Attached files

| file | filename |

|---|---|

| EX-31.2 - EXHIBIT 31.2 - PROCERA NETWORKS, INC. | ex31_2.htm |

| EX-23.1 - EXHIBIT 23.1 - PROCERA NETWORKS, INC. | ex23_1.htm |

| EX-10.17 - EXHIBIT 10.17 - PROCERA NETWORKS, INC. | ex10_17.htm |

| EX-32.1 - EXHIBIT 32.1 - PROCERA NETWORKS, INC. | ex32_1.htm |

| EX-31.1 - EXHIBIT 31.1 - PROCERA NETWORKS, INC. | ex31_1.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

þ

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2010

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from to.

Commission file 001-33691

PROCERA NETWORKS, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

33-0974674

|

|

|

(State of incorporation)

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

|

100C Cooper Court

|

95032

|

|

|

Los Gatos, California

|

(Zip Code)

|

|

|

(Address of principal executive offices)

|

|

Registrant’s telephone number, including area code: (408) 890-7100

Securities registered pursuant to Section 12(b) of the Act

|

Title of Each Class

|

Name of Each Exchange on Which Registered

|

|

|

Common Stock par value $0.001 per share

|

NYSE Amex Equities

|

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

1

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o

|

Accelerated filer þ

|

|

|

Non-accelerated filer o

(Do not check if a smaller reporting company)

|

Smaller reporting o

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

The aggregate market value of the voting stock held by non-affiliates of the registrant on June 30, 2010, based upon the closing price of common stock on such date as reported on the NYSE Amex Equities, was approximately $50,345,817. Shares of voting stock held by directors, officers and stockholders or stockholder groups whose beneficial ownership exceeds 5% of the registrant’s common stock outstanding have been excluded in that such persons may be deemed to be affiliates. The number of shares owned by stockholders whose beneficial ownership exceeds 5% was determined based upon information supplied by such persons and upon Schedules 13D and 13G, if any, filed with the Securities and Exchange Commission. This assumption regarding affiliate status is not necessarily a conclusive determination for other purposes.

The number of shares of common stock outstanding as of March 10, 2011 was 11,351,978.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement for its 2011 Annual Stockholders’ Meeting are incorporated by reference into Part III of this Annual Report on Form 10-K, to be filed within 120 days of the registrant’s fiscal year ended December 31, 2010.

2

PROCERA NETWORKS, INC.

Form 10-K

ANNUAL REPORT

TABLE OF CONTENTS

|

4

|

||||

|

|

Item 1.

|

|

4

|

|

|

|

Item 1A.

|

|

14

|

|

|

|

Item 1B.

|

|

24

|

|

|

|

Item 2.

|

|

24

|

|

|

|

Item 3.

|

|

25

|

|

|

|

Item 4.

|

|

25

|

|

|

26

|

||||

|

|

Item 5.

|

|

26

|

|

|

|

Item 6.

|

|

28

|

|

|

|

Item 7.

|

|

29

|

|

|

|

Item 7A.

|

|

39

|

|

|

|

Item 8.

|

|

40

|

|

|

|

Item 9.

|

|

65

|

|

|

|

Item 9A.

|

|

65

|

|

|

|

Item 9B.

|

|

66

|

|

|

67

|

||||

|

|

Item 10.

|

|

67

|

|

|

|

Item 11.

|

|

67

|

|

|

|

Item 12.

|

|

67

|

|

|

|

Item 13.

|

|

67

|

|

|

|

Item 14.

|

|

67

|

|

|

68

|

||||

|

|

Item 15.

|

|

68

|

|

|

|

71

|

|||

|

|

73

|

|||

|

Exhibit 10.17

|

||||

|

|

Exhibit 23.1

|

|

||

|

|

Exhibit 31.1

|

|

||

|

|

Exhibit 31.2

|

|

||

|

|

Exhibit 32.1

|

|

||

In addition to historical information, this Annual Report on Form 10-K contains forward-looking statements regarding our strategy, financial performance and revenue sources that involve a number of risks and uncertainties, including those discussed under the title “RISK FACTORS” in Item 1A. Forward-looking statements in this report include, but are not limited to, those relating to our potential for future revenues, revenue growth and profitability; markets for our products; our ability to continue to innovate and obtain patent protection; operating expense targets; liquidity; new product development; the possibility of acquiring (and our ability to consummate any acquisition of) complementary businesses, products, services and technologies; the geographical dispersion of our sales; expected tax rates; our international expansion plans; and our development of relationships with providers of leading Internet technologies.

While these forward-looking statements represent our current judgment on the future direction of our business, such statements are subject to many risks and uncertainties which could cause actual results to differ materially from any future performance suggested in this Annual Report due to a number of factors, including, without limitation, our ability to produce and commercialize new product introductions, particularly our acceleration-related technologies; our ability to successfully compete in an increasingly competitive market; the perceived need for our products; our ability to convince potential customers of the value of our products; the costs of competitive solutions; our reliance on third party contract manufacturers; continued capital spending by prospective customers and macro-economic conditions. Readers are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date of this Annual Report. We undertake no obligation to publicly release any revisions to forward-looking statements to reflect events or circumstances arising after the date of this document, except as required by law. See “RISK FACTORS” appearing in Item 1A. Investors may access our filings with the Securities and Exchange Commission, including our annual reports on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K and amendments to such reports on our website, free of charge, at www.proceranetworks.com, but the information on our website does not constitute part of this Annual Report.

Throughout this Annual Report on Form 10-K, we refer to Procera Networks, Inc., a Nevada corporation, as “Procera” or the “Company” and, together with its consolidated subsidiaries, as “we,” “our” and “us,” unless otherwise indicated. Any reference to “Netintact” refers to our wholly owned subsidiaries, Netintact, AB, a Swedish corporation and Netintact, PTY, an Australian corporation.

|

Business

|

We are a leading provider of Intelligent Policy Enforcement, or IPE, solutions that enable mobile and broadband network operators and entities managing private networks including higher education institutions, businesses and government entities (collectively referred to as network operators) to gain enhanced visibility into, and control of, their networks. Our solutions provide granular network intelligence to enable network operators to improve the quality and longevity of their networks, better monetize their network infrastructure investments, control security hazards and create and deploy new services for their users. The intelligence we provide about users and their usage enables qualified business decisions. Our network operator customers include mobile service providers, broadband service providers, cable multiple system operators, or MSOs, Internet Service Providers, or ISPs, educational institutions, enterprises and government agencies.

Our IPE products are part of the high-growth market for mobile packet and broadband core products. The market for IPE products is expected to grow from $249 million in 2009 to $1.5 billion in 2014 according to Infonetics Research, a compound annual growth rate (“CAGR”) of 44%. Our bundled products deliver a solution that is a key element of the mobile packet and broadband core ecosystems. Our solutions are often integrated with additional elements in the mobile packet and broadband core including Policy Management and Charging functions and are compliant with the widely adopted 3rd Generation Partnership Program, or 3GPP, standard. In order to respond to rapidly increasing demand for network capacity due to increasing subscribers and usage, network operators are seeking higher degrees of intelligence, optimization, network management, service creation and delivery in order to differentiate their offerings and deliver a high Quality of Experience, or QoE, to their subscribers. We believe the need to create more intelligent and innovative mobile and broadband networks will continue to drive demand for our products.

Our products are marketed under the PacketLogic brand name. We have a broad spectrum of products delivering IPE at the access, edge and core layers of the network. Our products are designed to offer maximum flexibility to our customers and enable differentiated services and revenue-enhancing applications, all while delivering a high Quality of Service, or QoS for subscribers.

We were founded in 2002 and became a public company in October 2003 following our merger with Zowcom, Inc., a publicly-traded Nevada corporation. In 2006, we completed acquisitions of the Netintact entities. Our Company is headquartered in Los Gatos, California with regional headquarters in Varberg, Sweden and Singapore. We sell our products through our direct sales force, resellers, distributors and systems integrators in the Americas, Asia Pacific and Europe.

Industry Background

Network traffic has risen sharply in recent years as a result of the advent of ubiquitous broadband Internet Protocol, or IP, and mobile networks covering an increasing portion of the world’s population, the proliferation of sophisticated edge devices including smartphones, tablets and laptops and the rise in connections, communications, social networking and data-intensive applications. We refer to this new era of hyper-connectivity as the New Digital Lifestyle. According to the Cisco Visual Networking Index, the sum of all forms of global IP traffic reached 20,396 petabytes, or PB, per month as of 2010 and is expected to grow to 63,904 PB per month in 2014, a CAGR of 33%.

Mobile data networks are an essential tool in the New Digital Lifestyle for streaming video, social networking and collaboration. Consumers are accessing content from multiple mobile broadband connections. Social networking, applications and entertainment content live in the cloud and without quality access to the Internet, the New Digital Lifestyle is disrupted. As networks advance in capabilities with faster, high-capacity networks, new advanced devices and applications will spur more competition for bandwidth. This results in greater network congestion, causing network operators to balance subscriber demand for network bandwidth with the cost of building additional capacity. In addition, network providers must be able to adapt to evolving user behavior by rapidly introducing new services and business models to keep pace with demand. IPE enables mobile and broadband network operators to provide unprecedented levels of personalization, service optimization, network assurance and rapid service creation to monetize network investments. A critical element for network operators to keep pace with demand and cope with evolving user behavior is to gain as much insight as possible into network activity.

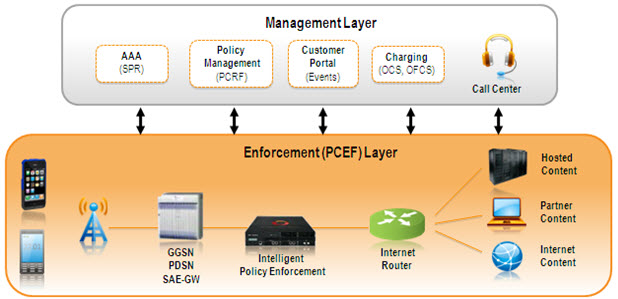

3GPP Policy Ecosystem

Within 3GPP, a framework has been defined for Policy Management and Policy Enforcement:

With the policy framework established by 3GPP, a management layer and an enforcement layer were created to control user behavior and network provisioning. The Policy and Charging Rules Function, or PCRF, was established as the policy decision point that establishes the policies that are applied to subscribers and mobile data traffic on the network. The management layer on the network has specifically defined protocols for interacting with the network layer to translate the policy decisions into policy enforcement.

The policy enforcement layer on the network is designed to enforce policies as instructed by the policy management layer. However, different devices on the network have different levels of visibility and intelligence, translating to different capabilities for enforcing policies. More intelligent network elements can implement more sophisticated policies. Sophisticated policies go far beyond simple byte counters or session timers that are used today and can include subscriber, location, device and application awareness. Awareness gives a powerful advantage in the policy enforcement and billing ecosystem in that policy enforcement “instructions” for highly aware network elements can be much simpler than for “un-aware” enforcement points. A contrasting example of this scenario would be if a PCRF is informed of congestion on a specific location, an intelligent policy enforcement point could be passed an instruction to “prioritize real-time applications at Site A”, where an un-aware enforcement point would need to pass a number of new rules that might match specific devices and flows using access control lists, or a much less sophisticated congestion management policy that might make all users equally unhappy. The signaling load on the network will be considerably lower on an intelligent network than on an unaware network, as intelligent systems have a greater awareness of location, devices and applications for each active subscriber on the network.

IPE enables mobile and broadband network operators to provide exceptional levels of personalization, service optimization, network assurance and rapid creation of business models to monetize network investments. IPE uses Deep Packet Inspection, or DPI, technology as the core technology to gain awareness of subscribers, location, devices and applications. This awareness can then be used with the 3GPP policy ecosystem to deliver superior collection of services and applications to mobile and broadband networks. Features of IPE include:

Business Intelligence – Monitors application and usage trends in order to offer more compelling service packages to subscribers in a timely fashion. The ability to innovate applications and service bundles includes creating new services targeted to specific consumer groups, age groups or application users with fast time to market with minimal cost.

Network Optimization – Ensures that network resources are used most effectively throughout the network, including high touch services for high usage subscribers and formatted for specific device types. Included in network optimization is the ability to manage network congestion by understanding the root cause for the congestion and effectively resolving it to deliver higher QoE to subscribers without excessive capital expenditures.

Network Protection – Reacts quickly to network threats and attacks to minimize subscriber impact and QoE, as well as protects network integrity.

Bill Shock Prevention – Prevents user churn due to excessive roaming charges, data usage or distributed denial of service attacks that can inflate a subscriber’s bill.

Industry Growth Catalysts

According to Infonetics Research, the market for IPE products is expected to grow from $249 million in 2009 to $1.5 billion in 2014, a CAGR of 44%. The increasing necessity for Policy Management and IPE will be spurred by growing subscriber demand for mobile content and applications, coupled with the network operators’ need to control usage, cost and create new personalized services. Growth will be aided in part by:

Increase in global broadband users – Broadband connectivity has become ubiquitous, particularly as developing markets continue to gain broadband access. According to reports by Gartner and International Data Corporation, or IDC, the total number of broadband users, both mobile and fixed broadband, is expected to increase from 498 million at the end of 2010 to approximately 1.1 billion by 2014, a CAGR of 23%. This is primarily driven by the growth in mobile broadband users, expected to grow at a CAGR of 143% to 487 million connections. This increase in the number of broadband users is placing significant stress on bandwidth capacity. Operators need to implement new tiered service plans and business models that utilize Policy Management and IPE solutions in order to effectively manage their user growth and sustain a high level of QoS.

Device penetration – Mobile network operators have made significant investments in new technology to increase network performance and alleviate bandwidth congestion. At the same time, new mobile devices, including smartphones and tablets, are being introduced to take advantage of higher capacity 3G and LTE networks. IDC forecasts that smartphone shipments will increase from 293 million in 2010 to 702 million in 2014, a CAGR of 24%. Over the same period, Gartner predicts that tablets will increase from 21 million in 2010 to 208 million in 2014, a CAGR of 78%. Unlike legacy devices, new smartphones and tablets are designed to take advantage of data-intensive services, like video and gaming, which will deplete available capacity. Mobile network operators need to adopt Policy Management and IPE solutions that provide more sophisticated network control and include subscriber, location, device and application awareness.

Competitive pressure across network operators – The competition among network operators continues to increase as they battle for the latest generation of broadband users and seek to capture new revenue opportunities. It is incumbent upon network operators to simultaneously upgrade their networks and improve user QoS and QoE to grow their subscriber base. Operators who adapt best to the evolving requirements of their users with more flexible business models and service plans will be well positioned to attract and retain subscribers. In order to do so, operators will need to integrate Policy Management and IPE solutions into their existing network infrastructure.

Industry Challenges

The industry is also faced with a number of challenges as an increasing amount of bandwidth is necessary to run increasingly sophisticated and data-intense applications. These network operator challenges include:

De-coupling of usage and revenue – Over the last few years, network capacity and service speeds have increased along with progressively sophisticated edge devices connected to the network such as smartphones, tablets and laptops, resulting in a tremendous surge of network traffic. A large catalyst of this surge is the ease of capture, ingestion and delivery of video, coupled with emerging business models for video publishing. In addition, new business models and the increasing popularity of applications have turned mobile handsets into mobile entertainment devices. However, this surge in traffic has not been accompanied by a similar rise in revenue in large part due to unlimited usage subscriptions and application models that have circumvented the carrier billing system, excluding the service providers’ revenue participation.

Multiple devices per user – As the New Digital Lifestyle becomes more pervasive, users in developed markets are increasingly adopting sophisticated devices. In addition to smartphones, a typical user can have multiple devices connected to the network, including tablets, e-readers, netbooks, laptops, televisions, gaming devices, digital music players, cameras and more. This incremental device population is increasing traffic on the network, often without associated revenue.

New data-intensive applications – The advent of smartphones and tablets has enabled an ecosystem of applications that are increasing in popularity among users. Many of these applications are free to download and use, but are very data-intensive. Social networking applications in particular result in constant subscriber connectivity and frequent information synchronization, which translates to higher session counts per user.

Limited service differentiation – Mobile and broadband network operators have been limited in their ability to view and identify network traffic, which has therefore limited their ability to appropriately charge and differentiate themselves by offering advanced services.

Our Technology

The foundational element of our IPE solutions is our Datastream Recognition Definition Language, or DRDL, DPI technology. DRDL facilitates a broad range of criteria to properly identify the application of each individual datastream. The identification relies on bidirectional information including header information, protocol, actual payload and other distinguishing characteristics of an application. This allows DRDL to properly identify even encrypted applications.

The standard-syntax language of DRDL enables rapid development of new signatures. The DRDL database currently consists of approximately 2,000 signatures. DRDL interconnects control and data sessions of protocols like File Transfer Protocol (“FTP”). During the identification process DRDL aggregates detailed traffic properties like Multipurpose Internet Mail Extensions (“MIME”)-type, filename, chat channel and Session Initiation Protocol (“SIP”) caller ID. A unique and integral feature of DRDL is the classification function. Connection flags classify the traffic based on its behavior. Typical classifications are “interactive”, “streaming”, “random-looking” and “bulky”. This enables operators to set preferences on unidentifiable traffic or when they need to be application agnostic.

Our technology has several advantages that we extend to our mobile and broadband network operator customers, including:

Service Flexibility – Our DRDL technology allows for a high degree of service flexibility. Our Subscriber Model is highly configurable to meet the varying needs of our customer base. We also enable our customers to provide mass personalization for their subscriber base, creating and delivering services based on individual customer needs and behaviors. Lastly, we allow our customers to provide tiered service levels based on usage or by application.

Granular Accuracy – We also have deep visibility into our customers’ networks, providing visibility to a subscriber level to determine location and device usage to enable a high degree of personalization and customer service. It also allows our customers to enforce policies on their network.

Performance & Scalability – Our DRDL technology is extremely robust and has industry-leading performance that supports millions of subscribers and tens of thousands of transactions per second.

Real-Time Analytics – All of our analytics are delivered in real-time, providing up-to-the-second visibility to our customers of subscriber location, behavior and activity. This allows our customers to deliver a high degree of QoS to their subscribers and manage network capacity. Our technology delivers detailed business intelligence and reports, and has deep application visibility.

Our Products & Solutions

We deliver IPE solutions for network operators, leveraging our industry-leading DRDL DPI technology. We believe our family of PacketLogic solutions is one of the engines that can drive the New Digital Lifestyle. Our solutions empower broadband providers with the ability to support more subscribers and services on their network with high performing and highly-scalable IPE systems. Our IPE solutions support deep levels of awareness and a broad universe of applications, enabling richer services to be offered to consumers. Our analytics provide highly relevant business intelligence reports that enable broadband and mobile operators to better understand consumer trends and rapidly respond to the dynamic application landscape.

Product Lines

Our IPE solutions are powered by our three main product lines:

PacketLogic Subscriber Manager (PSM) – Our PSM solution integrates PacketLogic with subscriber, charging and policy management systems. This integration enables IPE and the creation of innovative services based on user, location and device awareness. Personalized services can be created to attract new customers, minimize churn and increase average revenue per user through value-add services. Location awareness permits mobile operators to resolve or avoid congestion, enhancing the user-experience and minimizing capital expenses. It can also control roaming costs through automatic policy enforcement to comply with governmental regulations.

PacketLogic Intelligence Center (PIC) – Our PIC enables visualization of the application and subscriber intelligence gathered by our PacketLogic systems. Leveraging the subscriber and location awareness provided by the PSM and the application intelligence provided by our real-time enforcement platform, the PIC is able to present a wealth of information to the network operator based on the behavior of their network. The intelligence can be presented in a multi-dimensional format, with per user, application, location and device views available for business intelligence and planning. The PIC gives network managers access to relevant network traffic intelligence that facilitates network optimization, creation of appealing services and protection against malicious behavior.

PacketLogic Real-Time Enforcement Platform (PRE) – Our PRE solution utilizes multiple hardware platforms that run the same operating software. Each of the platforms offers consistent and enriched features through our PacketLogic software. The PacketLogic hardware platforms offer a range of configurations from the entry-level 200 Mbps PL5600 to the 2 Gbps PL7720. The PL8720 is a 2 rack unit with up to 15Gbps throughput, and the PL8820 is a 2RU unit with up to 30Gbps throughput. At the top of the line is the high-end PL10000 series with capacity up to 120 Gbps and 10 million subscribers per system. It consists of a modular AdvancedTCA chassis solution in two sizes – PL10005 5RU and PL10014 12RU.

Product Features

Our IPE solutions provide a deep visualization of network traffic and subscriber behavior that enables our customers to provide high QoS to their subscribers, both by maintaining network integrity and performance, as well as deploying new services demanded by their subscribers and creating additional revenue opportunities. Our product features include the following:

Awareness – Enabling the New Digital Lifestyle requires superior awareness of subscribers’ characteristics and behaviors to ensure that a high level of QoE is delivered. These characteristics and behaviors include subscriber location, device and application usage. Our solutions provide a high level of visibility through our DRDL traffic classification engine and the interaction with our PSM, which delivers comprehensive subscriber, location and device awareness.

Analysis – Mobile and broadband network operators require detailed reporting of subscriber behavior and evolving consumer trends. Our PIC ensures that mobile and broadband network operators understand what applications are most prevalent among their user base, where those applications are utilized most frequently and how changes in service plans affect network congestion. PIC delivers succinct, digestible and customizable reports that drive profitable services and efficient network management.

Control – Through our IPE solution we provide alternative service creation and congestion management for mobile and broadband network operators. Our solutions are designed for maximum implementation flexibility, and can be customized for each deployment to fit the business, financial and regulatory needs of each network operator.

Product Benefits

Our solutions provide many benefits to our broadband and mobile customers.

Superior Accuracy – Our proprietary DRDL software solution allows us to provide our customers with a high degree of application identification accuracy and the flexibility to regularly update our software to keep up with the rapid introduction of new applications.

Higher Scalability – Our family of products is scalable from a few hundred megabits to 120 gigabits of traffic per second, up to 10 million subscribers and up to 120 million simultaneous data flows, which is critical to service providers as they upgrade to LTE (enabling higher bandwidth mobile phone networks), FTTX (high bandwidth fiber to the home or neighborhood used by telecom broadband network providers) and DOCSIS 3.0 (a high bandwidth broadband cable standard) technologies in the access network.

Platform Flexibility – Our products are deployable in many locations in the network and leverage off-the-shelf hardware. Our products can rapidly leverage advances in computing technology which we believe to be a better solution than those that are dependent upon specific network silicon processors or hardware platforms.

Global Services

Our products and solutions are supported by our Global Services team that provides a suite of services that include both pre- and post-sales technical support to our direct field sales organization, channel partners and customers; professional services for planning, implementation and deployment; customer services for support post-deployment; training for our customers to maximize use of our IPE products and solutions; and consulting services to assist in all service phases from initial planning and evaluation to onsite testing and operation. Customers also have access to the technical support team via a web-based partner portal, email and interactive chat forum. Issues are logged and tracked using a computerized tracking system that provides automatic levels of escalation and quick visibility into problems by our Research and Development organization. This tracking system also provides input to our development team for new feature requests from our worldwide customer base.

Limitations of Alternative Solutions

We believe that first-generation IPE products have significant deficiencies, perhaps the greatest of which is their limited ability to accurately identify traffic types and applications. Because the first-generation IPE products provide limited visibility into traffic flows, they provide a limited ability to manage network traffic. First-generation IPE products were a good start at introducing network operators to the value of network visibility, and introduced the opportunity to provide some level of differentiated services. As applications have become more complex and increasingly web-based, differentiating between applications has become more challenging to products that have limited application signatures used to identify network traffic and less sophisticated application identification mechanisms.

Growth Strategy

Our goal is to become the leading provider of IPE solutions to mobile and broadband network operators on a global scale. We believe our PacketLogic solutions position us to capture an increasing share of the growing IPE market. We plan to achieve our strategic growth objectives through the following efforts:

Expand our technology advantage – Our technology was designed with the ability to rapidly identify new application signatures, and thereby adapt to a dynamic IP network environment across multiple hardware platforms. We are further developing our products and solutions based on feedback from our customers and industry experts as well as our ongoing research and development of technology, products and solutions that we believe will add value to our customers. We intend to build upon our innovations, continue to release leading-edge products with state-of-the-art capabilities and regularly release new solution features and performance upgrades.

Expand our customer footprint with leading mobile and broadband network operators – Our PacketLogic product line provides us with a solution that can address the network needs of leading mobile and broadband network operators. We have built a team with deep network operator experience, both from a technology perspective and from selling into network operators. We have experienced significant traction in the network operator space, and these achievements have provided us with improved access to potential customers and valuable references, which we believe will continue to enhance our sales growth effort. In addition, we intend to increase our indirect distribution channel. We intend to utilize existing value added reseller partners and to add new partners to increase our ability to address geographic regions and a greater quantity of customers.

Pursue new partnerships – We intend to establish partnerships with complementary mobile packet core ecosystem vendors to increase the value we can provide and gain additional access to leading mobile and broadband network operators. We intend to provide broader solutions by bundling our products with complementary products and technologies from other solution providers. The flexibility of our software platform has the potential to efficiently integrate with complementary solutions and thereby deliver greater benefits to our customers and enhance our ability to compete against competitors whose solutions are more hardware constrained.

Maximize opportunities with existing customers by increasing our share within their network footprint – We seek to increase our market share within our existing customers’ networks by expanding our product footprint within these networks. Typically, our first order from a new network operator represents a small portion of their total network as measured by either a single product function or by geography. We believe we can successfully sell additional solutions to our existing customers following their initial purchase as they realize the benefits of our products and seek to extend their IPE capabilities throughout their networks. In addition, many service providers operate dual networks (i.e., mobile and broadband) and in these instances, we believe there are opportunities for us to offer our solutions for each network. We have many captive mobile and broadband network operators that are well positioned to increase service creation and network performance. We believe we are well positioned to experience tremendous growth with these customers as they build out their capabilities and infrastructure.

Customers

We sell our products and solutions directly and indirectly to our end-customers. As of December 31, 2010, we had over 600 customers throughout North America, Europe and Asia. Our customers are mobile and broadband network operators. Broadband network operators include MSOs, telecommunications companies, ISPs and private network operators. Our customers either serve subscriber customers or operate private networks such as a university campus, or enterprise or government agency networks.

Our current customers and anticipated future customers include the following:

Mobile Network Operators – Mobile network operators are constrained by the bandwidth of their wireless signals and infrastructure. Additional upgrades in bandwidth and network infrastructure are immediately consumed by new applications and devices that place greater stress on the network. Managing network traffic and broadband usage more intelligently can greatly improve QoS and QoE for subscribers and save significant resources for operators.

MSOs – MSOs are constrained by the bandwidth of their network and the varying number of users connecting to any given loop in the network. Controlling network traffic by application type can greatly improve the quality of the experience of the average subscriber.

Fixed-Line Telecommunications Network Operators – Fixed-line telecommunications network operators use fiber infrastructure or digital subscriber lines to offer broadband services to end customers. Many fixed-line telecommunications network operators also operate mobile networks and provide either bundled service to end customers or mobile and broadband service on a stand-alone basis. These service bundles are increasingly including video services as networks increase in capacity and capabilities. Adding intelligence to their networks can help them offer differentiated services.

ISPs – ISPs generally lease, rather than own, access infrastructure. They compete by attempting to offer the best of breed Internet service. ISPs' greatest competitive advantages are brand and customer relationships. IPE solutions can improve the performance of ISPs by making the use of their bandwidth more efficient and by allowing them to offer best of breed quality.

Education, Business and Government Entities – Universities generally provide Internet access to students, faculty and employees. Universities are particularly vulnerable to low QoS for legitimate educational purposes because students frequently make extensive use of high-bandwidth applications such as peer-to-peer services. Businesses and government entities rely on large and complex networks for communication infrastructure. They typically rely on service providers for Internet access and interconnectivity, and can use IPE to optimize the use of their expensive network resources, prioritize business critical applications and limit leisure or unauthorized use of expensive network resources.

We are currently not dependent on any single customer. For the years ended December 31, 2010 and 2009, revenue from one customer (Cox Communications, Inc.) represented 11% and 44% of net revenues, respectively, with no other single customer accounting for more than 10% of net revenues. For the year ended December 31, 2008, revenue from two customers represented 16% and 10% of net revenues, respectively, with no other single customer accounting for more than 10% of net revenues.

Foreign Operations

Sales made to customers located outside the United States as a percentage of total net revenues were 41%, 38% and 82% for the years ended December 31, 2010, 2009 and 2008, respectively. Revenues derived from foreign sales generally are subject to additional risks such as fluctuations in exchange rates, tariffs, the imposition of other trade barriers, and potential currency restrictions. To date, however, the Company has experienced no notable burden from such risks. Further information regarding our foreign operations, as required by Item 101(d) of Regulation S-K, can be found in the Consolidated Financial Statements and related notes herein.

Partners

We have established critical technology, distribution and business partnerships to further promote our brand and suite of solutions for network operators. We believe our partnerships provide an immediate opportunity to extend our capabilities into adjacent, complimentary points within the mobile packet core and broadband core. For example, we recently announced a joint solution with one of our key technology partners that provides integrated policy management and PCRF functionality on top of our IPE platform.

Competition

The market for our products and services is highly competitive as mobile and broadband network operators seek to manage the rapid growth of data on both broadband and mobile networks. Our primary competitors include:

|

|

·

|

Allot Communications Ltd.;

|

|

|

·

|

Arbor Networks (acquired by Tektronix);

|

|

|

·

|

Blue Coat Systems;

|

|

|

·

|

Cisco Systems, Inc.;

|

|

|

·

|

Cloudshield Technologies (acquired by SAIC); and

|

|

|

·

|

Sandvine Corporation.

|

We also face competition from vendors supplying platform products with some limited IPE functionality, such as switches & routers, session border controllers and VoIP switches. In addition, we face competition from large integrators that package third-party IPE solutions into their products, including Alcatel-Lucent, Ericsson, Huawei Technologies Company and Nokia Siemens. It is possible that these companies will develop their own IPE solutions or strategically acquire existing IPE vendors in the future.

Most of our competitors are larger and have greater access to capital than we do. Nevertheless, we do not believe there is an entrenched dominant supplier in our market. We believe that our technological advantages provide an opportunity for us to capture increased market share and benefit from the expected growth in the IPE market. Given the lack of an established leader and the potential growth in the market, we expect competition to intensify.

Our primary method of differentiation from our competition is our IPE DRDL technology, which we believe to be a superior solution that enables service providers advanced identification of network traffic. However, we also believe we effectively compete with respect to price and service. Our products now address service provider requirements ranging from four megabit (edge applications) to the 120 gigabit per second market (core applications).

Sales and Marketing

We use a combination of direct sales and channel partnerships to sell our products and services. As of December 31, 2010, we had 20 employees in Sales and channel partners worldwide, including one of the largest original equipment manufacturers globally. We also engage a worldwide network of value added resellers to reach particular geographic regions and markets.

Our marketing organization is focused on building our brand awareness, managing channel marketing efforts and supporting our sales force in additional capacities. As of December 31, 2010, we had 4 marketing professionals globally.

Research and Development

We have built a team of skilled software programmers who continue to develop enhancements to our PacketLogic modules and proprietary DRDL processing software engine. We have enhanced our products with features and functionality to address the needs of mobile and broadband network operators, as well as to provide new functionality for network protection and subscriber management. As of December 31, 2010 we had 25 employees in research and development. Substantially all of our research and development is performed by our employees in Sweden. Our research and development costs were $3.3 million, $2.6 million and $3.3 million for the years ended December 31, 2010, 2009 and 2008, respectively.

Intellectual Property

Our intellectual property is central to our competitive position and our future success will depend on our continued ability to protect our core technologies. We believe that our DRDL signature compiler, and the inherent complexity of our software-based PacketLogic solution, makes it difficult to copy or replicate our features. We rely primarily on trademark law, trade secret protection and contractual rights to protect our intellectual property in our proprietary software. To help ensure this protection, we include proprietary information and confidentiality provisions in our agreements with customers, third parties and employees.

Manufacturing

We outsource the manufacturing of our hardware and software to a select group of contract manufacturing partners. We have negotiated minimum production quantities and lead times in our contracts to prevent supply shortages. We or our manufacturing partners will then load our proprietary software for specific orders, final testing and fulfillment. We believe that our manufacturing process allows us to focus on development of our PacketLogic software solution, reduce manufacturing costs and more quickly adjust to changes in demand. We have not historically experienced any production capacity shortages and do not foresee a need to alter our manufacturing process in the future.

We source completed hardware boards and chassis included in our products from leading industry suppliers, including Continuous Computing Corporation, Advantech Technologies Inc, and Lanner Electronics, Inc. All of the hardware used in our products is comprised of standard off-the-shelf components which are less susceptible to supply shortages and significant lead times. We believe our reliance on standard hardware components facilitates quicker time to market, rapid design cycles and the ability to take advantage of the latest semiconductor industry advances.

Employees

As of December 31, 2010, we had 63 full-time employees and 7 full-time independent contractors, including 7 operations and technical support employees, 25 research and development employees, 24 sales and marketing employees and 7 employees in general and administrative. As of December 31, 2010, our headcount was 22 employees in the United States, 37 employees in Sweden, and 4 employees in Australia, Singapore and Korea.

Our Executive Officers and Significant Employees

Set forth below are the name, age, position(s), and a description of the business experience of each of our executive officers and significant employees as of March 10, 2011:

|

Name

|

Age

|

|

Position(s)

|

Employee Since

|

|

James F. Brear

|

45

|

|

President, Chief Executive Officer and Director (Principal Executive Officer)

|

2008

|

|

Charles Constanti

|

47

|

|

Vice President and Chief Financial Officer (Principal Financial & Accounting Officer)

|

2009

|

|

Alexander Hдvang

|

32

|

|

Chief Technical Officer

|

2006

|

|

Paul Gracie

|

50

|

|

Vice President, Sales-Europe, Middle East & Africa (EMEA)

|

2009

|

|

Jon Lindйn

|

36

|

|

Vice President, Marketing

|

2008

|

|

David Ahee

|

44

|

|

Vice President, Sales-Americas

|

2009

|

|

Benjamin Teh

|

37

|

Vice President, Sales-Asia Pacific & China (APAC)

|

2010

|

James F. Brear joined us as our President, Chief Executive Officer and a member of our Board of Directors in February 2008. Mr. Brear is an industry veteran with more than 20 years of experience in the networking industry, most recently as Vice President of Worldwide Sales and Support for Bivio Networks, a maker of deep packet inspection platform technology, from July 2006 to January 2008. From September 2004 to July 2006, Mr. Brear was Vice President of Worldwide Sales for Tasman Networks, a maker of converged WAN solutions for enterprise branch offices and service providers for managed WAN services. From April 2004 to July 2004, Mr. Brear served as Vice President of Sales at Foundry Networks, a provider of switching, routing, security and application traffic management solutions. Earlier in his career, Mr. Brear was the Vice President of Worldwide Sales for Force10 Networks from March 2002 to April 2004, during which time the company grew from a pre-revenue start-up to the industry leader in switch routers for high performance Gigabit and 10 Gigabit Ethernet. In addition, he spent five years with Cisco Systems from July 1997 to March 2002 where he held senior management positions in Europe and North America with responsibility for delivering more than $750 million in annual revenues selling into the world's largest service providers. Previously, Mr. Brear held a variety of sales management positions at both IBM and Sprint Communications. He holds a Bachelor of Arts degree from the University of California at Berkeley.

Charles Constanti joined us as our Chief Financial Officer in May 2009 and has over 25 years of public company financial experience. Most recently, Mr. Constanti was the vice president and CFO of Netopia, Inc., a telecommunications equipment and software company, from April 2005 until its acquisition in February 2007 by Motorola, Inc., where he held a senior finance position until May 2009. From May 2001 to April 2005, Mr. Constanti was the vice president and corporate controller of Quantum Corporation, for which he earlier served in different accounting and finance positions since January 1997. Previously, Mr. Constanti held various finance positions at BankAmerica Corporation and was an auditor for PricewaterhouseCoopers. Mr. Constanti is a certified public accountant. He earned a B.S., magna cum laude, in Accounting from Binghamton University.

Alexander Haväng has been our Chief Technology Officer since August 2006 when we acquired Netintact AB. Mr. Haväng was a founder of Netintact AB, which was formed in August 2000. Mr. Haväng is responsible for our strategic technology direction. Mr. Haväng is widely known and a respected authority in the open source community, and is the lead architect for PacketLogic. Earlier in his career, Mr. Haväng was one of the chief architects for the open source streaming server software Icecast, along with the secure file transfer protocol GSTP. Mr. Haväng studied computer science at the Linköping University in Sweden.

Paul Gracie joined us in September 2009 as our Vice President of Sales in EMEA and has over 20 years of senior-level sales and management experience in the IT industry. Most recently, Mr. Gracie was the Vice President of Sales at Fortinet Inc. Previously, Mr. Gracie served as Vice President of EMEA sales for Bivio Networks supplying Open Source DPI appliances to leading EMEA information security solutions vendors. He was also Vice President of EMEA at Silver Peak Systems and Redline Networks. Mr. Gracie’s career in IT began with Case Communications; he later joined Bay Networks, a leading routing and switching vendor, which was acquired by Nortel Networks. Following this, he became the top European sales performer at ArrowPoint Communications, which was subsequently acquired by Cisco Systems.

Jon Lindén has been our Vice President of Marketing since January 2008. Mr. Lindén joined us in August 2006 as part of the acquisition of Netintact AB, a company he joined in 2001. Mr. Lindén has a background in sales and business development with experience in managing networking products throughout their lifecycle. Prior to joining Netintact, Mr. Lindén was the Chief Executive Officer of the venture-funded company TheSchoolbook.com from 1999 to 2001, and managed sales and marketing at a content management software company from 1998 to 1999. He was project manager at the Swedish Trade Council in Chicago from 1997 to 1998.

David Ahee joined us in January 2009 as our Vice President of Sales in the Americas and has over 20 years of sales and sales management experience in working with mobile, fixed, and cable operators worldwide, as well as large enterprises and OEMs/channels on a global basis. Most recently, Mr. Ahee served as Vice President of Worldwide Sales for Aylus Networks. Previously, Mr. Ahee served as Vice President of Worldwide Sales and Business Development at Auspice, prior to its acquisition by Arris. Mr. Ahee managed Sales at ThinkEngine Networks where he played a key role in the acquisition of the company by Cognitronics. Mr. Ahee served as Vice President of Worldwide Sales at Nexsi Systems, and as Vice President of North American Sales for Unisphere Networks (now part of Juniper Networks), where he grew revenues from zero to $60 million. Earlier, Mr. Ahee was with Ascend Communications, Newbridge Networks, and ROLM. Mr. Ahee holds a B.S. in Marketing with high honors from Wayne State University.

Benjamin Teh joined us in April 2010 as Vice President of Sales for the Asia Pacific and China (“APAC”) region. Mr. Teh has over 15 years of sales management experience in the computer networking industry, with experience in building sales teams, developing channel partner relationships, and growing revenue within the APAC region. Prior to joining Procera, Mr. Teh served as Regional Sales Director for Fortinet for over six years, supplying advanced network security products to telecommunication companies, education, financial institutions and regional enterprises. As one of the first employees for Fortinet in APAC, Mr. Teh created a strong brand and developed a channel program in the region. Previously, Mr. Teh served as Regional Sales Director at a business security pioneer, Watchguard Technologies, where he built up a sales presence in the APAC region by establishing high sales volume accounts. Mr. Teh holds a Bachelor of Science degree from La Trobe University in Melbourne, Australia.

Available information

Our annual reports on Form 10-K, our quarterly reports on Form 10-Q and our current reports on Form 8-K, and all amendments to those reports, filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, are available free of charge on our website at www.proceranetworks.com as soon as reasonably practicable after we file such reports with the Securities and Exchange Commission (the “SEC”).

The SEC also maintains a website containing reports, proxy and information statements, annual filings and other relevant information available free of charge to the public at www.sec.gov.

|

Risk Factors

|

You should carefully consider the risks described below, together with all of the other information included in this Annual Report on Form 10-K, in considering our business and prospects. Set forth below and elsewhere in this report and in other documents we file with the SEC are descriptions of the risks and uncertainties that could cause our actual results to differ materially from the results contemplated by the forward-looking statements contained in this report. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations. Each of these risk factors could adversely affect our business, operating results and financial condition, as well as adversely affect the value of an investment in our common stock.

Risks Related to Our Business

We expect to incur losses in future periods.

For the years ended December 31, 2010, 2009 and 2008, we incurred losses from operations of approximately $2.7 million, $6.2 million and $15.0 million, respectively. We expect to continue to incur losses from operations in future periods. Any profitability we may achieve in the future may not be indicative of sustained profitability. Any losses incurred in the future may result primarily from increased costs related to continued investments in sales and marketing, product development and administrative expenses. If our revenue growth does not occur or is slower than anticipated or our operating expenses exceed expectations, our losses will be greater. We may never achieve profitability.

Our PacketLogic family of products is our only product line. All of our current revenues and a significant portion of our future growth depend on our ability to continue its commercialization.

All of our current revenues and much of our anticipated future growth depend on the development, introduction and market acceptance of new and enhanced products in our PacketLogic product line that address additional market requirements in a timely and cost-effective manner. In the past, we have experienced delays in product development and such delays may occur in the future. We do not currently have plans or resources to develop additional product lines, and as a result, our future growth will largely be determined by market acceptance of our PacketLogic product line.

If additional customers do not adopt, purchase and deploy our PacketLogic products, our revenues will not grow and may decline. In addition, when we announce new products or product enhancements that have the potential to replace or shorten the life cycle of our existing products, customers may defer purchasing our existing products. These actions could harm our operating results by unexpectedly decreasing sales and exposing us to greater risk of product obsolescence.

We need to increase the functionality of our products and offer additional features in order to be competitive.

The market in which we operate is highly competitive and unless we continue to enhance the functionality of our products and add additional features, our competitive position may deteriorate and the average selling prices for our products may decrease over time. Such a decrease could result from the introduction of competing products and from the standardization of DPI technology. To counter this trend, we endeavor to enhance our products by offering higher system speeds and additional features, such as additional protection functionality, supporting additional applications and enhanced reporting tools. We may also need to reduce our per unit manufacturing costs at a rate equal to or faster than the rate at which selling prices decline. If we are unable to reduce these costs or to offer increased functionally and features, our results of operations and financial condition may be adversely affected.

If our products contain undetected software or hardware errors or performance deficiencies, we could incur significant unexpected expenses, experience purchase order cancellations and lose sales.

Network products frequently contain undetected software or hardware errors, failures or bugs when new products or new versions or updates of existing products are first released to the marketplace. Because we frequently introduce new versions and updates to our product line, previously unaddressed errors in the accuracy or reliability of our products, or issues with their performance, may arise. We expect that such errors or performance deficiencies will be found from time to time in the future in new or existing products, including the components incorporated therein, after the commencement of commercial shipments. These problems may have a material adverse effect on our business by requiring us to incur significant warranty repair costs and support related replacement costs, diverting the attention of our engineering personnel from new product development efforts, delaying the recognition of revenue and causing significant customer relations problems.

In addition, if our products are not accepted by customers due to software or hardware defects or performance deficiencies, orders contingent upon acceptance may be cancelled, which could result in lost sales opportunities. In this circumstance, or if warranty returns exceed the amount we have accrued for defect returns based on our historical experience, our results of operations and financial condition may be adversely affected.

Our products must properly interface with products from other vendors. As a result, when problems occur in a computer or communications network, it may be difficult to identify the sources of these problems. The occurrence of hardware and software errors, whether or not caused by our products, could result in the delay or loss of market acceptance of our products and any necessary revisions may cause us to incur significant expenses. The occurrence of any such problems would likely have a material adverse effect on our results of operations and financial condition.

We may need to raise further capital, which could dilute or otherwise adversely affect your interest in our company.

We believe that our existing cash, cash equivalents and short term investments, along with the cash that we expect to generate from operations and any required debt financing that management currently believes is available, will be sufficient to meet our anticipated cash needs for working capital and capital expenditures for the next twelve months.

However, a number of factors may negatively impact our level of cash availability and working capital requirements, including, without limitation:

|

|

●

|

lower than anticipated revenues;

|

|

|

●

|

higher than expected cost of goods sold or operating expenses; or

|

|

|

●

|

the inability of our customers to pay for the goods and services ordered.

|

We believe that current general economic conditions and the recent global credit market crisis have created a significantly more difficult environment for obtaining both equity and debt financing. If additional funds are raised through the issuance of equity or convertible debt securities, the percentage ownership of our stockholders will be reduced, stockholders may experience additional dilution and such securities may have rights, preferences and privileges senior to those of our common stock. There can be no assurance that additional financing will be available on terms favorable to us or at all, especially in light of the current economic environment. If adequate funds are not available on acceptable terms, we may not be able to fund expansion, take advantage of unanticipated growth or acquisition opportunities, develop or enhance services or products or respond to competitive pressures. In addition, we may be required to defer or cancel product development programs, lay-off employees and/or take other steps to reduce our operating expenses. Our inability to raise additional financing or the terms of any financing we do raise could have a material adverse effect on our business, results of operations and financial condition.

We have a limited operating history on which to evaluate our company.

The products we sell today are derived primarily from the acquisition of the Netintact companies in 2006. While we have the experience of Netintact operations on a stand-alone basis, we are continuing to determine how to operate most effectively on a combined basis. We have not developed sufficient experience to estimate the scope of the business opportunities that may be achieved from our combined operations.

Furthermore, we have only recently launched many of our products and services on a worldwide basis. Therefore, investors should consider the risks and uncertainties frequently encountered by companies in new and rapidly evolving markets, which include the following:

|

|

●

|

successfully introducing new products and entering new markets;

|

|

|

●

|

successfully servicing and upgrading new products once introduced;

|

|

|

●

|

increasing brand recognition;

|

|

|

●

|

developing strategic relationships and alliances;

|

|

|

●

|

managing expanding operations and sales channels;

|

|

|

●

|

successfully responding to competition; and

|

|

|

●

|

attracting, retaining and motivating qualified personnel.

|

If we are unable to address these risks and uncertainties, our results of operations and financial condition may be adversely affected.

Competition for experienced and skilled personnel is intense and our inability to attract and retain qualified personnel could significantly damage our business.

Our future performance will depend to a significant extent on the ability of our management to operate effectively, both individually and as a group. We are dependent on our ability to attract, retain and motivate high caliber key personnel. We have recently hired new employees and our plans to expand in all areas will require experienced personnel to augment our current staff. We expect to recruit experienced professionals in such areas as software and hardware development, sales, technical support, product marketing and management. We currently plan to expand our indirect channel partner program and we need to attract qualified business partners to broaden these sales channels. Economic conditions may result in significant competition for qualified personnel and we may not be able to attract and retain such personnel. Our business may suffer if we encounter material delays in hiring additional personnel.

Our performance is substantially dependent on the continued services and on the performance of our executive officers and other key employees, including our Chief Executive Officer, James Brear, and our Chief Technical Officer, Alexander Haväng. Mr. Brear joined the Company and became our Chief Executive Officer in February 2008. The loss of the services of any of our executive officers or other key employees could materially and adversely affect our business. We believe we will need to attract, retain and motivate talented management and other highly skilled employees in order to execute on our business plan. We may be unable to retain our key employees or attract, assimilate and retain other highly qualified employees in the future. Competitors and others have in the past, and may in the future, attempt to recruit our employees. In California, where we are headquartered, non-competition agreements with employees generally are unenforceable. As a result, if an employee based in California leaves the Company for any reason, he or she will generally be able to begin employment with one of our competitors or otherwise to compete immediately against us.

We currently do not have key person insurance in place. If we lose one of our key officers, we must attract, hire, and retain an equally competent person to take his or her place. There is no assurance that we would be able to find such an employee in a timely fashion. If we fail to recruit an equally qualified replacement or incur a significant delay, our business plans may slow down. We could fail to implement our strategy or lose sales and marketing and development momentum.

Failure to expand our sales teams or educate them about technologies and our product families may harm our operating results.

The sale of our products requires a multi-faceted approach directed at several levels within a prospective customer’s organization. We may not be able to increase net revenue unless we expand our sales teams to address all of the customer requirements necessary to sell our products. We expect to continue hiring in sales and marketing, but there can be no assurance that personnel additions will have a positive effect on our business.

We cannot assure you that we will be able to successfully integrate new employees into the Company or to educate current and future employees with regard to rapidly evolving technologies and our product families. Failure to do so may hurt our revenue growth and operating results.

Increased customer demands on our technical support services may adversely affect our relationships with our customers and our financial results.

We offer technical support services with our products. We may be unable to respond quickly enough to accommodate short-term increases in customer demand for support services. We also may be unable to modify the format of our support services to compete with changes in support services offered by our competitors. Further customer demand for these services, without corresponding revenues, could increase costs and adversely affect our operating results. If we experience financial difficulties, do not maintain sufficiently skilled workers and resources to satisfy our contracts, or otherwise fail to perform at a sufficient level under these contracts, the level of support services to our customers may be significantly disrupted, which could materially harm our relationships with these customers and our results of operations.

We must continue to develop and increase the productivity of our indirect distribution channels to increase net revenue and improve our operating results.

A key focus of our distribution strategy is developing and increasing the productivity of our indirect distribution channels through resellers and distributors. If we fail to develop and cultivate relationships with significant resellers, or if these resellers are not able to execute on their sales efforts, sales of our products may decrease and our operating results could suffer. Many of our resellers also sell products from other vendors that compete with our products. We cannot assure you that we will be able to enter into additional reseller and/or distribution agreements or that we will be able to manage our product sales channels. Our failure to do any of these could limit our ability to grow or sustain revenue. In addition, our operating results will likely fluctuate significantly depending on the timing and amount of orders from our resellers. We cannot assure you that our resellers and/or distributors will continue to market or sell our products effectively or continue to devote the resources necessary to provide us with effective sales, marketing and technical support. Such failure would negatively affect revenue and our potential to achieve profitability.

We may be unable to compete effectively with competitors which are substantially larger and more established and have greater resources.

In our rapidly evolving and highly competitive market, we compete on the price as well as the performance of our products. We expect competition to remain intense in the future. Increased competition could result in reduced prices and gross margins for our products and could require increased spending by us on research and development, sales and marketing and customer support, any of which could have a negative financial impact on our business. We compete with Allot Communications, Arbor Networks, Blue Coat Systems, Brocade Communications Systems, Cloudshield Technologies, Cisco Systems, Ericsson, Huawei Technologies Company, Juniper Networks, and Sandvine Corporation, as well as other companies which sell products incorporating competing technologies. In addition, our products and technology compete with other types of products that offer monitoring capabilities, such as probes and related software. We also face indirect competition from companies that offer broadband service providers increased bandwidth and infrastructure upgrades that increase the capacity of their networks, which may lessen or delay the need for bandwidth management solutions.

Most of our competitors are substantially larger than we are and have significantly greater name recognition and financial, sales and marketing, technical, manufacturing and other resources and more established distribution channels than we do. In addition, some potential customers have in the past advised us that we were not able to compete for their business due to concerns about our financial condition. While we have attempted to address balance sheet concerns with our recent financing activities, it is possible that a potential customer could raise similar concerns in the future. Our competitors may be able to respond more rapidly to new or emerging technologies and changes in customer requirements or devote greater resources to the development, promotion and sale of their products than we can. Furthermore, prospective customers often have expressed greater confidence in the product offerings of our competitors. Some of our competitors may make acquisitions or establish strategic relationships that may increase their ability to rapidly gain market share by addressing the needs of our prospective customers. Competitors may enter our existing or future markets with solutions that may be less expensive, provide higher performance or provide additional features than our solutions. Given the opportunities in the bandwidth management solutions market, we also expect that other companies may enter with alternative products and technologies, which could reduce the sales or market acceptance of our products and services, perpetuate intense price competition or make our products obsolete. If any technology that is competing with ours is or becomes more reliable, higher performing, less expensive or has other advantages over our technology, then the demand for our products and services would decrease, which would harm our business.

A substantial portion of our revenues may be dependent on a small number of Tier 1 service providers that purchase in large quantities. If we are unable to maintain or replace our relationships with these customers, our revenues may fluctuate and our growth may be limited.

Since 2008, when we first established customer relations with Tier 1 service providers, a significant portion of our revenues has come from a limited number of customers. There can be no guarantee that we will be able to sustain our revenue levels from these customers because their capacity requirements have become or will become fulfilled. For this reason, we do not expect that any single customer will generally remain a significant customer from year to year, and we will need to attract new customers in order to sustain our revenues. In the years ended December 31, 2010 and 2009, revenue from one customer represented 11% and 44% of net revenues, respectively, with no other single customer accounting for more than 10% of net revenue. For the year ended December 31, 2008, revenue from two other customers represented 16% and 10% of net revenues, respectively, with no other single customer accounting for more than 10% of net revenue. The proportion of our revenues derived from a limited number of customers may be even higher in any future year or quarter. If we cannot maintain or replace the customers that purchase large amounts of our products, or if they do not purchase products at the levels or at the times that we anticipate, our ability to maintain or grow our revenues will be adversely affected.

If we are unable to effectively manage our anticipated growth, we may experience operating inefficiencies and have difficulty meeting demand for our products.

We seek to manage our growth so as not to exceed our available capital resources. If our customer base and market grow rapidly, we would need to expand to meet this demand. This expansion could place a significant strain on our management, products and support operations, sales and marketing personnel and other resources, which could harm our business.

If demand for our products and services grows rapidly, we may experience difficulties meeting the demand. For example, the installation and use of our products requires customer training. If we are unable to provide adequate training and support for our products, the implementation process will be longer and customer satisfaction may be lower. In addition, we may not be able to exploit fully the growing market for our products and services. We cannot assure you that our systems, procedures or controls will be adequate to support the anticipated growth in our operations. The failure to meet the challenges presented by rapid customer and market expansion could cause us to miss sales opportunities and otherwise have a negative impact on our sales and profitability.

We may not be able to install management information and control systems in an efficient and timely manner, and our current or planned personnel, systems, procedures and controls may not be adequate to support our future operations.

Unstable market and economic conditions may have serious adverse consequences on our business.