Attached files

Table of Contents

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES

EXCHANGE ACT OF 1934 (THE “EXCHANGE ACT”)

For the Fiscal year ended December 31, 2010

Commission file number 1-31557

Wachovia Preferred Funding Corp.

(Exact name of registrant as specified in its charter)

| Delaware | 56-1986430 | |||||

| (State of incorporation) | (I.R.S. Employer Identification No.) |

90 South 7th Street, 13th Floor

Minneapolis, Minnesota 55402

(Address of principal executive offices)

(Zip Code)

(855) 825-1437

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Exchange Act:

| TITLE OF EACH CLASS | NAME OF EXCHANGE ON WHICH REGISTERED | |

| 7.25% Non-cumulative Exchangeable Perpetual Series A Preferred Securities |

New York Stock Exchange, Inc. (the “NYSE”) |

Securities registered pursuant to Section 12(g) of the Exchange Act:

TITLE OF EACH CLASS

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

| Large accelerated filer ¨ |

Accelerated filer ¨ | Non-accelerated filer þ (Do not check if a smaller reporting company.) |

Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold as of the last business day of the registrant’s completed second fiscal quarter: None (as of June 30, 2010, none of Wachovia Preferred Funding Corp.’s voting or nonvoting common equity was held by non-affiliates).

As of February 28, 2011, there were 99,999,900 shares of the registrant’s common stock outstanding.

| DOCUMENTS INCORPORATED BY REFERENCE IN FORM 10-K | ||||

| Incorporated Documents |

Where Incorporated in Form 10-K | |||

| Certain portions of Wachovia Preferred Funding Corp.’s Proxy Statement for the Annual Meeting of Stockholders to be held May 10, 2011. |

Part III-Items 10, 11, 12, 13 and 14. | |||

Item 15.1 of Wells Fargo & Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2010 (excluding the list of exhibits incorporated therein by reference).

Table of Contents

CROSS-REFERENCE INDEX

1

Table of Contents

| Item 1. | Business. |

General

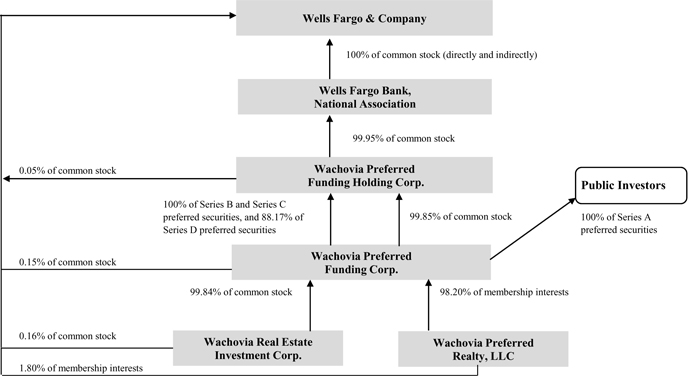

Wachovia Preferred Funding Corp. (Wachovia Funding) is a Delaware corporation, formed in July 2002, and the survivor of a merger with First Union Real Estate Asset Company of Connecticut, which was formed in 1996. As of December 31, 2010, Wachovia Funding is a direct subsidiary of Wachovia Preferred Funding Holding Corp. (Wachovia Preferred Holding) and an indirect subsidiary of both Wells Fargo & Company, a Delaware corporation (Wells Fargo) and Wells Fargo Bank, National Association (the Bank). Wachovia Preferred Holding owns 99.85% of our common stock and Wells Fargo owns the remaining 0.15%. The Bank owns 99.95% of the common stock of Wachovia Preferred Holding and Wells Fargo owns the remaining 0.05%. Wachovia Preferred Holding owns 88.17% of our Series D preferred securities, while the remaining 11.83% is owned by 108 employees of Wells Fargo or its affiliates.

On December 31, 2008, Wells Fargo acquired Wachovia Corporation, a North Carolina corporation (Wachovia) by a merger of Wachovia with and into Wells Fargo. As a result of this acquisition, each outstanding share of Wachovia common stock was converted into 0.1991 shares of Wells Fargo common stock and each share of Wachovia preferred stock outstanding or reserved for issuance was converted into a share of Wells Fargo preferred stock with substantially identical terms. The acquisition did not directly affect the outstanding shares of capital stock of Wachovia Funding. However, the Wachovia Funding Series A preferred securities are now conditionally exchangeable for shares of Wells Fargo preferred stock instead of Wachovia preferred stock. Following the acquisition, all subsidiaries of Wachovia became subsidiaries of Wells Fargo. On March 20, 2010, Wachovia Bank, National Association merged with and into the Bank, with the Bank as the surviving entity.

One of our subsidiaries, Wachovia Real Estate Investment Corp. (WREIC), was formed as a Delaware corporation in 1996 and has operated as a real estate investment trust (a REIT) since its formation. Of the 645 shares of WREIC common stock outstanding, we own 644 shares or 99.84% and the remaining one share is owned by Wells Fargo. Of the 667 shares of WREIC preferred stock outstanding, we own 533.3 shares or 79.96%, 127 shares or 19.04% are owned by employees of Wells Fargo or its affiliates and 6.7 shares or 1.00% are owned by Wells Fargo.

Our other subsidiary, Wachovia Preferred Realty, LLC (WPR), was formed as a Delaware limited liability company in October 2002. Under the REIT Modernization Act, which became effective on January 1, 2001, a REIT is permitted to own “taxable REIT subsidiaries” which are subject to taxation similar to corporations that do not qualify as REITs or for other special tax rules. We own 98.20% of the outstanding membership interests in WPR and the remaining 1.80% is owned by the Bank. Our majority ownership of WPR provides us with additional flexibility by allowing us to hold assets that earn non-qualifying REIT income while maintaining our REIT status.

2

Table of Contents

Our legal and organizational structure as of December 31, 2010 is:

Our principal business objective is to acquire, hold and manage domestic mortgage assets, and other authorized investments that will generate net income for distribution to our shareholders.

Although we have the authority to acquire interests in an unlimited number of mortgage and other assets from unaffiliated third parties, as of December 31, 2010, substantially all of our interests in mortgage and other assets that we have acquired have been acquired from the Bank or an affiliate pursuant to loan participation agreements between the Bank or its affiliate and us. The Bank either originated the mortgage assets, purchased them from other financial institutions or acquired them as part of the acquisition of other financial institutions. We may also acquire from time to time mortgage-backed securities and a limited amount of additional non-mortgage related securities from the Bank and its affiliates. We may also acquire from time to time mortgage assets or other assets from unaffiliated third parties.

The loans in our portfolio are serviced by the Bank pursuant to the terms of participation and servicing agreements between the Bank and us. The Bank has delegated servicing responsibility for certain of the residential mortgage loans to third parties, which are not affiliated with the Bank or us.

General Description of Mortgage Assets and Other Authorized Investments; Investment Policy

The Internal Revenue Code of 1986, as amended, (the Code) requires us to invest at least 75% of the total value of our assets in real estate assets, which includes residential mortgage loans and commercial mortgage loans, including participation interests in residential or commercial mortgage loans, mortgage-backed securities eligible to be held by REITs, cash, cash equivalents, including receivables and government securities, and other real estate assets. We refer to these types of assets as “REIT Qualified Assets.” The Code permits us to invest up to 25% of the value of a REIT’s total assets in non-real-estate-related securities as defined in the Investment Company Act of 1940, as amended (the Investment Company Act). However, we have established a policy of limiting authorized investments that are not Qualifying Interests (as defined herein) to no more than 20% of the value of our total assets to comply with the Investment Company Act. Under the Investment Company Act, the term “security” is defined broadly to include, among other things, any note, stock, treasury stock, debenture, evidence of indebtedness, or certificate of interest or participation in any profit sharing agreement or a group or index of securities. The Code also requires that not more than 20% of the value of a REIT’s assets constitute securities issued by taxable REIT subsidiaries and that the value of any one issuer’s securities, other than those securities included in the 75% test, may not exceed 5% of the value of the total assets of the REIT. In addition, under the Code, the REIT may not own more than 10% of the voting securities or more than 10% of the value of the outstanding securities of any one issuer, other than those securities included in the 75% test, the securities of wholly-owned qualified REIT subsidiaries or taxable REIT subsidiaries. Generally, the Code designation for REIT Qualified Assets is less stringent than the Investment Company Act designation for Qualifying Interests, due to the ability under the Code to treat cash and cash equivalents as REIT Qualified Assets and a lower required ratio of REIT Qualified

3

Table of Contents

Assets to total assets. For the tax year ended December 31, 2010, we expect to be taxed as a REIT, and we intend to comply with the relevant provisions of the Code to be taxed as a REIT.

REITs generally are subject to tax at the maximum corporate rate on income from foreclosure property less deductible expenses directly connected with the production of that income. Income from foreclosure property includes gain from the sale of foreclosure property and income from operating foreclosure property, but income that would be qualifying income for purposes of the 75% gross income test is not treated as income from foreclosure property. Qualifying income for purposes of the 75% gross income test includes, generally, rental income and gain from the sale of property not held as inventory or for sale in the ordinary course of a trade or business. In accordance with the terms of the commercial and industrial, commercial real estate and residential mortgage participation and servicing agreements, we maintain the authority to decide whether to foreclose on collateral that secures a loan. In the event we determine a foreclosure proceeding is appropriate, we may direct the Bank to prosecute the foreclosure on our behalf. Upon sale or other disposition of foreclosure property, the Bank will remit to us the proceeds less the cost of holding and selling the foreclosure property.

Commercial and Industrial and Commercial Real Estate Loans

We own participation interests in commercial and industrial loans secured by non-real property such as industrial equipment, furniture and fixtures, and inventory. Participation interests acquired in commercial real estate loans are secured by real property such as office buildings, multi-family properties of five units or more, industrial, warehouse and self-storage properties, office and industrial condominiums, retail space, strip shopping centers, mixed use commercial properties, mobile home parks, nursing homes, hotels and motels, churches and farms. In addition, some of our commercial and industrial loans are unsecured. Such unsecured loans are more likely than loans secured by real estate or personal property collateral to result in a loss upon default. Commercial and industrial and commercial real estate loans also may not be fully amortizing. This means that the loans may have a significant principal balance or “balloon” payment due on maturity. Additionally, there is no requirement regarding the percentage of any commercial and industrial or commercial real estate property that must be leased at the time we acquire a participation interest in a commercial and industrial or commercial real estate loan secured by such property nor are commercial and industrial loans required to have third party guarantees.

Commercial properties, particularly industrial and warehouse properties, generally are subject to relatively greater environmental risks than non-commercial properties. This gives rise to increased costs of compliance with environmental laws and regulations. We may be affected by environmental liabilities related to the underlying real property, which could exceed the value of the real property. Although the Bank has exercised and will continue to exercise due diligence to discover potential environmental liabilities prior to our acquisition of any participation in loans secured by such property, hazardous substances or wastes, contaminants, pollutants, or their sources may be discovered on properties during our ownership of the participation interests. To the extent that we acquire any participation in loans secured by such real property directly from unaffiliated third parties, we intend to exercise due diligence to discover any such potential environmental liabilities prior to our acquisition of such participation. Nevertheless there can be no assurance that we would not incur full recourse liability for the entire cost of any removal and clean up on a property, that the cost of removal and cleanup would not exceed the value of the property or that we could recoup any of the costs from any third party.

In general, our commercial and commercial real estate loans are subjected to individual grading assessment of borrower and collateral quality. We evaluate credit quality using these ratings and have provided a breakdown of pass and criticized credit quality metrics in the Notes to the Financial Statements in this Report, which we believe reflects the underlying risk of both the borrower and collateral quality. Foreclosures of defaulted commercial and industrial or commercial real estate loans generally are subject to a number of complicating factors, including environmental considerations, which are not generally present in foreclosures of residential mortgage loans.

Home Equity Loans

We own participation interests in home equity loans secured by a first or junior lien mortgage which primarily is on the borrower’s residence. These loans typically are made for reasons such as home improvements, acquisition of furniture and fixtures, purchases of automobiles and debt consolidation. Generally, junior liens are repaid on an installment basis and income is accrued based on the outstanding balance of the loan. First liens are repaid on an amortizing basis. Loans currently underlying the home equity loan participations bear interest at fixed and variable rates.

Residential Mortgage Loans

We have acquired both conforming and non-conforming residential mortgage loans from the Bank. Conforming residential mortgage loans comply with the requirements for inclusion in a loan guarantee or purchase program sponsored by either the Federal Home Loan Mortgage Corporation (FHLMC) or the Federal National Mortgage Association (FNMA). Non-conforming residential mortgage loans are residential mortgage loans that do not qualify in one or more respects for purchase by FHLMC or FNMA under their standard programs. A majority of the non-conforming residential mortgage loans acquired by us to date are non-conforming because they have original principal balances which exceeded the requirements for FHLMC or FNMA programs, the original terms are shorter than the minimum requirements for FHLMC or FNMA programs at the time of origination, the original balances are less than the minimum

4

Table of Contents

requirements for FHLMC or FNMA programs, or generally because they vary in certain other respects from the requirements of such programs other than the requirements relating to creditworthiness of the mortgagors.

Each residential mortgage loan is evidenced by a promissory note secured by a mortgage or deed of trust or other similar security instrument creating a first lien on one-to-four family residential property. Residential real estate properties underlying residential mortgage loans consist of single-family detached units, individual condominium units, two-to-four-family dwelling units and townhouses.

Our portfolio of residential mortgage loans currently consists of both adjustable and fixed rate mortgage loans and we may purchase additional interests in both types of residential mortgage loans in the future.

Dividend Policy

We currently expect to distribute annually an aggregate amount of dividends with respect to our outstanding capital stock equal to approximately 100% of our REIT taxable income for federal income tax purposes, which excludes capital gains. Such dividend distributions may in some periods exceed net income determined under U.S. generally accepted accounting principles (GAAP) due to differences in the timing of income and expense recognition for REIT taxable income determination purposes. In order to remain qualified as a REIT, we are required to distribute annually at least 90% of our REIT taxable income to our shareholders.

Dividends are authorized and declared at the discretion of our board of directors. Factors that would generally be considered by our board of directors in making this determination are our distributable funds, financial condition and capital needs, the impact of current and pending legislation and regulations, Delaware corporation law, economic conditions, tax considerations and our continued qualification as a REIT. We currently expect that both our cash available for distribution and our REIT taxable income will be in excess of the amounts needed to pay dividends on all outstanding series of preferred securities, even in the event of a significant drop in interest rate levels or increase in loan loss reserves because:

| — | substantially all of our mortgage assets and other authorized investments are interest-bearing; |

| — | while from time-to-time we may incur indebtedness, we will not incur an aggregate amount that exceeds 20% of our stockholders’ equity; |

| — | we expect that our interest-earning assets will continue to exceed the liquidation preference of our preferred stock; and |

| — | we anticipate that, in addition to cash flows from operations, additional cash will be available from principal payments on our loan portfolio. |

Accordingly, we expect that we will, after paying the dividends on all classes of preferred securities, pay dividends to holders of shares of our common stock in an amount sufficient to comply with applicable requirements regarding qualification as a REIT.

In January 2011, our board of directors declared a dividend in the amount of $2.5 billion payable to holders of our common stock on January 21, 2011. This dividend reduced relatively high levels of cash on Wachovia Funding’s balance sheet resulting from loan pay-downs in order to maintain Qualifying Assets greater than 80% of total assets. Based on our current expectations of loan pay-downs and anticipated reinvestment in REIT Qualified Assets during 2011, management expects to request our board of directors to consider a return of up to an additional $3.0 billion of capital to our holders of common stock in 2011. In January 2011, our board of directors also declared dividends payable to holders of our preferred securities payable on March 31, 2011, in accordance with our certificate of incorporation.

Under certain circumstances, including any determination that the Bank’s relationship to us results in an unsafe and unsound banking practice, the Office of the Comptroller of the Currency (the OCC) has the authority to issue an order that restricts our ability to make dividend payments to our shareholders, including holders of the Series A preferred securities. Banking capital adequacy rules limit the total dividend payments made by a consolidated banking entity to be the sum of earnings for the current year and prior two years less dividends paid during the same periods. Any dividends paid in excess of this amount can only be made with the approval of the Bank’s regulator.

Conflicts of Interest and Related Management Policies and Programs

General. In administering our loan portfolio and other authorized investments pursuant to the participation and servicing agreements, the Bank has a high degree of autonomy. The Bank has, however, adopted certain policies to guide the administration with respect to the acquisition and disposition of assets, use of capital and leverage, credit risk management, and certain other activities. These agreements with the Bank may be amended from time to time at the discretion of our board of directors and, in certain circumstances, subject to the approval of a majority of our Independent Directors, but without a vote of our shareholders, including holders of the Series A preferred securities.

5

Table of Contents

Asset Acquisition and Disposition Policies. It is our policy to purchase, or accept as capital contributions, loans or participation interests in loans from the Bank or its affiliates that generally are:

| — | performing, meaning they are current; |

| — | unencumbered; and |

| — | secured by real property such that they are REIT Qualified Assets. |

We may, however, from time to time acquire loans or participation interests in loans directly from unaffiliated third parties. It is our intention that any loans or participation interests acquired directly from unaffiliated third parties will meet the same general criteria as the loans or participation interests we acquire from the Bank or its affiliates.

Our policy also allows for investment in loans or assets that are not REIT Qualified Assets up to but not exceeding the statutory limitations imposed on organizations that qualify as a REIT under the Code. In the past, we have purchased or accepted as capital contributions loans and participation interests in loans both secured and not secured by real property along with other assets. We anticipate that we will acquire, or receive as capital contributions, interests in additional real estate-secured loans from the Bank or its affiliates. We may from time to time acquire loans or loan participation interests from unaffiliated third parties. We may use any proceeds received in connection with the repayment or disposition of loan participation interests in our portfolio to acquire additional loans. Although we are not precluded from purchasing additional types of loans, loan participation interests or other assets, we anticipate that participation interests in additional loans acquired by us will be of the types described above under the heading “—General Description of Mortgage Assets and Other Authorized Investments; Investment Policy.” In addition, we will not invest in assets that are not REIT Qualified Assets if such investments would cause us to violate the requirements for taxation as a REIT under the Code.

We may from time to time acquire a limited amount of other authorized investments. Although we currently do not intend to acquire any mortgage-backed securities representing interests in or obligations backed by pools of mortgage loans that are secured by single-family residential, multi-family or commercial real estate properties located throughout the United States, we are not restricted from doing so. We do not intend to acquire any interest-only or principal-only mortgage-backed securities. At December 31, 2010, we did not hold any mortgage-backed securities.

We currently anticipate that the Bank or its affiliates will continue to act as servicer of any additional commercial loans that we acquire through purchase or participation interests from the Bank or its affiliates. We anticipate that any such servicing arrangement that we enter into in the future with the Bank or its affiliates will contain fees and other terms that most likely will be substantially equivalent to but may be more favorable to us than those that would be contained in servicing arrangements entered into with unaffiliated third parties. To the extent we acquire additional loans or participation interests from unaffiliated third parties, we anticipate that such loans or participation interests may be serviced by entities other than the Bank or its affiliates. It is our policy that any servicing arrangements with unaffiliated third parties will be consistent with standard industry practices.

Credit Risk Management Policies. For a description of our credit risk management policies, see “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Risk Management.”

Conflict of Interest Policies. Because of the nature of our relationship with the Bank or its affiliates, it is likely that conflicts of interest will arise with respect to certain transactions, including, without limitation, our acquisition of participation interests in loans from, or disposition of participation interests in loans to the Bank, foreclosure on defaulted loans, management of the cash collateral related to the interest rate swaps and the modification of either the participation or servicing agreements. It is our policy that the terms of any financial dealings with the Bank will be consistent with those available from third parties in the lending industry.

Conflicts of interest among us and the Bank or its affiliates may also arise in connection with making decisions that bear upon the credit arrangements that the Bank or its affiliates may have with a borrower under a loan. Conflicts also could arise in connection with actions taken by us or the Bank or its affiliates. It is our intention that any agreements and transactions between us on the one hand, and the Bank or its affiliates on the other hand, including, without limitation, any loan participation agreements, be fair to all parties and consistent with market terms for such types of transactions. The requirement in our certificate of incorporation that certain of our actions be approved by a majority of our Independent Directors also is intended to ensure fair dealings among us and the Bank or its affiliates. There can be no assurance, however, that any such agreement or transaction will be on terms as favorable to us as could have been obtained from unaffiliated third parties.

Other Policies. We intend to operate in a manner that will not subject us to regulation under the Investment Company Act. Therefore, we do not intend to:

| — | invest in the securities of other issuers for the purpose of exercising control over such issuers; |

| — | underwrite securities of other issuers; |

6

Table of Contents

| — | actively trade in loans or other investments; |

| — | offer securities in exchange for property; or |

| — | make loans to third parties, including our officers, directors or other affiliates. |

The Investment Company Act exempts entities that, directly or through majority-owned subsidiaries, are “primarily engaged in the business of purchasing or otherwise acquiring mortgages and other liens on and interests in real estate.” We refer to these interests as “Qualifying Interests.” Under current interpretations by the staff of the Securities and Exchange Commission (SEC), in order to qualify for this exemption, we, among other things, must maintain at least 55% of our assets in Qualifying Interests and also may be required to maintain an additional 25% in Qualifying Interests or other real estate-related assets. The provisions of the Investment Company Act therefore may limit the assets that we may acquire. We have established a policy of limiting authorized investments that are not Qualifying Interests to no more than 20% of the value of our total assets to comply with these provisions.

We currently make investments and operate our business in such a manner consistent with the requirements of the Code to qualify as a REIT. However, future economic, market, legal, tax or other considerations may cause our board of directors, subject to approval by a majority of our Independent Directors, to determine that it is in our best interest and the best interest of our shareholders to revoke our REIT status. The Code prohibits us from electing REIT status for the four taxable years following the year of such revocation. See also “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Servicing

The loans currently in our portfolio are serviced by the Bank or their affiliates pursuant to the terms of participation and servicing agreements between the Bank or its affiliates and us. The Bank has delegated servicing responsibility for certain of the residential mortgage loans to third parties that are not affiliated with us or the Bank or its affiliates.

We pay the Bank a monthly loan servicing fee for their services under the terms of the loan participation and servicing agreements. The amount and terms of the fee are determined by mutual agreement of the Bank and us from time to time during the terms of the participation and servicing agreements.

Included in loan servicing costs were fees paid to the Bank for the years ended December 31, 2010 and 2009, of $58.5 million and $63.0 million, respectively. The monthly servicing fee with respect to the commercial loans is based on the total committed amount of each loan multiplied by a percentage per annum. For home equity loan products, the monthly fee was equal to the outstanding principal balance of each loan multiplied by a percentage per annum. Home equity loan products have a higher servicing fee compared with other loan products. For servicing fees related to residential mortgage products the monthly fee was equal to the outstanding principal of each loan multiplied by a percentage per annum or a flat fee per month.

The participation and servicing agreements currently in place require the Bank to service the loans in our portfolio in a manner substantially the same as for similar work performed by the Bank for transactions on their own behalf. The Bank or its affiliates collect and remit principal and interest payments, maintain perfected collateral positions, and submit and pursue insurance claims. The Bank and its affiliates also provide accounting and reporting services required by us for our participation interests and loans. We also may direct the Bank to dispose of any loans that are classified as nonperforming, are placed in a nonperforming status or are renegotiated due to the financial deterioration of the borrower. The Bank is required to pay all expenses related to the performance of its duties under the participation and servicing agreements, including any payment to its affiliates or third parties for servicing the loans.

In accordance with the terms of the commercial and industrial, commercial real estate and residential loan participation and servicing agreements currently in place, we maintain the authority to decide whether to foreclose on collateral that secures a loan. In the event we determine a foreclosure proceeding is appropriate, we may direct the Bank to prosecute the foreclosure on our behalf. Upon sale or other disposition of foreclosure property, the Bank will remit to us the proceeds less the cost of holding and selling the foreclosure property.

To the extent we acquire additional loans or participation interests directly from unaffiliated third parties in the future, we may also enter into servicing agreements with such unaffiliated third parties.

Competition

In order to qualify as a REIT under the Code, we can only be a passive investor in real estate loans and certain other assets. Thus, we do not originate loans. We anticipate that we will continue to hold interests in mortgage and other loans in addition to those in the current portfolio and that a majority of all of these loans will be obtained from the Bank, although we may also purchase loans from unaffiliated third parties. The Bank competes with mortgage conduit programs, investment banking firms, savings and loan associations, banks, savings banks, finance companies, mortgage bankers or insurance companies in acquiring and originating loans.

7

Table of Contents

To the extent we acquire additional loans or participation interests directly from unaffiliated third parties in the future, we will face competition similar to that which the Bank faces in acquiring such loans or participation interests.

Regulatory Considerations

Various legislative and regulatory proposals concerning the financial services industry are pending in Congress, the legislatures in states in which we conduct operations and before various regulatory agencies that supervise our operations. Given the uncertainty of the legislative and regulatory process, we cannot assess the impact of any such legislation or regulations on our financial condition or results of operations.

As a REIT, we are subject to regulation under the Code. The Code requires us to invest at least 75% of the total value of our assets in REIT Qualified Assets. See “—General Description of Mortgage Assets and Other Authorized Investments; Investment Policy” for more detailed descriptions of the requirements of the Code applicable to us. In addition, we intend to operate in a manner that will not subject us to regulation under the Investment Company Act. See “—Conflicts of Interest and Related Management Policies and Programs—Other Policies” for a more detailed description of the requirements we have to follow in order not to be subject to regulation under the Investment Company Act.

Under certain circumstances, including any determination that the Bank’s relationship to us results in unsafe and unsound banking practices, the OCC has the authority to restrict our ability to make dividend payments to our shareholders. See “—Dividend Policy” for a more detailed description of such restrictions.

Moreover, our Series A preferred securities are automatically exchangeable for depositary shares representing Series G, Class A preferred stock of Wells Fargo at the direction of the OCC if any of the following events occurs:

| — | the Bank becomes undercapitalized under the OCC’s “prompt corrective action” regulations; |

| — | the Bank is placed into conservatorship or receivership; or |

| — | the OCC, in its sole discretion, anticipates that the Bank may become “undercapitalized” in the near term or takes supervisory action that limits the payment of dividends by us and in connection therewith directs an exchange. |

In an exchange, holders of our Series A preferred securities would receive one depositary share representing a one-sixth interest in one share of Wells Fargo Series G, Class A preferred stock for each of our Series A preferred securities. The Wells Fargo Series G, Class A preferred stock will be non-cumulative, perpetual, non-voting preferred stock of Wells Fargo ranking equally upon issuance with the most senior preferred stock of Wells Fargo then outstanding. If such an exchange occurs, holders of our Series A preferred securities would own an investment in Wells Fargo and not in us at a time when the Bank’s and, ultimately, Wells Fargo’s financial condition is deteriorating or the Bank may have been placed into conservatorship or receivership. At December 31, 2010, the Bank was considered “well-capitalized” under risk-based capital guidelines issued by banking regulators.

In the event that Wachovia Funding is liquidated or dissolved, the holders of the preferred securities will be entitled to a liquidation preference for each security plus any authorized, declared and unpaid dividends that will be paid prior to any payments to common stockholders or general unsecured creditors. With respect to the payment of dividends and liquidation preference, the Series A preferred securities rank on parity with Series B and Series D preferred securities and senior to the common stock and Series C preferred securities. In the event that a supervisory event occurs in which the Bank is placed into conservatorship or receivership, the Series A and Series B preferred securities are convertible into certain preferred stock of Wells Fargo.

Except upon the occurrence of a Special Event (as defined below), the Series A preferred securities are not redeemable prior to December 31, 2022. On or after such date, we may redeem these securities for cash, in whole or in part, with the prior approval of the OCC, at the redemption price of $25 per security, plus authorized, declared, but unpaid dividends to the date of redemption. The Series B and Series C preferred securities may be redeemed for cash, in whole or in part, with the prior approval of the OCC, at redemption prices of $25 and $1,000 per security, respectively, plus authorized, declared, but unpaid dividends to the date of redemption, including any accumulation of any unpaid dividends for the Series C preferred securities. We can redeem the Series D preferred securities in whole or in part at any time at $1,000 per security plus authorized, declared and unpaid dividends.

A Special Event means: a Tax Event; an Investment Company Act Event; or a Regulatory Capital Event.

Tax Event means our determination, based on the receipt by us of a legal opinion, that there is a significant risk that dividends paid or to be paid by us with respect to our capital stock are not or will not be fully deductible by us for United States Federal income tax purposes or that we are or will be subject to additional taxes, duties, or other governmental charges, in an amount we reasonably determine to be significant as a result of:

8

Table of Contents

| — | any amendment to, clarification of, or change in, the laws, treaties, or related regulations of the United States or any of its political subdivisions or their taxing authorities affecting taxation; or |

| — | any judicial decision, official administrative pronouncement, published or private ruling, technical advice memorandum, Chief Counsel Advice, as such term is defined in the Code, regulatory procedure, notice, or official announcement. |

Investment Company Act Event means our determination, based on the receipt by us of a legal opinion, that there is a significant risk that we are or will be considered an “investment company” that is required to be registered under the Investment Company Act, as a result of the occurrence of a change in law or regulation or a written change in interpretation or application of law or regulation by any legislative body, court, governmental agency, or regulatory authority.

Regulatory Capital Event means our determination, based on the receipt by us of a legal opinion, that there is a significant risk that the Series A preferred securities will no longer constitute Tier 1 capital of the Bank or Wells Fargo for purposes of the capital adequacy guidelines or policies of the OCC or the Federal Reserve Board, or their respective successor as the Bank’s and Wells Fargo’s, respectively, primary Federal banking regulator, as a result of any amendments to, clarification of, or change in applicable laws or related regulations or official interpretations or policies; or any official administrative pronouncement or judicial decision interpreting or applying such laws or regulations.

We continue to evaluate the potential impact on liquidity management of regulatory proposals, including Basel III and those required under the Dodd-Frank Act, as they move closer to the final rule-making process.

For more information concerning Wells Fargo and the Bank, please see Part IV, Item 15.1 of Wells Fargo’s Annual Report on Form 10-K for the year ended December 31, 2010, which is incorporated by reference herein (excluding the list of exhibits incorporated therein by reference), and the audited supplementary consolidating financial information filed herewith as Exhibit (99).

Employees

We have two executive officers and eight additional non-executive officers. Our current executive officers are also executive officers of Wells Fargo. We do not anticipate that we will require any additional employees because employees of the Bank and its affiliates are servicing the loans under the participation and servicing agreements. All of our officers are also officers or employees of Wells Fargo and/or certain of its affiliates, including the Bank. We maintain corporate records and audited financial statements that are separate from those of the Bank. Except as borrowers under home equity or residential mortgage loans, none of our officers, employees or directors will have any direct or indirect pecuniary interest in any mortgage asset to be acquired or disposed of by us or in any transaction in which we have an interest or will engage in acquiring, holding and managing mortgage assets. However, 108 employees of Wells Fargo or its affiliates, including certain of the non-executive officers discussed above, own one Series D preferred security each.

Executive Offices

Our principal executive offices are located at 90 South 7th Street, 13th Floor, Minneapolis, Minnesota 55402 (telephone number (855) 825-1437).

Available Information

Wachovia Funding does not maintain its own website. Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 are accessible on the SEC’s website, www.sec.gov and on Wells Fargo’s website, www.wellsfargo.com at “About Us> Investor Relations More>Wachovia Information>SEC Filings and Regulatory Reports.”

9

Table of Contents

| Item 1A. | Risk Factors. |

Information in response to this item can be found under the “Risk Factors” section in this Report which information is incorporated by reference into this item.

| Item 1B. | Unresolved Staff Comments. |

None.

| Item 2. | Properties. |

Wachovia Funding does not own any properties and our primary executive offices are used primarily by affiliates of Wells Fargo. Because we do not have any of our own employees who are not also employees of Wells Fargo or the Bank, we do not need office space for such employees. All officers of Wachovia Funding are also officers of Wells Fargo or the Bank or affiliates and perform their services from office space owned or leased by Wells Fargo or the Bank, as applicable.

| Item 3. | Legal Proceedings. |

Information in response to this item can be found under Note 3 Commitments, Guarantees and Other Matters in this Report which information is incorporated by reference into this item.

| Item 4. | [Removed and Reserved.] |

10

Table of Contents

| Item 5. | Market For Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. |

General

Our common stock is 99.85% owned by Wachovia Preferred Holding and 0.15% owned by Wells Fargo and is not listed on any securities exchange. Wachovia Funding’s Series A preferred securities have been listed on the NYSE since January 10, 2003.

Prior to the December 2002 public offering of Wachovia Funding’s Series A preferred securities, Wachovia Preferred Holding acquired (i) 30,000,000 of Wachovia Funding’s Series A preferred securities, liquidation preference $25.00 per security, (ii) 40,000,000 of Wachovia Funding’s Series B preferred securities, liquidation preference $25.00 per security, and (iii) 4,233,754 of Wachovia Funding’s Series C preferred securities, liquidation preference $1,000 per security. The Series A, Series B and Series C preferred securities were acquired by Wachovia Preferred Holding in exchange for participations in commercial and industrial and commercial real estate loans with an aggregate fair value of $6.0 billion. The issuance of Wachovia Funding’s Series A, Series B and Series C preferred securities to Wachovia Preferred Holding was made in a private placement exempt from registration pursuant to Section 4(2) of the Securities Act. The Series A and Series B preferred securities are conditionally exchangeable, upon certain regulatory events, into preferred stock (or depositary shares representing such stock) of Wells Fargo.

In December 2002 and June 2003, Wachovia Preferred Holding sold 18,000,000 shares and 12,000,000 shares, respectively, of our Series A preferred securities in registered public offerings. Wachovia Funding did not receive any of the proceeds from these offerings.

Dividends

For the year ended December 31, 2010, Wachovia Funding declared and paid (i) cash dividends of $1.81 per share on its Series A preferred securities, (ii) cash dividends of $0.54 per share on its Series B preferred securities, (iii) cash dividends of $25.91 per share on its Series C preferred securities, and (iv) cash dividends of $85.00 per share on its Series D preferred securities. Wachovia Funding also paid dividends of $7.97 per share on its common stock in 2010. Please see “—Item 1. Business–Dividend Policy” for a description of our policies regarding dividends and for information regarding actions taken by our board of directors in January 2011.

Equity Compensation Plans

Wachovia Funding does not have any equity compensation plans. Our two executive officers are executive officers of Wells Fargo and receive certain equity-based compensation from Wells Fargo. See “Executive Compensation” in our definitive proxy statement to be filed no later than April 30, 2011, for more information.

Recent Sales of Unregistered Securities

Not applicable.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

Not applicable.

| Item 6. | Selected Consolidated Financial Data. |

On December 31, 2008, Wells Fargo acquired Wachovia and accordingly, under purchase accounting, the assets and liabilities of Wachovia and its subsidiaries, including Wachovia Funding, were recorded at their respective fair values at December 31, 2008. The more significant fair value adjustments were recorded to the loan portfolio.

Because the acquisition occurred on the last day of the 2008 reporting period, the income statement for 2008 was not affected by purchase accounting. Where disclosures include 2008 and prior years’ data, information for periods not affected by purchase accounting are labeled herein as “predecessor” and those reflecting purchase accounting are labeled “successor.”

As reflected on the following page, selected consolidated financial data for the six years ended December 31, 2010, is derived from our audited consolidated financial statements. This data should be read in conjunction with the consolidated financial statements, related notes and other financial information presented elsewhere in this Annual Report on Form 10-K, and the audited supplementary consolidating financial information filed herewith as Exhibit (99).

11

Table of Contents

|

Years ended December 31, |

||||||||||||||||||||||||

| (in thousands, except per share amounts) | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | ||||||||||||||||||

| (Successor) | (Successor) | (Successor) | (Predecessor) | (Predecessor) | (Predecessor) | |||||||||||||||||||

| Income statement data (1) |

||||||||||||||||||||||||

| Net interest income |

$ | 1,172,132 | 1,161,542 | 1,166,033 | 1,199,298 | 1,157,209 | 801,809 | |||||||||||||||||

| Noninterest income |

20,862 | 5,250 | 22,502 | 8,682 | (2,846 | ) | (7,309 | ) | ||||||||||||||||

| Revenue |

1,192,994 | 1,166,792 | 1,188,535 | 1,207,980 | 1,154,363 | 794,500 | ||||||||||||||||||

| Provision for credit losses |

354,025 | 217,573 | 321,605 | 21,162 | (9,251 | ) | 1,211 | |||||||||||||||||

| Noninterest expense |

68,635 | 79,974 | 86,493 | 102,947 | 104,039 | 67,641 | ||||||||||||||||||

| Net income |

769,416 | 867,650 | 767,276 | 1,067,033 | 1,046,154 | 721,522 | ||||||||||||||||||

| Diluted earnings per common share |

5.84 | 7.07 | 4.74 | 6.80 | 6.71 | 4.40 | ||||||||||||||||||

| Dividends declared per common share |

7.97 | 9.00 | 6.95 | 6.67 | 6.35 | 3.69 | ||||||||||||||||||

| Balance sheet data |

||||||||||||||||||||||||

| Cash and cash equivalents |

$ | 2,774,299 | 2,092,523 | 1,358,129 | 1,394,729 | 1,382,021 | 1,484,535 | |||||||||||||||||

| Loans, net of unearned income |

15,506,564 | 16,401,604 | 17,481,505 | 16,606,273 | 16,795,417 | 16,196,661 | ||||||||||||||||||

| Allowance for loan losses |

(402,960 | ) | (337,431 | ) | (269,343 | ) | (93,095 | ) | (81,350 | ) | (96,115 | ) | ||||||||||||

| Total assets |

18,178,117 | 18,410,128 | 18,836,915 | 18,233,647 | 18,427,969 | 17,896,219 | ||||||||||||||||||

| Total liabilities |

56,244 | 74,805 | 250,887 | 389,905 | 596,777 | 100,569 | ||||||||||||||||||

| Total stockholders’ equity |

18,121,873 | 18,335,323 | 18,586,028 | 17,843,742 | 17,831,192 | 17,795,650 | ||||||||||||||||||

| (1) | 2008 income statement data based on predecessor. |

12

Table of Contents

This Annual Report, including the Financial Review and the Financial Statements and related Notes, contains forward-looking statements, which may include forecasts of our financial results and condition, expectations for our operations and business, and our assumptions for those forecasts and expectations. Do not unduly rely on forward-looking statements. Actual results might differ materially from our forward-looking statements due to several factors. Some of these factors are described in the Financial Review and in the Financial Statements and related Notes. For a discussion of other factors, refer to the “Risk Factors” section in this Report.

“Wachovia Funding”, “we”, “our” and “us” refer to Wachovia Preferred Funding Corp. “Wachovia Preferred Holding” refers to Wachovia Preferred Funding Holding Corp., the “Bank” refers to Wells Fargo Bank, National Association including predecessor entities, “Wachovia” refers to Wachovia Corporation, a North Carolina corporation, and “Wells Fargo” refers to Wells Fargo & Company.

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

FINANCIAL REVIEW

Summary Financial Data

|

(in thousands, except per share data) |

2010 | 2009 | 2008 (3) | |||||||||

| (Successor) | (Successor) | (Successor) | ||||||||||

| For the year |

||||||||||||

| Net income |

$ | 769,416 | 867,650 | 767,276 | ||||||||

| Net income available to common stockholders |

583,550 | 706,972 | 474,047 | |||||||||

| Dilluted earnings per common share |

5.84 | 7.07 | 4.74 | |||||||||

| Profitability ratios |

||||||||||||

| Return on average assets |

4.18 % | 4.60 | 4.20 | |||||||||

| Return on average stockholders’ equity |

4.19 | 4.67 | 4.29 | |||||||||

| Average stockholders’ equity to assets |

99.70 | 98.40 | 98.07 | |||||||||

| Dividend payout ratio |

127.74 | 122.25 | 128.80 | |||||||||

| Total revenue |

$ | 1,192,994 | 1,166,792 | 1,188,535 | ||||||||

| Average loans |

15,830,856 | 17,110,538 | 16,346,575 | |||||||||

| Average assets |

18,401,911 | 18,879,972 | 18,258,032 | |||||||||

| Net interest margin |

6.39 % | 6.20 | 6.53 | |||||||||

| Net loan charge-offs |

$ | 284,904 | 149,780 | 89,176 | ||||||||

| As a percentage of average total loans |

1.80 % | 0.88 | 0.55 | |||||||||

| At year end |

||||||||||||

| Loans, net of unearned |

$ | 15,506,564 | 16,401,604 | 17,481,505 | ||||||||

| Allowance for loan losses |

402,960 | 337,431 | 269,343 | |||||||||

| As a percentage of total loans |

2.60 % | 2.06 | 1.54 | |||||||||

| Assets |

$ | 18,178,117 | 18,410,128 | 18,836,915 | ||||||||

| Total stockholders’ equity |

18,121,873 | 18,335,323 | 18,586,028 | |||||||||

| Total nonaccrual loans and other nonperforming assets (1) |

372,717 | 209,822 | 3,779 | |||||||||

| As a percentage of total loans |

2.40 % | 1.28 | 0.02 | |||||||||

| Loans 90 days or more past due and still accruing (2) |

$ | 40,384 | 50,532 | 3,146 | ||||||||

| (1) | Excludes loans that are accounted for as purchased credit-impaired (PCI) loans. As a result of Wells Fargo’s acquisition of Wachovia, subtainially all nonaccrual loans were eliminated in purchase accounting. |

| (2) | The carrying value of PCI loans contractually 90 days or more past due is excluded. These PCI loans are considered to be accruing due to the existence of the accretable yield and not based on consideration given to contractual interest payments. |

| (3) | 2008 income statement data based on predecessor. |

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with selected consolidated financial data set forth in Item 6 and our audited consolidated financial statements and related notes included in this Form 10-K.

OVERVIEW

Wachovia Funding is engaged in acquiring, holding and managing domestic real estate-related assets, and other authorized investments that generate net income for distribution to our shareholders. We are classified as a real estate investment trust (REIT) for income tax purposes. As of December 31, 2010, we had $18.2 billion in assets, which included $15.5 billion in loans. One of our subsidiaries, Wachovia Real Estate Investment Corp. (WREIC), has operated as a REIT since its formation in 1996. Our other subsidiary, Wachovia Preferred Realty, LLC (WPR), provides us with additional flexibility to hold assets that earn non-qualifying REIT income while we maintain our REIT status. Under the REIT Modernization Act, which became effective on January 1, 2001, a

13

Table of Contents

REIT is permitted to own “taxable REIT subsidiaries” which are subject to taxation similar to corporations that do not qualify as REITs or for other special tax rules.

We are a direct subsidiary of Wachovia Preferred Holding and an indirect subsidiary of Wells Fargo and the Bank. On March 20, 2010, Wachovia Bank, National Association, a wholly-owned subsidiary of Wells Fargo, merged with and into the Bank, with the Bank as the surviving entity. As a result of this merger, the Bank acquired all of the assets and assumed all of the liabilities of Wachovia Bank, National Association, including without limitation, the liabilities as a servicer of our loan participation interest portfolio. At December 31, 2010, the Bank was considered “well-capitalized” under risk-based capital guidelines issued by banking regulators.

Although we have the authority to acquire interests in an unlimited number of mortgage and other assets from unaffiliated third parties, as of December 31, 2010, substantially all of our interests in mortgage and other assets that we have acquired have been from the Bank or an affiliate pursuant to loan participation agreements between the Bank or its affiliate and us. The Bank originated the mortgage assets, purchased them from other financial institutions or acquired them as part of the acquisition of other financial institutions. We may also acquire from time to time mortgage-backed securities and a limited amount of additional non-mortgage related securities from the Bank and its affiliates, as well as mortgage assets or other assets from unaffiliated third parties. The loans in our portfolio are serviced by the Bank pursuant to the terms of participation and servicing agreements between the Bank and us. The Bank has delegated servicing responsibility for certain of the residential mortgage loans to third parties, which are not affiliated with the Bank or us.

For the tax year ended December 31, 2010, we expect to be taxed as a REIT, and we intend to comply with the relevant provisions of the Internal Revenue Code (the Code) to be taxed as a REIT. These provisions for qualifying as a REIT for federal income tax purposes are complex, involving many requirements, including among others, distributing the majority of our earnings to shareholders and satisfying certain asset, income and stock ownership tests. To the extent we meet those provisions, with the exception of the income of our taxable REIT subsidiary, we will not be subject to federal income tax on net income. We currently believe that we continue to satisfy each of these requirements and therefore continue to qualify as a REIT. We continue to monitor each of these complex tests.

In the event we do not continue to qualify as a REIT, we believe there should be minimal adverse effect of that characterization to us or to our shareholders:

| — | From a shareholder’s perspective, the dividends we pay as a REIT are ordinary income not eligible for the dividends received deduction for corporate shareholders or for the favorable maximum 15% rate applicable to qualified dividends received by non-corporate taxpayers. If we were not a REIT, dividends we pay generally would qualify for the dividends received deduction and the favorable tax rate applicable to non-corporate taxpayers. |

| — | In addition, we would no longer be eligible for the dividends paid deduction, thereby creating a tax liability for us. Wells Fargo agreed to make, or cause its subsidiaries to make, a capital contribution to us equal in amount to any income taxes payable by us. Therefore, we believe a failure to qualify as a REIT would not result in any net capital impact to us. |

For 2010, our net income was $769.4 million, or $5.84 per common share, compared with $867.7 million, or $7.07 a year ago. The decrease in net income was largely due to a higher provision for credit losses recorded in 2010. The provision for credit losses was $354.0 million in 2010, compared with $217.6 million for 2009. Net charge-offs were $284.9 million (1.80% of average total loans outstanding) for 2010 compared with $149.8 million (0.88%) in 2009.

Distributions made to holders of our preferred securities totaled $185.9 million in 2010, which included $54.4 million in dividends paid on our Series A preferred securities held by non-affiliated investors. Dividends on preferred stock were $160.7 million in 2009, which included $54.4 million in dividends on our Series A preferred securities.

Loans, which include loans and loan participation interests, totaled $15.5 billion at December 31, 2010, down from $16.4 billion at December 31, 2009. Loans represented approximately 85% and 89% of assets at December 31, 2010 and 2009, respectively. Our consumer loans include real estate 1-4 family first mortgages and real estate 1-4 family junior lien mortgages, and our commercial loans include commercial and industrial and commercial real estate (CRE) loans. The change in loans from the end of 2009 primarily reflected pay-downs, charge-offs and loan sales, partially offset by additional loan purchases from the Bank.

Certain loans acquired by Wells Fargo in the Wachovia acquisition completed on December 31, 2008, including loans held by Wachovia Funding, had evidence of credit deterioration since origination and it was probable that we would not collect all contractual principal and interest. Such purchased credit-impaired (PCI) loans were recorded at fair value with no carryover of the related allowance for loan losses. PCI loans were less than 1 percent of total loans at December 31, 2010 and 2009.

14

Table of Contents

In third quarter 2010, the Bank restructured a commercial lending relationship, which affected a participation interest from the Bank to Wachovia Funding. As a result, the Bank was required to purchase the participation interest, a commercial PCI loan, from Wachovia Funding at the unpaid principal balance. That participation interest had been recorded on our balance sheet at a value that was less than the unpaid principal balance. As a result of this transaction, we recorded a gain on sale to affiliate of $18.0 million.

Nonaccrual loans at December 31, 2010 were $366.8 million, up from $207.5 million at December 31, 2009. The increase in nonaccrual loans largely reflected increases in CRE and real estate 1-4 family loans, due to slow disposition.

We believe it is important to maintain a well controlled operating environment and manage risks inherent in our business. We manage our credit risk by setting what we believe are sound credit policies for acquired loans, while monitoring and reviewing the performance of our loan portfolio. We manage interest rate and market risks inherent in our asset and liability balances within established ranges, while ensuring adequate liquidity and funding. We maintain strong capital levels to support our business.

In each of the years in the three-year period ended December 31, 2010, we purchased loans from the Bank at estimated fair value. In 2010, 2009 and 2008, Wachovia Funding paid $3.2 billion, $2.7 billion and $3.6 billion, respectively, for consumer loans.

On December 31, 2008, Wells Fargo acquired Wachovia and accordingly, under purchase accounting, the assets and liabilities of Wachovia and its subsidiaries were recorded at their respective fair values at December 31, 2008. The more significant fair value adjustments were recorded to the loan portfolio. Because the acquisition occurred on the last day of the 2008 reporting period, the Statement of Income for 2008 was not affected by purchase accounting. Where disclosures include 2008 and prior years’ data, information for periods not affected by purchase accounting are labeled herein as “predecessor” and those reflecting purchase accounting are labeled “successor.” Refer to Note 1 to Notes to Consolidated Financial Statements in this Report for further information. As a result of the acquisition, the consolidated financial information of Wachovia Funding for the period after the acquisition is presented on a different cost basis than that for the periods before the acquisition, and therefore, is not comparable.

Earnings Performance

Net income available to common stockholders. We earned net income available to common stockholders of $583.6 million and $707.0 million in 2010 and 2009, respectively. This decrease was primarily attributable to higher provision for credit losses and higher dividends on preferred stock (due to an increase in an index rate in 2010), partially offset by gain on loan sales to affiliate, lower noninterest expense and higher net interest income.

Interest Income. Interest income of $1.2 billion in 2010 increased $10.2 million, or 1%, compared with 2009, due to a higher average yield on total interest-earning assets, partially offset by lower average interest-earning assets. The average yield on total interest-earning assets was 6.39% in 2010 compared with 6.20% in 2009. The overall increase in the average yield on the combined consumer and commercial loan portfolio was primarily attributable to an increase in the accretion of discounts on purchased consumer loans. In 2010 and 2009, interest income included $234.2 million and $124.0 million, respectively of discount accretion. The increase in discount accretion was primarily driven by (i) an acceleration of accretion due to loan pay-downs or loan pay-offs attributable to loan refinancing activity and (ii) an increase in amount of accretable discount in 2010 resulting from consumer loan purchases.

Average consumer and commercial loans decreased $862.9 million and $416.8 million to $14.0 billion and $1.8 billion, respectively, in 2010 and 2009 due to pay-downs, charge-offs and loan sales, partially offset by an increase in consumer loan reinvestments. When business conditions are suitable, we anticipate that we will reinvest loan pay-downs primarily in consumer real-estate secured loans and other REIT-eligible assets. See the interest rate risk management section under “Risk Management” for more information on interest rates and interest income.

The average balances, interest income and yields related to interest-earning assets for the years ended December 31, 2010 and 2009, are presented in the following table.

|

Year ended December 31, |

||||||||||||||||||||||||

| 2010 | 2009 | |||||||||||||||||||||||

| (in thousands) | Average balance |

Interest income |

Yields | Average balance |

Interest income |

Yields | ||||||||||||||||||

| Commercial loans (1) |

$ | 1,787,851 | 44,582 | 2.49 | % | $ | 2,204,638 | 56,113 | 2.55 | % | ||||||||||||||

| Real estate 1-4 family |

14,043,005 | 1,126,280 | 8.02 | 14,905,900 | 1,104,451 | 7.41 | ||||||||||||||||||

| Interest-bearing deposits in banks and other interest-earning assets |

2,522,215 | 1,279 | 0.05 | 1,641,713 | 1,358 | 0.08 | ||||||||||||||||||

| Total interest-earning assets |

$ | 18,353,071 | 1,172,141 | 6.39 | % | $ | 18,752,251 | 1,161,922 | 6.20 | % | ||||||||||||||

| (1) | 2010 includes taxable-equivalent adjustments. |

15

Table of Contents

We allocate the changes in net interest income to changes in either average balances or average interest rates. Because of the numerous simultaneous volume and rate changes during any period, it is not possible to precisely allocate such changes between volume and rate. For this table, changes that are not solely due to either volume or rate are allocated to these categories in proportion of the percentage changes in average volume and average interest rate. The dollar amount of change in interest income related to our interest-earning assets for the year ended December 31, 2010, is presented in the following table.

|

2010 Compared to 2009 |

||||||||||||

| Interest | Variance | |||||||||||

| income | attributable to | |||||||||||

| (in thousands) | variance | Rate | Volume | |||||||||

| Interest-earning assets |

||||||||||||

| Commercial loans |

$ | (11,531) | (1,030) | (10,501) | ||||||||

| Real estate 1-4 family |

21,829 | 88,400 | (66,571) | |||||||||

| Interest-bearing bank balances and other interest earning assets |

(79) | (666) | 587 | |||||||||

| Total interest-earning assets |

$ | 10,219 | 86,704 | (76,485) | ||||||||

Interest Expense. We did not have any borrowings on our line of credit in 2010; therefore, no interest expense was incurred, compared with $380 thousand in 2009. The line of credit with the Bank averaged $210.8 million for 2009.

Provision for Credit Losses. The provision for credit losses was $354.0 million in 2010 compared with $217.6 million in 2009. The 2010 increase in the provision for credit losses resulted from higher net charge-offs as well as a provision build to increase the allowance for loan losses. The increase in charge-offs compared with a year ago was in part attributable to minimal early-2009 charge-offs on non-PCI loans, which were all in performing status at the time of the Wachovia merger, as well as the challenging economic and housing conditions impacting the consumer real estate portfolio. The allowance increase was primarily due to credit deterioration as well as growth in troubled debt restructurings (TDRs) Please refer to the “—Balance Sheet Analysis and Risk Management-Allowance for Credit Losses” sections in this Report for further information on the allowance for loan losses.

Noninterest Income. Noninterest income totaled $20.9 million in 2010 compared with $5.3 million in 2009. The 2010 results include gain on loan sales to affiliate of $17.7 million. Refer to Note 8 to Notes to Consolidated Financial Statements in this Report for further information. Noninterest income also includes gains on interest rate swaps. Our interest rate swaps lose value in an increasing rate environment and gain value in a declining rate environment. The gain on interest rate swaps was $2.5 million in 2010 compared with a gain of $4.1 million in 2009. The lower gain in 2010 primarily reflects a lower magnitude of interest rate decreases compared with 2009. Included in gain on interest rate swaps was expense associated with derivative cash collateral received of $275 thousand and $360 thousand in 2010 and 2009, respectively.

Noninterest Expense. Noninterest expense totaled $68.6 million in 2010 compared with $80.0 million in the same period a year ago. Noninterest expense primarily consists of loan servicing costs, and to a lesser extent, management fees and other expenses.

Loan servicing costs decreased $6.9 million to $59.1 million in 2010, which reflected a decrease in the commercial and consumer loan portfolios. These costs are driven by the size and mix of our loan portfolio. Home equity loan products generally cost more to service than other loan products. All loans are serviced by the Bank pursuant to our participation and servicing agreements which include market-based fees. For home equity loan products, the monthly servicing fee charge is equal to the outstanding principal balance of each loan multiplied by a percentage per annum. For servicing fees related to residential mortgage products the monthly fee is equal to the outstanding principal of each loan multiplied by a percentage per annum or a flat fee per month. For commercial loans, the monthly fee is based on the total committed amount of each loan multiplied by a percentage per annum.

Management fees were $4.6 million in 2010 compared with $10.2 million in 2009, primarily reflecting a change in allocation methodology. Management fees represent reimbursements for general overhead expenses paid on our behalf. For 2010, management fees are calculated based on Wells Fargo’s total monthly allocated costs multiplied by a formula. The formula is based on Wachovia Funding’s proportion of Wells Fargo’s consolidated: 1) full-time equivalent employees (FTEs), 2) total average assets and 3) total revenue. In 2009, Wachovia Funding was assessed monthly management fees based on its relative percentage of the Bank’s total consolidated assets and noninterest expense.

Other expense primarily consists of costs associated with foreclosures on residential properties.

Income Tax Expense. Income tax expense, which is based on the pre-tax income of WPR, our taxable REIT subsidiary, was $918 thousand in 2010 compared with $1.6 million in 2009. WPR holds our interest rate swaps as well as certain cash investments. The decrease in income tax expense for 2010 was primarily related to the reduction in pre-tax income.

16

Table of Contents

Earnings Performance – Comparison of 2009 with 2008

Net income available to common stockholders. We earned net income available to common stockholders of $707.0 million and $474.0 million in 2009 and 2008, respectively. This increase was attributable to lower dividends on preferred stock (due to a decrease in the applicable index rate in 2009), lower provision for credit losses, lower management fees and lower income tax expense, partially offset by lower gains on interest rate swaps and lower net interest income.

Interest Income. Interest income of $1.2 billion in 2009 decreased $10.3 million, or 1%, compared with 2008. Higher average interest-earning assets were more than offset by decreases in interest rates compared with 2008. The average interest rate on total interest-earning assets was 6.20% in 2009 compared with 6.53% in 2008 which reflects the impact of a lower interest rate environment in 2009.

During 2009 average consumer loans increased $1.4 billion to $14.9 billion and average commercial loans decreased $643.6 million to $2.2 billion. These changes resulted from reinvesting commercial loan pay-downs in consumer loans combined with additional consumer loan purchases and 2008 purchase accounting adjustments. In 2009, interest income included $124.0 million from the accretion of discounts on purchased consumer loans primarily driven by an acceleration of accretion from repayment of loans during the period. Interest income on cash invested in overnight eurodollar deposits decreased $29.5 million to $1.4 million in 2009 compared with 2008, driven by significantly lower short-term interest rates from the same period one year ago.

The average balances, interest income and yields related to interest-earning assets for the years ended December 31, 2009 and 2008, are presented below.

|

Year ended December 31, |

||||||||||||||||||||||||

| 2009 | 2008 | |||||||||||||||||||||||

| (Successor) | (Predecessor) | |||||||||||||||||||||||

| (in thousands) | Average balance |

Interest income |

Yields | Average balance |

Interest income |

Yields | ||||||||||||||||||

| Commercial loans |

$ | 2,204,638 | 56,113 | 2.55 | % | $ | 2,848,256 | 130,127 | 4.57 | % | ||||||||||||||

| Real estate 1-4 family |

14,905,900 | 1,104,451 | 7.41 | 13,498,319 | 1,011,162 | 7.49 | ||||||||||||||||||

| Interest-bearing deposits in banks and other interest-earning assets |

1,641,713 | 1,358 | 0.08 | 1,592,639 | 30,892 | 1.94 | ||||||||||||||||||

| Total interest-earning assets |

$ | 18,752,251 | 1,161,922 | 6.20 | % | $ | 17,939,214 | 1,172,181 | 6.53 | % | ||||||||||||||

The dollar amount of change in interest income related to our interest-earning assets for the year ended December 31, 2009, is presented below.

|

2009 Compared to 2008 |

||||||||||||

| Interest | Variance | |||||||||||

| income | attributable to | |||||||||||

| (in thousands) | variance | Rate | Volume | |||||||||

| Interest-earning assets |

||||||||||||

| Commercial loans |

$ | (74,014) | (51,121) | (22,893) | ||||||||

| Real estate 1-4 family |

93,289 | (11,579) | 104,868 | |||||||||

| Interest-bearing bank balances and other interest earning assets |

(29,534) | (30,030) | 496 | |||||||||

| Total interest-earning assets |

$ | (10,259) | (92,730) | 82,471 | ||||||||

Interest Expense. Interest expense decreased to $380 thousand in 2009 compared with $6.1 million in 2008, primarily reflecting a significantly lower rate environment in 2009 compared with the same period one year ago. The line of credit with the Bank averaged $210.8 million in 2009 compared with $246.8 million in 2008. At December 31, 2009, there was no outstanding balance under the line of credit with the Bank.

Provision for Credit Losses. The provision for credit losses was $217.6 million in 2009 compared with $321.6 million in 2008. The decrease in the provision for credit losses resulted from the accounting for PCI loans, which offset credit deterioration in the non-impaired portfolio. Refer to Note 1 to Notes to Consolidated Financial Statements in this Report for more information on PCI loans.

Noninterest Income. Noninterest income totaled $5.3 million in 2009 compared with $22.5 million in 2008. Noninterest income included gains on interest rate swaps and other income. Our interest rate swaps lose value in an increasing rate environment and gain value in a declining rate environment. The gain on interest rate swaps was $4.1 million in 2009 compared with a gain of $16.1 million in 2008. The lower gain in 2009 primarily reflected a lower magnitude of interest rate decreases in 2009 compared with 2008.

17

Table of Contents

Included in gain on interest rate swaps was expense associated with derivative cash collateral received of $360 thousand and $5.6 million in 2009 and 2008, respectively.

Noninterest Expense. Noninterest expense totaled $80.0 million in 2009 compared with $86.5 million in 2008. Noninterest expense primarily consists of loan servicing costs, and to a lesser extent, management fees and other expenses.

Loan servicing costs increased $683 thousand to $66.0 million in 2009, which reflected the impact of reinvesting pay-downs in additional purchases of consumer loans.

Management fees were $10.2 million in 2009 compared with $18.7 million in 2008, primarily reflecting a decrease in the allocable expense base. In 2009, an affiliate was assessed monthly management fees based on its relative percentage of the Bank’s total consolidated assets and noninterest expense. For 2008, monthly management fees were assessed to affiliates with over $10 million in qualifying assets. If an affiliate qualified for an allocation, the affiliate was assessed monthly management fees based on its relative percentage of the Bank’s total consolidated assets and noninterest expense.

Other expense primarily consisted of costs associated with foreclosures on residential properties.

Income Tax Expense. Income tax expense, which is based on the pre-tax income of WPR, our taxable REIT subsidiary, was $1.6 million in 2009 compared with $13.2 million in 2008. WPR holds our interest rate swaps as well as certain cash investments. The decrease in income tax expense for 2009 was primarily related to the reduction in pre-tax income and lower state income tax expense.

Balance Sheet Analysis

Total Assets. Our assets primarily consist of commercial and consumer loans, although we have the authority to hold assets other than loans. Total assets were $18.2 billion at December 31, 2010, compared with $18.4 billion at December 31, 2009. Loans, net of unearned income were 85% of total assets at December 31, 2010, compared to 89% at December 31, 2009.