Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

[X]

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2010

|

or

|

[ ]

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______________ to _______________

|

Commission file number: 0-29466

National Research Corporation

(Exact name of registrant as specified in its charter)

|

Wisconsin

(State or other jurisdiction

of incorporation or organization)

|

47-0634000

(I.R.S. Employer

Identification No.)

|

|

1245 Q Street

Lincoln, Nebraska

(Address of principal executive offices)

|

68508

(Zip code)

|

Registrant’s telephone number, including area code: (402) 475-2525

Securities registered pursuant to Section 12(b) of the Act:

Title of Class Name of Each Exchange on Which Registered

Common Stock, $.001 par value The NASDAQ Global Market

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes £ No T

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes £ No T

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes T No £

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). [Registrant is not yet required to provide financial disclosure in an Interactive Data File Format.] Yes £ No £

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer £ Accelerated filer £ Non-accelerated filer T Smaller reporting company £

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act.) Yes £ No T

Aggregate market value of the voting stock held by nonaffiliates of the registrant at June 30, 2010: $42,424,896.

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

Common Stock, $0.001 par value, outstanding as of March 21, 2011: 6,713,407 shares

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the 2011 Annual Meeting of Shareholders are incorporated by reference into Part III.

TABLE OF CONTENTS

|

Page

|

||

|

PART I

|

||

|

Item 1.

|

Business

|

1

|

|

Item 1A.

|

Risk Factors

|

5

|

|

Item 1B.

|

Unresolved Staff Comments

|

8

|

|

Item 2.

|

Properties

|

8

|

|

Item 3.

|

Legal Proceedings

|

8

|

|

PART II

|

||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

9

|

|

Item 6.

|

Selected Financial Data

|

11

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

12

|

|

Item 7A.

|

Quantitative and Qualitative Disclosure About Market Risk

|

21

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

22

|

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

47

|

|

Item 9A.

|

Controls and Procedures

|

47

|

|

Item 9B.

|

Other Information

|

48

|

|

PART III

|

||

|

Item 10.

|

Directors and Executive Officers of the Registrant

|

49

|

|

Item 11.

|

Executive Compensation

|

49

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

49

|

|

Item 13.

|

Certain Relationships and Related Transactions

|

50

|

|

Item 14.

|

Principal Accountant Fees and Services

|

50

|

|

PART IV

|

||

|

Item 15.

|

Exhibits and Financial Statement Schedules

|

51

|

|

Signatures

|

54

|

i

PART I

Item 1. Business

Special Note Regarding Forward-Looking Statements

Certain matters discussed below in this Annual Report on Form 10-K are “forward-looking statements” within the meaning of Section 21E of the Securities Act of 1934, as amended. These forward-looking statements can generally be identified as such because the context of the statements include phrases such as the Company “believes,” “expects” or other words of similar import. Similarly, statements that describe the Company’s future plans, objectives or goals are also forwarding-looking statements. Such forward-looking statements are subject to certain risks and uncertainties which could cause actual results or outcomes to differ materially from those currently anticipated. Factors that could affect actual results or outcomes include, without limitation, the factors set forth in “Risk Factors.” Shareholders, potential investors, and other readers are urged to consider these and other factors in evaluating the forward-looking statements, and are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements included are only made as of the date of this Annual Report on Form 10-K and the Company undertakes no obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances.

General

National Research Corporation (“NRC,” the “Company” “we,” “our,” “us” or similar terms), a Wisconsin corporation, believes it is a leading provider of performance measurement and improvement services, healthcare analytics and governance education to the healthcare industry in the United States and Canada. The Company believes it has achieved this leadership position based on 30 years of industry experience and its relationships with many of the industry’s largest organizations. The Company’s portfolio of services addresses the growing needs of healthcare organizations to measure and improve satisfaction, quality and cost outcomes relative to the services that they provide. Since its founding in 1981 in Lincoln, Nebraska, NRC has focused on meeting the information needs of the healthcare industry. The Company’s services, which are comprehensive, include data collection, healthcare analytics, best practice identification and effective delivery of value-added business intelligence that enables its clients to improve performance across key business metrics. Through its extensive array of service capabilities and industry relationships, NRC is positioned to provide healthcare information services to organizations across a wide continuum of service delivery segments.

The NRC Solution

The Company addresses the healthcare industry’s growing need to measure and improve performance across the broad and rapidly changing continuum of healthcare service delivery. The Company provides services designed to enable its clients to obtain and effectively utilize healthcare analytics and business intelligence to improve performance against key metrics relative to satisfaction, quality and cost outcomes across the organization. The Company’s solutions are designed to respond to the rapidly changing needs of the healthcare industry. NRC utilizes dynamic data collection, analysis and business intelligence delivery processes to optimize its clients ability to improve performance. The flexibility of the Company’s data collection process allows healthcare organizations to add timely, market-driven questions relevant to matters such as industry performance mandates, employer performance guarantees and internal quality improvement initiatives. In addition, the Company assesses core service factors relevant to all healthcare respondent groups (patients, members, employers, employees, physicians, residents, families, etc.) and to all service points across the healthcare delivery continuum.

1

The Company’s performance measurement and improvement services and healthcare analytics are delivered throughout the healthcare industry under several brand names, including NRC Picker, My InnerView (“MIV”), Ticker, Outcome Concept Systems (“OCS”), which was acquired on August 3, 2010, and NRC Picker Canada.

Through its division known as The Governance Institute (“TGI”), NRC offers subscription-based governance information services and educational conferences designed to improve the effectiveness of hospital and healthcare systems by continually strengthening their boards, medical leadership, and management performance in the United States. TGI conducts timely conferences, produces publications, videos, white papers and research studies, and tracks industry trends showcasing the best practices of healthcare boards across the country.

Growth Strategy

The Company believes that it can continue to grow through (1) increasing sales of existing services to its existing clients, (2) increasing the number of clients through market share growth in existing market segments, (3) expanding the sale of existing services into new market segments, (4) introducing new services to new and existing clients, and (5) pursuing acquisitions of, or investments in, firms providing products, services or technologies which complement those of the Company.

Product Offerings

The Company’s performance measurement and improvement services are designed to enable its clients to effectively collect, analyze and utilize meaningful business intelligence to improve performance relative to satisfaction, quality, cost, clinical outcomes and other key performance metrics. NRC has developed proprietary web-based electronic delivery systems that provide clients the ability to review results and reports online, independently analyze data, query data sets, customize a number of reports and distribute reports electronically. The Company has also developed business intelligence solutions which provide clients with current key metric results, as well as best practice benchmarking information.

The Company’s MIV division is a leading provider of performance measurement and improvement services to the senior care profession. MIV works with over 8,000 senior-care providers throughout the United States, housing what the Company believes is the largest dataset of senior-care satisfaction metrics in the nation.

The OCS division is a leading provider of quality and performance improvement solutions to the home health market. OCS provides performance measurement and improvement services, healthcare analytics and hosted software solutions to a large segment of the leading home healthcare providers in the United States.

Ticker serves as a market information and competitive intelligence source, as well as a comparative performance database. Ticker is the largest consumer-based study of consumers’ perceptions of, and satisfaction with, hospitals and health systems in more than 300 markets across the country, representing the views of approximately 265,000 households in the largest markets in the continental United States. Ticker provides comprehensive assessments, including consumer quality perceptions, product-line preferences, service use and visit satisfaction for more than 4,900 hospitals and health systems. More than 200 data items relevant to healthcare providers and purchasers are reported in Ticker, including hospital quality and image ratings, hospital selection factors, household preventative health behaviors, presence of chronic conditions, and emerging market issues such as social media and retail mini clinics.

Through TGI, the Company offers subscription-based governance education services. These education services are provided for the boards of directors and medical leadership of hospital and healthcare systems. The Company provides information regarding organization governance as well as emerging healthcare issues through online content, publications, periodicals, reference books, and associated videos through its resource catalog. The Company also produces several executive healthcare leadership conferences each year which are exclusively available to clients.

2

Clients

The Company’s ten largest clients accounted for 19%, 19%, and 24% of the Company’s total revenue in 2010, 2009 and 2008, respectively. Approximately 8% of the Company’s revenue was derived from foreign customers in 2010, 2009, and 2008.

Sales and Marketing

The Company generates the majority of its revenue from client renewals, supplemented by sales of new products and services to existing clients and the addition of new clients. NRC sales activities are carried out by a direct sales organization staffed with professional, trained sales associates. As compared to the typical industry practice of compensating sales associates with relatively high base pay and a relatively small sales commission, NRC compensates its sales staff with relatively low base pay and a relatively high commission component. The Company believes this compensation structure provides incentives to its sales associates to surpass sales goals and increases the Company’s ability to attract top-quality sales associates.

In addition to prospect leads generated by direct sales associates, the Company’s integrated marketing activities facilitate its ongoing receipt of prospect request-for-proposals. NRC uses lead generation mechanisms to add generated leads to its database of current and potential client contacts. The Company also maintains an active public relations program which includes (1) an ongoing presence in leading industry trade press and in the mainstream press, (2) public speaking at strategic industry conferences, (3) fostering relationships with key industry constituencies, and (4) the annual Consumer Choice Award program recognizing top-ranking healthcare organizations.

Competition

The healthcare information and market research services industry is highly competitive. The Company has traditionally competed with healthcare organizations’ internal marketing, market research and/or quality improvement departments which create their own performance measurement tools, and with relatively small specialty research firms which provide survey-based healthcare market research and/or performance assessment. The Company’s primary competitors among such specialty firms include Press Ganey, which NRC believes has significantly higher annual revenue than the Company, and three or four other firms that NRC believes have less annual revenue than the Company. The Company, to a certain degree, currently competes with, and anticipates that in the future it may increasingly compete with, (1) traditional market research firms which are significant providers of survey-based, general market research and (2) firms which provide services or products that complement healthcare performance assessments such as healthcare software or information systems. Although only a few of these competitors have offered specific services that compete directly with the Company’s services, many of these competitors have substantially greater financial, information gathering, and marketing resources than the Company and could decide to increase their resource commitments to the Company’s market. There are relatively few barriers to entry into the Company’s market, and the Company expects increased competition in its market which could adversely affect the Company’s operating results through pricing pressure, increased marketing expenditures, and market share losses, among other factors. There can be no assurance that the Company will continue to compete successfully against existing or new competitors.

The Company believes the primary competitive factors within its market include quality of service, timeliness of delivery, unique service capabilities, credibility of provider, industry experience, and price. NRC believes that its industry leadership position, exclusive focus on the healthcare industry, dynamic survey tools, syndicated market research, accredited leadership conferences, educational programs, benchmarking database information, and relationships with leading healthcare payers and providers position the Company to compete in this market.

3

Intellectual Property and Other Proprietary Rights

The Company’s success depends in part upon its data collection processes, research methods, data analysis techniques and internal systems, and procedures that it has developed specifically to serve clients in the healthcare industry. The Company has no patents. Consequently, it relies on a combination of copyright and trade secret laws and associate nondisclosure agreements to protect its systems, survey instruments and procedures. There can be no assurance that the steps taken by the Company to protect its rights will be adequate to prevent misappropriation of such rights or that third parties will not independently develop functionally equivalent or superior systems or procedures. The Company believes that its systems and procedures and other proprietary rights do not infringe upon the proprietary rights of third parties. There can be no assurance, however, that third parties will not assert infringement claims against the Company in the future or that any such claims will not result in protracted and costly litigation, regardless of the merits of such claims or whether the Company is ultimately successful in defending against such claims.

Associates

As of December 31, 2010, the Company employed a total of 253 persons on a full-time basis. In addition, as of such date, the Company had 52 part-time associates primarily in its survey operations, representing approximately 28 full-time equivalent associates. None of the Company’s associates are represented by a collective bargaining unit. The Company considers its relationship with its associates to be good.

Executive Officers of the Registrant

The following table sets forth certain information as of March 1, 2011, regarding the executive officers of the Company:

|

Name

|

Age

|

Position

|

||

|

Michael D. Hays

|

56

|

President, Chief Executive Officer and Director

|

||

|

Patrick E. Beans

|

53

|

Vice President, Treasurer, Chief Financial Officer,

Secretary and Director

|

Michael D. Hays has served as Chief Executive Officer and a director since he founded the Company in 1981. He was appointed to the additional role of President of the Company in July 2008, a position in which he also served from 1981 to 2004. Prior to founding the Company, Mr. Hays served for seven years as a Vice President and a director of SRI Research Center, Inc. (n/k/a the Gallup Organization).

Patrick E. Beans has served as Vice President, Treasurer, Chief Financial Officer, Secretary and a director since 1997, and as the principal financial officer since he joined the Company in August 1994. From June 1993 until joining the Company, Mr. Beans was the finance director for the Central Interstate Low-Level Radioactive Waste Commission, a five-state compact developing a low-level radioactive waste disposal plan. From 1979 to 1988 and from June 1992 to June 1993, he practiced as a certified public accountant.

Executive officers of the Company are elected by and serve at the discretion of the Company’s Board of Directors. There are no family relationships between any directors or executive officers of NRC.

4

Item 1A. Risk Factors

You should carefully consider each of the risks described below, together with all of the other information contained in this Annual Report on Form 10-K, before making an investment decision with respect to our securities. If any of the following risks develop into actual events, our business, financial condition or results of operations could be materially and adversely affected and you may lose all or part of your investment.

We depend on contract renewals for a large share of our revenue and our operating results could be adversely affected.

We expect that a substantial portion of our revenue for the foreseeable future will continue to be derived from renewable service contracts. Substantially all contracts are renewable annually at the option of our clients, although a client generally has no minimum purchase commitment under a contract and the contracts are generally cancelable on short or no notice without penalty. To the extent that clients fail to renew or defer their renewals, we anticipate our results may be materially adversely affected. Our ability to secure renewals depends on, among other things, our ability to gather and analyze performance data in a consistent, high-quality, and timely fashion. In addition, the service needs of our clients are affected by accreditation requirements, enrollment in managed care plans, the level of use of satisfaction measures in healthcare organizations’ overall management and compensation programs, the size of operating budgets, clients’ operating performance, industry and economic conditions, and changes in management or ownership. As these factors are beyond our control, we cannot ensure that we will be able to maintain our renewal rates. Any material decline in renewal rates from existing levels would have an adverse effect on our revenue and a corresponding effect on our operating and net income.

Our operating results may fluctuate and this may cause our stock price to decline.

Our overall operating results may fluctuate as a result of a variety of factors, including the size and timing of orders from clients, client demand for our services (which, in turn, is affected by factors such as accreditation requirements, enrollment in managed care plans, operating budgets and clients’ operating performance), the hiring and training of additional staff, expense increases, and industry and general economic conditions. Because a significant portion of our overhead is fixed in the short-term, particularly some costs associated with owning and occupying our building and full-time personnel expenses, our results of operations may be materially adversely affected in any particular period if revenue falls below our expectations. These factors, among others, make it possible that in some future period our operating results may be below the expectations of securities analysts and investors which would have a material adverse effect on the market price of our common stock.

We operate in a highly competitive market and could experience increased price pressure and expenses as a result.

The healthcare information and market research services industry is highly competitive. We have traditionally competed with healthcare organizations’ internal marketing, market research and/or quality improvement departments that create their own performance measurement tools, and with relatively small specialty research firms that provide survey-based healthcare market research and/or performance assessment. The Company’s primary competitors among such specialty firms include Press Ganey, which we believe has significantly higher annual revenue than us, and three or four other firms that we believe have less annual revenue than us. To a certain degree, we currently compete with, and anticipate that in the future we may increasingly compete with, (1) traditional market research firms which are significant providers of survey-based, general market research, and (2) firms which provide services or products that complement healthcare performance assessments, such as healthcare software or information systems. Although only a few of these competitors have offered specific services that compete directly with our services, many of these competitors have substantially greater financial, information gathering, and marketing resources than the Company and could decide to increase their resource commitments to our market. There are relatively few barriers to entry into the Company’s market, and we expect increased competition in our market which could adversely affect our operating results through pricing pressure, increased marketing expenditures, and market share losses, among other factors. There can be no assurance that the Company will continue to compete successfully against existing or new competitors.

5

Because our clients are concentrated in the healthcare industry, our revenue and operating results may be adversely affected by changes in regulations, a business downturn or consolidation with respect to the healthcare industry.

Substantially all of our revenue is derived from clients in the healthcare industry. As a result, our business, financial condition and results of operations are influenced by conditions affecting this industry, including changing political, economic, competitive and regulatory influences that may affect the procurement practices and operation of healthcare providers and payers. Recently, Congressional leaders enacted a comprehensive healthcare reform plan, including provisions to control healthcare costs, improve healthcare quality and expand access to affordable health insurance. These programs could result in lower reimbursement rates and otherwise change the environment in which providers and payers operate. In addition, large private purchasers of healthcare services are placing increasing cost pressure on providers. Healthcare providers may react to these cost pressures and other uncertainties by curtailing or deferring purchases, including purchases of our services. Moreover, there has been consolidation of companies in the healthcare industry, a trend which we believe will continue to grow. Consolidation in this industry, including the potential acquisition of certain of our clients, could adversely affect aggregate client budgets for our services or could result in the termination of a client’s relationship with us. The impact of these developments on the healthcare industry is difficult to predict and could have an adverse effect on our revenue and a corresponding effect on our operating and net income.

In March 2010, President Obama signed into law the Patient Protection and Affordable Care Act and the Health Care and Education Reconciliation Act of 2010. The new legislation makes extensive changes to the current system of healthcare insurance and benefits that will include changes in Medicare and Medicaid payment policies and other healthcare delivery reforms that could potentially impact the Company’s business. At this time, it is difficult to estimate the impact of this legislation on the Company.

We rely on a limited number of key clients and a loss of one or more of these key clients will adversely affect our operating results.

We rely on a limited number of key clients for a substantial portion of our revenue. The Company’s ten largest clients accounted for 19%, 19%, and 24% of the Company’s total revenue in 2010, 2009, and 2008, respectively.

We cannot assure you that we will maintain our existing client base, maintain or increase the level of revenue or profits generated by our existing clients, or be able to attract new clients. Furthermore, the healthcare industry continues to undergo consolidation and we cannot assure you that such consolidation will not cause us to lose clients. The loss of one or more of our large clients or a significant reduction in business from such clients, regardless of the reason, may have a negative effect on our revenue and a corresponding effect on our operating and net income. See “Risk Factors - Because our clients are concentrated in the healthcare industry, our revenue and operating results may be adversely affected by changes in regulations, a business downturn or consolidation with respect to the healthcare industry.”

We face several risks relating to our ability to collect the data on which our business relies.

Our ability to provide timely and accurate performance measurement and improvement services to our clients depends on our ability to collect large quantities of high-quality data through surveys and interviews. If receptivity to our survey and interview methods by respondents declines, or for some other reason their willingness to complete and return surveys declines, or if we, for any reason, cannot rely on the integrity of the data we receive, then our revenue could be adversely affected, with a corresponding effect on our operating and net income. We also rely on third-party panels of pre-recruited consumer households to produce Ticker in a timely manner. If we are not able to continue to use these panels, or the time period in which we use these panels is altered and we cannot find alternative panels on a timely, cost-competitive basis, we could face an increase in our costs or an inability to effectively produce Ticker. In either case, our operating and net income could be negatively affected.

6

Our principal shareholder effectively controls our company.

Michael D. Hays, our President and Chief Executive Officer, beneficially owned 66.8% of our outstanding common stock as of March 10, 2011. In addition, Mr. Hays has created a grantor retained annuity trust and has transferred to such trust shares representing approximately 4.2% of our outstanding common stock as of March 10, 2011, all or a portion of which, will be returned to Mr. Hays over the next year. As a result, Mr. Hays can control matters requiring shareholder approval, including the election of directors and the approval of significant corporate matters such as change of control transactions. The effects of such influence could be to delay or prevent a change of control of our company unless the terms are approved by Mr. Hays.

Our business and operating results could be adversely affected if we are unable to attract or retain key managers and other personnel.

Our future performance may depend, to a significant extent, upon the efforts and ability of our key personnel who have expertise in gathering, interpreting and marketing survey-based performance information for healthcare markets. Although client relationships are managed at many levels within our company, the loss of the services of Michael D. Hays, our President and Chief Executive Officer, or one or more of our other senior managers, could have a material adverse effect, at least in the short to medium term, on most significant aspects of our business, including strategic planning, product development, and sales and customer relations. As of December 31, 2010, we maintained $500,000 of key officer life insurance on Mr. Hays. Our success will also depend on our ability to hire, train and retain skilled personnel in all areas of our business. Currently, we do not have employment agreements with our officers or our other key personnel. Competition for qualified personnel in our industry is intense, and many of the companies that compete with us for qualified personnel have substantially greater financial and other resources than us. Furthermore, we expect competition for qualified personnel to become more intense as competition in our industry increases. We cannot assure you that we will be able to recruit, retain and motivate a sufficient number of qualified personnel to compete successfully.

If intellectual property and other proprietary information technology were copied or independently developed by our competitors, our operating results could be negatively affected.

Our success depends in part upon our data collection process, research methods, data analysis techniques, and internal systems and procedures that we have developed specifically to serve clients in the healthcare industry. We have no patents. Consequently, we rely on a combination of copyright, trade secret laws and associate nondisclosure agreements to protect our systems, survey instruments and procedures. We cannot assure you that the steps we have taken to protect our rights will be adequate to prevent misappropriation of such rights, or that third parties will not independently develop functionally equivalent or superior systems or procedures. We believe that our systems and procedures and other proprietary rights do not infringe upon the proprietary rights of third parties. We cannot assure you, however, that third parties will not assert infringement claims against us in the future, or that any such claims will not result in protracted and costly litigation, regardless of the merits of such claims, or whether we are ultimately successful in defending against such claims.

7

Item 1B. Unresolved Staff Comments

The Company has no unresolved staff comments to report pursuant to this item.

Item 2. Properties

The Company’s headquarters is located in an owned office building in Lincoln, Nebraska, of which 62,000 square feet are used for the Company’s operations. This facility houses all the capabilities necessary for NRC’s survey programming, printing and distribution, data processing, analysis and report generation, marketing, and corporate administration.

The Company is leasing 2,600 square feet of office space in Markham, Ontario, 5,100 square feet of office space in San Diego, California and 8,900 square feet of office space in Seattle, Washington. The Company also leased 8,500 square feet of office space in Wausau, Wisconsin until February 1, 2011.

Item 3. Legal Proceedings

The Company is not subject to any material pending litigation.

8

PART II

Item 5. Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

The Company’s Common Stock, $0.001 par value (“Common Stock”), is traded on the NASDAQ Global Market under the symbol “NRCI.” The following table sets forth the range of high and low sales prices for, and dividends declared on, the Common Stock for the period from January 1, 2009, through December 31, 2010:

|

High

|

Low

|

Dividends

Declared Per

Common Share

|

|||||||

|

2009 Quarter Ended:

|

|||||||||

|

March 31

|

$29.01 | $19.48 | $.16 | ||||||

|

June 30

|

$28.10 | $23.10 | $.16 | ||||||

|

September 30

|

$26.74 | $23.55 | $.16 | ||||||

|

December 31

|

$25.30 | $20.32 | $.16 |

|

2010 Quarter Ended:

|

|||||||||

|

March 31

|

$25.91 | $19.00 | $.19 | ||||||

|

June 30

|

$27.50 | $21.45 | $.19 | ||||||

|

September 30

|

$26.90 | $22.07 | $.19 | ||||||

|

December 31

|

$35.33 | $25.21 | $.19 |

On March 10, 2011, there were approximately 26 shareholders of record and approximately 400 beneficial owners of the Common Stock.

In March 2005, the Company announced the commencement of a quarterly cash dividend. Cash dividends of $5.1 million and $4.3 million in the aggregate were declared and paid during the twelve-month periods ended December 31, 2010 and 2009, respectively. The payment and amount of future dividends is at the discretion of the Company’s Board of Directors and will depend on the Company’s future earnings, financial condition, general business conditions and other factors.

In February 2006, the Board of Directors of the Company authorized the repurchase of 750,000 shares of common stock in the open market or in privately negotiated transactions. As of December 31, 2010, the remaining number of shares that could be purchased under this authorization was 268,717. There was no stock repurchased in the three month period ended December 31, 2010.

9

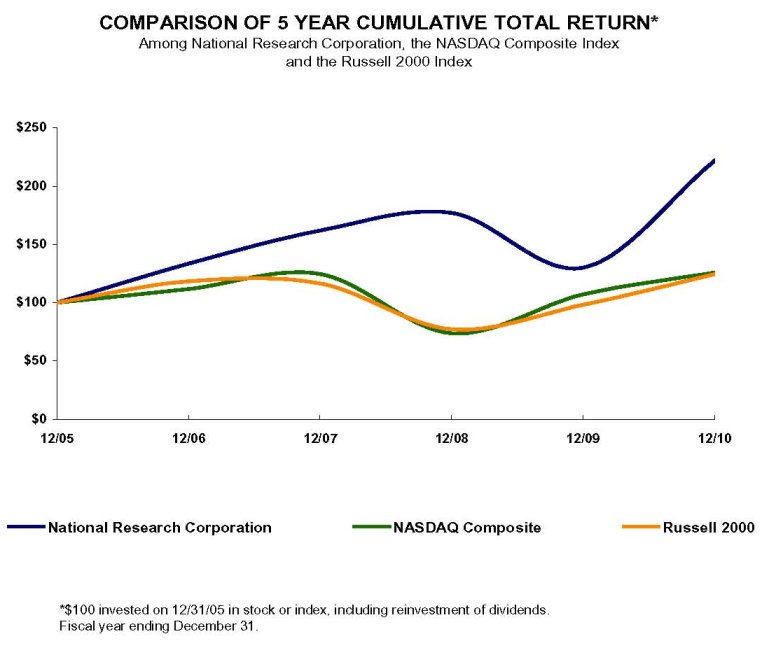

The following graph compares the cumulative 5-year total return provided shareholders on National Research Corporation's common stock relative to the cumulative total returns of the NASDAQ Composite Index and the Russell 2000 Index. An investment of $100 (with reinvestment of all dividends) is assumed to have been made in our common stock and in each of the indexes on December 31, 2005, and its relative performance is tracked through December 31, 2010.

COMPARISON OF FIVE-YEAR CUMULATIVE TOTAL RETURN DATA

|

12/05

|

12/06

|

12/07

|

12/08

|

12/09

|

12/10

|

||

|

National Research Corporation

|

100.00

|

133.54

|

161.91

|

177.12

|

130.11

|

221.81

|

|

|

NASDAQ Composite

|

100.00

|

111.74

|

124.67

|

73.77

|

107.12

|

125.93

|

|

|

Russell 2000

|

100.00

|

118.37

|

116.51

|

77.15

|

98.11

|

124.46

|

|

The stock price performance included in this graph is not necessarily indicative of future stock price performance.

10

Item 6. Selected Financial Data

The selected statement of income data for the years ended December 31, 2010, 2009, and 2008, and the selected balance sheet data at December 31, 2010 and 2009, are derived from, and are qualified by reference to, the audited consolidated financial statements of the Company included elsewhere in this Annual Report on Form 10-K. The selected statement of income data for the years ended December 31, 2007 and 2006, and the balance sheet data at December 31, 2008, 2007, and 2006, are derived from audited consolidated financial statements not included herein. The Company has made acquisitions and began recognizing share-based compensation expense during the five years covered by the selected statement financial data. See Note 2 and Note 7 to the Company's consolidated financial statements.

|

Year Ended December 31,

|

||||||||||||||||||||

|

2010

|

2009

|

2008

|

2007

|

2006

|

||||||||||||||||

|

(In thousands, except per share data)

|

||||||||||||||||||||

|

Statement of Income Data:

|

||||||||||||||||||||

|

Revenue

|

$ | 63,398 | $ | 57,692 | $ | 51,013 | $ | 48,923 | $ | 43,771 | ||||||||||

|

Operating expenses:

|

||||||||||||||||||||

|

Direct expenses

|

24,635 | 24,148 | 23,611 | 21,801 | 19,445 | |||||||||||||||

|

Selling, general and administrative

|

20,202 | 16,016 | 12,728 | 13,173 | 12,158 | |||||||||||||||

|

Depreciation and amortization

|

4,704 | 3,831 | 2,685 | 2,583 | 2,260 | |||||||||||||||

|

Total operating expenses

|

49,541 | 43,995 | 39,024 | 37,557 | 33,863 | |||||||||||||||

|

Operating income

|

13,857 | 13,697 | 11,989 | 11,366 | 9,908 | |||||||||||||||

|

Other expense

|

(542 | ) | (580 | ) | (6 | ) | (248 | ) | (402 | ) | ||||||||||

|

Income before income taxes

|

13,315 | 13,117 | 11,983 | 11,118 | 9,506 | |||||||||||||||

|

Provision for income taxes

|

4,816 | 4,626 | 4,538 | 4,278 | 3,622 | |||||||||||||||

|

Net income

|

$ | 8,499 | $ | 8,491 | $ | 7,445 | $ | 6,840 | $ | 5,884 | ||||||||||

|

Net income per share - basic

|

$ | 1.28 | $ | 1.28 | $ | 1.11 | $ | 1.00 | $ | 0.86 | ||||||||||

|

Net income per share - diluted

|

$ | 1.26 | $ | 1.26 | $ | 1.09 | $ | 0.98 | $ | 0.85 | ||||||||||

|

Dividends per share

|

$ | 0.76 | $ | 0.64 | $ | 0.56 | $ | 0.48 | $ | 0.40 | ||||||||||

|

Weighted average shares outstanding – basic

|

6,637 | 6,637 | 6,685 | 6,850 | 6,836 | |||||||||||||||

|

Weighted average shares outstanding – diluted

|

6,735 | 6,723 | 6,831 | 7,011 | 6,954 | |||||||||||||||

|

December 31,

|

||||||||||||||||||||

| 2010 | 2009 | 2008 | 2007 | 2006 | ||||||||||||||||

|

(In thousands)

|

||||||||||||||||||||

|

Balance Sheet Data:

|

||||||||||||||||||||

|

Working capital deficiency

|

$ | (8,809 | ) | $ | (4,432 | ) | $ | (10,650 | ) | $ | (2,384 | ) | $ | (1,482 | ) | |||||

|

Total assets

|

95,770 | 72,499 | 72,145 | 61,869 | 61,532 | |||||||||||||||

|

Total debt and capital lease obligations,

including current portion

|

16,599 | 7,719 | 12,954 | 2,993 | 11,093 | |||||||||||||||

|

Total shareholders’ equity

|

$ | 48,584 | $ | 44,171 | $ | 38,598 | $ | 42,286 | $ | 36,751 | ||||||||||

11

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Overview

The Company believes it is a leading provider of performance measurement and improvement services, healthcare analytics and governance education to the healthcare industry in the United States and Canada. The Company believes it has achieved this leadership position based on 30 years of industry experience and its relationships with many of the industry’s largest organizations. The Company’s portfolio of services addresses the growing needs of healthcare organizations to measure and improve satisfaction, quality and cost outcomes relative to the services that they provide. Since its founding in 1981 in Lincoln, Nebraska, NRC has focused on meeting the information needs of the healthcare industry. The Company’s services, which are comprehensive, include data collection, healthcare analytics, best practice identification and effective delivery of value-added business intelligence that enables its clients to improve performance across key business metrics. Through its extensive array of service capabilities and industry relationships, NRC is positioned to provide healthcare information services to organizations across a wide continuum of service delivery segments.

Acquisitions

On August 3, 2010, the Company acquired all of the issued and outstanding shares of stock and stock rights of OCS, a provider of clinical, financial and operational benchmarks and analytics to home care and hospice providers. The acquisition provides the Company with an entry in the home health and hospice markets through OCS’s customer relationships with home healthcare and hospice providers and expands the Company's service offerings across the continuum of care. Goodwill related to the acquisition of OCS primarily relates to intangible assets that do not qualify for separate recognition, including the depth and knowledge of management. The all-cash consideration paid at closing was $15.3 million, net of $1.0 million cash received.

On December 19, 2008, the Company acquired MIV, a leading provider of quality and performance improvement solutions to the senior care profession. MIV offers resident, family and employee satisfaction measurement and improvement products to the long-term care, assisted and independent living markets in the United States. MIV works with over 8,000 senior care providers throughout the United States housing what the Company believes is the largest dataset of senior care satisfaction metrics in the nation. The consideration paid at closing for MIV included payment of $11,500,000 in cash and $440,000 of direct expenses capitalized as purchase price. The merger agreement under which the Company acquired MIV provides for contingent earn-out payments of which $581,000 of the 2009 and 2010 earn-outs was included in this amount.

On April 1, 2008, approximately 10 customer contracts were purchased from SQ Strategies for $249,000. The recording of this asset purchase increased customer-related intangibles by $260,000 and deferred revenue by $11,000.

Critical Accounting Policies and Estimates

The preparation of financial statements requires management to make estimates and assumptions that affect amounts reported therein. The most significant of these areas involving difficult or complex judgments made by management with respect to the preparation of the Company’s consolidated financial statements for fiscal year 2010 include:

-

Revenue recognition;

-

Valuation of goodwill and identifiable intangible assets; and

-

Income taxes.

12

Revenue Recognition

The Company derives a majority of its operating revenue from its annually renewable services, which include performance measurement and improvement services, healthcare analytics and governance education services. The Company provides these services to its clients under annual client service contracts, although such contracts are generally cancelable on short or no notice without penalty. The Company also derives some revenue from its custom and other research projects.

Certain contracts are fixed-fee arrangements with a portion of the project fee billed in advance and the remainder billed periodically over the duration of the project. Revenue and direct expenses for services provided under these contracts are recognized under the proportional performance method. Under the proportional performance method, the Company recognizes revenue based on output measures or key milestones such as survey set-up, survey mailings, survey returns and reporting. The Company measures its progress based on the level of completion of these output measures and recognizes revenue accordingly. Management judgments and estimates must be made and used in connection with revenue recognized using the proportional performance method. If management made different judgments and estimates, then the amount and timing of revenue for any period could differ materially from the reported revenue.

Services are also provided under subscription-based service agreements. The Company recognizes subscription-based service revenue over the period of time the service is provided. Generally, the subscription periods are for twelve months and revenue is recognized equally over the subscription period.

The Company also derives revenue from hosting arrangements where our propriety software is offered as a service to our customers through our data processing facilities. The Company’s revenue also includes software-related revenue for software license revenue, installation services, post-contract support (maintenance) and training. Software-related revenue is recognized in accordance with the provisions of ASC 985-605, Software-Revenue Recognition.

Hosting arrangements to provide customers with access to the Company’s propriety software are marketed under long-term arrangements, generally over periods of one to three years. Under these arrangements, the customer is not provided the contractual right to take possession of the licensed software at any time during the hosting period without significant penalty, and the customer is not provided the right to run the software on their own hardware or contract with another party unrelated to us to host the software. Upfront fees for set-up services are typically billed for our hosting arrangements. However, these arrangements do not qualify for separation from the ongoing hosting services due to the absence of standalone value for the set-up services. Therefore, we account for these arrangements as service contracts and recognize revenue ratably over the hosting service period when all other conditions to revenue are met. Other conditions that must be met before the commencement of revenue recognition include achieving evidence of an arrangement, determining that the collection of the revenue is probable, and determining that fees are fixed and determinable.

The Company’s software arrangements typically involve the sale of a time-based license bundled with installation services, post-contract support (“PCS”) and training. License terms range from one year to three years and require an annual fee for bundled elements of the arrangement. PCS is also contractually provided for a period that is co-terminus with the term of the time-based license. The Company’s installation services are not considered to be essential to the functionality of the software license. The Company does not achieve vendor-specific objective evidence (“VSOE”) of the fair value of the undelivered elements of its software arrangements (primarily PCS) and, therefore, these arrangements are accounted for as a single unit of accounting with revenue recognized ratably over the minimum bundled PCS period.

13

The Company’s revenue arrangements (not involving software elements) may include multiple elements. In assessing the separation of revenue for elements of such arrangements, we first determine whether each delivered element has standalone value based on whether we or other vendors sell the services separately. We also consider whether there is sufficient evidence of the fair value of the elements in allocating the fees in the arrangement to each element. Revenue allocated to an element is limited to revenue that is not subject to refund or otherwise represents contingent revenue.

Valuation of Goodwill and Identifiable Intangible Assets

Intangible assets include customer relationships, trade names, non-compete agreements and goodwill. Intangible assets with estimable useful lives are amortized over their respective estimated useful lives to their estimated residual values and reviewed for impairment.

Goodwill is an asset representing the future economic benefits arising from other assets acquired in a business combination that are not individually identified and separately recognized. Goodwill is reviewed for impairment at least annually. The goodwill impairment test is a two-step test. Under the first step, the fair value of the reporting unit is compared with its carrying value (including goodwill). If the fair value of the reporting unit is less than its carrying value, an indication of goodwill impairment exists for the reporting unit and the entity must perform step two of the impairment test (measurement). Under step two, an impairment loss is recognized for any excess of the carrying amount of the reporting unit’s goodwill over the implied fair value of that goodwill. The implied fair value of goodwill is determined by allocating the fair value of the reporting unit in a manner similar to a purchase price allocation and the residual fair value after this allocation is the implied fair value of the reporting unit goodwill. Fair value of the reporting unit is determined using a discounted cash flow analysis. If the fair value of the reporting unit exceeds its carrying value, step two does not need to be performed.

All of the Company’s goodwill is allocated to its reporting units. As of October 1 of each year (or more frequently as changes in circumstances indicate), the Company tests goodwill for impairment. There are a number of inputs used to calculate the fair value using a discounted cash flow model, including operating results, business plans, projected cash flows and a discount rate. Discount rates, growth rates and cash flow projections are the most sensitive and susceptible to change as they require significant management judgment. Discount rates are determined by using a weighted average cost of capital, which considers market and industry data as well as Company-specific risk factors. Operational management develop growth rates and cash flow projections for each reporting unit considering industry and Company-specific historical and projected information. Terminal value rate determination follows common methodology of capturing the present value of perpetual cash flow estimates beyond the last projected period assuming a constant weighted average cost of capital and low long-term growth rates. On the evaluation dates, to the extent that the carrying value of the net assets of the Company’s reporting units having goodwill is greater than the estimated fair value, impairment charges will be determined and measured based on the estimated fair value of goodwill as compared to its carrying value. No impairments were recorded during the years ended December 31, 2010, 2009 or 2008.

Income Taxes

The Company uses the asset and liability method of accounting for income taxes. Under that method, deferred income tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases using enacted tax rates. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. Valuation allowances, if any, are established when necessary to reduce deferred tax assets to the amount that is more likely than not to be realized. The Company recognizes the effect of income tax positions only if those positions are more likely than not of being sustained. Recognized income tax positions are measured at the largest amount that is greater than 50% likely of being realized. Changes in recognition or measurement are reflected in the period in which the change in judgment occurs. Management judgment is required to determine the provision for income taxes and to determine whether deferred income taxes will be realized in full or in part. Such judgments include, but are not limited to, the likelihood we would realize the benefits of net operating loss carryforwards, the adequacy of valuation allowances, the election to capitalize or expense costs incurred, and the probability of outcomes of uncertain tax positions. It is possible that the various taxing authorities could challenge those judgments or positions and reach conclusions that would cause us to incur tax liabilities in excess of, or realize benefits less than, those currently recorded. In addition, changes in the geographical mix or estimated amount of annual pretax income could impact our overall effective tax rate.

14

Results of Operations

The following table sets forth, for the periods indicated, selected financial information derived from the Company’s consolidated financial statements, expressed as a percentage of total revenue and the percentage change in such items versus the prior comparable period. The trends illustrated in the following table may not necessarily be indicative of future results. The discussion that follows the table should be read in conjunction with the Company’s consolidated financial statements.

|

Percentage of Total Revenue

Year Ended December 31,

|

Percentage

Increase (Decrease)

|

|||||||||||||||||||

|

2010

|

2009

|

2008

|

2010 over 2009

|

2009 over 2008

|

||||||||||||||||

|

Revenue

|

100.0 | % | 100.0 | % | 100.0 | % | 9.9 | % | 13.1 | % | ||||||||||

|

Operating expenses:

|

||||||||||||||||||||

|

Direct expenses

|

38.8 | 41.9 | 46.3 | 2.0 | 2.3 | |||||||||||||||

|

Selling, general and administrative

|

31.9 | 27.8 | 24.9 | 26.1 | 25.8 | |||||||||||||||

|

Depreciation and amortization

|

7.4 | 6.6 | 5.3 | 22.8 | 42.7 | |||||||||||||||

|

Total operating expenses

|

78.1 | 76.3 | 76.5 | 12.6 | 12.7 | |||||||||||||||

|

Operating income

|

21.9 | % | 23.7 | % | 23.5 | % | 1.2 | % | 14.2 | % | ||||||||||

Year Ended December 31, 2010, Compared to Year Ended December 31, 2009

Revenue. Revenue increased 9.9% in 2010 to $63.4 million from $57.7 million in 2009. The acquisition of OCS accounted for $3.0 million of the increase with the remainder due to the addition of new clients and expanded sales from existing clients.

Direct expenses. Direct expenses increased 2% to $24.6 million in 2010 from $24.1 million in 2009. The primary reason for the increase in direct expenses was due to the acquisition of OCS, which added approximately $1.4 million, and investment in a new business unit, Illuminate, offset by increased use of more cost-efficient survey methodology, as well as staffing reductions. Direct expenses decreased as a percentage of revenue to 38.8% in 2010, from 41.9% during the same period of 2009.

Selling, general and administrative expenses. Selling, general and administrative expenses increased 26.1% to $20.2 million in 2010 from $16.0 million in 2009. The increase was primarily due to the addition of OCS (adding $1.0 million), $312,000 in acquisition and transition costs associated with the acquisition of OCS, investment in a new product development, expansion of the sales force, and the addition of several executives in various leadership roles. Selling, general and administrative expenses increased as a percentage of revenue to 31.9% in 2010 from 27.8% in 2009, mainly due to sales expansion efforts in 2010 throughout the Company, acquisition and transition costs associated with OCS and investment in a new product development.

15

Depreciation and amortization. Depreciation and amortization expenses increased 22.8% to $4.7 million in 2010 from $3.8 million in 2009. Depreciation and amortization increased as a percentage of revenue to 7.4% in 2010 from 6.6% in 2009. Approximately $351,000 of the increase was related to the acquisition of OCS, with the remainder primarily due to a large software project that was placed into service at the end of 2009.

Provision for income taxes. The provision for income taxes totaled $4.8 million (36.2% effective tax rate) for 2010 compared to $4.6 million (35.3% effective tax rate) for 2009. The effective tax rate was higher in 2010 due to an adjustment to deferred tax balances based on higher projected federal taxable rates and a decrease in research and development tax credits.

Year Ended December 31, 2009, Compared to Year Ended December 31, 2008

Revenue. Revenue increased 13.1% in 2009 to $57.7 million from $51.0 million in 2008. This was primarily due to the acquisition of MIV in December 2008.

Direct expenses. Direct expenses increased 2.3% to $24.1 million in 2009 from $23.6 million in 2008. The change was mainly due to increased costs of servicing the additional revenue from the MIV business, partially offset by the reductions in costs of servicing decreased revenue in other areas of the Company. Direct expenses decreased as a percentage of revenue to 41.9% in 2009 from 46.3% in 2008, primarily due to MIV’s current business model with direct expenses as a percentage of revenue lower than the other operating business units of the Company and growth in margin in the Ticker division.

Selling, general and administrative expenses. Selling, general and administrative expenses increased 25.8% to $16.0 million in 2009 from $12.7 million in 2008. The change was primarily due to increases in expenses related to the MIV acquisition and expansions in the sales force. Selling, general and administrative expenses increased as a percentage of revenue to 27.8% in 2009 from 24.9% in 2008, mainly due to sales expansion efforts in the latter portion of 2009 throughout the Company.

Depreciation and amortization. Depreciation and amortization expenses increased 42.7% to $3.8 million in 2009 from $2.7 million in 2008. Depreciation and amortization increased as a percentage of revenue to 6.6% in 2009 from 5.3% in 2008. The increase was primarily due to the depreciation of the fixed assets and amortization of intangible assets associated with the acquisition of MIV.

Provision for income taxes. The provision for income taxes totaled $4.6 million (35.3% effective tax rate) for 2009 compared to $4.5 million (37.9% effective tax rate) for 2008. The effective tax rate was lower in 2009 due to increases in research and development tax credits and state investment and growth act credits, and decreases in Canadian statutory income tax rates.

Inflation and Changing Prices

Inflation and changing prices have not had a material impact on revenue or net income in the last three years.

Liquidity and Capital Resources

The Company believes it has adequate capital resources and operating cash flow to meet its projected capital and debt maturity needs and dividend policy for the foreseeable future. Requirements for working capital, capital expenditures, and debt maturities will continue to be funded by operations and the Company’s borrowing arrangements.

16

Working Capital

The Company had a working capital deficiency of $8.8 million on December 31, 2010, compared to a $4.4 million working capital deficiency on December 31, 2009. The increase in the working capital deficiency was primarily due to a $5.8 million increase in deferred revenue, a $3.3 million increase in accrued expenses, accrued wages and accounts payable combined, and a $1.0 million increase in the current portion of notes payable, partially offset by a $4.0 million increase in accounts receivable and a $1.0 million increase in cash and cash equivalents. The working capital deficiency balance is primarily due to a deferred revenue balance of $17.7 million and $11.9 million as of December 31, 2010 and 2009, respectively.

The deferred revenue balance is primarily due to timing of initial billings on new and renewal contracts. The Company typically invoices clients for performance tracking services and custom research projects before they have been completed. Billed amounts are recorded as billings in excess of revenue earned, or deferred revenue, on the Company’s consolidated financial statements, and are recognized as income when earned. In addition, when work is performed in advance of billing, the Company records this work as revenue earned in excess of billings, or unbilled revenue. Substantially all deferred revenue and all unbilled revenue will be earned and billed respectively, within 12 months of the respective period ends.

Cash Flow Analysis

A summary of operating, investing, and financing activities are shown in the following table:

|

For the Year Ended December 31,

|

||||||||||||

|

2010

|

2009

|

2008

|

||||||||||

|

(In thousands)

|

||||||||||||

|

Provided by operating activities

|

$ | 14,603 | $ | 13,666 | $ | 15,175 | ||||||

|

Used in investing activities

|

(16,980 | ) | (3,002 | ) | (15,264 | ) | ||||||

|

Provided by (used in) financing activities

|

3,254 | (9,548 | ) | (1,755 | ) | |||||||

|

Effect of exchange rate change on cash

|

130 | 287 | (402 | ) | ||||||||

|

Net increase (decrease) in cash and cash equivalents

|

1,007 | 1,403 | (2,246 | ) | ||||||||

|

Cash and cash equivalents at end of period

|

$ | 3,519 | $ | 2,512 | $ | 1,109 | ||||||

Cash Flows from Operating Activities

Cash flows from operating activities consist of net income adjusted for non-cash items including depreciation and amortization, deferred taxes, and the effect of working capital changes.

Net cash provided by operating activities was $14.6 million for the year ended December 31, 2010, which included net income of $8.5 million, plus non cash charges (benefits) for deferred tax expense, depreciation and amortization and non-cash stock compensation totaling $6.1 million.

Net cash provided by operating activities was $13.7 million for the year ended December 31, 2009, which included net income of $8.5 million, plus non-cash charges (benefits) for deferred tax expense, depreciation and amortization, and non-cash stock compensation totaling $6.2 million. Changes in working capital reduced 2009 cash flows from operating activities by $1.0 million.

17

Net cash provided by operating activities was $15.2 million for the year ended December 31, 2008, which included net income of $7.4 million, plus non-cash charges (benefits) for deferred tax expense, depreciation and amortization, tax benefit from exercise of stock options and non-cash stock compensation totaling $4.3 million. Changes in working capital increased 2008 cash flows from operating activities by 3.5 million.

Cash Flows from Investing Activities

Net cash of $17.0 million was used for investing activities in the year ended December 31, 2010. Cash of $15.3 million was used for the acquisition of OCS and $172,000 was paid under the earn-out related to the MIV acquisition. Cash of $1.5 million was used for the purchase of property and equipment.

Net cash of $3.0 million was used for investing activities in the year ended December 31, 2009. Earn-out payments related to the MIV acquisition approximated $100,000 and purchases of property and equipment totaled $2.9 million.

Net cash of $15.3 million was used for investing activities in the year ended December 31, 2008. Cash of $12.6 million was used for the acquisition of MIV. Cash of $2.8 million was used for the purchase of property and equipment, which was offset by approximately $100,000 from proceeds from the maturity of available-for-sale securities.

Cash Flows from Financing Activities

Net cash provided by financing activities was $3.3 million in the year ended December 31, 2010. Cash was generated from borrowings under the term note and revolving credit note totaling $11.3 million. Proceeds from the exercise of stock options provided cash of $274,000. Cash was used to pay dividends of $5.1 million, repay borrowings under the term note and revolving credit note totaling $2.8 million, and repurchases of the Company’s common stock for $399,000.

Net cash used in financing activities was $9.5 million in the year ended December 31, 2009. Cash was generated from borrowings under the term note and revolving credit note totaling $4.9 million. Cash was used to pay dividends of $4.3 million and repay borrowings under the term note and revolving credit note totaling $10.1 million.

Net cash used in financing activities was $1.8 million in the year ended December 31, 2008. Cash was generated from borrowings under the term note and revolving credit note totaling $18.6 million. Proceeds from the exercise of stock options and the tax benefit on the exercise of stock options and vested restricted stock favorably impacted cash by $731,000 and $680,000, respectively. Cash was used to repurchase the Company’s common stock for $9.0 million, repay borrowings under the term note and revolving credit note totaling $9.0 million, and pay dividends of $3.8 million.

The effect of changes in foreign exchange rates increased (decreased) cash and cash equivalents by $130,000, $287,000 and ($402,000) in the years ended December 31, 2010, 2009 and 2008, respectively.

Capital Expenditures

Capital expenditures for the year ended December 31, 2010, were $2.3 million. Cash paid for these expenditures was $1.5 million. These expenditures consisted mainly of computer software, computer hardware, furniture and other equipment. The Company expects similar capital expenditure purchases in 2011 consisting primarily of computer software and hardware and other equipment, to be funded through cash generated from operations.

18

Debt and Equity

On December 19, 2008, the Company borrowed $9.0 million under a term note to partially finance the acquisition of MIV. In July 2010, the Company refinanced the existing term loan with a $6.9 million term loan. The new term loan is payable in 35 monthly installments of $80,104 with a balloon payment for the remaining principal balance and interest due on July 31, 2013. Borrowings under the term note bear interest at an annual rate of 3.79%. The outstanding balance of the term note at December 31, 2010, was $6.6 million.

On July 31, 2010, the Company borrowed $10.0 million under a term note to partially finance the acquisition of OCS. The term loan is payable in 35 monthly installments of $121,190 with a balloon payment for the remaining principal balance and interest due on July 31, 2013. Borrowings under the term note bear interest at an annual rate of 3.79%. The outstanding balance of the term note at December 31, 2010, was $9.6 million.

The term notes are secured by certain of the Company’s assets, including the Company’s land, building, accounts receivable and intangible assets. The term notes contain various restrictions and covenants applicable to the Company, including requirements that the Company maintain certain financial ratios at prescribed levels and restrictions on the ability of the Company to consolidate or merge, create liens, incur additional indebtedness or dispose of assets. As of December 31, 2010, the Company was in compliance with these restrictions and covenants.

The Company entered into a revolving credit note in 2006. The maximum aggregate amount available under the revolving credit note, following an addendum to the note in March 2008, is $6.5 million. The revolving credit note was renewed in July 2010 to extend the term to June 30, 2011. The Company may borrow, repay and re-borrow amounts under the revolving credit note from time to time until its maturity on June 30, 2011. The Company expects to extend the term of the revolving credit note for at least one year beyond the maturity date. If, however, the note cannot be extended, the Company believes it has adequate cash flows from operations to meet its debt and capital needs.

The maximum aggregate amount available under the revolving credit note of $6.5 million is subject to a borrowing base equal to 75% of the Company’s eligible accounts receivable. Borrowings under the renewed revolving credit note bear interest at a variable annual rate, with three rate options at the discretion of management as follows: 1) 2.5% plus the daily reset one-month LIBOR rate, or 2) 2.2% plus the one-, two-, three-, six- or twelve-month LIBOR rate, or 3) the bank’s Money Market Loan Rate. As of December 31, 2010, the revolving credit note did not have a balance. According to borrowing base requirements, the Company had the capacity to borrow $6.5 million as of December 31, 2010.

The agreement under which the Company acquired MIV provides for contingent earn-out payments over three years based on growth in revenue and earnings. The 2010 and 2009 earn-out payments, paid in February 2011 and 2010 were $1.6 million and $172,000, respectively, net of closing valuation adjustments and were recorded as additions to goodwill. The Company currently estimates that the 2011 earn-out could be approximately $2.6 million and expects to fund this through cash flow from operations.

Debt assumed through the MIV acquisition included $90,000 in capital leases for production and mailing equipment through 2011. The Company also assumed capital leases of $42,000 in connection with its acquisition of OCS for computer equipment through 2012. The capital leases meet capitalization requirements because the lease terms exceed more than 75% of the related assets’ estimated useful lives. Equipment is depreciated over the lease terms. The Company also purchased operational inserting equipment for $389,000 through a capital lease arrangement. The lease began November 1, 2010, for a five year term with a bargain purchase option. The equipment is being depreciated over seven years, the estimated useful life of the asset.

19

Contractual Obligations

The Company had contractual obligations to make payments in the following amounts in the future as of December 31, 2010:

|

Contractual Obligations

|

Total

Payments

|

Less than

One Year

|

One to

Three Years

|

Three to

Five Years

|

After

Five Years

|

||||||||||||||||

| (In thousands) | |||||||||||||||||||||

| Operating leases(1) | $ | 1,709 | $ | 560 | $ | 870 | $ | 279 | $ | -- | |||||||||||

| Capital leases | 536 | 150 | 208 | 178 | -- | ||||||||||||||||

| Uncertain tax positions(2) | 269 | -- | -- | -- | -- | ||||||||||||||||

| Long-term debt | 17,534 | 2,416 | 15,118 | -- | -- | ||||||||||||||||

| Total | $ | 20,048 | $ | 3,126 | $ | 16,196 | $ | 457 | $ | -- | |||||||||||

| (1) |

The Company terminated its lease for MIV’s Wausau office space in February 2011 for a lump-sum payment of $267,000. Contractual amounts as of December 31, 2010, included in the table that will not be required as a result of the termination are $130,000 less than one year and $281,000 in one to three years.

|

||||||||||||||||||||

| (2) |

We have $269,000 in liabilities associated with uncertain tax positions. We are unable to reasonably estimate the expected cash settlement dates of these uncertain tax positions with the taxing authorities.

|

||||||||||||||||||||

The Company generally does not make unconditional, non-cancelable purchase commitments. The Company enters into purchase orders in the normal course of business, but these purchase obligations do not exceed one year.

Shareholders’ equity increased $4.4 million to $48.6 million in 2010, from $44.2 million in 2009. The increase was primarily due to net income of $8.5 million and non-cash stock compensation expense of $779,000, offset by dividends paid of $5.1 million.

Stock Repurchase Program

In February 2006, the Board of Directors of the Company authorized the repurchase of 750,000 shares of common stock in the open market or in privately negotiated transactions. As of December 31, 2010, the remaining number of shares that could be purchased under this authorization was 268,717.

Off-Balance Sheet Obligations

The Company has no significant off-balance sheet obligations other than the operating lease commitments disclosed in “Liquidity and Capital Resources.”

Adoption of New Accounting Pronouncements

In January 2010, the Financial Accounting Standards Board (“FASB”) amended fair value guidance to require companies to make new disclosures about recurring and/or non-recurring fair value measurements including significant transfers into and out of Level 1 and Level 2 measurements. This guidance was effective for annual or interim reporting periods beginning after December 15, 2009. The adoption of this pronouncement has not had an effect on the consolidated financial statements as it pertains only to disclosure requirements. In addition, as part of this guidance and effective for annual or interim reporting periods beginning after December 15, 2010, disclosure of purchases, sales, issuances and settlement of assets must be on a gross basis for Level 3 measurements, where currently it is on a net basis. Also, the level of disaggregation will be increased by “class” instead of “major category.” The adoption of this pronouncement has not had an effect on the consolidated financial statements as it pertains to only disclosure requirements.

20

Recent Accounting Pronouncements

In September 2009, the FASB issued new guidance for revenue recognition with multiple deliverables, which is effective for revenue arrangements entered into or materially modified in fiscal years beginning on or after June 15, 2010, although early adoption is permitted. This guidance eliminates the residual method under the current guidance and requires the use of the “relative selling price” method when allocating revenue in a multiple deliverable arrangement. The selling price for each deliverable shall be determined using vendor specific objective evidence of selling price, if it exists, otherwise third-party evidence of selling price. If neither exists for a deliverable, the vendor shall use its best estimate of the selling price for that deliverable. After adoption, this guidance will also require expanded qualitative and quantitative disclosures. The Company plans to adopt this guidance on January 1, 2011, and is assessing the potential impact on its financial position and results of operations.

Item 7A. Quantitative and Qualitative Disclosure About Market Risk

The Company’s primary market risk exposure is changes in foreign currency exchange rates and interest rates.

The Company’s Canadian subsidiary uses as its functional currency the local currency of the country in which it operates. It translates its assets and liabilities into U.S. dollars at the exchange rate in effect at the balance sheet date. It translates its revenue and expenses at the average exchange rate during the period. The Company includes translation gains and losses in accumulated other comprehensive income (loss), a component of shareholders’ equity. Foreign currency translation gains (losses) were $339,000, $775,000, and ($937,000) in 2010, 2009, and 2008, respectively. Gains and losses related to transactions denominated in a currency other than the functional currency of the countries in which the Company operates and short-term intercompany accounts are included in other income (expense) in the consolidated statements of income.