Attached files

| file | filename |

|---|---|

| EX-31.1 - CERTIFICATION - CHINA YIDA HOLDING, CO. | f10k2010ex31i_chinayida.htm |

| EX-32.1 - CERTIFICATION - CHINA YIDA HOLDING, CO. | f10k2010ex32i_chinayida.htm |

| EX-31.2 - CERTIFICATION - CHINA YIDA HOLDING, CO. | f10k2010ex31ii_chinayida.htm |

| EX-32.2 - CERTIFICATION - CHINA YIDA HOLDING, CO. | f10k2010ex32ii_chinayida.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Mark One)

FORM 10-K

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2010

or

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ___________ to ___________

Commission File Number: 000-26777

China Yida Holding, Co.

(Exact name of as specified in its charter)

|

DELAWARE

|

50-0027826

|

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

28/F Yifa Building

No. 111 Wusi Road

Fuzhou, Fujian, P. R. China,

|

350003

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

+86 (591) 2830 8999

(Registrant’s telephone number, including area code)

|

Securities registered pursuant to Section 12(b) of the Act:

|

||

|

Title of each class

|

Name of each exchange on which registered

|

|

|

Common Stock, $0.001 par value per share

|

NASDAQ Capital Market

|

|

|

Securities registered under Section 12(g) of the Act

|

||

Not Applicable

_____________________________________

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [ X ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

Yes [ ] No [ X ]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [ X ] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [ ] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§232.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.[ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

¨

|

Accelerated filer

|

x

|

|

Non-accelerated filer

|

¨

|

Smaller reporting company

|

x

|

|

(Do not check if a smaller reporting company)

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes [ ] No [ X ]

The aggregate market value of the voting and non-voting stock held by non-affiliates of the registrant, as of June 30, 2010, the last business day of the registrant’s most recently completed second fiscal quarter, based on the closing price of the common stock on NASDAQ Capital Market exchange on such date was $120,670,242.

The number of shares outstanding of the registrant’s common stock as of March 15, 2011 was 19,551,785 shares.

DOCUMENTS INCORPORATED BY REFERENCE

|

Document

|

Parts Into Which Incorporated

|

|

|

Registrant’s Proxy Statement for the 2011 Annual Meeting of Stockholders which the registrant plans to file with the Securities and Exchange Commission within 120 days of the registrant’s fiscal year ended December 31, 2010

|

Part III

|

FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2010

|

PAGE

|

||||

|

PART I

|

||||

|

ITEM 1.

|

1

|

|||

|

ITEM 1A.

|

10

|

|||

|

ITEM 1B.

|

20 | |||

|

ITEM 2.

|

20

|

|||

|

ITEM 3.

|

20

|

|||

|

ITEM 4.

|

20

|

|||

|

PART II

|

|

|||

|

ITEM 5.

|

21

|

|||

|

ITEM 6.

|

22

|

|||

|

ITEM 7.

|

22

|

|||

|

ITEM 7A.

|

31

|

|||

|

ITEM 8.

|

31

|

|||

|

ITEM 9.

|

32

|

|||

|

ITEM 9A.

|

32

|

|||

|

ITEM 9B.

|

33

|

|||

|

PART III

|

|

|||

|

ITEM 10.

|

33

|

|||

|

ITEM 11.

|

33

|

|||

|

ITEM 12.

|

33

|

|||

|

ITEM 13.

|

33

|

|||

|

ITEM 14.

|

33

|

|||

|

PART IV

|

||||

|

ITEM 15.

|

34

|

|||

|

35

|

||||

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Except for the historical information contained herein, some of the statements in this Report contain forward-looking statements that involve risks and uncertainties. These statements are found in the sections entitled "Business," "Management's Discussion and Analysis of Financial Condition and Results of Operations," and "Risk Factors." They include statements concerning: our business strategy; expectations of market and customer response; liquidity and capital expenditures; future sources of revenues; expansion of our product lines; addition of new product lines; and trends in industry activity generally. In some cases, you can identify forward-looking statements by words such as "may," "will," "should," "expect," "plan," "could," "anticipate," "intend," "believe," "estimate," "predict," "potential," "goal," or "continue" or similar terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including, but not limited to, the risks outlined under "Risk Factors," that may cause our or our industry's actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. For example, assumptions that could cause actual results to vary materially from future results include, but are not limited to: our ability to successfully develop and market our products to customers; our ability to generate customer demand for our products in our target markets; the development of our target markets and market opportunities; our ability to produce and deliver suitable products at competitive cost; market pricing for our products and for competing products; the extent of increasing competition; technological developments in our target markets and the development of alternate, competing technologies in them; and sales of shares by existing shareholders. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Unless we are required to do so under U.S. federal securities laws or other applicable laws, we do not intend to update or revise any forward-looking statements.

PART I

Corporate Overview

We, together with our subsidiaries, operate as a diversified entertainment company in the People’s Republic of China, headquartered in Fuzhou, Fujian, China. Our business consists of two segments, advertisement and tourism. Our advertisement segment includes the operation and management of a domestic television channel and outdoor on-train programming. This segment manages the content and re-sells airtime to advertisers and agencies for the television channel, and produces the content for outdoor on-train programming. Our tourism segment develops, operates, manages and markets domestic tourist destinations, including natural, cultural, and historical tourist destinations and theme parks. This segment also creates / designs and constructs new tourist concepts, attractions and properties for our tourist destinations.

Our advertisement segment currently operates and manages the Fujian Education Television Channel (“FETV”), a province wide television channel in Fujian, and the “Journey through China on the Train” programming (or the “Railway Media”) on China’s high-speed railway networks.

Our tourism segment currently has three destinations that are open to the public. They are (i) the Great Golden Lake tourist destination (the “Great Golden Lake”, titled with Global Geopark and the part of China Danxia – a World Natural Heritage Site granted by the United Nations Educational, Scientific and Cultural Organization (“UNESCO”)) in Taining County, Fujian, (ii) Yunding Recreational Park (a large-scale recreational park, or the “Yunding Park”) in Yongtai County, Fujian, and (iii) Hua’An Tulou cluster (or the “Earth Buildings” or the “Tulou”, part of Fujian Tulou – a World Cultural Heritage Site granted by UNESCO) in Hua’An County, Fujian.

We also currently have three other destinations that are under the construction. These include, (i) Ming Dynasty Entertainment World (“Ming Dynasty Entertainment World”), a theme park style destination located in Bengbu, Anhui, (ii) the China Yang-sheng (Nourishing Life) Paradise (“Yang-sheng Paradise”), a theme park style destination featuring a rare salt water hot spring located in Zhangshu, Jiangxi, and (iii) the City of Caves (“City of Caves”), an underground natural attraction located in Xinyu, Jiangxi.

To operate our business in China, we need to enter into cooperation agreements with certain China government agencies / branches or government-owned-entities. In 2010, through our various wholly owned subsidiaries in China, we entered into four cooperation agreements. They are (i) an agreement with the Anhui Province Bengbu Municipal Government to obtain land-use-rights and develop, operate and manage Ming Dynasty Entertainment World, (ii) an agreement with Jiangxi Province Zhangshu Municipal Government to obtain land-use-rights and develop, operate and manage Yang-sheng Paradise, (iii) an agreement with Jiangxi Province People’s Government of Fenyi County to develop, operate and manage City of Caves, and (iv) an exclusive management rights agreement with Fujian Education Media Limited Company, a wholly state-owned entity by Fujian Education Television Station, for the operation of FETV with three years exclusive management rights for the operation of FETV with an option to renew for two additional years.

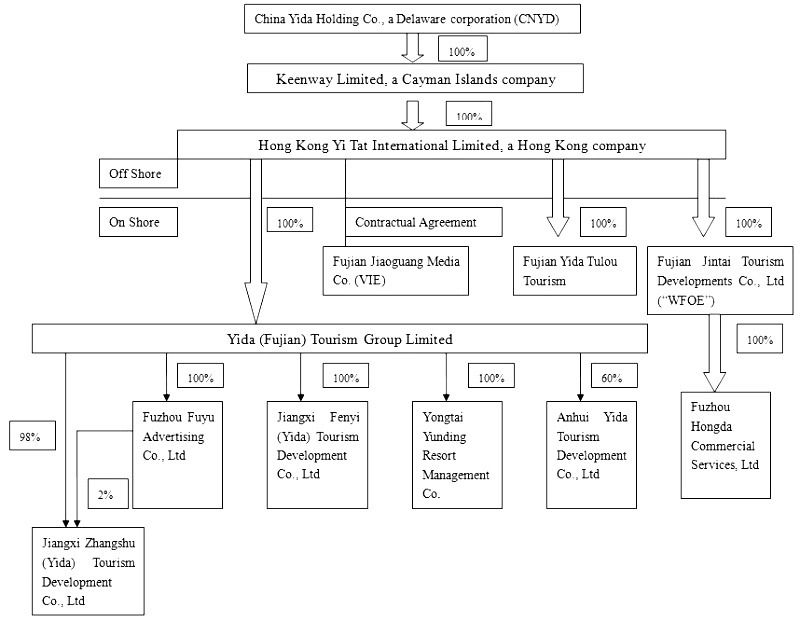

Our Corporate History and Structure

China Yida Holding Co. was organized as a Delaware Corporation in June 4, 1999, formerly known as Apta Holdings, Inc. (“Apta”). Keenway Limited was incorporated under the laws of the Cayman Islands on May 9, 2007 for the purpose of functioning as an off-shore holding company to obtain ownership interests in Hong Kong Yi Tat International Investment Co., Ltd (“Hong Kong Yi Tat”), a company incorporated under the laws of Hong Kong. Immediately prior to the Merger (defined below), Mr. Chen Minhua and his wife, Ms. Fan Yanling, were the majority shareholders of Keenway Limited.

On November 19, 2007, we entered into a share exchange and stock purchase agreement with Keenway Limited, Hong Kong Yi Tat, and the then shareholders of Keenway Limited, including Chen Minhua, Fan Yanling, Zhang Xinchen, Extra Profit International Limited, and Lucky Glory International Limited (collectively, the “Keenway Limited Shareholders”), pursuant to which in exchange for all of their shares of Keenway Limited common stock, the Keenway Limited Shareholders received 90,903,246 newly issued shares of our common stock and 3,641,796 shares of our common stock which were transferred from some of our then existing shareholders (the “Merger”). As a result of the closing of the Merger, the Keenway Limited Shareholders owned approximately 94.5% of our then issued and outstanding shares on a fully diluted basis and Keenway Limited became our wholly owned subsidiary.

Hong Kong Yi Tat was incorporated as the holding company of our operating entities, (i) Fujian Jintai Tourism Development, Co, Ltd. (“Fujian Jintai Tourism”), (ii) Yida (Fujian) Tourism Group., Ltd. (formerly known as, Fujian Yunding Tourism Industrial Co., Ltd.) (“Fujian Yida”), (iii) Fujian Jiaoguang Media, Co., Ltd. (“Fujian Jiaoguang”), and (iv) Fujian Yida Tulou Tourism Development Co. Ltd (“Tulou”). Hong Kong Yi Tat does not have any other operations.

Fujian Jintai Tourism

Fujian Jintai Tourism was formed on October 29, 2001. Its primary business is tourism at the Great Golden Lake. The Company also offers bamboo rafting, parking lot service, photography services and ethnic cultural communications.

Fujian Jintai Tourism has one wholly owned subsidiary, Fuzhou Hongda Commercial Services Co., Ltd, (“Hongda”). Hongda currently does not have any operations. On March 15, 2010, Hongda entered into an equity transfer agreement with Fujian Yida, pursuant to which Fujian Yida acquired 100% of the issued and outstanding shares of Fuzhou Fuyu Advertising Co., Ltd. (“Fuyu”) from Hongda at the aggregate purchase price of RMB 3,000,000. As a result, Fujian Yida became the 100% holding company of Fuyu. Fuyu is engaged in the mass media segment of our business. Its primary business is focused on advertising, including media publishing, television, cultural and artistic communication activities, and performance operation and management activities.

Fujian Jintai Tourism also owned 100% of the ownership interest in Fujian Yintai Tourism Co., Ltd. (“Yintai”). On March 15, 2010 Fujian Jintai Tourism entered into an equity transfer agreement with Fujian Yida, pursuant to which Fujian Yida acquired 100% of the issued and outstanding common stock of Yintai from Fujian Jintai Tourism at the aggregate purchase price of RMB 5,000,000. As a result, Yintai became a wholly owned subsidiary of Fujian Yida. Yintai was deregistered on November 18, 2010.

Fujian Yida

Fujian Yida’s primary business relates to the operation of our Yunding tourism destination and all of our newly engaged tourism destinations, and the management of our media business.

On March 16, 2010, Fujian Yida formed a wholly-owned subsidiary, Yongtai Yunding Resort Management Co., Ltd. (“Yunding Resort Management”) with its official address at No. 68 Xianfu Road, Zhangcheng Town, Yongtai County, China. Yunding Resort Management currently has no material business operations. We plan to develop Yunding Resort Management into a business entity primarily focusing on the operations of our Yunding Park.

On April 12, 2010, our operating subsidiary Fujian Yida, which was called “Fujian Yunding Tourism Industrial Co., Ltd” changed its name to “Yida (Fujian) Tourism Group Limited”. This was to reflect its new role of expanding our business in operations of domestic tourism destinations in China by acquiring new tourism destinations.

On April 15, 2010, Fujian Yida entered into agreement with Anhui Xingguang Group to set up a joint venture – Anhui Yida Tourism Development Co. Ltd (“Anhui Yida”) by investing 60% of the equity interest. Anhui Xingguang Group owns 40% of the equity interest of Anhui Yida. The primary business of Anhui Yida focuses on developing the Ming Dynasty Entertainment World.

On July 6, 2010, Fujian Yida formed a wholly-owned subsidiary, Jiangxi Zhangshu (Yida) Tourism Development Co. Ltd. (Zhangshu Tourism Development), in Zhangshu City, Jiangxi Province to develop the Yang-sheng Paradise.

On July 7, 2010, Fujian Yida formed a wholly-owned subsidiary, Jiangxi Fenyi (Yida) Tourism Development Co. Ltd. (Fenyi Tourism Development), in Xinyu City, Jiangxi Province to develop the City of Caves.

Fujian Jiaoguang

Fujian Jiaoguang and our contractual relationship met the requirements of the Accounting Standard Codification ("ASC") 810, to consolidate Jiaoguang’s financial statements as a Variable Interest Entity. Fujian Jiaoguang has no material business operations.

Tulou

Tulou is 100% owned by Hong Kong Yi Tat. Tulou’s primary business relates to the operation of Tulou, one of our tourism destinations.

The following chart depicts our current corporate structure:

Our Variable Interest Entity Agreements

We do not have a direct ownership interest in Fujian Jiaoguang. On December 30, 2004, Jiaoguang and its shareholders entered into a set of contractual arrangements with us which governs the relationships between Fijian Jiaoguang and the Company. The Contractual Arrangements are comprised of a series of agreements, including a Consulting Agreement and an Operating Agreement, through which we have the right to advise, consult, manage and operate Fujian Jiaoguang, and collect and own all of Fujian Jiaoguang’s respective net profits. Additionally, under a Proxy and Voting Agreement and a Voting Trust and Escrow Agreement, the shareholders of Fujian Jiaoguang have vested their voting control over Fujian Jiaoguang to the Company. In order to further reinforce the Company’s rights to control and operate Fujian Jiaoguang, Fujian Jiaoguang and its shareholders have granted us, under an Option Agreement, the exclusive right and option to acquire all of their equity interests in the Fujian Jiaoguang or, alternatively, all of the assets of Fujian Jiaoguang. Further, the shareholders of Fujian Jiaoguang have pledged all of their rights, titles and interests in Fujian Jiaoguang to us under an Equity Pledge Agreement. We effectuated this organizational structure due to China’s limitations on foreign investments and ownership in Chinese domestic businesses. Generally, the Chinese law prohibits foreign entities from directly owning certain types of businesses, such as the media industry. We have obtained an opinion from Allbright Law Office, our Chinese legal counsel, that this structure is legal and valid and that the U.S. holding corporation can obtain the same benefits and risks with this contractual structure as it would with a direct equity ownership.

Our Products, Services and Customers

Advertisement

FETV

Covering approximately 92% of the population of Fujian province located in southeastern China with a population of over 35 million, FETV, owned by the Fujian Education TV Station, is a provincial comprehensive entertainment television channel ranked #4 in ratings in Fujian province (Source: ACNielsen 2008 Survey).

On August 1, 2010, Fuyu, our wholly-owned subsidiary, entered into a Fujian Education Television Channel Project Management Agreement (the “Agreement”), with Fujian Education Media Limited Company, a wholly state-owned company organized by the Fujian Education TV Station under the laws of the People’s Republic of China (“Fuijan Education Media”), pursuant to which, Fujian Education Media granted to us five years of exclusive management rights for the FETV channel from August 1, 2010 to July 31, 2015 (the “Term”), with the first three years of the Term, from August 1, 2010 to July 31, 2013, as phase I (the “Phase I”) and the remaining two years of the Term, from August 1, 2013 to July 31, 2015, the phase II (the “Phase II”). At the end of the Phase I, we and Fujian Education Media shall conduct full performance review of our cooperation under the Agreement. If we and Fujian Education mutually agree that there is no event of violation or breach of contract, the Agreement shall be extended to Phase II. There is no assurance that the Agreement will be extended to Phase II. During the Phase I Period and Phase II Phase, we shall pay annual payment of RMB 12,000,000 to Fujian Education TV Station for the first year and shall be increased by 20% per year for each of subsequent years during two phases.

Under the management contract, we obtained the full rights to provide programming and content and content management services and to re-sell all advertising airtime of FETV. We have leveraged the FETV assets to produce high quality TV programming focused on tourism, successfully promoting our own tourist attractions branding the FETV station around the tourism theme and creating a network of potential partners for our tourism business, including hotels, travel agents, and entertainment resorts.

Railway Media

In February 2009, we entered into a six-year exclusive agreement with China’s Railway Media Center to create “Journey through China on the Train” infomercial programs, pursuant to which we will produce 20 minute monthly episodes focused on tourist destinations around China and travel ideas and tips with product placement advertisements. The infomercial programs will be broadcast on seven railway lines into Tibet, all high speed motor trains in China with TV panels made available by Ministry of Railways of P. R. China and cable TV channels covering 18 railway bureaus. We will pay an annual fee of approximately $46,154 or RMB 300,000 to Railway Media Center for the first three years and approximately $53,846 or RMB 350,000 for the second three years. We will generate revenue from selling product placement advertisements. At the end of 2010, “Journey through China on the Train” was shown on approximately 136 railroad lines.

Tourism

The Great Golden Lake

The Great Golden Lake is located in Taining County, surrounding Sanming, Nanping of Fujian Province and Nanchang of Jiangxi Province. This tourist attraction covers more than approximately 230 square kilometers, including five main scenic areas: (1) the Golden Lake; (2) Shangqing River; (3) Zhuangyuan Rock; (4) Luohan Mountain; and (5) Taining Old Town.

In 2001, we entered into a tourism management revenue sharing agreement with Taining government, to operate and to manage the Great Golden Lake destination from 2001 through 2032. We initially invested approximately $30 million to improve the infrastructure, and through a well-designed marketing campaign, we have succeeded in increasing the number of the visitors from approximately 30,000 in 2001 to approximately 470,000 in 2010. Currently most visitors to the Great Golden Lake are from Fujian, Shanghai, Guangdong and Jiangxi. With easier transportation and increased marketing, we expect that the Great Golden Lake should be able to attract more visitors from other provinces of China and even foreign countries. Our revenue from the operations of the Great Golden Lake is generated from entrance ticket fees. The Great Golden Lake as recognized as the Global Geopark and part of China Danxia – the World Natural Heritage Site grant by UNESCO in 2005 and 2010, respectively.

Yunding Park

In November 2008, we entered into the Tourist Destination Cooperative Development Agreement with Yongtai County Government effective until 2048. Pursuant to the agreement, we obtained the exclusive right to develop the Yunding Park, which is approximately 50 kilometer from Fuzhou, the capital city of Fujian. We plan to invest total of approximately $70 million to build the tourism, transportation and entertainment facilities. As of December 31, 2010, we have invested approximately $65 million. And we expect to generate revenue from entrance fees, cable cars and other entertainment activities. In September 2010, we timely announced the grand opening of our Yunding Park to the public.

Hua’an Tulou Cluster (or the “Earth Buildings” or the “Tulou”)

The Tulou Cluster, composed of large multilayer earth buildings built by ancient wealthy families as their residence, is known for their unique round shape, ingenious structure and oriental mystery. The Tulou Cluster was recognized as part of Fujian Tulou World Cultural Heritage Site in 2008 by UNESCO. The Tulou Cluster is a 1.5 hour drive from Xiamen City, one of Fujian’s most famous tourist coastal cities.

In December 2008, we entered into a Tourist Resources Development Agreement with Hua’an County Government. The agreement is effective until 2048. Pursuant to this agreement, we began to develop the Hua’an Tulou tourist destinations with a right of priority to develop other scenic areas in Hua’an County. Hua’an Tulou Cluster requires a total capital input of approximately $7.5 million to put it into infrastructure and facility constructions. The Hua’an Tulou Cluster was closed during the construction and re-opened to the public before the fourth quarter of 2009. Currently, approximately half of its visitors are from overseas, including Taiwan. We expect our revenue to be generated from the sale of entrance ticket fees, fees from rides on tour cars, and food at our restaurants.

Ming Dynasty Entertainment World

On April 15, 2010, we jointly with Anhui Xingguang Investment Group Ltd., a reputable privately held company engaged in real estate and commercial development in Anhui province, entered into an Emperor Ming Taizu Cultural and Ecological Resort and Tourist Project Finance Agreement (the “Agreement”) with Anhui Province Bengbu Municipal Government, pursuant to which we and Anhui Xingguang formed a limited liability company, with a total registered capital of RMB 100 million (approximately $14.6 million) to engage in construction and development of a new tourism destination -- Ming Dynasty Entertainment World in Bengbu City, Anhui Province.

The Ming Dynasty Entertainment World will be built on approximately 5,000 Mu of land (approximately 824 acres, 1 acre = 6.07 Mu, the “Project Land”), and is planned to include recreational developments of Royal Hot Spring World, Royal Tour Town, Filial Piety Temple and Royal Hunting Garden.

Yang-sheng Paradise

On April 18, 2010, we entered into a China Yang-sheng (Nourishing Life) Tourism Project Finance Agreement with Jiangxi Province Zhangshu Municipal Government, pursuant to which we will invest in construction and development of China Yang-sheng (Nourishing Life) Paradise on approximately 6,000 Mu of land (approximately 988 acres, 1 acre = 6.07 Mu) in Zhangshu, Jiangxi province. Preliminarily, Yang-sheng Paradise is planned to include (i) Salt Water Hot Spring SPA & Health Center, (ii) Yang-sheng Holiday Resort, (iii) World Yang-sheng Cultural Museum, (iii) International Camphor Tree Garden, (iv) Chinese Medicine and Herb Museum, (v) Yang-sheng Sports Club, (vi) Old Town of Chinese Traditional Medicine, and (vii) various other Yang-sheng related projects and tourism real estate projects. We formed a limited liability company with a total registered capital of RMB 20 million (approximately $3 million) as of December 31. 2010.

The City of Caves

On June 1, 2010, we entered into an agreement with Jiangxi Province People’s Government of Fenyi County in Xinyu city, Jiangxi Province, to develop a brand new tourism project to be named "The City of Caves", based on the largest and most characteristic karst land underground caverns in China.

The first phase, mainly composed of Altair Cave and Vega Cave, is scheduled to start trial operation in 2012. The second phase will include the Hanmao Cave Cluster and the third phase will include the tourism resources of Dagang Mountain. Investment budget for each phase will be RMB100 million ($14.7 million), with a total budget of RMB300 million ($44.1 million). The City of Caves will attract tourists who are visiting the several nearby world-class tourism destinations, including Sanqing Mountain, Longhu Mountain, Jinggang Mountain, and Lu Mountain, all of which are famous and popular attractions in China. In addition, the Project is approximately a one-hour drive from China Yida's Yang-sheng Paradise, which means the Company can integrate the resources of the two projects and launch a very cost-effective and powerful integrated marketing campaign. The Project will be designed to provide comprehensive cultural background and will feature a high level of interaction between natural views and entertainment experiences, as compared to simple sightseeing of peer caves. We formed a limited liability company and committed RMB 60 million (approximately $9 million) of capital investment. As of December 31, 2010, RMB 12 million (approximately $1.8 million) was contributed to the company.

MARKETING AND DISTRIBUTION METHODS OF PRODUCTS AND SERVICES

Tourist and related Operations

The current marketing strategy of our tourist and related operations has two major promotional elements. The first is promoting the unique brand and scenic locations through traditional advertisement mediums. These traditional channels include television, radio and print media. To reduce costs, the Company has implemented a cost minimization plan whereby the majority of the media advertisement and promotion of the tourist destination is done through the media platforms available to the Company, including FETV and Railway Media. This cost minimization plan allows our tourist and related operations to reduce its cost of advertising while maintaining a relatively high degree of exposure through our provincial TV channel province-wide and through China’s high-speed railway network.

The second element of the Company's marketing effort of tourist and related operations is promotion of the scenic destinations through the attainment of nationally and internationally recognized merits of scenic achievement. To this end, the Great Golden Lake has received the designation of the Global Geo-park from UNESCO and has become part of China Danxia – the World Natural Heritage Site by UNESCO and ranked in China’s Top 10 Most Appealing Destinations and Top 50 Places for Foreigners to Visit. During the second half of 2008, Dadi Tulou was included on the World Cultural Heritage List as part of the Fujian Tulou. By achieving this high degree of recognition, the destination becomes visible on a massive scale increasing the draw of tourists from a provincial to an international level. The goal is to significantly increase the daily visitation rate through attainment of significant merit.

Each element of the marketing strategy has been developed in order to increase the international consumer awareness of the Company's tourist destinations, to reduce the associated costs of such awareness and to ultimately increase the usage rate and revenues of the park.

Because the tourist destination is a static product/service, its distribution mainly consists of the promotional strategies described in the paragraphs above. The services are promoted and distributed through traditional forms of advertising media. Information and marketing materials regarding the park services are distributed on site.

Media and Related Operations

The marketing efforts of our media and related operations can also be split into two elements. The first is promoting advertising revenue through program contents with high viewing rates. The second is promoting advertising revenue through larger media coverage.

Promotion through viewing rate: Through our tourist destinations, network of partners and content exchange programs, we create and promote our own educational and entertainment contents which can increase consumer awareness of its contents. The goal of promoting its programming is to increase its daily viewing rates and in turn increase the fees it can charge to third party advertisers. By achieving high rankings in China's television statistics, the Company becomes better known by potential advertising clients. With a high degree of coverage, advertisers are willing to pay more for the Company’s services. The Company also engages in strategic partnerships with other content providers by which they share and promote each other’s advertising client base to one another. Oftentimes, the referring content provider will receive a finder's fee for introducing the Company to qualified advertising clients.

Promotion through media coverage: we attract a lot of our advertising clients through our media coverage. Our FETV channels reach an approximate coverage rate of 92% in Fujian Province which covers approximately 28 million people. Our Railway Media on China’s high-speed railway network railroad system currently covers approximately 200 million people a year.

STATUS OF PUBLICLY ANNOUNCED NEW PRODUCTS/SERVICES

We expect that our company will grow over the next few years. Following are new products/services we publicly announced during the fiscal year 2010

FETV

Pursuant to a management agreement (the “Management Agreement”) between Fujian Education TV Station and Fujian Jiaoguang, our subsidiary, we gained seven years management rights from the Fujian Education TV Station, from August 1, 2003 to July 31, 2010 (the “Initial Management Term”), to operate FETV at a fixed annual payment of RMB 10,000,000. On August 1, 2010, FETV and Fuyu, our wholly owned subsidiary, entered into a new management agreement with a term of three years, commencing on August 1, 2010 through July 31, 2013 (“Phase I Period”). Upon the expiration of Phase I Period, if the parties mutually agree that there is no action of violation or breach of contract, then the Management Agreement will be automatically extend for another two (2) years, commencing from August 1, 2013 and expiring on July 31, 2015. During the Phase I Period and Phase II Phase, we shall pay annual payment of RMB 12,000,000 to Fujian Education TV Station for the first year and shall be increased by 20% per year for each of subsequent years during two phases.

Under the management contract, we obtained the full rights to provide programming and content and content management services and to re-sell all advertising airtime of FETV. We have leveraged the FETV assets to produce high quality TV programming focused on tourism, successfully promoting our own tourist attractions branding the FETV station around the tourism theme and creating a network of potential partners for our tourism business, including hotels, travel agents, and entertainment resorts.

Yunding Park

On November 27, 2008, we entered into the Tourist Destination Cooperative Development Agreement with the Yongtai County People’s Government in Fuzhou, China. The total planned investment of Yunding Park was $740 million. Pursuant to the agreement, the Yongtai government granted us the exclusive right and special authorization to develop tourist destinations in Fuzhou located at Yongtai Beixi and Jiezhukou Lake for forty (40) years from 2008. Accordingly, we are obligated to construct, operate and manage the two tourist destinations, subject to specific terms and conditions negotiated between us and the Yongtai government. We have the exclusive right to develop both Yongtai Beixi and Jiezhukou Lake and the Yongtai government is prohibited from granting the right of development, operation and management to any third party during the existence of our agreement. In September 2010, we timely announced the grand opening of our Yunding Park to the public.

Ming Dynasty Entertainment World

On April 15, 2010, jointly with Anhui Xingguang Investment Group Ltd. (the “Anhui Xingguang”), we entered into an agreement with Bengbu Municipal Government to develop the Ming Dynasty Entertainment World in the southeast part of Bengbu, Anhui Province, which covers a total area of approximately 5,000 Mu (approximately 824 acres as 1 acre = 6.07 Mu).

Bengbu, located in the rich and populous Changjiang River Delta, is believed to be one of the most important transportation hubs in China given its proximity to the existing Beijing-Shanghai railway and Huai River. The Company expects Bengbu to become very accessible to a population of over 200 million within the 3-hour economic circle. The first emperor of the Ming Dynasty, Majesty Yuanzhang Zhu, was born in region of Bengbu in 1328. This city has a rich history, with several historical sites related to the Ming Dynasty, including the tomb of Majesty Yuanzhang Zhu's parents. The Ming Dynasty Entertainment World plans to include Royal Hot Spring World (a resort hotel), Royal Tour Town, Filial Piety Temple and Royal Hunting Garden. The destination will reproduce the royal life of the Ming Dynasty at its height of power and splendor. Management's vision is for visitors to experience the recreational activities of the ancient royal families. The Filial Piety Temple will commemorate his Majesty Yuanzhang Zhu, who embraced the Confucian ideal of filial piety, for respect for parents and ancestors throughout his life and introduced several related laws and policies. This temple, which could be as splendid as the Temple of Heaven in Beijing, and is expected to serve as an important educational base and contribute other social and economic benefits.

A new project company (hereinafter the Project Company), with a total registered capital of RMB100 million (approximately $14.6 million), has been formed by China Yida and Anhui Xingguang. The Company is required to contribute approximately RMB60 million (approximately $8.78 million) to retain 60% equity of the Project Company, and Anhui Xingguang is required to contribute approximately RMB40 million (approximately $5.8 million) to retain 40% equity of the Project Company. Anhui Xingguang is a reputable private company with businesses in the real estate and commercial sectors locally. This Project Company is expected to combine the expertise in real estate development, tourism and commerce from both shareholders. China Yida will be responsible for the planning and operation of the Ming Dynasty Entertainment World. For the first phase of construction, the Project Company is budgeting approximately RMB250 million (approximately $36.6 million), with China Yida and Anhui Xingguang contributing on a pro rata basis, and includes the purchase of the 40-year land use rights for a parcel of approximately 41.185 acres (commercial land use, "Commercial Land") and another parcel of approximately 82.37 acres (industrial land use, "Industrial Land") as well as the construction of the Royal Hot Spring World. Management expects to open the first phase of the Ming Dynasty Entertainment World to visitors by the end of 2012. The Project Company will be allowed to lease a larger piece of land with approximately 4,500 Mu (approximately 740 acres, ecological land use, "Ecological Land") for approximately RMB350,000 (approximately $51,300) per annum from the local residents.

The Company's management believes that it is able to fund the first phase construction from current cash and operating cash flow over the next two years, and does not expect to require additional equity financing. After the Royal Hot Spring World starts operation, the Company expects to obtain loans from local banks backed by fixed assets, including the land.

.

The revenues from Ming Dynasty Entertainment World will include entrance fees, hotel rental, conference room fees, and entertainment service fees. In addition, the Company has planned a Ming Dynasty featured shopping street in the Royal Tour Town and expects to generate revenues from commercial real estate rent and maintenance fees. On the Commercial Land, tourism real estate could be planned to generate additional revenues.

Yang-sheng Paradise

On April 22, 2010, we entered into an agreement with Zhangshu Municipal Government to develop the Yang-sheng Paradise, a large-scale vacation destination covering a total area of approximately 6,000 Mu (approximately 988 acres as 1 acre = 6.07 Mu), in Zhangshu City, Jiangxi Province. The Project is designed to focus on the theme of famous Taoist practice – Yang-sheng (nourishing life), with Zhangshu City’s rare natural resources – salt water hot spring, and reputation as one of China’s traditional medicine and herb center. Yang-sheng (nourishing life) is the foundation of Taoist lifestyle, which is still desired and actively pursued within today’s Asian community.

The Project will be developed approximately two (2) kilometers from Zhangshu’s downtown, and within one hour travel from the adjacent airport or Nanchang, the capital city of Jiangxi Province. In addition, the Project is on the route from Nanchang to Lu Mountain, a World Natural Heritage Site, and Jing-Gang Mountain, one of the most popular political education tourism destinations as it was at the origin of Chairman Mao’s military force.

The capital expenditure planned for the first development phase of Project is estimated at approximately RMB250 million (approximately $36.6 million), which includes the planned construction of the Salt Water Hot Spring Spa & Health Center (the “SPA Center”), the Yang-sheng Holiday Resort (the “Resort Hotel”), in-destination roads and lakes, and the purchase of the land use rights for a parcel of approximately 3,000 Mu (approximately 494 acres, commercial and residential land use, the “Commercial Land”) as well as the rental payment for a parcel of approximately 3,000 Mu (approximately 494 acres) with the annual rent estimated at RMB0.5 million (approximately $73,300).

Management expects that the SPA Center and the Resort Hotel will be open to the public by the end of 2012.

In addition to the SPA Center and the Resort Hotel, Company plans to build additional attractions on the Project site that may include the World Yang-sheng Cultural Museum, the International Camphor Tree Garden, the Chinese Medicine & Herb Museum, the Yang-sheng Sports Club, the Old Town of Chinese Traditional Medicine and other Yang-sheng related projects and tourism real estate projects. The Company is now conducting in-depth research, evaluation and preparation on these plans.

Zhangshu Municipal Government has agreed not to approve any additional salt water hot spring or related tourism projects to any third parties to protect the exclusivity of Project. The government will waive 100% of the income tax for the first two years commencing from the grand opening and 50% for the subsequent three years. It will also waive the salt water hot spring resources tax and tourism resources tax within the Project’s whole life. In addition, it will waive or reduce most of the administration fees throughout the Project’s constructions. It will also allow China Yida to pay for its outdoor lighting at a cheaper rate as of city’s street lighting.

City of Caves

On June 1, 2010, we entered into an agreement with Jiangxi Province People’s Government of Fenyi County in Xinyu City, Jiangxi Province, to develop a brand new tourism project to be named "The City of Caves" based on the largest and most characteristic karst land underground caverns in China, for a management period of forty (40) years commencing from 2010.

Fenyi County is located in the mid-west of Xinyu City, 30 kilometers from downtown Xinyu. Xinyu is believed to have highest industrialization among all cities of Jiangxi Province, featuring two key industries, steel and photovoltaic. Management estimates that a three-hour driving circle will cover a population of approximately 50 million in 11 cities including the three provincial capital cities of Nanchang, Changsha and Wuhan. Several rail lines and highways across Xinyu make transportation convenient.

The first phase, mainly composed of Altair Cave and Vega Cave, is scheduled to start trial operation in 2012. The second phase will include the Hanmao Cave Cluster and the third phase will include the tourism resources of Dagang Mountain. Investment budget for each phase will be RMB100 million ($14.7 million), with a total budget of RMB300 million ($44.1 million). The City of Caves will attract tourists who are visiting the several nearby world-class tourism destinations, including Sanqing Mountain, Longhu Mountain, Jinggang Mountain, and Lu Mountain, all of which are famous and popular attractions in China. In addition, the Project is only a one-hour drive from China Yida's Yang-sheng Paradise, which means the Company can integrate the resources of the two projects and launch a very cost-effective and powerful integrated marketing campaign. The Project will be designed to provide comprehensive cultural background and will feature a high level of interaction between natural views and entertainment experiences, as compared to simple sightseeing of peer caves.

The Government will waive or reduce most of the administration fees. It will also allow China Yida to pay for its landscape lighting based upon the discounted municipal public lighting rate. Yida will benefit from the preferential electricity rate because the electricity is expected to be a main component of the operational expenses due to the massive use of electricity for lighting in the scenery project. The Fenyi government will supply the land to China Yida to build tourism facilities at a rate no higher than direct cost through leasing or transferring land use rights.

INDUSTRY AND COMPETITIVE FACTORS

We are currently involved in the tourism and advertisement industries in China. Both industries are experiencing significant growth in China. New competitors are entering these industries at a record pace. Competition is increasing and it is beginning to become difficult to gain market share and grow. There are, however, certain factors that we believe will be critical for our growth:

1. Successful track record of operating both businesses and maintaining its leading management position; and

2. Experienced management team with more than 70 years of combined experience in China media, tourism and entertainment industry.

OUR INTELLECTUAL PROPERTY

We have obtained a trademark and the exclusive use permission for the “Great Golden Lake.” This trademark has been filed with Taining County State-owned Assets Investment Operation Co., Ltd. We do not own nor do we intend to own any patents or have any of our products or services patented. In the future, we intend to acquire other trademarks from companies that we acquire or file trademarks or patents in order to protect our intellectual property.

COMPLIANCE WITH ENVIRONMENTAL LAW

We comply with the Environmental Protection Law of PRC as well as applicable local regulations. In addition to statutory and regulatory compliance, we actively ensure the environmental sustainability of our operations. Penalties would be levied upon us if we fail to adhere to and maintain certain standards. Such failure has not occurred in the past, and we generally do not anticipate that it will occur in the future, but no assurance can be given in this regard.

EMPLOYEES

Currently, we have a total of 385 full-time employees in our Creation Division, Management Division and Marketing Division, including 16 executive officers and senior management.

Available Information

Our website is http://www.yidacn.net/html/index.php. We provide free access to various reports that we file with, or furnish to, the U.S. Securities and Exchange Commission, or the SEC, through our website, as soon as reasonably practicable after they have been filed or furnished. These reports include, but are not limited to, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to those reports. Information on our website does not constitute part of and is not incorporated by reference into this Annual Report on Form 10-K or any other report we file or furnish with the SEC. You may also read and copy any document that we file at the public reference facilities of the SEC in Washington, D.C. You may call the SEC at 1-800-SEC-0330 for further information on the public reference rooms. Our SEC filings are also available to the public from the SEC’s website at http://www.sec.gov.

RISK FACTORS

The market price of our common stock could fluctuate substantially due to a variety of factors, including market perception of our ability to achieve our planned growth, quarterly operating results of other companies in the same industry, trading volume in our common stock, changes in general conditions in the economy and the financial markets or other developments affecting our competitors or us. In addition, the stock market is subject to extreme price and volume fluctuations. This volatility has had a significant effect on the market price of securities issued by many companies for reasons unrelated to their operating performance and could have the same effect on our common stock.

Risks Relating to Our Business

|

●

|

IN ORDER TO INCREASE OUR REVENUES, WE BELIEVE WE MUST FURTHER EXPAND OUR BUSINESS OPERATIONS. WE CANNOT ASSURE YOU THAT OUR INTERNAL GROWTH STRATEGY WILL BE SUCCESSFUL WHICH MAY RESULT IN A NEGATIVE IMPACT ON OUR GROWTH, FINANCIAL CONDITION, RESULTS OF OPERATIONS AND CASH FLOW.

|

In order to maximize the potential growth in our current and potential markets, we believe that we must further expand the scope of our services in the tourism and mass media industry. One of our strategies is to grow internally through increasing the customers we target for advertising campaigns and locations where we promote tourism by penetrating existing markets in the PRC and entering new geographic markets in PRC as well as other parts of Asia and globally. However, many obstacles to this expansion exist, including, but not limited to, increased competition from similar businesses, international trade and tariff barriers, unexpected costs, costs associated with marketing efforts abroad and maintaining attractive foreign exchange ratios. We cannot, therefore, assure you that we will be able to successfully overcome such obstacles and establish our services in any additional markets. Our inability to implement this internal growth strategy successfully may have a negative impact on our growth, future financial condition, results of operations or cash flows.

|

●

|

IN ADDITION TO OUR INTERNAL GROWTH STRATEGY, WE MAY GROW THROUGH STRATEGIC ACQUISITIONS. WE CANNOT ASSURE YOU THAT OUR ACQUISITION GROWTH STRATEGY WILL BE SUCCESSFUL RESULTING IN OUR FAILURE TO MEET GROWTH AND REVENUE EXPECTATIONS.

|

We also intend to pursue opportunities to acquire businesses in the PRC that are complementary or related in product lines and business structure to us. However, we may not be able to locate suitable acquisition candidates at prices that we consider appropriate or to finance acquisitions on terms that are satisfactory to us. If we do identify an appropriate acquisition candidate, we may not be able to negotiate successfully the terms of an acquisition, or, if the acquisition occurs, integrate the acquired business into our existing business. Acquisitions of businesses or other material operations may require debt financing or additional equity financing, resulting in leverage or dilution of ownership. Integration of acquired business operations could disrupt our business by diverting management away from day-to-day operations. The difficulties of integration may be increased by the necessity of coordinating geographically dispersed organizations, integrating personnel with disparate business backgrounds and combining different corporate cultures.

We also may not be able to maintain key employees or customers of an acquired business or realize cost efficiencies or synergies or other benefits we anticipated when selecting our acquisition candidates. In addition, we may need to record write-downs from future impairments of intangible assets, which could reduce our future reported earnings. At times, acquisition candidates may have liabilities or adverse operating issues that we fail to discover through due diligence prior to the acquisition. In addition to the above, acquisitions in PRC, including state owned businesses, will be required to comply with laws of the PRC, to the extent applicable. There can be no assurance that any given proposed acquisition will be able to comply with PRC requirements, rules and/or regulations, or that we will successfully obtain governmental approvals which are necessary to consummate such acquisitions, to the extent required. If our acquisition strategy is unsuccessful, we will not grow our operations and revenues at the rate that we anticipate.

|

●

|

IN THE EVENT OF RAPID GROWTH OF OUR BUSINESS OPERATIONS, WE MAY EXPERIENCE A SIGNIFICANT STRAIN ON OUR MANAGEMENT AND OPERATIONAL INFRASTRUCTURE. OUR FAILURE TO MANAGE GROWTH WILL CAUSE A DISRUPTION OF OUR OPERATIONS RESULTING IN THE FAILURE TO GENERATE REVENUE.

|

If we expand our business through successful implementation of our internal growth strategy and/or acquisition strategy, our management and our operational, accounting, and information infrastructure may experience a significant strain caused by such expansion. In order to deal with the strain our anticipated business expansion could put on our resources, we will need to continue to improve our financial controls, operating procedures, and management information systems. We will also need to effectively train, motivate, and manage our employees. Our failure to manage our growth could disrupt our operations and ultimately prevent us from generating the revenues we expect.

|

●

|

IF WE ARE NOT ABLE TO IMPLEMENT OUR STRATEGIES OR EXPAND OUR MEDIA OPERATIONS AND ACQUIRE ADDITIONAL TOURIST ATTRACTIONS, OUR BUSINESS OPERATIONS AND FINANCIAL PERFORMANCE MAY BE ADVERSELY AFFECTED.

|

We expanded our business in 2010 by acquiring the operation rights of additional tourist attractions under various agreements, including the City of Caves, Yang-sheng Paradise, Ming Dynasty Entertainment World and FETV. Since 2008, we have entered various agreements for Yongtai Beixi and Jiezhukou Lake, Hua’an Tulou, and the Great Golden Lake, and establishing collaboration with Railway Media Center to produce programs titled “Journey through China on the Train.” Our continuous business development plan is based on a further expansion of our media services and acquisition of additional tourist attractions. There is inherent risks and uncertainties involved throughout these stages of development. There is no assurance that we will be successful in continuously expanding our media operations or acquiring additional tourist attractions, or that our strategies, even if implemented, will lead to the successful achievement of our objectives. If we are not able to successfully implement these further development strategies, our business operations and financial performance may be adversely affected.

|

●

|

TOURISM AND MEDIA ARE COMPETITVE BUSINESS ENVIRONMENTS WHICH COULD ADVERSELY AFFECT OUR FINANCIAL PERFORMANCE.

|

We operate in a competitive environment and have to compete with other tourist destinations and media outlets in order to attract visitors and customers. In order to be successful in attracting visitors or customers we may be forced to lower prices or spend more money on advertising to continue to compete with our competitors. These competitive measures may result in lower net income.

|

●

|

ECONOMIC CRISIS OR TURMOIL, OR SUPPRESSION ON INDIVIDUAL RIGHTS MAY CAUSE A DOWNTURN IN CHINA’S TOURISM INDUSTRY.

|

A downturn in the world economic markets, or just the Chinese economy, may have a negative impact on our business. Consumers with a lack of disposable incomes may decide not to vacation or travel to our tourism destinations, which would negatively impact our business. Additionally, the perceived suppression of individual rights by the Chinese government may deter tourists from visiting China, which may cause a decline in visitors to our attraction.

|

●

|

OUR BUSINESS MAY BE DIRECTLY AND INDIRECTLY AFFECTED BY UNFAVORABLE WEATHER CONDITIONS OR NATURAL DISASTERS THAT REDUCE THE VISITS OF OUR RESORTS AND DESTINATIONS

|

Poor or unusual weather conditions, can significantly affect the visits of the tourists to our resorts and destinations. Insufficient levels of rain or drought can cause significant affect to our tourist destination. Temperatures outside normal ranges can also reduce tourists’ volume. Natural calamities such as regional floods, hurricanes, earthquakes, tsunamis, or other storms, and droughts can have significant negative effects on our tourism business. In the second half of 2010, we had to close part of our tourist destination in Great Golden Lake due to flooding, as a result we had reduced revenue.

|

●

|

THE SLOW RECOVERY OF THE GLOBAL ECONOMIC CRISIS COULD AFFECT THE OVERALL AVAILABILITY AND COST OF EXTERNAL FINANCING FOR OUR OPERATIONS.

|

The slow recovery of the global financial markets from the global economic crisis and turmoil may adversely impact our business, the business and financial condition of our customers and the business of potential investors from whom we expect to generate our potential sources of capital financing. Presently it is unclear to what extent the economic stimulus measures and other actions taken or contemplated by the Chinese governments and other governments throughout the world will mitigate the effects of the negative impact caused by the economic turmoil on our industry and other industries that affect our business. Although these conditions have not presently impaired our ability to access credit markets and finance our operations, the impact of the current crisis on our ability to obtain capital financing in the future, and the cost and terms of same, is unclear.

|

●

|

A FAILURE TO EXPAND OUR MEDIA OPERATIONS OR GOVERNMENT REGULATIONS RESTRICTING THE MEDIA INDUSTRY IN CHINA COULD HAVE A NEGATIVE IMPACT ON OUR OPERATIONS.

|

If our advertising and media operations fail to grow, this would have a negative impact on our future operating results. Further, government regulations, if enacted, restricting media content would negatively affect our media operations. Any restriction on media content would limit the potential amount of customers able to use our media services and negatively impact our financial results.

|

●

|

WE DEPEND ON OUR KEY MANAGEMENT PERSONNEL AND THE LOSS OF THEIR SERVICES COULD ADVERSELY AFFECT OUR BUSINESS.

|

We place substantial reliance upon the efforts and abilities of our executive officers, Mr. Chen Minhua, our Chairman and Chief Executive Officer and Ms. Fan Yanling, our Vice President of Operations. The loss of the services of any of our executive officers could have a material adverse effect on our business, operations, revenues or prospects. We do not maintain key man life insurance on the lives of these individuals. We may not be able to attract or retain qualified management on acceptable terms in the future due to the intense competition for qualified personnel in our industry and as a result, our business could be adversely affected.

|

●

|

WE MAY NEVER PAY ANY DIVIDENDS TO SHAREHOLDERS.

|

We have never paid any dividends. Our board of directors does not intend to distribute dividends in the near future. The declaration, payment and amount of any future dividends will be made at the discretion of the board of directors, and will depend upon, among other things, the results of our operations, cash flows and financial condition, operating and capital requirements, and other factors as the board of directors considers relevant. There is no assurance that future dividends will be paid, and, if dividends are paid, there is no assurance with respect to the amount of any such dividend.

|

●

|

WE DO NOT CARRY ANY BUSINESS INTERRUPTION INSURANCE, PRODUCT LIABILITY OR RECALL INSURANCE OR THIRD-PARTY LIABILITY INSURANCE.

|

Operation of our business and facilities involves many risks, including natural disasters, labor disturbances, business interruptions, property damage, personal injury and death. We do not carry any business interruption insurance or third-party liability insurance for our business to cover claims in respect of personal injury or property or environmental damage arising from accidents on our property or relating to our operations. Therefore, we may not have insurance coverage sufficient to cover all risks associated with our business. As a result, we may be required to pay for financial and other losses, damages and liabilities, including those caused by natural disasters and other events beyond our control, out of our own funds, which could have a material adverse effect on our business, financial condition and results of operations.

|

●

|

MANAGEMENT EXERCISES SIGNIFICANT CONTROL OVER MATTERS REQUIRING SHAREHOLDER APPROVAL WHICH MAY RESULT IN THE DELAY OR PREVENTION OF A CHANGE IN OUR CONTROL.

|

Mr. Chen Minhua, our Chairman and Chief Executive Officer, through his common stock ownership, currently has voting power equal to approximately 28.70% of our voting securities. Ms. Fan Yanling, our Vice President of Operations and the spouse of Mr. Chen Minhua, through her common stock ownership, currently has voting power equal to approximately 28.70% of our voting securities. Mr. Chen Minhua and Ms. Fan Yanling have combined voting power in our Company equal to approximately 57.40% of our voting securities. As a result, management through such stock ownership exercises significant control over all matters requiring shareholder approval, including the election of directors and approval of significant corporate transactions. This concentration of ownership in management may also have the effect of delaying or preventing a change in control of us that may be otherwise viewed as beneficial by shareholders other than management.

|

●

|

WE MAY INCUR SIGNIFICANT COSTS TO ENSURE COMPLIANCE WITH UNITED STATES CORPORATE GOVERNANCE AND ACCOUNTING REQUIREMENTS.

|

We may incur significant costs associated with our public company reporting requirements, costs associated with newly applicable corporate governance requirements, including requirements under the Sarbanes-Oxley Act of 2002 and other rules implemented by the Securities and Exchange Commission. We expect all of these applicable rules and regulations to significantly increase our legal and financial compliance costs and to make some activities more time consuming and costly. We also expect that these applicable rules and regulations may make it more difficult and more expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our board of directors or as executive officers. We are currently evaluating and monitoring developments with respect to these newly applicable rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs. Even though we have been a reporting company since 1999, this risk applies to us because we completed a share exchange with Keenway Limited in 2007 whereby a Chinese operating company became our wholly owned subsidiary. This Chinese operating company is newly reporting and we are adjusting to the increased disclosure requirements for us to comply with corporate governance and accounting requirements.

|

●

|

IF WE FAIL TO MAINTAIN AN EFFECTIVE SYSTEM OF INTERNAL CONTROL OVER FINANCIAL REPORTING, OUR ABILITY TO ACCURATELY AND TIMELY REPORT OUR FINANCIAL RESULTS OR PREVENT FRAUD MAY BE ADVERSELY AFFECTED AND INVESTOR CONFIDENCE AND THE MARKET PRICE OF OUR ORDINARY SHARES MAY BE ADVERSELY IMPACTED.

|

As directed by Section 404 of the Sarbanes-Oxley Act of 2002, or SOX 404, the Securities and Exchange Commission adopted rules requiring public companies to include a report of management on the company’s internal controls over financial reporting in their annual reports, including Form 10-K. In addition, the independent registered public accounting firm auditing a company’s financial statements must also attest to and report on the effectiveness of the company’s internal controls over financial reporting. Under current SEC rules, we will be required to include a management report and our independent registered public accounting firm’s attestation report beginning with our annual report for the fiscal year ending December 31, 2010. Our management may conclude that our internal controls over our financial reporting are not effective. Even if our management concludes that our internal controls over financial reporting are effective, our independent registered public accounting firm may issue a report that is qualified if it is not satisfied with our controls or the level at which our controls are documented, designed, operated or reviewed, or if it interprets the relevant requirements differently from us. Any of these possible outcomes could result in an adverse reaction in the financial marketplace due to a loss of investor confidence in the reliability

|

●

|

WE MAY HAVE DIFFICULTY RAISING NECESSARY CAPITAL TO FUND OPERATIONS AS A RESULT OF MARKET PRICE VOLATILITY FOR OUR SHARES OF COMMON STOCK.

|

In recent years, the securities markets in the United States have experienced a high level of price and volume volatility, and the market price of securities of many companies have experienced wide fluctuations that have not necessarily been related to the operations, performances, underlying asset values or prospects of such companies. For these reasons, our shares of common stock can also be expected to be subject to volatility resulting from purely market forces over which we will have no control. If our business development plans are successful, we may require additional financing to continue to develop and exploit existing and new products and services related to our industries and to expand into new markets. The exploitation of our services may, therefore, be dependent upon our ability to obtain financing through debt and equity or other means.

|

●

|

WE HAVE A CONTRACTUAL RELATIONSHIP WITH FUJIAN JIAOGUANG MEDIA WHICH MAY BE IN NON-COMPLIANCE WITH PRC LAWS AND DOES NOT PROVIDE THE SAME OPERATIONAL CONTROL AS A DIRECT EQUITY INTEREST.

|

Our contractual relationship with Fujian Jiaoguang Media was structured as a contractual relationship as opposed to a direct equity interest in order to comply with PRC law. We have received a PRC legal counsel attesting that this structure is in compliance with the PRC law. However, the PRC law may be subject to change or the government may review the structure and determine that this contractual relationship is not in compliance with PRC laws and force the termination of this relationship. Additionally, the contractual relationship between us and Fujian Jiaoguang Media does not provide us with the same operational control as a direct equity interest. Therefore, we are subject to the risks associated with contractual rights as opposed to owning the company. Such risks could include breach of contract or failure to honor the terms of the contract.

Risks Relating to the People's Republic of China

|

●

|

SUBSTANTIALLY ALL OF OUR OPERATING ASSETS ARE LOCATED IN CHINA AND SUBSTANTIALLY ALL OF OUR REVENUE WILL BE DERIVED FROM OUR OPERATIONS IN CHINA SO OUR BUSINESS, RESULTS OF OPERATIONS AND PROSPECTS ARE SUBJECT TO THE ECONOMIC, POLITICAL AND LEGAL POLICIES, DEVELOPMENTS AND CONDITIONS IN CHINA.

|

The PRC’s economic, political and social conditions, as well as government policies, could impair our business. The PRC economy differs from the economies of most developed countries in many respects. China’s GDP has grown consistently since 1978 (National Bureau of Statistics of China). However, we cannot assure you that such growth will be sustained in the future. If, in the future, China’s economy experiences a downturn or grows at a slower rate than expected, there may be less demand for spending in certain industries. A decrease in demand for spending in certain industries could impair our ability to remain profitable. The PRC’s economic growth has been uneven, both geographically and among various sectors of the economy. The PRC government has implemented various measures to encourage economic growth and guide the allocation of resources. Some of these measures benefit the overall PRC economy, but may have a negative effect on us. For example, our financial condition and results of operations may be hindered by PRC government control over capital investments or changes in tax regulations.

The PRC economy has been transitioning from a planned economy to a more market-oriented economy. Although in recent years the PRC government has implemented measures emphasizing the use of market forces for economic reform, the reduction of state ownership of productive assets and the establishment of sound corporate governance in business enterprises, a substantial portion of productive assets in China is still owned by the PRC government. In addition, the PRC government continues to play a significant role in regulating industry development by imposing industrial policies. It also exercises significant control over PRC economic growth through the allocation of resources, controlling payment of foreign currency-denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies.

|

●

|

IF THE MINISTRY OF COMMERCE, OR MOFCOM, CHINA SECURITIES REGULATORY COMMISSION, OR CSRC, OR ANOTHER PRC REGULATORY AGENCY, DETERMINES THAT MOFCOM AND CSRC APPROVAL OF OUR MERGER WAS REQUIRED OR IF OTHER REGULATORY OBLIGATIONS ARE IMPOSED UPON US, WE MAY INCUR SANCTIONS, PENALTIES OR ADDITIONAL COSTS WHICH WOULD DAMAGE OUR BUSINESS.

|

On August 8, 2006, six PRC regulatory agencies, including the MOFCOM and the CSRC, promulgated the Rules on Acquisition of Domestic Enterprises by Foreign Investors, or the M&A Rules, a new regulation with respect to the mergers and acquisitions of domestic enterprises by foreign investors that became effective on September 8, 2006. Article 11 of the M&A Rules requires PRC companies, enterprises or natural persons to obtain MOFCOM approval in order to effectuate mergers or acquisitions between PRC companies and foreign companies legally established or controlled by such PRC companies, enterprises or natural persons. Article 40 of the M&A Rules requires that an offshore special purpose vehicle formed for overseas listing purposes and controlled directly or indirectly by PRC companies or individuals should obtain the approval of the CSRC prior to the listing and trading of such offshore special purpose vehicle’s securities on an overseas stock exchange, especially in the event that the offshore special purpose vehicle acquires shares of or equity interests in the PRC companies in exchange for the shares of offshore companies. On September 21, 2006, the CSRC published on its official website procedures and filing requirements for offshore special purpose vehicles seeking CSRC approval of their overseas listings.

On November 19, 2007, we completed a merger transaction pursuant to a share exchange and stock purchase agreement , which resulted in our current ownership and corporate structure. We believe, based on the opinion of our PRC legal counsel, Allbright Law Offices, that MOFCOM and CSRC approvals were not required for our merger transaction or for the listing and trading of our securities on a trading market because we are not an offshore special purpose vehicle that is directly or indirectly controlled by PRC companies or individuals. Although the merger and acquisition regulations provide specific requirements and procedures, there are still many ambiguities in the meaning of many provisions. Further regulations are anticipated in the future, but until there has been clarification either by pronouncements, regulation or practice, there is some uncertainty in the scope of the regulations and the regulators have wide latitude in the enforcement of the regulations and approval of transactions. If the MOFCOM, CSRC or another PRC regulatory agency subsequently determines that the MOFCOM and CSRC approvals were required, we may face sanctions by the MOFCOM, CSRC or another PRC regulatory agency. If this happens, these regulatory agencies may impose fines and penalties on our operations in China, limit our operating privileges in China, delay or restrict the repatriation of the proceeds from this offering into China, restrict or prohibit payment or remittance of dividends paid by Fujian Jintai, or take other actions that could damage our business, financial condition, results of operations, reputation and prospects, as well as the trading price of our securities.

|

●

|

THE NEW M&A REGULATIONS ESTABLISH MORE COMPLEX PROCEDURES FOR SOME ACQUISITIONS OF CHINESE COMPANIES BY FOREIGN INVESTORS, WHICH COULD MAKE IT MORE DIFFICULT FOR US TO PURSUE GROWTH THROUGH ACQUISITION IN CHINA.

|

The New M&A Regulations establish additional procedures and requirements that could make some acquisitions of PRC companies by foreign investors, such as ours, more time-consuming and complex, including requirements in some instances that the approval of the Ministry of Commerce shall be required for transactions involving the shares of an offshore listed company being used as the acquisition consideration by foreign investors. In the future, we may grow our business in part by acquiring complementary businesses. Complying with the requirements of the New M&A Regulations to complete such transactions could be time-consuming, and any required approval processes, including obtaining approval from the Ministry of Commerce, may delay or inhibit our ability to complete such transactions, which could affect our ability to expand our business or maintain our market share.

|

●

|

IF THE PRC IMPOSES RESTRICTIONS DESIGNED TO REDUCE INFLATION, FUTURE ECONOMIC GROWTH IN THE PRC COULD BE SEVERELY CURTAILED WHICH COULD HURT OUR BUSINESS AND PROFITABILITY.

|

While the economy of the PRC has experienced rapid growth, this growth has been uneven among various sectors of the economy and in different geographical areas of the country. Rapid economic growth often can lead to growth in the supply of money and rising inflation. In order to control inflation in the past, the PRC has imposed controls on bank credits, limits on loans for fixed assets and restrictions on state bank lending. Imposition of similar restrictions may lead to a slowing of economic growth, a decrease in demand for our steel products and generally damage our business and profitability.

|

●

|

FLUCTUATIONS IN EXCHANGE RATES COULD HARM OUR BUSINESS AND THE VALUE OF OUR SECURITIES.

|

The value of our ordinary shares will be indirectly affected by the foreign exchange rate between U.S. dollars and RMB and between those currencies and other currencies in which our sales may be denominated. Because substantially all of our earnings and cash assets are denominated in RMB and the net proceeds from this offering will be denominated and our financial results are reported in U.S. dollars, fluctuations in the exchange rate between the U.S. dollar and the RMB will affect the relative purchasing power of these proceeds, our balance sheet and our earnings per share in U.S. dollars following this offering. In addition, appreciation or depreciation in the value of the RMB relative to the U.S. dollar would affect our financial results reported in U.S. dollar terms without giving effect to any underlying change in our business or results of operations. Fluctuations in the exchange rate will also affect the relative value of any dividend we issue that will be exchanged into U.S. dollars as well as earnings from, and the value of, any U.S. dollar-denominated investments we make in the future. Since July 2005, the RMB has not been pegged to the U.S. dollar. Although the People’s Bank of China regularly intervenes in the foreign exchange market to prevent significant short-term fluctuations in the exchange rate, the RMB may appreciate or depreciate significantly in value against the U.S. dollar in the medium to long term. Moreover, it is possible that in the future PRC authorities may lift restrictions on fluctuations in the RMB exchange rate and lessen intervention in the foreign exchange market.

Very limited hedging transactions are available in China to reduce our exposure to exchange rate fluctuations. To date, we have not entered into any hedging transactions. While we may enter into hedging transactions in the future, the availability and effectiveness of these transactions may be limited, and we may not be able to successfully hedge our exposure at all. In addition, our foreign currency exchange losses may be magnified by PRC exchange control regulations that restrict our ability to convert RMB into foreign currencies.

|

●

|

EXCHANGE CONTROLS THAT EXIST IN THE PRC MAY LIMIT OUR ABILITY TO UTILIZE OUR CASH FLOW EFFECTIVELY.

|