UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 8, 2011

Sentry Petroleum Ltd.

(Exact name of registrant as specified in its charter)

Nevada | 000-52794 | 20-4475552 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

999 18th Street, Suite 3000, Denver, CO | 80202 |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (866) 680-7649

______________________________________________ (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

[ ] | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

[ ] | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

[ ] | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 1.01

Entry into Material Definitive Agreement.

On March 14, 2011, Sentry Petroleum Ltd. (the “Company”) entered into an option agreement (the “Agreement”) with Sino American Oil Company (“Sino”). Pursuant to the terms of the Agreement, the Company granted Sino the right to earn up to a 70% undivided working interest in the Company’s ATP 865 and ATP 866 permits located in Queensland, Australia (the “Option”) by drilling one conventional well to a depth of 1,660 meters, shooting 100 km of seismic within the two permits and providing to the Company an independent audit of the drilling results. Sino paid the Company $25,000 as consideration for entering into the Agreement.

In the event that Sino satisfies the conditions required to exercise the Option, the Company will have a period of 90 days from Sino’s exercise of the Option to reacquire a 20% working interest in the Company’s ATP 865 and ATP 866 permits from Sino (thereby reducing Sino’s working interest to 50%) by paying to Sino 40% of all costs incurred by Sino for drilling of the conventional well. In the event that Sino fails to exercise the Option for any reason, Sino is obligated to pay the Company an additional $250,000.

The foregoing description is qualified in its entirety by reference to the Agreement that is filed as Exhibit 10.1 to this Form 8-K and is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

On March 15, 2011, the Company distributed a news release announcing that it is receiving news coverage from as many as 11 Chinese news papers and that its has entered into the Option Agreement with Sino. A copy of the press release is attached hereto as Exhibit 99.1 to this Form 8-K and is incorporated herein by reference.

Item 9.01

Financial Statements and Exhibits.

(d) | Exhibits. | ||

Exhibit No. |

| Description | |

|

|

| |

10.1 |

| Agreement by and among Sino American Oil Company and Sentry Petroleum Ltd. dated as of March 14, 2011. | |

99.1 |

| Press Release entitled “Chinese Media Hubs Commence Coverage on Sentry Petroleum Ltd.” dated March 15, 2011. | |

|

|

| |

|

|

| |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: March 15, 2011

|

|

|

Sentry Petroleum Ltd. | ||

|

| |

By: |

| /s/ Dr. Paul Boldy |

Name: |

| Paul Boldy |

Title: |

| Chief Financial Officer and Director |

3

EXHIBIT INDEX

Exhibit No. |

| Description |

|

|

|

10.1 |

| Agreement by and among Sino American Oil Company and Sentry Petroleum Ltd. dated as of March 14, 2011. |

|

|

|

|

|

|

99.1 |

| Press Release entitled “Chinese Media Hubs Commence Coverage on Sentry Petroleum Ltd.” dated March 15, 2011. |

4

Exhibit 10.1

OPTION AGREEMENT

THIS AGREEMENT dated for reference the 14th day of March, 2011

BETWEEN:

SENTRY PETROLEUM (AUSTRALIA) PTY. LTD., a company incorporated under the laws of Australia and having a head office located at 38 Milson Street, South Perth, Western Australia 6151

(the "Optionor" or “Sentry”)

OF THE FIRST PART

AND:

SINO AMERICAN OIL COMPANY., a company incorporated under the laws of Nevada and having an office located at 5190 Neil Road Suite 430 Reno, Nevada 89502

(the "Optionee" or “Sino American”)

OF THE SECOND PART

WHEREAS:

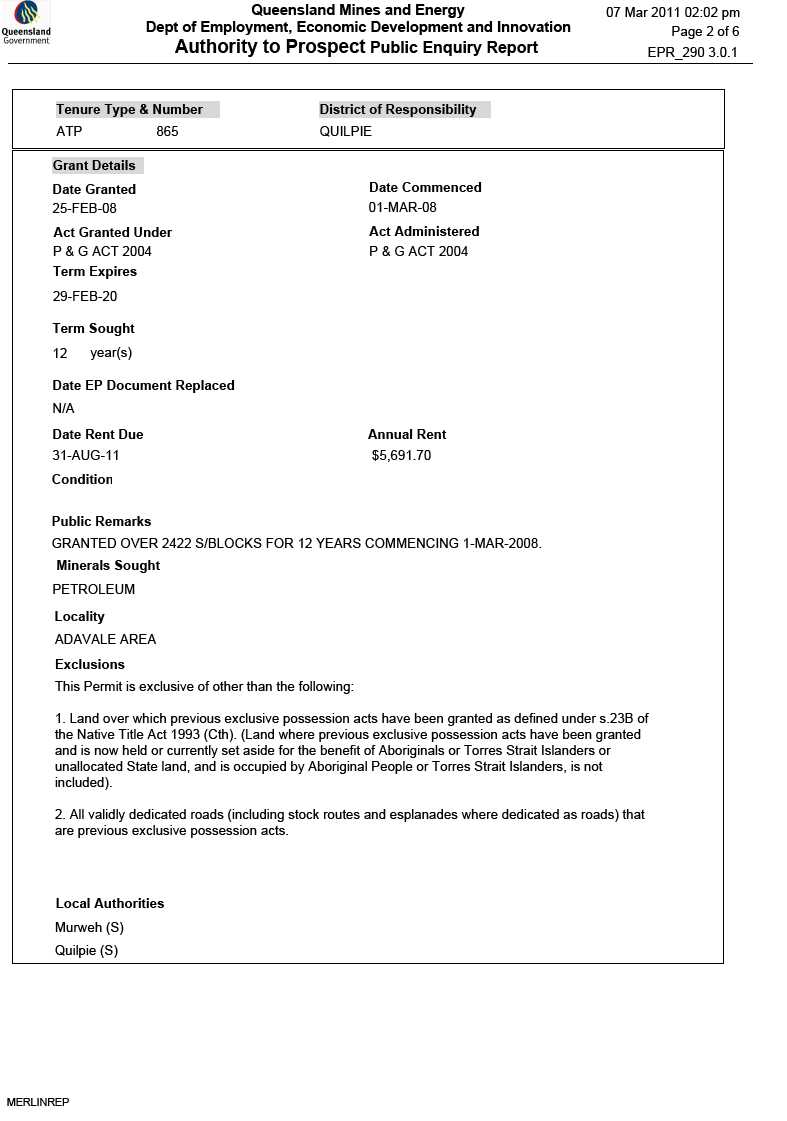

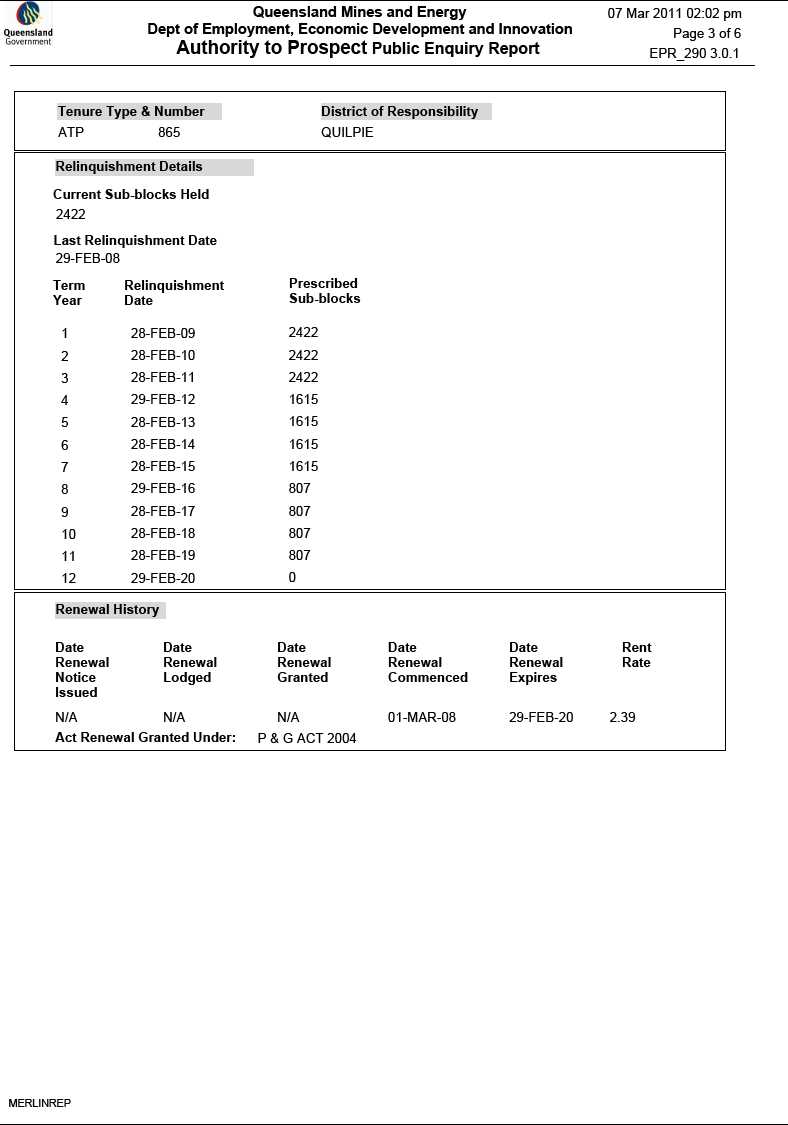

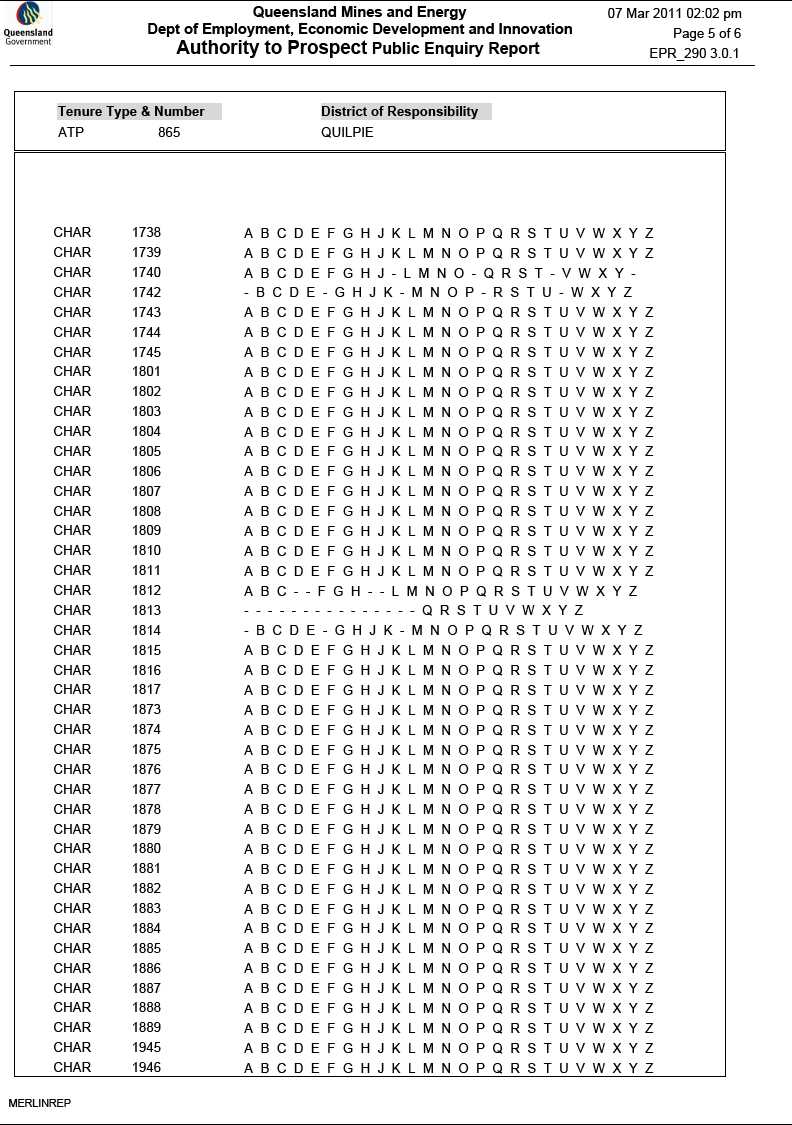

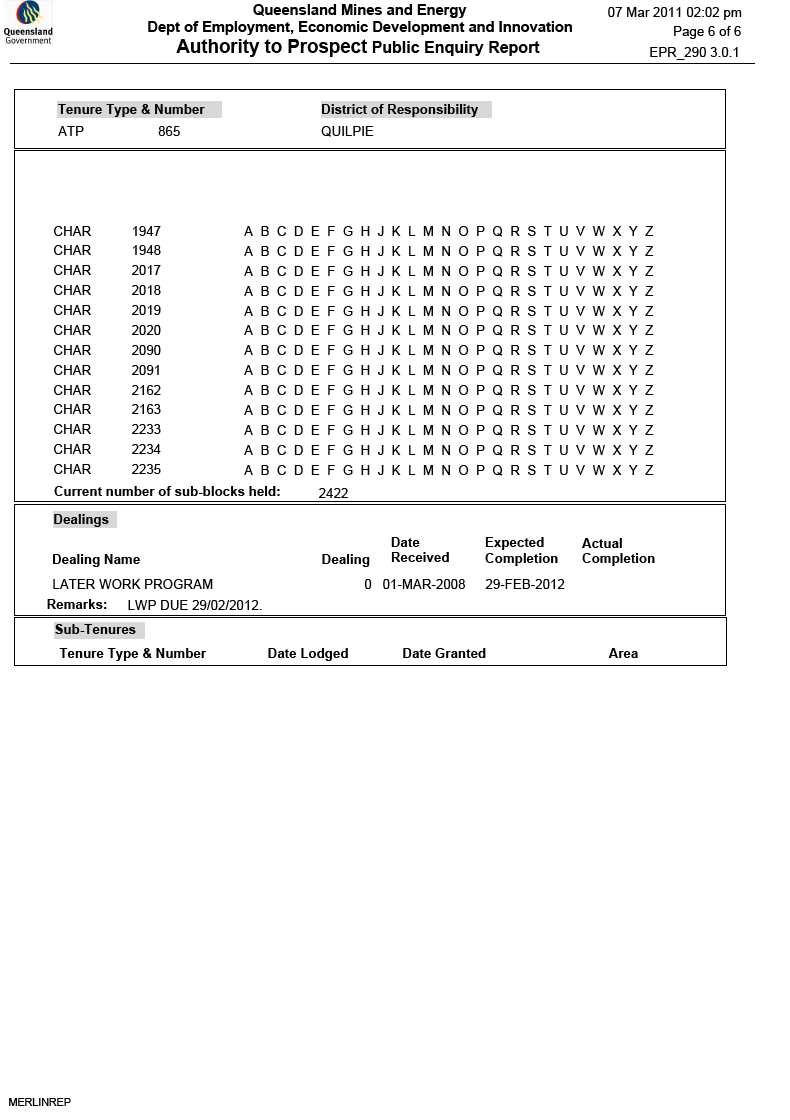

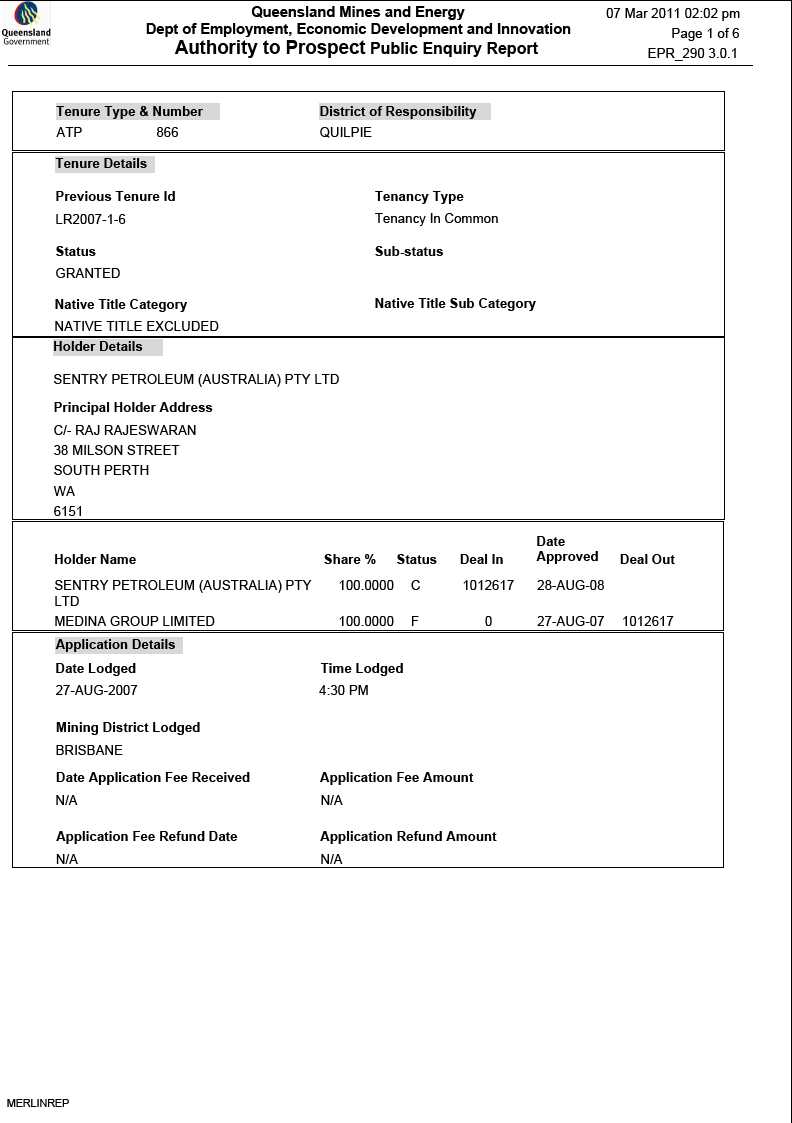

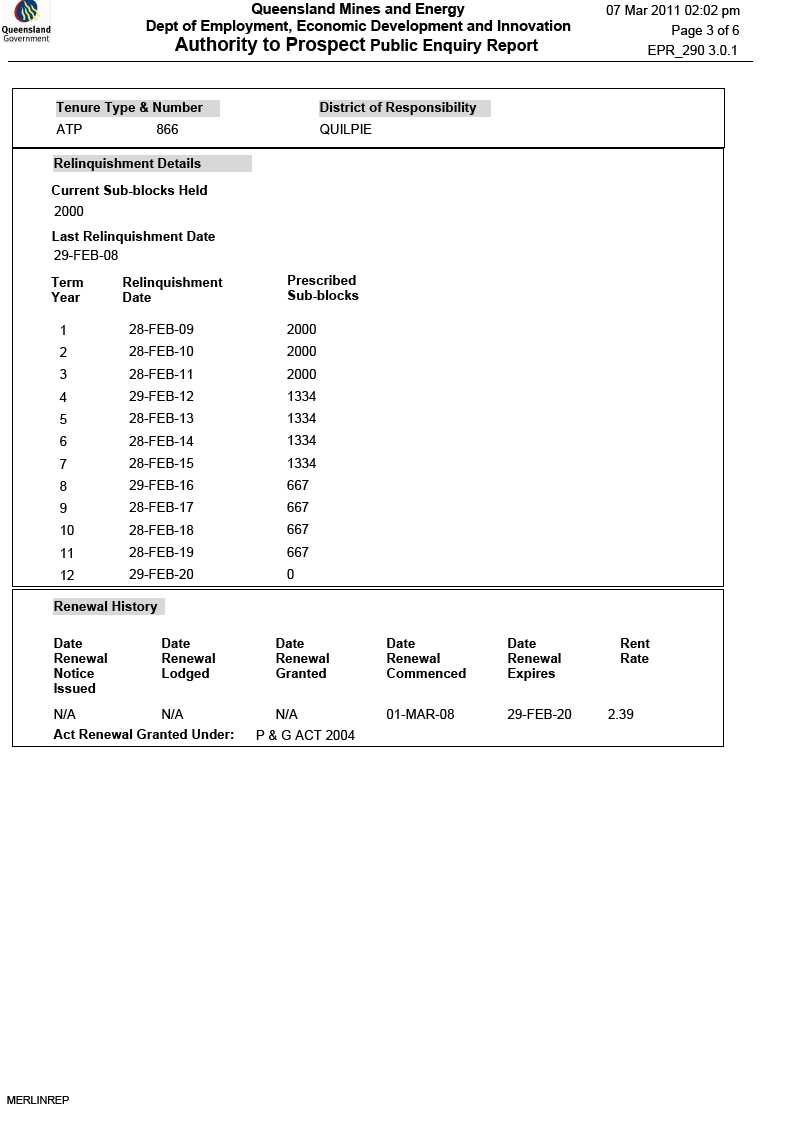

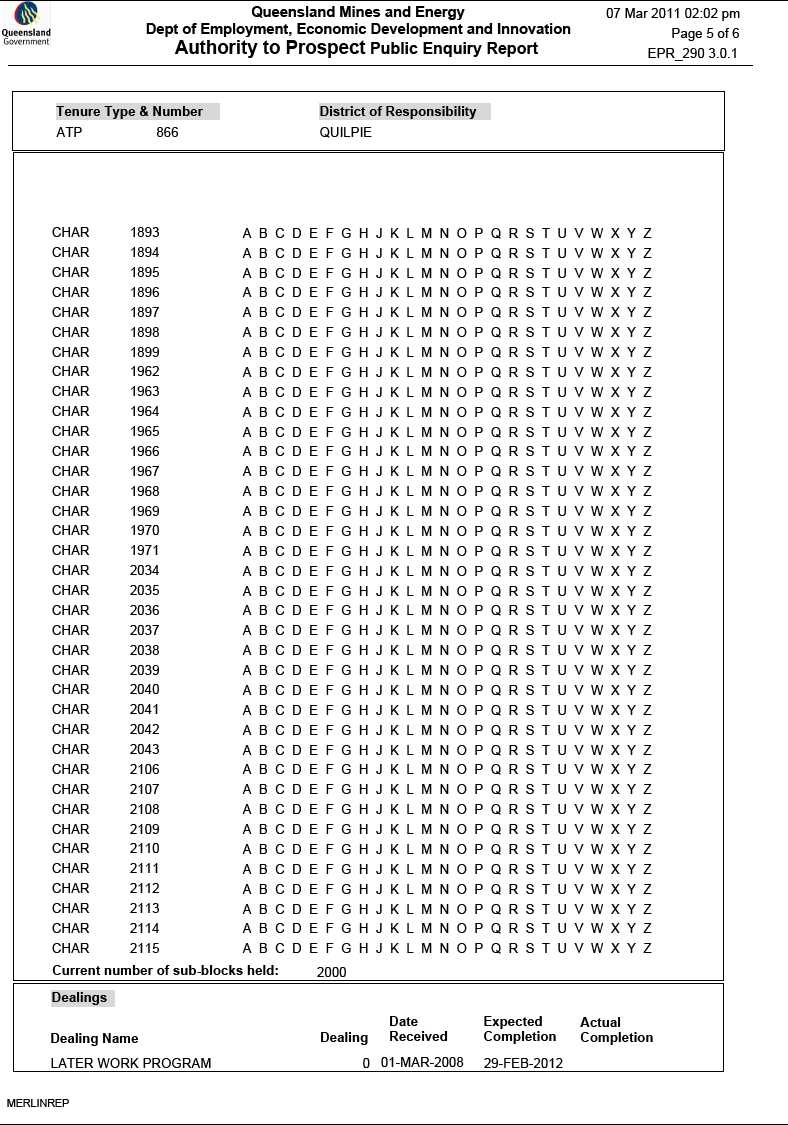

A. Optionor is the holder of 100% working interest and 93% revenue interest in Authority to Prospect 865 and Authority to Prospect 866, granted by the Department of Mines and Energy, Queensland Australia (the “ATPs”), further details of which are set out in Schedule 2. Optionor is wholly owned subsidiaries of Sentry Petroleum Ltd., a Nevada domiciled company.;

B. The Optionee wishes to acquire the right to earn an undivided 70% working interest in and to the Optionor's interest in the ATPs on the terms and subject to the conditions set out in this Agreement;

NOW THEREFORE THIS AGREEMENT WITNESSES that, for good and valuable consideration of USD25,000 to be credited against future work obligations of the Optionee, the receipt and sufficiency of which are acknowledged, the parties agree as follows:

1.

INTERPRETATION

In this Agreement, except where the context otherwise requires:

"Act" means the Queensland Government Petroleum and Gas ( Production and Safety ) Act 2004;

"AFE" means an authority for expenditure setting out details of the estimated expenditure in respect of a specific project which, when approved in accordance with this Agreement, constitutes authorization for the Operator to incur such expenditure;

"Agreement" means this Agreement including the Schedules to this Agreement;

5

"Appraisal Well" means a well drilled or proposed to be drilled for the purpose of evaluating the quantities of Petroleum in a Reservoir discovered by an Exploration Well;

"Area" means the area for the time being enclosed by the external boundaries of the Licenses which boundaries are, as at the Effective Date, for the purposes of identification only, shown on the map attached as Schedule 2, and any other area, whether or not contiguous to that area, which the Parties unanimously agree shall form part of the Area;

“ATP” means Authority To Prospect, granted by the Government of Queensland, Australia;

"Business Day" means a day, other than a Saturday, Sunday or public holiday, on which trading banks are open for business in Perth, Australia;

"Casing Point" means the time at which a well drilled under this Agreement has reached its projected depth or such depth as the Management Committee may have decided upon and all logs and tests necessary to enable a decision as to whether to plug and abandon the well or attempt to complete it as a producer have been carried out and communicated to the Parties;

"Complete" means with respect to a well the completion of the well as a producer of Petroleum, which operations shall include (without limitation):

(a)

to acquire, install and perforate production casing;

(b)

to run tubing;

(c)

to install equipment in the well up to and including the wing valve of the christmas tree (in the case of an oil well) and to the well head (in the case of a gas well);

(d)

to conduct such tests as are necessary to demonstrate that the well is capable of production;

(e)

to swab the well; and

(f)

to install such artificial lift equipment including subsurface pumps, pump rods, power cables and surface pump equipment as is necessary to initiate or promote the production of Petroleum to the surface,

and "Completing", "Completed" and "Completion" shall have corresponding meanings;

"Completion Costs" means all costs directly incurred in respect of Completion;

"Default Interest Rate" means in respect of any day the rate per annum which is the aggregate of 5% per annum and the rate of interest from time to time charged by the bank at which the Joint Account is held on corporate overdraft accounts in excess of $100,000.00 as advised by the said bank to the Operator;

"Default Notice" has the meaning given to that term in Clause 16.1;

"Defaulting Party" has the meaning given to that term in Clause 16.1;

"Drill" includes, where the context permits, to deepen, rework, frac, plug back, run logs, velocity surveys, obtain core and other samples, carry out testing on, recomplete or sidetrack a well; and Drilling has a corresponding meaning;

6

"Drilling Costs" means all costs and expenses directly incurred in Drilling including without limitation, rig mobilization and demobilization;

"Effective Date" means March 8th, 2011;

"Equip" means (with respect to a well which has been Completed) to acquire and install all such equipment as is necessary to place the well in production, and to handle, treat and bring Petroleum from such well to the Delivery Point including flow lines, treatment and separation facilities and stock tanks; and "Equipping" and "Equipped" have corresponding meanings;

"Equipping Costs" means all costs directly incurred in Equipping a well;

"Exploration Well" means any well whose purpose at the time of the commencement of drilling is to explore for an accumulation of Petroleum whose existence was at that time unproven by drilling;

“Farm-in Period” means:

(a)

Part 1 of the Farm-in; and

(b)

Part 2 of the Farm-in;

"Force Majeure" has the meaning given to that term in Clause 14.1;

"Government" means the government of the Queensland, Australia;

"Gross Negligence" means such wanton and reckless conduct as constitutes, or raises the reasonable belief that it constitutes, an utter disregard for the harmful foreseeable and avoidable consequences, which result from it;

"Information" has the meaning given to that term in Clause 8.1;

"Joint Account" means the accounts established and maintained by the Operator in accordance with this Agreement to record all charges, expenditures, credits and receipts in respect of Joint Operations which are chargeable or to be credited to each of the individual Parties as provided for in this Agreement; and "for the Joint Account" means for the account, expense, risk or benefit of the Parties in accordance with their Participating Interests;

"Joint Property" means:

a) Authority To Prospect 865 and Authority To Prospect 866;

b) the Licenses;

c) all Petroleum, prior to its distribution or allocation in kind to the Parties;

d) all other property of any nature or kind, whether real or personal, (including without limitation, any extraction, transportation, processing, treatment, storage or other facility or chose in action and any estate or interest therein) acquired by the Parties in the conduct, or for the purposes of, Joint Operations; and

e) all other estate, right, title or interest of the Parties arising under or by virtue of this Agreement;

"Joint Venture" means the joint venture between the Parties in accordance with and constituted by the terms of a Joint Venture Agreement;

7

"Licenses" means the petroleum exploration licenses granted under the Act, a list of which is set out in Schedule 2 and any licenses, permits or leases granted pursuant thereto together with any extensions, renewals, conversions, substitutions, modifications or variations thereof;

"License Period" means a period within which a Work Obligation stage is to be completed, as set out in Schedule 2 of the License, as varied or added to, in accordance with this Agreement and the Act;

"Management Committee" means the Management Committee established pursuant to Clause 4 of this Agreement;

“Net Revenue Interest” means a share of production after all burdens, such as royalty and overriding royalty, have been deducted from the working interest. It is the percentage of production that each party actually receives;

"Non-Operator" means a Party other than the Operator;

"Operating Costs" means all costs directly incurred in producing, handling, transporting and treating Petroleum from a well, exclusive of Drilling Costs, Completion Costs and Equipping Costs, up to the Delivery Point;

"Operator" means the party from time to time appointed pursuant to this Agreement to carry out the management of the Joint Venture and Joint Operations;

"Option to Buy-Back" has the meaning given to that term in Clause 3.1 Part 2 (d);

"Option Commencement Date" has the meaning given to that term in Clause 3.3;

“Outgoings” means all rates, rental and other holding costs in connection with the Area;

"Participating Interest" means the following obligations, benefits and rights of a Party, expressed as a percentage and determined in accordance with this Agreement:

a) the obligation, subject to this Agreement, to contribute that percentage of all expenditure and all other obligations arising under or by virtue of this Agreement;

b) the ownership of, and the right and benefit as a tenant in common to receive in kind and to dispose of for its own account, that percentage of Petroleum; and

c) the beneficial ownership as a tenant in common of an undivided share in the percentage of all Joint Property.

"Party" means a party to this Agreement, its successors and permitted assigns;

"Payable Quantities" means:

(a)

in the case of a well not Completed and Equipped for production, the anticipated output from that well of that quantity of Petroleum which, considering the Completion Costs, Equipping Costs, Operating Costs and other costs related to any of the foregoing, the kind and quality of Petroleum to be produced, the price to be received therefore and the royalties and other burdens payable in respect thereof, would in the opinion of the Management Committee warrant incurring the Completion Costs and Equipping Costs of the well; and

(b)

in the case of a well Completed and Equipped for production, the output from that well of that quantity of Petroleum which, considering the factors referred to in paragraph (a) above (other than Completion Costs and Equipping Costs), would in the opinion of the Management Committee warrant continuing production from the well;

8

"Petroleum" has the meaning given to that term in the Act;

"Receiving Parties" means the Parties other than the Proposing Party;

"Related Body Corporate" shall have the meaning given to it in the Australian Corporations Act 2001 (Cth);

"Reservoir" means that part of a geological formation which contains a single pool or accumulation of Petroleum separate from any other such pool or accumulation in the same or another geological formation, in a single pressure system so that production of Petroleum from any part affects the remainder;

“The Break-Up Fee” means the fee amount paid by either of the respective parties to the other party that causes this agreement to terminate prior to the date of the Approved Well Plan for Part 2 of the Farm-in;

"Wilful Misconduct" means intentional acts and omissions done or omitted to be done, which raise the reasonable belief that they were the result of a conscious indifference to the right or welfare of those who are or may be affected by them;

“Working Interest” means the percentage of ownership in the ATPs granting its owner the right to explore, drill and produce oil and gas from a tract of property. Each party is obligated to pay a corresponding percentage of the cost of leasing, drilling, producing and operating a well or unit. After royalties are paid, the working interest also entitles its owner to share in production revenues with other working interest owners, based on the percentage of working interest owned.

1.2

Interpretation

Except where the context otherwise requires:

(a)

words importing:

(i)

the singular include the plural and vice versa; and

(ii)

any gender includes the other genders;

(b)

if a word or phrase is defined, cognate words and phrases have corresponding definitions;

(c)

a reference to:

(i)

a person includes a firm, unincorporated association, corporation and a government or statutory body or authority;

(ii)

a person includes the legal personal representatives, successors and permitted assigns of that person;

(iii)

a statute, ordinance, code or other law includes regulations and other statutory instruments under it and consolidations, amendments, re-enactments or replacements of any of them;

(iv)

a right includes a benefit, remedy, discretion, authority or power;

9

(v)

an obligation includes a warranty or representation and a reference to a failure to observe or perform an obligation includes a breach of warranty or representation;

(d)

a reference to a clause number or schedule number is to a clause or schedule of this Agreement;

(e)

"$", "A$" or "dollars" is a reference to the lawful currency of Australia unless expressly stated otherwise;

(f)

this or any other document includes the document as varied or replaced and notwithstanding any change in the identity of the parties;

(g)

writing includes any mode of representing or reproducing words in a tangible and permanently visible form, and includes facsimile transmission; and

(h)

a reference to any thing (including, without limitation, any amount) is a reference to the whole or any part of it and a reference to a group of things or persons is a reference to any one or more of them.

1.3

Headings

The clause headings used herein are for convenience only and shall not be used in construing or interpreting any provision of this Agreement.

2.

REPRESENTATIONS AND WARRANTIES

2.1 The Optionee represents and warrants to the Optionor that:

(a) it is a company duly incorporated, validly subsisting, and in good standing under the laws of Nevada;

(b) it has full power and authority to carry on its business and to enter into this Agreement and any other agreement contemplated by this Agreement and to carry out and perform all of its obligations and duties under this Agreement; and

(c) the signing, delivery, and performance of this Agreement will not conflict with any other agreement to which it is a party or by which it is currently bound, and will not contravene any applicable laws.

2.2 The Optionor represents, warrants and covenants to and with the Optionee that:

(a) it is a company duly incorporated, validly subsisting, and in good standing under the laws of Western Australia;

(b) it has full power and authority to carry on its business and to enter into this Agreement and any other agreement contemplated by this Agreement and to carry out and perform all of its obligations and duties under this Agreement;

(c) it has full power and authority for the signing, delivery, and performance of this Agreement and the signing, delivery, and performance of this Agreement will not conflict with any other agreement to which it is a party or by which it is bound, and will not contravene any applicable laws;

10

(d) the ATPs are valid, subsisting and in full force and effect and it has observed and performed each and every covenant, agreement and obligation of it under the ATP required to be performed by it to the date of this Agreement;

(e) the ATPs are accurately described in Schedule "A" and are in good standing under the laws of the jurisdiction in which they are located, up to and including at least the expiry dates set forth in Schedule "A", and so far as the Optionor is aware, the conditions on and relating to the ATPs respecting all past and current operations are in compliance with all applicable laws, including all Environmental Laws;

(f) so far as the Optionor is aware, the ATPs (including all hydrocarbons which may be extracted or produced from the ATPs) is free and clear of any and all liens, charges, and encumbrances and is not subject to any right, claim, or interest of any other person;

(g) it has made all taxes, assessment, rentals, levies, or other payments relating to the ATPs required to be made to any federal, state, or municipal government instrumentality;

(h) it has not received from any government instrumentality any notice of or communication relating to any actual or alleged Environmental Claims, and, so far as the Optionor is aware, there are no outstanding work orders or actions required to be taken relating to environmental matters respecting the ATPs or any operations carried out on the ATPs; and

(i) it will make available to the Optionee all information in its possession or control relating to Exploration Work done on or regarding the ATPs that could possibly be considered to be materially significant in indicating whether the ATPs might or might not have the potential for economic production of hydrocarbons.

2.3 These representations and warranties are conditions on which the parties have relied in entering into this Agreement, are to be construed as both conditions and warranties, and will, regardless of any investigation that may have been made by or for any party as to the accuracy of these representations and warranties, survive the closing of the transaction contemplated by this Agreement. Each of the parties will indemnify and save the other harmless from all loss, damage, costs, actions, and suits arising out of or in connection with any breach of any representation or warranty contained in this Agreement, and each party will be entitled, in addition to any other remedy to which it may be entitled, to set-off any loss, damage, or costs suffered by it as a result of any breach against any payment required to be made by it to another party.

3.

OPTION

3.1 The Optionor irrevocably grants to the Optionee the sole and exclusive right and option to acquire an undivided 70% interest in and to the Optionor's interest in the ATPs, free and clear of all liens, charges, encumbrances, claims, rights, or interest of any person, other than pursuant to the Authority To Prospect including governmental Royalty payments and the 7% Gross Overriding Royalty to Median Group Limited, which option is to be exercisable by the Optionees follows:

a)

Part 1 of the Farm-in (Seismic Work);

i.

by undertaking and paying for 100% of all costs associated with an industry standard seismic survey during Part 1 of the Farm-in Period on the following terms and conditions:

1.

the seismic survey will be carried out on either or both ATPs as soon as practical and have a minimum total of 100 Line Kilometers surveyed (“Minimum Commitment”) exclusive of mobilization/demobilization, contracting, legal costs and any other costs normally accepted by industry best practices which shall be borne by Sino American in addition to the Minimum Commitment;

11

2.

the seismic survey will be designed so as to provide adequate delineation of prospects on the ATPs suitable for future Drilling;

3.

the seismic survey will be carried out in a timely manner and otherwise in accordance with the terms and conditions of the ATPs;

4.

the seismic survey obligation in full, can be met alternatively, by placing into trust, estimated seismic costs not to exceed US$1,000,000.00. Should said trust be created to the benefit of the Optionor, with said funds delivered by Sino American, those funds will be used exclusively towards the further development work, seismic (included but not limited to geological, geophysical and engineering work) on either or both ATP’s;

5.

Sino American may employ other appropriate and industry accepted geophysical exploration techniques to undertake all or part of the Minimum Commitment, provided that Sino American obtains the prior consent of SENTRY and such techniques are in accordance with the terms and conditions of the ATPs and all applicable laws of Queensland, Australia; and

6.

during Part 1 of the Farm-in, Sino American will be responsible for:

a.

the costs of any rehabilitation, expenses and compensation payable to land holders or other third parties arising as a result of the work carried out by Sino American in accordance with this Clause 3.1(a); and

b.

all costs in relation to Joint Operations including, without limitation, costs relating to office rental, employee salary and statutory entitlements and travel expenses.

b)

Part 2 of the Farm-in (Drilling to Depth and Completion of Conventional Well);

i.

by undertaking and paying for 100% of all costs including, without limitation, Operating Costs, Drilling Costs, Equipping Costs and Completion Costs associated with the Drilling (to Completion) of one conventional well during Part 2 of the Farm-in on the following terms and conditions:

ii.

the Drilling of the Ravenscourt well will be carried out on ATP 865 and have a minimum total depth of 1,660 meters (“Part 2 Minimum Commitment”) exclusive of mobilization/demobilization, contracting, legal costs and any other costs normally accepted by industry best practice, which shall be borne by Sino American in addition to the Part 2 Minimum Commitment;

iii.

the Drilling of the well will be carried out prior to November 30, 2011; and will have a 90 day extension at the sole discretion of Sino American;

iv.

during Part 2 of the Farm-in, Sino American will be responsible for:

1.

the costs of any rehabilitation, expenses and compensation payable to land holders or other third parties arising as a result of the work carried out by Sino American in accordance with this Clause 3.1(b); and

12

2.

all costs in relation to Joint Operations including, without limitation, costs relating to office rental, employee salary and statutory entitlements and travel expenses.

c)

Upon Sino American meeting its obligations under Clause 3.1 Part 1 and Part 2, Optionoor will convey to Opionee by assignment an undivided 70% Working Interest in the ATPs.

d)

SENTRY has a period of 90 days, commencing on the date Sino American completes its obligations under Clause 3.1 Part 2 and an independent audit of the drilling results have been provided to SENTRY, to acquire 20% Working Interest in the ATPs from Sino American by paying 40% of all costs incurred by Sino American in Clause 3.1 Part 2 (a).

e)

If Sino American fails to meet its obligations under Clause 3.1, this Agreement shall terminate and have no further force or effect, except for Sino American paying to SENTRY $250,000.00US (“ The Break-up Fee”).

3.2 The Optionee acknowledges that, on commencement of commercial production, the ATPs will be subject to the Royalty.

3.3 This Option may be exercised at any time and from time to time after 9:00 a.m., local time, on March 8th, 2011 (the “Exercise Commencement Date”), but no later than 5:00 p.m., local time, November 30, 2011 (the “Expiration Date”), at which point it shall become void and all rights under this Option shall cease.

4.

MANAGEMENT COMMITTEE AND OPERATOR

4.1 The parties will establish a management committee (the "Management Committee") upon execution of this Agreement. Each party will appoint two representatives and at least one alternative representative to the Management Committee. The alternate representative may act for a party's representative in his absence. In the event of a tie or deadlock, the Optionor will have one additional or casting vote.

4.2 An operator will conduct all Programs to be conducted on the ATPs as approved and directed by the Management Committee (the "Operator"). The Optionor will be the initial Operator until such time as the Option has been exercised. Prior to carrying out any program, the Operator will first submit the program to the Management Committee. Within thirty (30) days of the program being submitted by the Operator to the Management Committee, the Management Committee will review and either approve, approve with modifications, or decline by written notice to the Operator the proposed program. Any expenditures in excess of those required by the Optionee to maintain its Option in good standing must be first approved by the Optionee.

4.3 In respect of any program that has been approved, with or without modifications, by the Management Committee pursuant to section 4.2 hereof, failure by the Optionee to advance funds to the Operator within twenty-one (21) days of the date such funds are required to be advanced pursuant to such Program will constitute a default under this Agreement and be subject to the provisions of section 7.1 and section 15.1 of this Agreement.

13

4.4 Sentry may, as the initial operator, charge the following fees in consideration for acting as operator in supervising and carrying out each Program on the ATPs:

(a) with respect to each third party contract in excess of $50,000 within a program, five percent (5%) of the total contract cost; and

(b) with respect to all other Expenditures related to the program, ten percent (10%) of all costs.

Any fees paid to the Operator will be included in the calculation of Expenditures for the purposes of section 3.1(d) hereof.

5.

OPTIONOR'S POWERS, DUTIES, AND OBLIGATIONS

5.1 So long as the Optionor is Operator pursuant to this Agreement, the Optionor will have full right and authority to do everything necessary or desirable to carry out a Program on the ATPs and to determine the manner of exploration and development of the ATPs in accordance with a Program approved by the Management Committee and without limitation the duty and obligation to:

(a) regulate access to the ATPs, subject only to the right of the Optionee and its representatives, and in accordance with the restrictions set out in the ATP, and at their own risk and expense, to have access to the ATPs at all reasonable times for the purpose of inspecting Exploration Work being done on the ATPs, and to inspect all pertinent maps and factual data, including but not limited to geological, geophysical, geochemical, sample assay engineering, metallurgical and accounting records, core samples and reports;

(b) employ and engage any employees, agents, and independent contractors that it may consider necessary or advisable to carry out its duties and obligations under this Agreement and to delegate any of its powers and rights to perform its duties and obligations under this Agreement;

(c) conduct all Exploration Work on or regarding the ATPs in a careful manner and in accordance with the laws of the jurisdiction in which the ATPs are located, and indemnify and save the Optionee harmless from any claims, suits, or actions brought against the Optionee as a result of Exploration Work done by the Optionor or its contractors on or regarding the ATPs; and

(d) cause any contractor engaged by it hereunder to obtain and maintain, during any period in which Exploration Work is carried out hereunder, not less than the following:

(i) employer's liability insurance covering each employee of any contractor engaged in the Exploration Work hereunder to the extent of $1,000,000 where such employee is not covered by worker's compensation insurance;

(ii) comprehensive general liability insurance in such form as may be customarily carried by a prudent operator for similar Exploration Work with a bodily injury, death and property damage limit of $1,000,000 inclusive;

provided that the Optionor may, in its discretion, waive this requirement if the contractor is unable to obtain such insurance at a reasonable cost;

(e) obtain and maintain, or cause any contractor engaged by the Optionor to obtain and maintain, adequate worker's compensation insurance or equivalent coverage for all eligible employees engaged by the Optionor or its contractors in accordance with local statutory requirements;

14

(f) prepare and deliver to the Optionee:

(i) at reasonable intervals, but in any event not less frequently than once each calendar quarter, technical data and brief reports on all Exploration Work conducted by the Optionor while a Program is being carried out; and

(ii) within 90 days of completion of any Program and at least once each calendar year, a detailed report in respect of such Program, including the Exploration Work performed, results obtained, Expenditures incurred and conclusions and recommendations, the cost of which report will be borne by the Optionee and will be included in the calculation of its Expenditures for the purposes of section 3.1(d) hereof; and

(g) maintain true and correct books, accounts, and records of operations.

5.2 Until the Option is exercised or terminated in accordance with the terms of this Agreement, the Optionor will, for so long as it is the Operator pursuant to this Agreement, have the right, authority, duty and obligation to:

(a) keep the ATPs free and clear of all liens and encumbrances arising from the Optionor's operations (except liens contested in good faith by the Optionor) and in good standing by the doing and filing, or payment in lieu thereof, of all necessary assessment work and payment of all taxes required to be paid, and by the doing of all other acts and the making of all other payments required to be made, including without limitation the payment of all Advance Minimum Royalties pursuant to the ATPs, provided that the Optionor will not be obligated to make any payments for taxes, Advance Minimum Royalties or other such payments if the Optionee has not first advanced to the Optionor the required funds to make such payments, it being the intention of the parties that such payments are to form part of the Expenditures to be incurred by the Optionee pursuant to section 3.1(d) hereof;

(b) sign all documents and do all other things necessary to maintain valid title to the ATPs;

(c) conduct any title examinations and cure any title defects that may be advisable in the Optionor's reasonable judgment; provided, however, if the Optionor's title to the ATPs is deficient in any way, the Optionor, on receiving written notice from the Optionee, will have 60 days to remedy the deficiency and, if the Optionor fails to remedy any deficiency within this 60-day period, the Optionee will be entitled to terminate this Agreement or take the necessary steps to remedy any deficiency, in which event the cost and related expenses of the remedy will be included in the calculation of Expenditures for the purposes of section 3.1(d) hereof; and

(d) subject to the provisions of the ATPs, permit the Optionee and its representatives, duly authorized by it in writing, at their own risk and expense, access to the Property at all reasonable times and to all records prepared by the Optionor in connection with Exploration Work.

6.

VESTING OF INTEREST AND JOINT VENTURE

6.1 Forthwith on the Optionee exercising the Option by performing the requirements of section 3.1, an undivided 70% right, title, and interest in and to the Optionor's interest in the ATPs, subject only to the Royalty and the Gross Overriding Royalty to Medina Group Limited, and clause 3.1 (d), will vest in the Optionee, and the Optionor agrees to forthwith deliver to the Optionee a duly signed transfer or transfers, or any other instrument that may be required, in favor of the Optionee in recordable form, of an undivided 70% right, title, and interest in and to the Optionor's interest in the ATPs, and, on receipt of the such transfer(s), the Optionee will be entitled forthwith to record the transfer(s) in the appropriate office in the jurisdiction in which the ATPs are located.

15

6.2 The parties acknowledge the Optionor's and Optionee's right and privilege to file, register, and deposit a copy of this Agreement in the appropriate recording office for the jurisdiction in which the ATPs are located and with any other government agencies, to give third parties notice of this Agreement, and agree, each with the others, to do or cause to be done all acts reasonably necessary to effect the filing, registration, or deposit.

6.3 Upon the exercise of the Option, the parties will associate and will be deemed to have associated themselves as a single purpose joint venture pursuant to the terms of a Joint Venture Agreement, and the parties will negotiate expeditiously and in good faith the terms and conditions of the Joint Venture Agreement for the purpose of continuing exploration and development of the ATPs with a view to placing the ATPs or a portion thereof into Commercial Production.

6.4 The initial joint venture interests of the parties under the Joint Venture Agreement will be equal to their respective interests in the Property at the date upon which the Optionee's interest vests under section 6.1.

7.

TERMINATION OF OPTION

7.1 In the event of default in the performance of the requirements of section 2.1, 3.1, or section 4.3, then, subject to the provisions of sections 7.3 and 17.1 of this Agreement, the Option and this Agreement will terminate.

7.2 The Optionee will have the right to terminate this Agreement by giving 30 days' written notice of termination to the Optionor and the payment of USD $250,000 to the Optionor, on the effective date of termination, this Agreement will be of no further force and effect except the Optionee will be required to satisfy any requirements that have accrued under the provisions of this Agreement prior to the effective date of termination and that it has not satisfied.

7.3 Despite any other provisions of this Agreement, if this Agreement terminates, the Optionee will:

(a) deliver to the Optionor any and all reports, maps, samples, drill cores and logs, assay results, and other relevant technical data of any kind pertaining to the ATPs or related to Exploration Work that have not been previously delivered to the Optionor;

(b) ensure that, at the effective date of termination of this Agreement, the ATPs are free and clear of all liens and encumbrances arising from the Optionee's involvement with the ATPs (except liens contested in good faith by the Optionee) and in good standing for at least the next 12 months, whether by having done and filed, or paid in lieu thereof, all assessment work necessary for that purpose.

8.

CONFIDENTIALITY

8.1 All information and data concerning Exploration Work will be confidential and, except to the extent required by law or by regulation of any securities commission, stock exchange, or other regulatory body, will not be disclosed to any person other than a party's professional advisors without the prior written consent of the other party or parties, which consent will not unreasonably be withheld.

16

8.2 The text of any news releases or other public statements which a party desires to make with respect to the ATPs will be made available to the other party or parties prior to publication and the other party or parties will have the right to make suggestions for changes therein within forty-eight (48) hours of delivery.

9.

RESTRICTIONS ON ALIENATION

9.1 No party (the "Selling Party") may sell, transfer, convey, assign, mortgage or grant an option in respect of or grant a right to purchase or in any manner transfer or alienate all or any portion of its interest or rights under this Agreement without the prior consent in writing, within thirty (30) days of receipt of notice thereof, of the other parties, such consent not to be unreasonably withheld, and the failure to notify the Selling Party within the said 30 days that such consent has been withheld will be deemed to constitute the consent of the other parties.

9.2 Before the completion of any sale or other disposition by any party of its interests or rights or any portion thereof under this Agreement, the Selling Party will require the proposed acquirer to enter into an agreement with the party or parties not selling or otherwise disposing on the same terms and conditions as set out in this Agreement.

9.3 The provisions of sections 9.1 and 9.2 will not prevent a party from entering into an amalgamation or corporate reorganization which will have the effect in law of the amalgamated or surviving company possessing all the property, rights and interests and being subject to all the debts, liabilities and obligations of each amalgamating or predecessor company, or prevent a party from assigning its interest to an Affiliate of such party provided that the Affiliate first complies with section 9.2 and agrees in writing with the other parties to re-transfer such interest to the originally assigning party immediately before ceasing to be an Affiliate of such party.

10.

NOTICE

10.1 Any notices to be given by either party to the other will be sufficiently given if delivered personally or transmitted by facsimile or if sent by registered mail, postage prepaid, to the parties at their respective addresses shown on the first page of this Agreement, or to any other addresses as the parties may notify to the other from time to time in writing. This notice will be deemed to have been given at the time of delivery, if delivered in person or transmitted by facsimile, or within five business days from the date of posting if mailed.

11.

FURTHER ASSURANCES

11.1 Each of the parties covenants and agrees, from time to time and at all times, to do all other acts and execute and deliver all such further deeds, documents and assurances that may be reasonably required to fully perform and carry out the terms and intent of this Agreement.

12.

TIME OF THE ESSENCE

12.1 Time is of the essence of this Agreement.

13.

ENUREMENT

13.1 This Agreement will

enure to the benefit of and be binding on the parties and their respective heirs, executors, administrators, and permitted assigns.

17

14.

FORCE MAJEURE

14.1 No party will be liable for its failure to perform any of its obligations under this Agreement due to a cause beyond its reasonable control including, but not limited to, acts of God, fire, storm, flood, explosion, strikes, lockouts or other industrial disturbances, acts of public enemy, war, riots, laws, rules and regulations or orders of any duly constituted governmental authority, or non-availability of materials or transportation (each an "Intervening Event").

14.2 All time limits imposed by this Agreement will be extended by a period equivalent to the period of delay resulting from an Intervening Event.

14.3 A party relying on the provisions of section 14.1, insofar as possible, will promptly give written notice to the other party of the particulars of the Intervening Event, will give written notice to the other party as soon as the Intervening Event ceases to exist, will take all reasonable steps to eliminate any Intervening Event, and will perform its obligations under this Agreement as far as practicable, but nothing in this Agreement will require this party to settle or adjust any labor dispute or to question or to test the validity of any law, rule, regulation, or order of any constituted governmental authority or to complete its obligations under this Agreement if an Intervening Event renders completion impossible.

15.

DEFAULT

15.1 If a party (the "Defaulting Party") is in default of any requirement of this Agreement, the party affected by the default (the "Non-Defaulting Party") will give written notice to the Defaulting Party, within 30 days of becoming aware of the default, specifying the default, and the Defaulting Party will not lose any rights under this Agreement, nor will the Agreement or the Option terminate, nor will the Non-Defaulting Party have any rights, remedies, or cause of action under this Agreement or otherwise as a result of the default unless, within 30 days after the Non-Defaulting Party gives notice of default, the Defaulting Party has failed to cure the default, in which case the Non-Defaulting Party will only then be entitled to seek any remedy it may have on account of the default.

16.

SEVERABILITY

16.1 If any one or more of the provisions contained in this Agreement is invalid, illegal, or unenforceable in any respect in any jurisdiction, the validity, legality, and enforceability of this provision will not in any way be affected or impaired thereby in any other jurisdiction and the validity, legality, and enforceability of the remaining provisions contained in this Agreement will not in any way be affected or impaired thereby.

17.

AMENDMENT

17.1 This Agreement may be changed only by a written agreement signed by the parties.

18.

ENTIRE AGREEMENT

18.1 This Agreement constitutes the entire agreement between the parties and supersedes all prior agreements, whether oral or written, express or implied, statutory or otherwise, between the parties.

19.

OPTION ONLY

19.1 This Agreement provides for an option only and, except for the Break Up Fee of USD$250,000 as set out in section 3.1(e), or as otherwise provided, nothing in this Agreement will be construed as obligating the Optionee to do any acts or make any other payments and any act(s) or payment(s) made under this Agreement will not be construed as obligating the Optionee to do any further act or make any further payment.

18

20.

CONDITION PRECEDENT

20.1 The Optionee's obligations under this Agreement are subject to the approval of this Agreement by the Optionee's Board of Directors.

20.2 If the above condition precedent is not satisfied within 15 days from the date of this Agreement, the Optionor may terminate this Agreement on 15 days written notice to the Optionee.

20.3 The Optionor's obligations under this Agreement are subject to the consent of the Optinor’s Directors as Owner to this Agreement.

21.

GOVERNING LAW

21.1 This Agreement and the rights and obligations and relations of the parties will be governed by and construed in accordance with the laws of Nevada. Subject to section 23.1, the parties agree that the courts of Nevada will have the jurisdiction to entertain any action or other legal proceedings based on any provisions of this Agreement. Each party attorns to the jurisdiction of the courts of Nevada.

22.

ARBITRATION

22.1 All disputes arising out of or in connection with this Agreement, or in respect of any legal relationship associated therewith or derived therefrom, will be referred to and finally resolved by arbitration by a single arbitrator governed by the rules of the Nevada Uniform Arbitration Act of 2000.

23.

SIGNING IN COUNTERPARTS

23.1 The parties may sign this Agreement in one or more counterparts, each of which will be deemed an original but all of which will constitute one and the same instrument.

19

IN WITNESS WHEREOF the parties have signed this Agreement as of the date written on the first page of this Agreement.

THE CORPORATE SEAL OF | ) |

| |

SENTRY PETROLEUM (AUSTRALIA) PTY LTD. | ) |

| |

was affixed in the presence of: | ) |

| |

| ) |

| |

| ) |

| |

/s/ Paul Boldy |

| ) |

|

Authorized Signatory | ) |

| |

| ) |

| |

| |||

| |||

THE CORPORATE SEAL OF | ) |

| |

SINO AMERICAN OIL COMPANY. | ) |

| |

was affixed in the presence of: | ) |

| |

| ) |

| |

| ) |

| |

/s/ Ronald Hughes |

| ) |

|

Authorized Signatory | ) |

| |

| ) |

| |

20

SCHEDULE "A"

Description of Property

The property consists of fee lands, mineral rights and surface rights to the following parcels of fee land located in Queensland Australia:

21

Exhibit 99.1

Chinese Media Hubs Commence Coverage on Sentry Petroleum Ltd.

Hong Kong, China (March 15, 2011 - FSC) Sentry Petroleum Ltd. (OTCBB:SPLM) announced today that in cooperation with Invest Hong Kong, (the Government department of the Hong Kong Special Administrative Region (HKSAR) responsible for Foreign Direct Investment and foreign businesses expansion in Hong Kong) the Company and its exploration development is being covered by over 11 Chinese media hubs including Xinhua News, Ifeng News and various Chinese governmental websites.

Commenting on the Chinese coverage, CFO Dr. Paul Boldy commented: “The interest in our company and our leases in Queensland Australia has grown dramatically, especially in China. Since establishing a presence in Hong Kong the level of interest has blossomed. We are grateful for the efforts of Invest Hong Kong and have certainly received a boost in recognition throughout Asia and Australia. What we expected to accomplish in a year has taken a few short months. With the completion of the independent resource estimate by Resource Investment Strategy Consultants and the announcement of a potential 2,000 sq. mile coal seam gas deposit in our northern permits the extensive coverage is certainly warranted and welcomed.”

In other news the company announced it has entered into an exclusive option agreement with Sino American Oil Company. The option grants Sino American the right to earn up to 70% interest in ATP 865 and ATP 866. Sentry will have the right to reduce the interest to 50% by paying 40% of the expenses for one well.

Commenting on the option, Sentry President and CEO Dr. Rajeswaran noted: "We are pleased with the terms and it comes at a time when our efforts are focused exclusively on the potential coal seam gas deposit in our northern permits. It gives us the opportunity to have a highly prospective oil well drilled quickly. Additionally, it combines important seismic work to enhance the opportunity for other wells to be drilled expeditiously.”

About Sentry Petroleum:

Sentry Petroleum Ltd is an American energy company with 10,600 square miles of oil, gas and coal seam gas rights in Queensland, Australia. The company has identified over 50 separate oil, gas and coal seam gas targets and leads within its permit area. Sentry Petroleum’s strategy is to drill the prospects and leads and independently certify the results. The company will continue to leverage its strengths with a vision of becoming a premier independent oil and gas company positioned for merger or sale. For more information, please visit www.sentrypetroleum.com.

Contact:

Investor Relations 866.680.7649

ir@sentrypetroleum.com

www.SentryPetroleum.com

Or

Philippe Niemetz, PAN Consultants Ltd.

212-344-6464 or 800-477-7570

p.niemetz@panconsultants.com

Forward-Looking Statements:

This release includes certain statements that may be deemed to be “forward-looking statements” within the meaning of applicable legislation. Other than statements of historical fact, all statements in this release addressing future operations, undiscovered hydrocarbon resource potential, exploration, potential reservoirs, prospects, leads and other contingencies are forward-looking statements. Although management believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance, and actual results may differ materially from those in the forward-looking statements due to factors such as market prices, exploration successes, continued availability of capital and financing, and general economic, market, political or business conditions. Please see our public filings at http://www.sec.gov and http://www.sedar.com for further information.