Attached files

| file | filename |

|---|---|

| EX-23.1 - PSYCHEMEDICS CORP | v215958_ex23-1.htm |

| EX-32.1 - PSYCHEMEDICS CORP | v215958_ex32-1.htm |

| EX-31.2 - PSYCHEMEDICS CORP | v215958_ex31-2.htm |

| EX-32.2 - PSYCHEMEDICS CORP | v215958_ex32-2.htm |

| EX-31.1 - PSYCHEMEDICS CORP | v215958_ex31-1.htm |

| EX-10.13 - PSYCHEMEDICS CORP | v215958_ex10-13.htm |

| EX-10.2.7 - PSYCHEMEDICS CORP | v215958_ex10-2x7.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the Fiscal Year Ended December 31, 2010

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Commission File Number: 1-13738

PSYCHEMEDICS CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware

|

58-1701987

|

|

|

(State or Other Jurisdiction of

|

(I.R.S. Employer

|

|

|

Incorporation or Organization)

|

Identification No.)

|

|

125 Nagog Park

|

01720

|

|

|

Acton, Massachusetts

|

||

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

Registrant’s Telephone Number Including Area Code: (978) 206-8220

Securities registered pursuant to Section 12(b) of the Act:

Common Stock, $0.005 par value

(Title of Class)

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by a check mark if the registrant is a well-known seasoned issuer (as defined in Rule 405 of the Securities Exchange Act of 1934). Yes ¨ No x

Indicate by a check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934). Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files.) Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer” and “large accelerated filer” in Rule 12b-2 of the Securities Exchange Act of 1934.

|

Large Accelerated Filer ¨

|

Accelerated Filer ¨

|

Non-Accelerated Filer ¨

|

Smaller Reporting Company x

|

|

(Do not check if a smaller reporting company)

|

|||

Indicate by a check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities and Exchange Act of 1934). Yes ¨ No x

As of June 30, 2010, there were 5,212,835 shares of Common Stock of the Registrant outstanding. The aggregate market value of the Common Stock of the Registrant held by non-affiliates (assuming for these purposes, but not conceding, that all executive officers, directors and 5% shareholders are “affiliates” of the Registrant) as of June 30, 2010 was approximately $18 million, computed based upon the closing price of $7.98 per share on June 30, 2010.

As of March 22, 2011, there were 5,212,013 shares of Common Stock of the Registrant outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Part III of this Annual Report on Form 10-K incorporates by reference portions of the Registrant’s definitive proxy statement, to be filed with the Securities and Exchange Commission no later than 120 days after the close of its fiscal year; provided that if such proxy statement is not filed with the Commission in such 120-day period, an amendment to this Form 10-K shall be filed no later than the end of the 120-day period.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements under “Business,” “Risk Factors,” “Legal Proceedings,” “Market for Registrant’s Common Stock and Related Stockholder Matters” and “Management Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere in this Annual Report on Form 10-K (this “Form 10-K”) constitute forward-looking statements under Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements made with respect to future earnings per share, future revenues, future operating income, future cash flows, competitive and strategic initiatives, potential stock repurchases and future liquidity needs. These statements involve known and unknown risks, uncertainties and other factors that may cause results, levels of activity, growth, performance, earnings per share or achievements to be materially different from any future results, levels of activity, growth, performance, earnings per share or achievements expressed or implied by such forward-looking statements.

The forward-looking statements included in this Form 10-K and referred to elsewhere are related to future events or our strategies or future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may,” “should,” “believe,” “anticipate,” “future,” “potential,” “estimate,” “encourage,” “opportunity,” “growth,” “leader,” “could”, “expect,” “intend,” “plan,” “expand,” “focus,” “through,” “strategy,” “provide,” “offer,” “allow,” “commitment,” “implement,” “result,” “increase,” “establish,” “perform,” “make,” “continue,” “can,” “ongoing,” “include” or the negative of such terms or comparable terminology. All forward-looking statements included in this Form 10-K are based on information available to us as of the filing date of this report, and the Company assumes no obligation to update any such forward-looking statements. Our actual results could differ materially from the forward-looking statements. Important factors that could cause actual results to differ materially from expectations reflected in our forward-looking statements include those described in Item 1A, “Risk Factors.”

1

TABLE OF CONTENTS

PSYCHEMEDICS CORPORATION

FORM 10-K

ANNUAL REPORT

For the Year Ended December 31, 2010

|

Page

|

||||

|

PART I

|

||||

|

Item 1.

|

Business

|

3

|

||

|

Item 1A.

|

Risk Factors

|

8

|

||

|

Item 1B.

|

Unresolved Staff Comments

|

12

|

||

|

Item 2.

|

Properties

|

12

|

||

|

Item 3.

|

Legal Proceedings

|

12

|

||

|

Item 4.

|

Reserved

|

12

|

||

|

PART II

|

||||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

13

|

||

|

Item 6.

|

Selected Financial Data

|

15

|

||

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

15

|

||

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

21

|

||

|

Item 8.

|

Financial Statements and Supplementary Data

|

21

|

||

|

Item 9.

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

39

|

||

|

Item 9A.(T.)

|

Controls and Procedures

|

39

|

||

|

Item 9B.

|

Other Information

|

40

|

||

|

PART III

|

||||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

41

|

||

|

Item 11.

|

Executive Compensation

|

42

|

||

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

42

|

||

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

42

|

||

|

Item 14.

|

Principal Accounting Fees and Services

|

42

|

||

|

PART IV

|

||||

|

Item 15.

|

Exhibits, Financial Statement Schedules

|

43

|

||

|

OTHER ITEMS

|

||||

|

Signatures

|

44

|

|||

|

Power of Attorney

|

44

|

|||

2

PART I

Available Information; Background

Psychemedics Corporation (“the Company” or “Psychemedics”) maintains executive offices located at 125 Nagog Park, Acton, MA 01720. Our telephone number is (978) 206-8220. Our stock is traded on the NASDAQ Stock Exchange Market under the symbol “PMD”. Our Internet address is www.psychemedics.com . The Company makes available, free of charge, on the Investor Information section of its website, its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with the Securities and Exchange Commission (the “SEC”). Copies are also available, without charge, from Psychemedics Corporation, Attn: Investor Relations, 125 Nagog Park, Acton, MA 01720. Alternatively, reports filed with the SEC may be viewed or obtained at the SEC Public Reference Room in Washington, D.C., or the SEC’s Internet site at www.sec.gov . We do not intend for information contained in our website to be part of this Annual Report on Form 10-K.

Item 1. Business

General

Psychemedics Corporation is a Delaware corporation organized on September 24, 1986 to provide testing services for the detection of abused substances through the analysis of hair samples. The Company’s testing methods utilize a patented technology to enzymatically dissolve hair samples and then perform radioimmunoyassays on the hair sampled, with confirmation testing by mass spectrometry.

The Company’s primary application of its patented technology is as a testing service that analyzes hair samples for the presence of certain drugs of abuse. Employing radioimmunoassay procedures to drug test hair samples differs from the more commonly used approach in which immunoassay procedures are employed to test urine samples. The Company’s tests provide quantitative information that can indicate the approximate amount of drug ingested as well as historical data, which can show a pattern of individual drug use over a longer period of time providing superior detection compared to other types of drug testing. This information is useful to employers for both applicant and employee testing, as well as to physicians, treatment professionals, law enforcement agencies, school administrators, parents concerned about their children’s drug use and other individuals or entities engaged in any business where drug use or potential drug use is an issue. The Company provides commercial testing and confirmation by mass spectrometry using industry-accepted practices for cocaine, marijuana, PCP, methamphetamine (including Ecstasy, which is difficult to detect in urine due to sporadic use patterns and rapid clearance from the body) and opiates (including heroin, hydrocodone, hydromorphone and oxycodone).

Testing services are currently performed at the Company’s laboratory at 5832 Uplander Way, Culver City, California. The Company’s services are marketed under the name RIAH (Radioimmunoassay of Hair), a registered service mark.

Development of Radioimmunoassay of Hair

The application of unique radioimmunoassay procedures to the analysis of hair was initially developed in 1978 by the founders of the Company, Annette Baumgartner and Werner A. Baumgartner, Ph.D. The Baumgartners demonstrated that when certain chemical substances enter the bloodstream, the blood carries these substances to the hair where they become “entrapped” in the protein matrix in amounts approximately proportional to the amount ingested. The Company’s patented drugs of abuse testing procedure involves direct analysis of liquefied hair samples by radioimmunoassay procedures utilizing effective reagents and antibodies. The antibodies detect the presence of a specific drug or drug metabolite in the liquefied hair sample by reacting with the drug present in the sample solution, as well as an added radioactive analog of the drug. The resulting antibody-drug complex is precipitated and analyzed. The amount of drug present in the sample is inversely proportional to the amount of radioactive analog in the precipitate. RIA positive results are then confirmed by Mass Spectrometry. Depending upon the length of head hair, the Company is able to provide historical information on drug use by the person from whom the sample was obtained. Since head hair grows approximately 1.3 centimeters per month, a 3.9 centimeter head hair sample can reflect drug ingestion over the approximate several months prior to the collection of the sample. Another testing option involves sectional analysis of the head hair sample. In this procedure, the hair is sectioned lengthwise to approximately correspond to certain time periods. Each section corresponds to a time period, which allows the Company to provide information on patterns of drug use.

3

Validation of the Company’s Proprietary Testing Method

The process of analyzing human hair for the presence of drugs using the Company’s patented method has been the subject of numerous peer-reviewed, scientific field studies. Results from the studies that have been published or accepted for publication in scientific journals are generally favorable to the Company’s technology. Some of these studies were performed with the following organizations: Boston University School of Public Health; Citizens for a Better Community Court, Columbia University; Connecticut Department of Mental Health and Addictive Services; Koba Associates-DC Initiative, Harvard Cocaine Recovery Project, Hutzel Hospital, ISA Associates (Interscience America)-NIDA Workplace Study, University of California-Sleep State Organization, Maternal/Child Substance Abuse Project, Matrix Center, National Public Services Research Institute, Narcotic and Drug Research Institute, San Diego State University-Chemical Dependency Center, Spectrum Inc., Stapleford Centre (London), Task Force on Violent Crime (Cleveland, Ohio); University of Miami-Department of Psychiatry, University of Miami-Division of Neonatology, University of South Florida-Operation Par Inc., University of Washington, VA Medical Center-Georgia, U.S. Probation Parole-Santa Ana and Wayne State University. The above studies include research in the following areas: effects of prenatal drug use, treatment evaluation, workplace drug use, the criminal justice system and epidemiology. Many of the studies have been funded by the National Institute of Justice or the National Institute on Drug Abuse (“NIDA”). Several hundred research articles written by independent researchers have been published supporting the general validity and usefulness of hair analysis.

Some of the Company’s customers have also completed their own testing to validate the Company’s proprietary hair testing method as a prelude to utilizing the Company’s services. These studies have consistently confirmed the Company’s superior detection rate compared to urinalysis testing. When results based on the Company’s patented hair testing method were compared to urine results in side-by-side evaluations, 4 to 10 times as many drug abusers were accurately identified by the Company’s proprietary method. In addition to these studies, the Company’s proprietary method is validated through the services it offers to the thousands of clients for whom it has performed testing.

In 1998, the National Institute of Justice, utilizing Psychemedics hair testing, completed a Pennsylvania Prison study where hair analysis revealed an average prison drug use level of approximately 7.9% in 1996. Comparatively, urinalysis revealed virtually no positives. After measures to curtail drug use were instituted (drug-sniffing dogs, searches and scanners), the use level fell to approximately 2% according to the results of hair analysis in 1998. Again, the urine tests showed virtually no positives. The study illustrates the usefulness of hair analysis to monitor populations and the weakness of urinalysis.

The Company has received 510k clearance from the United States Food and Drug Administration (“FDA”) on all five of its assays used to test human hair for drugs of abuse. As of the date of this report, Psychemedics has received FDA clearance for a five-drug panel test that is not restricted to head hair samples for drugs of abuse.

Advantages of Using the Company’s Patented Method

The Company asserts that hair testing using its patented method confers substantive advantages relative to existing means of drug detection through urinalysis. Although urinalysis testing can provide accurate drug use information, the scope of the information is short-term and is generally limited to the type of drug ingested within a few days of the test. Studies published in many scientific publications have indicated that most drugs disappear from urine within a few days.

In contrast to urinalysis testing, hair testing using the Company’s patented method can provide long-term historical drug use information resulting in a significantly wider “window of detection.” This “window” may be several months or longer depending on the length of the hair sample. The Company’s standard test offering, however, uses a 3.9 centimeter length head hair sample cut close to the scalp which measures use for approximately the previous several months.

4

This wider window enhances the detection efficiency of hair analysis, making it particularly useful in pre-employment and random testing. Hair testing not only identifies more drug users, but it may also uncover patterns and severity of drug use (information most helpful in determining the scope of an individual’s involvement with drugs), while serving as a deterrent against the use of drugs. Hair testing employing the Company’s patented method greatly reduces the incidence of “false negatives” associated with evasive measures typically encountered with urinalysis testing. For example, urinalysis test results are adversely impacted by excessive fluid intake prior to testing and by adulteration or substitution of the urine sample. Moreover, a drug user who abstains from use for a few days prior to urinalysis testing can usually escape detection. Hair testing is effectively free of these problems, as it cannot be thwarted by evasive measures typically encountered with urinalysis testing. Hair testing is also attractive to customers since sample collection is typically performed under close supervision yet is less intrusive and less embarrassing for test subjects.

Hair testing using the Company’s patented method (with mass spectrometry confirmation) further reduces the prospects of error in conducting drug detection tests. Urinalysis testing is more susceptible to problems such as “evidentiary false positives” resulting from passive drug exposure or poppy seeds. To combat this problem, in federally mandated testing, the opiate cutoff levels for urine testing were raised 667% (from 300 to 2,000 ng/ml) on December 1, 1998 and testing for the presence of a heroin metabolite, 6-AM, was required. These requirements, however, effectively reduced the detection time frame for confirmed heroin with 6-AM in urine down to several hours post drug use. In contrast, the metabolite 6-AM is stable in hair and can be detected for months.

In the event a positive urinalysis test result is challenged, a test on a newly collected urine sample is not a viable remedy. Unless the forewarned individual continues to use drugs prior to the date of the newly collected sample, a re-test may yield a negative result when using urinalysis testing because of temporary abstinence. In contrast, when the Company’s hair testing method is offered on a repeat hair sample, the individual suspected of drug use cannot as easily affect the results because historical drug use data remains locked in the hair fiber.

When compared to other hair testing methods, not only are the Company’s assays cleared by the FDA, they also employ a unique patented method of enzyme digestion that the Company believes allows for the most efficient release of drugs from the hair without destroying the drugs. The Company’s method of releasing drugs from hair is a key advantage and results in superior detection rates.

Disadvantages of Hair Testing

There are some disadvantages of hair testing as compared to drug detection through urinalysis. Because hair starts growing below the skin surface, drug ingestion evidence does not appear in hair above the scalp until approximately five to seven days after use.

Thus, hair testing is not suitable for determining drug presence in “for cause” testing as is done in connection with an accident investigation. It does, however, provide a drug history which can complement urinalysis information in “for cause” testing.

Currently, radioimmunoassay testing using hair samples under the Company’s patented method is only practiced by Psychemedics Corporation.

The Company’s prices for its tests are generally somewhat higher than prices for tests using urinalysis, but the Company believes that its superior detection rates provide more value to the customer. This pricing policy could, however, adversely impact the growth of the Company’s sales volume.

Intellectual Property

Certain aspects of the Company’s hair analysis method are covered by six US patents and a number of foreign patents and trade secrets owned by the Company. One U.S. patent expires in 2011 ( see risk factors) and two additional patent applications have been filed. The Company believes that its superior technology is protected by this combination of US and foreign patents and trade secrets. The Company’s ability to protect the confidentiality of these trade secrets is dependent upon the Company’s internal safeguards and upon the laws protecting trade secrets and unfair competition.

Target Markets

1. Workplace

The Company focuses its primary marketing efforts on the private sector, with particular emphasis on job applicant and employee testing.

5

Most businesses use drug testing to screen job applicants and employees. The Hazeldon Foundation survey from 2007 indicated that 85 percent of human resource professionals believe that drug testing is an effective way to diagnose substance abuse. The prevalence of drug screening programs reflects a concern that drug use contributes to employee health problems and costs (as the same study found that 62 percent of HR professionals believe that absenteeism is the most significant problem caused by substance abuse and addiction, followed at 49 percent by reduced productivity, a lack of trustworthiness at 39 percent, a negative impact on the company’s external image at 32 percent and missed deadlines at 31 percent and in certain industries, safety hazards.) It has been estimated that the cost to American businesses is more than $100 billion annually.

The principal criticism of employee drug testing programs centers on the effectiveness of the testing program. Most private sector testing programs use urinalysis. Such programs are susceptible to evasive maneuvers and the inability to obtain confirmation through repeat samples in the event of a challenged result. An industry has developed over the Internet, and through direct mail, marketing a wide variety of adulterants, dilutants, clean urine and devices to assist drug users in falsifying urine test results.

Moreover, scheduled tests such as pre-employment testing and some random testing programs provide an opportunity for many drug users to simply abstain for a few days in order to escape detection by urinalysis.

The Company presents its patented hair analysis method to potential clients as a better technology well suited to employer needs. Field studies and actual client results support the accuracy and effectiveness of the Company’s patented technology and its ability to detect varying levels of drug use. This information provides an employer with greater flexibility in assessing the scope of an applicant’s or an employee’s drug problem.

The Company performs a confirmation test of all presumptive positive results through mass spectrometry. The use of mass spectrometry is an industry accepted practice used to confirm positive drug test results of an initial screen. In an employment setting, mass spectrometry confirmation is typically used prior to the taking of any disciplinary action against an employee. The Company offers its clients a five-drug screen with mass spectrometry confirmation of cocaine, PCP, marijuana, amphetamines (including Ecstasy), and opiates (including heroin and oxycodone).

2. Schools

The Company currently serves hundreds of schools throughout the United States and in several foreign countries. The Company offers its school clients the same five-drug screen with mass spectrometry confirmation that is used with the Company’s workplace testing service.

3. Parents

The Company also offers a personal drug testing service, known as “PDT-90”®, for parents concerned about drug use by their children. It allows parents to collect a small sample from their child in the privacy of the home, send it to the Company’s laboratory and have it tested for drugs of abuse by the Company. The PDT-90 testing service uses the same patented method that is used with the Company’s workplace testing service.

Research

The Company is involved in ongoing studies involving use of drugs of abuse in various populations, including the following: Boston Medical Center, Boston University School of Public Health, University of North Carolina Chapel Hill, Johns Hopkins Bloomberg School Of Public Health, Mclean Hospital, Wayne State University and Chemistry and Drug Metabolism Section, NIDA.

Sales and Marketing

The Company markets its corporate drug testing services primarily through its own sales force. Sales offices are located in several major cities in the United States in order to facilitate communications with corporate employers. The Company markets its home drug testing service, PDT-90, through the Internet and retail distributors.

Competition

The Company competes directly with numerous commercial laboratories that test for drugs primarily through urinalysis testing. Most of these laboratories, such as Laboratory Corporation of America and Quest Diagnostics, have substantially greater financial resources, market identity, marketing organizations, facilities, and numbers of personnel than the Company. The Company has been steadily increasing its base of corporate customers and believes that future success with new customers is dependent on the Company’s ability to communicate the advantages of implementing a drug program utilizing the Company’s patented hair analysis method.

6

The Company’s ability to compete is also a function of pricing. The Company’s prices for its tests are generally somewhat higher than prices for tests using urinalysis. However, the Company believes that its superior detection rates, coupled with the customer’s ability to test less frequently due to hair testing’s wider window of detection (several months versus approximately three days with urinalysis) provide more value to the customer. This pricing policy could, however, lead to slower sales growth for the Company.

Although other laboratories also offer hair testing for drugs of abuse, Psychemedics is the only laboratory with FDA clearance for a five-drug panel test that is not limited to head hair samples for drugs of abuse. To date, no other laboratory engaged in hair testing has received approval or clearance from the FDA on all of its assays for the testing of both head and body hair samples (two other laboratories have either partial FDA clearance or clearance specific to head hair samples only). Additionally, several of these laboratories that purport to test hair samples use a method that the Company presumes includes the use of a form of immunoassay procedures. The Company, however, does not believe that immunoassay testing of hair samples is as effective on a commercial basis without using the Company’s unique patented method, which allows for the efficient release of drugs from the hair through enzyme digestion without destroying the drugs.

Government Regulation

The Company is licensed as a clinical laboratory by the State of California as well as certain other states. All tests are performed according to the laboratory standards established by the Department of Health and Human Services, through the Clinical Laboratories Improvement Amendments (“CLIA”), and various state licensing statutes.

A substantial number of states regulate drug testing. The scope and nature of such regulations varies greatly from state to state and is subject to change from time to time. The Company addresses state law issues on an ongoing basis.

In 2000, the FDA issued regulations under the Federal Food, Drug and Cosmetic Act, as amended (the “FDC Act”) with respect to companies that market “drugs of abuse test sample collection systems”. Under the regulations, companies engaged in the business of testing for drugs of abuse using a test (screening assay) not previously recognized by the FDA are required to submit their assay to the FDA for recognition prior to marketing. In addition, the laboratory performing the tests is required to be certified by a recognized agency. The regulations included a transitional period in order for companies not immediately in compliance with the proposed requirements to obtain the necessary data they needed for submission to the FDA.

By May 3, 2002, the Company had received 510k clearance to market all five of its assays.

In June 2008, Psychemedics also received the first CAP (College of American Pathologists) certification specifically including hair testing.

Research and Development

The Company is continuously engaged in research and development activities. During the years ended December 31, 2010, 2009 and 2008, $481,433, $467,435, and $474,622, respectively, were expended for research and development. The Company continues to perform research activities to develop new products and services and to improve existing products and services utilizing the Company’s proprietary technology. The Company also continues to evaluate methodologies to enhance its drug screening capabilities. Additional research using the Company’s proprietary technology is being conducted by outside research organizations through government-funded studies.

Research has continued on the interactions of different types of hair with drugs in the environment and from actual drug usage. This work has concentrated on assessments of various published methods for removal of externally deposited drug from hair surfaces and on methods of extraction of metabolically deposited drugs from the solid hair matrix. Some of the work has been presented at meetings of the Society of Forensic Toxicologists and the European Society of Hair Testing.

Sources and Availability of Raw Materials

Since its inception, the Company has purchased raw materials for its laboratory services from outside suppliers. The most critical of these raw materials are the radio-labeled drugs which the Company purchases from a single supplier, although other suppliers of radio-labeled drugs exist. The Company has entered into an agreement with its principal supplier to purchase certain proprietary information regarding the manufacture of such radio-labeled drugs owned by the supplier in the event that the supplier ceases to be able to supply such radio-labeled drugs to the Company.

7

Employees

As of December 31, 2010, the Company had 91 full-time equivalent employees, of whom 3 full-time employees were in research and development. None of the Company’s employees are subject to a collective bargaining agreement.

Item 1A. Risk Factors

In addition to other information contained in this Form 10-K, the following risk factors should be carefully considered in evaluating Psychemedics Corporation and its business because such factors could have a significant impact on our business, operating results and financial condition. These risk factors could cause actual results to materially differ from those projected in any forward-looking statements.

Companies may develop products that compete with our products and some of these companies may be larger and better capitalized than we are.

Many of our competitors and potential competitors are larger and have greater financial resources than we do and offer a range of products broader than our products. Some of the companies with which we now compete or may compete in the future may develop more extensive research and marketing capabilities and greater technical and personnel resources than we do, and may become better positioned to compete in an evolving industry. Failure to compete successfully could harm our business and prospects.

Increased competition, including price competition, could have a material impact on the Company’s net revenues and profitability.

Our business is intensely competitive, both in terms of price and service. Pricing of drug testing services is a significant factor often considered by customers in selecting a drug testing laboratory. As a result of the clinical laboratory industry undergoing significant consolidation, larger clinical laboratory providers are able to increase cost efficiencies afforded by large-scale automated testing. This consolidation results in greater price competition. The Company may be unable to increase cost efficiencies sufficiently, if at all, and as a result, its net earnings and cash flows could be negatively impacted by such price competition. The Company may also face increased competition from companies that do not comply with existing laws or regulations or otherwise disregard compliance standards in the industry. Additionally, the Company may also face changes in fee schedules, competitive bidding for laboratory services or other actions or pressures reducing payment schedules as a result of increased or additional competition. Additional competition, including price competition, could have a material adverse impact on the Company’s net revenues and profitability.

Our results of operations are subject in part to variation in our customers’ hiring practices and other factors beyond our control.

Our results of operations have been and may continue to be subject to variation in our customers’ hiring practices, which in turn is dependent, to a large extent, on the general condition of the economy. Results for a particular quarter may vary due to a number of factors, including:

|

|

•

|

economic conditions in our markets in general;

|

|

|

•

|

economic conditions affecting our customers and their particular industries;

|

|

|

•

|

the introduction of new products and product enhancements by us or our competitors; and

|

|

|

•

|

pricing and other competitive conditions.

|

A failure to obtain and retain new customers, or a loss of existing customers, or a reduction in tests ordered, could impact the Company’s ability to successfully grow its business.

The Company needs to obtain and retain new customers. In addition, a reduction in tests ordered, without offsetting growth in its customer base, could impact the Company’s ability to successfully grow its business and could have a material adverse impact on the Company’s net revenues and profitability. We compete primarily on the basis of the quality of testing, reputation in the industry, the pricing of services and ability to employ qualified personnel. The Company’s failure to successfully compete on any of these factors could result in the loss of customers and a reduction in the Company’s ability to expand its customer base.

8

Our business could be harmed if we are unable to protect our proprietary technology.

We rely primarily on a combination of trade secrets, patents and trademark laws and confidentiality procedures to protect our technology. Despite these precautions, unauthorized third parties may infringe or copy portions of our technology. In addition, because patent applications in the United States are not publicly disclosed until either (1) 18 months after the application filing date or (2) the publication date of an issued patent wherein applicant(s) seek only US patent protection, applications not yet disclosed may have been filed which relate to our technology. Moreover, there is a risk that foreign intellectual property laws will not protect our intellectual property rights to the same extent as United States intellectual property laws. One of our patents is due to expire in 2011. In the absence of protections afforded by patents or by trade secrets, we may be vulnerable to competitors who attempt to copy our products, processes or technology.

Our business could be affected by a computer or other IT System failure.

A computer or IT system failure could affect our ability to perform tests, report test results or properly bill customers. Failures could occur as a result of the standardization of our IT systems and other system conversions, telecommunications failures, malicious human acts (such as electronic break-ins or computer viruses) or natural disasters. Sustained system failures or interruption of the Company’s systems in one or more of its operations could disrupt the Company’s ability to process and provide test results in a timely manner and/or bill the appropriate party. Failure of the Company’s information systems could adversely affect the Company’s business, profitability and financial condition.

Failure to maintain confidential information could result in a significant financial impact.

The Company maintains confidential information regarding the results of drug tests and other information including credit card and payment information from our customers. The failure to protect this information could result in lawsuits, fines or penalties. Any loss of data or breach of confidentiality, such as through a computer security breach, could expose the Company to a financial liability.

Our future success will depend on the continued services of our key personnel.

The loss of any of our key personnel could harm our business and prospects. We may not be able to attract and retain personnel necessary for the development of our business. We do not have key personnel under contract other than 3 officers who have agreements providing for severance and non compete covenants in the event of termination of employment following a change of control. Further, we do not have any key man life insurance for any of our officers or other key personnel.

We may become exposed to potential risks and related costs as a result of the internal control assessment and attestation process mandated on certain issuers by Section 404 of the Sarbanes-Oxley Act of 2002.

We evaluated, tested and implemented internal controls over financial reporting to enable management to report on such internal controls as required by Section 404 of the Sarbanes-Oxley Act of 2002. At such time we cease qualifying as a “smaller reporting company”, under SEC rules (under $75 million market cap), we will be required to provide an auditor attestation on internal controls. The auditor attestation could cause us to incur significant costs, including increased accounting fees and staffing levels. While we believe that we are compliant with the management evaluation requirements of Section 404, if our independent registered public accounting firm were unable to attest in a timely manner to our evaluation, we could be subject to regulatory scrutiny and a loss of public confidence in our internal controls. In addition, any failure to implement required new or improved controls, or difficulties encountered in their implementation, could harm our operating results or cause us to fail to meet our reporting obligations.

Our reliance on one supplier for certain raw materials used in our testing procedures could harm our business and prospects.

Since its inception, the Company has purchased raw materials for its laboratory services from outside suppliers. The most critical of these raw materials are the radio-labeled drugs, which the Company purchases from a single supplier, although other suppliers of radio-labeled drugs exist. The Company has entered into an agreement with its principal supplier to purchase certain proprietary information regarding the manufacture of such radio-labeled drugs owned by the supplier in the event that the supplier ceases to be able to supply such radio-labeled drugs to the Company. Obtaining alternative sources of supply of the radio-labeled drugs could involve delays and other costs; however, the Company maintains a surplus supply. The failure of the Company’s primary or any alternative supplier of radio-labeled drugs to provide such radio-labeled drugs at an acceptable price, or an interruption of supplies from such a supplier and the exhaustion of the Company’s current supply on hand could result in lost or deferred sales.

9

There is a risk that our insurance will not be sufficient to protect us from errors and omissions liability or other claims, or that in the future errors and omissions insurance will not be available to us at a reasonable cost, if at all.

Our business involves the risk of claims of errors and omissions and other claims inherent to our business. We maintain errors and omissions and general liability insurance subject to deductibles and exclusions. There is a risk that our insurance will not be sufficient to protect us from all such possible claims. An under-insured or uninsured claim could harm our operating results or financial condition.

Our research and development capabilities may not produce viable new services or products.

We are attempting to develop further capabilities in the drug testing arena. It is uncertain whether we will be able to develop services that are more efficient, effective or that are suitable for our customers. Our ability to create viable products or services depends on many factors, including the implementation of appropriate technologies, the development of effective new research tools, the complexity of the chemistry and biology, the lack of predictability in the scientific process and the performance and decision-making capabilities of our scientists.

Further, some of our existing patents are due to expire within the next 3 years, including one in 2011. Our research and development teams are working to develop improved processes with the aim of gaining additional patent protection. There is no guarantee that they will be successful in developing these improvements or gaining such additional patent protection. If any or all of our patents expire, there may be increased competition in the marketplace for our service or we might be required to rely to a greater extent on trade secret protection.

Improved testing technologies, or the Company’s customers using new technologies to perform their own tests, could adversely affect the Company’s business.

Advances in technology may lead to the development of more cost-effective technologies such as point-of-care testing equipment that can be operated by third parties or customers themselves in their own offices, without requiring the services of a freestanding laboratory. Development of such technology and its use by the Company’s customers could reduce the demand for its testing services and negatively impact our revenues.

We may not be able to recruit and retain the experienced scientists and management we need to compete in our industry.

Our future success depends upon our ability to attract, retain and motivate highly skilled scientists and management. Our ability to achieve our business strategies depends on our ability to hire and retain high caliber scientists and other qualified experts. We compete with other testing companies, research companies and academic and research institutions to recruit personnel and face significant competition for qualified personnel. We may incur greater costs than anticipated, or may not be successful, in attracting new scientists or management or in retaining or motivating our existing personnel.

Our future success also depends on the personal efforts and abilities of the principal members of our senior management and scientific staff to provide strategic direction, to manage our operations and maintain a cohesive and stable environment.

Our facilities and practices may fail to comply with government regulations.

Our testing facilities and processes must be operated in conformity with current government regulations. These requirements include, among other things, quality control, quality assurance and the maintenance of records and documentation. If we fail to comply with these requirements, we may not be able to continue our services to certain customers, or we could be subject to fines and penalties, suspension of production, or withdrawal of our certifications. We operate a facility that we believe conforms to all applicable requirements. This facility and our testing practices are subject to periodic regulatory inspections to ensure compliance.

Our business could be harmed from the loss or suspension of any licenses.

The forensic laboratory testing industry is subject to significant regulation and many of these statutes and regulations are subject to change. The Company cannot assure that applicable statutes and regulations will not be interpreted or applied by a regulatory authority in a manner that would adversely affect its business. Potential sanctions for violation of these regulations could include the suspension or loss of various licenses, certificates and authorizations, which could have a material adverse effect on the Company’s business.

10

If our use of chemical and hazardous materials violates applicable laws or regulations or causes personal injury we may be liable for damages.

Our drug testing activities, including the analysis and synthesis of chemicals, involve the controlled use of chemicals, including flammable, combustible, toxic and radioactive materials that are potentially hazardous. Our use, storage, handling and disposal of these materials is subject to federal, state and local laws and regulations, including the Resource Conservation and Recovery Act, the Occupational Safety and Health Act and local fire codes, and regulations promulgated by the Department of Transportation, the Drug Enforcement Agency, the Department of Energy, and the California Department of Public Health and Environment. We may incur significant costs to comply with these laws and regulations in the future. In addition, we cannot completely eliminate the risk of accidental contamination or injury from these materials, which could result in material unanticipated expenses, such as substantial fines or penalties, remediation costs or damages, or the loss of a permit or other authorization to operate or engage in our business. Those expenses could exceed our net worth and limit our ability to raise additional capital.

Our operations could be interrupted by damage to our specialized laboratory facilities.

Our operations are dependent upon the continued use of our highly specialized laboratories and equipment in Culver City, California. Catastrophic events, including earthquakes, fires or explosions, could damage our laboratories, equipment, scientific data, work in progress or inventories of chemicals and may materially interrupt our business. We employ safety precautions in our laboratory activities in order to reduce the likelihood of the occurrence of certain catastrophic events; however, we cannot eliminate the chance that such events will occur. The availability of laboratory space in these locations is limited, and rebuilding our facilities could be time consuming and result in substantial delays in fulfilling our agreements with our customers. We maintain business interruption insurance to cover continuing expenses and lost revenue caused by such occurrences. However, this insurance does not compensate us for the loss of opportunity and potential harm to customer relations that our inability to meet our customers’ needs in a timely manner could create.

Agreements we have with our employees, consultants and customers may not afford adequate protection for our trade secrets, confidential information and other proprietary information.

In addition to patent protection, we also rely on copyright and trademark protection, trade secrets, know-how, continuing technological innovation and licensing opportunities. In an effort to maintain the confidentiality and ownership of our trade secrets and proprietary information, we require our employees, consultants and advisors to execute confidentiality and proprietary information agreements. However, these agreements may not provide us with adequate protection against improper use or disclosure of confidential information and there may not be adequate remedies in the event of unauthorized use or disclosure. Furthermore, we may from time to time hire scientific personnel formerly employed by other companies involved in one or more areas similar to the activities we conduct. In some situations, our confidentiality and proprietary information agreements may conflict with, or be subject to, the rights of third parties with whom our employees, consultants or advisors have prior employment or consulting relationships. Although we require our employees and consultants to maintain the confidentiality of all proprietary information of their previous employers, these individuals, or we, may be subject to allegations of trade secret misappropriation or other similar claims as a result of their prior affiliations. Finally, others may independently develop substantially equivalent proprietary information and techniques or otherwise gain access to our trade secrets. Our failure or inability to protect our proprietary information and techniques may inhibit or limit our ability to compete effectively, or exclude certain competitors from the market.

Risks Related to Our Stock

Our quarterly operating results could fluctuate significantly, which could cause our stock price to decline.

Our quarterly operating results have fluctuated in the past and are likely to fluctuate in the future. Our results are impacted by the extent to which we are able to gain new customers and on the hiring practices of our existing customers, which are, in turn, impacted by general economic conditions. Entering into new customer contracts can involve a long lead time. Accordingly, negotiation can be lengthy and is subject to a number of significant risks, including customers’ budgetary constraints and internal reviews. Due to these and other market factors, our operating results could fluctuate significantly from quarter to quarter. In addition, we may experience significant fluctuations in quarterly operating results due to factors such as general and industry-specific economic conditions that may affect the budgets and the hiring practices of our customers.

11

Due to the possibility of fluctuations in our revenue and expenses, we believe that quarter-to-quarter comparisons of our operating results are not necessarily a good indication of our future performance. Our operating results in some quarters may not meet the expectations of stock market analysts and investors. If we do not meet analysts’ and/or investors’ expectations, our stock price could decline.

Our stock price could experience substantial volatility.

The market price of our common stock has historically experienced and may continue to experience extensive volatility. Our quarterly operating results, the success or failure of future development efforts, changes in general conditions in the economy or the financial markets and other developments affecting our customers, our competitors or us could cause the market price of our common stock to fluctuate substantially. This volatility may adversely affect the price of our common stock. In the past, securities class action litigation has often been instituted following periods of volatility in the market price of a company’s securities. A securities class action suit against us could result in potential liabilities, substantial costs and the diversion of management’s attention and resources, regardless of whether we win or lose.

Payment of a dividend could decline or cease.

Because we have historically paid dividends, any cessation of our program or reduction in our quarterly dividend could affect our stock price. We have paid dividends on our common stock for 58 consecutive quarters. It is our intent to continue this practice as long as we are able. However, if we are forced to cease this practice or reduce the amount of the regular dividend, due to operating or economic conditions, our stock price could suffer. In December 2008, the Company also paid a special dividend. Investors should not anticipate or expect any future or recurring special dividends. Further, if the Company ceases its future dividends, a return on investment in our common stock would depend entirely upon future appreciation. There is no guarantee that our common stock will appreciate in value or even maintain the price at which stockholders have purchased their shares.

The general economic condition could continue to deteriorate.

Our business is dependent upon new hiring and the supply of new jobs created by overall economic conditions. If the economy continues to deteriorate, leading to high unemployment and the lack of new job creation, our business and stock price could be adversely affected.

Item 2. Properties

The Company maintains its corporate office and northeast sales office at 125 Nagog Park, Acton, Massachusetts; the office consists of 3,971 square feet and is leased through February 2015.

The Company leases 18,000 square feet of space in Culver City, California, for laboratory purposes. This facility is leased through December 31, 2012 with an option to renew for an additional three years. The Company also leases an additional 5,400 square feet of space in Culver City, California for customer service and information technology purposes. This office space is leased through December 31, 2012 with an option to renew for an additional three years.

Item 3. Legal Proceedings

The Company is involved in various suits and claims in the ordinary course of business. The Company does not believe that the disposition of any such suits or claims will have a material adverse effect on the continuing operations or financial condition of the Company.

Item 4. Reserved

Not applicable.

12

Item 5. Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities

The Company’s common stock is traded on the NASDAQ Stock Market under the symbol “PMD”. As of March 25, 2011, there were 190 record holders of the Company’s common stock. The number of record owners was determined from the Company’s stockholder records maintained by the Company’s transfer agent and does not include beneficial owners of the Company’s common stock whose shares are held in the names of various security holders, dealers and clearing agencies. The Company believes that the number of beneficial owners of the Company’s common stock held by others as or in nominee names exceeds 2,000.

The following table sets forth for the periods indicated the range of prices for the Company’s common stock as reported by the NASDAQ Stock Exchange and dividends declared by the Company.

|

High

|

Low

|

Dividends

|

||||||||||

|

Fiscal 2009:

|

||||||||||||

|

First Quarter

|

$ | 7.32 | $ | 3.03 | $ | 0.170 | ||||||

|

Second Quarter

|

6.99 | 5.51 | 0.170 | |||||||||

|

Third Quarter

|

7.05 | 6.00 | 0.120 | |||||||||

|

Fourth Quarter

|

7.70 | 5.10 | 0.120 | |||||||||

|

Fiscal 2010:

|

||||||||||||

|

First Quarter

|

$ | 8.21 | $ | 7.17 | $ | 0.120 | ||||||

|

Second Quarter

|

9.03 | 7.54 | 0.120 | |||||||||

|

Third Quarter

|

9.72 | 7.76 | 0.120 | |||||||||

|

Fourth Quarter

|

9.95 | 6.89 | 0.120 | |||||||||

The Company has paid dividends over the past fourteen years. It most recently declared a dividend in March 2011, which was paid in March 2011. The Company’s current intention is to continue to declare dividends to the extent funds are available and not required for operating purposes or capital requirements, and only then, upon approval by the Board of Directors.

Issuer Purchases of Equity Securities

During 2010, the Company repurchased 822 common shares for treasury. See Item 7 for more detail.

Unregistered Sales of Equity Securities and Use of Proceeds

There were no unregistered repurchases of common stock of the Company during 2010.

13

EQUITY COMPENSATION PLAN INFORMATION

The following table provides information as of December 31, 2010, with respect to shares of the Company’s common stock that were issuable under the Company’s 2006 Equity Incentive Plan (the “2006 Equity Incentive Plan”).

The table does not include information with respect to shares subject to outstanding options granted under other equity compensation plans that were no longer in effect on December 31, 2010. Footnote (2) to the table sets forth the total number of shares of common stock issuable upon the exercise of options under such expired or discontinued plans as of December 31, 2010, and the weighted average exercise price of those options. No additional options may be granted under such other expired or discontinued plans.

|

Number of Securities to

Be Issued Upon

Exercise of Outstanding

Options, Warrants and

Rights

(a)

|

Weighted Average

Exercise Price of

Outstanding Options,

Warrants and Rights

(b)

|

Number of Securities

That Remained

Available

for Future Issuance

(c)

|

||||||||||

|

Equity compensation plans approved by security holders (1)

|

94,700 | $ | 0.00 | 84,450 | ||||||||

|

Equity compensation plans not approved by security holders

|

— | — | — | |||||||||

|

Total

|

94,700 | $ | 0.00 | 84,450 | ||||||||

|

(1)

|

Consists of the 2006 Equity Incentive Plan.

|

|

(2)

|

This table does not include information for the Company’s 2000 Stock Option Plan (discontinued on May 11, 2006). As of December 31, 2010, a total of 289,371 shares of common stock were issuable upon the exercise of outstanding options under the foregoing discontinued plan. The weighted average exercise price of outstanding options under such plan is $13.96 per share. No additional options may be granted under the 2000 Stock Option Plan.

|

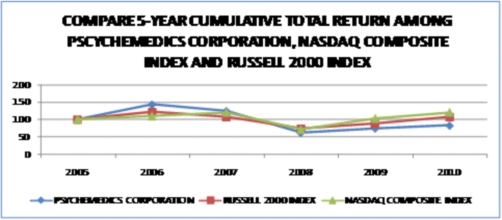

Performance Graph

|

2005

|

2006

|

2007

|

2008

|

2009

|

2010

|

|||||||||||||||||||

|

Psychemedics Corporation

|

100.00 | 142.93 | 124.28 | 61.67 | 74.49 | 82.25 | ||||||||||||||||||

|

Russell 2000 Index

|

100.00 | 121.40 | 106.90 | 74.58 | 88.03 | 107.83 | ||||||||||||||||||

|

NASDAQ Composite Index

|

100.00 | 109.52 | 120.27 | 71.51 | 102.89 | 120.29 | ||||||||||||||||||

|

*

|

Calculated by the Company using www.yahoo.com/finance historical prices

|

|

(1)

|

The above graph assumes a $100 investment on December 31, 2005, through the end of the 5-year period ended December 31, 2010 in the Company’s Common Stock, the Russell 2000 Index and the NASDAQ Composite Index. The prices all assume the reinvestment of dividends.

|

|

(2)

|

The Russell 2000 Index is composed of the smallest 2,000 companies in the Russell 3,000 Index. The Company has been unable to identify a peer group of companies that engage in testing of drugs of abuse, except for large pharmaceutical companies where such business is insignificant to such companies’ other lines of businesses. The Company therefore uses in its proxy statements a peer index based on market capitalization.

|

14

|

(3)

|

The NASDAQ Composite Index includes companies whose shares are traded on the NASDAQ Stock Exchange Market. In September 2008, Psychemedics moved its listing to the NASDAQ Stock Exchange Market from the AMEX Stock Exchange Market.

|

Item 6. Selected Financial Data

The selected financial data presented below is derived from our financial statements and should be read in connection with those statements.

|

As of and for the Years Ended

December 31,

|

||||||||||||||||||||

|

|

2010

|

2009

|

2008

|

2007

|

2006

|

|||||||||||||||

|

|

(In Thousands, Except for per Share Data)

|

|||||||||||||||||||

|

Revenue

|

$ | 20,109 | $ | 16,955 | $ | 22,949 | $ | 24,569 | $ | 23,425 | ||||||||||

|

Gross profit

|

12,042 | 9,610 | 13,350 | 14,677 | 14,056 | |||||||||||||||

|

Income from operations

|

4,414 | 2,584 | 4,707 | 7,139 | 7,563 | |||||||||||||||

|

Net income

|

2,614 | 1,527 | 2,969 | 4,484 | 4,902 | |||||||||||||||

|

Basic net income per share

|

0.50 | 0.29 | 0.57 | 0.86 | 0.95 | |||||||||||||||

|

Diluted net income per share

|

0.50 | 0.29 | 0.57 | 0.85 | 0.94 | |||||||||||||||

|

Total assets

|

11,766 | 10,602 | 12,628 | 15,561 | 13,261 | |||||||||||||||

|

Working capital

|

8,566 | 8,471 | 9,516 | 12,773 | 10,534 | |||||||||||||||

|

Shareholders’ equity

|

9,748 | 9,294 | 10,560 | 13,878 | 11,504 | |||||||||||||||

|

Cash dividends declared per common share

|

0.480 | 0.530 | 1.160 | 0.575 | 0.475 | |||||||||||||||

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The Management’s Discussion and Analysis of Financial Condition and Results of Operations should be read together with the more detailed business information and financial statements and related notes that appear elsewhere in this annual report on Form 10-K. This annual report may contain certain “forward-looking” information within the meaning of the Private Securities Litigation Reform Act of 1995. This information involves risks and uncertainties. Actual results may differ materially from the results discussed in the forward-looking statements. Factors that might cause such a difference include, but are not limited to, those discussed in “Item 1A — Risk Factors.”

Overview

Psychemedics Corporation is the world’s largest provider of hair testing for drugs of abuse, utilizing a patented hair analysis method involving radioimmunoassay technology and confirmation by mass spectrometry to analyze human hair to detect abused substances. The Company’s customers include Fortune 500 companies, as well as small to mid-size corporations, schools and governmental entities located primarily in the United States. During the year ended December 31, 2010, the Company generated $20.1 million in revenue, while maintaining a gross margin of 60% and pre-tax margins of 22%. At December 31, 2010, the Company had $5.7 million of cash, cash equivalents and short-term investments. During 2010, the Company had operating cash flow of $3.3 million and it distributed approximately $2.5 million or $0.48 per share of cash dividends to its shareholders. To date, the Company has paid fifty-eight consecutive quarterly cash dividends.

15

The following table sets forth, for the periods indicated, the selected statements of operations data as a percentage of total revenue:

|

Year Ended December 31,

|

||||||||||||

|

|

2010

|

2009

|

2008

|

|||||||||

|

Revenue

|

100.0 | % | 100.0 | % | 100.0 | % | ||||||

|

Cost of revenue

|

40.1 | % | 43.3 | % | 41.8 | % | ||||||

|

Gross profit

|

59.9 | % | 56.7 | % | 58.2 | % | ||||||

|

Operating expenses:

|

||||||||||||

|

General and administrative

|

20.9 | % | 21.2 | % | 19.7 | % | ||||||

|

Marketing and selling

|

14.6 | % | 17.5 | % | 15.9 | % | ||||||

|

Research and development

|

2.4 | % | 2.8 | % | 2.1 | % | ||||||

|

Total operating expenses

|

37.9 | % | 41.5 | % | 37.7 | % | ||||||

|

Operating income

|

22.0 | % | 15.2 | % | 20.5 | % | ||||||

|

Other income

|

||||||||||||

|

Interest income

|

0.1 | % | 0.3 | % | 1.3 | % | ||||||

|

Other income

|

— | — | — | |||||||||

|

Total other income

|

0.1 | % | 0.3 | % | 1.3 | % | ||||||

|

Income before taxes

|

22.1 | % | 15.5 | % | 21.8 | % | ||||||

|

Provision for income taxes

|

9.1 | % | 6.5 | % | 8.9 | % | ||||||

|

Net income

|

13.0 | % | 9.0 | % | 12.9 | % | ||||||

Results for the Year Ended December 31, 2010 Compared to Results for the Year Ended December 31, 2009

Revenue increased $3.2 million or 19% to $20.1 million in 2010 compared to $17.0 million in 2009. This increase was due to an increase in volume from new and existing clients. Average revenue per sample increased 2% between 2010 and 2009.

Gross profit increased $2.4 million to $12.0 million in 2010 compared to $9.6 million in 2009. Direct costs increased by 10% from 2009 to 2010, mainly associated with the direct cost of materials resulting from higher volumes. The gross profit margin increased from 57% in 2009 to 60% in 2010 as revenue increased more than direct costs.

General and administrative (“G&A”) expenses were $4.2 million for the year ended December 31, 2010 compared to $3.6 million for the year ended December 31, 2009, representing an increase of 17%. As a percentage of revenue, G&A expenses were 20.9% and 21.2% for the years ended December 31, 2010 and 2009, respectively. The increase in general and administrative expenses in 2010 was due to several factors: an increase in salary expense due to the reinstatement of salaries in 2010 following a salary cut in the second half of 2009, an increase in accounting and audit fees, an increase in legal fees defending our technology on behalf of our customers, and bonuses earned in 2010 and not in 2009.

Marketing and selling expenses were $2.9 million for the year ended December 31, 2010, compared to $3.0 million for the year ended December 31, 2009, a decrease of less than 1%. Total marketing and selling expenses represented 14.6% and 17.5% of revenue for the years ended December 31, 2010 and 2009, respectively.

Research and development (“R&D”) expenses for 2010 were $0.5 million compared to $0.5 million for 2009. R&D expenses represented 2.4% and 2.8% of revenue for the years ended December 31, 2010 and 2009, respectively.

Interest income decreased approximately $22,000 to approximately $23,000 for the year ended December 31, 2010 compared to $45,000 for the year ended December 31, 2009. Interest income in both periods represented interest and dividends earned on cash equivalents and short-term investments. A decrease in the yield on investment balances in 2010 as compared to 2009 caused the decrease in interest income.

During the year ended December 31, 2010, the Company recorded a tax provision of $1.8 million, representing an effective tax rate of 41.1%. During the year ended December 31, 2009, the Company recorded a tax provision of $1.1 million, representing an effective tax rate of 41.9%. We do not expect a significant change in our tax rate in the foreseeable future.

16

Results for the Year Ended December 31, 2009 Compared to Results for the Year Ended December 31, 2008

Revenue decreased $6.0 million or 26% to $17.0 million in 2009 compared to $22.9 million in 2008. This decrease was due in part to decreased testing volume, which fell 26% compared to 2008. Average revenue per sample was unchanged between 2009 and 2008. Revenue included the recognition of deferred revenue relating to the sale of PDT-90 products was $0.1 million for each of the years ended December 31, 2009 and 2008.

Gross profit decreased $3.7 million to $9.6 million in 2009 compared to $13.4 million in 2008. Direct costs decreased by 23% from 2008 to 2009, mainly due to lower labor and associated direct cost of materials. The gross profit margin fell from 58% in 2008 to 57% in 2009 as revenue declined more than direct costs.

General and administrative (‘‘G&A’’) expenses were $3.6 million for the year ended December 31, 2009 compared to $4.5 million for the year ended December 31, 2008, representing a decrease of 20%. As a percentage of revenue, G&A expenses were 21.2% and 19.7% for the years ended December 31, 2009 and 2008, respectively. The decrease in general and administrative expenses in 2009 was due primarily to a decrease in several categories: lower legal fees defending our technology on behalf of our customers, reduced salaries and stock compensation, decreased bad debt expense and lower consulting fees.

Marketing and selling expenses were $3.0 million for the year ended December 31, 2009, compared to $3.6 million for the year ended December 31, 2008, a decrease of 19%. The variation in marketing and selling expenses was primarily due to lower staffing levels, salary expense and reduced benefit expense of approximately $289,000. Total marketing and selling expenses represented 17.5% and 15.9% of revenue for the years ended December 31, 2009 and 2008, respectively.

Research and development (‘‘R&D’’) expenses for 2009 were $0.5 million compared to $0.5 million for 2008. R&D expenses represented 2.8% and 2.1% of revenue for the years ended December 31, 2009 and 2008, respectively.

Interest income decreased approximately $263,000 to approximately $45,000 for the year ended December 31, 2009 compared to $308,000 for the year ended December 31, 2008. Interest income in both periods represented interest and dividends earned on cash equivalents and short-term investments. Lower average investment balances along with a decrease in the yield on investment balances in 2009 as compared to 2008 caused the decrease in interest income.

During the year ended December 31, 2009, the Company recorded a tax provision of $1.1 million, representing an effective tax rate of 41.9%. During the year ended December 31, 2008, the Company recorded a tax provision of $2.0 million, representing an effective tax rate of 40.8%.

At December 31, 2010, the Company had $5.7 million of cash, cash equivalents and short term investments, compared to $5.8 million at December 31, 2009. The Company’s operating activities generated net cash of $3.3 million in 2010, $2.4 million in 2009 and $3.7 million in 2008. Investing activities used $1.9 million in 2010, used $1.1 million in 2009 and generated $3.5 million in 2008. Financing activities used $2.6 million in 2010, $3.1 million in 2009 and $6.7 million in 2008.

Operating cash flow of $3.3 million in 2010 primarily reflected net income of $2.6 million adjusted for depreciation and amortization of $0.3 million, stock compensation expense of $0.4 million, an increase in prepaid expenses and accounts receivable of $0.9 million and an increase in accounts payable of $0.5 million, and an increase in accrued expenses of $0.2 million. Operating cash flow of $2.4 million in 2009 primarily reflected net income of $1.5 million adjusted for depreciation and amortization of $0.3 million, stock compensation expense of $0.4 million, a decrease in prepaid expenses and accounts receivable of $0.8 million and accounts payable of $0.5 million, and a decrease in accrued expenses of $0.2 million. Operating cash flow of $3.7 million in 2008 primarily reflected net income of $3.0 million adjusted for depreciation and amortization of $0.3 million, stock compensation expense of $0.4 million and an increase in prepaid expenses of $0.6 million, offset by an increase in accrued expenses of $0.3 million. We expect operating cash flow to increase as our projected sales increase.

17

Investing cash flow principally reflected the purchase of short-term investments and capital expenditures. During 2010, the Company invested in short-term investments of $1.0 million. During 2009, the Company invested in short-term investments of $1.0 million while in 2008 the Company redeemed at par investments of $3.9 million. Capital expenditures were $0.8 million, $0.04 million, and $0.3 million in 2010, 2009 and 2008, respectively. The expenditures related principally to new equipment, including laboratory and computer equipment. We expect capital expenditures to increase from the current year as additional software and equipment is purchased primarily for our laboratory.

During 2010, the Company repurchased 822 shares for treasury. In 2009, the Company repurchased 17,219 shares of common stock for treasury. The Company has authorized 750,000 shares for repurchase since June of 1998, of which 250,000 shares of common stock were authorized in March of 2009 for repurchase. Since 1998, a total of 547,899 shares have been repurchased. The Company also distributed $2.5 million, $3.0 million, and $6.1 million (of which $2.6 million was a special dividend) of cash dividends to its shareholders in 2010, 2009, and 2008 respectively.

At December 31, 2010, the Company’s principal sources of liquidity included approximately $5.7 million of cash, cash equivalents and short-term investments. Management currently believes that such funds, together with future operating profits, should be adequate to fund anticipated working capital requirements and capital expenditures in the near term. Depending upon the Company’s results of operations, its future capital needs and available marketing opportunities, the Company may use various financing sources to raise additional funds. Such sources could include joint ventures, issuance of common stock or debt financing, although there is no assurance that such financings will be available to the Company on terms it deems acceptable, if at all. At December 31, 2010, the Company had no long-term debt.

The Company has paid dividends over the past fifty-eight quarters. It most recently declared a dividend in March 2011 which was paid in March 2011 and amounted to $625,442. The Company’s current intention is to continue to declare dividends to the extent funds are available and not required for operating purposes or capital requirements, and only then, upon approval by the Board of Directors. There can be no assurance that in the future the Company will declare dividends.

Contractual obligations as of December 31, 2010 were as follows:

|

Payments Due by Period

|

||||||||||||||||||||

|

Less

|

Greater

|

|

||||||||||||||||||

|

Than 1

|

1 – 3

|

3 – 5

|

Than 5

|

|||||||||||||||||

|

Contractual Obligation

|

Year

|

Years

|

Years

|

Years

|

Total

|

|||||||||||||||

|

|

(Amounts in Thousands)

|

|||||||||||||||||||

|

Operating leases

|

$ | 546 | $ | 738 | $ | 54 | $ | — | $ | 1,338 | ||||||||||

|

Purchase commitment

|

569 | — | — | — | 569 | |||||||||||||||

|

Total

|

$ | 1,155 | $ | 738 | $ | 54 | $ | — | $ | 1,907 | ||||||||||

Purchase Commitment

The Company has a supply agreement with a vendor which requires the Company to purchase isotopes used in its drug testing procedures from this sole supplier at prices based upon prior year purchase levels. Purchases amounted to $432,000, $584,000, and $606,000 in 2010, 2009 and 2008 respectively. The Company expects to purchase $569,000 in 2011. In exchange for exclusivity, the supplier has provided the Company with the right to purchase the isotope technology at fair market value under certain conditions, including the failure to meet the Company’s purchase commitments. This agreement does not include a fixed termination date; however, it is cancelable upon mutual agreement by both parties or after six months termination notice by the Company of its intent to use a different technology in connection with its drug testing procedures.

18

Critical Accounting Policies