Attached files

As filed with the Securities and Exchange Commission on March 16, 2011 Registration No. (333-172139)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

to

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

BIOPOWER OPERATIONS CORPORATION

(Exact name of registrant as specified in its charter)

|

Nevada

|

0191

|

27-4460232

|

|

(State or other Jurisdiction of Incorporation

or Organization)

|

(Primary Standard Industrial Classification

Code Number)

|

(I.R.S. Employer Identification No.)

|

5379 Lyons Rd. Suite 301, Coconut Creek, Florida 33073 | Tel: 954-509-9830

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Robert Kohn | 5379 Lyons Rd., Suite 301, Coconut Creek, Florida 33073 | 954-509-9830

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of Communications to:

Peter J. Gennuso, Esq.

Gersten Savage LLP

600 Lexington Avenue, 10th Floor

New York, NY 10022

Facsimile: (212) 980-5192

Approximate date of commencement of proposed sale to the public - As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

|

Large accelerated filer

|

¨

|

Accelerated filer

|

¨

|

|

Non-accelerated filer

|

¨

|

Smaller reporting company

|

x

|

|

(Do not check if a smaller reporting company)

|

|||

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of

Securities To Be

Registered

|

Amount To Be Registered

(1)

|

Proposed Maximum

Offering Price Per Share

(4)

|

Proposed Maximum

Aggregate Offering Price

|

Amount of Registration

Fee

|

||||||||||||

|

Common Stock, par

value $0.0001

|

10,000,000 | (2) | $ | 0.50 | $ | 5,000,000 | $ | 580.50 | ||||||||

|

Common Stock, par

value $0.0001

|

16,250,000 | (3) | $ | 0.50 | $ | 8,125,000 | $ | 943.31 | ||||||||

|

Common Stock, par

value $0.0001, issuable

upon exercise of warrant

|

1,000,000 | $ | 1.00 | $ | 1,000,000 | $ | 116.10 | |||||||||

|

TOTAL:

|

$ | 1,639.91 | ||||||||||||||

|

(1)

|

In accordance with Rule 416(a), the registrant is also registering hereunder an indeterminate number of additional shares of common stock that may be issued and resold pursuant to stock splits, stock dividends, recapitalization and other similar transactions.

|

|

(2)

|

Direct Public Offering.

|

|

(3)

|

Selling Stockholders.

|

|

(4)

|

There is no current market for the securities and the price at which the Shares are being offered has been arbitrarily determined by the Company and used for the purpose of computing the amount of the registration fee in accordance with Rule 457 under the Securities Act of 1933, as amended.

|

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the U.S. Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is declared effective. This prospectus is not an offer to sell these securities and it is not a solicitation of an offer to buy these securities in any state or jurisdiction where the offer or sale is not permitted by the law of such state or jurisdiction. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or passed upon the adequacy or accuracy of the prospectus. Any representation to the contrary is a criminal offense.

|

PRELIMINARY PROSPECTUS

|

Subject to Completion, Dated: March 16, 2011

|

BIOPOWER OPERATIONS CORPORATION

Up to 10,000,000 Shares of Common Stock at $0.50 per share via a Direct Public Offering

And

17,250,000 Shares of Common Stock from Existing Stockholders

This Prospectus relates to the sale of 17,250,000 shares of common stock, $0.0001 par value (“Common Shares”) of BioPower Operations Corporation, a Nevada company (“BIO”, “we”, “us”, “our”, “Company” or similar terms) by existing stockholders (the “selling stockholders”). Of these shares, up to 1,000,000 shares may be issued upon the exercise of a warrant at $1.00 per share. In addition, we are offering on a best efforts basis up to 10,000,000 shares of our common stock in a direct public offering, without any involvement of underwriters or broker-dealers, for up to ninety (90) days following the date of this Prospectus. If all shares being offered by the Company are sold, the Company would receive an aggregate of $5,000,000.

The offering price is $0.50 per share for the Company shares being offered pursuant to this Prospectus. No public market currently exists for the securities being offered. The shares being offered by the selling stockholders will be sold at $0.50 per share until such time as the Company’s shares of common stock are quoted on the OTC Bulletin Board and thereafter at prevailing market prices. The selling stockholders will not bear any of the costs associated with the registration or offering of their shares.

Our common stock is presently not listed on any national securities exchange or the Nasdaq Stock Market. Subsequent to the initial filing date of this registration statement on Form S-1, in which this Prospectus is included, we intend to have an application filed on our behalf by a market maker for approval of our common stock for quotation on the Over-the-Counter Bulletin Board (“OTC-BB”) quotation system. No assurance can be made, however, that we will be able to locate a market maker to submit such application or that such application will be approved.

The Company is currently in the development stage and has no operations or revenues to date and there can be no assurance that the Company will be successful in furthering its operations. Persons should not invest unless they can afford to lose their entire investment. Before purchasing any of the Common Shares covered by this Prospectus, carefully read and consider the risk factors included in the section entitled “Risk Factors” beginning on Page 3. These securities involve a high degree of risk, and prospective purchasers should be prepared to sustain the loss of their entire investment. There is currently no public trading market for the securities.

Neither the United States Securities and Exchange Commission (“SEC”), nor any state securities commission, has approved or disapproved of these securities or passed upon the accuracy or adequacy of this Prospectus. Any representation to the contrary is a criminal offense.

The date of this Prospectus is March , 2011

TABLE OF CONTENTS

|

Prospectus Summary

|

1

|

|

|

Risk Factors

|

3

|

|

|

Risks Relating to our Business

|

3

|

|

|

Risks Relating to our Common Shares and the Trading Market

|

7

|

|

|

Forward Looking Statements

|

10

|

|

|

Use of Proceeds

|

10

|

|

|

Determination of Offering Price

|

12

|

|

|

Dilution

|

12

|

|

|

Selling Security Holders

|

14

|

|

|

Plan of Distribution

|

16

|

|

|

Description of Securities to be Registered

|

18

|

|

|

Interests of Named Experts and Counsel

|

18

|

|

|

Information with Respect to the Registrant

|

19

|

|

|

Description of Business

|

19

|

|

|

Description of Property

|

24

|

|

|

Legal Proceedings

|

24

|

|

|

Market Price of and Dividends on the Registrant’s Common Equity and Related Stockholder Matters

|

24

|

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

26

|

|

|

Directors, Executive Officers, Promoters and Control Persons

|

28

|

|

|

Executive Compensation, Corporate Governance

|

29

|

|

|

Security Ownership of Certain Beneficial Owners and Management

|

30

|

|

|

Transactions with Related Persons, Promoters and Certain Control Persons

|

31

|

|

|

Director Independence

|

32

|

|

|

Material Changes

|

32

|

|

|

Incorporation of Certain Information by Reference

|

32

|

|

|

Disclosure of Commission Position on Indemnification for Securities Act Liabilities

|

33

|

|

|

Financial Statements

|

34

|

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with different information. We are not making offers to sell or seeking offers to buy these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information contained in this Prospectus is accurate as of the date in the front of this Prospectus only. Our business, financial condition, results of operations and Prospectus may have changed since that date.

We obtained statistical data, market data and other industry data and forecasts used throughout this Prospectus from market research, publicly available information and industry publications. Industry publications generally state that they obtain their information from sources that they believe to be reliable, but they do not guarantee the accuracy and completeness of the information.

i

PROSPECTUS SUMMARY

Prospective investors should consider carefully the information discussed under Risk Factors and Use of Proceeds sections, commencing on Page 3 and Page 10, respectively. An investment in our securities presents substantial risks, and you could lose all or substantially all of your investment.

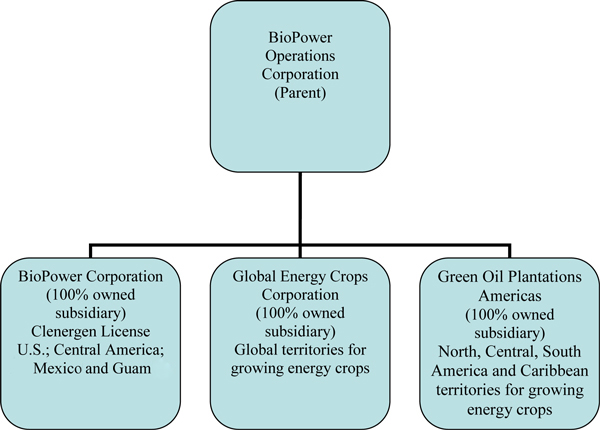

BioPower is a development stage renewable energy company, with no operations and revenues to date, focused on growing biomass energy crops including trees and bamboo (“biomass feedstock”) to be converted into electricity and biofuels. We intend to operate our Company through three wholly-owned subsidiaries, BioPower Corporation, Global Energy Crops Corporation and Green Oil Plantations Americas Inc. BioPower Corporation has the exclusive license for the United States, Central America, Guam, and Mexico from Clenergen Corporation to utilize their biomass growing technologies. Clenergen Corporation is a public company which utilizes a tree adapation technology applied to selected tree species, namely, Paulownia and Melia dubia and a grass Beema Bamboo. Clenergen only began generating revenues in 2010. Green Oil Plantations Americas has the exclusive license for North, Central, South America and the Caribbean from Green Oil Plantations Ltd. and their affiliates to utilize their biomass growing technologies and turnkey project management to grow biomass energy crops. As a development stage company, our plan is to grow biomass energy crops by (1) acquiring land, (2) joint venturing with land owners who have land which cannot grow food and would like to grow energy crops and (3) joint venturing with investors looking to acquire land and grow energy crops. We then intend to sell the biofuels and sell biomass feedstock for the generation of electricity.

Through this Offering, we are seeking to raise on a best efforts basis up to $5,000,000 from the sale of 10,000,000 shares of common stock at $0.50 per share. This is the maximum amount, and there is no minimum amount. We have no intention to return any funds raised to investors if the maximum amount is not raised.

We will use our best efforts to raise the entire $5,000,000 under this Offering in order to proceed with our business plan. However, should we not be successful in doing so, we will be required to adjust our business plan according to the amounts raised, which may have a material and adverse effect on our operations. As a specific example, should we only be able to raise 25% of the amount being sought, we anticipate we will have only very limited working capital, and would therefore be required to raise additional funds. If we are unable to do so, our entire business could fail. Notwithstanding, even if we raise the entire $5,000,000, we will need substantial additional financing to implement our business plan to the point of commencing an energy crop growing operation.

Should we be successful in raising the entire $5,000,000, and together with our existing cash in hand, we will have sufficient resources to commence the implementation of our business plan, including the project development of our first growing location and putting together the project finance elements necessary for normal project finance.

We have elected to make this public Offering of securities to raise the funds that are necessary to establish our project development operations for growing biomass energy crops in the United States, Central America, Mexico, Guam and other countries. Our decision to finance our operations through this Offering is based on a presumption that we will be more successful by offering securities under an effective registration statement than through a private offering of equity or through debt financing. There can be no assurance that we will sell all or any of the shares being offered, and if we are unable to sell all of the shares, our ability to implement the plan of operations as identified in this Offering may be materially and adversely affected as further identified under the Use of

Proceeds section commencing on Page 10.

Following is a brief summary of this Offering:

|

Securities being offered:

|

Up to 27,250,000 shares of common stock, par value $0.0001, of which 10,000,000 shares are part of the direct public offering, and 17,250,000 are being offered for sale by existing stockholders, including up to 1,000,000 shares which may be issued upon exercise of a warrant for the purchase of 1,000,000 shares of our common stock at $1.00 per share.

|

|

|

Offering price per share:

|

$0.50

|

|

|

Offering period:

|

The shares are being offered for a period not to exceed 90 days from the effectiveness of this Prospectus, unless extended by our Board of Directors for an additional 90 days.

|

1

|

Net proceeds to us:

|

$5,000,000, based on the maximum 10,000,000 shares being sold. There is no assurance that we will be successful in selling this entire amount. Furthermore, there is no minimum amount of shares that may be sold under this Offering, and we have no intention to return funds raised to investors should we sell lesser amounts than the maximum, even if the amounts raised are not sufficient to fully undertake our plan as identified in this Prospectus.

The Company will not receive any proceeds from the sale of shares by the selling stockholders. However, the Company may receive up to $1,000,000 in the event that the warrant described herein is exercised for the purchase of 1,000,000 shares of our common stock.

|

|

|

Use of proceeds:

|

If we are successful in raising the entire $5,000,000, we intend to use the proceeds to pay administrative and legal costs, further the implementation of our business plan, and to provide additional working capital to the Company.

If we are unsuccessful in raising the entire amount under this Offering our ability to implement the business plan as identified in this Prospectus may be materially and adversely affected. Refer to Use of Proceeds section commencing on Page 10 for additional information.

|

|

|

Number of shares outstanding before the Offering:

|

90,250,000

|

|

|

Number of shares outstanding after the Offering if all the shares are sold:

|

100,250,000

|

Our principal executive offices are located at 5379 Lyons Road, Suite 301, Coconut Creek, Florida 33073. Our telephone number is (954) 509-9830. Our website address is www.biopoweroperations.com. The information on or accessible through our website is not part of this Prospectus.

2

RISK FACTORS

An investment in our securities should be considered highly speculative due to various factors, including the nature of our business and the present stage of our development. An investment in our securities should only be undertaken by persons who have sufficient financial resources to afford the total loss of their investment. In addition to the usual risks associated with investment in a business, you should carefully consider the following known material risk factors and all other information contained in this Prospectus before deciding to invest in our Common Stock. If any of the following risks occur, our business, financial condition and results of operations could be materially and adversely affected.

Risks Relating to our Business

We are subject to a going concern opinion from our independent auditors.

Our independent auditors have added an explanatory paragraph to their audit issued in connection with the financial statements for the period ended November 30, 2010, relative to our ability to continue as a going concern. We had a working capital deficit of ($1,333) and we had a deficit accumulated during the development stage of ($1,334), as at November 30, 2010. Because our auditors have issued a going concern opinion, it means there is substantial uncertainty we will continue operations in which case you could lose your investment. The financial statements do not include any adjustments that might result from the uncertainty about our ability to continue our business. As such we may have to cease operations and investors could lose their entire investment.

We have had no operations to date and have earned no revenues to date.

We have had no operations to date and no revenues. We expect to incur losses at least in the first year, and possibly beyond, due to significant costs associated with our business development. There can be no assurance that we will be able to successfully implement our business plan, or that our business development will ever lead to us generating sufficient revenues to fund our continuing operations or that we will ever generate positive cash flow from our operations. Further, we can give no assurance that we will attain or thereafter sustain profitability in any future period. Since our resources are presently

very limited, insufficient future revenues would result in termination of our operations, as we cannot sustain unprofitable operations, unless additional equity or debt financing is obtained.

We have had no operations to date, and are competing with well-established companies in our business sector, and may never achieve profitability.

The Company intends to commence operations in February 2011 and to date has been focused on raising money and filing this registration statement. We are faced with all of the risks associated with a company in the early stages of development. Our business is subject to numerous risks associated with a relatively new, undercapitalized company engaged in our business sector. Such risks include, but are not limited to, competition from well-established and well-capitalized companies and unanticipated difficulties regarding the marketing and sale of our products. There can be no assurance that we will ever generate significant commercial sales or achieve profitability. Should this be the case, our common stock could become worthless and investors in our common stock or other securities could lose their

entire investment.

We need to obtain a significant amount of debt and/or equity capital to commence acquiring land and growing and managing energy crops, which we may not be able to obtain on acceptable terms or at all.

We will require additional capital to fund our business and development plan, including the acquisition of land and planting and management of biomass energy crops (“biomass operations”). In addition, once these farms have been planted, we will have to fund the start-up costs of these biomass operations until, if ever, the biomass is sold and generates sufficient cash flow. We may also encounter unforeseen costs that could also require us to seek additional capital. As a result, we expect to seek to raise additional debt and/or equity funding. The full and timely development and implementation of our business plan and growth strategy will require significant additional resources, and we may not be able to obtain the funding necessary to implement our growth strategy on acceptable terms

or at all. An inability to obtain such funding would prevent us from planting any tree farms or plantations. Furthermore, our plantation strategy may not produce revenues even if successfully funded. We have not yet identified the sources for the additional financing we require and we do not have commitments from any third parties to provide this financing. We might not succeed, therefore, in raising additional equity capital or in negotiating and obtaining additional and acceptable financing. Our ability to obtain additional capital will also depend on market conditions, national and global economies and other factors beyond our control. We might not be able to obtain required working capital, the need for which is substantial given our business and development plan. The terms of any future debt or equity funding that we may obtain may be unfavorable to us and to our stockholders.

We have limited financial and management resources to pursue our growth strategy.

Our growth strategy may place a significant strain on our management, operational and financial resources. We have negative cash flow from our development stage activities and continue to seek additional capital. We will have to obtain additional capital either through debt or equity financing to continue our business and development plan. There can be no assurance, however, that we will be able to obtain such financing on terms acceptable to our company.

3

If we raise additional funds through the issuance of equity or convertible securities, these new securities may contain certain rights, preferences or privileges that are senior to those of our common shares. Additionally, the percentage of ownership of our company held by existing shareholders will be reduced.

Our proposed business may be adversely affected if one or both of our license agreements with Clenergen and Green Oil Plantations, Ltd. is terminated.

Although we believe our relationships with our Licensors are very good, our license agreements do provide that the Licensors may terminate such agreements upon two years prior written notice in the event that certain events occur. Such events include but are not limited to, our failure to perform or observe any of our obligations, or the filing of bankruptcy. In the event that one or both of the license agreements are terminated by the licensors as provided in the license agreements, our business and operations will be materially and adversely affected.

We will be dependent on third parties for expertise in the management of our Biomass plantations and any loss or impairment of these relationships could cause delay and added expense. In addition, we currently have no binding definitive agreements with such parties and their failure to perform could hinder our ability to generate revenues.

The number of biomass plantation management companies with the necessary expertise to manage the biomass plantations is limited. We will be dependent on our relationships with third parties for their expertise. Any loss of, or damage to, these relationships, particularly during the planting and start-up period for the plantation(s), may significantly delay or even prevent us from continuing operations at these plantations and result in the failure of our business. The time and expense of locating new plantation management companies could result in unforeseen expenses and delays. Unforeseen expenses and delays may reduce our ability to generate revenue and significantly damage our competitive position in the industry.

We will be required to hire and retain skilled technical and managerial personnel.

Personnel qualified to operate and manage our future plantations and product sales are in great demand. Our success depends in large part on our ability to attract, train, motivate and retain qualified management and skilled employees, particularly managerial, technical, sales, and marketing personnel, technicians, and other critical personnel. Any failure to attract and retain the highly-trained managerial and technical personnel may have a negative impact on our operations, which would have a negative impact on our future revenues. There can be no assurance that we will be able to attract and retain skilled persons and the loss of skilled technical personnel would adversely affect our company.

We are dependent upon our officers for management and direction, and the loss of any of these persons could adversely affect our operations and results.

We are dependent upon our officers for execution of our business plan, especially Mr. Robert Kohn, our Chief Executive Officer, Secretary and a Director. The loss of Mr. Kohn or any of our other officers could have a material adverse effect upon our results of operations and financial position. We do not maintain “key person” life insurance for any of our officers. The loss of any of our officers could delay or prevent the achievement of our business objectives.

Delays or defects could result in delays in our proposed future production and sale of energy from Biomass and negatively affect our operations and financial performance.

Projects often involve delays for a number of reasons including delays in obtaining permits, delays due to weather conditions, or other events. Also, any changes in political administrations at each level that result in policy changes towards energy produced from Biomass could also cause delays. If it takes us longer to plant our proposed plantations, our ability to generate revenues could be impaired. In addition, there can be no assurance that defects in materials and/or workmanship will not occur. Such defects could delay the commencement of operations of the plantation or cause us to halt or discontinue the plantations operation or reduce the intended production capacity. Halting or discontinuing plantation operations could delay our ability to generate revenues.

Our proposed plantation sites may have unknown environmental problems that could be expensive and time consuming to correct which may delay or halt planting and delay our ability to generate revenue.

Liability costs associated with environmental cleanups of contaminated sites historically have been very high as have been the level of fines imposed by regularity authorities upon parties deemed to be responsible for environmental contamination. If contamination should take place for which we are deemed to be liable, potentially liable or a responsible party, the resulting costs could have a material effect on our business. This risk is mitigated by our program of supplying organic fertilizer and pesticides to each location where we are cultivating trees and/or bamboo for the purpose of Biomass.

We may encounter hazardous conditions at or near each of our proposed facility sites that may delay or prevent planting at a particular location. If we encounter a hazardous condition at or near a site, work may be suspended and we may be required to correct the condition prior to continuing the plantation. The presence of a hazardous condition would likely delay or prevent planting at a particular location and may require significant expenditure of resources to correct the condition. If we encounter any hazardous condition during planting, estimated sales and profitability may be adversely affected.

Changes in environmental regulations or violations of the regulations could be expensive and hinder our ability to operate profitably.

We are and will continue to be subject to extensive air, water and other environmental regulations and will need to maintain a number of environmental permits to plant and operate our future plantations. If for any reason, any of these permits are not granted, costs for the plantations may increase, or the plantations may not be planted at all. Additionally, any changes in environmental laws and regulations could require us to invest or spend considerable resources in order to comply with future environmental regulations. Violations of these laws and regulations could result in liabilities that affect our financial condition and the expense of compliance alone could be significant enough to reduce profits.

4

Our joint ventures and strategic alliances may not achieve their goals.

We expect to rely on joint ventures and strategic alliances for land acquisition and development, plantation, planting, growing and management, sale and marketing of products, funding of projects and project development. Even if we are successful in forming these alliances, they may not achieve their goals.

Dependence upon our officers without whose services Company Operations could cease.

At this time two of our officers in particular, Robert Kohn and Dale Shepherd, both of whom have extensive experience in the energy and fuels business, are primarily responsible for the development and execution of our business plan. Both individuals have long-term employment contracts with the Company commencing January and February, 2011, respectively, however after 5 years and 2 years, respectively, these contracts may be terminated by the officers, with payout provisions applicable. If either of our two officers should choose to leave us for any reason before we have hired additional personnel, our operations may fail. Even if we are able to find additional personnel, it is uncertain whether we could find qualified management who could develop our business along the lines described

herein or would be willing to work for compensation the Company could afford. Without such management, the Company could be forced to cease operations and investors in our common stock or other securities could lose their entire investment. We do not maintain “key person” life insurance for any of our officers and will be implementing a D&O Insurance policy in the near future.

Because there is no minimum share sale requirement, it is possible that we will fail to adequately fund our operations even if we raise some funds from this Offering.

This Offering is not subject to any minimum share sale requirement. Consequently, the early investor is not assured of any other, later shares being sold. You may be the only purchaser. If we fail to sell the entire amount under this Offering, we may never be able to adequately fund our operations and your investment would be lost. Please refer to the Use of Proceeds section starting on Page 10 for additional information on, and risks associated with, different levels of success in our funding efforts.

We do not have a traditional credit facility with a financial institution. This absence may adversely impact our operations.

We do not have a traditional credit facility with a financial institution, such as a working line of credit. The absence of a facility could adversely impact our operations, as it may constrain our ability to have the working capital for inventory purchases or other operational requirements. If adequate funds are not otherwise available, we may be required to delay, scale back or eliminate portions of our operations and project development efforts. Without credit facilities, the Company could be forced to cease operations and investors in our common stock or other securities could lose their entire investment.

Our inability to successfully achieve a critical mass of sales could adversely affect our financial condition.

No assurance can be given that we will be able to successfully achieve a critical mass of sales in order to cover our operating expenses and achieve sustainable profitability. Without such critical mass of sales, the Company could be forced to cease operations and investors in our common stock or other securities could lose their entire investment.

Other companies with greater resources and operating experience offer products similar to or the same as the products we sell.

We intend to operate in a very competitive industry with many established and well-recognized competitors. These competitors range from large, international oil companies such as Shell, Exxon-Mobil, BP, who have announced plans to create renewable energy projects and International Paper to smaller renewable energy companies and tree growing companies. Most of our competitors (including all of the competitors named above) have substantially greater market leverage, distribution networks, and vendor relationships, longer operating histories and industry experience, greater financial, technical, sales, marketing and other resources, more name recognition and larger customer bases than we do and potentially may react strongly to our marketing efforts. Other competitive responses might include, without limitation,

intense and aggressive price competition and offers of employment to our key marketing or management personnel. We may not be successful in the face of increasing competition from existing or new competitors, or the competition may have a material adverse effect on our business, financial condition and results of operations. If we are not successful in competing with our competitors, the Company could be forced to cease operations and investors in our common stock or other securities could lose their entire investment.

Our future sales and marketing efforts may not lead to sales of our products.

Our sales and marketing efforts have not yet commenced, and we believe we will have to establish significant sales and marketing capabilities in order to establish sufficient awareness to launch broader sales of our energy products. There can be no assurance that we will be able to expand our sales and marketing efforts to the extent we believe necessary or that any such efforts, if undertaken, will be successful in achieving substantial sales of our products. If we are unable to expand our sales and marketing efforts, the Company could be forced to cease operations and investors in our common stock or other securities could lose their entire investment.

5

The average selling prices of our products, and our gross margins resulting from the sale of such products, may decline as a result of industry trends, competitive pressures and other factors.

The renewable energy industry has experienced a significant shift in awareness due to a number of factors, particularly competitive and macroeconomic pressures and shortages of oil in the future. Our competitors have announced spending billions of dollars on tree and bamboo growing programs. This may lower sales prices from time to time in order to gain market share or create more demand. We may have to reduce the sales prices of our products in response to such intense pricing competition, which could cause our gross margins to decline and may adversely affect our business, operating results or financial condition. If we cannot maintain adequate profit margins on the sales of our products, the Company could be forced to cease operations and investors in our common stock or other securities

could lose their entire investment.

Our failure to manage growth effectively could impair our success.

In order for us to expand successfully, management will be required to anticipate the changing demands of a growth in operations, should such growth occur, and to adapt systems and procedures accordingly. There can be no assurance that we will anticipate all of the changing demands that a potential expansion in operations might impose. If we were to experience rapid growth, we might be required to hire and train a large number of sales and support personnel, and there can be no assurance that the training and supervision of a large number of new employees would not adversely affect the high standards that we seek to maintain. Our future will depend, in part, on our ability to integrate new individuals and capabilities into our operations, should such operations expand in the future, and there can be no

assurance that we will be able to achieve such integration. Failure to manage growth effectively during an expansion in our operations (should such an expansion occur) could adversely affect our business, financial condition and results of operations.

Changes in generally accepted accounting principles could have an adverse effect on our business, financial condition, cash flows, revenue and results of operations.

We are subject to changes in and interpretations of financial accounting matters that govern the measurement of our performance. Based on our reading and interpretations of relevant guidance, principles or concepts issued by, among other authorities, the American Institute of Certified Public Accountants, the Financial Accounting Standards Board, and the United States Securities and Exchange Commission, our management believes that our current contract terms and business arrangements have been properly reported. However, there continue to be issued interpretations and guidance for applying the relevant standards to a wide range of contract terms and business arrangements that are prevalent in the industries in which we operate. Future interpretations or changes by the regulators of existing accounting standards

or changes in our business practices could result in future changes in our revenue recognition and/or other accounting policies and practices that could have a material adverse effect on our business, financial condition, cash flows, revenue and results of operations.

The Company is controlled by its officers and directors and new investors will not have any voice in our management, which could result in decisions adverse to them.

Should this Offering be fully subscribed, our directors and officers collectively own or have the right to vote approximately 33.8% of our then outstanding Common Shares. In addition, on January 28, 2011, the Company filed with the Secretary of State of the State of Nevada a Certificate of Designation of Series A Preferred Stock. The Certificate was approved by the Board and did not require shareholder vote. The Certificate created a new class of preferred stock known as Series A Preferred Stock. There is one share designated as Series A Preferred Stock. One share of Series A Preferred Stock is entitled to 50.1% of the outstanding votes on all shareholder voting matters. Series A Preferred Stock has no dividend rights and no rights upon a liquidation event. On January 31, 2011, the Company

issued one share of Series A Preferred Stock to China Energy Partners, LLC, an entity controlled by Mr. Robert Kohn, our Chief Executive Officer and a Director and Ms. Bonnie Nelson, a Director, with each owning 50% of that entity. Through this entity, Mr. Kohn and Ms. Nelson are empowered with supermajority voting rights despite the amount of outstanding voting securities they each own.

As a result they will have the ability to control substantially all matters submitted to our stockholders for approval including:

|

|

-

|

election of our board of directors;

|

|

|

-

|

removal of any of our directors;

|

|

|

-

|

amendment of our Articles of Incorporation or By-laws; and

|

|

|

-

|

adoption of measures that could delay or prevent a change in control or impede a merger, takeover or other business combination involving us.

|

In addition, sales of significant amounts of shares held by selling stockholders, or the prospect of these sales, could adversely affect the market price of our Common Shares. Preferred stock and common stock ownership of our principal stockholders and our officers and directors may discourage a potential acquirer from making a tender offer or otherwise attempting to obtain control of us, which in turn could reduce our stock price or prevent our stockholders from realizing a premium over our stock price.

6

We will incur significant increased costs as a result of operating as a public company, and our management will be required to devote substantial time to new compliance initiatives.

As a public company, we will incur significant legal, accounting and other expenses that we did not incur as a private company. The Sarbanes-Oxley Act of 2002, as well as rules subsequently implemented by the Securities and Exchange Commission (the “SEC”), have imposed various requirements on public companies, including requiring establishment and maintenance of effective disclosure and financial controls and changes in corporate governance practices. Our management and other personnel will need to devote a substantial amount of time to these new compliance initiatives. Moreover, these rules and regulations will increase our legal and financial compliance costs and will make some activities more time consuming and costly. We expect these rules and regulations to make it more difficult and more

expensive for us to obtain director and officer liability insurance and we may be required to incur substantial costs to maintain the same or similar coverage.

Section 404 of the Sarbanes-Oxley Act of 2002 requires, among other things, that we maintain effective internal control over financial reporting and disclosure controls and procedures. As a smaller reporting company, while we are not required to obtain the attestation of our accounting firm regarding the effectiveness of our internal control over financial reporting, our management is still required to assess the effectiveness of such internal controls. If we are unable to comply with the requirements of Section 404 in a timely manner or if we are not able to remediate any deficiencies, we could be subject to sanctions or investigations by the SEC or other regulatory authorities, which would require additional financial and management resources.

Risks Relating to our Common Shares and the Trading Market

We may, in the future, issue additional Common Shares which would reduce investors’ percent of ownership and may dilute our share value.

Our Articles of Incorporation authorize the issuance of 500,000,000 Common Shares with par value of $0.0001 per share and 10,000 shares of Preferred Stock with par value of $1.00 per share. The future issuance of our authorized Common Shares and Preferred Stock, to the extent that it is convertible into shares of common stock, may result in substantial dilution in the percentage of our Common Shares held by our then existing stockholders. We may value any Common Shares issued in the future on an arbitrary basis. The issuance of Common Shares for future services or acquisitions or other corporate actions may have the effect of diluting the value of the Common Shares held by our investors, and might have an adverse effect on any trading market for our Common Shares.

Because of the early stage of development and the nature of our business, our securities are considered highly speculative.

Our securities must be considered highly speculative, generally because of the nature of our business and the early stage of its development. We are seeking to commence a new business in the highly competitive renewable energy industry, and we have yet to establish or operate our first planned energy crop growing operation. Accordingly, we have not generated any revenues nor have we realized a profit from our operations to date, and there is little likelihood that we will generate any revenues or realize any profits in the short to medium term. Any profitability in the future from our business will be dependent upon our successfully implementing our business plan, which itself is subject to numerous risk factors as set forth herein. Since we have not generated any revenues, we will

have to raise additional monies through the sale of our equity securities or debt in order to undertake our business operations.

There is no current trading market for our securities and if a trading market does not develop, purchasers of our securities may have difficulty selling their shares.

There is currently no established public trading market for our securities and an active trading market in our securities may not develop or, if developed, may not be sustained. We intend to have a market maker apply for admission to quotation of our Common Shares on the OTC Bulletin Board. If for any reason our Common Shares are not quoted on the OTC Bulletin Board or a public trading market does not otherwise develop, purchasers of the Common Shares may have difficulty selling their shares should they desire to do so. No market makers have committed to becoming market makers for our Common Shares and it may be that none will do so.

7

Our Common Shares are subject to the “Penny Stock” Rules of the SEC and the trading market in our securities is limited, which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock.

The SEC has adopted regulations that generally define a "penny stock" to be any equity security other than a security excluded from such definition by Rule 3a51-1 under the Securities Exchange Act of 1934, as amended. For the purposes relevant to our Company, it is any equity security that has a market price of less than $5.00 per share, subject to certain exceptions.

If our shares are accepted for quotation on the OTC Bulletin Board, it is anticipated that our Common Shares will be regarded as a “penny stock”, since our shares aren’t to be listed on a national stock exchange or quoted on the NASDAQ Market within the United States, to the extent the market price for our shares is less than $5.00 per share. The penny stock rules require a broker-dealer to deliver a standardized risk disclosure document prepared by the SEC, to provide the customer with additional information including current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, monthly account statements showing the market value of each penny stock held in the customer's account, and to make a special written

determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. To the extent these requirements may be applicable they will reduce the level of trading activity in the secondary market for the Common Shares and may severely and adversely affect the ability of broker-dealers to sell the Common Shares.

United States securities laws may limit secondary trading, which may restrict the states in which and conditions under which you can sell the shares offered by this Offering.

Secondary trading in Common Shares sold in this Offering will not be possible in any state in the U.S. unless and until the Common Shares are qualified for sale under the applicable securities laws of the state or there is confirmation that an exemption, such as listing in certain recognized securities manuals, is available for secondary trading in such state. There can be no assurance that we will be successful in registering or qualifying the Common Shares for secondary trading, or identifying an available exemption for secondary trading in our Common Shares in every state. If we fail to register or qualify, or to obtain or verify an exemption for the secondary trading of, the Common Shares in any particular state, the Common Shares could not be offered or sold to, or purchased by, a resident of that

state. In the event that a significant number of states refuse to permit secondary trading in our Common Shares, the market for the Common Shares could be adversely affected.

We have not and do not intend to pay any cash dividends on our Common Shares, and consequently our stockholders will not be able to receive a return on their shares unless they sell them.

We intend to retain any future earnings to finance the development and expansion of our business. We have not, and do not, anticipate paying any cash dividends on our Common Shares in the foreseeable future. Unless we pay dividends, our stockholders will not be able to receive a return on their shares unless they sell them.

The elimination of monetary liability against the Company’s directors, officers and employees under Nevada law and the existence of indemnification rights to the Company’s directors, officers and employees may result in substantial expenditures by the Company and may discourage lawsuits against the Company’s directors, officers and employees .

The Company’s certificate of incorporation contains a specific provision that eliminates the liability of directors for monetary damages to the Company and the Company’s stockholders; further, the Company is prepared to give such indemnification to its directors and officers to the extent provided by Nevada law. The Company may also have contractual indemnification obligations under its employment agreements with its executive officers. The foregoing indemnification obligations could result in the Company incurring substantial expenditures to cover the cost of settlement or damage awards against directors and officers, which the Company may be unable to recoup. These provisions and resultant costs may also discourage the Company from bringing a lawsuit against directors and officers for breaches of

their fiduciary duties and may similarly discourage the filing of derivative litigation by the Company’s stockholders against the Company’s directors and officers even though such actions, if successful, might otherwise benefit the Company and its stockholders.

8

If we do not comply with the state regulations in regard to the sale of these securities or find an exemption therefrom there may be potential limitations on the resale of your stock.

With few exceptions, every offer or sale of a security must, before it is offered or sold in a state, be registered or exempt from registration under the securities, or blue sky laws, of the state(s) in which the security is offered and sold. Similarly, every brokerage firm, every issuer selling its own securities and an individual broker or issuer representative (i.e., finder) engaged in selling securities in a state, must also be registered in the state, or otherwise exempt from such registration requirements. Most states securities laws are modeled after the Uniform Securities Act of 1956 ("USA"). To date, approximately 40 states use the USA as the basis for their state blue sky laws.

However, although most blue sky laws are modeled after the USA, blue sky statutes vary widely and there is very little uniformity among state securities laws. Therefore, it is vital that each state's statutes and regulations be reviewed before embarking upon any securities sales activities in a state to determine what is permitted, or not permitted, in a particular state. While we intend to review the blue sky laws before the distribution of any securities in a particular state, should we fail to properly register the securities as required by the respective states or find an exemption from registration, then you may not be able to resell your stock once purchased.

9

FORWARD-LOOKING STATEMENTS

This Prospectus contains forward-looking statements that involve risks and uncertainties. We use words such as: anticipate, believe, plan, expect, future, intend and similar expressions, to identify such forward-looking statements. You should not place too much reliance on these forward-looking statements. Actual results are most likely to differ materially from those anticipated in these forward-looking statements for many reasons, including the risks faced as described in the Risk Factors section and elsewhere in this Prospectus. Factors which may cause the actual results or the actual plan of operations to vary include, among other things, decisions of the board of directors not to pursue a specific course of action based on its re-assessment of the facts or new

facts, or changes in general economic conditions and those other factors set out in this Prospectus.

Forward-looking statements include all statements that are not historical facts. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “could,” “would,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “projects,” “predicts,” “potential,” or the negative of those terms, and similar expressions and comparable terminology intended to identify forward-looking statements. These statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking

statements. These forward-looking statements represent our estimates and assumptions only as of the date of this prospectus and, except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise after the date of this prospectus. The forward-looking statements contained in this prospectus are excluded from the safe harbor protection provided by the Private Securities Litigation Reform Act of 1995 and Section 27A of the Securities Act of 1933, as amended, referred to herein as the Securities Act.

USE OF PROCEEDS

We plan to raise up to $5,000,000 dollars from the sale of 10,000,000 shares of common stock at $0.50 per share. This Offering has a maximum amount of $5,000,000 dollars and no minimum. We have no intention to return any stock sales proceeds to investors if the maximum amount is not raised.

All proceeds from the sale of the 16,250,000 shares from the selling stockholders will be paid directly to those stockholders, and the Company will not receive proceeds therefrom. However, we may receive proceeds from the exercise of the warrant to purchase 1,000,000 common shares if and to the extent that such warrant is exercised by the selling stockholder.

We will use our best efforts to raise the entire $5,000,000 under this Offering in order to fully proceed with our business plan. However, should we not be successful in doing so, we will be required to adjust our business plan according to the amounts raised, which may have a material and adverse effect on our operations. The following table outlines our planned use of proceeds based on different percentages of shares sold and the corresponding proceeds raised:

|

Use of Proceeds based on % of Offering sold / Net Proceeds Raised

|

|||||||||||||

|

Use of Proceeds

|

25% /

$1,250,000

|

50% /

$2,500,000

|

75% /

$3,750,000

|

100% /

$5,000,000

|

|||||||||

|

Establishment of permanent corporate headquarters

|

$ | 50,000 | $ | 50,000 | $ | 50,000 | $ | 50,000 | |||||

|

Project development costs for energy crop growing operations

|

$ | 1,000,000 | $ | 1,500,000 | $ | 2,250,000 | $ | 3,250,000 | |||||

|

Working capital from Proceeds of Offering

|

$ | 200,000 | $ | 950,000 | $ | 1,450,000 | $ | 1,700,000 | |||||

|

Plus, existing Working Capital:

|

$ | 300,000 | $ | 300,000 | $ | 300,000 | $ | 300,000 | |||||

|

Total Working Capital after Offering:

|

$ | 500,000 | $ | 1,750,000 | $ | 1,750,000 | $ | 2,000,000 | |||||

|

Officers and Directors Salaries

|

$ | 0 | $ | 617,500 | $ | 617,500 | $ | 617,500 | |||||

|

Employees

|

$ | 195,000 | $ | 422,500 | $ | 422,500 | $ | 710,000 | |||||

|

Consultants

|

$ | 125,000 | $ | 250,000 | $ | 250,000 | $ | 375,000 | |||||

|

Legal and Accounting

|

$ | 125,000 | $ | 150,000 | $ | 175,000 | $ | 200,000 | |||||

|

Other Working Capital Expenses

|

$ | 55,000 | $ | 310,000 | $ | 285,000 | $ | 97,500 |

Our corporate headquarters is a sublease we are negotiating for 2,000 square feet of office space for 26 months and will cost us approximately $50,000 per year including all furniture.

Our project development costs are a budget which cover the development costs related to potential projects to be developed including feasibility studies for each project. We will be limited as to the number of projects we can develop by the funds available for project development costs. Project development costs include travel, engineering, soil studies, negotiations with third party purchasers of products produced, presentations to governments, municipalities and prospective joint venture partners, licenses, legal and accounting and related feasibility project costs. Project development costs do not include the cost of a biomass project. As we increase the amount of shares sold under this Offering we will be able to develop more projects and therefore our project development costs will increase.

10

In the event we are able to sell only 25% of the shares under this Offering, we believe we have sufficient funds from our proceeds raised to allocate the necessary funds required to commence project development for our first biomass project. We would pay costs associated with setting up corporate headquarters. We would seek to raise the remaining $3,750,000 identified as being optimal for establishing our project development activities. Under this scenario we will have limited working capital and therefore there is a chance of our business failing. Our officers would accrue, but not be paid, a salary in this circumstance.

Should we only be able to sell 50% of the shares under this Offering we would expend the funds as detailed above to set up the corporate office, project development costs for biomass projects and working capital. Our working capital would in this situation be approximately $1,750,000 total. While the raise of $2,500,000 is sufficient to start project development of our initial biomass projects and generally operate the Company for the first year, we will not have raised enough capital to be in a position to develop additional biomass projects. We would therefore seek to raise the remaining $2,500,000 as soon as possible, in order to continue our business plan fully. We believe that by having sufficient funds to develop a first operating biomass operation, it will be somewhat

easier to raise the remaining funds. However, there is no assurance we will be successful in doing so. If we are unable to raise the funds, we will be in a position whereby a substantial amount of funds has been invested into establishing and developing only one or two biomass projects but we won’t have a solid foundation for further growth and expansion.

If we are able to sell 75% of the shares under the Offering, we believe that we will have sufficient funds to generally effect our business plan and develop multiple biomass projects for a period of one year. We would still seek to raise the remaining $1,250,000, and we believe this should be less challenging to accomplish, though there is no assurance of success. If we cannot raise the required funds, we won’t have a solid foundation for further growth and expansion.

In any of the three scenarios presented representing our not selling 100% of the shares under the Offering, while we will be able to advance our business plan to varying degrees, we will be required to raise additional capital in some manner that we have not yet identified, in order to achieve the level of progress in our business plan identified in the 100% scenario. If we are unsuccessful in doing so, the risks to an investor in this Prospectus are increased, particularly in the 25% and 50% scenarios. In all these situations, management will accrue but will not be paid their salary until $2,500,000 has been raised either through the Offering or in some other fashion.

Should we raise the entire $5,000,000 we are seeking from this Offering, we will have sufficient funds for our operations for the twelve month period following the completion of this Offering (“Initial Period”), inclusive of having paid $50,000 towards our permanent corporate headquarters and $3,250,000 towards our project development costs. Our working capital would then be $1,700,000 plus the approximately $300,000 working capital already on hand. This is expected to be sufficient to pay for the project development costs and feasibility studies to obtain project financing for our first biomass project during the Initial Period. If our project development operations do not generate sufficient revenue, and profitability, within the Initial Period, we

would be required to raise additional funds, for which we have not identified any sources at this time. There can be no assurance that even though we prepare the feasibility studies showing profitability, that we will be able to obtain the necessary financing required for a fully operating biomass project.

11

In the event that we sell less than 25% of the shares in this Offering, we will have a Use of Proceeds which will follow the below order:

|

Establishment of permanent corporate headquarters

|

$ | 50,000 | ||

|

Legal and Accounting

|

$ | 125,000 | ||

|

Employee Expense

|

$ | 65,000 | ||

|

Total Use of Proceeds

|

$ | 240,000 |

Any remaining funds from initial $300,000 raise will be applied to working capital. All other shares sold from this Offering will be used for project development costs for energy crop growing projects.

As of November 30, 2010, our period end, our wholly-owned subsidiary, BioPower Corporation, had raised $1 through the sale of 10,000 shares of our common stock and secured a loan of $19,999 from our CEO and a Director which such shares have been cancelled as of January 5, 2011 and are not being registered as part of this Prospectus.

Subsequent to our period end, we accepted subscription agreements on February 2, 2011 for the sale of 1,200,000 shares of our common stock at a price of $0.25 per share with no commissions paid, for total proceeds of $300,000. From this total of $300,000, $15,000 has been expended towards the preparation of our Registration Statement. As of the date of this filing, we have approximately $300,000 cash in hand.

DETERMINATION OF OFFERING PRICE

There is no established market for our stock. The offering price for shares sold pursuant to this Offering is set at $0.50 per common share. To date, we have issued a total of 90,250,000 common shares, 85,100,000 common shares of which were sold at an average price of $0.0036 per share, for total gross proceeds of $308,310.

The $0.50 price of the shares that are being offered, that being the 10,000,000 direct issue shares, was arbitrarily determined in order for us to raise up to a total of $5,000,000 in this Offering through the direct issue.

The shares being offered by the selling stockholders will be sold at $0.50 per share until such time as the Company’s shares of common stock are quoted on the OTC Bulletin Board and thereafter at prevailing market prices.

The offering price bears no relationship whatsoever to our assets, earnings, book value or other criteria of value. Among the factors considered were:

|

|

-

|

our cash requirements;- the proceeds to be raised by the Offering;

|

|

|

-

|

our lack of operating history; and

|

|

|

-

|

the amount of capital to be contributed by purchasers in this Offering in proportion to the amount of stock to be retained by our existing stockholders.

|

The offering price stated in this prospectus should not be considered an indication of the actual value of the shares. That price is subject to change as a result of market conditions and other factors, and we cannot assure you that the shares can be resold at or above the public offering price.

There are no warrants, rights or convertible securities associated with this Offering.

DILUTION

“Net tangible book value” is the amount that results from subtracting the total liabilities and intangible assets from the total assets of an entity. Dilution occurs because we determined the offering price based on factors other than those used in computing book value of our stock. Dilution exists because the book value of shares held by existing stockholders is lower than the offering price offered to new investors.

We are offering shares of our common stock for $0.50 per share through this Offering. At November 30, 2010 our net tangible book value was ($1,333). We have adjusted the Net tangible book value to reflect the following stock sales. In 2011, founding shareholders of the Company purchased a total of 83,900,000 shares of our common stock for $8390. In addition, we have sold an additional 1,200,000 shares of our common stock at a price of $0.25 per share with no commissions paid, for total proceeds of $300,000. Of the total 85,100,000 shares sold, the average selling price was $0.0036 per share. 5,150,000 shares were issued at no cost for agreements for services and an exclusive license. We have 90,250,000 shares outstanding prior to the offering.

12

Following is a table detailing dilution to investors if 25%, 50%, 75%, or 100% per cent of the Offering is sold.

|

25%

|

50%

|

75%

|

100%

|

|||||||||||||

|

Total Assets at November 30, 2010

|

$ | 20,124 | $ | 20,124 | $ | 20,124 | $ | 20,124 | ||||||||

|

Total Liabilities at November 30, 2010

|

(21,457 | ) | (21,457 | ) | (21,457 | ) | (21,457 | ) | ||||||||

|

Less: Costs of Preparing Prospectus

|

(40,250 | ) | (40,250 | ) | (40,250 | ) | (40,250 | ) | ||||||||

|

Plus: Proceeds from Sale of 85,100,000 Shares

|

308,390 | 308,390 | 308,390 | 308,390 | ||||||||||||

|

Net Tangible Book Value (Numerator)

|

$ | 266,807 | $ | 266,807 | $ | 266,807 | $ | 266,807 | ||||||||

|

Shares Outstanding (Denominator)

|

90,250,000 | 90,250,000 | 90,250,000 | 90,250,000 | ||||||||||||

|

Net Tangible Book Value Per Share Prior to Stock Sale(1)

|

$ | 0.0030 | $ | 0.0030 | $ | 0.0030 | $ | 0.0030 | ||||||||

|

25%

|

50%

|

75%

|

100%

|

|||||||||||||

|

Net Tangible Book Value

|

$ | 266,807 | $ | 266,807 | $ | 266,807 | $ | 266,807 | ||||||||

|

Net Proceeds from the Offering

|

1,250,000 | 2,500,000 | 3,750,000 | 5,000,000 | ||||||||||||

|

Adjusted Net Tangible Book Value after Offering (Numerator)(2)(3)

|

$ | 1,516,807 | $ | 2,766,807 | $ | 4,016,807 | $ | 5,266,807 | ||||||||

|

Shares Outstanding before Offering

|

90,250,000 | 90,250,000 | 90,250,000 | 90,250,000 | ||||||||||||

|

Shares from Offering

|

10,000,000 | 10,000,000 | 10,000,000 | 10,000,000 | ||||||||||||

|

Adjusted Shares Outstanding after Offering (Denominator)

|

100,250,000 | 100,250,000 | 100,250,000 | 100,250,000 | ||||||||||||

|

Net Tangible Book Value Per Share After Stock Sale

|

$ | 0.0151 | $ | 0.0276 | $ | 0.0401 | $ | 0.0525 | ||||||||

|

25%

|

50%

|

75%

|

100%

|

|||||||||||||

|

Net Tangible Book Value at November 30, 2010

|

$ | (1,333 | ) | $ | (1,333 | ) | $ | (1,333 | ) | $ | (1,333 | ) | ||||

|

Net Proceeds from the Offering

|

1,250,000 | 2,500,000 | 3,750,000 | 5,000,000 | ||||||||||||

|

Adjusted Net Tangible Book Value after Offering (Numerator)

|

$ | 1,248,667 | $ | 2,498,667 | $ | 3,748,667 | $ | 4,998,667 | ||||||||

|

Shares Outstanding before Offering

|

90,250,000 | 90,250,000 | 90,250,000 | 90,250,000 | ||||||||||||

|

Shares from Offering

|

10,000,000 | 10,000,000 | 10,000,000 | 10,000,000 | ||||||||||||

|

Adjusted Shares Outstanding after Offering (Denominator)

|

100,250,000 | 100,250,000 | 100,250,000 | 100,250,000 | ||||||||||||

|

Increase (Decrease) in Net Book Value Per Share Due to Stock Sale

|

$ | 0.0125 | $ | 0.0249 | $ | 0.0374 | $ | 0.0499 | ||||||||

|

|

(1)

|

The net tangible book value per share before the Offering is determined by dividing the number of shares of common stock outstanding into our net tangible book value at 11/30/2010 plus the $308,390 received from sales of stock in 2011.

|

|

|

(2)

|

The net tangible book value after the Offering is determined by adding the net tangible book value before the Offering to the estimated proceeds to us from the current Offering less the remaining Prospectus preparation costs of $40,250. The net tangible book value before the Offering, as at February 7, 2011, was determined by including the $5,000,000 of new capital, less $40,250 for payment of the costs of preparing the Prospectus.

|

|

|

(3)

|

The net tangible book value per share after the Offering is determined by dividing the number of shares that will be outstanding after the Offering into the net tangible book value after the Offering as determined in Note 3.

|

Following is a comparison of the differences of your investment in our shares with the share investment our existing stockholders.

The existing stockholders have purchased a total of 85,100,000 common shares for an aggregate amount of $308,310 or an average cost of approximately $0.0036 per share. Your investment in our shares will cost you $0.50 per share. In the event that this Offering is fully subscribed, the net tangible book value of the stock held by the existing stockholders will increase by $0.0532 per share, while your investment will decrease by $0.497 per share. If this Offering is fully subscribed, the total capital contributed by new investors will be $5,000,000. The percentage of capital contribution will then be 5.81% for the existing stockholders and 94.2% for the new investors. The existing stockholders will then hold, as a percentage, 84.89% of our issued and outstanding shares,

while the new investors will hold, as a percentage, 9.98%.

13

SELLING STOCKHOLDERS

The persons listed in the following table plan to offer the shares shown opposite their respective names by means of this Prospectus. The owners of the shares to be sold by means of this Prospectus are referred to as the “selling stockholders”. The selling stockholders acquired their shares from us in privately negotiated transactions. These shares may be sold by one or more of the following methods, without limitations.

|

|

-

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits investors;

|

|

|

-

|

block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

-

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

|

-

|

at a fixed price of $0.50 per share until such time as, and if, the Company’s common stock is quoted on the OTCBB and thereafter at such prevailing market prices;

|

|

|

-

|

privately negotiated transactions;

|

|

|

-

|

to cover short sales after the date the registration statement, of which this Prospectus is a part, is declared effective by the Securities and Exchange Commission;

|

|

|

-

|

a combination of any such methods of sale; and

|

|

|

-

|

any other method permitted pursuant to applicable law.

|

In competing sales, brokers or dealers engaged by the selling stockholders may arrange for other brokers or dealers to participate. Brokers or dealers may receive commissions or discounts from selling stockholders in amounts to be negotiated. As to any particular broker-dealer, this compensation might be in excess of customary commissions. Neither, we nor the selling stockholders can presently estimate the amount of such compensation. Any broker/dealers who act in connection with the sale of the shares will be deemed to be “underwriters” within the meaning of the Securities Acts of 1933, and any commissions received by them and any profit on any resale of the shares as a principal might be deemed to be underwriting discounts and commissions under the Securities Act.

If any selling stockholders enters into an agreement to sell his or her shares to a broker/dealer as principal and the broker/dealer is acting as an underwriter, we will file a post-effective amendment to the registration statement, of which this Prospectus is a part, identifying the broker/dealer, providing required information concerning the plan of distribution, and otherwise revising the disclosures in this Prospectus as needed. We will also file the agreement between the selling shareholder and the broker/dealer as an exhibit to the post-effective amendment to the registration statement.

The selling stockholders have been advised that any securities broker/dealers or others who will be deemed to be statutory underwriters will be subject to the prospectus delivery requirements under the Securities Act of 1933. We have advised each selling shareholder that in the event of a “distribution” of the shares owned by the selling shareholder, such selling shareholder, any “affiliated purchasers”, and any broker/dealer or other person who participates in the distribution may be subject to Rule 102 of Regulation M under the Securities Exchange Act of 1934 (“1934 Act”) until their participation in that distribution is complete. Rule 102 makes it unlawful for any person who is participating in a distribution to bid for or purchase stock of the same class, as is the subject

of the distribution. A “distribution” is defined in Rule 102 as an offering of securities “that is distinguished from ordinary trading transaction by the magnitude of the offering and the presence of special selling efforts and selling methods”. We have advised the selling stockholders that Rule 101 of Regulation M under the 1934 Act prohibits any “stabilizing bid” or “stabilizing purchase” for purpose of pegging, fixing or stabilizing the price of the common stock in connection with this Offering.

Notwithstanding, certain selling stockholders have entered into a lockup agreement with the Company effectively restricting them from transferring some or all of their common stock for a period of one-year without the prior written consent of the Company, which consent may be unreasonably withheld. Subsequent to the one year lockup period, the selling stockholder may sell its common stock every calendar quarter in an amount equal to no more than one percent (1%) of the Company’s issued and outstanding shares of common stock; provided, however, that the selling stockholder shall not be permitted to make any transfer, or portion thereof, that would exceed twenty percent (20%) of the average weekly reported volume of trading of the Company’s common stock on all national securities exchanges and/or reported through the automated