinan Yinquan became the wholly-owned subsidiary of Honest. Honest retains the right to manage Jinan Yinquan and continue to develop its business operations. The purpose of this transfer was to foster the development of Jinan Yinquan in China, since the Chinese government offers stronger support to local companies.

On August 24, 2010, BPUT acquired 1% of the outstanding shares of Jinan Yinquan at a price of RMB291,774.16.

On September 20, 2010, Jinan Yinquan transferred its 9.09% of the outstanding shares of BPUT to Honest at a price of RMB1,000,000.

The following chart reflects our organizational structure after the consummation of the reorganization:

5

Virtualization Business

The Company’s main businesses are:

|

|

1.

|

Development and Promotion of Server Virtualization Technology;

|

|

|

2.

|

Virtual Desktop Infrastructures (VDI);

|

|

|

3.

|

Disaster Tolerance Backup and Management Technology under Virtualization Infrastructure;

|

|

|

4.

|

Information Technology Outsourcing services of virtualization products and technology (ITO);

|

|

|

5.

|

Info-security Storage Products;

|

|

|

6.

|

Development and Promotion of Cloud Computing Platform;

|

|

|

7.

|

Cloud Computing products and consultation, solution services for large-scale enterprises and government departments;

|

|

|

8.

|

Cloud Computing services for SME and individuals.

|

Jinan Yinquan is focusing on the virtualization marketing in the Shandong area, while BPUT is focusing on the large enterprise client market and also exploring the markets outside of Shandong area. Since 2008, the Company’s integral virtualization solutions and services have obtained strong support from the Chinese governments, and the Company has several breakthroughs in the virtualization field. We have developed the:

|

|

·

|

Virtualization Technology Application Engineering Research Center of Shandong Province supported by the Department of Science & Technology of Shandong Province;

|

6

|

|

·

|

Shandong Virtualization Technology Promotion and Application Center supported by the Department of Information Industry of Shandong Province; and

|

|

|

·

|

Virtualization Technology Laboratory supported by the Department of Information Industry of Shandong Province.

|

Certifications and Awards:

BPUT is qualified as a

VMware Technology Alliance Partner (TAP),

VMware Community Source (VCS),

VMware Premier Partner (VPN),

VMware Authorized Training Center (VATC) and

VMware Authorized Consultant (VAC).

BPUT is also the VIP Partner and Platinum Partner of Vizioncore. It has completed the localization of Vizioncore’s software in China.

Jinan Yinquan has received the following certifications: ,

|

|

l

|

Hi-tech Enterprise authorized by Science and Technology Department of Shandong Province;

|

|

|

l

|

Double-software certified Enterprise by Information Industry Department of Shandong Province;

|

|

|

l

|

SME Technology Innovation Fund Implementation Enterprise by Ministry of Science and Technology;

|

|

|

l

|

Virtualization Technology Application Engineering Research Center of Shandong Province supported by the Department of Science & Technology of Shandong Province;

|

|

|

Shandong Virtualization Technology Promotion and Application Center supported by the Department of Information Industry of Shandong Province;

|

|

|

l

|

Virtualization Technology Laboratory supported by the Department of Information Industry of Shandong Province;

|

|

|

l

|

Cloud Computing R&D and Promotion Center of Shandong Province;

|

|

|

l

|

Internet of Things R&D and Promotion Center of Shandong Province;

|

|

|

l

|

The Model E-Commerce Company of Shandong granted by Shandong Information Industry Department;

|

Jinan Yinquan’s Virtualization Technology for Data Center received the “2008 Shandong Province Outstanding Energy Saving Achievement” award from the government; and Jinan Yinquan has passed ISO9001 Quality Certification, ISO 27001 information security certification, China System Integration Qualification Level 3 and passed CMMI Level 3 Appraisal.

Industry Background

Virtualization was first introduced in the 1970s to enable multiple business applications to share and fully harness the centralized computing capacity of mainframe systems. Virtualization was effectively abandoned during the 1980s and 1990s when client-server applications and inexpensive x86 servers and personal computers established the model of distributed computing. Rather than sharing resources centrally in the mainframe model, organizations used the low cost of distributed systems to build up islands of computing capacity, providing some benefits but also introducing new challenges.

The increased usage of x86 servers and desktops caused new operating risks and challenges on the IT basic infrastructure to emerge. These risks and challenges include:

|

|

1.

|

Low utilization of infrastructures. According to a survey conducted by International Data Corporation (IDC), the average utilization of typical x86 servers can only reach 10% to 15%. An organization can only run one application on each server to avoid interruptions between applications. This “one server one application” style leads to low utilization of infrastructures.

|

7

|

|

2.

|

Increased costs of physical infrastructure. Due to the expansion of physical infrastructure, the running cost has increased rapidly. A large proportion of computing infrastructure has to stay running, resulted in increased costs such as power consumption, cooling and storage.

|

|

|

3.

|

Increased costs of IT management. As the computing environment is getting more complicated, the requirements for infrastructure administrators’ professional training increase as well and so does the corresponding HR cost. Organizations have to spend much time and more resources on server maintenance, and employ a large number of administrators to do the work. Also, given the complexity and heterogeneity of the computing environments, it’s virtually impossible to achieve the processing automation.

|

|

|

4.

|

Lack of back-up protection and disaster recovery option. Application failures on critical servers are fatal to organizations. Hackers, natural disasters, viruses and even terrorist activities are the main threats to business continuity of organizations.

|

|

|

5.

|

Desktop management and security. Organizations are facing a series of challenges managing desktops and keeping them secured. The process of strengthening management, access and security policies under a distributed desktop environment is complicated and costly. Administrators have to install a number of patches and updates into the desktop environment to reduce security leakages.

|

Under the circumstances, the Company introduced the energy-saving “Green IT” solution for data centers based on virtualization technology. The key advantages of the Green IT solution are:

|

|

·

|

It efficiently achieves resource sharing between servers (so the virtualization solution can reduce up to 90% of the number of servers. As a result, the solution can significantly lower the power consumption and cut down the carbon emission)

|

|

|

·

|

It reduces the operating, management and maintenance costs

|

|

|

·

|

It enhances data security (solving the issues in the traditional data centers, virtualization can create a quick responding application platform with high IT resource utilization and low costs)

|

Due to their increased reliance on information technology to run their operations, large-scale datacenters in enterprises and government departments operate an increasing number of applications. According to VMware, many traditional datacenters operate inefficiently due to the difficulty of having communications between different systems and difficulty using servers and storage to their full capacity. Moreover, the operating cost of such data centers keeps increasing, and there are numerous new viruses and potential security threats. Enterprises and government departments who use multiple applications and customized software will demand more servers, while the old equipment needs to be periodically replaced.

At this stage, the organizations need adequate electricity supplies, cooling equipment and UPS to ensure a stable and high efficiency running of each server. Each server will consume an average of approximately 8,000 degrees of electricity per year. Furthermore, the cooling equipment’s electricity consumption will be 3,000 degrees per year, and UPS backup power-sharing expenditures are about RMB2,000 per year. Each running server will consume approximately 11,000 degrees of electricity per year, with a direct expense of up to RMB13,000.

Prior to the virtualization technology, one server only ran one application. Some important applications may need another 2-3 backup servers at the same time. Most servers’ usage rate is only 5%-8%, which represents a waste of resources of over 90%.

Virtualization technology breaks the status that one server only runs one application. The virtualization software may virtualize one server to several virtualized servers, and each virtualized server may run different operating systems and application software. The maximum configuration of each virtualized server may be the same of that for individual traditional physical servers.

8

By putting all CPUs, RAMs and network cards within a servers group to establish a resource pool, we may virtualize more virtualized servers and run more applications. In this way, the wasted resources under traditional server running status, which can exceed 90%, can be recaptured. Meanwhile, the virtualization system could optimize the usage rate of the hardware automatically and continuously to ensure a safe and high efficiency running of each application software.

The significances of server virtualization are as follows:

|

|

1.

|

Lower construction cost: Establishing a network data center based on virtualization could directly reduce up to 90% of costs in terms of the number of servers. Server virtualization aavoids purchasing multiple servers with different operating system for one application project so the solution can completely eliminate the problems caused by system upgrade.

|

|

|

2.

|

Reducing power consumption, carbon emission, operating and maintenance costs: When virtualization was applied, the number of servers decreased to 10% of the original number. In addition, the number of server cabinets, the size of the server room, the power consumption, the UPS power and batteries, and the cooling system cost were significantly reduced as well. Also, the new data center based on server virtualization required fewer administrators and the virtual desktop device could satisfy various office demands.

|

|

|

3.

|

High manageability: After the implementation of virtualization solutions, operating status and server utilization can be monitored. If a new application is required, it only takes approximately 30 minutes to create a virtual server. It is not necessary to arrange server down time to perform hardware maintenance. Administrator can create a virtual desktop for a user in several minutes. If a problem appears in a user’s virtual environment, it only takes a few minutes for the administrator to recover a brand new environment for the user, and the user’s data can be completely recovered.

|

|

|

4.

|

High reliability: When virtualization technology is applied, a system could automatically isolate a broken-down server, and transfer all tasks to another one. The system could run upgrades without any interruption and the virtualization also supports fast server transfer and backup. These will greatly reduce system downtime and other abnormal accidents.

|

|

|

5.

|

Improving system protection and ensuring information security: Partition is the most basic component of a virtualization solution. All the virtual machines must be completely isolated, so the process of dynamic connections and the applications will not impact other virtual servers. Comparing to the regular servers, virtual machines are well protected from normal security attacks since virtualization has changed access nodes and components. Virtual system uses central storage mode. All users’ data reside in a data center to ensure data security. Administrators can control all the virtual desktops which can effectively prevent the viruses and outflows of important data. Virtualization puts an end to the leaks of important information, and ensures the security of the information.

|

|

|

6.

|

Conforming to national policies of China: Virtualization technology has been widely used globally though it was used in the Chinese government and enterprises in the recent years. Its energy saving and emission reduction are consistent to the “Green IT” concept, which is initiated by the Chinese government. It is an advanced technology with significant economic and social benefits.

|

In response to these needs, the Company introduced the energy-saving “Green IT” solution for data centers based on virtualization technology. The key advantages of the Green IT solution are: that it

|

·

|

efficiently achieves resource sharing between servers (so the virtualization solution can reduce up to 90% of the number of servers. As a result, the solution can significantly lower the power consumption and cut down the carbon emission);

|

|

·

|

reduces the operating, management and maintenance costs;

|

|

·

|

enhances data security (solving the issues in the traditional data centers, virtualization can create a quick responding application platform with high IT resource utilization and low costs).

|

9

Business Strategy

We provide high quality products and responsive service. We intend to profitably grow our business by pursuing the following strategies:

|

l

|

Targeting the existing and potential users based on their industries, and forming the unique cooperation relationship with VMware and Vizioncore, we may be able to lower the cost of products and services. Meanwhile, we will add our independently developed products into the solutions to expand the scope of consulting, plan, design and after-sale services. We are the solution provider who offers customers on-demand solutions.

|

|

l

|

Focusing on the regional market development, we have obtained the substantial support from the local governments. Jinan Yinquan has become the unique virtualization solution provider for the Shandong government. We plan to duplicate this business model in other areas including Sichuan, Liaoning, Tianjin and Beijing. Meanwhile, we actively participate in the establishment of the local and national virtualization standards.

|

|

l

|

Cooperating with system integrators (SIs) in various areas, we provide turn-key virtualization solutions, which include system consultation, plan, implementation, training and service). As a result, the SIs are well equipped to offer complete virtualization solutions to customers in various industries and locations. Through the large numbers of SIs, we should be able to increase our market share quickly and strengthen our leading position in the virtualization industry in China.

|

|

l

|

We focus on product developments and technology upgrades. We are also exploring the international markets. With the advanced technologies, an experienced technical support and sales and marketing teams, and expanded distribution channels, we aim to provide more comprehensive virtualization solutions to multinational enterprises both domestically and internationally.

|

Technology

SERVER VIRTUALIZATION TECHNOLOGY

The virtualization platform is built on a business-ready architecture. Use virtualization software to transform or “virtualize” the hardware resources of an x86-based computer—including the CPU, RAM, hard disk and network controller—to create a fully functional virtual machine that can run its own operating system and applications just like a “real” computer. Each virtual machine contains a complete system, eliminating potential conflicts. Multiple operating systems run concurrently on a single physical computer and share hardware resources with each other. By encapsulating an entire machine, including CPU, memory, operating system, and network devices, and a virtual machine is completely compatible with all standard x86 operating systems, applications, and device drivers. You can safely run several operating systems and applications at the same time on a single computer, with each having access to the resources it needs when it needs them. In this way, over 90% resources will be used rather than that wasted under the traditional server run mode.

Advantages:

|

|

·

|

Lowers construction cost by eliminating 90%+ server and application software purchase;

|

|

|

·

|

Saves energy and protect the environment, lower operation and maintenance cost;

|

|

|

·

|

Eliminates abnormal downtime with highest availability and reliability;

|

|

|

·

|

Improves system security protection capability; and

|

|

|

·

|

In compliance with the government policy, expedite information process.

|

10

VIRTUAL DESKTOP INFRASTRUCTURES (VDI)

Desktop virtualization separates a personal desktop computer from the physical machine through a client-server computing model. The resulting “virtualized” desktop is stored on a remote central server, instead of on the local storage of a remote client. Thus, when users work from their remote desktops, all the programs, applications, processes, and data are maintained and run centrally. This solution can help users reduce cost and facilitate management, achieving higher energy-savings, lower emissions and more environmentally-friendly goals.

Advantages:

|

|

·

|

With a thin client, there is no need to buy any host since only the keyboard, mouse, monitor are required;

|

|

|

·

|

The overall hardware expense and IT waste will be reduced substantially since it is not necessary to buy new PCs in the following 3-5 years. Resources shared and allocated to users are on an as-needed basis;

|

|

|

·

|

Help enterprises achieve Green IT objective as the power dissipation of each PC is lowered from 260W to 30W;

|

|

|

·

|

The integrity of user information is improved since all data can be maintained and backed up in the data center;

|

|

|

·

|

Users have the ability to logon their desktops anywhere; and

|

|

|

·

|

The maintenance expense is reduced dramatically.

|

11

DISASTER TOLERANCE, BACKUP AND MANAGEMENT TECHNOLOGY UNDER VIRTUALIZATION STRUCTURE

The company designs customized virtualization solution by combining disaster tolerance technology, in order to provide cost effective disaster recovery solution with world-leading class virtualization performance monitor that can realize backup, recover and backup management under virtualization environment. By detecting and recycling the over-allocated storage in virtual machines, it will lower unnecessary storage cost significantly.

Advantages:

|

|

·

|

Enables continuity of the operation process;

|

|

|

·

|

Improves monitor performance, lowers the resource sharing risks and optimizes resource utilization;

|

|

|

·

|

Designs disaster recovery solutions which are compatible with most third-party backup software;

|

|

|

·

|

Provides self-service applications and multiple virtual machines control, lowers administrative cost of the virtual machines and increases the consistency of management; and

|

|

|

·

|

Rapidly detects and recycles the over-loaded storage in virtual machines, lowers unnecessary storage cost significantly.

|

TECHNOLOGY FOR OPTIMAL STRUCTURE AND BUSINESS CONTINUITY

Based on users’ specific demands, deliver high available, continuous and disaster-recovery solution to them in order to help them better prepare for the risks and ensure their business continuity. This solution with world-leading technology and our independently developed software, has been highly praised and widely accepted by the users.

Advantages:

|

|

·

|

Continuous access to the applications even under the local server malfunction;

|

|

|

·

|

Non-disruptive automated backup and restore processes;

|

|

|

·

|

Inter-city data recovery when disaster destroys the production center;

|

|

|

·

|

IT structure optimization and continuous business; and

|

|

|

·

|

Energy saving and Green IT effect.

|

CLOUD COMPUTING TECHNOLOGY

Cloud computing is a general term for anything that involves delivering hosted services over the Internet. These services are broadly divided into three categories: Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS) and Software-as-a-Service (SaaS). The name “cloud computing” was inspired by the cloud symbol that's often used to represent the Internet in flowcharts and diagrams.

A cloud service has three distinct characteristics that differentiate it from traditional hosting. It is sold on demand, typically by the minute or the hour; it is elastic — a user can have as much or as little of a service as they want at any given time; and the service is fully managed by the provider (the consumer needs nothing but a personal computer and Internet access). Significant innovations in virtualization and distributed computing, as well as improved access to high-speed Internet and a weak economy, have accelerated interest in cloud computing.

Products and Services

We are committed to be the integral virtualization solution provider (including products, technology, service, consultation, design and implementation) rather than a mere reseller of VMware and Vizioncore’s products. Selling virtualization products is only one segment of our business. We provide a full range of solutions to the clients, and we are capable of developing new virtualization-related products and services (including solution design, implementation and consultation) based on client’s specific requirements. Once the client adopts our virtualization solutions, we also have the exclusive right to provide long-term after-sale maintenance and upgrade services.

12

To end users:

|

|

·

|

IT Platform Reconstruction: We provide a full range services including consultation, plan, design, products, implementation and after-sale service to clients on the reconstruction of their existing IT platforms.

|

|

|

·

|

Disaster Tolerance Backup Solution: We design customized virtualization solution by combining Vizioncore’s disaster tolerance technology, in order to provide cost effective disaster recovery solution with world-leading class virtualization performance monitor that can realize backup, recover and backup management under virtualization environment.

|

|

|

·

|

VDI solution: Desktop virtualization is the concept of separating a personal desktop computer from the physical machine through a client-server computing model. The resulting "virtualized" desktop is stored on a remote central server, instead of on the local storage of a remote client. Thus, when users work from their remote desktop client, all the programs, applications, processes, and data are maintained and run centrally.

|

|

|

·

|

Upgrade and maintenance services after implementation: We will provide 7/24 technical services to our clients via hotline and in-site, and help them maintain or upgrade their systems when necessary.

|

|

|

·

|

Information Technology Outsourcing services of virtualization products and technology (ITO): We offer the ITO sales mode to government departments, telecom carriers as well as the well-known enterprises home and abroad. Based on their specific demands, we can provide the outsourcing services for “ Turn-key project of virtualization”. The products provided are virtualization software products of Vmware and software of Vizioncore. We could provide any solution related to these software as a “Turn-key project” covering professional consultation, design, implementation, training and services. We may either charge the clients based on our services or the power supply saved amount in the light of our solution.

|

|

|

·

|

Info-security Storage Product: The DIVER brand hard-disk computer series, an end-user device designed by using virtualization technology, provides the same Windows operation environment as the normal computers. The user may enter his/her own operation environment in DIVER by connecting it with a normal computer. The Windows in DIVER will not interfere that in the computer, while all the operations done in DIVER won’t leave any trace in the computer. The DIVER looks like a hard disk, however, it’s actually a computer with virtual operation platform. It not only provides user a huge storage space, but also a stable and safe information environment.

|

To Cooperated System Integrators (SIs):

Given our superior technology, large implementation capacity, high-quality service and excellent performance-to-price ratio, we can provide the SIs a comprehensive technical supports including pre-sale training, test evaluation, solution design, and software delivery, implementation and training. We call this support package as the turn-key solution. The turn-key solution will help the SIs without the sales qualifications and capabilities (all are strictly required before implementing the virtualization projects) to implement virtualization solutions.

Info-Security Storage Product

The DIVER brand hard-disk computer series, an end-user device designed by using virtualization technology, provides the same Windows operation environment as the normal computers. The user may enter his/her own operation environment in DIVER by connecting it with a normal computer. The Windows in DIVER will not interfere that in the computer, while all the operations done in DIVER won’t leave any trace in the computer. The DIVER looks like a hard disk; however, it’s actually a computer with virtual operation platform. DIVER not only provides user a huge storage space, but also a stable and safe information environment.

13

According to VMware, IT infrastructures have become increasingly complex and brittle. Currently, 70% of IT investment focuses on maintenance, leaving little time to support strategic business developments. Customers are demanding faster response times and lower costs, cloud computing is a new solution to reducing IT complexity. Loucd computing leverages efficiency by pooling demand and self-managed virtual infrastructure. Cloud computing is central to an enhanced IT strategy.

As the leading virtualization solutions provider in China, CIISI sees how cloud computing is changing the IT industry by its business model and infrastructure advantages. We foresee that cloud computing will be the development super-trend for the virtualization industry. In order to capture the first mover opportunity in the market, the Company has decided to develop the cloud computing platform.

The platform, based on virtualization technology, is developed as a basic cloud computing infrastructure with various cloud modules, including private cloud, government cloud and business cloud. The platform aims to provide uniform, standardized and automated management services to organizations which have IDCs (Internet Datacenters) and other datacenters, such as telecom carriers. The platform, designed under the “service-oriented infrastructure management” concept, focuses on integrating basic infrastructures in organizations’ datacenters by abstracting and managing computing resources within the environment. The Calm platform’s core technology is to deploy applications in the Cloud (web-based environment) and provide uniform, standardized and automated management during the entire life cycle of the applications including development, deployment, execution, update and offline. The Calm platform realizes on-demand creation, rapid deployment and intelligent management, and represents a new innovative way to reconfigure solutions from the cloud resources for its next version.

The Company will operate this platform as a carrier to provide virtual machine leasing services to organizations. We will also develop customized cloud computing platforms and provide on-demand services to the companies with IDCs and other datacenters.

The Company expects to release updated versions of the cloud computing platform on a regular basis and will integrate a Software-as-a-Service (SaaS) model.

Competition

The virtualization industry is relatively nascent in China and is in its rapidly developing early stage. The major competition is from other operators of Vmware and Vizioncore in China. However, given the technical alliance partnership the Company has with VMware and Vizioncore, the Company is in a good position to take advantage of the market growth. Most importantly, the virtualization technology provided by the Company has obtained strong support from the government.

The Company’s leadership in the China virtualization industry is demonstrated by the following:

|

|

·

|

BPUT won the Infrastructure Virtualization Competency Partner award granted by Vmware in February 2011;

|

|

|

·

|

We won the bid of data center virtualization software renovation project for State Grid and all its subordinate units in October 2010 , and we were granted the exclusive representative right to provide VMware consulting, sales and service within two years; and

|

|

|

·

|

We signed several contracts with large-scale customers, including State Grid and all its subordinate units, Southern Grid most of its subordinate units; State Administration of Taxation; the boarder defense and fire protection departments under public security system; Huaneng Power International Inc, Geely Group, Peking Union Medical College Hospital, State Administration of Foreign Exchange, the Ministry of Public Security of PRC, China Power Investment Group and China Unicom. We believe the agreements with Southern Grid and its subsidiaries will account for more than five percent of our revenues in the fiscal year 2011.

|

We believe that the key competitive factors in the virtualization market include:

|

|

·

|

The level of reliability and new functionality of product offerings;

|

|

|

·

|

The ability to provide full virtual infrastructure solutions;

|

|

|

·

|

The ability to offer products that support multiple hardware platforms and operating systems;

|

|

|

·

|

The pricing of products, individually and in bundles;

|

|

|

·

|

The ability to attract and preserve a large installed base of customers;

|

14

|

|

·

|

The ability to create and maintain partnering opportunities with hardware and infrastructure software vendors and development of robust indirect sales channels; and

|

We believe the strong governmental support, our market leadership, large customer base, consolidated partnership with Vmware and Vizioncore, exclusive partnership with large-scale industry customers, broad and innovative solutions suite, and enhancing SI cooperation network position us favorably to compete effectively.

15

Research and Development

We specialize in virtualization technology development, project design and consultation. We also cooperate with well-known scientific research institutes, such as Tsinghua University, Shandong University and other well-known universities on research.

We have focused our research and development on virtualization and have achieved the following:

|

l

|

Successfully developed a special and complete disaster recovery and backup system for datacenter by combining the technologies from VMware and Vizioncore.

|

|

l

|

Independently developed a new generation Audio-Visual Teaching System for education industry;

|

|

l

|

Developed the DIVER brand hard-disk computer to satisfy users’ demand for information security;

|

|

l

|

Developed the new generation IDC management system for telecom carriers;

|

|

l

|

Independently designed and developed Green2C Cloud Computing Platform.

|

We have had several breakthroughs in the virtualization field.

We have the first:

|

|

·

|

Virtualization Technology Application Engineering Research Center of Shandong Province supported by the Department of Science & Technology of Shandong Province;

|

|

|

·

|

Shandong Virtualization Technology Promotion and Application Center supported by the Department of Information Industry of Shandong Province; and

|

|

|

·

|

Virtualization Technology Laboratory supported by the Department of Information Industry of Shandong Province.

|

We also take part in the establishment of the Implementation Standards for Virtualization Technology of Shandong Province, and we plan to push forward this local standard to the national standard.

On July 20, 2010, we made an investment to Shandong Yinquan Investment Holding Limited (Yinquan Holding). The capital contribution is $2,654,919 (RMB17,500,000), which takes account of 27% of the shareholder interest of Yinquan Holding. The main purpose of the investment is for Yinquan Holding to establish China Cloud Computing Science Park in Nanhai New Areas of Wendeng City. The city is located in Shandong Province.

Intellectual Property and Proprietary Rights

Our ability to compete depends, in part, on our ability to obtain and enforce intellectual property protection for our technology in China and internationally. We currently rely primarily on a combination of trade secrets, patents, copyrights, trademarks and licenses to protect our intellectually property. As of December 31, 2010, we have seven (7) software copyrights. In particular, we have a software copyright certificate for NP Network Telephone, a software copyright certificate for billing and managing system of IP phone systems, a software copyright certificate for a long-distance video monitoring system, a software copyright of Yinquan’s IBCC communication system ,a software copyright of Yiquan’s Virtualization Software V1.0., a software copyright of Yinquan’s disaster tolerance system software V1.0 and a software copyright of Yinquan’s Green2C cloud computing platform software V1.0. Our copyrights expire on dates ranging from 2028 to 2030. We have two patents are in application process, however, we cannot predict whether our pending patent applications will result in issued patents.

To protect our trade secrets and other proprietary information, we require our employees to sign agreements providing for the maintenance of confidentiality and also the assignment of rights to inventions made by them while in our employ. There can be no assurance that our means of protecting our proprietary rights will be adequate or that competition will not independently develop technologies that are similar or superior to our technology, duplicate our technology or design around any of our patents. Our failure to protect our proprietary information could cause our business and operating results to suffer.

We license intellectual property from third parties and incorporate such intellectual property into our services. These relationships are generally non-exclusive and have a limited duration. Moreover, we have certain obligations with respect to non-use and non-disclosure of such intellectual property. We cannot assure you that the steps we have taken to prevent infringement or misappropriation of our intellectual property or the intellectual property of third parties will be successful.

16

Employees

As of December 31, 2010, we had 90 full-time employees: 10 are in research and development, 13 are in pre-sale support,23 are in sales and marketing, 13 are in after-sale support and project implementation and 31 are in general and administrative functions. Although our employees are covered by employment agreements titled, “Labor Contracts” none of our employees are covered by collective bargaining agreements. We believe that our relations with our employees are good.

ITEM 1A. RISK FACTORS

Risks Related to Our Business

The virtualization products and services we sell are based on a technology with emerging applications and therefore the potential market for our products remains uncertain.

The virtualization technology is relatively nascent in China; it’s still an emerging technology for customers which may require more time to eliminate customers’ doubt about virtualization’s reliability and stability and therefore delay our development..

Customers may also be concerned about the application risks after using virtualization solutions. Although the use of virtualization technologies on servers and in on-premises data centers has gained acceptance on computer servers for enterprise-level applications, the extent of adoption of virtualization for desktop interface and by small and medium-size businesses remains uncertain. As the markets for our products and services mature and the scale of our business increases, the rate of growth in our product and services sales will likely be lower than those we have experienced in earlier periods. In addition, to the extent that rates of adoption of virtualization infrastructure solutions occur more slowly or less comprehensively than we expect, our revenue growth rates may slow materially or our revenue may decline substantially.

Our future success may be impaired and our operating results will suffer if we cannot respond to rapid market, competitive and technological conditions in the software industry

The market for our software products and services is characterized by:

|

|

•

|

rapidly changing technology;

|

|

|

•

|

frequent introduction of new products and services and enhancements to existing products and services by platform vendors of database, application and Windows products and by our competitors;

|

|

|

•

|

increasing complexity and interdependence of software applications;

|

|

|

•

|

consolidation of the software industry;

|

|

|

•

|

changes in industry standards and practices; and

|

|

|

•

|

changes in customer requirements and demands.

|

To maintain our competitive position, we must continue to enhance our existing products and develop new products and services, functionality, and technology that address the increasingly sophisticated and varied needs of our customers and prospective customers, which requires significant investment in research and development resources and capabilities, involves significant technical and business risks and requires substantial lead-time and significant investments in product development. If we fail to anticipate new technology developments, customer requirements, industry standards, or if we are unable to develop new products and services that adequately address these new developments, requirements, and standards in a timely manner, or if we are incapable of timely bringing new or enhanced products to market, our products and services may become obsolete, we may not generate suitable returns from our research and development investments, and our ability to compete may be impaired, our revenue could decline, and our operating results may suffer.

Until we discontinued the VoIP business in 2009, a large portion of our revenue was been attributable to the growth of our VoIP products and services as well as the virtualization business, and we relied upon cash flow generation from these two businesses to fund sales, marketing and research and development initiatives associated with our other product areas. Our operation relies on the new virtualization business. We cannot provide any assurance that we will sustain or grow the revenues we derive from this area. We cannot provide any assurance the new business will be successful or that the release of our enhanced products and services will increase our revenue growth rate.

17

The independently developed technologies by us, contracts with partners and agreements with cooperated system integrators are all confidential information. We have established strict access limitation level for the personnel in the company to review and use such information by signing Non-disclosure Agreements with relevant people. The usage and disclosure of such information have been managed stringently by the company. We also sign a long-term engagement contract with the core technical people who may hold major technologies of the company. Despite the foregoing measurements adopted by the Company, we cannot assure the confidential information will not be disclosed definitely.

Ongoing uncertainty regarding the duration and extent of the recovery from the recent economic downturn and in global economic conditions generally may reduce information technology spending below current expectations and therefore adversely impact our revenues, impede end user adoption of new products and product upgrades and adversely impact our competitive position.

Our business depends on the overall demand for information technology and on the economic health of our current and prospective customers. The purchase of our products is often discretionary and may involve a significant commitment of capital and other resources. Weak economic conditions or significant uncertainty regarding the recovery from the recent economic downturn could adversely impact our business, financial condition and results of operations in a number of ways, including by lengthening sales cycles (for example, ELAs), lowering prices for our products and services, reducing unit sales, decreasing or reversing quarterly growth in our revenues, reducing the rate of adoption of our products by new customers and the willingness of current customers to purchase upgrades to our existing products.

The recent global economic disruption also resulted in general and ongoing tightening in the credit markets, lower levels of liquidity and increases in the rates of default and bankruptcy, while the potential for extreme volatility in credit, equity and fixed income markets continues. As a result, current or potential customers may be unable to fund software purchases, which could cause them to delay, decrease or cancel purchases of our products and services. Even if customers are willing to purchase our products and services, if they do not meet our credit requirements, we may not be able to record accounts receivable or deferred revenue or recognize revenues from these customers until we receive payment, which could adversely affect the amount of revenues we are able to recognize in a particular period.

Risks Related to Doing Business in China

Adverse changes in China’s political or economic situation could harm us and our operational results.

Economic reforms adopted by the Chinese government have had a positive effect on the economic development of the country, but the government could change these economic reforms or any of the legal systems at any time. This could either benefit or damage our operations and profitability. Some of the things that could have this effect are:

|

|

•

|

Level of government involvement in the economy;

|

|

|

•

|

Control of foreign exchange;

|

|

|

•

|

Methods of allocating resources;

|

The Chinese economy differs from the economies of most countries belonging to the Organization for Economic Cooperation and Development, or OECD, in many ways. As a result of these differences, we may not develop in the same way or at the same rate as might be expected if the Chinese economy were similar to those of the OECD member countries.

18

Our business is largely subject to the uncertain legal environment in China and your legal protection could be limited.

The Chinese legal system is a civil law system based on written statutes. Unlike common law systems, it is a system in which precedents set in earlier legal cases are not generally used. The overall effect of legislation enacted over the past 20 years has been to enhance the protections afforded to foreign invested enterprises in China. However, these laws, regulations and legal requirements are relatively recent and are evolving rapidly, and their interpretation and enforcement involve uncertainties. These uncertainties could limit the legal protections available to foreign investors, such as the right of foreign invested enterprises to hold licenses and permits such as requisite business licenses. In addition, all of our executive officers are residents of China and not of the U.S., and substantially all the assets of these persons are located outside the U.S. As a result, it could be difficult for investors to effect service of process in the U.S., or to enforce a judgment obtained in the U.S. against us or any of these persons.

The Chinese government exerts substantial influence over the manner in which we must conduct our business activities.

China only recently has permitted provincial and local economic autonomy and private economic activities. The Chinese government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to taxation, import and export tariffs, environmental regulations, land use rights, property and other matters. We believe that our operations in China are in material compliance with all applicable legal and regulatory requirements. However, the central or local governments of these jurisdictions may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations.

Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions thereof, and could require us to divest ourselves of any interest we then hold in Chinese properties or joint ventures.

Future inflation in China may inhibit our ability to conduct business profitably in China.

In recent years, the Chinese economy has experienced periods of rapid expansion and high rates of inflation. During the past ten years, the rate of inflation in China has been as high as 20.7% and as low as -2.2%. These factors have led to the adoption by the Chinese government, from time to time, of various corrective measures designed to restrict the availability of credit or regulate growth and contain inflation. High inflation may in the future cause the Chinese government to impose controls on credit and/or prices, or to take other action, which could inhibit economic activity in China, and thereby harm the market for our products.

Any recurrence of severe acute respiratory syndrome, or SARS, or another widespread public health problem, could harm our operations.

A renewed outbreak of SARS or another widespread public health problem in China, where our operations are conducted, could have a negative effect on our operations.

Our operations may be impacted by a number of health-related factors, including the following:

Any of the foregoing events or other unforeseen consequences of public health problems could damage our operations.

Restrictions on currency exchange may limit our ability to receive and use our revenues effectively.

The majority of our revenues will be settled in RMB and U.S. dollars, and any future restrictions on currency exchanges may limit our ability to use revenue generated in RMB to fund any future business activities outside China or to make dividend or other payments in U.S. dollars. Although the Chinese government introduced regulations in 1996 to allow greater convertibility of the RMB for current account transactions, significant restrictions still remain, including primarily the restriction that foreign-invested enterprises may only buy, sell or remit foreign currencies after providing valid commercial documents, at those banks in China authorized to conduct foreign exchange business. In addition, conversion of RMB for capital account items, including direct investment and loans, is subject to governmental approval in China, and companies are required to open and maintain separate foreign exchange accounts for capital account items. We cannot be certain that the Chinese regulatory authorities will not impose more stringent restrictions on the convertibility of the RMB.

19

Failure to comply with PRC regulations relating to the establishment of offshore special purpose companies by PRC residents may subject our PRC resident stockholders to personal liability, limit our ability to acquire PRC companies or to inject capital into our PRC subsidiaries, limit our PRC subsidiaries’ ability to distribute profits to us or otherwise materially adversely affect us.

In October 2005, the PRC State Administration of Foreign Exchange, or SAFE, issued the Notice on Relevant Issues in the Foreign Exchange Control over Financing and Return Investment Through Special Purpose Companies by Residents Inside China, generally referred to as Circular 75, which required PRC residents to register with the competent local SAFE branch before establishing or acquiring control over an offshore special purpose company, or SPV, for the purpose of engaging in an equity financing outside of China on the strength of domestic PRC assets originally held by those residents. Internal implementing guidelines issued by SAFE, which became public in June 2007 (known as Notice 106), expanded the reach of Circular 75 by (i) purporting to cover the establishment or acquisition of control by PRC residents of offshore entities which merely acquire “control” over domestic companies or assets, even in the absence of legal ownership; (ii) adding requirements relating to the source of the PRC resident’s funds used to establish or acquire the offshore entity; (iii) covering the use of existing offshore entities for offshore financings; (iv) purporting to cover situations in which an offshore SPV establishes a new subsidiary in China or acquires an unrelated company or unrelated assets in China; and (v) making the domestic affiliate of the SPV responsible for the accuracy of certain documents which must be filed in connection with any such registration, notably, the business plan which describes the overseas financing and the use of proceeds. Amendments to registrations made under Circular 75 are required in connection with any increase or decrease of capital, transfer of shares, mergers and acquisitions, equity investment or creation of any security interest in any assets located in China to guarantee offshore obligations, and Notice 106 makes the offshore SPV jointly responsible for these filings. In the case of an SPV which was established, and which acquired a related domestic company or assets, before the implementation date of Circular 75, a retroactive SAFE registration was required to have been completed before March 31, 2006; this date was subsequently extended indefinitely by Notice 106, which also required that the registrant establish that all foreign exchange transactions undertaken by the SPV and its affiliates were in compliance with applicable laws and regulations. Failure to comply with the requirements of Circular 75, as applied by SAFE in accordance with Notice 106, may result in fines and other penalties under PRC laws for evasion of applicable foreign exchange restrictions. Any such failure could also result in the SPV’s affiliates being impeded or prevented from distributing their profits and the proceeds from any reduction in capital, share transfer or liquidation to the SPV, or from engaging in other transfers of funds into or out of China.

We believe our stockholders who are PRC residents as defined in Circular 75 have registered with the relevant branch of SAFE, as currently required, in connection with their equity interests in us and our acquisitions of equity interests in our PRC subsidiaries. However, we cannot provide any assurances that their existing registrations have fully complied with, and they have made all necessary amendments to their registration to fully comply with, all applicable registrations or approvals required by Circular 75. Moreover, because of uncertainty over how Circular 75 will be interpreted and implemented, and how or whether SAFE will apply it to us, we cannot predict how it will affect our business operations or future strategies. For example, our present and prospective PRC subsidiaries’ ability to conduct foreign exchange activities, such as the remittance of dividends and foreign currency-denominated borrowings, may be subject to compliance with Circular 75 by our PRC resident beneficial holders. In addition, such PRC residents may not always be able to complete the necessary registration procedures required by Circular 75. We also have little control over either our present or prospective direct or indirect stockholders or the outcome of such registration procedures. A failure by our PRC resident beneficial holders or future PRC resident stockholders to comply with Circular 75, if SAFE requires it, could subject these PRC resident beneficial holders to fines or legal sanctions, restrict our overseas or cross-border investment activities, limit our subsidiaries’ ability to make distributions or pay dividends or affect our ownership structure, which could adversely affect our business and prospects.

We may be unable to complete a business combination transaction efficiently or on favorable terms due to complicated merger and acquisition regulations that became effective on September 8, 2006.

On August 8, 2006, six PRC regulatory agencies promulgated the Regulation on Mergers and Acquisitions of Domestic Companies by Foreign Investors, which became effective on September 8, 2006. This new regulation, among other things, governs the approval process by which a PRC company may participate in an acquisition of assets or equity interests. Depending on the structure of the transaction, the new regulation will require the PRC parties to make a series of applications and supplemental applications to the government agencies. In some instances, the application process may require the presentation of economic data concerning a transaction, including appraisals of the target business and evaluations of the acquirer, which are designed to allow the government to assess the transaction. Government approvals will have expiration dates by which a transaction must be completed and reported to the government agencies. Compliance with the new regulations is likely to be more time consuming and expensive than in the past and the government can now exert more control over the combination of two businesses. Accordingly, due to the new regulation, our ability to engage in business combination transactions has become significantly more complicated, time consuming and expensive, and we may not be able to negotiate a transaction that is acceptable to our stockholders or sufficiently protect their interests in a transaction.

20

The new regulation allows PRC government agencies to assess the economic terms of a business combination transaction. Parties to a business combination transaction may have to submit to the Ministry of Commerce and other relevant government agencies an appraisal report, an evaluation report and the acquisition agreement, all of which form part of the application for approval, depending on the structure of the transaction. The regulations also prohibit a transaction at an acquisition price obviously lower than the appraised value of the PRC business or assets and in certain transaction structures, require that consideration must be paid within defined periods, generally not in excess of a year. The regulation also limits our ability to negotiate various terms of the acquisition, including aspects of the initial consideration, contingent consideration, holdback provisions, indemnification provisions and provisions relating to the assumption and allocation of assets and liabilities. Transaction structures involving trusts, nominees and similar entities are prohibited. Therefore, such regulation may impede our ability to negotiate and complete a business combination transaction on financial terms that satisfy our investors and protect our stockholders’ economic interests.

The value of our securities will be affected by the foreign exchange rate between U.S. dollars and RMB.

The value of our common stock will be affected by the foreign exchange rate between U.S. dollars and RMB, and between those currencies and other currencies in which our sales may be denominated. For example, to the extent that we need to convert U.S. dollars into RMB for our operational needs and should the RMB appreciate against the U.S. dollar at that time, our financial position, the business of the company, and the price of our common stock may be harmed. Conversely, if we decide to convert our RMB into U.S. dollars for the purpose of declaring dividends on our common stock or for other business purposes and the U.S. dollar appreciates against the RMB, the U.S. dollar equivalent of our earnings from our subsidiaries in China would be reduced.

Risks Related to the Market for Our Stock

Our common stock is quoted on the OTCQB, which may have an unfavorable impact on our stock price and liquidity.

Our common stock is quoted on the OTCQB. The OTC QB is a significantly more limited market than the New York Stock Exchange or NASDAQ system. The quotation of our shares on the OTC QB may result in a less liquid market available for existing and potential stockholders to trade shares of our common stock, could depress the trading price of our common stock and could have a long-term adverse impact on our ability to raise capital in the future

We may be subject to penny stock regulations and restrictions and you may have difficulty selling shares of our common stock.

The SEC has adopted regulations which generally define so-called “penny stocks” to be an equity security that has a market price less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exemptions. If our common stock becomes a “penny stock”, we may become subject to Rule 15g-9 under the Exchange Act, or the “Penny Stock Rule”. This rule imposes additional sales practice requirements on broker-dealers that sell such securities to persons other than established customers and “accredited investors” (generally, individuals with a net worth in excess of $1,000,000 or annual incomes exceeding $200,000, or $300,000 together with their spouses). For transactions covered by Rule 15g-9, a broker-dealer must make a special suitability determination for the purchaser and have received the purchaser’s written consent to the transaction prior to sale. As a result, this rule may affect the ability of broker-dealers to sell our securities and may affect the ability of purchasers to sell any of our securities in the secondary market.

For any transaction involving a penny stock, unless exempt, the rules require delivery, prior to any transaction in a penny stock, of a disclosure schedule prepared by the SEC relating to the penny stock market. Disclosure is also required to be made about sales commissions payable to both the broker-dealer and the registered representative and current quotations for the securities. Finally, monthly statements are required to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stock.

There can be no assurance that our common stock will qualify for exemption from the Penny Stock Rule. In any event, even if our common stock were exempt from the Penny Stock Rule, we would remain subject to Section 15(b)(6) of the Exchange Act, which gives the SEC the authority to restrict any person from participating in a distribution of penny stock, if the SEC finds that such a restriction would be in the public interest.

ITEM 2. PROPERTIES

The Company’s executive office is located in Jinan City, Shandong Province, China. The address is 11th Floor No.11 Building, Shuntai Square, No.2000 Shunhua Rd, High-tech Industrial Development Zone, Jinan, China. The Company move into the newly purchased office building in June 2008. The new building is located in Shuntai Squareat Jinan High-Tech Industrial Development Zone, on the eleventh floor, occupying 2,000 square meters.

ITEM 3. LEGAL PROCEEDINGS

Currently we are not aware of any litigation pending or threatened by or against the Company.

21

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

No matters were submitted to a vote of security holders during the fourth quarter of fiscal year 2010.

PART II

|

ITEM 5.

|

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS, AND ISSUER PURCHASES OF EQUITY SECURITIES

|

Market Information

On November 24, 2010, the change of the Company’s name to China Intelligence Information Systems, Inc. from China VoIP & Digital Telecom Inc., and the symbol from CVDT.OB to IICN.OB has been effected. The Company has been still quoted and traded on the OTC Bulletin Board. In February of 2011, due to the transformation of its market makers to use the platform provided by OTC Markets Group to quote OTC securities, the Company began trading on the OTCQB, a marketplace developed by the OTC Markets Group, as of the reporting date, under the ticker symbol IICN.

The OTCQB is a market tier for U.S. listed companies that are in compliance with their SEC reporting obligations.