Attached files

| file | filename |

|---|---|

| 8-K - JOINT FORM 8-K - KANSAS CITY POWER & LIGHT CO | f8kinvestordeck.htm |

March 28 & 29, 2011 Investor Presentation

Great Plains Energy

Investor Presentation

March 28 & 29, 2011

Exhibit 99.1

March 28 & 29, 2011 Investor Presentation

Tony Carreño

Director, Investor Relations

816-654-1763

anthony.carreno@kcpl.com

2

Michael Cline

Vice President - Investor Relations and Treasurer

816-556-2622

michael.cline@kcpl.com

Company Representatives

March 28 & 29, 2011 Investor Presentation

Forward-Looking Statement

Statements made in this presentation that are not based on historical facts are forward-looking, may involve risks and uncertainties, and are intended to be as

of the date when made. Forward-looking statements include, but are not limited to, the outcome of regulatory proceedings, cost estimates of capital projects

and other matters affecting future operations. In connection with the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, Great

Plains Energy and KCP&L are providing a number of important factors that could cause actual results to differ materially from the provided forward-looking

information. These important factors include: future economic conditions in regional, national and international markets and their effects on sales, prices and

costs, including but not limited to possible further deterioration in economic conditions and the timing and extent of any economic recovery; prices and

availability of electricity in regional and national wholesale markets; market perception of the energy industry, Great Plains Energy and KCP&L; changes in

business strategy, operations or development plans; effects of current or proposed state and federal legislative and regulatory actions or developments,

including, but not limited to, deregulation, re-regulation and restructuring of the electric utility industry; decisions of regulators regarding rates the companies

can charge for electricity; adverse changes in applicable laws, regulations, rules, principles or practices governing tax, accounting and environmental matters

including, but not limited to, air and water quality; financial market conditions and performance including, but not limited to, changes in interest rates and

credit spreads and in availability and cost of capital and the effects on nuclear decommissioning trust and pension plan assets and costs; impairments of long-

lived assets or goodwill; credit ratings; inflation rates; effectiveness of risk management policies and procedures and the ability of counterparties to satisfy

their contractual commitments; impact of terrorist acts; ability to carry out marketing and sales plans; weather conditions including, but not limited to,

weather-related damage and their effects on sales, prices and costs; cost, availability, quality and deliverability of fuel; the inherent uncertainties in estimating

the effects of weather, economic conditions and other factors on customer consumption and financial results; ability to achieve generation goals and the

occurrence and duration of planned and unplanned generation outages; delays in the anticipated in-service dates and cost increases of additional generation,

transmission, distribution or other projects; the inherent risks associated with the ownership and operation of a nuclear facility including, but not limited to,

environmental, health, safety, regulatory and financial risks; workforce risks, including, but not limited to, increased costs of retirement, health care and other

benefits; and other risks and uncertainties.

of the date when made. Forward-looking statements include, but are not limited to, the outcome of regulatory proceedings, cost estimates of capital projects

and other matters affecting future operations. In connection with the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, Great

Plains Energy and KCP&L are providing a number of important factors that could cause actual results to differ materially from the provided forward-looking

information. These important factors include: future economic conditions in regional, national and international markets and their effects on sales, prices and

costs, including but not limited to possible further deterioration in economic conditions and the timing and extent of any economic recovery; prices and

availability of electricity in regional and national wholesale markets; market perception of the energy industry, Great Plains Energy and KCP&L; changes in

business strategy, operations or development plans; effects of current or proposed state and federal legislative and regulatory actions or developments,

including, but not limited to, deregulation, re-regulation and restructuring of the electric utility industry; decisions of regulators regarding rates the companies

can charge for electricity; adverse changes in applicable laws, regulations, rules, principles or practices governing tax, accounting and environmental matters

including, but not limited to, air and water quality; financial market conditions and performance including, but not limited to, changes in interest rates and

credit spreads and in availability and cost of capital and the effects on nuclear decommissioning trust and pension plan assets and costs; impairments of long-

lived assets or goodwill; credit ratings; inflation rates; effectiveness of risk management policies and procedures and the ability of counterparties to satisfy

their contractual commitments; impact of terrorist acts; ability to carry out marketing and sales plans; weather conditions including, but not limited to,

weather-related damage and their effects on sales, prices and costs; cost, availability, quality and deliverability of fuel; the inherent uncertainties in estimating

the effects of weather, economic conditions and other factors on customer consumption and financial results; ability to achieve generation goals and the

occurrence and duration of planned and unplanned generation outages; delays in the anticipated in-service dates and cost increases of additional generation,

transmission, distribution or other projects; the inherent risks associated with the ownership and operation of a nuclear facility including, but not limited to,

environmental, health, safety, regulatory and financial risks; workforce risks, including, but not limited to, increased costs of retirement, health care and other

benefits; and other risks and uncertainties.

This list of factors is not all-inclusive because it is not possible to predict all factors. Other risk factors are detailed from time to time in Great Plains Energy’s

and KCP&L’s quarterly reports on Form 10-Q and annual report on Form 10-K filed with the Securities and Exchange Commission. Each forward-looking

statement speaks only as of the date of the particular statement. Great Plains Energy and KCP&L undertake no obligation to publicly update or revise any

forward-looking statement, whether as a result of new information, future events or otherwise.

and KCP&L’s quarterly reports on Form 10-Q and annual report on Form 10-K filed with the Securities and Exchange Commission. Each forward-looking

statement speaks only as of the date of the particular statement. Great Plains Energy and KCP&L undertake no obligation to publicly update or revise any

forward-looking statement, whether as a result of new information, future events or otherwise.

3

March 28 & 29, 2011 Investor Presentation

• Solid Midwest electric utility operating under the KCP&L brand

• Transformational events in 2008 to focus business model on fully regulated

utility operations

utility operations

– Sale of Strategic Energy

– Acquisition of Aquila (now KCP&L Greater Missouri Operations, or

“GMO”)

“GMO”)

• Company attributes

– ~823,200 customers / 3,200 employees

– ~6,600 MW of primarily low-cost coal baseload generation

– 5-year projected synergies post-GMO acquisition of ~$760M

– ~$8.8bn in assets and $5.7bn* in rate base at 2010YE

*Includes MO portion of Iatan 2 subject to MPSC decision in rate cases

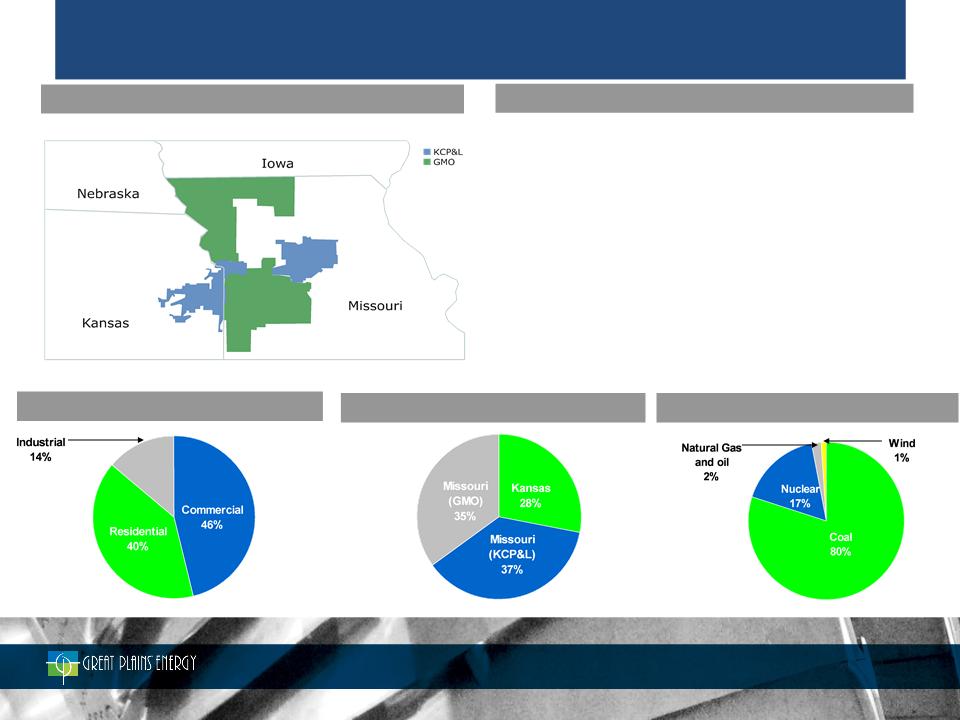

Service Territories: KCP&L and GMO

Business Highlights

2010 Retail MWh Sold by Customer Type

2010 Retail MWh Sales by Jurisdiction

2010 MWh Generated by Fuel Type

Total: ~ 23,806 MWhs

Total: ~ 23,806 MWhs

Total: ~ 26,679 MWhs

4

Solid Vertically-Integrated Midwest Utility

March 28 & 29, 2011 Investor Presentation

• Strong Midwest electric utilities focused on regulated operations in Missouri and Kansas

• Diversified customer base includes ~823,200 residential, commercial, and industrial customers

• ~6,600 Megawatts of generation capacity

• Low-cost generation mix: 80% coal, 17% nuclear (Wolf Creek), 2% natural gas/oil and 1% wind in 2010

100% Regulated

Electric Utility

Operations Focus

• Growth and stability in earnings driven by sizable regulated investments as part of the Comprehensive Energy Plan (“CEP”)

– Wind, environmental retrofits and Iatan 2 baseload coal plant all in-service

• Organic growth potential through environmental, transmission, renewable energy and on-going reliability-related investment

Attractive Platform for

Long-Term Earnings

Growth

Long-Term Earnings

Growth

• Constructive outcomes in 2006, 2007 and 2008 rate cases in Missouri and Kansas

• Recent and current cases

– Kansas - In 2010, the KCC authorized a revenue requirement increase of $22 million and brought Iatan 2 into rate base

with minimal disallowance

with minimal disallowance

– Missouri - $144 million rate increase request pending for KCP&L -MO and GMO; decisions expected 2Q11

Diligent Regulatory

Approach

Approach

• Cash flow and earnings heavily driven by regulated operations and cost recovery mechanisms

• Ample liquidity currently available under $1.25bn credit facilities

• Sustainable dividend and pay-out, right-sized to fund growth and to preserve liquidity

• Stable Outlook at Moody’s and S&P

Improved Financial

Position

Position

5

Strong Platform

March 28 & 29, 2011 Investor Presentation

|

Comprehensive Energy Plan

|

||

|

|

Project description

|

Comments

|

|

• 100 MW plant in Spearville, KS

• Began construction in 2005

|

ü Completed in Q3 2006

ü In rate base from 1/1/2007

ü No regulatory disallowance

|

|

|

• Selective Catalytic Reduction (SCR) unit at LaCygne 1

|

ü Completed in Q2 2007

ü In rate base from 1/1/2008

ü No regulatory disallowance

|

|

|

• Air Quality Control System at Iatan 1

|

ü Completed in Q2 2009

ü In rate base starting 3Q 2009 (KS 8/1 & MO 9/1)

ü No regulatory disallowance in 2009 MO and KS cases; minimal

disallowance in 2010 KS case and capped exposure in 2010 MO cases |

|

|

• Construction of Iatan 2 super-critical coal plant (850 MW; 73%

GXP ownership share)1 |

ü In-service on 8/26/2010; confirmed by KCC in October; MPSC view

to be communicated through pending rate cases ü Included in KS rate base with minimal disallowance Q4 2010; MO

rate base treatment to be determined Q2 2011 |

|

|

Great Plains Energy has effectively executed all elements of its Comprehensive Energy Plan to date and has received

constructive regulatory treatment

|

||

Iatan 2

Iatan 1

Environmental

LaCygne

Environmental

Wind

1 Includes post-combustion environmental technologies including an SCR system, wet flue gas desulphurization system and fabric filter to control emissions

6

Strong Track Record of Execution

March 28 & 29, 2011 Investor Presentation

|

Rate Case Outcomes

|

||||||

|

Rate Jurisdiction

|

Initial Request

|

Amount

Approved |

Effective Date

|

Rate Base

|

Return on Equity

|

Rate-making

Equity Ratio |

|

KCP&L - Missouri

|

$55.8

|

$50.6

|

1/1/2007

|

$1,270

|

11.25%

|

53.69%

|

|

KCP&L - Missouri

|

$45.4

|

$35.3

|

1/1/2008

|

$1,298

|

10.75%

|

57.62%

|

|

KCP&L - Missouri

|

$101.5

|

$95.0

|

9/1/2009

|

$1,4961

|

n/a4

|

46.63%

|

|

KCP&L - Kansas

|

$42.3

|

$29.0

|

1/1/2007

|

$1,0001

|

n/a2

|

n/a

|

|

KCP&L - Kansas

|

$47.1

|

$28.0

|

1/1/2008

|

$1,1001

|

n/a3

|

n/a

|

|

KCP&L - Kansas

|

$71.6

|

$59.0

|

8/1/2009

|

$1,2701

|

n/a4

|

50.75%

|

|

KCP&L - Kansas

|

$55.1

|

$22.0

|

12/1/2010

|

$1,781

|

10.00%

|

49.66%

|

|

GMO - MPS

|

$94.5

|

$45.2

|

6/1/2007

|

$918

|

10.25%

|

48.17%

|

|

GMO - MPS

|

$66.0

|

$48.0

|

9/1/2009

|

$1,1881

|

n/a5

|

45.95%

|

|

GMO - L&P

|

$24.4

|

$13.6

|

6/1/2007

|

$186

|

10.25%

|

48.17%

|

|

GMO - L&P

|

$17.1

|

$15.0

|

9/1/2009

|

$2861

|

n/a5

|

45.95%

|

1 Rate Base amounts are approximate amounts since the cases were black box settlements; 2 Iatan 2 AFUDC calculation was set at 8.5%; 3 Iatan 2 AFUDC calculation was

set at 8.3%; 4 Iatan 2 AFUDC calculation was set at 8.25%; 5 Iatan 2 AFUDC calculation was set at 10.2%

set at 8.3%; 4 Iatan 2 AFUDC calculation was set at 8.25%; 5 Iatan 2 AFUDC calculation was set at 10.2%

7

Focused Regulatory Approach

March 28 & 29, 2011 Investor Presentation

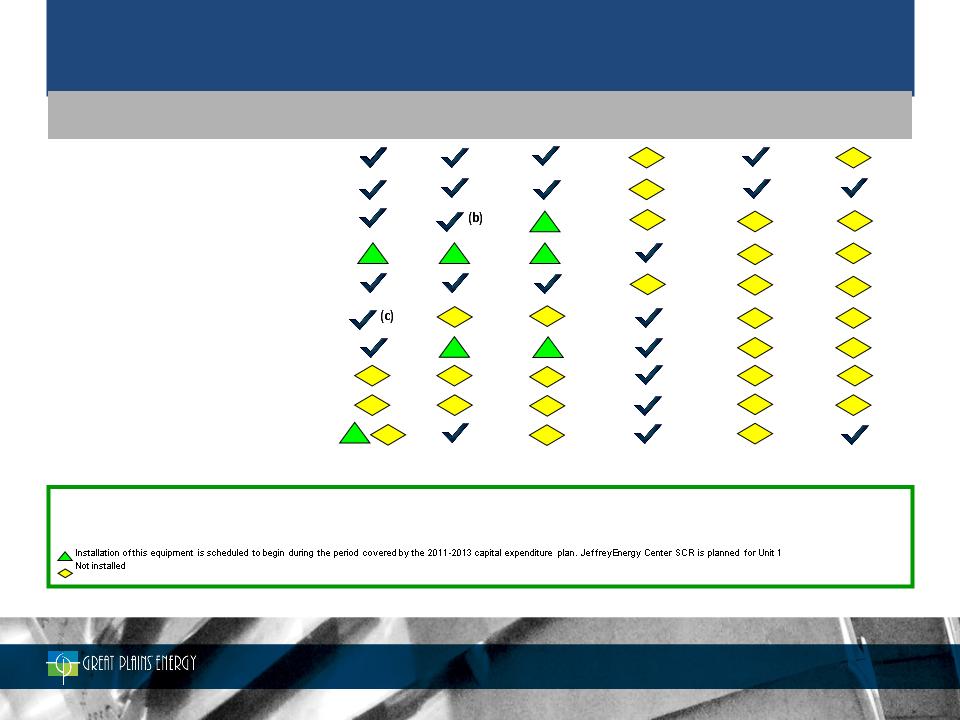

Coal Fleet Emissions Control Equipment

|

Coal Unit

|

MW

|

SCR

/SNCR |

Scrubber

|

Bag House

|

Precipitator

|

Mercury

Controls |

Cooling

Tower |

|

Iatan 1

|

621(a)

|

|

|

|

|

|

|

|

Iatan 2

|

618(a)

|

|

|

|

|

|

|

|

LaCygne 1

|

368(a)

|

|

|

|

|

|

|

|

LaCygne 2

|

341(a)

|

|

|

|

|

|

|

|

Hawthorn 5

|

563

|

|

|

|

|

|

|

|

Sibley 1 and 2

|

102

|

|

|

|

|

|

|

|

Sibley 3

|

364

|

|

|

|

|

|

|

|

Montrose 1, 2 and 3

|

510

|

|

|

|

|

|

|

|

Lake Road 4

|

99

|

|

|

|

|

|

|

|

Jeffrey Energy Center 1, 2 and 3

|

173(a)

|

|

|

|

|

|

|

|

If a scrubber is installed on both LaCygne 2 and Sibley 3, roughly 81 percent of the installed coal capacity would have scrubbers

|

|||||||

(a) Share of jointly-owned facility

(b) LaCygne 1 currently has a scrubber installed; however, our 2011 capital expenditure plan includes the installation a new scrubber on the unit

(c) Sibley 1 and 2 both have SNCRs installed; however, both units would require an SCR for compliance with NOx reduction under the NAAQS

ü Installed

8

March 28 & 29, 2011 Investor Presentation

2010 Highlights and Regulatory /

Operations Update

9

March 28 & 29, 2011 Investor Presentation

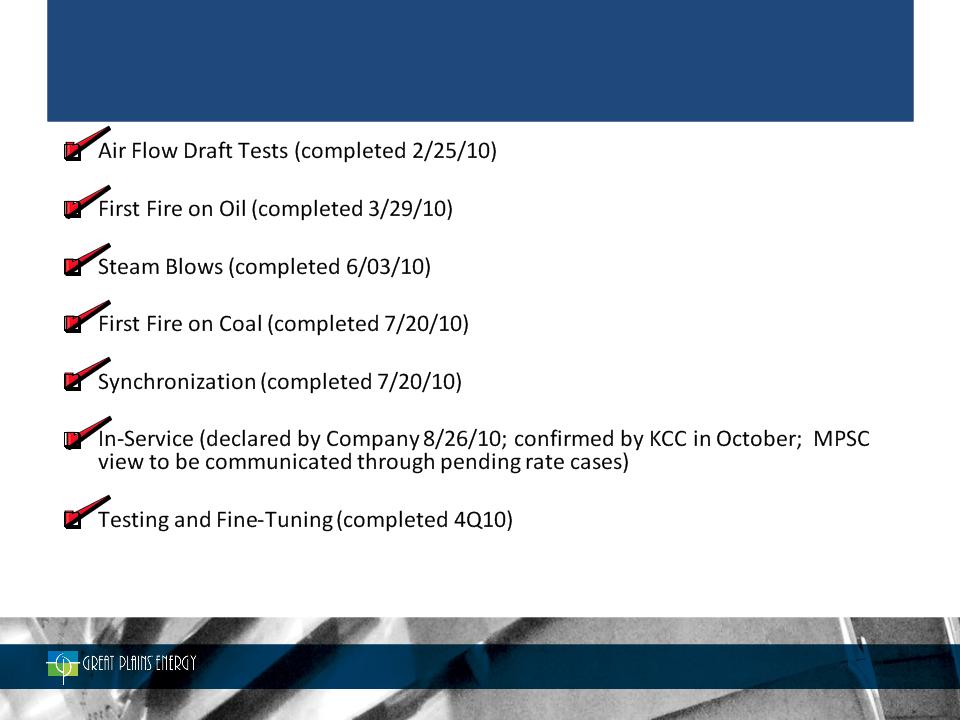

ü Completed Iatan 2 consistent with 2005 schedule commitment of “summer

2010”

2010”

ü Achieved top-tier customer satisfaction

ü Completed KCP&L’s Kansas rate case; filed cases for KCP&L and GMO in

Missouri

Missouri

ü Improved generation fleet performance

ü Completed 48 MW Spearville 2 wind facility

ü Obtained improved outlooks (from “Negative” to “Stable”) at Moody’s and S&P

10

2010 Highlights

March 28 & 29, 2011 Investor Presentation

2011 Rating Agency Presentation

11

2010 Milestones - Iatan 2

March 28 & 29, 2011 Investor Presentation

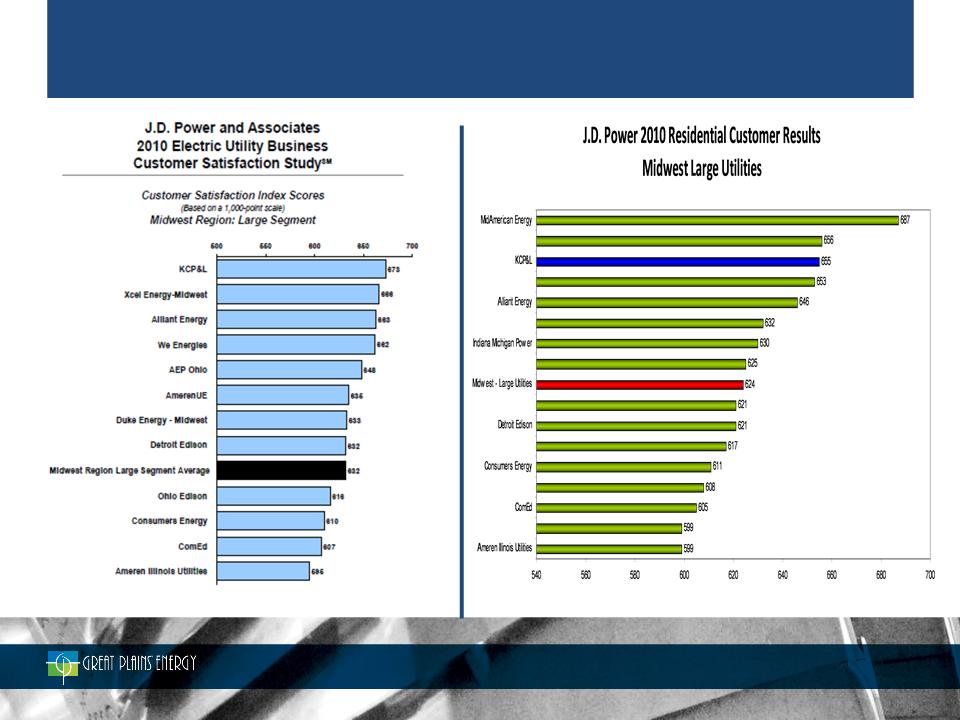

Source: 2010 JD Power Residential Study Results (3Q09 to 2Q10)

12

Customer Satisfaction

March 28 & 29, 2011 Investor Presentation

• Annual Revenue Increase of $22.0 million (vs. Updated Company Request of $50.9 Million)

• 10.00% Authorized ROE (vs. Updated Company Request of 10.75%); Equity Ratio of 49.66%

• Iatan 2 in Service and Added to Rate Base

– Total project disallowance of $20.4 million of budgeted costs, or about 1% ($5.1

million KCP&L Kansas jurisdictional share)

million KCP&L Kansas jurisdictional share)

• Minimal Iatan 1 Environmental Project Disallowance

• Kansas Jurisdictional Rate Base of $1.781 Billion

• Requested Environmental Rider Denied

• New Rates Effective 12/1/10

13

KCP&L Kansas Rate Case Results

March 28 & 29, 2011 Investor Presentation

1 KCP&L’s initial request was subsequently adjusted to $55.8 million, mainly due to lower fuel and purchased power costs and increased deferred income

taxes from bonus depreciation

taxes from bonus depreciation

2 GMO - MPS’s initial request was subsequently adjusted to $65.2 million

3 GMO - L&P’s initial request was subsequently adjusted to $23.2 million

4 The requested ROE was adjusted by KCP&L and GMO to 10.75%

|

(in $ millions)

Jurisdiction

|

Requested

Increase |

Requested

ROE4 |

Rate Base

|

Rates

Effective |

Decision

|

|

KCP&L - MO

|

$92.11

|

11.00%

|

2,122.8

|

5/4/2011

|

Spring 2011

|

|

GMO - MPS

|

$75.82

|

11.00%

|

1,468.7

|

6/4/2011

|

Spring 2011

|

|

GMO - L&P

|

$22.13

|

11.00%

|

422.0

|

6/4/2011

|

Spring 2011

|

|

Total

|

$190.0

|

-

|

4,013.5

|

-

|

-

|

14

Missouri Rate Cases Status

March 28 & 29, 2011 Investor Presentation

• LaCygne Predetermination Filing in Kansas

• Plant Performance

• Renewable Energy Update

• Customer Consumption - 4Q and Full-year 2010

15

Operations Update

March 28 & 29, 2011 Investor Presentation

16

• Project includes the installation of:

– LaCygne 1 - Wet scrubber and baghouse

– LaCygne 2 - Selective Catalytic Reduction system (SCR), wet scrubber, baghouse and low

NOx burners

NOx burners

• Predetermination filing is for total project cost of $1.23 billion; KCP&L’s total share is $615 million

and Kansas jurisdictional share is $281 million

and Kansas jurisdictional share is $281 million

• Filing includes request for a LaCygne project-specific rider

• Decision expected in August 2011

• New KCC general investigation docket regarding KCP&L and Westar environmental retrofits will

run concurrently with KCP&L’s LaCygne predetermination filing

run concurrently with KCP&L’s LaCygne predetermination filing

Kansas Predetermination Filing - LaCygne

Environmental Retrofit Project

Environmental Retrofit Project

March 28 & 29, 2011 Investor Presentation

17

Plant Performance

March 28 & 29, 2011 Investor Presentation

18

• 48 MW of new wind generation operational in 4Q10 at Spearville 2 site

• Addition of Spearville 2 along with purchase of 52 MW of RECs ensures compliance with

Kansas RES effective later in 2011

Kansas RES effective later in 2011

• Will pursue additional wind generation required under Collaboration Agreement by end of

2012, subject to regulatory approval

2012, subject to regulatory approval

– RFPs issued for 100MW; evaluating responses

– Considering options for the remainder

Renewable Energy

March 28 & 29, 2011 Investor Presentation

Weather-Normalized

Weather-Normalized

0.1%*

(0.1%)*

0.2%*

5.6%

(1.7%)*

(1.8%)*

0.2%*

(1.4%)

3.0%

4.3%

(1.3%)

4.6%

1.7%

2.9%

(1.2%)

2.4%

Industrial

(0.7%)

(1.0%)

0.3%

2.9%

(0.1%)

(0.7%)

0.6%

0.5%

Commercial

0.1%

(0.1%)

0.2%

9.4%

(4.8%)

(4.9%)

0.1%

(4.9%)

Residential

Change MWh

Sales

Sales

Use /

Customer

Customers

Total Change in

MWh Sales

MWh Sales

Change MWh

Sales

Sales

Use /

Customer

Customers

Total Change in

MWh Sales

MWh Sales

Full-Year 2010 Compared to Full-Year 2009

4Q 2010 Compared to 4Q 2009

Retail MWh Sales and Customer Growth Rates

19

* Weighted average

|

Statistics by Customer Class Full-Year 2010

|

||||

|

|

Customers

|

Revenue (in millions)

|

Sales (000s of MWhs)

|

% of MWh Sales

|

|

Residential

|

724,200

|

$915.8

|

9,459

|

40%

|

|

Commercial

|

96,300

|

838.0

|

10,950

|

46%

|

|

Industrial

|

2,300

|

193.5

|

3,286

|

14%

|

Customer Consumption

March 28 & 29, 2011 Investor Presentation

Financial Overview

20

March 28 & 29, 2011 Investor Presentation

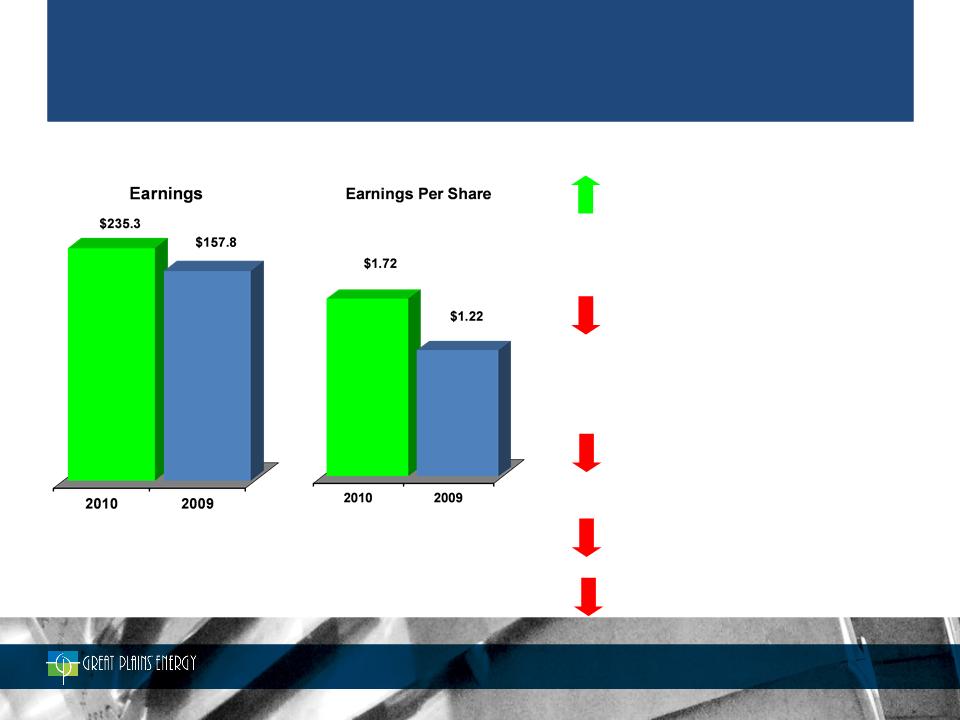

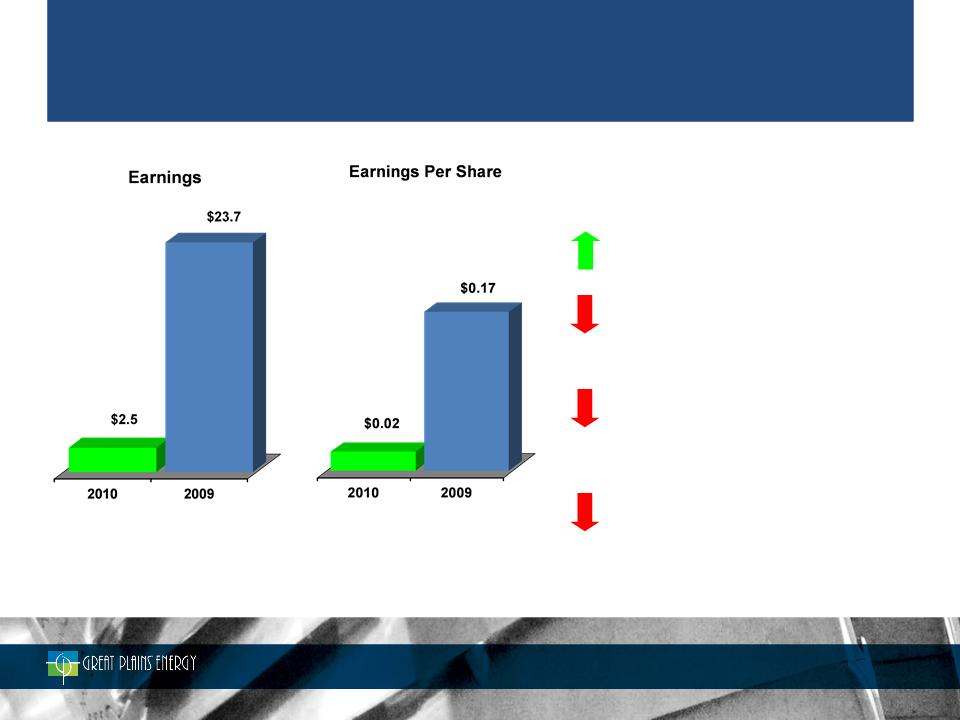

• Electric Utility’s net income increased $77.5 million primarily driven by a $234.7 million increase in gross margin* due to a full year of

new retail rates effective in 3Q09 and favorable impacts from weather

new retail rates effective in 3Q09 and favorable impacts from weather

• A $17.4 million decrease in Other category results, attributable primarily to a $16 million tax benefit in 2009

• Increased number of shares outstanding primarily from the May 2009 equity offering resulted in dilution of $0.09 per share

*Gross margin is defined and reconciled to GAAP operating revenues at the end of the presentation

21

Great Plains Energy Consolidated Earnings and Earnings Per

Share Year Ended December 31

(Unaudited)

$ 1.14

$ 1.53

$ 148.5

$ 210.1

Earnings available for common shareholders

(0.02)

(0.02)

(1.6)

(1.6)

Preferred dividends

1.16

1.55

150.1

211.7

Net income attributable to Great Plains Energy

-

-

(0.3)

(0.2)

Less: Net income attributable to noncontrolling interest

1.16

1.55

150.4

211.9

Net income

(0.01)

-

(1.5)

-

Strategic Energy discontinued operations

1.17

1.55

151.9

211.9

Income from continuing operations

(0.05)

(0.17)

(5.9)

(23.4)

Other

$ 1.22

$ 1.72

$ 157.8

$ 235.3

Electric Utility

2009

2010

2009

2010

Earnings per Share

Earnings (in Millions)

March 28 & 29, 2011 Investor Presentation

• Decline in 2010 quarter vs. 2009 period includes two key items:

– Electric Utility - $8 million / $0.06 per share from the impact of disallowed costs on Iatan 1 and Iatan 2

– Other - $7 million / $0.05 per share from write-down of affordable housing investments

22

|

Great Plains Energy Consolidated Earnings and Earnings Per

Share Three Months Ended December 31

(Unaudited)

|

|||||

|

|

Earnings (Loss) (in Millions)

|

|

Earnings (Loss) per Share

|

||

|

|

2010

|

2009

|

|

2010

|

2009

|

|

Electric Utility

|

$ 2.5

|

$ 23.7

|

|

$ 0.02

|

$ 0.17

|

|

Other

|

(7.3)

|

(8.8)

|

|

(0.06)

|

(0.06)

|

|

Income (loss) from continuing operations

|

(4.8)

|

14.9

|

|

(0.04)

|

0.11

|

|

Strategic Energy discontinued operations

|

-

|

0.8

|

|

-

|

0.01

|

|

Net income (loss)

|

(4.8)

|

15.7

|

|

(0.04)

|

0.12

|

|

Less: Net income attributable to noncontrolling interest

|

(0.1)

|

(0.1)

|

|

-

|

-

|

|

Net income (loss) attributable to Great Plains Energy

|

(4.9)

|

15.6

|

|

(0.04)

|

0.12

|

|

Preferred dividends

|

(0.4)

|

(0.4)

|

|

-

|

(0.01)

|

|

Earnings (loss) available for common shareholders

|

$ (5.3)

|

$ 15.2

|

|

$ (0.04)

|

$ 0.11

|

March 28 & 29, 2011 Investor Presentation

23

(in millions)

* Gross margin is defined and reconciled to GAAP operating revenues in the

Appendix

Appendix

Increased gross margin* of $234.7 million due to

approximately $150 million from the full-year

impact of new retail rates which took effect in

2009, and about $105 million due to favorable

weather;

approximately $150 million from the full-year

impact of new retail rates which took effect in

2009, and about $105 million due to favorable

weather;

Key Earnings Drivers

Increased other operating expense of $61.4

million primarily driven by $18 million increase in

plant operating and maintenance expenses,

recognition of a $16.8 million loss attributed to

Iatan 1 environmental and Iatan 2 construction

costs, $15 million in general taxes and

approximately $5 million due to other accounting

effects of the KCC November rate order;

million primarily driven by $18 million increase in

plant operating and maintenance expenses,

recognition of a $16.8 million loss attributed to

Iatan 1 environmental and Iatan 2 construction

costs, $15 million in general taxes and

approximately $5 million due to other accounting

effects of the KCC November rate order;

Increased depreciation and amortization of $29.4

million including additional regulatory amortization

from 2009 rate cases, a full year of depreciation on

Iatan 1 and the commencement of depreciation on

Iatan 2 for the KS jurisdiction;

million including additional regulatory amortization

from 2009 rate cases, a full year of depreciation on

Iatan 1 and the commencement of depreciation on

Iatan 2 for the KS jurisdiction;

Decreased non-operating income and expense of

$14.6 million principally due to lower AFUDC

equity; and

$14.6 million principally due to lower AFUDC

equity; and

Increased income tax expense of $59.7 million

resulting from higher pretax income

resulting from higher pretax income

Electric Utility Full-Year Results

March 28 & 29, 2011 Investor Presentation

24

(in millions)

* Gross margin is defined and reconciled to GAAP operating revenues in the

Appendix

Appendix

Key Earnings Drivers

Decreased income tax expense of

approximately $10 million resulting from

lower pre-tax income;

approximately $10 million resulting from

lower pre-tax income;

Decreased gross margin* of $5 million

primarily due to a 1.7 percent decline in

weather-normalized demand;

primarily due to a 1.7 percent decline in

weather-normalized demand;

Increased other operating expenses of $20.7

million primarily driven by $13 million loss

attributed to Iatan 1 and 2 construction costs and

approximately $5 million due to other accounting

effects of the KCC November order; and

million primarily driven by $13 million loss

attributed to Iatan 1 and 2 construction costs and

approximately $5 million due to other accounting

effects of the KCC November order; and

Decreased non-operating income and expenses

of $6.5 million principally due to lower AFUDC

equity

of $6.5 million principally due to lower AFUDC

equity

Electric Utility Fourth Quarter Results

March 28 & 29, 2011 Investor Presentation

|

Debt Profile as of December 31, 2010

($ in millions)

|

||||||||

|

|

KCP&L

|

GMO (1)

|

GPE

|

Consolidated

|

||||

|

|

Amount

|

Rate (2)

|

Amount

|

Rate (2)

|

Amount

|

Rate (2)

|

Amount

|

Rate (2)

|

|

Short-term debt

|

$ 358.5

|

0.64%

|

$ 0.0

|

N/A

|

$ 9.5

|

3.06%

|

$ 368.0

|

0.70%

|

|

Long-term debt (3)

|

1,780.0

|

6.13%

|

1,011.4

|

9.88%

|

637.0

|

7.57%

|

3,428.4

|

7.47%

|

|

Total

|

$ 2,138.5

|

5.21%

|

$ 1,011.4

|

9.88%

|

$ 646.5

|

7.50%

|

$ 3,796.4

|

6.80%

|

Secured debt = $862.7 (23%), Unsecured debt = $2,933.7 (77%)

(1) GPE guarantees substantially all of GMO’s debt

(2) Weighted Average Rates - excludes premium / discounts and fair market value adjustments; includes full Equity Units coupon (12%) for GPE

(3) Includes current maturities of long-term debt

Long-term Debt Maturities

25

March 28 & 29, 2011 Investor Presentation

Moody's

Standard & Poor's

Great Plains Energy

Outlook

Stable

Stable

Corporate Credit Rating

-

BBB

Preferred Stock

Ba2

BB+

Senior Unsecured Debt

Baa3

BBB-

KCP&L

Outlook

Stable

Stable

Senior Secured Debt

A3

BBB+

Senior Unsecured Debt

Baa2

BBB

Commercial Paper

P-2

A-2

GMO

Outlook

Stable

Stable

Senior Unsecured Debt

Baa3

BBB

Current Credit Ratings

26

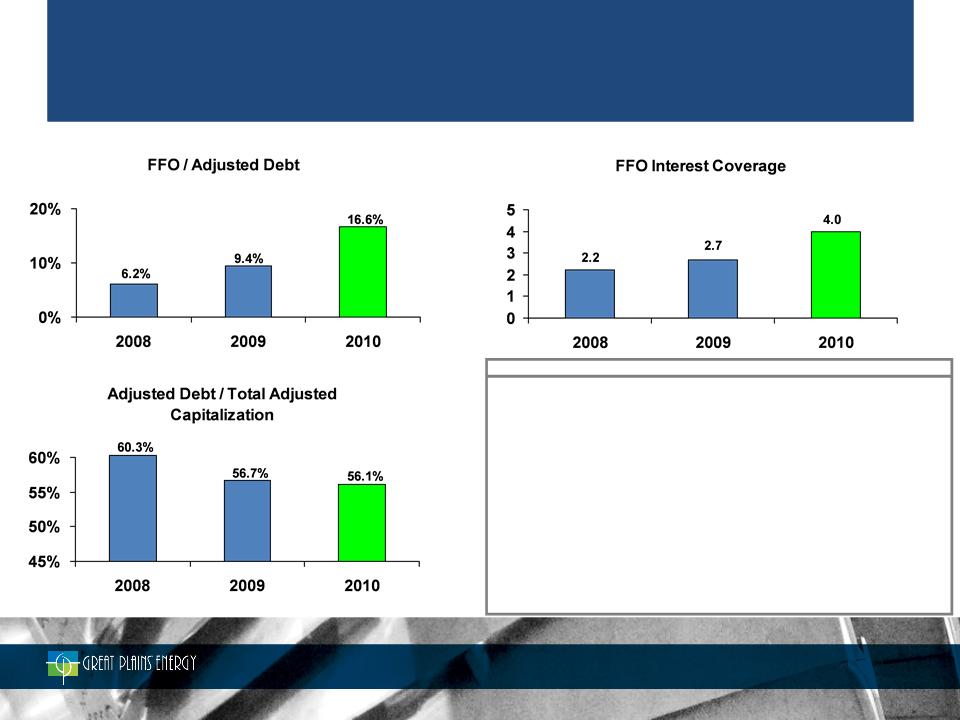

*All ratios calculated using Standard and Poor’s methodology

Credit Profile for Great Plains Energy

March 28 & 29, 2011 Investor Presentation

27

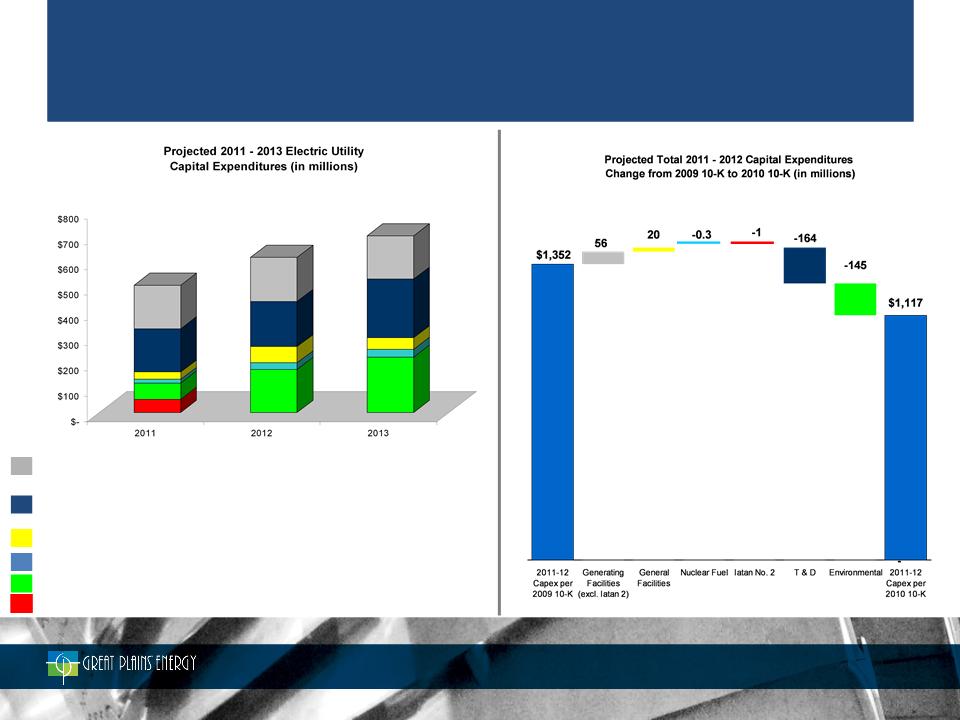

$614

$503

$699

|

|

|

|

|

|

Generating

Facilities (excl. Iatan 2) |

172.2

|

174.6

|

171.8

|

|

Transmission &

Distribution |

171.0

|

178.9

|

232.2

|

|

General

Facilities

|

29.2

|

63.2

|

44.6

|

|

Nuclear Fuel

|

14.8

|

26.2

|

31.5

|

|

Environmental

|

63.0

|

171.0

|

219.1

|

|

Iatan No. 2

|

53.1

|

-

|

-

|

Capital Expenditures Forecast

March 28 & 29, 2011 Investor Presentation

Rate Case True-up and Effective Date Implications

• Full-year impact from new KS rates

• True-up date in MO rate cases at end of 2010; new rates expected to be effective early May 2011

(KCP&L) / early June 2011 (GMO)

(KCP&L) / early June 2011 (GMO)

• Regulatory lag January - April from new rail contract for KCP&L in Missouri (no FAC)

• Iatan 2 depreciation effective with new rates will be lower due to lower depreciable plant from

additional amortization granted during the CEP to maintain credit metrics

additional amortization granted during the CEP to maintain credit metrics

Construction Accounting - Missouri

• Missouri jurisdictional share of Iatan 2 carried as a regulatory asset until effective date of new rates in

MO

MO

– Carrying cost reduces interest expense

– Iatan-related O&M and property taxes deferred as regulatory asset until effective date of new rates

– Depreciation expense deferred as regulatory asset until effective date of new rates

– Iatan 2 system energy value recorded to regulatory asset as an offset to costs listed above

Interest Expense

• Interest expense impacted by carrying cost offset, new long-term debt issued in 2010 and new debt

anticipated in 2011

anticipated in 2011

28

Considerations for 2011

March 28 & 29, 2011 Investor Presentation

Weather-Normalized MWh Sales

• Expectation is for growth of 0.7 percent compared to 2010 weather-normalized level

O&M

• Projected to be consistent with levels requested in rate cases

Generation Fleet

• Projected EAF for combined fleet - 83%

• LaCygne outage expected to conclude mid-March

• Wolf Creek refueling and expanded maintenance outage beginning in late 1Q

Taxes

• No cash taxes in 2011 as a result of bonus depreciation / NOL utilization

• Effective tax rate of approximately 34% based on normal conditions

29

Considerations for 2011 (continued)

March 28 & 29, 2011 Investor Presentation

Looking Ahead / Conclusion

30

March 28 & 29, 2011 Investor Presentation

• Regional economy poised to improve; impact on customer energy

consumption still difficult to assess

consumption still difficult to assess

• Rate cases pending in Missouri; new rates in effect for 7 months for

GMO and 8 months for KCP&L in 2011

GMO and 8 months for KCP&L in 2011

• Internal project underway to identify regulatory and operating

strategies to reduce regulatory lag going forward

strategies to reduce regulatory lag going forward

• Decisive management actions implemented in 2011 to manage costs

within levels reflected in rates, enhance organizational effectiveness

and contribute to solid credit metrics

within levels reflected in rates, enhance organizational effectiveness

and contribute to solid credit metrics

• Impact of new EPA rules

31

Looking Ahead

March 28 & 29, 2011 Investor Presentation

Accomplishments in 2009 through 2011 YTD reflect and support our

strong commitment to credit quality:

strong commitment to credit quality:

ü Reduced risk profile with completion of construction phase of CEP - Iatan 1 (2009) and Iatan 2

(2010);

(2010);

ü Achieved constructive 2009 settlements in Missouri and Kansas and excellent Iatan 1 and 2

prudency outcome in Kansas in 2010;

prudency outcome in Kansas in 2010;

ü Improved generation fleet operations significantly in 2009-10;

ü Reduced dividend by 50% in 2009;

ü In the face of challenging market conditions, raised $450 million of equity and hybrid capital in

2009 to support credit profile;

2009 to support credit profile;

ü Developed a prudent, disciplined 2011-13 capital expenditure view that satisfies mandatory

requirements while targeting improved credit metrics even in an environment in which equity

financing remains challenging; and

requirements while targeting improved credit metrics even in an environment in which equity

financing remains challenging; and

ü Implemented in 2011 strong management actions to support sufficiently robust credit metrics

in the midst of a still-challenging regional economy

in the midst of a still-challenging regional economy

Entire organization has had…and will maintain…an intense focus on credit.

32

Conclusion

March 28 & 29, 2011 Investor Presentation

Great Plains Energy

Investor Presentation

March 28 & 29, 2011

33

March 28 & 29, 2011 Investor Presentation

Appendix

Gross Margin Reconciliation

34

March 28 & 29, 2011 Investor Presentation

Gross margin is a financial measure that is not calculated in accordance with generally accepted accounting principles (GAAP). Gross

margin, as used by Great Plains Energy, is defined as operating revenues less fuel, purchased power and transmission of electricity by

others. The Company’s expense for fuel, purchased power and transmission of electricity by others, offset by wholesale sales margin, is

subject to recovery through cost adjustment mechanisms, except for KCP&L’s Missouri retail operations. As a result, operating revenues

increase or decrease in relation to a significant portion of these expenses. Management believes that gross margin provides a more

meaningful basis for evaluating the Electric Utility segment’s operations across periods than operating revenues because gross margin

excludes the revenue effect of fluctuations in these expenses. Gross margin is used internally to measure performance against budget and

in reports for management and the Board of Directors. The Company’s definition of gross margin may differ from similar terms used by

other companies. A reconciliation to GAAP operating revenues is provided in the table above.

margin, as used by Great Plains Energy, is defined as operating revenues less fuel, purchased power and transmission of electricity by

others. The Company’s expense for fuel, purchased power and transmission of electricity by others, offset by wholesale sales margin, is

subject to recovery through cost adjustment mechanisms, except for KCP&L’s Missouri retail operations. As a result, operating revenues

increase or decrease in relation to a significant portion of these expenses. Management believes that gross margin provides a more

meaningful basis for evaluating the Electric Utility segment’s operations across periods than operating revenues because gross margin

excludes the revenue effect of fluctuations in these expenses. Gross margin is used internally to measure performance against budget and

in reports for management and the Board of Directors. The Company’s definition of gross margin may differ from similar terms used by

other companies. A reconciliation to GAAP operating revenues is provided in the table above.

35

|

Great Plains Energy Incorporated Reconciliation of Gross

Margin to Operating Revenues (Unaudited)

|

||||

|

(millions)

|

Three Months Ended December 31

|

Year Ended December 31

|

||

|

|

2010

|

2009

|

2010

|

2009

|

|

Operating revenues

|

$ 467.8

|

$ 477.6

|

$ 2,255.5

|

$ 1,965.0

|

|

Fuel

|

(97.5)

|

(103.0)

|

(430.7)

|

(405.5)

|

|

Purchase power

|

(42.4)

|

(42.8)

|

(213.8)

|

(183.7)

|

|

Transmission of

electricity by others |

(6.5)

|

(5.7)

|

(27.4)

|

(26.9)

|

|

Gross margin

|

$ 321.4

|

$ 326.1

|

$ 1,583.6

|

$ 1,348.9

|