Attached files

| file | filename |

|---|---|

| EX-32.1 - EX-32.1 - Hawaiian Telcom Holdco, Inc. | a2203032zex-32_1.htm |

| EX-31.2 - EX-31.2 - Hawaiian Telcom Holdco, Inc. | a2203032zex-31_2.htm |

| EX-32.2 - EX-32.2 - Hawaiian Telcom Holdco, Inc. | a2203032zex-32_2.htm |

| EX-31.1 - EX-31.1 - Hawaiian Telcom Holdco, Inc. | a2203032zex-31_1.htm |

| EX-23.1 - EX-23.1 - Hawaiian Telcom Holdco, Inc. | a2203032zex-23_1.htm |

| EX-10.36 - EX-10.36 - Hawaiian Telcom Holdco, Inc. | a2203032zex-10_36.htm |

| EX-10.25 - EX-10.25 - Hawaiian Telcom Holdco, Inc. | a2203032zex-10_25.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| (Mark one) | ||

ý |

ANNUAL REPORT PURSUANT TO SECTIONS 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2010 |

||

OR |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

Commission File No. 000-54196

HAWAIIAN TELCOM HOLDCO, INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

16-1710376 (I.R.S. Employer Identification No.) |

1177 Bishop Street

Honolulu, Hawaii 96813

(Address of principal executive offices) (Zip Code)

808-546-4511

(Registrant's telephone number, including area code)

Securities to be registered pursuant to Section 12(b) of the Act: None

Securities to be registered pursuant to Section 12(g) of the Act:

| |

Common Stock, par value $0.01 per share | |

||

|---|---|---|---|---|

| (Title of class) |

Indicate by check mark if the registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer o | Accelerated Filer o | Non-Accelerated Filer ý (Do not check if a smaller reporting company) |

Smaller Reporting Company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

As of June 30, 2010, there were no shares of voting or non-voting common equity held by non-affiliates of the registrant.

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ý No o

As of March 28, 2011, 10,138,346 shares of the registrant's common stock, $0.10 par value, were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of registrant's Proxy Statement dated March 28, 2011 (Part III of Form 10-K)

TABLE OF CONTENTS

i

This Annual Report on Form 10-K contains certain statements that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. In particular, any statement, projection or estimate that includes or references the words "believes", "anticipates", "intends", "expects", or any similar expression falls within the safe harbor of forward-looking statements contained in the Reform Act. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our historical experience and our present expectations or projections. Forward-looking statements by us are based on estimates, projections, beliefs, and assumptions of management and are not guarantees of future performance. Such forward-looking statements may be contained in this Form 10-K under "Item 1A—Risk Factors" and "Item 7—Management's Discussion and Analysis of Financial Condition and Results of Operations" and elsewhere. In light of these risks, uncertainties and assumptions, you should not place undue reliance on any forward-looking statements. Additional risks that we may currently deem immaterial or that are not currently known to us could also cause the forward-looking events discussed in this Form 10-K not to occur as described. Except as otherwise required by applicable securities laws, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed circumstances or any other reason after the date of this Form 10-K.

ii

Business Overview

Hawaiian Telcom Holdco, Inc. (the "Company") is the largest full-service provider of communications services and products in Hawaii. We operate two primary business segments:

Wireline Services. This segment provides local telephone service including voice and data transport, enhanced custom calling features, network access, directory assistance and private lines. In addition, the Wireline Services segment provides high-speed Internet, long distance services, next generation Internet protocol (IP)-based network services, customer premises equipment, data solutions, billing and collection, and pay telephone services, and expects to provide an IP-based, next generation television service beginning in 2011. Our current services are offered on all of Hawaii's major islands. As of March 1, 2011, our telecommunication operations served approximately 437,500 local access lines, of which 55% served residential customers and 44% served business customers, with the remaining 1% serving other customers; 225,400 long distance lines, of which 65% served residential customers and 35% served business customers; and 100,700 high-speed Internet lines, which served 82,800 retail residential lines, 16,700 retail business lines, and 1,200 wholesale business and resale lines.

Other. This segment consists primarily of wireless services, including the sale of wireless handsets and accessories.

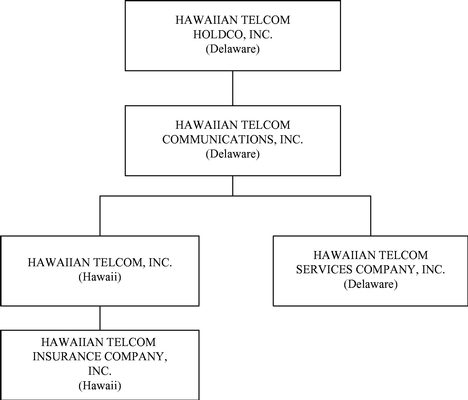

History and Organizational Structure

General

The Company was incorporated in Delaware in 2004. Originally incorporated in Hawaii in 1883 as Mutual Telephone Company, our Hawaiian Telcom, Inc. subsidiary has a strong heritage of over 125 years as Hawaii's communications carrier. From 1967 to May 1, 2005, we operated as a division of Verizon Communications Inc. (Verizon) or its predecessors. On May 2, 2005, the Verizon businesses conducted in Hawaii (comprised of Verizon Hawaii Inc. and carved-out components of Verizon Information Services, GTE.NET LLC (dba Verizon Online), Bell Atlantic Communications Inc. (dba Verizon Long Distance) and Verizon Select Services, Inc. (collectively, the "Verizon Hawaii Business")) were transferred to Verizon Holdco LLC, which then was merged (the "2005 Acquisition") with and into Hawaiian Telcom Communications, Inc., a Delaware corporation and wholly-owned subsidiary of the Company. As a result of the 2005 Acquisition, we became a stand-alone provider of communications services, operating as Hawaiian Telcom, Inc. (fka Verizon Hawaii Inc.) and Hawaiian Telcom Services Company, Inc., both wholly-owned subsidiaries of Hawaiian Telcom Communications, Inc.

Hawaiian Telcom, Inc., a Hawaii corporation, operates our regulated local exchange carrier business. It has a wholly-owned subsidiary, Hawaiian Telcom Insurance Company, Incorporated, which is a captive insurance subsidiary that until December 31, 2003 provided auto liability, general liability and worker's compensation insurance to Verizon Hawaii Inc. on a direct basis, and which continues to settle claims related to incidents which occurred prior to January 1, 2004. Current incidents are insured with external carriers.

Hawaiian Telcom Services Company, Inc., a Delaware corporation, operates our other businesses including our long distance, Internet, advanced communication and network services and wireless businesses. It also operated a directories publishing business until November 30, 2007, when it consummated the sale of the business to HYP Media Holdings LLC, a Delaware limited liability company and wholly-owned subsidiary of CBD Investor, Inc. In connection with the sale, HYP Media Holdings LLC entered into a 50-year publishing agreement pursuant to which it serves as the exclusive,

1

official publisher of telephone directories on behalf of Hawaiian Telcom, Inc. Under this agreement, HYP Media Holdings LLC publishes both white and yellow pages print telephone directories under the Hawaiian Telcom® brand.

The following is a chart of our organizational structure.

Bankruptcy Proceedings

On December 1, 2008, the Company, Hawaiian Telcom Communications, Inc., Hawaiian Telcom, Inc., Hawaiian Telcom Services Company, Inc. and certain other affiliates (collectively, the "Debtors") filed voluntary petitions for relief under chapter 11 of the U.S. Bankruptcy Code in the United States Bankruptcy Court for the District of Delaware (later transferred to the United States Bankruptcy Court for the District of Hawaii (the "Bankruptcy Court")) in order to facilitate a balance sheet restructuring. At the time of our chapter 11 filing, we had more than $1.1 billion of debt, consisting of approximately $575 million in senior secured debt under an Amended and Restated Credit Agreement dated as of June 1, 2007, $500 million in Senior Notes and Subordinated Notes, $40 million in unpaid trade debt, and $15 million in senior secured obligations under various swap agreements. In November 2009, the Bankruptcy Court confirmed the Debtors' chapter 11 plan of reorganization (the "Plan of Reorganization") at the conclusion of the confirmation hearing and entered a written confirmation order (the "Confirmation Order") on December 30, 2009. The Confirmation Order allowed us to emerge from chapter 11 with a significantly deleveraged capital structure.

Under the Plan of Reorganization, the senior secured lenders under the Amended and Restated Credit Agreement and the swap counterparties (collectively, the "Senior Secured Creditors") received nearly all of the new equity of the reorganized Company, and, after making disbursements pursuant to the Plan of Reorganization, we emerged with approximately $75 million in cash to enable continuation

2

of our operations in the ordinary course of business. Among other things, the Plan of Reorganization and the Confirmation Order provided for, on or about the Effective Date (defined below):

- •

- the cancellation of the Debtors' obligations under the Amended and Restated Credit Agreement, Senior Notes Indenture and

Subordinated Notes Indenture;

- •

- the cancellation of all outstanding shares of the existing stock of the Company and cancellation of all outstanding

options and other rights to purchase or otherwise receive shares of the existing stock of the Company;

- •

- the authorization to issue up to (i) 245 million shares of new common stock of the Company (the "New Common

Stock"), of which 10 million shares were issued to the holders of senior secured claims and 135,063 shares were issued to certain holders of unsecured claims who exercised subscription rights

for the right to receive shares of New Common Stock, and (ii) 5 million shares of preferred stock;

- •

- the reservation of 10% of the outstanding New Common Stock on a fully diluted basis for a new management compensation

incentive program (the "2010 Equity Incentive Plan");

- •

- the issuance to certain holders of Senior Notes with allowed claims of (i) subscription rights entitling them to

purchase their pro rata share of 3,125,000 shares of the New Common Stock at a subscription purchase price of $16.00 per share based on the Company's $160 million equity value under the Plan of

Reorganization and (ii) warrants to acquire shares of New Common Stock equal to 12.75% of the outstanding New Common Stock (on a diluted basis prior to consideration of the 2010 Equity

Incentive Plan) at a 12.5% discount to the Company's $160 million equity value and with an expiration date of five years from the Effective Date;

- •

- the receipt by unsecured creditors of cash in an amount equal to their pro rata share of $500,000;

- •

- the execution by the Debtors of and entry into a new senior secured term loan with the Senior Secured Creditors with a

first priority lien on all assets of the Debtors in the original principal amount of $300 million (the "New Term Loan"), with customary carve-outs and baskets including a basket for

a first-out senior secured revolving credit facility with a first priority lien on all assets of the Debtors in the original principal amount of $30 million (the "Revolving Credit

Facility") with the Senior Secured Creditors; and

- •

- the selection of a new Board of Directors of the Company by the Senior Secured Creditors, with the current Chief Executive Officer continuing to serve as a Director.

The Plan of Reorganization became effective, and the Company and other Debtors emerged from chapter 11, on October 28, 2010 (the "Effective Date"), following obtaining necessary regulatory approvals from the Federal Communications Commission (FCC) and the Public Utilities Commission of the State of Hawaii (HPUC) and satisfaction of other requisite conditions.

Industry Overview

The telecommunications industry is comprised of companies involved in the transmission of voice, data and video communications over various media and through various technologies. There are two predominant types of local telephone service providers, or carriers, in the telecommunications industry: incumbent local exchange carriers (ILECs) and competitive local exchange carriers (CLECs). An ILEC refers to the regional Bell operating companies (RBOCs), which were the local telephone companies created from the break up of AT&T in 1984, as well as small and midsize independent telephone companies, such as Hawaiian Telcom, Inc., Cincinnati Bell Inc. and Consolidated Communications, Inc., which sell local telephone service. These ILECs were the traditional monopoly providers of local telephone service prior to the passage of the Telecommunications Act of 1996. On the other hand, a

3

CLEC is a competitor to local telephone companies that has been granted permission by a state regulatory commission to offer local telephone service in an area already served by an ILEC.

In recent years, the U.S. telecommunications industry has undergone significant structural changes. Many of the largest service providers have achieved growth through acquisitions and mergers, while an increasing number of competitive providers have restructured or entered bankruptcy to obtain protection from their creditors. Since 2001, capital in the form of public financing has been generally difficult to obtain for new entrants and competitive providers. Capital constraints have caused a number of competitive providers to change their business plans, resulting in consolidation. Despite these changes, the demand for all types of telecommunications services, particularly data services, has not diminished, and telecommunications companies increasingly bundle services and provide integrated offerings for end-user customers.

Hawaii's telecommunications industry remains active, and demand for telecommunications services is strong, due in part to the comparative advantage provided by the state's geographic position. With its location between the mainland United States and Asia, Hawaii has been and will likely continue to be a surfacing location for cables running between the two continents. Hawaii is also connected to the mainland United States and Asia via several satellite networks.

Our Business Strategy

Our primary objective is to grow our business with a focus on delivering superior service to our customers, so that we can be recognized as the number one service provider of innovative "Always OnSM" communication, information and entertainment solutions to the people and businesses of Hawaii.

The key elements of our business strategy include the following:

- •

- Further leverage our broadband

network. Our broadband network is the foundation for our services to our customers, and we continue to expand its footprint and invest

in advanced technology platforms that support advanced communications services. We completed the build out of our Multiprotocol Label Switching (MPLS) core network statewide and continue to deploy

fiber-to-the-node (FTTN) access technologies over fiber optic cables to enhance and expand the speed and reach of our broadband network. We are deploying

high-speed VDSL2 technology, which will enable us to deliver new broadband consumer services, such as next generation television service, over our broadband network. We have deployed

advanced services to upgrade business customers, including business Voice over Internet Protocol (VoIP), Internet protocol Virtual Private Network (IP-VPN), and managed services, and

continue to enhance our services by adding new features and functionality.

- •

- Drive a customer- and sales-focused

organization. We have organized our operations to focus effectively on our customers and ensure the successful delivery of our services.

We strive to deliver a consistent and comprehensive customer experience. In addition, we have restructured the sales compensation program to better drive sales results and developed a more

comprehensive sales training program.

- •

- Deliver new and innovative products and solutions to attract and retain customers. We have successfully added and expect to continue to add new products and services to our customer offerings. We offer a full range of services including voice, Internet, data, customer premises equipment (CPE), wireless, and advanced communication and network services supported by the reach and reliability of our network and Hawaii's only 24x7 state-of-the-art network operations center. Our suite of IP-based services such as our business VoIP and IP-VPN services better positions us to compete for new customers and drive winback opportunities while also allowing us to improve retention of existing customers by migrating them from legacy services. Our planned next generation television service is an important growth component for our consumer

4

- •

- Improve operating profitability and capital efficiencies. We maintain a disciplined approach to managing operating expenses and capital spending. Our focus on driving operational improvements in our business has resulted in cost savings, and we have identified several key initiatives that we believe will further improve our cost structure. In addition, we continue to review and renegotiate contracts with key IT and outsource suppliers, which has led to additional cost savings. We manage our capital expenditures to optimize returns through disciplined planning and targeted investment of capital. Our strategy will be to continue to make strategic investments in our business in order to position us for long-term growth.

products portfolio and critical to our strategy to win the home and capture a share of the significant video and entertainment market opportunity that we currently do not address today.

Our Competitive Strengths

We believe the following are among our core competitive strengths and enable us to differentiate ourselves in the marketplace and help us successfully execute our business strategy:

- •

- Strong Local

Presence. We have been serving Hawaii's communities for over 125 years and employ approximately 1,400 employees statewide. Each

year, we donate to various local charities and our employees volunteer thousands of hours of community service. We understand our customers' needs because they are our needs as well. We share Hawaii's

history, heritage, and values. We are locally managed, making us more competitive and responsive to Hawaii's consumers and businesses.

- •

- Growth-Oriented Product

Portfolio. We are the only communications service provider in our market that can provide such a broad array of services to both

consumers and business customers that includes voice, Internet, data, CPE, wireless, and advanced communication and IP-based network services. Our expanding service suite, including

high-quality enhanced data networking services such as our business VoIP and IP-VPN services, and our managed services, are targeted at the key growth areas in our marketplace.

Our proposed next generation video service, employing Microsoft® Mediaroom™, is targeted at capturing a share of the significant video and entertainment market opportunity that

we currently do not address today.

- •

- Advanced Network

Infrastructure. We own the State's most extensive and reliable communications network, which includes approximately 75,000 strand miles

of fiber optic cable and more than 11,000 route miles of copper wire distribution lines. We completed the build out of our MPLS core network, which is deployed statewide and allows us to deliver

IP-based services to well over 90% of the State's population. Our network is supported by Hawaii's only 24x7 state-of-the-art network operations center.

We continue to push fiber deeper into the network and to enhance and expand the speed and reach of our broadband network, which we believe will enable us to offer new products and services that will

generate growth in our business and allow us to compete more effectively in the marketplace.

- •

- Attractive Market

Characteristics. Hawaii compares favorably to national averages in median household income ($64,661 vs. $51,425) (more so for Oahu

($67,066) where the majority of the population resides). Our market is characterized by high density, with approximately 70% of the state's population concentrated on Oahu over an area of

approximately 598 square miles, or 1,500 persons per square mile. In addition, 37% of the households in Hawaii reside in multi-dwelling units (MDUs)—43% on Oahu—which compares

favorably to 22% in the U.S. overall. More specifically, 25% of the households on Oahu reside in housing structures with 20 or more units versus 8% in the U.S. overall.

- •

- Strong Management Team. We have assembled an experienced management team that we believe is well-qualified to lead our Company and execute our strategy. Our management team has

5

significant operational experience in the telecommunications industry combined with extensive knowledge of our local market, which will be a critical driver of our success going forward.

Our Products and Services

Wireline Services

Local Exchange Services

Our local exchange carrier business generates revenue from local network services, network access services and certain other services, each of which is described below.

Local Network Services

Our traditional local network service enables customers to originate and receive telephone calls within a defined "exchange" area. We provide basic local services on a retail basis to residential and business customers, generally for a fixed monthly recurring charge. Basic local service also includes non-recurring charges to customers for the installation of new products and services. Basic local exchange services are enhanced with a variety of value-added services such as call waiting, caller ID, voice messaging, three-way calling, call forwarding and speed dialing. Value-added services may be purchased individually or as part of a package offering for a monthly recurring charge. We also offer other local exchange services such as local private line and inside wire maintenance. The rates that can be charged to customers for basic local and certain other services are regulated by the HPUC. We charge business customers higher rates to recover a portion of the costs of providing local service to residential customers, as is customary in the industry. See "—Regulation" for further discussion of regulatory matters.

Network Access Services

Our network access services are offered in connection with the origination and termination of long distance, or toll, calls that typically involve more than one company in the provision of end-to-end long distance service. Since toll calls are generally billed to the customer originating the call, a mechanism is required to compensate each company providing services relating to the call. This mechanism is the access charge, which we bill to each interexchange carrier for the use of our facilities to access our customers. In addition, we bill a component of access charges directly to our customers. Our network access services generate intrastate access revenue when an intrastate long distance call that involves us and an interexchange carrier is originated and terminated within Hawaii. This access charge is regulated by the HPUC. Similarly, our network access services generate interstate access revenue when an interstate long distance call is originated from a Hawaii local calling area served by us and is terminated in a local calling area in another state and vice versa. Interstate access charges are regulated by the FCC. We also offer special access voice and data services, which are a key area of growth driven by demand for increasing bandwidth from business and wholesale customers. Special access services include switched and non-switched (or dedicated) services such as point-to-point single channel circuits, Synchronous Optical Network (SONET) and Time Division Multiplexing (TDM) transport services, as well as IP-based private networks. See "—Regulation" for further discussion of access charges.

Long Distance Services

We provide long distance services to transmit international calls, interLATA (Local Access Transport Area) domestic calls and regional toll calls made to points outside a customers' local calling area, but within our local service area (intraLATA toll). In Hawaii, each of the islands is a local calling area, and calls between the islands are intraLATA toll calls. Other long distance services include 800-number services and wide area telecommunication services, or WATS, private line services, and operator services associated with long distance calls. As of March 1, 2011, we served approximately

6

225,400 long distance lines, of which 65% served residential customers and 35% served business customers.

Internet Services

We provide high-speed Internet (HSI) access to our residential and business customers. Our data network enables us to provide extensive high-speed network access. We have HSI available in 79 of our 86 central offices. As of March 1, 2011, we served approximately 82,800 retail residential HSI lines, 16,700 retail business HSI lines, and 1,200 wholesale business and resale HSI lines. We also provided dial-up Internet access to approximately 1,400 subscribers as of the same date.

Advanced Communication and Network Services

The role of business communication providers is evolving. Consistent with this, we have been pursuing opportunities to expand into application-centric, advanced communication and network services. Our advanced communication and network services include Managed Services, deployed in 2008, which provides customers with security audit and monitoring, fault monitoring, and performance management services; Routed Network Service, a high-performance IP network service for business customers launched in April 2009; Enhanced Internet Protocol Data Service, a multipoint Ethernet virtual private local area network service launched in May 2007; and Business All-in-One, a business VoIP service launched in December 2009 to provide small-to-medium-sized businesses with complete communication needs in a hosted package.

Next Generation Television Service

We continued preparations to launch our next generation television service. Our planned video service will be a critical growth component for our consumer products portfolio and an anticipated anchor of our service bundling strategy. During 2010, we continued to develop a network capable of providing integrated digital video, high-speed broadband and voice services to new and existing customers. We also completed and made operational our video head end. Negotiations with the Cable TV Division of the State of Hawaii Department of Commerce and Consumer Affairs concerning our application for a video franchise for the island of Oahu are ongoing. In addition to investing in our network to offer video services, we have developed the requisite hardware and software platform and secured programming content. Our ability to provide an attractive and successful video offering will depend significantly on the results of these regulatory and infrastructure development efforts.

Other Wireline Services

We seek to capitalize on our local presence and network infrastructure by offering other services to customers and interexchange carriers. Sales and maintenance of customer premises equipment to the business markets are an important source of local exchange revenues. Customer premises equipment services are also an area of potential growth as attractive contracts with major equipment providers allow us to offer complete voice and data network and management solutions. For the wholesale or carrier market, we offer services including operator services, billing and collection services and space and power rents for collocation services. We also offer public pay telephone services at approximately 4,900 locations throughout the State of Hawaii.

Other

We offer wireless services pursuant to a mobile virtual network operator (MVNO) services agreement with Sprint Spectrum, L.P. (Sprint). That agreement allows us to resell Sprint wireless services, including access to Sprint's nationwide personal communication service (PCS) wireless network to residential and business customers in Hawaii under the Hawaiian Telcom® brand name. The services agreement with Sprint was effective as of May 2009 and has a term of three years and is renewable for up to three additional one-year terms after the initial period.

7

Markets and Customers

Wireline Services

We have been a telecommunications provider in Hawaii for more than 125 years. Our market consists of 86 central offices serving an area of approximately 6,263 square miles on the islands of Oahu, Maui, Hawaii, Kauai, Molokai and Lanai. We are the incumbent provider of local exchange services within this area and own the state's most extensive local telecommunications network, with approximately 437,500 local access lines served as of March 1, 2011, of which 55% served residential customers, 44% served business customers and the remaining 1% served other customers. Other customers include (1) interexchange carriers that pay for access to long distance calling customers located within our local service area and (2) CLECs that pay for wholesale access to our network to provide competitive local service on either a resale or unbundled network element (UNE) basis as prescribed under the Communications Act of 1934, as amended (the "Communications Act").

Our market is characterized by high population density, with approximately 70% of the state's population concentrated on Oahu. This concentration of customers and commerce provides opportunities to leverage our network infrastructure to deliver products and services efficiently and in a cost-effective manner and to market and sell our services more effectively. Given Hawaii's geographic location, its distance from the mainland United States and the diversity of its population (approximately 39% being of Asian descent), Hawaii residents and businesses have telecommunications needs that may be different from those on the mainland United States. Furthermore, in 2010, the median household income in Hawaii is estimated at approximately $64,600, compared to the national average of approximately $51,400. For the foregoing reasons, our strategy is to leverage the distinctive qualities of the Hawaii market to develop customized, local marketing strategies.

Our business marketplace is dominated by several key industries. State and federal government account for 24% of gross state product. With the U.S. Pacific Command, one of the largest U.S. unified service commands, based in Hawaii and approximately 37,000 military personnel stationed in Hawaii, the federal government is one of our largest customers. The hospitality industry and financial institutions also account for a significant portion of our business. The operations of these leading sectors are communications intensive, and we believe that they are dependent on our modern, reliable services. Hawaii's small business market (in the aggregate) is also a key driver of Hawaii's economy—approximately 95% of the companies in Hawaii employ fewer than 50 employees, and these businesses make up a market of approximately 51,000 business customers. We believe that these business customers represent an underserved segment that we are targeting aggressively with new product and service offerings.

Other

We have been providing wireless services since 2005. It is estimated that there are approximately 1,180,000 wireless subscribers in Hawaii. Currently, less than 1% of these subscribers utilize us as their wireless provider. We are investigating opportunities to capture a greater share of this market and to leverage the Hawaiian Telcom® brand and our existing customer base to enhance customer loyalty for our various product and service offerings.

Competition

The telecommunications industry is highly competitive. We experience competition from many communications service providers, including the local cable operator Oceanic Time Warner (Oceanic), wireless carriers, long distance providers, competitive local exchange carriers, Internet service providers, Internet information providers, over-the-top hybrid voice providers, and other companies that offer network services and managed enterprise solutions. Many of these companies have a strong market presence, brand recognition, and existing customer relationships, all of which contribute to competition

8

that may affect our future revenue growth. We expect competition to intensify as a result of the entrance of new competitors and the rapid development of new technologies, products and services.

The local cable operator Oceanic Time Warner, a subsidiary of Time Warner Cable Inc., the second largest cable operator in the United States, is one of our most significant competitors. Approximately 90% of the households in Hawaii (94% of households on Oahu) subscribe to Oceanic's cable service and it has majority market share in high-speed Internet, which Oceanic uses as a platform to offer voice services utilizing VoIP technology, and markets these services through competitive bundled offerings. In addition, Oceanic has targeted communications service offerings to small and medium-sized businesses.

Wireless communications services continue to constitute a significant source of competition, especially as wireless carriers expand and improve their network coverage and continue to lower their prices. As a result, some customers have chosen to completely forego use of traditional wireline phone service and instead rely solely on wireless services. We anticipate the wireless substitution trend will continue, and could pose additional threat to our high-speed Internet product, particularly if wireless service rates continue to decline and the wireless service providers upgrade their networks to 4G technology and are able to deliver faster data speeds. Over-the-top hybrid providers, such as Skype and Magic Jack, also offer the capability to provide local voice and long distance calls using an internet-equipped personal computer.

The advanced communication and network services business is highly competitive due to the absence of significant barriers to entry. The emergence of non-traditional, application-centric players in the market is redefining the role of communications providers. We currently compete for business customers with vendors such as tw telecom of hawaii l.p., Pacific LightNet, Inc., NetEnterprise Inc., Tri-net Solutions, L.L.C., Systemmetrics Corporation and other traditional and non-traditional carriers.

We employ a number of strategies to combat the competitive pressures. Our strategies are focused on preserving and generating new revenues through customer retention, upgrading and up selling services to existing customers, new customer growth, winbacks of former customers, new product and feature deployment, and by managing our profitability and cash flow through targeted reductions in operating expenses and efficient deployment of capital. Key to success in these strategies is continued enhancement and expansion in the speed and reach of our broadband network, which we believe will enable us to offer new products and services that will generate growth in our business and allow us to compete more effectively in the marketplace. Another key is a focus on enhancing the customer experience, as we believe exceptional customer service will differentiate us from our competition. Customers expect industry leading service from their service providers. As technologies and services evolve, the requirement of the carrier to excel in this area is crucial for customer retention.

Network Architecture and Technology

Our strategy is to build and operate the most technologically advanced communications network in the state of Hawaii. Pursuing such a strategy has enabled us, among other things, to begin offering advanced communications and network services beginning in 2007. In 2010, we invested approximately $61.3 million in our network including significant expenditures to expand the reach, capacity, and resiliency of our IP-based packet and broadband network. Significant strides were made in 2010 to add hundreds of miles to our state-leading fiber network and continuing our transformation toward an optical, IP-based broadband network.

Packet Optical Network

We continued expansion of our statewide MPLS network in 2010. Growth from new services offered on our MPLS network, such as our Enhanced Internet Protocol Data Service and Routed Network Service, as well as growth from our high-speed Internet service, continue to drive increases in

9

the backbone bandwidth requirements and improvements to our mesh designs. To meet the explosive bandwidth growth of our consumer and business customers, we continue to add additional broadband capacity and increase the resiliency and reliability of our network. In 2010, we upgraded our border routers to larger systems and added 20 gigabytes of bandwidth on our trans-Pacific fiber route to the mainland. Evaluation and lab testing of industry leading Packet Optical Transport Systems were done in our Innovation Center to introduce this technology into our network in 2011 to meet our growing bandwidth needs while greatly reducing the cost per gigabyte. Evolution in our MPLS core will continue toward a converged packet optical networking platform. Our current backbone infrastructure consists of two border routers, seven core MPLS routers, 36 service edge routers, 21 Frame Relay switches and 13 asynchronous transfer mode (ATM) switches. There are also 809 Synchronous Optical Network (SONET) rings in service.

Our telecommunication infrastructure includes more than 13,500 sheath miles of fiber optic cable and copper wire distribution lines. Submarine and deep-sea fiber optic cables connect the islands of Kauai, Oahu, Maui and Hawaii, while digital microwave provides other inter-island connections. In addition to our owned interisland cables between Oahu and Kauai, Oahu and Maui, and Maui and Hawaii, we are also connected by trans-Pacific fiber optic cables between the Hawaiian islands and to the U.S. Mainland which provide ring diversity to protect our communications between the islands and high-speed broadband links in and out of the State.

Voice Network

In 2009, we installed a new VoIP application server for the introduction of our new Business All-in-One business VoIP (BVoIP) service. The new BVoIP service targets our small-to-midsize business market, combining voice and data services over an IP connection to the customer. In addition, we added a new, next generation voicemail platform to the network that we believe ties in well with our IP migration strategy and positions us for new unified communication services. Our voicemail customers migrated off the old TDM platform onto our new voicemail platform in 2010. Plans are being finalized to consolidate this network into a much smaller IP softswitch platform.

As of March 1, 2011, we owned 107 local base and remote switches and five tandem switches serving approximately 446,600 total lines on the islands of Hawaii, Kauai, Lanai, Maui, Molokai and Oahu. All of our access lines are served by digital switches provided predominantly by Alcatel-Lucent and Genband. Since 2002, we have updated our infrastructure to meet the technological needs of our customers. Our switches on every island are linked through a combination of extensive aerial, underground and undersea cable, as well as microwave facilities, allowing us to provide our services to customers in a very challenging geographical territory. In 2010, we also replaced and upgraded our signal transfer points (STPs) to a next generation IP-based router.

Access Infrastructure

In 2010, we continued to deploy fiber-to-the-premise (FTTP) solutions to serve green field multi-dwelling unit (MDU) and single-family subdivision developments, adding 13 new developments. By laying fiber and utilizing various passive optical network components from these developments to our central offices, we can further leverage the capabilities of our MPLS backbone, provide higher bandwidth services to our customers, including the proposed video services, and reduce maintenance costs. Additionally, in 2010 we continued our replacement of obsolete digital loop carrier equipment with new broadband loop carrier (BLC) equipment. The versatile BLCs are IP-based and offer a wide range of services including landline telephone service, DSL, Ethernet over copper, and gigabit passive optical network service. At the same time, we retired and removed over 22 miles of copper cable from our network. These projects further our transformation to a broadband network and replace copper lines once served by TDM switches. Through this strategy, we seek to meet the bandwidth needs of our customers in an economical manner.

10

Next Generation Television Service

The implementation of IP-based television service is driving one of the largest network transformations in the telecommunications industry. Our next generation television service will enable the delivery of multimedia services over our IP-based network and provide our customers with new viewing experiences and applications. In 2010, we reached a major milestone by successfully completing a pilot deployment to select trial participants. In 2011, we will continue to invest in the network to increase the reach of our next generation television service.

Network Surveillance and Operations

Network management operations are provided by our Network Operations Center (NOC) located in Honolulu. The NOC provides surveillance 24x7, 365 days a year, over our statewide network consisting of 86 central offices and associated interoffice facilities. We have a customer service center which also operates on a 24x7, 365 days a year basis to handle customer inquiries, repairs, and provide call completion services. All customer installations and repairs requiring a field technician are offered during extended hours and coordinated by our Dispatch Center. All construction activity, for both outside and inside plant, is coordinated by our engineering operations team located at our Honolulu office.

In addition to our network infrastructure, we operate a wide range of equipment from large boom trucks to small passenger vehicles, mobile generators, and other miscellaneous trailers, tools and test equipment. We own or lease most of our administrative and maintenance facilities, central offices, remote switching platforms, and transport and distribution network facilities. Our assets are located primarily in the State of Hawaii.

Information Technology and Support Systems

Since the 2005 Acquisition, we have made substantial investments in a new back-office and IT infrastructure. We initially engaged BearingPoint, Inc. (BearingPoint) to build the back-office and IT infrastructure. In February 2007, we terminated our relationship with BearingPoint and transferred certain services previously performed by BearingPoint to Accenture LLP (Accenture). See "—Transition to Becoming a Stand-alone Provider." In 2009, we signed a five-year agreement with Accenture that amended the prior agreement and lowered costs while improving operational efficiencies.

We continue to enhance our back-office systems and IT infrastructure with the objective of improving and expanding our customer services and streamlining our operations. We implemented the capability for ordering and provisioning new products and services for our customers while increasing productivity and improving operational capabilities.

To support the launch of new products in 2010, we implemented ordering, provisioning, and service assurance functionality for our next generation television service. We developed automation that enabled us to offer higher Internet access speeds and to provide certain existing customers with higher Internet access speeds without cost to them.

Continuing improvement initiatives are being conducted that are aimed at improving the quality and movement of data across systems, enhancing operational productivity, and ensuring that customer orders are processed accurately and in a timely fashion. These initiatives included creating on-line ordering capability for packaged CENTREX business customers, which represent the largest group of business customers, as well as introducing automated flow-through from order entry through billing for orders from our wholesale customers. These efforts reduced manual processing of complex orders, increased productivity, and enhanced overall data quality. Order flow-through continues to improve, manual processing queues are now at the lowest levels since the 2005 Acquisition, and order backlogs are down 85% from 2008 due to systems and process improvements. The end result is increased data

11

integrity, faster order processing speeds, higher levels of automated order flow-through, increased productivity, and an improved customer experience.

A number of other IT initiatives in 2010 were aimed at delivering advanced technologies to our customers as well as delivering a superior service experience for our customers. We deployed an advanced mobile workforce management system that provides us with enhanced capabilities to manage customer appointments. Operating systems were upgraded to provision a number of new network devices needed to deliver our next generation television and HSI services.

To make the delivery of IT services more cost effective and efficient, we consolidated two of our three data centers and revised the working agreement with the service provider managing the consolidated data center. We are in the planning stages of refreshing data center infrastructure that has reached the end of its serviceable life with state-of-the-art technology involving server virtualization and cloud computing. This effort will result in lower operating costs and energy consumption at our data centers as well as more efficient and reliable operations.

Employees

As of March 1, 2011, we employed approximately 1,400 full-time employees in Hawaii. Of the total employees, 57% were represented by the International Brotherhood of Electrical Workers (IBEW) Local 1357. The current collective bargaining agreement with IBEW Local 1357 is effective from September 13, 2008 through September 12, 2011. We expect to re-negotiate the collective bargaining agreement in 2011. Under the Plan of Reorganization, the collective bargaining agreement was assumed upon emergence from chapter 11. We believe that management currently has a constructive relationship with the represented and non-represented employee groups.

Insurance

We have insurance to cover risks incurred in the ordinary course of business, including errors and omissions, general liability, property coverage (which includes business interruption), director and officers and employment practices liability, auto, crime, fiduciary and worker's compensation insurance in amounts typical of similar operators in our industry and with reputable insurance providers. Central office equipment, buildings, furniture and fixtures and certain operating and other equipment are insured under a blanket property insurance program. This program provides substantial coverage against "all risks" of loss including fire, windstorm, flood, earthquake, and other perils not specifically excluded by the terms of the policies. As is typical in the telecommunications industry, we are self-insured for damage or loss to certain of our transmission facilities, including our buried, undersea and above-ground transmission lines. We believe that our insurance coverage is adequate; however, if we become subject to substantial uninsured liabilities due to damage or loss to such facilities, our financial results may be adversely affected.

Regulation

Federal and State Regulation of Telecommunications Services

Our telephone operations generally are subject to the jurisdiction of the FCC with respect to interstate services and the HPUC with respect to intrastate services. The following summary does not purport to describe all current and proposed applicable federal and state regulation.

Competition

We face increasing competition in all areas of our business. Regulatory changes brought on by the 1996 amendments to the Communications Act, regulatory and judicial actions, and the development of new technologies, products and services have created opportunities for alternative telecommunication

12

service providers, many of which are subject to fewer regulatory constraints than our ILEC. We are unable to predict definitively the impact that the ongoing changes in the telecommunications industry will ultimately have on our business, results of operations or financial condition. The financial impact will depend on several factors, including the timing, extent and success of competition in our markets, the timing and outcome of various regulatory proceedings and any appeals, the timing, extent and success of our pursuit of new opportunities resulting from the amendments to the Communications Act and technological advances, and any changes in the state or federal laws or regulations governing communications.

Universal Service

As a provider of interstate telecommunications, we are required to contribute to federal universal service programs. The FCC adjusts the contribution amount quarterly and may increase or decrease this amount depending on demand for support and the total base of contributors. Pending proposals to change the contribution methodology could increase or reduce our total obligation to this funding. We also draw Interstate Access Support from this funding.

On December 31, 2007, we filed a petition with the FCC requesting a waiver to determine our eligibility to receive federal high-cost loop support according to our average line costs per wire center instead of our statewide average line costs. Grant of the petition would increase the amount of support we receive. There is no definite timeframe for an FCC decision on this petition.

In April 2010, in response to a remand from the United States Court of Appeals for the Tenth Circuit, the FCC reaffirmed its non-rural mechanism for distributing universal service high-cost loop support without significant change. At the same time, the FCC began a proceeding to replace the existing universal service mechanism with a new fund that would be designed to support high-speed broadband and voice service for those areas of the country which would not receive such services without government support. In February 2011, the FCC adopted a Notice of Proposed Rulemaking that included a number of proposals relating to reforming existing universal service support mechanisms. One of the proposals proposes to phase out Interstate Access Support in two years beginning on January 1, 2012. The money thereby saved is expected to be used to support the provision of broadband services in unserved areas through a competitive bidding mechanism. The intention of the rulemaking is to replace eventually all of the existing high cost support for voice services with mechanisms that would fund broadband deployment (that would include a voice component), including providing one-time capital support as well as ongoing operational support for areas where broadband services could not be economically provided without government support. We do not know when this proceeding will be concluded, how the FCC will implement the proposals, if at all, or how such proceeding will impact our pending support level or waiver petition.

Government Regulation of Retail Rates

The FCC and the HPUC are the two agencies that regulate telecommunications services. In general, the FCC regulates interstate service, and the HPUC regulates intrastate service. The HPUC has, slowly over time, reduced its rate regulation of some of our services. The HPUC classifies all regulated telecommunications services as fully competitive, partially competitive, or non-competitive.

In 2009, the Hawaii State Legislature passed Act 180, which it clarified with an amendment in 2010 (Act 8). As amended, Act 180 requires that the HPUC treat all intrastate retail telecommunications services, including intrastate toll (i.e., inter-island), central exchange (Centrex), residential and business local exchange services, integrated service digital network (ISDN) private lines and special assemblies, and directory assistance, as "fully competitive" under the HPUC's rules with certain qualifications. In addition, HPUC approval and cost support filings are no longer required to establish or reduce rates or to bundle service offerings; however, all service offerings must be priced

13

above the service's long-run incremental cost, and the HPUC can require us to provide such cost support demonstrating compliance with its costing rules at any time. If the HPUC is not satisfied, it retains the ability to investigate the offering and to suspend the offering pending the outcome of its investigation. In addition, HPUC approval is required in order to increase the rate for a service to a level that is greater than the rate for the retail service in the tariff at the time of implementation of either Act 180 or Act 8, whichever is applicable. Local rates historically have been set at a level that will allow the recovery of embedded costs for local service. Recognized costs include an allowance for a rate of return on investment in plant used and useful to provide local service. Competitive forces may cause us to be unable to raise our local rates in the future

The classification of retail local exchange intrastate services as fully competitive and the ability to bundle the services with other fully or partially competitive services or other services that are not within the HPUC's jurisdiction enable us to charge a discounted rate for bundled service offerings and have helped us to respond to competition.

State and Federal Regulation of Long Distance Services

We are subject to certain conditions imposed by the HPUC and the FCC on the manner in which we conduct our long distance operations. For example, we are prohibited from joint ownership of local and long-distance telephone transmission or switching facilities. The HPUC is responsible for ensuring that our ILEC does not discriminate against other long distance providers.

Federal Requirements

As an ILEC, we are subject to a number of access and interconnection requirements under federal law. Among other things, an ILEC must negotiate in good faith with other carriers requesting interconnection and access to UNEs and must offer its competitors access to UNEs, such as local loops and inter-office transport, at regulated rates. However, we are no longer required to provide our competitors with access to switching UNEs, or the combination of loop, transport and switching UNEs known as the UNE Platform (UNE-P). The FCC also has limited our obligation to unbundle fiber facilities to multiple dwelling units, such as apartment buildings, and to homes and offices deployed in fiber-to-the-curb and fiber-to-the-premises arrangements. In addition, federal law regulates competitors' requests to collocate facilities within our central offices and to have access to our subscriber list information in order to produce competing directories, and other matters, including the manner in which we must protect our customers' information. The FCC currently is examining its pricing standard for UNEs and may modify other aspects of its UNE rules as market conditions change. The FCC also has imposed specific rules regarding the manner and time within which a customer's telephone number must be ported to a competing carrier's service.

Interstate and Intrastate Access Charges

The rates that we can charge for interstate access are regulated by the FCC. The FCC has made various reforms to the existing rate structure for access charges, which, combined with the development of competition, have generally caused the aggregate amount of access charges paid by long-distance carriers to decrease over time. For example, the FCC has instituted caps on the per-minute rate we can charge for our switched access services as well as on our monthly subscriber line charges (SLCs). The FCC has adopted rules for special access services that provide for pricing flexibility and ultimately the removal of services from price regulation when prescribed competitive thresholds are met. We currently have pricing flexibility for certain special access services offered throughout our territory. The FCC currently is considering whether to modify the special access pricing rules for price cap carriers like us, including whether the pricing flexibility rules should be modified or eliminated. On May 18, 2008, the FCC granted our request for pricing flexibility for certain special access services offered on the neighbor islands. We also have pricing flexibility for certain special access services offered on Oahu.

14

Our intrastate access rates are set forth in an interim tariff approved by the HPUC in 1995 and are based on our embedded costs. Although it has been the HPUC's intention to initiate a proceeding to adopt permanent access rates based on a forward-looking cost methodology, the HPUC has not yet initiated a proceeding to do so.

Federal Framework for Intercarrier Compensation

The FCC has an ongoing rulemaking that could fundamentally restructure the regulatory regime for intercarrier compensation. Intercarrier compensation consists of state and interstate access charges and local reciprocal compensation. This comprehensive reform proposal seeks, among other things, to unify state and interstate intercarrier charges in certain circumstances, provide a mechanism to replace intercarrier revenues lost through rate unification, and resolve a number of outstanding disputes among carriers regarding interconnection and compensation obligations. The FCC has also sought comment on whether access charges should apply to VoIP or other Internet protocol-based service providers. The FCC in February 2011 adopted a Further Notice of Proposed Rulemaking that proposed to establish a relatively gradual phase-down of intercarrier compensation that would occur in conjunction with the changes to universal service identified previously in this section. It currently is unknown what specific actions the FCC will take in this proceeding or when it will implement such actions.

The FCC has found that Internet-bound traffic is not subject to reciprocal compensation under Section 251(b)(5) of the Communications Act. Instead, the FCC established a federal rate cap for this traffic, which is and will remain $0.0007 per minute until the FCC decides otherwise.

Federal Regulatory Classification of Broadband and Internet Services

The FCC has been considering whether, and under what circumstances, services that employ Internet protocol are "telecommunications services" subject to regulations that apply to other telecommunications services, but it has not definitively ruled on the issue and instead has made a series of decisions addressing specific services and regulations. For example, some VoIP providers must comply with the federal wiretap law and with FCC requirements to provide enhanced 911 emergency calling capabilities, ensure disability access and provide local number portability. Certain VoIP providers are exempt from state telecommunications market entry regulation. As a result, our VoIP competitors may be less heavily regulated than we are.

In September 2005, the FCC ruled that ILECs like ours may offer dedicated broadband Internet access service as an information service. As a result, we are no longer required to offer the underlying broadband transmission capacity used to provide our HSI service on a tariffed, common carrier basis to competing Internet Service Providers (ISPs). This decision gives us greater flexibility in how we offer and price such transmission capacity. It also puts us on more even footing with our cable competitors in the broadband market since the FCC had previously held that high-speed Internet access service delivered using cable television facilities constitutes an information service not subject to common carrier regulations, a determination that was upheld by the United States Supreme Court.

In March 2006, a request of Verizon that sought forbearance from Title II regulation for certain specified advanced broadband special access services was deemed granted by operation of law. This forbearance grant was applicable to us since Hawaiian Telcom Communications, Inc. was part of Verizon when the original Verizon petition for forbearance was filed. This action permits us to deregulate covered advanced broadband special access services, giving us greater flexibility in our pricing and terms and conditions of offering.

In February 2009, Congress enacted a law that required the FCC to establish a national broadband plan to promote broadband service availability to all Americans. This plan was released by the FCC in March 2010 and contained recommendations on how to promote the provision of broadband in unserved and underserved areas of the country, including an increase in the speed at which current

15

customers can obtain broadband services. It also addressed how to increase the adoption of broadband services by those consumers who currently do not have access to those services. The FCC announced that there will be additional rulemakings to implement the recommendations of the plan. It is not known how this plan will impact our business operations given that the rules have not yet been adopted.

In December 2010, the FCC adopted "net neutrality" rules, termed "open Internet" rules, that would bar Internet service providers from blocking or slowing Web content sent to homes and businesses. The rules continue to treat broadband Internet access services under the FCC's Title I authority, but adopted as rules the existing guidelines applicable to Internet service providers. The FCC also adopted three additional rules concerning blocking, non-discrimination, and transparency. The no-blocking rule prohibits a fixed broadband Internet access service provider from blocking lawful content, applications, services, or devices, subject to reasonable network management. The anti-discrimination rule prohibits a fixed broadband Internet access service provider from unreasonably discriminating in the transmission of lawful network traffic over a consumer's broadband Internet access services, subject to reasonable network management. Wireless broadband providers are not subject to these two rules, but only to a scaled-back version of the no-blocking rule applicable to fixed providers. The transparency rule requires all Internet access service providers to disclose publicly accurate information regarding their network management practices, performance, and commercial terms of service so that consumers are able to make informed choices and device providers are able to develop, market, and maintain Internet offerings. The FCC's net neutrality rules are being challenged in the courts.

Other Federal and State Regulatory Proceedings

The FCC has been exploring whether to modify its rules requiring utilities to provide telecommunications carriers and cable television companies with access to their poles, ducts, and rights of way. These proposals seek, among other things, to require access to poles and conduit within a shorter period of time, and to better limit make ready costs. These proposals, if adopted, would tend to increase the burdens and costs of pole and conduit owners such as us. We cannot predict what rule changes the FCC might make or when it might adopt them.

Currently pending before the HPUC is a proceeding, filed on October 6, 2006, concerning our service quality and performance levels and standards in relation to our wholesale and retail customers. The HPUC, as part of its approval of the 2005 Acquisition pursuant to which we acquired Verizon's Hawaii assets, had called for such service quality review to take place beginning six months after the systems cutover from Verizon, which occurred April 1, 2006. The Consumer Advocate of the State of Hawaii, the Department of Defense, tw telecom of hawaii l.p. (fka Time Warner Telecom of Hawaii LLP) and Pacific LightNet, Inc. are parties to the proceeding. In general, the HPUC is examining the effect that the 2005 Acquisition had on our wholesale and retail customers, including whether any audit or other remedy should be required to mitigate any negative effects. The HPUC also is addressing whether any of the current service quality standards with which we are required to comply should be modified or eliminated and whether any new standards should be enacted, including whether a procedure should be established to impose fines for any failure to meet the service standards. All formal filings provided for in the schedule established by the HPUC, as well as a hearing, have been completed. We continue to file periodic service quality reports as required by the HPUC. We cannot predict the outcome of this or other proceedings before the FCC, the HPUC or the courts.

16

Environmental, Health and Safety Regulations

We are subject to various environmental, health and safety laws and regulations that govern our operations and may adversely affect our costs. Some of our properties use, or may have used in the past, on-site facilities or underground storage tanks for the storage of hazardous materials that could create the potential for the release of hazardous substances or contamination of the environment. We cannot predict with any certainty our future capital expenditure requirements for environmental regulatory compliance, although we have not currently identified any of our facilities as requiring major expenditures for environmental remediation or to achieve compliance with environmental regulations.

Business Transactions

Transition to Becoming a Stand-alone Provider

Verizon and its affiliates historically provided our predecessor with services that were critical to the operation of our businesses. In connection with the 2005 Acquisition, we had engaged BearingPoint to build a back-office and IT infrastructure in order to enable us to migrate off Verizon's software systems and begin operating as a stand alone provider of telecommunications services. These "build services" generally consisted of integration and installation of software, databases, hardware, operating systems and internal network systems; providing the services of the primary and back-up data centers; providing certain training; and business process definition. The new back-office and IT infrastructure was integrated with certain core operations support systems purchased from Verizon as part of the 2005 Acquisition and provided network operations support functions and operated our billing systems, customer relationship management systems, corporate finance systems, human resource and payroll systems. We completed our transition from Verizon's software systems in April 2006 by (a) terminating the services from Verizon and transitioning those services to us and (b) migrating the data used in Verizon's Hawaii Business from Verizon's systems to our systems. However, while the major network operational systems were built and functioned without significant problems following the April 2006 transition, critical systems related to back-office functions, such as customer care, order management, billing, supply chain and other systems interfacing with our financial systems, lacked significant functionality. This led to deficiencies in billings and collections, revenue assurance and order entry flow-through. To help remediate the deficiencies, we engaged the services of Accenture. Under an Application Services Agreement with Accenture effective as of February 2007, Accenture agreed to perform certain of the application development and management services previously provided by BearingPoint and assumed responsibility for the completion and ongoing development of applications from BearingPoint. We subsequently executed an Amended and Restated Master Application Services Agreement with Accenture effective as of March 2009 to provide long-term IT support services.

Through the maintenance and remediation efforts beginning in 2006 and continuing into 2011, we have seen substantial improvements in system stability and reductions in system defect rates. Implementation of order-to-cash flow-through upgrades continues to improve overall performance and accuracy of orders and invoices and to reduce third-party support costs. These improvements in stability and accuracy have allowed the implementation and support of new products and services for our customers, such as new product bundles and HSI products, and provided us with improved capability to offer targeted and timed promotions.

Intellectual Property Agreements

Although the merger agreement for the 2005 Acquisition contains several provisions relating to the disposition of intellectual property assets related to our business, such as an obligation of GTE to use commercially reasonable efforts from signing of the merger agreement through May 2, 2006 to obtain for us the right to use all third-party network element software that is installed on our network elements in Hawaii, our ownership, rights and licenses of intellectual property are generally established

17

under an Intellectual Property Agreement and Verizon Proprietary Software License Agreement entered into with GTE on May 2, 2005.

Pursuant to the Intellectual Property Agreement, we acquired certain trademarks and trade names that relate to our business, although the majority of the marks and names that were used in the business before the 2005 Acquisition were retained by Verizon and GTE, which required us to undertake a re-branding process. We also acquired (a) the copyrights to 41 specified phone books and compilation copyrights to all of the white page, yellow page and other telephone print directory products published by Verizon's Hawaii Business for use by its customers (subject to a license back to GTE in such copyrights), (b) all customer proprietary network information (other than subscriber list information) that relates solely to customers of Verizon's Hawaii Business and (c) a joint ownership interest (with GTE) in the other non-technical proprietary business information relating to Verizon's Hawaii Business. In addition, under the Intellectual Property Agreement we are licensing from GTE all other intellectual property used in the business (other than trademarks, third-party intellectual property and Verizon proprietary software).

Pursuant to the Verizon Proprietary Software License Agreement with GTE, we have nonexclusive, perpetual, internal-use only licenses to use certain Verizon proprietary software (including object and source code) that was used by Verizon in connection with Verizon's Hawaii Business. The software licensed to us consists of numerous back-office systems that were used in various operations of Verizon's Hawaii Business. The software includes, among other things, the assignment, activation and inventory system (AAIS); an automated workforce administration system (AWAS); an FTTP and HSI loop qualification system (LQP); and data exchange utility and connection engine systems (DEU/DEUCE). In addition, Verizon's AIN Service Logic programs are licensed to us perpetually pursuant to the Verizon Proprietary AIN Software License Agreement, entered into in May 2005.

Agreements Relating to Directories Publishing

In November 2007, we completed the sale of our directories publishing business to HYP Media Holdings LLC ("HYP Holdings"), a wholly-owned subsidiary of CBD Investor, Inc. ("CBD"). The sale was made pursuant to the Purchase Agreement dated as of April 29, 2007 among Hawaiian Telcom Communications, Inc., Hawaiian Telcom Services Company, Inc. and HYP Holdings as assignee of CBD, for a cash purchase price of $435.0 million plus certain adjustments related to working capital. In connection with the sale, we transferred the copyrights to our phone books (including those acquired from GTE) to HYP Media LLC, a wholly-owned subsidiary of HYP Holdings, and licensed to HYP Media LLC the right to use several of our trademarks in connection with certain of its directory products. We also entered into continuing commercial arrangements with HYP Media LLC relating to the directory publishing business, including but not limited to a 50-year publishing agreement pursuant to which HYP Media LLC will serve as the exclusive official publisher of telephone directories on behalf of Hawaiian Telcom, Inc. Under this agreement, HYP Media LLC will publish both white and yellow pages print directories under the Hawaiian Telcom® brand. Also as part of this transaction, HYP Media LLC assumed our rights and obligations under our directory services agreement with L.M. Berry and Company, a subsidiary of AT&T. In April 2008, The Berry Company LLC, an affiliate of HYP Media LLC, acquired substantially all the assets of L.M. Berry and Company's Independent Line of Business, including the directory services agreement. In July 2008, HYP Media LLC assigned all its rights under the directory services agreement to HYP Media Finance LLC, an indirect, wholly owned subsidiary of HYP Media LLC. Under the directory services agreement, The Berry Company LLC (as assignee of L.M. Berry and Company), on behalf of HYP Media Finance LLC, is responsible for selling advertising in the Hawaiian Telcom, Inc. print directories as well as for the publication, printing and distribution of the print directories.

18

Agreement Relating to Procurement and Logistics

We entered into a Supply Chain Services Agreement with KGP Logistics, Inc. ("KGP") dated December 7, 2009, pursuant to which KGP provides us with a variety of telecommunications products and handles the logistics with respect to such products, including procurement, shipping, warranty returns and related services such as testing.

We have the ability to purchase a significant portion of our telecommunications equipment from KGP under the agreement. The agreement is non-exclusive and has no minimum purchase requirements. The agreement also contains benchmarking and most-favored-customer provisions that enable us to receive pricing that is roughly equivalent to prices generally available to similarly situated customers in the telecommunications industry. The term of the agreement is two years from December 7, 2009 with the option to extend the agreement for up to three renewal terms of one year each. We may terminate the agreement for convenience at any time upon 180 days notice to KGP.

Agreements Relating to our Wireless Business

Sprint Wireless Agreement

We entered into a Private Label PCS Services Agreement with Sprint, dated as of May 8, 2009, by which we purchase wireless telephone and data services from Sprint and resell those services to our own end users under the Hawaiian Telcom® brand name. This agreement allows us to buy airtime from Sprint at wholesale rates that decline with volume. The agreement has a term of three years and is renewable for up to three additional one-year terms after the initial period.

Other Agreements