Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2010

Or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-34879

Nuveen Diversified Commodity Fund

(Exact name of registrant as specified in its charter)

| Delaware | 27-2048014 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 333 West Wacker Drive Chicago Illinois |

60606 | |

| (Address of principal executive offices) | (Zip Code) | |

(877) 827-5920

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common Units of Beneficial Interest | NYSE Amex |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated file, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||||

| Non-accelerated filer | x | (Do not check if smaller reporting company) | Smaller reporting company | ¨ | ||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of March 23, 2011, the registrant had 9,267,040 shares outstanding.

The registrant completed its initial public offering in September 2010, and as a result had no shares outstanding held by non-affiliates as of June 30, 2010.

NUVEEN DIVERSIFIED COMMODITY FUND

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

TABLE OF CONTENTS

| Page No. | ||||||

| Part I |

||||||

| Item 1. | 4 | |||||

| Item 1A. | 10 | |||||

| Item 1B. | 20 | |||||

| Item 2. | 20 | |||||

| Item 3. | 20 | |||||

| Item 4. | 20 | |||||

| Part II | ||||||

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 21 | ||||

| Item 6. | 23 | |||||

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 24 | ||||

| Item 7A. | 30 | |||||

| Item 8. | 34 | |||||

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 57 | ||||

| Item 9A. | 57 | |||||

| Item 9B. | 57 | |||||

| Part III |

||||||

| Item 10. | 58 | |||||

| Item 11. | 61 | |||||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 62 | ||||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence |

62 | ||||

| Item 14. | 62 | |||||

| Part IV | ||||||

| Item 15. | 64 | |||||

| Signatures | 65 | |||||

2

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING INFORMATION

This annual report on Form 10-K (the “Annual Report”) includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that involve substantial risks and uncertainties. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential” or the negative of these terms or other comparable terminology. These forward-looking statements are based on current expectations, estimates and projections and are subject to a number of risks, uncertainties and other factors, both known (such as those described in “Risk Factors” and elsewhere in this Annual Report) and unknown, that could cause the actual results, performance, prospects or opportunities of the registrant to differ materially from those expressed in, or implied by, these forward-looking statements.

You should not place undue reliance on any forward-looking statements. Except as expressly required by the federal securities laws or otherwise, the registrant undertakes no obligation to publicly update or revise any forward-looking statements or the risks, uncertainties or other factors described in this Annual Report, as a result of new information, future events or changed circumstances or for any other reason after the date of this Annual Report.

3

PART I

Organization

The Nuveen Diversified Commodity Fund (the “Fund”) was organized as a Delaware statutory trust on December 7, 2005, to operate as a commodity pool and commenced operations on September 27, 2010, with the public offering of 8,550,000 shares. The Fund operates pursuant to an Amended and Restated Trust Agreement (“Trust Agreement”). The Fund’s shares represent units of fractional undivided beneficial interest in, and ownership of, the Fund. Fund shares trade on the New York Stock Exchange Amex (“NYSE Amex”) under the ticker symbol “CFD.” The Fund is not a mutual fund, a closed-end fund, or any other type of “investment company” within the meaning of the Investment Company Act of 1940, as amended (the “1940 Act”), and is not subject to regulation thereunder.

Prior to its initial public offering, the Fund had no operations other than those related to organizational matters and the recording of organizational expenses ($597,000) and their reimbursement by Nuveen Investments, LLC, an affiliate of the Manager and a wholly-owned subsidiary of Nuveen Investments, Inc. (“Nuveen”). On May 11, 2010, the Fund received a $20,055 initial capital contribution from, and issued 840 shares to, Nuveen Commodities Asset Management, LLC, the Fund’s manager (“NCAM” or the “Manager”), a wholly-owned subsidiary of Nuveen. NCAM is a Delaware limited liability company registered as a commodity pool operator and commodity trading advisor with the Commodity Futures Trading Commission (the “CFTC”) and is a member of the National Futures Association (“NFA”). The Manager has the power and authority, without shareholder approval, to cause the Fund to issue shares from time to time as it deems necessary or desirable. The number of shares authorized is unlimited.

The Manager selected Gresham Investment Management LLC (“Gresham” or the “Commodity Sub-advisor”) to manage the Fund’s commodity investment strategy and its options strategy. Gresham is a Delaware limited liability company, the successor to Gresham Investment Management, Inc., formed in July 1992. Gresham is registered with the CFTC as a commodity trading advisor and commodity pool operator, is a member of the NFA and is registered with the Securities and Exchange Commission (“SEC”) as an investment adviser.

The Manager selected its affiliate, Nuveen Asset Management (the “Collateral Sub-advisor”), an affiliate of the Manager and a wholly-owned subsidiary of Nuveen, to invest the Fund’s collateral in short-term, high grade debt securities. Effective January 1, 2011, Nuveen Asset Management changed its name to Nuveen Fund Advisors, Inc. (“Nuveen Fund Advisors”). Concurrently, Nuveen Fund Advisors formed a wholly-owned subsidiary, Nuveen Asset Management, LLC, to house its portfolio management capabilities. Nuveen Asset Management, LLC now serves as the Fund’s Collateral Sub-advisor. Nuveen Asset Management, LLC is a Delaware limited liability company and is registered with the SEC as an investment adviser.

Investment Objective and Investment Strategy

The Fund’s investment objective is to generate higher risk-adjusted total return than leading commodity market benchmarks, specifically the Dow Jones-UBS Commodity Index® (“DJ-UBSCI”) and the S&P GSCI® Commodity Index (“GSCI”), and passively managed commodity funds. Risk-adjusted total return refers to the income and capital appreciation generated by a portfolio (the combination of which equals its total return) per unit of risk taken, with such risk measured by the volatility of the portfolio’s total returns over a specific period of time. In pursuing its investment objective, the Fund invests directly in a diversified portfolio of commodity futures and forward contracts to obtain broad exposure to all principal groups in the global commodity markets. The Fund’s investment strategy has three elements:

• An actively managed portfolio of commodity futures and forward contracts utilizing Gresham’s proprietary Tangible Asset Program (“TAP®”), a long-only rules-based commodity investment strategy designed to maintain consistent, fully collateralized exposure to commodities as an asset class;

4

• An integrated program of writing commodity call options designed to enhance the risk-adjusted total return of the Fund’s commodity investments (TAP® and the options strategy are collectively referred to as TAP PLUSSM); and

• A collateral portfolio of cash equivalents and short-term, high grade debt securities.

Commodity Investments. The Fund invests in a diversified portfolio of commodity futures and forward contracts pursuant to TAP®, an actively managed, fully collateralized, long-only, rules-based commodity investment strategy. TAP® is designed to maintain consistent, fully collateralized exposure to commodities as an asset class. “Fully collateralized” means that the Fund maintains as collateral high grade debt securities in an aggregate amount corresponding to the full notional value of its commodity investments. “Long-only, rules-based” means that the Fund holds it futures contracts until just before expiration pursuant to a set of clearly defined rules.

The Fund makes commodity investments in the six principal commodity groups in the global commodities markets:

| • | energy; |

| • | industrial metals; |

| • | agriculturals; |

| • | precious metals; |

| • | foods and fibers; and |

| • | livestock. |

Except for certain limitations described herein, there are no restrictions or limitations on the specific commodity contracts in which the Fund may invest. The specific commodities in which the Fund invests, and the relative target weighting of those commodities, are determined annually by the Commodity Sub-advisor. The target weights are expected to remain unchanged until the next annual determination. The Fund’s portfolio concentration in any single commodity or commodity group will be limited in an attempt to moderate volatility. Initially, the Fund intends to limit the target weightings of each commodity group such that no group’s target weighting may constitute more than 35% of TAP®, no two groups’ combined target weightings may constitute more than 60% of TAP® and no single commodity’s target weighting can constitute more than 70% of its group. Under normal market circumstances, the Commodity Sub-advisor avoids exercising discretion between such annual determinations. However, the actual portfolio weights may vary during the year and may in certain circumstances be rebalanced subject to TAP®’s rule-based procedures. The Commodity Sub-advisor may change the TAP® rules at year end and as a result may change the commodities it invests in. During temporary defensive periods or during adverse market circumstances, the Fund may deviate from its investment policies and objective. For TAP® target weightings as of December 31, 2010, see Item 7 of this Annual Report.

Gresham believes that the relative performance of strategies that invest in exchange-traded commodity futures and forward contracts may be enhanced through active implementation. Generally, the Fund expects to invest in short-term commodity futures and forward contracts with terms of one to three months but may invest in commodity contracts with terms of up to six months. Gresham regularly purchases and subsequently sells, i.e. “rolls,” individual commodity futures and forward contracts throughout the year so as to maintain a fully invested position. As the commodity contracts near their expiration dates, Gresham rolls them over into new contracts. Gresham seeks to add value compared with leading commodity market benchmarks and passively managed commodity funds by actively managing the implementation of the rolls of the commodity contracts. As a result, the roll dates, terms and contract prices selected by Gresham may vary based upon Gresham’s judgment of the relative value of different contract terms. Gresham’s active management approach is market driven and opportunistic and is intended to minimize market impact and avoid market congestion during certain days of the trading month.

5

Because the nature of the Fund’s investments in commodity futures and forward contracts does not require significant outlays of principal, less than 25% of the Fund’s net assets are committed to establishing those positions. In addition, the Fund expects that, if put options are purchased in the future, no more than 5% of the Fund’s net assets would be used to purchase commodity put options at any one time and that option premiums generated by the sale of call options on commodity futures and forward contracts would be sufficient to cover the premiums paid for those put options.

Most of the commodity futures and options contracts acquired to facilitate implementing the investment strategy are exchange listed and generally qualify as “Section 1256 Contracts” for tax purposes.

Options Strategy. Pursuant to the options strategy, the Fund writes “out-of-the-money” call options on individual futures and forward contracts held by it, on baskets of commodities or on broad-based commodity indices, such as the DJ-UBSCI or the GSCI, whose prices are expected to closely correspond to at least a substantial portion of the commodity futures and forward contracts held by the Fund. A call option gives its owner (buyer) the right but not the obligation to buy the underlying futures contract at a particular price, known as the strike price, at anytime between the purchase date and the expiration date of the option. The person who writes (sells) the option to the buyer is thus required to fulfill the contractual obligation (by selling the underlying futures contract to the buyer at the strike price) should the option be exercised. If the option is covered, the writer (seller) has an offsetting futures position. The Fund writes commodity call options that are U.S. exchange-traded and that are typically “American-style” (exercisable at any time prior to expiration). The Fund also writes commodity call options that are non-U.S. exchange traded and that are typically “European-style” (exercisable only at the time of expiration). The Fund may write commodity call options on a continual basis on up to approximately 50% of the notional value of each of its commodity futures and forward contract positions that, in Gresham’s determination, have sufficient option trading volume and liquidity. The Fund may write commodity call options with terms up to one year and with strike prices that may be up to 20% “out-of-the-money.” Generally, the Fund expects to write commodity call options with terms of one to three months. Subject to the foregoing limitations, the implementation of the options strategy is within Gresham’s discretion. Over extended periods of time, the term and “out of-the-moneyness” of the commodity options may vary significantly. While generating option premiums for the Fund, the call options will cause the Fund to forgo the right to any appreciation above the exercise price of the call options on the percentage of the notional value of the Fund’s long commodity positions covered by the call options. The Fund’s risk-adjusted return over any particular period may be positive or negative.

Collateral Investments. The Fund’s investments in commodity futures and forward contracts and options on commodity futures and forward contracts generally do not require significant outlays of principal. Approximately 25% of the Fund’s assets are committed as “initial” and “variation” margin to secure the long futures and forward contract positions. These assets are placed in one or more commodity futures accounts maintained by the Fund at Barclays Capital Inc. (“BCI”), the Fund’s clearing broker, and are held in cash or invested in U.S. Treasury bills and other direct or guaranteed debt obligations of the U.S. government maturing within less than one year at the time of investment. The remaining collateral (approximately 75%) is held in a separate collateral investment account managed by the Collateral Sub-advisor.

The Fund’s assets held in the Fund’s separate collateral account are invested in cash equivalents or short-term debt securities with final terms not exceeding one year at the time of investment. These collateral investments are rated at all times at the applicable highest short-term or long-term debt or deposit rating or money market fund rating as determined by at least one nationally recognized statistical rating organization (“NRSRO”) or, if unrated, are judged by the Collateral Sub-advisor to be of comparable quality. These collateral investments consist primarily of direct and guaranteed obligations of the U.S. Government and senior obligations of U.S. Government agencies and may also include, among others, money market funds and bank money market accounts invested in U.S. Government securities as well as repurchase agreements collateralized with U.S. Government securities.

6

Management of the Fund

Trustees

Wilmington Trust Company (the “Delaware Trustee”), a Delaware banking corporation, is the Delaware Trustee of the Fund. The Delaware Trustee is unaffiliated with the Manager. The Delaware Trustee’s duties and liabilities with respect to the Fund’s management are limited to its express obligations under the Trust Agreement. In particular, the Delaware Trustee will accept service of legal process on the Fund in the State of Delaware and will make certain filings as required under the Delaware Statutory Trust Act, as amended (the “Delaware Statutory Trust Act”). The rights and duties of the Delaware Trustee, the individual trustees, the Manager and the shareholders are governed by the provisions of the Delaware Statutory Trust Act and by the Trust Agreement. Except for the limited duties described herein and in the Trust Agreement, that are exercised by the Delaware Trustee and the individual trustees, all duties and responsibilities to manage the business and affairs of the Fund are vested in the Manager, pursuant to the Trust Agreement and Delaware Statutory Trust Act.

The individual trustees, all of whom are unaffiliated with the Manager, make up the audit committee and nominating committee of the Fund and meet the independent director requirements established by the NYSE Amex and the Sarbanes-Oxley Act of 2002, as amended. The individual trustees serve as the board of the Fund. Each of the individual trustees receives an annual retainer fee of $25,000 as well as reimbursement for travel and out of pocket expenses.

The board of the Fund has the right under limited circumstances to terminate the manager of the Fund only for cause. “Cause” consists of a statutory disqualification of the manager under Sections 8a(2) or 8a(3) of the Commodity Exchange Act, as amended (“CEA”), suspension or revocation of the manager’s commodity pool operator (“CPO”) or commodity trading advisor (“CTA”) registrations or the bankruptcy, insolvency or receivership of the manager. The audit committee is responsible for the appointment, compensation, retention and oversight of the work of the independent registered public accounting firm engaged by the Fund. The nominating committee is responsible for appointing individual trustees in the event of any vacancy caused by death, resignation or removal and determining their compensation. Other than the responsibilities mandated by the NYSE Amex, the individual trustees have limited authority and responsibilities, which are set forth under the Trust Agreement. The Manager is vested with authority under the Trust Agreement to manage the affairs of the Fund and to assure compliance by the Fund with its responsibilities under the CEA.

Manager

NCAM is the manager of the Fund, and is responsible for determining the Fund’s overall investment strategy and its implementation, including:

| • | the selection and ongoing monitoring of: |

| (a) | the Commodity Sub-advisor, which invests the Fund’s assets pursuant to TAP PLUSSM ; and |

| (b) | the Collateral Sub-advisor, which invests the Fund’s collateral in short-term, high grade debt securities; |

| • | assessment of performance and potential needs to modify strategy or change sub-advisors; |

| • | the management of the Fund’s business affairs; and |

| • | the provision of certain clerical, bookkeeping and other administrative services for the Fund. |

The Manager may change, or temporarily deviate from, the Fund’s investment strategy and the manner in which the strategy is implemented if the manager determines that it is in the best interests of Fund shareholders to do so

7

based on existing market conditions or otherwise. For instance, the Manager could change or deviate from the Fund’s investment strategy or the manner in which it is implemented if, among other things, the Manager determined to replace Gresham (in which case the Fund would no longer employ TAP® or TAP PLUSSM because TAP® and TAP PLUSSM are proprietary to Gresham), the commodity option markets experienced a lack of volatility or liquidity so that it was no longer in the best interest of the Fund and its shareholders for the Fund to employ the options strategy, or unforeseen circumstances arose that necessitated a change in the Fund’s strategy or its implementation. In addition, the Manager has the rights and obligations with respect to the Fund as described under the Trust Agreement.

The Manager is a wholly-owned subsidiary of Nuveen, a Delaware corporation. Founded in 1898, Nuveen and its affiliates had approximately $197 billion of assets under management as of December 31, 2010. Nuveen is a principal of the Manager.

The Manager is registered with the CFTC as a CTA (effective date of registration January 4, 2006) and as a CPO (effective date of registration January 4, 2006) and is a member of the NFA. The Manager has complete responsibility to ensure that the Fund complies with all obligations under the CEA.

Commodity Sub-advisor

The Manager selected Gresham to manage the assets of the Fund to be invested pursuant to TAP PLUSSM (TAP® plus the options strategy). Gresham is a Delaware limited liability company, the successor to Gresham Investment Management, Inc. formed in July 1992. Gresham is registered with the CFTC as a CTA (effective date of registration August 17, 1994) and as a CPO (effective date of registration August 17, 1994) and is a member of the NFA. Gresham also is registered with the SEC as an investment adviser. Gresham’s sole business activity is to render commodity investment advisory services and manage assets on behalf of its clients and in doing so it administers several commodity investment programs.

Gresham pursues the Fund’s investment objective by utilizing an actively-managed, fully collateralized, long-only, rules-based commodity investment strategy and an options strategy (together referred to as TAP PLUSSM). Gresham believes that commodities as an asset class are often under represented in the investment portfolios of individuals, and that maintaining consistent exposure to commodities may potentially add significant diversification benefits to an investor’s portfolio that is otherwise composed primarily of U.S equities and U.S. bonds.

Collateral Sub-advisor

The Manager selected Nuveen Asset Management to invest the Fund’s collateral (excluding the initial and variation margin maintained at BCI) in short-term, high grade debt securities. Effective January 1, 2011, Nuveen Asset Management changed its name to Nuveen Fund Advisors. Concurrently, Nuveen Fund Advisors formed a wholly-owned subsidiary, Nuveen Asset Management, LLC, to house its portfolio management capabilities. Nuveen Asset Management, LLC now serves as the Fund’s Collateral Sub-advisor. Douglas M. Baker continues to serve as the portfolio manager of the Fund’s collateral investments and has become an employee of Nuveen Asset Management, LLC. Nuveen Asset Management, LLC is a Delaware limited liability company and is registered with the SEC as an investment adviser. Founded in 1898, Nuveen and its affiliates had approximately $197 billion in assets under management as of December 31, 2010, of which approximately $109 billion was managed by the Collateral Sub-advisor.

The Collateral Sub-advisor invests the Fund’s collateral not otherwise held in a margin account by BCI using a short-term, near-cash, fixed-income strategy. The Collateral Sub-advisor emphasizes current income, liquidity and preservation of capital. As a result, the Fund maintains significant collateral that is invested in short-term debt securities with maturities up to one year that, at the time of investment, are of high grade quality, including

8

obligations issued or guaranteed by the U.S. government, its agencies and instrumentalities and corporate obligations. A debt instrument is considered of high grade quality if it is rated AA or better by at least one of the NRSROs that rate such instrument (even if rated lower by another), or it is unrated by any NRSRO but judged to be of comparable quality by the Collateral Sub-advisor.

Management Fees

For the services and facilities provided by the Manager, the Fund has agreed to pay the Manager an annual fee, payable monthly, based on the Fund’s average daily net assets, according to the following schedule:

| Average Daily Net Assets |

Management Fee | |||

| Up to $500 million |

1.250 | % | ||

| $500 million to $1 billion |

1.225 | % | ||

| $1 billion to $1.5 billion |

1.200 | % | ||

| $1.5 billion to $2 billion |

1.175 | % | ||

| $2 billion and over |

1.150 | % | ||

Pursuant to an agreement among the Manager, the Fund and the Commodity Sub-advisor, the Commodity Sub-advisor receives from the Manager a fee of .35% based on the Fund’s average daily net assets, payable on a monthly basis.

Pursuant to an agreement among the Manager, the Fund and the Collateral Sub-advisor, the Collateral Sub-advisor receives from the Manager a fee based on the Fund’s average daily net assets, payable on a monthly basis as follows:

| Average Daily Net Assets |

Management Fee | |||

| Up to $500 million |

.3000 | % | ||

| $500 million to $1 billion |

.2875 | % | ||

| $1 billion to $1.5 billion |

.2750 | % | ||

| $1.5 billion to $2 billion |

.2625 | % | ||

| $2 billion and over |

.2500 | % | ||

“Average daily net assets” means the total assets of the Fund, minus the sum of its liabilities.

In addition to the fee of the Manager, the Fund pays all other costs and expenses of its operations, including custody fees, transfer agent expenses, legal fees, expenses of independent auditors, expenses of preparing, printing and distributing reports, notices, information statements, proxy statements, reports to governmental agencies, and taxes, if any.

The agreements with each of the Sub-advisors may be terminated at any time, without penalty, by either the Manager or a sub-advisor upon 120 days written notice. Also, the agreement with the Commodity Sub-advisor can be terminated by the Commodity Sub-advisor in certain circumstances on 90 days notice. Each of the agreements provides that the sub-advisor will not be liable to the Fund in connection with the performance of its duties, and the Fund will indemnify the sub-advisor for losses and costs arising out of its status as a sub-advisor to the Fund if the sub-advisor acted in good faith and in a manner it reasonably believed to be in or not opposed to the best interests of the Fund, except, in each case, for a loss resulting from the sub-advisor’s willful misfeasance, bad faith or gross negligence or reckless disregard of its duties and obligations under the agreement. The sub-advisor will indemnify the Fund and the Manager for losses and costs attributable to such willful misfeasance, bad faith or gross negligence or reckless disregard.

9

If the Manager determines it is in the best interests of shareholders to select additional CTAs or replace a sub-advisor, the Manager will consider certain information with respect to each new CTA, including the following:

| • | general information including the identity of its affiliates and key personnel; |

| • | investment strategy and risk management of the CTA; |

| • | the CTA’s financial condition; |

| • | relevant performance history and the quality of services provided; |

| • | fees and expenses; and |

| • | capacity to take on new business. |

None of the foregoing agreements, or any extensions or replacements of such agreements, are subject to the approval of the Fund’s trustees or shareholders. As a result, the Manager may amend, extend or replace any such agreement in its sole discretion, and therefore may increase the fees of the Manager and either sub-advisor without any trustee or shareholder approval.

Employees

The Fund has no employees.

Available Information

The Fund files with or submits to the SEC annual and quarterly reports and other information meeting the information requirements pursuant to Section 13(a) and 15(d) of the Exchange Act. These reports are available on the Fund’s website at http://www.nuveen.com/CommodityInvestments. Investors may also inspect and copy any materials the Fund files with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. Investors may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet site that contains reports, proxy and information statements and other information filed electronically with the SEC which are available on the SEC’s Internet site at http://www.sec.gov. The Fund also posts on its website an information statement and certain daily and monthly reports required by CFTC regulations.

An investment in shares of the Fund involves a high degree of risk. Investors should consider carefully all of the risks described below, together with the other information contained in this Annual Report and the Fund’s other filings with the SEC. If any of the following risks occur, the business, financial condition and results of operations of the Fund may be adversely affected.

Commodity Investment Strategy Risks

Your investment may lose value—An investment in the Fund’s shares is subject to investment risk, including the possible loss of the entire amount that you invest. An investment in the Fund’s shares represents an indirect investment in the commodity futures and forward contracts owned by the Fund, the prices of which can be volatile, particularly over short time periods. Investments in individual commodity futures and forward contracts historically have had a high degree of price variability and may be subject to rapid and substantial changes. The Fund could incur significant losses on its investments in those commodity futures and forward contracts. If the Fund experiences in the aggregate more losses than gains during the period you hold shares, you will experience

10

a loss for the period even if the Fund’s historical performance is positive. Movements in commodity investment prices are outside of the Fund’s control and may not be anticipated by the Commodity Sub-advisor. Price movements may be influenced by, among other things:

| • | governmental, agricultural, trade, fiscal, monetary and exchange control programs and policies; |

| • | weather and climate conditions; |

| • | changing supply and demand relationships; |

| • | changes in international balances of payments and trade; |

| • | U.S. and international rates of inflation; |

| • | currency devaluations and revaluations; |

| • | U.S. and international political and economic events; |

| • | changes in interest and foreign currency/exchange rates; |

| • | market liquidity; and |

| • | changes in philosophies and emotions of market participants. |

The changing interests of investors, hedgers and speculators in the commodity markets may influence whether futures prices are above or below the expected future spot price—In order to induce investors or speculators to take the corresponding long side of a futures contract, commodity producers must be willing to sell futures contracts at prices that are below the present value of expected future spot prices. Conversely, if the predominant participants in the futures market are the ultimate purchasers of the underlying commodity futures contracts in order to hedge against a rise in prices, then speculators should only take the short side of the futures contract if the futures price is greater than the present value of the expected future spot price of the commodity. This can have significant implications for the Fund when it is time to reinvest the proceeds from a maturing futures contract into a new futures contract. If the interests of investors, hedgers and speculators in futures markets have shifted such that commodity purchasers are the predominant participants in the market, the Fund will be constrained to reinvest at higher futures prices which could have a negative effect on the Fund’s returns.

Regulatory developments could significantly and adversely affect the Fund—Commodity markets are subject to comprehensive statutes, regulations and margin requirements. Recent legislation has created a new multi-tiered structure of exchanges in the U.S. subject to varying degrees of regulation, and rules and interpretations regarding various aspects of this regulatory structure have only recently been finalized. Traditional futures exchanges, which are called designated contract markets, are subject to more streamlined and flexible core principles rather than the prior statutory and regulatory mandates. However, with respect to these traditional futures exchanges, the CFTC and the exchanges are authorized to take extraordinary actions in the event of a market emergency, including, for example, the retroactive implementation of speculative position limits or higher margin requirements, the establishment of daily limits and the suspension of trading. Any of these actions, if taken, could adversely affect the returns of the Fund by limiting or precluding investment decisions the Fund might otherwise make. The regulation of commodity transactions in the U.S. is a rapidly changing area of law and is subject to ongoing modification by government and judicial action. In addition, various national governments have expressed concern regarding the disruptive effects of speculative trading in the currency markets and the need to regulate the derivatives markets in general. The effect of any future regulatory change on the Fund is impossible to predict, but could be substantial and adverse to the Fund.

Changing regulatory environment—The CFTC has recently withdrawn relief previously granted to Gresham concerning position limits with respect to certain agricultural commodities (soybeans, corn and wheat) in which

11

Gresham invests under TAP®. The effect of such withdrawal is that, beginning January 15, 2010, Gresham became subject to the same position limit rules as other investors. Gresham has taken steps to mitigate the potential risks associated with becoming subject to such limits (including expanding the number of exchanges on which it trades). However, the CFTC has recently announced a proposal to set aggregate position limits on contracts in certain energy commodities, irrespective of the exchange on which a contract is traded, which would adversely impact the effectiveness of the mitigating efforts of the Commodity Sub-advisor. Any position limits established by the CFTC or the exchanges may in the future restrict the full implementation of the Fund’s investment strategy and result in substantial losses on your investment.

Any deflation or reduced inflation may negatively affect the expected future spot price of underlying commodities—Deflation or a reduced rate of inflation may result in a decrease in the future spot price of the underlying commodities, negatively affecting the Fund’s profitability and resulting in potential losses. In addition, reduced economic growth may lead to reduced demand for the underlying commodities and put downward pressure on the future spot prices, adversely affecting the Fund’s operations and profitability. Although the Manager and the Commodity Sub-advisor believe that the Fund’s options strategy can provide the potential for current gains from option premiums, in up markets the Fund will forego potential appreciation in the value of the underlying contracts to the extent the price of those contracts exceeds the exercise price of options written by the Fund plus the premium collected by writing the call options.

Options Strategy Risks

There can be no assurance that the Fund’s options strategy will be successful—The Fund uses options on commodity futures and forward contracts to enhance the Fund’s risk-adjusted total returns. The Fund may seek to protect its commodity futures and forward contracts positions in the event of a market decline in those positions by purchasing commodity put options that are “out-of-the money.” The Fund’s use of options, however, may not provide any, or only partial, protection for modest market declines. In addition, the return performance of the Fund’s commodity futures and forward contracts may not parallel the performance of the commodities or indices that serve as the basis for the options bought or sold by the Fund; this basis risk may reduce the Fund’s overall returns. Purchasing or writing options is volatile and requires an accurate assessment of the market and the underlying instrument. Factors such as increased or reduced volatility, limited dollar value traded and timing of placing and executing orders may preclude the Fund from achieving the desired results of the options strategy and could affect the Fund’s ability to generate income and gains and limit losses.

The Fund may forego price appreciation above the option exercise price on up to approximately 50% of its commodity futures and forward contracts as a result of writing “out-of-the-money” commodity call options—The Fund writes commodity call options with terms up to one year that may be up to 20% “out-of-the-money” on a continual basis on up to approximately 50% of the notional value of each of its commodity futures and forward contract positions that, in Gresham’s determination, have sufficient option trading volume and liquidity. The Fund sells commodity call options on approximately 50% of the notional value of its commodity futures and forward contract positions. As the writer of a call option, the Fund sells, in exchange for receipt of a premium, the right to any appreciation in the value of the futures or forward contract over a fixed price on or before a certain date in the future. Accordingly, the Fund is effectively limiting its potential for appreciation to the amount the option is “out-of-the-money” during the term of the option on up to approximately 50% of the notional value of its portfolio invested in commodity futures and forward contract positions. As commodity prices change, an option that was “out-of-the-money” when written may subsequently become “in-the-money.”

The Fund may incur put premium costs without benefiting from its investment in commodity put options—Although the Fund does not currently intend to do so, in the future the Fund may purchase commodity put options on all or substantially all of the notional value of its commodity futures and forward contract positions. As a holder of a put option, the Fund, in exchange for payment of a premium, has the right to receive from the seller of the commodity put option, if the current price is lower than the exercise price, the difference between the put exercise price and the current price of the underlying commodity futures or forward contract on or before

12

a specified date (in the case of “American-style” options, on or before the date of exercise or, in the case of “European-style” options, at the exercise date). If the price of the commodity futures or forward contract is greater than the exercise price of the put option upon expiration, then the Fund will have incurred the cost of the option but not have received any benefit from its purchase. In addition, because the Fund generally will purchase commodity put options that are substantially “out-of-the-money,” at the time of purchase, the Fund will not be protected against, and will bear the loss associated with, a market decline down to the exercise price of the option.

Risk that the Fund’s Shares May Trade at a Discount to Net Asset Value

There is a risk that the Fund’s shares may trade at prices other than the Fund’s net asset value per share—The net asset value of each share will change as fluctuations occur in the market value of the Fund’s portfolio. Investors should be aware that the public trading price of a share may be different from the net asset value of a share. The price difference may be due, in large part, to the fact that supply and demand forces at work in the secondary trading market for shares may be related to, but are not identical to, the forces influencing the prices of the commodity futures and forward contracts and other instruments held by the Fund at any point in time.

Risks Related to an Exchange Listing

The NYSE Amex may halt trading in the shares which would adversely impact your ability to sell shares—The Fund’s shares are listed on the NYSE Amex under the market symbol CFD. Trading in shares may be halted due to market conditions or, in light of the NYSE Amex rules and procedures, for reasons that, in the view of the NYSE Amex, make trading in shares inadvisable. In addition, trading is subject to trading halts caused by extraordinary market volatility pursuant to “circuit breaker” rules that require trading to be halted for a specified period based on a specified market decline. There can be no assurance that the requirements necessary to maintain the listing of the shares will continue to be met or will remain unchanged.

The lack of an active trading market for shares may result in losses on your investment at the time of disposition of your shares—There can be no guarantee that an active trading market for the shares will be maintained. If you need to sell your shares at a time when no active market for them exists, the price you receive for your shares, assuming that you are able to sell them, likely will be lower than that you would receive if an active market did exist.

Commodity Sub-advisor Risks

Gresham utilizes a strategy for the Fund that differs from the strategy on which its historical performance record is based—Gresham’s historical performance record (as presented in the Fund’s information statement posted on its website) reflects the use of TAP®, not TAP PLUSSM. Before the Fund’s initial public offering, Gresham had not previously employed TAP PLUSSM (TAP® plus the options strategy) for the accounts of clients and, as a result, its historical performance record is not based on an investment approach that is identical to the investment approach used for the Fund. TAP PLUSSM is designed to enhance the Fund’s risk-adjusted total returns, which may have the effect of limiting the level of gains or losses that the Fund otherwise would achieve. Therefore, Gresham’s historical performance record for TAP® is not as relevant to investors in the Fund as it would be if Gresham were using only TAP® in investing for the Fund.

Past performance is no assurance of future results—Gresham bases its investment decisions on three inputs: (i) systematic calculations of the values of global commodity production; (ii) total U.S. dollar trading volume on commodity futures and forwards exchanges and (iii) global import/export trade values. Any subsequent commodity sub-advisor to the Fund may employ a different commodity investment strategy. Neither Gresham’s systematic methodology nor the investment methodology that may be used by any subsequent commodity sub-advisors take into account unanticipated world events that may cause losses to the Fund. Past performance does not assure future results.

13

Descriptions of the Commodity Sub-advisor’s strategies may not be applicable in the future—The Commodity Sub-advisor or any subsequent commodity sub-advisor may make material changes to the investment strategy it uses in investing the Fund’s assets with the consent of the Manager, who has the sole authority to authorize any material changes. If this happens, the descriptions in this document would no longer be accurate or useful. The Manager does not anticipate that this will occur frequently, if at all. You will be informed of any changes to the Commodity Sub-advisor’s strategy that the Manager deems to be material; however, you may not be notified until after a change occurs. Non-material changes may be made by the Commodity Sub-advisor or any subsequent commodity sub-advisor without the Manager’s consent. These changes may nevertheless affect the Fund’s performance.

Speculative position limits and daily trading limits may reduce profitability and result in substantial losses—The CFTC and U.S. commodities exchanges limit the amount of fluctuation permitted in futures contract prices during a single trading day by regulations referred to as “daily price fluctuation limits” or “daily trading limits.” Once the daily trading limit has been reached in a particular futures contract, no trades may be made that day at a price beyond that limit or trading may be suspended for specified periods during the trading day. Futures contract prices could move to the limit for several consecutive trading days with little or no trading, thereby preventing prompt liquidation of futures positions and potentially disguising substantial losses the Fund may ultimately incur.

Separately, the CFTC and the U.S. commodity exchanges and certain non-U.S. exchanges have established limits referred to as “speculative position limits” or “accountability levels” on the maximum net long or short futures positions that any person may hold or control in contracts traded on such exchanges. All accounts owned or managed by commodity trading advisors, such as the Commodity Sub-advisor, their principals and their affiliates are typically combined for speculative position limit purposes.

The Commodity Sub-advisor may, in the future, reduce the size of positions that would otherwise be taken for the Fund or not trade in certain markets on behalf of the Fund in order to avoid exceeding such limits. Modification of trades that would otherwise be made by the Fund, if required, could adversely affect the Fund’s operations and profitability by increasing potential transaction costs. In addition, a violation of speculative position limits by the Commodity Sub-advisor could lead to regulatory or self-regulatory action resulting in mandatory liquidation of certain positions held by the Commodity Sub-advisor on behalf of its accounts. There can be no assurance that the Commodity Sub-advisor will liquidate positions held on behalf of all the Commodity Sub-advisor’s accounts, including the Commodity Sub-advisor’s own accounts, in a proportionate manner. In the event the Commodity Sub-advisor chooses to liquidate a disproportionate number of positions held on behalf of the Fund at unfavorable prices, the Fund may incur substantial losses.

The Fund may apply to the CFTC or to the relevant exchange, as appropriate, for relief from certain speculative position limits. If the Fund applies and is unable to obtain such relief, the Fund’s ability to reinvest income in additional commodities contracts and ability to implement its investment strategies may be limited to the extent these activities would cause the Fund to exceed applicable speculative position limits, limiting potential profitability.

Increased competition could reduce the profitability of the Commodity Sub-advisor’s strategy—The Commodity Sub-advisor believes that there has been, over time, an increase in interest in commodity investing. As Gresham’s capital under management increases, an increasing number of traders may attempt to initiate or liquidate substantial positions at or about the same time as the Commodity Sub-advisor, or otherwise alter historical trading patterns or affect the execution of trades, to the detriment of the Fund.

Other Risks of the Fund’s Investment Strategy

There may be a loss on investments in short-term debt securities—When the Fund purchases a futures contract, the Fund is required to deposit with its futures commission merchant only a portion of the value of the contract. This deposit is known as “initial margin.” If and when the market moves against the position, the Fund is

14

required to make additional deposits known as “variation margin.” The Fund invests its assets, other than the amount of margin required to be maintained by the Fund, in short-term, high grade debt securities. The value of these high grade debt securities generally moves inversely with movements in interest rates (declining as interest rates rise). The value of these high grade debt securities might also decline if the credit quality of the issuer deteriorates, or if the issuer defaults on its obligations. If the Fund is required to sell short-term debt securities before they mature when the value of the securities has declined, the Fund will realize a loss. This loss may adversely impact the price of the Fund’s shares.

Daily disclosure of portfolio holdings could allow replication of the Fund’s portfolio and could have a negative effect on the Fund’s holdings—Because the Fund’s total portfolio holdings are disclosed on a daily basis, other investors may attempt to replicate the Fund’s portfolio or otherwise use the information in a manner that could have a negative effect on the Fund’s individual portfolio holdings and the Fund’s portfolio as a whole.

Certain of the Fund’s investments may become illiquid—The Fund may not always be able to liquidate its investments at the desired price. It is difficult to execute a trade at a specific price when there is a relatively small volume of buy and sell orders in a market. A market disruption, such as a foreign government taking political actions that disrupt the market in its currency or in a major export, can also make it difficult to liquidate a position. Alternatively, limits imposed by futures exchanges or other regulatory organizations, such as speculative position limits and daily price fluctuation limits, may contribute to a lack of liquidity with respect to some commodity investments.

Unexpected market illiquidity may cause losses to investors. The large stated value of the investments that the Commodity Sub-advisor acquires for the Fund increases the risk of illiquidity.

An investment in the Fund may not necessarily diversify an investor’s overall portfolio—Historically, the investment performance of commodities has shown a low correlation to the performance of other asset classes such as equities and U.S. bonds. Low correlation means that there is a low statistical relationship between the performance of commodity investments, on the one hand, and equities and U.S. bonds, on the other hand. Because this historical negative correlation is low, the Fund cannot be expected to be automatically profitable during unfavorable periods in the stock or bond markets, or vice versa. If, during a particular period of time, the Fund’s performance moves in the same general direction as the other financial markets or the Fund does not perform successfully relative to overall commodity markets, you may obtain little or no diversification benefits during that period from an investment in the Fund’s shares. In such a case, the Fund may have no gains to offset your losses from such other investments, and you may suffer losses on your investment in the Fund at the same time losses on your other investments are increasing.

Because the futures contracts have no intrinsic value, the positive performance of your investment is wholly dependent upon an equal and offsetting loss—Futures trading is a risk transfer economic activity. For every gain there is an equal and offsetting loss rather than an opportunity to participate over time in general economic growth. Unlike most alternative investments, an investment in shares of the Fund does not involve acquiring any asset with intrinsic value. Overall stock and bond prices could rise significantly and the economy as a whole prosper while shares of the Fund trade unprofitably.

Risk of Investing in Non-U.S. Markets

Investing in non-U.S. markets will expose the Fund to additional credit and regulatory risk—The Fund currently expects that up to 30% of its net assets invested in commodity futures and forward contracts and options on commodity futures and forward contracts may be in non-U.S. markets. Some non-U.S. markets present risks because they are not subject to the same degree of regulation as their U.S. counterparts. None of the SEC, CFTC, NFA, or any domestic exchange regulates activities of any foreign boards of trade or exchanges, including the execution, delivery and clearing of transactions, nor has the power to compel enforcement of the

15

rules of a foreign board of trade or exchange or of any applicable non-U.S. laws. Similarly, the rights of market participants, such as the Fund, in the event of the insolvency or bankruptcy of a non-U.S. market or broker are also likely to be more limited than in the case of U.S. markets or brokers. As a result, in these markets, the Fund would have less legal and regulatory protection than it does when it invests domestically.

Investing through non-U.S. exchanges is subject to the risks presented by exchange controls, expropriation, increased tax burdens and exposure to local economic declines and political instability. An adverse development with respect to any of these variables could reduce the profit or increase the loss on investments of the Fund in the affected international markets.

The Fund’s non-U.S. investments may be exposed to losses resulting from non-U.S. exchanges that are less developed or less reliable than U.S. exchanges—Some non-U.S. commodity exchanges may be in a more developmental stage than U.S. exchanges, so that prior price histories may not be indicative of current price dynamics. In addition, the Fund may not have the same access to certain contracts on foreign exchanges as do local traders, and the historical market data on which the Commodity Sub-advisor bases its strategies may not be as reliable or accessible as it is in the U.S. All of these factors could adversely affect the performance of the Fund.

Regulatory and Operating Risks

The Fund is not a regulated investment company—Unlike other Nuveen-sponsored funds, the Fund is not a mutual fund, a closed-end fund, or any other type of investment company within the meaning of the 1940 Act. Accordingly, you do not have the protections afforded by that statute which, among other things, regulates the relationship between the investment company and its investment adviser and mandates certain authority to be held by the board of directors of an investment company.

The Fund has no significant operating history—The Fund has a very brief operating history. Therefore, there is not sufficient performance history of the Fund to serve as a basis for you to evaluate an investment in the Fund.

Manager and Commodity Sub-advisor experience—The Manager has not previously operated a commodity pool or selected a commodity trading advisor. While the Commodity Sub-advisor has previously managed assets pursuant to TAP®, it had never employed TAP PLUSSM when managing assets for clients prior to the Fund’s initial public offering. Neither the Manager nor any of its trading principals has previously operated any other pools or traded any other accounts.

Conflicts of interest could adversely affect the Fund—There are conflicts of interest in the structure and operation of the Fund. The Manager has sole authority to manage the Fund, and its interests may conflict with those of Fund shareholders. In addition, the Collateral Sub-advisor is an affiliate of the Manager. Neither the Fund, the Manager, nor the Sub-advisors have established formal procedures to resolve potential conflicts of interest related to managing the investments and operations of the Fund. Each sub-advisor may encounter conflicts between the interests of the Fund and its other clients. Each of the Manager and the Sub-advisors resolve conflicts of interest as they arise based on its judgment and analysis of the particular issue. There are no formal procedures to resolve conflicts of interest and as a result, the Manager and/or the Sub-advisors could resolve a potential conflict in a manner that is not in the best interest of the Fund or its shareholders.

Departure of key personnel could adversely affect the Fund—In managing and directing the Fund’s day-to-day activities and affairs, the Manager relies heavily on Gresham and in particular on Jonathan S. Spencer, Douglas J. Hepworth and Dr. Henry G. Jarecki. If those individuals were to leave or be unable to carry out their present responsibilities, it may have an adverse effect on the Fund’s management. In addition, should market conditions deteriorate or for other reasons, Nuveen, NCAM, the Collateral Sub-advisor and the Commodity Sub-advisor may need to implement cost reductions in the future which could make the retention of qualified and experienced personnel more difficult and could lead to personnel turnover.

16

Reliance on affiliates of Nuveen—The Fund is dependent upon services and resources provided by its Manager and Collateral Sub-advisor and their parent Nuveen. Nuveen has a substantial amount of indebtedness. Nuveen, through its own business or the financial support of its affiliates, may not be able to generate sufficient cash flow from operations or ensure that future borrowings will be available in an amount sufficient to enable it to pay its indebtedness, with scheduled maturities beginning in 2014, or to fund its other liquidity needs. Nuveen’s failure to satisfy the terms of its indebtedness, including covenants therein, may generally have an adverse affect on the financial condition of Nuveen.

Shareholders have limited voting rights, and the individual trustees have limited duties and powers, and neither will be able to affect management of the Fund regardless of performance—Unlike the holder of capital stock in an investment company, Fund shareholders have limited voting rights or other means to control or affect the Fund’s business. In addition, the powers and duties of the individual trustees are very limited. The individual trustees’ sole powers are (i) to terminate for cause the Manager of the Fund (which, under the Trust Agreement, will automatically cause the Fund to terminate and be liquidated if at the time there is not a remaining manager and shareholders have not voted to elect a replacement manager), and (ii) to serve as the audit committee and nominating committee of the Fund. The individual trustees of the Fund, unlike the board of directors of an investment company, do not have the power to cause the Fund to change its investment objective or policies, effect changes to operations, approve the advisory fees of the Manager or replace the Manager or Sub-advisors. Rather, the power to determine the Fund’s policies and direct its operations is conferred on the Manager. Thus, the Fund shareholders do not benefit from the protection of their interests afforded to registered investment companies under the 1940 Act through the existence of an independent board of directors with extensive powers to control the operations of the company. Therefore, the shareholders to a large extent are dependent on the abilities, judgment and good faith of the Manager in exercising its wide-ranging powers over the Fund, limited solely by the implied covenant of good faith and fair dealing applicable to the Manager in its relations with the Fund and its shareholders. If the Manager voluntarily withdraws or is removed by a vote of shareholders and shareholders have not voted to elect a replacement manager, the Fund will terminate and will liquidate its assets.

The Manager may not be removed as manager by Fund shareholders except upon approval by the affirmative vote of the holders of at least 50% of the outstanding shares (excluding shares owned by the Manager and its affiliates), subject to the satisfaction of certain conditions. Any removal of the Manager by Fund shareholders or by the individual trustees (upon 90 days written notice and under certain limited circumstances) will result in the liquidation of the Fund if at the time there is not a remaining manager unless a successor manager is appointed as provided in the Trust Agreement.

Thus, it is extremely unlikely that Fund shareholders will be able to make any changes in the management of the Fund, even if performance is poor.

Fees and expenses are charged regardless of profitability and may result in depletion of assets—The Fund pays brokerage commissions, over-the-counter dealer spreads, management fees and operating and extraordinary expenses, in all cases regardless of whether the Fund’s activities are profitable. The expenses of the Fund could, over time, result in significant losses to your investment. You may not achieve profits, significant or otherwise.

The value of the shares may be adversely affected if the Fund is required to indemnify the individual trustees or the Manager—Under the Trust Agreement, each of the individual trustees and the Manager has the right to be indemnified for any liability or expense it incurs absent actual fraud or willful misconduct. That means that the Manager may require the assets of the Fund to be sold in order to cover losses or liability suffered by it or by the individual trustees. Any sale of that kind would reduce the net asset value of the Fund and the value of the shares.

The failure or bankruptcy of one of its clearing brokers could result in a substantial loss of Fund assets—Under CFTC regulations, a clearing broker maintains customers’ assets in a bulk segregated account. If a clearing broker fails to do so, or is unable to satisfy a substantial deficit in a customer account, its other customers may be subject to risk of loss of their funds in the event of that clearing broker’s bankruptcy. In that

17

event, the clearing broker’s customers, such as the Fund, are entitled to recover, even in respect of property specifically traceable to them, only a proportional share of all property available for distribution to all of that clearing broker’s customers. The Fund also may be subject to the risk of the failure of, or delay in performance by, any exchanges and their clearing organizations, if any, on which commodity interest contracts are traded.

The clearing brokers may be subject to legal or regulatory proceedings in the ordinary course of their business. A clearing broker’s involvement in costly or time-consuming legal proceedings may divert financial resources or personnel away from the clearing broker’s trading operations, which could impair the clearing broker’s ability to successfully execute and clear the Fund’s trades.

An investment in the shares may be adversely affected by competition from other methods of investing in commodities—The Fund constitutes a new, and thus untested, type of investment methodology. It competes with other financial vehicles, including other commodity pools, hedge funds, traditional debt and equity securities issued by companies in the commodities industry, other securities backed by or linked to such commodities, and direct investments in the underlying commodities or commodity futures contracts. Market and financial conditions, and other conditions beyond the Manager’s or Commodity Sub-advisor’s control, may make it more attractive to invest in other financial vehicles or to invest in such commodities directly, which could limit the market for the shares.

Commodity market volatility risk—The commodity markets have experienced periods of extreme volatility since the latter half of 2007. General market uncertainty and consequent repricing risk have led to market imbalances of sellers and buyers, which in turn have resulted in significant reductions in values of a variety of commodities. Similar future market conditions may result in rapid and substantial valuation increases or decreases in the Fund’s holdings. In addition, volatility in the commodity and securities markets may directly and adversely affect the setting of distribution rates on the Fund’s shares.

The Fund has not been subject to independent review or review on your behalf—Shareholders do not have legal counsel representing them in connection with the Fund. Accordingly, a shareholder should consult its legal, tax and financial advisers regarding the desirability of investing in the Fund shares. As previously noted, you cannot predict the expected results of this Fund from the performance history of other accounts managed by the Commodity Sub-advisor.

Deregistration of the Manager or Sub-advisors could disrupt operations—The Manager and the Commodity Sub-advisor are registered commodity pool operators and registered commodity trading advisors. If the CFTC were to terminate, suspend, revoke or not renew the Manager’s registrations, the Manager would be compelled to withdraw as the Fund’s Manager. The shareholders would then determine whether to select a replacement manager or to dissolve the Fund. If the CFTC and/or the SEC were to terminate, suspend, revoke or not renew either of the Sub-advisor’s registrations, the Manager would terminate the management agreement with that sub-advisor. The Manager could choose to appoint a new sub-advisor or terminate the Fund. No action is currently pending or threatened against the Manager, the Commodity Sub-advisor or the Collateral Sub-advisor.

The Fund’s distribution policy may change at any time—Distributions paid by the Fund to its shareholders are derived from the current income and gains from the Fund’s portfolio investments and the options strategy, but to the extent such current income and gains are not sufficient to pay distributions, the Fund’s distributions may represent a return of capital. The total return generated by the Fund’s investments can vary widely over the short term and long term and the Fund may liquidate investments in order to make distributions. The timing and terms of any such liquidation could be disadvantageous to the Fund. The Fund reserves the right to change its distribution policy and the basis for establishing the rate of its monthly distributions, or may temporarily suspend or reduce distributions without a change in policy, at any time and may do so without prior notice to shareholders.

18

Tax Risk

Your tax liability may exceed cash distributions—You will be taxed on your share of the Fund’s taxable income and gain each year, regardless of whether you receive any cash distributions from the Fund. Your share of such income or gain, as well as the tax liability generated by such income or gain, may exceed the distributions you receive from the Fund for the year.

You could owe tax on your share of the Fund’s ordinary income despite overall losses—Gain or loss on futures and forward contracts and options on futures and forward contracts will generally be taxed as capital gains or losses for U.S. federal income tax purposes. Interest income is ordinary income. In the case of an individual, capital losses can only be used to offset capital gains plus $3,000 ($1,500 in the case of a married taxpayer filing a separate return) of ordinary income each year. Therefore, you may be required to pay tax on your allocable share of the Fund’s ordinary income, even though the Fund incurs overall losses.

Certain Fund expenses may be treated as miscellaneous itemized deductions rather than as deductible ordinary and necessary business expenses—Certain expenses incurred by the Fund may be treated as miscellaneous itemized deductions for federal income tax purposes, rather than as deductible ordinary and necessary business expenses, with the result that shareholders who are individuals, trusts, or estates may be subject to limitations on the deductibility of their allocable share of such expenses.

Tax-exempt investors may recognize unrelated business taxable income with respect to their investment in the Fund—Persons that are otherwise exempt from federal tax may be allocated unrelated business taxable income as a result of their investment in the Fund. In particular, for charitable remainder trusts, investment in the Fund may not be appropriate.

Non-U.S. investors may face U.S. tax consequences—Non-U.S. investors should consult their own tax advisors concerning the applicable foreign as well as the U.S. tax implications of an investment in the Fund. Non-U.S. investors may also be subject to special withholding tax provisions if they fail to furnish the Fund (or another appropriate person) with a timely and properly completed Form W-8BEN or other applicable form.

If the IRS treated the Fund as a corporation for tax purposes, it would adversely affect distributions to shareholders—Based upon the continued accuracy of the representations of the Manager, the Fund believes that under current law and regulations it will be classified as a partnership for federal income tax purposes. However, the Fund has not requested, nor will it request, any ruling from the Internal Revenue Service (“IRS”) as to this status. In addition, you cannot be sure that those representations will continue to be accurate. If the IRS were to challenge the federal income tax status of the Fund, such a challenge could result in (i) an audit of each shareholder’s entire tax return and (ii) adjustments to items on that return that are unrelated to the ownership of shares. In addition, each shareholder would bear the cost of any expenses incurred in connection with an examination of its personal tax return.

If the Fund were taxable as a corporation for federal income tax purposes in any taxable year, its income, gains, losses and deductions would be reflected on its own tax return rather than being passed through to shareholders, and it would become subject to an entity-level income tax on its net income at corporate rates. This would adversely affect the Fund’s overall performance and ability to make distributions. In addition, some or all of the distributions made to shareholders, which would have been reduced as a result of the federal, state and local taxes paid by the Fund, would be classified as dividend income to the extent of the Fund’s current or accumulated tax basis earnings and profits.

Items of income, gain, deduction, loss and credit with respect to Fund shares could be reallocated if the IRS does not accept the conventions used by the Fund in allocating Fund tax items—U.S. federal income tax rules applicable to partnerships are complex and often difficult to apply to widely held partnerships. The Fund will apply certain conventions in an attempt to comply with applicable rules and to report income, gain, deduction,

19

loss and credit to Fund shareholders in a manner that reflects shareholders’ share of Fund items, but these conventions may not be in full technical compliance with applicable tax requirements. It is possible that the IRS will successfully assert that the conventions used by the Fund to allocate income to the shareholders do not satisfy the technical requirements of the U.S. tax law and could require that items of income, gain, deduction, loss or credit be reallocated in a manner that adversely affects you.

The current treatment of long-term capital gains under current U.S. federal income tax law may be adversely affected in the future—Under current law, long-term capital gains are taxed to non-corporate investors at a maximum U.S. federal income tax rate of 15% through December 31, 2012. Absent further legislation, after December 31, 2012, the tax rate on non-corporate investors’ long-term capital gains will increase to 20%. The treatment of long-term capital gains can be adversely affected by future changes in tax laws at any time.

Shareholders are strongly urged to consult their own tax advisors and counsel with respect to the possible tax consequences to them of an investment in any shares. The tax consequences may differ in respect of different shareholders.

Item 1B. Unresolved Staff Comments

None.

Not applicable.

None.

Item 4. [Removed and Reserved]

20

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

a) On September 27, 2010, the shares of the Fund began trading on the NYSE Amex under the ticker symbol “CFD.”

The following table sets forth, for the calendar quarters indicated, the high and low intraday market prices per share.

| Share Price | ||||||||

| Quarter Ended |

High | Low | ||||||

| December 31, 2010 |

$ | 28.00 | $ | 22.54 | ||||

| September 30, 2010* |

$ | 25.13 | $ | 24.85 | ||||

| * | This period covers the time from the Fund’s initial public offering (September 27, 2010) to the end of the quarter. |

The Fund’s shares will likely trade at a market price that is different from the daily computed net asset value of a share of the Fund. This is due, in large part, to the fact that supply and demand forces at work in the secondary trading market for shares of the Fund, which may be related to, but not identical to, the forces influencing the prices of the commodity futures and forward contracts and other instruments held by the Fund that affect the net asset value of the Fund’s shares. When the Fund’s shares are trading on the NYSE Amex at a price above the net asset value, the shares are referred to as trading at a “premium,” and conversely when the Fund’s shares are trading on the exchange at a price below the net asset value, the shares are referred to as trading at a “discount.” The following table sets forth, for the calendar quarters indicated, the high and low end of day premium and/or discount, as applicable.

| Premium/(Discount) | ||||||||

| Quarter Ended |

High | Low | ||||||

| December 31, 2010 |

5.42 | % | (4.82 | %) | ||||

| September 30, 2010* |

5.37 | % | 4.71 | % | ||||

| * | This period covers the time from the Fund’s initial public offering (September 27, 2010) to the end of the quarter. |

As of December 31, 2010, the Fund had approximately 7,000 shareholders.

21

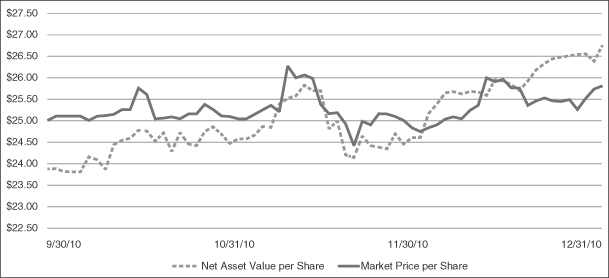

The following graph presents the relationship between the Fund’s net asset value per share and its market price during the period September 27, 2010 through December 31, 2010.

During the fiscal year ended December 31, 2010, the Fund declared distributions per share as detailed in the table below:

| Ex Date |

Record Date |

Payable Date |

Amount | |||

| December 28, 2010 |

December 30, 2010 | December 31, 2010 | $ 0.145 | |||

| November 26, 2010 |

November 30, 2010 | December 1, 2010 | $ 0.145 | |||

| October 27, 2010 |

October 31, 2010 | November 1, 2010 | $ 0.145 |

The Fund intends to make regular monthly distributions to its shareholders based on the past and projected performance of the Fund. Among other factors, the Fund seeks to establish a distribution rate that roughly corresponds to the Manager’s projections of the total return that could reasonably be expected to be generated by the Fund over an extended period of time. As market conditions and portfolio performance may change, the rate of distributions on the shares and the Fund’s distribution policy could change.