Attached files

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the Year Ended December 31, 2010

Commission File Number: 000-14319

STANDARD GOLD, INC.

(Exact Name of Small Business Issuer as Specified in its Charter)

|

COLORADO

|

84-0991764

|

|

|

(State or Other Jurisdiction of

|

(I.R.S. Employer Identification Number)

|

|

|

Incorporation or Organization)

|

900 IDS CENTER, 80 SOUTH EIGHTH STREET, MINNEAPOLIS, MINNESOTA 55402-8773

(Address of Principal Executive Offices)

Issuer’s telephone number including area code: (612) 349-5277

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under Section 12(g) of the Exchange Act:

COMMON STOCK, $0.001 PAR VALUE

Title of Class

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the issuer (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K x.

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

|

Non-accelerated filer ¨

|

Smaller reporting company x

|

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.) Yes ¨ No x

The Registrant’s revenues for its most recent fiscal year: None.

As of June 30, 2010, the Registrant’s non-affiliates owned shares of its common stock having an aggregate market value of approximately $1,171,100 (based upon the closing sales price of the Registrant’s common stock on that date on the OTCBB).

On March 18, 2011, there were 40,520,143 shares of common stock issued and outstanding, which is the Registrant’s only class of voting stock.

Documents Incorporated by Reference: None.

STANDARD GOLD, INC.

Annual Report on Form 10-K

For the Year Ended December 31, 2010

Table of Contents

|

Page

|

||

|

PART I

|

|

|

|

Item 1.

|

Description of Business

|

4

|

|

Item 1A.

|

Risk Factors

|

10

|

|

Item 2.

|

Description of Properties

|

15

|

|

Item 3.

|

Legal Proceedings

|

15

|

|

Item 4.

|

Submission of Matters to a Vote of Security Holders

|

15

|

|

PART II

|

||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities

|

16

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

17

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

21

|

|

Item 9.

|

Changes and Disagreements with Accountants on Accounting and Financial Disclosure

|

21

|

|

Item 9A(T).

|

Controls and Procedures

|

22

|

|

Item 9B.

|

Other Information

|

24

|

|

PART III

|

||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

25

|

|

Item 11.

|

Executive Compensation

|

26

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters

|

29

|

|

Item 13.

|

Certain Relationships, Related Transactions and Director Independence

|

31

|

|

Item 14.

|

Principal Accountant Fees and Services

|

33

|

|

Item 15.

|

Exhibits and Financial Statement Schedules

|

33

|

|

Signatures

|

36

|

2

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains both historical statements and statements that are forward-looking in nature. Historical statements are based on events that have already happened. Certain of these historical events provide some basis to our management, with which assumptions are made relating to events that are reasonably expected to happen in the future. Management also relies on information and assumptions provided by certain third party operators of our projects as well as assumptions made with the information currently available to predict future events. These future event predictions, or forward-looking statements, include (but are not limited to) statements related to the uncertainty of the quantity or quality of probable ore reserves or tailings grades, the fluctuations in the market price of such

reserves, as well as gold, silver and other precious minerals derived from our tailings, general trends in our operations or financial results, plans, expectations, estimates and beliefs. You can identify forward-looking statements by terminology such as “may,” “could,” “should,” “anticipate,” “believe,” “estimate,” “continue,” “expect,” “intend,” “plan,” “predict,” “potential” and similar expressions and their variants. These forward-looking statements reflect our judgment as of the date of this Annual Report with respect to future events, the outcome of which is subject to risks, which may have a significant impact on our business, operating results and/or financial condition. Readers are cautioned that these forward-looking statements are inherently uncertain. Should one or more of these risks or uncertainties materialize, or should

underlying assumptions prove incorrect, actual results or outcomes may vary materially from those described herein. We undertake no obligation to update forward-looking statements. The risks identified in PART I Item 1A, among others, may impact forward-looking statements contained in this Annual Report.

3

PART I

ITEM 1. BUSINESS

OVERVIEW

Standard Gold, Inc. (with its subsidiaries “we,” “us,” “our,” “Standard Gold” or the “Company”) is a minerals exploration and development company based in Minneapolis, Minnesota. As of December 31, 2010, we own, through our wholly owned subsidiary Hunter Bates Mining Corporation, a Minnesota corporation (“Hunter Bates”), a prior producing gold mine in Colorado called the Bates-Hunter Mine. The following is a summary of the Bates-Hunter Mine project.

On June 12, 2008, Hunter Bates completed the acquisition of the Bates-Hunter Mine, located in Central City, Colorado, which included real property, mining claims, permits and equipment. Wits Basin Precious Minerals Inc., a Minnesota corporation and public reporting company quoted on the Over-the-Counter Bulletin Board under the symbol “WITM” (“Wits Basin”) transferred its right to purchase the Bates-Hunter Mine to Hunter Bates (a wholly owned subsidiary of Wits Basin until September 29, 2009). The purchase of the Bates-Hunter Mine was financed through a limited recourse promissory note of Hunter Bates payable to Mr. George Otten (on behalf of all of the Sellers) in the principal amount of Cdn$6,750,000 (with a principal balance of $6,519,500 US as of December 31, 2010) and Wits

Basin issued 3,620,000 shares of its common stock. Through August 2008, approximately 12,000 feet of surface drilling had been accomplished on the Bates-Hunter Mine properties and we have no further exploration activities scheduled at this time. As of the date of this Annual Report, we do not claim to have any mineral reserves at the Bates-Hunter Mine.

On March 15, 2011, we closed a series of transactions (collectively, the “Shea Transaction”) whereby we acquired substantially all of the assets of Shea Mining & Milling, LLC (“Shea Mining”), which assets included the assignment to us of a lease (with a right to purchase), to operate an assay lab and toll milling facility, with permits and water rights, located in Amargosa Valley, Nevada. We also acquired the rights to four toll-milling contracts for mines and mineral projects located in Nevada, California and Colorado, along with the rights to certain mine dumps in Manhattan, Nevada. In addition, we purchased from Shea Mining certain assets located in Tonopah, Nevada, consisting of land, mine tailings, and a milling facility. A detailed description of the Shea

Transaction is contained below.

As of December 31, 2010, the few pieces of equipment we own were not being utilized in any operations and we employed insufficient numbers of personnel necessary to actually explore and/or mine for minerals.

All dollar amounts expressed in this Annual Report are in US Dollars (“$”), unless specifically noted as Canadian Dollars (“Cdn$”).

OUR HISTORY

Standard Gold (formerly known as Princeton Acquisitions, Inc.) was incorporated in the State of Colorado on July 10, 1985, as a blind pool or blank check company. From its incorporation until September 29, 2009, its strategy was to complete a merger with, or acquisition of, a private company, partnership or sole proprietorship without any particular industry or geographical location. Princeton Acquisitions, Inc. had a June 30 fiscal year end. On September 11, 2009, Standard Gold entered into a share exchange agreement with Hunter Bates and certain of its shareholders, in which Hunter Bates’ shareholders would exchange all of their capital securities into similar capital securities of Standard Gold. The share exchange was consummated on September 29, 2009 (the “Share Exchange”).

4

Accordingly, the Share Exchange represented a change in control and Hunter Bates became a wholly owned subsidiary of Standard Gold. For accounting purposes, the Share Exchange has been accounted for as a reverse acquisition with Hunter Bates as the accounting acquirer (legal acquiree) and Standard Gold as the accounting acquiree (legal acquirer). Upon completion of the Share Exchange, Wits Basin (which held a majority of the interest of Hunter Bates before the Share Exchange), held approximately 95% of our issued and outstanding capital stock at September 29, 2009.

Upon effectiveness of the Share Exchange, Standard Gold adopted the business model of Hunter Bates and as such has become a stand-alone minerals exploration and development company with a focus on gold projects. Furthermore, Hunter Bates had a fiscal year end of December 31, and as such we changed our fiscal year end from June 30 to December 31.

Subsequent to December 31, 2010, we entered into the Shea Transaction; see the information that follows for details of the transaction.

OUR EXPLORATION PROJECT: BATES-HUNTER MINE

Overview

On January 21, 2005, Wits Basin acquired an option to purchase all of the outstanding capital stock of the Hunter Gold Mining Corp. (a corporation incorporated under the laws of British Columbia, Canada) who held all of the assets of the Bates-Hunter Mine. On July 21, 2006, Wits Basin executed a stock purchase agreement to supersede the option agreement. On September 20, 2006, Wits Basin executed an Asset Purchase Agreement to purchase the Bates-Hunter Mine on different economic terms than previously agreed upon in the stock purchase agreement or option. On June 12, 2008, Wits Basin entered into a fifth amendment to the Asset Purchase Agreement to, among other changes, reflect its assignment of its rights in the Asset Purchase Agreement to Hunter Bates and thereby allowing Hunter Bates to complete

the acquisition of the Bates-Hunter Mine. The acquisition of the assets of the Bates-Hunter Mine was completed on June 12, 2008.

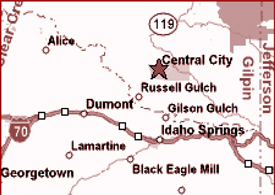

The Bates-Hunter Mine is located about 35 miles west of Denver, Colorado and is located within the city limits of Central City. The Central City mining district lies on the east slope of the Front Range where elevations range from 8,000 feet in the east to 9,750 feet in the west. Local topography consists of gently rolling hills with local relief of as much as 1,000 feet.

The mine site is located in the middle of a residential district within the city limits of Central City and is generally zoned for mining or industrial use. The Bates-Hunter Mine shaft is equipped with a two-compartment, 85 foot tall steel headframe and a single drum hoist using a one inch diameter rope to hoist a two ton skip from approximately 1,000 feet deep. A water treatment plant has been constructed adjacent to the mine headframe. This is a significant asset given the mine site location and environmental concerns.

5

Geology

The regional geology of the Central City district is not “simple” but the economic geology is classically simple. The Precambrian granites and gniesses in the area were intensely fractured during a faulting event resulting in the emplacement of many closely spaced and roughly parallel veins. The veins are the result of fracture filling by fluids that impregnated a portion of the surrounding gneisses and granites with lower grade gold concentrations “milling ore” and usually leaving a high grade “pay streak” of high grade gold sulphides within a quartz vein in the fracture. There are two veins systems present, one striking east-west and the other striking sub parallel to the more predominant east-west set. These veins hosted almost all of the gold in the camp. The veins vary

from 2 to 20 feet in width and dip nearly vertical. Where two veins intersect, the intersection usually widens considerably and the grade also increases, sometimes to bonanza grades. In the Timmins camp, this same feature was described as a “blow out” and resulted in similar grade and thickness increases. The Bates vein in the area of the Bates-Hunter Mine has been reported to have both sets of veins and extremely rich “ore” where the two veins intersected. These veins persist to depth and consist of gold rich sulphides that include some significant base metal credits for copper and silver.

Previous Exploration Efforts

The following is based on the information from a report titled “Exploration and Development Plan for the Bates-Hunter Project,” prepared by Glenn R. O’Gorman, P. Eng., dated March 1, 2004.

Lode gold was first discovered in Colorado in 1859 by John H. Gregory. The first veins discovered were the Gregory and the Bates. This discovery started a gold rush into the area with thousands of people trying to stake their claims. The Central City mining district is the most important mining district in the Front Range mineral belt. Since 1859, more than 4,000,000 ounces of gold have been mined from this district. Over 25% of this production has come from the area immediately surrounding the Bates-Hunter Project. Although the Bates vein was one of the richest and most productive in the early history of the area, it was never consolidated and mined to any great depth.

The majority of production on the claims occurred during the period prior to 1900. Technology at that time was very primitive in comparison to today's standards. Hand steel and hand tramming was the technology of the day. The above limitations coupled with limited claim sizes generally restricted mining to the top few hundred feet on any one claim.

During the early 1900’s cyanidation and flotation recovery technologies were developed along with better hoists and compressed air operated drills. Consolidation of land was a problem. Production rates were still limited due to the lack of mechanized mucking and tramming equipment. Issues that were major obstacles prior to the 1900’s and 1930’s are easily overcome with modern technology.

Colorado legislated their own peculiar mining problem by limiting claim sizes to 500 feet in length by 50 feet wide and incorporated the Apex Law into the system as well. A typical claim was 100 to 200 feet long in the early days. This resulted in making it extremely difficult for any one owner to consolidate a large group of claims and benefit from economies of scale. The W.W.II Production Limiting Order # 208 effectively shut down gold mining in the area and throughout Colorado and the United States in mid 1942.

Historical production records indicate that at least 350,000 ounces of gold were recovered from about half of the Bates Vein alone to shallow depths averaging about 500 feet below surface.

6

GSR Goldsearch Resources drilled two reverse circulation holes on the property in 1990. The first hole did not intersect the Bates Vein. However, the second drilled beneath the Bates-Hunter shaft bottom intersected the Bates Vein at about 900 feet below surface. The drill cuttings graded 0.48 oz. Au/ton over 10 feet. This drillhole intersected three additional veins as well with significant gold assays.

Through August 2008, over 12,000 feet of drilling was accomplished, which provided detailed data, which has been added to our existing 3-D map of the region. Several narrow intervals of potential ore grade gold values were intersected, which require further exploration efforts to delineate any valuation.

Our Exploration Plans

No further exploration activities will be conducted at the Bates-Hunter Mine until such time as we have sufficient funds to complete a detailed analysis of the projects potential. We have taken measures to secure the property while it remains inactive. As part of the Shea Transaction (as further described below), we have the right, at our option, at any time prior to June 13, 2011, to transfer the Hunter-Bates Mine and all related obligations and liabilities, to Wits Basin, in exchange for the cancellation by Wits Basin of a promissory note in the principal amount of $2,500,000 issued by Hunter Bates to Wits Basin. We are in the process of determining whether we want to exercise this transfer right.

THE SHEA TRANSACTION AND TOLL MILLING

On March 15, 2011, we acquired assets from Shea Mining which will allow us to enter the precious-metal toll milling business. Toll milling is a process whereby ore is crushed and ground into fine particles to ease the extraction of any precious minerals contained therein, such as gold, silver, lead, zinc and copper, and rare earth metals.

Pursuant to an Exchange Agreement, dated March 15, 2011, by and between us, Shea Mining, Afignis, LLC, Leslie Lucas Partners, LLC, Wits Basin and Alfred A. Rapetti (the “Exchange Agreement”), we acquired a lease (with a right to purchase), formerly held by Shea Mining, to operate an assay lab and toll milling facility, with permits and water rights, located in Amargosa Valley, Nevada. In connection with the assignment of the lease for the Amargosa facility, we extended the term of the lease until March 31, 2014. We pay a monthly base rent of $17,500 for this facility, increasing to $20,000 per month in April 2012, and $22,250 in April 2013. We have an option to purchase the facility for $6,000,000 at any time between April 1, 2012 and March 31, 2013. We also acquired

the rights to four toll-milling contracts for mines and mineral projects located in Nevada, California and Colorado, along with the rights to certain mine dumps in Manhattan, Nevada. Due to this facility’s proximity to mines within economical trucking distances that do not have their own facilities to process ore, we believe that this facility, and the related tolling contracts, will produce profitable revenue for us in the second half of 2011. We are in the early stages of determining the cost of starting operations at the Amargosa facility, but an initial estimate is that we will need to expend approximately $250,000 before operations can begin. We anticipate starting operations late in the second quarter of 2011.

Pursuant to an Assignment and Assumption of Loan Documents and Loan Modification Agreement, dated as of March 15, 2011, by and between us, Shea Mining and NJB Mining, Inc. (the “Loan Modification Agreement”), we acquired from Shea Mining certain assets located in Tonopah, Nevada, consisting of land, mine tailings, and a milling facility. The land encompasses 1,174 deeded acres, which may be the largest private land holding in Esmeralda County, Nevada. Approximately 334 acres of this land contains 2.2 million tons of tailings, which we believe is the largest single deposit of historic mine tailings in the state of Nevada, known as the Millers Tailings, from the historic gold rush of Goldfield and Tonopah, Nevada. Based on results from 40 drill holes, the Millers Tailings show a preliminary grade of

approximately 0.009 ounces per ton gold and 1.22 ounces per ton silver. We plan to execute a complete characterization of the tailings. The milling facility, known as Millers Mill, is an existing milling facility built in 1981 by Lurgi Engineering, a German firm, which had the capacity to process up to 2,000 tons of tailings per day. Millers Mill successfully processed gold and silver from the tailings on the property until 1984, when the falling price of metals caused the suspension of operations at this facility. The property comes with 387 acre-feet per year of water rights. After preliminary investigations of Millers Mill, we estimate that we will need to expend approximately $3,000,000 to make Millers Mill operational. We cannot predict a timetable for when such operations will begin, but we hope to have Millers Mill operational within the next year.

7

Pursuant to the Exchange Agreement, we issued a total of 35 million shares of our common stock to the equity holders of Shea Mining in exchange for the Shea Mining assets, resulting in those holders owning an ownership interest of approximately 87% of our currently outstanding common stock, and an approximately 56% ownership interest in our company on a fully diluted basis. Alfred A. Rapetti, our Chief Executive Officer, has been granted an irrevocable voting proxy for half of the shares issued to the Shea Mining equity holders, which continues until the affected shares are publicly sold after a period of at least six months, and thereafter in accordance with all applicable securities laws. In addition to the issuance of our common stock, we paid approximately $450,000 in cash to Shea Mining, and agreed to pay an

additional $450,000 to Shea Mining within one year following closing. We paid certain transaction costs and assumed certain debts relating to the assets which aggregate approximately $300,000. We also agreed to indemnify Shea Mining from any liabilities arising after March 15, 2011 out of the Loan Modification Agreement or the loan agreements referenced therein.

We acquired the Miller’s Mill property subject to a $2.5 million existing first deed of trust which was in default at the time of acquisition. As part of the transaction, the holder of the deed of trust, NJB Mining, modified the related note to allow us a sixty-day period, starting on March 15, 2011, to refinance this mortgage.

Simultaneous with these transactions, pursuant to the Exchange Agreement, Wits Basin exchanged 19,713,544 shares of our common stock it held for 10 million shares of our newly created non-voting 5% preferred stock, referred to as the “Series A Preferred Stock.” The Series A Preferred Stock has a liquidation preference of $10 million, payable only upon certain liquidity events or upon achievement of a market value of our equity equaling $200 million or more. Additional details regarding the Series A Preferred Stock can be found in our Second Amended and Restated Articles of Incorporation, which were filed with the Colorado Secretary of State on March 15, 2011, and are attached hereto as Exhibit 3.1. Wits Basin retained 1,800,000 shares of our common stock, which shares are subject to a

voting proxy, effective until March 15, 2012, held by our Chief Executive Officer, Alfred A. Rapetti. Additionally, we obtained the right to transfer our entire interest and related debt of the Bates-Hunter Mine, at any time prior to June 13, 2011, to Wits Basin in exchange for the cancellation of a promissory note issued by Hunter Bates payable in favor of Wits Basin in the approximate amount of $2.5 million. Effective as of the closing of the Shea Mining transaction, Stephen King and Donald Stoica stepped down from our Board of Directors, and Alfred A. Rapetti assumed the additional role of Chairman of the Board.

We plan to commence toll milling at the Amargosa lab and toll-milling facility late in the second quarter of 2011. Plans are to gradually increase capacity at Amargosa and seek additional small mine toll-milling sources. Amargosa has a Water Pollution Control Permit for processing of up to 18,500 tons of ore per year. We plan to initially process 50 –70 tons of ore per day; with expansion and the appropriate permits, we believe that processing capacity could be increased to 600 tons of ore per day.

INDUSTRY BACKGROUND

The exploration for and development of mineral deposits involves significant capital requirements. While the discovery of an ore body may result in substantial rewards, few properties are ultimately developed into producing mines. Some of the factors involved in determining whether a mineral exploration project will be successful include, without limitation:

|

|

·

|

competition;

|

|

|

·

|

financing costs;

|

|

|

·

|

availability of capital;

|

|

|

·

|

proximity to infrastructure;

|

|

|

·

|

the particular attributes of the deposit, such as its size and grade; and

|

8

|

|

·

|

governmental regulations, particularly regulations relating to prices, taxes, royalties, infrastructure, land use, environmental protection matters, green house gas legislation, property title, rights and options of use, and license and permitting obligations.

|

All of which leads to a speculative endeavor of very high risk. Even with the formation of new theories and new methods of analysis, unless the minerals are simply lying exposed on the surface of the ground, exploration will continue to be a “hit or miss” process.

PRODUCTS AND SERVICES

As of December 31, 2010, we only own the past producing gold mine in Colorado (Bates-Hunter Mine).

EXPLORATION AND DEVELOPMENT EXPENSES

If we acquire a project that has no revenue, exploration expenses will be charged to expense as incurred.

EMPLOYEES

As of December 31, 2010, we employed three individuals – our chief executive officer, our chief financial officer (both which were being shared by Wits Basin) and our president. Gregory Gold Producers (a wholly owned subsidiary of Hunter Bates) employs one individual as caretaker for the Bates-Hunter Mine. None of our employees are represented by a labor union and we consider our employee relations to be good.

FINANCIAL INFORMATION IN INDUSTRY SEGMENTS

During the year ended December 31, 2010, our operations included one reportable segment: that of minerals exploration and development.

AVAILABLE INFORMATION

We make available free of charge, through our Internet web site at www.standardgoldmining.com, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after we electronically file such material, or furnish it to the Securities and Exchange Commission (“SEC”). You can also request a free copy of the above filings by writing or calling us at:

Standard Gold, Inc.

Attention: Mark D. Dacko, Secretary

900 IDS Center, 80 South 8th Street

Minneapolis, Minnesota 55402-8773

(612) 349-5277

9

ITEM 1A. RISK FACTORS

RISKS RELATING TO OUR CAPITAL STOCK

INVESTORS MAY BE UNABLE TO ACCURATELY VALUE OUR COMMON STOCK.

Investors often value companies based on the stock prices and results of operations of other comparable companies. Currently, we do not believe another public gold exploration company exists that is directly comparable to our size and scale. Prospective investors, therefore, have limited historical information about the property held by us upon which to base an evaluation of our performance and prospects and an investment in our common stock. As such, investors may find it difficult to accurately value our common stock.

BECAUSE OF BECOMING PUBLIC BY MEANS OF A REVERSE ACQUISITION, WE MAY NOT BE ABLE TO ATTRACT THE ATTENTION OF MAJOR BROKERAGE FIRMS.

Additional risks may exist since we became public through a “reverse acquisition.” Security analysts of major brokerage firms may not provide coverage of the Company. No assurance can be given that brokerage firms will want to conduct any secondary offerings on behalf of the Company in the future.

WE DO NOT INTEND TO PAY DIVIDENDS FOR THE FORESEEABLE FUTURE.

We have never declared or paid any dividends on our common stock. We intend to retain all of our earnings, if any, for the foreseeable future to finance the operation and expansion of our business, and we do not anticipate paying any cash dividends in the future. Our board of directors retains the discretion to change this policy.

OUR NEWLY-ISSUED SERIES A PREFERRED STOCK HAS A SIGNIFICANT LIQUIDATION PREFERENCE.

In connection with the Shea Transaction, we converted 19,713,544 shares of our common stock held by Wits Basin into 10 million shares of our newly created Series A Preferred Stock. The Series A Preferred Stock has a liquidation preference of $10 million, payable only upon certain liquidity events or upon achievement of a market value of our equity equaling $200 million or more. Although there are requirements that must be met before the liquidation preference is payable to holders of the Series A Preferred Stock, if we are successful in the operation of our business and our market value increases, or if we consummate a change of control transaction that requires payment of the $10 million liquidation preference (plus accrued interest), there may be significantly less funds remaining after the payment of the

liquidation preference for holders of our common stock.

RISKS RELATING TO OUR FINANCIAL CONDITION

WE CURRENTLY DO NOT HAVE ENOUGH CASH TO FUND OPERATIONS, DEBT REDUCTION OR POTENTIAL ACQUISITIONS DURING 2011.

We have very limited funds, and such funds are not adequate to develop our current business plan, or even to satisfy our existing working capital requirements. As of March 17, 2011, we had only approximately $97,000 of cash and cash equivalents and with an expected cash expenditure of approximately $3,800,000 in debt that will become due during 2011 (assuming some or all of such debt is not converted into equity prior to such date) we will be required to raise additional funds to effectuate our current business plan for exploration of the Bates-Hunter Mine and to satisfy our working capital requirements. Without significant additional capital, we will be unable to fund exploration of our current property interests or acquire interests in other mineral exploration projects that may become available. We

continue to seek additional opportunities relating to our mining operations, and our ability to seek out such opportunities, perform due diligence, and, if successful, acquire such properties or opportunities requires additional capital. With respect to our proposed toll milling operations, the costs and ability to successfully operate have not been fully verified because none of our proposed tolling operations have been run recently and we may incur unexpected costs or delays in connection with starting operations. The cost of designing and building our operations and of finding new toll-milling sources can be extensive and will require us to obtain additional financing, and there is no assurance that we will have the resources necessary or the financing available to attain operations or to acquire the new toll-milling sources necessary for our long-term business. Our ultimate success will depend on our ability to raise additional capital. There is no assurance that funds

will be available from any source, or if available, that they can be obtained on terms acceptable to us.

10

We continue to seek additional opportunities relating to our mining operations, and our ability to seek out such opportunities, perform due diligence, and, if successful, acquire such properties or opportunities requires additional capital. We expect to raise such additional capital by selling shares of our capital stock or by borrowing money. Additionally, such additional capital may not be available to us at acceptable terms or at all. Further, if we increase our capitalization and sell additional shares of our capital stock, your ownership position in our Company will be subject to dilution. In the event that we are unable to obtain additional capital, we may be forced to cease our search for additional business opportunities, reduce our operating expenditures or to cease operations

altogether.

WE ARE A DEVELOPMENT- AND EXPLORATION-STAGE COMPANY WITH LITTLE HISTORY OF OPERATIONS AND WE EXPECT TO INCUR LOSSES FOR THE FORESEEABLE FUTURE.

We are a development- and exploration-stage company, and have yet to commence active operations. As of December 31, 2010, we have incurred an aggregate net loss of $10,591,071 since our incorporation. We have no prior operating history from which to evaluate our success, or our likelihood of success in operating our business, generating any revenues, or achieving profitability. These operations provide a limited basis for you to assess our ability to commercialize our product candidates and the advisability of investing in our securities. We have generated no revenue to date and there can be no assurance that our plans for exploring the Bates-Hunter Mine, and possibly producing minerals, will be successful, or that we will ever attain significant sales or profitability. Furthermore, pursuant to our transaction

with Shea Mining, we acquired a number of assets in order to enter into the business of toll milling. Toll milling is a new area of business for us, and our management team has little experience in toll milling operations. Although we intend to hire knowledgeable and experienced employees and/or consultants with significant experience in toll milling operations, there is no guarantee that this line of business will be profitable in the near future, if at all. We anticipate we will incur development- and exploration-stage losses until our exploration efforts are completed and in the development of our toll milling operations. As a development- and exploration-stage company, we are subject to unforeseen costs, expenses, problems and difficulties inherent in new business ventures.

OUR INDEPENDENT AUDITORS HAVE SUBSTANTIAL DOUBT ABOUT OUR ABILITY TO CONTINUE AS A GOING CONCERN.

The financial statements for each of these periods were prepared assuming that we would continue as a going concern. We have had net losses for each of the years ended December 31, 2010 and 2009, and we have an accumulated deficit as of December 31, 2010. In the view of our independent auditors, these conditions raise substantial doubt about our ability to continue as a going concern. Furthermore, since we do not expect to generate any significant revenues from operations for the foreseeable future, our ability to continue as a going concern depends, in large part, on our ability to raise additional capital through equity or debt financing transactions. If we are unable to raise additional capital, we may be forced to discontinue our business.

11

OUR MAJOR DEBT AGREEMENT REQUIRES PAYMENTS IN CANADIAN DOLLARS AND IS SUBJECT TO EXCHANGE RATE FLUCTUATIONS.

Currently, the Bates-Hunter Mine acquisition agreement requires payments in Canadian Dollars and it is possible that we could enter into other agreements requiring different world currency payments. Fluctuations in exchange rates between the U.S. Dollar and other currencies, could have a significant affect on the actual amount of payments and potentially may be in excess of the amounts we have budgeted for. We do not enter into hedging schemes to offset potential currency fluctuations.

RISKS RELATED TO THE COMPANY

WE HAVE VERY LIMITED ASSETS IN OPERATION.

We are an exploration stage company and only own the past producing gold project of the Bates-Hunter Mine in Colorado, which we have financed through a limited recourse promissory note (as of December 31, 2010, the outstanding principal balance is Cdn$6,500,000 or approximately $6,519,500 US). Currently, we are only performing maintenance activities at this property and we do not anticipate having any revenues from this property for the foreseeable future. Furthermore, this property may never produce any significant mineral deposits. Although we recently acquired assets pursuant to the Shea Transaction for the operation of a toll mining business, we have yet to utilize those assets and there can be no guarantee that we will be successful in utilizing these assets going forward.

WE HAVE PROVIDED GUARANTEES AND ENCUMBERED OUR ASSETS AS SECURITY FOR CERTAIN OF WITS BASIN’S OBLIGATIONS.

Prior to the completion of the Share Exchange, Hunter Bates was a direct subsidiary of Wits Basin and as such entered into guarantees for debt obligations of Wits Basin under certain of their loan agreements with third-party lenders. Hunter Bates also entered into security agreements with certain of these lenders and its assets have been pledged to secure certain of these obligations of Wits Basin. In the event Wits Basin is unable to satisfy its obligations under these third-party loan arrangements, we may be required by such third-party lenders to satisfy Wits Basin’s obligations, and such lenders may be able to foreclose on our assets. Additionally, certain of Wits Basin’s lenders hold a pledge of a significant number of Standard Gold shares held by Wits Basin, and it is possible a majority

interest of our equity could be seized by a third-party. If any of these events occur, it could be harmful to our business. See Item 13 — Certain Relationships, Related Transactions and Director Independence for more information.

OUR MANAGEMENT TEAM MAY NOT BE ABLE TO SUCCESSFULLY IMPLEMENT OUR BUSINESS STRATEGIES.

If our management team is unable to execute on our business strategies, then our development would be materially and adversely affected. In addition, we may encounter difficulties in effectively managing the budgeting, forecasting and other process control issues presented by any future growth. In acquiring the toll milling assets in the Shea Transaction, we have entered into a new line of business in which our management team has little experience. We may seek to augment or replace members of our management team or we may lose key members of our management team, and we may not be able to attract new management talent with sufficient skill and experience.

OUR SUCCESS IN THE FUTURE MAY DEPEND ON OUR ABILITY TO ESTABLISH AND MAINTAIN STRATEGIC ALLIANCES, AND ANY FAILURE ON OUR PART TO ESTABLISH AND MAINTAIN SUCH RELATIONSHIPS WOULD ADVERSELY AFFECT OUR MARKET PENETRATION AND REVENUE GROWTH.

We may be required to establish strategic relationships with third parties in the mining and toll milling industries. Our ability to establish strategic relationships will depend on a number of factors, many of which are outside our control, such as the suitability of property relative to our competitors, or the quality grade of precious minerals found in our tailings. We can provide no assurance that we will be able to establish other strategic relationships in the future.

12

In addition, any strategic alliances that we establish, will subject us to a number of risks, including risks associated with sharing proprietary information, loss of control of operations that are material to developed business and profit-sharing arrangements. Moreover, strategic alliances may be expensive to implement and subject us to the risk that the third party will not perform its obligations under the relationship, which may subject us to losses over which we have no control or expensive termination arrangements. As a result, even if our strategic alliances with third parties are successful, our business may be adversely affected by a number of factors that are outside of our control.

RISKS RELATING TO OUR BUSINESS

WE WILL REQUIRE ADDITIONAL FINANCING TO CONTINUE TO FUND OUR CURRENT EXPLORATION PROJECT AND TOLL MILLING INTERESTS OR TO ACQUIRE INTERESTS IN OTHER EXPLORATION PROJECTS.

Substantial additional financing will be needed in order to fund beyond the current maintenance programs underway or to potentially complete other acquisitions or joint ventures with other business models. Our means of acquiring investment capital is limited to private equity and debt transactions. We have no significant sources of currently available funds to engage in additional exploration and development. Without significant additional capital, we will be unable to fund exploration of our current property interests, acquire interests in other mineral exploration projects that may become available, or make our toll milling facilities operational. See “—Risks Relating to Our Financial Condition – We Currently Do Not Have Enough Cash to Fund Operations During 2011.”

OUR PERFORMANCE MAY BE SUBJECT TO FLUCTUATIONS IN MINERAL PRICES.

The profitability of our exploration project and toll milling could be significantly affected by changes in the market price of minerals. Demand for minerals can be influenced by economic conditions and attractiveness as an investment vehicle. Other factors include the level of interest rates, exchange rates and inflation. The aggregate effect of these factors is impossible to predict with accuracy.

In particular, mine production and the willingness of third parties such as central banks to sell or lease gold affects the supply of gold. Worldwide production levels also affect mineral prices. In addition, the price of gold, silver and other precious minerals have on occasion been subject to very rapid short-term changes due to speculative activities.

WE CANNOT MAKE ESTIMATES REGARDING THE RESERVES OF PRECIOUS METALS IN OUR TAILINGS OR THE ORE OF OTHERS THAT WE PROCESS, WHICH MAY NEGATIVELY AFFECT OUR FINANCIAL RESULTS.

Although we have contracts with owners of potentially valuable minerals, we cannot make any estimates regarding probable reserves in connection with any of these sources of minerals, and any estimates relating to possible reserves are subject to significant risks. We have initial indications of grade from these toll-milling sources, but have not fully investigated any of them. Therefore, no assurance can be given of the size of reserves or grades of reserves at the toll-milling sources that are planned to supply our toll milling operations. The tonnage and grade of the tailings that we propose to process have not been fully verified. We have done initial internal metallurgical testing on some of these toll-milling source materials, but have not done comprehensive metallurgical testing on any of

them. Therefore, we cannot be certain of the level of recovery of valuable metals we can attain in our toll milling operations.

13

MINERAL EXPLORATION IS EXTREMELY COMPETITIVE.

There is a limited supply of desirable mineral properties available for claim staking, lease or other acquisition in the areas where we contemplate participating in exploration activities. We compete with numerous other companies and individuals, including competitors with greater financial, technical and other resources than we possess, in the search for and the acquisition of attractive mineral properties. Our ability to acquire properties in the future will depend not only on our ability to develop our present property, but also on our ability to select and acquire suitable producing properties or prospects for future mineral exploration. We may not be able to compete successfully with our competitors in acquiring such properties or prospects.

THE NATURE OF MINERAL EXPLORATION IS INHERENTLY RISKY.

The exploration for and development of mineral deposits involves significant financial risks, which even experience and knowledge may not eliminate, regardless of the amount of careful evaluation applied to the process. Very few properties are ultimately developed into producing mines. Whether a gold mineral deposit will become commercially viable depends on a number of factors, including:

|

|

·

|

financing costs;

|

|

|

·

|

proximity to infrastructure;

|

|

|

·

|

the particular attributes of the deposit, such as its size and grade; and

|

|

|

·

|

governmental regulations, including regulations relating to prices, taxes, royalties, infrastructure and land use.

|

The outcome of any of these factors may prevent us from receiving an adequate return on invested capital.

OUR EXPLORATION AND TOLL MILLING OPERATIONS ARE SUBJECT TO ENVIRONMENTAL REGULATIONS AND PERMITTING, WHICH COULD RESULT IN THE INCURRENCE OF ADDITIONAL COSTS AND OPERATIONAL DELAYS.

All phases of our operations are subject to current environmental protection regulation. There is no assurance that future changes in environmental regulation, such as greenhouse gas emissions, carbon footprint and the like, will not adversely affect our project. We will be subject to environmental protection regulations with respect to our property in Colorado, under applicable federal and state laws and regulations. With respect to our toll milling operations, some of our proposed operations will require additional permits, which could incur additional cost and may delay startup and cash flow. In addition, each toll-milling mineral source must be fully permitted for its own operation, a process over which we have no control.

OUR TOLL MILLING OPERATIONS WILL REQUIRE US TO DEPEND ON THIRD PARTIES AND OTHER ELEMENTS BEYOND OUR CONTROL, WHICH COULD RESULT IN HARM TO OUR BUSINESS.

Our toll milling operations will rely largely on mineral material produced by others, but we have no control over their operations. Delivery of ore to our processing facilities is also subject to the risks of transportation, including trucking operations run by others, regulations and permits, fuel cost, weather, and road conditions. Toll milling requires that the mineral producer and the mineral processor agree on the grade of the incoming mineral, which can be a source of conflict between parties. Any disagreements with mineral producers, or problems with the delivery of ore, could result in additional costs, disruptions and other problems in the operation of our business.

U.S. FEDERAL LAWS

Under the U.S. Resource Conservation and Recovery Act, mining companies may incur costs for generating, transporting, treating, storing, or disposing of hazardous waste, as well as for closure and post-closure maintenance once they have completed mining activities on a property. Our mining operations may produce air emissions, including fugitive dust and other air pollutants, from stationary equipment, storage facilities, and the use of mobile sources such as trucks and heavy construction equipment which are subject to review, monitoring and/or control requirements under the Federal Clean Air Act and state air quality laws. Permitting rules may impose limitations on our production levels or create additional capital expenditures in order to comply with the rules.

14

The U.S. Comprehensive Environmental Response Compensation and Liability Act of 1980, as amended (CERCLA) imposes strict joint and several liability on parties associated with releases or threats of releases of hazardous substances. The groups who could be found liable include, among others, the current owners and operators of facilities which release hazardous substances into the environment and past owners and operators of properties who owned such properties at the time the disposal of the hazardous substances occurred. This liability could include the cost of removal or remediation of the release and damages for injury to the surrounding property. We cannot predict the potential for future CERCLA liability with respect to our property.

THE GLOBAL FINANCIAL CRISIS MAY HAVE IMPACTS ON OUR BUSINESS AND FINANCIAL CONDITION THAT WE CURRENTLY CANNOT PREDICT.

The continued credit crisis and related instability in the global financial system has had, and may continue to have, an impact on our business and our financial condition. We may face significant challenges if conditions in the financial markets do not improve. Our ability to access the capital markets may be severely restricted at a time when we would like, or need, to access such markets, which could have an impact on our flexibility to react to changing economic and business conditions. The credit crisis could have an impact on any potential lenders or on our customers, causing them to fail to meet their obligations to us.

ITEM 2. PROPERTIES

On June 12, 2008, Hunter Bates completed the acquisition of the Bates-Hunter Mine located in Central City, Colorado, which includes a water treatment plant, headframe, buildings, miscellaneous equipment and land, financed through a limited recourse promissory note in the principal amount of Cdn$6,750,000. As of December 31, 2010, we do not claim to have any mineral reserves at the Bates-Hunter Mine and further development is contingent upon available funds.

We currently share office space with Wits Basin at 900 IDS Center, 80 South 8th Street, Minneapolis, Minnesota 55402-8773.

ITEM 3. LEGAL PROCEEDINGS

None.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

None.

15

PART II

|

ITEM 5.

|

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED SHAREHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

PRICE RANGE OF COMMON STOCK

Our common stock is quoted on the OTCBB under the symbol “SDGR.” Prior to January 11, 2010, our common stock was quoted under the symbol “PRAQ.” As of March 17, 2011, the last closing sale price of our common stock as reported by OTCBB was $0.80 per share. The following table sets forth for the periods indicating the range of high and low closing sale prices of our common stock:

|

Period

|

High

|

Low

|

||||||

|

Quarter Ended March 31, 2009

|

$ | 0.10 | $ | 0.05 | ||||

|

Quarter Ended June 30, 2009

|

$ | 0.10 | $ | 0.05 | ||||

|

Quarter Ended September 30, 2009

|

$ | 0.10 | $ | 0.05 | ||||

|

Quarter Ended December 31, 2009

|

$ | 7.00 | $ | 1.50 | ||||

|

Quarter Ended March 31, 2010

|

$ | 1.65 | $ | 1.01 | ||||

|

Quarter Ended June 30, 2010

|

$ | 1.94 | $ | 0.70 | ||||

|

Quarter Ended September 30, 2010

|

$ | 1.01 | $ | 0.25 | ||||

|

Quarter Ended December 31, 2010

|

$ | 1.05 | $ | 0.35 | ||||

The quotations from the OTCBB above reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not reflect actual transactions.

RECORD HOLDERS

As of March 17, 2011, there were approximately 130 record holders of our common stock, excluding shareholders holding securities in “street name.” Based on securities position listings, we believe that there are approximately 40 beneficial holders of our common stock in “street name.”

DIVIDENDS

We have never paid cash dividends on our common stock and have no present intention of doing so in the foreseeable future. Rather, we intend to retain all future earnings to provide for the growth of our Company. Payment of cash dividends in the future, if any, will depend, among other things, upon our future earnings, requirements for capital improvements and financial condition.

RECENT SALES OF UNREGISTERED SECURITIES

In addition to the sales of unregistered securities that we reported in Quarterly Reports on Form 10-Q and Current Reports on Form 8-K during fiscal year ended 2010, we made the following sales of unregistered securities during the quarter ended December 31, 2010:

In October 2010: (i) we issued 100,000 shares of our unregistered common stock to Donald Stoica in consideration of his serving on the board of directors, and (ii) two warrant holders exercised certain warrants and received 1,476,923 shares of our common stock by surrendering 1,500,000 of their available warrants to pay for the exercise, via the cashless exercise provision.

16

In December 2010, in a private placement, we accepted subscriptions for 16,000 shares of our common stock at a price of $0.50 per share and received gross proceeds of $883 (net of offering costs totaling $7,117).

Except as noted above, sales of the securities identified above were made pursuant to privately negotiated transactions that did not involve a public offering of securities and, accordingly, we believe that these transactions were exempt from the registration requirements of the Securities Act pursuant to Section 4(2) thereof and rules promulgated thereunder. Based on representations from the above-referenced investors, we have determined that such investors were “accredited investors” (as defined by Rule 501 under the Securities Act) and were acquiring the shares for investment and not distribution, and that they could bear the risks of the investment and could hold the securities for an indefinite period of time. The investors received written disclosures that the securities had not been registered

under the Securities Act and that any resale must be made pursuant to a registration or an available exemption from such registration. All of the foregoing securities are deemed restricted securities for purposes of the Securities Act.

|

ITEM 7.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

The following discussion should be read in conjunction with the Financial Statements of the Company and notes thereto included elsewhere in this Annual Report. See “—Financial Statements.”

Readers are cautioned that the following discussion contains certain forward-looking statements and should be read in conjunction with the “Special Note Regarding Forward-Looking Statements” appearing at the beginning of this Annual Report.

Standard Gold, Inc. (formerly known as Princeton Acquisitions, Inc.) was incorporated in the State of Colorado on July 10, 1985, as a blind pool or blank check company. From the date of our incorporation until September 29, 2009, our business model was to complete a merger with, or acquisition of a private company, partnership or sole proprietorship without any particular industry or geographical location preference.

On September 11, 2009, we entered into a share exchange agreement with Hunter Bates Mining Corporation, a Minnesota corporation (“Hunter Bates”) and certain of its shareholders, in which its shareholders would exchange all of their capital securities into similar capital securities of ours. Hunter Bates was formed as a wholly owned subsidiary of Wits Basin Precious Minerals Inc. (a Minnesota corporation and public reporting company quoted on the Over-the-Counter Bulletin Board under the symbol “WITM”) (“Wits Basin”) to acquire the prior producing gold mine properties located in Central City, Colorado, known as the “Bates-Hunter Mine.” We consummated the share exchange with all of the Hunter Bates shareholders on September 29, 2009 (the “Share

Exchange”).

Accordingly, the Share Exchange represented a change in control and Hunter Bates became a wholly owned subsidiary of ours. For accounting purposes, the Share Exchange has been accounted for as a reverse acquisition with Hunter Bates as the accounting acquirer (legal acquiree) and Standard Gold as the accounting acquiree (legal acquirer). Upon effectiveness of the Share Exchange, we adopted the business model of Hunter Bates and as such have become a stand-alone minerals exploration and development company with a focus on gold projects.

Hunter Bates is an exploration and development stage Minnesota corporation formed in April 2008. It was formed as a wholly owned subsidiary of Wits Basin to acquire the Bates-Hunter Mine property pursuant to an Asset Purchase Agreement dated September 20, 2006. On June 12, 2008, Hunter Bates completed the acquisition of the Bates-Hunter Mine, which included real property, mining claims, permits and equipment. The purchase was financed through a limited recourse promissory note of Hunter Bates payable to Mr. George Otten (on behalf of all of the Sellers) in the principal amount of Cdn$6,750,000 and Wits Basin issued 3,620,000 shares of its common stock.

17

When Wits Basin acquired the rights to purchase the Bates-Hunter Mine in January 2005, it also acquired exploration rights of the Bates-Hunter Mine properties. Wits Basin utilized Gregory Gold as an oversight management company for the exploration activities conducted at the Bates-Hunter Mine since that time. On September 3, 2009, prior to the Share Exchange, Wits Basin contributed all of its equity interest in Gregory Gold to Hunter Bates, thereby making Gregory Gold a wholly owned subsidiary of Hunter Bates. Gregory Gold holds minimal assets related to operating the water treatment plant and area maintenance used in the exploration activities of the Bates-Hunter Mine.

The Bates-Hunter Mine property, which was a prior producing gold mine when operations ceased during the 1930’s, consists of land, buildings, equipment, mining claims and permits. The Bates-Hunter Mine is located about 35 miles west of Denver, Colorado and is located within the city limits of Central City.

On September 7, 2010, we entered into an option agreement with US American Exploration Inc., which specifies terms and conditions by which we may acquire an interest in the Rex Gold Mine project (“Rex”) located in La Paz County, Arizona. In order for us to acquire an irrevocable ten percent (10%) joint venture interest, we paid an initial $100,000 non-refundable fee and must provide an additional $1,900,000 for expenditures that must begin within five months and be completed within 23 months. To date, we have only provided an additional $20,000 towards exploration and are in negotiations with US American.

As of December 31, 2010, our only assets were the Bates-Hunter Mine property and minimal assets held in Gregory Gold and we do not claim to have any mineral reserves at the Bates-Hunter Mine. Furthermore, we possessed only a few pieces of equipment and employ insufficient numbers of personnel necessary to actually explore and/or mine for minerals; we therefore remain substantially dependent on third party contractors to perform such operations.

We previously hired two Canadian drilling companies who completed approximately 12,000 feet of surface drilling, which provided detailed data, which has been added to the existing 3-D map of the region. With the surface drilling program completed in August 2008, no further exploration activities will be conducted at the Bates-Hunter Mine until such time as we have sufficient funds to complete a detailed analysis of the projects potential; only property and safekeeping processes are being maintained.

On March 15, 2011, we closed the Shea Transaction whereby we acquired substantially all of the assets of Shea Mining, which assets included the assignment to us of a lease (with a right to purchase), to operate an assay lab and toll milling facility, with permits and water rights, located in Amargosa Valley, Nevada. We also acquired the rights to four toll-milling contracts for mines and mineral projects located in Nevada, California and Colorado, along with the rights to certain mine dumps in Manhattan, Nevada. In addition, we purchased from Shea Mining certain assets located in Tonopah, Nevada, consisting of land, mine tailings, and a milling facility.

RESULTS OF OPERATIONS

FOR THE YEAR ENDED DECEMBER 31, 2010 COMPARED TO THE YEAR ENDED DECEMBER 31, 2009.

Revenues

We had no revenues from operations for the years December 31, 2010 and 2009. Furthermore, we do not anticipate having any significant future revenues until an economic mineral deposit is discovered or unless we make further acquisitions or complete other mergers or joint ventures with business models that produce such results.

18

Operating Expenses

General and administrative expenses were $2,463,291 for 2010 as compared to $133,640 for 2009. The significant increase in 2010 primarily represents our engaging of consultants, wages and salaries and deferred compensation expense. The increase in expenses includes approximately $1,102,000 of deferred compensation expense, $958,000 of consultant fees and $184,000 of salary expenses. We anticipate that our operating expenses will continue to increase over current levels as we continue to build the infrastructure of the Company in order to proceed with exploration development of the Bates-Hunter project and due diligence followed by potential acquisitions of other gold projects, such as the Rex project.

Exploration expenses relate to the cash expenditures being reported on the work-in-process for the Bates-Hunter project and our due diligence of other potential projects. Exploration expenses were $356,290 for 2010 as compared to $146,428 for 2009. Part of this increase is due to the $100,000 option expense for the Rex project. Other exploration expenses relate to the cash expenditures being reported for our maintenance work at the Bates-Hunter project (the last drilling accomplished at the Bates-Hunter was in August of 2008) and for due diligence on other gold projects. In 2009, the Company was only maintaining the Bates-Hunter project, while in 2010, we continued to maintain the property and continue to investigate other possible gold projects. Depending upon our success in obtaining dedicated funds and the

timeframe for receipt of such funds, we anticipate the rate of spending for fiscal 2011 exploration expenses to be greater than 2010 expenses.

Depreciation and amortization expenses were $88,557 for 2010 as compared to $105,723 for 2009, which represents depreciation of fixed assets for the Bates-Hunter Mine itself and the equipment purchased for work that was being performed there. We anticipate that our depreciation expense will remain at or near current levels over the next fiscal year.

Other Income and Expenses

Interest Expense

Interest expense for 2010 was $652,696 compared to 2009, which was $504,067. The 2010 amount relates to the interest due on our notes payable: (i) the Cdn$6,750,000 limited recourse promissory note for the Bates-Hunter Mine, which was interest-free until January 1, 2010, and from such date accrues interest at a rate of 6% per annum, (ii) in April 2009, we entered into a 12% Convertible Debenture with Cabo Drilling (America) Inc., in the principal amount of $511,590, (iii) in August 2009, Hunter Bates issued a note payable in favor of Wits Basin (at which time held 100% of the equity interest in Hunter Bates) in the principal amount of $2,500,000 in consideration of various start-up and developments costs and expenses incurred by Wits Basin on its behalf while Hunter Bates and Gregory Gold were

consolidated, wholly owned subsidiaries of Wits Basin, and (iv) eight short-term notes payable we entered into during 2010, for an aggregate of $211,000 in funds. The 2009 amount was the amortization of imputed interest discount on the Otten Note. We anticipate that interest expense will continue at this level for 2011.

Foreign Currency

With the consummation of the Bates-Hunter Mine acquisition in June 2008, we are recording direct non-cash foreign currency exchange gains and losses due to our dealings with the limited recourse promissory note, which is payable in Canadian Dollars. We recorded a loss of $329,732 for 2010 and a loss of $916,170 for 2009 due to fluctuations in the exchange rate between the US Dollar and the Canadian Dollar. We will continue to record gains or losses related to foreign currency exchange rate fluctuations as long as the Otten Note is outstanding.

LIQUIDITY AND CAPITAL RESOURCES

Liquidity is a measure of an entity’s ability to secure enough cash to meet its contractual and operating needs as they arise. We have funded our operations and satisfied our capital requirements through private placements of our equities and advances from Wits Basin. We do not anticipate generating sufficient net positive cash flows from our operations to fund the next twelve months. We had a working capital deficit of $3,246,020 at December 31, 2010. Cash and cash equivalents were $154 at December 31, 2010, representing a decrease of $450,733 from the cash and cash equivalents of $450,887 at December 31, 2009.

19

Subsequent to December 31, 2010, we entered into the Shea Transaction. Therefore, our basic operational expenses will continue to increase during 2011. In anticipation of entering into the Shea Transaction, we raised approximately $1,000,000 pursuant to private sales of short-term convertible debt. If we are not able to raise additional working capital, whether from affiliated entities or third parties, we may have to cease operations altogether.

For the years ended December 31, 2010 and 2009, we had net cash used in operating activities of $684,935 and $260,385, respectively. During 2010, the significant increase over 2009 is due to our engagement of a number of consultants, both for marketing and for strategic planning, our due diligence on a number of other gold properties (including $100,000 spent on the Rex option) and wages and salaries. During 2009, we mainly performed maintenance activities only at the Bates-Hunter Mine site.

For the years ended December 31, 2010 and 2009, we had net cash provided by financing activities of $234,202 and $709,617, respectively. During 2010: (i) we issued 50,000 shares of our unregistered common stock through a private placement unit offering at $0.50 per unit, each unit consisting of one share of our common stock, par value $0.001 per share, and one five-year warrant to purchase a share of common stock at an exercise price of $1.00 per share, resulting in net cash proceeds of $25,000, (ii) we issued 16,000 shares of our unregistered common stock through a private placement offering at $0.50 per share, resulting in net cash proceeds of $883 (iii) we entered into eight short-term notes payable and received an aggregate of $136,000 in funds, and (iv) Wits Basin provided us operating funds of

$72,319 in 2010. During 2009: (i) immediately prior to the completion of the Share Exchange (on September 29, 2009) Hunter Bates completed a private placement offering of 1,000,000 Units, each Unit consisting of one share of Hunter Bates common stock and one warrant to purchase a share of Hunter Bates common stock at an exercise price of $1.00, at a per Unit price of $0.50 for a total value of $500,000, in which we received cash proceeds of $231,672 net of closing costs totaling $18,328 and a credited payment of $250,000 against the Wits Basin Note, (ii) Wits Basin provided us operating funds of $179,950 and (iii) we issued an aggregate 1,630,000 shares of our unregistered common stock through December 2009 in a unit private placement offering with Wits Basin at $0.50 per unit, each unit consisting of one share of our common stock, par value $0.001 per share, and one five-year warrant to purchase a share of common stock at an exercise price of $1.00 per share, resulting in net proceeds

of $815,000.

The following table summarizes our debt as of December 31, 2010:

|

Outstanding

Amount

|

Interest

Rate

|

Unamortized

Discounts

|

Accrued

Interest

|

Maturity

Date

|

Type

|

||||||||||||

| $ | 25,000 | 18 | % | $ | — | $ | 1,664 |

October 17, 2010

|

Conventional (1)

|

||||||||

| $ | 25,000 | 5 | % | $ | — | $ | 394 |

November 30, 2010

|

Conventional

|

||||||||

| $ | 50,000 | 5 | % | $ | — | $ | 788 |

November 30, 2010

|

Conventional

|

||||||||

| $ | 111,000 | (2) | 12 | % | $ | — | $ | 1,261 |

December 30, 2010

|

Conventional (1)

|

|||||||

| $ | 484,923 | 12 | % | $ | 26,667 | $ | 109,992 |

April 27, 2012

|

Convertible (3)

|

||||||||

| $ | 2,000,000 | (4) | 6 | % | $ | — | $ | 120,000 |

December 31, 2013

|

Conventional

|

|||||||

| $ | 6,519,500 | (5) | 6 | % | $ | — | $ | 380,144 |

December 31, 2015

|

Conventional

|

|||||||

|

|

(1)

|

Promissory note was issued with a warrant.

|

|

|

(2)

|

The Company received five loans during the fourth quarter of 2011 for an aggregate of $111,000 all from the same lender and all due December 30, 2010.

|

|

|

(3)

|

Cabo Debenture convertible at $0.20 per share into shares of Wits Basin common stock.

|

|

|

(4)

|

Hunter Bates issued a note payable in favor of Wits Basin, in the principal amount of $2,500,000 in consideration of various start-up and development costs and expenses incurred by Wits Basin on Hunter Bates’ behalf while it was a consolidated, wholly owned subsidiary of Wits Basin.

|

20

|

|

(5)

|

The limited recourse promissory note of Hunter Bates payable to Mr. Otten began accruing interest at a rate of 6% per annum on January 1, 2010, with quarterly interest only payments due beginning April 1, 2010.

|

Summary

Our existing sources of liquidity will not provide cash to fund operations and make the required payments on our debt service for the next twelve months. Our ability to continue as a going concern is dependent entirely on raising funds through the sale of equity or debt. If we are unable to obtain the necessary capital, we may have to cease operations.

Foreign Exchange Exposure

Since our entrance into the minerals arena, most of our dealings have been with Canadian companies and the funds have required a mixture of US Dollar and Canadian denominations. Even though currently we may not record direct losses due to our dealings with market risk, as we reach points in time requiring payment obligations, we may have direct losses of actual cash expenditures and realize the associated reduction in the productivity of our assets. We do not enter into hedging schemes to offset potential foreign currency exchange fluctuations.

Off-Balance Sheet Arrangements

During the year ended December 31, 2010, we did not engage in any off balance sheet arrangements as defined in item 303(a)(4) of the SEC’s Regulation S-K.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

The Financial Statements of the Company, the accompanying notes and the report of independent registered public accounting firm are included as part of this Annual Report on Form 10-K beginning on page F-1, which follows the signature page.

|

ITEM 9.

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

|

Effective October 15, 2009, following the date of the reverse merger transaction between Princeton Acquisitions, Inc. and Hunter Bates, the Company dismissed Cordovano and Honeck LLP as its independent registered public accounting firm. The Company's Board of Directors participated in and approved the decision to change its independent registered public accounting firm.

The report of Cordovano and Honeck on the Company's financial statements for the past fiscal year (i.e., the financial statements of Princeton Acquisitions, Inc. for the year ended June 30, 2009) did not include an adverse opinion or a disclaimer of opinion and was not qualified or modified as to uncertainty, audit scope or accounting principles, except as to Cordovano and Honeck’s independent auditor’s report dated September 10, 2009, furnished in connection with Princeton Acquisition’s annual report on Form 10-K for the period ended June 30, 2009, which contained an opinion raising substantial doubt about Princeton Acquisition’s ability to continue as a going concern.

In connection with its audit for the most recent fiscal year and through September 10, 2009, there were no disagreements with Cordovano and Honeck on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Cordovano and Honeck, would have caused it to make reference to the matter thereof in connection with its report.

21

On October 15, 2009, the Company's Board of Directors retained and appointed Moquist Thorvilson Kaufmann Kennedy & Pieper LLC (f/k/a Carver Moquist & O’Connor, LLC) (“MTK”) as our independent registered public accounting firm. MTK served as the independent registered public accounting firm for Hunter Bates prior to the Share Exchange.

During the Company’s two most recent fiscal years and any subsequent interim period prior to October 15, 2009, neither the Company nor anyone acting on its behalf consulted with MTK regarding either (a) the application of accounting principles to a specific completed or contemplated transaction, or the type of audit opinion that might be rendered on the Company’s financial statements, and neither a written report or oral advice was provided to the Company that MTK concluded was an important factor considered by the Company in reaching a decision as to the accounting, auditing or financial reporting issue; or (b) any matter that was the subject of a disagreement or event identified in response to Item 304(a)(1)(iv)or 304(a)(1)(v) of Regulation S-K and the related instructions to Item 304 of Regulation

S-K.

ITEM 9A(T). CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures

We maintain disclosure controls and procedures designed to provide reasonable assurance that information required to be disclosed in our reports filed pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”), is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms, and that such information is accumulated and communicated to our management, including our Chief Executive Officer and Chief Financial Officer as appropriate, to allow timely decisions regarding required disclosures. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance the objectives of the control system are met.

Under the supervision of, and the participation of, our management, including our Chief Executive Officer and Chief Financial Officer, we have conducted an evaluation of our disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) as of the end of the period covered by this Annual Report on Form 10-K to ensure that information required to be disclosed by us in the reports that we file or submit under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in Securities and Exchange Commission rules and forms, and is accumulated and communicated to our management as appropriate to allow timely decisions regarding required disclosure. Based on this evaluation, our

Chief Executive Officer and Chief Financial Officer concluded that the design and operation of our disclosure controls and procedures were not effective as of December 31, 2010, because of the identification of the material weaknesses in internal control over financial reporting described below. Notwithstanding the material weaknesses that existed as of December 31, 2010, our Chief Executive Officer and Chief Financial Officer have each concluded that the consolidated financial statements included in this Annual Report on Form 10-K present fairly, in all material respects, the financial position, results of operations and cash flows of the Company and its subsidiaries in conformity with accounting principles generally accepted in the United States of America (“GAAP”). We are currently taking steps to remediate such material weaknesses as described below.

Management’s Report on Internal Control over Financial Reporting