Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For fiscal year ended December 31, 2010

Commission File Number: 001-33123

SOLTA MEDICAL, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 68-0373593 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

25881 Industrial Boulevard,

Hayward, California 94545

(510) 782-2286

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common Stock, $0.001 par value per share | The NASDAQ Stock Market, Inc. |

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period than the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act (check one):

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company x

Indicate by check mark whether registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the registrant’s common stock, held by non-affiliates of the registrant as of June 30, 2010 (which is the last business day of registrant’s most recently completed second fiscal quarter) based upon the closing price of such stock on the NASDAQ Global Market on that date, was approximately $69.7 million. For purposes of this disclosure, shares of common stock held by entities and individuals who own 5% or more of the outstanding common stock and shares of common stock held by each officer and director have been excluded in that such persons may be deemed to be “affiliates” as that term is defined under the Rules and Regulations of the Securities Exchange Act of 1934. This determination of affiliate status is not necessarily conclusive.

The number of shares of Registrant’s common stock issued and outstanding as of February 28, 2011 was 60,139,364.

DOCUMENTS INCORPORATED BY REFERENCE

Part III incorporates by reference certain information from the registrant’s definitive proxy statement for the 2010 Annual Meeting of Stockholders.

Table of Contents

ANNUAL REPORT ON FORM 10-K

INDEX

| Page | ||||||

| PART I | ||||||

| ITEM 1. | 1 | |||||

| ITEM 1A. | 28 | |||||

| ITEM 1B. | 45 | |||||

| ITEM 2. | 45 | |||||

| ITEM 3. | 45 | |||||

| ITEM 4. | 46 | |||||

| PART II | ||||||

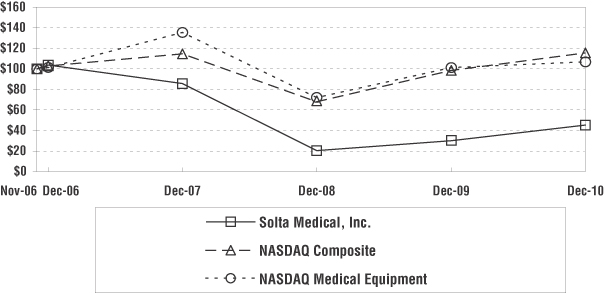

| ITEM 5. | Market for Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities | 47 | ||||

| ITEM 6. | 49 | |||||

| ITEM 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 51 | ||||

| ITEM 7A. | 68 | |||||

| ITEM 8. | 69 | |||||

| ITEM 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 109 | ||||

| ITEM 9A. | 109 | |||||

| ITEM 9B. | 110 | |||||

| PART III | ||||||

| ITEM 10. | Directors, Executive Officers of the Registrant and Corporate Governance |

111 | ||||

| ITEM 11. | 111 | |||||

| ITEM 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 111 | ||||

| ITEM 13. | Certain Relationships and Related Transactions, and Director Independence |

111 | ||||

| ITEM 14. | 111 | |||||

| PART IV | ||||||

| ITEM 15. | 112 | |||||

i

Table of Contents

| Item 1. | Business |

Overview

We design, develop, manufacture and market professional and consumer energy-based medical device systems for aesthetic applications. Our professional systems are marketed under the brand names Fraxel®, Thermage® and Isolaz® and are FDA-cleared for dermatological procedures in the following applications:

| • | Skin Tightening. The Thermage NXT™ and CPT™ systems offer non-invasive treatment options for skin tightening and contouring, body shaping, and improvement in the appearance of cellulite. |

| • | Skin Rejuvenation. The Fraxel re:fine, Fraxel re:store, and Fraxel re:store Dual systems offer treatments for skin conditions such as fine lines and pigmentation. In addition, the Fraxel re:store system offers treatments for acne and surgical scars, deeper lines and wrinkles, and actinic keratoses. |

| • | Skin Resurfacing. The Fraxel re:pair system is for dermatological procedures requiring ablation, coagulation and resurfacing of soft tissue as well as for rhytides, pigmentation and vascular dyschromia. |

| • | Acne. Isolaz is the only technology that combines vacuum with broadband light indicated for the treatment of inflammatory acne, comedonal acne, and mild to moderate inflammatory acne. |

Each of our professional systems consists of one or more handpieces, a console that incorporates a graphical user interface, an energy source and electronics, and a disposable treatment tip. We market our systems and treatment tips in the United States to physician practices primarily through a direct sales force and internationally in over 100 countries through both a network of distributors and direct sales force. Our customers consist primarily of dermatologists and plastic surgeons and our expanded customer base includes other specialties such as general and family practitioners, gynecologists, ophthalmologists and others. As of December 31, 2010, we had a global installed base of over 7,000 systems.

In addition to our professional systems, we have also recently begun to manufacture and market a consumer energy-based system under the brand name CLARO™. The CLARO™ personal care acne treatment system an intense pulse light (“IPL”) acne treatment system that has FDA over-the-counter clearance for the treatment of mild-to-moderate inflammatory acne. It is a device that uses a combination of both heat and light to clear acne in 24-to-48 hours. Distribution of the CLARO is through prestige retail and associated retailer’s web sites and our own web site and is currently only available in the United States.

1

Table of Contents

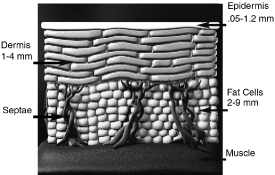

The Structure of Skin and Connective Tissue

The skin is comprised of the epidermis, dermis and the hypodermis, or subcutaneous fat layer. The top two layers of skin, the epidermis and dermis, together are known as the cutis and on most areas of the body are approximately two to three millimeters thick. The dermis contains blood vessels, hair follicles and other skin components. The deepest layer of the skin, the hypodermis, contains 50% of the body’s fat cells. The hypodermis also contains collagen strands, or fibrous septae, that connect the dermis to the underlying bone and muscle. Collagen has been shown to be a very flexible and stretchable protein with high tensile strength. The following diagram illustrates the basic anatomy of the skin:

Electromagnetic radiation, specifically light and heat, applied to the different layers of the skin can have an effect on the skin’s appearance. Many factors, such as advancing age, smoking, and exposure to damaging environmental factors such as the sun, can result in undesirable hair growth, enlargement or swelling of blood vessels, deterioration of collagen that enables formation of wrinkles and sagging tissue, and uneven pigmentation or sun spots. Devices such as aesthetic lasers have been designed to generate light waves to deliver heat through the epidermis, into the dermis, for removal of hair, vein treatment and other aesthetic applications. Gels, coolants and other means are used to protect the epidermis from burning during this process. Delivery of heat below the dermis, into the subcutaneous fat layer, has been accomplished using other forms of energy for aesthetic effect.

Light and heat can also be used to treat acne, one of the most prevalent skin diseases today. Acne is the result of a skin infection. Acne Vulgaris, the most common form of acne, is caused when hair follicles in the skin become plugged, usually due to hormonal changes. The condition is most common during adolescence but can occur at any age. Hormonal changes increase oil production (sebum) which conspires with dead skin cells to plug pores The sebaceous (oil) glands continue to produce more oil in the plugged pore and the area becomes a perfect breeding ground for acne. Once the pore is plugged, a common skin bacterium, P. Acnes begins to proliferate and produce porphyrins, which cause even more swelling. The infection then causes pimples and other permanent scars if not properly treated. The bacteria that causes acne, p. acnes, is particularly susceptible to certain wavelengths of blue and red light. Additionally, heat can also destroy these bacteria. Both our Isolaz and CLARO devices use light and heat to treat acne.

2

Table of Contents

The Market for Aesthetic Procedures to Treat the Skin

The American Society for Aesthetic Plastic Surgery reports that in 2009, total expenditures for aesthetic procedures in the U.S. were almost $10.5 billion. From 1997 to 2009 the total number of aesthetic procedures increased from approximately 2.1 million to just under 10 million procedures, representing approximately a 14% compounded annual growth rate. Non-surgical aesthetic procedures were primarily responsible for the overall increase, rising from approximately 1.1 million to approximately 8.5 million procedures over the same period, representing approximately a 19% compounded annual growth rate. We believe there are several factors that have contributed to this historical growth of non-invasive and minimally-invasive aesthetic procedures, including:

| • | Aging of the U.S. Population. The “baby boomer” demographic segment, defined by the U.S. Census as those Americans born between 1946 and 1964, represented nearly 30% of the U.S. population in 2006. Baby boomers control approximately $2 trillion in spending power and 50% of all discretionary income. The size and wealth of this aging segment and its desire to retain a youthful appearance have driven the growth for aesthetic procedures. |

| • | Emergence of Non-Traditional Practitioners. The traditional providers of aesthetic procedures include dermatologists and plastic surgeons. In 2007, there were approximately 17,000 physicians within the specialties of dermatology and plastic surgery according to the American Board of Medical Specialties. Manufacturers of aesthetic systems have placed an increasingly important focus on sales to other physician groups including approximately 72,000 family practitioners, 40,000 obstetricians and gynecologists, and 39,000 general surgeons. Additionally, physician directed medi-spas and non-medical day spas have entered the aesthetics market. |

| • | Broader Range of and Accessibility to Safe and Effective Treatments. Technological developments have made non-invasive treatment alternatives increasingly safe and effective. These technological developments have also reduced the required treatment and recovery time from invasive surgical procedures, which in turn have led to greater patient demand. These factors, along with the easy-to-use and low-cost nature of these products, have attracted both traditional and non-traditional practitioners to aesthetic procedures. |

| • | Market Shift Towards Less Invasive Procedures. Market trends confirm that patients are moving away from invasive procedures towards minimally-invasive or non-invasive treatments. Notably, the American Society for Aesthetic Plastic Surgery reports that from 1997 to 2009 the total number of laser skin resurfacing procedures increased from approximately 154,000 to 510,000 procedures, representing a 10% compounded annual growth rate, and the total number of Botox injection procedures increased from 650,000 to 2.5 million injections over the same period, representing a 12% compounded annual growth rate. |

| • | Changing Practitioner Economics. Managed care and government payor reimbursement restrictions in the United States, and similar payment-related constraints outside the United States, are motivating practitioners to establish or expand their elective aesthetic practices with procedures that are paid for directly by patients. We expect this trend to continue as physicians look for ways to expand their practices. |

| • | Increasing Acceptance of Aesthetic Procedures. Mass-market television shows like Extreme Makeover, The Doctors and 10 Years Younger reflect the mainstream acceptance of aesthetic procedures. Additionally, features in many popular television and print media have the effect of widely advertising the aesthetic procedures undertaken by celebrities, enhancing the glamour associated with and demand for self-improving treatments. |

3

Table of Contents

Similar market trends also exist outside the United States, where demand for non-invasive and minimally-invasive aesthetic procedures has also experienced strong growth. Manufacturers of these aesthetic devices typically derive one-third to one-half of their revenue from international sales.

Aesthetic Procedures for Skin and Their Limitations

Many medical treatments are available to treat wrinkles, rejuvenate the skin and give a patient a more youthful appearance. The most popular treatments include invasive surgical procedures, minimally-invasive needle injections and a variety of other procedures, many of which are energy-based.

Surgical Procedures

Of the various aesthetic alternatives for reducing wrinkles and rejuvenating appearance, invasive surgical procedures, such as cosmetic eyelid surgery, tummy tucks and facelifts, can create the most pronounced and long-lasting changes in appearance. They are performed by plastic surgeons with the patient under anesthesia. Compared to alternative treatments, however, invasive surgical procedures are expensive, costing thousands of dollars, and can involve weeks of post-surgical recovery and time away from work. They carry risk of infection, adverse reactions to anesthesia and hematoma, or accumulation of blood under the skin that may require removal.

Injections

Popular alternatives for temporarily improving appearance and reducing wrinkles include toxins, such as Botox, and soft tissue fillers, such as Restylane and Juvederm, that are injected into the skin. These injections are typically administered by dermatologists at a cost of several hundred dollars. In most instances, they involve little or no restricted recovery time for the patients. The effects of these procedures are temporary, however, and require repeat treatment, with Botox lasting from three to four months and injectable fillers typically lasting from three to six months.

Chemical Peels and Microdermabrasion

Chemical peels use acidic solutions to peel away the epidermis and microdermabrasion generally utilizes small sand crystals to resurface the skin. These techniques can lead to stinging, redness, irritation and scabbing, and more severe complications such as changes in skin color. In addition, patients undergoing these treatments are often required to avoid sun exposure for several months following a procedure.

Laser and Light-based Procedures

Lasers and light based skin rejuvenation procedures typically involve the process of damaging the patient's skin in a controlled manner in order to induce the skin's natural wound-healing process. The objective is to stimulate the growth of new skin, resulting in a more youthful appearance.

One approach to skin resurfacing, referred to as a bulk ablative approach, is to completely remove one or more layers of the skin in the treatment area. This procedure is often limited to patients with light skin and is rarely used off the face. Bulk CO2 laser treatments are one example of this approach. Bulk CO2 laser procedures and other bulk ablative procedures can be effective in rejuvenating the skin, however they often expose patients to substantial pain, long healing times and substantial risk of complications. Bulk ablative procedures can cause bleeding and oozing following a treatment, resulting in significant wound care and associated downtime for the patient. Adverse side effects may include infection, scarring and other possible complications such as hypopigmentation, which is a permanent or long-lasting whitening of the skin. Bulk ablative procedures are typically performed by experienced plastic surgeons and dermatologists and the number of these bulk ablative procedures performed annually has declined in recent years.

4

Table of Contents

A second approach to skin rejuvenation is a bulk non-ablative approach which stimulates the skin's natural wound healing process by mildly damaging collagen in the dermis without breaking or removing one or more layers of the skin. Intense pulsed light treatments are one example of this approach. Intense pulsed light procedures and other bulk non-ablative procedures treat many of the same skin conditions as bulk ablative approaches and are associated with shorter patient downtime and are less invasive. Nevertheless, intense pulse light and other bulk non-ablative approaches commonly have drawbacks such as:

| • | Limited effectiveness. Bulk non-ablative procedures are typically less effective than bulk ablative procedures and many bulk non-ablative procedures are not typically used on areas other than the face or on patients with darker skin colors. |

| • | Adverse side effects. Possible side effects associated with bulk non-ablative procedures include temporary bruising, localized darkening and scarring of the skin as a result of the indiscriminate bulk nature of the treatment and other factors. |

| • | Inconsistent results. Bulk non-ablative procedures have a narrow therapeutic window because an appropriate treatment setting that produces results for one patient may have a risk of scarring for another while settings that are consistently safe for all patients often result in minimal or no improvement. |

Acne Treatment Procedures

Acne is a common skin condition that is most prevalent during adolescence, but can affect persons of all ages. There are a variety of acne treatments available today ranging from over-the-counter medications, prescription medications and energy-based treatments.

| • | Over-the-Counter Medications. When confronted with acne, consumers usually turn to washes and lotions to treat their acne at home. These products generally contain benzoyl peroxide or salicylic acid and can be effective for treating very mild cases of acne and occasional breakouts. Leading products in this category include Pro Active® and Clearasil®. When these treatments prove ineffective consumers usually turn to a physician for more aggressive treatment. |

| • | Prescription Medications. Prescription medications used to treat acne include a variety of antibiotics, retinoids and higher concentrations of some over the counter medications. Usually, these are systemic treatments intended to provide long-term acne clearance. Prescription medications can carry side-effects. Isotretinoin, for example is very effective at treating acne, but has been linked to birth defects and psychological problems. Other prescription medications can also have undesired side effects, both short and long-term. |

| • | Energy-based treatments. IPL and lasers are new options for treating acne. Using light to treat acne is gaining acceptance because of minimal side effects. It can be used on most skin types and it is effective without the need for medications or special washers and cleaners. |

| • | Other Treatment Options. In addition, to the foregoing, acne can be treated with chemical peels and microdermabrasion. |

The Solta Medical Solution

Our four branded systems; Fraxel, Thermage, Isolaz and CLARO are aesthetic treatment systems. Fraxel systems provide treatment alternatives for skin rejuvenation and resurfacing and our Thermage systems provide non-invasive skin tightening, contouring and cellulite reduction treatments. Our acne treatment systems, Isolaz and CLARO, provide both professional and consumer treatment options that are complementary to each other.

5

Table of Contents

Fraxel

A new class of skin rejuvenation therapy, first introduced and commercialized by us, is referred to as “fractional” resurfacing. Fractional resurfacing creates thousands of microscopic treatment zones per square centimeter in the skin to stimulate repair and rejuvenation in the tissue by inducing the skin's natural wound-healing response. At the same time, fractional resurfacing spares a significant portion of the tissue in the treatment area, and stimulates the spared tissue around each microscopic treatment zone to rejuvenate and resurface the skin. We believe fractional resurfacing overcomes the safety shortfalls associated with bulk ablative procedures and the efficacy and safety limitations associated with bulk non-ablative approaches by fundamentally changing the method of treatment.

We believe our Fraxel laser systems afford a new class of skin rejuvenation therapy that provides patients with effective, consistent results without significant downtime and risk of complications. We currently market four Fraxel products: The re:store, re:store Dual, re:fine and re:pair. The Fraxel re:store, re:store Dual and re:fine laser platforms non-ablatively treat a range of applications that include wrinkles and fine lines, pigmentation, sun damage, uneven skin texture and melasma. In addition, the Fraxel re:store DUAL system features two lasers, the first application of the 1927 Thulium wavelength in aesthetics and the 1550 nm gold standard laser for non-ablative fractional resurfacing. The Fraxel re:store platform is optimized for treating more severe conditions, such as acne and surgical scars, deeper lines and wrinkles, and actinic keratoses. The Fraxel re:pair laser system, our ablative fractional resurfacing system, treats the above conditions as well as skin laxity and vascular dyschromia. This system has already received the United States Food and Drug Administration (“FDA”) 510(k) clearance for indications requiring ablation, coagulation and resurfacing of soft tissue.

Our Fraxel systems provide a number of benefits for physicians and patients seeking to provide or receive skin rejuvenation and resurfacing treatments:

| • | Effective Treatments. Our Fraxel laser systems generate and deliver precise wavelengths of energy that create deep microscopic lesions to target specific skin conditions. Our technology also incorporates precise dosage control, which automatically adjusts the amount, pattern, depth and location of energy delivered into the skin to optimize treatment results and enable consistent results from patient to patient. |

| • | Ease of Use. The motion control technology within our Fraxel laser systems enables practitioners to deliver Fraxel laser treatments by performing a simple painting motion on the patient’s skin. The motion control technology automatically delivers a consistent level and pattern of energy by compensating for how rapidly the practitioner moves the handpiece, enabling the practitioner to provide a more uniform post-treatment appearance and a reduced treatment time. |

| • | Broad Applications. We offer Fraxel laser systems that can treat multiple skin conditions on all skin colors, and can be used on all skin surfaces, while other laser technologies are often confined to facial applications. Our Fraxel laser systems have gained FDA 510(k) clearance for the treatment of multiple skin conditions and we are continually evaluating additional opportunities. |

| • | Enhanced Safety. Technologies contained in our Fraxel laser systems improve the safety profiles of our systems. One example is our Integrated Optical Tracking System which reduces the risk of operator error, including deactivating the laser if it is not in motion on the skin. The fact that our consumable treatment tips can be removed and disinfected further enhances the safety of the Fraxel re:store and Fraxel re:fine laser systems. |

| • | System Reliability. Our Fraxel re:store and re:fine laser systems incorporate advanced fiber laser technology that eliminates the need for optical alignment or adjustments within the laser source. These Fraxel laser systems require minimal regular maintenance and have a reduced total cost of ownership. |

6

Table of Contents

Thermage

Our Thermage systems consist of a radiofrequency (“RF”) generator with cooling capability, through the delivery of a coolant to protect the outer layer of the skin from over-heating, and a handpiece that, in conjunction with a treatment tip, regulates epidermis cooling and monitors treatment data. Our system includes a variety of single-use, disposable treatment tips that attach to the handpiece and are selected by physicians based on the procedure to be performed and the size of the area to be treated. The Thermage procedure is typically performed in a medical office setting by, or under the supervision of, trained and qualified physicians, including not only plastic surgeons and dermatologists, but also physicians who do not traditionally perform cosmetic procedures, such as general and family practitioners, obstetricians and gynecologists, and general and vascular surgeons.

Our Thermage systems provide the following benefits for physicians and patients seeking to provide or receive skin tightening, contouring and cellulite reduction treatments:

| • | Controlled Heating of Collagen. Collagen is found in the dermis and in fibrous septae strands in the subcutaneous fat layers of the skin. As we age, our skin loses collagen and the collagen that remains stretches, creating loose, saggy skin. Because RF energy delivery depends on tissue resistance and not on optical light absorption, it can penetrate to a much greater depth than conventional lasers down to the subcutaneous fat layer of the skin. Our monopolar RF heating technology has two mechanisms of action that impact collagen, an initial response and a secondary response. The initial response is an immediate collagen contraction, a dermal contraction for tightening and a fibrous septae contraction in the subcutaneous fat layer for contouring. A secondary wound healing response results in collagen deposition and remodeling, resulting in a continual tightening improvement over time. This tissue tightening effect of the Thermage procedure is demonstrated not only by our clinical experience but corroborated with independently published affiliated scientific data. This body of data provides potential physician customers with objective evidence that they can evaluate when considering a purchase of our system. |

| • | Non-Invasive, Non-Ablative Alternative to Surgery. The Thermage procedure is non-invasive, involving no surgery or injections, and offers an alternative to surgery at a lower price with little or no downtime from patients’ normal routines. It is also a non-ablative procedure that causes minimal temporary surface tissue damage. If desired, the Thermage procedure can be used in a complementary fashion in conjunction with invasive therapies such as liposuction, facelift and thread implants, as well as injectable fillers and other minimally-invasive and non-invasive aesthetic procedures. |

| • | Single Procedure Treatment. The Thermage procedure is normally performed in a medical office setting as a single treatment that takes from 20 minutes to an hour and a half, depending on the treatment area. Studies have shown clinical effect from a Thermage procedure that is both immediate and that can improve over a time period of six months following treatment. In addition, Thermage procedures have been used effectively on all skin types and tones and on various areas of the body. |

| • | Compelling Physician Economics. We believe the Thermage system provides a compelling return on investment for physicians. Thermage systems typically require relatively lower capital costs than competing laser and RF systems, while providing higher average procedure fees than those of our competitors. We continue to design new treatment tips to address new applications. |

| • | Ease of Use. The Thermage NXT™ and CPT™ systems incorporate a straightforward user interface that allows a trained physician to easily perform procedures across various parts of the body. Different treatment sites may use different tips, each of which is pre-customized by size, |

7

Table of Contents

| pulse counts, pulse durations and heating profile to the intended procedure. The system provides real-time feedback and can be adjusted during the procedure as needed. The handpieces are designed with a small profile for accurate placement during treatment, comfort and ease of use. |

| • | Comfort Pulse Technology. The Thermage CPT™ system leverages proprietary Comfort Pulse Technology™ to greatly improve patient comfort during treatment. This proprietary technology combines vibration and a unique energy delivery mechanism to improve the overall patient treatment experience while maintaining the same tightening and firming results that physicians and patients have come to expect from Thermage treatments. |

Isolaz

Our Isolaz systems, which we acquired through our acquisition of Aesthera Corporation in February 2010, integrate vacuum and broadband light to deliver effective acne treatment. This unique combination cleanses deep pores by using a vacuum to help loosen and extract blockage and excessive oil from deep inside the pores. It kills acne-producing bacteria with the blue light component of a broadband light while the heat generated from the rest of the spectrum shocks the oil generating glands and reduce inflammation and redness. Isolaz disposable single patient tips are specific to different skin types. Special filters are also used to make the treatment safe for different skin types. The tips come also in different sizes accordingly to the area to be treated. Isolaz is typically performed in medical settings by or under the supervision of qualified physicians.

Our Isolaz systems provide the following benefits to patients and physicians:

| • | Life Changing Procedure. Although acne is not a life threatening disease, it deeply affects not only the appearance of the sufferer but can have profound effect on the self esteem, confidence and overall personality. Isolaz offers an effective solution for acne patients without affecting their normal life and routine. |

| • | Effective, proven and safe. Isolaz provides an effective treatment of most acne conditions and is also safe to use on virtually all skin types. The treatment is practically painless and allows the patients to return to their normal activities immediately after the procedure. |

| • | Profitable. Isolaz treatments are affordable for patients and provide a source of income for a physician’s practice. Isolaz can also be combined with other therapies already used in a physician’s medical practice such as topical or oral medication to provide faster, more effective and durable results. |

CLARO

CLARO is a hand-held battery operated IPL device that is designed for use by consumers. The CLARO is intended for the treatment of individual pimples and acne lesions. Our CLARO system utilizes a filtered Zenon flash lamp to produce the light wavelengths and heat that destroy the bacteria that causes acne. The flash lamp produces the light in multiple flashes during its 6-second treatment cycle. The CLARO was designed for ease of use, simplicity and with integrated safety features that allow consumers to use it with no special training. We acquired the CLARO system through our acquisition of CLRS Technology Corporation in October 2010.

8

Table of Contents

Solta Medical’s Products

The following table provides information regarding Solta Medical’s products:

| Thermage NXT (1) |

Thermage CPT |

Fraxel re:store (2) |

Fraxel re:store |

Fraxel re:fine |

Fraxel re:pair |

Isolaz (3) |

CLARO | |||||||||

| Commercial Launch Date |

January 2007 | August 2009 | September 2006 | September 2009 | June 2007 | November 2007 | February 2007 | October 2009 | ||||||||

| Modality |

Non-ablative | Non-ablative | Non-ablative | Non-ablative | Non-ablative | Ablative | Non-ablative | Non-ablative | ||||||||

| Energy Source |

Monopolar Radio-frequency |

Monopolar Radio- |

Erbium Glass Fiber Laser |

Erbium and Thulium Glass Fiber Laser |

Raman-shifted Fiber Laser |

CO2 Laser | Photo pneumatic (vacuum and broadband light) | IPL – Intense Pulsed Light | ||||||||

| Wavelength |

N/A | N/A | 1550 nm | 1550 nm and 1927 nm | 1410 nm | 10600 nm | 400 – 1200 nm | 400-1100 nm | ||||||||

| Indications: |

||||||||||||||||

| Cellulite Reduction |

X | |||||||||||||||

| Eyelid Wrinkles |

X | X | ||||||||||||||

| Periorbital Wrinkles |

X | X | X | X | X | |||||||||||

| Melasma |

X | X | X | |||||||||||||

| Resurfacing |

X | X | X | X | ||||||||||||

| Pigmentation |

X | X | X | X | ||||||||||||

| Surgical/Acne Scars |

X | X | X | |||||||||||||

| Actinic Keratoses |

X | X | ||||||||||||||

| Wrinkles and Rhytides |

X | X | X | |||||||||||||

| Vascular Dyschromia |

X | |||||||||||||||

| Pustular Acne |

X | |||||||||||||||

| Comedonal Acne |

X | |||||||||||||||

| Inflamatory Acne (mild to moderate) |

X | X | ||||||||||||||

| Acne vulgaris |

X | |||||||||||||||

| Typical Patient Treatments |

1 | 1 | 1 – 4 | 3 – 4 | 5 – 6 | 1 – 2 | 4 – 6 | 2 per pimple | ||||||||

| Consumable Treatment Tip |

Yes | Yes | Yes | Yes | Yes | Yes | Yes | N/A | ||||||||

| Approximate Tip Life |

One treatment (face/body part) |

One treatment (face/body |

3 – 5 full face treatments |

3 – 5 full face treatments |

5 – 6 full face treatments |

1 – 2 full face treatments |

6 full face treatments |

N/A, unit is designed to last approx. 900 treatments | ||||||||

| Treatment Length |

20 – 90 minutes |

20 – 90 minutes |

20 – 30 minutes |

20 – 30 minutes |

20 – 30 minutes |

20 – 30 minutes |

20 – 30 minutes |

6 seconds | ||||||||

| (1) | System updated from previous system launched in 2002 |

| (2) | System updated from previous system launched in 2004 |

| (3) | System updated from previous system launched in 2004 |

9

Table of Contents

Fraxel re:store DUAL System

Launched in September 2009, the Fraxel re:store Dual system provides superior results for large body areas during a single treatment. Prior to the non-ablative Fraxel re:store Dual system, laser skin resurfacing procedures were largely limited to the face. The Fraxel re:store Dual provides two wavelengths, a 1550 nm wavelength and a 1927 nm wavelength, for clearance of pigmentation, actinic keratosis (pre-cancerous lesions), acne scars, skin texture and tone and melasma. The system offers a better safety profile than ablative fractional laser devices treatment speed that is 25% faster than its predecessor, and cooling built into the handpiece that allows for single operator use.

Fraxel re:store System

Our Fraxel re:store system was launched in September 2006 as an improved next generation product to our first system launched in September 2004 and offers a fractional non-ablative treatment utilizing a fiber laser. We believe the Fraxel re:store system provides an effective solution for skin conditions such as wrinkles, acne scars, skin texture and tone, and pigmentation, including melasma. This system can be operated at a wide range of treatment levels offering the clinician the versatility to treat both superficial and deep conditions based on the patient’s needs and preferences. Our targeted customer base for the Fraxel re:store and re:store Dual systems are physicians who have experience with aesthetic lasers or otherwise have practices performing various aesthetic treatments.

Fraxel re:fine System

Our Fraxel re:fine system, which we launched in June 2007, offers a fractional non-ablative treatment utilizing a fiber laser. The Fraxel re:fine system provides an effective, low discomfort treatment solution in a compact design. The Fraxel re:fine system is for physician practices that want to provide treatment for skin tone and texture, pigmentation and fine lines rather than the broader range of conditions treated by the Fraxel re:store system. Our target customer for the Fraxel re:fine system is a physician practice that is expanding into aesthetics or has a younger patient base primarily interested in preventative or lighter treatments.

Fraxel re:pair System

Our Fraxel re:pair system offers a fractional ablative treatment utilizing a CO2 laser. We believe our Fraxel re:pair system produces similar effectiveness to traditional bulk ablative treatments, with less downtime and risks. The system also penetrates deeper into the skin than bulk ablative treatments, which may provide additional skin tightening. The Fraxel re:pair system delivers a new type of treatment we call fractional deep dermal ablation, for FDDA treatment. The Fraxel re:pair system has received FDA 510(k) clearance for dermatological procedures requiring ablation, coagulation and resurfacing of soft tissue. Our targeted customer base for the Fraxel re:pair system is physician practices that have significant experience in working with aesthetic lasers and are seeking effective but safer ablative procedures with less downtime than those currently offered in the market.

Fraxel Treatment Tips

Our Fraxel laser systems use proprietary consumable treatment tips. To perform a treatment, the physician attaches to the handpiece a treatment tip, which is designed to ensure the treatment is delivered consistently, safely and effectively. After approximately three to five treatments with the Fraxel re:store and re:store Dual laser systems, approximately five to six treatments with the Fraxel re:fine laser system and one or two treatments with the Fraxel re:pair laser system, the consumable tip is depleted of its useful life and must be replaced.

10

Table of Contents

Fraxel Laser Systems Components

Our Fraxel laser systems are comprised of a laser system and a delivery system, including the control console and handpiece. These components generate the laser energy, create individual fractional laser beams and deliver the treatment to the patient according to our optimized treatment parameters.

| • | Fraxel re:store, Fraxel re:store Dual and Fraxel re:fine lasers. Our Fraxel re:store, Fraxel re:store Dual and Fraxel re:fine system consoles each contain a fiber laser which generates laser pulses at 1550 nm, 1550 nm and 1927 nm, and 1410 nm wavelengths, respectively. These wavelengths were specifically chosen to target water in the skin and to optimize the treatment results of each system. The fiber laser technology is specifically designed to produce a high quality beam of energy that maintains its wavelength accuracy to within a few nanometers. The fiber laser is also highly efficient, with low power requirements that can be provided by a standard wall outlet, and without the need for water cooling. Furthermore, the fiber laser is durable and robust with a long life span, and it is easy to set up and maintain, with no service requirement or need for optical alignments or adjustments. |

| • | Fraxel re:pair lasers. Our Fraxel re:pair laser system utilizes an air-cooled CO2 laser at 10600 nm. The specific water absorption characteristics of this wavelength in the skin enable the laser to ablate the tissue immediately, creating a needle-like crater and thin zones of coagulation into the dermis. The treatment is made up of deep microscopic ablated zones surrounded by undamaged tissue, rather than a thin, general ablation of the entire surface as typically achieved with traditional CO2 lasers. By utilizing this fractional deep dermal ablation treatment, we believe treatments with the CO2 laser can be optimized for safety and shorter patient downtime. |

| • | Control Console and Graphical User Interface. Our Fraxel laser systems feature a touch screen graphical user interface that allows the practitioner to select the energy level, treatment level and number of passes. In addition, each system has a dosage feedback system that enables the physician to accurately monitor the total energy delivered to the treatment area by utilizing measurement information obtained from our Intelligent Optical Tracking System. The console also features a simulation mode for training and patient demonstration. |

| • | Handpiece. The laser energy is delivered to our Fraxel laser handpieces, which incorporate our high speed scanner and our Intelligent Optical Tracking System. An additional feature in the Fraxel re:store and Fraxel re:fine handpieces is an automated spot size control system. This system delivers optimum lesion penetration at each energy setting and minimizes bulk heating and discomfort. The Fraxel re:store Dual now features integrated cooling through a Zimmer chiller designed into the system. This allows for a single operator to perform the treatment. |

| • | Treatment Tips. Our Fraxel laser systems use consumable treatment tips that attach to the handpiece. We offer large and small tip solutions enabling the physician to treat all areas of the body effectively. The Fraxel re:pair tips are designed to support evacuation of tissue debris from the treatment field and are intended to eliminate any risk of biohazard, due to the ablative nature of the treatment. Each treatment tip contains a proprietary internal EPROM, or programmable memory chip, which stores treatment parameters and safety limits in order to optimize performance and safety in the selected treatment. |

11

Table of Contents

Thermage NXT and CPT Systems

Our Thermage NXT and CPT system use our patented method of delivering monopolar RF energy for heating collagen.

| • | Monopolar Radiofrequency. Monopolar RF delivery uses two electrodes, with one active electrode being held in the device handpiece by the physician and the second, a passive return electrode, typically attached to the patient’s back. Monopolar delivery allows for precise administration of energy because the electrical current is concentrated where the active electrode touches the body and disperses quickly as it travels towards the return electrode. The monopolar RF process is distinct from bipolar RF-based technology, which is superficial in depth, relying on current passing through tissue located between two probes placed close together on the surface of the skin. We believe that monopolar technology delivers energy effectively to a greater tissue depth than bipolar technology. |

| • | The Treatment Tip Capacitive Coupling Mechanism of Action for Collagen Heating. The single-use treatment tip device contains our patented technology that uses monopolar RF energy as a controlled tissue heating source through the use of a non-conducting material, known as a dielectric. Capacitive coupling is the use of the dielectric to create an electric field in the area where our treatment tip touches the body. The electric field induces a current within the surrounding tissue, resulting in volumetric heating of the tissue due to the tissue’s natural resistance to electrical current flow. The heating depth is based upon the size and geometry of the treatment tip and can be controlled from a few hundred microns to several millimeters in depth, depending upon the particular treatment tip selected for various treatment areas. Collagen is a more efficient conductor of electricity than fat tissue and therefore acts as a pathway for the electric current. To achieve this deep heating with simultaneous surface cooling, the surface of the treatment tip transmits RF energy to the skin while serving as a dynamic contact cooling membrane for the cryogen spray. The contact membrane continually monitors skin surface temperature to help protect the epidermis. |

| • | Comfort and Safety. Since the initial launch of our original Thermage system in 2002, we have monitored and revised our procedure guidelines to safely and effectively deliver RF energy and cryogen cooling to the treatment site with minimal discomfort to the patient. An energy-based aesthetic treatment, if not used according to the manufacturer’s protocol, has the potential to cause patient discomfort, irritation or surface tissue burning. We have designed our system to minimize the risk of these types of occurrences through stringent built-in safety precautions in addition to extensive user training. Our system regulates a combination of inputs to precisely and uniformly distribute RF energy over the treatment site, including temperature and pressure sensors on the treatment tip and pre-programmed power levels and times for specific treatments. |

Thermage NXT and CPT System Components

Our Thermage NXT and CPT systems include three major components: the RF generator, the reusable handpiece and a single-use treatment tip, as well as several consumable accessories. Physicians attach a single-use treatment tip to the handpiece, which is connected to the RF generator. The RF generator authenticates the treatment tip and programs the system for the desired treatment without physician intervention.

| • | Radiofrequency Generator. The RF generator produces a 6.78 megahertz signal and is simple and efficient to operate. Controls are within easy reach, and important user information is clearly displayed on the built-in display, including energy delivered, tissue impedance, duration and feedback on procedure technique. Cooling is achieved through the delivery of a coolant that cools and helps to protect the epidermal surface during a Thermage procedure. |

12

Table of Contents

| • | Handpiece. The reusable handpiece holds the treatment tip in place for the treatment and processes information about skin temperature and contact, treatment force against the skin, cooling system function and other important data. A precision control valve within the handpiece meters the delivery of the coolant. In addition, the CPT hand piece has the ability to vibrate the treatment tip at 3 levels to provide greater comfort forth patient. |

| • | Single-use Treatment Tips. The treatment tip is available in four sizes with several configurations of pulse counts, pulse durations and three heating profiles for efficient implementation of treatment guidelines, based on the size and nature of the treatment area. Physicians currently can order sterile treatment tips in sizes of 0.25 cm2, 1.5 cm2, 3.0 cm2 and 16.0 cm2 on the NXT platform and tips in sizes of 0.25 cm2, 3.0 cm2 and 16.0 cm2 on the CPT platform. The CPT tips provide more uniform heating through a tip frame that has been added to the surface of the electrode. Each treatment tip contains a proprietary internal EPROM, or programmable memory chip, which stores treatment parameters and safety limits in order to optimize performance and safety in the selected treatment. To enhance procedural safety, we have also programmed the EPROM for single-use treatments. Using the same treatment tip to perform multiple treatments could result in injury, as a result of the eventual breakdown of the treatment tip’s electrode dielectric membrane. Therefore, the EPROM ensures that the treatment tip is not reused following a particular procedure. |

Our NXT and CPT systems also include other consumable components in addition to treatment tips. The systems house a canister of coolant that can be used for an average of three to six procedures, depending on the total skin surface area treated and the treatment tip used. Each patient procedure also requires a return pad, which is typically adhered to the patient’s lower back to allow a path of travel for the RF current through the body and back to the generator. We also sell proprietary coupling fluid, an electrically conductive viscous liquid that helps ensure electrical and thermal contact with the treatment tip.

Isolaz Systems

Our Isolaz systems use a unique combination of vacuum and broadband light to deliver effective acne treatment.

| • | Vacuum. Gentle, user adjustable vacuum is responsible for effective pore cleansing which directly extracts debris, sebum and material that clog the pores and, in addition, expose the acne producing bacteria to the intense light. The vacuum levels can be manually adjusted to provide a comfortable treatment to the patient without compromising effectiveness. The vacuum level is also automatically adjusted by the system according to the size of the disposable tip used and can also be manually adjusted. |

| • | Broadband Light. Isolaz uses intense broadband light between 400 and 1200nm. This broadband light is generated by a discharge flash lamp providing intense, effective and targeted treatment for acne. The blue spectrum of the light, 400 to 500nm approximately, has been proven to be the most effective at killing acne-causing bacteria by interacting with bio-products the bacteria creates. The rest of the spectrum, 500 to 1200nm produces deep heat that shock the sebaceous glands while reducing inflammation and redness producing an almost immediate effect on the overall appearance of the skin. The intensity, duration and repetition of the light is adjustable by the operator. |

| • | Disposable Tips. Isolaz uses disposable single-patient tips in different sizes and for different skin types. Unfiltered tips, allowing the broadband light in its full to be delivered, are recommended for lighter skin types, types I to IV in the Fitzpatrick scale. Darker skin types, types IV to VI in the same scale, are more sensitive to lower spectrum light and recommended for filtered tips which cut the low frequencies of the broadband light. |

13

Table of Contents

| • | Profusion. Isolaz also offer a unique topical delivery method by the use of a specially designed treatment called Profusion. In this modality the system uses only the vacuum component and a specially designed tip with single-use sponge cartridges. During a Profusion treatment, a topical solution is applied to the skin. When the tip is applied the skin is stretched by the vacuum and put into close contact with the sponge in the cartridge which pushes the topical deeper into the skin, enhancing the absorption of the topical. |

Isolaz System Components

Our Isolaz system comprises two main elements: a console with an integrated handpiece and disposable single-patient tips. A cart and other accessories are also part of the system.

| • | System console with handpiece. The console integrates the components responsible for the vacuum generation unit, the electric power for the lamp and the touch screen display. The handpiece is ergonomically designed and permanently attached to the console, where the flash lamp is housed and where the disposable single-patient tips are connected for the treatment. The user interface display consists of a touch screen where all the parameters for the treatment can be adjusted by the operator. |

| • | Disposable single-patient tips. The Isolaz disposable tips come in different sizes, small, medium and large for use in different areas of the body such as nose, face and back respectively or for targeted treatment areas. The tips are classified in two groups accordingly to the skin type they are more appropriate for: unfiltered tips for lighter skin types that allow the pass of the full spectrum of the broadband light and filtered tips for darker skin types that cut off the lower spectrum of the light. The flash lamp is also replaceable and has a life span of 35,000 flashes. |

Other components of the system are the system cart, designed with a modern and user-friendly approach, allows for a comfortable access to the system controls and handpiece and mobility. Provider goggles, patient eye covers and tip cooling spray are other accessories available with the system.

CLARO

The CLARO device uses clinically proven IPL to clear acne. CLARO is a FDA IPL cleared for over-the-counter sale. It is intended for spot treatment of mild to moderate inflammatory acne “pimples”, including pustular acne. The life expectance of a CLARO unit is approximately 900 treatments and at the end of its life-cycle the unit must be replaced by the consumer.

Business Strategy

Our goal is to become a leading provider of energy-based medical devices for aesthetic applications by:

| • | Broadening our Physician Customer Base. We intend to continue penetrating the traditional aesthetic practitioner specialties, which include dermatologists and plastic surgeons. We are also seeking to increase our penetration in non-core physician specialties and physician-directed medi-spas with track records of safe and successful aesthetic treatments. Additionally, we continue to devote substantial resources to increasing our market penetration and strengthening our physician relationships in international markets. |

| • | Optimizing Customer Base through Cross-selling. In 2009, when we merged together Reliant and Thermage, we saw a strong cross-selling opportunity between the two portfolios as our installed bases had only a 10% overlap. Our sales force continued to take advantage of this opportunity, along with a similar cross-selling opportunity arising from our acquisition of Aesthera Corporation, during 2010. |

14

Table of Contents

| • | Driving Treatment Tip Usage. Unlike most traditional energy-based medical device businesses, which rely solely on the sale of new capital equipment to generate revenue, our disposable treatment tip business model enables us to maintain a continuous relationship with our customer base. We work collaboratively with our customer base to increase treatment tip usage by expanding clinical applications and augmenting and facilitating the marketing efforts of our physician customers. We believe that our customers’ interests are closely aligned with our own, and we monitor the market to foster continued procedure growth for our customers and treatment tip sales for us. With marketing programs such as the Diamond Rewards Program and our international Partner Plan, our sales force works with physician customers to help develop profitable Thermage, Fraxel and Isolaz businesses within their practice. |

| • | Developing New and Improving Current Applications. Our current product portfolio allows us to offer products that meet a broad range of physician, practitioner and patient needs. By continuing to invest in research and development, we intend to expand our product offerings even further by improving our current products and commercializing products that address new clinical treatment applications. |

| • | Seeking Growth Opportunities via Complementary Products, Technologies or Businesses. We intend to continue pursuing opportunities to expand our core business by identifying opportunities to further complement our existing array of products for the aesthetics market with synergistic technologies and/or applications. |

| • | Expanding our International Presence. We believe the size of the international market is comparable to the U.S. market, and we are focused on increasing our market penetration overseas and building global brand-recognition. We intend to continue adding sales representatives and support staff to increase direct sales and strengthen physician relationships in international markets. |

| • | Becoming a Leader in Personal Care Devices. We believe that there is significant and untapped growth potential in the market for consumer-use aesthetic devices. In October 2010 we acquired CLRS Technology Corporation, the developer of the CLARO acne device in order to position ourselves to become a leader in this market. |

Sales and Marketing

Professional Systems

We sell our Thermage, Fraxel and Isolaz systems to physicians in the United States primarily through a direct sales force of trained sales consultants. As of December 31, 2010, we had a U.S. direct sales force team, including area sales directors, area sales representatives and clinical specialists, managed by the Vice President of Sales. Our U.S. sales organization is divided into two groups, with half of the sales force focusing on existing customers to sell treatment tips, upgrades, accessory sales and training, and the remainder focusing on securing and broadening our new customer base. Outside of the United States, we primarily sell our Thermage, Fraxel and Isolaz systems to physicians in over 100 countries through independent distributors. In select countries such as Canada, Australia, Hong Kong, Japan, Germany, France, Spain, Portugal and the United Kingdom, we also have direct sales organizations.

United States Sales

Our strategy to increase sales in the United States is to:

| • | remove obstacles for purchase, including treatment discomfort, time of treatment, efficacy and cost, and increase the variety of applications we offer; |

15

Table of Contents

| • | continue to position the Thermage, Fraxel and Isolaz procedures as attractive alternatives to other aesthetic treatments for skin tightening, skin rejuvenation, skin resurfacing and body shaping; |

| • | work closely with our physician customers to increase product usage and enhance the marketing of Thermage, Fraxel and Isolaz procedures in their practices; |

| • | invest in consumer public relations; and |

| • | expand our sales efforts to reach physicians outside of the traditional specialties for aesthetic procedures. |

Further, we actively engage in promotional opportunities through participation in industry tradeshows, clinical workshops and company-sponsored conferences with expert panelists, as well as through trade journals, brochures and our website. We actively seek opportunities to obtain positive media exposure, and have been highlighted on such national broadcasts as The Doctors, Dr. Oz, Good Morning America, Oprah, Rachel Ray, and The Today Show, as well as numerous local news programs.

| • | Consultative Sales Process. Through our consultative sales process, we form strong relationships with our customers through frequent interactions. Beyond performing initial system installation and on-site training and certification, which can occur within two weeks of a physician’s purchase decision, our sales consultants provide consultation to physicians on how to integrate our systems into their practices and market procedures to their patients. Our sales consultants’ compensation structure emphasizes consumable sales and customer service over capital equipment sales, although our sales force also has incentives to generate new accounts through system sales. We require our sales consultants to invest substantial time in training and servicing our physician customers, and therefore we discourage sales to physicians who do not show the potential to drive aesthetic procedure volume. |

| • | Physician Training and Certification. We provide comprehensive training and education to each physician upon delivery of the Thermage, Fraxel and Isolaz systems. We require this initial training to assist physicians in safely and effectively performing these procedures. The majority of physicians operating our installed base of systems have pursued and met the training criteria that we establish. To signify their achievement, we award a certificate of training to these physicians and identify them within the physician locator on our website. We do not list physicians within our physician locator unless they have met these training requirements. |

| • | Diamond Rewards Program. This is an industry-exclusive customer loyalty program available to Solta Medical customers in the United States. The program allows physicians to lock-in preferred pricing for Thermage and Fraxel treatment tips along with other preferred customer benefits to help physicians grow their practices and increase practice profitability. |

| • | Direct-to-Consumer Marketing (“DTC”). We have historically invested in consumer programs designed to build brand awareness and recognition, demonstrate our commitment to supporting our physician customers and distributors and increase demand for Thermage and Fraxel procedures. We have consumer websites targeted to consumers interested in learning more about Thermage, Fraxel, Isolaz and CLARO treatments and include information on our underlying technology and potential treatment outcomes, as well as short films and listings of local physicians who offer Thermage, Fraxel and Isolaz procedures. We have observed our website traffic increase significantly following national television appearances and their periodic re-broadcasts and following our DTC efforts. Due to women’s interest in anti-aging treatments and procedures, our current DTC efforts are focused on public relations where we utilize public relations outreach, |

16

Table of Contents

| such as desk-side briefings and pitching of new product press releases, to consumer health and beauty publications. This effort generates billions of gross impressions and has generated a high awareness of the Thermage, Fraxel and Isolaz brands among this key target demographic. |

International Sales

As of December 31, 2010, we had an international sales team including regional managing directors, regional sales representatives and clinical specialists managed by the Vice President of Sales. We support our independent distributors who market our Thermage, Fraxel and Isolaz systems in over 100 countries. We require our distributors to provide customer training, to invest in equipment and marketing, and to attend certain exhibitions and industry meetings. The percentage of our revenue from customers located outside North America was approximately 55%, 53% and 48% in 2010, 2009 and 2008, respectively.

Our strategy to grow sales outside the United States is to:

| • | increase penetration of Thermage, Fraxel and Isolaz systems in international markets in which our systems are currently sold; |

| • | increase utilization of our systems through increased treatment tips and consumable sales; |

| • | sell direct into select international markets; and |

| • | expand our marketing efforts to support direct sales into select international markets. |

Competition

Our industry is subject to intense competition. We compete directly against professional laser and light-based skin rejuvenation products and procedures offered by companies such as Alma Laser, Cutera, Cynosure, Lumenis, Lutronic, Palomar Medical Technologies, Sciton, and Syneron Medical. Our consumer device competes against companies that offer laser, LED and other light-based devices for skin rejuvenation and acne treatment such as Clarisonic, Palomar Medical Technologies, Syneron Medical Technologies, Tria Beauty and Zeno.

In addition, we compete against existing and emerging treatment alternatives such as cosmetic surgery, chemical peels, microdermabrasion, Botox, dermal fillers, collagen injections and both prescription and OTC acne medications. Some of these alternative procedures require a lower initial capital investment by a practitioner, some of these procedures may not require the purchase of a consumable treatment tip to perform a procedure and in the area of acne, consumers have a wide variety of treatment choices. Some of our competitors are also publicly-traded companies and others have longer operating histories than we do. Many of them may enjoy several competitive advantages, including:

| • | greater name recognition; |

| • | more extensive intellectual property protection; |

| • | established relationships with practitioners and other health care professionals; |

| • | established domestic and international distribution networks; |

| • | broader product lines and existing treatment systems, and the ability to offer rebates or bundle products to offer higher discounts or incentives; |

17

Table of Contents

| • | greater experience in conducting research and development, manufacturing, clinical trials, obtaining regulatory approval for products and marketing approved products; and |

| • | greater financial resources for product development, sales and marketing and patent litigation. |

Competition among providers of laser and other light-based devices for the aesthetic market is characterized by intensive sales and marketing activities. There are few barriers to entry that would prevent new entrants or existing competitors from developing products that could compete with ours. There are many companies, both public and private, that are developing devices that use light-based, radiofrequency-based and alternative technologies. Additional competitors may enter the market and we are likely to compete with new companies in the future. To compete effectively, we have to spend significantly on sales and marketing activities and differentiate our products on the basis of performance, brand name, reputation and price. We have encountered and expect to continue to encounter potential customers who, due to existing relationships with our competitors, are committed to, or prefer the products offered by these competitors.

Research and Development

The focus of our research and development team is to provide technological innovation and associated intellectual property that expands the value proposition of our Thermage, Fraxel, Isolaz and CLARO brand technologies and product platforms. We work closely with medical thought leaders and physician entrepreneurs to understand unmet needs and emerging applications in aesthetic medicine. We focus our efforts on improving the utility of existing products as well as developing new technology platforms for emerging aesthetic applications. We have a fully-staffed, co-located aesthetic clinic and an on-site biomedical laboratory that we believer promotes the rapid conversion of concepts into products. Our primary ongoing investments are in skin tightening, non-ablative and minimally ablative skin resurfacing, body shaping and contouring. We are committed to a recurring revenue business model and our research and development team is focused on a product portfolio with both disposable/consumable and capital equipment products. Current research and development activities address both the professional and consumer markets and are focused on:

| • | developing new laser wavelengths, laser delivery systems and new treatment indications; |

| • | improving the efficacy and predictability of monopolar RF treatment and developing new energy delivery technologies for the future; |

| • | developing algorithms, technology and devices for on-board skin diagnostics, precision dosage control and patient comfort management; and |

| • | improving and developing state of the art security systems to ensure the safety and efficacy of our systems. These security systems also maintain integrity of our long-term recurring revenue in the form of tips, hand pieces and other consumables. |

As of December 31, 2010, we had a staff of 48 technical professionals focused on product development projects and the clinical, biomedical and regulatory support of these projects. We use off-site animal testing facilities and our fully equipped, on-site biomedical lab for the early development and evaluation of product concepts and for providing support to scientific and clinical studies conducted by our co-located clinic and by off-site investigators and institutions. We use transmission electron microscopy on biopsied tissue samples to corroborate that our products induce the denaturing of collagen that leads to immediate tissue tightening. We have developed histology techniques to investigate the depth of heat in tissue and the wound healing process that we believe is responsible for long-term improvement and tightening of tissue. Our staff of laser tissue interaction specialists has amassed over 50,000 histological images in the quantification of treatment parameters. We have also created three-dimensional computer models to study tissue treatment with our products. In addition, we have

18

Table of Contents

also formed strategic relationships with outside contractors for assistance on specialized projects, and we work closely with experts in the medical community to supplement our internal research and development resources. Research and development expenses for 2010, 2009 and 2008 were $16.3 million, $16.2 million and $9.5 million, respectively. The advanced research and development team includes physicists and biomedical systems engineers who create the prototype devices that enable the biomedical engineering team to explore the skin science. The biomedical engineering team is led by RF and laser tissue interaction specialists who model the laser tissue interactions, and create the databases that are utilized for the design of treatment systems. The product engineering team consists of experienced program managers, optical engineers, mechanical engineers, electrical engineers and embedded machine control software engineers who have the responsibility for design of ergonomic, reliable products, for documentation of those products, release to manufacturing and long-term design support.

We entered into an agreement with Philips Consumer Lifestyle B.V. (“Philips”) in March 2008 to develop and commercialize a home-use, laser-based device for skin rejuvenation. We believe this represents a significant opportunity to bring laser-based devices directly to consumers. Under the agreement, Philips made quarterly payments to us for research and development related to the device. Under the terms of this arrangement, Philips made advance quarterly payments for the costs incurred in performing activities under the arrangement. As of December 31, 2010, all payments have been collected on the agreement. Philips may terminate the agreement at any time if it chooses not to proceed with commercialization of the device. Upon commercialization of the device, Philips will pay us a percentage of net sales of the device and related products. As long as certain technology transfer payments are paid to us, the agreement is exclusive with respect to the right of Philips to manufacture, distribute, sell and commercialize the device and the related products. After termination of the agreement and/or termination of the exclusivity period as described above, we are prohibited from directly or indirectly manufacturing, selling, distributing and commercializing any laser-based devices for home-use by consumers that are similar to the device developed under this agreement. This program, by its nature, is generating component and system level cost reduction opportunities for our future professional products, as well.

Patents and Proprietary Technology

We rely on a combination of patent, copyright, trademark and trade secret laws and confidentiality and invention assignment agreements to protect our intellectual property rights. As of December 31, 2010, we had 89 issued U.S. patents, 70 pending U.S. patent applications, 52 issued foreign patents and 56 pending foreign patent applications, some of which foreign applications preserve an opportunity to pursue patent rights in multiple countries. The issued U.S. patents have expiration dates between 2011 and 2029. Expiration may occur earlier under certain circumstances, such as if we do not continue to pay maintenance fees to the United States Patent and Trademark Office. Not all of our patents and patent applications are related to our current or future product lines, and some of our patents have been licensed to third parties. The pending foreign applications relate to similar underlying technological claims to the U.S. patents and/or patent applications. We intend to file for additional patents to strengthen our intellectual property rights.

Our patent applications may not result in issued patents, and we cannot assure you that any patents that issue will protect our intellectual property rights. Third parties may challenge any patents issued to us as invalid, may independently develop similar or competing technology or may design around any of our patents. We cannot be certain that the steps we have taken will prevent the misappropriation of our intellectual property, particularly in foreign countries where the laws may not protect our proprietary rights in these foreign countries as fully as in the United States.

As a result of a settlement of litigation reached in June 2005, we and Syneron have granted each other a non-exclusive paid-up license under the patents asserted in the lawsuit and related patents under the parties’ control. We excluded from this license any rights to utilize monopolar RF technologies and capacitive electrical

19

Table of Contents

coupling, which we believe in combination allow the Thermage procedure to create a reverse thermal gradient and deep, near uniform, volumetric heating to achieve tissue tightening effects. Syneron excluded from its license any patents related to its proprietary Electro-Optical Synergy technology. Both parties admitted the validity of all patents in the litigation, but neither admitted any wrongdoing or liability.

We advised Alma Lasers Ltd. and Alma Lasers, Inc (together “Alma”) as early as February 2006 that Alma’s Accent product infringed numerous Thermage patents. On April 26, 2007 Alma filed a lawsuit against us in the United States District Court for the District of Delaware requesting a declaratory judgment that Alma’s Accent product does not infringe our patents and that our patents are invalid.

On June 20, 2007, we filed patent infringement counterclaims against Alma in the United States District Court for the District of Delaware asserting that that Alma’s AccentXL and Harmony systems infringe ten of our U.S. patents. The counterclaims were amended on December 10, 2007 to include a claim of infringement of an eleventh patent. In addition to damages and attorney fees, we are asking the Court to enjoin Alma from further infringement. During May, June and July 2008, Alma filed with the United States Patent and Trademark Office requests that all of the 11 patents asserted by us be reexamined. The United States Patent and Trademark Office has made rejections of some claims in each of these 11 patents. We believe the United States Patent and Trademark Office will reaffirm the validity of our patents. Some of the patents in reexamination have been reaffirmed, while others remain under rejection. As a result of a settlement reached on May 10, 2010, the Company and Alma granted each other a covenant not to sue under the patents asserted in the lawsuit and related patents. In addition, Alma paid the Company a non-returnable one-time amount of $2,250,000 in connection with this settlement. External legal fees incurred during year ended December 31, 2010 in connection with the settlement amounted to approximately $37,000. In connection with this settlement, the Company has recorded a net gain of approximately $2,213,000 in operating expenses during the year ended December 31, 2010. We do not believe the final disposition of these reexaminations will have a material adverse effect on our financial statements and future cash flows.

Through the acquisition of Reliant in December 2008, we acquired an exclusive, royalty bearing, worldwide license, with the right to sub-license, with Massachusetts General Hospital (“MGH”) to patent applications relating to some of the technology used in the Fraxel laser systems. The license, ongoing royalty obligations and all rights thereunder terminated on December 31, 2010, provided however that MGH has granted a non-assert provision that applies to all of our products in the professional marketplace.

On November 10, 2008, we entered into agreements with Palomar Medical Technologies and Massachusetts General Hospital to create the Fractional Technology Open Patent Program (“FTOPP”). The FTOPP was designed to provide third parties the opportunity to license technology related to fractional light-based treatments in the professional field. Subject to certain conditions, we agreed to license patents that are included in the FTOPP on a non-discriminatory basis to such third parties. The FTOPP agreements require that the royalties from FTOPP licensees be allocated amongst the three parties.