Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - interCLICK, Inc. | ex31_1.htm |

| EX-31.2 - EXHIBIT 31.2 - interCLICK, Inc. | ex31_2.htm |

| EX-23.1 - EXHIBIT 23.1 - interCLICK, Inc. | ex23_1.htm |

| EX-32.1 - EXHIBIT 32.1 - interCLICK, Inc. | ex32_1.htm |

| EX-21.1 - EXHIBIT 21.1 - interCLICK, Inc. | ex21_1.htm |

| EX-10.23 - EXHIBIT 10.23 - interCLICK, Inc. | ex10_23.htm |

| 10-K - INTERCLICK 10-K 12-31-2010 - interCLICK, Inc. | form10k.htm |

Exhibit 10.22

INTERCLICK, INC.

2007 INCENTIVE STOCK AND AWARD PLAN

FORM OF NONQUALIFIED STOCK OPTION AGREEMENT

This NONQUALIFIED STOCK OPTION AGREEMENT (the “Option Agreement”), dated as of the ____ day of ___ 20__ (the “Grant Date”), is between interclick, inc., a Delaware corporation (the “Company”), and _____________ (the “Optionee”), a director, officer or employee of, or consultant or advisor to, the Company or a subsidiary of the Company (a “Related Corporation”), pursuant to the Company’s 2007 Incentive Stock and Award Plan (the “Plan”).

WHEREAS, the Company desires to give the Optionee the opportunity to purchase shares of common stock of the Company, par value $0.001 (“Common Shares”), in accordance with the provisions of the Plan, a copy of which is attached hereto.

NOW, THEREFORE, in consideration of the mutual covenants hereinafter set forth and for other good and valuable consideration, the parties hereto, intending to be legally bound hereby, agree as follows:

1. Grant of Option. The Company hereby grants to the Optionee the right and option (the “Option”) to purchase all or any part of an aggregate of ___________________ (______) Common Shares. The Option is in all respects limited and conditioned as hereinafter provided, and is subject in all respects to the terms and conditions of the Plan now in effect and as it may be amended from time to time (but only to the extent that such amendments apply to outstanding options). Such terms and conditions are incorporated herein by reference, made a part hereof, and shall control in the event of any conflict with any other terms of this Option Agreement. The Option granted hereunder is intended to be a nonqualified stock option and not an incentive stock option as such term is defined in section 422 of the Internal Revenue Code of 1986, as amended (the “Code”).

2. Exercise Price. The exercise price of the Common Shares covered by this Option shall be $_________ per share. It is the determination of the committee administering the Plan (the “Committee”) that on the Grant Date the exercise price was not less than the greater of (i) 100% of the “Fair Market Value” (as defined in the Plan) of a Common Share, or (ii) the par value of a Common Share.

3. Term. Unless earlier terminated pursuant to any provision of the Plan or of this Option Agreement, this Option shall expire at 5:30 p.m. New York time 10 years from the Grant Date (the “Expiration Date”). This Option shall not be exercisable on or after the Expiration Date.

1

4. Exercise of Option.

(a) The Option shall vest in equal [annual/semi-annual] increments over a __-year period with the first vesting date being ________, 20__, provided that Optionee remains continuously engaged as a director, officer or employee of, or consultant or advisor to, the Company or a Related Corporation from the date hereof through the applicable vesting date:

The Committee may accelerate any vesting date of the Option, in its discretion, if it deems such acceleration to be desirable. Once the Option becomes exercisable, it will remain exercisable until it is exercised or until it terminates.

(b) Notwithstanding any other provision of this Option Agreement, at the discretion of the Board or the Committee (as defined in the Plan), the Option, whether vested or unvested, shall be immediately forfeited in the event any of the following events occur:

[Employee Clawbacks]

(1) The Optionee is dismissed as an employee based upon fraud, theft, or dishonesty, which is reflected in a written or electronic notice given to the employee;

(2) The Optionee purchases or sells securities of the Company in violation of the Company’s insider trading guidelines then in effect;

(3) The Optionee breaches any duty of confidentiality including that required by the Company’s insider trading guidelines then in effect;

(4) The Optionee competes with the Company during a period of one year following termination of employment by soliciting customers located within or otherwise where the Company is doing business within any state, or where the Company expects to do business within three months following termination and, in this later event, the Optionee has actual knowledge of such plans;

(5) The Optionee recruits Company personnel for another entity or business within 24 months following termination of employment;

(6) The Optionee is unavailable for consultation after termination of the Optionee if such availability is a condition of any agreement between the Company and the Optionee;

(7) The Optionee fails to assign any invention, technology or related intellectual property rights to the Company if such assignment is a condition of any agreement between the Company and the Optionee;

(8) The Optionee acts in a disloyal manner to the Company; or

2

(9) A finding by the Board that the Optionee has acted against the interests of the Company.

[Director/Advisor/Consultant – Clawbacks]

(1) The Optionee purchases or sells securities of the Company in violation of the Company’s insider trading guidelines then in effect;

(2) The Optionee breaches any duty of confidentiality including that required by the Company’s insider trading guidelines then in effect;

(3) The Optionee competes with the Company during a period of one year following termination as a director, advisor or consultant (as applicable) by soliciting customers located within, or otherwise where the Company is doing business within, any state, or where the Company expects to do business within three months following termination, and in this later event, the director, advisor or consultant (as applicable) has actual knowledge of such plans;

(4) The Optionee recruits Company personnel for another entity or business within 24 months following ceasing to be a director, advisor or consultant; or

(5) The Optionee acts in a disloyal manner to the Company.

For purposes of this Section 4(b), “Company” shall include subsidiaries and/or affiliates of the Company.

5. Profits on the Sale of Certain Shares; Redemption. If any of the events specified in Section 4(b) of this Option Agreement occur within one year from the date the Optionee last performed services for the Company (the “Termination Date”) (or such longer period required by any written employment agreement) all profits earned from the sale of the Common Shares underlying this Option, during the two-year period commencing one year prior to the Termination Date shall be forfeited and immediately paid by the Optionee to the Company. Further, in such event, the Company may at its option redeem Common Shares acquired upon exercise of this Option by payment of the exercise price to the Optionee. The Company’s rights under this Section 5 do not lapse one year from the Termination Date but are a contract right subject to any appropriate statutory limitation period.

6. Method of Exercising Option. (a) Subject to the terms and conditions of this Option Agreement and the Plan, the Option may be exercised by written notice to the Company at its principal office to the attention of the Company’s Chief Financial Officer. The form of such notice is attached hereto and shall state the election to exercise the Option and the number of whole shares with respect to which it is being exercised; shall be signed by the person or persons so exercising the Option; and shall be accompanied by payment of the full exercise price of such shares. Only full shares will be issued.

3

(b) The exercise price shall be paid to the Company:

(i) in cash, or by certified check, bank draft, or postal or express money order;

(ii) by delivering a properly executed notice of exercise of the Option to the Company and the Company’s exclusive broker, with irrevocable instructions to the broker promptly to deliver to the Company the amount necessary to pay the exercise price of the Option; or

(iii) in any combination of (i) and (ii) above.

(c) Upon receipt of notice of exercise and payment, the Company shall deliver a certificate or certificates representing the Common Shares with respect to which the Option is so exercised. The Optionee shall obtain the rights of a shareholder upon receipt of a certificate(s) representing such Common Shares.

(d) Such certificate(s) shall be registered in the name of the person so exercising the Option (or, if the Option is exercised by the Optionee and if the Optionee so requests in the notice exercising the Option, shall be registered in the name of the Optionee and the Optionee’s spouse, jointly, with right of survivorship), and shall be delivered as provided above to, or upon the written order of, the person exercising the Option. In the event the Option is exercised by any person after the death or disability (as determined in accordance with Section 22(e)(3) of the Code) of the Optionee, the notice shall be accompanied by appropriate proof of the right of such person to exercise the Option. All Common Shares that are purchased upon exercise of the Option as provided herein shall be fully paid and non-assessable.

(e) Upon exercise of the Option, the Optionee shall be responsible for all employment and income taxes then or thereafter due (whether Federal, State or local), and if the Optionee does not remit to the Company sufficient cash (or, with the consent of the Committee, Common Shares) to satisfy all applicable withholding requirements, the Company shall be entitled to satisfy any withholding requirements for any such tax by disposing of Common Shares at exercise, withholding cash from Optionee’s salary or other compensation or any payment of any kind due Optionee or such other means as the Committee considers appropriate, to the fullest extent permitted by applicable law. Nothing in the preceding sentence shall impair or limit the Company’s rights with respect to satisfying withholding obligations under Section 10 of the Plan.

7. Termination of Services. If the Optionee’s services with the Company and all Related Corporations are terminated for any reason (other than death or disability) prior to the Expiration Date, then this Option may be exercised by Optionee, to the extent of the number of Common Shares with respect to which the Optionee could have exercised it on the date of such termination of services, at any time prior to the earlier of (i) the Expiration Date, or (ii) three months after such termination of services. Any part of the Option that was not exercisable immediately before the termination of Optionee’s services shall terminate at that time.

4

8. Disability. If the Optionee becomes disabled (as determined in accordance with section 22(e)(3) of the Code) during the period of his or her service and, prior to the Expiration Date, the Optionee’s services are terminated as a consequence of such disability, then this Option may be exercised by the Optionee or by the Optionee’s legal representative, to the extent of the number of Common Shares with respect to which the Optionee could have exercised it on the date of such termination of services, at any time prior to the earlier of (i) the Expiration Date or (ii) one year after such termination of services. Any part of the Option that was not exercisable immediately before the Optionee’s termination of services shall terminate at that time.

9. Death. If the Optionee dies during the period of his or her services and prior to the Expiration Date, or if the Optionee’s services are terminated for any reason (as described in Paragraphs 7 and 8) and the Optionee dies following his or her termination of services but prior to the earliest of (i) the Expiration Date, or (ii) the expiration of the period determined under Paragraph 7 or 8 (as applicable to the Optionee), then this Option may be exercised by the Optionee’s estate, personal representative or beneficiary who acquired the right to exercise this Option by bequest or inheritance or by reason of the Optionee’s death, to the extent of the number of Common Shares with respect to which the Optionee could have exercised it on the date of his or her death, at any time prior to the earlier of (i) the Expiration Date or (ii) one year after the date of the Optionee’s death. Any part of the Option that was not exercisable immediately before the Optionee’s death shall terminate at that time.

10. Securities Matters.

(a) If, at any time, counsel to the Company shall determine that the listing, registration or qualification of the Common Shares subject to the Option upon any securities exchange or under any state or federal law, or the consent or approval of any governmental or regulatory body, or that the disclosure of non-public information or the satisfaction of any other condition is necessary as a condition of, or in connection with, the issuance or purchase of Common Shares hereunder, such Option may not be exercised, in whole or in part, unless such listing, registration, qualification, consent or approval, or satisfaction of such condition shall have been effected or obtained on conditions acceptable to the Board of Directors. The Company shall be under no obligation to apply for or to obtain such listing, registration or qualification, or to satisfy such condition. The Committee shall inform the Optionee in writing of any decision to defer or prohibit the exercise of an Option. During the period that the effectiveness of the exercise of an Option has been deferred or prohibited, the Optionee may, by written notice, withdraw the Optionee’s decision to exercise and obtain a refund of any amount paid with respect thereto.

5

(b) The Company may require: (i) the Optionee (or any other person exercising the Option in the case of the Optionee’s death or disability) as a condition of exercising the Option, to give written assurances, in substance and form satisfactory to the Company, to the effect that such person is acquiring the Common Shares subject to the Option for his or her own account for investment and not with any present intention of selling or otherwise distributing the same, and to make such other representations or covenants; and (ii) that any certificates for Common Shares delivered in connection with the exercise of the Option bear such legends, in each case as the Company deems necessary or appropriate, in order to comply with federal and applicable state securities laws, to comply with covenants or representations made by the Company in connection with any public offering of its Common Shares or otherwise. The Optionee specifically understands and agrees that the Common Shares, if and when issued upon exercise of the Option, may be “restricted securities,” as that term is defined in Rule 144 under the Securities Act of 1933, as amended (the “Securities Act”) and, accordingly, the Optionee may be required to hold the shares indefinitely unless they are registered under such Securities Act or an exemption from such registration is available.

(c) The Optionee shall have no rights as a shareholder with respect to any Common Shares covered by the Option (including, without limitation, any rights to receive dividends or non-cash distributions with respect to such shares) until the date of issue of a stock certificate to the Optionee for such Common Shares. No adjustment shall be made for dividends or other rights for which the record date is prior to the date such stock certificate is issued.

11. Governing Law. This Option Agreement shall be governed by the applicable Code provisions to the maximum extent possible. Otherwise, the laws of the State of Delaware (without reference to the principles of conflict of laws) shall govern the operation of, and the rights of the Optionee under, the Plan and this Option Agreement.

12. Attorney’s Fees. In the event that there is any controversy or claim arising out of or relating to this Option Agreement, or to the interpretation, breach or enforcement thereof, and any action or proceeding is commenced to enforce the provisions of this Option Agreement, the prevailing party shall be entitled to reasonable attorneys’ fees, costs and expenses.

13. Venue. The venue for any action related to this Option Agreement shall be in a court of competent jurisdiction for New York County, New York.

[SIGNATURE PAGE FOLLOWS]

IN WITNESS WHEREOF, the parties hereto have duly executed this Nonqualified Stock Option Agreement as of the ____ day of ___, 20__.

6

|

INTERCLICK, INC.

|

|||

|

By:

|

|||

|

Name:

|

|||

|

Title:

|

|||

|

Optionee

|

|||

7

INTERCLICK, INC.

2007 INCENTIVE STOCK AND AWARD PLAN

NOTICE OF EXERCISE OF NONQUALIFIED STOCK OPTION

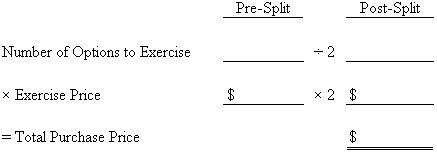

I, _____________________, hereby exercise the nonqualified stock option granted to me pursuant to the Nonqualified Stock Option Agreement dated as of ____________________ by interclick, inc. (the “Company”), with respect to the following number of shares of the Company’s common stock (“Shares”), par value $0.001 per Share, covered by said option. If my options were granted prior to October 23, 2009, the number of options and exercise price are reflected below on a Pre-Split and Post-Split basis.

Payment and Delivery - circle one of the following:

|

|

A.

|

Enclosed is cash or my certified check, bank draft, or postal or express money order in the amount of the Total Purchase Price above in payment for such Shares. Please send the certificate to the following address: ______________________________________; or

|

|

|

B.

|

I have provided a copy of this Notice of Exercise to Morgan Stanley Smith Barney (“MSSB”), a broker, to whom I have also provided irrevocable instructions to render payment for such Shares. Please send the Shares to MSSB upon their request. I have also provided MSSB.

|

|

Name in which to register the certificate representing the purchased Shares

|

|

|

Optionee’s Signature

|

|

|

Date

|

|