Attached files

| file | filename |

|---|---|

| EX-31.1 - EROOMSYSTEM TECHNOLOGIES INC | v215783_ex31-1.htm |

| EX-32.1 - EROOMSYSTEM TECHNOLOGIES INC | v215783_ex32-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

|

(Mark

One)

|

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the fiscal year ended December 31, 2010

|

|

|

OR

|

|

|

o

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the transition period from to

|

Commission file number: 000-31037

eRoomSystem Technologies, Inc.

(Exact name of registrant as specified in its charter)

|

Nevada

|

87-0540713

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

1072 Madison Ave., Lakewood, NJ

|

08701

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (732) 730-0116

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which registered

|

|

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.0001 per share

Title of each class

Title of each class

Indicate by check mark if the registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES o NO x

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o

|

Accelerated filer o

|

||

|

Non-accelerated filer o (Do not check if a smaller reporting company)

|

Smaller reporting company x

|

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Act). Yes o No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently computed second fiscal quarter.

$3,825,258 based upon $0.16 per share which was the last price at which the common equity purchased by non-affiliates was last sold, since there is no public bid or ask price. There was a public bid and ask price of $0.17 and $0.14, respectively, for an average price of $0.155 on June 30, 2010.

The number of shares of the issuer’s common stock issued and outstanding as of March 21, 2011 was 23,907,865 shares.

DOCUMENTS INCORPORATED BY REFERENCE

None.

TABLE OF CONTENTS

|

PART I

|

1

|

|

|

ITEM 1.

|

DESCRIPTION OF BUSINESS

|

1

|

|

ITEM 2.

|

DESCRIPTION OF PROPERTY.

|

5

|

|

ITEM 3.

|

LEGAL PROCEEDINGS.

|

6

|

|

ITEM 4.

|

(REMOVED AND RESERVED)

|

|

|

PART II

|

6

|

|

|

ITEM 5.

|

MARKET FOR COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

|

6

|

|

ITEM 7.

|

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITIONS AND RESULTS OF OPERATIONS.

|

8

|

|

ITEM 8.

|

FINANCIAL STATEMENTS.

|

13

|

|

ITEM 9.

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

|

27

|

|

ITEM 9A

|

CONTROLS AND PROCEDURES

|

27

|

|

ITEM 9B.

|

OTHER INFORMATION

|

27

|

|

PART III

|

28

|

|

|

ITEM 10.

|

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE.

|

28

|

|

ITEM 11.

|

EXECUTIVE COMPENSATION.

|

29

|

|

ITEM 12.

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS.

|

30

|

|

ITEM 13.

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE.

|

31

|

|

ITEM 14.

|

PRINCIPAL ACCOUNTING FEES AND SERVICES.

|

31

|

|

ITEM 15.

|

EXHIBITS, FINANCIAL STATEMENT SCHEDULES

|

32

|

ii

PART I

ITEM 1. DESCRIPTION OF BUSINESS

As used in this Annual Report on Form 10-K (this “Report”), references to the “Company,” the “Registrant,” “we,” “our” or “us” refer to eRoomSystem Technologies, Inc., and includes our subsidiaries, unless the context otherwise indicates .

Forward-Looking Statements

This Report contains forward-looking statements. For this purpose, any statements contained in this Report that are not statements of historical fact may be deemed to be forward-looking statements. Forward-looking information includes statements relating to future actions, prospective products, future performance or results of current or anticipated products, sales and marketing efforts, costs and expenses, interest rates, outcome of contingencies, financial condition, results of operations, liquidity, business strategies, cost savings, objectives of management, and other matters. You can identify forward-looking statements by those that are not historical in nature, particularly those that use terminology such as “may,” “will,” “should,” “expects,” “anticipates,” “contemplates,” “estimates,” “believes,” “plans,” “projected,” “predicts,” “potential,” or “continue” or the negative of these similar terms. The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for forward-looking information to encourage companies to provide prospective information about themselves without fear of litigation so long as that information is identified as forward-looking and is accompanied by meaningful cautionary statements identifying important factors that could cause actual results to differ materially from those projected in the information.

These forward-looking statements are not guarantees of future performance and involve risks, uncertainties and assumptions that we cannot predict. In evaluating these forward-looking statements, you should consider various factors, including the following: (a) those risks and uncertainties related to general economic conditions, (b) whether we are able to manage our planned growth efficiently and operate profitable operations, (c) whether we are able to generate sufficient revenues or obtain financing to sustain and grow our operations, (d) whether we are able to successfully fulfill our primary requirements for cash, which are explained below under “Liquidity and Capital Resources”. We assume no obligation to update forward-looking statements, except as otherwise required under the applicable federal securities laws.

Overview

eRoomSystem Technologies has developed and introduced to the lodging industry an intelligent, in-room computerized platform and communications network, or the eRoomSystem. The eRoomSystem is a computerized platform and processor-based system that is installed within our eRoomServ refreshment centers and is designed to collect and control data. The eRoomSystem also supports our: (i) eRoomSafe, an electronic in-room safe, (ii) eRoomTray, an in-room ambient tray that can sell a wide variety of products at room temperature, and, (iii) eRoomEnergy, an in-room digital thermostat that is designed to control virtually any fan coil unit or packaged-terminal air conditioner found in hotel rooms. In addition to the eRoomSystem in the fiscal year 2009 we have purchased Kooltech refreshment centers that were installed in various hotels.

Our eRoomSystem and related products deliver in-room solutions that reduce operating costs, enhance hotel guest satisfaction and provide higher operating profits to our customers. The solutions offered by our eRoomSystem and related products have allowed us to establish relationships with many premier hotel chains. In addition to providing our customers with valuable in-room solutions, our revenue-sharing program has allowed us to partner with our customers. Through our revenue-sharing program, we have been able to install our products at little upfront cost to hotels, and share in the recurring revenues generated from the sale of goods and services related to our products.

On July 24, 2008, we provided a secured loan to BlackBird Corporation, a Florida corporation (“BlackBird”), an unrelated entity. The funding of the loan took place on completion of a transaction by BlackBird to acquire an unrelated company, USA Datanet Corporation. The acquisition took place on July 24, 2008. The loan is evidenced by a 10% senior secured convertible promissory note, made by BlackBird (the “Secured Note”). The Secured Note was extended to March 31, 2011 and the interest rate increased to 18% annually on January 1, 2009, with interest payable quarterly on the last business day of each quarter.

On June 17, 2009, the Company purchased the assets of Kooltech SPE which had been acquired by Cardinal Pointe Capital (“CPC”). CPC sold the minibars, baskets and stock owned by Kooltech SPE to the Company. The Company has formed a subsidiary, eFridge, LLC (“eFridge”) for the purposes of this purchase. The purchase price is an amount equal to thirty percent (30%) of eFridge’s EBITDA and an amount equal to thirty percent (30%) of New Equipment Cash Flow. Payment of the Purchase Price shall be made by eFridge to CPC on a monthly basis within twenty days after the end of each month, based on the eFridge’s EBITDA for the month then ended.

We have deployed over 10,000 eRoomServ refreshment centers, and over 6,000 eRoomSafes at many hotel properties. In addition we operate approximately 1,000 KoolTech refreshment centers purchased from CPC.

1

Summary of Our Diversification Initiatives

We are continuously performing due diligence on third party companies for the purpose of making investments in privately-held or publicly traded emerging growth stage companies. In the future, we may acquire an existing operating company if the opportunity arises. At this time, we have not reached a definitive agreement with any such third party companies.

Our Products and Services

eRoomSystem

Since our inception, it has been our objective to provide innovative in-room amenities to the lodging industry. Our technologies provide an intelligent, in-room computerized platform and communications network that comprises the eRoomSystem. At the core of the eRoomSystem is our proprietary hardware and software that operate as a multi-tasking imbedded operating system. Our hardware and software can operate multiple devices and provide an interactive environment that allows the hotel guest to input and receive information.

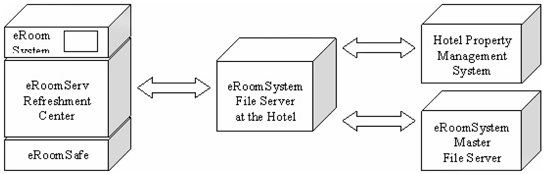

Installed as part of our eRoomServ refreshment center, the eRoomSystem provides the communication link between the hotel guest, our products, our file server located at the hotel (the eRoomSystem file server), the hotel's property management system, and the file server located at our headquarters (the eRoomSystem master file server). Our software is remotely upgradeable from our Salt Lake City and New Jersey facilities, which reduces the need for costly on-site visits. We can also remotely adjust pricing, change messages on the liquid crystal display, lock and unlock our units and change the input touchpad layout. From our facility, we can also determine whether our products are active and working properly and, in the event a participating hotel fails to pay outstanding invoices or otherwise violates the terms of its agreement with us, control the use of our products by remotely locking the units.

The eRoomSystem consists of a microprocessor, memory, input/output ports, communications transceiver, liquid crystal display, touchpad, power supply and our proprietary software. The proprietary architecture of our circuit boards has been designed to minimize the need for hardware upgrades. The eRoomSystem includes an embedded system processor that handles simple instructions and routes all billing functions and processor-intensive instructions to the eRoomSystem file server.

eRoomServ Refreshment Centers

Our eRoomServ refreshment centers consist of the eRoomSystem, a small refrigeration unit, electronic controls, LCD display and vending racks. Our newest models utilize an upright multi-vending rack. The upright multi-vending rack offers greater flexibility for the snack and beverage products offered by hotels, and is viewed more favorably by our hotel clients than our prior side-vend rack design.

The upright multi-vending rack displays up to 30 different beverages and/or snacks and provides an environment similar to that of a convenience store beverage cooler. Upon removal of a product, the gravity-based design uses the weight of the remaining products to cause the products to roll or slide forward. In addition to the upright multi-vending rack in the refreshment center, the eRoomTray allows hotel properties to separately vend a variety of products at room temperature within the eRoomSystem environment, including snacks, wine, disposable cameras, film, souvenirs, maps and other sundries.

Our eRoomServ refreshment center and eRoomTray communicate through the eRoomSystem, which uses the hotel property's existing telephone lines, network cabling or cable television lines. Our eRoomServ refreshment centers and eRoomTray operate as follows:

|

§

|

A hotel guest selects a beverage or snack from our eRoomServ refreshment center or eRoomTray;

|

|

§

|

The purchase is either immediately confirmed on the liquid crystal display and acknowledged with an audible beep or subject to a countdown of a predetermined (by the hotel) number of seconds prior to purchase confirmation;

|

|

§

|

Upon confirmation, the transaction information, such as product type, price and time of purchase, is simultaneously transferred to the eRoomSystem file server;

|

|

§

|

The eRoomSystem file server communicates on a real-time basis with the hotel's property management system and periodically with our eRoomSystem master file server located at our Salt Lake City facility; and

|

|

§

|

The hotel's property management system posts the purchase to the hotel guest's room account.

|

2

The sales data from the eRoomSystem is transmitted to the eRoomSystem file server from which hotel employees can access real-time sales reports, inventory levels for restocking purposes and demographic data. As for the maintenance of our refreshment centers, the repair or replacement of any component of our refreshment center is relatively simple and is typically provided at no additional charge to the property pursuant to the terms of our service and maintenance agreement.

eRoomSafe

Our eRoomSafes are electronic in-room safes offered in conjunction with our eRoomSystem. The eRoomSafes have storage space large enough for laptop computers, video cameras and briefcases and include an encrypted electronic combination that can be changed by the hotel guest. The eRoomSafes utilize the eRoomSystem to interface with the eRoomSystem file server that communicates with the hotel's property management system.

The following diagram represents the structure and communications network of our eRoomSystem, the eRoomSystem file server, the hotel property management system, and the eRoomSystem master file server:

Our eRoomTray is an ambient tray for dry goods. The eRoomTray has a terraced design and can hold three, to more than twenty, different products. The eRoomTray utilizes cross-sensing technology that provides significant flexibility in product selection for hotels. The eRoomTray uses the visible countdown timer located on the liquid crystal display of the eRoomServ Refreshment Center. This solution allows the hotel to sell music CD's souvenirs, disposable cameras, maps, snacks and other profitable items. The eRoomTray is unique in that it can generally be located anywhere in a guestroom.

eRoomEnergy Management

In 2001, we announced our agreement with INNCOM International, Inc., a leader in hotel guest-room control systems, through which INNCOM private-labels its e4 Smart Digital Thermostat for us as eRoomEnergy and provides assistance in the installation and maintenance of the units. The e4 Smart Digital Thermostat is designed to control virtually any fan coil unit or packaged terminal air conditioner found in hotel rooms and comes standard with an illuminated digital display, a Fahrenheit/Celsius button, one-touch temperature selection, an off/auto button, fan and display buttons. In addition to these user-friendly features, the e4 Smart Digital Thermostat includes five relays, an optional on-board infrared transceiver, a passive infrared occupancy sensor, and is expandable to include functions such as humidity control, outside temperature display, refreshment center access reporting, occupancy reporting to housekeeping and automatic lighting control.

eRoomData Management

One of the byproducts of our technology is the information we have collected since our first product installation. To date, we have collected several million room-nights of data. The eRoomSystem file server collects information regarding the usage of our eRoomServ refreshment centers on a real-time basis. We use this information to help our customers increase their operational efficiencies. The information we obtain is unique because we are able to categorize the information according to specific consumer buying patterns and demographics.

The information we collect is currently offered to our customers as part of our service and maintenance agreement, including specific information about their guests' buying patterns and non-confidential information about other hotels in similar geographic regions. To this end, our hotel clients benefit in various ways from the information we provide. The hotels are responsible for restocking the goods sold from our refreshment centers and the real-time sales data generated by our refreshment centers helps the hotel maximize personnel efficiencies. The transfer of sales data to the hotel prevents guest pilferage and minimizes disputes over refreshment center usage, both of which are prevalent in the lodging industry, particularly with non-automated units. Finally, the ability to track product sales performance allows the hotel to stock the refreshment centers with more popular items, which generally leads to increased sales of product from the refreshment centers. Our system can provide reports on daily restocking requirements, daily, monthly and annual product sales statistics, overnight audits, inventory control and a variety of customized reports.

3

Research and Development

At the core of our products and services is our proprietary software and hardware that make up our eRoomSystem. In 2008, we initiated some research and development projects for the purpose of creating a new product line. We have stepped up our research and development in 2010. There is no assurance that the products we are working on will be successfully completed or deployed.

Sales and Marketing

We have deployed more than 10,000 refreshment centers, and over 6,000 eRoomSafes at many hotel properties. We have renewed our sales and marketing efforts with respect to new product placements for the refreshment centers. There is no assurance that we will be successful in selling or placing additional units.

Manufacturing

We do not anticipate manufacturing new refreshment centers in our own facilities in the future, however, we may utilize outside manufacturing companies to manufacture additional units as necessary. We will continue to service our existing products placed pursuant to existing revenue sharing and maintenance agreements.

Competition

The market for in-room amenities in the lodging industry is quite competitive, and the competition has further intensified in recent years. Management is focusing on servicing our existing client base. If we decide to redeploy products following the maturity of certain outstanding revenue sharing agreements, we will be subject to significant competition in doing so from our historical competitors, including Bartech, MiniBar America and Dometic, among others.

Intellectual Property

We rely upon a combination of trademark and copyright law, trade secret protection and confidentiality and/or license agreements with our employees, customers and business partners to protect our proprietary rights in our products, services, know-how and information.

We have registered RoomSystems, RoomSafe, eRoomEnergy, eRoomData, eRoomSystem, and eRoomServ with the United States Patent and Trademark Office. In addition, we have pending applications for the following trademarks and service marks: eRoomSafe; eRoomManagement; and eRoomSystem Technologies. We have also registered our logo.

Our proprietary software consists of three modules and provides the operating system for our eRoomSystem. The first module is an operating system that permits messages to be scrolled on the flat panel display of our eRoomSystem and allows hotel guests to interface with our products. The second module is a Windows(R) based program that provides a communication link between our eRoomSystem, our products, our eRoomSystem hotel file server and the hotel's property management system. The third module is a Windows(R) based program that collects data from our eRoomSystem hotel file server and produces a wide-variety of management and operational reports. Three years ago, we introduced our eRoomSystem version 4 software and thereafter our newest version 4.1 software. All, but one, of our existing hotel clients are utilizing our version 4.1 software that provides users with a friendly, easy-to-learn graphical environment which generally expands the report generating capabilities of the property.

We do not know if our future patent applications will be issued with the full scope of claims we seek, if at all, or whether any patents we receive will be challenged or invalidated. Our means of protecting our proprietary rights in the United States, and abroad, may not be adequate and competitors may independently develop similar technology. We cannot be certain that our services do not infringe on patents or other intellectual property rights that may relate to our services. Like other technology-based businesses, we face the risk that we will be unable to protect our intellectual property and other proprietary rights, and the risk that we will be found to have infringed on the proprietary rights of others. Further, as previously mentioned, it is our intention to focus solely on servicing our existing hotel clients.

4

Historical Summary

We were originally incorporated under the laws of the State of North Carolina on March 17, 1993 as InnSyst! Corporation. On September 28, 1993, the operations of InnSyst! were transferred to RoomSystems, Inc., a Virginia corporation, incorporated on August 12, 1993, or RoomSystems Virginia. On April 29, 1996, the operations of RoomSystems Virginia were transferred to RoomSystems, Inc., a Nevada corporation, or RoomSystems. Through an agreement and plan of reorganization approved by a majority of our stockholders dated December 31, 1999, RoomSystems became the wholly owned subsidiary of RoomSystems International Corporation. Pursuant to this agreement and plan of reorganization, all shares of RoomSystems common stock, including all shares of common stock underlying outstanding options and warrants, Series A convertible preferred stock and Series B convertible preferred stock were exchanged for the identical number and in the same form of securities of RoomSystems International Corporation. On February 1, 2000, we changed our name from RoomSystems International Corporation to RoomSystems Technologies, Inc. Subsequently, on March 29, 2000, with the approval of our stockholders, we changed our name to eRoomSystem Technologies, Inc. Thereafter, we changed the name of RoomSystems, Inc. to eRoomSystem Services, Inc.

We have four wholly owned subsidiaries, eRoomSystem Services, Inc. (formerly RoomSystems), eRoomSystem SPE, Inc., eFridge, LLC and eLiftLLC, LLC. RSi BRE, Inc., or RSi BRE, a former wholly-owned subsidiary, was liquidated into eRoomSystem Technologies, Inc. in 2004.

eRoomSystem Services is our service and maintenance subsidiary that installs all of our products, provides electronic software upgrades to our customers, provides customer service and maintenance for our products and trains hotel personnel on the use and maintenance of our products.

RSi BRE was formed as part of the Equipment Transfer Agreement we entered into in September 1998 with RSG Investments, LLC, or RSG, a privately held company. Previously, RSi BRE held title to 1,717 eRoomServ refreshment centers and 1,304 eRoomSafes. On February 29, 2004, we entered into a Settlement Agreement and Mutual Release Agreement with RSG whereby we paid the sum of $152,823 as a full and final cancellation of the Equipment Transfer Agreement and subsequent Settlement Agreement dated September 1999. As a result, the Company immediately commenced recognizing all revenue generated from the four revenue sharing lease agreements relating to the 1,717 eRoomServ refreshment centers and 1,304 eRoomSafes. In 2004, RSi BRE was liquidated.

eRoomSystem SPE was formed as part of our long-term financing arrangement with AMRESCO Leasing Corporation, which was terminated in August 2002. eRoomSystem SPE owns all of the equipment previously funded by AMRESCO under our revenue-sharing program, consisting of nine properties comprising 2,775 eRoomServ refreshment centers and 2,622 eRoomSafes. AMRESCO had taken a senior security interest in all of the assets of eRoomSystem SPE. We control eRoomSystem SPE and its financial results are consolidated with those of eRoomSystem Technologies and eRoomSystem Services. On July 14, 2006, the Company repaid the full amount due and owing under the financing arrangement.

eLiftLLC was formed as a new subsidiary in November 2008. eLift provides online parts procurement for the material handling industry.

eFridge, LLC was formed as a new subsidiary in June 2009. eFridge purchased the KoolTech minibars and baskets from CPC and operates them in the Hotels in which they were installed.

Government Regulation

We are subject to laws and regulations applicable to businesses generally, as well as to laws and regulations directly applicable to the lodging industry and minibars in particular. These laws and regulations relate to qualifying to do business in the various states and in foreign nations in which we currently have, or propose to have, our products.

Apart from laws and regulations applicable to us, some of our existing and potential customers are subject to additional laws or regulations, such as laws and regulations related to liquor and gaming, which may have an adverse effect on our operations. Due to the licensing requirements relating to the sale of alcohol in each state, the failure of any of our revenue-sharing partners to obtain or maintain its liquor license would result in the loss of revenue for our revenue-sharing partner and us. In addition, due to the heightened hotel-casino regulatory environment and our ongoing revenue-sharing agreements with hotel-casinos, our operations may be subject to review by a hotel-casino's compliance committee to verify that its involvement with us would not jeopardize its gaming license. The regulatory compliance committee of a hotel-casino has broad discretion in determining whether or not to approve a transaction with a third party, which review typically includes the character, fitness and reputation of the third party and its officers, directors and principals. If our history or operations present problems for a hotel-casino, we would either have to expend resources to address or eliminate the concerns or forego the business.

Employees

We currently employ approximately 3 full-time employees and 8 part-time employees in addition to one consultant. None of our employees are subject to a collective bargaining agreement.

ITEM 2. DESCRIPTION OF PROPERTY.

Our headquarters and principal executive offices, comprising approximately 1,100 square feet, are located at 1072 Madison Ave., Lakewood, NJ 08701. We pay $1,300 per month and lease on a month to month basis.

5

In addition, we currently utilize storage space in Salt Lake City, Utah, Jersey City, NJ, Lakewood, NJ and Jackson, NJ. We maintain inventory and replacement parts at these facilities. We pay approximately $1,600 per month for these facilities, which have a month to month arrangement.

ITEM 3. LEGAL PROCEEDINGS.

We are, from time to time, parties to various legal proceedings arising out of our business. Notwithstanding, there are no pending legal proceedings to which the Company is a party or in which any director, officer or affiliate of the Company, any owner of record or beneficially of more than 5% of any class of voting securities of the Company, or security holder is a party adverse to the Company or has a material interest adverse to the Company. The Company’s property is not the subject of any pending legal proceedings.

PART II

ITEM 5. MARKET FOR COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

Our authorized capital stock consists of 50,000,000 shares of common stock, $0.001 par value; 5,000,000 shares of preferred stock, $0.001 par value including; 500,000 shares of Series A convertible preferred stock, $0.001 par value; 2,500,000 shares of Series B convertible preferred stock, $0.001 par value; 2,000,000 shares of Series C convertible preferred stock, $0.001 par value; and 2,777,778 shares of Series D convertible preferred stock, $0.001 par value. Our current authorized capital was effected through an amendment and restatement of our articles of incorporation on March 29, 2000, and the filing of a Certificate of Rights, Preferences and Privileges relating to the Series D convertible preferred stock in November 2002. There are no shares of preferred stock issued and outstanding.

Market Information

Prior to August 3, 2000, there was no public market for our common stock. In conjunction with our initial public offering, our common stock was accepted for listing on the NASDAQ SmallCap Market under the trading symbol "ERMS". In April 2003, our common stock was delisted from the NASDAQ SmallCap market. Our common stock is currently quoted on the Over-The-Counter Bulletin Board under the same symbol. As of March 21, 2011, there were 23,907,865 shares of common stock outstanding and no shares of any class of preferred stock outstanding.

High And Low Sale Prices Of Our Common Stock

The following table sets forth the high and low bid information of our common stock, as quoted on the Over The Counter Bulletin Board (which quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions) for each quarter during the period January 1, 2009 through December 31, 2010:

|

Calendar Quarter Ended

|

Low

|

High

|

||||||

|

March 31, 2009

|

$ | 0.11 | $ | 0.19 | ||||

|

June 30, 2009

|

$ | 0.09 | $ | 0.15 | ||||

|

September 30, 2009

|

$ | 0.09 | $ | 0.17 | ||||

|

December 31, 2009

|

$ | 0.14 | $ | 0.26 | ||||

|

March 31, 2010

|

$ | 0.17 | $ | 0.23 | ||||

|

June 30, 2010

|

$ | 0.11 | $ | 0.20 | ||||

|

September 30, 2010

|

$ | 0.14 | $ | 0.22 | ||||

|

December 31, 2010

|

$ | 0.11 | $ | 0.22 | ||||

|

March 31, 2011 (through March 21, 2011)

|

$ | 0.12 | $ | 0.23 | ||||

The last reported price of our common stock on the Over-The-Counter Bulletin Board on March 21, 2011 was $0.17 per share. We are not aware of any public market for our options or warrants.

Holders

As of March 21, 2011, there were approximately 400 stockholders of record holding our outstanding common stock.

6

Dividends

We have never declared or paid any cash dividends on our common stock. Our Board of Directors presently, and for the foreseeable future, intends to retain all of our earnings, if any, for the purchase of securities in private or publicly traded emerging growth companies, or possibly, the acquisition of an operating company if the opportunity arises. The declaration and payment of cash dividends in the future will be at the discretion of our Board and will depend upon a number of factors, including, among others, our future earnings, operations, funding requirements, restrictions under our credit facility, our general financial condition and any other factors that our board considers important. Investors should not purchase our common stock with the expectation of receiving cash dividends.

Recent Sales of Unregistered Securities; Use of Proceeds

There were no recent sales of unregistered securities in fiscal years ended December 31, 2010 and 2009.

During the year ended December 31, 2010, the Company issued 75,000 shares of common stock valued at $11,250 ($0.15 per share based on market value on the date issued) to its Board of Directors for services rendered. This reflects the issuance of 25,000 shares of common stock to each of Mssrs. Hardt, Wein and Savas. The shares were issued under Section 4(2) of the Securities Act of 1933, as amended.

During the year ended December 31, 2009, the Company issued 75,000 shares of common stock valued at $11,250 ($0.15 per share based on market value on the date issued) to its Board of Directors for services rendered. This reflects the issuance of 25,000 shares of common stock to each of Mssrs. Hardt, Wein and Savas. The shares were issued under Section 4(2) of the Securities Act of 1933, as amended.

Purchases of Equity Securities by the Small Business Issuer and Affiliated Purchasers

290,300 shares of our common stock were purchased in the fiscal year ended December 31, 2008 pursuant to the share buyback authorized by the Board of Directors on August 29, 2007.

|

c) Total Number of Shares (or

|

(d) Maximum Number (or Approximate

|

|||||||||||||||

|

a) Total Number

|

(b) Average

|

Units) Purchased as Part of

|

Dollar Value) of Shares (or Units) that

|

|||||||||||||

|

of Shares (or

|

Price Paid per

|

Publicly Announced Plans or

|

May Yet Be Purchased Under the Plans

|

|||||||||||||

|

Period

|

Units) Purchased

|

Share (or Unit)

|

Programs

|

or Programs

|

||||||||||||

|

Oct-08

|

30,000 | $ | 0.1443 | 30,000 | - | |||||||||||

|

Nov-08

|

10,300 | $ | 0.1576 | 10,300 | - | |||||||||||

|

Dec-08

|

250,000 | $ | 0.1300 | 250,000 | - | |||||||||||

Securities Authorized for Issuance under Equity Compensation Plans

The following table sets forth information about the common stock available for issuance under compensatory plans and arrangements as of December 31, 2010.

|

Weighted-average

|

||||||||||||

|

|

Number of securities to

|

exercise price of

|

Number of securities

|

|||||||||

|

of outstanding options,

|

outstanding options,

|

available for future

|

||||||||||

|

Plan Category

|

warrants and rights

|

warrants and rights

|

issuance

|

|||||||||

|

(a)

|

(b)

|

(c)

|

||||||||||

|

|

||||||||||||

|

Equity compensation plan approved by security holders

|

1,942,446 | $ | 0.32 | 1,057,554 | ||||||||

|

Equity compensation plans not approved by security holders

|

305,898 | $ | 0.26 | - | ||||||||

|

Total

|

2,248,344 | $ | 0.31 | 1,057,554 | ||||||||

Equity Compensation Plans Approved by Security Holders

The 2000 Stock Option and Incentive Plan, or the 2000 Plan, was adopted by our board on February 3, 2000 and approved by our stockholders on March 29, 2000. The 2000 Plan was amended by our stockholders on May 7, 2001 when the shares of common stock authorized under the 2000 Plan were increased from 2,000,000 shares to 2,400,000 shares, amended on July 29, 2002 by our stockholders effectively increasing the number of shares issuable hereunder to 2,700,000, and amended further on November 15, 2004 by our stockholders effectively increasing the number of shares issuable hereunder to 3,000,000. The 2000 Plan provides us with the vehicle to grant to employees, officers, directors and consultants stock options and bonuses in the form of stock and options. Under the 2000 Plan, we can grant awards for the purchase of up to 3,000,000 shares of common stock in the aggregate, including "incentive stock options" within the meaning of Section 422 of the United States Internal Revenue Code of 1986 and non-qualified stock options. As of March 21, 2011, we had options to purchase 1,942,446 shares of our common stock outstanding under the 2000 Plan.

7

Equity Compensation Plans Not Approved by Security Holders

Except as otherwise noted below, the options and warrants under the following compensation plans are transferable. These options and warrants are exercisable for the remainder of their stated term in the event of death of the holder or the termination of the holder's employment with the Company. None of these options or warrants have cashless exercise provisions.

The 2001 Variable Stock Option and Incentive Plan consists of 205,004 options to purchase shares of common stock of which 205,004 options were issued to employees in 2001 at an exercise price of $0.26 with a term of 10 years.

The 2001(B) Stock Option and Incentive Plan consists of 100,894 options to purchase shares of common stock of which 100,894 options were issued to consultants in 2001 at an exercise price ranging from $0.26 to $0.33 with a term of 10 years.

The compensation committee has authority to determine the persons to whom awards will be granted, the nature of the awards, the number of shares to be covered by each grant, the terms of the grant and with respect to options, whether the options granted are intended to be incentive stock options, the duration and rate of exercise of each option, the option price per share, the manner of exercise and the time, manner and form of payment upon exercise of an option.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITIONS AND RESULTS OF OPERATIONS.

Certain statements contained in this prospectus, including statements regarding the anticipated development and expansion of our business, our intent, belief or current expectations, primarily with respect to the future operating performance of the Company and the services we expect to offer and other statements contained herein regarding matters that are not historical facts, are “forward-looking” statements. Future filings with the Securities and Exchange Commission, future press releases and future oral or written statements made by us or with our approval, which are not statements of historical fact, may contain forward-looking statements, because such statements include risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements.

All forward-looking statements speak only as of the date on which they are made. We undertake no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they are made.

Overview

Our core business was the development and installation of an intelligent, in-room computer platform and communications network, or the eRoomSystem, for the lodging industry. The eRoomSystem is a computerized platform and processor-based system designed to collect and control data. The eRoomSystem supports our fully automated and interactive eRoomServ refreshment centers, eRoomSafes, eRoomEnergy products, and the eRoomTray. In 2005, we commenced our diversification strategy of investing in third party emerging growth companies. We may make investments in promising emerging growth companies, and potentially acquire an operating company if the opportunity arises.

Our existing products interface with the hotel's property management system through our eRoomSystem communications network. The hotel's property management system posts usage of our products directly to the hotel guest's room account. The solutions offered by our eRoomSystem and related products have allowed us to install our products and services in several premier hotel chains, including Marriott International, Hilton Hotels, Helmsley and Carlson Hospitality Worldwide, in the United States and internationally.

One of the byproducts of our technology is the information we have collected since our first product installation. To date, we have collected several million room-nights of data. Through our eRoomSystem, we are able to collect information regarding the usage of our products on a real-time basis. We use this information to help our customers increase their operating efficiencies.

Description of Revenues

Historically, we have received most of our revenues from the sale or placement under a revenue-sharing program of our products in hotels. More recently we have purchased minibars and baskets already placed in Hotels and setup a turnkey solution at these Hotels. In these hotels we receive most of the revenues for the product sold in the minibars and baskets. We provide 3-5%of revenues to the some of the Hotels. We expect that these revenues will account for a substantial majority of our revenues for the foreseeable future. We also generate revenues from maintenance and support services relating to our existing installed products.

Our dependence on the lodging industry, including its guests, makes us extremely vulnerable to downturns in the lodging industry caused by the general economic environment. Such a downturn could result in fewer purchases by hotel guests of goods and services from our products installed in hotels, and accordingly lower revenues where our products are placed pursuant to a turnkey or revenue sharing agreement. Time spent by individuals on travel and leisure is often discretionary for consumers and may be particularly affected by adverse trends in the general economy. The success of our operations depends, in part, upon discretionary consumer spending and economic conditions affecting disposable consumer income such as employment, wages and salaries, business conditions, interest rates, and availability of credit and taxation.

8

Our revenue-sharing program provided us with a seven-year revenue stream under each revenue-sharing agreement. Because many of our customers in the lodging industry traditionally have limited capacity to finance the purchase of our products, we designed our revenue-sharing program accordingly. Through our revenue-sharing plan, we installed our products at little or no upfront cost to our customers and share in the recurring revenues generated from sales of goods and services related to our products. We retain the ownership of the eRoomServ refreshment centers and eRoomSafes throughout the term of the revenue-sharing agreements and the right to re-deploy any systems returned to us upon the expiration or early termination of the revenue-sharing agreements. We have failed to place any products, either on a revenue sharing or sale basis in the prior seven years. However, we have added some hotels through the purchase of KoolTech’s minibars in which we provide a turnkey solution to those hotels. We intend to continue to service and maintain our existing installed product base for the remaining life of the contracts relating thereto.

Our revenues over the past few years have been decreasing steadily as we have focused on service and maintenance of our existing installed products and have not installed new products at hotels. However, they have increased this year due to the purchase of the KoolTech minibars in 2009. Over time, our revenues relating to our installed products will decline as existing agreements conclude. Given the foregoing, in 2005 we commenced our diversification strategy to invest in emerging growth companies. We continue to explore opportunities and perform due diligence on third parties with respect to potential investments. At this time, we have not reached a definitive agreement to make further investments. In addition, we may acquire an operating company in the future if the opportunity arises. The timing and return on such investments, however, cannot be assured.

No new products were installed during the years ended December 31, 2010 and 2009. However, we have replaced a large number of the KoolTech minibars with a newer model.

Revenue Recognition

Equipment sales revenue from our products is recognized upon completion of installation and acceptance by the customer. Sales revenue for product in the minibars that we sell under a turnkey solution is recognized upon completion of the sale. Sales revenue from the placement of our eRoomServ refreshment centers and eRoomSafes under our revenue-sharing program are accounted for similar to an operating lease, with the revenues recognized as earned over the term of the agreement. In some instances, our revenue-sharing agreements provided for a guaranteed minimum daily payment by the hotel. We negotiated our portion of the revenues generated under our revenue-sharing program based upon the cost of the equipment installed and the estimated daily sales per unit for the specific customer.

We have entered into installation, maintenance and license agreements with most of our existing hotel customers. Installation, maintenance and license revenues are recognized as the services are performed, or pro rata over the service period. We defer all revenue paid in advance relating to future services and products not yet installed and accepted by our customers.

Our installation, maintenance and license agreements stipulate that we collect a maintenance fee per eRoomServ refreshment center per day, payable on a monthly basis. Our objective is to generate gross profit margins of approximately 50% from our maintenance-related revenues. We base this expectation on our historical cost of maintenance of approximately $0.04 per unit per day and, pursuant to our maintenance agreements, our projected receipt of generally not less than $0.08 per unit per day.

Description of Expenses

Cost of product sales consists primarily of production, shipping and installation costs for equipment sales and cost of goods and labor for our sale of minibar products. Cost of revenue-sharing arrangements consists primarily of depreciation of capitalized costs for the products placed in service. We capitalize the production, shipping, installation and sales commissions related to the eRoomServ refreshment centers, eRoomSafes, eRoomTrays and eRoomEnergy management products placed under revenue-sharing agreements. Cost of maintenance fee revenues primarily consists of expenses related to customer support and maintenance.

Selling, general and administrative expenses primarily consist of general and administrative expenses including professional fees, salaries and related costs for accounting, administration, finance, human resources, information systems and legal personnel.

Research and development expenses consist of payroll and related costs for hardware and software engineers, quality assurance specialists, management personnel, and the costs of materials used by our consultants in the maintenance of our existing installed products. As we have initiated development of new product lines there was some research and development expenses in the fiscal years 2010 and 2009.

9

In accordance with Financial Accounting Standards Board, or FASB, Statement of Financial Accounting Standards, or SFAS, No. 86, "Accounting for the Costs of Computer Software to be Sold, Leased or Otherwise Marketed," development costs incurred in the research and development of new software products to be sold, leased or otherwise marketed are expensed as incurred until technological feasibility in the form of a working model has been established. Internally generated capitalizable software development costs have not been material to date. We have charged our software development costs to research and development expense in our consolidated statements of operations.

Comparison of Years Ended December 31, 2010 and 2009

Revenues

Product Sales — Our revenue from product sales was $873,606 in 2010, as compared to $349,416 in 2009, representing an increase of $524,190, or 150%. The increase in revenue from product sales in 2010 was a result of the sales of minibar items to customers with our turnkey minibar solution provided to certain hotels. This service was initiated in mid-2009 and therefore the increase is reflected in the full year results for 2010

Maintenance Fee Revenue — Our maintenance fee revenue was $195,346 in 2010 and $131,052 for 2009, representing an increase of $64,294, or 49.1%. The increase in maintenance fee revenue was due a hotel that was added in third quarter of 2009.

Revenue Sharing Arrangements — We had no revenue from revenue-sharing arrangements in 2010 as compared to $239,213 for 2009, representing a decrease of $239,213, or 100%. The decrease in revenue from revenue-sharing arrangements was due to the completion of revenue-sharing agreements in 2009. During the years ended December 31, 2010 and 2009, we did not place additional products on a revenue sharing basis.

During the year ended December 31, 2010, revenues from three customers accounted for 65% of our total revenues.

Interest — Our income from interest was $116,767 in 2010, compared to $123,868 in 2009, representing a decrease of $7,101, or 5.7%. The decrease related to lower interest rates. Revenue from interest was reclassified from operating expenses to demonstrate that it is presently an integral part of our core business plan.

Cost of Revenue

Cost of Product Sales Revenue — Our cost of product sales revenue was $513,345 for 2010 as compared to $223,052 for 2009, representing an increase of $290,293, or 130.1%. The increase was primarily due to the increased product sales revenue from the turnkey solution that we provided to hotels in 2010. The gross margin percentage on revenue from product sales revenue was 41.2% in 2010 as compared to 36.2% in 2009.

Cost of Maintenance Revenue — Our cost of maintenance revenue was $31,889 for 2010 as compared to $73,093 for 2009, representing a decrease of $41,204, or 56.4%. The decrease in the cost of maintenance revenue was due to increased operating efficiencies in 2010. The gross margin percentage on maintenance revenues was 83.7% in 2010 as compared to 44.2% in 2009.

Cost of Revenue-Sharing Revenue — Our cost of revenue-sharing revenue was $57,642 for 2009. The gross margin percentage on revenue-sharing revenue was 75.9% in 2009.

The changes and percent changes with respect to our revenues and our cost of revenue for the years ended December 31, 2010 and 2009 are as follows:

10

|

For the Years Ended

|

||||||||||||||||

|

December 31,

|

||||||||||||||||

|

Percent

|

||||||||||||||||

|

2010

|

2009

|

Change

|

Change

|

|||||||||||||

|

REVENUE

|

||||||||||||||||

|

Product sales

|

$ | 873,606 | $ | 349,416 | $ | 524,190 | 150.0 | % | ||||||||

|

Maintenance fees

|

195,346 | 131,052 | 64,294 | 49.1 | % | |||||||||||

|

Revenue-sharing arrangements

|

- | 239,213 | (239,213 | ) | -100.0 | % | ||||||||||

|

Interest income

|

116,767 | 123,868 | (7,101 | ) | -5.7 | % | ||||||||||

|

Loss on other than temporary decline in marketable securities

|

(50,000 | ) | - | (50,000 | ) | 100.0 | % | |||||||||

|

Total Revenue

|

1,135,719 | 843,549 | 292,170 | 34.6 | % | |||||||||||

|

COST OF REVENUE

|

||||||||||||||||

|

Product sales

|

513,345 | 223,052 | 290,293 | 130.1 | % | |||||||||||

|

Maintenance fees

|

31,889 | 73,093 | (41,204 | ) | -56.4 | % | ||||||||||

|

Revenue-sharing arrangements

|

- | 57,642 | (57,642 | ) | -100.0 | % | ||||||||||

|

Total Cost of Revenue

|

$ | 545,234 | $ | 353,787 | $ | 191,447 | 54.1 | % | ||||||||

Although the preceding table summarizes the net changes and percent changes with respect to our revenues and our cost of revenue for the years ended December 31, 2010 and 2009, the trends contained therein are limited to a two-year comparison and should not be viewed as a definitive indication of our future results.

Operating Expenses

Selling, General and Administrative — Selling, general and administrative expenses were $494,374 for 2010 and $619,873 for 2009, representing a decrease of $125,499, or 20.2%. Selling, general and administrative expenses represented 43.5% of our total revenues in 2010 and 73.5% of our total revenues in 2009. The decrease in our selling, general and administrative expenses reflects primarily the increased costs in 2009 relating to the acquisition of the KoolTech minibars as well as the write-off of an uncollectible account in 2009 among other items.

Research and Development Expenses — Research and development expenses were $77,766 for 2010 and $7,538 for 2009, representing an increase of $70,228, or 931.7%. The increase in research and development expenses was due to increased development initiated on new product lines in 2010. Research and development expenses represented 6.8% of our total revenue in 2010 and 1% of our total revenue in 2009.

Net Income (Loss) Attributable to Common Stockholders

We realized a net income attributable to common stockholders of $18,345 in 2010, as compared to a net loss of $137,649 in 2009. The $155,994 increase in net income was primarily due to a significant increase in product sales revenue in 2010 from the refreshment centers installed as a turnkey solution. In addition in 2009 the many costs involved in the initial stages of setting up the KoolTech minibar system as well as the write-off of an uncollectible account increased selling, general and administrative costs.

Liquidity and Capital Resources

At December 31, 2010, we had $2,145,709 of cash and working capital of $2,971,373, as compared to $2,302,620 of cash and working capital of $2,957,088 at December 31, 2009. In addition, our stockholders' equity was $3,096,018 at December 31, 2010 as compared to $2,970,215 at December 31, 2009, an increase of $125,803. The decrease in cash reflects primarily the purchase of investments in real property tax liens and increase in inventory in 2010. The increase in working capital reflects the decrease in accrued liabilities. The increase in stockholders’ equity reflects the net income in 2010 as well as the other comprehensive gain picked up in 2010.

Our accumulated deficit decreased to $31,129,700 at December 31, 2010 as compared to $31,148,045 at December 31, 2009. The decrease in accumulated deficit is a direct result of our net income of $18,345 in the year ended December 31, 2010.

Net cash provided by operating activities for the year ended December 31, 2010 was $28,597, as compared to $55,616 of net cash used by operating activities during the year ended December 31, 2009. The $84,213 change in net cash provided by operating activities resulted primarily from the increase in net income in 2010.

Net cash used by investing activities for the year ended December 31, 2010 was $185,508, as compared to net cash provided during the year ended December 31, 2009 of $222,422. The change resulted primarily from the purchase of property and equipment and real property tax liens in 2010 versus the repayment of a note receivable in 2009.

11

Net cash used in financing activities for the years ended December 31, 2010 and 2009 was $0.

Recent Accounting Pronouncements

In October 2009, the FASB issued an Accounting Standards Update or “ASU” regarding accounting for own-share lending arrangements in contemplation of convertible debt issuance or other financing. This ASU requires that at the date of issuance of the shares in a share-lending arrangement entered into in contemplation of a convertible debt offering or other financing, the shares issued shall be measured at fair value and be recognized as an issuance cost, with an offset to additional paid-in capital. Further, loaned shares are excluded from basic and diluted earnings per share unless default of the share-lending arrangement occurs, at which time the loaned shares would be included in the basic and diluted earnings-per-share calculation. This ASU is effective for fiscal years beginning on or after December 15, 2009, and interim periods within those fiscal years for arrangements outstanding as of the beginning of those fiscal years. The adoption of this standard did not have a material impact on our consolidated financial statements.

On December 15, 2009, the FASB issued ASU No. 2010-06 Fair Value Measurements Topic 820 “Improving Disclosures about Fair Value Measurements.” This ASU requires some new disclosures and clarifies some existing disclosures requirements about fair value measurement as set forth in Codification Subtopic 820-10. The FASB’s objective is to improve these disclosures and, thus, increase the transparency in financial reporting. This ASU is effective for fiscal years beginning on or after December 15, 2009. The adoption of this ASU will not have a material impact on our consolidated financial statements.

Software Revenue Recognition - In October 2009, the FASB issued accounting guidance which changes the accounting model for revenue arrangements that include both tangible products and software elements. Under this guidance, tangible products containing software components and nonsoftware components that function together to deliver the tangible product's essential functionality are excluded from the software revenue recognition guidance given prior to this new guidance. In addition, hardware components of a tangible product containing software components are always excluded from the software revenue guidance. This guidance is effective prospectively for revenue arrangements entered into or materially modified in fiscal years beginning on or after June 15, 2010. Early adoption is permitted. These provisions are not expected to have a material impact on our financial position or results of operations.

Disclosures about Fair Value Measurements – In January 2010, the FASB issued guidance requires an entity to disclose the following:

|

|

Separately disclose the amounts of significant transfers in and out of Level 1 and Level 2 fair value measurements and describe reasons for the transfers.

|

|

|

Present separately information about purchases, sales, issuances and settlements, on a gross basis, rather than on one net number, in the reconciliation for fair value measurements using significant unobservable inputs (Level 3).

|

|

|

Provide fair value measurement disclosures for each class of assets and liabilities.

|

|

|

Provide disclosures about the valuation techniques and inputs used to measure fair value for both recurring and nonrecurring fair value measurements for fair value measurements that fall in either Level 2 or level 3.

|

This guidance is effective for interim and annual reporting periods beginning after December 15, 2009, except for the disclosures about purchases, sales, issuances, and settlements in the roll forward of activity in Level 3 fair value measurements. Those disclosures are effective for fiscal years beginning after December 15, 2010. These provisions are not expected to have a material impact on our financial position or results of operations.

Off Balance Sheet Arrangements

We have no off-balance sheet arrangements.

We currently believe that our cash on hand will provide sufficient capital resources and liquidity to fund our expected operating expenditures for the next twelve months.

Qualitative and Quantitative Disclosures about Market Risk

A smaller reporting company, as defined by Rule 229.10(f)(1), is not required to provide the information required by this Item.

12

ITEM 8. FINANCIAL STATEMENTS.

eROOMSYSTEM TECHNOLOGIES, INC. AND SUBSIDIARIES

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

|

Report of Independent Registered Public Accounting Firm

|

14

|

|

Consolidated Balance Sheets

|

15

|

|

Consolidated Statements of Operations and Comprehensive Income

|

16

|

|

Consolidated Statements of Stockholders' Equity

|

17

|

|

Consolidated Statements of Cash Flows

|

18

|

|

Notes to Consolidated Financial Statements

|

19

|

13

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and the Stockholders

eRoomSystem Technologies, Inc.

We have audited the accompanying consolidated balance sheets of eRoomSystem Technologies, Inc. and subsidiaries (the “Company”) as of December 31, 2010 and 2009, and the related consolidated statements of operations and comprehensive income, stockholders’ equity, and cash flows for the years then ended. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of eRoomSystem Technologies, Inc. and subsidiaries as of December 31, 2010 and 2009, and the results of their operations and their cash flows for the years then ended in conformity with accounting principles generally accepted in the United States of America.

|

HANSEN, BARNETT & MAXWELL, P.C.

|

|

|

Salt Lake City, Utah

|

|

|

March 22, 2011

|

14

eROOMSYSTEM TECHNOLOGIES, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

|

December 31,

|

||||||||

|

2010

|

2009

|

|||||||

|

ASSETS

|

||||||||

|

CURRENT ASSETS

|

||||||||

|

Cash and cash equivalents

|

$ | 2,145,709 | $ | 2,302,620 | ||||

|

Investment in equity securities available for sale

|

42,500 | - | ||||||

|

Investment in real property tax liens

|

60,299 | - | ||||||

|

Accounts receivable, net of allowance for doubtful accounts of $18,240 at December 31, 2010 and $19,087 at December 31, 2009

|

103,802 | 105,826 | ||||||

|

Inventory

|

147,069 | 75,911 | ||||||

|

Advance to supplier

|

48,678 | 53,011 | ||||||

|

Note receivable

|

522,685 | 522,685 | ||||||

|

Prepaid expenses

|

5,043 | 18,716 | ||||||

|

Total Current Assets

|

3,075,785 | 3,078,769 | ||||||

|

PROPERTY AND EQUIPMENT

|

||||||||

|

Property and equipment, net of accumulated depreciation of $23,975 at December 31, 2010 and $11,971 at December 31, 2009

|

120,707 | 4,801 | ||||||

|

INTANGIBLE ASSETS, net of accumulated amortization of $3,376 at December 31, 2010 and $1,688 at December 31, 2009

|

1,688 | 3,376 | ||||||

|

DEPOSITS

|

2,250 | 4,950 | ||||||

|

Total Assets

|

$ | 3,200,430 | $ | 3,091,896 | ||||

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

||||||||

|

CURRENT LIABILITIES

|

||||||||

|

Accounts payable

|

$ | 21,399 | $ | 25,037 | ||||

|

Accrued liabilities

|

81,009 | 94,640 | ||||||

|

Customer deposits

|

2,004 | 2,004 | ||||||

|

Total Current Liabilities

|

104,412 | 121,681 | ||||||

|

Total Liabilities

|

104,412 | 121,681 | ||||||

|

STOCKHOLDERS' EQUITY

|

||||||||

|

Preferred stock, $0.001 par value; 5,000,000 shares authorized; none outstanding

|

- | - | ||||||

|

Common stock, $0.001 par value; 50,000,000 shares authorized; shares 23,907,865 at December 31, 2010 and 23,832,865 at December 31, 2009

|

23,908 | 24,123 | ||||||

|

Additional paid-in capital

|

34,159,310 | 34,079,467 | ||||||

|

Treasury stock at cost; 0 shares at December 31, 2010 and 290,300 shares at December 31, 2009

|

- | (38,453 | ) | |||||

|

Warrants and options outstanding

|

- | 103,123 | ||||||

|

Accumulated deficit

|

(31,129,700 | ) | (31,148,045 | ) | ||||

|

Accumulated other comprehensive gain/(loss)

|

42,500 | (50,000 | ) | |||||

|

Total Stockholders' Equity

|

3,096,018 | 2,970,215 | ||||||

|

Total Liabilities and Stockholders' Equity

|

$ | 3,200,430 | $ | 3,091,896 | ||||

See accompanying notes to consolidated financial statements

15

eROOMSYSTEM TECHNOLOGIES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME

|

For the years ended

|

||||||||

|

December 31,

|

||||||||

|

2010

|

2009

|

|||||||

|

REVENUE AND INVESTMENT INCOME (LOSSES)

|

||||||||

|

Product sales

|

$ | 873,606 | $ | 349,416 | ||||

|

Maintenance fees

|

195,346 | 131,052 | ||||||

|

Revenue-sharing arrangements

|

- | 239,213 | ||||||

|

Interest income

|

116,767 | 123,868 | ||||||

|

Loss on other than temporary decline in marketable securities

|

(50,000 | ) | - | |||||

|

Total Revenue and Investment Income (Losses)

|

1,135,719 | 843,549 | ||||||

|

COST OF REVENUE

|

||||||||

|

Product sales

|

513,345 | 223,052 | ||||||

|

Maintenance

|

31,889 | 73,093 | ||||||

|

Revenue-sharing arrangements

|

- | 57,642 | ||||||

|

Total Cost of Revenue

|

545,234 | 353,787 | ||||||

|

OPERATING EXPENSES

|

||||||||

|

Selling, general and administrative expense, including non-cash compensation of $14,958 and $26,145, respectively

|

494,374 | 619,873 | ||||||

|

Research and development expense

|

77,766 | 7,538 | ||||||

|

Net Operating Expenses

|

572,140 | 627,411 | ||||||

|

Net Income (Loss)

|

18,345 | (137,649 | ) | |||||

|

OTHER COMPREHENSIVE INCOME

|

||||||||

|

Unrealized gain on investment

|

42,500 | - | ||||||

|

Reclassification adjustment for losses included in operations

|

50,000 | - | ||||||

|

Comprehensive Income (Loss)

|

$ | 110,845 | $ | (137,649 | ) | |||

|

Basic Earnings (Loss) Per Common Share

|

$ | 0.00 | $ | (0.01 | ) | |||

|

Diluted Earnings (Loss) Per Common Share

|

$ | 0.00 | $ | (0.01 | ) | |||

See accompanying notes to consolidated financial statements

16

eROOMSYSTEM TECHNOLOGIES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY

|

Shares

|

Amount

|

|||||||||||||||

|

2010

|

2009

|

2010

|

2009

|

|||||||||||||

|

COMMON STOCK

|

||||||||||||||||

|

Balance at Beginning of Year

|

24,123,165 | 24,048,165 | $ | 24,123 | $ | 24,048 | ||||||||||

|

Cancellation of shares in treasury

|

(290,300 | ) | - | (290 | ) | - | ||||||||||

|

Issuance to directors for services

|

75,000 | 75,000 | 75 | 75 | ||||||||||||

|

Balance at End of Year

|

23,907,865 | 24,123,165 | 23,908 | 24,123 | ||||||||||||

|

TREASURY SHARES

|

||||||||||||||||

|

Balance at Beginning of Year

|

(38,453 | ) | (38,453 | ) | ||||||||||||

|

Cancellation of shares in treasury

|

38,453 | - | ||||||||||||||

|

Balance at End of Year

|

- | (38,453 | ) | |||||||||||||

|

ADDITIONAL PAID-IN-CAPITAL

|

||||||||||||||||

|

Balance at Beginning of Year

|

34,079,467 | 34,042,247 | ||||||||||||||

|

Issuance to directors for services

|

11,175 | 11,175 | ||||||||||||||

|

Cancellation of shares in treasury

|

(38,161 | ) | - | |||||||||||||

|

Issuance of options and warrants to employees

|

3,706 | 14,895 | ||||||||||||||

|

Reclass of options and warrants

|

103,123 | - | ||||||||||||||

|

Expiration of warrants and options

|

- | 11,150 | ||||||||||||||

|

Balance at End of Year

|

34,159,310 | 34,079,467 | ||||||||||||||

|

WARRANTS AND OPTIONS OUTSTANDING

|

||||||||||||||||

|

Balance at Beginning of Year

|

103,123 | 114,273 | ||||||||||||||

|

Expiration of warrants and options

|

- | (11,150 | ) | |||||||||||||

|

Reclass of options and warrants

|

(103,123 | ) | - | |||||||||||||

|

Balance at End of Year

|

- | 103,123 | ||||||||||||||

|

ACCUMULATED DEFICIT

|

||||||||||||||||

|

Balance at Beginning of Year

|

(31,148,045 | ) | (31,010,396 | ) | ||||||||||||

|

Net income/(loss)

|

18,345 | (137,649 | ) | |||||||||||||

|

Balance at End of Year

|

(31,129,700 | ) | (31,148,045 | ) | ||||||||||||

|

ACCUMULATED OTHER COMPREHENSIVE LOSS

|

||||||||||||||||

|

Balance at Beginning of Year

|

(50,000 | ) | (50,000 | ) | ||||||||||||

|

Unrealized gain on marketable securities

|

42,500 | - | ||||||||||||||

|

Reclassification adjustment for losses included in operations

|

50,000 | - | ||||||||||||||

|

Balance at End of Year

|

42,500 | (50,000 | ) | |||||||||||||

|

Total Stockholders' Equity at End of Year

|

$ | 3,096,018 | $ | 2,970,215 | ||||||||||||

See accompanying notes to consolidated financial statements

17

eROOMSYSTEM TECHNOLOGIES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

For the Years Ended

|

||||||||

|

December 31,

|

||||||||

|

2010

|

2009

|

|||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES

|

||||||||

|

Net income (loss)

|

$ | 18,345 | $ | (137,649 | ) | |||

|

Adjustments to reconcile net income (loss) to net cash provided by (used in)operating activities:

|

||||||||

|

Depreciation and amortization

|

13,691 | 62,088 | ||||||

|

Gain on sale of refreshment centers

|

- | (4,248 | ) | |||||

|

Loss from other than temporary decline in marketable securities

|

50,000 | 14,075 | ||||||

|

Non-cash compensation expense

|

14,958 | 26,145 | ||||||

|

Changes in operating assets and liabilities:

|

||||||||

|

Accounts receivable

|

2,024 | 19,071 | ||||||

|

Accrued interest receivable

|

- | (10,082 | ) | |||||

|

Inventory

|

(71,158 | ) | (75,911 | ) | ||||

|

Advance to supplier

|

4,333 | - | ||||||

|

Prepaid expenses

|

13,673 | 42,785 | ||||||

|

Accounts payable

|

(3,638 | ) | (26,650 | ) | ||||

|

Accrued liabilities

|

(13,631 | ) | 42,106 | |||||

|

Customer deposits and deferred maintenance revenue

|

- | (7,346 | ) | |||||

|

Net Cash Provided By (Used In) Operating Activities

|

28,597 | (55,616 | ) | |||||

|

CASH FLOWS FROM INVESTING ACTIVITIES

|

||||||||

|

Purchase of property and equipment

|

(127,909 | ) | (3,032 | ) | ||||

|

Proceeds from sale of refreshment centers

|

- | 44,995 | ||||||

|

Purchase of investments in real property tax liens

|

(123,653 | ) | - | |||||

|

Proceeds from collections of real property tax liens

|

63,354 | - | ||||||

|

Payment of note receivable

|

- | 183,159 | ||||||

|

Change in long term deposits and restricted funds

|

2,700 | (2,700 | ) | |||||

|

Net Cash Provided by (Used In) Investing Activities

|

(185,508 | ) | 222,422 | |||||

|

CASH FLOWS FROM FINANCING ACTIVITIES

|

- | - | ||||||

|

Net Increase (Decrease) in Cash

|

(156,911 | ) | 166,806 | |||||

|

Cash and cash equivalents at Beginning of Period

|

2,302,620 | 2,135,814 | ||||||

|

Cash and cash equivalents at End of Period

|

$ | 2,145,709 | $ | 2,302,620 | ||||

See accompanying notes to consolidated financial statements

18

eROOMSYSTEM TECHNOLOGIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1 - BASIS OF PRESENTATION AND SIGNIFICANT ACCOUNTING POLICIES

Organization, Nature of Operations and Principles of Consolidation - eRoomSystem Technologies, Inc. is a Nevada corporation. eRoomSystem Technologies, Inc. and its subsidiaries, collectively referred to as the "Company," provide a complete line of fully-automated eRoomServ refreshment centers and eRoomSafes in hotels. The eRoomServ refreshment centers and eRoomSafes use proprietary software that integrates with a data collection computer in each hotel. The Company also invests in real property tax liens from various municipalities in New Jersey, as further described in Note 2.