Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 CERTIFICATION - PROGENICS PHARMACEUTICALS INC | ex31_112312010.htm |

| EX-32.2 - EXHIBIT 32.2 CERTIFICATION - PROGENICS PHARMACEUTICALS INC | ex32_212312010.htm |

| EX-32.1 - EXHIBIT 32.1 CERTIFICATION - PROGENICS PHARMACEUTICALS INC | ex32_112312010.htm |

| EX-10.37 - EXHIBIT 10.37 PROGENICS - PROGENICS PHARMACEUTICALS INC | ex10_3712312010.htm |

| EX-23.1 - EXHIBIT 23.1 CONSENT OF PRICEWATERHOUSECOOPERS - PROGENICS PHARMACEUTICALS INC | ex23_112312010.htm |

| EX-31.2 - EXHIBIT 31.2 CERTIFICATION - PROGENICS PHARMACEUTICALS INC | ex31_212312010.htm |

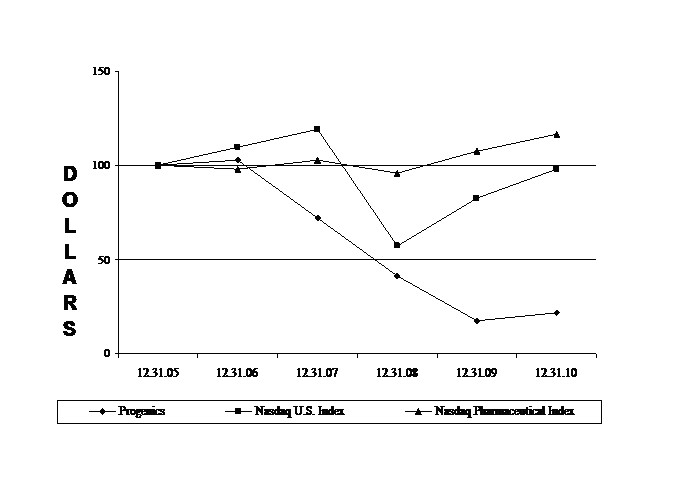

perfgraph2010.jpg Progenics Performance Graph 2010

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_____________

FORM 10-K

(Mark One)

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the fiscal year ended December 31, 2010

|

|

|

Or

|

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the transition period from ___________ to ___________

|

Commission File No. 000-23143

_____________

PROGENICS PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

13-3379479

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer Identification Number)

|

_____________

777 Old Saw Mill River Road

Tarrytown, NY 10591

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (914) 789-2800

Securities registered pursuant to Section 12(b) of the Act:

Title of each class Name of each exchange on which registered

Common Stock, par value $0.0013 per share The NASDAQ Stock Market LLC

|

Securities registered pursuant to Section 12(g) of the Act:

|

None

|

_____________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Act:

|

Large Accelerated Filer ¨

|

Accelerated Filer x

|

|

Non-accelerated Filer ¨ (Do not check if a smaller reporting company)

|

Smaller Reporting Company ¨

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of the voting and non-voting stock held by non-affiliates of the registrant on June 30, 2010, based upon the closing price of the Common Stock on The NASDAQ Stock Market LLC on that date of $5.48 per share, was $99,913,733 (1).

|

(1)

|

Calculated by excluding all shares that may be deemed to be beneficially owned by executive officers, directors and five percent stockholders of the Registrant, without conceding that any such person is an “affiliate” of the Registrant for purposes of the Federal securities laws.

|

As of March 4, 2011, 33,361,497 shares of Common Stock, par value $.0013 per share, were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Specified portions of the Registrant’s definitive proxy statement to be filed in connection with solicitation of proxies for its 2011 Annual Meeting of Shareholders are hereby incorporated by reference into Part III of this Form 10-K where such portions are referenced.

|

PART I

|

||

|

Item 1.

|

2

|

|

|

Item 1A.

|

12

|

|

|

Item 1B.

|

21

|

|

|

Item 2.

|

21

|

|

|

Item 3.

|

21

|

|

|

Item 4.

|

21

|

|

|

PART II

|

||

|

Item 5.

|

22

|

|

|

Item 6.

|

23

|

|

|

Item 7.

|

24

|

|

|

Item 7A.

|

39

|

|

|

Item 8.

|

39

|

|

|

Item 9.

|

39

|

|

|

Item 9A.

|

39

|

|

|

Item 9B.

|

40

|

|

|

PART III

|

||

|

Item 10.

|

41

|

|

|

Item 11.

|

41

|

|

|

Item 12.

|

41

|

|

|

Item 13.

|

41

|

|

|

Item 14.

|

41

|

|

|

PART IV

|

||

|

Item 15.

|

42

|

|

|

F-1

|

||

|

S-1

|

||

|

E-1

|

||

PART I

This document and other public statements we make may contain statements that do not relate strictly to historical fact, any of which may be forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. When we use the words “anticipates,” “plans,” “expects” and similar expressions, we are identifying forward-looking statements. Forward-looking statements involve known and unknown risks and uncertainties which may cause our actual results, performance or achievements to be materially different from those expressed or implied by forward-looking statements. While it is impossible to identify or predict all such matters, these differences may result from, among other things, the inherent uncertainty of the timing and success of, and expense associated with, research, development, regulatory approval and commercialization of our products and product candidates, including the risks that clinical trials will not commence or proceed as planned; products appearing promising in early trials will not demonstrate efficacy or safety in larger-scale trials; clinical trial data on our products and product candidates will be unfavorable; our products will not receive marketing approval from regulators or, if approved, do not gain sufficient market acceptance to justify development and commercialization costs; competing products currently on the market or in development might reduce the commercial potential of our products; we, our collaborators or others might identify side effects after the product is on the market; or efficacy or safety concerns regarding marketed products, whether or not originating from subsequent testing or other activities by us, governmental regulators, other entities or organizations or otherwise, and whether or not scientifically justified, may lead to product recalls, withdrawals of marketing approval, reformulation of the product, additional pre-clinical testing or clinical trials, changes in labeling of the product, the need for additional marketing applications, declining sales or other adverse events.

We are also subject to risks and uncertainties associated with the actions of our corporate, academic and other collaborators and government regulatory agencies, including risks from market forces and trends; potential product liability; intellectual property, litigation, environmental and other risks; the risk that we may not be able to enter into favorable collaboration or other relationships or that existing or future relationships may not proceed as planned; the risk that current and pending patent protection for our products may be invalid, unenforceable or challenged, or fail to provide adequate market exclusivity, or that our rights to in-licensed intellectual property may be terminated for our failure to satisfy performance milestones; the risk of difficulties in, and regulatory compliance relating to, manufacturing products; and the uncertainty of our future profitability.

Risks and uncertainties also include general economic conditions, including interest and currency exchange-rate fluctuations and the availability of capital; changes in generally accepted accounting principles; the impact of legislation and regulatory compliance; the highly regulated nature of our business, including government cost-containment initiatives and restrictions on third-party payments for our products; trade buying patterns; the competitive climate of our industry; and other factors set forth in this document and other reports filed with the U.S. Securities and Exchange Commission (SEC). In particular, we cannot assure you that RELISTOR® will be commercially successful or be approved in the future in other formulations, indications or jurisdictions, or that any of our other programs will result in a commercial product.

We do not have a policy of updating or revising forward-looking statements and we assume no obligation to update any statements as a result of new information or future events or developments. It should not be assumed that our silence over time means that actual events are bearing out as expressed or implied in forward-looking statements.

Available Information

We file annual, quarterly and current reports, proxy statements and other documents with the SEC under the Securities Exchange Act of 1934. The SEC maintains an Internet website that contains reports, proxy and information statements and other information regarding issuers, including Progenics, that file electronically with the SEC. You may obtain documents that we file with the SEC at http://www.sec.gov, and read and copy them at the SEC’s Public Reference Room at 100 F Street NE, Washington, DC 20549. You may obtain information on operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. We also make available our annual, quarterly and current reports and proxy materials on http://www.progenics.com.

Additional information concerning Progenics and its business may be available in press releases or other public announcements and quarterly and current reports and documents filed with the SEC.

Item 1. Business

Progenics Pharmaceuticals, Inc. is a biopharmaceutical company focusing on the development and commercialization of innovative therapeutic products to treat the unmet medical needs of patients with debilitating conditions and life-threatening diseases. Our principal programs are directed toward gastroenterology, oncology and virology. We commenced principal operations in 1988, became publicly traded in 1997 and throughout have been engaged primarily in research and development efforts, developing manufacturing capabilities, establishing corporate collaborations and related activities. All of our operations are conducted at our facilities in Tarrytown, New York. Additional information concerning Progenics and its business may be available in press releases or other public announcements and quarterly and current reports and documents filed with the SEC after the filing of this Annual Report.

In gastroenterology, our first commercial product is RELISTOR (methylnaltrexone bromide) subcutaneous injection, a first-in-class therapy for opioid-induced constipation approved for sale in over 50 countries worldwide, including the United States, the European Union, Canada and Australia. Marketing applications are pending elsewhere throughout the world.

On February 3, 2011, we entered into an exclusive License Agreement with Salix Pharmaceuticals, by which Salix acquired the rights to RELISTOR worldwide except in Japan, where we have previously licensed to Ono Pharmaceutical Co., Ltd. the subcutaneous formulation of the drug. Under the License Agreement, Salix is responsible for further developing and commercializing subcutaneous RELISTOR, including completing clinical development necessary to support regulatory marketing approvals for potential new indications and formulations. Salix will market RELISTOR directly through its specialty sales force in the U.S., and outside the U.S., RELISTOR will be marketed with sublicenses to regional companies.

Under the Salix License Agreement, we received a $60.0 million upfront payment and are eligible to receive development milestone payments of up to $90.0 million contingent upon the achievement of specified U.S. regulatory approvals and commercialization milestone payments of up to $200.0 million contingent upon the achievement of specified U.S. sales targets. Salix must pay us royalties based on a percentage ranging from 15 to 19 percent of net sales by it and its affiliates, and 60% of any upfront, milestone, reimbursement or other revenue (net of costs of goods sold, as defined, and territory-specific research and development expense reimbursement) it receives from sublicensees in respect of any country outside the U.S.

In our other gastroenterology efforts, we have recently presented preclinical data on novel monoclonal antibodies against toxins produced by the bacterium Clostridium difficile (C. difficile), the leading cause of hospital-acquired diarrhea in the U.S. and a recognized growing global public health challenge.

See Gastroenterology; Licenses and Risk Factors.

In oncology, we recently announced preliminary data from a phase 1 clinical trial of a fully human monoclonal antibody-drug conjugate (ADC) directed against prostate specific membrane antigen (PSMA), a protein found at high levels on the surface of prostate cancer cells and also on the neovasculature of a number of other types of solid tumors. While we have to date conducted PSMA ADC research and development on our own, we are considering as appropriate strategic collaborations with biopharmaceutical companies for development of PSMA ADC.

We are also engaged in research to identify multiplex phosphoinositide 3-kinase (PI3K) inhibitors that may be effective in blocking signaling pathways that are critical in the growth of aggressive cancers.

See Oncology.

In virology, we have been developing a viral-entry inhibitor -- a humanized monoclonal antibody, PRO 140 -- for human immunodeficiency virus (HIV), the virus that causes acquired immunodeficiency syndrome, or AIDS, and are conducting a clinical trial of PRO 140 with outside funding. Advancement of this program, including clinical trial efforts, is subject to obtaining additional outside funding, for which we have applied to government agencies. We are also evaluating hepatitis C virus entry inhibitors as possible development candidates. See Virology.

Recent changes in executive responsibilities. On March 3, 2011, our Board of Directors appointed Mark R. Baker Chief Executive Officer of the Company. At the same time, Paul J. Maddon was appointed Vice Chairman of the Board; he retains the title of Chief Science Officer. Both Mr. Baker and Dr. Maddon continue as Board members.

Following is a summary of our principal therapeutic and research programs:

|

Commercial product

|

Approved indication

|

Status

|

||

|

Gastroenterology

|

||||

|

RELISTOR®(1)-Subcutaneous injection

|

Treatment of opioid-induced constipation (OIC) in advanced-illness patients receiving palliative care when laxative therapy has not been sufficient (2)

|

Marketed in the U.S., E.U., Canada, Australia and elsewhere; Recently licensed to Salix Pharmaceuticals worldwide other than Japan, where Ono Pharmaceutical is developing subcutaneous RELISTOR

|

||

|

Therapeutic or Research Program

|

Proposed therapeutic area

|

Status (3)

|

||

|

Gastroenterology

|

||||

|

RELISTOR-Subcutaneous injection

|

Treatment of OIC in patients with non-cancer pain

|

Phase 3 testing completed; preparing sNDA for submission in first half of 2011

|

||

|

RELISTOR-Oral

|

Treatment of OIC

|

In Phase 3 testing

|

||

|

C. difficile

Evaluating anti-toxin monoclonal antibodies

|

Treatment of conditions caused by Clostridium difficile toxins

|

Research

|

||

|

Oncology

|

||||

|

PSMA ADC

|

Treatment of prostate cancer

|

Phase 1

|

||

|

Evaluating multiplex PI3K inhibitor compounds

|

Treatment of cancer

|

Research

|

||

|

Virology

|

||||

|

Human Immunodeficiency Virus (HIV)

|

||||

|

PRO 140

|

Treatment of HIV infection

|

Phase 2 (4)

|

||

|

Hepatitis C Virus (HCV)

Evaluating HCV-entry inhibitor compounds

|

Treatment of HCV infection

|

Research

|

||

_______________

|

(1)

|

RELISTOR is a registered trademark which is in the process of being transitioned from Progenics' former collaborator, Wyeth, in connection with the transition of development and commercialization responsibility for RELISTOR to Salix. In this document, “RELISTOR” refers to methylnaltrexone as it has been and is being developed and commercialized by or in collaboration with Progenics. Subcutaneous RELISTOR has received regulatory marketing approval for specific indications, and references to RELISTOR do not imply that any other form or possible use of the drug has received such approval.

|

|||||

|

(2)

|

The approved U.S. label for RELISTOR also provides that use of RELISTOR beyond four months has not been studied. Full U.S. prescribing information is available at www.RELISTOR.com.

|

|||||

|

(3)

|

Research means initial research related to specific molecular targets, synthesis of new chemical entities, assay development or screening for identification and optimization of lead compound.

|

|||||

|

Pre-clinical means lead compound(s) undergoing toxicology, formulation and other testing in preparation for clinical trials.

|

||||||

|

Phase 1-3 clinical trials are safety and efficacy tests in humans:

|

||||||

|

Phase 1: Initial evaluation of safety in humans; study method of action and metabolization.

|

||||||

|

Phase 2: Evaluation of safety, dosing and activity or efficacy; continue safety evaluation.

|

||||||

|

Phase 3: Larger scale evaluation of safety, efficacy and dosage.

|

||||||

|

(4)

|

Advancement of this program, including clinical trial efforts, is subject to obtaining additional outside funding, for which we have applied to government agencies.

|

|||||

Gastroenterology

Opioid-based medications such as morphine and codeine are used to control moderate-to-severe pain in patients receiving palliative care, undergoing surgery, experiencing chronic pain or with other medical conditions. Opioids relieve pain by interacting with receptors located in the brain and spinal cord, but also activate receptors in the gut, often resulting in constipation, referred to as opioid-induced constipation or OIC. As a result of OIC, many patients may stop or reduce their opioid therapy, opting to endure pain in order to obtain relief from their OIC and its associated side effects.

RELISTOR, the first approved treatment for OIC that addresses the underlying mechanism of this condition, is a selective, peripherally acting, mu-opioid-receptor antagonist that decreases the constipating side effects induced by opioid pain medications in the gastrointestinal tract without diminishing the ability of these medications to relieve pain. Relief of OIC is an important need that is not adequately met by any other approved drug or intervention. Because of its chemical composition, RELISTOR has restricted access to the blood-brain barrier to enter the central nervous system, where pain is perceived. Outside the central nervous system, RELISTOR competes with opioid pain medications for binding sites on opioid receptors, displacing the pain medications only in the periphery and selectively “turning off” the constipating effects of those medications on the gastrointestinal tract without affecting pain relief occurring in the central nervous system.

Subcutaneous RELISTOR. RELISTOR is currently approved by regulatory authorities in the U.S. and other countries for treatment of OIC in advanced-illness patients receiving palliative care when laxative therapy has not been sufficient. In the second quarter of 2008 we began earning royalties on sales of RELISTOR by our former collaborator, Wyeth Pharmaceuticals, now a Pfizer Inc. subsidiary. RELISTOR net sales and related royalties earned through the end of 2010 are set forth below. Our recognition of royalty revenue for financial reporting purposes is explained in Management’s Discussion and Analysis of Financial Condition and Results of Operations (MD&A) and our financial statements elsewhere in this document.

|

First

Quarter

|

Second

Quarter

|

Third

Quarter

|

Fourth

Quarter

|

Full

Year

|

||||||

|

(in thousands)

|

||||||||||

|

2010:

|

||||||||||

|

Net Sales By Wyeth

|

$4,200

|

$3,800

|

$4,100

|

$4,000

|

$16,100

|

|||||

|

Royalties Earned

|

625

|

581

|

620

|

-(1)

|

1,826

|

|||||

|

2009:

|

||||||||||

|

Net Sales By Wyeth

|

$1,900

|

$3,200

|

$3,300

|

$3,900

|

$12,300

|

|||||

|

Royalties Earned

|

280

|

487

|

497

|

589

|

1,853

|

|||||

|

2008:

|

||||||||||

|

Net Sales By Wyeth

|

n.a.

|

$2,100

|

$800

|

$1,500

|

$4,400

|

||||||||||||

|

Royalties Earned

|

n.a.

|

321

|

117

|

227

|

665

|

||||||||||||

________________

(1) Under the terms of the Wyeth transition, no royalties are payable in respect of net sales after September 30, 2010.

RELISTOR has previously been developed and commercialized worldwide except Japan by Progenics and Wyeth pursuant to a 2005 collaboration agreement that was terminated in October 2009. Under our Transition Agreement with Wyeth, Wyeth is continuing to distribute RELISTOR worldwide other than Japan through March 31, 2011. Salix, Wyeth and Progenics plan an April 1, 2011 transition of U.S. commercial responsibility for RELISTOR to Salix from Wyeth, and are currently discussing the transition of ex-U.S. commercialization responsibilities on a country-by-country basis. While Salix effects a country-by-country transition of ex-U.S. commercialization rights, Wyeth remains the marketing authorization holder for RELISTOR and continues to supply product. See Licenses – RELISTOR.

Under the Ono License Agreement, Ono began clinical testing of RELISTOR subcutaneous injection in June 2009; Ono’s development efforts are continuing with a phase 2 trial designed to demonstrate efficacy and safety.

We have received U.S., E.U. and Canadian approvals to market RELISTOR in pre-filled syringes, which are designed to ease preparation and administration for patients and caregivers, and currently plan to coordinate the launch of that product with Salix in 2011.

We are also developing subcutaneous RELISTOR for treatment of OIC outside the advanced-illness setting, in individuals with non-cancer pain. Based on results from a recently completed one-year, open-label safety study, together with results from a previous phase 3 efficacy trial, we plan to submit regulatory filings in the first half of 2011 in the U.S., E.U. and elsewhere for approval of subcutaneous RELISTOR to treat OIC in the non-cancer pain setting.

Oral RELISTOR. We are developing an oral formulation of RELISTOR for the treatment of OIC in patients with non-cancer pain. In September 2010, we initiated an ongoing phase 3 trial of oral methylnaltrexone in this patient population, which pursuant to our License Agreement is continuing as part of Salix’s development responsibilities for RELISTOR.

In our other gastroenterology efforts, we have recently presented preclinical data on novel monoclonal antibodies against toxins produced by C. difficile showing these monoclonal antibodies to have effectively neutralized the cell-killing activities of the toxins in vitro and significantly improved survival in a stringent animal model.

Oncology

Conventional prostate cancer therapies, including radical prostatectomy, radiation, hormone therapies and chemotherapy, may have or increase the risk of side effects, including impotence, incontinence, high cholesterol levels and increased blood-clot risk, and some are generally not intended to be curative and are not actively used to treat localized, early-stage prostate cancer. Through PSMA Development Company, our wholly owned subsidiary, we conduct research and development programs directed at prostate specific membrane antigen, or PSMA, a protein that is abundantly expressed on the surface of prostate cancer cells as well as cells in the newly formed blood vessels of many other solid tumors. The principal focus of these efforts is our fully human monoclonal ADC, which is designed to deliver a chemotherapeutic agent to cancer cells by targeting the three-dimensional structure of the PSMA protein on these cells and binding to and internalizing within the cell. We believe a PSMA-directed therapy may have application in prostate cancer and solid tumors of other types of cancer. We recently announced preliminary data from an ongoing phase 1 dose-escalation clinical study to assess PSMA ADC’s safety, tolerability and initial clinical activity in patients with advanced prostate cancer.

We are also engaged in research on, and recently presented data from preclinical studies of, novel multiplex phosphoinositide 3-kinase (PI3K) inhibitors -- synthetic, small-molecule compounds identified by us that in laboratory studies blocked both PI3K, a key regulator of one molecular signaling pathway, and MNK, an oncogenic kinase in the Ras pathway. We believe simultaneously blocking these interlinked cellular pathways may provide a strategy to combat some of the most aggressive forms of cancer.

Virology

HIV and HCV. Viral entry inhibitors such as our drug candidate PRO 140 represent the newest class of drugs for HIV patients. Our program is based on blocking the binding of HIV to a particular co-receptor used by the virus, which does not block the entry of some strains of HIV that use a less ubiquitous co-receptor. Advancement of this program is subject to obtaining outside funding, for which we have applied to government agencies.

We are also evaluating HCV-entry inhibitors as potential compounds to treat the most common blood-borne infection in the U.S. and a major cause of chronic liver disease.

Licenses

Following is a summary of significant license agreements under which we have in- and/or out-licensed rights to use certain technologies and materials.

RELISTOR

· Under our recent License Agreement, Salix Pharmaceuticals is responsible for further developing and commercializing subcutaneous RELISTOR worldwide other than Japan, including completing clinical development necessary to support regulatory marketing approvals for potential new indications and formulations, and marketing and selling the product. Salix will market RELISTOR directly through its specialty sales force in the U.S., and outside the U.S., RELISTOR will be marketed with sublicenses to regional companies.

Salix is assuming overall responsibilities for RELISTOR, which Wyeth returned to us under our 2009 Transition Agreement. That Agreement provided for the termination of our 2005 collaboration with Wyeth and the transition to Progenics of responsibility for the development and commercialization of RELISTOR, which is now being assumed by Salix under its License Agreement. Under the Transition Agreement, Wyeth is continuing to distribute RELISTOR during the transition period. Wyeth also agreed, at its expense, to continue certain ongoing development efforts for subcutaneous RELISTOR including conducting specified clinical studies, and to provide financial resources and/or other assistance with respect to additional agreed-upon regulatory, manufacturing, supply and clinical matters, in accordance with an agreed-upon development plan. Financial resources of approximately $9.5 million, for which we have recognized $1.2 million, constitute reimbursement for development of a multi-dose pen for subcutaneous RELISTOR.

Under the Transition Agreement, Wyeth paid us $10.0 million in six quarterly installments through January 2011, and continued to pay royalties on 2010 ex-U.S. sales as provided in the 2005 collaboration agreement except to the extent certain fourth quarter financial targets were not met. These targets were not met during the fourth quarter and royalties on ex-U.S. sales were not payable to us. No other royalties are payable in respect of RELISTOR net sales after September 30, 2010. Salix has agreed to pay us royalties on its net sales of RELISTOR as it commences commercialization efforts. Salix will also pay us 60% of any upfront, milestone, reimbursement or other revenue (net of costs of goods sold, as defined, and territory-specific research and development expense reimbursement) it receives from sublicensees in respect of any country outside the U.S., as sublicensees commence their commercialization efforts. We agreed to purchase Wyeth’s remaining inventory of subcutaneous RELISTOR at the end of the Sales Periods on agreed-upon terms and conditions, and Salix has agreed to purchase our inventory of subcutaneous RELISTOR on similar agreed-upon terms and conditions. The Wyeth Transition Agreement also provided for transfer of development, manufacturing and commercialization records and other materials, mutual releases between the parties and indemnification, dispute resolution, non-disparagement and other customary provisions. We have no further obligations to Wyeth under the 2005 collaboration agreement.

The 2005 Wyeth collaboration agreement was in effect until October 2009, which includes periods covered by this report. Under that agreement, we granted to Wyeth an exclusive, worldwide license to develop and commercialize RELISTOR and assigned certain agreements to it. We were responsible for developing the subcutaneous and intravenous formulations in the U.S. until they received regulatory approval, while Wyeth was responsible for these formulations outside the U.S. (other than Japan after execution of the Ono License) and for developing the oral formulation worldwide. From January 2006 to October 2009, development costs for RELISTOR were paid by Wyeth. We were reimbursed for out-of-pocket costs and received reimbursement for our efforts based on our employees devoted to them, subject to Wyeth’s audit rights and possible reconciliation. Commercialization decisions were made by Wyeth, which also was obligated to pay all commercialization costs, including manufacturing costs, and retained all proceeds from product sales, subject to royalties and other amounts payable to us.

· We have exclusive rights to develop and commercialize methylnaltrexone, the active ingredient of RELISTOR, under license from the University of Chicago for which we are obligated to make milestone and royalty payments to the University.

· We have licensed to Ono Pharmaceutical the rights to subcutaneous RELISTOR in Japan, where Ono is responsible for developing and commercializing subcutaneous RELISTOR, including conducting clinical development to support regulatory marketing approval and will own the subcutaneous filings and approvals relating to RELISTOR. Our relationship with Ono is not affected by the Salix License Agreement. We received a $15.0 million upfront payment from Ono, and are entitled to receive up to an additional $20.0 million, payable upon achievement of development milestones. Ono is also obligated to pay us royalties and commercialization milestones on sales of subcutaneous RELISTOR in Japan. Ono has the option to acquire the rights to develop and commercialize other formulations of RELISTOR in Japan, on terms to be negotiated separately. Supervision of and consultation with respect to Ono’s development and commercialization responsibilities are carried out by joint committees. The Ono License contains, among other terms, provisions which permit termination by either party upon the occurrence of certain events.

PSMA

· PSMA Development Company LLC has a collaboration agreement with Seattle Genetics, Inc., under which SGI has granted it an exclusive worldwide license to SGI’s proprietary ADC technology. PSMA LLC has the right to use this technology, which is based in part on technology licensed by SGI from third parties, to link chemotherapeutic agents to PSMA LLC’s monoclonal antibodies that target prostate specific membrane antigen. PSMA LLC is responsible for research, product development, manufacturing and commercialization of all products, and may sublicense the ADC technology to a third party manufacturer. PSMA LLC is obligated to make maintenance and milestone payments aggregating up to $14.3 million and to pay royalties to SGI and its licensors, as applicable, on a percentage of net sales. The SGI agreement terminates at the latest of (i) the tenth anniversary of the first commercial sale of each licensed product in each country or (ii) the latest date of expiration of patents underlying the licensed products. PSMA LLC may terminate the agreement upon advance written notice, and SGI may terminate if PSMA LLC fails to cure a breach of an SGI in-license within a specified time period after written notice. In addition, either party may terminate the agreement after written notice upon an uncured breach or in the event of bankruptcy of the other party. As of December 31, 2010, PSMA LLC has paid approximately $3.7 million under this agreement, including $1.0 million in milestone payments.

· PSMA LLC also has a worldwide exclusive licensing agreement with Abgenix (now Amgen Fremont, Inc.) to use its XenoMouse® technology for generating fully human antibodies to PSMA LLC’s PSMA antigen. PSMA LLC is obligated to make development and commercialization milestone payments with respect to products incorporating an antibody generated utilizing the XenoMouse technology. As of December 31, 2010, PSMA LLC has paid $0.9 million under this agreement and is obligated to pay up to an additional $6.3 million if certain milestones are met, along with royalties based upon net sales of antibody products, if any. This agreement may be terminated, after an opportunity to cure, by Abgenix for cause upon 30 days prior written notice; PSMA LLC has the right to terminate upon 30 days prior written notice. The agreement continues until the later of the expiration of the XenoMouse technology patents that may result from pending patent applications or seven years from the first commercial sale of the products.

· PSMA LLC has a worldwide exclusive license agreement with AlphaVax Human Vaccines to use its Replicon Vector system to create a therapeutic prostate cancer vaccine incorporating PSMA LLC’s proprietary PSMA antigen. PSMA LLC is obligated to make development and commercialization milestone payments with respect to products incorporating AlphaVax’s system. As of December 31, 2010, PSMA LLC has paid $2.1 million under this agreement and is obligated to pay up to an additional $5.4 million if certain milestones are met along with annual maintenance fees and royalties based upon net sales of any products developed using AlphaVax’ system. This agreement may be terminated, after an opportunity to cure, by AlphaVax under specified circumstances, including PSMA LLC’s failure to achieve milestones; the consent of AlphaVax to revisions to the milestones due dates may not, however, be unreasonably withheld. PSMA LLC has the right to terminate upon 30 days prior written notice. The agreement continues until the later of the expiration of the patents relating to AlphaVax’s system or seven years from the first commercial sale of the products developed using that system. Pending U.S. and international patent applications and patent-term extensions may extend the period of our license rights when and if they are allowed, issued or granted.

Virology - PRO 140

· Protein Design Labs (now Facet Biotech Corporation, a wholly owned subsidiary of Abbott Laboratories) humanized a murine monoclonal antibody developed by us (humanized PRO 140) and granted us related licenses under patents and patent applications, in addition to know-how. In general, these licenses are fully paid after the latest of (i) the tenth anniversary of the first commercial sale of a product developed thereunder, (ii) expiration of the last-to-expire relevant patent or (iii) the tenth anniversary of the latest filed pending patent application. Pending U.S. and international patent applications and patent-term extensions may extend the period of our license rights when and if they are allowed, issued or granted. We may terminate the license on 60 days prior written notice, and either party may terminate on 30 days prior written notice for an uncured material breach (ten days for payment default). As of December 31, 2010, we have paid $5.5 million under this agreement, and if all milestones are achieved, we will be obligated to pay an additional $2.5 million, including annual maintenance fees and royalties on sales of products developed under the license.

· We have a letter agreement with the Aaron Diamond AIDS Research Center pursuant to which we have the exclusive right to pursue the commercial development, directly or with a partner, of products related to HIV based on patents jointly owned by ADARC and us.

Patents and Proprietary Technology

Our policy is to protect our proprietary technology, and we consider the protection of our rights to be important to our business. In addition to seeking U.S. patent protection for many of our inventions, we generally file patent applications in Canada, Japan, European countries that are party to the European Patent Convention and additional foreign countries on a selective basis in order to protect the inventions that we consider to be important to the development of our foreign business. Generally, patents issued in the U.S. are effective:

· if the patent application was filed prior to June 8, 1995, for the longer of 17 years from the date of issue or 20 years from the earliest asserted filing date; or

· if the application was filed on or after June 8, 1995, for 20 years from the earliest asserted filing date.

In certain instances, the U.S. patent term can be extended up to a maximum of five years to recapture a portion of the term during which the FDA regulatory review was being conducted. The duration of foreign patents varies in accordance with the provisions of applicable local law, although most countries provide for patent terms of 20 years from the earliest asserted filing date and allow patent extensions similar to those permitted in the U.S.

We also rely on trade secrets, proprietary know-how and continuing technological innovation to develop and maintain a competitive position in our product areas. We generally require our employees, consultants and corporate partners who have access to our proprietary information to sign confidentiality agreements.

Information with respect to our patent portfolio regarding our therapeutic and research programs, as of year-end 2010, is set forth below.

|

Therapeutic or

|

Number of Patents

|

Expiration

|

Number of Patent Applications

|

|||||||

|

Research Program

|

U.S.

|

International

|

Dates (1)

|

U.S.

|

International

|

|||||

|

Gastroenterology

(RELISTOR; C. difficile)

|

7

|

25

|

2011-2028

|

24

|

143

|

|||||

|

Oncology (PSMA; PI3K)

|

9

|

25

|

2013-2025

|

7

|

28

|

|||||

|

Virology (PRO 140; HCV)

|

15

|

24

|

2015-2024

|

13

|

15

|

|||||

| _____________________________ | ||||||||||

|

(1)

|

Patent term extensions and pending patent applications may extend the period of patent protection afforded our products and product candidates under development.

|

Our patents may not enable us to preclude competitors from commercializing drugs in direct competition with our products, and consequently may not provide us with any meaningful competitive advantage. See “Risk Factors.”

We are aware of intellectual property rights held by third parties that relate to products or technologies we are developing. For example, we are aware of others investigating methylnaltrexone and other peripheral opioid antagonists, PSMA or related compounds, monoclonal antibodies directed at targets relevant to PRO 140 and HCV viral entry inhibitors, and of patents and applications held or filed by others in those areas. While the validity of issued patents, patentability of claimed inventions in pending applications and applicability of any of them to our programs are uncertain, patent rights asserted against us could adversely affect our ability to commercialize or collaborate with others regarding our products.

Research, development and commercialization of a biopharmaceutical product often require choosing between alternative development and optimization routes at various stages in the development process. Preferred routes depend upon subsequent discoveries and test results and cannot be identified with certainty at the outset. There are numerous third-party patents in our field, and we may need to obtain a license under a patent in order to pursue the preferred development route of one or more of our product candidates. The need to obtain a license would decrease the ultimate profitability of the applicable product. If we cannot negotiate a license, we might have to pursue a less desirable development route or terminate the entire program altogether.

Government Regulation

Progenics and its product candidates are subject to comprehensive regulation by the U.S. FDA and comparable authorities in other countries. Pharmaceutical regulation currently is a topic of substantial interest in lawmaking and regulatory bodies in the U.S. and internationally, and numerous proposals exist for changes in FDA and non-U.S. regulation of pre-clinical and clinical testing, safety, effectiveness, approval, manufacture, labeling, marketing, export, storage, recordkeeping, advertising, promotion and other aspects of biologics, small molecule drugs and medical devices, many of which, if adopted, could significantly alter our business and the current regulatory structure described below.

FDA Regulation. FDA approval of our product candidates, including a review of the manufacturing processes and facilities used to produce them, are required before they may be marketed in the U.S. This process is costly, time consuming and subject to unanticipated delays, and a drug candidate may fail to progress at any point.

None of our product candidates other than RELISTOR has received marketing approval from the FDA or any other regulatory authority. The process required by the FDA before product candidates may be approved for marketing in the U.S. generally involves:

· pre-clinical laboratory and animal tests;

· submission to and favorable review by the FDA of an IND (Investigational New Drug) application before clinical trials may begin;

· adequate and well-controlled human clinical trials to establish the safety and efficacy of the product for its intended indication (animal and other nonclinical studies also are typically conducted during each phase of human clinical trials);

· submission to the FDA of a marketing application; and

· FDA review of the marketing application in order to determine, among other things, whether the product is safe and effective for its intended uses.

Pre-clinical tests include laboratory evaluation of product chemistry and animal studies to gain preliminary information about a product’s pharmacology and toxicology and to identify safety problems that would preclude testing in humans. Products must generally be manufactured according to current Good Manufacturing Practices, and pre-clinical safety tests must be conducted by laboratories that comply with FDA good laboratory practices regulations.

Results of pre-clinical tests are submitted to the FDA as part of an IND which must become effective before clinical trials may commence. The IND submission must include, among other things, a description of the sponsor’s investigational plan; protocols for each planned study; chemistry, manufacturing and control information; pharmacology and toxicology information and a summary of previous human experience with the investigational drug. Unless the FDA objects to, makes comments or raises questions concerning an IND, it becomes effective 30 days following submission, and initial clinical studies may begin. Companies often obtain affirmative FDA approval, however, before beginning such studies.

Clinical trials involve the administration of the investigational new drug to healthy volunteers or to individuals under the supervision of a qualified principal investigator. Clinical trials must be conducted in accordance with the FDA’s Good Clinical Practice requirements under protocols submitted to the FDA that detail, among other things, the objectives of the study, parameters used to monitor safety and effectiveness criteria to be evaluated. Each clinical study must be conducted under the auspices of an Institutional Review Board, which considers, among other things, ethical factors, safety of human subjects, possible liability of the institution and informed consent disclosure which must be made to participants in the trial.

Clinical trials are typically conducted in three sequential phases, which may overlap. During phase 1, when the drug is initially administered to human subjects, the product is tested for safety, dosage tolerance, absorption, metabolism, distribution and excretion. Phase 2 involves studies in a limited population to evaluate preliminarily the efficacy of the product for specific, targeted indications, determine dosage tolerance and optimal dosage and identify possible adverse effects and safety risks.

When a product candidate is found in phase 2 evaluation to have an effect and an acceptable safety profile, phase 3 trials are undertaken in order to further evaluate clinical efficacy and test for safety within an expanded population. Safety studies are conducted in accordance with the FDA’s International Conference on Harmonization (ICH) Guidelines. Phase 2 results do not guarantee a similar outcome in phase 3 trials. The FDA may suspend clinical trials at any point in this process if it concludes that clinical subjects are being exposed to an unacceptable health risk.

A New Drug Application, or NDA, is an application to the FDA to market a new drug. A Biologic License Application, or BLA, is an application to market a biological product. The new drug or biological product may not be marketed in the U.S. until the FDA has approved the NDA or issued a biologic license. The NDA must contain, among other things, information on chemistry, manufacturing and controls; non-clinical pharmacology and toxicology; human pharmacokinetics and bioavailability; and clinical data. The BLA must contain, among other things, data derived from nonclinical laboratory and clinical studies which demonstrate that the product meets prescribed standards of safety, purity and potency, and a full description of manufacturing methods. Supplemental NDAs (sNDAs) are submitted to obtain regulatory approval for additional indications for a previously approved drug.

The results of the pre-clinical studies and clinical studies, the chemistry and manufacturing data, and the proposed labeling, among other things, are submitted to the FDA in the form of an NDA or BLA. The FDA may refuse to accept the application for filing if certain administrative and content criteria are not satisfied, and even after accepting the application for review, the FDA may require additional testing or information before approval of the application, in either case based upon changes in applicable law or FDA policy during the period of product development and FDA regulatory review. The applicant’s analysis of the results of clinical studies is subject to review and interpretation by the FDA, which may differ from the applicant’s analysis, and in any event, the FDA must deny an NDA or BLA if applicable regulatory requirements are not ultimately satisfied. If regulatory approval of a product is granted, such approval may be made subject to various conditions, including post-marketing testing and surveillance to monitor the safety of the product, or may entail limitations on the indicated uses for which it may be marketed. Finally, product approvals may be withdrawn if compliance with regulatory standards is not maintained or if problems occur following initial marketing.

Both before and after approval is obtained, a product, its manufacturer and the sponsor of the marketing application for the product are subject to comprehensive regulatory oversight. Violations of existing or newly-adopted regulatory requirements at any stage, including the pre-clinical and clinical testing process, the approval process, or thereafter, may result in various adverse consequences, including FDA delay in approving or refusal to approve a product, withdrawal of an approved product from the market or the imposition of criminal penalties against the manufacturer or sponsor. Later discovery of previously unknown problems may result in restrictions on the product, manufacturer or sponsor, including withdrawal of the product from the market.

Regulation Outside the U.S. Whether or not FDA approval has been obtained, approval of a pharmaceutical product by comparable government regulatory authorities in foreign countries must be obtained prior to marketing the product there. The approval procedure varies from country to country, and the time required may be longer or shorter than that required for FDA approval. The requirements for regulatory approval by governmental agencies in other countries prior to commercialization of products there can be rigorous, costly and uncertain, and approvals may not be granted on a timely basis or at all.

In the European Union, Canada, Australia and Japan, regulatory requirements and approval processes are similar in principle to those in the United States. Regulatory approval in Japan requires that clinical trials of new drugs be conducted in Japanese patients. Depending on the type of drug for which approval is sought, there are currently two potential tracks for marketing approval in the E.U. countries: mutual recognition and the centralized procedure. These review mechanisms may ultimately lead to approval in all E.U. countries, but each method grants all participating countries some decision-making authority in product approval. The centralized procedure, which is mandatory for biotechnology derived products, results in a recommendation in all member states, while the E.U. mutual recognition process involves country-by-country approval.

In other countries, regulatory requirements may require additional pre-clinical or clinical testing regardless of whether FDA approval has been obtained. This is the case in Japan, where Ono is responsible for developing and commercializing the subcutaneous form of RELISTOR and where trials are required to involve patient populations which we and our other collaborators have not examined in detail. If the particular product is manufactured in the U.S., we must also comply with FDA and other U.S. export provisions. In most countries outside the U.S., coverage, pricing and reimbursement approvals are also required which may affect the profitability of the affected product.

Other Regulation. In addition to regulations enforced by the FDA, we are also subject to regulation under the Occupational Safety and Health Act, the Environmental Protection Act, the Toxic Substances Control Act, the Resource Conservation and Recovery Act and various other current and potential future federal, state or local regulations. Biopharmaceutical research and development involves the controlled use of hazardous materials, chemicals, viruses and various radioactive compounds. Even strict compliance with safety procedures for storing, handling, using and disposing of such materials prescribed by applicable regulations cannot completely eliminate the risk of accidental contaminations or injury from these materials, which may result in liability for resulting legal and regulatory violations as well as damages.

See Risk Factors.

Manufacturing

Under our recent License Agreement for RELISTOR, Salix is responsible for the manufacture and supply, at its expense, of all active pharmaceutical ingredient (API) and finished and packaged products for its commercialization efforts, including assuming relationships we have entered into in anticipation of establishing a new collaboration partnership or contracting with one or more other contract manufacturing organizations (CMOs) for supply of RELISTOR API and subcutaneous and oral finished drug product. See Risk Factors.

We manufacture clinical trial supplies of our PSMA monoclonal antibody in our biologics pilot production facilities in Tarrytown, New York, and have engaged third-party CMOs for other portions of the PSMA ADC manufacturing process. We expect our manufacturing capacity will not be sufficient for all of our late-stage clinical trials or commercial-scale requirements. If we are unable to arrange for satisfactory CMO services, or otherwise determine to acquire additional manufacturing capacity, we will need to expand our manufacturing staff and facilities or obtain new facilities. In order to establish a full-scale commercial manufacturing facility for any of our product candidates, we would need to spend substantial additional funds, hire and train significant numbers of employees and comply with the extensive FDA regulations applicable to such a facility.

Sales and Marketing

We from time to time seek strategic collaborations and other funding support for product candidates in our pipeline. We expect that we would market other products for which we obtain regulatory approval through co-marketing, co-promotion, licensing and distribution arrangements with third-party collaborators, and might also consider contracting with professional detailing and sales organizations to perform promotional and/or medical-scientific support functions for them. See Risk Factors.

Competition

Competition in the biopharmaceutical industry is intense and characterized by ongoing research and development and technological change. We face competition from many for-profit companies and major universities and research institutions in the U.S. and abroad. We face competition from companies marketing existing products or developing new products for diseases targeted by our technologies. Many of our competitors have substantially greater resources, experience in conducting pre-clinical studies and clinical trials and obtaining regulatory approvals for their products, operating experience, research and development and marketing capabilities and production capabilities than we do. Our products and product candidates under development may not compete successfully with existing products or products under development by other companies, universities and other institutions. Drug manufacturers that are first in the market with a therapeutic for a specific indication generally obtain and maintain a significant competitive advantage over later entrants and therefore, the speed with which industry participants develop products, complete clinical trials, approve processes and commercialize products are important competitive factors.

RELISTOR is the first FDA-approved product for any indication involving OIC. We are, however, aware of products in pre-clinical or clinical development that target the side effects of opioid pain therapy. For example: Adolor Corporation markets ENTEREG® (alvimopan) for the treatment of postoperative ileus, and is also evaluating a phase 1 and early-stage compound for opioid-bowel dysfunction in chronic-pain patients. Sucampo Pharmaceuticals, Inc., in collaboration with Takeda Pharmaceutical Company Limited, markets AMITIZA® (lubiprostone), a selective chloride channel activator, for chronic idiopathic (non-opioid related) constipation and recently completed two phase 3 pivotal clinical trials of this drug for opioid-induced bowel dysfunction. In Europe, Mundipharma International Limited markets TARGIN® (oxycodone/naloxone), a combination of an opioid and a systemic opioid antagonist, and Movetis NV, which has recently been acquired by Shire plc, has announced that it has started a phase 3 clinical trial with prucalopride in patients with constipation induced by opioid based pain medications. A Nektar Therapeutics-AstraZeneca PLC collaboration has announced phase 2 results of an oral peripheral mu-opioid receptor antagonist in patients with OIC and is developing a related combination product. AstraZeneca is a leader in gastrointestinal medicine, and this collaboration may have a time-to-market advantage over us with respect to an oral therapy for OIC in non-cancer pain patients. Alkermes, Inc. recently announced preliminary results from a phase 2 clinical study of an oral peripherally-restricted opioid antagonist, and has a combination product in preclinical testing. Theravance, Inc. is conducting phase 2 clinical testing of an oral peripheral mu-opioid antagonist.

Radiation and surgery are two traditional forms of treatment for prostate cancer, to which our PSMA-based development efforts are directed. If the disease spreads, hormone (androgen) suppression therapy is often used to slow the cancer’s progression. This form of treatment, however, can eventually become ineffective. We are aware of several competitors who are developing alternative treatments for castrate-resistant prostate cancer, some of which are directed against PSMA.

With respect to our PI3K inhibitor research, recent evidence suggests that activation of complementary oncogenic pathways can confer resistance to PI3K inhibition, requiring co-administration of agents targeting these “resistance” pathways. We are aware of several competitors who are developing small molecule PI3K inhibitors that co-target additional oncogenic pathways.

C. difficile infection typically is treated with antibiotics such as vancomycin or metronidazole. Treatment often is associated with alleviation of symptoms, but incomplete response or disease recurrence is observed in approximately 30% of patients and there is no standard treatment for severe, complicated cases of disease. We are aware of competitors who are developing biologic agents for the treatment and/or prevention of C. difficile infection.

Currently approved drugs for the treatment of HIV infection and AIDS have shown efficacy alone and in conjunction with other agents, the latter of which we have not demonstrated for PRO 140. We are aware of two approved drugs, Trimeris, Inc.’s FUZEON® and Pfizer’s SELZENTRY®, designed to treat HIV infection by blocking viral entry.

The current standard for HCV infection is a combination therapy of pegylated interferon and ribavirin. These therapies act via non-specific mechanisms and are associated with substantial toxicities. In addition, the current treatment regimen requires a long duration of up to 48 weeks and is only 50% effective against the most prominent strains found in Europe and the U.S. We are aware of several competitors who are developing small molecule inhibitors of different stages of the HCV lifecycle, including inhibitors of viral entry, such as the oral Hepatitis C protease inhibitor telaprevir being developed by a Vertex Pharmaceuticals Incorporated-Janssen Pharmaceutica, N.V.-Mitsubishi Tanabe Pharma Corporation collaboration, and Merck & Co., Inc.’s bocepravir.

A significant amount of research in the biopharmaceutical field is also being carried out at academic and government institutions. An element of our research and development strategy is to in-license technology and product candidates from academic and government institutions. These institutions are sensitive to the commercial value of their findings and pursue patent protection and negotiate licensing arrangements to collect royalties for use of technology they develop. These institutions may also market competitive commercial products on their own or in collaboration with competitors and compete with us in recruiting highly qualified scientific personnel, which may result in increased costs or decreased availability of technology or product candidates from these institutions to other industry participants.

Competition with respect to our technologies and products is based on, among other things, product efficacy, safety, reliability, method of administration, availability, price and clinical benefit relative to cost; timing and scope of regulatory approval; sales, marketing and manufacturing capabilities; collaborator capabilities; insurance and other reimbursement coverage; and patent protection. Competitive position in our industry also depends on a participant’s ability to attract and retain qualified personnel, obtain patent protection or otherwise develop proprietary products or processes, and secure sufficient capital resources for the typically substantial period between technological conception and commercial sales.

Product Liability

The testing, manufacturing and marketing of our product candidates and products involves an inherent risk of product liability attributable to unwanted and potentially serious health effects. To the extent we elect to test, manufacture or market product candidates and products independently, we bear the risk of product liability directly. We maintain product liability insurance coverage in the amount of $10.0 million per occurrence, subject to a deductible and a $10.0 million aggregate limitation. Where local statutory requirements exceed the limits of our existing insurance or local policies of insurance are required, we maintain additional clinical trial liability insurance to meet these requirements. This insurance is subject to deductibles and coverage limitations. The availability of and cost of maintaining insurance may change over time.

Human Resources

At December 31, 2010, we had 159 full-time employees, 23 of whom hold Ph.D. degrees, five of whom hold M.D. degrees and two of whom hold both Ph.D. and M.D. degrees. At that date, 122 employees were engaged in research and development, medical, regulatory affairs and manufacturing activities and 37 were engaged in finance, legal, administration and business development. We consider our relations with our employees to be good. None of our employees is covered by a collective bargaining agreement.

Item 1A. Risk Factors

Our business and operations entail a variety of serious risks and uncertainties. Our business is inherently risky. We are subject to the risks of failure inherent in the development of product candidates based on new technologies. We must complete successfully clinical trials and obtain regulatory approvals for our product candidates, and will rely on Salix to complete development and obtain regulatory approvals for additional formulations of and indications for RELISTOR. In the Japanese market, we must rely on Ono to conduct successful clinical trials and obtain regulatory approvals. Our other research and development programs involve novel approaches to human therapeutics. There is little precedent for the successful commercialization of products based on our technologies, and there are a number of technological challenges that we must overcome to complete most of our development efforts. We may not be able successfully to develop further any of our products.

In addition to the risks we face in our research and development activities, and our business as a publicly held commercial enterprise devoted to developing and commercializing high-technology consumer products, the transitioning of RELISTOR to our new partner Salix presents us with new risks, including the following:

We are dependent on Salix, Ono, Wyeth (until completion of its involvement) and other business partners to develop and commercialize RELISTOR in their respective areas, exposing us to significant risks.

We are and will be dependent upon Salix, Ono, Wyeth (until completion of its responsibilities pursuant to the Transition Agreement) and any other business partner(s) with which we may collaborate in the future to perform and fund development, including clinical testing of RELISTOR, make related regulatory filings and manufacture and market products in their respective territories. Revenues from the sale of RELISTOR will soon depend almost entirely upon the efforts of Salix, which will have significant discretion in determining the efforts and resources it applies to sales of RELISTOR. Ono will have similar discretion with respect to sales in Japan. Neither may be effective in marketing such products. Our business relationships with Salix, Ono and other partners may not be scientifically, clinically or commercially successful. For example, Salix is a larger pharmaceutical company than Progenics with a variety of marketed products. Unlike Wyeth and Pfizer, however, Salix is not a large diversified pharmaceutical company and does not have resources commensurate with those companies. Salix has its own corporate objectives, which may not be consistent with our best interests, and may change its strategic focus or pursue alternative technologies in a manner that results in reduced or delayed revenues to us. Changes of this nature might also occur if Salix were acquired or if its management changed.

We may have future disagreements with Salix and Ono concerning product development, marketing strategies, manufacturing and supply issues, and rights relating to intellectual property. Both of them have significantly greater financial and managerial resources than we do, which either could draw upon in the event of a dispute. Disagreements between either of them and us could lead to lengthy and expensive litigation or other dispute-resolution proceedings as well as extensive financial and operational consequences to us, and have a material adverse effect on our business, results of operations and financial condition.

We are subject to extensive regulation, which can be costly and time consuming and can subject us to unanticipated fines and delays.

Progenics and its products are subject to comprehensive regulation by the FDA and comparable authorities in other countries. These agencies and other entities regulate the pre-clinical and clinical testing, safety, effectiveness, approval, manufacture, labeling, marketing, export, storage, recordkeeping, advertising, promotion and other aspects of our products. If we violate regulatory requirements at any stage, whether before or after marketing approval is obtained, we may be subject to forced removal of a product from the market, product seizure, civil and criminal penalties and other adverse consequences. We cannot guarantee that approvals of proposed products, processes or facilities will be granted on a timely basis, or at all. If we experience delays or failures in obtaining approvals, commercialization of our product candidates will be slowed or stopped. Even if we obtain regulatory approval, the approval may include significant limitations on indicated uses for which the product could be marketed or other significant marketing restrictions. Under our License Agreement with Salix, we will be dependent on our new partner for compliance with these regulations as they apply to RELISTOR.

Our products may face regulatory, legal or commercial challenges even after approval.

Even if our products receive regulatory approval:

· They might not obtain labeling claims necessary to make the product commercially viable (in general, labeling claims define the medical conditions for which a drug product may be marketed, and are therefore very important to the commercial success of a product), or may be required to carry “black box” or other warnings that adversely affect their commercial success.

· Approval may be limited to uses of the product for treatment or prevention of diseases or conditions that are relatively less financially advantageous to us than approval of greater or different scope, or subject to an FDA-imposed Risk Evaluation and Mitigation Strategy (REMS) that limits the sources from and conditions under which they may be dispensed.

· We or our collaborators might be required to undertake post-marketing trials to verify the product’s efficacy or safety.

· We, our collaborators or others might identify side effects after the product is on the market.

· Efficacy or safety concerns regarding marketed products may lead to product recalls, withdrawals of marketing approval, reformulation of the product, additional pre-clinical testing or clinical trials, changes in labeling of the product, the need for additional marketing applications, declining sales or other adverse events. These potential consequences may occur whether or not the concerns originate from subsequent testing or other activities by us, governmental regulators, other entities or organizations or otherwise, and whether or not they are scientifically justified.

· We or our collaborators might experience manufacturing problems, which could have the same, similar or other consequences.

· We and our collaborators will be subject to ongoing FDA obligations and continuous regulatory review.

· If products lose previously received marketing and other approvals, our financial results would be adversely affected.

Competing products in development may adversely affect acceptance of our products.

As described in this Annual Report under Business – Competition, we are aware of a number of products and product candidates which compete or may potentially compete with RELISTOR. Any of these approved products or product candidates, or others which may be developed in the future, may achieve a significant competitive advantage relative to RELISTOR, and, in any event, the existing or future marketing and sales capabilities of these competitors may impair our ability to compete effectively in the market.

We are also aware of competitors described in that section who are developing alternative treatments for disease targets to which our research and development programs are directed, any of which – or others which may be developed in the future – may achieve a significant competitive advantage relative to any product we may develop.

Developing product candidates may require us to obtain additional financing. Our access to capital funding is uncertain.

We expect to continue to incur significant development expenditures for our product candidates, and do not have committed external sources of funding for most of these projects. These expenditures will be funded from cash on hand, or we may seek additional external funding for them, most likely through collaborative, license or royalty financing agreements with one or more pharmaceutical companies, securities issuances or government grants or contracts. We cannot predict when we will need additional funds, how much we will need, the form any financing may take (such as securities issuance or royalty or other financing), or whether additional funds will be available at all, especially in light of current conditions in global credit and financial markets. Our need for future funding will depend on numerous factors, such as the availability of new product development projects or other opportunities which we cannot predict, and many of which are outside our control. We cannot assure you that any currently-contemplated or future initiatives for funding our product candidate programs will be successful.

Our access to capital funding is always uncertain. Stresses in international markets are still affecting access to capital. We may not be able at the necessary time to obtain additional funding on acceptable terms, or at all. Our inability to raise additional capital on terms reasonably acceptable to us would seriously jeopardize our business.

If we raise funds by issuing and selling securities, it may be on terms that are not favorable to existing stockholders. If we raise funds by selling equity securities, current stockholders will be diluted, and new investors could have rights superior to existing stockholders. Raising funds by selling debt securities often entails significant restrictive covenants and repayment obligations.

If we are unable to negotiate collaborative agreements, our cash burn rate could increase and our rate of product development could decrease.

We may not be successful in negotiating additional collaborative arrangements with pharmaceutical and biotechnology companies to develop and commercialize product candidates and technologies. If we do not enter into new collaborative arrangements, we would have to devote more of our resources to clinical product development and product-launch activities, seeking additional sources of capital, and our cash burn rate would increase or we would need to take steps to reduce our rate of product development.

If testing does not yield successful results, our products will not be approved.

Regulatory approvals are necessary before product candidates can be marketed. To obtain them, we or our collaborators must demonstrate a product’s safety and efficacy through extensive pre-clinical and clinical testing. Numerous adverse events may arise during, or as a result of, the testing process, such as:

· results of pre-clinical studies being inconclusive or not indicative of results in human clinical trials;

· potential products not having the desired efficacy or having undesirable side effects or other characteristics that preclude marketing approval or limit their commercial use if approved;

· after reviewing test results, we or our collaborators may abandon projects which we previously believed to be promising; and

· we, our collaborators or regulators may suspend or terminate clinical trials if we or they believe that the participating subjects are being exposed to unacceptable health risks.

Clinical testing is very expensive and can take many years. Results attained in early human clinical trials may not be indicative of results in later clinical trials. In addition, many of our investigational or experimental drugs are at an early stage of development, and successful commercialization of early stage product candidates requires significant research, development, testing and approvals by regulators, and additional investment. Our products in the research or pre-clinical development stage may not yield results that would permit or justify clinical testing. Our failure to demonstrate adequately the safety and efficacy of a product under development would delay or prevent marketing approval, which could adversely affect our operating results and credibility.

Setbacks in clinical development programs could adversely affect us.

We and our collaborators continue to conduct clinical trials of RELISTOR. If the results of these or future trials are not satisfactory, we encounter problems enrolling subjects, clinical trial supply issues or other difficulties arise, or we experience setbacks in developing drug formulations, including raw material-supply, manufacturing or stability difficulties, our entire RELISTOR development program could be adversely affected, resulting in delays in trials or regulatory filings for further marketing approval. Conducting additional clinical trials or making significant revisions to our clinical development plan would lead to delays in regulatory filings. If clinical trials indicate a serious problem with the safety or efficacy of a RELISTOR product, we, Salix or Ono may stop development or commercialization of affected products. Since RELISTOR is our only approved product, any setback of these types could have a material adverse effect on our business, results of operations and financial condition.