Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ENDO HEALTH SOLUTIONS INC. | d8k.htm |

ENDO

PHARMACEUTICALS Barclays Capital 2011 Global Healthcare Conference

March 15, 2011

grow. collaborate. innovate.

thrive. Exhibit

99.1 |

grow.

collaborate. innovate. thrive. 2

FORWARD LOOKING STATEMENTS

This presentation contains forward-looking statements within the meaning of the Private

Securities Litigation

Reform

Act

of

1995.

Statements

including

words

such

as

“believes,”

“expects,”

“anticipates,”

“intends,”

“estimates,”

“plan,”

“will,”

“may,”

“look forward,”

“intend,”

“guidance,”

“future”

or similar

expressions are forward-looking statements. Because these statements reflect our

current views, expectations and beliefs concerning future events, these

forward-looking statements involve risks and uncertainties. Investors should note

that many factors, as more fully described under the caption “Risk

Factors”

in our Form 10-K, Form 10-Q and Form 8-K filings with the Securities and Exchange

Commission and as otherwise enumerated herein or therein, could affect our future

financial results and could cause our actual results to differ materially from those

expressed in forward-looking statements contained in our Annual Report on Form

10-K. The forward-looking statements in this presentation are qualified by

these risk factors. These are factors that, individually or in the aggregate, could cause our

actual results to differ materially from expected and historical results. We assume no

obligation to publicly update any forward-looking statements, whether as a result

of new information, future developments or otherwise. ©2011 Endo Pharmaceuticals

Inc. |

grow.

collaborate. innovate. thrive. ©2011 Endo Pharmaceuticals Inc.

PRESENTATION OVERVIEW

3

I.

Sustaining Growth

II.

Our Business Model:

Branded Pharmaceuticals

Devices and Services

Generic Pharmaceuticals

III.

Financial Outlook |

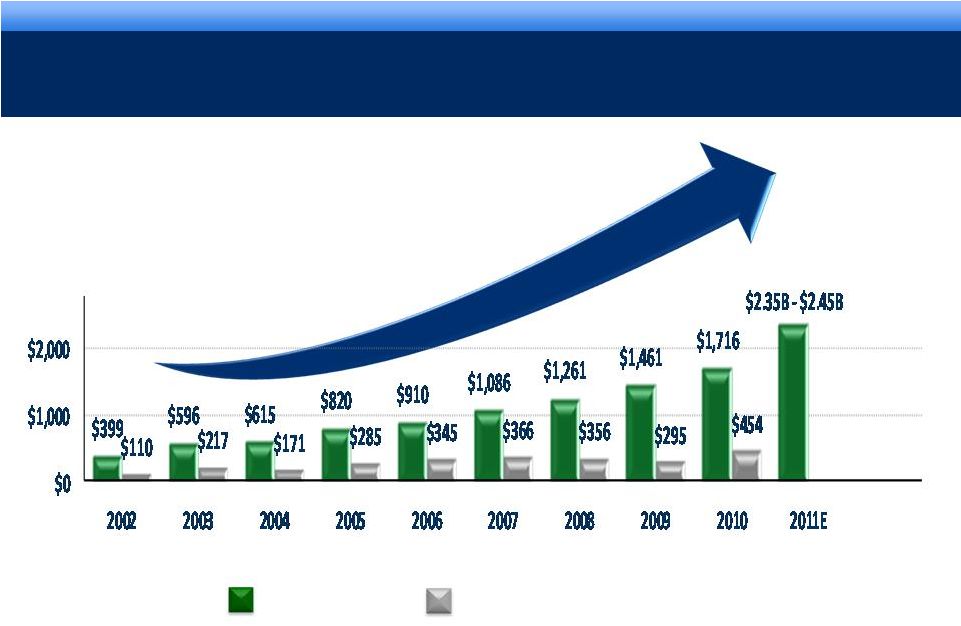

STRONG

OPERATING PERFORMANCE 16% 3-YEAR CAGR FOR REVENUE*

* Revenue CAGR 2007-2010.

$mm

4

Revenue

Cash Flow from Operations

grow. collaborate. innovate. thrive.

©2011 Endo Pharmaceuticals Inc.

Sustaining our Growth |

grow.

collaborate. innovate. thrive. ©2011 Endo Pharmaceuticals Inc.

5

Through Organic Growth

•

Diversified business lines to maximize growth

•

Enhanced commercial model driving growth via

strategic resource deployment

•

Invested in R&D portfolio yielding a diversified

pipeline of products and a recent FDA approval

•

Bolstered management team by adding

expertise and experience in managing and

growing a larger enterprise

5

ENDO’S TRANSFORMATION

Through Strategic Growth

•

With Indevus, we secured a position in urology

•

HealthTronics gave us an established presence

in Devices & Services and critical mass in

urology

•

Penwest strengthened our pain business

enhancing profitability & flexibility in the opioid

franchise

•

Qualitest brings critical mass to our generics

business & strengthens our pain portfolio |

grow.

collaborate. innovate. thrive. ©2011 Endo Pharmaceuticals Inc.

6

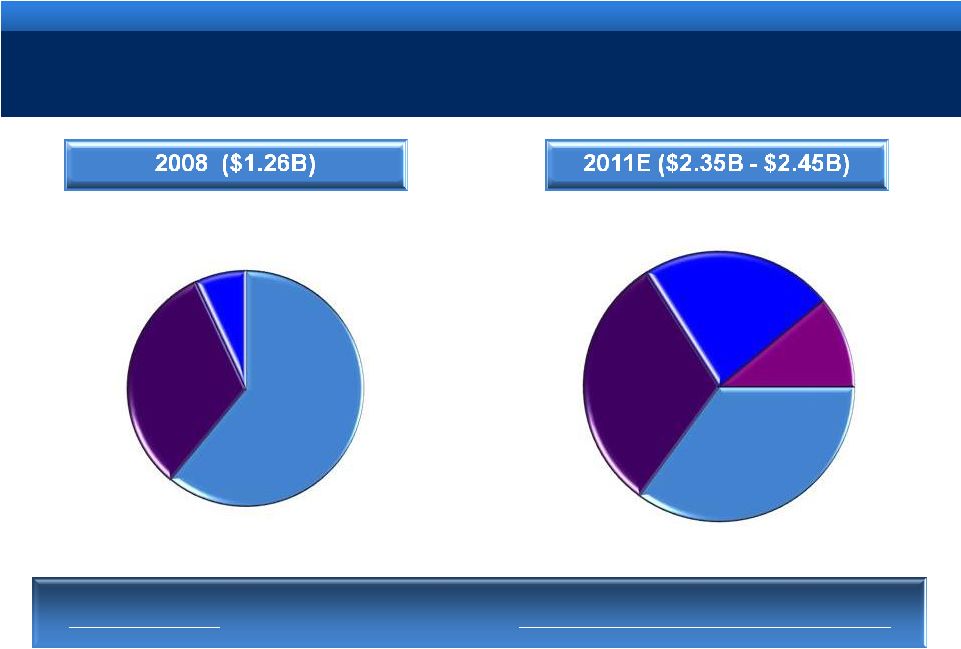

DIVERSIFICATION OF BUSINESS

Diversifying

our revenues through organic and strategic growth

Lidoderm

Other

Brands

Generics

Devices &

Services

Lidoderm

Other

Brands

Generics |

grow.

collaborate. innovate. thrive. ©2011 Endo Pharmaceuticals Inc.

7

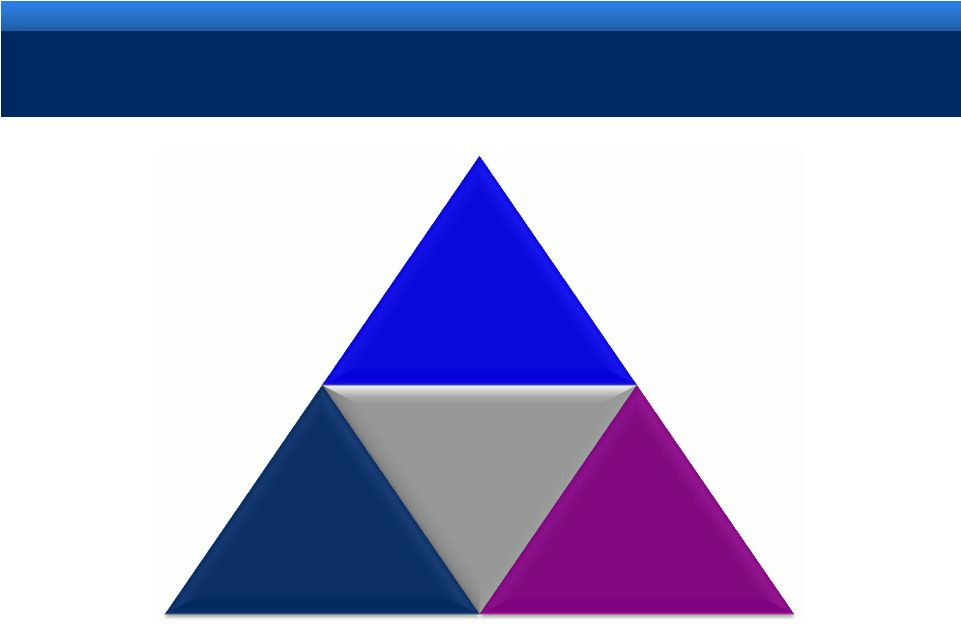

ENDO’S INTEGRATED BUSINESS MODEL

Branded

Pharmaceuticals

Generics

Pain

Urology

Oncology

Endocrinology

Devices

& Services |

grow.

collaborate. innovate. thrive. ©2011 Endo Pharmaceuticals Inc.

PRESENTATION OVERVIEW

8

I.

Sustaining Growth

II.

Our Business Model:

Branded Pharmaceuticals

Devices and Services

Generic Pharmaceuticals

III.

Financial Outlook |

grow.

collaborate. innovate. thrive. NEW TESTOSTERONE REPLACEMENT THERAPY

14 million men suffer with hypogonadism in US

9% are treated

Market TRx Net Sales: >$1.2B

Growth Rate: approximately 20% CAGR last 5 years

Gels have the greatest utilization in the TRT market: ~72%

PCPs account for majority of TRT prescriptions:

More than 60% through Primary Care Physicians

Approximately 30% through specialty (Urologists/Endocrinologists)

Method of Payment for TRT class:

Approximately 80% Commercial

Approximately 12% Government

Remainder from Cash Payment

9

©2011 Endo Pharmaceuticals Inc. |

STRONG CORE

BUSINESS SUPPORTING GROWTH 10

grow. collaborate. innovate. thrive.

©2011 Endo Pharmaceuticals Inc. |

grow.

collaborate. innovate. thrive. STRONG CORE BUSINESS SUPPORTING GROWTH

11

LIDODERM®

key component of our core business

Strong source of operating cash flow

Expect low single digit sales growth in 2011

Stable TRx trends and solid managed care positioning

10-year Commercial launch anniversary in September 2009

Differentiated

product

profile

provides

unique

offering

for

HCPs

and

patients suffering from PHN

Improved PHN physician targeting for more efficient utilization

of resources

Paragraph IV filings update:

Filed suit on March 14, 2011 in response to

Mylan

Technologies’

Paragraph IV Notice

©2011 Endo Pharmaceuticals Inc. |

grow.

collaborate. innovate. thrive. ©2011 Endo Pharmaceuticals Inc.

©2011 Endo Pharmaceuticals Inc.

LONG-ACTING OPIOID FRANCHISE

OPANA®

ER

Settlement with generic companies provides for 2013 entry on primary dosage forms

>35% YOY TRx growth for full year 2010

Gaining share; Growing source of cash flow

Completed Acquisition of Penwest

Advances our leadership and growth in pain management

New formulation of OPANA ER designed to be crush resistant

Complete Response Letter from FDA on January 7, 2011

Letter did not require additional clinical trials

Confident that we can address the issue set forth

Currently anticipate responding to the FDA by mid-2011

Expect a 6-month review cycle once our response is filed

12 |

grow.

collaborate. innovate. thrive. ©2011 Endo Pharmaceuticals Inc.

©2011 Endo Pharmaceuticals Inc.

DEVELOPMENT PIPELINE*

* There can be no assurance that any of these development programs

will be successful or if successful, the products will ultimately be approved by FDA.

** Granted orphan drug designation

*** Licensed from Orion Corporation for joint development and

commercialization 13

Phase I

Phase II

Phase III

NDA

OPANA®

ER

Formulation designed to be crush-resistant

AVEED

TM

Long Acting Injectable Testosterone

Urocidin

TM

Bladder Cancer

Octreotide Implant

Acromegaly**

Axomadol

Moderate to moderately severe chronic pain

Androgen Receptor Agonist***

Castration Resistant Prostate Cancer

Pending

Update Pending |

grow.

collaborate. innovate. thrive. ©2011 Endo Pharmaceuticals Inc.

©2011 Endo Pharmaceuticals Inc.

EXPANDING OUR RESEARCH CAPABILITIES

14

Building capabilities and investing for organic growth

Creating virtual discovery networks at multiple stages of

discovery and early development

Select partnerships:

Discovery: Aurigene and Jubilant

Early development: Orion

Flexible, efficient relationships focused on value creation |

grow.

collaborate. innovate. thrive. ©2011 Endo Pharmaceuticals Inc.

PRESENTATION OVERVIEW

15

I.

Sustaining Growth

II.

Our Business Model:

Branded Pharmaceuticals

Devices and Services

Generic Pharmaceuticals

III.

Financial Outlook |

©2011

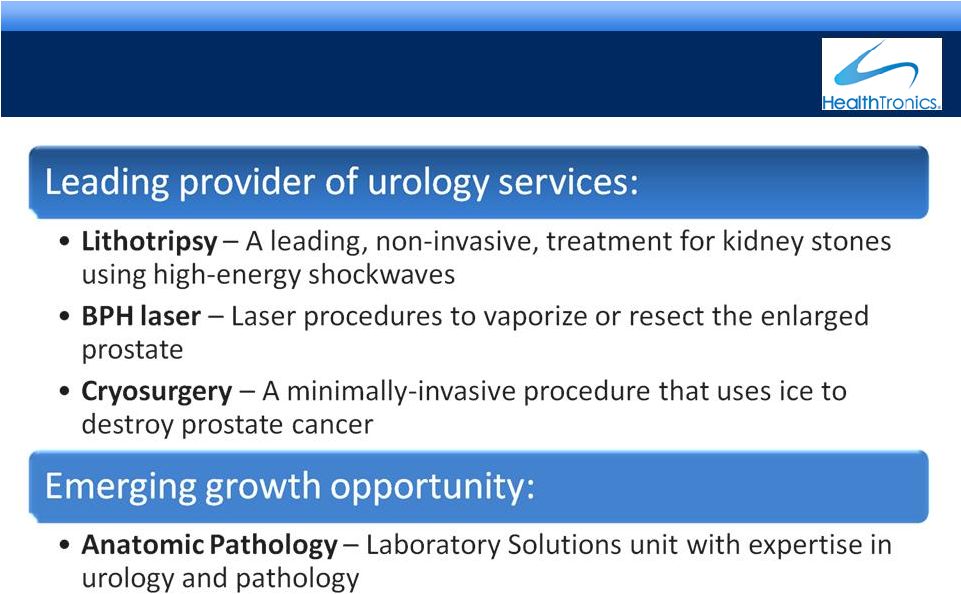

Endo Pharmaceuticals Inc. HEALTHTRONICS SERVICES

16

grow. collaborate. innovate. thrive. |

grow.

collaborate. innovate. thrive. ©2011 Endo Pharmaceuticals Inc.

Established business channel with 1/3 of urologists in U.S.

Furthers our commitment to the urologist community

Opportunities for a complete suite of Endo products in this specialty:

Branded Drugs

Generic Drugs

Devices and Services

Total solution for the urology marketplace

Improve patient care

Enhance practice economics

HEALTHTRONICS OVERVIEW

17 |

grow.

collaborate. innovate. thrive. PRESENTATION OVERVIEW

18

I.

Sustaining Growth

II.

Our Business Model:

Branded Pharmaceuticals

Devices and Services

Generic Pharmaceuticals

III.

Financial Outlook

©2011 Endo Pharmaceuticals Inc. |

grow.

collaborate. innovate. thrive. 19

QUALITEST -

A STRATEGIC FIT

Furthers our stated strategy to build a healthcare company better able

to respond to the changing economics that drive the U.S. healthcare

environment

Adds critical mass to our current generics business, alongside

Branded Pharmaceuticals and Devices & Services

Enhances our core pain franchise

As a high-growth asset, will significantly diversify and accelerate the

growth of Endo’s revenue and earnings’

streams

©2011 Endo Pharmaceuticals Inc. |

grow.

collaborate. innovate. thrive. ©2011 Endo Pharmaceuticals Inc.

20

A STRONGER GENERICS BUSINESS WITH ROBUST

PIPELINE

Combined Generics Business

•

Solid commercial base entering 2011

•

Expect to file 14 ANDAs in 2011

•

45 ANDAs currently under review by FDA

•

Expect 14 ANDA product launches in 2011

We expect our combined generics business to grow over 15% over the

2010-12 period driven by launches from the development portfolio

2011 Generic Development

14 ANDA

Filings

45 Current

ANDA

Reviews

14 ANDA

Product

Launches |

grow.

collaborate. innovate. thrive. PRESENTATION OVERVIEW

21

I.

Sustaining Growth

II.

Our Business Model:

Branded Pharmaceuticals

Devices and Services

Generic Pharmaceuticals

III.

Financial Outlook

©2011 Endo Pharmaceuticals Inc. |

grow.

collaborate. innovate. thrive. ©2011 Endo Pharmaceuticals Inc.

22

2011 ENDO GUIDANCE

Guidance

Revenue range

$2.35BN -

$2.45BN

Adjusted diluted EPS range

$4.20 -

$4.30

Reported (GAAP) diluted EPS range

$2.43 -

$2.53 |

ENDO

PHARMACEUTICALS grow. collaborate. innovate. thrive. |

grow.

collaborate. innovate. thrive. ©2011 Endo Pharmaceuticals Inc.

24

24

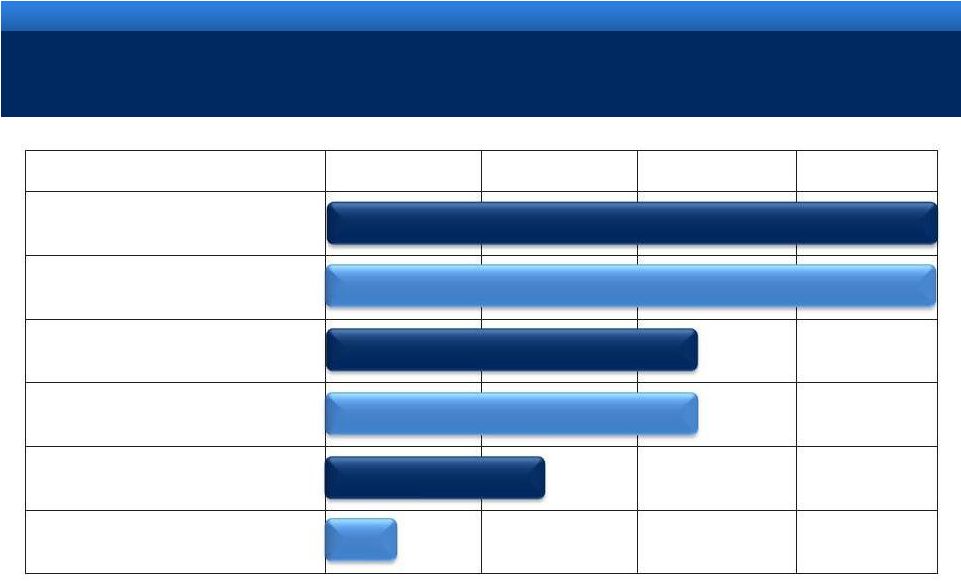

RECONCILIATION OF NON-GAAP MEASURES

24

For an explanation of Endo’s reasons for using non-GAAP measures, see Endo’s

Current Report on Form 8-K filed today with the Securities and Exchange Commission

Reconciliation of Projected GAAP Diluted Earnings Per Share to Adjusted Diluted Earnings Per

Share Guidance for the Year Ending December 31, 2011 Lower End of Range

Upper End of Range

Projected GAAP diluted income per common share

$2.43

$2.53

Upfront and milestone-related payments to partners

$0.35

$0.35

Amortization of commercial intangible assets and inventory step-up

$1.33

$1.33

Acquisition and integration costs related to recent acquisitions.

$0.26

$0.26

Interest expense adjustment for ASC 470-20 and the amortization of

the premium on debt acquired from Indevus

$0.16

$0.16

Tax effect of pre-tax adjustments at the applicable tax rates and

certain other expected cash tax savings as a result of recent

acquisitions

($0.33)

($0.33)

Diluted adjusted income per common share guidance

$4.20

$4.30

The company's guidance is being issued based on certain assumptions including:

•Certain of the above amounts are based on estimates and there

can be no assurance that Endo will achieve these results

•Includes all completed business development transactions as of

February 28, 2011 |

grow.

collaborate. innovate. thrive.

Barclays Capital 2011 Global Healthcare Conference

March 15, 2011 |