Attached files

| file | filename |

|---|---|

| EX-23.4 - CONSENT OF BURR PILGER MAYER, INC. - GigPeak, Inc. | dex234.htm |

| EX-23.2 - CONSENT OF PRICEWATERHOUSECOOPERS LLP - GigPeak, Inc. | dex232.htm |

| EX-23.3 - CONSENT OF GRANT THORNTON LLP - GigPeak, Inc. | dex233.htm |

Table of Contents

As filed with the Securities and Exchange Commission on March 25, 2011

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

GigOptix, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 3674 | 26-2439072 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

2300 Geng Road, Suite 250

Palo Alto, CA 94303

(650) 424-1937

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Avi S. Katz

GigOptix, Inc.

2300 Geng Road, Suite 250

Palo Alto, CA 94303

(650) 424-1937

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Jeffrey C. Selman, Esq.

Nixon Peabody LLP

2 Palo Alto Square

3000 El Camino Real, Suite 500

Palo Alto, CA 94306-2016

(650) 320-7700

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. Yes x No ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. Yes ¨ No ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. Yes ¨ No ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting Company | x | |||

CALCULATION OF REGISTRATION FEE

| Title of securities to be registered |

Amount to be Registered (1) |

Proposed maximum offering price per share (2) |

Proposed maximum aggregate offering price (2) |

Amount of registration fee (2) | ||||

| Common Stock, $0.001 par value (3) |

1,715,161 | $3.04 | $5,214,089 | $605.36 | ||||

| (1) | Pursuant to Rule 416 under the Securities Act, the shares being registered hereunder include such indeterminate number of shares of common stock as may be issuable with respect to the shares being registered hereunder as a result of stock splits, stock dividends or similar transactions. |

| (2) | Estimated pursuant to Rule 457(c) solely for purposes of calculating the registration fee based on the average of the high and low sales prices of the common stock on March 23, 2011, as reported on the Over-the-Counter Bulletin Board. |

| (3) | Reflects shares of common stock being registered for resale by the selling stockholder set forth herein. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. The selling stockholder may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MARCH 25, 2011

Preliminary Prospectus

1,715,161 Shares

GIGOPTIX, INC.

Common Stock

This prospectus relates to the resale of up to 1,715,161 shares of common stock, par value $0.001 per share, of GigOptix, Inc. that may be sold from time to time by the selling stockholder named in this prospectus on page 59. We will not receive any proceeds from the sale of the common stock by the selling stockholder.

The selling stockholder may, from time to time, sell, transfer or otherwise dispose of any or all of its shares of common stock or interests in shares of common stock on any market or trading facility on which our shares are traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices. No underwriter or other person has been engaged to facilitate the sale of shares of our common stock in this offering. We are paying the cost of registering the shares covered by this prospectus as well as various related expenses. The selling stockholder is responsible for all discounts, selling commission and other costs related to the offer and sale of its shares.

Our common stock is currently traded on the Over-the-Counter Bulletin Board (“OTCBB”) under the symbol “GGOX.OB.” On March 23, 2011 the last reported sale price of our common stock on the OTCBB was $3.04 per share.

You should read this prospectus carefully before you invest. Investing in our common stock involves a high degree of risk. See the section entitled “Risk Factors,” beginning on page 5 of this prospectus for risks and uncertainties you should consider before buying shares of our common stock.

None of the Securities and Exchange Commission, any state securities commission, nor any other governmental agency has approved or disapproved of these securities or determined that this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2011

Table of Contents

You should rely only on the information contained in this prospectus and in the documents incorporated by reference herein or any amendment or supplement hereto or any free writing prospectus prepared by us or on our behalf. We have not authorized any other person to provide you with different information. We are not making an offer to sell our common stock in any jurisdiction in which the offer or sale is not permitted. The information contained in this prospectus, the documents incorporated by reference or any free writing prospectus is accurate only as of its date, regardless of the time of delivery of this prospectus or any free writing prospectus or of any sale of the common stock.

Neither we nor any of our officers, directors, agents or representatives make any representation to you about the legality of an investment in our common stock. You should not interpret the contents of this prospectus to be legal, business, investment or tax advice. You should consult with your own advisors for that type of advice and consult with them about the legal, tax, business, financial and other issues that you should consider before investing in our common stock.

Unless the context indicates otherwise, all references in this prospectus to “GigOptix,” “we,” “us,” “our company” and “our” refer to GigOptix, Inc. and its consolidated subsidiaries.

i

Table of Contents

This summary highlights information contained elsewhere in this prospectus and may not contain all of the information that may be important to you. You should read this entire prospectus, as well as the information to which we refer you and the information incorporated by reference herein, before deciding whether to invest in our common stock. You should pay special attention to the “Risk Factors” section of this prospectus to determine whether an investment in our common stock is appropriate for you.

GigOptix, Inc.

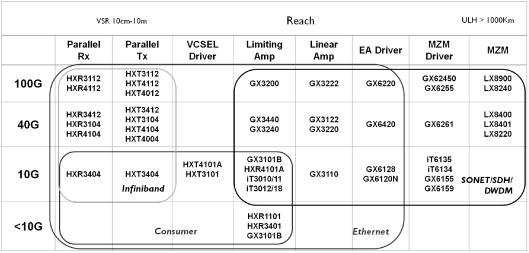

GigOptix is a leading supplier of electronic and electro-optic semiconductor products that enable high speed telecommunications, or telecom, and data-communications, or data-com, networks. Its products amplify, process, convert and modulate signals between electrical and optical formats for transmission and reception of voice, data and video, enabling global network providers to offer “triple play” and other enhanced services. GigOptix has a history of innovation in designing and bringing to market unique technologies in 10Gbps, 40Gbps and the emerging 100Gbps standards, both in parallel and serial applications, spanning from short reach datacenter applications up through ultra long-haul submarine networks. Its digital and analog integrated circuit, or IC, products include broadband amplifiers, low noise receivers, mixed-signal integrated circuits, and monolithic microwave integrated circuits, or MMICs, and GigOptix recently introduced electro-optical thin film polymer on silicon, or TFPS, modulators for ultra-broadband applications. These products offer its customers numerous benefits over those of its competitors including the ability to operate at higher speeds and over wider temperature ranges, consume less power at peak loads, and offer a smaller footprint compared to other products. GigOptix has a global customer base including leading telecommunications and data-communications network equipment systems vendors such as Alcatel-Lucent, Cisco, Finisar, Fujitsu, JDSU, Mitsubishi, Multiplex, Opnext, Source Photonics, ZTE, and other “Tier-One” equipment vendors in the United States, Europe and Asia, as well as leading industrial, aerospace and defense customers such as Adtran, Anritsu, Avocent, Boeing, Hamilton Sundstrand, John Deere, LeCroy, National Instruments, Northrop Grumman, Raytheon and Rockwell-Collins, Rohde & Schwartz, and Teradyne.

GigOptix operates as a fabless company, which means that it outsources the manufacturing of silicon wafers and believe it has positioned itself uniquely given its ability to offer the three key components in a transponder, namely, TFPS-modulators, matching drivers, and receiver amplifiers, thereby solving the challenging issue of component interoperability and allowing a more highly integrated and durable product at a smaller footprint and lower cost.

GigOptix also develops and markets custom application specific integrated circuits, or ASICs, based on GigOptix’ Structured ASIC and Hybrid ASIC platforms. GigOptix has over 60 different designs encompassing analog-to-digital converter, digital-to-analog converters, regulators and various power management functions. These products enable GigOptix to enhance its product offerings to its telecom and data-com network customers, as well as cross-sell its optical components to its defense and aerospace customers. In 2010, GigOptix sold its products to over 100 customers globally.

Industry Background

Over the last 30 years, optical networks using light waves to carry digital packets have systematically replaced electrical networks in data-com and telecom due to their inherent technical advantages that enable higher speeds, denser packing of data, lower cost and reduced energy consumption. Cisco recently estimated in its Visual Networking Index that internet video now accounts for more than one-third of all consumer internet traffic and will account for more than 91% of global consumer Internet traffic by 2013; moreover, Cisco forecasts that global internet protocol, or IP, traffic will continue to grow with a 34% compound annual growth rate, or CAGR, from 2009 to 2014 and that mobile IP traffic will grow at a CAGR of 92% from 2010 to 2015 driven to a large degree by increased use of cloud services and viewing of internet video both over fixed and over mobile networks.

Optical technologies such as Dense Wavelength Division Multiplexing, or DWDM, enable multiple independent data streams to travel over the same length of fiber simultaneously without interfering with each other, greatly expanding the potential throughput of the network. These advantages have driven optical networks from ultra-long haul distances greater than 1000 kilometers (trans-oceanic undersea cables) into short distance applications (metropolitan and enterprise networks) and recently even into distances as small as 30 meters (data centers). Additionally, optical interfaces are in early development for very short-range applications, including chip-to-chip interfaces such as those required by PCs and other consumer electronics that will be designed to take advantage of initiatives such as USB 3.0 and Intel’s Light Peak optical standards, which will surpass the abilities of traditional copper circuitry.

1

Table of Contents

Telecommunications and data-communications network systems vendors are producing optical systems increasingly based on 10Gbps, and are moving to 40Gbps and recently introduced 100Gbps standards. Faced with technological and cost challenges, original equipment manufacturers, or OEMs, are focusing on core competencies of software and systems integration, and are relying on component suppliers, such as GigOptix, to design, develop and supply the critical electronic and electro-optic components to perform the key transmit and receive functions. Moreover, the growing complexity of the components and the need to increase the pace of innovation while reducing costs and energy consumption are driving customers to reduce their number of suppliers and favor vendors with comprehensive product portfolios and deeper product and system expertise. GigOptix expects to meet this challenge to become a strategic part of customers’ early product planning, allowing access to technology development and trends, and increasing the likelihood of garnering meaningful market share.

Based on data from market research firms Ovum and LightCounting, GigOptix expects total worldwide sales of electronic and electro-optic sales of components operating at 10Gbps and above in the telecommunication and data-communication segments to increase from approximately $200 million in 2010 to approximately $800 million in 2015, a CAGR of more than 30%. GigOptix believes it has a growing presence in these markets, while in certain sub-segments, such as optical modulators, GigOptix believes that it will be an early leader due to the superior properties of its proprietary thin film polymer on silicon technology.

Our Key Advantages

We believe that the key advantages of our business include:

| • | Technology Leadership: Our products are built on a strong foundation of semiconductor and electro-optic polymer technologies supported by over 20 years of innovation and research and development experience that has resulted in more than 100 patents awarded and patent applications pending worldwide. Our technology innovation extends from the design of ultra-high speed semiconductor integrated circuits, monolithic microwave integrated circuit design, multi-chip modules, electro-optic thin-film polymer materials, and optical modulator design. Our many years of experience allow us to design solutions that few companies can offer. |

| • | Broad Product Line: We have a comprehensive portfolio of products for telecommunications, data-communications, defense and industrial applications designed for speeds of 10Gbps and beyond. Our products support a wide range of data rates, protocols, transmission distances and industry standards. This wide product offering allows us to serve as a “one-stop shop” to our customers in offering them a comprehensive product arsenal, as well as allowing us to be more cost-effective as we re-utilize pre-existing design building-blocks. |

| • | Superior Performance: Our performance advantage is derived from industry leading drivers, receivers, modulators and superior integration and module design capabilities. Our core III-V and silicon semiconductor, as well TFPS technology knowledge allows us to design products that exceed the current performance, power, size, temperature and reliability requirements of our customers. |

| • | Continuous Innovation: Our customers involve us early in their planning process for new products, resulting in our increased strategic importance to these customers. Our strategic alliances with our customers and contractor manufacturers allowed us to introduce approximately 46 new products to the market over the last two years. |

| • | Fabless Manufacturing Strategy: Our fabless model enables us to leverage outside expertise and infrastructure without significant capital outlays, allowing us to choose the right technology for any given technical problem. We create products using silicon, silicon-germanium, III-V compound semiconductors and electro-optic polymer technologies. |

Our Strategy

Our objective is to be a leading supplier of semiconductor electronic and electro-optic products for high speed optical communications and other applications to systems developers, and to leverage our core competency into other segments such as the wired and wireless communications markets.

Principal elements of our strategy include:

| • | Focus on high growth product and market opportunities in our current markets and expand into new markets utilizing our core technologies and continuous innovation; |

| • | Broaden our strategic relationship with key customers to enable early stage engagement in their product planning, resulting in faster time to market for their next generation products; |

| • | Leverage our broad portfolio of products to enable cost synergies for our customers, but also provide superior performing products through the integration of different technologies; |

2

Table of Contents

| • | Pursue strategic acquisitions that allow us to strengthen our market position, enhance our technology or product base, and/or acquire strategic customer channels and expand our geographic presence; |

| • | Utilize external funding sources, such as state and federal government grants, to continue to improve our products, such as our thin film electro-optical polymer technologies to enable next generation optical components; and |

| • | Partner with electronics contract manufacturers, or ECMs, to accelerate introduction of advanced integrated components to our customers. |

Our business is subject to numerous risks that are highlighted in the section entitled “Risk Factors” immediately following this prospectus summary. These risks, among others, represent challenges to the successful implementation of our strategy and to the growth and future profitability of our business. Some of these risks are:

| • | we depend on a limited number of customers for a substantial portion of our revenue; |

| • | we rely on third parties for our manufacturing operations, including wafer fabrication, assembly and test; |

| • | we are a market leader and face intense competition and expect competition to increase in the future; |

| • | we need to develop and introduce new or enhanced products on a timely basis; |

| • | we need to penetrate new and existing markets in order to continue to grow our business; and |

| • | we are a rapidly growing company, with almost 4 years of operational history. |

Corporate History

GigOptix, Inc., the successor to GigOptix LLC, was formed as a Delaware corporation in March 2008 in order to facilitate a combination between GigOptix LLC and Lumera Corporation (Lumera). Before the combination, GigOptix LLC acquired the assets of iTerra Communications LLC in July 2007 (iTerra) and Helix Semiconductors AG (Helix) in January 2008. On November 9, 2009, GigOptix acquired ChipX, Incorporated (ChipX). As a result of the acquisitions, Helix, Lumera and ChipX all became wholly owned subsidiaries of GigOptix. On February 4, 2011, GigOptix, Endwave Corporation, a Delaware corporation (Endwave) and Aerie Acquisition Corporation, a Delaware corporation and wholly-owned subsidiary of GigOptix (Merger Subsidiary), entered into an Agreement and Plan of Merger (the Merger Agreement) pursuant to which Merger Subsidiary will, subject to the satisfaction or waiver of the conditions therein, merge with and into Endwave, the separate corporate existence of Merger Subsidiary shall cease and Endwave will be the successor or surviving corporation of the merger and a wholly-owned subsidiary of GigOptix. We have included audited financial statements of Endwave for the years ended December 31, 2008, December 31, 2009 and December 31, 2010. We have also included unaudited pro forma financial information reflecting the merger in this prospectus. See “Unaudited Pro Forma Condensed Combined Financial Data.”

Corporate Information

Our principal executive offices are located at 2300 Geng Rd, Suite 250, Palo Alto, CA 94303 and our telephone number is (650) 424-1937. Our Internet address is www.gigoptix.com. Information contained on our website does not constitute part of this prospectus.

The names “GigOptix” and “Lumera” and “ChipX” are our registered trademarks. All other trademarks and trade names appearing in this prospectus are the property of their respective owners.

3

Table of Contents

Summary of the Offering

| Common stock offered | 1,715,161 shares of common stock, $0.001 par value per share, offered by the selling stockholder. | |

| Common stock outstanding after the offering(1) | 12,343,071 shares | |

| Use of proceeds | We will not receive any of the proceeds from the sale of the common stock by the selling stockholder. | |

| Over-the-Counter Bulletin Board Symbol | GGOX.OB | |

| Risk factors | Investing in our common stock involves a number of risks. Before investing, you should carefully consider the information set forth under “Risk Factors,” beginning on page 5 of this prospectus, for a discussion of the risks related to an investment in our common stock. | |

| (1) | The number of shares of common stock outstanding after this offering includes 12,343,071 shares outstanding as of March 23, 2011, but does not include: |

| • | 7,472,993 shares reserved for issuance upon exercise of stock options with a weighted-average exercise price of $2.60 per share, which have been granted and remained outstanding; |

| • | 1,917,632 shares underlying currently outstanding warrants; |

| • | 3,078,905 shares issuable under our stock option plan; and |

| • | Such number of shares to be issued upon consummation of the merger with Endwave, which as of March 2, 2011 was estimated to be 9,157,293 shares. |

4

Table of Contents

Investing in our common stock involves risk. In deciding whether to invest in our common stock, you should carefully consider the following risks, which should be read together with our other disclosures in this prospectus and in the documents we incorporate by reference. These risks could materially affect our business, results of operations or financial condition and cause the trading price of our common stock to decline. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties that we are unaware of, or that we currently deem immaterial, also may become important factors that affect us. If any of the following risks occur, our business, financial condition or results of operations could be materially and adversely affected. In that case, the value of our common stock could decline and you could lose part or all of your investment.

Risks Related to Our Business

We and our predecessors have incurred substantial operating losses in the past and we may not be able to achieve profitability in the future.

We have incurred negative cash flows from operations since inception. For the years ended December 31, 2010 and 2009, we incurred net losses of $4.4 million and $10.0 million, respectively, and cash outflows from operations of $3.8 million and $4.1 million, respectively. As of December 31, 2010 and 2009, we had an accumulated deficit of $73.4 million and $69.0 million, respectively. We expect development, sales and other operating expenses to increase in the future as we expand our business. If our revenue does not grow to offset these expected increased expenses, we may not be profitable. In fact, in future quarters we may not have any revenue growth and our revenues could decline. Furthermore, if our operating expenses exceed expectations, financial performance will be adversely affected and we may continue to incur significant losses in the future.

In addition, we acquired ChipX in November 2009. ChipX incurred net losses of $5.7 million for the year ended December 31, 2008 and an additional net loss of $3.3 million for the period from January 1, 2009 through the date of acquisition of November 9, 2009.

We may require additional capital to continue to fund our operations. If we need but do not obtain additional capital, we may be required to substantially limit operations.

We may not generate sufficient cash needed to finance our anticipated operations for the foreseeable future from such operations. Accordingly, we may seek funding through public or private financings, including equity financings, and through other arrangements

5

Table of Contents

including collaborations. We could require additional financing sooner than expected if we have poor financial results, including unanticipated expenses, or an unanticipated drop in projected revenues. Such financing may be unavailable when needed or may not be available on acceptable terms. If we raise additional funds by issuing equity or convertible debt securities, the percentage ownership of our current stockholders will be reduced, and these securities may have rights superior to those of our common stock. If adequate funds are not available to satisfy either short-term or long-term capital requirements, or if planned revenues are not generated, we may be required to limit our operations substantially. These limitations of operations may include a possible sale or shutdown of portions of our business, reductions in capital expenditures and reductions in staff and discretionary costs.

We have incurred negative cash flows from operations since inception. For the years ended December 31, 2010 and 2009, we incurred net losses of $4.4 million and $10.0 million, respectively, and cash outflows from operations of $3.8 million and $4.1 million, respectively. As of December 31, 2010 and 2009, we had an accumulated deficit of $73.4 million and $69.0 million, respectively. We have incurred significant losses since inception, attributable to our efforts to design and commercialize our products. We have managed our liquidity during this time through a series of cost reduction initiatives and through increasing our line of credit with our bank. Our ability to continue as a going concern is dependent on many events outside of our direct control, including, among other things, obtaining additional financing either privately or through public markets and consumers’ purchasing our products in substantially higher volumes. During 2010, we raised approximately $3.9 million in additional equity capital from institutional investors which stabilized our cash position. We have used that cash to substantially reduce our outstanding accounts payable and accrued expenses balances. In addition, we have access to a line of credit with Silicon Valley Bank which enables us to borrow up to $3 million based on 80% of eligible invoiced amounts to customers. We also were close to breakeven, incurring a loss of $97,000, on an operating income basis in the fourth quarter of 2010. Additionally, our pending merger with Endwave upon closing will provide us with additional cash and equivalents which should mitigate near-term liquidity issues. Based on these events and factors we believe that our cash, cash from operations and our line of credit will be sufficient for at least the next 12 months.

We may fail to realize the anticipated benefits of our mergers with ChipX and Lumera, and our pending merger with Endwave.

Our future success will depend in significant part on our ability to utilize Endwave’s cash and cash equivalents and to realize the cost savings, operating efficiencies and new revenue opportunities that are expected to result from the integration of the GigOptix, Lumera, ChipX and Endwave businesses. Our operating results and financial condition will be adversely affected if we are unable to integrate successfully the operations of GigOptix, Lumera, ChipX and Endwave, fail to achieve or achieve on a timely basis such cost savings, operating efficiencies and new revenue opportunities, or incur unforeseen costs and expenses or experience unexpected operating difficulties that offset anticipated cost savings. In particular, the integration of GigOptix, Lumera, ChipX and Endwave may involve, among other matters, integration of sales, marketing, billing, accounting, quality control, management, personnel, payroll, regulatory compliance, network infrastructure and other systems and operating hardware and software, some of which may be incompatible and therefore may need to be replaced.

Any estimates of cost savings are based upon our assumptions concerning a number of factors, including operating efficiencies, the consolidation of functions, and the integration of operations, systems, marketing methods and procedures. These assumptions are uncertain and are subject to significant business, economic and competitive conditions that are difficult to predict and are often beyond our control.

Endwave will be subject to business uncertainties and contractual restrictions while the merger is pending that could adversely affect its business.

Uncertainty about the effect of the merger on employees and customers may have an adverse effect on Endwave and consequently on us following the merger. These uncertainties may impair each company’s ability to attract, retain and motivate key personnel until the merger is completed and for a period of time thereafter, and could cause customers, suppliers and others that deal with Endwave to seek to change existing business relationships with Endwave. Employee retention may be particularly challenging during the pendency of the merger, as employees may experience uncertainty about their future roles with Endwave. If, despite Endwave’s retention efforts, key employees depart because of issues relating to the uncertainty and difficulty of integration or a desire not to remain with Endwave, Endwave’s business and consequently the our business following the merger could be seriously harmed.

Failure to complete the merger could negatively affect us and Endwave.

If the merger is not completed for any reason, we and Endwave may be subject to a number of material risks, including the following:

| • | the companies will not realize the benefits expected from becoming part of a combined company, including a potentially enhanced competitive and financial position; |

6

Table of Contents

| • | the trading price of each company’s common stock may decline to the extent that the current market price of the common stock reflects a market assumption that the merger will be completed; and |

| • | some costs related to the merger, such as legal, accounting and some financial advisory fees, must be paid even if the merger is not completed. |

Our strategy of growth through acquisition could harm our business.

It is our intent to continue to grow through strategic acquisitions. Successful integration of newly acquired target companies may place a significant burden on our management and internal resources. The diversion of management’s attention and any difficulties encountered in the transition and integration processes could harm our business, financial condition and operating results. In addition, we may be unable to execute our acquisition strategy, resulting in under-utilized resources and a failure to achieve anticipated growth.

We face intense competition and expect competition to increase in the future, which could have an adverse effect on our revenue, revenue growth rate, if any, and market share.

The global semiconductor market in general is highly competitive. We compete in different target markets to various degrees on the basis of a number of principal competitive factors, including our products’ performance, features and functionality, energy efficiency, size, ease of system design, customer support, products, reputation, reliability and price, as well as on the basis of our customer support, the quality of our product roadmap and our reputation. We expect competition to increase and intensify as more and larger semiconductor companies as well as the internal resources of large, integrated original equipment manufacturers or OEMs, enter our markets. Increased competition could result in price pressure, reduced profitability and loss of market share, any of which could materially and adversely affect our business, revenue, revenue growth rates and operating results.

Our competitors range from large, international companies offering a wide range of semiconductor products to smaller companies specializing in narrow markets and internal engineering groups within device manufacturers, some of which may be our customers. Our primary competitors include Triquint, Vitesse, Oki, Inphi and Gennum. We expect competition in the markets in which we participate to increase in the future as existing competitors improve or expand their product offerings. In addition, we believe that a number of other public and private companies are in the process of developing competing products for digital television and other broadband communication applications. Because our products often are “building block” semiconductors that provide functions that in some cases can be integrated into more complex integrated circuits, we also face competition from manufacturers of integrated circuits, some of which may be existing customers that develop their own integrated circuit products.

Our ability to compete successfully depends on elements both within and outside of our control, including industry and general economic trends. During past periods of downturns in our industry, competition in the markets in which we operate intensified as manufacturers of semiconductors reduced prices in order to combat production overcapacity and high inventory levels. Many of our competitors have substantially greater financial and other resources with which to withstand similar adverse economic or market conditions in the future. Moreover, the competitive landscape is changing as a result of consolidation within our industry as some of our competitors have merged with or been acquired by other competitors, and other competitors have begun to collaborate with each other. These developments may materially and adversely affect our current and future target markets and our ability to compete successfully in those markets.

If we fail to develop and introduce new or enhanced products on a timely basis, our ability to attract and retain customers could be impaired and our competitive position could be harmed.

We operate in a dynamic environment characterized by rapidly changing technologies and industry standards and technological obsolescence. To compete successfully, we must design, develop, market and sell new or enhanced products that provide increasingly higher levels of performance and reliability and meet the cost expectations of our customers. The introduction of new products by our competitors, the market acceptance of products based on new or alternative technologies, or the emergence of new industry standards could render our existing or future products obsolete. Our failure to anticipate or timely develop new or enhanced products or technologies in response to technological shifts could result in decreased revenue. In particular, we may experience difficulties with product design, manufacturing, marketing or certification that could delay or prevent our development, introduction or marketing of new or enhanced products. If we fail to introduce new or enhanced products that meet the needs of our customers or penetrate new markets in a timely fashion, we will lose market share and our operating results will be adversely affected.

We rely on a limited number of third parties to manufacture, assemble and test our products, and the failure to manage our relationships with our third-party contractors successfully could adversely affect our ability to market and sell our products.

We do not have our own manufacturing facilities. We operate an outsourced manufacturing business model that utilizes third-party foundry and assembly and test capabilities. As a result, we rely on third-party foundry wafer fabrication and assembly and test

7

Table of Contents

capacity, including sole sourcing, for many components or products. Currently, our semiconductor devices are manufactured by foundries operated by IBM, Win, Triquint, UMC and SEI. We also use third-party contractors for all of our assembly and test operations, including Bourns, Spel, IMT and Sanmina SCI.

Relying on third party manufacturing, assembly and testing presents significant risks to us, including the following:

| • | failure by us, or our customers or their end customers to qualify a selected supplier; |

| • | capacity shortages during periods of high demand; |

| • | reduced control over delivery schedules and quality; |

| • | shortages of materials and potential lack of adequate capacity during periods of excess demand; |

| • | misappropriation of our intellectual property; |

| • | limited warranties on wafers or products supplied to us; |

| • | potential increases in prices; |

| • | inadequate manufacturing yields and excessive costs; |

| • | difficulties selecting and integrating new subcontractors; and |

| • | potential instability in countries where third-party manufacturers are located. |

The ability and willingness of our third-party contractors to perform is largely outside our control. If one or more of our contract manufacturers or other outsourcers fails to perform its obligations in a timely manner or at satisfactory quality levels, our ability to bring products to market and our reputation could suffer. For example, in the event that manufacturing capacity is reduced or eliminated at one or more facilities, including as a response to the recent worldwide decline in the semiconductor industry, manufacturing could be disrupted, we could have difficulties fulfilling our customer orders and our net revenue could decline. In addition, if these third parties fail to deliver quality products and components on time and at reasonable prices, we could have difficulties fulfilling our customer orders, our net revenue could decline and our business, financial condition and results of operations would be adversely affected.

We do not have any long-term supply contracts with our contract manufacturers or suppliers, and any disruption in our supply of products or materials could have a material adverse effect on our business, revenue and operating results.

We currently do not have long-term supply contracts with any of our third-party vendors. We make substantially all of our purchases on a purchase order basis, and our contract manufacturers are not required to supply us products for any specific period or in any specific quantity. We expect that it would take approximately nine to twelve months to transition performance of our foundry or assembly services to new providers. Such a transition would likely require a qualification process by our customers or their end customers. We generally place orders for products with some of our suppliers approximately four to five months prior to the anticipated delivery date, with order volumes based on our forecasts of demand from our customers. Accordingly, if we inaccurately forecast demand for our products, we may be unable to obtain adequate and cost-effective foundry or assembly capacity from our third-party contractors to meet our customers’ delivery requirements, or we may accumulate excess inventories. Our third-party contractors have not provided any assurance to us that adequate capacity will be available to us within the time required to meet additional demand for our products.

Average selling prices of our products could decrease rapidly, which could have a material adverse effect on our revenue and gross margins.

We may experience substantial period-to-period fluctuations in future operating results due to the erosion of our average selling prices. From time to time, we have reduced the average unit price of our products in anticipation of competitive pricing pressures, new product introductions by us or our competitors and for other reasons. We expect that we will have to do so again in the future. If we are unable to offset any reductions in our average selling prices by increasing our sales volumes or introducing new products with higher operating margins, our revenue and gross margins will suffer. To maintain our gross margins, we must develop and introduce new products and product enhancements on a timely basis and continually reduce our and our customers’ costs. Failure to do so would cause our revenue and gross margins to decline.

8

Table of Contents

Due to our limited operating history, we may have difficulty accurately predicting our future revenue and appropriately budgeting our expenses.

We were incorporated in 2008 and have only a limited operating history from which to predict future revenue. This limited operating experience, combined with the rapidly evolving nature of the markets in which we sell our products, substantial uncertainty concerning how these markets may develop and other factors beyond our control, reduces our ability to accurately forecast quarterly or annual revenue. We are currently expanding our staffing and increasing our expense levels in anticipation of future revenue growth. If our revenue does not increase as anticipated, we could incur significant losses due to our higher expense levels if we are not able to decrease our expenses in a timely manner to offset any shortfall in future revenue.

Our customers require our products and our third-party contractors to undergo a lengthy and expensive qualification process which may delay and does not assure product sales.

Prior to purchasing our products, our customers require that both our products and our third-party contractors undergo extensive qualification processes, which involve testing of the products in the customer’s system and rigorous reliability testing. This qualification process may continue for six months or more. However, qualification of a product by a customer does not assure any sales of the product to that customer. Even after successful qualification and sales of a product to a customer, a subsequent revision to the product, changes in our customer’s manufacturing process or our selection of a new supplier may require a new qualification process, which may result in delays and in us holding excess or obsolete inventory. After our products are qualified, it can take an additional six months or more before the customer commences volume production of components or devices that incorporate our products. Despite these uncertainties, we devote substantial resources, including design, engineering, sales, marketing and management efforts, to qualifying our products with customers in anticipation of sales. If we are unsuccessful or delayed in qualifying any of our products with a customer, sales of this product to the customer may be precluded or delayed, which may impede our growth and cause our business to suffer.

We are subject to order and shipment uncertainties, and differences between our estimates of customer demand and product mix and our actual results could negatively affect our inventory levels, sales and operating results.

Our revenue is generated on the basis of purchase orders with our customers rather than long-term purchase commitments. In addition, our customers can cancel purchase orders or defer the shipments of our products under certain circumstances. Our products are manufactured using a silicon foundry according to our estimates of customer demand, which requires us to make separate demand forecast assumptions for every customer, each of which may introduce significant variability into our aggregate estimate. We have limited visibility into future customer demand and the product mix that our customers will require, which could adversely affect our revenue forecasts and operating margins. Moreover, because our target markets are relatively new, many of our customers have difficulty accurately forecasting their product requirements and estimating the timing of their new product introductions, which ultimately affects their demand for our products. In addition, the rapid pace of innovation in our industry could render significant portions of our inventory obsolete. Excess or obsolete inventory levels could result in unexpected expenses or increases in our reserves that could adversely affect our business, operating results and financial condition. Conversely, if we were to underestimate customer demand or if sufficient manufacturing capacity were unavailable, we could forego revenue opportunities, potentially lose market share and damage our customer relationships. In addition, any significant future cancellations or deferrals of product orders or the return of previously sold products due to manufacturing defects could materially and adversely impact our profit margins, increase our write-offs due to product obsolescence and restrict our ability to fund our operations.

Winning business is subject to lengthy competitive selection processes that require us to incur significant expenditures. Even if we begin a product design, a customer may decide to cancel or change its product plans, which could cause us to generate no revenue from a product and adversely affect our results of operations.

The selection process for obtaining new business typically is lengthy and can require us to incur significant design and development expenditures and dedicate scarce engineering resources in pursuit of a single customer opportunity. We may not win the competitive selection process and may never generate any revenue despite incurring significant design and development expenditures. These risks are exacerbated by the fact that some of our customers’ products likely will have short life cycles. Failure to obtain business in a new product design could prevent us from offering an entire generation of a product, even though this has not occurred to date. This could cause us to lose revenue and require us to write off obsolete inventory, and could weaken our position in future competitive selection processes.

After securing new business, we may experience delays in generating revenue from our products as a result of the lengthy development cycle typically required. Our customers generally take a considerable amount of time to evaluate our products. The typical time from early engagement by our sales force to actual product introduction could run from 12 to 24 months. The delays inherent in these lengthy sales cycles increase the risk that a customer will decide to cancel, curtail, reduce or delay its product plans,

9

Table of Contents

causing us to lose anticipated sales. In addition, any delay or cancellation of a customer’s plans could materially and adversely affect our financial results, as we may have incurred significant expense and generated no revenue. Finally, our customers’ failure to successfully market and sell their products could reduce demand for our products and materially and adversely affect our business, financial condition and results of operations. If we were unable to generate revenue after incurring substantial expenses to develop any of our products, our business would suffer.

Many of our products will have long sales cycles, which may cause us to expend resources without an acceptable financial return and which makes it difficult to plan our expenses and forecast our revenue.

Many of our products will have long sales cycles that involve numerous steps, including initial customer contacts, specification writing, engineering design, prototype fabrication, pilot testing, regulatory approvals (if needed), sales and marketing and commercial manufacture. During this time, we may expend substantial financial resources and management time and effort without any assurance that product sales will result. The anticipated long sales cycle for some of our products makes it difficult to predict the quarter in which sales may occur. Delays in sales may cause us to expend resources without an acceptable financial return and make it difficult to plan expenses and forecast revenues.

We are subject to the cyclical nature of the semiconductor industry.

The semiconductor industry is highly cyclical and is characterized by constant and rapid technological change, rapid product obsolescence and price erosion, evolving standards, short product life cycles and wide fluctuations in product supply and demand. The industry is experiencing a significant downturn during the current global recession. These downturns have been characterized by diminished product demand, production overcapacity, high inventory levels and accelerated erosion of average selling prices. The current downturn and any future downturns could have a material adverse effect on our business and operating results. Furthermore, any upturn in the semiconductor industry could result in increased competition for access to third-party foundry and assembly capacity. We are dependent on the availability of this capacity to manufacture and assemble our products, and our third-party manufacturers have not provided assurances that adequate capacity will be available to us in the future.

A large proportion of our products are directed at the telecommunications and data communications markets that continue to be subject to overcapacity.

The technology equipment industry is cyclical and has experienced significant and extended downturns in the past, often in connection with, or in anticipation of, maturing product cycles, and capital spending cycles and declines in general economic conditions. The cyclical nature of these markets has led to significant imbalances in demand, inventory levels and production capacity. It has also accelerated the decrease of average selling prices per unit. We may experience periodic fluctuations in our financial results because of these or other industry-wide conditions. Developments that adversely affect the telecommunications or data communications markets, including delays in traffic growth and changes in U.S. government regulation, could halt our efforts to generate revenue or cause revenue growth to be slower than anticipated from sales of electro-optic modulators, semiconductors and related products. Reduced spending and technology investment by telecommunications companies may make it more difficult for our products to gain market acceptance. Our potential customers may be less willing to purchase new technology such as our technology or invest in new technology development when they have reduced capital expenditure budgets.

We derive a significant portion of our revenue from a small number of customers and the loss of one or more of these key customers, the diminished demand for our products from a key customer, or the failure to obtain certifications from a key customer or its distribution channel could significantly reduce our revenue and profits.

A relatively small number of customers account for a significant portion of our revenue in any particular period. For instance, Alcatel-Lucent and contracts with the U.S. government accounted for 11% and 14%, respectively, of our revenue for fiscal year 2010. One or more of our key customers may discontinue operations as a result of consolidation, liquidation or otherwise, or reduce significantly its business with us due to the current economic conditions. Reductions, delays and cancellation of orders from our key customers or the loss of one or more key customers could significantly further reduce our revenue and profits. There is no assurance that our current customers will continue to place orders with us, that orders by existing customers will continue at current or historical levels or that we will be able to obtain orders from new customers.

We rely on a small number of development contracts with the U.S. Department of Defense and government contractors for a large portion of our revenue. The termination or non-renewal of one or more of these contracts could reduce our future revenue.

Fourteen percent of our revenue for the year ended December 31, 2010 was derived from performance on a limited number of development contracts with various agencies within the U.S. government. Any failure by us to continue these relationships or

10

Table of Contents

significant disruption or deterioration of our relationship with the U.S. Department of Defense may reduce revenues. Government programs must compete with programs managed by other contractors for limited and uncertain levels of funding. The total amount and levels of funding are susceptible to significant fluctuations on a year-to-year basis. Our competitors frequently engage in efforts to expand their business relationships with the government and are likely to continue these efforts in the future. In addition, our development contracts with government agencies are subject to potential profit and cost limitations and standard provisions that allow the U.S. government to terminate such contracts at any time at its convenience. Termination of these development contracts, a shift in government spending to other programs in which we are not involved, or a reduction in government spending generally or defense spending specifically could severely harm our business. We intend to continue to compete for government contracts and expect such contracts will be a large percentage of our revenue for the foreseeable future. The development contracts in place with various agencies within the U.S. Department of Defense require ongoing compliance with applicable federal procurement regulations. Violations of these regulations can result in civil, criminal or administrative proceedings involving fines, compensatory and punitive damages, restitution and forfeitures, as well as suspensions or prohibitions from entering into such development contracts. Also, the reporting and appropriateness of costs and expenses under these development contracts are subject to extensive regulation and audit by the Defense Contract Audit Agency (DCAA), an agency of the U.S. Department of Defense. In addition, we obtain provisional billing rates from the DCAA to bill under government contracts. Any differences between provisional billing rates and actual billed rates may result in an adjustment to revenue Any failure to comply with applicable government regulations could jeopardize our development contracts and otherwise harm our business.

Our future success depends in part on the continued service of our key senior management, design engineering, sales, marketing, and technical personnel and our ability to identify, hire and retain additional, qualified personnel.

Our future success depends to a significant extent upon the continued service of our senior management personnel, including our Chief Executive Officer, Dr. Avi Katz and our Chief Technical Officer, Andrea Betti-Berutto. We do not maintain key person life insurance on any of our executive officers and do not intend to purchase any in the future. The loss of key senior executives could have a material adverse effect on our business. There is intense competition for qualified personnel in the semiconductor and polymer industries, and we may not be able to continue to attract and retain engineers or other qualified personnel necessary for the development of our business, or to replace engineers or other qualified personnel who may leave our employment in the future. There may be significant costs associated with recruiting, hiring and retaining personnel. Periods of contraction in our business may inhibit our ability to attract and retain our personnel. Loss of the services of, or failure to recruit, key design engineers or other technical and management personnel could be significantly detrimental to our product development or other aspects of our business.

We are subject to the risks frequently experienced by early stage companies.

The likelihood of our success must be considered in light of the risks frequently encountered by early stage companies, especially those formed to develop and market new technologies. These risks include our potential inability to:

| • | establish product sales and marketing capabilities; |

| • | establish and maintain markets for our potential products; |

| • | identify, attract, retain and motivate qualified personnel; |

| • | continue to develop and upgrade our technologies to keep pace with changes in technology and the growth of markets using semiconductors and polymer materials; |

| • | develop expanded product production facilities and outside contractor relationships; |

| • | maintain our reputation and build trust with customers; |

| • | improve existing and implement new transaction processing, operational and financial systems; |

| • | scale up from small pilot or prototype quantities to large quantities of product on a consistent basis; |

| • | contract for or develop the internal skills needed to master large volume production of our products; and |

| • | fund the capital expenditures required to develop volume production due to the limits of available financial resources. |

Our future growth will suffer if we do not achieve sufficient market acceptance of our products.

Our success depends, in part, upon our ability to maintain and gain market acceptance of our products. To be accepted, these products must meet the quality, technical performance and price requirements of our customers and potential customers. The optical communications industry is currently fragmented with many competitors developing different technologies. Some of these technologies may not gain market acceptance. Our products, including products based on polymer materials, may not be accepted by

11

Table of Contents

OEMs and systems integrators of optical communications networks and consumer electronics. In addition, even if we achieve some degree of market acceptance for our potential products in one industry, we may not achieve market acceptance in other industries for which we are developing products, which market acceptance is critical to meeting our financial targets.

Many of our current products, particularly those based on polymer technology, are either in the development stage or are being tested by potential customers. We cannot be assured that our development efforts or customer tests will be successful or that they will result in actual material sales, or that such products will be commercially viable.

Achieving market acceptance for our products will require marketing efforts and the expenditure of financial and other resources to create product awareness and demand by customers. It will also require the ability to provide excellent customer service. We may be unable to offer products that compete effectively due to our limited resources and operating history. Also, certain large corporations may be predisposed against doing business with a company of our limited size and operating history. Failure to achieve broad acceptance of our products by customers and to compete effectively would harm our operating results.

Successful commercialization of current and future products will require us to maintain a high level of technical expertise.

Technology in our target markets is undergoing rapid change. To succeed in these target markets, we will have to establish and maintain a leadership position in the technology supporting those markets. Accordingly, our success will depend on our ability to:

| • | accurately predict the needs of target customers and develop, in a timely manner, the technology required to support those needs; |

| • | provide products that are not only technologically sophisticated but are also available at a price acceptable to customers and competitive with comparable products; |

| • | establish and effectively defend our intellectual property; and |

| • | enter into relationships with other companies that have developed complementary technology into which our products may be integrated. |

We cannot assure you that we will be able to achieve any of these objectives.

The failure to compete successfully could harm our business.

We face competitive pressures from a variety of companies in our target markets. The telecom, data-com and consumer opto-electronics markets are highly competitive and we expect that domestic and international competition will increase in these markets, due in part to deregulation, rapid technological advances, price erosion, changing customer preferences and evolving industry standards. Increased competition could result in significant price competition, reduced revenues or lower profit margins. Many of our competitors and potential competitors have or may have substantially greater research and product development capabilities, financial, scientific, marketing, and manufacturing and human resources, name recognition and experience than we do. As a result, these competitors may:

| • | succeed in developing products that are equal to or superior to our products or that will achieve greater market acceptance than our products; |

| • | devote greater resources to developing, marketing or selling their products; |

| • | respond more quickly to new or emerging technologies or scientific advances and changes in customer requirements, which could render our technologies or potential products obsolete; |

| • | introduce products that make the continued development of our potential products uneconomical; |

| • | obtain patents that block or otherwise inhibit our ability to develop and commercialize potential products; |

| • | withstand price competition more successfully than us; |

| • | establish cooperative relationships among themselves or with third parties that enhance their ability to address the needs of prospective customers better than us; and |

| • | take advantage of acquisitions or other opportunities more readily than us. |

Competitors may offer enhancements to existing products, or offer new products based on new technologies, industry standards or customer requirements that are available to customers on a more timely basis than comparable products from our company or that

12

Table of Contents

have the potential to replace or provide lower cost alternatives to our products. The introduction of enhancements or new products by competitors could render our existing and future products obsolete or unmarketable. Each of these factors could have a material adverse effect on our company’s business, financial condition and results of operations.

We may be unable to obtain effective intellectual property protection for our potential products and technology.

Any intellectual property that we have or may acquire, license or develop in the future may not provide meaningful competitive advantages. Our patents and patent applications, including those we license, may be challenged by competitors, and the rights granted under such patents or patent applications may not provide meaningful proprietary protection. For example, there are patents held by third parties that relate to polymer materials and electro-optic devices. These patents could be used as a basis to challenge the validity or limit the scope of our patents or patent applications. A successful challenge to the validity or limitation of the scope of our patents or patent applications could limit our ability to commercialize the technology and, consequently, reduce revenues.

Moreover, competitors may infringe our patents or those that we license, or successfully avoid these patents through design innovation. To combat infringement or unauthorized use, we may need to resort to litigation, which can be expensive and time-consuming and may not succeed in protecting our proprietary rights. In addition, in an infringement proceeding, a court may decide that our patents or other intellectual property rights are not valid or are unenforceable, or may refuse to stop the other party from using the intellectual property at issue on the ground that it is non-infringing. Policing unauthorized use of our intellectual property is difficult and expensive, and we may not be able to, or have the resources to, prevent misappropriation of our proprietary rights, particularly in countries where the laws may not protect these rights as fully as the laws of the United States.

We also rely on the law of trade secrets to protect unpatented technology and know-how. We try to protect this technology and know-how by limiting access to those employees, contractors and strategic partners with a need to know this information and by entering into confidentiality agreements with these parties. Any of these parties could breach the agreements and disclose our trade secrets or confidential information to competitors, or such competitors might learn of the information in other ways. Disclosure of any trade secret not protected by a patent could materially harm our business.

We may be subject to patent infringement claims, which could result in substantial costs and liability and prevent us from commercializing potential products.

Third parties may claim that our potential products or related technologies infringe their patents. Any patent infringement claims brought against us may cause us to incur significant expenses, divert the attention of management and key personnel from other business concerns and, if successfully asserted, require us to pay substantial damages. In addition, as a result of a patent infringement suit, we may be forced to stop or delay developing, manufacturing or selling potential products that are claimed to infringe a patent covering a third party’s intellectual property unless that party grants us rights to use its intellectual property. We may be unable to obtain these rights on acceptable terms, if at all. Even if we are able to obtain rights to a third party’s patented intellectual property, these rights may be non-exclusive, and therefore competitors may obtain access to the same intellectual property. Ultimately, we may be unable to commercialize our potential products or may have to cease some business operations as a result of patent infringement claims, which could severely harm our business.

If our potential products infringe the intellectual property rights of others, we may be required to indemnify customers for any damages they suffer. Third parties may assert infringement claims against our current or potential customers. These claims may require us to initiate or defend protracted and costly litigation on behalf of customers, regardless of the merits of these claims. If any of these claims succeed, we may be forced to pay damages on behalf of these customers or may be required to obtain licenses for the products they use. If we cannot obtain all necessary licenses on commercially reasonable terms, we may be unable to continue selling such products.

The technology that we license from various third parties may be subject to government rights and retained rights of the originating research institution.

We license technology from various companies or research institutions, such as the University of Washington. Many of these partners and licensors have obligations to government agencies or universities. Under their agreements, a government agency or university may obtain certain rights over the technology that we have developed and licensed, including the right to require that a compulsory license be granted to one or more third parties selected by the government agency.

In addition, our partners often retain certain rights under their licensing agreements, including the right to use the technology for noncommercial academic and research use, to publish general scientific findings from research related to the technology, and to make

13

Table of Contents

customary scientific and scholarly disclosures of information relating to the technology. It is difficult to monitor whether such partners limit their use of the technology to these uses, and we could incur substantial expenses to enforce our rights to this licensed technology in the event of misuse.

If we fail to develop and maintain the quality of our manufacturing processes, our operating results would be harmed.

The manufacture of our products is a multi-stage process that requires the use of high-quality materials and advanced manufacturing technologies. With respect to our polymer-based products, polymer-related device development and manufacturing must occur in a highly controlled, clean environment to minimize particles and other yield- and quality-limiting contaminants. In spite of stringent quality controls, weaknesses in process control or minute impurities in materials may cause a substantial percentage of a product in a lot to be defective. If we are unable to develop and continue to improve on our manufacturing processes or to maintain stringent quality controls, or if contamination problems arise, our operating results would be harmed.

The complexity of our products may lead to errors, defects and bugs, which could result in the necessity to redesign products and could negatively impact our reputation with customers.

Products as complex as ours may contain errors, defects and bugs when first introduced or as new versions are released. Delivery of products with production defects or reliability, quality or compatibility problems could significantly delay or hinder market acceptance of our products or result in a costly recall and could damage our reputation and adversely affect our ability to retain existing customers and to attract new customers. In particular, certain products are customized or designed for integration into specific network systems. If our products experience defects, we may need to undertake a redesign of the product, a process that may result in significant additional expenses.

We may also be required to make significant expenditures of capital and resources to resolve such problems. There is no assurance that problems will not be found in new products after commencement of commercial production, despite testing by us, our suppliers and our customers.

We could be exposed to significant product liability claims that could be time-consuming and costly and impair our ability to obtain and maintain insurance coverage.

We may be subject to product liability claims if any of our products are alleged to be defective or harmful. Product liability claims or other claims related to our potential products, regardless of their outcome, could require us to spend significant time and money in litigation, divert management’s time and attention from other business concerns, require us to pay significant damages, harm our reputation or hinder acceptance of our products. Any successful product liability claim may prevent us from obtaining adequate product liability insurance in the future on commercially reasonable terms. Any inability to obtain sufficient insurance coverage at an acceptable cost or otherwise to protect against potential product liability claims could impair our ability to commercialize our products. In addition, certain of our products are sold under warranties. The failure of our products to meet the standards set forth in such warranties could result in significant expenses to us.

If we fail to effectively manage our growth, and effectively transition from our focus on research and development activities to commercially successful products, our business could suffer.

Failure to manage growth of operations could harm our business. To date, a large number of our activities and resources have been directed at the research and development of our technologies and development of potential related products. The transition from a focus on research and development to being a vendor of products requires effective planning and management. Additionally, growth arising from the expected synergies from future acquisitions will require effective planning and management. Future expansion will be expensive and will likely strain management and other resources.

In order to effectively manage growth, we must:

| • | continue to develop an effective planning and management process to implement our business strategy; |

| • | hire, train and integrate new personnel in all areas of our business; and |

| • | expand our facilities and increase capital investments. |

There is no assurance that we will be able to accomplish these tasks effectively or otherwise effectively manage our growth.

14

Table of Contents

Our business, financial condition and operating results would be harmed if we do not achieve anticipated revenue.

From time to time, in response to anticipated long lead times to obtain inventory and materials from outside contract manufacturers, suppliers and foundries, we may need to order materials in advance of anticipated customer demand. This advance ordering may result in excess inventory levels or unanticipated inventory write-downs if expected orders fail to materialize, or other factors render our products less marketable. If we are forced to hold excess inventory or incur unanticipated inventory write-downs, our financial condition and operating results could be materially harmed.

Our expense levels are relatively fixed and are based on our expectations of future revenue. We will have limited ability to reduce expenses quickly in response to any revenue shortfalls. Changes to production volumes and impact of overhead absorption may result in a decline in our financial condition or liquidity.

We could suffer unrecoverable losses on our customers’ accounts receivable which would adversely affect our financial results.

Our operating cash flows are dependent on the continued collection of receivables. We could suffer losses if a customer is unable to pay. A significant loss on any accounts receivable would have an adverse impact on our business and financial results.

The industry and markets in which we compete are subject to consolidation, which may result in stronger competitors, fewer customers and reduced demand.

There has been industry consolidation among communications IC companies, network equipment companies and telecommunications companies in the past. This consolidation is expected to continue as companies attempt to strengthen or hold their positions in evolving markets. Consolidation may result in stronger competitors, fewer customers and reduced demand, which in turn could have a material adverse effect on our business, operating results, and financial condition.

Our operating results are subject to fluctuations because we have international sales.

International sales account for a large portion of our revenue and may account for an increasing portion of future revenue. The revenue derived from international sales may be subject to certain risks, including:

| • | foreign currency exchange fluctuations; |

| • | changes in regulatory requirements; |

| • | tariffs and other barriers; |

| • | timing and availability of export licenses; |

| • | political and economic instability; |

| • | difficulties in accounts receivable collections; |

| • | difficulties in staffing and managing foreign operations; |

| • | difficulties in managing distributors; |

| • | difficulties in obtaining governmental approvals for communications and other products; |

| • | reduced or uncertain protection for intellectual property rights in some countries; |

| • | longer payment cycles to collect accounts receivable in some countries; |

| • | the burden of complying with a wide variety of complex foreign laws and treaties; and |

| • | potentially adverse tax consequences. |

We are subject to regulatory compliance related to our operations.

We are subject to various U.S. governmental regulations related to occupational safety and health, labor and business practices. Failure to comply with current or future regulations could result in the imposition of substantial fines, suspension of production, alterations of our production processes, cessation of operations, or other actions, which could harm our business.

15

Table of Contents

We may incur liability arising from our use of hazardous materials.