Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FIRSTFED FINANCIAL CORP | d8k.htm |

EXHIBIT 99.1

UNITED STATES DEPARTMENT OF JUSTICE

OFFICE OF THE UNITED STATES TRUSTEE

CENTRAL DISTRICT OF CALIFORNIA

| In Re: | CHAPTER 11 (BUSINESS) | |||||||

| FirstFed Financial Corp |

||||||||

| Case Number: | 2:10-bk-12927-ER | |||||||

| Operating Report Number: | 14 | |||||||

| Debtor(s). | For the Month Ending: | February 28, 2011 | ||||||

I. CASH RECEIPTS AND DISBURSEMENTS

A. (GENERAL ACCOUNT*)

| 1. |

TOTAL RECEIPTS PER ALL PRIOR GENERAL ACCOUNT REPORTS |

228,570.55 | ||||||||

| 2. |

LESS: TOTAL DISBURSEMENTS PER ALL PRIOR GENERAL ACCOUNT REPORTS | 441,998.53 | ||||||||

| 3. |

BEGINNING BALANCE: |

3,628,459.06 | ||||||||

| 4. |

RECEIPTS DURING CURRENT PERIOD: |

|||||||||

| Accounts Receivable—Post-filing |

||||||||||

| Accounts Receivable—Pre-filing |

||||||||||

| General Sales |

||||||||||

| **Other—Rent deposit refund |

0.00 | |||||||||

| TOTAL RECEIPTS THIS PERIOD: |

0.00 | |||||||||

| 5. |

BALANCE: |

3,628,459.06 | ||||||||

| 6. |

LESS: TOTAL DISBURSEMENTS DURING CURRENT PERIOD |

|||||||||

| Transfers to Other DIP Accounts (from page 2) |

0.00 | |||||||||

| Disbursements (from page 2) |

240,768.01 | |||||||||

| TOTAL DISBURSEMENTS THIS PERIOD:*** |

|

240,768.01 | ||||||||

| 7. |

ENDING BALANCE: |

3,387,691.05 | ||||||||

| 8. |

General Account Number(s): |

xxxxxxxx | ||||||||

| Union Bank | ||||||||||

| Depository Name & Location: |

445 South Figueroa | |||||||||

| Los Angeles, CA 90071 | ||||||||||

| * | All receipts must be deposited into the general account. |

| ** | Include receipts from the sale of any real or personal property out of the ordinary course of business; attach an exhibit specifying what was sold, to whom, terms, and date of Court Order or Report of Sale. |

| *** | This amount should be the same as the total from page 2. |

| Date |

Page 1 of 18 | Principal for debtor-in-possession |

TOTAL DISBURSEMENTS FROM GENERAL ACCOUNT FOR CURRENT PERIOD

| Date mm/dd/yyyy |

Check |

Payee or DIP account |

Purpose |

*Amount Transfered |

**Amount Disbursed |

Amount | ||||||||||||||

| 2/2/2011 | 1073 | VOID | — | — | ||||||||||||||||

| 2/2/2011 | 1074 | Landau, Gottfried, & Berger | Legal-Bankruptcy Counsel | 26,820.23 | 26,820.23 | |||||||||||||||

| 2/2/2011 | 1075 | Carl W McKinzie | Professional Svcs. (Feb 2011) | 16,000.00 | 16,000.00 | |||||||||||||||

| 2/3/2011 | 1076 | Chris Damore | Accounting Svcs-Jan 2011 | 850.00 | 850.00 | |||||||||||||||

| 2/3/2011 | 1077 | RR Donnelly | 8k filing | 719.00 | 719.00 | |||||||||||||||

| 2/10/2011 | 1078 | Crowe, Horwath, LLP | Accounting Fees-May 2010 | 29,098.10 | 29,098.10 | |||||||||||||||

| 2/10/2011 | 1079 | Crowe, Horwath, LLP | Accounting Fees-Jun 2010 | 17,600.95 | 17,600.95 | |||||||||||||||

| 2/10/2011 | 1080 | Crowe, Horwath, LLP | Accounting Fees-Jul 2010 | 38,036.85 | 38,036.85 | |||||||||||||||

| 2/10/2011 | 1081 | Crowe, Horwath, LLP | Accounting Fees-Aug 2010 | 58,112.40 | 58,112.40 | |||||||||||||||

| 2/10/2011 | 1082 | Crowe, Horwath, LLP | Accounting Fees-Sep 2010 | 43,287.72 | 43,287.72 | |||||||||||||||

| 2/10/2011 | 1083 | Crowe, Horwath, LLP | Accounting Fees-Oct 2010 | 8,283.60 | 8,283.60 | |||||||||||||||

| 2/11/2011 | EFT | Hartford Insurance | payroll costs, workman’s comp | 75.00 | 75.00 | |||||||||||||||

| 2/28/2011 | 1084 | Riordon, Lewis & Haden | Rent-Mar 2011 | 1,500.00 | 1,500.00 | |||||||||||||||

| 2/28/2011 | 1085 | Registrar & Transfer Co. | Transfer Agent Fees | 384.16 | 384.16 | |||||||||||||||

| TOTAL DISBURSEMENTS THIS PERIOD: | — | 240,768.01 | 240,768.01 | |||||||||||||||||

| * | Fill in amounts in this column if they are TRANSFERS to another DIP account (e.g. Payroll or Tax); the “amount” column will be filled in for you. |

| ** | Fill in amounts in this column if they are DISBURSEMENTS to outside payees; the “amount” column will be filled in for you. |

| Date |

Page 2 of 18 | Principal for debtor-in-possession |

GENERAL ACCOUNT

BANK RECONCILIATION

| Bank statement Date: |

2/28/2011 | Balance on Statement: | $ | 3,389,575.21 | ||||||||

| Plus deposits in transit (a): |

||||||||||||

| Deposit Date |

Deposit Amount | |||||||||||

| TOTAL DEPOSITS IN TRANSIT |

0.00 | |||||||||||

| Less Outstanding Checks (a): |

||||||||||||

| Check Number |

Check Date |

Check Amount |

||||||||||

| 1084 | 2/28/2011 | 1,500.00 | ||||||||||

| 1085 | 2/28/2011 | 384.16 | ||||||||||

| TOTAL OUTSTANDING CHECKS: |

1,884.16 | |||||||||||

| Bank statement Adjustments: |

||||||||||||

| Explanation of Adjustments- |

||||||||||||

| ADJUSTED BANK BALANCE: |

$ | 3,387,691.05 | ||||||||||

| * | It is acceptable to replace this form with a similar form |

| ** | Please attach a detailed explanation of any bank statement adjustment |

| Date |

Page 3 of 18 | Principal for debtor-in-possession |

I. CASH RECEIPTS AND DISBURSEMENTS

B. (PAYROLL ACCOUNT)

| 1. | TOTAL RECEIPTS PER ALL PRIOR PAYROLL ACCOUNT REPORTS |

0.00 | ||||||||

| 2. | LESS: TOTAL DISBURSEMENTS PER ALL PRIOR PAYROLL |

343,029.59 | ||||||||

| 3. | BEGINNING BALANCE: |

156,970.41 | ||||||||

| 4. | RECEIPTS DURING CURRENT PERIOD: |

|||||||||

| 5. | BALANCE: |

156,970.41 | ||||||||

| 6. | LESS: TOTAL DISBURSEMENTS DURING CURRENT PERIOD TOTAL DISBURSEMENTS THIS PERIOD:*** |

10,820.67 | ||||||||

| 7. | ENDING BALANCE: |

146,149.74 | ||||||||

| 8. | PAYROLL Account Number(s): |

|||||||||

| xxxxxxxxx | ||||||||||

| Depository Name & Location: |

Union Bank | |||||||||

| 445 South Figueroa | ||||||||||

| Los Angeles, CA 90071 | ||||||||||

| Date |

Page 4 of 18 | Principal for debtor-in-possession |

TOTAL DISBURSEMENTS FROM PAYROLL ACCOUNT FOR CURRENT PERIOD

| Date mm/dd/yyyy |

Check Number |

Payee |

Purpose |

Amount | ||||||||

| 2/28/2011 |

EFT | Brian Argrett | Mar 2011 Salary (net of payroll taxes) | 7,343.34 | ||||||||

| 2/28/2011 |

EFT | various governments | Payroll Taxes—Mar 2011 | 3,421.66 | ||||||||

| 2/28/2011 |

EFT | CBIZ | Payroll Processing Charge | 55.67 | ||||||||

| March 2011 payroll paid on 02/28/11 by payroll processor | ||||||||||||

| TOTAL DISBURSEMENTS THIS PERIOD: | 10,820.67 | |||||||||||

| Date |

Page 5 of 18 | Principal for debtor-in-possession |

PAYROLL ACCOUNT

BANK RECONCILIATION

| Bank statement Date: | 2/28/2011 | Balance on Statement: | $ | 146,149.74 | ||||||||||||

| Plus deposits in transit (a): |

||||||||||||||||

| Deposit Date |

Deposit Amount | |||||||||||||||

| TOTAL DEPOSITS IN TRANSIT |

0.00 | |||||||||||||||

| Less Outstanding Checks (a): |

||||||||||||||||

| Check Number | Check Date |

Check Amount | ||||||||||||||

| TOTAL OUTSTANDING CHECKS: |

0.00 | |||||||||||||||

| Bank statement Adjustments: |

||||||||||||||||

| Explanation of Adjustments- |

||||||||||||||||

| ADJUSTED BANK BALANCE: |

$ | 146,149.74 | ||||||||||||||

| * | It is acceptable to replace this form with a similar form |

| ** | Please attach a detailed explanation of any bank statement adjustment |

| Date |

Page 6 of 18 | Principal for debtor-in-possession |

I. CASH RECEIPTS AND DISBURSEMENTS

C. (TAX ACCOUNT)

| 1. | TOTAL RECEIPTS PER ALL PRIOR TAX ACCOUNT REPORTS |

0.00 | ||||||

| 2. | LESS: TOTAL DISBURSEMENTS PER ALL PRIOR TAX ACCOUNT REPORTS | 0.00 | ||||||

| 3. | BEGINNING BALANCE: |

10,000.00 | ||||||

| 4. | RECEIPTS DURING CURRENT PERIOD: |

|||||||

| 5. | BALANCE: |

10,000.00 | ||||||

| 6. | LESS: TOTAL DISBURSEMENTS DURING CURRENT PERIOD TOTAL DISBURSEMENTS THIS PERIOD:*** |

0.00 | ||||||

| 7. | ENDING BALANCE: |

10,000.00 | ||||||

| 8. | TAX Account Number(s): |

xxxxxxxxx | ||||||

| Union Bank | ||||||||

| Depository Name & Location: |

445 South Figueroa | |||||||

| Los Angeles, CA 90071 | ||||||||

| Date |

Page 7 of 18 | Principal for debtor-in-possession |

TOTAL DISBURSEMENTS FROM TAX ACCOUNT FOR CURRENT PERIOD

| Date mm/dd/yyyy |

Check Number |

Payee |

Purpose |

Amount | ||||||||

| NONE |

none | |||||||||||

| TOTAL DISBURSEMENTS THIS PERIOD: |

0.00 | |||||||||||

| Date |

Page 8 of 18 | Principal for debtor-in-possession |

TAX ACCOUNT

BANK RECONCILIATION

| Bank statement Date: | 2/28/2011 | Balance on Statement: | $ | 10,000.00 | ||||||

| Plus deposits in transit (a): |

||||||||||

| Deposit Date |

Deposit Amount |

|||||||||

| TOTAL DEPOSITS IN TRANSIT |

0.00 | |||||||||

| Less Outstanding Checks (a): |

||||||||||

| Check Number |

Check Date |

Check Amount |

||||||||

| TOTAL OUTSTANDING CHECKS: |

0.00 | |||||||||

| Bank statement Adjustments: |

||||||||||

| Explanation of Adjustments- |

||||||||||

| ADJUSTED BANK BALANCE: |

$ | 10,000.00 | ||||||||

| * | It is acceptable to replace this form with a similar form |

| ** | Please attach a detailed explanation of any bank statement adjustment |

| Date |

Page 9 of 18 | Principal for debtor-in-possession |

I. D SUMMARY SCHEDULE OF CASH

ENDING BALANCES FOR THE PERIOD:

(Provide a copy of monthly account statements for each of the below)

| General Account: | 3,387,691.05 | |||||||||

| Payroll Account: | 146,149.74 | |||||||||

| Tax Account: | 10,000.00 | |||||||||

| *Other Accounts: |

||||||||||

| *Other Monies: |

||||||||||

| **Petty Cash (see below): | 11.24 | |||||||||

| TOTAL CASH AVAILABLE: |

3,543,852.03 | |||||||||

| Petty Cash Transactions: |

||||||||||

| Date |

Purpose |

Amount | ||||||||

| Opening balance | 11.24 | |||||||||

| TOTAL PETTY CASH TRANSACTIONS: |

0.00 | |||||||||

| ENDING PETTY CASH |

11.24 | |||||||||

| * | Specify the Type of holding (e.g. CD, Savings Account, Investment Security), and the depository name, location & account # |

| ** | Attach Exhibit Itemizing all petty cash transactions |

| Date |

Page 10 of 18 | Principal for debtor-in-possession |

II. STATUS OF PAYMENTS TO SECURED CREDITORS, LESSORS

AND OTHER PARTIES TO EXECUTORY CONTRACTS

| Creditor, Lessor, Etc. |

Frequency of Payments (Mo/Qtr) |

Amount of Payment | Post-Petition payments not made (Number) |

Total Due | ||||||||||||

| Regus Mgt, lessor* |

monthly | $ | 0.00 | 0 | 0.00 | |||||||||||

| Premier Business Centers** |

monthly | $ | 0.00 | 0 | 0.00 | |||||||||||

| Riordon, Lewis & Haden *** |

monthly | $ | 1,500.00 | 0 | 0.00 | |||||||||||

| TOTAL DUE: | 0.00 | |||||||||||||||

| * | FirstFed Financial Corp. vacated offices managed by Regus Mgt. on 06/22/10. |

| ** | FirstFed Financial Corp vacated offices managed by Premier Business Centers prior to 09/30/10. |

| *** | FirstFed Financial Corp entered into a new lease agreement effective 10/01/10. |

| The | offices are managed by Riordan, Lewis & Haden. |

III. TAX LIABILITIES

FOR THE REPORTING PERIOD:

| Gross Sales Subject to Sales Tax: | 0.00 | |||||||||||

| Total Wages Paid: | 10,000.00 | |||||||||||

| Total Post-Petition Amounts Owing |

Amount Delinquent | Date Delinquent Amount Due |

||||||||||

| Federal Withholding* |

||||||||||||

| State Withholding* |

||||||||||||

| FICA—Employer’s Share* |

||||||||||||

| FICA—Employee’s Share* |

||||||||||||

| Federal Unemployment* |

||||||||||||

| Sales and Use |

||||||||||||

| Real Property |

||||||||||||

| Other-Delaware Franchise** |

3,125.00 | 0.00 | ||||||||||

| TOTAL: |

3,125.00 | 0.00 | ||||||||||

| * | Amounts paid through the payroll account. See “Total Disbursements from Payroll Account Current Period” |

| ** | The State of Delaware is requesting additional information from the Debtor as the Debtor changed its methodology from the authorized share method to the capital method (using gross assets). See also “Aging of Accounts Receivable” |

| Date |

Page 11 of 18 | Principal for debtor-in-possession |

IV. AGING OF ACCOUNTS PAYABLE AND RECEIVABLE

| *Accounts Payable Post-Petition |

Accounts Receivable | |||||||||||

| Pre-Petition | Post- Petition |

|||||||||||

| 30 days or less |

3,760.00 | 0.00 | 0.00 | |||||||||

| 31—60 days |

0.00 | 0.00 | 0.00 | |||||||||

| 61—90 days |

0.00 | 0.00 | 0.00 | |||||||||

| 91—120 days |

0.00 | 0.00 | 0.00 | |||||||||

| Over 120 days |

0.00 | 124,600.00 | 0.00 | |||||||||

| TOTAL: |

3,760.00 | 124,600.00 | 0.00 | |||||||||

Delaware receivable of $124,600 proposed by Debtor is still pending.

V. INSURANCE COVERAGE

| Type |

Name of Carrier |

Amount of Coverage |

Policy Expiration Date |

Premium Paid Through (Date) |

||||||||||

| General Liability |

Hartford | 1,000,000.00 | 6/11/2011 | 6/11/2011 | ||||||||||

| Worker’s Compensation |

Hartford | 1,000,000.00 | 6/11/2011 | |

Paid with Payroll |

| ||||||||

| Casualty |

None | |||||||||||||

| Vehicle |

None | |||||||||||||

The Debtor also maintains directors and officers liability coverage purchased pre-petition for the 2009/2010 coverage year and an extended reporting period for the policies covering the 2008/2009 coverage year also purchased pre-petition.

VI. UNITED STATES TRUSTEE QUARTERLY FEES

(TOTAL PAYMENTS)

| Quarterly Period Ending (Date) |

Total Disbursements |

Quarterly Fees |

Date Paid | Amount Paid |

Quarterly Fees Still Owing |

|||||||||||||||

| 31-Mar-2010 |

134,229.09 | 975.00 | 18-Apr-2010 | 975.00 | 0.00 | |||||||||||||||

| 30-Jun-2010 |

157,114.39 | 1,625.00 | 20-Jul-2010 | 1,625.00 | 0.00 | |||||||||||||||

| 30-Sep-2010 |

89,586.25 | 975.00 | 12-Oct-2010 | 975.00 | 0.00 | |||||||||||||||

| 31-Dec-2010 |

333,124.03 | 4,875.00 | 10-Jan-2011 | 4,875.00 | 0.00 | |||||||||||||||

| 0.00 | ||||||||||||||||||||

| 0.00 | ||||||||||||||||||||

| 0.00 | ||||||||||||||||||||

| 0.00 | ||||||||||||||||||||

| 0.00 | ||||||||||||||||||||

| 8,450.00 | 8,450.00 | 0.00 | ||||||||||||||||||

| * | Post-Petition Accounts Payable SHOULD NOT include professionals’ fees and expenses which have been incurred but not yet awarded by the court. Post-Petition Accounts Payable SHOULD include professionals’ fees and expenses authorized by Court Order but which remain unpaid as of the close of the period report |

| Date |

Page 12 of 18 | Principal for debtor-in-possession |

VII SCHEDULE OF COMPENSATION PAID TO INSIDERS

| Name of Insider |

Date of Order Authorizing Compensation |

*Authorized Gross Compensation |

Gross Compensation Paid During the Month*** |

|||||||

| Babette Heimbuch |

** | $ | 20,000/ month | 0.00 | ||||||

| Vikas Arora |

** | $ | 17,500/ month | 0.00 | ||||||

| Brenda Battey |

*** | $ | 20,000/month | 0.00 | ||||||

| Brian Argrett |

**** | $ | 10,000/month | 10,000.00 | ||||||

| * | Please indicate how compensation was identified in the order (e.g. $1,000/week, $2,500/month) |

| ** | Notice of Insider Compensation for Babette Heimbuch and Vikas Arora was filed and served on the UST and other necessary parties on January 7, 2010; no objections were filed. |

| *** | Ms. Heimbuch and Mr. Arora no longer work for the Debtor. Ms. Battey works periodically for the Debtor at a rate of $150.00 per hour. |

| **** | Notice of Insider Compensation for Brian Argrett was filed and served on the UST and other necessary parties on June 10, 2010; no objections were filed. Mr, Argrett was engaged by the Debtor upon the resignation of Ms. Heimbuch to provide Debtor with a second officer and to serve as its then Chief Executive Officer. Mr. Argrett currently serves as Corporate Secretary. |

VIII. SCHEDULE OF OTHER AMOUNTS PAID TO INSIDERS

| Name of Insider |

Date of Order Authorizing Compensation |

Description | Amount Paid During the Month |

|||||||||

| NONE |

||||||||||||

| Date |

Page 13 of 18 | Principal for debtor-in-possession |

IX. PROFIT AND LOSS STATEMENT

(ACCRUAL BASIS ONLY)

| Current Month | Cumulative Post-Petition | |||||||

| Sales/Revenue: |

||||||||

| Gross Sales/Revenue |

— | — | ||||||

| Less: Returns/Discounts |

— | — | ||||||

| Net Sales/Revenue |

— | — | ||||||

| Cost of Goods Sold: |

||||||||

| Beginning Inventory at cost |

||||||||

| Purchases |

||||||||

| Less: Ending Inventory at cost |

||||||||

| Cost of Goods Sold (COGS) |

— | — | ||||||

| Gross Profit |

— | — | ||||||

| Other Operating Income (Itemize) |

||||||||

| Operating Expenses: |

||||||||

| Payroll—Insiders |

10,000.00 | 316,153.85 | ||||||

| Payroll—Other Employees |

— | — | ||||||

| Payroll Taxes |

1,059.00 | 25,689.56 | ||||||

| Other Taxes (Itemize) |

— | — | ||||||

| Legal & Professional-Special Counsel * |

10,546.40 | 289,724.88 | ||||||

| Legal & Professional-Bankruptcy Counsel ** |

26,820.23 | 422,063.68 | ||||||

| Legal & Professional-Administration *** |

16,000.00 | 136,000.00 | ||||||

| Legal & Professional-Accounting & Auditing **** |

194,929.62 | 202,472.12 | ||||||

| Legal & Professional-Other ***** |

— | 50,000.00 | ||||||

| Depreciation and Amortization |

24.00 | 336.00 | ||||||

| Rent Expense—Real Property |

1,500.00 | 20,757.79 | ||||||

| Lease Expense—Personal Property |

— | — | ||||||

| Insurance |

75.00 | 2,016.00 | ||||||

| Real Property Taxes |

— | — | ||||||

| Telephone and Utilities |

— | 1,194.20 | ||||||

| IT Expenses |

— | 371.00 | ||||||

| Travel and Entertainment (Itemize) |

— | |||||||

| Parking & Mileage |

— | 1,320.75 | ||||||

| Miscellaneous Operating Expenses (Itemize) |

— | |||||||

| Stock registrar fees |

384.16 | 7,349.48 | ||||||

| Delaware & Calif filing fees & franchise tax |

— | 3,980.00 | ||||||

| Indentured Trustee Expenses |

— | 600.00 | ||||||

| SEC 8K fees |

719.00 | 12,135.00 | ||||||

| Relocation Expenses |

— | 1,605.88 | ||||||

| CSC fee for Delaware representation |

— | 356.00 | ||||||

| US Trustee fees accrued |

2,600.00 | 11,700.00 | ||||||

| Office Supplies |

— | 347.86 | ||||||

| Postage & Courier |

— | 192.04 | ||||||

| Document Management |

— | 12,869.20 | ||||||

| Payroll Processing Fees |

300.67 | 1,186.18 | ||||||

| Total Operating Expenses |

264,958.08 | 1,520,421.47 | ||||||

| Net Gain/(Loss) from Operations |

(264,958.08 | ) | (1,520,421.47 | ) | ||||

| Date |

Page 14 of 18 | Principal for debtor-in-possession |

IX. PROFIT AND LOSS STATEMENT

(ACCRUAL BASIS ONLY)

| Current Month | Cumulative Post-Petition | |||||||

| Non-Operating Income: |

||||||||

| Interest Income |

||||||||

| Net Gain on Sale of Assets (Itemize) |

||||||||

| Other (Itemize) |

||||||||

| Total Non-Operating income |

— | — | ||||||

| Non-Operating Expenses: |

||||||||

| Interest Expense |

||||||||

| Legal and Professional (Itemize) |

||||||||

| Other (Itemize) |

||||||||

| Total Non-Operating Expenses |

— | — | ||||||

| NET INCOME/(LOSS) |

(264,958.08 | ) | (1,520,421.47 | ) | ||||

(Attach exhibit listing all itemizations required above)

Footnotes:

| * | Special counsel Manatt, Phelps & Phillips, LLP were paid pre-petition an initial retainer of $300,000. No Pre-petition fees and costs credited were used against the retainer. A $300,000 adjustment to Prepaid Legal Expense was made through Owners’ Equity. Costs and expenses incurred between the filing date and February-2011 were $289,724.88. |

| ** | Bankruptcy counsel Landau, Gottfried & Berger, LLP were paid pre-petition an initial retainer of $250,000. Pre-petition fees and costs credited against the retainer were $50,810.31 leaving a remaining retainer of $199,189.69 as of the filing date. A $199,189.69 adjustment to Prepaid Legal Expense was made through Owners’ Equity. Costs and fees from the filing date until August 2010 were $210,461.44 exhausting the remaining retainer. Pending court approval, $66,151.30 in fees for January and February 2011 have been incurred but not accrued. Additionally, $53,177.77 in unpaid fees for August through December 2010 representing the 20% withheld amount per the Knudsen Order remain unpaid. See footnote ** on Schedule X—Balance Sheet. |

| *** | June and July Professional fees totaling $40,000 for Delta Corps, Inc., hiring Donald Pelgrim as Chief Administrative Officer, were paid after approval for payment by the Bankruptcy court. September 2010 through February 2011 professional fees of $120,000 for Carl McKinzie as Chief Executive Officer were incurred. $96,000 was paid after approval for payment by the Bankruptcy Court. |

| **** | Accounting & Auditing Professional fees in the amount of $13,356 for Hutchinson & Bloodgood, LLP were incurred and unpaid pending approval of the fee statement from Bankruptcy court. Hutchinson & Bloodgood is no longer providing services to the Debtor. |

| **** | The Debtor engaged Crowe Horwath, LLP for assistance with various tax matters including a 2008 federal tax audit and the filing of the 2009 tax returns. May through October 2010 costs and professional fees of $194,416.62 for Crowe Horwath’s engagement were paid after court approval, Pending court approval $134,175.07 in costs and fees for November 2010 through February 2011 have been incurred but not accrued. Additionally, $48,450.90 in unpaid fees for May through October 2010 representing the 20% withheld amount over the Knudsen Order remain unpaid. See footnote ** on Schedule X -Balance Sheet. |

| ***** | In June, the Debtor engaged the firm of Rus Miliband & Smith, LLP in investigate potential claims which may be brought by the Debtor. The initial engagement is on an hourly basis with a $50,000 cap. An application for employment has been submitted and approved by the bankruptcy court. This amount has been fully utilized and additional fees & expenses have been incurred. |

| Date |

Page 15 of 18 | Principal for debtor-in-possession |

X. BALANCE SHEET

(ACCRUAL BASIS ONLY)

| Current Month End | ||||||||

| ASSETS |

||||||||

| Current Assets: |

||||||||

| Unrestricted Cash |

3,543,852.03 | |||||||

| Restricted Cash |

||||||||

| Accounts Receivable (Itemized, see below)* |

124,600.00 | |||||||

| Inventory |

||||||||

| Notes Receivable |

||||||||

| Prepaid Expenses (Rent) |

1,500.00 | |||||||

| Prepaid Expense-Legal Special Counsel |

10,275.12 | |||||||

| Prepaid Expense-Legal Bankruptcy Counsel |

— | |||||||

| Prepaid Expense-Other Legal Counsel |

— | |||||||

| Other (Prepaid Payroll) |

10,820.67 | |||||||

| Total Current Assets |

3,691,047.82 | |||||||

| Property, Plant, and Equipment |

875.00 | |||||||

| Accumulated Depreciation/Depletion |

336.00 | |||||||

| Net Property, Plant, and Equipment |

539.00 | |||||||

| Other Assets (Net of Amortization): |

||||||||

| Due from Insiders |

||||||||

| Other (Rent Deposits) |

2,912.00 | |||||||

| Total Other Assets |

2,912.00 | |||||||

| TOTAL ASSETS |

3,694,498.82 | |||||||

| LIABILITIES |

||||||||

| Post-petition Liabilities: |

||||||||

| Accounts Payable (Itemized, see below)** |

4,479.00 | |||||||

| Taxes Payable—Delaware Franchise Tax 2010 |

3,125.00 | |||||||

| Notes Payable |

||||||||

| Professional fees |

||||||||

| Secured Debt |

||||||||

| Other (Itemize) |

||||||||

| Total Post-petition Liabilities |

7,604.00 | |||||||

| Pre-petition Liabilities: |

||||||||

| Secured Liabilities |

||||||||

| Priority Liabilities |

||||||||

| Unsecured Liabilities*** |

159,617,187.50 | |||||||

| Other (Itemized, see below)**** |

1,521.21 | |||||||

| Total Pre-petition Liabilities |

159,618,708.71 | |||||||

| TOTAL LIABILITIES |

159,626,312.71 | |||||||

| EQUITY: |

||||||||

| 1 Pre-petition Owners’ Equity (original amount) |

(155,177,680.00 | ) | ||||||

| 2 Direct Charges to Equity (Itemized, see below)***** |

766,287.58 | |||||||

| 3 Post-petition Profit/(Loss) |

(1,520,421.47 | ) | ||||||

| TOTAL EQUITY |

(155,931,813.89 | ) | ||||||

| TOTAL LIABILITIES & EQUITY |

3,694,498.82 | |||||||

| Date |

Page 16 of 18 | Principal for debtor-in-possession |

| * Itemization of Accounts Receivable: |

||||||||

| Delaware Franchise Tax Refund Due (prior years) |

124,600.00 | |||||||

| Total |

124,600.00 | |||||||

| ** Itemization of Post-Petition Liabilities: |

||||||||

| RR Donnelley (8-K filing services) |

719.00 | |||||||

| Christopher Damore (Accounting Svcs-MOR Prep) |

510.00 | |||||||

| U.S. Quarterly Trustee Fees |

3,250.00 | |||||||

| subtotal |

4,479.00 | |||||||

| ** Not included in the above table are the following incured and unpaid amount that are pending Bankruptcy Court approval: | ||||||||

| Carl McKinzie (Chief Executive Officer) |

24,000.00 | |||||||

| Hutchinson & Bloodgood, LLP (accounting & auditing) |

13,356.00 | |||||||

| Crowe Horwath, LLP (accounting & audit) |

182,625.97 | |||||||

| Landau, Gottfried, & Berger, LLP |

119,329.07 | |||||||

| subtotal |

339,311.04 | |||||||

| *** Itemization of Pre-Petition Unsecured Liabilities |

||||||||

| Senior Debt Due 2015 |

53,429,687.56 | |||||||

| Senior Debt Due 2016 |

53,244,791.61 | |||||||

| Senior Debt Due 2017 |

52,942,708.33 | |||||||

| Total |

159,617,187.50 | |||||||

| **** Itemization of Pre-Petition Other Liabilities |

||||||||

| Nixon Peabody |

318.74 | |||||||

| Registrar & Transfer |

983.52 | |||||||

| DF King & Co |

218.95 | |||||||

| Total |

1,521.21 | |||||||

| ***** Itemization of Direct Charges to Equity |

||||||||

| Reduction in Delaware tax |

157,600.00 | |||||||

| Refund from Auditors |

110,883.44 | |||||||

| Legal Retainer—Manatt, Phelps & Phillips, LLP |

300,000.00 | |||||||

| Legal Retainer—Landau, Gottfried & Berger , LLP |

199,189.69 | |||||||

| Change in SEC Refund |

135.53 | |||||||

| Bills received and accrued after BK filing (see above) |

(1,521.21 | ) | ||||||

| Change in Opening Cash Balance |

0.04 | |||||||

| Change in New Oak receivable |

0.09 | |||||||

| Total |

766,287.58 | |||||||

The prepaid retainer of $250,000 for Bankruptcy Counsel-Landau, Gottfried & Berger was adjusted downward $50,810.31 as the activity occurred pre-petition. As of the petition date, the prepaid legal retainer for Bankruptcy Counsel was $199,189.69.

| Date |

Page 17 of 18 | Principal for debtor-in-possession |

XI. QUESTIONNAIRE

| No | Yes | |||||||||

| 1. | Has the debtor-in-possession made any payments on its pre-petition unsecured debt, except as have been authorized by the court? If “Yes”, explain below: | x | ||||||||

| No | Yes | |||||||||

| 2. | Has the debtor-in-possession during this reporting period provided compensation or remuneration to any officers, directors, principals, or other insiders without appropriate authorization? If “Yes”, explain below: | x | ||||||||

| 3. | State what progress was made during the reporting period toward filing a plan of reorganization: | |||||||||

| The Debtor has negotiated the terms of a liquidating chapter 11 plan with its principal creditor, Wilmington Trust Company as Trustee for the bulk of its debt. That plan was filed with the Court on October 1, 2010. On November 12, 2010, the Debtor filed its disclosure statement and a motion seeking an order of the Court approving the same and setting plan solicitation and confirmation procedures. | ||||||||||

| 4. | Describe potential future developments which may have a significant impact on the case: | |||||||||

| There is a potential refund of over $90 million relating to loss carrybacks from earlier tax years. The FDIC, in its capacity as Receiver for the Debtor’s bank subsidiary, has submitted a proof of claim which, among other things, claims that the FDIC is entitled to some or all of any such tax refund and may have other super priority claims. If the FDIC’s claim is successful, it will reduce or potentially eliminate any assets available for distribution to general unsecured creditors. The Debtor reserves its rights with respect to any such claims by the FDIC. | ||||||||||

| Debtor continues to investigate potential claims against third parties to determine potential for recovery. No Committee of Unsecured Creditors has been appointed in the case. However, the Debtor continues to work and communicate cooperatively with Wilmington Trust, its principal unsecured creditor, concerning all aspects of the case. | ||||||||||

| 5. | Attach copies of all Orders granting relief from the automatic stay that were entered duing the reporting period. | |||||||||

| See Exhibit 1 | ||||||||||

| No | Yes | |||||||||

| 6. | Did you receive any exempt income this month, which is not set forth in the operating report? If “Yes”, please set forth the amounts and sources of the income below. | x | ||||||||

|

|

||||||||||

| I, Carl W. McKinzie, Chief Executive Officer,

declare under penalty of perjury that I have fully read and understood the foregoing debtor-in-possession operating report and that the information contained herein is true and complete to the best of my knowledge. |

||||||||||||

| /s/ Carl W. McKinzie |

Dated: 03/15/2011 | |||

| Carl W. McKinzie | ||||

| Chief Executive Officer |

| Date |

Page 18 of 18 | Principal for debtor-in-possession |

Exhibit 1

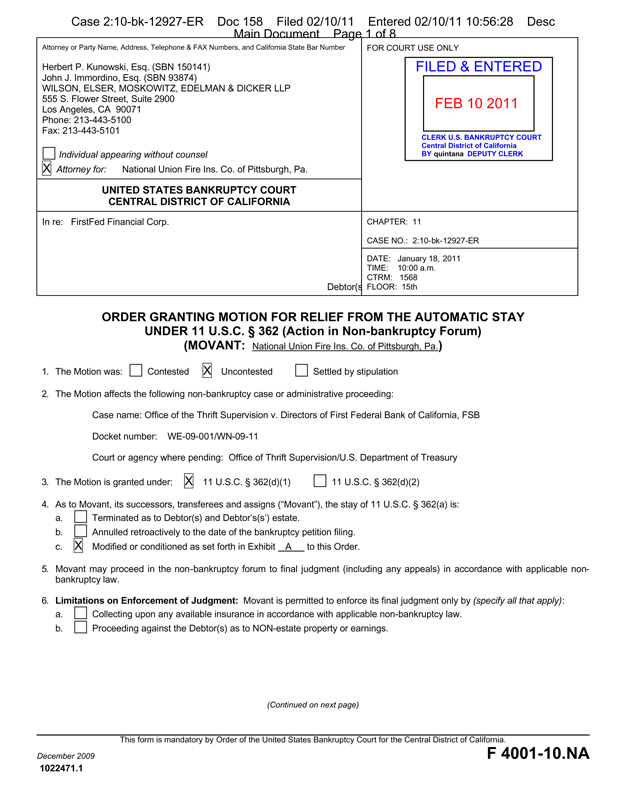

Case 2:10-bk-12927-ER Doc 158 Filed 02/10/11 Entered 02/10/11 10:56:28 Desc Main Document Page 1 of 8

Attorney or Party Name, Address, Telephone & FAX Numbers, and California State Bar Number FOR COURT USE ONLY

Herbert P. Kunowski, Esq. (SBN 150141) FILED & ENTERED

John J. Immordino, Esq. (SBN 93874)

WILSON, ELSER, MOSKOWITZ, EDELMAN & DICKER LLP

555 S. Flower Street, Suite 2900 FEB 10 2011

Los Angeles, CA 90071

Phone: 213-443-5100

Fax: 213-443-5101

CLERK U.S. BANKRUPTCY COURT

Central District of California

Individual appearing without counsel BY quintana DEPUTY CLERK

Attorney for: National Union Fire Ins. Co. of Pittsburgh, Pa.

UNITED STATES BANKRUPTCY COURT

CENTRAL DISTRICT OF CALIFORNIA

In re: FirstFed Financial Corp. CHAPTER: 11

CASE NO.: 2:10-bk-12927-ER

DATE: January 18, 2011

TIME: 10:00 a.m.

CTRM: 1568

Debtor(s). FLOOR: 15th

ORDER GRANTING MOTION FOR RELIEF FROM THE AUTOMATIC STAY UNDER 11 U.S.C. § 362 (Action in Non-bankruptcy Forum)

(MOVANT: National Union Fire Ins. Co. of Pittsburgh, Pa.)

1. The Motion was: Contested Uncontested Settled by stipulation

2. The Motion affects the following non-bankruptcy case or administrative proceeding:

Case name: Office of the Thrift Supervision v. Directors of First Federal Bank of California, FSB

Docket number: WE-09-001/WN-09-11

Court or agency where pending: Office of Thrift Supervision/U.S. Department of Treasury

3. The Motion is granted under: 11 U.S.C. § 362(d)(1) 11 U.S.C. § 362(d)(2)

4. As to Movant, its successors, transferees and assigns (“Movant”), the stay of 11 U.S.C. § 362(a) is:

a. Terminated as to Debtor(s) and Debtor’s(s’) estate.

b. Annulled retroactively to the date of the bankruptcy petition filing.

c. Modified or conditioned as set forth in Exhibit A to this Order.

5. Movant may proceed in the non-bankruptcy forum to final judgment (including any appeals) in accordance with applicable non-

bankruptcy law.

6. Limitations on Enforcement of Judgment: Movant is permitted to enforce its final judgment only by (specify all that apply):

a. Collecting upon any available insurance in accordance with applicable non-bankruptcy law.

b. Proceeding against the Debtor(s) as to NON-estate property or earnings.

(Continued on next page)

This form is mandatory by Order of the United States Bankruptcy Court for the Central District of California.

December 2009 F 4001-10.NA 1022471.1

Case 2:10-bk-12927-ER Doc 158 Filed 02/10/11 Entered 02/10/11 10:56:28 Desc Main Document Page 2 of 8

F 4001-10.NA

Order on Motion for Relief from Stay (Non-bankruptcy Action) - Page 2 of 7

In re (SHORT TITLE) CHAPTER: 11

FirstFed Financial Corp.,

Debtor(s). CASE NO.: 2:10-bk-12927-ER

7. This Court further orders as follows:

a. This Order shall be binding and effective despite any conversion of this bankruptcy case to a case under any other chapter of Title 11 of the United States Code.

b. The 14-day stay provided by Bankruptcy Rule 4001(a)(3) is waived.

c. The provisions set forth in the Extraordinary Relief Attachment shall also apply (attach Optional Form F 4001-1O.ER).

d. See attached continuation page for additional provisions.

###

DATED: February 10, 2011

Ernest Robles

United States Bankruptcy Judge

This form is mandatory by Order of the United States Bankruptcy Court for the Central District of California.

December 2009 F 4001-10.NA 1022471.1

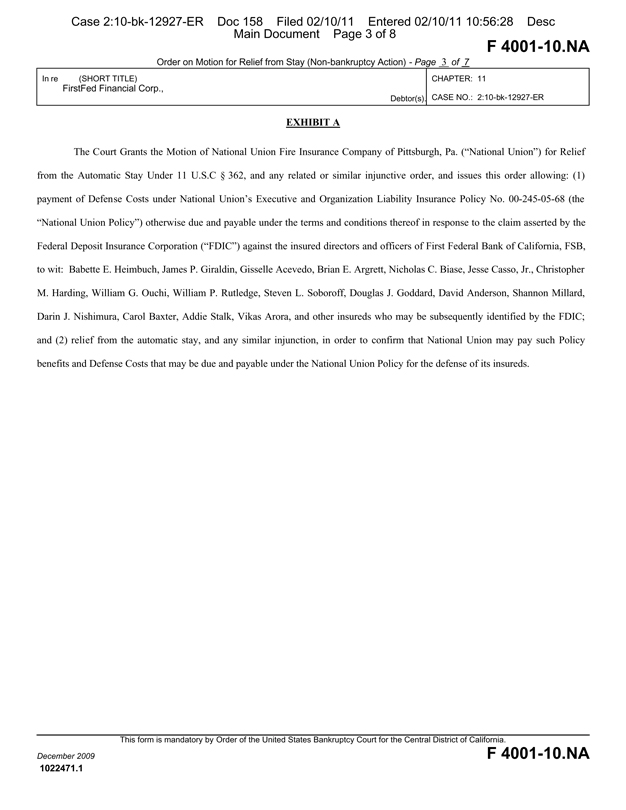

Case 2:10-bk-12927-ER Doc 158 Filed 02/10/11 Entered 02/10/11 10:56:28 Desc Main Document Page 3 of 8

F 4001-10.NA

Order on Motion for Relief from Stay (Non-bankruptcy Action) - Page 3 of 7

In re (SHORT TITLE) CHAPTER: 11

FirstFed Financial Corp.,

Debtor(s). CASE NO.: 2:10-bk-12927-ER

EXHIBIT A

The Court Grants the Motion of National Union Fire Insurance Company of Pittsburgh, Pa. (“National Union”) for Relief from the Automatic Stay Under 11 U.S.C § 362, and any related or similar injunctive order, and issues this order allowing: (1) payment of Defense Costs under National Union’s Executive and Organization Liability Insurance Policy No. 00-245-05-68 (the “National Union Policy”) otherwise due and payable under the terms and conditions thereof in response to the claim asserted by the Federal Deposit Insurance Corporation (“FDIC”) against the insured directors and officers of First Federal Bank of California, FSB, to wit: Babette E. Heimbuch, James P. Giraldin, Gisselle Acevedo, Brian E. Argrett, Nicholas C. Biase, Jesse Casso, Jr., Christopher M. Harding, William G. Ouchi, William P. Rutledge, Steven L. Soboroff, Douglas J. Goddard, David Anderson, Shannon Millard, Darin J. Nishimura, Carol Baxter, Addie Stalk, Vikas Arora, and other insureds who may be subsequently identified by the FDIC; and (2) relief from the automatic stay, and any similar injunction, in order to confirm that National Union may pay such Policy benefits and Defense Costs that may be due and payable under the National Union Policy for the defense of its insureds.

This form is mandatory by Order of the United States Bankruptcy Court for the Central District of California.

December 2009 F 4001-10.NA 1022471.1

Case 2:10-bk-12927-ER Doc 158 Filed 02/10/11 Entered 02/10/11 10:56:28 Desc Main Document Page 4 of 8

F 4001-10.NA

Order on Motion for Relief from Stay (Non-bankruptcy Action) - Page 4 of 7

In re (SHORT TITLE) CHAPTER: 11

FirstFed Financial Corp.,

Debtor(s). CASE NO.: 2:10-bk-12927-ER

NOTE TO USERS OF THIS FORM:

1) Attach this form to the last page of a proposed Order or Judgment. Do not file as a separate document.

2) The title of the judgment or order and all service information must be filled in by the party lodging the order.

3) Category I. below: The United States trustee and case trustee (if any) will always be in this category.

4) Category II. below: List ONLY addresses for debtor (and attorney), movant (or attorney) and person/entity (or attorney) who filed an opposition to the requested relief. DO NOT list an address if person/entity is listed in category I.

NOTICE OF ENTERED ORDER AND SERVICE LIST

Notice is given by the court that a judgment or order entitled (specify) ORDER GRANTING MOTION FOR RELIEF FROM THE

AUTOMATIC STAY UNDER 11 U.S.C. SECTION 362

was entered on the date indicated as “Entered” on the first page of this judgment or order and will be served in the manner indicated below:

I. SERVED BY THE COURT VIA NOTICE OF ELECTRONIC FILING (“NEF”) ¥ Pursuant to controlling General Order(s) and Local Bankruptcy Rule(s), the foregoing document was served on the following person(s) by the court via NEF and hyperlink to the judgment or order. As of , the following person(s) are currently on the Electronic Mail Notice List for this bankruptcy case or adversary proceeding to receive NEF transmission at the email address(es) indicated below.

Louis J. Cisz lcisz@nixonpeabody.com

Jon L. Dalberg jdalberg@lgbfirm.com, nceresto@lgbfirm.com

Ivan L. Kallick Ikallick@manatt.com, ihernandez@manatt.com

Service information continued on attached page

II. SERVED BY THE COURT VIA U.S. MAIL: A copy of this notice and a true copy of this judgment or order was sent by

United States Mail, first class, postage prepaid, to the following person(s) and/or entity(ies) at the address(es) indicated

below:

Herbert P. Kunowski

FirstFed Financial Corp.

555 S. Flower Street, Suite 2900

10900 Wilshire Blvd., Suite 850

Los Angeles, CA 90071

Los Angeles, CA 90024

Service information continued on attached page

III. TO BE SERVED BY THE LODGING PARTY: Within 72 hours after receipt of a copy of this judgment or order which bears an “Entered” stamp, the party lodging the judgment or order will serve a complete copy bearing an “Entered stamp by U.S. Mail, overnight mail, facsimile transmission or email and file a proof of service of the entered order on the following person(s) and/or entity(ies) at the address(es), facsimile transmission number(s), and/or email address(es) indicated below:

Service information continued on attached page

This form is mandatory by Order of the United States Bankruptcy Court for the Central District of California.

December 2009 F 4001-10.NA

1022471.1

Case 2:10-bk-12927-ER Doc 158 Filed 02/10/11 Entered 02/10/11 10:56:28 Desc Main Document Page 5 of 8

F 4001-10.NA

Order on Motion for Relief from Stay (Non-bankruptcy Action) - Page 5 of 7

In re (SHORT TITLE) CHAPTER: 11

FirstFed Financial Corp.,

Debtor(s). CASE NO.: 2:10-bk-12927-ER

SERVICE LIST CONTINUED FIRSTFED FINANCIAL CORP

CASE NO. 2:10-bk-12927-ER

PART I. SERVED BY THE COURT VIA NOTICE OF ELECTRONIC FLING (“NEF”)

Rodger M. Landau rlandau@lgbfirm.com, kmoss@lgbfirm.com

Ian Landsberg ilandsberg@landsberg-law.com bgomelsky@landsberg-law.com rbenitez@landsberg-law.com

Joel S. Miliband jmiliband@rusmiliband.com

John W. Kim jkim@nossaman.com

United States Trustee (LA) ustpregion16.la.ecf@usdoj.gov

This form is mandatory by Order of the United States Bankruptcy Court for the Central District of California.

December 2009 F 4001-10.NA

1022471.1

Case 2:10-bk-12927-ER Doc 158 Filed 02/10/11 Entered 02/10/11 10:56:28 Desc Main Document Page 6 of 8

F 4001-10.NA

Order on Motion for Relief from Stay (Non-bankruptcy Action) - Page 6 of 7

In re (SHORT TITLE) CHAPTER: 11

FirstFed Financial Corp.,

Debtor(s). CASE NO.: 2:10-bk-12927-ER

SERVICE LIST CONTINUED FIRSTFED FINANCIAL CORP

CASE NO. 2:10-bk-12927-ER

PART III. TO BE SERVED BY THE LODGING PARTY

U.S. Trustee

Office of the United States Trustee

ATTN: Gary Baddin/Susa Trevino/Dare Law 725 S. Figueroa Street, Suite 2600 Los Angeles, CA 90017

Debtor

FirstFed Financial Corp.

10900 Wilshire Blvd., Suite 850 Los Angeles, CA 90024

Counsel for Debtor

Jon L.R. Dalberg, Esq.

LANDAU GOTTFRIED & BERGER LLP 1801 Century Park East, Suite 1460 Los Angeles, CA 90067

Special Counsel for Debtor

Ellen R. Marshall, Esq.

MANAT, PHELPS & PHILLIPS LLP 695 Town Center Drive, 14th Floor Costa Mesa, CA 92626

Special Litigation Counsel for Debtor

Ronald Rus, Esq.

RUS, MILIBAND & SMITH, APC 2211 Michelson Drive, 7th Floor Irvine, CA 92612

Debtor’s Post-Petition Accountants

Howard B. Grobstein, CPA CROWE HORWATH LLP 15233 Ventura Blvd., 9th Floor Sherman Oaks, CA 91403

This form is mandatory by Order of the United States Bankruptcy Court for the Central District of California.

December 2009 F 4001-10.NA

1022471.1

Case 2:10-bk-12927-ER Doc 158 Filed 02/10/11 Entered 02/10/11 10:56:28 Desc Main Document Page 7 of 8

F 4001-10.NA

Order on Motion for Relief from Stay (Non-bankruptcy Action) - Page 7 of 7

In re (SHORT TITLE) CHAPTER: 11

FirstFed Financial Corp.,

Debtor(s). CASE NO.: 2:10-bk-12927-ER

Debtor’s Post-Petition Special Accountants

Mica Miyamoto, CPA

HUTCHINSON & BLOODGOOD LLP 101 North Brand Blvd., Suite 1600 Glendale, CA 91203

Counsel for FDIC as Receiver of First Federal Bank of California, FSB

John W. Kim, Esq. NOSSAMAN LLP

445 South Figueroa Street, 31st Floor Los Angeles, CA 90071

Counsel for Wilmington Trust Company as Indenture Trustee

Louis J. Cisz, III, Esq. NIXON PEABODY LLP

One Embarcadero Center, 18th Floor San Francisco, CA 94111

Creditors with 20 Largest Claims

Delaware Division of Corporations ATTN: Mazie Kramer 401 Federal Street, Suite 4 Dover, DE 19901

FBR Capital Markets

1001 Nineteenth Street North Arlington, VA 22209

First Federal Bank of California, FSB 12555 West Jefferson Blvd.

Los Angeles, CA 90066

Grant Thornton LLP

1000 Wilshire Blvd., Suite 300 Los Angeles, CA 90017

Grazia M. Galuppo 27145 Manor Circle Santa Clarita, CA 91354

Hexagon Securities LLC

555 Madison Avenue, 25th Floor New York, NY 10022

This form is mandatory by Order of the United States Bankruptcy Court for the Central District of California.

December 2009 F 4001-10.NA

1022471.1

Case 2:10-bk-12927-ER Doc 158 Filed 02/10/11 Entered 02/10/11 10:56:28 Desc Main Document Page 8 of 8

F 4001-10.NA

Order on Motion for Relief from Stay (Non-bankruptcy Action) - Page 8 of 7

In re (SHORT TITLE) CHAPTER: 11

FirstFed Financial Corp.,

Debtor(s). CASE NO.: 2:10-bk-12927-ER

HQ Global Workplaces

6320 Canoga Avenue, Suite 1500 Woodland Hills, CA 91367

Manatt Phelps & Phillips LLP 695 Town Center Drive, 14th Floor Costa Mesa, CA 92626

Manatt Phelps & Phillips LLP ATTN: Ivan L. Kallick, Esq. 11355 West Olympic Blvd. Los Angeles, CA 90064

Morrison & Foerster LLP

555 West Fifth Street, Suite 3500 Los Angeles, CA 90013

Nixon Peabody LLP

ATTN: Catherine Ng, Esq./Frank Hamblett, Esq. 100 Summer Street Boston, Massachusetts 02110

Registrar and Transfer Company ATTN: Dan Flynn

10 Commerce Drive Cranford, NJ 07016

R R Donnelley 333 South Grand Ave Los Angeles, CA 90071

Securities and Exchange Commission ATTN: S. Lavigna, Esq.

5670 Wilshire Boulevard, 11th Floor Los Angeles, CA 90036

Wilmington Trust Company ATTN: Patrick Healy Rodney Square North 1100 North Market Street Wilmington, DE 19890

This form is mandatory by Order of the United States Bankruptcy Court for the Central District of California.

December 2009 F 4001-10.NA

1022471.1