Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - MLM INDEX FUND | ex32_2.htm |

| EX-31.1 - EXHIBIT 31.1 - MLM INDEX FUND | ex31_1.htm |

| EX-32.1 - EXHIBIT 32.1 - MLM INDEX FUND | ex32_1.htm |

| EX-31.2 - EXHIBIT 31.2 - MLM INDEX FUND | ex31_2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

|

x

|

Annual report pursuant to Section 13 or 15 (d) of the Securities Exchange Act of 1934 for the fiscal year ended December 31, 2010

|

|

o

|

Transition report pursuant to Section 13 or 15 (d) of the Securities Exchange Act of 1934

|

For the transition period from __________________ to ___________________

Commission file number 0-49767

MLM INDEX™ FUND

(Exact name of registrant as specified in its charter)

|

Delaware

|

Unleveraged Series: 22-2897229

|

|

|

Leveraged Series: 22-3722683

|

||

|

Commodity L/S Unleveraged Series: 20-8806944

|

||

|

Commodity L/N Unleveraged Series: 27-1198002

|

||

|

(State of Incorporation)

|

(I.R.S. Employer Identification No.) |

|

405 South State Street

|

||

|

Newtown, PA

|

18940

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (267) 759-3500

Securities registered pursuant to Section 12 (b) of the Act:

|

Title of Each Class

|

Name of Exchange on Which Registered

|

|

|

None

|

None

|

Securities registered pursuant to Section 12 (g) of the Act:

Business Trust Interests – Unleveraged Series

Business Trust Interests – Leveraged Series

Business Trust Interests – Commodity L/S Unleveraged Series

Business Trust Interests – Commodity L/N Unleveraged Series

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o. No x.

1

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yeso. No x.

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Exchange Act from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No o.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “accelerated filer”, “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one)

|

Large accelerated filer o

|

Accelerated filer o

|

|

|

Non-accelerated filer x

|

Smaller reporting company o

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). o Yes x No

As of June 30, 2010, the aggregate fair value of the business trust units of the Unleveraged Series of the registrant held by non-affiliates of the registrant was approximately $38.7 million, the aggregate fair value of the business trust units of the Leveraged Series of the registrant held by non-affiliates of the registrant was approximately $36.9 million, the aggregate fair value of the business trust units of the Commodity L/S Unleveraged Series of the registrant held by non-affiliates of the registrant was approximately $12.7 million, and the aggregate fair value of the business trust units of the Commodity L/N Unleveraged Series of the registrant held by non-affiliates of the registrant was approximately $23.1 million.

As of February15, 2011, the Trust had in issuance 33,624; 47,431; 11; 457,511Unleveraged Series trust units in the A, B, C and D classes respectively; 28,468; 85,272; 13; 207,168 Leveraged Series trust units in the A, B, C and D classes respectively; 123,631Commodity L/S Unleveraged Series in Class D and 453,843 Commodity L/N Unleveraged Series in Class D trust units.

Documents Incorporated by Reference: Certain exhibits in Item 15 are incorporated by reference in this Form 10-K, as specifically set forth in Item 15.

Forward Looking Statements

This Annual Report on Form 10-K contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and other Federal Securities Laws. These forward-looking statements are based on our present intent, beliefs and expectations as well as assumptions made by and information currently available to us, but they are not guaranteed to occur and they may not occur. Although we believe that the expectations reflected in these forward-looking statements are reasonable, such statements are subject to known and unknown risks and uncertainties that may be beyond our control, which could cause actual performance or results to differ materially from projected performance or results expressed or implied by the forward-looking statements. Additional information concerning the factors that could cause actual results to differ materially from those in the forward-looking statements is contained in Item 1, “Business”, and Item 1A, “Risk Factors”. You should not place undue reliance upon forward-looking statements. Except as required by law, we undertake no obligation to update or release any forward-looking statements as a result of new information, future events or otherwise.

2

|

Page

|

|||

|

Item 1.

|

4

|

||

|

Item 1B.

|

18

|

||

|

Item 2.

|

18

|

||

|

Item 3.

|

18

|

||

|

Item 4.

|

18

|

||

|

Item 5.

|

19

|

||

|

Item 6.

|

23

|

||

|

Item 7.

|

26

|

||

|

Item 7A.

|

29

|

||

|

Item 8.

|

31

|

||

|

Item 9.

|

33

|

||

|

Item 9A.

|

33

|

||

|

Item 9B.

|

34

|

||

|

Item 10.

|

34

|

||

|

Item 11.

|

35

|

||

|

Item 12.

|

36

|

||

|

Item 13.

|

36

|

||

|

Item 14.

|

36

|

||

|

Item 15.

|

38

|

Item 1. Business

General and Business Segments

The MLM Index™ Fund (the “Trust”) is a business trust organized under the laws of Delaware. The Trust engages primarily in the speculative trading of a diversified portfolio of futures contracts using the MLM Index™ Trading Program (the “Trading Program”). Futures contracts are standardized contracts made on or through a commodity exchange and provide for future delivery of commodities, precious metals, foreign currencies or financial instruments and, in the case of certain contracts such as stock index futures contracts and Eurodollar futures contracts, provide for cash settlement. The Trust's objective is the appreciation of its assets through speculative trading. The Trust began trading on January 4, 1999.

The Trust consists of several separate series of interests (each, a “Series”), each with its own assets and liabilities. Under the Trust Agreement, the Trust may issue multiple Series of Interests. The Trust maintains separate and distinct records for each Series and the assets associated with each such Series are held and accounted for separately from the other assets of the Trust and of any other Series thereof. The debts, liabilities, obligations and expenses incurred, contracted for or otherwise existing with respect to a particular Series are enforceable against the assets of such Series only and not against the assets of the Trust generally or the assets of any other Series. A Statement of Financial Condition and Statement of Operations for each Series can be found in Item 15 of this document.

Mount Lucas Management Corporation (the “Manager”), a Delaware corporation, acts as the manager and trading advisor of the Trust. The Manager was formed in 1986 to act as an investment manager. As of December 31, 2010, the Manager had approximately $1.9 billion of assets under advisement. The Manager is a registered investment adviser under the Investment Advisers Act of 1940, a registered commodity trading advisor and commodity pool operator with the Commodity Futures Trading Commission (the "CFTC") and a member of the National Futures Association (the "NFA"). The Manager may from time to time operate other investment vehicles.

The Trust and the Manager maintain their principal business office at 405 South Street, Newtown, PA 18940 and their telephone number is 267-759-3500.

Wilmington Trust Company, a Delaware banking corporation, acts as trustee for the Trust. The Trustee's office is located at Rodney Square North, 1100 North Market Street, Wilmington, Delaware 19890. The Trustee is unaffiliated with the Manager. The Trustees duties and liabilities are limited to its express obligations under the Amended and Restated Declaration of Trust and Trust Agreement, dated as of August 31, 1998, among the Trustee, the Manager and the Interest Holders from time to time thereunder, as amended (the "Trust Agreement").

Citigroup Global Markets currently acts as clearing broker for all of the Series the Trust. A clearing broker accepts orders to trade futures on behalf of another party and accepts money to support such orders. The clearing broker is a futures commission merchant registered with the CFTC and is a member of the NFA.

Trading Program

Each series of the Trust trades speculatively in a wide range of futures contracts traded on U.S. and foreign exchanges using the Trading Program, which is based upon the MLM Index™ and various subsets (collectively, "MLM Index"). The MLM Index™ and the Trading Program are both proprietary products of the Manager. The Trading Program attempts to replicate the MLM Index™, before fees and expenses. Currently the Trust has four series of interests: the Unleveraged Series, the Leveraged Series, the Commodity L/S Unleveraged Series and the Commodity L/N Unleveraged Series. The Unleveraged Series attempts to replicate the MLM Index™ without any leverage, while the Leveraged Series trades the Trading Program at three times leverage. Leverage is the ability to control large dollar amounts of a commodity with a comparatively small amount of capital. The Leveraged Series purchases or sells $3 fair value of contracts for every $1 invested in the Series. The Commodity L/S Unleveraged Series and Commodity L/N Unleveraged Series attempt to replicate the MLM Commodity Long/Short Index and MLM Commodity Long/Neutral Index respectively, without leverage. The MLM Commodity Long/Short Index is a subset of the MLM Index and contains only the commodity futures contracts of the entire MLM Index. The MLM Commodity Long/Neutral Index contains the same commodity futures contracts, but does not have short positions when the MLM Index algorithm indicates a short position in a particular contract.

In attempting to replicate the MLM Index™, the Manager will invest in the same markets as the MLM Index™; use the same algorithm to determine long versus short positions; make the same allocations to each market; and generally execute positions at almost the same time. The Manager may also use swaps in attempting to replicate the MLM Index™. These swaps would be agreements with dealers to provide the returns which are the same as holding a specific number of futures contracts in a specific market, without holding the actual contracts. The economic effect on the Trust would be substantially identical to holding futures contracts. However, since the holder of swaps assumes additional counterparty risk, swaps are only held infrequently. For the year ended and as of December 31, 2010, none of the Series of the Trust neither held nor hold any swap positions.

The MLM Index™

In 1988, the Manager created the MLM Index™ as a benchmark of the returns to speculation in futures markets. Broadly speaking, the futures markets have two classes of participants, hedgers and speculators. Hedgers are the commercial businesses that use the futures markets to transfer unwanted or excessive price risk to those more willing to absorb that risk. Speculators are position holders who absorb this price risk. In essence, they provide "insurance" to the commercial interest so that the commercial interests can focus on their basic business while being protected from unforeseen changes in commodity prices, interest rates or foreign exchange rates. Basic finance theory argues that the reduction in risk experienced by the hedgers exacts a cost, or risk premium, that is earned by those holding the risk. The intent of the MLM Index™ is to measure this risk premium. In this general sense it is analogous to an index of stocks that measures the premium to holding equity risk.

Price risk in futures markets exists when markets rise and when they fall. For example, an operator of a wheat storage facility is damaged by a fall in the price of wheat in that the value of the inventory in their facility falls. On the other hand, a consumer of wheat, like a baker, incurs financial risk if the price of wheat rises, as the cost of future operations increases. In both cases, steady prices are favorable. Thus, an index designed to capture the risk premium earned must capture returns as markets move up and move down, yet suffer when markets are stable. The MLM Index™ is designed to measure this effect by taking long and short positions in the constituent markets. The existence of the long and short positions in the construction of the MLM Index™ is a significant innovation and important difference from other risk premium measurements.

The MLM Index™ currently invests in futures contracts on the following: Chicago corn, Chicago soybeans, New York sugar, Chicago wheat, Canadian Government Bonds, Euro Bunds, Japanese Government Bonds, Long Gilts, 10-year Treasury Notes, crude oil, heating oil, natural gas, unleaded gasoline, live cattle, New York gold, New York copper, Australian Dollar, British Pound, Canadian Dollar, Swiss Franc, Japanese Yen, and Euro Currency. The selection of the markets in the MLM Index™ is made by the Manager. The selection is based on a variety of factors, including liquidity of the underlying futures contract, the relationship with the other markets in the MLM Index™, and the reasonableness of including the market in the MLM Index™. The choice of markets for a calendar year is made in the December preceding the start of the year, and, except in unusual circumstances, markets are not normally added to or deleted from the MLM Index™ during a year. An extraordinary event that may lead to the removal of a contract during the year might be the permanent suspension of normal trading or an abrupt permanent change in the liquidity of the contract. For example, the Chicago Mercantile Exchange suspended floor trading of the Deutsche Mark contract in August of 2000, ahead of the announced schedule. If a commodity is traded on more than one futures exchange, only the one with the largest open interest is included in the MLM Index™. The open interest is the number of all long or short futures contracts in one delivery month for one market that have been entered into and not yet liquidated by an offsetting transaction or fulfilled by delivery. For example, Chicago Board of Trade wheat has larger open interest than Kansas City Board of Trade wheat; consequently, Chicago Board of Trade wheat is included in the MLM Index™ but Kansas City Board of Trade wheat is not.

In addition to the markets in the MLM Index™, the Manager determines which delivery months will be traded for each market in the MLM Index™. Generally, for each market, four deliveries are chosen that are both liquid and spaced throughout the calendar year. For example, for the Wheat market, the deliveries traded are March, May, July and December. The choice of deliveries is set for each calendar year, but can change due to similar extraordinary circumstances as with the market selection.

The calculation of the MLM Index™ is explained below.

Calculation of the MLM Index™

1. Determination of long or short futures position for each market.

The rate of return of an individual market depends on whether the market position is long or short. Since a futures contract eventually expires, the MLM Index™ is based on the unit asset value of a market, rather than on the actual futures price. This month's unit asset value of a futures market is determined by multiplying last month's value by 1 plus the percentage change in this month's nearby futures price. The market position is long during the current month if the market's closing value on the next-to-last trading day of the prior month is greater than or equal to the market's 252 business day moving average of closing values; otherwise, the market position is short.

2. Calculation of the monthly rate of return for each market.

If the market position is long, then the market monthly rate of return equals the percentage change in the market price during the month, i.e., the market monthly rate of return (%) equals the closing price of the current month divided by the closing price of the prior month, minus 1, times 100. If the market position is short, then the market monthly rate of return (%) equals -1 (minus one) times the percentage change in the market price during the month, i.e., the market monthly rate of return equals the closing price of the current month divided by the closing price of the prior month, minus 1, times -100 (minus 100).

3. Calculation of the monthly rate of return for the MLM Index™.

The monthly rate of return of the MLM Index™ equals the weighted average of the individual market monthly rates of return plus the Treasury Bill rate of return.

4. Determination of the MLM Index™ value.

The value of the MLM Index™ is computed by compounding the MLM Index™ monthly rates of return. The beginning value of the MLM Index™ is defined to be 1000 in January 1961. Each month thereafter, the MLM Index™ is changed by the monthly rate of return. That is, each month's MLM Index™ value is determined by multiplying the prior month's value by 1 plus the current percentage monthly rate of return.

The annual performance of the MLM Index™ and its subsets (MLM Commodity Long/Short Index and MLM Commodity Long/Neutral Index) for each of the past ten years is set forth below.

|

Year

|

Annual Return

|

Annual Return

|

Annual Return

|

|

MLM Index

|

MLM Commodity

|

MLM Commodity

|

|

| Long/Short Index | Long/Neutral Index | ||

|

2001

|

3.67%

|

-1.19

|

-12.13

|

|

2002

|

-1.63

|

-1.34

|

14.15

|

|

2003

|

3.92

|

6.41

|

16.21

|

|

2004

|

3.52

|

19.13

|

16.66

|

|

2005

|

3.75

|

4.56

|

16.67

|

|

2006

|

0.40

|

-4.28

|

-1.76

|

|

2007

|

2.87

|

2.19

|

16.71

|

|

2008

|

13.60

|

34.05

|

-1.40

|

|

2009

|

-2.71

|

-7.19

|

8.01

|

|

2010

|

3.49

|

5.28

|

11.49

|

The MLM Index™ is published daily on the Bloomberg system and is available from the Manager. Since the development of the MLM Index™, other firms have computed similar indices, including the CMI of AssetSight Corporation and an index computed by SAIS in Switzerland. Both indices are variations on the construction of the MLM Index™, either in the derivation of the long and short positions or the relative weights of the markets. In addition, there are many "commodity" indexes, such as the GSCI from Goldman Sachs and AIG Commodity Index. These indexes are long only, and do not include currencies or financial instruments.

Fees and Expenses

Set forth below is a summary of the basic fees that the each of the Series and Classes is subject to.

Brokerage Fee

Each Series of the Trust pays the Manager a brokerage fee at the annual rates set forth below.

|

Classes A and B Unleveraged Series

|

0.85% of net asset value

|

|

|

Classes C and D Unleveraged Series

|

0.40% of net asset value

|

|

|

Classes A and B Commodity L/S Unleveraged Series

|

0.85% of net asset value

|

|

|

Classes C and D Commodity L/S Unleveraged Series

|

0.40% of net asset value

|

|

|

Classes A and B Commodity L/N Unleveraged Series

|

0.85% of net asset value

|

|

|

Classes C and D Commodity L/N Unleveraged Series

|

0.40% of net asset value

|

|

|

Classes A and B Leveraged Series

|

1.75% of net asset value

|

|

|

Classes C and D Leveraged Series

|

0.90% of net asset value

|

The brokerage fee is based on net asset value as of the first day of each month. The net asset value of the Trust equals the sum of all cash, the fair value (or cost of liquidation) of all futures positions and the fair value of all other assets of the Trust, less all liabilities of the Trust (including accrued liabilities), in each case determined per Series by the Manager in accordance with U.S. generally accepted accounting principles. For purposes of determining the brokerage fee, there is no reduction for:

|

(1)

|

the accrued brokerage or management fees,

|

|

(2)

|

any allocation or reallocation of assets effective as of the day the brokerage fee is being calculated, or

|

|

(3)

|

any distributions or redemptions as of the day the brokerage fee is being calculated.

|

No assurance can be given that the brokerage fee will be competitive with the charges of other brokerage firms.

The Manager is responsible for paying all of the Trust's costs of executing and clearing futures trades, including floor brokerage expenses and give-up charges, as well as the NFA, exchange and clearing fees incurred in connection with the Trust's futures trading activities. The Manager may also pay from the brokerage fees, custody fees or amounts necessary for certain administrative and marketing assistance provided by broker/dealers who are also authorized selling agents. NFA fees equal $0.04 per round-turn trade of a futures contract.

Management Fee

Each Series is divided into Class A Interests, Class B Interests, Class C Interests and Class D interests. Class A and C Interests are generally sold through registered broker-dealers and Class B and D Interests are generally offered through fee-only advisors. The Trust pays the Manager a monthly management fee at the annual rates set forth below.

Unleveraged Series, Commodity L/S Unleveraged Series and Commodity L/N Unleveraged Series

Class A 1.50% of net asset value

Class B 0.50% of net asset value

Class C 1.00% of net asset value

Class D 0.50% of net asset value

Leveraged Series

Class A 2.80% of net asset value

Class B 1.30% of net asset value

Class C 2.05% of net asset value

Class D 1.30% of net asset value

The management fee is determined and paid as of the first day of each calendar month. For purposes of determining the management fee, there is no reduction for:

|

(1)

|

accrued management fees,

|

|

(2)

|

any allocation or reallocation of assets effective as of the day the management fee is being calculated, or

|

|

(3)

|

any distributions or redemptions as of the day the management fee is being calculated.

|

The Manager pays from the management fee an annual fee for interests sold by authorized selling agents appointed by the Manager for the Class A Series, in the amount of 100 basis points for the Unleveraged Series, Commodity L/S Unleveraged Series and Commodity L/N Unleveraged Series and 150 basis points for the Leveraged Series of the Trust's net asset value for each respective series; and for the Class C Series, in the amount of 50 basis points for the Unleveraged Series, Commodity L/S Unleveraged Series and Commodity L/N Unleveraged Series and 50 basis points for the Leveraged Series, L/S Leveraged Series and Commodity L/N Leveraged Series of the Trust's net asset value for each respective series. As of December 31, 2010, the L/S Leveraged Series and Commodity L/N Leveraged Series of the Trust have not commenced trading and have no assets.

Organizational Fee

Prior to January 1, 2010, investors in Classes A and B of each Series paid an organizational fee of 0.50% of their initial and any subsequent investment(s) (excluding exchanges) to the Manager to cover expenses associated with the organization of the Trust and the offering of interests. This fee will be deducted from each investment in determining the number of interests purchased. An organizational fee was charged until an investor’s total contribution was greater than or equal to $1,000,000. If the organizational expenses exceeded the organizational fees collected by the Manager, the Manager paid any costs above the collected fees. If the organizational fees paid to the Manager exceed actual organizational expenses, any excess was retained by the Manager and may be shared with consultants that the Manager may engage from time to time. Specifically, consultants who assist the Trust in distributing the interests may be paid a share of the organizational fees. Subsequent to January 1, 2010, the investors in classes A and B of all series no longer pay an organizational fee.

Operating and Administrative Expenses

Each Series of the Trust pays the Manager an annual fee of 0.35% of the net asset value as reimbursement for its legal, accounting and other routine administrative expenses and fees, including fees to the Trustee. The Trustee is paid an annual fee and reimbursed for out-of-pocket expenses. Each Series pays its own cash manager fees and banking fees. The relevant series generally pays any extraordinary expenses, including legal claims and liabilities and litigation costs and any indemnification related thereto. To the extent the extraordinary expenses arise as a result of the gross negligence or willful misconduct of the Manager, the Manager may be deemed responsible to pay the extraordinary expenses to that extent.

Selling Commission

Investors who subscribe for Class A Interests and Class C Interests will be charged a sales commission of 0% to 4% of the subscription amount, payable to the selling agent from the investor's investment. The amount of the sales commission is determined by the selling agent. Investors who subscribe for Class B Interests and Class D Interests will generally not be charged a sales commission.

Futures Trading

Futures Contracts

Futures contracts are contracts made on or through a commodity exchange and provide for future delivery of agricultural and industrial commodities, precious metals, foreign currencies or financial instruments and, in the case of certain contracts such as stock index futures contracts and Eurodollar futures contracts, provide for cash settlement. Futures contracts are uniform for each commodity on each exchange and vary only with respect to price and delivery time. A contract to buy or sell may be satisfied either by taking or making delivery of the commodity and payment or acceptance of the entire purchase price thereof, or by offsetting the obligation with a contract containing a matching contractual obligation on the same (or a linked) exchange prior to delivery. United States commodity exchanges individually or, in certain limited situations, in conjunction with certain foreign exchanges, provide a clearing mechanism to facilitate the matching of offsetting trades. Once trades made between members of an exchange have been confirmed, the clearinghouse becomes substituted for the clearing member acting on behalf of each buyer and each seller of contracts traded on the exchange and in effect becomes the other party to the trade. Thereafter, each clearing member firm party to the trade looks only to the clearinghouse for performance. Clearinghouses do not deal with customers, but only with member firms, and the guarantee of performance under open positions provided by the clearinghouse does not run to customers. If a customer’s commodity broker becomes bankrupt or insolvent, or otherwise defaults on such broker’s obligations to such customer, the customer in question may not receive all amounts owed to such customer in respect of his trading, despite the clearinghouse fully discharging all of its obligations.

Hedgers and Speculators

Two broad classifications of persons who trade in commodity futures are (1) hedgers and (2) speculators. Commercial interests, including banks and other financial institutions, and farmers, who market or process commodities, use the futures markets for hedging. Hedging is a protective procedure designed to minimize losses which may occur because of price fluctuations. The commodity markets enable the hedger to shift the risk of price fluctuations to the speculator. The usual objective of the hedger is to protect the expected profit from financial or other commercial operations, rather than to profit strictly from futures trading.

The speculator, such as the Trust, risks its capital with the expectation of making profits from the price fluctuations in futures contracts. The hedger seeks to offset any potential loss (measured as the difference between the price at which he had expected to buy or sell and the price at which he is eventually able to buy or sell) in the purchase or sale of the commodity hedged. Likewise, losses in futures trading might be offset by unexpected gains on transactions in the actual commodity. The speculator assumes the risks which the hedger seeks to avoid.

Speculators rarely expect to take or make delivery of the cash or actual physical commodity in the futures market. Rather, they generally close out their futures positions by entering into offsetting purchases or sales of futures contracts. Because the speculator may take either a long or short position in the futures markets, it is possible for the speculator to earn profits or incur losses regardless of the direction of price trends.

Trading Approaches

Commodity traders generally may be classified as either systematic or discretionary. A systematic trader will rely primarily on trading programs or models to generate trading signals. A systematic trader will also rely, to some degree, on judgmental decisions concerning, for example, what markets to follow and commodities to trade, when to liquidate a position in a contract month which is about to expire and how large a position to take in a particular commodity. The systems utilized to generate trading signals are changed from time to time, but the trading instructions generated by the then-current systems are generally followed without significant additional analysis or interpretation.

In contrast, discretionary traders, while sometimes utilizing a variety of price charts and computer programs to assist them in making trading decisions, make these decisions on the basis of their own judgment. It is possible to describe a discretionary trader's experience, the type of information which he consults, the number of commodities he follows or trades and the degree to which he leverages his accounts. However, in assessing the potential for future profitability in the case of a discretionary trader, the talents and abilities of the individual, rather than the profitability of any particular system or identifiable method, must be evaluated.

Margins

Margins are good faith deposits which must be made with a commodity broker in order to initiate or maintain an open position in a futures contract. When futures contracts are traded in the United States and on most exchanges abroad, both buyer and seller are required to post margins with the broker handling their trades as security for the performance of their buying and selling undertakings, and to offset losses on their trades due to daily fluctuations in the markets. Minimum margins usually are set by the exchanges.

A customer's margin deposit is treated as equity in his account. A change in the market price of the futures contract will increase or decrease the equity. If this equity decreases below the maintenance margin amount (generally 75% of the initial margin requirement), the broker will issue a margin call requiring the customer to increase the account's equity to the initial margin. Failure to honor such a margin call generally will result in the closing out of the open position. If, at the time such open position is closed, the account equity is negative, then the equity in the customer's remaining open positions, if any, in excess of the required margins, as well as the customer's cash reserves will be used to offset such debit balance, and if such equities and reserves are not sufficient the customer will be liable for the remaining unpaid balance.

United States Regulations

Commodity Exchange Act (“the CE Act”). The United States Congress enacted the CE Act to regulate trading in commodities, the exchanges on which they are traded, the individual brokers who are members of the exchanges, and commodity professionals and commodity brokerage houses that trade in these commodities in the United States.

Commodity Futures Trading Commission (the “CFTC”). The CFTC is an independent governmental agency which administers the CE Act and is authorized to promulgate rules thereunder. A function of the CFTC is to implement the objectives of the CE Act in preventing price manipulation and excessive speculation and promoting orderly and efficient commodity futures markets. The CFTC has adopted regulations covering, among other things:

|

|

·

|

the designation of contract markets;

|

|

|

·

|

the monitoring of United States commodity exchange rules;

|

|

|

·

|

the establishment of speculative position limits;

|

|

|

·

|

the registration of commodity brokers and brokerage houses, floor brokers, introducing brokers, leverage transaction merchants, commodity trading advisors, commodity pool operators and their principal employees engaged in non-clerical commodities activities (associated persons); and

|

|

|

·

|

the segregation of customers funds and record keeping by, and minimum financial requirements and periodic audits of, such registered commodity brokerage houses and professionals.

|

Under the CE Act, the CFTC is empowered, among other things, to:

|

|

·

|

hear and adjudicate complaints of any person (e.g., an Interest Holder) against all individuals and firms registered or subject to registration under the CE Act (reparations),

|

|

|

·

|

seek injunctions and restraining orders,

|

|

|

·

|

issue orders to cease and desist,

|

|

|

·

|

initiate disciplinary proceedings,

|

|

|

·

|

revoke, suspend or not renew registrations and

|

|

|

·

|

levy substantial fines.

|

The CE Act also provides for certain other private rights of action and the possibility of imprisonment for certain violations.

The CFTC has adopted extensive regulations affecting commodity pool operators and commodity trading advisors such as the Manager and their associated persons. These regulations, among other things, require the giving of disclosure documents to new customers and the retention of current trading and other records, prohibit pool operators from commingling pool assets with those of the operators or their other customers and require pool operators to provide their customers with periodic account statements and an annual report. Upon request by the CFTC, the Manager will also furnish the CFTC with the names and addresses of the interest holders, along with copies of all transactions with, and reports and other communications to, the interest holders.

United States Commodity Exchanges. United States commodity exchanges are given certain latitude in promulgating rules and regulations to control and regulate their members and clearing houses, as well as the trading conducted on their floors. Examples of current regulations by an exchange include establishment of initial and maintenance margin levels, size of trading units, daily price fluctuation limits and other contract specifications. Except for those rules relating to margins, all exchange rules and regulations relating to terms and conditions of contracts of sale or to other trading requirements currently must be reviewed and approved by the CFTC.

National Futures Association (the “NFA”). Substantially all commodity pool operators, commodity trading advisors, futures commission merchants, introducing brokers and their associated persons are members or associated members of the NFA. The NFA's principal regulatory operations include:

|

|

·

|

auditing the financial condition of futures commission merchants, introducing brokers, commodity pool operators and commodity trading advisors;

|

|

|

·

|

arbitrating commodity futures disputes between customers and NFA members;

|

|

|

·

|

conducting disciplinary proceedings; and

|

|

|

·

|

registering futures commission merchants, commodity pool operators, commodity trading advisors, introducing brokers and their respective associated persons, and floor brokers.

|

The regulation of commodities transactions in the United States is a rapidly changing area of law and the various regulatory procedures described herein are subject to modification by United States congressional action, changes in CFTC rules and amendments to exchange regulations and NFA regulations.

Item 1A. Risk Factors

Historical Results of the MLM Index™ may not be indicative of future results

The MLM Index™ historical results may not be indicative of future results. The MLM Index™ results are based on the analysis of a particular period of time. The future performance of the MLM Index™ is entirely unpredictable.

Performance of the Trust May be Different than the MLM Index™

Each Series attempts to replicate the MLM Index™. In doing so, each Series will establish positions in the futures markets. The prices at which a Series executes these positions may be significantly different than the prices used to calculate the MLM Index™. In addition, the Trust charges various fees and commissions which will lower the return of each Series vs. the MLM Index™. All these factors mean that Series performance will be different and in all likelihood lower than the results of the comparable MLM Index™.

Futures Trading Involves Substantial Leverage

Futures contracts are typically traded on margin. This means that a small amount of capital can be used to invest in contracts of much greater total value. The resulting leverage means that a relatively small change in the market price of a futures contract can produce a substantial profit or loss. Leverage enhances the Trust's sensitivity to market movements that can result in greater profits when the Trading Program anticipates the direction of the move correctly or greater losses when the Trading Program is incorrect. The Unleveraged Series, Commodity L/S Unleveraged Series and Commodity L/N Unleveraged Series attempt to replicate the MLM Index™, the MLM Commodity Long/Short Index and the MLM Commodity Long/Neutral Index respectively without leverage and the Leveraged Series trades the MLM Index™ at three times leverage.

Futures Trading Is Speculative, Highly Volatile and Can Result in Large Losses

A principal risk in futures trading is the rapid fluctuation in the market prices of futures contracts. A Series' profitability depends greatly on the Trading Program correctly anticipating trends in market prices. If the Trading Program incorrectly predicts the movement of futures prices, large losses could result. Price movements of futures contracts are influenced by such factors as: changing supply and demand relationships; government trade, fiscal, monetary and exchange control programs and policies; national and international political and economic events; and speculative frenzy and the emotions of the market place. The Manager has no control over these factors.

Illiquid Markets Could Make It Impossible for the Trust to Realize Profits or Limit Losses

Although each Series trades in ordinarily highly liquid markets, there may be circumstances in which it is not possible to execute a buy or sell order at the desired price, or to close out an open position, due to market conditions. Daily price fluctuation limits are established by the exchanges and approved by the CFTC. When the market price of a futures contract reaches its daily price fluctuation limit, no trades can be executed at prices outside such limit. The holder of a commodity futures contract (including a Series) may be locked into an adverse price movement for several days or more and lose considerably more than the initial margin put up to establish the position. Another possibility is the unforeseen closure of an exchange due to accident or government intervention.

Speculative Position Limits May Require the Manager to Modify Its Trading to the Detriment of the Trust

The exchanges have established and the CFTC has approved speculative position limits (referred to as position limits) on the maximum futures position which any person, or group of persons acting in concert, may hold or control in particular futures contracts. In addition, certain exchanges, in lieu of speculative position limits, have adopted position accountability requirements that could require a person whose positions in a contract exceed a specified level to provide information to the exchange relating to the nature of such person's trading strategy. The Manager may be required to reduce the size of the future positions which would otherwise be taken to avoid exceeding such limits or requirements. Such modification of the Trust's trades, if required, could adversely affect the operations and profitability of the Trust.

Trading of Swaps Could Subject the Trust to Substantial Losses

Each Series may enter into swap and similar transactions. Swap contracts are not traded on exchanges and are not subject to the same type of government regulation as exchange markets. As a result, many of the protections afforded to participants on organized exchanges and in a regulated environment are not available in connection with these transactions. The swap markets are "principals' markets," in which performance with respect to a swap contract is the responsibility only of the counterparty which the participant has entered into a contract, and not of any exchange or clearinghouse. As a result, the Trust is subject to the risk of the inability or refusal to perform with respect to such contracts on the part of the counterparties with which the Trust trades. Any such failure or refusal, whether due to insolvency, bankruptcy, default, or other cause, could subject the Trust to substantial losses. There are no limitations on daily price movements in swap transactions. Speculative position limits do not apply to swap transactions, although the counterparties with which each Series deals may limit the size or duration of positions available to a Series as a consequence of credit considerations. Participants in the swap markets are not required to make continuous markets in the swap contracts they trade. Participants could refuse to quote prices for swap contracts or quote prices with an unusually wide spread between the price at which they are prepared to buy and the price at which they are prepared to sell.

Substantial Expenses Will Cause Losses for the Trust Unless Offset by Profits and Interest Income

Each Series is subject to substantial fees and expenses, including brokerage fees, management fees and operating and administrative expenses. In addition, certain investors are subject to an organizational charge and/or a selling commission. Set forth below are tables which set forth the basic fees that each of the Series and Classes is subject to.

|

Leveraged Series

|

||||||||||||||||||||||||

|

Brokerage Fee

|

Management Fee

|

Organizational Fee

|

Admin Fee

|

Selling Expense

|

Total Fees and Commissions

|

|||||||||||||||||||

|

Class A

|

1.75 | % | 2.80 | % | N/A | * | 0.35 | % | 4.00 | % | 8.90 | % | ||||||||||||

|

Class B

|

1.75 | % | 1.30 | % | N/A | * | 0.35 | % | N/A | 3.40 | % | |||||||||||||

|

Class C

|

0.90 | % | 2.05 | % | N/A | 0.35 | % | 4.00 | % | 7.30 | % | |||||||||||||

|

Class D

|

0.90 | % | 1.30 | % | N/A | 0.35 | % | N/A | 2.55 | % | ||||||||||||||

|

Unleveraged Series, Commodity L/S Unleveraged Series and Commodity L/N Unleveraged Series

|

||||||||||||||||||||||||

|

Brokerage Fee

|

Management Fee

|

Organizational Fee

|

Admin Fee

|

Selling Expense

|

Total Fees and Commissions

|

|||||||||||||||||||

|

Class A

|

0.85 | % | 1.50 | % | N/A | * | 0.35 | % | 4.00 | % | 7.20 | % | ||||||||||||

|

Class B

|

0.85 | % | 0.50 | % | N/A | * | 0.35 | % | N/A | 2.20 | % | |||||||||||||

|

Class C

|

0.40 | % | 1.00 | % | N/A | 0.35 | % | 4.00 | % | 5.75 | % | |||||||||||||

|

Class D

|

0.40 | % | 0.50 | % | N/A | 0.35 | % | N/A | 1.25 | % | ||||||||||||||

*effective January 1, 2010

The Brokerage Fee and the Management Fee shall be paid to the Manager. It will be necessary for each Series to achieve gains from trading and interest income in excess of its charges for investors to realize increases in the net asset value of their interests. A Series may not be able to achieve any appreciation of its assets.

The Manager Alone Makes the Trust's Trading Decisions

The Manager makes all commodity trading decisions for all Series and, accordingly, the success of each Series largely depends upon the Manager's judgment and abilities to make the necessary adjustments to the Trading Program. There is no guarantee that the Trading Program's trading on behalf of the Trust will prove successful under all or any market conditions. The performance record of the Trading Program also reflects significant variations in profitability from period to period.

You Have No Right to Remove the Manager

Under the Trust Agreement, interest holders have no right to remove the Manager as manager of the Trust for cause or for any other reason.

The Manager Advises Other Clients

The Manager may be managing and advising large amounts of other funds for other clients at the same time as it is managing Trust assets and, as a result, the Trust may experience increased competition for the same contracts.

Limited Ability To Liquidate Investment In Interests

You can only redeem your interests at month-end upon 10 business days advance notice. The net asset value per interest may vary significantly from month-to-month. You will not know at the time you submit a redemption request what the redemption value of your interests will be. The restrictions imposed on redemptions limit your ability to protect yourself against major losses by redeeming part or all of your interests.

The Manager must consent before you can transfer or assign your interests and the securities laws provide additional restrictions on the transferability of interests. There will not be a secondary market for interests.

You Have No Rights Of Control

You will be unable to exercise any control over the business of the Trust. In addition, the Manager can cause a Series to redeem your interests upon 10 business days prior written notice for any reason in the Manager's sole discretion. The Manager may elect to cause a Series to redeem your interests when your continued holding of interests would or might violate any law or constitute a prohibited transaction under ERISA or the Internal Revenue Code and a statutory, class or individual exemption from the prohibited transaction provisions of ERISA for such transaction or transactions does not apply or cannot be obtained from the Department of Labor (or the Manager determines not to seek such an exemption).

You Have Limited Rights to Inspect Books and Records

You will have only limited rights to inspect the books and records of the Trust and the Manager. You will generally only have the right to inspect the books and records of the Trust and the Manager as are specifically granted under the Delaware Business Trust Act. In particular, information regarding positions held by a Series, to the extent deemed proprietary or confidential by the Manager, will not be made available to you except as required by law.

Limited Arms-Length Negotiation

The initial offering price per interest was established arbitrarily. Except for the agreements with the Trustee, the terms of this offering and the structure of the Trust have not been established as the result of arms-length negotiation.

Each Series Could Lose Assets and Have Its Trading Disrupted Due to the Bankruptcy of its Clearing Broker or Others

Each Series is subject to the risk of clearing broker, exchange or clearinghouse insolvency. Series assets could be lost or impounded in such an insolvency during lengthy bankruptcy proceedings. Were a substantial portion of a Series' capital tied up in a bankruptcy, the Manager might suspend or limit trading, perhaps causing a Series to miss significant profit opportunities.

Each Series Is Subject to Certain Conflicts of Interest

The Manager and the clearing broker are subject to certain actual and potential conflicts of interests.

Although the Manager is not affiliated with a commodity broker, the Manager may have a conflict of interest in selecting brokers because of long-standing business dealings with certain brokers. In addition, the Manager, its principals and affiliates may have commodity accounts at the same brokerage firms as the Trust, and, because of the amount traded through such brokerage firms, may pay lower commissions than the Trust.

The Manager, the clearing broker, their respective affiliates and each of their principals, directors, officers, employees and families may be trading and directing other futures accounts, including their own accounts. Each will not be aware of what others are doing on behalf of a Series, and they may take positions similar or opposite to those of a Series or in competition with a Series. Generally, a Series will enter orders only once a month. The Manager will allocate transactions among the Series of the Trust and other clients in a manner believed by the Manager to be equitable to each.

In certain instances, the clearing broker may have orders for trades from a Series and orders from its own employees and it might be deemed to have a conflict of interest between the sequence in which such orders are transmitted to the trading floor.

The Manager and its principals are engaged in substantial activities, including managing other accounts not involving the Trust, and will devote to the Trust such amount of their time as they determine reasonable and necessary. The compensation received by the Manager and its principals from such other accounts and entities may differ from the compensation it receives from the Trust.

Investment advisers and broker-dealers receiving continuing compensation from the Manager on interests sold by them will have a financial incentive to encourage investors to purchase and not to redeem their interests.

The Trust could be Taxed as a Corporation

In the opinion of the Trust's counsel, under current federal income tax law, each Series will be classified as a partnership and not as an association taxable as a corporation for federal income tax purposes, and each such Series should not be subject to federal income taxation as a corporation under the provisions applicable to so-called publicly traded partnerships. However, you should note that the Trust has not and will not request a ruling from the Internal Revenue Service to this effect. If the Trust or a Series were taxed as a corporation for federal income tax purposes, the net income of the Trust or a Series would be taxed to the Trust or a Series at corporate income tax rates, no losses of the Trust or a Series would be allowable as deductions to the interest holders, and all or a portion of any distributions by the Trust or a Series to the interest holders, other than liquidating distributions, would constitute dividends to the extent of the Trust's or a Series' current or accumulated earnings and profits and would be taxable as such.

You Are Taxed Every Year on Your Share of a Series' Profits Not Only When You Redeem as Would Be the Case if You Held Stocks or Bonds

You will be taxed each year on your investment in a Series, irrespective of whether you receive distributions or redeem any interests. In contrast, an investor holding stocks or bonds generally pays no tax on their capital appreciation until the securities are sold. Over time, the deferral of tax on stock and bond appreciation has a compounding effect.

Deductibility of Expenses May be Limited

You could be required to treat the management fees, as well as certain other expenses of a Series, as investment advisory fees, which are subject to substantial restrictions on deductibility for individual taxpayers. The Manager has not, to date, been classifying the management fee or such expenses as investment advisory fees, a position to which the Internal Revenue Service might object. Should the Internal Revenue Service re-characterize the management fee or other expenses as investment advisory fees, you may be required to pay additional taxes, interest and penalties.

The Series' Trading Gains May Be Taxed at Higher Rates

You will be taxed on your share of any trading profits of a Series at both short- and long-term capital gain rates. These tax rates are determined irrespective of how long you hold Interests. Consequently, the tax rate on a Series' trading gains may be higher than those applicable to other investments you hold for a comparable period.

Tax Could Be Due from You on Your Share of a Series' Interest Income Despite Overall Losses

You may be required to pay tax on your allocable share of a Series' interest income, even though the Series incurs overall losses. Trading losses can only be used by individuals to offset trading gains and $3,000 of interest income each year. Consequently, if you were allocated $5,000 of interest income net of expenses and $10,000 of net trading losses, you would owe tax on $2,000 of interest income even though you would have a $5,000 loss for the year. The $7,000 capital loss would carry forward, but subject to the same limitation on its deductibility against interest income.

Possibility of Tax Audit

There can be no assurance that tax returns of a Series will not be audited by the Internal Revenue Service or that such audits will not result in adjustments to such returns. If an audit results in an adjustment, you may be required to file amended returns and to pay additional taxes plus interest.

Employee Benefit Plan Considerations

Although the Manager will be a fiduciary to the ERISA investors with respect to the assets of such investors invested in a Series, neither the Manager, nor the Trustee, nor any of their affiliates, agents, or employees will act as a fiduciary to any ERISA investor with respect to the ERISA investor's decision to invest assets in a Series. Fiduciaries of prospective ERISA investors, in consultation with their advisors, should carefully consider the application of ERISA and the regulations issued there under on an investment in a Series.

Absence of Certain Statutory Registrations

The Trust is not registered as an investment company or mutual fund, which would subject it to extensive regulation under the Investment Company Act of 1940, as amended. If the Trust were required to register as an investment company, it would be subject to additional regulatory restrictions. Some of these restrictions would be fundamentally inconsistent with the operation of the Trust, including among other things, restrictions relating to the liquidity of portfolio investments, to the use of leverage, to custody requirements, and to the issuance of senior securities. As a result, it would be impractical for the Trust to continue its current operations. Consequently, you will not benefit from certain of the protections afforded by the Investment Company Act of 1940, as amended. However, the Manager is registered with the Securities and Exchange Commission under the Investment Advisers Act of 1940, as amended, and thus is an investment manager for purposes of ERISA. In addition, the Manager is registered as a commodity pool operator and a commodity trading advisor with the CFTC, is a member of the NFA and is subject to extensive regulation under the Commodity Exchange Act.

No Independent Counsel

No independent counsel has been selected to represent the interests of the interest holders and there have been no negotiations between the Manager and any interest holders in connection with the terms of the offering or the terms of the Trust Agreement.

Item 1B Unresolved Staff Comments

None

Item 2. Properties

The Trust does not own or lease any physical properties. The Trust's office is located within the office of the Manager at 405 South Street, Newtown, PA 18940.

Item 3. Legal Proceedings

There are no pending legal proceedings to which the Trust or the Manager is a party or to which any of their assets are subject.

Item 4. (Removed and Reserved)

Not applicable.

Item 5. Market For Registrant's Common Equity and Related Stockholder Matters

There currently is no established public trading market for the interests. As of December 31, 2010, approximately $36 million Leveraged Series interests were held by 494 owners, $50 million Unleveraged Series interests were held by 317 owners, $14 million Commodity L/S Unleveraged Series interests were held by 4 owners and $49 million Commodity L/N Unleveraged Series interests were held by 8 owners.

The interests are "restricted securities" within the meaning of Rule 144 promulgated under the Securities Act of 1933, as amended (the "Securities Act"), and may not be sold unless registered under the Securities Act or sold in accordance with an exemption therefrom, such as Rule 144. The Trust has no plans to register any of the interests for resale. In addition the Trust Agreement provides that an interest holder may transfer its interests only upon the approval of the Manager in the Manager's sole and absolute discretion.

Pursuant to the Trust Agreement, the Manager has the sole discretion to determine whether distributions (other than on redemption of interests), if any, will be made to interest holders. The Trust has never paid any distribution and does not anticipate paying any distributions of interest holders in the foreseeable future.

Recent Sales of Unregistered Securities

From October 1, 2010 to December 31, 2010, a total of 131,192 interests were sold for the aggregate net subscription amount of $13,841,400. Total number of purchasers was 14. There were no non-accredited investors during this period. Details of the sale of these interests are as follows:

|

Series

|

Date

|

Subscriptions

|

Units

|

Price

|

# of Purchasers

|

||||||||||||

|

|

|

|

|

|

|

||||||||||||

|

Leveraged A Units

|

10/1/2010

|

$ | 0 | 0 | $ | 0 | 0 | ||||||||||

|

Leveraged B Units

|

10/1/2010

|

74,550 | 696 | 107.05 | 2 | ||||||||||||

|

Leveraged C Units

|

10/1/2010

|

0 | 0 | 0 | 0 | ||||||||||||

|

Leveraged D Units

|

10/1/2010

|

0 | 0 | 0 | 0 | ||||||||||||

|

Leveraged A Units

|

11/1/2010

|

0 | 0 | 0 | 0 | ||||||||||||

|

Leveraged B Units

|

11/1/2010

|

0 | 0 | 0 | 0 | ||||||||||||

|

Leveraged C Units

|

11/1/2010

|

0 | 0 | 0 | 0 | ||||||||||||

|

Leveraged D Units

|

11/1/2010

|

0 | 0 | 0 | 0 | ||||||||||||

|

Leveraged A Units

|

12/1/2010

|

0 | 0 | 0 | 0 | ||||||||||||

|

Leveraged B Units

|

12/1/2010

|

0 | 0 | 0 | 0 | ||||||||||||

|

Leveraged C Units

|

12/1/2010

|

0 | 0 | 0 | 0 | ||||||||||||

|

Leveraged D Units

|

12/1/2010

|

285,000 | 2,654 | 107.39 | 2 | ||||||||||||

|

Total Leveraged Series

|

359,550 | 3,350 | 4 | ||||||||||||||

|

Unleveraged A Units

|

10/1/2010

|

0 | 0 | 0 | 0 | ||||||||||||

|

Unleveraged B Units

|

10/1/2010

|

61,050 | 483 | 126.39 | 1 | ||||||||||||

|

Unleveraged C Units

|

10/1/2010

|

0 | 0 | 0 | 0 | ||||||||||||

|

Unleveraged D Units

|

10/1/2010

|

2,599,938 | 22,849 | 113.79 | 4 | ||||||||||||

|

Unleveraged A Units

|

11/1/2010

|

0 | 0 | 0 | 0 | ||||||||||||

|

Unleveraged B Units

|

11/1/2010

|

0 | 0 | 0 | 0 | ||||||||||||

|

Unleveraged C Units

|

11/1/2010

|

0 | 0 | 0 | 0 | ||||||||||||

|

Unleveraged D Units

|

11/1/2010

|

699,938 | 6,083 | 115.07 | 2 | ||||||||||||

|

Unleveraged A Units

|

12/1/2010

|

0 | 0 | 0 | 0 | ||||||||||||

|

Unleveraged B Units

|

12/1/2010

|

924 | 7 | 125.51 | 1 | ||||||||||||

|

Unleveraged C Units

|

12/1/2010

|

0 | 0 | 0 | 0 | ||||||||||||

|

Unleveraged D Units

|

12/1/2010

|

120,000 | 1,061 | 113.09 | 1 | ||||||||||||

|

Total Unleveraged Series

|

3,481,850 | 30,476 | 9 | ||||||||||||||

|

Commodity L/S D Units

|

10/1/2010

|

0 | 0 | 0 | 0 | ||||||||||||

|

Commodity L/S D Units

|

11/1/2010

|

0 | 0 | 0 | 0 | ||||||||||||

|

Commodity L/S D Units

|

12/1/2010

|

0 | 0 | 0 | 0 | ||||||||||||

|

Total Commodity L/S Series

|

0 | 0 | 0 | ||||||||||||||

|

Commodity L/N D Units

|

10/1/2010

|

0 | 0 | 0 | 0 | ||||||||||||

|

Commodity L/N D Units

|

11/1/2010

|

10,000,000 | 97,359 | 102.72 | 1 | ||||||||||||

|

Commodity L/N D Units

|

12/1/2010

|

0 | 0 | 0 | 0 | ||||||||||||

|

Total Commodity L/N Series

|

10,000,000 | 97,359 | 1 | ||||||||||||||

|

Trust Total

|

$ | 13,841,400 | 131,192 | 14 | |||||||||||||

The price of the interests of each Class reflects the net asset value of interests in the Class. The interests were sold pursuant to Rule 506 of Regulation D and the sales were exempt from registration under the Securities Act of 1933. Purchasers of the interests completed subscription documents in which they represented that they were accredited investors as defined in Regulation D and a Form D was filed with the Securities and Exchange Commission in the time periods prescribed by Regulation D.

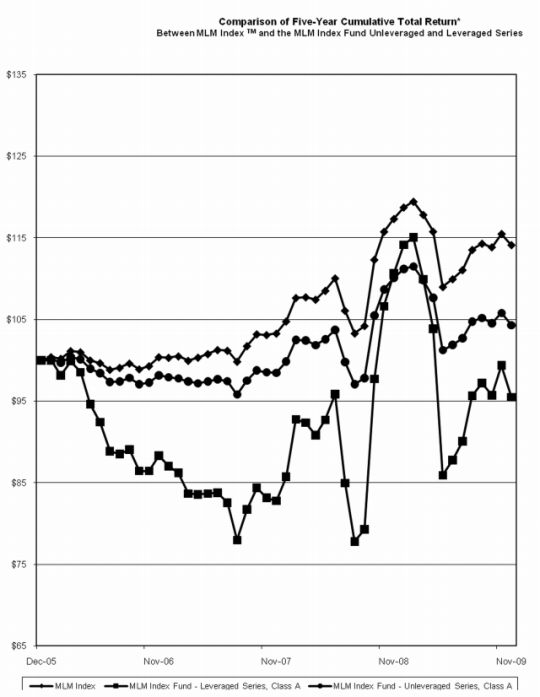

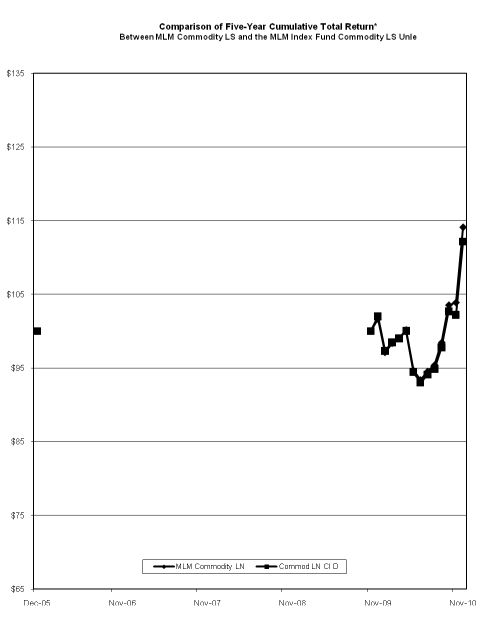

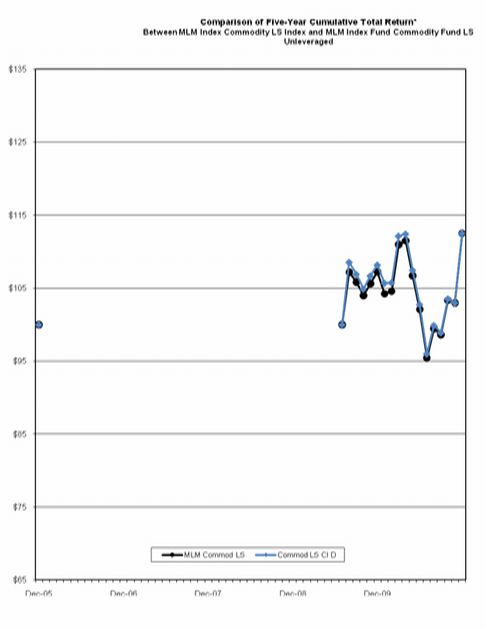

Five Year Cumulative Performance of the Trust

Since the Trust does not deal in equities, it cannot compare its return against an equivalent broad-based equities market index. As set forth below, the Trust has selected the MLM Index™, with which to compare its cumulative five-year return. Although the Trust contains multiple classes of interests, it has taken as a representative example, the highest fee classes in both the Leveraged and Unleveraged Series. In both cases, the Trust has indicated the cumulative total return for Class A interests for the Leveraged and Unleveraged Series.

So as to comply as much as possible with the promulgated rules, the Trust has used the MLM Index™ to compare its cumulative total return. Created in 1988, the MLM Index™ is a benchmark of the returns available to a futures investor. It is based on daily closing prices of the nearby contract month of a portfolio chosen from among the most active futures markets. The Index Committee of Mount Lucas Management Corporation makes the choice of markets for a calendar year in the December preceding the start of the year, and, except in unusual circumstances, markets are not normally added to or deleted from the MLM Index™ during a year. The MLM Index™ is a widely recognized benchmark for evaluating managed futures performance that is frequently discussed in periodicals such as the Wall Street Journal, Institutional Investor, Pension World and Pensions & Investments. Performance of the MLM Index™ is available through Bloomberg™, LP and Morningstar.

The MLM Index™ is unique in the industry in that the Index contains long and short positions in the various futures contracts. Since no other publicly available, widely distributed, transparent index in the market place has this feature it is not possible to compare the performance of the MLM Index Fund with another index.

The Comparison of Five-Year Cumulative Total Returns Graphs, set forth below, assumes that an investment in units in the Trust, and the MLM Index™, was $100 on December 31, 2005 or the start date of the Series, whichever occurred later. The Cumulative Total Return is based on unit price appreciation (there were no dividends declared or paid during the period) from December 31, 2005 through December 31, 2010.

|

12/31/06

|

12/31/07

|

12/31/08

|

12/31/09

|

12/31/10

|

|

|

MLM Index™

|

100.40

|

103.29

|

117.33

|

114.13

|

118.10

|

|

MLM Commodity Long/Short Index

|

107.24

|

112.52

|

|||

|

MLM Commodity Long/Neutral Index

|

101.65

|

114.10

|

|||

|

MLM Index Fund - Leveraged Series, Class A

|

88.29

|

82.76

|

100.63

|

95.48

|

99.99

|

|

MLM Index Fund - Unleveraged Series, Class A

|

98.17

|

98.46

|

110.11

|

104.30

|

104.88

|

|

MLM Index Fund – Commodity L/S Unleveraged Series, Class D

|

108.17

|

112.51

|

|||

|

MLM Index Fund – Commodity L/N Unleveraged Series, Class D

|

102.00

|

112.15

|

Item 6. Selected Financial Data

The Trust began trading on January 4, 1999. Set forth below is certain selected historical data for the Trust and each of its respective Series for the 5 years ended December 31, 2010. The selected historical financial data were derived from the financial statements of the Trust, which were audited by EisnerAmper LLP for years 2006 through 2010. The information set forth below should be read in conjunction with the Financial Statements and notes thereto contained elsewhere in this document.

Years Ended December 31,

|

2010

|

2009

|

2008

|

2007

|

2006

|

||||||||||||||||

|

Operations Data:

|

||||||||||||||||||||

|

Realized Gains

|

||||||||||||||||||||

| (Losses) | ||||||||||||||||||||

|

Leveraged Series

|

$ | (731,228 | ) | $ | 198,011 | $ | 11,308,833 | $ | (4,660,063 | ) | $ | (12,460,759 | ) | |||||||

|

Unleveraged Series

|

(13,088 | ) | 324,223 | 7,795,635 | (2,177,898 | ) | (3,968,131 | ) | ||||||||||||

|

Commodity L/N Unleveraged Series

|

631,617 | 4,594 | - | - | - | |||||||||||||||

|

Commodity L/S Unleveraged Series

|

(1,172,228 | ) | 205,095 | - | - | - | ||||||||||||||

|

Total

|

$ | (1,284,927 | ) | $ | 731,923 | $ | 19,104,468 | $ | (6,837,961 | ) | $ | (16,428,890 | ) | |||||||

|

Net Change in Unrealized Gains (Losses)

|

||||||||||||||||||||

|

Leveraged Series

|

$ | 4,174,060 | $ | (4,946,374 | ) | $ | 2,930,402 | $ | (612,748 | ) | $ | (5,582,435 | ) | |||||||

|

Unleveraged Series

|

1,843,174 | (2,556,563 | ) | 1,558,204 | 127,795 | (1,702,910 | ) | |||||||||||||

|

Commodity L/N Unleveraged Series

|

5,408,440 | 100,833 | - | - | - | |||||||||||||||

|

Commodity L/S Unleveraged Series

|

1,469,821 | 57,497 | - | - | - | |||||||||||||||

|

Total

|

$ | 12,895,495 | $ | (7,344,607 | ) | $ | 4,488,606 | $ | (484,953 | ) | $ | (7,285,345 | ) | |||||||

|

2010

|

2009

|

2008

|

2007

|

2006

|

||||||||||||||||

|

Interest Income

|

||||||||||||||||||||

|

Leveraged Series

|

$ | 24,329 | $ | 51,086 | $ | 949,382 | $ | 3,133,540 | $ | 6,947,358 | ||||||||||

|

Unleveraged Series

|

44,746 | 108,814 | 1,974,332 | 5,391,102 | 7,256,355 | |||||||||||||||

|

Commodity L/N Unleveraged Series

|

13,054 | - | - | - | - | |||||||||||||||

|

Commodity L/S Unleveraged Series

|

4,237 | - | - | - | - | |||||||||||||||

|

Total

|

$ | 86,366 | $ | 159,900 | $ | 2,923,714 | $ | 8,524,642 | $ | 14,203,713 | ||||||||||

|

Brokerage Commissions

|

||||||||||||||||||||

|

Leveraged Series

|

$ | 466,282 | $ | 592,105 | $ | 579,037 | $ | 860,634 | $ | 2,180,755 | ||||||||||

|

Unleveraged Series

|

237,734 | 362,198 | 398,556 | 584,137 | 908,722 | |||||||||||||||

|

Commodity L/N Unleveraged Series

|

94,306 | 1,667 | - | - | - | |||||||||||||||

|

Commodity L/S Unleveraged Series

|

41,609 | 5,270 | - | - | - | |||||||||||||||

|

Total

|

$ | 839,931 | $ | 961,240 | $ | 977,593 | $ | 1,444,771 | $ | 3,089,477 | ||||||||||

|

Management Fees

|

||||||||||||||||||||

|

Leveraged Series

|

$ | 548,317 | $ | 720,477 | $ | 668,846 | $ | 930,244 | $ | 2,260,375 | ||||||||||

|

Unleveraged Series

|

270,067 | 414,080 | 446,769 | 606,029 | 888,488 | |||||||||||||||

|

Commodity L/N Unleveraged Series

|

117,883 | 2,084 | - | - | - | |||||||||||||||

|

Commodity L/S Unleveraged Series

|

52,012 | 6,588 | - | - | - | |||||||||||||||

|

Total

|

$ | 988,279 | $ | 1,143,229 | $ | 1,115,615 | $ | 1,536,273 | $ | 3,148,863 | ||||||||||

|

Operating Expenses

|

||||||||||||||||||||

|

Leveraged Series

|

$ | 181,522 | $ | 273,557 | $ | 173,994 | $ | 718,369 | $ | 896,006 | ||||||||||

|

Unleveraged Series

|

232,177 | 391,907 | 332,446 | 681,081 | 929,934 | |||||||||||||||

|

Commodity L/N Unleveraged Series

|

95,549 | 1,459 | - | - | - | |||||||||||||||

|

Commodity L/S Unleveraged Series

|

42,085 | 5,574 | - | - | - | |||||||||||||||

|

Total

|

$ | 551,333 | $ | 672,497 | $ | 506,440 | $ | 1,399,451 | $ | 1,825,940 | ||||||||||

|

Net Income (Loss)

|

||||||||||||||||||||

|

Leveraged Series

|

$ | 2,271,040 | $ | (6,283,416 | ) | $ | 13,766,740 | $ | (4,648,518 | ) | $ | (16,432,972 | ) | |||||||

|

Unleveraged Series

|

1,134,854 | (3,291,711 | ) | 10,150,400 | 1,469,750 | (1,141,829 | ) | |||||||||||||

|

Commodity L/N Unleveraged Series

|

5,745,373 | 100,217 | - | - | - | |||||||||||||||

|

Commodity L/S Unleveraged Series

|

166,124 | 245,160 | - | - | - | |||||||||||||||

|

Total

|

$ | 9,317,391 | $ | (9,229,750 | ) | $ | 23,917,140 | $ | (3,178,768 | ) | $ | (17,574,801 | ) | |||||||

|

2010

|

2009

|

2008

|

2007

|

2006

|

||||||||||||||||

|

Financial Condition Data

|

||||||||||||||||||||

|

Investors' Interest

|

||||||||||||||||||||

|

Leveraged Series

|

$ | 36,025,320 | $ | 46,295,886 | $ | 51,982,221 | $ | 38,446,483 | $ | 105,628,317 | ||||||||||

|

Unleveraged Series

|

50,458,589 | 46,435,691 | 84,214,513 | 78,939,248 | 123,596,233 | |||||||||||||||

|

Commodity L/N Unleveraged Series

|

48,946,590 | 8,601,217 | - | - | - | |||||||||||||||

|

Commodity L/S Unleveraged Series

|

13,912,284 | 3,246,160 | - | - | - | |||||||||||||||

|

Total

|

$ | 149,342,783 | $ | 104,578,954 | $ | 136,196,734 | $ | 117,385,731 | $ | 229,224,550 | ||||||||||

|

Total Assets

|

||||||||||||||||||||

|

Leveraged Series

|

$ | 36,847,815 | $ | 48,102,341 | $ | 54,944,275 | $ | 40,139,770 | $ | 114,171,919 | ||||||||||

|

Unleveraged Series

|

50,964,459 | 70,001,656 | 84,666,129 | 79,877,166 | 131,089,103 | |||||||||||||||

|

Commodity L/N Unleveraged Series

|

48,990,089 | 8,604,968 | - | - | - | |||||||||||||||

|

Commodity L/S Unleveraged Series

|

13,925,388 | 3,247,962 | - | - | - | |||||||||||||||

|

Total

|

$ | 150,727,751 | $ | 129,956,927 | $ | 139,610,404 | $ | 120,016,936 | $ | 245,261,022 | ||||||||||

|

Net Asset Value Per Class A Leveraged Series Interest

|

95.00 | 90.73 | 105.12 | 78.88 | 83.94 | |||||||||||||||

|

Net Asset Value Per Class B Leveraged Series Interest

|

112.17 | 105.53 | 120.43 | 89.06 | 93.36 | |||||||||||||||

|

Net Asset Value Per Class C Leveraged Series Interest

|

91.75 | 86.24 | 98.31 | 72.63 | 76.06 | |||||||||||||||

|

Net Asset Value Per Class D Leveraged Series Interest

|

114.91 | 107.20 | 121.29 | 88.95 | 92.46 | |||||||||||||||

|

Net Asset Value Per Class A Unleveraged Series Interest

|

113.91 | 113.28 | 119.60 | 106.89 | 106.39 | |||||||||||||||

|

Net Asset Value Per Class B Unleveraged Series Interest

|

128.31 | 126.32 | 132.04 | 116.85 | 115.15 | |||||||||||||||

|

Net Asset Value Per Class C Unleveraged Series Interest

|

112.67 | 110.99 | 116.06 | 102.77 | 101.32 | |||||||||||||||

|

Net Asset Value Per Class D Unleveraged Series Interest

|

115.65 | 113.35 | 117.94 | 103.92 | 101.94 | |||||||||||||||

|

Net Asset Value Per Class D Commodity L/S Unleveraged Series Interest

|

112.53 | 108.17 | - | - | - | |||||||||||||||

|

Net Asset Value Per Class D Commodity L/N Unleveraged Series Interest

|

112.17 | 102.00 | - | - | - | |||||||||||||||

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

General