Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark one)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2010

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

REVETT MINERALS INC.

(Exact name of registrant as specified in its charter)

| Canada | Not Applicable |

| (State or other jurisdiction of incorporation | (IRS Employer Identification No.) |

| or organization) |

11115 East Montgomery, Suite G

Spokane Valley,

Washington 99206

(Address of principal executive offices)

Registrant's telephone number, including area code: (509) 921-2294

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered under Section 12(g) of the Act:

Common Stock

Title of each class

Indicate by check mark if the Registrant is a well-known

seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [

] No [X]

Indicate by check mark if the Registrant is not required to file

reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [

] No [X]

Indicate by check mark whether the Registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the

Registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

Yes [X] No

[ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

Small Reporting Company [ ] Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [X]

Indicate by check mark whether the Registrant is a shell company

(as defined in Rule 12b-2 of the Exchange Act).

Yes [

] No [X]

The aggregate market value of the voting stock held by non-affiliates of the Registrant, computed by reference to the closing price at which such equity was last sold on the Toronto Stock Exchange, was approximately $39.5 million as of June 30, 2010, the last business day of the registrant’s most recently completed second fiscal quarter.

Shares of common stock outstanding at March 22, 2011: 33,516,884.

Documents Incorporated by Reference: None

TABLE OF CONTENTS

(ii)

Special Note on Forward-Looking Statements

Certain statements contained in this report (including information incorporated by reference) are “forward-looking statements” and are intended to be covered by the safe harbor provided for under Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Our forward-looking statements include our current expectations and projections about future results, performance, prospects and opportunities. We have tried to identify these forward-looking statements by using words such as “may,” “might,” “will,” “expect,” “anticipate,” “believe,” “could,” “intend,” “plan,” “estimate” and similar expressions. These forward-looking statements are based on information currently available to us and are expressed in good faith and believed to have a reasonable basis. However, our forward-looking statements are subject to a number of risks, uncertainties and other factors that could cause our actual results, performance, prospects or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements.

These risks, uncertainties and other factors include, but are not limited to, those set forth under Item 1A. — Business — Risk Factors. Given these risks and uncertainties, readers are cautioned not to place undue reliance on our forward-looking statements. Projections included in this Form 10-K have been prepared based on assumptions, which we believe to be reasonable, but not in accordance with United States generally accepted accounting principles (“GAAP”) or any guidelines of the Securities and Exchange Commission (“SEC”). Actual results will vary, perhaps materially, and we undertake no obligation to update the projections at any future date. You are strongly cautioned not to place undue reliance on such projections. All subsequent written and oral forward-looking statements attributable to Revett Minerals Inc. or to persons acting on our behalf are expressly qualified in their entirety by these cautionary statements. Except as required by federal securities laws, we do not intend to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

[The balance of this page has been intentionally left blank.]

1

PART I

Item 1. Business.

|

Explanatory Note: As used in this report, the terms the “Company,” “we,” “us” and “our” are sometimes used to refer to Revett Minerals Inc. and, where the context so requires, its subsidiary corporations. Unless otherwise noted, all monetary denominations are in U.S. dollars. |

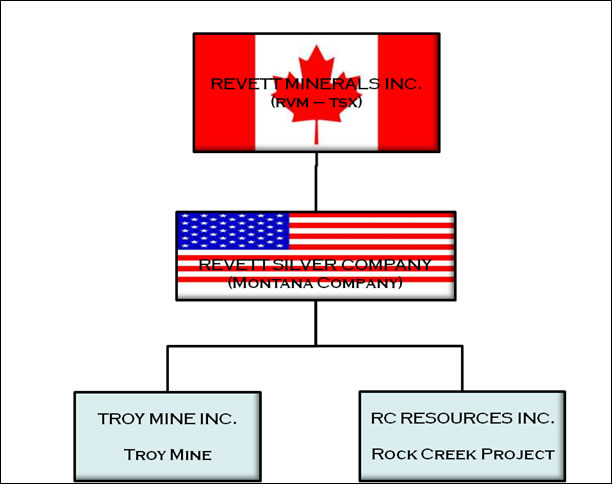

General Development of Business. Revett Minerals Inc. (“Revett Minerals”) was incorporated under the Canada Business Corporations Act in August 2004 to acquire Revett Silver Company (“Revett Silver”), a Montana corporation, and undertake a public offering of its common stock in Canada, transactions that were completed in February 2005. Revett Silver was organized in April 1999 (as Sterling Mining Company) to acquire the Troy mine (“Troy” or “Troy Mine”) and the Rock Creek project (“Rock Creek” or “Rock Creek Project”) from ASARCO Incorporated (“ASARCO”) and Kennecott Montana Company (“Kennecott”), transactions that were completed in October 1999 and February 2000. Revett Silver paid ASARCO and Kennecott approximately $25 million in total for these assets.

2

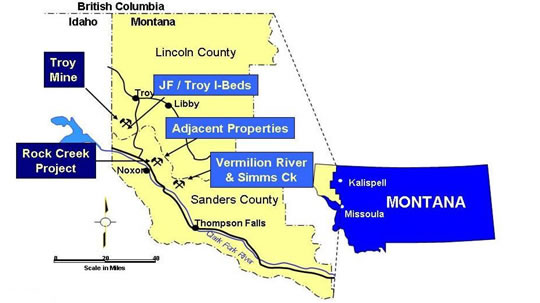

The following map depicts the locations of our two principal mining assets, Troy and Rock Creek and our other properties, all of which are located in northwestern Montana.

Troy is an underground copper and silver mine. From 1981 to 1993, the mine was operated by ASARCO and then placed on care and maintenance. The Company restarted operations at Troy in 2004 and resumed commercial production in January 2005. Rock Creek is a large development-stage underground copper and silver project. Revett Silver owns 100% of Troy and Rock Creek through two wholly-owned Montana subsidiaries, Troy Mine Inc. and RC Resources Inc., respectively.

On November 17, 2010, the Company completed a one for five common share consolidation. This report reflects the impact of this consolidation for all common shares and per share amounts reported herein.

At March 22, 2011, 33,516,884 common shares of Revett Minerals were issued and outstanding, and an additional 3,135,386 common shares were deemed outstanding pursuant to presently exercisable options and warrants. Such shares are listed for trading on the Toronto Stock Exchange under the symbol “RVM” and on the Over-the-Counter Bulletin Board under the symbol “RVMID”.

The principal executive office of the Company is located at 11115 East Montgomery, Suite G, Spokane Valley, Washington 99206, and its telephone number at that address is (509) 921-2294. Revett Minerals’ registered office is located at 1 First Canadian Place, 100 King Street West, Suite 1600, Toronto, Ontario, Canada M5X 1G5.

Financial Information about Segments. Revett Minerals’ operations comprise a single business segment, located in the United States. Information concerning its revenues, profits and losses, and total assets, liabilities and equity for the years ended December 31, 2010, 2009 and 2008 is included in the consolidated financial statements that appear elsewhere in this report.

Narrative Description of Business. Revett Minerals operates the Troy Mine, an underground copper and silver mine that has been in production since January 2005 and is engaged in the development of the Rock Creek Project.

The Troy Mine. Troy is an underground copper and silver mine located in Lincoln County, Montana, approximately fifteen miles south of the town of Troy. The mine comprises 24 patented lode-mining claims, approximately 569 unpatented lode-mining claims, 850 acres of fee land and 356 acres of patented land. The patented claims were legally surveyed in 1983. All of the mining claims are in good standing.

3

Revett Silver rehabilitated the mine in late 2004, and commenced commercial production in January 2005 following an eleven year care and maintenance period. Ore from the mine is extracted using the “room and pillar” method and is processed on site using standard flotation technology. The resulting copper and silver concentrate is sold under contract to a third party and is currently shipped by rail from a load out facility located in Libby, Montana.

The Troy concentrate typically contains between 34% and 40% copper, and between 70 to 110 ounces of silver per ton. During 2010, Troy produced 8.8 million pounds of copper and 1.0 million ounces of silver in concentrate. At December 31, 2010, the estimated proven and probable ore reserves at Troy were 10.5 million tons grading 1.21 ounces per ton silver and 0.47% copper using a net smelter return cut off of $25.57 per ton.

Rock Creek. Rock Creek is a development-stage copper and silver deposit located in Sanders County, Montana, approximately five miles northeast of Noxon, Montana and sixteen air miles from the Troy Mine. The project comprises 99 patented lode-mining claims, 162 unpatented lode-mining claims, 5 tunnel site claims, 85 mill site claims and 1,427 acres of fee land, 673 of which will be used as habitat replacement for grizzly bears. The patented claims lying within the Cabinet Mountain Wilderness Area convey mineral rights only; the claims lying outside the wilderness area convey both mineral and surface rights. The patented claims were legally surveyed in 1983 and occupy an area of approximately 1,809 acres. All of the Rock Creek Project mining claims are in good standing.

The next phase of development at Rock Creek is the completion of a two to three year evaluation program, estimated to cost from $20 million to $25 million, to determine if it is economical to develop the mineral deposit. The proposed evaluation program will include the development of an evaluation adit to collect additional technical information on the deposit, additional infill drilling to establish and confirm resource estimates, geotechnical design studies and bulk sampling of the mineralization for use in metallurgical testing. The evaluation program is subject to receipt of permits and approvals from the various federal and state agencies having jurisdiction over the project. In addition to permitting approval, the Company will also be required to satisfy certain mitigation requirements before it can develop the adit, which will include procurement of a reclamation bond and funding of a grizzly bear mitigation plan, design and construction of a water treatment facility and construction of improvements to the road leading to the proposed adit site.

The permitting process is complex and time-consuming. The deposit is located on United States Forest Service (the “Forest Service”) land (within the Kootenai National Forest) and under the Cabinet Mountains Wilderness Area, and federal and state approval is required to explore and develop it. In 2001, the Forest Service issued the final environmental impact statement (“Final EIS”) under the National Environmental Policy Act (“NEPA”). In 2003, the Forest Service and the Montana Department of Environmental Quality (the “DEQ”) issued a joint administrative decision approving the Company’s proposed plan of operations at the Rock Creek Project (the “Record of Decision”). The Record of Decision was based primarily on the findings in the Final EIS and a companion biological opinion issued by the U.S. Fish and Wildlife Service (“USFWS”) in 2003 pursuant to the requirements of the Endangered Species Act (“ESA”).

Several regional and national environmental groups challenged the Record of Decision and biological opinion under NEPA and the ESA. After exhausting their administrative appeals under the applicable statutory framework, these same groups initiated lawsuits in the Unites States District Court for the District of Montana seeking to overturn the Forest Service and USFWS determinations.

On May 4, 2010, the district court issued a decision dismissing the challenges of the environmental groups under the ESA, but vacating the 2001 Final EIS and Record of Decision, both of which were remanded to the Forest Service for further action. The district court determined that certain informational reports issued by the Forest Service in 2007 required the preparation and issuance of a supplemental EIS under NEPA. The environmental groups have appealed the dismissal of their ESA challenges to the Ninth Circuit Court of Appeals. The Company cannot reasonably predict how or when this appeal will be resolved. The defendants in the proceedings are the governmental agencies that issued or approved the permits, opinions and plan of operations. The Company is an intervener in the action. If the Company is required to submit a modified plan of operation for the Rock Creek Project, it would likely delay development and likely engender additional legal challenges and appeals, which could materially and adversely affect the Company. In the interim, the Company is working with the Forest Service to develop a supplemental EIS.

4

The Copper and Silver Markets. Copper and silver are internationally traded metals whose prices are determined by global economic conditions of supply and demand.

Historically, copper prices have been very volatile. The following table sets forth the average annual prices of copper on the London Metal Exchange since 2006, as reported by the exchange. During this period, average annual copper prices have ranged from a low of $2.32 per pound in 2009 to a high of $3.42 per pound in 2010.

LME Average Cash Official Price (US$/Pound)

| 2010 | 2009 | 2008 | 2007 | 2006 |

| 3.42 | 2.32 | 3.19 | 3.23 | 3.05 |

Copper is used in a variety of industrial and high technology applications throughout the world, including building construction, electrical generation and distribution, manufacturing electrical products, transportation and automotive industries. Copper is an excellent conductor of heat and electricity, is resistant to corrosive environments, is strong yet malleable and has a high tensile strength.

We believe copper prices will remain favourable in the long term because of lack of investment in exploration and mine development during the past decade or so. This has resulted in low to modest growth rates in supplies and inventory, compared to higher consumption rates that are attributable to continued consumption in the developed economies of North America, Europe and Asia, and rapid industrialization and emergence of consumer product markets in countries such as China and India.

Silver prices are also highly volatile from year to year. The following table illustrates the average annual London Bullion Market Association (“LBMA”) Silver Fix since 2006. These average annual prices have ranged from a low of $11.55 per ounce in 2006 to a high of $20.16 per ounce in 2010.

London Average Fix (US$/Ounce)

| 2010 | 2009 | 2008 | 2007 | 2006 |

| 20.16 | 14.65 | 15.03 | 13.38 | 11.55 |

We believe silver prices will remain generally favourable in the long term because of strong demand in the electronics industry and consistent demand from institutions that purchase and hold silver for investment purposes.

Environmental Matters. Like all mining companies doing business in the United States, the Company is subject to a variety of federal, state and local statutes, rules and regulations designed to protect the quality of the air and water, and threatened or endangered species in the vicinity of its mining operations. These include permitting or pre-operating approval requirements designed to ensure the environmental integrity of a proposed mining facility, operating requirements designed to mitigate the effects of discharges into the environment during mining operations, and reclamation or post-operation requirements designed to remediate the lands affected by mining activities once commercial operations have ceased. These laws are administered and enforced by various federal agencies and, in many instances, by state agencies operating under parallel state statutes and regulations. The principal environmental laws affecting the Company’s current and proposed operations at Troy and Rock Creek are described elsewhere in this report (Item 3. Legal Proceedings).

Employees. The Company had 197 full-time employees and one part-time employee at December 31, 2010. Approximately 192 of these employees work at Troy in production and management capacities, and the remainder work in management and administrative capacities at the Company’s corporate office. These employees are not represented by a collective bargaining unit.

5

Item 1A. Risk Factors.

Revett Minerals is a speculative investment, for many reasons, and the following risk factors should be carefully considered in evaluating it. In addition, this report contains forward-looking statements that involve known and unknown risks and uncertainties. These forward-looking statements include statements of our plans, objectives, expectations and intentions. Actual results could differ from those discussed in the forward-looking statements as a result of certain factors, including those set forth below. You should carefully consider the risks and uncertainties described below and the other information in this report before investing.

We have had losses in prior years. We have been engaged in commercial mining operations at Troy for just over six years and only recently attained a significant level of earnings. In 2010 we had net income of $4.4 million from revenues of $47.0 million. In 2009 we incurred a loss of $5.0 million on revenues of $33.1 million. In 2008 we incurred a loss of $6.7 million on revenues of $39.5 million, and in 2007 we earned $0.9 million on revenues of $38.9 million. Our loss in 2008 and 2009 was primarily due to significantly lower metal prices during the last half of 2008 and the first half of 2009.

Copper and silver prices fluctuate markedly. Our operations are significantly influenced by the price of copper and silver. Copper and silver prices fluctuate widely and are affected by numerous factors that are beyond our control, such as the strength of the United States dollar, global and regional industrial demand, and the political and economic conditions of major producing countries throughout the world. Since 1990, world average copper prices have fluctuated from a low of $0.71 per pound in 2002 to a high of $3.42 per pound in 2010, and world average annual silver prices have fluctuated from a low of $3.95 per ounce in 1992 to a high of $20.16 per ounce in 2010. As at December 31, 2010, we have contracts outstanding to sell 5.2 million pounds of copper at an average price of $3.55 per pound and 360,000 ounces of silver at an average price of $19.00. These contracts mature at various dates from March 2011 to February 2012.

There are other formidable risks to mining. We are subject to all of the risks inherent in the mining industry, including industrial accidents, labor disputes, environmental related issues, unusual or unexpected geologic formations, cave-ins, surface subsidence, flooding, power disruptions and periodic interruptions due to inclement weather. These risks could result in damage to or destruction of our mineral properties and production facilities, personal injury, environmental damage, delays, monetary losses and legal liability. In addition, we are subject to competition for new minerals properties, management and skilled miners from other mining companies, many of which have significantly greater resources than we do. We also have no control over changes in governmental regulation of mining activities, the speculative nature of mineral exploration and development, operating hazards, fluctuating metal prices and inflation and other economic conditions.

Environmental challenges could prevent us from ever developing Rock Creek. Our proposed development of Rock Creek has been challenged on environmental grounds by several regional and national environmental organizations at various times subsequent to the Forest Service’s issuance of a Record of Decision approving our plan of operation in 2003. Some of these challenges are substantial and ongoing, and allege violations of the procedural and substantive requirements of a variety of federal and state laws and regulations pertaining to our permitting activities at Rock Creek, including ESA, NEPA, the 1872 Mining Law, the Federal Land Policy Management Act, the Wilderness Act, the National Forest Management Act, the Clean Water Act, the Forest Service Organic Act of 1897 and the Administrative Procedural Act. Although we have generally been successful in addressing most of the environmental challenges to our operations, we cannot predict with any degree of certainty how the pending challenges will be resolved. Rock Creek is potentially the more significant of our two mining assets. Continued court challenges to the Record of Decision and its accompanying biological opinion have delayed us from proceeding with our planned development. If we are successful in defending these challenges, we still must comply with a number of requirements and conditions as development progresses, failing which we could be denied the ability to continue with our proposed activities at Rock Creek. (See the section of this report entitled “Legal Proceedings.”)

Our reclamation liability at Troy could be substantial. In acquiring Troy, we agreed to indemnify ASARCO and hold it harmless from all of the liabilities associated with the reclamation, restoration and closure of the mine. This entailed our procurement of a $12.9 million performance bond. We have submitted a revised reclamation plan for Troy to the Montana DEQ and they have been in the process of completing environmental analysis in cooperation with the Forest Service. The Agencies have given notice that an Environmental Impact Statement will be completed and subsequently changes may be made to the estimated reclamation costs and the amount of the performance bond. One of the key issues yet to be resolved is the extent to which we may be required to treat water from Troy after mining operations have ceased. We do not presently know whether our revised plan will actually result in increased reclamation costs at Troy. Laws governing the closure of mining operations in Montana have become more stringent since Troy was first placed into production, and could include provisions requiring us to perpetually treat all of the discharged water from the mine. These factors could result in the imposition of a higher performance bond. Further, our reclamation liability at Troy is not limited by the amount of the performance bond itself. The bond serves only as security for the payment of these obligations; any substantial increase in actual costs over and above the $16.8 million maximum allowed under the current surety agreement would necessarily be borne by the Company. Payment of such costs could have a material adverse effect on our financial condition.

6

We presently do not have the financial resources to develop Rock Creek. At December 31, 2010 we had cash and cash equivalents and short term investments of $8.8 million. We do not have sufficient cash to fund our evaluation program at Rock Creek and we do not have sufficient funds to allow us to develop a mine or begin mining operations should it prove feasible to do so. The estimated capital cost of constructing a mine at Rock Creek is in the range of $250 to $275 million and could change materially.

The Rock Creek mineral resources are not equivalent to reserves. This report includes information concerning the estimated size of our mineral resource at Rock Creek and the amount of ore that may be produced from the project were it to be developed. Since no ore has been produced from Rock Creek, these estimates are preliminary in nature. This report also includes information concerning mineral resources at Troy. Although we believe these amounts are significant, it does not mean the mineral resource can be economically mined. A mineral resource is not equivalent to a commercially mineable ore body or “proven reserves” or “probable reserves” under standards promulgated by the SEC, principally because they are less certain and not necessarily amenable to economic development. We will not be able to determine whether Rock Creek contains a commercially mineable ore body until our evaluation program has been completed and we have obtained a final, economic and technical feasibility study that will include an analysis of the amount of ore that can be economically produced under then-prevailing market conditions. United States investors are cautioned that the terms “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” are not recognized by the SEC. The estimation of mineral resources involves greater uncertainty as to their existence and economic feasibility than the estimation of proven and probable reserves. United States investors are cautioned not to assume that mineral resources will ever be converted into reserves.

Item 1B. Unresolved Staff Comments.

The Company is neither an accelerated filer nor a large accelerated filer as defined in Rule 12b-2 of the Exchange Act, nor a well-known seasoned issuer as defined in Rule 405 of the Securities Act. The Company does not have any unresolved staff comments outstanding at December 31, 2010.

Item 2. Properties.

We acquired our interest in the Troy Mine and Rock Creek Project in February 2005 through our acquisition of Revett Silver. Revett Silver, in turn, acquired Troy and Rock Creek from ASARCO and Kennecott in October 1999 and February 2000. Revett Silver holds Troy through its wholly-owned subsidiary Troy Mine Inc. and it holds Rock Creek through its wholly-owned subsidiary RC Resources Inc. Both properties are located in northwestern Montana

7

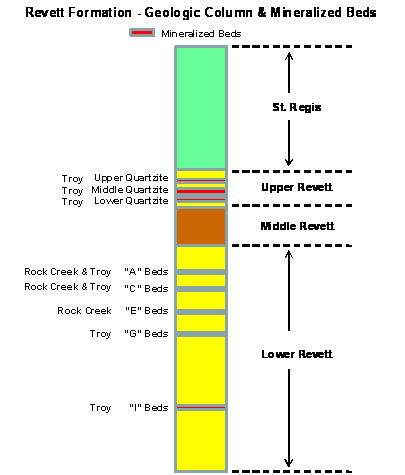

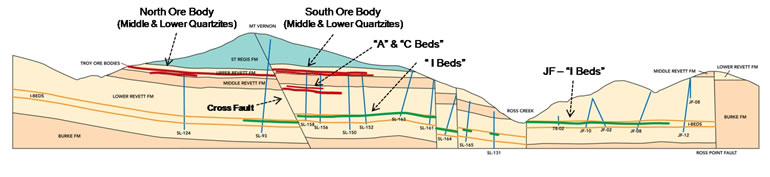

Geological Setting. The geology of the region is characterized by a thick sedimentary sequence Proterozoic in age. Within this sequence, there are four major conformable groups: Lower Belt, Ravalli, Middle Belt Carbonate and Missoula Groups. The Troy and Rock Creek deposits are found within the Ravalli Group, specifically in the Revett Formation. These formations represent a mature, clastic sandstone of varying thicknesses with the sulphide mineralization being stratabound and disseminated. Copper and silver mineralization occurs within favorable beds throughout the Revett Formation (in excess of 2,000 feet thick) as depicted in the following diagram.

8

Stratabound Copper-Silver Deposits. Base and precious metals mineralization is associated with sulphide dissemination occurring within selected portions of the Precambrian Belt Supergroup, and more specifically within the Revett Formation. This type of mineralization, referred to as stratabound disseminated copper deposits, is interpreted to result from the migration of hydrothermal solutions through unconsolidated porous sediments prior to, or during, diagenesis. This class of copper and silver deposits has received considerable research to understand their genesis and determine the fundamental controls on ore distribution. All deposits are very similar and exhibit consistent lateral metal and mineral zoning which were interpreted to derive from primary ore-forming processes.

Copper-Silver Mineralization. Copper is found in the sulphide minerals bornite and chalcocite and most often occurs as fine-grained disseminations with concentration of these minerals (less than two percent up to approximately six percent) along fractures, veinlets and bedding planes. There are two adjacent copper sulphide zones: the bornite-calcite zone and the chalcocite-chlorite zone. Significant amounts of silver are found only in these two copper sulphide zones, primarily as native silver. The thickness of these zones and their copper and silver grades are generally quite continuous across large areas, while locally there are segments considerably thinner or of lower grade. Enveloping the bornite-calcite and chalcocite-chlorite zones are four additional concentric mineral zones that generally have no economic interest. In concentric shells away from the core these are: the chalcopyrite-ankerite, chalcopyrite-calcite zones, galena-calcite and pyrite-calcite zones.

Physiography, Climate and Infrastructure. The Cabinet Mountains form a northwest-trending mountain range of rugged relief. Maximum relief in the area is about 5,500 feet ranging from 2,200 feet in the valleys to 7,700 feet at the peaks. The area’s topography is controlled by the underlying rock types and structural features. Rocks in the area are relatively competent and resistant to erosion. The talus slopes and hogback ridges are usually formed by the more weather resistant quartzite and limestone rocks.

9

The major land-forming features were created by the Rocky Mountain uplift that was active approximately 60 million years ago, and were subsequently modified by shifts in the earth’s crust, alpine glaciation and alluvial deposits. Topography in the area of the projects has been influenced by Pleistocene-age glaciation. In the northern part of the project area, Pleistocene alpine glaciers carved the landscape into a series of cirques, and horns characterized by nearly vertical cliffs, ledges, steep colluvial slopes and talus fields. Pleistocene-age glaciation scoured some lower elevation areas and created a veneer of glacial deposits. Glacial lake bed deposits, silt and clay accumulations approximately 1,000 feet in thickness were deposited in the low-elevation drainages.

The climate of the area is characterized by a combination of Pacific maritime and continental climates. The maritime influences are strongest in the winter when relatively warm, moist air from the Pacific Ocean is cooled as it is lifted over the mountains and mixes with colder Arctic air moving south. This results in snowfall with significant accumulations in the higher elevations. Continental influences are more prevalent in the summer with thundershowers during May and June followed by hot, dry weather into mid-September. Annual precipitation totals vary from about 30 inches along the Clark Fork River valley to about 80 inches at the highest elevations in the Cabinet Mountains. Temperatures in the area are moderate. During the summer months, minimum night-time temperatures are in the 50 to 60 degrees Fahrenheit range. Winter cold waves occur, but mild weather is more common. The long-term annual average temperature is about 45 degrees Fahrenheit. The warmest month, July, averages 65 degrees Fahrenheit and the coldest month, January, averages 24 degrees Fahrenheit.

The Troy Mine is located in Lincoln County, Montana which is sparsely inhabited with several rural communities. Libby, the county seat, is located approximately 32 miles northeast of the mine. The mine site is accessed by a seven mile paved mine road which connects to Montana Highway 56, a paved all-weather road connecting Montana Highway 200 to U.S. Highway 2. The copper concentrates from Troy are trucked to a leased load out facility and rail siding in Libby for rail shipment to a port as designated by our concentrate purchaser. The mine is connected to the local power grid managed by a local electric cooperative.

Rock Creek is located in Sanders County, Montana, approximately 5 miles northeast of the town of Noxon. Thompson Falls, the county seat, is located approximately 37 miles southeast of Noxon along Montana Highway 200. An active railway line parallels Highway 200 and will connect directly to a copper concentrate load out facility at the project site. Electrical service is available throughout the area including a high voltage power line which passes through the project area. Rock Creek is ideally situated from an infrastructure standpoint as all major services (power, highway, rail and water) are available within four miles of the planned and approved project site.

The local economy is based primarily on agriculture and tourism and, to a lesser extent, logging and the production of wood products. Unemployment in Lincoln and Sanders Counties is high relative to state and national unemployment rates.

Development History. The Company’s asset development dates back to 1963 when the Bear Creek Mining Company (a subsidiary of Kennecott Copper Corp.; “Kennecott”) discovered stratabound copper and silver mineralization in the Cabinet Mountains of northwestern Montana. Over the next two decades, extensive exploration activity delineated both the Troy and Rock Creek deposits. The Troy and Rock Creek deposits share many similarities in geology, geochemistry, and physiology. Based on extensive analysis of these similarities, the State and Federal agencies responsible for permitting and oversight of mining operations gained sufficient comfort from the environmentally compatible operating history at Troy to grant approvals for Rock Creek.

In 1973, ASARCO leased the Troy project from Kennecott and began permitting and development of the Troy Mine. Production commenced in August 1981 continuing until 1993 when operations were placed on care and maintenance due mainly to low metal prices. During the twelve year period of production, the Troy Mine produced approximately 4.0 million ounces of silver and 34 million pounds of copper per year. A total of 44.4 million ounces of silver and 389.9 million pounds of copper were produced during this period. The mine and plant improvements were owned by ASARCO with Kennecott retaining a 25% net profits interest.

10

In 1973, ASARCO also acquired Rock Creek claims from Kennecott and commenced an exploration program comprising 121 boreholes. According to a final exploration report prepared by ASARCO in 1989, the Rock Creek deposit contained a mineral resource estimated at 143.76 million tons grading an average of 0.68% copper and 1.65 ounces of silver per ton using a polygonal method.

In 1982 and 1983, U.S. Borax and Chemical Corporation, a subsidiary of Rio Tinto PLC (“U.S. Borax”), explored the lateral extensions of Rock Creek deposit on adjacent claims. In 1984 U.S. Borax estimated the mineral inventory of 48 million tons grading 0.54%Cu and 1.66opt Ag in three satellite zones (the “Adjacent Properties”) using a polygonal methodology. This mineral inventory and methodology has not been audited. Revett Silver acquired these Adjacent Properties in 2000 as part of the Kennecott (also a subsidiary of Rio Tinto) transaction.

Revett Silver subsequently acquired the mineral rights to two other exploration stage stratabound copper/silver prospects located south of, and on trend with Rock Creek, these being the Vermilion River and Sims Creek projects.

The Troy Mine. Troy is an underground “room and pillar” copper and silver mine with a conventional flotation mill located in Lincoln County, Montana. Developed by ASARCO in 1980 and 1981 at a cost of approximately $100 million, the mine comprises 24 patented lode-mining claims and approximately 569 unpatented lode-mining claims. We re-opened Troy in December 2004 at a cost of approximately $8 million, and have continuously operated it since then. Copper concentrate high in silver content is currently shipped by rail to offsite smelters under a renewable long term contract. The Troy concentrates typically contain 34% to 40% copper and 70 to 110 troy ounces of silver per ton. The Troy concentrates are considered high grade and clean with no deleterious elements.

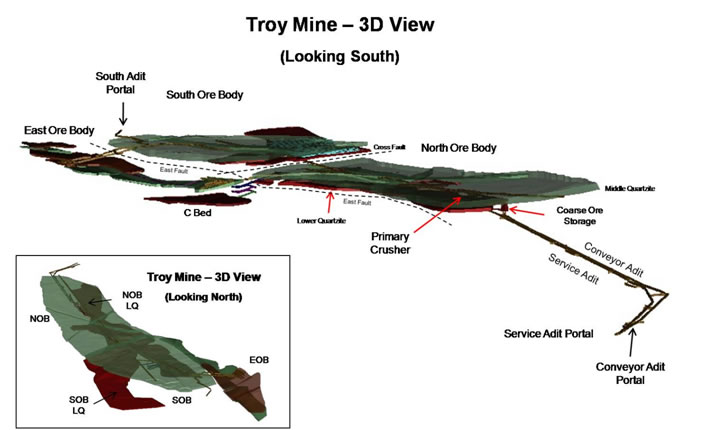

The Troy Deposit Economically significant mineralization occurs at Troy within a number of distinct stratigraphically adjacent quartzite sub-units. The Upper, Middle and Lower Quartzites are located within the Upper Member of the Revett Formation and the “A”, “C” and “I” Beds are contained in the Lower Member of the Revett Formation. In plan view, the stratiform deposit measures approximately 7,500 feet by 1,800 feet. In the vicinity of the mine, the stratigraphy is generally flat with a shallow dip of four degrees (7% grade). There are two styles of faults in the mine area. Northwest trending faults are brittle-ductile structures with common clay gouge as exemplified by the East Fault. The East Fault displays a close spatial relationship with the copper-silver mineralization. The second type of faults represents late brittle and generally open faults with sandy infill typified by the Cross Fault which separates the north and south ore bodies. These faults trend ENE to ESE and have steep southerly dips. These faults are late structures offsetting the mineralized sedimentary units. The Cross Fault also offsets the East Fault.

The Troy deposit has been subdivided into three separate mining areas; the North Ore Body (“NOB”), South Ore Body (“SOB”) and the East Ore Body (“EOB”), delineated primarily by the Cross Fault and the East Fault dissecting the mineralized quartzite sub-units (see following Mine Layout diagram). The main mining quartzite sub-unit has been the middle quartzite which averages approximately sixty feet thick. The NOB and SOB are mined in both the Lower and Middle Quartzite while the Middle and Upper Quartzite sub-units are mined in the EOB. No economic copper and silver mineralization was delineated in the Upper Quartzite west of the East Fault and similarly in the Lower Quartzite east of the East Fault (which represents the eastern boundary of the NOB and SOB). The South fault delineates the southern margin of the SOB. All other lateral ore boundaries are assay delimited and do not represent hard geological boundaries. Both the A and C Beds are mined in the South Ore Body.

11

Exploration drilling by the Company between 2006 and 2010 to delineate additional mineralization beneath the SOB in the lower member of the Revett formation was successful in discovering several new ore bodies located in the “C-Beds” as well as adding reserves in the “A” and “I” Beds in the South Ore Body. These deposits are now incorporated in our probable reserves (see following Troy Exploration discussion).

12

Current Troy Reserve Estimates (December 31, 2010)

| Ag Grade | Cu Grade | Contained | Contained | |||

| Category | Area | Million Tons | (Opt) | (%) | Ag (Moz) | Cu (Mlbs) |

| Proven Reserve | North Ore Body | 2.01 | 1.33 | 0.68 | 2.68 | 27.39 |

| South Ore Body | 0.93 | 1.60 | 0.83 | 1.49 | 15.50 | |

| East Ore Body | 0.08 | 1.26 | 0.63 | 0.09 | 0.95 | |

| Total Proven Reserve | 3.02 | 1.41 | 0.73 | 4.26 | 43.84 | |

| Probable Reserve | North Ore Body | 0.23 | 0.65 | 0.34 | 0.15 | 1.56 |

| South Ore Body | 0.19 | 0.71 | 0.35 | 0.13 | 1.31 | |

| East Ore Body | 0.91 | 1.40 | 0.61 | 1.28 | 11.07 | |

| Lower Revett A Bed | 0.82 | 0.90 | 0.27 | 0.73 | 4.46 | |

| Lower Revett C Bed | 1.32 | 1.56 | 0.56 | 2.06 | 14.62 | |

| Lower Revett I Bed | 4.02 | 1.02 | 0.27 | 4.09 | 21.81 | |

| Total Probable Reserve | 7.48 | 1.13 | 0.37 | 8.45 | 54.85 | |

| Proven & Probable Reserve | North Ore Body | 2.24 | 1.26 | 0.64 | 2.83 | 28.95 |

| South Ore Body | 1.12 | 1.45 | 0.75 | 1.62 | 16.81 | |

| East Ore Body | 0.99 | 1.39 | 0.61 | 1.38 | 12.02 | |

| Lower Revett A Bed | 0.82 | 0.90 | 0.27 | 0.73 | 4.46 | |

| Lower Revett C Bed | 1.32 | 1.56 | 0.56 | 2.06 | 14.62 | |

| Lower Revett I Bed | 4.02 | 1.02 | 0.27 | 4.09 | 21.81 | |

| Total Proven & Probable | 10.50 | 1.21 | 0.47 | 12.71 | 98.69 |

The following key factors were used in determining the foregoing reserves:

| Criteria | Silver | Copper | Other |

| Metal Prices (prior 5 year averages) | $14.90 | $3.02 | |

| NSR Cutoff (Incl. Royalty) | $25.57 / Ton | ||

| NSR by Metal (1.21 Ag, 0.47 Cu) | $14.86 | $24.28 | |

| Mining Recovery | 100% | ||

| Dilution (Incl. Reserve Calc.) | 0% | ||

| Metallurgical Recoveries – LOM Ave. | 87.5% | 86.0% |

13

Current Troy Resources Estimate (December 31, 2010)

| Ag Grade | Cu Grade | ||||

| Category | Area | Million Tons | (Opt) | (%) | |

| Measured Resource | North Ore Body | 28.02 | 1.32 | 0.65 | |

| South Ore Body | 17.08 | 1.47 | 0.71 | ||

| East Ore body | 3.15 | 1.13 | 0.52 | ||

| Total Measured Resource | Total | 48.25 | 1.36 | 0.67 | |

| Indicated Resource | North Ore Body | 0.12 | 0.65 | 0.34 | |

| South Ore Body | 2.62 | 0.96 | 0.27 | ||

| East Ore body | 2.75 | 1.34 | 0.62 | ||

| Lower Revett | 9.27 | 1.12 | 0.33 | ||

| Total Indicated Resource | Total | 14.76 | 1.13 | 0.37 | |

| Inferred Resource | North Ore Body | 0.00 | 0.00 | 0.00 | |

| South Ore Body | 0.00 | 0.00 | 0.00 | ||

| East Ore body | 0.00 | 0.00 | 0.00 | ||

| Total Inferred Resource | Total | 0.00 | 0.00 | 0.00 | |

| Total Measured & Indicated | North Ore Body | 28.14 | 1.32 | 0.65 | |

| South Ore Body | 19.70 | 1.40 | 0.66 | ||

| East Ore body | 5.89 | 1.23 | 0.56 | ||

| Lower Revett | 9.27 | 1.12 | 0.33 | ||

| Total Measured &Indicated | Total | 63.00 | 1.30 | 0.60 | |

| (Pillars Incl in Meas. & Ind.) | (Total) | (44.23) | (1.35) | (0.66) | |

| Total Inferred (JF Property)1 | Total | 11.00 | 1.40 | 0.40 |

| 1) |

Resources listed for the JF Property are a historical estimate within the meaning of National Instrument 43-101 of Canadian Securities Administrators (“NI 43-101”) and have not been audited by a qualified person. In 1992, ASARCO reported in an internal report a “Mineral Reserve” for the JF deposit of “11 million tons grading 0.4% Cu and 1.4 opt Ag.” This historical mineral resource estimate, which was prepared before the adoption of NI 43-101 and uses categories other than the ones set out in section 1.2 of NI 43-101, is considered relevant. A Qualified Person has not, however, done sufficient work to classify the historical estimate as current mineral resources and accordingly, we do not treat ASARCO’s historical estimate as current mineral resources. You are cautioned that the ASARCO historical estimate should not be relied upon. While we have not yet taken the steps to validate this drilling information with new drilling data, Larry Erickson, P Eng., a qualified person in accordance with NI 43-101, has reviewed ASARCO’s drilling data (i.e.; core logs, assay results, sections) and believes it to be reliable. |

Reserve and mineral resource estimates were performed by Larry Erickson, P. Eng., an employee of the Company. Reserve and mineral resource estimates conform to Canadian Standards on Mineral Resources and Mineral Reserves Definitions and Guidelines (CIM Guidelines, August 20, 2000) in compliance with NI 43-101 requirements. Proven and probable reserves do not include resources contained in planned pillars; only represents material scheduled to be extracted and milled. United States investors are cautioned that the terms “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” are not recognized by the SEC. The estimation of mineral resources involves greater uncertainty as to their existence and economic feasibility than the estimation of proven and probable reserves. United States investors are cautioned not to assume that mineral resources will ever be converted into reserves.

14

Operations. ASARCO operated Troy at approximately 8,500 tons per day (“tpd”) between 1981-1993 while mining primarily in the 60 foot thick Middle Quartzite unit where two-thirds of the production came from bench mining. We are currently operating at the planned rate of approximately 4,000 tpd with the majority of our mine plan focused on the remaining 30 to 40 foot thick East Ore Body, Lower Quartzites, C Bed and I Bed areas. We believe continued workforce training focused on safety and productivity combined with development of access to new mining areas such as the I Beds will help us work towards increasing production levels.

| Troy Mine Production | Total | ||||||||

| (1,000s) | 2006 | 2007 | 2008 | 2009 | 2010 | 2006-10 | 2011e | ||

| Mill Production (tons) | 945 | 1,109 | 1,307 | 1,337 | 1,363 | 6,061 | 1,444 | ||

| Grades | - Ag (opt) | 1.13 | 1.07 | 1.00 | 1.00 | 0.87 | 1.00 | 1.24 | |

| - Cu (%) | 0.46% | 0.50% | 0.43% | 0.38% | 0.40% | 0.43% | 0.46% | ||

| Recovery | - Ag (%) | 86.2% | 88.9% | 89.8% | 84.7% | 85.0% | 86.9% | 87.5% | |

| - Cu (%) | 83.6% | 86.9% | 87.5% | 83.2% | 81.0% | 84.5% | 85.7% | ||

| Production | - Ag (oz) | 917 | 1,054 | 1,179 | 1,128 | 1,008 | 5,294 | 1,300 | |

| - Cu (lbs) | 7,304 | 9,681 | 9,791 | 8,568 | 8,794 | 44,196 | 11,000 | ||

| Cash Cost ($/st) | $ 31.13 | $ 32.46 | $ 30.88 | $ 23.13 | $ 24.83 | $ 28.14 | $ 26.00 | ||

Note: Cash Costs are in dollars per short ton including all direct site costs, treatment, freight, refining and royalty costs. The cash cost per ton is a non-GAAP measure. The Company believes that cash cost per ton is a benchmark for performance and is well understood and widely reported in the mining industry.

In 2010, Troy achieved the highest mill throughput since the mine was reopened in December 2004. During the period when access to the higher grade C Bed area was being developed more of the Lower Quartzite ore (71% of the total) was being mined which resulted in lower head grades. The lower head grades, coupled with a period of lower metallurgical recoveries, due to a higher level of non-sulfide ores encountered, yielded lower silver and copper production and higher unit cash cost of production. Mining has now progressed through the higher non-sulfide area and recoveries and head grades have returned to normal in the fourth quarter as production began from the C Beds.

In 2011, we expect to process 1.4 million tons of ore grading 1.2 ounces per ton silver and 0.46% copper and recover 1.3 million ounces of silver and 11 million pounds of copper. The proven and probable reserves currently defined at Troy provide for a seven year life-of-mine plan at our current production rate.

Ongoing Troy Exploration. We have been exploring beneath and adjacent to the current workings at Troy for the past several drilling seasons. Our primary target has been stratabound copper/silver mineralization located in the “I-Beds” of the Lower Revett Formation, approximately 1,200 feet stratagraphically below the main ore body at the mine. ASARCO had initially identified mineralization in these beds during drill programs in the 1980s but did not follow up with subsequent drilling as metal prices began to fall in the early 1990s.

Since the Rock Creek Project is hosted in the upper quartzite units of the Lower Revett Formation, specifically the “A, C, E & G-Beds”, we believe the potential for ore grade mineralization exists in these and other beds. Our drilling confirmed mineralization in the “I-Beds” but also resulted in the discovery of a mineable reserve hosted in the “C-Beds” and “A Beds” directly beneath the current workings. Based on currently available information, the “C-Beds” contain probable reserves of 1.32 million tons grading 1.56 ounces per ton of silver and 0.56% copper. An access decline was completed to the “C Bed” area in the third quarter of 2010. We have also defined resources of 1.2 million tons grading 0.90 ounces per ton silver and 0.27% copper in the “A Beds” and 6.0 million tons grading 1.02 ounces per ton silver and 0.27% copper in the “I Beds”. Drilling primarily targeting expansion of the “I Beds” will continue in the 2011 drilling program which has been budgeted at $631,000.

15

Generalized Cross-Section of the Troy Mine Area Looking East

In addition to the “I-Bed” mineralization beneath the current Troy workings, ASARCO discovered and delineated the “JF” copper/silver deposit to the south of the mine. ASARCO reported in an internal report a “Mineral Reserve” for the JF deposit of “11 million tons grading 1.4 ounces per ton of silver and 0.4% copper.” We plan to re-assay existing core from the ASARCO drill program on the JF property and continue a confirmatory drill program on the area between Troy and JF as well as the JF deposit area.

Our longer range goals are to step out from the immediate mine area to explore for additional resources that would allow us to use our existing mine and processing infrastructure. There are promising mineralization trends to the north and east of the Troy Mine, which will be our initial targets. We have been expanding our claim holdings in these areas as well as reviewing prior geophysical and drill data.

Mine Reclamation Plan. We have posted a reclamation performance bond for the Troy Mine. The amount of the bond was $12.9 million as of December 31, 2010, which included $6.5 million in a restricted cash account. We are presently conducting environmental studies at the mine in conjunction with the DEQ and the Forest Service for completion of a revised reclamation plan. This plan, once accepted, may dictate a further adjustment of the amount of the reclamation performance bond. A key issue involving Troy’s reclamation and remediation is whether water discharges from the mine will require treatment even though there is presently no evidence of acid rock drainage nor any evidence of the mobilization of other deleterious constituents at the mine site. At December 31, 2010, we had accrued a $7.9 million liability relating to our reclamation and remediation obligations at Troy.

Rock Creek. Rock Creek is a large development-stage stratabound copper and silver deposit located in Sanders County, Montana. The project comprises 99 patented lode-mining claims, 162 unpatented lode-mining claims, 5 tunnel site claims and 85 mill site claims. The patented claims lying within the Cabinet Mountain Wilderness Area convey mineral rights only and the claims lying outside the wilderness area convey both mineral and surface rights. The patented claims were legally surveyed in 1983 and occupy an area of approximately 1,809 acres. All of the Rock Creek mining claims are in good standing. The project also includes 745 acres of fee land associated with project facilities and 673 acres of fee land to be used for grizzly bears mitigation purposes.

The project is approximately sixteen air miles or forty-five road miles from the Troy Mine. While the ore body lies under the Cabinet Mountain Wilderness area, the Company will access mining operations from outside the wilderness. The project development plan will be very similar to that used at the Troy Mine. The designs for Rock Creek contemplate operations at a rate of 10,000 tpd, producing on average fifty-two million pounds of copper and six million ounces of silver per year.

The Rock Creek Deposit. The stratigraphy in the vicinity of the Rock Creek Project is nearly identical to that found at the nearby Troy Mine. Bedrock exposed in the area consists primarily of the Revett and St. Regis Formations. In this area, Belt Supergroup rocks are gently folded and cut by several northwest-trending faults. In the vicinity of the deposit, two faults, the Copper Lake and Moran Faults, subdivide the deposit into three segments: The Chicago Peak, St. Paul and North Basin blocks. The more significant portion of the Rock Creek deposit forms an oblong body measuring at least 16,000 feet along the long axis by 7,200 feet along the short axis. The long axis of the copper and silver mineralization is generally oriented along the north-south direction. The copper and silver mineralization occurs within an anticlinal structure, plunging slightly to the northwest. The copper and silver mineralization occurs between elevations of 4,300 and 6,000 feet above mean sea level. Mineralization occurs primarily within quartzite units of the Lower Member of the Revett Formation and subordinately within siltite and argillite sub-units of the lower and middle Revett Formation. The Lower Member of the Revett has been locally subdivided into the same individual units as Troy named the “A” through “I” Quartzite Beds (from top to bottom). The bulk of the mineralization is confined to one layer, but locally there may be up to four vertically stacked, potentially minable layers. The copper and silver mineralization ranges in thickness from six feet up to a maximum of 235 feet, near the Copper Lake Fault. The average thickness is approximately twenty-seven feet.

16

Current Rock Creek Resource Estimates (December 31, 2009)

| Category | Area | Million Tons | Ag Grade | Cu Grade |

| (Opt) | (%) | |||

| Inferred Resource | Chicago Block | 78 | 1.4 | 0.65 |

| Saint Paul Block | 48 | 2.1 | 0.92 | |

| North Basin Block | 11 | 1.5 | 0.57 | |

| Total Inferred Resource | Total | 137 | 1.7 | 0.72 |

Permitting History and Status. After seventeen years of study and review, the Forest Service and DEQ jointly issued a Record of Decision in June 2003 approving our proposed plan of operation. The Record of Decision was based primarily on the findings detailed in the Final EIS issued in 2001 and a non-jeopardy biological opinion issued by the USFWS in May 2003. The Final EIS followed six years of public and inter-agency review and comment (the initial draft EIS was issued in October 1995) with subsequent project development modifications and mitigations, as required under NEPA. As is disclosed more fully in the section of this report entitled “Legal Proceedings” the Record of Decision and Final EIS have been remanded back to the Forest Service for further action by the Federal District Court in Montana and completion of a Supplemental EIS is now required to address several deficiencies noted by the Judgment.

The Company has support infrastructure including an office and core storage building at the site in anticipation of a favorable ruling from the courts. Approval was granted to construct the evaluation adit support facilities (office, shop, dry, etc.) on private land and reclamation bonding was provided.

Project Development. If we are allowed to proceed with our evaluation program at Rock Creek, we will install remaining infrastructure (including improvements to the access road, power transmission and a water treatment facility) and construct an adit approximately 7,000 feet long to gain access into the deposit. After mineralization is reached (at approximately 3,500 feet), we will then collect data to support a full technical and economic feasibility study. This process is expected to take approximately two to three years and will include both direct development in mineralization and an infill drilling program with a view to establishing proven and probable reserves within a portion of the ore body.

Assuming the feasibility study is positive, and financing is available, we will then commence construction of the 10,000 tpd mine and process facility. The longest lead time item will be the development of two parallel adits (approximately 15,500 feet) driven uphill at a 10% grade into the deposit; one for conveyor haulage out of the mine and the other for services and access for men and materials. Other underground construction in waste rock (such as the installation of primary crushing facilities) will be relatively limited since mine development for ore haulage will largely be confined to the ore zone. The processing plant and surface infrastructure will use conventional technology and will be based on the experience we have gained from operating the Troy processing plant. Construction, including development of the service and conveyor adits, is estimated to take about three years.

17

Other Properties. The Company has acquired the mineral rights to three other exploration-stage prospects located in the vicinity of Troy or Rock Creek: the Adjacent Properties at Rock Creek (the “Adjacent Properties”), the JF Property at Troy (discussed above) and the Vermillion River and Sims Creek properties south east of Rock Creek. All of these projects are Revett Formation-hosted, stratabound silver and copper prospects.

The Adjacent Properties are comprised of three unpatented claim groups, Copper Gulch, Horizon Basin and Rock Peak, which cover lateral extensions of the Rock Creek deposit. The prior owners of the Adjacent Properties drilled 36 boreholes into the mineralization of these claims groups and estimated the mineral inventory of 48 million tons grading 0.54% Cu and 1.66 opt Ag in three satellite zones using a polygonal methodology. This mineral inventory and methodology has not been audited.

The JF property consists of an unpatented claim group located approximately one mile south of the Troy Mine. ASARCO conducted a limited drilling program on the property over 20 years ago, consisting of twelve diamond drill holes totaling 12,183 feet and three smaller holes that tested the mineralization outcropping totaling 752 feet. The drill hole spacing ranged from 250 to 700 feet, and revealed copper-silver mineralization in a flat lying north-south trending zone approximately 800 feet wide and approximately one mile long, with an estimated average thickness of 27 feet. The JF deposit remains open on its east, west and south margins. We believe confirmation of a commercially mineable resource on the JF property could extend the life of the Troy Mine by as much as five years.

The Vermillion River and the Sims Creek properties consist of two unpatented claim groups located approximately 25 miles southeast of Rock Creek. Limited drilling was conducted by the previous owner of the Vermillion River claim group. The Sims group is untested.

Item 3. Legal Proceedings.

Revett Minerals and certain of its subsidiaries are parties to several pending legal actions in the federal and state courts as of the date of this report, most of which are predicated on alleged violations of various federal and state environmental laws and regulations at Troy and Rock Creek. These pending actions and the primary federal and state laws and regulations to which we are subject are set forth below:

The Federal Clean Water Act and the Montana Water Quality Act. The federal Clean Water Act and the Montana Water Quality Act are the principal environmental protection laws regulating the Company’s operations at Troy and Rock Creek pertaining to water quality. The federal act imposes limitations on water discharges into waters of the United States, including discharges from point sources such as mine facilities, and is administered by the federal Environmental Protection Agency. The Montana act imposes similar limitations on discharges into state waters and is administered by the Montana DEQ.

The Company holds all of the permits required for discharge to groundwater at Troy and is in the process of designing a water treatment facility for its proposed evaluation activities at Rock Creek. The Company has also established an environmental risk transfer program to cover the reclamation and remediation costs at Troy once mining operations cease. There are two components to this program: a $12.9 million surety bond that is held in trust that can be used only for reclamation and remediation; and a prepaid insurance policy that protects the Company from reclamation and remediation costs in excess of the cash bond. The surety bond is secured by restricted cash and is included among the Company’s long-term assets. Interest on the bond is recorded as income when earned. The Company amortizes the costs associated with the environmental risk transfer program using the units of production method, which is consistent with the manner in which it accounts for other asset retirement obligations pertaining to its mining assets. The DEQ is currently preparing an environmental assessment to determine the adequacy of the final reclamation plan. One of the key items under review is the long term effectiveness of metals attenuation in the tailings facility.

The Company held a water discharge permit (“MPDES Permit”) under the Montana Water Quality Act pertaining to its proposed development at the Rock Creek Project; however it was challenged in Montana state court by several environmental organizations, who contended that the DEQ arbitrarily issued the permit without first conducting a required non-degradation review. MPDES Permits are required to be renewed every five years and an application for renewal had been prepared as the case progressed. The case was taken to the Montana Supreme Court and a decision was issued on December 4, 2008 whereby the MPDES Permit application was remanded to Montana DEQ “for further proceedings in conformity herewith”. The Company will continue to pursue the renewal of the MPDES Permit with Montana DEQ; however, the MPDES Permit is not required for Phase 1 of the Project (the evaluation adit) due to the permitting approval of treated water discharge via an infiltration pond. The Company will be required to post a bond with the DEQ in conjunction with its proposed evaluation activities at Rock Creek which will cover water treatment activities. Management estimates that the initial amount of this bond will be approximately $3 million for the first phase of the project subject to increases if and when Rock Creek is commercially developed.

18

The Endangered Species Act. ESA requires federal agencies to ensure that any action authorized, funded or carried out by such agency is not likely to jeopardize the continued existence of any endangered species or threatened species. ESA’s definition of “species” includes any distinct population segment of any vertebrate fish or wildlife that interbreeds when mature. In order to facilitate the conservation of imperilled species, ESA establishes an interagency consultation process. When a federal agency proposes an action that “may affect” a listed species, which in the case of the Rock Creek Project includes grizzly bears and bull trout, the Forest Service must provide a “biological assessment” of the effects of the proposed action. Unless the USFWS determines that the proposed action will have no adverse effect on listed species, it must review all of the information provided by the action agency, as well as any other relevant information, and prepare a “biological opinion” setting forth the effects of the proposed action. In preparing such an opinion, the USFWS must use the best available scientific and commercial data to determine whether the proposed action is likely to jeopardize the species, the amount and extent of any incidental “taking” or harm to the species that may result from the action, and whether it should identify any conservation measures to promote the recovery of the listed species. ESA also provides that, once the interagency consultation process has been initiated, neither the federal agency nor the permit or license applicant (in this case, the Company) may make any irreversible commitment of resources with respect to the proposed agency action that would have the effect of foreclosing the formulation or implementation of any reasonable or prudent measures to avoid jeopardizing the listed species.

The USFWS issued a biological opinion in May 2003, which concluded that the proposed development of Rock Creek would not jeopardize the continued existence of grizzly bears or bull trout. The opinion was subsequently challenged by several environmental organizations on ESA grounds in a lawsuit brought in the United States District Court for the District of Montana and was later remanded to the USFWS for further study. In October 2006 the USFWS issued a revised biological opinion reaffirming its earlier decision. The revised opinion was also challenged in the district court. On May 4, 2010, the district court issued a decision dismissing the groups’ ESA challenge. That dismissal has been appealed to the Ninth Circuit Court of Appeals. (See the section of this report entitled “Legal Proceedings.”)

The Wilderness Act. The federal Wilderness Act of 1964 created a National Wilderness Preservation System composed of federally owned areas designated by Congress as “wilderness areas.” “Wilderness” is generally defined in the Act as “an area where the earth and its community of life are untrammelled by man, where man himself is a visitor who does not remain.” Once included in the system, the Act requires that these areas be administered by the federal department or agency having prior jurisdiction in the system in such a manner as to preserve their wilderness character and leave them unimpaired for future use and enjoyment as wilderness. The Cabinet Mountains Wilderness Area overlays Rock Creek and was included in the National Wilderness Preservation System in 1964. The Wilderness Act does not affect mineral leasing activities conducted prior to 1983, however it does authorize the Secretary of Agriculture (through the Forest Service) to impose such reasonable stipulations as are necessary to protect the wilderness character of the land for the purposes for which they are leased, permitted or licensed. In the case of Rock Creek, these stipulations have been the focus of public opposition to the development of the project.

The Federal Clean Air Act and the Montana Air Quality Act. The federal Clean Air Act limits the ambient air discharge of certain materials deemed to be hazardous and establishes a federal air quality permitting program for such discharges. The Montana Air Quality Act imposes similar limitations and permitting requirements. Hazardous materials are defined in both acts and in their enabling regulations to include various metals. The Company holds all of the required air quality permits pertaining to its operations at Troy. In December 2001, it obtained an air quality permit from the DEQ with respect to Rock Creek, however an environmental group subsequently challenged that permit, contending that nitrous emissions from diesel-powered mining equipment operating underground would exceed permitted levels. The suit was voluntarily dismissed during the first quarter of 2003.

19

The National Environmental Policy Act and the Montana Environmental Policy Act. NEPA requires all governmental agencies to consider the impact of major federal actions on the human environment. The state act mandates similar considerations with respect to major state actions. Because Rock Creek is located on federal lands, the Company was required to prepare and file an EIS outlining the environmental effects of its proposed operations and the Company’s plans to ameliorate the effects of Rock Creek’s operations. The final EIS for Rock Creek was issued in 2001, and the Forest Service, the lead government agency on the project, released its Record of Decision on the Company’s proposed operating plan in June 2003. The Company is working with the Forest Service to develop a supplemental EIS as required by the district court’s May 4, 2010 decision. (See the section of this report entitled “Legal Proceedings.”)

The Federal Comprehensive Environmental Response, Compensation and Liability Act and the Montana Metal Mine Reclamation Act. The federal Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”) imposes clean-up and reclamation obligations stemming from unlawful discharges into the environment, and establishes significant criminal and civil penalties against those persons who are primarily responsible for such discharges. The Montana Metal Mine Reclamation Act (“MMRA”) is similar to CERCLA in principal, but focuses principally on the clean up and reclamation of mining properties and unlawful discharges from mining operations. CERCLA is jointly administered and enforced by the Environmental Protection Agency and the DEQ. The MMRA is administered and enforced by the DEQ alone. A number of opposition groups have challenged the validity of Troy’s closure plan. (See the section of this report entitled “Legal Proceedings.”)

The Multiple-Use Sustained Yield Act of 1960 and the National Forest Management Act of 1974. The federal Multiple-Use Sustained Yield Act of 1960 (“MUSYA”) directs the Secretary of the U.S. Department of Agriculture to administer Forest Service and other federal lands in ways that promote multiple uses of these resources (such as outdoor recreation, grazing, timber harvesting and mining) and are protective of watersheds, fish and wildlife, thereby balancing the needs of current and future generations. The federal National Forest Management Act of 1974 requires the Secretary to adopt and implement regulations pertaining to land and resource management plans that are consistent with MUSYA’s objectives.

The Resource Conservation and Recovery Act. Resource Conservation and Recovery Act (“RCRA”) was designed and implemented to regulate the disposal of hazardous wastes. It mandates that such wastes be treated, disposed of or stored, and requires those doing so to obtain permits from the Environmental Protection Agency or the authorized state regulatory authority.

Troy-Related Actions.

Cabinet Resource Group, Inc. v. Montana Department of Environmental Quality, Revett Minerals Inc. and Genesis Inc., Montana Nineteenth Judicial District Court in and for Lincoln County (Case No. DV-07-118). This action was brought in 2007. The plaintiff, a regional environmental organization, alleges that Troy Mine Inc. is operating Troy in violation of the MMRA because of deficiencies in its reclamation plan, and that all of the defendants have violated the Montana constitution and various state statutes and regulations by allowing such operations to continue. The plaintiff seeks a declaration that the Troy operating permit and reclamation plan are void and invalid; alternatively, it seeks a writ of mandamus from the court requiring DEQ to enforce the MMRA and presumably suspend or revoke the operating permit, declare a forfeiture of the Company’s performance bond, and enjoin the Company from further operations at Troy pending approval of a reclamation plan. The plaintiff also alleges DEQ failed to maintain a clean and healthful environment in violation of the Montana constitution.

We have answered the complaint and asserted several affirmative defenses to plaintiff’s claims. We have also filed a motion seeking to dismiss Revett Minerals on the grounds that it does not do business in Montana. Discovery has been substantially completed, although no trial date has been set. The court has indicated that it will not set a trial date until DEQ has completed its required review of the reclamation plan. We are funding an ongoing environmental impact statement with DEQ concerning proposed revisions to the existing reclamation plan and increased performance bond requirements, and therefore believes the claim is without merit.

20

Rock Creek-Related Actions.

Rock Creek Alliance, Clark Fork Coalition, Cabinet Resource Group, Montana Wilderness Association, Earthworks, and Alliance for the Wild Rockies, Plaintiffs, vs. United States Forest Service, U.S. Department of Agriculture, Tom Tidwell, in his official capacity as Regional Forester for the Northern Region, Paul Bradford, in his official capacity as Forest Supervisor of the Kootenai National Forest, and Ed Schafer, in his official capacity as Secretary of the U.S. Department of Agriculture, Defendants, United States District Court for the District of Montana, Missoula Division, Case No. CV-05-107-M-DWM (“Case 1”). Rock Creek Alliance, Cabinet Resource Group, Sierra Club, Earthworks, Alliance for the Wild Rockies, Natural Resources Defense Council, Trout Unlimited, Idaho Council of Trout Unlimited, Pacific Rivers Council, and Great Old Broads for Wilderness vs. United States Fish and Wildlife Service, United States District Court for the District of Montana, Missoula Division, case No. CV-08-28-M-DWM (“Case 2”). Revett Silver is a defendant-intervener in both cases.

The complaint in Case 1 was originally filed in June 2005 and was amended in February 2008. The complaint alleges violations of the ESA, NEPA, the Clean Water Act, the Forest Service Organic Administration Act of 1897 and the National Forest Management Act, and specifically challenges the 2001 final EIS, the 2003 Record of Decision, the Plan of Operations, the 2007 determination letter from the Forest Service and the three supplemental information reports issued by the Forest Service in 2007. The complaint in Case 2 was filed in February 2008. It alleges violations of Section 7 of the ESA and specifically challenges the USFWS’ “no jeopardy” findings with regard to grizzly bears and bull trout in the USFWS’ 2006 biological opinion and the 2007 supplement to that opinion. Plaintiffs seek determinations in both cases that the governmental agencies violated the aforementioned statutes and should be enjoined from authorizing or approving any further activities relating to the Rock Creek Project until they are in compliance.

The two cases were subsequently consolidated and cross motions for summary judgment were filed. On May 4, 2010, the district court entered a decision dismissing the environmental groups’ ESA challenges, yet vacated the 2001 Final EIS and Record of Decision, both of which were remanded to the Forest Service with directives to update the NEPA analysis of the Rock Creek Project’s effect on the bull trout population and habitat, and to incorporate sediment reduction measures to minimize the adverse environmental effect of Phase I of the mine project. The Company is currently working with the Forest Service on a supplemental EIS to address the issues identified in the court’s decision. The environmental groups have appealed the dismissal of their ESA challenges to the Ninth Circuit Court of Appeals. All of the briefing had been completed as of the date of this report, but oral argument had not yet been scheduled.

Management’s Analysis of Actions pertaining to Rock Creek. Management expects the Forest Service will be able to complete a supplemental EIS addressing the issues raised by the court’s decision in Case 1, and that once that supplemental EIS is issued, the Forest Service will be in a position to issue a revised Record of Decision for the Rock Creek Project. The Company is currently working with the Forest Service on the supplemental EIS.

Management cannot predict with any degree of certainty whether the Company and the USFWS will be successful in defending the Ninth Circuit appeal of the district court’s decision dismissing the environmental groups’ ESA challenges.

Even if the Company successfully completes a supplemental EIS addressing the issues identified in the Case 1 decision and successfully defends the appeal of the ESA dismissal in Case 2, there could be continuing delays to the Company’s planned evaluation program at Rock Creek. These delays could make it more difficult to obtain the financing needed to fund commercial development. Even if the Company is ultimately successful in defending these matters, it still must comply with a number of requirements and conditions as development of Rock Creek progresses, failing which it could be denied the ability to continue.

Item 4. Submission of Matters to a Vote of Security Holders.

No matters were submitted to a vote of our security holders through the solicitation of proxies or otherwise during the fourth quarter of 2010.

21

PART II

Item 5. Market for Registrant’s Common Equity and Related Stockholder Matters.

Market Information. The following table sets forth the high and low closing prices per share, denominated in Canadian dollars, for our common stock for each quarter of 2010, 2009 and 2008 as reported on the Toronto Stock Exchange. The prices reflect inter-dealer prices without regard to retail mark-ups, markdowns or commissions, and do not necessarily reflect actual transactions. As of March 22, 2011, the Federal Reserve Bank of New York noon buying rate was $0.9844 Canadian dollars per U.S. dollar.

| 2010 | 2009 | ||||

| Low | High | Low | High | ||

| First Quarter | (Cdn) $1.65 | (Cdn) $2.30 | (Cdn) $0.35 | (Cdn) $0.65 | |

| Second Quarter | (Cdn) $1.48 | (Cdn) $2.05 | (Cdn) $0.45 | (Cdn) $1.00 | |

| Third Quarter | (Cdn) $1.33 | (Cdn) $2.50 | (Cdn) $0.45 | (Cdn) $0.85 | |

| Fourth Quarter | (Cdn) $2.15 | (Cdn) $4.90. | (Cdn) $0.65 | (Cdn) $1.75 | |

| 2008 | |||||

| Low | High | ||||

| First Quarter | (Cdn) $3.40 | (Cdn) $4.80 | |||

| Second Quarter | (Cdn) $2.65 | (Cdn) $3.90 | |||

| Third Quarter | (Cdn) $1.55 | (Cdn) $3.10 | |||

| Fourth Quarter | (Cdn) $0.20 | (Cdn) $2.20 |

Shareholders. The Company had 131 shareholders of record as of March 22, 2011.

Dividends. The Company has not declared or paid any cash or stock dividends on its common stock since inception, and does not anticipate declaring or paying any cash or stock dividends in the foreseeable future.

Securities Authorized for Issuance under Equity Incentive Plans. The following table sets forth information as of March 22, 2011 concerning securities authorized for issuance pursuant to Revett Mineral’s equity compensation plans.

Equity Compensation Plan Information

| Number of securities remaining | |||

| Number of securities to be | available for future issuance | ||

| issued upon exercise of | Weighted average exercise | under equity compensation plans | |

| outstanding options, warrants | price of outstanding options, | (excluding securities reflected | |

| Plan Category | and rights | warrants and rights | in column (a)) |

| (a) | (b) | (c) | |

| Equity compensation plans approved by security holders | 3,135,386 | $2.23 | 1,356,427 |

Sales of Unregistered Securities. Revett Minerals sold the following securities during the past three years without registering them under the Securities Act: