Attached files

| file | filename |

|---|---|

| 8-K - ROCK-TENN COMPANY 8-K - Rock-Tenn CO | a6661868.htm |

Exhibit 99.1

RockTenn to Acquire Smurfit-Stone Paper Week 2011 March 28, 2011 James B. Porter Filed by Rock-Tenn Company Pursuant to Rule 425 under the Securities Act of 1933 and Deemed Filed under Rule 14a-12 of the Securities Exchange Act of 1934 Subject Company: Rock-Tenn CompanyCommission File No. 001-12613

Cautionary Statement Regarding Forward-Looking Information This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are typically identified by words or phrases such as “may,” “will,” “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “target,” “forecast,” and other words and terms of similar meaning. Forward-looking statements involve estimates, expectations, projections, goals, forecasts, assumptions, risks and uncertainties. RockTenn cautions readers that any forward-looking statement is not a guarantee of future performance and that actual results could differ materially from those contained in the forward-looking statement. Such forward-looking statements include, but are not limited to, statements regarding the anticipated closing date of the transaction, the successful closing of the transaction and the integration of Smurfit-Stone as well as opportunities for operational improvement including but not limited to cost reduction and capital investment, the strategic opportunity and perceived value to RockTenn and shareholders of the transaction, the opportunity to recognize benefits from Smurfit-Stone’s NOLs, the transaction’s impact on, among other things, RockTenn’s business mix, margins, transitional costs and integration to achieve the synergies and the timing of such costs and synergies and earnings. With respect to these statements, RockTenn and Smurfit-Stone have made assumptions regarding, among other things, whether and when the proposed transaction will be approved; whether and when the proposed transaction will close; the availability of financing on satisfactory terms; the amount of debt RockTenn will assume; the results and impacts of the acquisition; preliminary purchase price allocations which may include material adjustments to the preliminary fair values of the acquired assets and liabilities; economic, competitive and market conditions generally; volumes and price levels of purchases by customers; competitive conditions in RockTenn and Smurfit-Stone’s businesses and possible adverse actions of our respective customers, competitors and suppliers. Further, Rock-Tenn and Smurfit-Stone’s businesses are subject to a number of general risks that would affect any such forward-looking statements including, among others, decreases in demand for their products; increases in energy, raw materials, shipping and capital equipment costs; reduced supply of raw materials; fluctuations in selling prices and volumes; intense competition; the potential loss of certain customers; and adverse changes in general market and industry conditions. Such risks and other factors that may impact management’s assumptions are more particularly described in RockTenn and Smurfit-Stone’s filings with the Securities and Exchange Commission, including under the caption “Business – Forward-Looking Information” and “Risk Factors” in RockTenn’s Annual Report on Form 10-K for the most recently ended fiscal year and “Business – Risk Factors” and “Forward-Looking Information” in Smurfit-Stone’s Annual Report on Form 10-K for the most recently ended fiscal year. The information contained herein speaks as of the date hereof and neither RockTenn nor Smurfit-Stone have or undertake any obligation to update or revise its forward-looking statements, whether as a result of new information, future events or otherwise.

Additional Information Additional Information and Where to Find It In connection with the proposed transaction, RockTenn has filed a Registration Statement on Form S-4 (File No. 333-172432) (the “Registration Statement”) with the Securities and Exchange Commission (the “SEC”) that includes a preliminary joint proxy statement of RockTenn and Smurfit-Stone that also constitutes a preliminary prospectus of RockTenn. The Registration Statement has not yet become effective. RockTenn and Smurfit-Stone will be filing other relevant documents concerning the proposed transaction with the SEC. Following the Registration Statement having been declared effective by the SEC, RockTenn and Smurfit-Stone will mail the final joint proxy statement-prospectus to their respective shareholders. RockTenn and Smurfit-Stone stockholders are urged to read the Registration Statement and the final joint proxy statement/prospectus, when it becomes available, as well as other documents filed with the SEC, because they will contain important information. Investors and security holders may obtain free copies of these documents (when they are available) and other documents filed with the SEC at the SEC’s website at www.sec.gov, or by contacting RockTenn Investor Relations at (678) 291-7900 or Smurfit-Stone Investor Relations at (314) 656-5553. Participants in the Merger Solicitation RockTenn, Smurfit-Stone and their respective directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the transaction. Information concerning RockTenn’s executive officers and directors is set forth in its definitive proxy statement filed with the SEC on December 17, 2010. Information concerning Smurfit-Stone’s executive officers and directors is set forth in its annual report on Form 10-K for the year ended December 31, 2010, which was filed with the SEC on February 15, 2011. Additional information regarding the interests of participants of RockTenn and Smurfit-Stone in the solicitation of proxies in respect of the transaction is included in the above-referenced Registration Statement and will be included in the final joint proxy statement/prospectus when it becomes available. You can obtain free copies of these documents from RockTenn and Smurfit-Stone using the contact information above.

Transaction Overview RockTenn has agreed to acquire Smurfit-Stone Container Corporation, the second-largest North American containerboard and corrugated container manufacturer Announced purchase price value of $35/share, payable with 0.30605 RKT shares and $17.50 in cash per SSCC share Announced total purchase consideration of approximately $5.0 billion, including Smurfit-Stone net debt of $0.7 billion at 12/31/10 and after-tax unfunded pension liability of $0.7 billion Announced purchase price is 6.1 times Q4 2010 annualized Adjusted EBITDA of $820 million Combined pro forma company total net sales exceeding $9 billion and Pro Forma Adjusted EBITDA of $1.34 billion(1), pre-synergies $3.7 billion of committed financing to fund the transaction from Wells Fargo, SunTrust, Rabobank, BofA Merrill Lynch and J.P. Morgan Chase Senior Leadership Team: James A. Rubright - Chairman, CEO James B. Porter III - EVP, Corrugated Packaging Michael E. Kiepura - EVP, Consumer Packaging Steven C. Voorhees - EVP, CFO and CAO Headquarters : Corporate HQ in Norcross, GA The transaction is expected to close during the second quarter of 2011 Pro Forma Adjusted EBITDA is RockTenn LTM 12/31/10 Credit Agreement EBITDA plus annualized Smurfit-Stone Adjusted EBITDA for three months ended 12/31/2010, assumes no synergies.

Acquisition Consistent with RockTenn’s Core Business Principles RockTenn will be the most respected company in our business by: Providing superior paperboard, packaging and marketing solutions for consumer products companies at very low costs RockTenn’s expanded network of mills and converting plants are cost-competitive with numerous opportunities to further optimize the combined system Investing for competitive advantage RockTenn’s and Smurfit-Stone’s assets are well-capitalized, with significant opportunities identified for further profit-improving investments Maximizing the efficiency of our manufacturing processes by optimizing economies of scale Acquisition significantly increases RockTenn’s opportunities for optimizing scale Systematically improving processes and reducing costs throughout the Company Acquisition combines RockTenn’s Six Sigma continuous improvement method with Smurfit-Stone’s Lean Manufacturing method to further optimize manufacturing and administrative processes Seeking acquisitions that can dramatically improve the business RockTenn views Smurfit-Stone’s virgin containerboard mill system as a key strategic asset giving the acquisition a compelling strategic rationale

Compelling Strategic Acquisition Containerboard has become a very good businessUS virgin containerboard is a highly strategic global assetSmurfit-Stone’s assets are much lower cost than before their transformationAmple opportunities to improve cost position through continued transformation of box plant system and investments in millsEstimated annual transaction synergies run rate of $150 million within 24 months after transaction close RockTenn’s customer-focused value approach to the market, disciplined execution and record of continuous operational and administrative excellence provide broad runway for operational gains

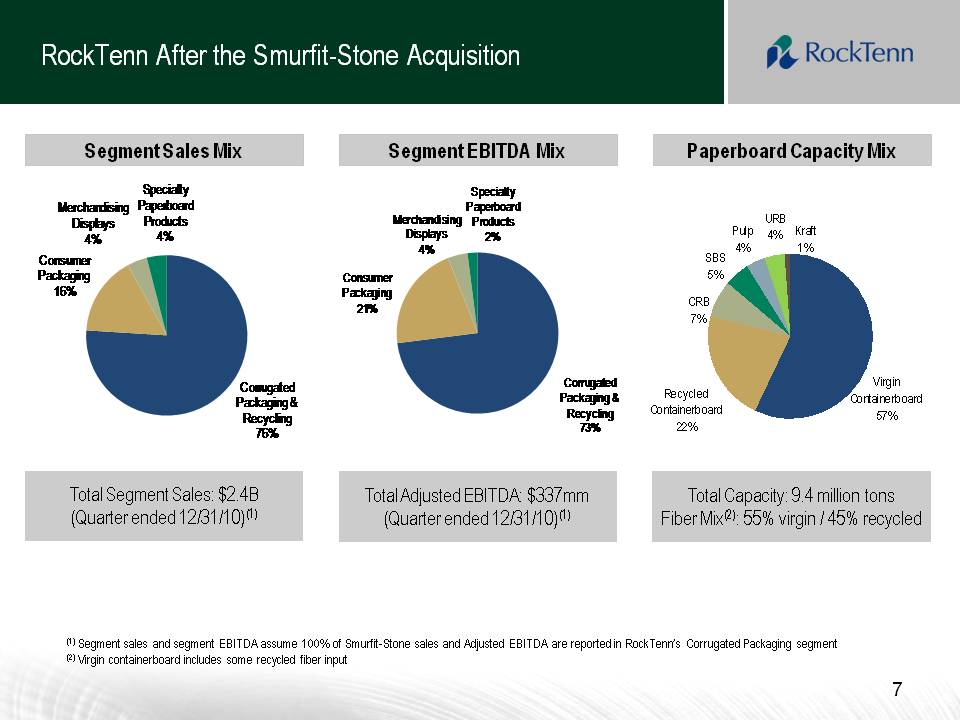

RockTenn After the Smurfit-Stone Acquisition Total Adjusted EBITDA: $337mm (Quarter ended 12/31/10)(1) Total Capacity: 9.4 million tons Fiber Mix(2): 55% virgin / 45% recycled Total Segment Sales: $2.4B (Quarter ended 12/31/10)(1) (1) Segment sales and segment EBITDA assume 100% of Smurfit-Stone sales and Adjusted EBITDA are reported in RockTenn’s Corrugated Packaging segment (2) Virgin containerboard includes some recycled fiber input Segment Sales Mix Segment EBITDA Mix Paperboard Capacity Mix

Combined RockTenn and Smurfit-Stone Combined RockTenn and Smurfit-Stone#2 producer of containerboard in North America#2 producer of coated recycled board in North AmericaManagement team with strong record of shareholder value creation and excellent record of integrating acquisitionsThe mix of fiber inputs is 55% virgin fiber and 45% recycled fiberExpands geographic footprint to the Midwest and West CoastConservative capital structure with significant liquidity at closeOpportunity to improve results through cost reduction and capital investment We believe the acquisition of Smurfit-Stone represents a significant opportunity to continue our track record of creating shareholder value

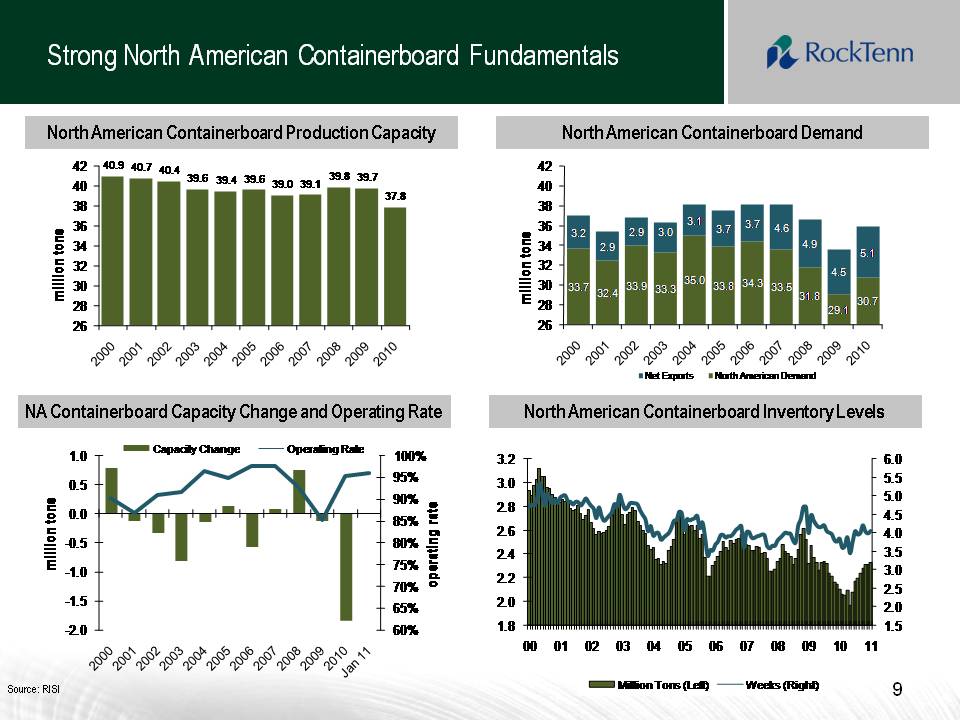

Strong North American Containerboard Fundamentals North American Containerboard Demand North American Containerboard Production Capacity North American Containerboard Inventory Levels NA Containerboard Capacity Change and Operating RateSource: RISI

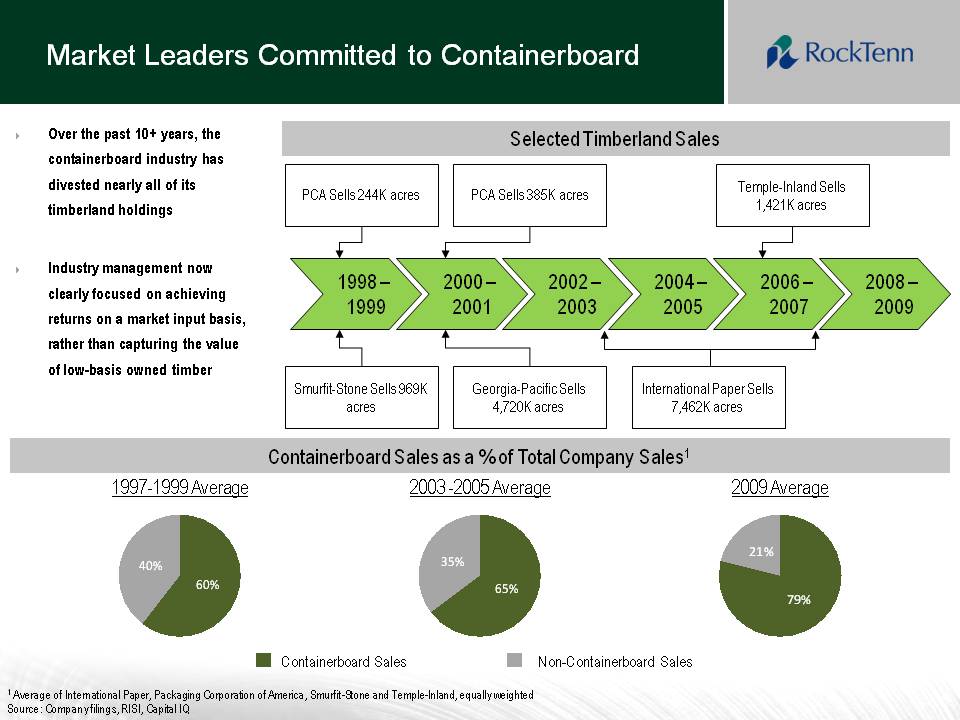

Market Leaders Committed to Containerboard 2000 – 2001 2002 – 2003 2004 – 2005 2006 – 2007 2008 – 2009 1998 – 1999 Smurfit-Stone Sells 969K acres PCA Sells 385K acres PCA Sells 244K acres Temple-Inland Sells 1,421K acres International Paper Sells 7,462K acres Georgia-Pacific Sells 4,720K acres Selected Timberland Sales Containerboard Sales as a % of Total Company Sales1 1997-1999 Average 2003 -2005 Average 2009 Average 1 Average of International Paper, Packaging Corporation of America, Smurfit-Stone and Temple-Inland, equally weightedSource: Company filings, RISI, Capital IQ (Gp:) Containerboard Sales (Gp:) Non-Containerboard Sales Over the past 10+ years, the containerboard industry has divested nearly all of its timberland holdings Industry management now clearly focused on achieving returns on a market input basis, rather than capturing the value of low-basis owned timber

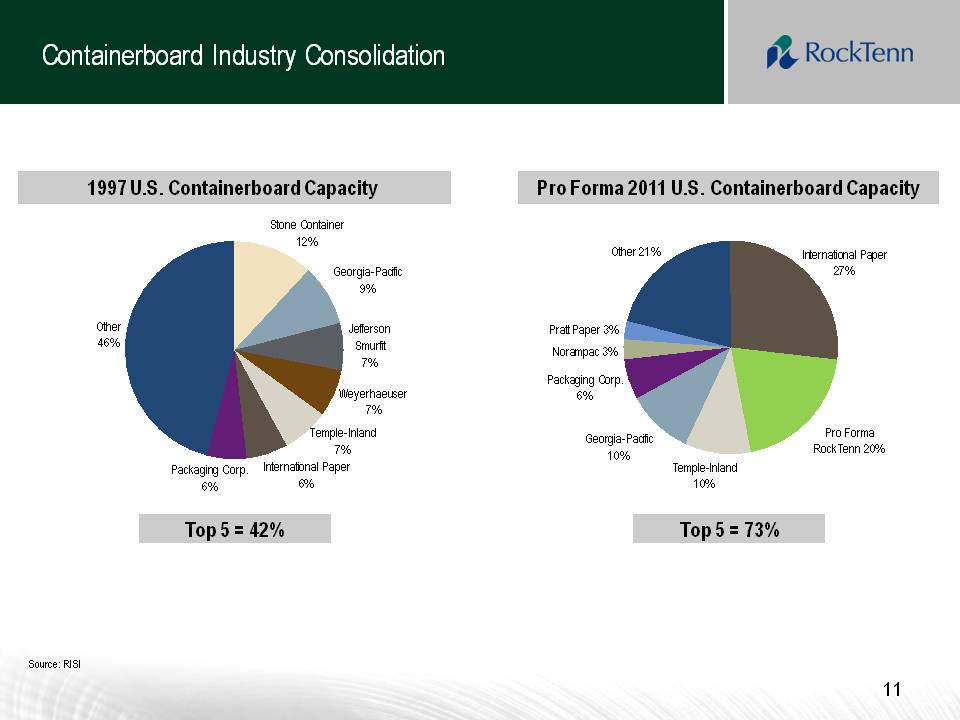

Containerboard Industry Consolidation Source: RISI 1997 U.S. Containerboard Capacity Pro Forma 2011 U.S. Containerboard Capacity Top 5 = 42% Top 5 = 73%

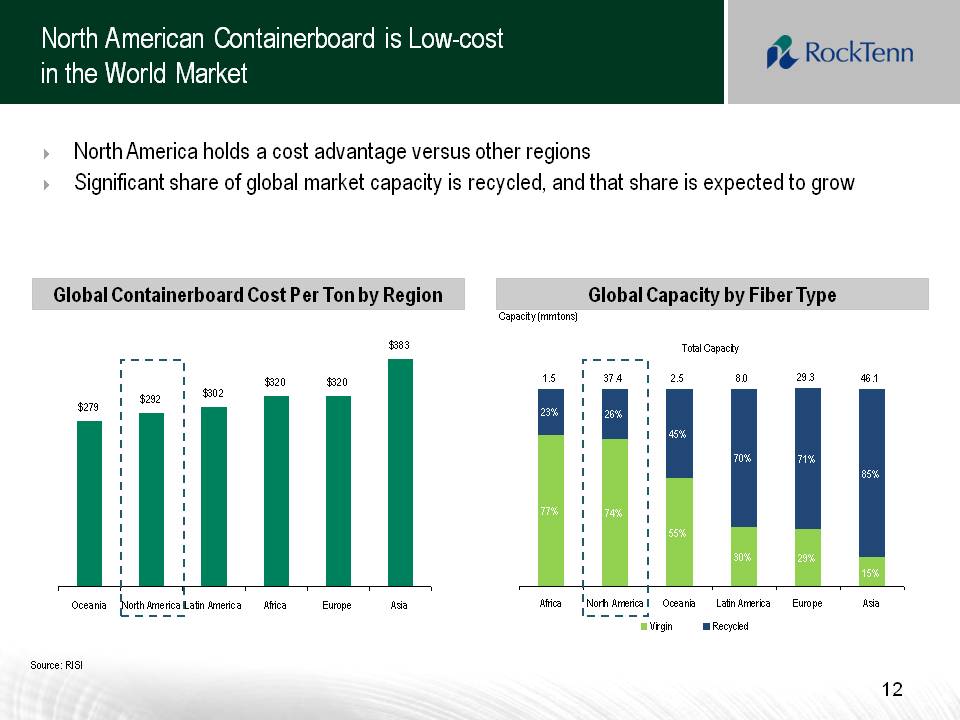

North American Containerboard is Low-cost in the World Market Global Capacity by Fiber Type Global Containerboard Cost Per Ton by Region North America holds a cost advantage versus other regionsSignificant share of global market capacity is recycled, and that share is expected to grow Source: RISI Capacity (mm tons)

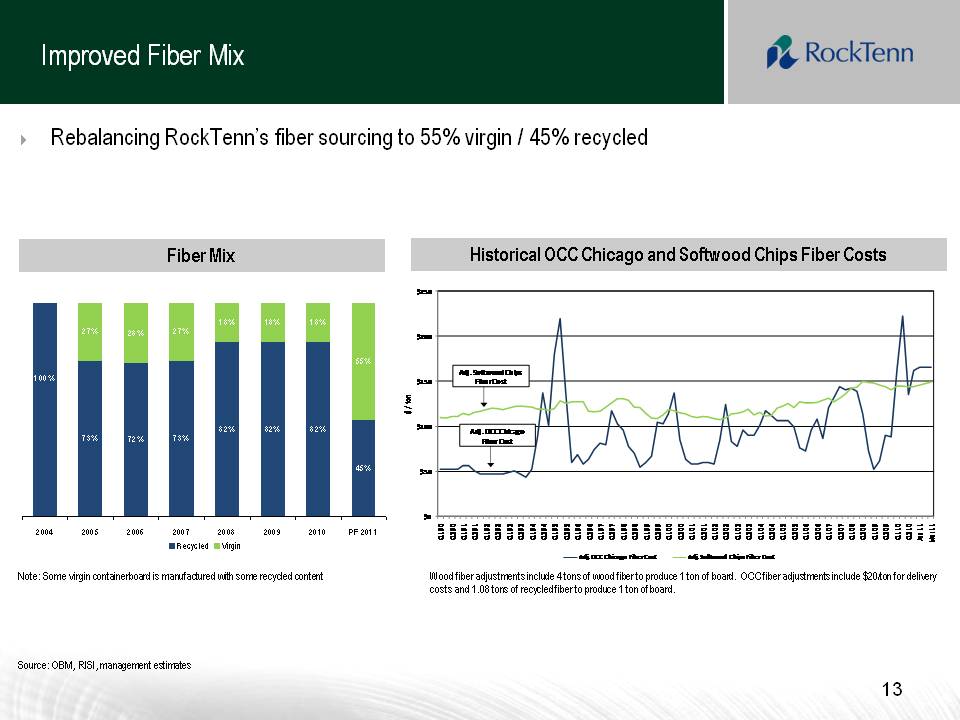

Improved Fiber Mix Rebalancing RockTenn’s fiber sourcing to 55% virgin / 45% recycled Note: Some virgin containerboard is manufactured with some recycled content Source: OBM, RISI, management estimates Wood fiber adjustments include 4 tons of wood fiber to produce 1 ton of board. OCC fiber adjustments include $20/ton for delivery costs and 1.08 tons of recycled fiber to produce 1 ton of board. Fiber Mix Historical OCC Chicago and Softwood Chips Fiber Costs

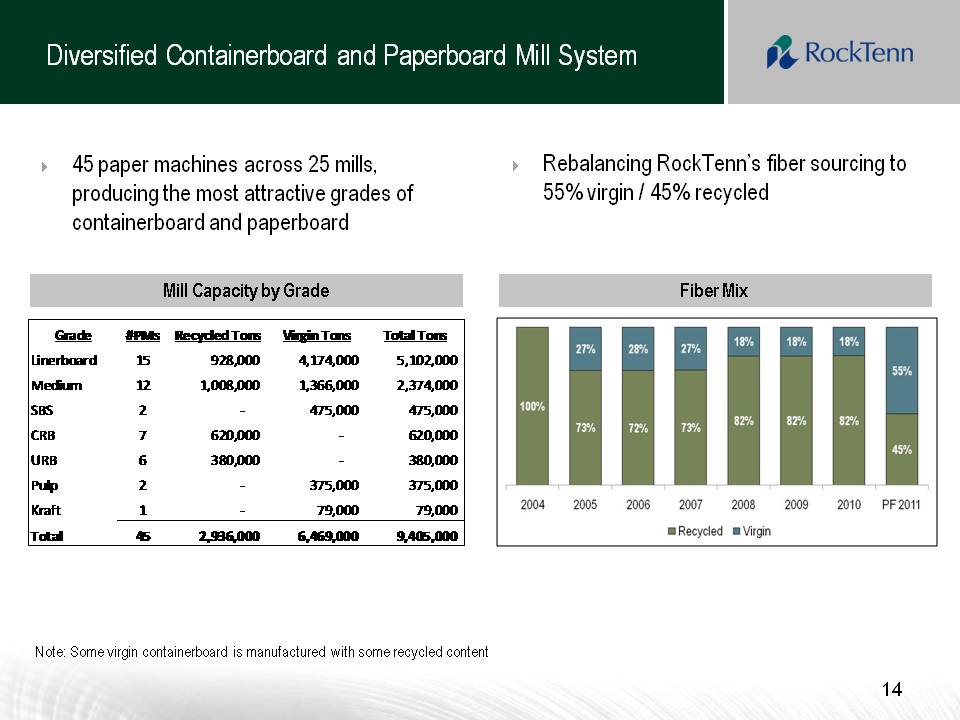

Diversified Containerboard and Paperboard Mill System Rebalancing RockTenn’s fiber sourcing to 55% virgin / 45% recycled 45 paper machines across 25 mills, producing the most attractive grades of containerboard and paperboard Fiber Mix Mill Capacity by Grade Note: Some virgin containerboard is manufactured with some recycled content

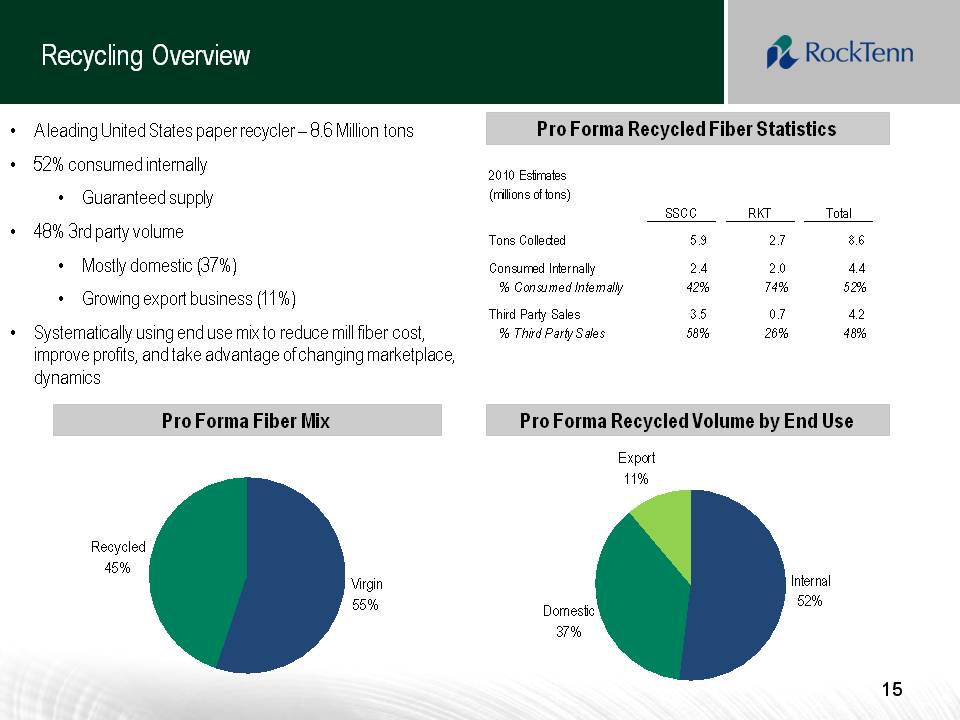

Recycling Overview A leading United States paper recycler – 8.6 Million tons52% consumed internallyGuaranteed supply48% 3rd party volumeMostly domestic (37%)Growing export business (11%)Systematically using end use mix to reduce mill fiber cost, improve profits, and take advantage of changing marketplace, dynamics Pro Forma Recycled Fiber Statistics Pro Forma Recycled Volume by End Use Pro Forma Fiber Mix

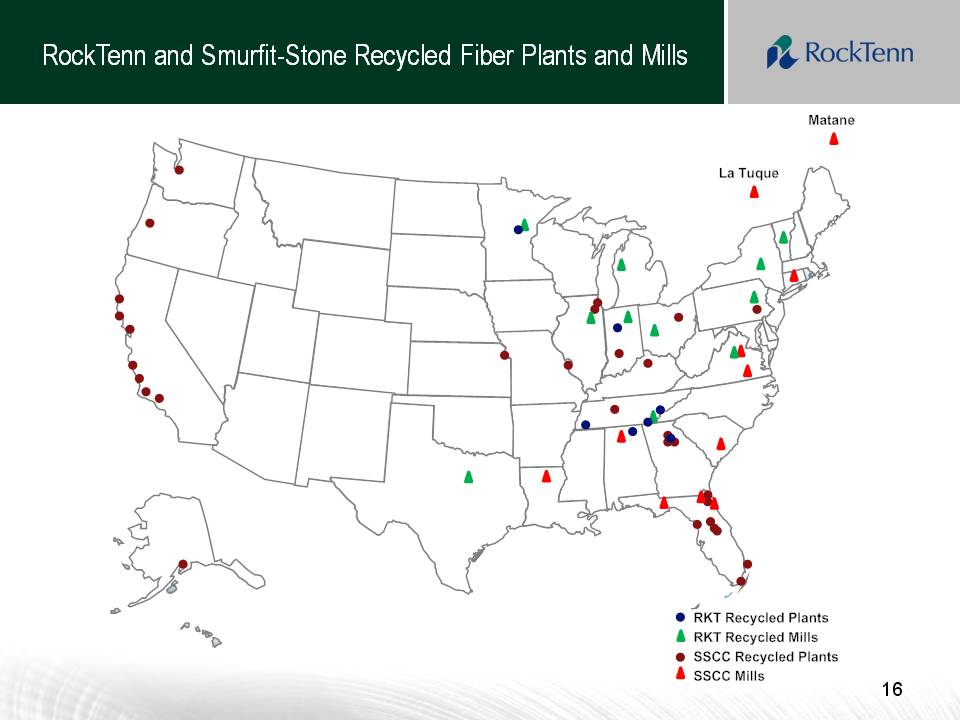

RockTenn and Smurfit-Stone Recycled Fiber Plants and Mills

Recycled Fiber Strategy Become known within our market footprint as the leader in paper recycling and environmental stewardship through involvement within the communities in which we operate. Continuously measure and optimize fiber and freight costs through systems and analysis. Be known as “Easy to do business with”, utilizing innovative partnerships and state-of-the-art transaction systems to provide recycling and waste management solutions to retailers, manufacturers, grocers, printers, communities and waste haulers. Provide unparalleled value to customers who require sustainable packaging and waste management solutions by continuing to find new ways to penetrate the waste stream to collect incremental fiber and other materials.

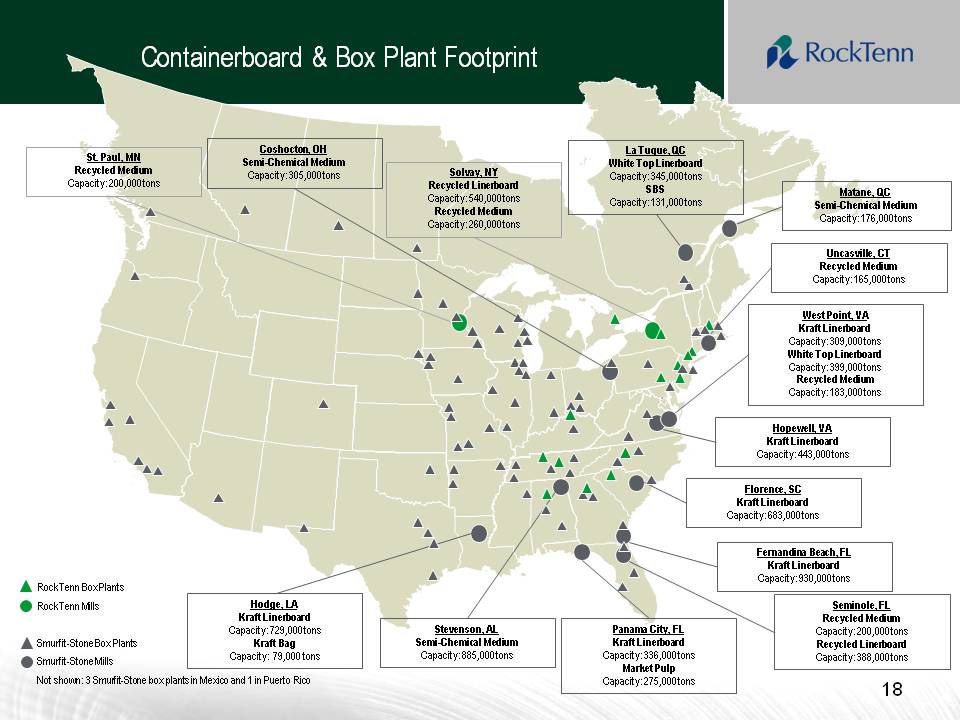

Containerboard & Box Plant Footprint RockTenn Box PlantsRockTenn MillsSmurfit-Stone Box PlantsSmurfit-Stone MillsNot shown: 3 Smurfit-Stone box plants in Mexico and 1 in Puerto Rico Hodge, LAKraft LinerboardCapacity: 729,000 tonsKraft BagCapacity: 79,000 tons Seminole, FLRecycled MediumCapacity: 200,000 tonsRecycled LinerboardCapacity: 388,000 tons Fernandina Beach, FLKraft LinerboardCapacity: 930,000 tons Stevenson, ALSemi-Chemical MediumCapacity: 885,000 tons Florence, SCKraft LinerboardCapacity: 683,000 tons Hopewell, VAKraft LinerboardCapacity: 443,000 tons West Point, VAKraft LinerboardCapacity: 309,000 tonsWhite Top LinerboardCapacity: 399,000 tonsRecycled MediumCapacity: 183,000 tons Uncasville, CTRecycled MediumCapacity: 165,000 tons Coshocton, OHSemi-Chemical MediumCapacity: 305,000 tons Solvay, NYRecycled LinerboardCapacity: 540,000 tonsRecycled MediumCapacity: 260,000 tons St. Paul, MNRecycled MediumCapacity: 200,000 tons Matane, QCSemi-Chemical MediumCapacity: 176,000 tons La Tuque, QCWhite Top LinerboardCapacity: 345,000 tonsSBSCapacity: 131,000 tons Panama City, FLKraft LinerboardCapacity: 336,000 tonsMarket PulpCapacity: 275,000 tons

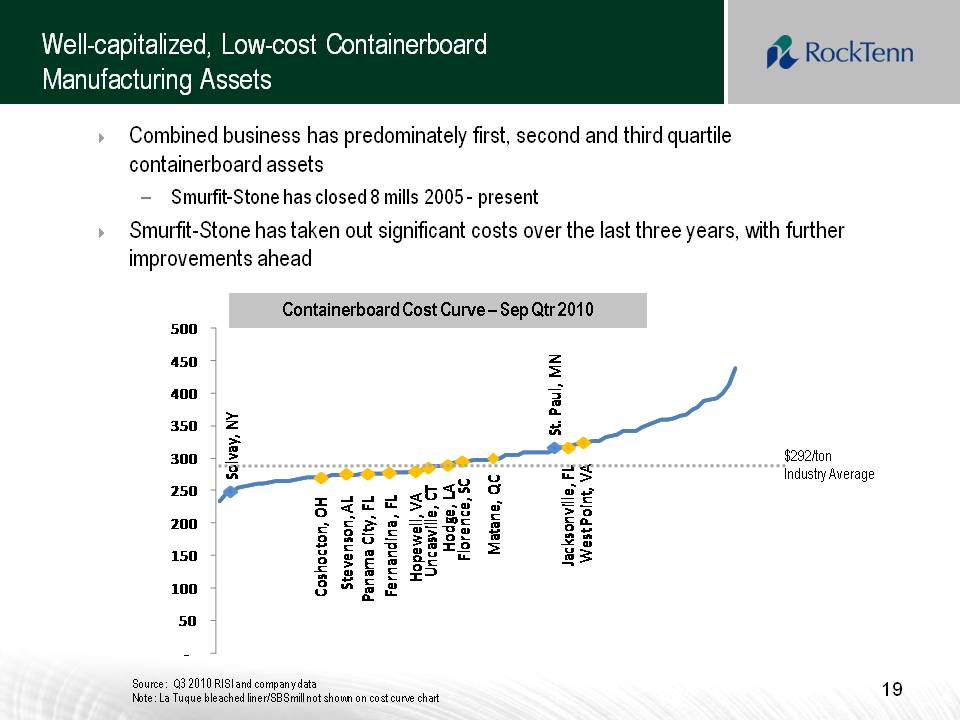

Combined business has predominately first, second and third quartile containerboard assetsSmurfit-Stone has closed 8 mills 2005 - presentSmurfit-Stone has taken out significant costs over the last three years, with further improvements ahead Well-capitalized, Low-cost Containerboard Manufacturing Assets $292/ton Industry Average Source: Q3 2010 RISI and company dataNote: La Tuque bleached liner/SBS mill not shown on cost curve chart Containerboard Cost Curve – Sep Qtr 2010

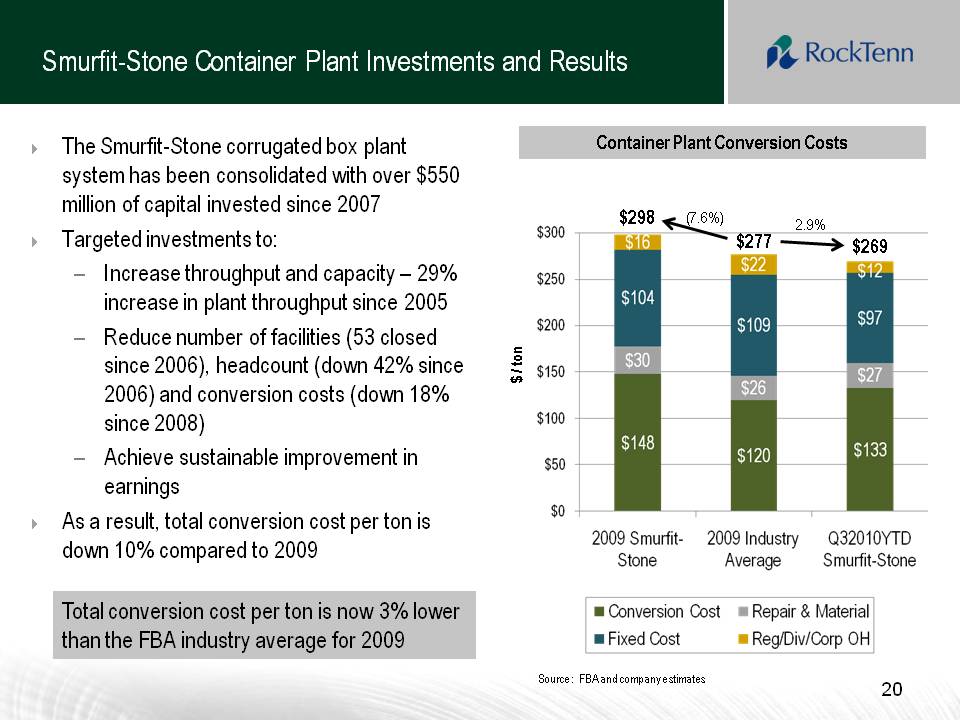

Smurfit-Stone Container Plant Investments and Results The Smurfit-Stone corrugated box plant system has been consolidated with over $550 million of capital invested since 2007Targeted investments to:Increase throughput and capacity – 29% increase in plant throughput since 2005Reduce number of facilities (53 closed since 2006), headcount (down 42% since 2006) and conversion costs (down 18% since 2008) Achieve sustainable improvement in earningsAs a result, total conversion cost per ton is down 10% compared to 2009 $277 $298 $269 Container Plant Conversion Costs (7.6%) 2.9% Source: FBA and company estimates Total conversion cost per ton is now 3% lower than the FBA industry average for 2009 $ / ton

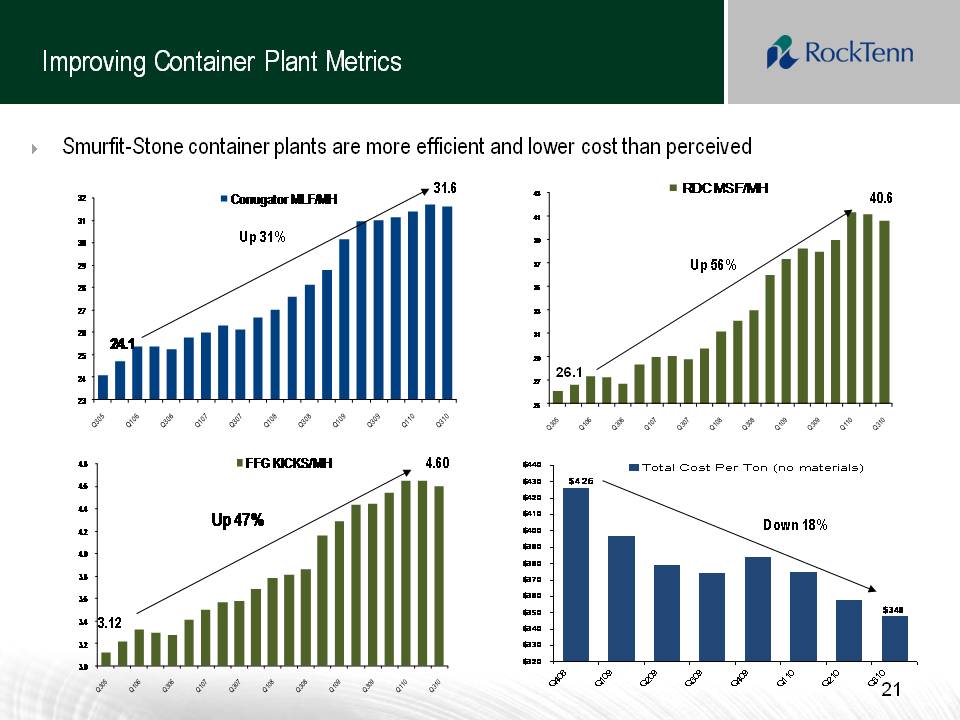

Improving Container Plant Metrics 31.6 4.60 3.12 40.6 26.1 Up 56% Up 31% Down 18% Smurfit-Stone container plants are more efficient and lower cost than perceived

Smurfit-Stone’s corrugated assets will be combined with RockTenn’s corrugated assets under the leadership of Jim Porter with a five-pronged integration strategy:Opportunities to invest capital in the mill system and optimize the footprint to reduce cost and maximize production efficiencyComplete the box plant consolidation and optimization strategy initiated by SSCC managementApply the RockTenn business model to the box plant system, driving product innovation, customer satisfaction and low-cost manufacturing while maximizing sales revenueConsolidate the divisional entity into one RockTenn headquarters located in Norcross, GABuild a single cultural model which inspires a high-performing corrugated business and creates the most respected company in the industryAdministrative integration to be led by Steve Voorhees, who led the successful Gulf States and Southern Container integrations Integration Strategy

Conclusion Other Placeholder: Combined RockTenn and Smurfit-Stone#2 producer of containerboard in North America#2 producer of coated recycled board in North AmericaManagement team with strong record of shareholder value creation and excellent record of integrating acquisitionsThe mix of fiber inputs is 55% virgin fiber and 45% recycled fiberExpands geographic footprint to the Midwest and West CoastConservative capital structure with significant liquidity at closeOpportunity to improve results through cost reduction and capital investment We believe the acquisition of Smurfit-Stone represents a significant opportunity to continue our track record of creating shareholder value

Questions?