Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2010

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File Number: 0-51142

UNIVERSAL TRUCKLOAD SERVICES, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Michigan | 38-3640097 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

12755 E. Nine Mile Road

Warren, Michigan 48089

(Address, including Zip Code of Principal Executive Offices)

(586) 920-0100

(Registrant’s telephone number, including area code)

Securities registered pursuant to section 12(b) of the Act: None

Securities registered pursuant to section 12(g) of the Act:

Common Stock, no par value

(TITLE OF CLASS)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by checkmark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for a shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated filer ¨ | Accelerated filer x | |

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2). Yes ¨ No x

As of July 3, 2010, the last business day of the registrant’s most recently completed second quarter, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant, based upon the closing sale price of the common stock on July 2, 2010, as reported by The Nasdaq Stock Market, was approximately $82.7 million (assuming, but not admitting for any purpose, that all directors and executive officers of the registrant are affiliates).

The number of shares of common stock, no par value, outstanding as of March 1, 2011, was 15,621,783.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the following document, to the extent specified in this report, are incorporated by reference in Part III of this report:

| Document | Incorporated by reference in: | |

| Proxy Statement for 2011 Annual Meeting of Shareholders | Part III, Items 10 - 14 |

Table of Contents

UNIVERSAL TRUCKLOAD SERVICES, INC.

2010 ANNUAL REPORT ON FORM 10-K

| PART I | ||||||

| Item 1. |

3 | |||||

| Item 1A. |

11 | |||||

| Item 1B. |

18 | |||||

| Item 2. |

18 | |||||

| Item 3. |

18 | |||||

| Item 4. |

18 | |||||

| PART II | ||||||

| Item 5. |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 19 | ||||

| Item 6. |

22 | |||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

24 | ||||

| Item 7A. |

34 | |||||

| Item 8. |

35 | |||||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

63 | ||||

| Item 9A. |

63 | |||||

| Item 9B. |

65 | |||||

| PART III | ||||||

| Item 10. |

66 | |||||

| Item 11. |

66 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 66 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

66 | ||||

| Item 14. |

67 | |||||

| PART IV | ||||||

| Item 15. |

68 | |||||

| 69 | ||||||

| EX-21.1 List of Subsidiaries |

||||||

| EX-23.1 Consent of KPMG |

||||||

| EX-31.1 Section 302 CEO Certification |

||||||

| EX-31.2 Section 302 CFO Certification |

||||||

| EX-32.1 Section 906 CEO and CFO Certification |

||||||

Table of Contents

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements and assumptions in this Form 10-K are forward-looking statements. These statements identify prospective information. Important factors could cause actual results to differ, possibly materially, from those in the forward-looking statements. In some cases you can identify forward-looking statements by words such as “anticipate,” “believe,” “could,” “estimate,” “plan,” “intend,” “may,” “should,” “will” and “would” or other similar words. You should read statements that contain these words carefully because they discuss our future expectations, contain projections of our future results of operations or of our financial position or state other “forward-looking” information. Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of the times at, or by which, such performance or results will be achieved. Forward-looking information is based on information available at the time and/or management’s good faith belief with respect to future events, and is subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in the statements. The factors listed in the section captioned “Risk Factors” in Item 1A in this Form 10-K, as well as any other cautionary language contained in this Form 10-K, provide examples of risks, uncertainties and events that may cause our actual results to differ materially from the expectations we describe in our forward-looking statements.

Forward-looking statements speak only as of the date the statements are made. We assume no obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information except to the extent required by applicable securities laws. If we do update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect thereto or with respect to other forward-looking statements.

Unless the context indicates otherwise, “we,” “our” and “us” refers to Universal Truckload Services, Inc. and its subsidiaries.

PART I

Overview

We are primarily an asset-light provider of transportation services to shippers throughout the United States and in the Canadian provinces of Ontario and Quebec. Our over-the-road trucking services include both flatbed and dry van operations and we provide rail-truck and steamship-truck intermodal support services. We also offer truck brokerage services, which allow us to supplement our capacity and provide our customers with transportation of freight not handled by our owner-operators. In addition, we offer full service international freight forwarding and customs house brokerage services.

We primarily operate through a contractor network of agents and owner-operators who provide us with approximately 2,800 tractors and approximately 3,000 trailers. At December 31, 2010, the Company had approximately 660 agents. Customer relationships are primarily managed by our agents who solicit freight business directly from shippers and also provide dispatch and other services to our owner-operators. Our owner-operators own, operate and maintain substantially all of the tractors and over 50% of the trailers used in our business. Some of our owner-operators also act as fleet contractors and provide us with multiple tractors and drivers. In return for their services, we pay our agents and owner-operators fixed commissions based on a percentage of the revenue they generate for us. This network of agents and owner-operators allows us to minimize our investment in tractors and trailers, manage our sales effort in a manner we believe is more efficient than employing a large sales staff, and maximize the variable portion of our cost structure. In addition, through our brokerage operations, we are able to expand our capacity by arranging for other carriers to transport shipments when we generate more freight shipments than our owner-operators can service.

3

Table of Contents

We believe our commission schedule, prompt payment practices, industry reputation, financial stability, back office support and national freight network helps us to attract agents and owner-operators. In addition, we acquired the operations of 22 transportation companies between October 2000 and December 2010. We are continually evaluating new acquisition opportunities.

We were incorporated in Michigan on December 11, 2001. Our common stock began trading on the NASDAQ Global Select Market under the symbol “UACL” on February 11, 2005, the date of our initial public offering. Our principal executive offices are located at 12755 E. Nine Mile Road, Warren, Michigan 48089. Our website address is www.goutsi.com. The information contained on, or accessible through, our website is not a part of this Form 10-K.

Industry

According to the American Trucking Association, or ATA, the trucking industry was estimated at approximately $544.4 billion in revenue in 2009 and accounted for approximately 81.9% of domestic spending on freight transportation. The trucking industry is highly competitive on the basis of service and price and is necessary in many industries operating in the United States. Customers generally choose truck transportation over other surface transportation modes due to the industry’s higher levels of reliability, shipment integrity and speed.

The trucking industry includes both private fleets and for-hire’ carriers. Private fleets consist of trucks owned and operated by shippers that move their own goods and, according to the ATA, accounted for approximately $259.6 billion of revenue in 2009. For-hire carriers include both truckload and less-than truckload operations. We primarily operate in the highly fragmented for-hire truckload segment of this market, which according to the ATA generated revenues of approximately $284.8 billion in 2009. Truckload carriers dedicate an entire trailer to one customer from origin to destination and can be further classified by the trailing equipment they use to haul a customer’s freight, such as dry van, temperature-controlled, tank or flatbed.

Our primary source of revenue results from hauling flatbed and dry van freight, which during the year ended December 31, 2010 accounted for $509.0 million, or 84.0% of our revenues. We believe the truckload market offers significant opportunities for expansion by for-hire carriers, such as ourselves, because shippers increasingly are focused on operating within and conserving capital for their core competencies, which often do not include freight transportation. In our intermodal support services, which during the year ended December 31, 2010 accounted for $87.9 million or 14.5% of our revenues, we believe that third party logistics companies, railroads and ocean carriers are increasingly seeking efficiencies gained by using companies with greater service offerings, capacity and geographic coverage than the smaller private operators upon which they have historically relied.

Recent economic trends have led to a continuing consolidation of the truckload industry. We believe that the truckload market will continue to experience further consolidation due to a number of economic factors that have forced many smaller carriers to exit the business, merge or file for bankruptcy. These factors include rising insurance costs, scarcity of capital, volatility of fuel prices, increased prices for new environmentally friendly equipment, purchasing advantages available to larger carriers and customer demand for total service solutions that can only be provided by large carriers. As a result, we believe that larger, better-capitalized companies, like us, will have greater opportunities to gain market share and increase profit margins.

Asset Light Strategy

We primarily employ an asset light business model. Substantially all tractors and over 50% of trailers are provided by our owner-operators. In addition, our use of agents reduces our need for sizable terminals. The primary physical assets we provide to our agents and owner-operators include a portion of our trailer fleet, our intermodal depot facilities, our headquarters facility and our management information systems. We believe that

4

Table of Contents

our business model offers the following advantages compared with primarily asset-based trucking companies that own significant tractor fleets and use an employee sales force:

| • | Variable cost structure. We pay our agents and owner-operators a percentage of the revenue they generate, which gives us flexibility to quickly adjust to increases or decreases in customer demand. Additionally, having a high proportion of variable costs reduces our risks of making fixed payments on under-utilized equipment and personnel and minimizes our exposure to fluctuating equipment values. In 2010, approximately 84.7% of our total operating expenses were variable in nature. |

| • | Reduced capital expenditures. Limiting our investment in tractors and trailers reduces our capital needs and allows us to grow organically using relatively small amounts of cash. This allows us to conserve our financial resources to fund our expansion strategy, including acquisitions. Our operating revenues have grown from $213.3 million in 2001 to $605.9 million in 2010, reaching a maximum level of $759.5 million in 2008, while we have spent an aggregate of $104.8 million on capital expenditures over the same period of time, excluding property and equipment acquired in connection with the acquisitions of businesses. |

| • | Higher financial returns. Given similar operating performance, we believe that our low fixed costs and capital expenditure requirements will produce higher returns on our assets than many of our asset-based competitors. We manage our business with a view toward enhancing these returns. In 2010, we achieved a 4.7% return on average assets, excluding gains on the sales of marketable securities. |

| • | Entrepreneurial spirit. Our agents and owner-operators are business owners who are compensated based on the revenue they produce. We believe this model gives our agents a strong incentive to seek new revenue opportunities. In addition, we believe that our owner-operators have a greater incentive to operate their equipment more reliably, efficiently and safely than would be the case with employee drivers using employer-provided equipment. |

Although we believe our asset light business model is advantageous, there are certain disadvantages. Our use of owner-operators limits the pool of potential drivers and could constrain our growth. In addition, our variable cost structure does not allow us to take advantage of freight cycles as well as a fixed cost structure would. Thus, in times of very high economic activity and increasing freight rates, our profitability may not expand as much as that of an asset-based carrier. We share control over customer relationships with our agents and may be constrained in our ability to seek large national contracts. Overall, however, we believe our long experience with this business model and our growth, profitability, and financial returns demonstrate that we have adequately managed these risks.

Growth Strategy

We believe that our flexible business model offers us substantial opportunities to grow. By continuing to implement our strategy, we believe that we can continue to increase our revenues and profitability, while generating a higher return on assets than many of our asset-based competitors. The key elements of our strategy are as follows:

| • | Grow our brokerage operations. Our brokerage services have grown substantially, expanding to $148.0 million in operating revenues in 2010 from $25.7 million in 2001, a compound annual growth rate of 21.5%. In 2010, brokerage services accounted for 24.4% of our operating revenues. We encourage our agents to generate shipping contracts above the levels that can be accommodated by our owner-operators and provide the training and management information systems that enable our agents to broker these contracts to third party carriers. We intend to continue to grow this business both organically and through investments in management information systems and strategic acquisitions. |

| • | Make strategic acquisitions. Acquisitions have been an important part of our growth and we continually evaluate strategic acquisition opportunities. Our acquisition plan is to focus on targets that are primarily non-asset based, but we also will consider companies that derive a portion of their |

5

Table of Contents

| business from asset-based operations. Our predecessor began operations in 1981 when Universal Am-Can Ltd. was formed as an owner-operator and agent based carrier. Since then, we have successfully integrated 25 acquisitions, 22 of which we have consummated between October 2000 and December 2010. During each of the years ended December 31, 2010, 2009, and 2008 acquisition revenues totaled 10.3%, 4.2% and 5.1%, respectively, of our total revenue in each year. Our current growth is highly dependent upon being able to continue to make strategic acquisitions. Our operational integration strategy is to centralize administrative functions of acquired businesses at our headquarters, while maintaining the localized operations of the acquired businesses and maintaining the target’s network of agents and owner-operators. We believe that allowing most of our acquired businesses to continue to operate under their pre-acquisition names, in their original regions and with the same agents and owner-operators enables us to maintain the loyalty of the agents and owner-operators and continue pre-existing customer relationships. |

| • | Expand our network of agents and owner-operators. Increasing the number of agents and owner-operators has also been a driver of our historical growth. We intend to continue to recruit qualified agents and owner-operators in order to penetrate new markets and expand our operations in existing markets. Our agents typically focus on a small number of shippers in a particular market and are attuned to the specific transportation needs of that core group of shippers, while remaining alert to growth opportunities. With their detailed knowledge of local trucking markets, our agents serve as an excellent platform for recruiting additional owner-operators. In addition, we believe that the current environment of increasing costs and industry consolidation has created substantial uncertainty for agents, owner-operators and shippers. This uncertainty has led to a desire within these constituencies to associate themselves with a stable company that has an established market presence, and we have successfully converted small independent trucking companies into agents and owner-operators. |

| • | Expand our intermodal support services. Our intermodal support services have grown from $28.9 million in operating revenues in 2001 to $87.9 million in 2010, a compound annual growth rate of 13.2%. We intend to continue the growth of this business by expanding our service offerings, acquiring or renting additional intermodal facilities and also expanding our network of intermodal agents. We will evaluate future intermodal facility sites based on regional and international shipping volumes and market saturation. We currently operate eight full service container yards located in the mid-western and south-western United States and own over 475 chassis. Our facilities provide container and chassis inventory systems, full service repair facilities, and overhead lift capabilities. U.S. Customs has approved our Dearborn, Michigan facility as a container freight station. With the assistance of our container and chassis management services, we are able to offer steamship companies a neutral facility to store, repair, and track their equipment for future use. At our container freight station in Michigan, we can transfer bonded freight between overseas containers and other equipment for delivery to its final destination. We believe that providing container and chassis management as well as bonded customs services will allow us the opportunity to provide additional services for these customers. |

Our Operations

We conduct our operations through our eleven wholly owned operating subsidiaries under the brand names Universal Am-Can, Ltd., Mason & Dixon Lines, Inc., Economy Transport, Inc., Louisiana Transportation Inc., Mason Dixon Intermodal, Inc., Great American Lines, Inc., CrossRoad Carriers Inc., NYP of Michigan, Inc., Universal Logistics, Inc., D. Kratt International, and Cavalry Transportation, LLC.

We broadly group our services into the following three categories: truckload services, brokerage services and intermodal support services.

| • | Truckload. Our truckload operations represented approximately $370.1 million, or 61.1%, of our operating revenues in 2010. We transport a wide variety of general commodities, including machinery, building materials, paper, food, consumer goods, automotive parts, furniture, steel and other metals on behalf of customers in various industries. |

6

Table of Contents

| • | Brokerage. Our brokerage operations represented approximately $148.0 million, or 24.4%, of our operating revenues in 2010. We primarily broker freight to third party transportation providers through our agent network at times when we generate more freight business than we can service with our available owner-operators. These transportation providers may include competing truckload carriers or, occasionally, shipper-owned and operated private motor carrier transport fleets with excess capacity. We also offer full service international freight forwarding and customs house brokerage services as well as third-party logistic services. |

| • | Intermodal support services. Our intermodal support services represented $87.9 million or 14.5% of our operating revenues in 2010. Our intermodal support services are primarily short-to-medium distance delivery of rail and steamship containers between the railhead or port and the customer and drayage services. |

Independent Contractor Network

We utilize a network of agents and owner-operators located throughout the United States and in the Canadian provinces of Ontario and Quebec. These agents and owner-operators are independent contractors who earn a fixed commission calculated as a percentage of the revenue they generate for us and who bring an entrepreneurial spirit to our business. We believe that this gives them greater incentive to respond quickly to customer needs and market opportunities and, in the case of owner-operators, to operate their equipment more reliably, efficiently and safely than would be the case with employee-drivers.

Agents

Our agents provide the primary interaction with our shippers. Approximately 72.9% of the freight we hauled in 2010 was solicited and controlled by our agents, with the remaining 27.1% generated by company-managed terminals and full service freight forwarding and customs house brokerage offices. Of our approximately 660 agents, 401 generated more than $100,000 of operating revenues and 119 generated more than $1.0 million of operating revenues, in 2010. Our agents typically focus on three or four shippers within a particular market and solicit most of their freight business from this core group. By focusing on a relatively small number of shippers, each agent is attuned to the specific transportation needs of that core group of shippers, while remaining alert to growth opportunities.

While the agent’s most important function is to generate freight shipments, they also provide valuable terminal and dispatch services for our owner-operators and are an important source for recruitment of new owner-operators. Our agents use a company-provided software program to list available freight procured by the agent, dispatch owner-operators to haul the freight and provide all administrative information necessary for us to establish the credit arrangements for each shipper. Our agents do not have the authority to execute or fulfill shipping contracts on their own, as all shipping contracts are between one of our operating subsidiaries and the shipper directly, and we generally assume the liability for freight loss or damages.

We believe that our commission schedule, prompt payment practices, industry reputation, financial stability, back-office support and national freight network are attractive to agents and we have grown from 209 agents who generated more than $100,000 of operating revenues in 2000 to 401 who generated more than $100,000 of operating revenues in 2010. Our top 100 agents in 2010 generated 49.5% of our annual operating revenues. We generally pay our full-service agents a commission of 8% of revenue generated, excluding fuel surcharges. While we have signed agreements with most of our newer agents, we rely on verbal agreements with most of our long-term agents. We believe that very few of our agents work exclusively with us. The loss of any large-volume agent or a significant decrease in volume from one of these agents could have a materially adverse effect on our results of operations.

Owner-Operators

Owner-operators are individuals who own, operate and maintain one or more tractors that they either provide drivers for, or drive themselves. Our owner-operators provide us with approximately 2,800 tractors, which

7

Table of Contents

represent substantially all of the tractors used in our business. Owner-operators also may own trailers that they provide to us in addition to their tractor and driving services. Our owner-operators provide approximately 3,000 trailers, which represent over 50% of the trailers we use in our business. Owner-operators are responsible for all expenses of owning and operating their equipment, including the wages and benefits paid to any drivers, fuel, physical damage insurance, maintenance, fuel taxes, highway use taxes and debt service.

We believe that our commission schedule, prompt payment practices, financial stability, back-office support and national freight network are attractive to owner-operators. The number of tractors provided by our owner-operators has grown from 2,266 at December 31, 2001 to 2,839 at December 31, 2010, a compound annual growth rate of 2.5%. We generally pay our owner-operators a commission of 75% of the revenue generated from the freight they haul, if both a tractor and trailer are supplied. We generally also pass on 100% of any fuel surcharges we receive and a portion of other accessorial charges (at the commission rate) to our owner-operators. Most owner-operators are recruited directly by our agents. All owner-operators enter into standard, short-term written contracts with one of our operating subsidiaries that can be terminated by either party on short notice.

Pursuant to our arrangements with the owner-operators, we maintain the federal and state licensing required for them to operate a motor coach carrier. We also provide insurance coverage for the owner-operators and are primarily liable to the shipper for damaged or lost freight and to third parties for personal injury claims arising out of accidents involving the owner-operators. We also administer the owner-operators’ compliance with safety, vehicle licensing and fuel-tax reporting rules. Each owner-operator must meet our guidelines with respect to matters such as motor vehicle records, or MVR’s, insurance, driving experience and past work history and must pass a federally mandated physical exam. Additionally, our owner-operators are also subject to pre-lease drug and alcohol screening and are subject to subsequent random testing.

Corporate Services

We oversee certain administrative functions at our headquarters, while all operations and sales efforts are performed by our operating subsidiaries, each of which functions as a distinct operational unit and is not dependant on the operations of any of the other subsidiaries. These administrative functions are primarily focused on providing support to our agents, which includes billing and collections, contractor settlements, management information systems, purchasing, safety, and risk management. In addition, we conduct our accounting, strategic planning and human resource management functions at our headquarters. The management information systems used by our agents and owner-operators in connection with our operations are centralized in our corporate administrative offices in Warren, Michigan. We provide systems that handle all billing with shippers, allow agents to list pending freight shipments and owner-operators with available capacity, and track particular shipments at various points in the shipping route. We rely on the proper operation of our management information systems. Any significant disruption or failure of these systems could have a materially adverse effect on our operations and results of operations.

Customers

We provide our truckload, brokerage and intermodal support services throughout the United States and in the Canadian provinces of Ontario and Quebec to a wide variety of shippers, including a number of Fortune 500 and multi-national companies across a wide variety of industries. Our largest concentration of customers comes from the steel, automotive and alternative energy industries geographically located throughout the United States. In addition, a significant portion of our revenue results from our providing capacity to other transportation companies who aggregate loads from a variety of shippers in these and other industries. No single customer has accounted for more than 5% of our operating revenues in 2008, 2009 or 2010, and the aggregate operating revenues generated by our top ten customers did not account for more than 18% of our operating revenues in any such year. We believe the diversity of our customers and their industries lessens the impact of business cycles affecting any one company or industry.

8

Table of Contents

Revenue Equipment

We offer our customers a wide range of transportation services by utilizing a diverse fleet of trailing equipment provided by us and our owner-operators. At December 31, 2010, our owner-operators provided us with approximately 2,800 tractors and 3,000 trailers. At December 31, 2010, the Company owned approximately 115 tractors, 1,750 trailers, 475 chassis and operated 13 leased tractors with company drivers.

Insurance

We maintain auto liability, workers compensation and general liability insurance with licensed insurance carriers. We are self-insured for all cargo and equipment damage claims. Insurance and claims expense represents premiums paid by us and the accruals made for claims within our self-insured retention amounts. The accruals are primarily related to auto liability, cargo and equipment damage claims. A liability is recognized for the estimated cost of all self-insured claims and for claims expected to exceed our policy limit, based on our knowledge of the facts and, in certain cases, opinions of outside counsel, including estimates of incurred but not reported claims based on historical experience. We may also make accruals for personal injury and property damage to third parties, and workers’ compensation claims if a claim exceeds our insurance coverage.

To reduce our exposure to non-trucking use liability claims (claims incurred while the vehicle is being operated without a trailer attached or is being operated with an attached trailer which does not contain or carry any cargo), we require our owner-operators to maintain non-trucking use liability coverage, which we refer to as deadhead bobtail coverage, of $2.0 million per occurrence.

In brokerage arrangements, our exposure to liability associated with accidents incurred by other third-party carriers, who haul freight on our behalf, is reduced by various factors including the extent to which the third party providers maintain their own insurance coverage.

Our insurance and claims expense varies primarily based upon the frequency and severity of the Company’s accident experience, the market for insurance, our coverage limits, and self-insured retention amounts.

Competitive Environment

We compete for truckload freight primarily in the U.S. markets of the transportation industry. The transportation industry is extremely competitive and fragmented. We compete with asset and non-asset based truckload carriers, intermodal transportation, logistics providers and, in some aspects of our business, with less-than-truckload carriers and railroads. We also compete with other motor carriers for owner-operators and agents.

Recent economic trends have led to a consolidation of the truckload industry. We believe that the truckload market will continue to experience further consolidation due to a number of economic factors that have forced many smaller carriers to exit the business, merge or file for bankruptcy. These factors include rising insurance costs, scarcity of capital, volatility of fuel prices, increased prices for new environmentally friendly equipment, purchasing advantages available to larger carriers and customer demand for total service solutions that can only be provided by large carriers.

Government Regulation

Our operations are regulated and licensed by various federal and state agencies. Interstate motor carrier operations are subject to safety and insurance requirements prescribed by the Federal Motor Carrier Safety Administration, or FMCSA. Such matters as weight and equipment dimensions also are subject to federal and state regulation. We operate in the United States throughout the 48 contiguous states pursuant to operating authority granted by the FMSCA and in various Canadian provinces pursuant to operation authority granted by the Ministries of Transportation and Communications in such provinces. To the extent that we conduct operations outside the United States, we are subject to the Foreign Corrupt Practices Act, which generally prohibits U.S. companies and their intermediaries from bribing foreign officials for the purpose of obtaining or retaining favorable treatment.

9

Table of Contents

In November 2008, following the submission of additional data by FMCSA and a series of appeals and related court rulings, the FMCSA adopted the final hours-of-service (HOS) provisions of its December 2007 Interim Final Ruling (IFR), which allows commercial motor carrier drivers to continue to drive up to 11 hours within a 14-hour workday and mandates at least 10 consecutive off-duty hours between workdays. The ruling also allows drivers to continue to restart their calculations of weekly on-duty time limits after having at least 34 consecutive hours off-duty. Advocacy groups continued to challenge HOS regulations and on October 27, 2009, the FMCSA announced that it will “completely rewrite” the 2008 regulations. In December 2010, the FMCSA published proposed HOS rules, which comply with a court imposed settlement agreement that would require publication of the final rules by July 2011. The proposed rules include changes to the 34-hour restart, a mandatory 1 hour break during the work day, and the completion of all work within 14 hours. Although no decision has been made, the Company believes that the FMCSA also favors a 10-hour driving limit, which would yield a loss of 1-hour of service from current standards.

In December 2010, the FMCSA also initiated its Compliance Safety Accountability (CSA) initiative (formerly Comprehensive Safety Analysis 2010). The CSA system fundamentally changes the safety evaluation process for all motor carriers and includes a scope of enforcement to the driver level (in our case the owner-operator) to make driver safety performance history more transparent to law enforcement and motor carriers. The Company believes the intent is to improve regulatory oversight of motor carriers and drivers.

We are also preparing for an anticipated change in the manner in which commercial drivers will be required to document their HOS. In April 2010, the FMCSA published a regulation that will require interstate carriers with documented patterns of HOS violations to install electronic on-board recorders (EOBR) in their vehicles. EOBR’s are devices attached to the vehicle that automatically record the number of hours a driver spends operating the vehicle. The current system is a manual log system. In January 2011, the FMCSA proposed to expand this requirement to all motor carriers. It is expected that a final rule will be published in June 2012, and motor carriers will have 3 years to comply with the mandate.

We are also subject to regulations relating to testing and specifications of equipment and product handling requirements. In addition, our owner-operators must comply with safety and fitness regulations promulgated by the FMCSA, including those relating to drug and alcohol testing.

Environmental

We are subject to various environmental laws and regulations and, among other things, our operations are subject to the risk of fuel spillage and the consequential environmental damage. If we are involved in a fuel spill or other accident involving hazardous substances, we are subject to substantial fines or penalties and to criminal and civil liability.

Laws and regulations concerning the discharge of pollutants into the air and water, the handling and disposal of hazardous materials, the investigation and remediation of property contamination, and other aspects of environmental protection are in effect wherever we operate. Our current operations do not involve material costs to comply with such laws and regulations, and they have not given rise to, and are not expected to give rise to, material liabilities under these laws and regulations for investigation or remediation of contamination.

Claims for environmental liabilities arising out of property contamination have been asserted against us and our predecessors from time to time. Such claims, in some instances, have been associated with businesses related to entities we acquired and have been based on conduct that occurred prior to our acquisition of those entities. While none of the claims identified to date have resulted in a material liability to us, additional environmental liabilities relating to any of our former operations or any entities we have acquired could be identified and give rise to claims against us involving significant losses.

In August 2005, UTS Realty, LLC, or Realty, purchased a container storage facility in Cleveland, Ohio. In connection with the acquisition of the property, Realty received indemnity from the seller from any and all

10

Table of Contents

claims, which Realty may incur as a direct consequence of any environmental condition of which the seller had actual knowledge as of the date of the acquisition of the property.

Seasonality

Our results of operations are subject to seasonal trends common to the trucking industry. Our results of operations in the first fiscal quarter of each year are typically lower than the other quarters, principally because some shippers reduce their shipments and the productivity of our owner-operators generally decreases during the winter season because inclement weather impedes operations.

Employees

At December 31, 2010, we employed 714 individuals. None of our employees is represented by a collective bargaining unit. We believe that our employee relations are good.

Available Information

We make available free of charge on or through our website our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with or furnished to the Securities and Exchange Commission, or the SEC. Our website address is www.goutsi.com. The SEC maintains a website at www.sec.gov that contains the Company’s current and periodic reports, proxy and information statements and other information filed electronically with the SEC.

We primarily rely on owner-operators to provide transportation services to our customers. Continued reliance primarily on owner-operators, as well as reductions in our pool of available driver candidates could limit our growth.

The transportation services that we provide are primarily carried out by owner-operators who are generally responsible for paying for their own equipment, fuel and other operating costs. Our owner-operators provide substantially all of the tractors and over 50% of the trailers used in our business. Owner-operators make up a relatively small portion of the pool of all truck drivers. Thus, continued reliance primarily on owner-operators could limit our ability to grow. In addition, the following factors recently have combined to create a difficult operating environment for owner-operators:

| • | increases in the prices of new and used tractors; |

| • | a tightening of financing sources available to owner-operators for the acquisition of equipment; |

| • | high fuel prices; and |

| • | increases in insurance costs. |

In recent years, these factors have caused many owner-operators to join company-owned fleets or to exit the industry entirely. As a result of the smaller available pool of qualified owner-operators, the already strong competition among carriers for their services has intensified. Due to the difficult operating environment and intense competition, turnover among owner-operators in the trucking industry is high. In 2010, turnover among our owner-operators was approximately 84%. Additionally, our agreements with our owner-operators are terminable by either party upon short notice and without penalty. Consequently, we regularly need to recruit qualified owner-operators to replace those who have left our fleet. We are also preparing for the FMCSA to change the carrier review, safety measurement and enforcement standards to a new system known as Comprehensive Safety Analysis 2010 (CSA 2010). The CSA 2010 system changes the safety evaluation process

11

Table of Contents

for all motor carriers and includes a scope of enforcement to the driver level (in our case the owner-operator) to make driver safety performance history more transparent to law enforcement and motor carriers. If we are unable to retain our existing owner-operators or recruit new owner-operators, it could have a materially adverse effect on our business and results of operations.

In the event that the current operating environment for owner-operators worsens, we could adjust our owner-operator compensation package or, alternatively, acquire more of our own revenue equipment and seat it with employee drivers in order to maintain or increase the size of our fleet. The adoption of either of these measures could materially and adversely affect our financial condition and results of operations. If we are required to increase the compensation of owner-operators, our results of operations would be adversely affected to the extent increased expenses are not offset by higher freight rates. If we elect to purchase more of our own tractors and hire additional employee drivers, our capital expenditures would increase, we would incur additional employee benefits costs and depreciation, interest, and/or equipment rental expenses, our financial return on our assets would decline and we would be exposed to the risks associated with implementing a business model with which we have limited experience.

We rely heavily upon our agents to develop customer relationships and to locate freight, and the loss of any agent or agents responsible for a significant portion of our revenue could adversely affect our revenue and results of operations.

We rely heavily upon our agents to market our transportation services, to act as intermediaries with customers and to recruit owner-operators. Although we employ a small field management staff that maintains direct relationships with some of our larger, national customers and is responsible for supporting, coordinating and supervising our agent’s activities, the primary relationship with our customers generally is with our agents and not directly with us. We rely on verbal agreements with many of our agents and these verbal agreements do not obligate our agents to provide us with a specific amount of service or to refer freight exclusively to us. Our reliance on verbal agreements may increase the likelihood that we or our agents have a disagreement or a misunderstanding of our and their respective rights and obligations. In addition, in the event of a dispute with one of our agents, we may not be able to verify the terms of the agreement.

We compete with other trucking companies that utilize agent networks both to recruit quality agents and for the business that they generate, which typically involves both competition with respect to the freight rates that we charge shippers and the compensation paid to the agents. There can be no assurance that we will be able to retain our agents or that our agents will continue to refer to us the amount of business that they have in the past. In 2010, 119 of our agents generated more than $1.0 million in operating revenues each and our five largest revenue-producing agents generated an aggregate of approximately 8.6% of our operating revenues. If we were to lose the service of an agent or agents responsible for a significant portion of our operating revenues or if any such agent or agents were to significantly reduce the volume of business that they refer to us, it would have a materially adverse effect on our operating revenues and results of operations. Further, if we were required to increase the compensation we pay to agents in order to retain, or maintain business volumes with them, our operating results would be adversely affected to the extent that we could not pass these increased costs on to our customers.

We self-insure for a significant portion of our potential liability for auto liability, workers’ compensation and general liability claims. One or more significant claims, our failure to adequately reserve for such claims, or the cost of maintaining our insurance, could have a materially adverse impact on our financial condition and results of operations.

We maintain auto liability, workers compensation and general liability insurance with licensed insurance carriers. We are self-insured for all cargo and equipment damage claims.

The nature of our industry is that auto accidents occur and, when they do, they almost always result in equipment damage and they often result in injuries or death. Since January 1, 2000, less than 1% of our total casualty claims

12

Table of Contents

exceeded our insurance policy limits. If we experience claims that are not covered by our insurance or that exceed our reserves, or if we experience claims for which coverage is not provided, it could increase the volatility of our earnings and have a materially adverse effect on our financial condition and results of operations.

Our insurance premiums continue to increase over our historical levels and as a result we expect our insurance and claims expense to continue to increase over historical levels, even if we do not experience an increase in the number of insurance claims. Insurance carriers have significantly raised premiums for many businesses, including trucking companies. If this continues, the cost of maintaining our insurance would increase. In addition, if we decide to increase our insurance coverage in the future, our costs would be expected to further increase.

Our business is subject to general economic and business factors that are largely out of our control, any of which could have a materially adverse effect on our operating results.

Our business is dependent upon a number of general economic and business factors that may have a materially adverse effect on our results of operations. Many of these are beyond our control, including new equipment prices and used equipment values, interest rates, fuel taxes, tolls, and license and registration fees, all of which could increase the costs borne by our owner-operators, and capacity levels in the trucking industry, particularly in the market segments and geographic regions in which we operate.

We also are affected by recessionary economic cycles, changes in inventory levels, and downturns in customers’ business cycles, particularly in market segments and industries where we have a significant concentration of customers, such as automotive, steel and other metals, building materials and machinery. Economic conditions may adversely affect our customers, their need for our services or their ability to pay for our services. Adverse changes in any of these factors could have a materially adverse effect on our business and results of operations.

We operate in a highly competitive and fragmented industry, and our business may suffer if we are unable to adequately address factors that may adversely affect our revenue and costs relative to our competitors.

Numerous competitive factors could impair our ability to maintain our current profitability. These factors include the following:

| • | we compete with many other truckload carriers of varying sizes and to a lesser extent, with less than truckload carriers and railroads, some of which have more equipment, a broader coverage network, a wider range of services and greater capital resources than we do; |

| • | some of our competitors periodically reduce their freight rates to gain business, especially during times of reduced growth rates in the economy, which may limit our ability to maintain or increase freight rates, maintain our operating margins or maintain significant growth in our business; |

| • | many customers reduce the number of carriers they use by selecting so-called “core carriers” as approved service providers, and in some instances we may not be selected; |

| • | many customers periodically accept bids from multiple carriers for their shipping needs, and this process may depress freight rates or result in the loss of some of our business to competitors; |

| • | the trend toward consolidation in the trucking industry may create other large carriers with greater financial resources and other competitive advantages relating to their size and with whom we may have difficulty competing; |

| • | advances in technology require increased investments to remain competitive, and our customers may not be willing to accept higher freight rates to cover the cost of these investments; |

| • | competition from Internet-based and other brokerage companies may adversely affect our relationships with our customers and freight rates; and |

| • | economies of scale that may be passed on to smaller carriers by procurement aggregation providers may improve the ability of smaller carriers to compete with us. |

13

Table of Contents

Fluctuations in the price or availability of fuel and our ability to collect fuel surcharges may affect our ability to retain or recruit owner-operators.

Our owner-operators bear the costs of operating their tractors, including the cost of fuel and fuel taxes. The tractors operated by our owner-operators consume large amounts of diesel fuel. Diesel fuel prices fluctuate greatly due to economic, political and other factors beyond our control. For example, average weekly diesel fuel prices ranged from $3.00 per gallon to $3.29 per gallon in the fourth quarter 2010, compared with $2.58 per gallon to $2.73 per gallon in the fourth quarter of 2009. To address fluctuations in fuel prices, we seek to impose fuel surcharges on our customers and pass these surcharges on to our owner-operators. These arrangements will not fully protect our owner-operators from fuel price increases. If costs for fuel escalate significantly it could make it more difficult to attract additional qualified owner-operators and retain our current owner-operators. Our owner-operators also may seek higher compensation from us in the form of higher commissions, which could have a materially adverse effect on our results of operations. If we lose the services of a significant number of owner-operators or are unable to attract additional owner-operators, it could have a materially adverse effect on our business and results of operations.

We may not be able to successfully execute our acquisition strategy, which could cause our business and future growth prospects to suffer.

One component of our growth strategy is to pursue strategic acquisitions of truckload and other transportation companies that meet our acquisition criteria. During each of the years ended December 31, 2010, 2009, and 2008 acquisition revenues totaled 10.3%, 4.2% and 5.1%, respectively, of our total revenue in each year. Our current growth is highly dependent upon being able to continue to make strategic acquisitions. However, suitable acquisition candidates may not be available on terms and conditions we find acceptable. In pursuing acquisitions, we compete with other companies, many of which may have greater resources than we do. If we are unable to secure sufficient funding for potential acquisitions, we may not be able to complete strategic acquisitions that we otherwise find desirable. Further, if we succeed in consummating strategic acquisitions, our business, financial condition and results of operations may be negatively affected because:

| • | some of the acquired businesses may not achieve anticipated revenues, earnings or cash flows; |

| • | we may assume liabilities that were not disclosed to us or exceed our estimates; |

| • | we may be unable to integrate acquired businesses successfully and realize anticipated economic, operational, and other benefits in a timely manner, which could result in substantial costs and delays or other operational, technical or financial problems; |

| • | acquisitions could disrupt our ongoing business, distract our management and divert our resources; |

| • | we may experience difficulties operating in markets in which we have had no or only limited direct experience; |

| • | we may lose the customers, key employees, agents and owner-operators of the acquired company; |

| • | we may finance future acquisitions by issuing common stock for some or all of the purchase price, which could dilute the ownership interests of our shareholders; |

| • | we may incur additional debt related to future acquisitions; or |

| • | we may acquire companies that derive a portion of their revenues from asset-based operations and experience unforeseen difficulties in integrating this unfamiliar business model. |

If we are unable to retain our executive officers, our business and results of operations could be harmed.

We are highly dependent upon the services of our executive officers and the officers of our operating subsidiaries. We do not maintain key-man life insurance on any of these persons. The loss of the services of any of these individuals could have a materially adverse effect on our operations and future profitability. We also need to continue to develop and retain a core group of managers if we are to realize our goal of expanding our

14

Table of Contents

operations and continuing our growth. The market for qualified employees can be highly competitive, and we cannot assure you that we will be able to attract and retain the services of qualified executives, managers or other employees.

We operate in a highly regulated industry and increased costs of compliance with, liability for violation of, or changes in, existing or future regulations could have a materially adverse effect on our business and our ability to retain or recruit owner-operators.

The U.S. Federal Motor Carrier Safety Administration, or FMCSA, and various state and local agencies exercise broad powers over our business, generally governing such activities as authorization to engage in motor carrier operations, safety and insurance requirements. Our owner-operators must comply with the safety and fitness regulations promulgated by the FMCSA, including those relating to drug and alcohol testing and hours-of-service. There also are regulations specifically relating to the trucking industry, including testing and specifications of equipment and product handling requirements. These measures could disrupt or impede the timing of our deliveries and we may fail to meet the needs of our customers. The cost of complying with these regulatory measures, or any future measures, could have a materially adverse effect on our business or results of operations.

In November 2008, following the submission of additional data by FMCSA and a series of appeals and related court rulings, the FMCSA adopted the final hours-of-service (HOS) provisions of its December 2007 Interim Final Ruling (IFR), which allows commercial motor carrier drivers to continue to drive up to 11 hours within a 14-hour workday and mandates at least 10 consecutive off-duty hours between workdays. The ruling also allows drivers to continue to restart their calculations of weekly on-duty time limits after having at least 34 consecutive hours off-duty. Advocacy groups continued to challenge HOS regulations and on October 27, 2009, the FMCSA announced that it will “completely rewrite” the 2008 regulations. In December 2010, the FMCSA published proposed HOS rules, which comply with a court imposed settlement agreement that would require publication of the final rules by July 2011. The proposed rules include changes to the 34-hour restart, a mandatory 1 hour break during the work day, and the completion of all work within 14 hours. Although no decision has been made, the Company believes that the FMCSA also favors a 10-hour driving limit, which would yield a loss of 1-hour of service from current standards.

In December 2010, the FMCSA also initiated its Compliance Safety Accountability (CSA) initiative (formerly Comprehensive Safety Analysis 2010). The CSA system fundamentally changes the safety evaluation process for all motor carriers and includes a scope of enforcement to the driver level (in our case the owner-operator) to make driver safety performance history more transparent to law enforcement and motor carriers. The Company believes the intent is to improve regulatory oversight of motor carriers and drivers.

We are also preparing for an anticipated change in the manner in which commercial drivers will be required to document their HOS. In April 2010, the FMCSA published a regulation that will require interstate carriers with documented patterns of HOS violations to install electronic on-board recorders (EOBR) in their vehicles. EBOR’s are devices attached to the vehicle that automatically record the number of hours a driver spends operating the vehicle. The current system is a manual log system. In January 2011, the FMCSA proposed to expand this requirement to all motor carriers. It is expected that a final rule will be published in June 2012, and motor carriers will have 3 years to comply with the mandate.

Advocacy groups may continue to challenge the final rulings of the FMCSA, and we are unable to predict how a court may rule on such challenges. We will continue to monitor the actions of the FMCSA.

Our operations are subject to various environmental laws and regulations, the violation of which could result in substantial fines or penalties.

Our operations involve the risks of fuel spillage and environmental damage, among others, and we are subject to various environmental laws and regulations. If we are involved in a spill or other accident involving hazardous

15

Table of Contents

substances, or if we are found to be in violation of applicable laws or regulations, we could be subject to substantial fines or penalties and to criminal and civil liability, which could have a materially adverse effect on our business and operating results. In addition, claims for environmental liabilities arising out of property contamination have been asserted against us from time to time. Such claims, in some instances, have been associated with businesses related to entities or facilities we acquired and have been based on conduct that occurred prior to our acquisition of those entities or facilities. While none of the claims identified to date have resulted in a material liability to us, additional environmental liabilities relating to any of our former operations or any entities or facilities we have acquired could be identified and give rise to claims against us involving significant losses.

A determination by regulators that our agents and owner-operators are employees could expose us to various liabilities and additional costs.

From time to time, tax and other regulatory authorities have sought to assert that independent contractors in the trucking industry, such as our agents and owner-operators, are employees rather than independent contractors. There can be no assurance that these interpretations and tax laws that consider these persons independent contractors will not change or that these authorities will not successfully assert this position. If our agents or owner-operators are determined to be our employees, that determination could materially increase our exposure under a variety of federal and state tax, workers’ compensation, unemployment benefits, labor, employment and tort laws, as well as our potential liability for employee benefits. Our business model relies on the fact that our agents and owner-operators are not deemed to be our employees, and exposure to any of the above increased costs would have a materially adverse effect on our business and operating results.

Our business may be harmed by terrorist attacks, future war or anti-terrorism measures.

In the aftermath of the terrorist attacks of September 11, 2001, federal, state and municipal authorities have implemented and continue to follow various security measures, including checkpoints and travel restrictions on large trucks. Such measures may have costs associated with them, which we or our owner-operators could be forced to bear, or may otherwise reduce the productivity of our owner-operators. For example, security measures imposed at bridges, tunnels, border crossings and other points on key trucking routes may cause delays and increase the non-driving time of our owner-operators, which could have a materially adverse effect on our operating results. In addition, war, risk of war or a terrorist attack also may have an adverse effect on the economy. A decline in economic activity could adversely affect our revenues or restrict our future growth. Instability in the financial markets as a result of terrorism or war also could affect our ability to raise capital. In addition, the insurance premiums charged for some or all of the coverage currently maintained by us could increase dramatically or such coverage could be unavailable in the future.

Our ability to grow may be affected if shippers refuse to use our services because we operate primarily through agents and owner-operators.

In our experience, certain high-volume shippers have determined that their freight must be hauled by carriers that use company drivers and equipment. Such shippers believe that they can obtain a more homogenous fleet and more control over service standards. Such policies could prevent us from pursuing certain business opportunities, which could adversely affect our growth and results of operations.

A decrease in intermodal volume shipments could adversely affect our business.

A portion of our business comes from the intermodal segment of the trucking market and we believe that by expanding our intermodal support services we have a substantial opportunity to grow our business. A decrease in intermodal transportation services resulting from general economic conditions or other factors such as work stoppages, price competition from other modes of transportation, or a disruption in steamship or rail service could have an adverse effect on these growth opportunities and have a materially adverse effect on our business.

16

Table of Contents

Seasonality and the impact of weather can affect our operations.

The productivity of our owner-operators generally decreases during the winter season because some shippers reduce their shipments and inclement weather impedes operations. At the same time, our operating expenses generally increase because harsh weather creates higher accident frequency and increased claims.

We have incurred and will continue to incur increased costs as a result of being a public company.

As a public company, we have incurred and will continue to incur significant legal, accounting and other expenses that we did not incur as a private company. In addition, recent acts such as the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 and the Sarbanes-Oxley Act of 2002 and the rules and regulations promulgated thereunder, as well as anticipated rules subsequently implemented by the SEC and the NASDAQ National Market, have required changes in corporate governance practices of public companies. We expect new rules and regulations to continuously increase our legal and financial compliance costs and to make some activities more time-consuming and costly. We are continuously evaluating and monitoring developments with respect to these new laws, rules and regulations, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs. The costs of compliance or our failure to comply with these laws, rules and regulations could adversely affect our reputation, financial condition, results of operation and the price of our common stock.

We may be required to write down goodwill and other intangible assets, causing our financial condition and results to be negatively impacted.

When we acquire a business, a portion of the purchase price is allocated to goodwill and other identifiable intangible assets. Goodwill represents the excess purchase price over the fair value of assets acquired in connection with our acquisitions. At December 31, 2010, our goodwill and other identifiable intangible assets were approximately $29.2 million. Under current accounting standards, if we determine goodwill or intangible assets are impaired, we would be required to write down the value of these assets. We are required to test goodwill for impairment annually or more frequently, whenever events occur or circumstances change that would more likely than not reduce the fair value of a reporting unit with goodwill below its carrying amount. We annually test goodwill impairment as of the last day of our 2nd fiscal quarter. During the third quarter of 2010 we completed our impairment analysis and concluded that no impairment charge was necessary for the year ended December 31, 2010. We cannot provide assurance whether we will be required to take an impairment charge in the future. Any impairment charge would have a negative effect on our financial results.

We may be subject to additional impairment charges due to further declines in the fair value of our equity securities.

As of December 31, 2010, we held equity securities with a fair value of $15.0 million as short term investments. Holding equity securities subjects us to fluctuations in the market value of our investment portfolio based on current market prices. Marketable securities are carried at fair value and are marked to market at the end of each quarter, with the unrealized gains and losses, net of tax, included as a component of accumulated other comprehensive income, unless the declines in value are judged to be other-than-temporary, in which case an impairment charge is included in the determination of net income. During 2009, the Company recorded pre-tax other-than-temporary impairment charges of $1.3 million for marketable equity securities classified as available-for-sale. We may incur future impairment charges if declines in market values continue or worsen and impairments are no longer considered temporary.

Any disputes that arise between us and CenTra, an entity controlled by our majority shareholders, with respect to our past and ongoing relationships could harm our business operations.

Disputes may arise between CenTra and us in a number of areas relating to our past and ongoing relationships, including:

| • | labor, tax, employee benefit, indemnification and other matters arising from our separation from CenTra; |

17

Table of Contents

| • | employee retention and recruiting; |

| • | the nature, quality and pricing of transitional services CenTra has agreed to provide us; and |

| • | business opportunities that may be attractive to both CenTra and us. |

We may not be able to resolve any potential conflicts, and even if we do, the resolution may be less favorable than if we were dealing with an unaffiliated party. The agreements we have entered into with CenTra may be amended upon agreement between the parties. While we are controlled by Matthew T. Moroun and Manuel J. Moroun, who also control CenTra, CenTra may be able to require us to agree to amendments to these agreements that may be less favorable to us than the original terms of the agreements.

ITEM 1B: UNRESOLVED SECURITIES & EXCHANGE COMMISSION STAFF COMMENTS

None.

We are headquartered and maintain our corporate administrative offices in Warren, Michigan. We own our corporate administrative offices, as well as terminal yards in the following locations: Dearborn, Michigan; Columbus, Ohio; Reading, Ohio; Latty, Ohio; Cleveland, Ohio; Gary, Indiana; Millwood, West Virginia; Dallas, Texas; South Kearny, New Jersey; Garden City, Georgia and Memphis, Tennessee; offices in Tampa, Florida; Houston, Texas and a condominium in Monroeville, Pennsylvania. As of December 31, 2010, our subsidiaries also leased 47 office, terminal and yard facilities in various cities and states. The leased facilities are generally leased on a month-to-month basis and 13 of these facilities are leased from affiliates of CenTra, an entity controlled by our majority shareholders. We believe that all of the properties we lease from affiliates of our majority shareholders are leased at market rates. We believe that all of the properties leased by us are suitable for their purposes and adequate to meet our needs.

The nature of our business routinely results in litigation incidental to the ordinary course of our business, primarily involving claims for personal injury and property damage incurred in the transportation of freight. Based on knowledge of the facts and, in certain cases, opinions of outside counsel, we believe all such litigation is adequately covered by insurance or otherwise reserved for and that adverse results in one or more of those cases would not have a materially adverse effect on our financial condition, operating results and cash flows.

ITEM 4: (REMOVED AND RESERVED)

18

Table of Contents

PART II

| ITEM 5: | MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market Information

Our common stock is traded on The NASDAQ Global Select Market under the symbol “UACL”. Our common stock began trading on February 11, 2005, the date of our initial public offering. Prior to such date, there was no public market for our common stock. The following table shows the reported high and low sales prices of our common stock for the periods indicated.

| 2010 | 2009 | |||||||||||||||

| Fiscal Period |

High | Low | High | Low | ||||||||||||

| First Quarter |

$ | 18.85 | $ | 15.39 | $ | 15.63 | $ | 10.51 | ||||||||

| Second Quarter |

$ | 19.19 | $ | 13.57 | $ | 18.94 | $ | 12.13 | ||||||||

| Third Quarter |

$ | 15.66 | $ | 13.25 | $ | 17.45 | $ | 14.00 | ||||||||

| Fourth Quarter |

$ | 16.00 | $ | 14.07 | $ | 18.58 | $ | 15.17 | ||||||||

The reported last sale price per share of the Common Stock as quoted through the NASDAQ Global Select Market on March 1, 2011 was $15.90 per share. The number of shareholders of record on March 1, 2011, was 4. However, we estimate that we have a significantly greater number of shareholders because a substantial number of our common shares are held at The Depository Trust & Clearing Corporation on behalf of our shareholders.

Dividends

Historically, we have not paid dividends and no dividends or distributions on our common stock were paid during 2007, 2008 or 2010. However, on February 25, 2009, the Board of Directors declared a special one-time cash dividend of $1.00 per common share payable to stockholders of record on March 7, 2009. As a result of the special dividend, a total of approximately $16.0 million was paid on our 16.0 million common shares outstanding. We currently intend to retain any future earnings to finance the growth, development and expansion of our business and do not anticipate paying cash dividends in the future. Any future determination to pay dividends will be at the discretion of our Board of Directors and will depend on our financial condition, results of operations, capital requirements, any legal or contractual restrictions on the payment of dividends and other factors the Board of Directors deems relevant.

Limitations on our ability to pay dividends are described under the section captioned “Liquidity and Capital Resources—Unsecured Line of Credit” in Item 7 of this Form 10-K.

19

Table of Contents

Equity Compensation Plan Information

We maintain one stock incentive plan, the 2004 Stock Incentive Plan. In December 2004, our Board of Directors approved, effective upon completion of our initial public offering, the issuance of 260,000 stock options to employees under such plan. These options were issued on February 11, 2005. Through December 31, 2010, 4,983 of these options were exercised and 67,517 were forfeited. For more information on the 2004 Stock Incentive Plan, see Note 14 to the Consolidated Financial Statements, included in Item 8 of this report. The following table presents information related to securities authorized for issuance under this plan at December 31, 2010:

| Plan Category |

Number of securities to be issued upon exercise of outstanding options, warrants and rights |

Weighted average exercise price of outstanding options, warrants and rights |

Number of securities remaining available for future issuance |

|||||||||

| Equity compensation plans approved by security holders |

0 | $ | 0 | 0 | ||||||||

| Equity compensation plans not approved by security holders |

187,500 | $ | 22.50 | 240,000 | ||||||||

| Total |

187,500 | $ | 22.50 | 240,000 | ||||||||

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

The following table provides information regarding the Company’s purchases of its Common Stock during the period from October 3, 2010 to December 31, 2010, the Company’s fourth fiscal quarter:

| Fiscal Period |

Total Number of Shares Purchased |

Average Price Paid per Share |

Total Number of Shares Purchased as Part of Publicly Announced Program |

Maximum Number of Shares that May Yet be Purchased Under the Program |

||||||||||||

| October 2, 2010 |

245,900 | 554,100 | ||||||||||||||

| Oct. 3, 2010 – Oct. 30, 2010 |

49,200 | $ | 14.75 | 295,100 | 504,900 | |||||||||||

| Oct. 31, 2010 – Nov. 27, 2010 |

66,400 | 14.66 | 361,500 | 438,500 | ||||||||||||

| Nov. 28, 2010 – Dec. 31, 2010 |

93,500 | 15.08 | 455,000 | 345,000 | ||||||||||||

| Total |

209,100 | $ | 14.87 | 455,000 | 345,000 | |||||||||||

On November 6, 2007, the Company announced that it had been authorized to purchase up to 800,000 shares of its Common Stock from time to time in the open market. No specific expiration date has been assigned to the authorization.

20

Table of Contents

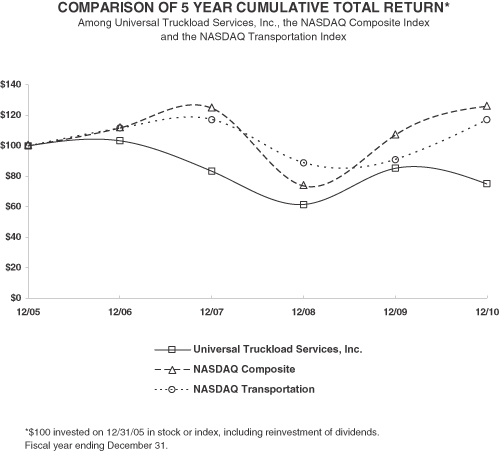

Performance Graph

The graph below compares the cumulative 5-year total return provided to shareholders on Universal Truckload Services, Inc.’s common stock relative to the cumulative total returns of the NASDAQ Composite index and the NASDAQ Transportation index. An investment of $100 (with reinvestment of all dividends) is assumed to have been made in our common stock and in each of the indexes on 12/31/2005 and its relative performance is tracked through 12/31/2010.

| 12/05 | 12/06 | 12/07 | 12/08 | 12/09 | 12/10 | |||||||||||||||||||

| Universal Truckload Services, Inc. |

100.00 | 103.26 | 83.30 | 61.57 | 85.17 | 74.91 | ||||||||||||||||||

| NASDAQ Composite |

100.00 | 111.74 | 124.67 | 73.77 | 107.12 | 125.93 | ||||||||||||||||||

| NASDAQ Transportation |

100.00 | 111.57 | 117.39 | 88.90 | 91.15 | 117.01 | ||||||||||||||||||

The stock price performance included in this graph is not necessarily indicative of future stock price performance.

21