Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Discover Financial Services | d8k.htm |

2011

Financial Community Briefing March 23, 2011

Exhibit 99.1 |

2

Notice

The following slides are part of a presentation by Discover Financial Services (the

"Company") and are intended to be viewed as part of that

presentation. No representation is made that the information in these slides

is complete. The information provided herein may include certain

non-GAAP financial measures. The reconciliations of such

measures

to

the

comparable

GAAP

figures

are

included

in

the

Company’s

Annual

Report

on

Form

10-K

for the year ended November 30, 2010 and the Company’s Current Report on Form

8-K dated March 22, 2011, each of which are on file with the SEC and

available on the Company’s website at www.discoverfinancial.com. Certain reconciliations are also included at the end of this presentation.

The presentation contains forward-looking statements. You are cautioned not to

place undue reliance on forward-looking statements, which speak only as

of the date on which they are made, which reflect management’s

estimates, projections, expectations or beliefs at that time and which are subject to risks and

uncertainties that may cause actual results to differ materially. For a discussion

of certain risks and uncertainties

that

may

affect

the

future

results

of

the

Company,

please

see

"Special

Note

Regarding

Forward-

Looking

Statements,"

"Risk

Factors,"

"Business

–

Competition,"

"Business

–

Supervision

and

Regulation"

and

"Management’s Discussion and Analysis of Financial Condition and Results

of Operations" in the Company’s Annual Report on Form 10-K for

the year ended November 30, 2010, which is on file with the SEC.

Certain historical financial information about the Company that we have included in

this presentation has been derived from Morgan Stanley’s consolidated

financial statements and does not necessarily reflect what our financial

condition, results of operations or cash flows would have been had we operated as a separate,

stand-alone company during the periods presented.

We own or have rights to use the trademarks, trade names and service marks that we

use in conjunction with the

operation

of

our

business,

including,

but

not

limited

to:

Discover

®

,

PULSE

®

,

Cashback

Bonus

®

,

Discover

®

Network

and

Diners

Club

International

®

.

All

other

trademarks,

trade

names

and

service

marks

included

in

this

presentation are the property of their respective owners.

|

3

Roger Hochschild

PRESIDENT & CHIEF OPERATING OFFICER

Carlos Minetti

PRESIDENT CONSUMER BANKING & OPERATIONS

Harit Talwar

PRESIDENT U.S. CARDS

Diane Offereins

PRESIDENT PAYMENT SERVICES

Exploiting the payments

opportunity

Diversifying into higher growth

asset classes

Driving profitable card growth

2010 Accomplishments &

2011 Priorities

Delivering shareholder value

through strong financial performance

Roy Guthrie

CHIEF FINANCIAL OFFICER

Q&A

Agenda

David Nelms

CHAIRMAN & CHIEF EXECUTIVE OFFICER

Using our Direct Banking & Payments

assets to deliver profitable growth |

2011

Financial Community Briefing David Nelms

Chairman &

Chief Executive Officer

Using our Direct Banking and Payments assets to deliver profitable growth

CONSUMER

CONSUMER

DEPOSITS

DEPOSITS

DISCOVER

DISCOVER

CARD

CARD

CONSUMER

CONSUMER

LOANS

LOANS

PULSE

PULSE

DEBIT

DEBIT

NETWORK

NETWORK

DINERS

DINERS

CLUB

CLUB

INTERNATIONAL

INTERNATIONAL

DISCOVER

DISCOVER

NETWORK

NETWORK |

5

Strong results in Direct Banking and Payments

•

Card business generating strong profitability

–

Credit trends provide flexibility to invest for growth

–

Expect modest Card receivable growth in 2H 2011

•

Have continued to diversify our portfolio with the acquisition of The

Student Loan Corporation

–

Other consumer lending receivables are now ~15% of total receivables

–

Leveraging unsecured lending and marketing capabilities to drive

more

rapid asset growth at attractive returns

•

Focused on increasing acceptance globally and exploiting opportunities

in debit and mobile

–

Targeting Payment Services long-term profit growth of 15-20% with 10%+

volume CAGR

•

We continue to generate excess capital and are one of the first financial

services companies to restore the dividend

–

Fully restored quarterly dividend to $0.06 |

6

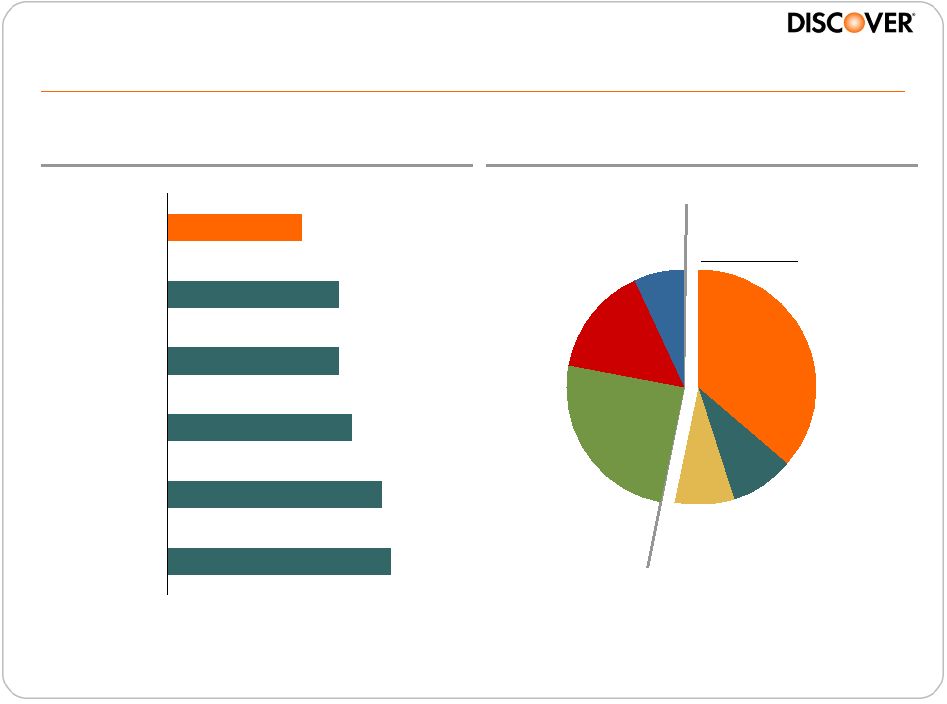

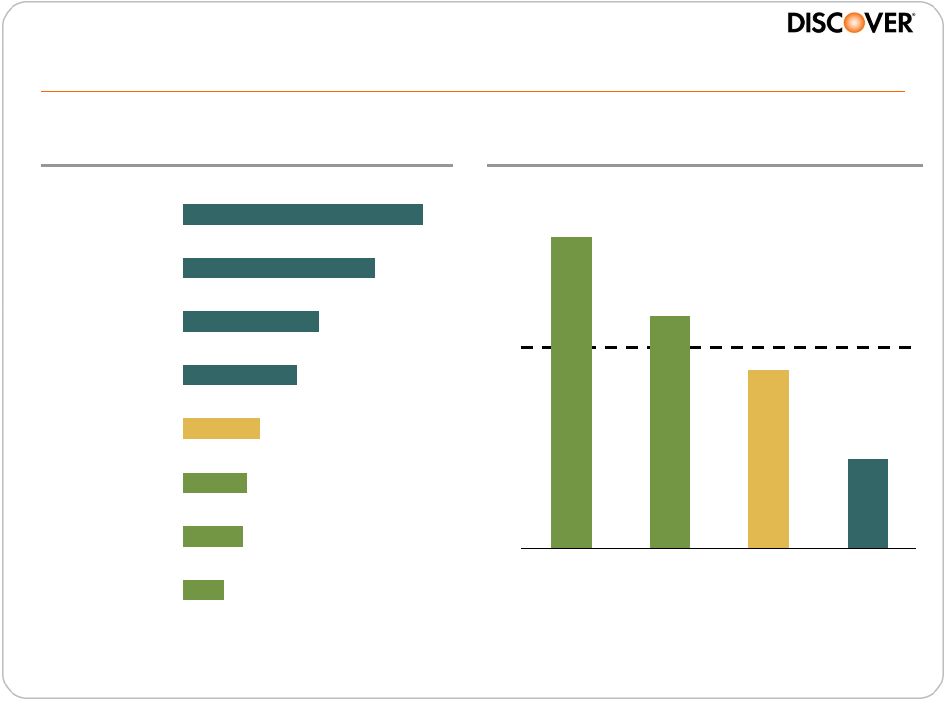

Preferred Banking Channel (%)

Source

American Bankers Association Survey 2010

95%

82%

76%

76%

59%

99%

Citi

BofA

Amex

JPMorgan

CapOne

DFS

2 Yr Avg. Risk Adjusted

Efficiency Ratio

(1)

(%)

Source

SNL, Regulatory Reports FY2010 & FY2009

Note(s)

1.

Non-interest expense divided by net revenue less provisions

2.

Excludes one-time special items per Bank of America presentation dated

3/9/11 Direct banking is efficient & aligns with consumer preference

(2)

Direct

Channels

Internet

36%

Mail

8%

Branch

25%

ATM

15%

NA

7%

Phone /

Mobile

9% |

7

•

Discover Network

–

Growth in merchant acceptance

and partnerships

–

Mobile and alternative payment

opportunities

provide

longer-term potential

•

PULSE

–

Continue rapid volume and

profit growth

–

Regulatory changes may create

opportunity for share gain

•

Diners Club

–

Improve competitive position in

key markets

–

Drive growth from network deals

with JCB, BC Card, etc.

Unique payments assets are growing rapidly

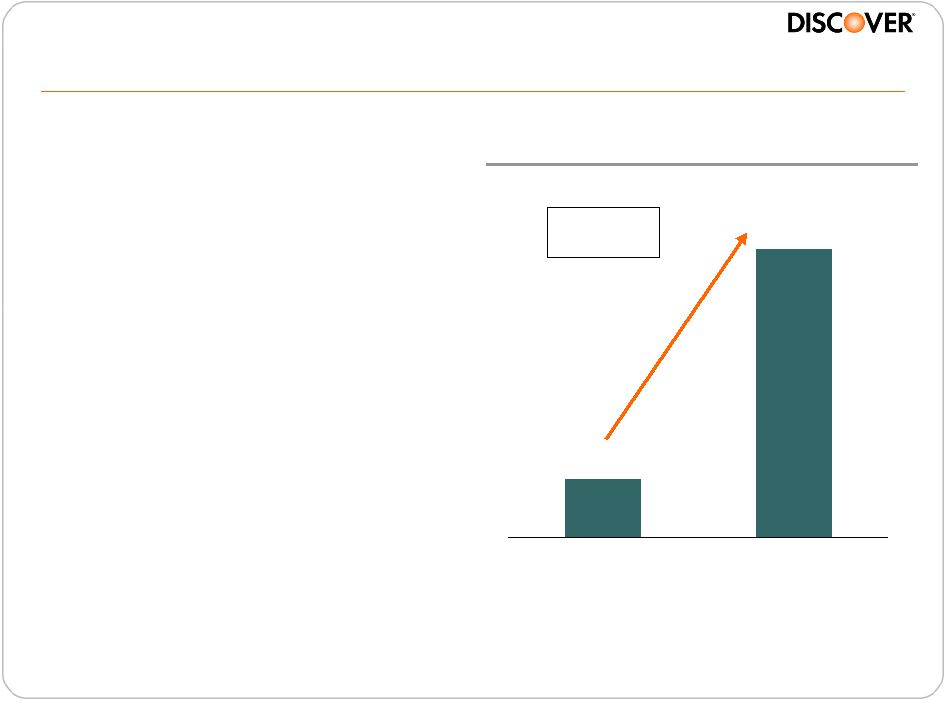

$29

$141

2006

2010

Payment Services

Pre-Tax Profits (MM)

2006 –

2010

CAGR: 48% |

8

Profitable long-term growth model

Asset Growth

EPS Growth /

Contribution

Card

2 - 4%

3 - 4%

Other Consumer Lending

20 - 25%

3 - 4%

Payments

NA

2%+/-

Organic Growth

5 - 6%

8 - 10%

Capital Management /

Acquisitions

0 - 4%

2 - 5%

Total Growth

5 - 10%

10 - 15%

Targets:

TCE / TA

(1)

~8%

ROE

15% +

Note(s)

1.

Defined as tangible common equity to tangible assets |

2010

Accomplishments & 2011 Priorities Roger Hochschild

President &

Chief Operating Officer

CONSUMER

CONSUMER

DEPOSITS

DEPOSITS

DISCOVER

DISCOVER

CARD

CARD

CONSUMER

CONSUMER

LOANS

LOANS

PULSE

PULSE

DEBIT

DEBIT

NETWORK

NETWORK

DINERS

DINERS

CLUB

CLUB

INTERNATIONAL

INTERNATIONAL

DISCOVER

DISCOVER

NETWORK

NETWORK |

10

•

Record year for Discover card sales volume

–

$92.5 billion with growth of 6% YOY

•

Announced acquisition of The Student Loan Corporation

–

~$4 billion in private student loans

(1)

•

Continued success in direct-to-consumer (DTC) deposit funding

–

64% increase in DTC deposits to $20Bn+

•

Increased merchant acceptance

–

8% increase in net active merchant outlets

•

Improved credit performance

–

185bps decrease in net charge-offs from 4Q09 to 4Q10

•

Strong year of profits

–

$765 million net income with ROE 15%+ for 2Q10 to 4Q10

•

Focused on capital / liquidity / funding

–

10% tangible common equity / tangible assets

(2)

2010 –

another year of significant accomplishments

Note(s)

1.

$3.1 billion after purchase accounting on 12/31/10

2.

See appendix for reconciliation

|

11

Superior risk management drives credit outperformance

Note(s)

1.

Discover data based on calendar year; adjusted for FAS 166/167 for periods prior to

1Q10 2.

Includes JPM Chase (Card Services), Citi (Branded Card NA), American Express (U.S.

Card), Capital One (U.S. Card) and Bank of America (U.S. Card)

Credit Card

Net Charge-Off Rate (%)

4%

5%

6%

7%

8%

9%

10%

11%

1Q08

3Q08

1Q09

3Q09

1Q10

3Q10

Discover

Peer Avg

(1)

4Q10

•

Disciplined approach

–

Continuous investment in

analytics / data sources

–

Strong credit performance and

well positioned portfolio

•

Using card capabilities to drive

growth

–

Viable cross-sell opportunities

to existing card customers

–

Judgmental underwriting with

analysis of cash flows

(2) |

12

2011 Performance Priorities

Card

•

Return to growth by gaining wallet

share and increasing new accounts

•

Expand merchant acceptance and

marketing partnerships to drive sales

Payments

•

Capture opportunities from

changing debit market

•

Leverage strategic partnerships to

build global network

Student & Personal Loans

•

Integrate SLC & build upon profitable

position in private student lending

•

Continue to generate strong returns

in personal loans and expand into

new categories

Savings

•

Leverage retail deposit channel to

provide liquidity and optimize

funding cost

•

Expand affinity business and suite

of banking products |

Harit Talwar

President, U.S. Cards

Driving profitable card growth

CONSUMER

CONSUMER

DEPOSITS

DEPOSITS

DISCOVER

DISCOVER

CARD

CARD

CONSUMER

CONSUMER

LOANS

LOANS

PULSE

PULSE

DEBIT

DEBIT

NETWORK

NETWORK

DINERS

DINERS

CLUB

CLUB

INTERNATIONAL

INTERNATIONAL

DISCOVER

DISCOVER

NETWORK

NETWORK |

14

Well positioned for profitable growth

•

Our business is positioned to generate a pre-tax ROA of 2.5%+ and an ROE

of 15%+ on a sustainable basis

•

Increasing usage and wallet share with existing customers, leveraging:

–

Brand leadership in Rewards, Service and Value

–

Unique partnerships with leading merchants

–

New programs and acceptance expansion

–

Increased brand presence

•

Strong growth in new accounts

•

Outperforming the industry over the last two years:

Discover

(1)

Peer Avg

(2)

Sales

2%

(11%)

Receivables

(9%)

(23%)

•

Continued momentum

–

1Q11: Sales 7% and receivables (3%)

Note(s)

1.

Calendar year; data prior to 2010 adjusted for FAS 166/167

2.

Includes AXP, BAC, C, COF, and JPM

Source

Internal data, public company filings and The Nilson Report (Nilson)

|

15

Delivering robust revenue margin through the cycle

Restrictions on re-pricing / fees

Interest charge-offs

Pricing actions

Lower promotional receivables

–

–

+

+

Restrictions on re-pricing / fees

Higher promotional receivables

Spend margin

Interest charge-offs

–

–

+

+

Post CARD Act /

Economic Cycle

CARD Act /

Economic Cycle Impact |

16

Note(s)

1.

Discover fiscal 2008

52%

66%

75%

27%

22%

10%

21%

12%

15%

Pre-CARD Act

1Q 11

Normalized

Promotional

Standard

Default / Cash

Modified the business model to reduce reliance

on promotional balances

(1) |

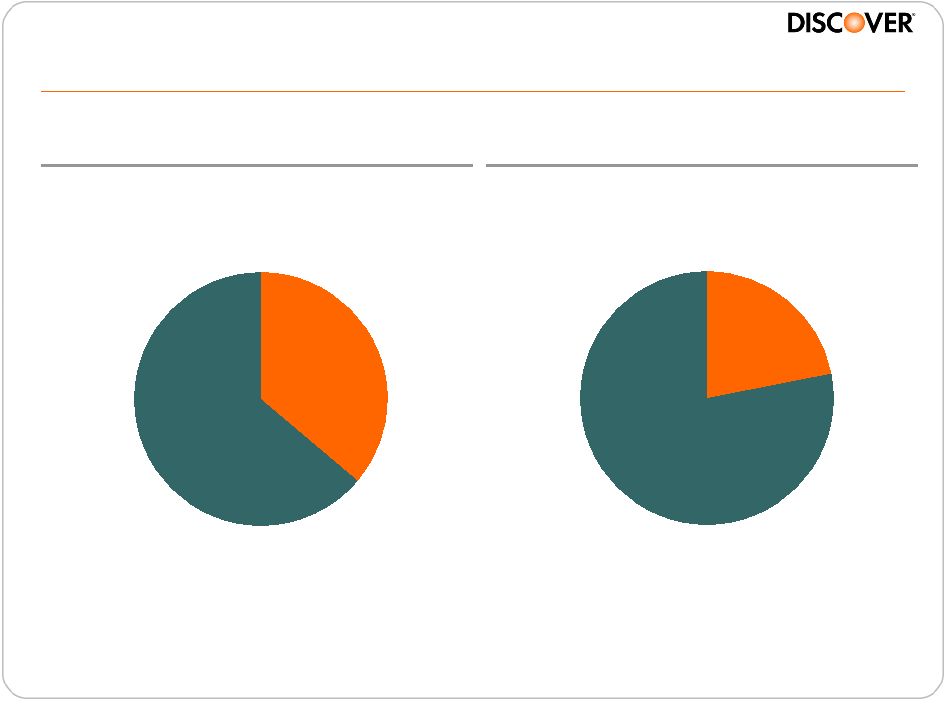

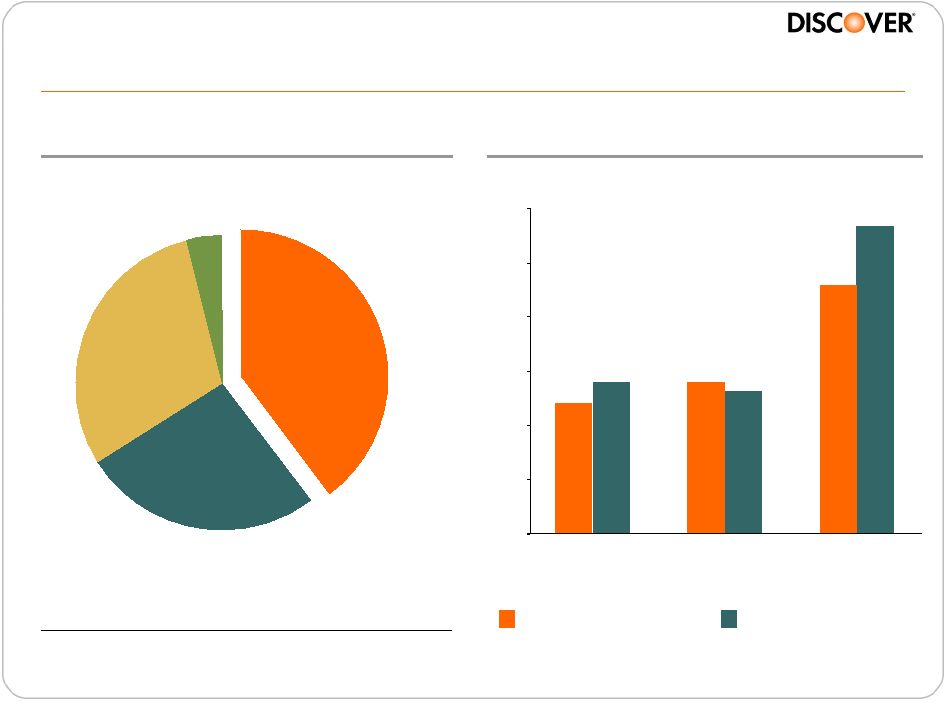

17

Attractive opportunity for growth with existing customers

Discover

Discover

Off-Us

Off-Us

On-Us

On-Us

Sales

Loans

Note(s)

Loans / Sales –

Credit bureau data and internal modeling

On-Us represents activity with Discover Card; Off-Us represents activity by

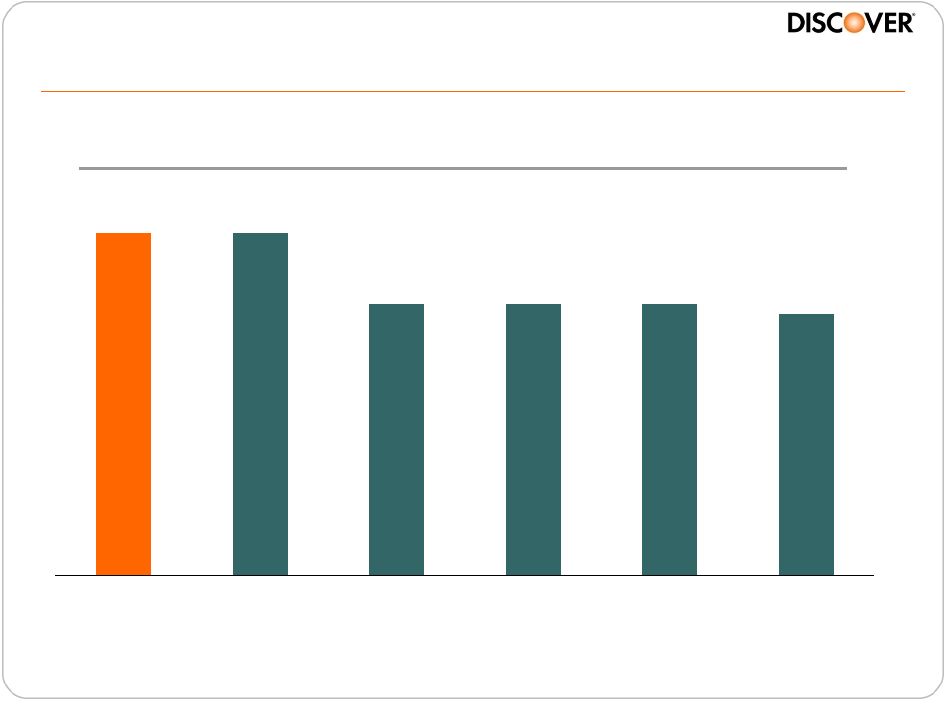

Discover Cardmembers with other competitors |

18

79%

79%

72%

72%

72%

71%

DFS

AXP

JPM

C

BAC

COF

Source

4Q 2010 Brand Tracker study, Millward Brown

Brand resonating strongly with customers

Recommend to a Friend

(1)

1.

% of survey participants who strongly / somewhat agree with the statement “I would recommend to a

friend”; among cardholders who say they use that brand’s card most often to make

purchases

Note(s) |

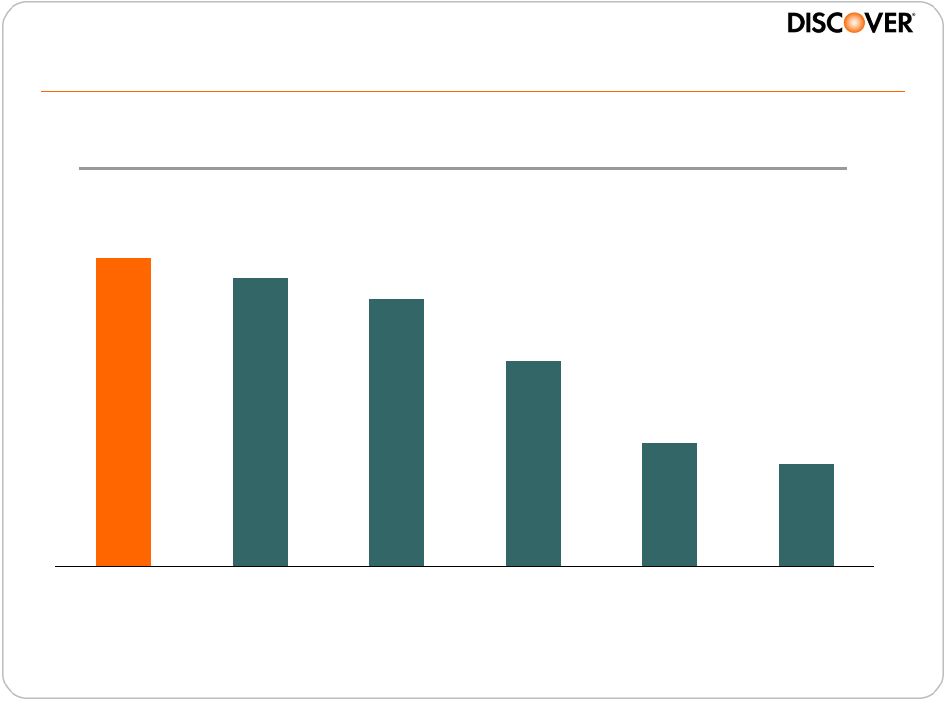

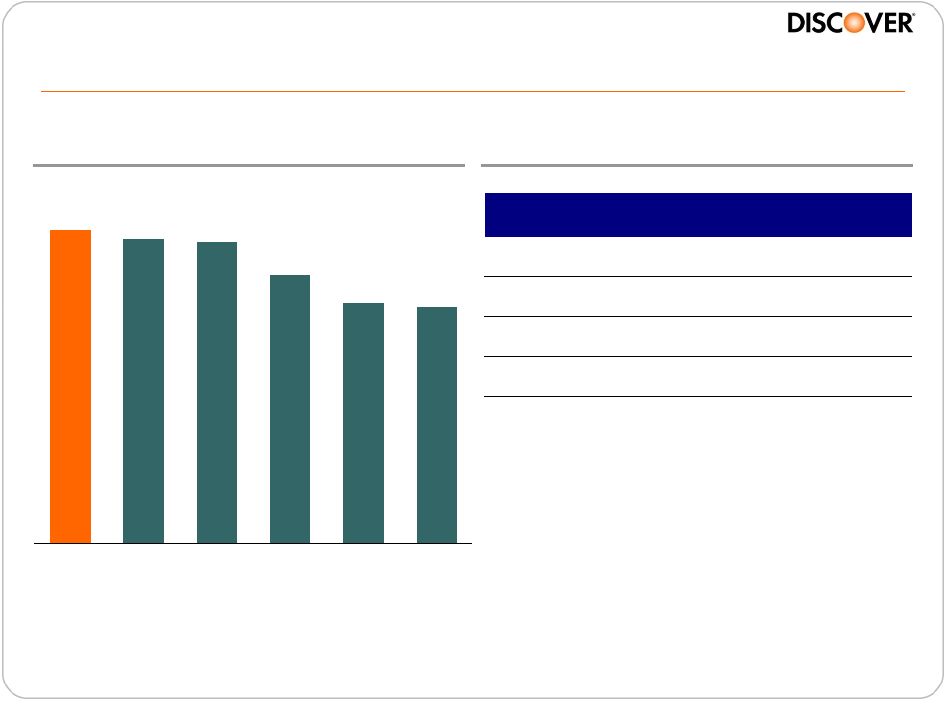

19

Sustained rewards leadership

67%

42%

33%

29%

23%

18%

DFS

JPM

AXP

C

COF

BAC

Best Cash Rewards

(1)

Source

4Q 2010 Brand Tracker study, Millward Brown

Note(s)

1.

% of unaided cardmembers who identify the brand with the statement “best cash

rewards”; among cardholders who say they use that brand’s card most often to make purchases |

20

Rewards programs driving record levels of

customer engagement

14

18

23

2008

2009

2010

Enrollments (MM) |

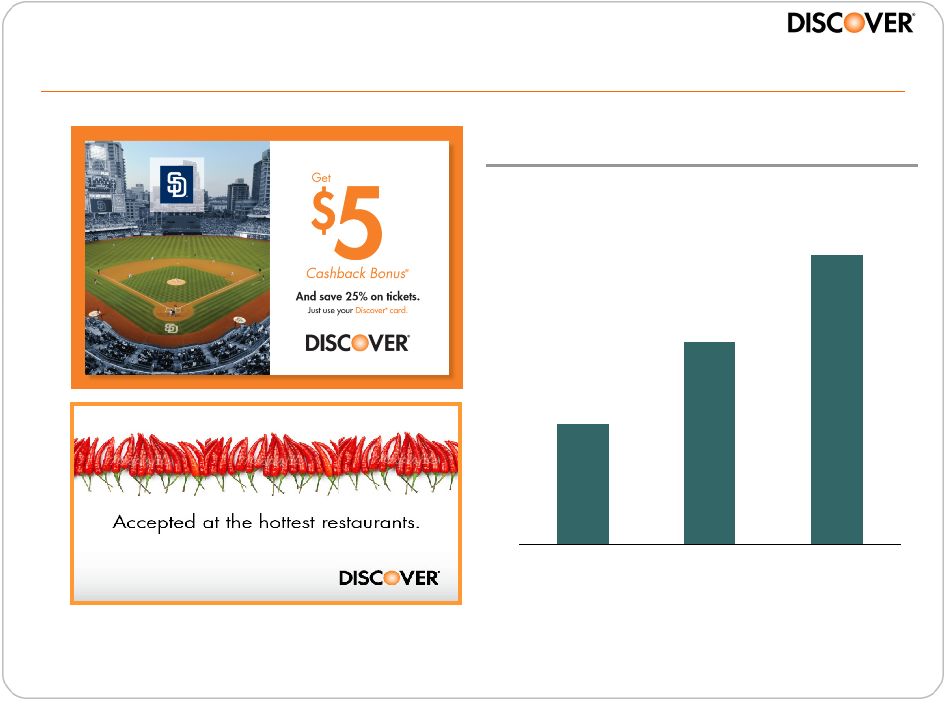

21

Merchant programs delivering value to customers

Note(s)

Internal data; Value to Customers reflects the extra rewards/discounts received by

customers from merchants on Discover offers 13%

Value to

Customers

Merchant Partners

$ 100MM

300+

24%

YOY |

22

Acceptance and marketing programs driving usage and sales

Note(s)

1.

Estimation based upon previously non-accepting and accelerated sign-up of

new merchants

Sales Impact ($Bn)

(1)

$3.4

$2.4

$1.4

2008

2009

2010 |

23

280MM+ opportunities to deliver great customer experience

J.D. Power

Customer Satisfaction Score

769

757

711

699

699

692

AXP

DFS

JPM

BAC

COF

C

Source

J.D. Power and Associates, 2010 Credit Card Satisfaction Study

33MM Conversations

250MM Interactions

Note(s)

Overall score is a composite of six weighted factors including interaction,

billing and payment process, credit card terms, rewards, benefits and

services, and problem resolution. Total possible score = 1000

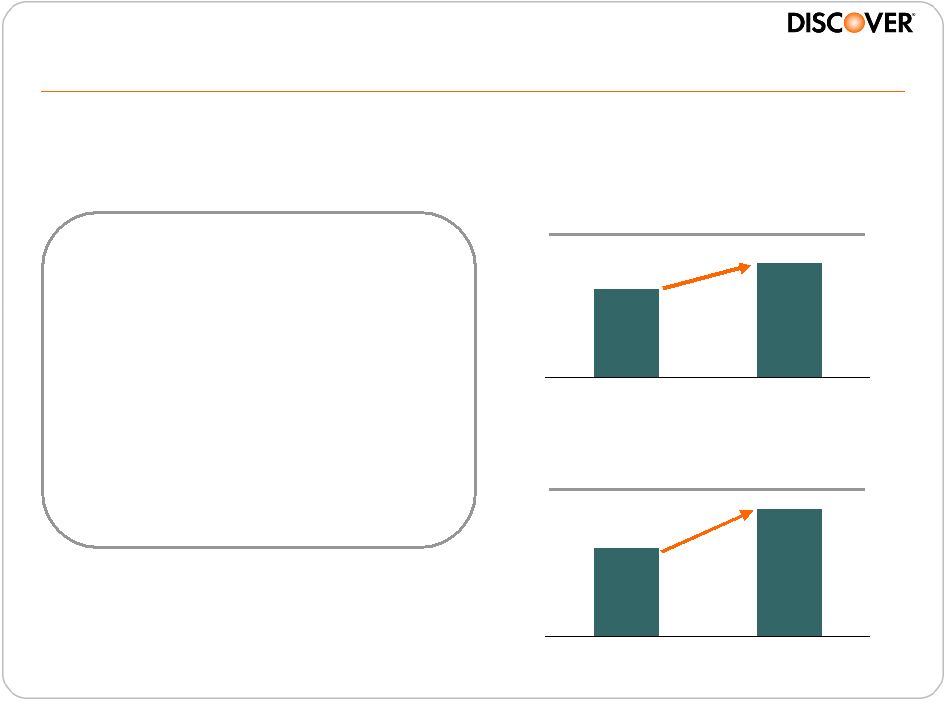

|

24

Strong analytics and risk management identifying

growth opportunities

Integrated account lifecycle

management

Investment in judgmental underwriting

Customer insight driving offers

Enhanced balance transfer

functionality

Control

Test

Control

Test

45%

30%

Customer Response Rate

Balance Transfer Volume

Case Study:

Balance Transfer Functionality

Note(s)

Control population mailed standard offer. Test population mailed alternative

offer. Test conducted in 3Q10. |

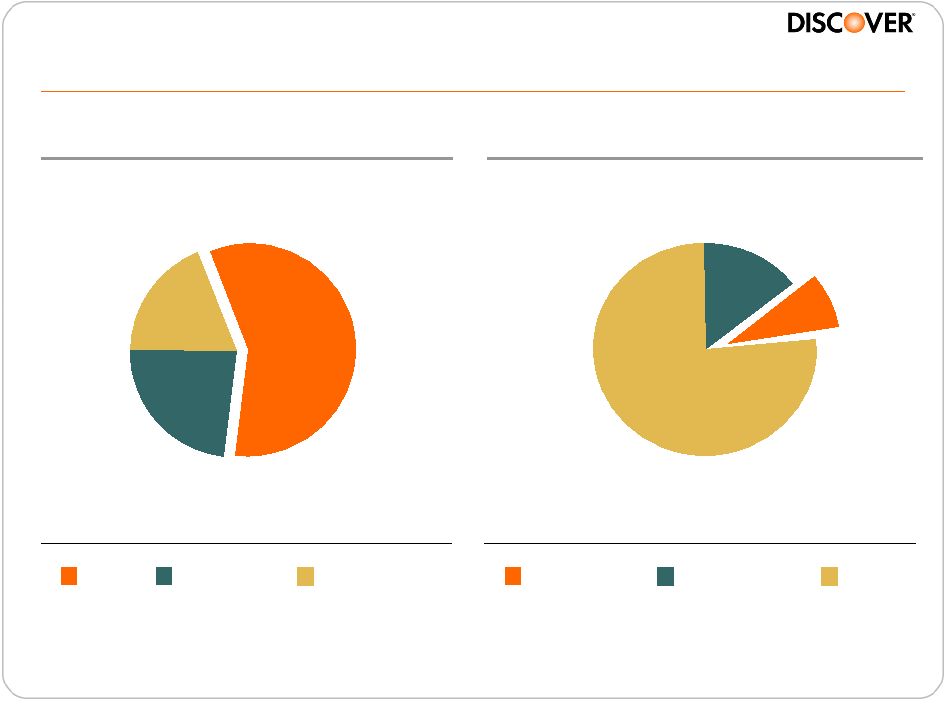

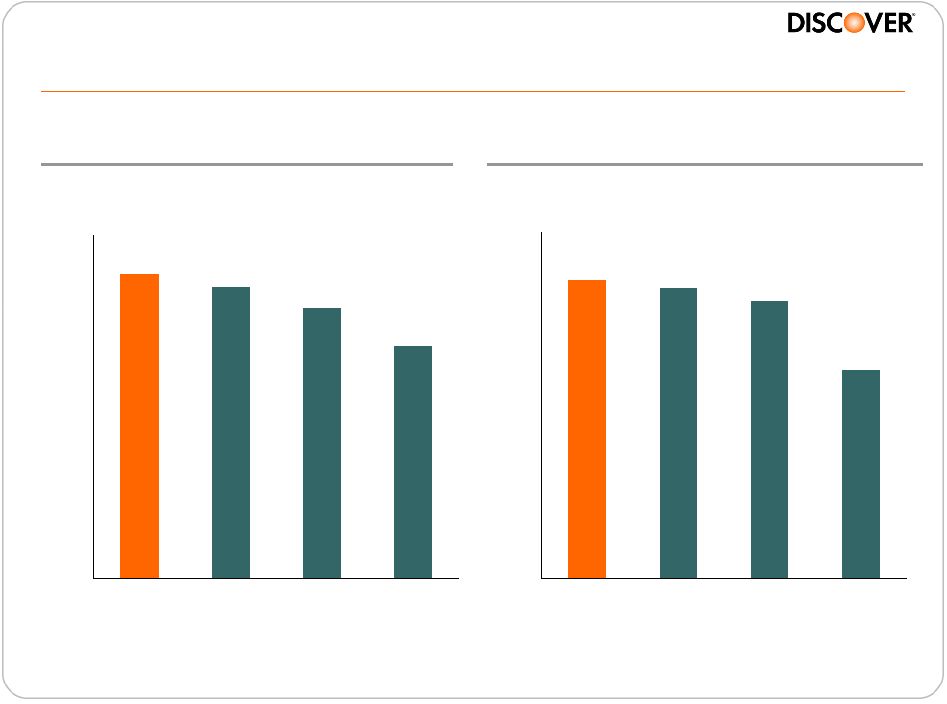

25

Increasing wallet share

2008

2010

2008

2010

Wallet Share

of Loans

Wallet Share

of Sales

16%

27%

Sources

Internal calendar year data and public company data

Note(s)

Wallet Share is the amount of customer loans / sales with Discover vs. other cards

in the wallet Share based upon credit bureau data and internal modeling

|

Strong new account growth

24%

Spend per Account

Average FICO

New Accounts

25%

728

1Q11 YOY

Note(s)

1.

Based on the 2010 Brand Keys Customer Loyalty Engagement Index Report

(1)

26 |

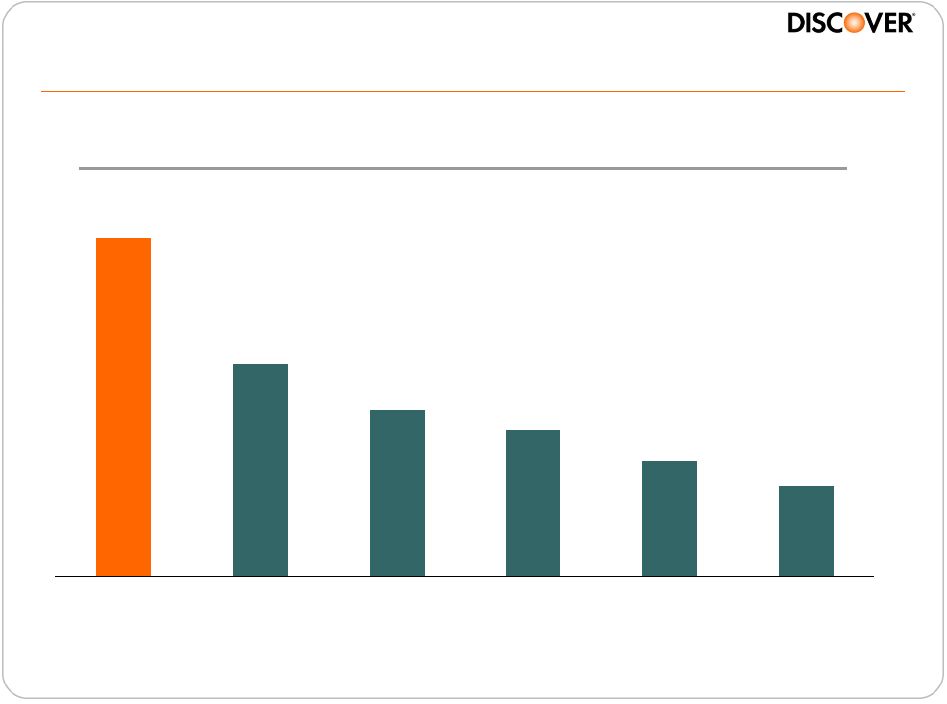

27

Note(s)

1.

Among general population; % of cardmembers who strongly / somewhat agree with the

statement “provides excellent overall value” Source

4Q 2010 Brand Tracker study, Millward Brown

35%

34%

33%

30%

26%

25%

DFS

JPM

AXP

COF

BAC

C

Establishing value leadership

Provides

Excellent

Overall

Value

(1) |

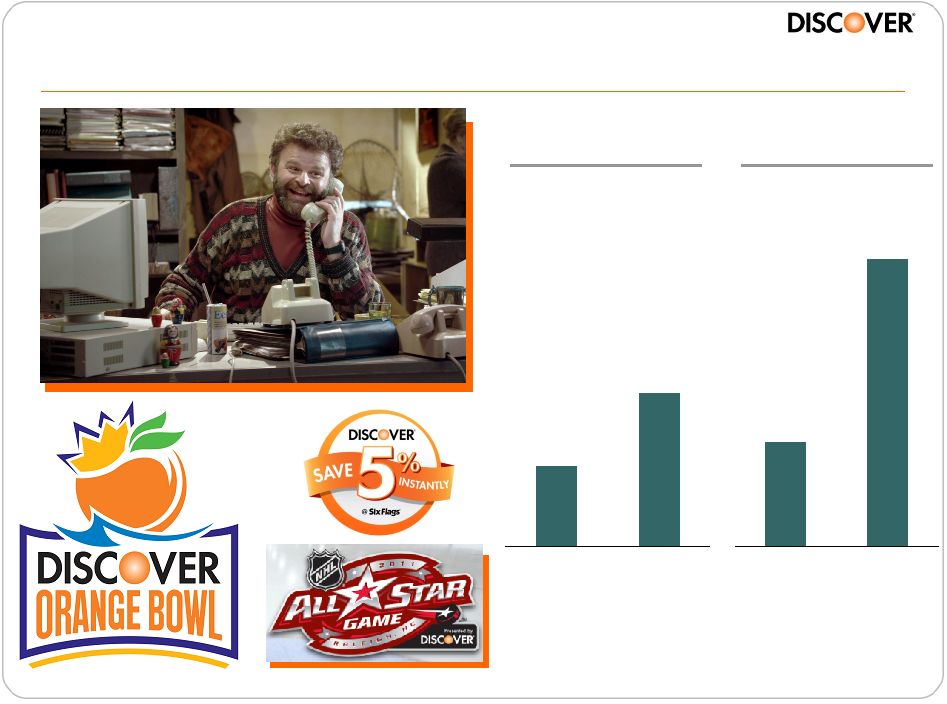

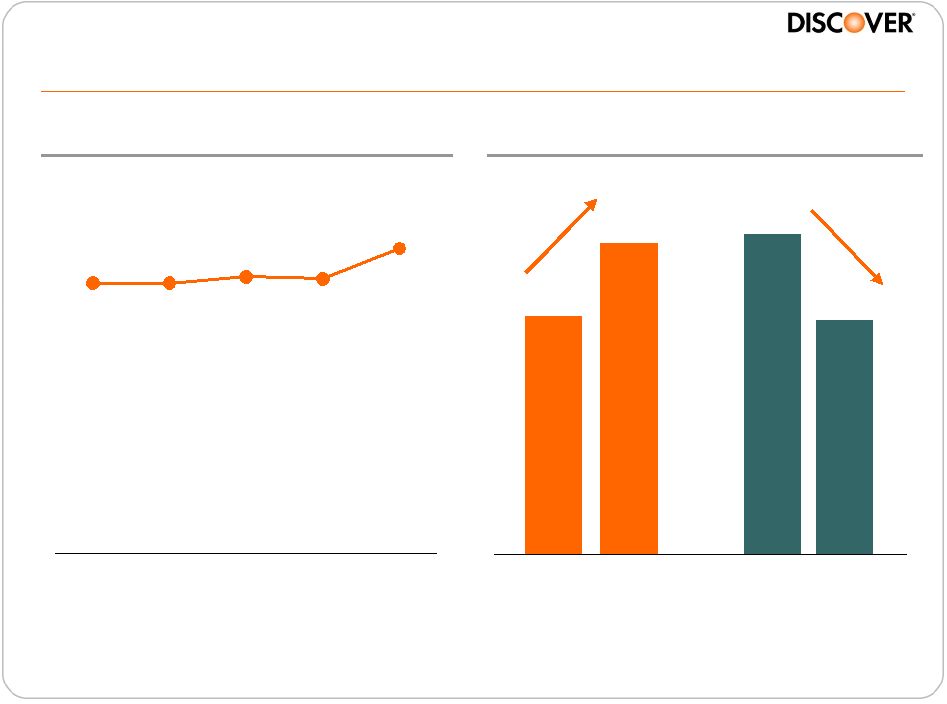

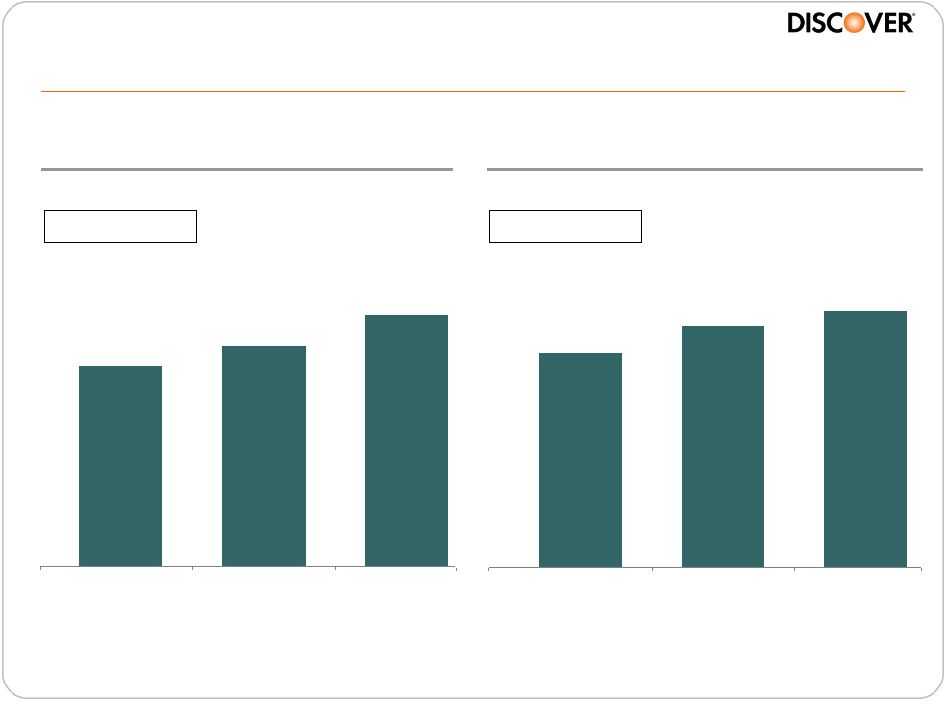

28

Significantly increasing brand presence

Share of

Media Spend

(1)

Share of

Voice

(2)

Note(s)

1.

Share

of

Spend

=

Discover

media

spend

vs. AXP,

BAC,

C,

COF,

JPM,

V,

MA

2.

Share

of

Voice

=

Total

Discover

media

impressions

vs.

AXP,

BAC,

C,

COF,

JPM,

V,

MA

3.

Average of 2005-2009

6%

11%

Historical

2010

7%

20%

Historical

2010

(3)

(3)

Source

Nielsen |

|

|

31

Well positioned for profitable growth

•

Our business is positioned to generate a pre-tax ROA of 2.5%+

and an ROE of 15%+ on a sustainable basis

•

Increasing usage and wallet share with existing customers

•

Strong growth in new accounts

•

Outperforming the industry in sales and receivables over the last

two years |

Carlos Minetti

President, Consumer Banking &

Operations

Diversifying into higher growth asset classes

CONSUMER

CONSUMER

DEPOSITS

DEPOSITS

DISCOVER

DISCOVER

CARD

CARD

CONSUMER

CONSUMER

LOANS

LOANS

PULSE

PULSE

DEBIT

DEBIT

NETWORK

NETWORK

DINERS

DINERS

CLUB

CLUB

INTERNATIONAL

INTERNATIONAL

DISCOVER

DISCOVER

NETWORK

NETWORK |

33

Achieved significant milestones in direct

banking expansion

•

Delivered a differentiated value proposition and extended reach of

Discover brand to become top 5 in:

–

Direct deposits

–

Personal loans

–

Student loans

•

Achieved scale and earned customer loyalty in deposits

•

Attained growth and profitability targets in personal loans

•

Acquired The Student Loan Corporation and became a leader in

student loans |

34

Discover Direct Deposits |

35

Discover has grown to become a leader in

direct deposits

Direct Deposits (Bn)

Direct

Deposit

Competitors

(Bn)

(1)

$20.6

$12.6

$6.1

$3.4

2007

2008

2009

2010

4Q10

Market

Share %

ING Bank, FSB

$77.7

29%

Charles Schwab Bank

$50.6

19%

USAA Federal Savings Bank

$35.6

13%

Ally Bank

$24.7

9%

Discover Bank

$20.6

8%

E*TRADE Bank

$15.6

6%

American Express Bank, FSB

$8.9

3%

Other

$35.1

13%

Total

$268.8

100%

Note(s)

1. Includes non-brokered, direct banks with fewer than 10 branches

2007 –

2010

CAGR: 82%

Source

Informa Research Services, SNL, internal data |

36

Note(s)

1.

Balance percentages as of FYE2010

2.

Transaction expected to close mid-year, subject to regulatory approval

We have developed strong customer and

affinity relationships

•

Surpassed $2Bn in

deposits in 2010

•

Launched in May

2010

•

Announced in

February 2011

•

Acquiring ~ $1Bn

in deposits

(2)

•

Signed in March

2011

Depth

of

Relationships

(1)

Affinity Relationships

Single

Deposit

Account

Multiple

Deposit

Accounts

Deposit +

Card

Account

Deposit +

Affinity

Account

43%

12%

20%

25% |

37

Our success comes from a focus on service

and value |

38

Our value proposition resonates with consumers

$37K

$50K

$36K

CD Retention Rate

Money Market Balance Build

79%

77%

77%

77%

77%

4Q09

1Q10

2Q10

3Q10

4Q10

30%

Note(s)

1. Discover 2010 annual data

2. Representative

of

industry

over-the-cycle

experience,

2006

–

2010

-28%

Initial

Balance

After

1 Yr

Initial

Balance

After

1 Yr

Discover

(1)

Industry

(2)

$48K

Source

First Manhattan Consulting Group |

39

Direct deposits has become a large and

attractive funding source

Relative Funding Costs

March 2011

Funding Sources

November 2010

Direct-to-

Consumer

(1)

Brokered CDs

(2)

ABS

Other

Internal

Benchmark

(1)

Direct-to-Consumer

30%

26%

40%

4%

Total: $52Bn

On-line

Savings

24-month

CD

5-year CD

0%

1%

2%

3%

Note(s)

1.

Obtained from consumers directly or through affinity relationships

2.

Obtained through third-party securities brokerage firms who offer our deposits

to their customers

Note(s)

1.

Internal analysis of Discover funding sources |

40

Direct deposits is positioned to support firm-wide growth

•

Targeting deposit growth of 20-25% in 2011

–

Product expansion

–

Additional affinity relationships

•

Continue investment in infrastructure

•

Economics further improve in rising rate environment |

41

Discover Personal Loans |

42

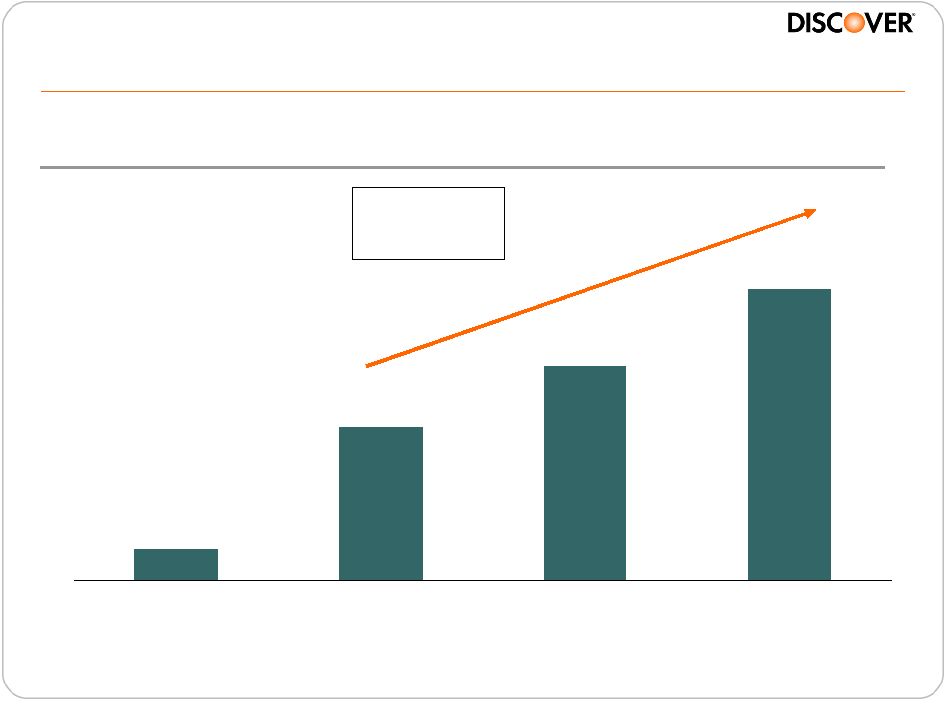

Personal Loans poised for sustained growth

Personal Loans Receivables Growth ($Bn)

$0.2

$1.0

$1.4

$1.9

2007

2008

2009

2010

2008 –

2010

CAGR: 37% |

43

We have achieved leadership in the prime

credit segment

2010 Industry Originations ($Bn)

Market Position (Prime Only)

$12

$5

$4

Prime

Near Prime

Sub Prime

16%

8%

76%

Discover

5 Peers

(1)

Others

Note(s)

1. Includes: Citibank, Chase, Wells Fargo, Bank of America and Capital

One Total: $21Bn

Total: $12Bn

Source

Credit bureau data, Discover analysis

Source

Credit bureau data, Discover analysis |

44

Consumer acceptance is driven by a

compelling value proposition

•

Competitive rates relative to substitutes

–

300bps –

400bps lower than existing debt

(1)

•

Financial control

–

Fixed single monthly payment

–

Paydown within set time frame

•

Customer experience

–

Consultative underwriting

–

Quick decision and funds disbursement

Note(s)

1.

Discover internal analysis |

45

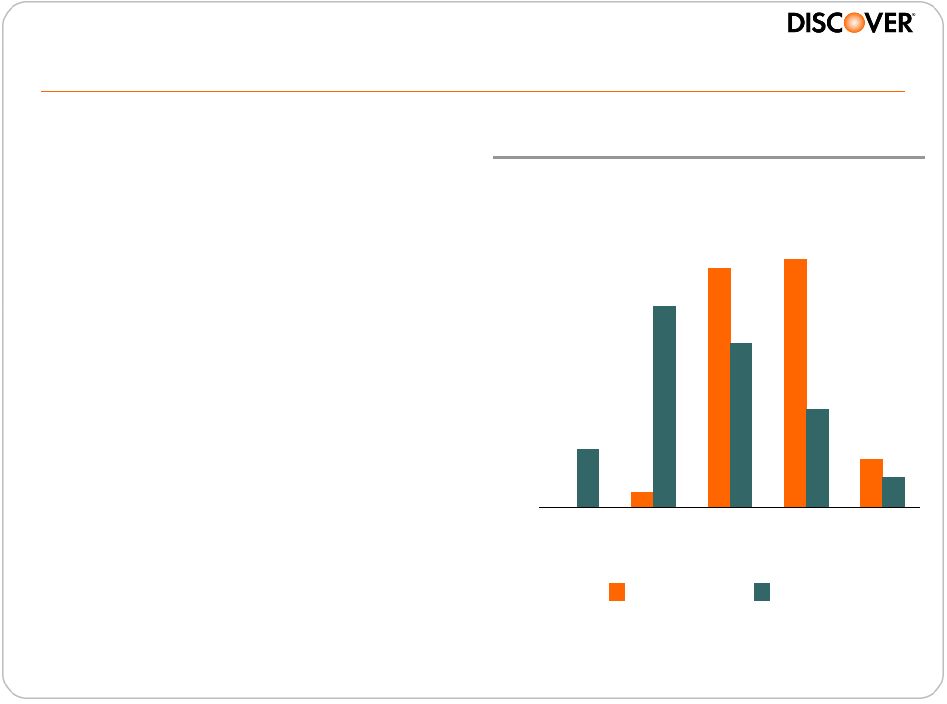

Disciplined underwriting is a key contributor to profitability

•

Custom credit and paydown

models –

40% lift compared to

generic models

•

Judgmental underwriting with

analysis of cash flows

•

Verification of income or

employment

•

Direct payment to creditors for

debt consolidation

Origination by Credit Score

Industry

Discover

0%

10%

20%

30%

40%

50%

501-

600

601-

700

701-

800

801-

900

901-

990

Source

Credit bureau data, Discover analysis of 2010 originations

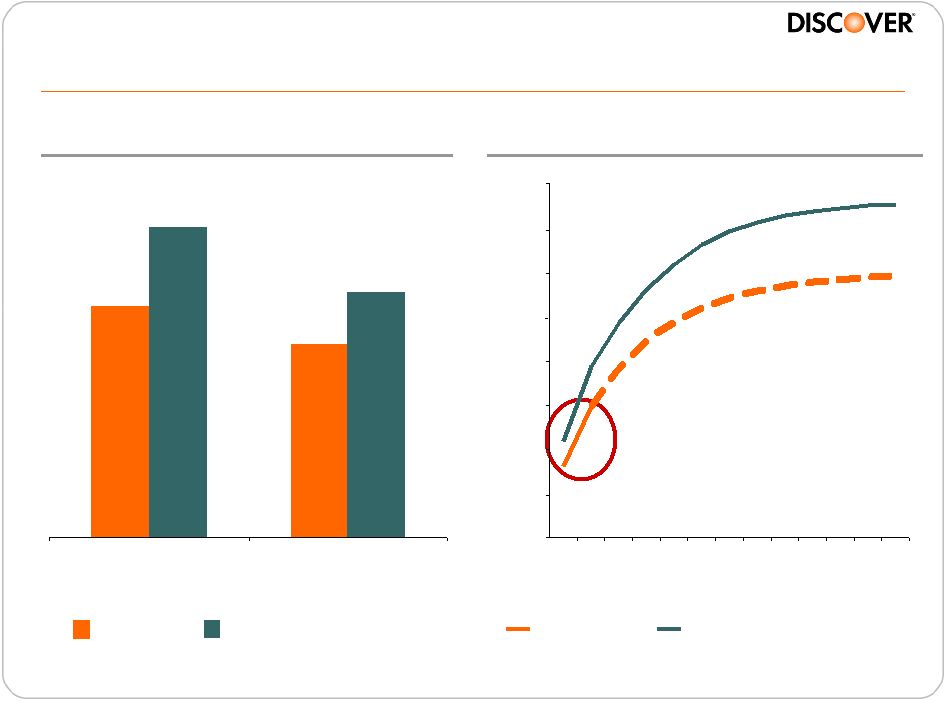

|

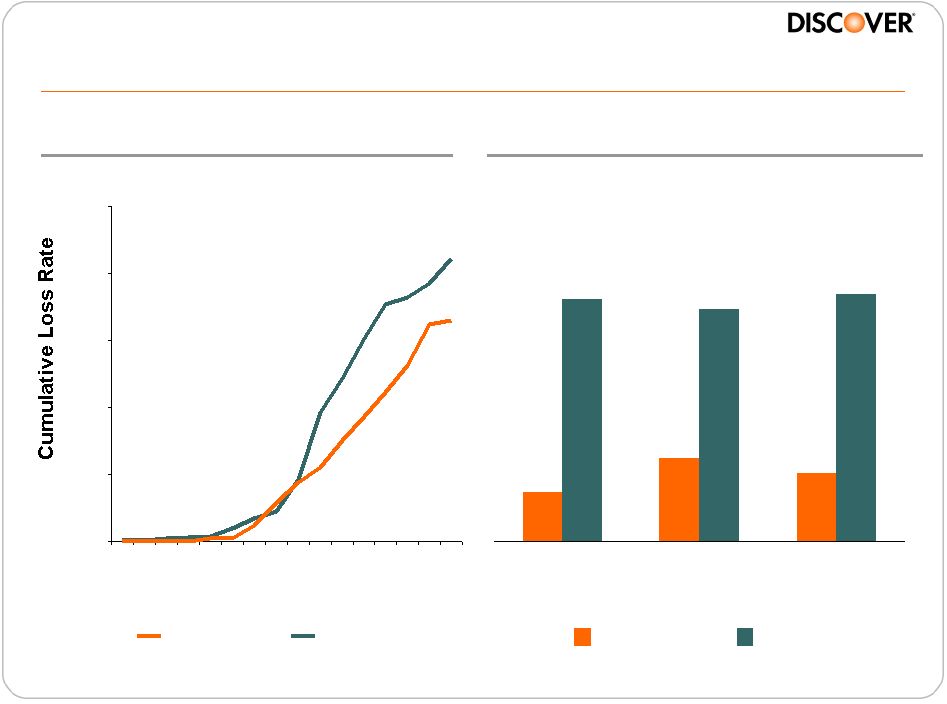

46

Our business model generates competitive

credit performance

Vintage Charge-Off Curves

60+ Past Due Rates (%)

Industry

Discover

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

2

4

6

8

10

12

14

16

Months on Book

Prime Peers

Discover

0.73%

1.37%

0.98%

3.45%

3.31%

3.54%

Q4-08

Q4-09

Q4-10

Source

Industry

-

credit

bureau

data;

Discover

–

internal

data

Source

Credit bureau data, Discover analysis |

47

We are on track to deliver targeted returns

Net Interest Income

Loss Provision

Operating Expenses

Target ROA

9%

(4%)

(2%)

3%

Targeted Personal Loan Returns

(1)

Note(s)

1. Over life of loan |

48

Personal loans is positioned for profitable growth

•

Targeting receivables growth of 20-25% in 2011 while maintaining

credit quality

•

Increase product awareness

•

Penetrate deeper into broad market population

•

Expand into pertinent segments

–

Smaller loan size

–

Shorter duration

•

Develop affinity partnerships |

49

Discover Student Loans |

50

Higher education is a good investment

Income

by

Education

Level

($000)

(1)

Unemployment

Rates

(1)

Note(s)

1.

Age 25 and over; based on highest degree obtained

National

Average 9%

14%

10%

8%

4%

No High

School

Diploma

Associate

or Some

College

Bachelor's

Degree or

Higher

High

School

Graduates

Sources

U.S. Census, Current Population Surveys 2008

Sources

U.S. Bureau of Labor Statistics, January 2011

Note(s)

1.

Based on highest degree obtained

21

31

33

40

59

71

100

125

Not a high school

graduate

High school

Some college

Associate's

Bachelor's

Master's

Doctorate

Professional |

51

Enrollment and costs continue to increase

Average

Annual

College

Cost

(1)

($K)

Note(s)

1.

Average published tuition, fees, room and board in current dollars

Sources

College

Board,

Trends

in

College

Pricing

(2010);

National

Center

for

Education Statistics, Enrollment in Postsecondary Institutions

(‘07-’09) Total College Enrollment (MM)

$17.8

$18.8

$19.3

2007-2008

2008-2009

2009-2010

18.7

19.6

21.0

2007-2008

2008-2009

2009-2010

CAGR: 6%

CAGR: 4%

Sources

College

Board,

Trends

in

College

Pricing

(2010);

National

Center

for

Education Statistics, Enrollment in Postsecondary Institutions

(‘07-’09) |

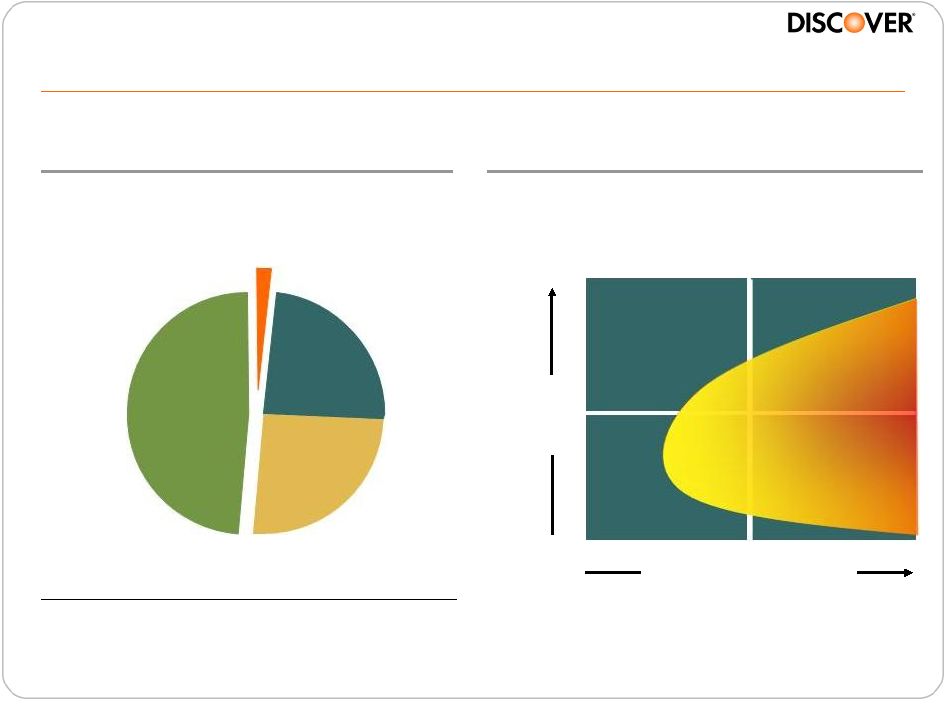

52

Private loans are an important source of

educational funding

Target Market for Private Loans

2010 Sources of Educational

Funding ($Bn)

Private

Loans

$8

Personal

Funds

$198

Grants

and Other

$103

Federal

Loans

$97

Total: $406Bn

Source

College Board, Trends in Student Aid (2010)

Cost of Attendance

Household

Income

Target Market |

53

Private student loans are an attractive business

•

Students and parents need private loans to supplement other

sources of aid as education costs continue to rise

•

Private student loans have better features and consumer protections

than other types of unsecured loans

•

Student

loans

are

an

asset

with

long

duration

and

relatively

low

credit

losses

•

Top 5 lenders account for significant market share and benefit from

scale

•

Students are an upwardly mobile customer base |

54

Our approach provides strong value to

students, parents and schools

Students & Parents

100% Solution

Private education loans for students

at 4-year colleges and graduate

schools, up to the cost of attendance

Simplicity

Easy application and repayment

processes and assistance as

customers enter repayment

Rewarding

2% Graduation Reward and periodic

extras

Schools

Reliable

Stable and consistent, providing

industry-leading service

Responsible

Responsible lending at every step of

the process

Flexible

Support for school processing

preferences |

55

Compelling value proposition drives customer satisfaction

Recommend to a Friend

Satisfaction with Loan Provider

0%

10%

20%

30%

40%

50%

60%

70%

80%

Discover

Chase

Wells

Fargo

Sallie

Mae

0%

10%

20%

30%

40%

50%

60%

70%

80%

Discover

Chase

Wells

Fargo

Sallie

Mae

Source

Milward Brown 2011; based on Discover originated loans

Source

Milward Brown 2011; based on Discover originated loans

|

56

Disciplined underwriting is critical to profitability

Origination FICO Distribution

•

Proprietary underwriting /

scoring models

•

Only 4-year colleges and

graduate schools

•

High co-signer rate

•

School selection based on low

government default rates

•

100% school certified

•

100% disbursed through school

4%

11%

20%

25%

27%

13%

<

=690

720

750

780

810

>

810

Source

2010 Discover originations |

57

Early credit performance consistent with expectations

Cumulative Lifetime Loss Rate

Loss as % of Original Balance

0%

2%

4%

6%

8%

10%

12%

14%

16%

1

3

5

7

9

11

13

Years in Repayment

Sallie Mae Traditional

Discover

3.20%

2.68%

4.30%

3.40%

0-12

13-24

Months in Repayment

Sallie Mae Traditional

Discover

Source

Sallie Mae 4Q10 Investor Presentation, Discover analysis

Source

Sallie Mae 4Q10 Investor Presentation, Discover analysis

|

58

We are on track to deliver targeted returns

Net Interest Income

Loss Provision

Operating Expenses

Target ROA

5%

(1%)

(1.5%)

2.5%

Targeted Student Loan Returns

(1)

Note(s)

1. Over life of loan |

59

The Student Loan Corporation acquisition

strengthens Discover Student Loans

•

Diversifies Discover loan portfolio

at attractive returns

•

Enhances competitive position with

combined entity expected to be a

top 3 originator of private loans

•

Adds scale in servicing, capacity

and expertise

•

Increases product breadth to meet

a larger set of customer needs and

expands lifecycle marketing

opportunities

•

Complements network of school

relationships and online properties

•

Deepens proprietary underwriting

capabilities

2009-2010 Disbursements ($Bn)

DFS

$0.4

$0.6

SLC

$0.8

$2.0

$2.3

Sallie Mae

Wells

Fargo

Discover

Chase

$1.2

Source

Student

Lending

Analytics

(2010),

College

Board,

Trends

in

Student

Aid

(2010) |

60

We acquired a seasoned portfolio with

attractive characteristics and scale

75%

Loans in repayment

74%

Loans with co-signer

724

Average FICO

83%

ABS funding

$4.2Bn

(1)

Total assets

The Student Loan Corporation

Note(s)

1. Represents book value as of 11/30/10 |

Acquisition expanded penetration among target schools

SLC

350

Discover is on Preferred Lender List

at 1150 of 1350 Target Schools

Target Schools

Top

School

Penetration

(1)

200

•

83% of top 100 colleges

•

91% of top 50 Business schools

•

90% of top 50 Law schools

•

87% of top 50 Medical schools

Note(s)

1. Incorporates US News Rankings, 2010

DSL

250

550

61 |

62

Leading online presence

www.wellsfargo.com

www.chasestudentloans.com

www.salliemae.com

www.studentloan.com

#14

#8

#2

#1

Google Unpaid Search Return Rankings

Keyword “Student Loan”

Source

www.google.com, March 2011 |

63

Student loans is positioned for profitable future growth

•

Integration of The Student Loan Corporation is on track

•

Targeting net receivable growth of $1Bn+ in 2011

•

Strong pipeline of repeat business

•

Competitive product set with opportunities for expansion

•

Increased marketing to Card customer base and new affinity

partnerships |

64

Consumer banking businesses have matured

and are well positioned for future expansion

•

Achieved robust growth in Consumer Lending and Deposits

-

~$21Bn in direct-to-consumer deposits

-

~$7Bn in consumer lending receivables

•

Extended the Discover Brand beyond credit cards

•

Attained profitability and established a solid foundation for growth

•

Capitalized on shifting market dynamics and consumer behaviors

|

Exploiting the payments opportunity

Diane Offereins

President Payment Services

CONSUMER

CONSUMER

DEPOSITS

DEPOSITS

DISCOVER

DISCOVER

CARD

CARD

CONSUMER

CONSUMER

LOANS

LOANS

PULSE

PULSE

DEBIT

DEBIT

NETWORK

NETWORK

DINERS

DINERS

CLUB

CLUB

INTERNATIONAL

INTERNATIONAL

DISCOVER

DISCOVER

NETWORK

NETWORK |

66

Delivering growth in all three payment networks

Domestic acceptance

network for Discover

proprietary cards and

partner issuers

•

$103Bn volume

•

30+ issuers

Domestic PIN debit

network with global ATM

acceptance

•

$118Bn volume

•

4,400+ issuers

•

783,000 ATMs

•

80+ countries

Global payments

network targeting

upscale customers,

frequent travelers and

corporate clients

•

$27Bn volume

•

80+ licensees

•

185 countries

and territories

Note(s)

Based on the trailing four quarters ending 4Q10

Volume

Change (YOY)

+6%

+6%

+8%

+8%

+4%

+4% |

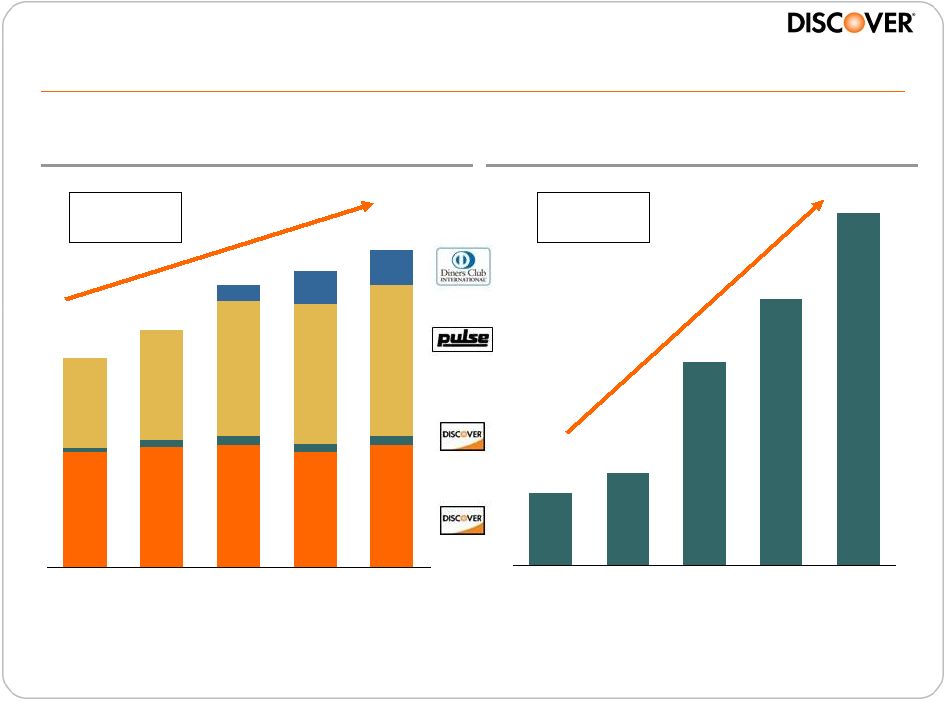

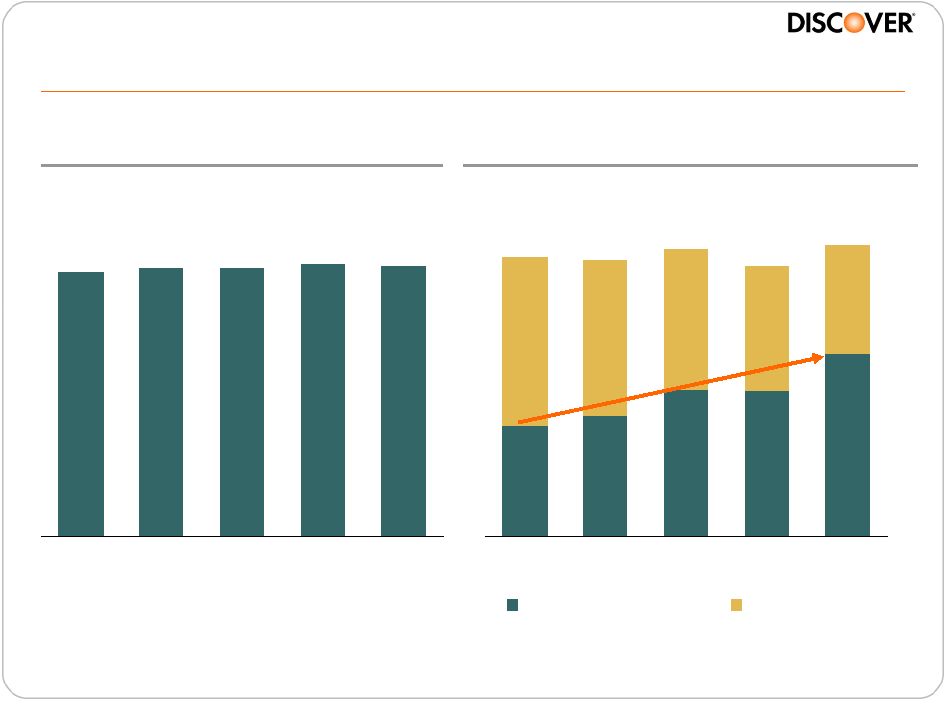

67

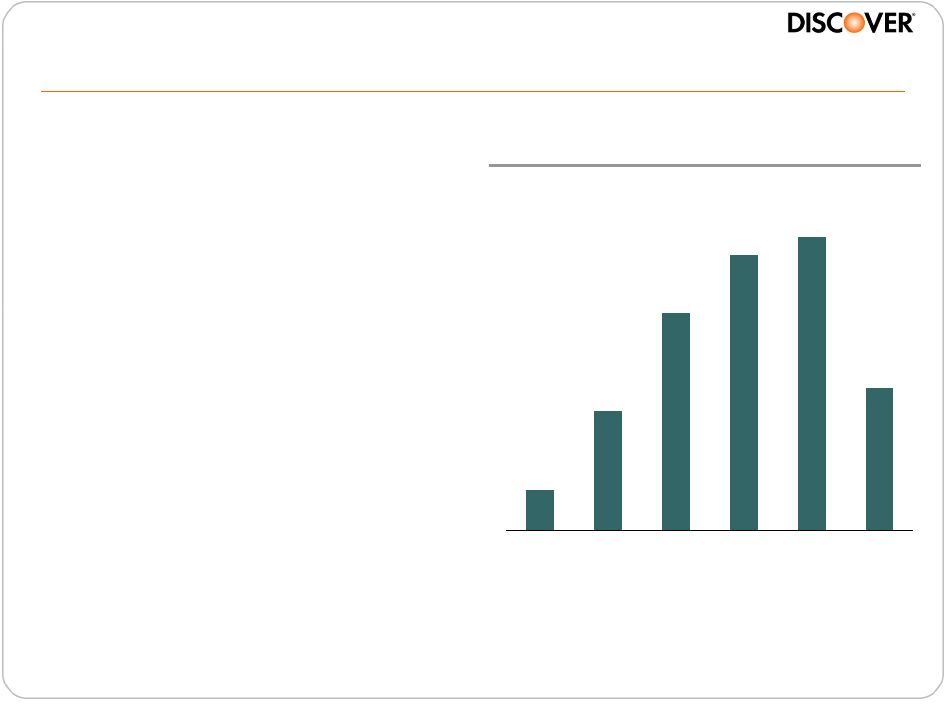

Momentum -

strong increase in volume and profits

$141

$107

$81

$37

$29

2006

2007

2008

2009

2010

91

96

70

86

106

109

118

13

$163

$186

$221

$232

$248

90

94

96

7

6

6

5

3

26

27

2006

2007

2008

2009

2010

Volume Growth (Bn)

Payment Services PBT (MM)

Partner

Issuance

Proprietary

2006 –

2010

CAGR: 48%

2006 –

2010

CAGR: 11% |

68

Growth initiatives for 2011 and beyond

Primary efforts include

•

Increase acceptance and volume

–

U.S. efforts

–

Invest in global acceptance

–

Increase partner issuance volume

•

PULSE –

address regulatory disruptions

•

Continue to grow Diners Club

•

Increase global footprint through alliances

•

Focus on alternative payment solutions and innovative technologies

|

69

The last mile -

Discover acceptance in the U.S.

•

Accelerating growth of 30 day

active merchants

•

Increased volumes on the

Discover Network

•

Closing the gaps

–

Industry partners

–

High impact merchant focus

–

Awareness

•

Success with merchant partners

Domestic Focus

Merchant

Outlet

Coverage

(1)

Source

Internal data

76%

86%

92%

96%

97%

2006

2007

2008

2009

2010

Note(s)

1.

U.S. points of sale enabled for Discover acceptance per Discover internal analytic

study |

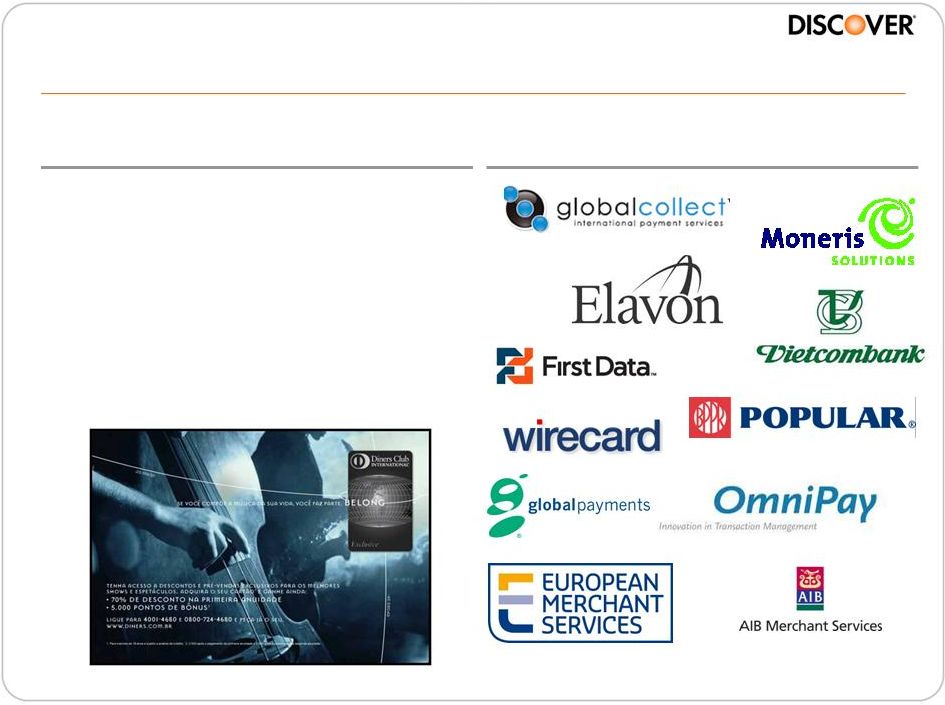

Building the future -

investing in global acceptance

•

Significant investments are being

made related to global acceptance

•

Utilizing hybrid acceptance model

for accelerated global growth

•

Implementation of multiple

partnerships with acquirers and

franchises

Global Focus

Global Merchant Acquirers

70 |

Cultivating partner volume on the networks

•

Volume growth driven by:

–

GE / Wal-Mart / Sam’s Club

–

HSBC

–

International agreements

•

New business pipeline continues

to grow

•

Prepaid strategy that is driven by

campus, incentive and

promotional cards leveraging our

unique network assets

•

Announced new relationship with

First National Bank of Omaha

Partner Issuance

Network-to-Network

71 |

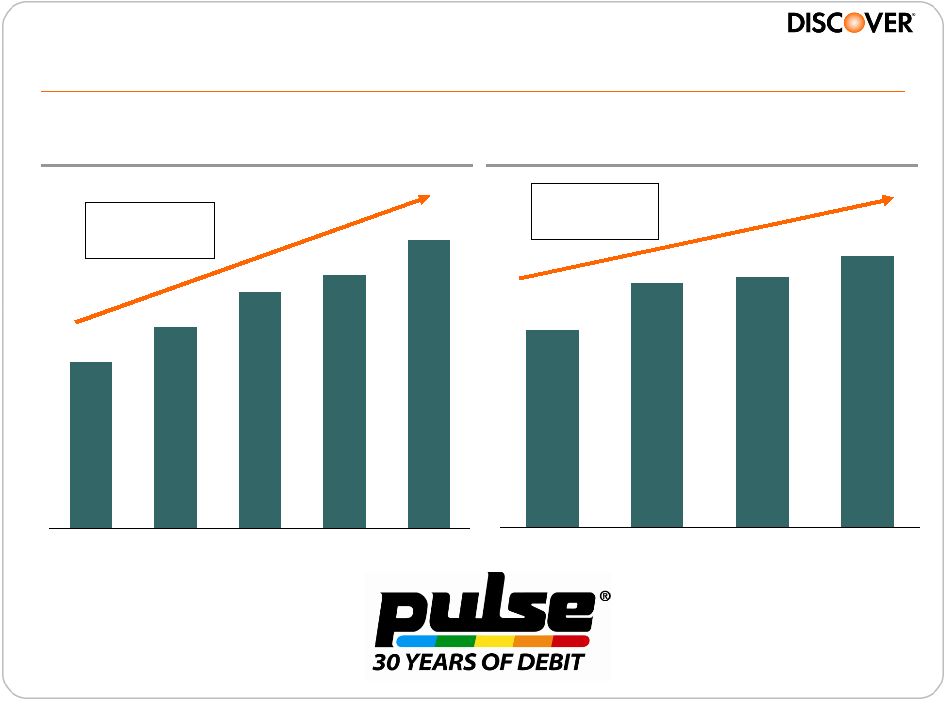

72

PULSE -

continued strong growth in 2010

3.3

2.9

2.7

2.3

1.9

2006

2007

2008

2009

2010

Transactions (Bn)

2006 –

2010

CAGR: 15%

Volume ($Bn)

$118

$109

$106

$86

2007

2008

2009

2010

2007 –

2010

CAGR: 11% |

Implications of the Durbin amendment

•

Changes in network participation

requirements expected to result in

redistribution of PIN debit volume

•

PULSE positioned to on-board

issuers that need to add an

unaffiliated debit network

•

Increasing capacity to address

potential demand

73 |

Strategic Initiatives

PULSE®

Internet PIN Debit

•

Continue to invest in leading

products and technology

•

Expand international and

domestic ATM acceptance

•

Support issuers in responding

to changing landscape

•

Continue to focus on cost

management and efficiency

initiatives

•

Implement the next generation

of world class infrastructure

•

Available network-wide

October 25, 2010

•

Delivers economic benefits to

both issuers and acquirers as

compared to signature debit

•

Secure payment method

•

Ease of use

PULSE –

seizing opportunities

74 |

75

Diners Club –

on track to deliver long-term value

Strategic plans

•

Invest in product development efforts

•

Add franchises

•

Help franchises build stronger value propositions |

76

Building a global brand that feels exclusive

Strategic directions

•

Continuing to re-invigorate brand

•

Expand global advertising and extend growth incentives

•

BELONG campaign |

Partnering in alternative payments and technology

•

Explosive growth in mobile devices has cultivated the

demand for innovative payment methods and services

•

Focus on new ways to facilitate credit, debit and

alternative transactions

•

Grow

consumer

base

beyond

the

“tech

forward”

crowd

77 |

•

On the path of reinvention

•

Focusing on collaboration

•

Embracing innovation

•

Addressing a changing landscape

•

Seizing opportunities

A globally diversified payments business

2011 and Beyond

78 |

Delivering shareholder value through strong

financial performance

Roy Guthrie

Chief Financial Officer

CONSUMER

CONSUMER

DEPOSITS

DEPOSITS

DISCOVER

DISCOVER

CARD

CARD

CONSUMER

CONSUMER

LOANS

LOANS

PULSE

PULSE

DEBIT

DEBIT

NETWORK

NETWORK

DINERS

DINERS

CLUB

CLUB

INTERNATIONAL

INTERNATIONAL

DISCOVER

DISCOVER

NETWORK

NETWORK |

80

Financial performance

($ MM, except per share data)

1Q11

1Q10

Net Interest Income

$1,170

$1,145

$25

Other Operating Revenue

563

546

17

Total Revenue

$1,733

$1,691

$42

Net Charge-offs

$689

$1,082

($393)

Reserve Changes build/(release)

(271)

305

(576)

Provision for Loan Loss

$418

$1,387

($969)

Total Operating Expense

$595

$475

$120

Pretax Income

$720

($171)

$891

Net Income (Loss)

$465

($104)

$569

EPS

$0.84

($0.22)

$1.06

ROE

28%

-6%

NM

Total Average Receivables

$51,488

$51,555

($68)

Net Interest Margin

9.22%

9.01%

21bps

YOY

Change |

81

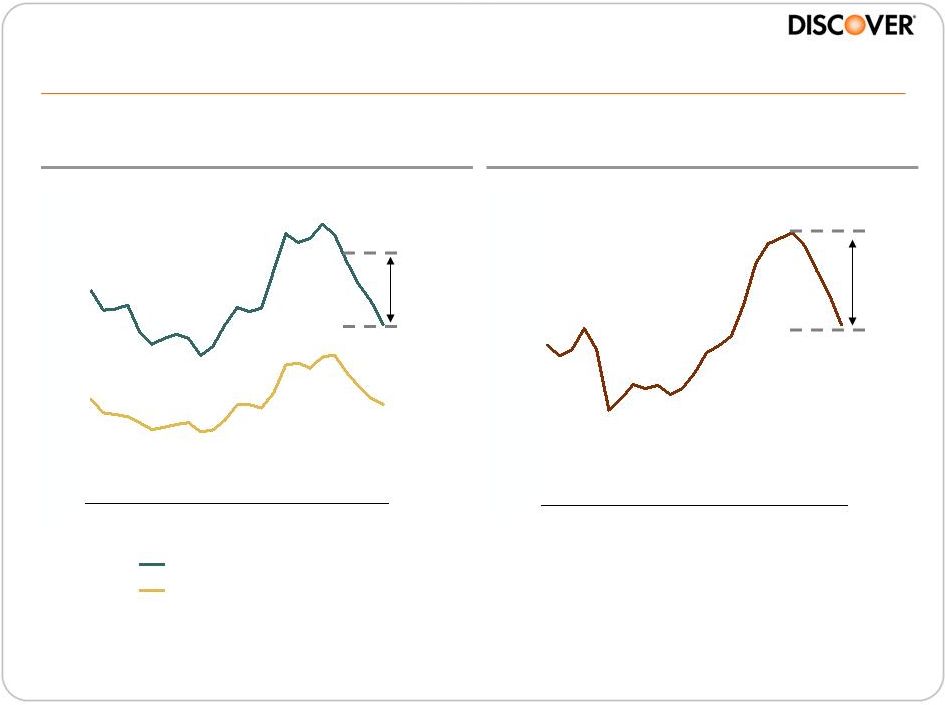

Improving credit fundamentals with stable revenues…

Net

Interest

Margin

(%)

(1)

Revenues

(2)

Note(s)

1.

Defined as net interest income (annualized) divided by average total loans for the

period 2.

Defined as revenue before rewards expense less interest expense for Direct Banking

segment 3.

Defined as revenue before rewards expense less interest expense and charge-offs

for Direct Banking segment 9.2%

9.3%

9.2%

9.1%

9.0%

1Q10

2Q10

3Q10

4Q10

1Q11

900

797

689

$1,792

$1,769

$1,837

$1,730

710

768

938

933

1,173

1,001

1,082

$1,862

1Q10

2Q10

3Q10

4Q10

1Q11

Net Credit Revenue

Charge-offs

(3) |

82

…

partially offset by higher investment spending…

$413

$416

$435

$469

$459

1Q10

2Q10

3Q10

4Q10

1Q11

131

150

136

$252

$272

$325

$352

$342

167

174

194

202

206

98

85

1Q10

2Q10

3Q10

4Q10

1Q11

Rewards

Mkt & Bus. Development

Core

Operating

Expenses

(1)

Investment Spending

Note(s)

1.

Represents

total

company

“other

expenses”

excluding

marketing

and

business

development

2.

Excludes 1Q10 credit related to settlement

3.

Excludes one-time SLC transaction expenses

Source

Total Company

Source

Total Company

(2)

(3) |

0%

2%

4%

6%

8%

10%

1Q05

3Q06

1Q08

3Q09

1Q11

…

with expectation for continued credit

improvement driving reserve releases

Credit Card

Delinquency Rates (%)

Credit Card Net

Charge-off Rate (%)

Note(s)

Data prior to 1Q10 have been adjusted for FAS 166/167

~$400MM

/ Quarter

$1.1Bn

Reserve

Releases

0%

1%

2%

3%

4%

5%

6%

1Q05

3Q06

1Q08

3Q09

1Q11

30+ Delinquency Rate

90+ Delinquency Rate

83 |

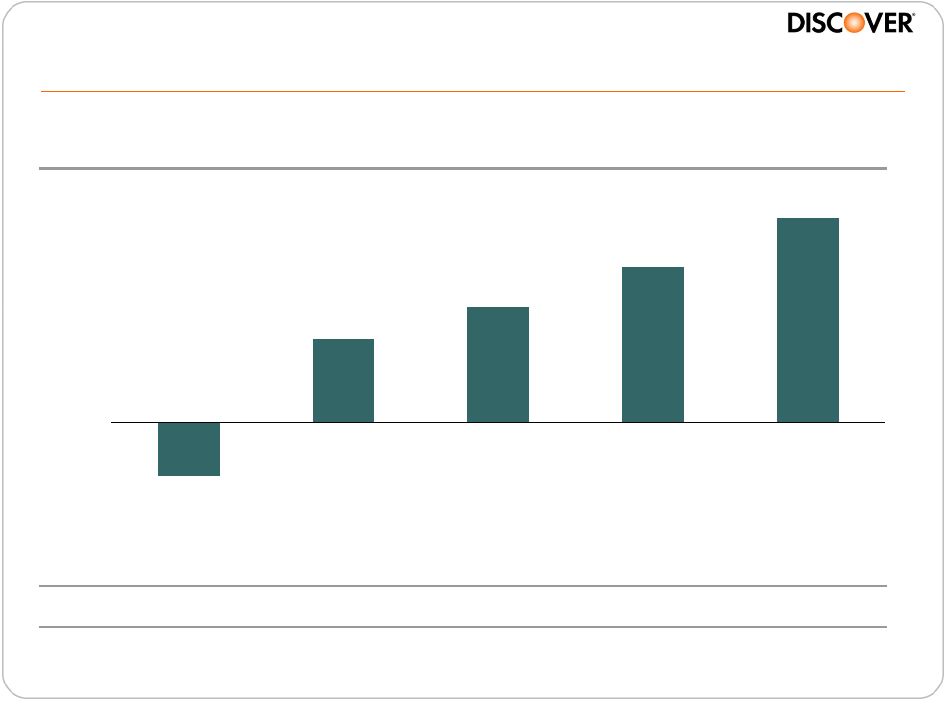

84

$459

$347

$258

$185

($122)

1Q10

2Q10

3Q10

4Q10

1Q11

Profits drive further improvement in balance sheet flexibility

Net Income to

Common Stockholders

Note(s)

1.

Defined as tangible common equity to tangible assets; see appendix for

reconciliation TCE

Ratio

(1)

8.1%

9.1%

9.5%

10.0%

10.2% |

85

4Q10 Tier 1 Common Ratio

8.6%

8.8%

9.8%

11.0%

11.1%

11.4%

DFS

AXP

C

JPM

COF

BAC

Source

SNL, Regulatory Reports dated 12/31/10

Regulatory implications for capital

Pro

forma

Basel

III

Ratios

(1)

Ratios

Proposed

Minimum

DFS

Consolidated

(2)

Tier 1 Common

7.0%

10.8%

Tier 1 RBC

8.5%

10.8%

Total RBC

10.5%

14.1%

Tier 1 Leverage

(3)

3.0%

7.9%

Note(s)

1.

Preliminary view based on December 2010 Basel Committee guidance, subject to

change 2.

12/31/10

estimates

for

deferred

tax

assets

(DTA);

assumes

that

the

two

year

carryback

is

allowed

and

the

portion

of

DTA

realized

as

a

result

of

future

profitability

is

capped

at

10%

of

common

equity

3.

Assets include 10% of the $163Bn undrawn credit card lines

|

86

$5.0

$1.4

1Q11

Illustrative Target

Excess Capital

Excess capital deployment

Tangible

Common

Equity

(1)

(Bn)

Note(s)

1.

See appendix for reconciliation

2.

Certain potential uses subject to regulatory approval

8%+/-

Target

Potential

Uses

of

Excess

Capital

(2)

•

Dividend actions

•

Organic growth

•

Acquisitions

•

Share repurchase |

87

Summary

•

Stable

revenue

with

improving

credit

trends

is

driving

increased

net

credit revenues and reserve releases

•

These benefits will be partially offset by investment spending to drive

future growth

•

Resulting growth in earnings provides balance sheet flexibility

–

Dividend restored

–

Evaluating excess capital alternatives |

2011

Financial Community Briefing Using our Direct Banking and Payments assets to

deliver profitable growth CONSUMER

CONSUMER

DEPOSITS

DEPOSITS

DISCOVER

DISCOVER

CARD

CARD

CONSUMER

CONSUMER

LOANS

LOANS

PULSE

PULSE

DEBIT

DEBIT

NETWORK

NETWORK

DINERS

DINERS

CLUB

CLUB

INTERNATIONAL

INTERNATIONAL

DISCOVER

DISCOVER

NETWORK

NETWORK |

89

Appendix |

90

Reconciliations

($MM)

2/28/10

5/31/10

8/31/10

11/30/10

12/31/10

2/28/11

Tangible Common Equity Ratio Calculation:

Total Common Equity (TCE)

5,854

6,038

6,111

6,457

6,565

6,899

Less: Goodwill and Intangibles

(449)

(448)

(446)

(444)

(448)

(449)

Tangible Common Equity

5,405

5,590

5,665

6,013

6,117

6,450

Total Assets

66,819

62,154

60,058

60,785

63,550

63,506

Less: Goodwill and Intangibles

(449)

(448)

(446)

(444)

(448)

(449)

Tangible Assets (TA)

66,370

61,706

59,612

60,341

63,102

63,057

TCE/TA Ratio

8.1%

9.1%

9.5%

10.0%

9.7%

10.2%

Note(s)

Tangible common equity ("TCE"), a non-GAAP financial measure,

represents common equity less goodwill and intangibles. A reconciliation of TCE

to

common

equity,

a

GAAP

financial

measure,

is

shown

above.

Other

financial

services

companies

may

also

use

TCE

and

definitions

may

vary,

so

we advise users of this information to exercise caution in comparing TCE of

different companies. TCE is included because management believes

that

common

equity

excluding

goodwill

and

intangibles

is

a

more

meaningful

valuation

to

investors

of

the

true

net

asset

value

of

the

company. |