Attached files

| file | filename |

|---|---|

| EX-32.1 - CLEAN POWER CONCEPTS 10Q, CERTIFICATION 906, CEO/CFO - CLEAN POWER CONCEPTS INC. | cleanpowerexh32_1.htm |

| EX-31.1 - CLEAN POWER CONCEPTS 10Q, CERTIFICATION 302, CEO - CLEAN POWER CONCEPTS INC. | cleanpowerexh31_1.htm |

| EX-31.2 - CLEAN POWER CONCEPTS 10Q, CERTIFICATION 302, CFO - CLEAN POWER CONCEPTS INC. | cleanpowerexh31_2.htm |

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________________

FORM 10-Q

x QUARTERLY REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the Quarter Ended January 31, 2011

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM _______________________ TO _______________________

Commission File # 000-52035

CLEAN POWER CONCEPTS INC.

(Exact name of registrant as specified in its charter)

Nevada

(State or other jurisdiction of incorporation or organization)

98-0490694

(IRS Employer Identification Number)

1620 McAra Street

Regina, Saskatchewan, Canada S4N 6H6

(Address of principal executive offices) (Zip Code)

(306) 546-8327

(Registrant’s telephone no., including area code)

Indicate by check mark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated file, or a smaller reporting company.

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

|

|

Non-accelerated filer

|

o

|

Smaller reporting company

|

x

|

Indicate by check mark whether the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act. Yes o No x

The issuer had 240,077,763 shares of common stock issued and outstanding as of March 22, 2011.

CLEAN POWER CONCEPTS INC. AND SUBSIDIAIRIES

Table of Contents

|

Page

|

|||

PART I – FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

Period Ended January 31, 2011

CLEAN POWER CONCEPTS INC. AND SUBSIDIAIRIES

Consolidated Balance Sheets

|

|

(UNAUDITED)

January 31,

2011

|

April 30,

2010

|

||||||

|

ASSETS

|

||||||||

|

Current Assets

|

||||||||

|

Cash

|

$ | 26,998 | $ | 36,262 | ||||

|

Accounts receivable

|

390,088 | 191,331 | ||||||

|

Prepaid expenses

|

4,834 | 22,031 | ||||||

|

Inventory

|

17,247 | 124,797 | ||||||

|

Total current assets

|

439,167 | 374,421 | ||||||

|

Property, Plant, and Equipment (net of accumulated depreciation)

|

458,278 | 451,407 | ||||||

|

Total assets

|

$ | 897,445 | $ | 825,828 | ||||

|

LIABILITIES AND STOCKHOLDERS’ (DEFICIT)

|

||||||||

|

Current Liabilities

|

||||||||

|

Line of credit

|

59,739 | 97,624 | ||||||

|

Accounts payable and accrued expenses

|

760,133 | 626,416 | ||||||

|

Related party advances (Note 5)

|

847,961 | 714,763 | ||||||

|

Loans payable (Note 6)

|

772,610 | 425,900 | ||||||

|

Interest payable (Note 6)

|

56,656 | 118,781 | ||||||

|

Current portion of capital lease obligations

|

15,368 | 21,154 | ||||||

|

Current portion of long-term debt

|

21,491 | 18,077 | ||||||

|

Total current liabilities

|

$ | 2,533,958 | $ | 2,022,715 | ||||

|

Long-Term Liabilities

|

||||||||

|

Capital lease obligations

|

75,473 | 20,036 | ||||||

|

Long-term debt

|

220,934 | 228,961 | ||||||

|

Total long-term liabilities

|

296,407 | 248,997 | ||||||

|

Total liabilities

|

$ | 2,830,365 | $ | 2,271,712 | ||||

|

Commitments and Contingencies

|

- | - | ||||||

|

Stockholders’ (Deficit)

|

||||||||

|

Common shares, 1,000,000,000 shares with par value $0.001 authorized, 240,077,763 and 150,048,000 shares issued and outstanding at January 31, 2011 and April 30, 2010, respectively (Note 9)

|

240,078 | 150,048 | ||||||

|

Common shares subscribed but not issued (Note 9)

|

20,000 | 2,019,459 | ||||||

|

Share subscriptions

|

- | (994 | ) | |||||

|

Paid-in Capital

|

1,081,288 | (759,023 | ) | |||||

|

Accumulated deficit

|

(2,929,332 | ) | (2,524,685 | ) | ||||

|

Accumulated other comprehensive (loss)

|

(198,745 | ) | (196,500 | ) | ||||

|

Total Clean Power Concepts and Subsidiaries equity

|

(1,786,711 | ) | (1,311,695 | ) | ||||

|

Non-Controlling Interest (Note 2)

|

(135,339 | ) | (123,411 | ) | ||||

|

Non-Controlling Interest accumulated other comprehensive (loss)

|

(10,870 | ) | (10,778 | ) | ||||

|

Total Non-Controlling Interest

|

(146,209 | ) | (134,189 | ) | ||||

|

Total stockholders’ (deficit)

|

(1,932,920 | ) | (1,445,884 | ) | ||||

|

Total liabilities and stockholders’ (deficit)

|

$ | 897,445 | $ | 825,828 | ||||

The accompanying notes to financial statements are an integral part of these consolidated financial statements

CLEAN POWER CONCEPTS INC. AND SUBSIDIARIES

Consolidated Statements of Operations and Comprehensive Income

(UNAUDITED)

|

Three Months

ended

January 31,

2011

|

Three Months

ended

January 31,

2010

|

Nine Months

ended

January 31,

2011

|

Nine Months

ended

January 31,

2010

|

|||||||||||||

|

SALES:

|

||||||||||||||||

|

Canola Meal

|

$ | 141,982 | $ | - | $ | 352,964 | $ | - | ||||||||

|

Canola Oil

|

72,018 | 8,563 | 288,215 | 27,026 | ||||||||||||

|

Other

|

7,732 | 58,957 | 23,624 | 230,510 | ||||||||||||

|

Total Revenue

|

221,732 | 67,520 | 664,803 | 257,536 | ||||||||||||

|

COST OF SALES

|

(168,160 | ) | (16,190 | ) | (502,586 | ) | (79,499 | ) | ||||||||

|

GROSS PROFIT

|

$ | 53,572 | $ | 51,330 | $ | 162,217 | $ | 178,037 | ||||||||

|

EXPENSES:

|

||||||||||||||||

|

Production expenses

|

33,971 | - | 80,276 | 31,526 | ||||||||||||

|

General and Administrative expenses

|

72,002 | 24,309 | 378,282 | 116,464 | ||||||||||||

|

Depreciation

|

30,944 | 50,953 | 77,535 | 162,594 | ||||||||||||

|

Salaries and wages

|

132,305 | 46,170 | 139,294 | 89,941 | ||||||||||||

|

Professional and consultant fees

|

77,143 | 2,631 | 120,426 | 22,366 | ||||||||||||

|

Advertising

|

15,413 | 13,828 | 36,524 | 20,646 | ||||||||||||

|

Investor relations

|

18,086 | 6,534 | 26,836 | 8,216 | ||||||||||||

|

Total expenses

|

$ | 379,864 | $ | 144,425 | $ | 859,173 | $ | 451,753 | ||||||||

|

Net loss from operations

|

$ | (326,292 | ) | $ | (93,095 | ) | $ | (696,956 | ) | $ | (273,716 | ) | ||||

|

Interest expense

|

(28,855 | ) | (16,789 | ) | (98,894 | ) | (42,510 | ) | ||||||||

|

Other Income:

Scientific Research & Experimental Development Tax Refund

|

379,275 | - | 379,275 | - | ||||||||||||

|

NET INCOME (LOSS)

|

$ | 24,128 | $ | (109,884 | ) | $ | (416,575 | ) | $ | (316,226 | ) | |||||

|

Less: Net Loss attributable to Non-Controlling Interest (Note 2)

|

(4,655 | ) | 3,954 | 11,928 | 16,034 | |||||||||||

|

Equals:

Net Loss attributable to Clean Power Concepts and Subsidiaries (Note 2)

|

19,473 | (105,930 | ) | (404,647 | ) | (300,192 | ) | |||||||||

|

Loss per common share (Note 2), basic and diluted

|

$ | 0.00 | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | |||||

|

Weighted average shares outstanding (Note 2)

|

238,925,175 | 150,048,000 | 236,526,948 | 150,048,000 | ||||||||||||

(continued)

The accompanying notes to financial statements are an integral part of these consolidated financial statements

CLEAN POWER CONCEPTS INC. AND SUBSIDIARIES

Consolidated Statements of Operations and Comprehensive Income

(UNAUDITED)

(continued)

|

Three Months

ended

January 31,

2011

|

Three Months

ended

January 31,

2010

|

Nine Months

ended

January 31,

2011

|

Nine Months

ended

January 31,

2010

|

|||||||||||||

|

OTHER COMPREHENSIVE INCOME (LOSS)

|

||||||||||||||||

|

Net Income (loss)

|

$ | 24,128 | $ | (109,884 | ) | $ | (416,575 | ) | $ | (316,226 | ) | |||||

|

Foreign currency translation adjustment

|

14,953 | 3,631 | (2,337 | ) | (64,138 | ) | ||||||||||

|

Other Comprehensive Income (Loss)

|

$ | 39,081 | $ | (106,253 | ) | $ | (418,912 | ) | $ | (380,364 | ) | |||||

|

Less: Net Loss attributable to Non-Controlling Interest (Note 2)

|

(4,655 | ) | 4,124 | 11,928 | 12,883 | |||||||||||

|

Less: Foreign currency translation adjustment attributable to Non-Controlling Interest (Note 2)

|

(706 | ) | (170 | ) | 92 | 3,151 | ||||||||||

|

Equals: Other comprehensive income (loss) attributable to Clean Power Concepts and Subsidiaries (Note 2)

|

$ | 33,720 | $ | (102,299 | ) | $ | (406,892 | ) | $ | (364,330 | ) | |||||

The accompanying notes to financial statements are an integral part of these consolidated financial statements

CLEAN POWER CONCEPTS INC. AND SUBSIDIARIES

Consolidated Statements of Cash Flows

(UNAUDITED)

|

Nine Months

ended

January 31,

2011

|

Nine Months

ended

January 31,

2010

|

|||||||

|

Cash flows from operating activities:

|

||||||||

|

Net Income (Loss) for period

|

$ | (416,575 | ) | $ | (316,226 | ) | ||

|

Reconciling adjustments:

|

||||||||

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

||||||||

|

Depreciation

|

77,535 | 162,594 | ||||||

|

Net change in operating assets and liabilities:

|

||||||||

| Accrued interest on loans | 56,656 | 42,510 | ||||||

|

Prepaid expenses

|

17,197 | 4,789 | ||||||

|

Accounts payable and accrued expenses

|

120,618 | 120,932 | ||||||

|

Accounts receivable

|

(198,757 | ) | (81,004 | ) | ||||

|

Inventory

|

2,802 | 1,694 | ||||||

|

Net cash (used) by operating activities

|

(340,524 | ) | (64,711 | ) | ||||

|

Cash flows from investing activities:

|

||||||||

|

Purchases of property, plant and equipment

|

(6,871 | ) | (626,848 | ) | ||||

|

Net cash (used) by investing activities

|

(6,871 | ) | (626,848 | ) | ||||

|

Cash flows from financing activities:

|

||||||||

|

Proceeds from common shares issued for cash

|

- | 494,362 | ||||||

|

Proceeds from common shares subscribed but not issued

|

20,000 | |||||||

|

Proceeds provided by loans

|

227,929 | - | ||||||

|

Principal repayments toward capital leases

|

- | (657 | ) | |||||

|

Proceeds provided by long-term debt

|

- | 19,885 | ||||||

|

Principal repayments toward long-term debt

|

(4,613 | ) | - | |||||

|

Proceeds provided by Line of Credit

|

- | 14,546 | ||||||

|

Payments toward Line of Credit

|

(37,885 | ) | - | |||||

|

Proceeds provided by related party advances

|

133,198 | 187,040 | ||||||

|

Net cash provided by financing activities

|

338,629 | 715,176 | ||||||

|

Effect of foreign currency exchange rates on cash

|

(498 | ) | (64,138 | ) | ||||

|

Net increase (decrease) in cash

|

(9,264 | ) | (40,521 | ) | ||||

|

Cash, beginning of period

|

36,262 | 41,766 | ||||||

|

Cash, end of period

|

26,998 | $ | 1,245 | |||||

The accompanying notes to financial statements are an integral part of these consolidated financial statements

CLEAN POWER CONCEPTS INC. AND SUBSIDIARIES

Consolidated Supplemental Disclosure of Non-cash Investing and Financing Activities

|

Nine Months

ended

January 31,

2011

|

Nine Months

ended

January 31,

2010

|

|||||||

|

Shares issued for purchase of inventory included in COGS

|

$ | 104,748 | - | |||||

|

Shares issued for account payable settlements

|

12,000 | - | ||||||

The accompanying notes to financial statements are an integral part of these consolidated financial statements

CLEAN POWER CONCEPTS INC. AND SUBSIDIAIRIES

Notes to Consolidated Financial Statements

(Unaudited)

Note 1 – Basis of Presentation

Clean Power Concepts Inc. was incorporated in the State of Nevada on October 17, 2005. On October 28, 2005, we incorporated a British Columbia company named Loma Verde Explorations Ltd. as a wholly owned subsidiary and, on April 29, 2010, we acquired 94.8% of General Bio Energy Inc., a Saskatchewan Corporation as our primary operating subsidiary. During the period ended January 31, 2011, we also acquired additional General Bio Energy Inc. shares which increased our share of the subsidiary to 95.1%. The consolidated audited financial statements included herein have been prepared by Clean Power Concepts Inc. and its subsidiaries, General Bio Energy Inc. and Loma Verde Explorations Ltd. (collectively “Clean Power”, “We”, the “Registrant”, or the “Company”), in accordance with accounting principles generally accepted in the United States. Our financial statements are presented on a consolidated basis and include all accounts of Clean Power Concepts Inc., General Bio Energy Inc. and Loma Verde Explorations Ltd. and eliminate all intercompany balances.

Since inception the Company has not been involved in any bankruptcy, receivership or similar proceedings and the reclassification, consolidation, or merger arrangements in which the Company has been involved are as follows: (i) The Company was originally incorporated in Nevada as Loma Verde Inc. on October 17, 2005. On March 22, 2007, the Company incorporated a wholly owned subsidiary named Clean Power Concepts Inc. in Nevada and by agreement effective April 2, 2007, Clean Power Concepts, Inc. was merged into the Company for the sole purpose of changing the name of the Company. We then became the surviving entity with the name Clean Power Concepts Inc. In conjunction with the aforementioned merger, the Company forward split its authorized, issued and outstanding common stock on a 56 new for 1 old basis. On October 26, 2009, the Company decreased its authorized common shares limit from 11,200,000,000 to 1,000,000,000; and (ii) Through a share exchange agreement executed on April 29, 2010, incorporated herein by reference (the ‘Exchange Agreement’), we acquired 94.8% of the issued and outstanding common shares of General Bio Energy Inc. (‘GBE’), a Saskatchewan Corporation, in return for issuance (the ‘Exchange’) of 28,426,612 restricted shares of our common stock (the ‘Shares’) based on a ratio of 18.21 common shares of Clean Power for each 1.00 share common share of GBE submitted for exchange. The Shares have not been registered under the Securities Act of 1933, as amended (the "Securities Act") are be deemed "restricted" securities under the Securities Act and may not be sold or transferred other than pursuant to an effective registration statement under the Securities Act or any exemption from the registration requirements of the Securities Act.

The Company was originally organized for the purpose of acquiring and developing mineral properties and was therefore considered to be in the pre-exploration stage. Mineral claims with unknown reserves were acquired, but the Company did not establish the existence of commercially mineable ore deposits and determined it should abandon its mineral claims and pursue other business opportunities, one of which was the alternative energy business. On April 29, 2010 we acquired General Bio Energy Inc. through a reverse merger and are currently operating a business focused on the environmentally friendly green energy industry. General Bio Energy Inc. (“GBE”) was incorporated in the Province of Saskatchewan on February 14, 2006. GBE was originally named Canadian Green Fuels Inc. and changed its name to General Bio Energy Inc. on September 18, 2008. GBE commenced its pre-production stage on May 1, 2006 and began selling products in July 2008. From 2008 to 2010, GBE has continued to develop, research, and test its pilot production equipment, and refine its alternative energy technology. The Company is a producer of a range of products manufactured by crushing fuel grade oilseed. The Company’s production facility and head office is located in Regina, Saskatchewan.

CLEAN POWER CONCEPTS INC. AND SUBSIDIAIRIES

Notes to Consolidated Financial Statements

(Unaudited)

Effective with the execution of our reverse merger on April 29, 2010, we changed our fiscal year end from June 30th to April 30th. These financial statements are presented in US Dollars.

The Company’s common stock is publicly traded in the NASD Over-The-Counter Market under the symbol “CPOW”.

The consolidated unaudited financial statements included herein have been prepared the Company in accordance with accounting principles generally accepted in the United States for interim financial information. Certain information and footnote disclosures normally included in the financial statements prepared in accordance with generally accepted accounting principles have been condensed or omitted as allowed by such rules and regulations, and the Company believes that the disclosures are adequate to make the information presented not misleading. It is suggested that these financial statements be read in conjunction with the April 30, 2010 audited financial statements and the accompanying notes included in the Company’s Form 10-K filed with the Securities and Exchange Commission. The results of operations for the interim periods are not necessarily indicative of the results for the full year. In management’s opinion all adjustments necessary for a fair presentation of the Company’s financial statements are of a normal recurring nature and are reflected in the interim periods included.

Note 2 – Summary of Significant Accounting Policies

This summary of significant accounting policies is presented to assist in understanding Clean Power’s financial statements. The financial statements and notes are representations of the Company’s management, who is responsible for their integrity and objectivity. These accounting policies conform to generally accepted accounting principles in the United States of America and have been consistently applied in the preparation of the financial statements, which are stated in U.S. Dollars.

The financial statements reflect the following significant accounting policies:

Consolidation of Financial Statements

These financial statements include the accounts of the Company and its subsidiaries General Bio Energy Inc. and Loma Verde Explorations Ltd. on a consolidated basis. All inter-company accounts have been eliminated.

Revenue Recognition

The Company recognizes revenue from the sale of bio-diesel, additives, canola meal, and canola oil, when evidence of an arrangement exists, the product has been shipped, and the price to the buyer has been determined.

Inventory

Inventory is valued at the lower of cost or net realizable value. Cost is determined by the weighted average method. Net realizable value is the estimated selling price in the ordinary course of business, less estimated costs of completion and selling costs.

CLEAN POWER CONCEPTS INC. AND SUBSIDIAIRIES

Notes to Consolidated Financial Statements

(Unaudited)

Non-Controlling Interest

As required by GAAP, the Consolidated Balance Sheet and Consolidated Statements of Operations of these financial statements include the allocation to ‘Non-Controlling Interest’ of a proportionate share of the Company’s net losses relating to the 4.9% ownership interest in General Bio Energy Inc. which is not owned by the Company.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the period. Actual results could differ from those estimates.

Earnings or (Loss) per Share

Basic loss per share is calculated by dividing the net loss available to common stockholders by the weighted average number of common shares outstanding for the period. The denominator in this calculation is adjusted to reflect any stock splits or stock dividends.

Diluted loss per share is calculated using the treasury method which requires the calculation of diluted loss per share by assuming that any outstanding stock options with an average market price that exceeds the average exercise prices of the options for the year, are exercised and the assumed proceeds are used to repurchase shares of the Company at the average market price of the common shares for the year. An incremental per share effect is then calculated for each option. The denominator of the diluted loss per share formula is the number common shares outstanding at balance sheet date plus the incremental shares assumed to be issued from treasury for option exercises, less the number of shares assumed to be repurchased, weighted by the period they are assumed to be outstanding. This dilution calculation did not affect current fiscal year results because the Company does not have an Option Plan and has not issued any stock options.

Fair Value of Financial Instruments

The carrying value of the Company’s financial instruments reflected in the financial statements approximates fair value due to the short-term maturity of the instruments. It is management’s opinion that the Company is not exposed to significant interest, currency or credit risks arising from these financial instruments.

Income Taxes

The Company follows the asset and liability method of accounting for future income taxes. Under this method, future income tax assets and liabilities are recorded based on temporary differences between the carrying amount of balance sheet items and their corresponding tax bases. In addition, the future benefits of income tax assets, including unused tax losses, are recognized, subject to a valuation allowance, to the extent that it is more likely than not that such future benefits will ultimately be realized. Future income tax assets and liabilities are measured using substantively enacted tax rates and laws expected to apply when the tax liabilities or assets are to be either settled or realized.

CLEAN POWER CONCEPTS INC. AND SUBSIDIAIRIES

Notes to Consolidated Financial Statements

(Unaudited)

Foreign Currency

The consolidated books of the Company are maintained in United States dollars and this is the Company’s functional and reporting currency. The books of General Bio Energy Inc. are maintained in Canadian Dollars and the consolidation of GBE into the Company results in foreign currency translation adjustments which are recognized as other comprehensive income. Transactions denominated in other than the United States dollar are translated as follows with the related transaction gains and losses being recorded in the Statements of Operations:

|

|

(i)

|

Monetary items are recorded at the rate of exchange prevailing as at the balance sheet date;

|

|

|

(ii)

|

Non-Monetary items including equity are recorded at the historical rate of exchange; and

|

|

|

(iii)

|

Revenues and expenses are recorded at the period average in which the transaction occurred

|

Cash and Cash Equivalents

The Company considers cash and cash equivalents to consist of cash on hand and demand deposits in banks with an initial maturity of 90 days or less.

Risks and Uncertainties

The Company is subject to substantial business risks and uncertainties inherent in starting a new business. There is no assurance the Company will be able to generate sufficient revenues or obtain sufficient funds necessary to succeed in its new business venture.

Allowance for doubtful accounts

The Company maintains allowances for doubtful accounts for estimated losses from the inability of its customers to make required payments. The Company determines its reserves by specific identification of customer accounts. If the financial condition of the Company’s customers were to deteriorate, resulting in an impairment of their ability to make payments, additional allowances could possibly be required.

Property, Plant, and Equipment

Capital assets are recorded at cost. Depreciation is recorded based on estimated useful lives of assets at time of acquisition.

Comprehensive income (loss)

Comprehensive income (loss) includes all changes in equity of the Company. Comprehensive income (loss) is the total of net income (loss) and other comprehensive income (loss). Other comprehensive income (loss) comprises revenues, expenses, gains and losses that, in accordance with United States generally accepted accounting principles, require recognition, but are excluded from net income (loss). The books of General Bio Energy Inc. are maintained in Canadian Dollars and the consolidation of GBE into the Company results in foreign currency translation adjustments which are recognized as other comprehensive income.

Reclassifications

Certain prior period amounts have been reclassified to conform with current period presentation.

CLEAN POWER CONCEPTS INC. AND SUBSIDIAIRIES

Notes to Consolidated Financial Statements

(Unaudited)

Recent Accounting Pronouncements

Various accounting pronouncements have been issued during 2010 and 2009, none of which are expected to have a material effect on the financial statements of the Company.

Other

The Company consists of one reportable business segment.

The Company's assets with carrying value are located in Canada.

Advertising is expensed as it is incurred.

We did not have any off-balance sheet arrangements as at January 31, 2011.

Note 3 – Going Concern

Generally accepted accounting principles in the United States of America contemplate the continuation of the Company as a going concern. However, the Company has accumulated operating losses since its inception and has limited business operations, which raises substantial doubt about the Company’s ability to continue as a going concern. During the nine month period ended January 31, 2011, the net loss attributable to Clean Power Concepts Inc. and Subsidiaries was $(404,647). The continuation of the Company is dependent upon the continuing financial support of investors and stockholders of the Company. As of January 31, 2011 we projected the Company would need additional cash resources to operate during the upcoming 12 months and would raise this capital through private placements of our common shares and advances from our President. The Company intends to attempt to acquire additional operating capital through private equity offerings to the public and existing investors to fund its business plan. However, there is no assurance that equity or debt offerings will be successful in raising sufficient funds to assure the eventual profitability of the Company. The financial statements do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts of and classification of liabilities that might be necessary in the event the Company cannot continue in existence.

Note 4 – Line of Credit

GBE established a line of credit with a supplier for input stock. The line of credit has a maximum limit of $198,807. The line of credit has an interest rate of 10%, and is unsecured. The line of credit is repayable on demand. The balances due on the line of credit were $59,739 and $97,624 respectively for the nine months ended January 31, 2011 and the year ended April 30, 2010.

Note 5 – Related Party Advances

At January 31, 2011 the Company had related party advances owing to two related parties totaling $847,961. These

advances are uncollateralized, have no fixed repayment dates, do not accrue interest, and are callable at any time. During the nine months ended January 31, 2011 related party advances increased by $133,198.

CLEAN POWER CONCEPTS INC. AND SUBSIDIAIRIES

Notes to Consolidated Financial Statements

(Unaudited)

Note 6 – Loans and Interest Payable

At January 31, 2011, the Company had loans outstanding from three individuals totaling $90,438. These loans are uncollateralized, have no fixed repayment date, are callable at any time and have interest rates of 12% calculated on a daily basis. During the nine months ended January 31, 2011 interest of $7,920 accrued to these loans and this amount was added to interest payable on the balance sheet.

At January 31, 2011, the Company had a loan payable and interest payable to a private company which totaled $666,681 and $48,736 respectively. This loan is uncollateralized, accrues interest at 10% per annum, is payable on demand and has no fixed repayment date. During the period ended January 31, 2011, three lenders who had balances owing by the Company assigned their loans to another lender. This restructuring consolidated a total principal balance of $425,900 owed to the three lenders and a corresponding interest payable balance of $118,781 debt which was outstanding at year end into a beginning balance for the new lender of $544,681. During the period ended January 31, 2011, the new lender also advanced $122,000 to the Company. Loans payable also include a bank loan payable of $13,392 and a supplier note payable of $2,099.

NOTE 7 – Long-term debt and Capital Lease Obligations

|

Description of loan

|

Interest rate

|

Repayment terms

|

Maturity date

|

Principal Balance

|

||||||

|

Loan 1 - first security interest in all present and acquired personal property. Seventy five percent of the outstanding balance has been personally guaranteed by shareholders.

|

Fixed interest rate of 9.6%

|

Interest is to be paid monthly. Principal repayments of $2,315 per month commence November 2009.

|

October 2018

|

$ | 240,775 | |||||

|

Loan 2 - first security interest in all present and acquired personal property. Seventy five percent of the outstanding balance has been personally guaranteed by shareholders.

|

Variable interest rate of base plus 1%. The rate was 5.75% as of April 30, 2010

|

Interest is to be paid monthly. Principal repayments of $165 per month commence February 2008.

|

January 2013

|

$ | 1,650 | |||||

|

Less: current portion

|

$ | 21,491 | ||||||||

|

Long-term

|

$ | 220,934 | ||||||||

|

Total long-term debt

|

$ | 242,425 | ||||||||

CLEAN POWER CONCEPTS INC. AND SUBSIDIAIRIES

Notes to Consolidated Financial Statements

(Unaudited)

Future minimum lease payments on obligation under capital leases are as follows:

|

Year

|

$ | |||

|

2011

|

15,368 | |||

|

2012

|

27,230 | |||

|

2013

|

27,230 | |||

|

2014

|

27,229 | |||

|

Totals

|

$ | 97,057 | ||

|

Less: imputed interest

|

$ | 6,216 | ||

|

Less: current portion

|

$ | 15,368 | ||

|

Long-term

|

$ | 75,473 | ||

Note 8 – Related Party Transactions

Compensation of $139,294 was accrued to management and human resources salaries during the nine months ended January 31, 2011. During the period, the following transactions with related entities / persons were also conducted:

(i) The Company occupies leased premises subject to minimum monthly rent of $2,794. The premises are leased from a corporation controlled by a group of GBE shareholders. $61,243 was accrued for rent up to the period ended January 31, 2011. A rent payment of $28,755 was paid to the related Company during the period ended January 31, 2011.

(ii) At January 31, 2011 the Company had related party advances owing to two related parties totaling $847,961. These advances are uncollateralized, have no fixed repayment dates, do not accrue interest, and are callable at any time. During the nine months ended January 31, 2011 related party advances to the Company increased by $133,198.

Note 9 – Common Shares and Common Shares Subscribed but Not Issued

Common Shares

The Company’s common stock is traded in the NASD Over-The-Counter Market under the symbol “CPOW”.

At the year-end balance sheet date of April 30, 2010, the Company had not issued shares arising from a share exchange agreement executed on April 29, 2010 and these share balances were recorded as shares subscribed but not issued. During the nine month period ended January 31, 2011 these shares were issued, which had the effect of increasing the issued and outstanding share capital of the Company from 50,0160,000 shares to 78,442,612 shares.

Stock Dividend

On November 18, 2010, the Company declared a two (2) share for every one (1) share stock dividend, which resulted in an increase of the Company’s issued and outstanding share capital from 78,442,612 shares to 240,077,763 shares of common stock, including the effect of the share issuances which occurred between declaration of the stock dividend and payment date. The Record Date for the stock dividend was the 30th day of November, 2010; and the Payment Date, approved by FINRA, was the 6th day of December, 2010. The Corporation did not issue fractional shares but instructed its transfer agent to round up to one for any fractional interest which resulted from the stock dividend. Dividend Stock Certificates were mailed out on, or around, December 6, 2010.

CLEAN POWER CONCEPTS INC. AND SUBSIDIAIRIES

Notes to Consolidated Financial Statements

(Unaudited)

All share references in these financial statements have been retroactively adjusted for this stock dividend.

Debt and post share exchange conversions

During the period ended January 31, 2011, two GBE shareholders who had not participated in the share exchange on April 29, 2010, offered to exchange their GBE shares for shares of the Company on the same terms as the share exchange. The Company accepted these offers and on November 26, 2010, issued 273,060 restricted common shares of the Company in exchange for an additional 0.03% of the previously outstanding shares of GBE.

During the period ended January 31, 2011, two debt conversions offers were accepted by the Company which resulted in the issuance of 4,476,774 restricted common shares of the Company in exchange for cancelation of a total of $104,748 related to payment for inventory recorded in Cost of Goods Sold and $12,000 for an account payable related to a service provider.

Common Shares Subscribed but not issued

At the balance sheet date of January 31, 2011, the Company had not issued shares arising from a private placement totaling $20,000 and this share balance was recorded as shares subscribed but not issued.

Note 10 – Commitments and Contingencies

On October 9, 2009, Shafer Commodities Inc. of Vancouver, BC, Canada filed a Statement of Claim for $24,345 in the Court of Queen's Bench Saskatoon against General Bio Energy Inc. pursuant to an invoice dispute. In respect of this matter, General Bio Energy is the plaintiff in a counterclaim against Shafer Commodities Inc. of Vancouver, BC, Canada in respect to an amount of $68,171 owed by Shafer Commodities to General Bio Energy Inc. A court date to settle this matter has not yet been set.

Note 11 – Subsequent Event

On February 17, 2011, the Company received confirmation from Canada Revenue Agency that its claim for a refund, as filed on October 29, 2009, relating to a Canadian Government sponsored Scientific Research and Experimental Development (‘SR&ED’) program had been approved. This resulted in the recognition of other income and an account receivable of $379,275. Additionally, expenses and an account payable of $75,855 were recorded relating to consultant services arising from preparation and administration of the claim. These amounts have been recorded in these financial statements.

ITEM 2. MANAGEMENTS’ DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

This quarterly report on Form 10-Q contains "forward-looking statements" relating to the registrant which represent the registrant's current expectations or beliefs including, statements concerning registrant’s operations, performance, financial condition and growth. For this purpose, any statement contained in this quarterly report on Form 10-Q that are not statements of historical fact are forward-looking statements. Without limiting the generality of the foregoing, words such as "may", "anticipation", "intend", "could", "estimate", or "continue" or the negative or other comparable terminology are intended to identify forward-looking statements. These statements by their nature involve substantial risks and uncertainties, such as credit losses, dependence on management and key personnel and variability of quarterly results, ability of registrant to continue its growth strategy and competition, certain of which are beyond the registrant's control. Should one or more of these risks or uncertainties materialize or should the underlying assumptions prove incorrect, actual outcomes and results could differ materially from those indicated in the forward-looking statements.

Overview

Clean Power Concepts Inc. was incorporated in the State of Nevada on October 17, 2005. On October 28, 2005, we incorporated a British Columbia company named Loma Verde Explorations Ltd. as a wholly owned subsidiary and, on April 29, 2010, we acquired 94.8% of General Bio Energy Inc., a Saskatchewan Corporation as our primary operating subsidiary. The consolidated audited financial statements included herein have been prepared by Clean Power Concepts Inc. and its subsidiaries, General Bio Energy Inc. and Loma Verde Explorations Ltd. (collectively “Clean Power”, “We”, the “Registrant”, or the “Company”), in accordance with accounting principles generally accepted in the United States. Our financial statements are presented on a consolidated basis and include all accounts of Clean Power Concepts Inc., General Bio Energy Inc. and Loma Verde Explorations Ltd. and eliminate all intercompany balances. In management’s opinion all adjustments necessary for a fair presentation of the Company’s financial statements are of a normal recurring nature and are reflected in the periods included.

Since inception the Company has not been involved in any bankruptcy, receivership or similar proceedings and the reclassification, consolidation, or merger arrangements in which the Company has been involved are as follows: (i) The Company was originally incorporated in Nevada as Loma Verde Inc. on October 17, 2005. On March 22, 2007, the Company incorporated a wholly owned subsidiary named Clean Power Concepts Inc. in Nevada and by agreement effective April 2, 2007, Clean Power Concepts, Inc. was merged into the Company for the sole purpose of changing the name of the Company. We then became the surviving entity with the name Clean Power Concepts Inc. In conjunction with the aforementioned merger, the Company forward split its authorized, issued and outstanding common stock on a 56 new for 1 old basis. On October 26, 2009, the Company decreased its authorized common shares limit from 11,200,000,000 to 1,000,000,000; and (ii) Through a share exchange agreement executed on April 29, 2010, incorporated herein by reference (the ‘Exchange Agreement’), we acquired 94.8% of the issued and outstanding common shares of General Bio Energy Inc. (‘GBE’), a Saskatchewan Corporation, in return for issuance (the ‘Exchange’) of 28,426,612 restricted shares of our common stock (the ‘Shares’) based on a ratio of 18.21 common shares of Clean Power for each 1.00 share common share of GBE submitted for exchange. The Shares have not been registered under the Securities Act of 1933, as amended (the "Securities Act") are be deemed "restricted" securities under the Securities Act and may not be sold or transferred other than pursuant to an effective registration statement under the Securities Act or any exemption from the registration requirements of the Securities Act.

The Company was originally organized for the purpose of acquiring and developing mineral properties and was therefore considered to be in the pre-exploration stage. Mineral claims with unknown reserves were acquired, but the Company did not establish the existence of commercially mineable ore deposits and determined it should abandon its mineral claims and pursue other business opportunities, one of which was the alternative energy business. On April 29, 2010 we acquired

General Bio Energy Inc. through a reverse merger and are currently operating a business focused on the environmentally friendly green energy industry. General Bio Energy Inc. (“GBE”) was incorporated in the Province of Saskatchewan on February 14, 2006. GBE was originally named Canadian Green Fuels Inc. and changed its name to General Bio Energy Inc. on September 18, 2008. GBE commenced its pre-production stage on May 1, 2006 and began selling products in July 2008. From 2008 to 2010, GBE has continued to develop, research, and test its pilot production equipment, and refine its alternative energy technology. The Company is a producer of a range of products manufactured by crushing fuel grade oilseed. The Company’s production facility and head office is located in Regina, Saskatchewan.

Effective with the execution of our reverse merger on April 29, 2010, we changed our fiscal year end from June 30th to April 30th. These financial statements are presented in US Dollars.

The Company’s common stock is publicly traded in the NASD Over-The-Counter Market under the symbol “CPOW.

New operations based on acquisition of General Bio Energy Inc.

Present Operations

The Company’s subsidiary, General Bio Energy Inc. (‘GBE’), operates a fully integrated commercial oilseed crushing, bio-diesel refinery, and environmental lubricants manufacturing and bottling, and nutraceutical and food processing plant in Regina, Saskatchewan. The current plant has a crush capacity of 19.7 million liters of crushed oil annually. Its biodiesel fuel processor can produce up to 20 million liters of biofuel and biofuel additives and the crushing system can produce nearly 32.8 thousand metric tonnes of meal and protein related products for agricultural and aquaculture feedstock annually. The plant is capable of specialty and toll crushing a wide variety of oil seeds.

In 2006, GBE was formed under the name of Canadian Green Fuels Inc., with the intention to provide a Saskatchewan based alternative fuel to an emerging North American market. Using Canola or camelina as its preferred input stock, it sought to create a market niche by adapting its process to off-grade oil seed. This method of production improved the financial viability of the company and allowed it to develop product innovations based on its value-added production.

For most of 2009, the company crushed camelina on a toll basis for Sustainable Oils, who are currently supplying the U.S. Military with camelina based bio-jet fuel.

GBE entered development stage through a small crushing capacity with five crushers and a prototype biofuel processor that allowed the company to produce either feedstock based canola oil or biodiesel. GBE has developed, and also licenses, proprietary processes which allow the company to pursue its vision of being “green” manufacturing facility with minimal effluents, using a methods which are emissions friendly and do not use a water-wash system. This biofuel production method also gave birth to the development of additives and value-added products such as its MOPO brand of biodiesel based diesel fuel lubricants and conditioners, penetrating sprays, dust suppressants, cutting oils and other “ECO-lubricants”.

GBE invested over two years in manufacturing process and produce development trials to prove the integrity of its production system and create markets. During this time the Company achieved the following:

|

|

●

|

Refined its biofuel processor and created a second generation machinery,

|

|

|

●

|

Developed a proprietary hydro-jacket seed entry double crushing system

|

|

|

●

|

Created an exportable meal and pelleting operation

|

|

|

●

|

Established a successful retail product line and distribution network and delivery process

|

|

|

●

|

Engaged in Canada’s first Bio-Fuel Research and Technology partnership with the University of Regina and the Saskatchewan Forest Centre (Forest First) for the development of next generation technologies

|

|

|

●

|

Engaged with a leading edge hydrodynamic cavitation technology as an exclusive applications developer for Biofuels, which technology is expected to improve the way in which biodiesel is created and distributed

|

|

|

●

|

Pioneered biomass gasification technologies

|

|

|

●

|

Grew to become one of the largest crushers of next generation jet fuel feed stock camelina oilseed

|

Future Plans

GBE’s plans, contingent upon financing and profitability of operations during the next fiscal year, are to expand its crushing capacity to a potential of 450 MT crushing capacity per day and improve and increase its refining capacity. We also plan to research acquisition of a U.S. based biodiesel operation to assist in meeting this production goal and to capitalize on a ‘blenders credit’ that is provided by the U.S. government. The company is also investigating expansion within Canada to develop, or acquire, additional crushing facilities and biodiesel operations and is working on an initiative to develop camelina and canola oil refining with a view to producing bio jet fuel.

GBE intends to market itself domestically and in foreign countries to obtain domestic and export contracts for the sale of its product lines by contacting distributors and purchasing agents of retail operations that sell products and that compete with the company’s products. Additionally, GBE has plans to enter niche food markets by developing an organic and/or camelina, flax, hemp and canola based oil products for Health food markets. It anticipates this to occur in the short term using General Bio Health Division’s ‘Spirit of Health’ brand.

Competitive Conditions

The bio energy industry is complex, competitive, and has multiple companies competing for the limited inputs of various grains and oil seeds. It is possible demand for input stocks will not remain economically viable based on growing demand and future input prices and this is a concern to us but, in general, input stocks of GBE are subject to normal commodity price variations and we do not believe any single company, or group of companies, has sufficient market power to affect the price or supply of bio energy in the world market.

With the price of crude oil at high current levels, production activity in the bio energy industry has increased dramatically, and competition is also high for the recruitment of qualified technical personnel and processing equipment. However, a primary source of GBE’s input stock is off-grade market of oil seed inputs. These inputs represent 20-30% of annual oil seed crop totals and for the foreseeable are expected to provide a sufficient supply of inputs for the company. This factor provides the Company with a competitive advantage as it is the only company currently operating in Canada which has an off-grade seed crusher and produces fuel, fuel grade oil, and additives from off grade oil seed.

Government Regulation

Bio energy operations in Canada are subject to various federal, provincial and local laws and regulations which govern, development, production, exports, taxes, labour standards, occupational health, waste disposal, protection of the environment, safety, hazardous substances and other matters. The Company believes that it is, and will continue to be, in compliance in all material respects with applicable statutes and the regulations passed in Canada. There are no current orders or directions relating to the Company with respect to the foregoing laws and regulations.

Environmental Regulation

GBE’s activities are subject to various federal, provincial and local laws and regulations governing protection of the environment. In general, these laws are amended often and are becoming more restrictive. GBE’ policy is to conduct its business in a way that safeguards public health and the environment and believes that its operations are conducted in material compliance with applicable environmental laws and regulations. Since its incorporation, GBE has not had any material environmental incidents or non-compliance with any applicable environmental laws or regulations. The Company estimates that it will not incur material capital expenditures for environmental control facilities during the current fiscal year. GBE currently has a discretionary use permit and a Phase I Environmental Assessment completed.

REGINA PROCESSING PLANT

The operations of General Bio Energy are located within the city limits of Regina, Saskatchewan, Canada at 1620 McAra Street. This manufacturing facility comprises a rented building and land on a 1.5 acre corner property with an 8,800 square foot manufacturing plant on site. The facility has a fully certified weigh scale and silo grain storage for more than 100,000 bushels of input storage as well as shed and open-air storage for more than 2000 Metric Tonnes (‘MT’) of processed oilseed meal.

GBE’s plant is Western Canada’s first retail Bio-Diesel Fueling station and contains all the primary assets of the company.

The manufacturing facility has a rated capacity to generate a total annual production of oil on a current run rate of 150 MT of crushing capacity equal to 19.7 million liters (approximately 18, 250 MT) and approximately 30,000 MT of meal.

The manufacturing facility has the capacity to generate a total annual production of biofuel on current run rates equal to 19.7 million (18,250 MT). Additionally, our Biofuel processors have a capacity to exceed25 million liters of fuel production capability. We estimate future production capacity will reach 450 MT crush capacity (approximately 59.6 million liters of oil / biofuel) and approximately 108,000 MT of meal annually, and biofuel production will be enhanced to match the oil supply capacity.

Crushing Operations

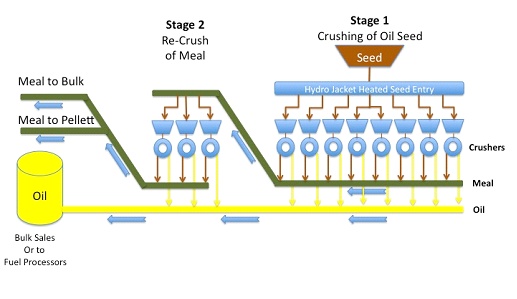

GBE’s plant has 150 MT/Day of oil seed crushing capacity based on a proprietary process that utilizes a double crush mechanical process with a “Hydro Jacket Heated Seed Entry” system that maximizes oil extraction to more than 90% and creates an oil seed meal capable of being pelletized, further processed to manufacture pet or other livestock feeds, extract proteins, or shipped raw due to its dry non-compacting properties.

The crushing process begins at Stage 1 (see diagram 1 below) where various oil seeds enter the crushing operations located inside the manufacturing facility through an initial hopper where the seed is dispersed along the proprietary heated hydro jacket that heats the seed to 60 degrees. This heat increases the capacity of the crushers to extract a maximum amount of oil. After passing along the entire span of the heated hydro jacket the seed is equally distributed to the array of primary crushers for its initial expeller crush. The oil and seed are separated and the meal is conveyed through an auger system to second stage crushing. The oil is then deposited into a common oil filter system where it is heated and centrifuged and sent to bulk storage located inside a heated environment in the building.

The crushed meal from Stage 1 is deposited into the re-crushers at stage 2 where additional oil is extracted and deposited to the common oil filter system. The meal is then conveyored and distributed through an auger system to storage outside the main facility where it holds for customer pick up. Or, the meal is re-directed to two peletting machines where it can be further prepared for either bagging or bulk pick up by the customer.

The oil produced is a COPA Type III which can be sold to food processors for additional refining or because it meets or exceeds specifications required to produce ASTM D6571 standard for retail bio-diesel and is sold at the retail pump located on the premises, or is manufactured into value added retail products on the premises.

Two Stage Crushing System of GBE

Processor Operations

The company has both a prototype and a reengineered second generation biofuel processors on site. The capacity of these two processors when combined is greater than 20 - 30 Million liters per year. The processors are shielded in a firewalled separate location inside the main facility, but are sufficiently portable to be rapidly deployed to other locations.

The oil generated from the crushing process can be further processed using a “waterless” processing method that, through low heat and no pressure, converts Bio Oil to Biodiesel. This is achieved by putting the oil through a chemical process that adds a mixture of methoxide and using various mineral plate filters that creates biodiesel. GBE uses a bleaching clay to clarify the fuel, which is then pumped through filtration centrifuges and finally to storage tanks for retail distribution. A by-product of this process is Glycerin that can be sold for various secondary industries including cosmetic and co-generation power systems.

All processes of the company are waterless, non-toxic, effluent friendly, and are considered “green” because of their continuous flow nature.

Meal and Pelleting Operations

Meal is the remaining seed elements that are the remnants of the crush of oil seed. It takes on the appearance of a soil or peat moss texture, and is a highly valued commodity due to its protein and high fat content. Through the process of GBE’s crushing, approximately 80% of the fat (oil) is removed from the seed in its double crush process, leaving approx 8% fat in the meal. In this raw form it is used primarily for livestock feed and is a high demand product due to bans on the use of animal tallow.

The meal is dealt with in the plant through a series of augers and conveyors which move it from the primary crusher output funnels to the secondary crush input funnels and finally to the exterior storage environment where it waits for shipping to the customer. The meal can be further refined through a filtration process where a highly valued protein powder can be extracted which can be sold for use in a variety of applications from pet food to aquaculture and exported globally.

In January 2009 GBE commissioned two 5 MT/day pelletizing machines to increase its ability to sell its meal in pellets. These pellets can be used for products bagged for retail markets as well as to provide added assurance of non-compacting when shipping meal to distant locations. Once the meal is put into its pellet form, the pellets are put into shipping containers or bagged for retail market purposes.

Meal is a primary co-product of the company and we are initiating plans to commercialize the use of meal through the patented process licensed from the Canadian Department of Fisheries and Oceans. A top priority will be to develop high margin fish food for aquaculture and other primary protein products.

Bottling & Retail Operations

All of the retail functions, product creation, bottling, labeling and marketing are, where possible, performed at the manufacturing facility. The product creation is a labour intensive process of filling bottles and wrapping them with labels. As the company grows, we plan to automate some processes in this area.

One of our primary trade names is: ‘MOPO Environmental Lubricants. The various products sold under the “MOPO Environmental Lubricants” brand created in our manufacturing facility are:

|

1)

|

Dust Suppressants

|

|

2)

|

Environmental Lubricants used for:

|

|

|

a)

|

Cutting Oil

|

|

|

b)

|

Chain Oil

|

|

|

c)

|

General All Purpose Lubricant

|

|

|

d)

|

Gun Oil

|

|

|

e)

|

Penetrating Oil (the oil/solution is prepared at the facility but is outsourced for aerosolizing)

|

|

3)

|

Environmental Fuel Line Conditioners packaged in:

|

|

|

a)

|

1 Liter F style bottle

|

|

|

b)

|

4 Liter F style jug

|

|

|

c)

|

205 Liter barrel

|

|

|

d)

|

1036 Liter totes

|

|

|

e)

|

Bulk

|

Other primary trade names include: ‘General Bio Health’ and ‘Spirit of Health’, under which we manufacture, distribute, and retail essential oils, camelina, canola, flax, and hemp, in various formats including capsules, gourmet cooking oils, and skin care formulations.

Subsidiaries

Our primary subsidiary is General Bio Energy Inc., a Saskatchewan corporation is a 95.1% owned subsidiary and we also wholly own Loma Verde Explorations, Ltd., a British Columbia corporation which is currently inactive.

Employees

Our subsidiary General Bio Energy Inc. employees 8 full time technical and administrative staff. We expect a significant increase in the number of our employees over the next 12 month period as we implement our strategic plans. We contract with outside professionals for legal, audit, accounting, and regulatory filing services as required.

Intellectual Property

We do not own, either legally or beneficially, any patents, trademarks, servicemarks, or other registered intellectual property. We license certain patented intellectual property from the Canadian Department of Fisheries and Oceans.

News Highlights During the Quarter:

Clean Power Concepts Named One of Canada’s Emerging Growth Companies

On December 21, 2010, the Company announced its operating subsidiary General Bio Energy Inc. (‘General Bio’) was recently named as one of Canada’s top 50 emerging growth companies by Profit Magazine.

“Each year Profit Magazine names fifty organizations that have experienced tremendous growth,” comments Michael Shenher, Clean Power’s President and CEO. “We’re thrilled that General Bio has been included on the Profit Magazine 2010 ‘Hot Fifty List’ among some very innovative companies during tough economic times.”

The ranking was based on General Bio’s impressive sales growth of its agricultural based bio-tech products including essential oils and vegetable oil seed proteins. General Bio was formed in 2006 and has successfully developed a consumer base for its environmentally friendly products over the last four years. Revenues continue to grow, as evidenced by sales during the six month period ended October 31, 2010, which increased by 133% versus the six period ended October 31, 2009.

Shenher added, “We at Clean Power are honored that we’ve been included on a list which the editors of Profit Magazine refer to as:

“...entrepreneurial bright lights who have shown a keen eye for exploiting under-served niches, a willingness to take risks, a ruthless attention to cost control and, above all, a passionate commitment to delivering value to their customers.”

Shenher concluded by commenting, “It’s wonderful that the hard work and dedication of our management, staff and stakeholders have translated into an appearance on Profit’s Hot Fifty List. We’re dedicated to serving the growth market in environmentally friendly produces and expect the upward trend of our company to continue. This recognition is definitely an indication that we’re on the right track and will is a great way to end the year.”

Clean Power Concepts Launches "Spirit of Health" Natural Consumer Products Brand

On December 22, 2010, we announced the creation of the 'Spirit of Health' brand under which Clean Power will launch a new line of natural consumer products.

"The creation of the 'Spirit of Health' brand is another step in our diversification into consumer driven environmentally friendly health products," said CEO Michael Shenher." The 'Spirit of Health' brand will include a line of natural health supplements made from essential camelina oil, which is an extremely high source of omega 3, omega 6 and vitamin E, in quantities rivaling salmon oil."

Initially, the line will consist of three products: camelina oil capsules, gourmet cooking oil, and a skin care health and beauty formulation aimed to be a remedy for several skin maladies. Plans are also underway to expand the product base into flax, canola and hemp oil based essential oil products.

Shenher closed by saying, "Clean Power sees this natural product brand as being highly attractive to Asian markets which are major consumers of traditional medicine products and fits well into our medium and long-term marketing plans."

Major Sales Agreement Reached

On January 13, 2011, we reported today that Clean Power had signed a significant long-term agreement with K.N.D. Feeds Ltd. (‘KND’) of Saskatchewan to market the company’s crude canola oil and canola meal off-take on an on-going basis to an expanded base of customers on a global scale.

KND is a well-respected Saskatchewan based supplier to the livestock feed market, which has been in the feed/commodities sales business since the mid 1980’s. Under this marketing agreement, KND has committed to market Clean Power’s canola products. The agreement is comprehensive and has sales estimates of 400 metric tons of canola oil and 600 metric tons of canola meal off take per month for the next five (5) years. The majority of this oil is intended for the fast growing animal feed market.

“We at Clean Power are fortunate to have the opportunity to work with such successful and reputable people as Ken Kuntz at KND,” commented Mike Shenher, President and CEO. “We believe that expanding our sales network with partners like KND is enhancing our competitiveness and positioning the Company for further growth. In doing so we’ve significantly enhanced our ability to capitalize on global sales opportunities through this sales agreement.” Shenher added. "We have been working diligently in 2010 to execute our business plan – to build our infrastructure, expand our product line and establish meaningful, tenured and protected sales and distribution agreements with well established companies such as KND whose innovative sales focus and values fit our exacting criteria," concluded Shenher. "Today's announcement is pivotal for the Company as we turn our attention now in 2011 from supply and development, to targeted sales execution."

About K.N.D. Feeds Ltd.

K.N.D. Feeds Ltd.(‘KND’) is located in Bjorkdale, Saskatchewan and has been in operation since the mid 1980’s. KND facilitates sales of approximately 60,000 metric tonnes commodities per year and specializes in the livestock feed business. The company’s CEO Ken Kuntz will be instrumental in assisting Clean Power in developing its product lines and sales channels.

Letter of Intent Executed to Acquire Assets of Alabama Bio Energy LLC and Subsidiary

On February 3, 2011 we executed a letter of intent to acquire the assets of Alabama Bio Energy LLC, and its subsidiary Eagle Bio Diesel Inc. ofBridgeport, Alabama. Its founder and CEO, Dr. William J. Freeman, MD, has agreed to join the board of directors of Clean Power Concepts Inc., and becomes President of the General Bio Health division of Clean Power.

The Bridgeport facility has a current production capacity of 100 million liters of biodiesel annually from a variety of feedstock. The closing date is March 15, 2011.

"We have worked with Dr. Freeman as a supplier, and we are very pleased to welcome Bill to the team, and we are excited for the prospects for Clean Power in Alabama and area," said Michael Shenher CEO of Clean Power Concepts Inc.

About Dr. William J. Freeman:

Dr. William J. Freeman, MD, is a University of Washington (Seattle) graduate and holds an MD degree from Johns Hopkins, as well as several years of postgraduate residency at Johns Hopkins Hospital in Baltimore. He is a Board Certified Otolaryngologist-Head & Neck Surgeon, and also a practicing Allergist. He designed, initiated, constructed, licensed, syndicated, and managed a total of 9 different multi-specialty freestanding surgical centers spread across states. He is a graduate of the Brooks Air Force School of Aerospace medicine and was an astronaut candidate. He is a land and sea rated pilot, including rating in the F-4 Phantom jet fighter and former flight surgeon.

Clean Power Concepts Letter of Intent Marks Entry Into Chinese Market

On December 28, 2010, we signed a letter of intent (the ‘Agreement’) to supply the Chongqing Grain Group Co. Ltd. of China (‘Chongqing’) with crude canola oil.

President and CEO Michael Shenher commented, “The Chinese market represents an incredible opportunity for Clean Power. We’ve been targeting this market for a few years and negotiating with Chongqing for the past two.” Shenher added, “This Agreement is a breakthrough for us and we’re now refining our working plan to meet and exceed the expectations of our new major customer.”

This agreement will help Chongqing in its goal of establishing supply chains for canola which diversify its reliance on major supplies such as ADM, Cargill and Bunge and is part of a long term plan to create a food processing zone in the Chong Qing region of China which has a processing capacity of 30,000 metric tonnes (‘MT’) of rapeseed and 30,000 MT of grain and oil.

Under the agreement, Chongqing has committed to purchasing up to 3,000 MT per month of crude degummed canola oil from Clean Power’s operating subsidiary and ship the oil to China where it will be refined into ‘Refined Bleached and Deodorized’ (‘RBD’) oil which is table ready. The refined oil will then be marketed under Chongqing’s ‘Red Dragon Fly Oil’ brand, which is well established in the Chong Qing Region. The parties have agreed that Clean Power will initially supply Chongqing from its own inventory and through purchases from third party suppliers as it increases production facilities to bring all production sold to Chongqing in-house. To complete the agreement Clean Power Concepts will be hosting a formal delegation from Chongqing within the next 60 days which will be comprised of private company officials and Chinese state representatives.

About Chongqing Grain Group Co. Ltd.

The Chongqing Grain Group Co. Ltd. (the ‘Group’) is located in Chong Qing, which is the youngest municipality in China and the economic and financial center of the upper reaches of the Yangtze River. The Group owns 51 subsidiaries and has 21,507 employees. Total assets of the Group have reached 6.1 Billion Yuan Renminbi (‘RMB’), or approximately US$920 million. The Group has abundant storage facilities, a developed logistics system, an integrated market network, efficient management and excellent marketing groups. The quality of the Group’s three brands - ‘Red Dragonfly’ cooking oil, ‘Ren He’ rice and ‘Ren Ji’ flour - have earned a high reputation in China. More information about The Group is available at www.cqgrain.com. Address: Chongqing Grain Group Co. Ltd., Fourth Floor, Lin Hua Huan Dao Ming Du, No. 13 Ba Yi Road, Yu Zhong District, Chong Qing, China 400010.

Results of Operations for the Three Month Periods Ended January 31, 2011 and January 31, 2010

Clean Powers operating results, for the nine month periods ended January 31, 2011 and 2009 are summarized as follows:

|

Nine months Ended

|

||||||||

|

January 31

|

||||||||

|

2010

|

2009

|

|||||||

|

Revenue

|

$ | 664,803 | $ | 257,536 | ||||

|

Cost of Sales

|

(502,586 | ) | (79,499 | ) | ||||

|

Gross Profit

|

162,217 | 178,037 | ||||||

|

Expenses

|

(859,173 | ) | (451,753 | ) | ||||

|

Interest

|

(98,894 | ) | (42,510 | ) | ||||

|

Other Income

|

379,275 | - | ||||||

|

Net Loss

|

(416,575 | ) | (316,226 | ) | ||||

Revenues

Sales totaled $221,732 and $664,803 respectively for the three and nine month periods ended January 31, 2011 versus $67,520 and $257,536 respectively for the three and nine month periods ended January 31, 2010. The two primary components of revenue were sales of canola meal and canola oil. Other revenue primarily included fees charged for toll crushing. We project sales will continue to rise as we implement our strategic plans during the coming year.

Cost of Sales

Cost of Sales are primarily comprised of agricultural seed input stocks. Cost of sales were $168,160 and $502,586 respectively for the three and nine months ended January 31, 2011 versus $16,190 and $79,499 respectively for the three and nine months ended January 31, 2010. The increase in these costs is tied directly to an increase in sales over the same periods respectively. We cannot accurately predict our future cost of sales because this is primarily driven by the prices of agricultural commodities which vary widely based on many circumstances.

Production Expenses

Production expenses primarily comprise: repairs and maintenance, indirect production supplies, vehicle expenses, and costs related to pre-production testing. Production expenses were $33,971 and $80,276 respectively for the three and nine month periods ended January 31, 2011 versus $nil and $31,526 respectively for the three and nine month periods ended January 31, 2010.We expect production expenses to increase significantly during the coming year as we implement our strategic plans.

General and Administrative Expenses

General and administrative expenses primarily comprise: rent, organizational administration expenses and the cost of bad debts. General and administrative expenses were $72,002 and $378,282 respectively for the three and nine month periods ended January 31, 2011 versus $24,309 and $116,464 for the three and nine month periods ended January 31, 2010.We expect administrative fees to increase moderately during the coming year.

Depreciation

Depreciation is comprised of depreciation expenses for our capital equipment and amortization of lease expenses. Depreciation totaled $30,944 and $77,535 respectively for the three and nine month periods ended January 31, 2011 versus $50,953 and $162,594 respectively for the three and nine month periods ended January 31, 2010.We expect amortization expenses to increase moderately during the coming year in line with our equipment purchases.

Salaries and Wages

Salaries and wages comprise payroll taxes and similar costs related to our management and administrative employees. Salaries and wages totaled $132,305 and $139,294 respectively for the three and nine month periods ended January 31, 2011 versus $46,170 and $89,941 respectively for the same periods ended January 31, 2010. We expect salaries and wages will increase incrementally in line with our planned increase in staff levels.

Professional and Consultant Fees

Professional and consultant fees totaled $77,143 and $120,426 respectively for the three and nine months ended January 31, 2011 versus $2,631 and $22,366 respectively for the same periods ended January 31, 2010. Professional fees are primarily composed of technical consultant, legal, auditor, and accounting fees. During the coming year, we project professional fees will increase moderately.

Advertising

Advertising expenses are related to advertising purchases for the promotion of our products. Advertising totaled $15,413 and $36,524 respectively for the three and nine month periods ending January 31, 2011 versus $13,828 and $20,646 respectively for the same period ended January 31, 2010. We expect advertising expenses to increase moderately over the coming year as we implement our strategic plans.

Investor Relations

Investor Relations expenses comprise costs for press releases, maintenance of the Company’s website and other investor information initiatives. During the three and nine month periods ended January 31, 2011, these expenses totaled $18,086 and $26,836 respectively versus $6,534 and $8,216 respectively for the comparative periods ended January 31, 2010. We anticipate Investor Relations expenses will increase substantially during the coming year as we continue our efforts to raise further capital and keep investors informed of Company developments.

Other Income Related to Scientific Research and Experimental Development Tax Refund

On February 17, 2011, the Company received confirmation from Canada Revenue Agency that its claim for a refund relating to a Canadian Government sponsored Scientific Research and Experimental Development (‘SR&ED’) program had been approved. This resulted in the recognition of other income and an account receivable of $379,275. Additionally, expenses and an account payable of $75,855 were recorded relating to consultant services arising from preparation and administration of the claim. These amounts have been recorded in these financial statements.

Net Income (Loss)

We had net income of $24,128 and incurred a net loss of $(416,575) respectively, for the three and nine months ended January 31, 2011 compared with net losses of $(109,884) and $(316,226) for the same periods ended January 31, 2010. We anticipate net losses will continue during the coming year as we invest in expanding our business.

Liquidity and Capital Resources

Our financial position as at January 31, 2011 and April 30, 2010 were as follows:

Working Capital

|

|

As at

January 31,

2011

|

As at

April 30,

2010

|

||||||

|

Current Assets

|

$ | 439,167 | $ | 374,421 | ||||

|

Current Liabilities

|

2,553,958 | 2,022,715 | ||||||

|

Working Capital (Deficiency)

|

$ | (2,114,791 | ) | $ | (1,628,294 | ) | ||

Our working capital deficit increased by $(486,497) between April 30, 2010 and January 31, 2011 due to an inventory drawdown and increased loans and advances payable.

Cash Flows

|

|

Nine months

ended

January 31,

2011

|

Nine months

ended

January 31,

2010

|

||||||

|

Net cash (used) by Operating Activities

|

$ | (340,254 | ) | $ | (64,711 | ) | ||

|

Net cash provided (used) by Investing Activities

|

(6,871 | ) | (626,848 | ) | ||||

|

Net cash provided in Financing Activities

|

338,629 | 715,176 | ||||||

|

(Decrease) Increase in Cash during the period

|

(9,264 | ) | (40,521 | ) | ||||

|

Cash, Beginning of Period

|

36,262 | 41,766 | ||||||

|

Cash, End of Period

|

26,998 | 1,245 | ||||||

Material Events and Uncertainties

The continuation of our business is dependent upon obtaining further financing, sales of our products, and achieving a profitable level of operations. The issuance of additional equity securities by us could result in a significant dilution in the equity interests of our current stockholders. Obtaining commercial loans, assuming those loans would be available, will increase our liabilities and future cash commitments.