Attached files

| file | filename |

|---|---|

| EX-21.1 - EXHIBIT 21.1 - TRUE RELIGION APPAREL INC | a2202584zex-21_1.htm |

| EX-31.2 - EXHIBIT 31.2 - TRUE RELIGION APPAREL INC | a2202584zex-31_2.htm |

| EX-31.1 - EXHIBIT 31.1 - TRUE RELIGION APPAREL INC | a2202584zex-31_1.htm |

| EX-32.2 - EXHIBIT 32.2 - TRUE RELIGION APPAREL INC | a2202584zex-32_2.htm |

| EX-32.1 - EXHIBIT 32.1 - TRUE RELIGION APPAREL INC | a2202584zex-32_1.htm |

| EX-23.1 - EXHIBIT 23.1 - TRUE RELIGION APPAREL INC | a2202584zex-23_1.htm |

| EX-10.10 - EXHIBIT 10.10 - TRUE RELIGION APPAREL INC | a2202584zex-10_10.htm |

| EX-10.11 - EXHIBIT 10.11 - TRUE RELIGION APPAREL INC | a2202584zex-10_11.htm |

| EX-10.13 - EXHIBIT 10.13 - TRUE RELIGION APPAREL INC | a2202584zex-10_13.htm |

| EX-10.16 - EXHIBIT 10.16 - TRUE RELIGION APPAREL INC | a2202584zex-10_16.htm |

| EX-10.14 - EXHIBIT 10.14 - TRUE RELIGION APPAREL INC | a2202584zex-10_14.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

| ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended December 31, 2010 |

||

or |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

||

Commission file number 000-51483

TRUE RELIGION APPAREL, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 98-0352633 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification Number) |

|

2263 E. Vernon Ave. Vernon, California |

90058 |

|

| (Address of Principal Executive Offices) | (Zip Code) |

(323) 266-3072

(Registrant's Telephone Number, Including Area Code)

| Securities registered pursuant to Section 12(b) of the Exchange Act: | ||

Common Stock, par value $0.0001 per share (Title of Class) |

Nasdaq Global Market (Name of Each Exchange on Which Registered) |

|

Securities registered under Section 12(g) of the Act: |

||

| None (Title of Class) |

None (Name of Each Exchange on Which Registered) |

|

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendments to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer," "non-accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The aggregate market value of the voting common equity held by non-affiliates as of June 30, 2010, was approximately $527,258,000, computed by reference to the price of $22.07 per share, the price at which the common equity was last sold on such date as reported on the Nasdaq Global Market. For purposes of this computation, it is assumed that the shares beneficially held by directors and officers of the registrant would be deemed to be stock held by affiliates.

On March 9, 2011, 25,124,585 shares of common stock were outstanding.

ANNUAL REPORT ON FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2010

TABLE OF CONTENTS

Exhibit 10.10

Exhibit 10.11

Exhibit 10.13

Exhibit 10.14

Exhibit 10.16

Exhibit 21.1

Exhibit 23.1

Exhibit 31.1

Exhibit 31.2

Exhibit 32.1

Exhibit 32.2

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains statements that constitute "forward-looking statements" within the meaning of Section 21E of the Securities Exchange Act of 1934 and Section 27A of the Securities Act of 1933. The words "expect," "estimate," "anticipate," "predict," "believe" and similar expressions and variations thereof are intended to identify forward-looking statements. Such statements appear in a number of places in this filing and include statements regarding the intent, belief or current expectations of the Company, our directors or officers with respect to, among other things (a) trends affecting our financial condition and (b) our business and growth strategies. Our stockholders are cautioned not to put undue reliance on such forward-looking statements. Such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and actual results may differ materially from those projected in this Report, for the reasons, among others, discussed in the Sections—"Management's Discussion and Analysis of Financial Condition and Results of Operations," and "Risk Factors." The following discussion should be read in conjunction with our financial statements and related notes, which are part of this Report or incorporated by reference to our reports filed with the Securities Exchange Commission. We undertake no obligation to publicly revise these forward-looking statements to reflect events or circumstances that arise after the date hereof.

General

True Religion Apparel, Inc. (referred to in this Annual Report on Form 10-K as "the Company," "our," "we," or "True Religion") designs, markets, distributes, and sells apparel under the brand name "True Religion Brand Jeans" to fashion-conscious consumers on six continents, including North America, Europe, Asia, Australia, Africa and South America. We seek to be a trend setting leader in the design, marketing, distribution and sale of fashion jeans and related sportswear apparel. Our products can be categorized as denim, knit and non-denim, and most come in 'tops' and 'bottoms'. Knit styles include hoodies, t-shirts and sweats, and non-denim fabrics include corduroy and twill. Tops range from shirts to jackets, and bottoms encompass pants, shorts and skirts. We operate in four distinct but integrated segments: U.S. Wholesale, International, U.S. Consumer Direct and Core Services, which includes licensing activity. Our U.S. Consumer Direct segment consists of branded retail stores located in the United States and e-commerce sales. The Core Services segment provides product design, production, distribution, marketing and other overhead resources to the other segments. During the past eight years, we have developed a recognizable brand, expanded vertically into the U.S. Consumer Direct segment, expanded our product offerings, and initiated a strategy to leverage our brand by entering into product licensing agreements.

We market our products to domestic and international wholesale customers by attendance at industry trade shows. Our collections are also presented to the wholesale customers in our showrooms, located in New York City, Los Angeles, Hong Kong, Seoul, Tokyo, London, Milan, Dusseldorf and Munich. We have wholesale sales teams at each of our showrooms. Wholesale customers can be found in six continents and include specialty stores, major department stores, off-price retailers, and wholesale distributors.

Our products are sold in the United States in leading national premium stores, including Bloomingdale's, Neiman Marcus, Nordstrom, Saks Fifth Avenue, and in approximately 750 boutique and specialty stores. We also sell our products in the United States through our 94 branded retail stores and through our True Religion Brand Jeans website, which is operated for us by a third party. Our products are sold internationally through our seven branded retail stores and distributed internationally through our wholesale sales teams, international distributors and sales agents, who sell

1

our products to boutiques and specialty stores in major cities throughout Africa, Asia, Australia, Europe, the Middle East, South America and Canada.

Business Strategy

Our strategy is to build brand recognition by marketing our products to fashion-conscious, affluent consumers who shop in our own branded retail stores, premium nationwide stores, select boutiques and specialty stores, and who want to wear and be seen in the latest and most fashionable premium jeans and related apparel. True Religion Brand Jeans often sell in the range of $168 to $376 per pair at retail; occasionally, we offer specialty items at higher prices. We continually update our product offerings to be seen as a trend-setter in the high fashion jeans apparel market.

For our adult denim jeans and other fabrications, we utilize contract manufacturers located in the United States. We brand products as having been "Made in the U.S.A." Local contract manufacturing helps us control our costs, ensures fast turnaround of popular styles, and keeps fixed overhead to a minimum. Approximately 80 percent of our sportswear is made in the USA by contract manufacturers, and the remaining merchandise is made by foreign contract manufacturers.

We maintain and exercise control over advertising and marketing activities from our headquarters, where we set the tone for integrity, consistency and direction of the True Religion Brand Jeans brand image worldwide. Furthermore, we control our brand image by controlling the distribution of our products. We sell our in-season merchandise only through our own branded retail stores, premium nationwide stores, boutiques and specialty stores, and international distributors that display and merchandise our products in a way that supports our brand image and is in synch with the lifestyle and shopping experience expected by our customers. We sell our prior season merchandise and 'seconds' through our own branded retail stores located in outlet malls and through select off-price retailers.

Our Brand and Products

Since 2003, our brand name has become a familiar name in premium denim and apparel. We believe the strength of the True Religion Brand Jeans brand name and image is due mainly to our emphasis on seeking innovative and distinctive product designs that stand for exceptional fit, styling details and quality. We seek to be an innovator in premium lifestyle branding. Our fashion perspective is significantly influenced by our Chairman, Chief Executive Officer and Chief Merchant, Jeffrey Lubell.

Our principal products are high fashion denim jeans in a wide variety of styles that we design, market, distribute and sell under the True Religion Brand Jeans trademarks. We currently sell men's, women's and kid's styles. Our products are sold in the United States and abroad through our branded retail stores, upscale retailers and boutiques and specialty stores. In addition to denim jeans, we sell a wide variety of related products for men, women and children, including corduroy pants and jackets, cotton, twill, linen and velvet pants and jackets, fleece sweat suits and hooded sweatshirts, skirts, knit shirts, t-shirts, shorts and sportswear. Many of our products can be viewed on our website located at www.truereligionbrandjeans.com. We intend to continue to introduce new styles and styling details in jeans and sportswear.

True Religion Brand Jeans products are made with high quality fabrics primarily from the United States, Turkey, Japan, and Italy that are gently and naturally aged, hand finished and boldly stitched in multiple thread colors. Although we operate in a highly competitive market, we seek to distinguish True Religion Brand Jeans products by emphasizing superior fit and unique styling details. Many of our products are made to look, feel and fit like they have been owned for years. We believe that we have a competitive advantage in the detailing of the design, the quality of the fabric and the superiority of the fit.

2

Each year we introduce new collections that we expect will be considered trend setting by fashion-conscious consumers.

Our 2010 net sales categorized by gender were approximately as follows: women—48%; men—48%; and kids—4%. Our largest retail product category in terms of units sold in 2010 was denim bottoms, which accounted for 72% of total units sold in our U.S. Consumer Direct segment. Our average sales price for women's products in our full price retail stores was $170 in 2010; for men's products, it was $175; and for kid's products, it was $104.

Our Sales Segments

Information regarding net sales, gross profit and operating income, attributable to each of our segments, is included within Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations, and within Item 8. Financial Statements and Supplementary Data in Note 15, Segment Information, of our Notes to Consolidation Financial Statements, which are incorporated herein by reference.

Our U.S. Consumer Direct Segment

Our U.S. Consumer Direct segment includes our United States branded retail stores and our e-commerce sales. As of December 31, 2010, we operated 94 branded retail stores in the United States, including 27 stores located in outlet centers. We added 24 branded retail stores in 2010, and in 2011 we expect to add approximately15 branded retail stores in the United States. Our branded retail stores are located across the United States in a variety of upscale shopping areas ("street" locations, regional malls, and a limited number of outlet centers). Our typical branded retail store is approximately 1,700 square feet, while our typical branded retail store located in an outlet center is approximately 2,500 square feet. Our branded retail stores showcase the full range of our branded merchandise including licensed products, in an environment that emphasizes our unique "Malibu hippie-bohemian chic" image through an extensive use of hand-hewn hickory pecan wood. Our e-commerce sales are made through a third-party who receives sales commissions in exchange for operating the 'True Religion Brand Jeans' website, accepting customer orders and fulfilling customer orders from their distribution center, where they hold our merchandise on consignment. In 2010, our U.S. Consumer Direct segment generated net sales of $189.1 million, comprising 52.0% of our total net sales.

Our U.S. Wholesale Segment

Our U.S. Wholesale segment sells our products to leading nationwide premium department stores, specialty retailers and boutiques that have the image and merchandising expertise that we demand for the effective presentation of our products. In 2010, our products were sold in Bloomingdale's, Neiman Marcus, Nordstrom and Saks Fifth Avenue, and in approximately 750 specialty and boutique stores. Our U.S. Wholesale segment also sells our products, primarily prior season or excess merchandise, to off-price retailers. In 2010, our U.S. Wholesale segment generated net sales of $104.9 million, comprising 28.8% of our total net sales.

Our International Segment

Our International segment sells our products through a variety of channels, including subsidiaries that operate retail stores and sell to wholesale customers who operate retail stores; distributors and sales agents who sell to upscale boutiques in their respective territory; and directly to wholesale customers who operate retail stores. As of December 31, 2010, our International segment includes one full price and three outlet retail stores in Japan, one full price retail store in the United Kingdom, one full price retail store in Canada and one full price retail store in Germany. Through our wholesale sales teams, international distributors and sales agents, our products are found in major cities throughout

3

Africa, Asia, Australia, Europe, the Middle East, North America and South America. In 2010, our International segment generated net sales of $64.4 million, comprising 17.7% of our total net sales. We have established a Europe, Middle East, and Africa (EMEA) regional office in Switzerland and a regional office for Asia/Pacific in Hong Kong. We plan to grow our net sales and net earnings from the International segment by presenting our merchandise at True Religion Brand Jeans stores and at premium retailers' stores in markets where fashion-conscious consumers shop. In 2011, we expect to open a total of approximately eight branded retail stores in Canada, the United Kingdom, Germany and the Netherlands.

Our Licensing Business

We selectively license our brand name and logo to be included on products sold by other companies to enhance and extend the True Religion Brand Jeans brand. Through licensing alliances, we combine our consumer insight, design, and marketing skills with the specific product competencies of our licensing partners to create, build and expand our product offerings to fashion-conscious consumers. We grant our product licensees the right to design, manufacture and sell at wholesale specified categories of products under our trademark. We have the right to approve or disapprove the licensees' designs, products and wholesale customers. Each licensing partner pays us royalties based upon its wholesale sales of products that use our trademark. In addition, licensing partners may be required to allocate a portion of their sales revenues to advertise our products and share in the creative costs associated with these products. Our licenses typically have three year terms and may grant the licensee conditional renewal options. We recognized $5.3 million in royalty revenue through our licensing business in 2010 as a component of our Core Services segment.

At the end of 2010, our licensed merchandise categories were: footwear, fragrances, headwear (including scarves and gloves), sunglasses and swimwear. In 2010, we terminated our legwear licensed merchandise category.

Marketing

The True Religion Brand Jeans marketing and public relations strategy is designed to communicate the signature design aesthetic and lifestyle of our brand, and to reinforce our position as a global leader in premium denim. Our unique, "bohemian-chic" style was created by our founder, Chief Executive Officer and Chief Merchant, Mr. Jeffrey Lubell. Mr. Lubell continues to oversee every aspect of our marketing, including the creative aspect.

The True Religion Brand Jeans marketing department is based in Vernon, California. The department works hand-in-hand with Mr. Lubell to create seasonal advertising campaigns which serve as the basis for all of our media and marketing communication efforts. The marketing mix consists of a variety of channels including: national and international print advertising, strategic outdoor advertising, in-store advertising, digital advertising, and social media. This mix of media and channels is designed to support the brand's growth across diverse consumer groups and markets. In addition, the brand strategically cultivates and enjoys a strong and loyal celebrity following. These unpaid celebrity endorsements have been, and continue to be, highly effective in expanding our brand awareness and affinity.

Trademarks

We have 26 trademarks registered in the United States for "True Religion Brand Jeans" logos and marks. We have also secured international trademark registrations in 43 countries and we continue to seek trademark registrations that we believe are necessary to protect the True Religion Brand Jeans brand. Generally, our trademarks remain valid and enforceable so long as we continue to use the marks in commerce and the required registration renewals are filed. We consider our trademarks as

4

valuable assets in the marketing of our products and seek to protect them from infringement worldwide.

We have been issued a patent in the United States for our Joey style jeans and three patents for our QT stitch, which are distinctive designs. The patent for our Joey style jeans will expire in 2021 and the three patents for our QT stitch will expire in 2024. We have also been issued six patents in the European Community for our QT stitch which will expire in 2035.

Sources and Availability of Raw Materials

The fabrics used in our denim products are sourced from fabric manufacturers located in the United States, Italy and Japan. Generally, the fabric used in our products is not purchased directly by us but by our contract manufacturers. The thread and other materials are sourced from various industry suppliers within the United States. Our contract manufacturers use high quality fabric in the manufacturing of our products. Although we do not currently have any long-term agreements in place for the supply of our fabric, thread or other components, such high quality fabric is currently readily available from a number of suppliers, including mills located both in the United States and abroad.

Design and Product Development

Our design team, which has 29 employees and is led by Mr. Lubell, is responsible for the design and development of our products. We do not currently have a formal research and development effort but our design team plans to continue to develop new merchandise styles for each season. Our design team is diverse in all our product categories and is known for designing leading fashion trends. Our washes are constantly in development to react to the demand for new and exciting products for consumers. The development of our products from concept through manufacturing is engineered to be not only fashionable but durable as well.

Manufacturing

We outsource all of our manufacturing to third parties on an order-by-order basis. Currently, we have contract manufacturers in the United States for our women's and men's denim, knits and some fleece products, Mexico for our kid's denim, knits, and some fleece products, and Asia for knit shirts, outerwear, woven shirts and non-denim bottoms. We believe we can meet our current production needs using these and other available contract manufacturers. These contractors purchase the fabric and materials and then sew and finish our products to our design specifications. In addition to the contract manufacturers, we utilize various laundry and finishing houses in the Los Angeles area to complete the production of many of our products.

Our production and sourcing staff oversee the manufacturing and quality control of our products and researches and develops new sources of supply for the materials used in the manufacturing of our products.

Quality Control

Our quality control program ensures that products meet our high quality standards. We monitor the quality of the fabrics used by our contract manufacturers prior to the production of garments and inspect prototypes of each product before production runs commence. We also perform random on-site quality control checks during and after production before our products are shipped from our contract manufacturers. Final random inspections of our products occur when our products are received in our distribution center. We believe that our policy of inspecting our products at both our distribution centers and on-site at our contract manufacturers' facilities is integral in maintaining the quality, consistency and reputation of our products.

5

Government Regulation and Supervision

We are subject to customs, truth-in-advertising and other laws, including consumer protection regulations and zoning and occupancy ordinances that regulate retailers generally and/or govern the promotion and sale of merchandise and the operation of retail stores. Some of our merchandise is manufactured by factories located outside of the United States. These products are imported and are subject to U.S. customs laws, which impose tariffs as well as import quota restrictions for textiles and apparel. While importation of goods from some countries from which we buy our products may be subject to embargo by U.S. customs authorities if shipments exceed quota limits, we currently are not restricted by quotas in the operation of our business. In addition, custom duties and tariffs do not comprise a material portion of the cost of our products.

We are committed to product quality and safety; we focus our efforts to adhere to all applicable Federal and state laws and regulations including Consumer Product Safety Improvement Act ("CPSIA"), and all Federal Trade Commission ("FTC") rules and regulations for product labeling. Labeling and advertising of our products is subject to regulation by the FTC. We use a government approved third party testing lab to verify all federally mandated testing requirements for wearing apparel as applicable. We believe that we are in material compliance with these regulations.

Competition

The retail apparel industry is highly competitive. We compete with numerous designers and manufacturers of apparel and accessories, domestic and foreign, including 7 for All Mankind, AG Adriano Goldschmied, Citizens of Humanity, Diesel, G-Star, J Brand, Joe's Jeans and Levi Strauss & Co,. Some of our competitors may be significantly larger and have substantially greater resources than us. We compete primarily on the basis of fashion, fit and quality, which depend on our ability to:

- •

- anticipate and respond to changing consumer demands in a timely manner;

- •

- maintain favorable brand recognition;

- •

- develop and produce high quality products that appeal to consumers;

- •

- appropriately price our products;

- •

- ensure product availability; and

- •

- obtain sufficient retail floor space and effectively present our products at retail.

Employees

As of December 31, 2010, we employed on a full or part-time basis a total of 1,663 employees, consisting of 1,367 in our retail stores, 149 in design and production, and 147 in general administration.

Website Availability of Our Reports Filed with the Securities and Exchange Commission

Our Internet Web site address is www.truereligionbrandjeans.com. We make available free of charge on or through our Internet Web site our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports as soon as reasonably practicable after we electronically file the report with or furnish it to the SEC.

6

Risks Relating to Our Industry

Our business may be negatively impacted by general economic conditions and the current global financial crisis.

Our performance is subject to worldwide economic conditions and their impact on levels of consumer spending that affect not only the ultimate consumer, but also retailers, our largest direct customers. The United States and global economies have suffered from a prolonged recession for the past several years and as a result consumer spending has deteriorated significantly from pre-recession levels and may remain depressed, or be subject to further deterioration, for the foreseeable future. The worldwide apparel industry is heavily influenced by general economic cycles. Purchases of high-fashion apparel and accessories tend to decline in periods of recession or uncertainty regarding future economic prospects, as disposable income declines. During periods of recession or economic uncertainty, we may not be able to maintain or increase our sales to existing customers, make sales to new customers, open and operate new retail stores, maintain sales levels at our existing stores or the mix between full price and off-price stores, maintain or increase our international operations on a profitable basis, or maintain our earnings from operations as a percentage of net sales. As a result, our operating results may be adversely and materially affected by continued downward trends or uncertainty in the United States or global economies.

Our continued operations depend on current fashion trends. If our designs and products do not continue to be fashionable, our business could be adversely affected.

Our success depends in large part on our ability to develop, market and deliver innovative and stylish products that are consistent with and build on our brand and image at a pace and intensity competitive with our competition. The novelty and the design of our True Religion Brand Jeans apparel is critical to our success and competitive position. The apparel industry is subject to rapidly evolving fashion trends and shifting consumer demands. If we are unable to continue to develop and offer unique products to our customers, our sales and margins will decline and we may be faced with a significant amount of unsold finished goods inventory. We cannot be certain that high-fashion denim and related apparel will continue to be fashionable. Should the trend steer away from high-fashion denim and related apparel, our sales could decrease and our business could be adversely affected. In addition, our future designs and plans to expand our product offerings may not be successful, and any unsuccessful designs or product offerings could adversely affect our business.

Our business and the success of our products could be harmed if we are unable to maintain our brand image.

Our success to date has been due in large part to the growth of our brand image. If we are unable to timely and appropriately respond to changing consumer demand, our brand name and brand image may be impaired. Even if we react appropriately to changes in consumer preferences, consumers may consider our brand image to be outdated or associate our brand with styles that are no longer popular. In the past, many apparel companies have experienced periods of rapid growth in sales and earnings followed by periods of declining sales and losses. Our business may be similarly affected in the future.

We face intense competition, including competition from companies with significantly greater resources than ours, and if we are unable to compete effectively with these companies, our market share may decline and our business could be harmed.

We face intense competition in the apparel industry from other established companies. A number of our competitors may have significantly greater financial, technological, manufacturing, sales, marketing and distribution resources than we do. Their greater capabilities in these areas may enable them to better withstand periodic downturns in the apparel industry, compete more effectively on the

7

basis of price and production, and more quickly develop new products. In addition, there are low barriers of entry into this industry and new companies may enter the markets in which we compete, further increasing competition in the industry. Our branded retail stores compete with many other retailers, including department stores, some of whom are our major wholesale customers. We believe that our ability to compete successfully depends on a number of factors, including the style and quality of our products and the strength of our brand name, as well as many factors beyond our control. We may not be able to compete successfully in the future, and increased competition may result in price reductions, reduced profit margins, loss of market share and an inability to generate cash flows that are sufficient to maintain or expand our development and marketing of new products, which would adversely impact the trading price of our common stock.

Increases in the price of raw materials or their reduced availability could increase our cost of goods and decrease our profitability.

The principal fabrics used in our business are cotton, blends, synthetics and wools. The prices we pay our suppliers for our products are dependent in part on the market price for raw materials—primarily cotton—used to produce them. The price and availability of cotton may fluctuate substantially, depending on a variety of factors, including demand, crop yields, weather, supply conditions, transportation costs, work stoppages, government regulation, economic climates and other unpredictable factors. Cotton prices world-wide have increased significantly in the past year, and the outlook for future prices is uncertain. Increases in raw material costs, together with other factors, will make it difficult for us to sustain the gross margin level we have achieved in recent years and result in a decrease of our profitability unless we are able to pass higher prices on to our wholesale and retail customers, reduce the costs of other inputs, or improve our production process so we reduce the amount of excess inventory that is sold at a discount. Moreover, any decrease in the availability of cotton could impair our ability to meet our production requirements in a timely manner.

We may be unable to sustain our past growth or manage our future growth, which may have a material adverse effect on our future operating results.

We have experienced rapid growth since our inception, and have increased our net sales from $140.5 million in 2006 to $363.7 million in 2010. We anticipate that our future growth rate will depend upon various factors, including the strength of our brand image, the market success of our current and future products, the success or our growth strategies, competitive conditions and our ability to manage our future growth. Future growth may place a significant strain on our management and operations. As we continue to grow in our operations, our operational, administrative, financial and legal procedures and controls will need to be expanded. As a result, we may need to train and manage an increasing number of employees, which could distract our management team from our business. Our future success will depend substantially on the ability of our management team to manage our anticipated growth. If we are unable to anticipate or manage our growth effectively, our future operating results could be adversely affected.

Our profitability may decline as a result of increasing pressure on margins.

The high fashion apparel industry is subject to significant pricing pressure caused by many factors, including intense competition, consolidation in the retail industry, pressure from retailers to reduce the costs of products and changes in consumer spending patterns. These factors may cause us to reduce our sales prices for sales of products to retailers and directly to consumers in our Consumer Direct segment which could cause our gross margin to decline. If our sale prices decline and we are unable to offset such price reductions with comparable reductions in our operating costs, our future operating results could be adversely affected.

8

The loss of our Chief Executive Officer or other key management personnel would have an adverse impact on our future development and could impair our ability to succeed.

Our performance is substantially dependent upon the expertise of our Chief Executive Officer, Jeffrey Lubell, and other key management personnel. In addition to his executive officer functions, Mr. Lubell is our chief merchant and heads our design team. His leadership in the design, marketing and operational areas of our business has been instrumental to our growth. The death or disability of Mr. Lubell or other extended or permanent loss of his services, or any negative market or industry perception with respect to him or arising from his loss, could have a material adverse effect on our business. Our other executive officers and other members of senior management have substantial experience and expertise in our business and have made significant contributions to our growth and success. The unexpected loss of services of one or more of these individuals could also have a material adverse effect on us. We do not maintain "key man" insurance with respect to Mr. Lubell or any of our other key management personnel, and any of them may leave us at any time, which could severely disrupt our business and future operating results.

Our business could be harmed if we fail to maintain proper inventory levels.

We place orders with our manufacturers for some of our products prior to the time we receive all of our customers' orders. We do this to minimize purchasing costs, the time necessary to fill customer orders and the risk of non-delivery. We also maintain an inventory of certain products that we anticipate will be in greater demand. However, we may be unable to sell the products we have ordered in advance from manufacturers or that we have in our inventory. Inventory levels in excess of customer demand may result in inventory write-downs, and the sale of excess inventory at discounted prices could significantly impair our brand image and have a material adverse effect on our operating results and financial condition. Conversely, if we underestimate consumer demand for our products or if our manufacturers fail to supply the quality products that we require at the time we need them, we may experience inventory shortages. Inventory shortages might delay shipments to customers, negatively impact retailer and distributor relationships, and diminish brand loyalty.

Increasing the number of branded company-operated stores will require us to develop new capabilities and increase our expenditures.

Our growth strategy is dependent in part on our ability to open and operate new stores and the availability of suitable store locations on acceptable terms. Although we operated 94 branded retail stores in the United States and seven international branded retail stores as of December 31, 2010, we historically have been primarily a wholesaler. In 2011, we plan to open approximately 15 company-operated branded retail and outlet stores in the United States and eight stores in other countries. The success of this strategy is dependent upon, among other factors, the identification of suitable markets and sites for store locations, the negotiation of acceptable lease terms, the hiring, training and retention of competent sales personnel, and making capital expenditures for these stores. We must also offer a broad product assortment, appropriately manage retail inventory levels, install and operate effective retail systems, execute effective pricing strategies and integrate our stores into our overall business mix. An increase in the number of branded company-operated stores will place increased demands on our operational, managerial and administrative resources and require us to further develop our retailing skills and capabilities. These increased demands could cause us to operate our business less effectively, which in turn could cause deterioration in the financial performance of our existing stores. The commitments associated with our expansion will increase our operating expenses may be costly to terminate, and these investments may be difficult to recapture if we decide to close a store or change our strategy.

9

We may be unsuccessful in implementing our planned international expansion, which could impair the value of our brand, harm our business and negatively affect our result of operation.

We plan to grow our net sales and net earnings from our International segment by opening True Religion Brand Jeans stores in various international markets. For example, we recently established a regional office for EMEA in Switzerland and a regional office for Asia/Pacific in Hong Kong and currently plan to open stores in Canada, the United Kingdom, Germany and the Netherlands. As we expand outside the United States, we may incur significant costs relating to starting up, maintaining and expanding foreign operations. Costs may include, but are not limited to obtaining prime locations for stores, setting foreign offices and hiring personnel. We may be unable to open and operate new stores successfully and our growth may be limited, unless we are able to:

- •

- identify desirable markets and sites for store locations;

- •

- negotiate acceptable lease terms;

- •

- efficiently build and equip new stores;

- •

- hire, train and retain competent store personnel;

- •

- manage inventory effectively to meet the needs of new and existing stores on a timely basis;

- •

- successfully integrate stores into our existing operations;

- •

- manage foreign currency risk effectively;

- •

- satisfy the fashion preferences of customers in new geographic areas; and

- •

- achieve acceptable operating margins from new stores.

We cannot be sure that we can successfully open new stores or that our new stores will be profitable. Additionally, our international expansion may place increased demands on our operational, managerial and administrative resources and these increased demands may cause the Company to operate its business less efficiently, which could harm the performance of its existing stores.

We must successfully maintain and/or upgrade our information technology systems.

We rely on various information technology systems to manage our operations, which subjects us to inherent costs and risks associated with maintaining, upgrading, replacing and changing these systems, including impairment of our ability to fulfill customer orders, potential disruption of our internal control structure, substantial capital expenditures, demands on management time and other risks of delays or difficulties in upgrading, transitioning to new systems or of integrating new systems into our current systems.

We rely on contract manufacturing of our products. Our inability to secure production sources meeting our quality, cost, working conditions and other requirements, or failures by our contractors to perform, could harm our sales, service levels and reputation.

We source our products from independent manufacturers who purchase fabric and other raw materials. As a result, we must locate and secure production capacity. We depend on independent manufacturers to maintain adequate financial resources, secure a sufficient supply of raw materials, and maintain sufficient development and manufacturing capacity in an environment characterized by continuing cost pressure and demands for product innovation and speed-to-market. In addition, we do not have material long-term contracts with any of our independent manufacturers, and these manufacturers generally may unilaterally terminate their relationship with us at any time.

Our dependence on contract manufacturing could subject us to difficulty in obtaining timely delivery of products of acceptable quality. A manufacturer's failure to ship products to us in a timely

10

manner or to meet our quality standards could cause us to miss the delivery date requirements of our wholesale customers. In addition, any interference with our ability to receive shipments from those manufacturers, such as conditions at ports or issues that otherwise affect transportation and warehousing providers, could cause delayed delivery of product. Additionally, if we experience a significant increase in demand, or if we need to replace any of the manufacturers that we currently use, we may have to expand our third party manufacturing capacity. This capacity may not be available to us, or available on terms that are acceptable to us. Failing to make timely deliveries may cause our customers to cancel orders, refuse to accept deliveries, impose non-compliance charges through invoice deductions or other charge-backs, demand reduced prices or reduce future orders, any of which could harm our sales and margins.

Our success depends on the continued protection of our trademark and other proprietary intellectual property rights.

Our trademark and other intellectual property rights are important to our success and competitive position, and the loss of or inability to enforce trademark and other proprietary intellectual property rights could harm our business. We devote substantial resources to the establishment and protection of our trademark and other proprietary intellectual property rights on a worldwide basis. Despite any precautions we may take to protect our intellectual property, policing unauthorized use of our intellectual property is difficult, expensive and time consuming, and we may be unable to adequately protect our intellectual property or determine the extent of any unauthorized use, particularly in those foreign countries where the laws do not protect proprietary rights as fully as in the United States. Our efforts to establish and protect our trademark and other proprietary intellectual property rights may not be adequate to prevent imitation or counterfeiting of our products by others or to prevent others from seeking to block sales of our products for violating their trademarks and proprietary rights. Unauthorized copying of our products or unauthorized use of our trademarks or other proprietary rights may not only erode sales of our products but may also cause significant damage to our brand names and our ability to effectively represent ourselves to our customers. Also, we cannot assure you that others will not assert rights in, or ownership of, trademarks and other proprietary rights of True Religion, that our proprietary rights would be upheld if challenged or that we would, in that event, not be prevented from using our trademarks, any of which could have a material adverse effect on our financial condition and results of operations. Further, we could incur substantial costs in legal actions relating to our use of intellectual property or the use of our intellectual property by others. Even if we are successful in these actions, the costs we incur could have a material adverse effect on us.

Our business could suffer from the financial instability of our customers.

In the United States, we sell our products to certain retail companies on open account with 30 to 60 day payment terms. We generally request a letter of credit or wire transfer before shipment to our foreign distributors, but these arrangements are not always possible. Customer financial difficulties could result in losses to us.

A significant disruption at our distribution center could have a material adverse impact on our business and operating results.

We primarily rely on a single distribution center located at our corporate offices in Vernon, California to receive, store and distribute merchandise to all of our stores and wholesale customers. Any significant interruption in the operation of our Vernon distribution center due to natural disasters, accidents, system failures or other unforeseen causes could have a material adverse effect on our business and operating results.

11

Our ability to attract customers to our stores depends heavily on the success of the shopping centers and street locations in which they are located.

In order to generate customer traffic, we locate many of our stores in prominent locations within successful shopping centers or in fashionable shopping districts. We cannot control the development of new shopping centers or districts; the availability or cost of appropriate locations within existing or new shopping centers or districts; competition with other retailers for prominent locations; or the success of individual shopping centers or districts. All of these factors may impact our ability to meet our growth targets and could have a material adverse effect on our financial condition or results of operations.

A privacy breach could damage our reputation and our relationship with our customers, expose the Company to litigation risk and adversely affect our business.

As part of our normal course of business, we collect, process and retain sensitive and confidential customer information. Despite security measures we have in place, our facilities and systems, and those of the Company's third party service providers, may be vulnerable to security breaches, acts of vandalism, computer viruses, misplaced or lost data, programming and/or human errors, or other similar events. Any security breach involving the misappropriation, loss or other unauthorized disclosure of confidential information, whether by the Company or its vendors, could severely damage our reputation and our relationships with our customers, expose the Company to risks of litigation and liability and adversely affect our business.

Our ability to conduct business in international markets may be affected by legal, regulatory, political and economic risks.

As we continue to increase our international operations, we face the possibility of greater losses from a number of risks inherent in doing business in international markets and from a number of factors which are beyond our control. These factors include, among other things:

- •

- political instability or acts of terrorism, which disrupt trade with the countries in which our contractors, suppliers or

customers are located; difficulties in managing our foreign operations;

- •

- local business practices that do not conform to legal or ethical guidelines; adoption of additional or revised quotas,

restrictions or regulations relating to imports or exports;

- •

- additional or increased customs duties, tariffs, taxes and other charges on imports;

- •

- significant fluctuations in the value of the dollar against foreign currencies;

- •

- increased difficulty in protecting our intellectual property rights in foreign jurisdictions;

- •

- social, legal or economic instability in the foreign markets in which we do business, which could influence our ability to

sell our products in these international markets;

- •

- restrictions on the transfer of funds between the United States and foreign jurisdictions; and

- •

- the ability of our international distributors to locate and continue to open desirable new retail locations.

Foreign currency fluctuations could adversely impact our financial condition and results of operations.

We generally purchase our products in U.S. dollars. However, we source some of our products overseas. The cost of these products may be affected by changes in the value of the applicable currencies. Changes in currency exchange rates may also affect the U.S. dollar value of the foreign currency denominated prices at which our international business will sell products. Furthermore, our international sales and some of our licensing revenue are generally derived from sales in foreign currencies. This revenue, when translated into U.S. dollars for consolidated reporting purposes, could

12

be materially affected by fluctuations in the U.S. dollar, negatively impacting our results of operations and our ability to generate revenue growth.

Our licensees may not comply with our product quality, manufacturing standards, marketing and other requirements.

We license our trademarks to third parties for manufacturing, marketing and distribution of various products. While we enter into agreements with our licensees covering product design, product quality, sourcing, manufacturing, marketing and other requirements, our licensees may not comply fully with those agreements. Non-compliance could include marketing products under our brand names that do not meet our quality and other requirements or engaging in manufacturing practices that do not meet our standards. These activities could harm our brand equity, our reputation and our business.

Violation of labor laws and practices by our licensees or suppliers could harm our business.

We require our licensing partners and suppliers to operate in compliance with applicable laws and regulations. While our code of conduct promotes ethical business practices, we do not control our licensees or suppliers or their labor practices. The violation of labor or other laws by any of our licensees or suppliers, or divergence of a licensee's or supplier's labor practices from those generally accepted as ethical in the United States, could interrupt or otherwise disrupt the shipment of our products, harm the value of our trademarks, damage our reputation or expose us to potential liability for their wrongdoings.

Our quarterly sales and operating results fluctuate as a result of a variety of factors, including seasonal fluctuations in demand for premium denim and related apparel, and accessories, delivery date delays, timing of new store openings, recognition of stock-based compensation and potential fluctuations in our annualized tax rate, which may result in volatility of our stock price.

Our quarterly sales and operating results have varied significantly in the past and can be expected to fluctuate in the future due to a number of factors, many of which are beyond our control. For example, sales of our products have historically been somewhat seasonal in nature with the largest sales generally occurring in the second half of the year. Delays in scheduling or pickup of products by our wholesale customers could negatively impact our net sales and results of operations for any given quarter. The timing of new store openings and the amount of sales contributed by new stores could also impact our net sales and results of operations for any given quarter. The compensation expense for the awards that vest immediately caused an increase in our selling, general and administrative expenses and reduced our net income and earnings per share in our quarterly income statements. Also, our annualized tax rate is based on projections of our operating results for the year, which we review and revise as necessary at the end of each quarter. Any quarterly fluctuations in our annualized tax rate that may occur could have a material impact on our quarterly operating results. As a result of these specific and other general factors, our operating results will likely vary from quarter to quarter and the results for any particular quarter may not be necessarily indicative of results for the full year. Any shortfall in sales or net income from levels expected by securities analysts and investors could cause a decrease in the trading price of our common stock.

Item 1B. Unresolved Staff Comments.

None.

We lease our corporate headquarters facility, which is a 119,000 square foot industrial building located in Vernon, California. The lease agreement expires on August 31, 2016, and we have the right

13

to renew the lease agreement for up to ten years if we comply with the lease agreement terms. We conduct our design, administrative and distribution operations at this facility.

We lease our retail store locations under operating lease agreements expiring on various dates through 2022. Standard store lease agreements cover a period of ten years and do not include a renewal option. These facilities are located in the United States, the United Kingdom, Japan, Canada and Germany. Many of the store lease agreements allow us to terminate the agreement, generally in the third or fourth year, if our sales do not meet a pre-determined level. As of December 31, 2010, we had 101 stores open, including four in Japan and one each in the United Kingdom, Canada and Germany. In 2011, we expect to open approximately 15 stores in the United States and eight stores internationally. At the end of 2010, our total retail square footage, which includes international retail stores and storage space at all stores, was approximately 209,000. Our retail stores range in size from 600 to 4,700 square feet.

We also lease our domestic and international showrooms and international administrative offices under lease agreements expiring on various dates through 2019. The showrooms are located in Los Angeles, New York, Duesseldorf, Munich and Milan and total approximately 17,000 square feet. The international administrative offices are located in Tokyo, Dusseldorf, Hong Kong and Seoul and total approximately 11,000 square feet. The offices in Tokyo, Hong Kong and Seoul include showroom spaces.

In the ordinary course of business, we are involved in various legal proceedings. We do not believe that these matters, either alone or in the aggregate, will have a material impact on our financial condition.

14

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market Information

Our common stock trades under the symbol "TRLG" on the Nasdaq Global Market. The high and low sales prices for our common stock, as reported by the Nasdaq Global Market for the periods indicated are as follows:

| |

2010 | 2009 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

High | Low | High | Low | |||||||||

First Quarter |

$ | 30.85 | $ | 18.73 | $ | 14.13 | $ | 7.83 | |||||

Second Quarter |

$ | 33.11 | $ | 22.07 | $ | 24.52 | $ | 11.87 | |||||

Third Quarter |

$ | 25.79 | $ | 17.54 | $ | 26.51 | $ | 19.64 | |||||

Fourth Quarter |

$ | 23.86 | $ | 18.73 | $ | 28.33 | $ | 17.57 | |||||

Holders

As of March 4, 2011 there were 57 record holders and approximately 16,500 beneficial holders of our Common Stock.

Dividends

We have not declared or paid any cash dividends since inception and we do not intend to pay any cash dividends in the foreseeable future. There are no restrictions that limit our ability to pay dividends on our common shares. Any future determination as to the payment of dividends on our common stock will be at the discretion of our Board of Directors and will depend on our results of operations, financial condition, capital requirements and other factors deemed relevant by the Board of Directors, including the General Corporation Law of the State of Delaware, which provides that dividends are only payable out of surplus or current net profits.

15

Stock Price Performance

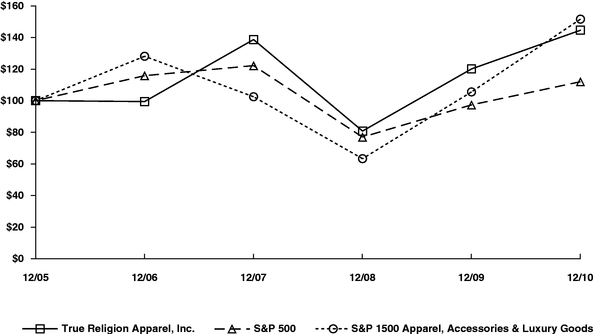

The following graph compares, for each of the last five fiscal years, commencing on December 31, 2005 and ending December 31, 2010, the cumulative total return of True Religion Apparel, Inc. common stock, Standard & Poor's 500 Index, and Standard & Poor's 1500 Apparel, Accessories & Luxury Goods Index. The Apparel, Accessories & Luxury Goods Index is comprised of 17 companies, also representing a sector of the Standard & Poor's 500 Index. The cumulative total return of True Religion Apparel, Inc. common stock assumes $100 invested on December 31, 2005 in our common stock and in each of the foregoing indices. The stock price performance graph is not necessarily indicative of future stock price performance. The return on $100 invested in the S&P 500 and the S&P 1500 Apparel, Accessories & Luxury Goods Index over the 5 year period from December 2005 to December 2010 was $112 and $152, respectively.

- *

- $100 invested on 12/31/05 in stock or index, including reinvestment or dividends.

Fiscal year ending December 31.

Copyright ©2011 S&P, a division of The McGraw-Hill Companies, Inc. All rights reserved.

Transactions in Our Equity Securities

For the period covered by this report, we have not engaged in any transactions involving the sale of our unregistered equity securities that were not disclosed in a quarterly report on Form 10-Q or a current report on Form 8-K. We have not engaged in any sales of registered securities for which the

16

use of proceeds is required to be disclosed. This table provides certain information with respect to our purchases of shares of our common stock during the fourth quarter of 2010:

Period

|

Total Number of Shares Purchased(a) |

Average Price Paid Per Share(a) |

Total Number of Shares Purchased as Part of Publicly Announced Plan |

Approximate Dollar Value of Shares That May Yet Be Purchased Under the Plan |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

October 1, 2010—October 31, 2010 |

1,346 | $ | 22.04 | — | — | ||||||||

November 1, 2010—November 30, 2010 |

245 | $ | 20.82 | — | — | ||||||||

December 1, 2010—December 31, 2010 |

— | $ | — | — | — | ||||||||

Total |

1,591 | $ | 21.85 | — | — | ||||||||

- (a)

- These columns reflect the surrender to us of shares of common stock to satisfy minimum statutory tax withholding obligations in connection with the vesting of restricted stock awards issued to employees.

Item 6. Selected Financial Data.

The following selected financial data are derived from the audited Consolidated Financial Statements and should be read in conjunction with Item 1A "Risk Factors," Item 7 "Management's Discussion and Analysis of Financial Condition and Results of Operations," and our Consolidated Financial Statements and the related notes included in Item 8 Financial Statements and Supplementary Data of this Annual Report on Form 10-K.

| |

For the Years Ended December 31, | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2010 | 2009 | 2008 | 2007 | 2006 | |||||||||||

Statement of operations data (In Thousands): |

||||||||||||||||

Net sales |

$ | 363,714 | $ | 311,001 | $ | 270,000 | $ | 173,256 | $ | 140,489 | ||||||

Operating income |

69,922 | 77,597 | 68,876 | 47,142 | 34,977 | |||||||||||

Provision for income taxes |

26,690 | 30,434 | 25,570 | 21,100 | 14,035 | |||||||||||

Net income attributable to True Religion Apparel, Inc. |

43,496 | 47,332 | 44,371 | 27,845 | 21,746 | |||||||||||

Earnings per share attributable to True Religion Apparel, Inc.: |

||||||||||||||||

Basic |

$ | 1.78 | $ | 1.97 | $ | 1.89 | $ | 1.21 | $ | 0.97 | ||||||

Diluted |

$ | 1.75 | $ | 1.92 | $ | 1.83 | $ | 1.16 | $ | 0.92 | ||||||

Weighted number of shares outstanding—basic |

24,495 | 23,993 | 23,511 | 22,964 | 22,496 | |||||||||||

Weighted number of shares outstanding—diluted |

24,852 | 24,659 | 24,270 | 23,949 | 23,608 | |||||||||||

| |

As of December 31, | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2010 | 2009 | 2008 | 2007 | 2006 | |||||||||||

Balance sheet data ($000's): |

||||||||||||||||

Working capital |

$ | 211,833 | $ | 166,565 | $ | 113,108 | $ | 72,846 | $ | 58,845 | ||||||

Total assets |

$ | 295,884 | $ | 229,806 | $ | 166,452 | $ | 113,258 | $ | 79,751 | ||||||

Stockholders' equity |

$ | 249,032 | $ | 197,854 | $ | 142,250 | $ | 95,247 | $ | 64,147 | ||||||

17

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

Executive Summary

We design, market, distribute and sell premium denim apparel, centered on our core denim products using the brand name "True Religion Brand Jeans." Our products include pants, tops and jackets, made from denim, fleece, corduroy and other fabrics. We are known for our unique fit and styling details. Through multiple wholesale and retail channels, our expanding product line reaches fashion-conscious consumers on six continents, including North America, Europe, Asia, Australia, Africa and South America.

Strategic Initiatives

We believe that our brand, differentiated design vision, high-quality supply chain and diversified business strategy anchored by our direct to consumer sales model enable us to be well positioned to expand our business and enhance shareholder value through execution of our strategy and focusing on key strategic initiatives, which include:

- •

- Expand in International markets—We believe that our net sales

in our international segment can grow significantly in the future. Our approach to each market may vary, but in general we intend to have our merchandise presented in multi-brand retail stores

(wholesale channel) and in True Religion Brand Jeans stores (retail channel), which is consistent with our domestic presentation. We have established three regions to manage our international

business: Asia Pacific, based in Hong Kong; Europe, Middle East and Africa (EMEA), based in Switzerland; and Americas, based at our company headquarters in Vernon, California. We have leadership teams

in place in each of these three regions to direct the growth of our international business.

- •

- Grow our U.S. Direct to Consumer store base while achieving targeted

margins—From the beginning of 2008 to the end of 2010, we opened 79 stores in the United States, reaching 94 stores at December 31, 2010. Our goal for each

domestic retail store is to achieve a 30 percent operating margin. We are studying our current store base in an attempt to identify factors that are linked to

better-than-average financial results; if we identify these factors, we will use them as we consider and rollout future store locations. Also, we are adding experienced retail

business leaders to manage our operating expenses better.

- •

- Increase sales to the boutique and specialty stores in the

U.S.—We transitioned from a third party sales agent to an in-house sales team in 2010. The in-house sales team will direct more effort

toward increasing sales to specialty boutique stores.

- •

- Develop our ecommerce business—Many consumers use the internet

to learn about fashion trends and purchase merchandise. We are refining our on-line merchandise strategy and considering new on-line marketing approaches to enhance our fashion

brand position and increase our on-line sales.

- •

- Build overall brand awareness—Since True Religion Brand Jeans was founded in 2002, the brand was recognized for innovative styling and fit. Many consumers were introduced to the brand and its latest styles as it was presented in leading fashion retailers and in our own branded retail stores. In the future, we seek new avenues to present our innovative, trendsetting merchandise to existing and new consumers. To do this, we are expanding our use of product placement, social media and on-line search.

Presentation of Segment Financial Information

We have reclassified certain prior period segment information to conform to the current year presentation. We reclassified our reportable segment formerly titled "Other" to include the functions

18

which support the overall business and were previously classified in the U.S. Wholesale segment. The functions that were reclassified include the design, production, marketing, distribution, credit, customer service, information technology and accounting departments. In connection with this reclassification, we renamed the segment "Core Services". As a result of this change, we have reclassified certain SG&A expenses previously presented in the U.S. Wholesale segment to Core Services in order to conform to the revised presentation. We made the change to our reportable segments to more closely align them with how management reviews and monitors the performance of our operating segments. Total consolidated SG&A expenses and total consolidated operating income were not changed as a result of these reclassifications. The reclassifications had no impact upon previously reported consolidated net sales and consolidated gross profit by reportable segment. Additionally, these reclassifications did not impact the consolidated balance sheets, statements of income, or statements of cash flows.

2010 Compared to 2009

The following table summarizes results of operations for 2010 compared to 2009 (dollar amounts in thousands, except per share data):

| |

Years Ended December 31, | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2010 | 2009 | |

|

||||||||||||||||

| |

Amount | % | Amount | % | Change | % | ||||||||||||||

Net sales |

$ | 363,714 | 100.0 | % | $ | 311,001 | 100.0 | % | $ | 52,713 | 16.9 | % | ||||||||

Gross profit |

229,979 | 63.2 | % | 195,562 | 62.9 | % | 34,417 | 17.6 | % | |||||||||||

Selling, general and administrative expenses |

160,057 | 44.0 | % | 117,965 | 37.9 | % | 42,092 | 35.7 | % | |||||||||||

Operating income |

69,922 | 19.2 | % | 77,597 | 25.0 | % | (7,675 | ) | (9.9 | )% | ||||||||||

Other income, net |

403 | 0.1 | % | 169 | 0.0 | % | 234 | 138.5 | % | |||||||||||

Provision for income taxes |

26,690 | 7.3 | % | 30,434 | 9.8 | % | (3,744 | ) | (12.3 | )% | ||||||||||

Net Income attributable to True Religion Apparel, Inc. |

$ | 43,496 | 12.0 | % | $ | 47,332 | 15.2 | % | $ | (3,836 | ) | (8.1 | )% | |||||||

Earnings per share attributable to True Religion Apparel, Inc.: |

||||||||||||||||||||

Basic |

$ | 1.78 | $ | 1.97 | $ | (0.19 | ) | (9.6 | )% | |||||||||||

Diluted |

$ | 1.75 | $ | 1.92 | $ | (0.17 | ) | (8.9 | )% | |||||||||||

Net Sales

The following table summarizes net sales by segment (dollar amounts in thousands):

| |

Years Ended December 31, | Change | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2010 | 2009 | Amount | % | |||||||||

U.S. Consumer Direct |

189,097 | 129,030 | 60,067 | 46.6 | % | ||||||||

U.S. Wholesale |

104,874 | 123,203 | (18,329 | ) | (14.9 | )% | |||||||

International |

64,443 | 54,479 | 9,964 | 18.3 | % | ||||||||

Core Services |

5,300 | 4,289 | 1,011 | 23.6 | % | ||||||||

Total net sales |

$ | 363,714 | $ | 311,001 | $ | 52,713 | 16.9 | % | |||||

19

The following table summarizes percentage of total net sales by segment:

| |

December 31, | Change | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

2010 | 2009 | % | |||||||

U.S. Consumer Direct |

52.0 | % | 41.5 | % | 10.5 | % | ||||

U.S. Wholesale |

28.8 | 39.6 | (10.8 | )% | ||||||

International |

17.7 | 17.5 | 0.2 | % | ||||||

Core Services |

1.5 | 1.4 | 0.1 | % | ||||||

Total net sales |

100.0 | % | 100.0 | % | ||||||

U.S. Consumer Direct net sales increased by 46.6% to $189.1 million in 2010, primarily because we opened 24 stores in 2010, finishing the year with 94 stores compared to 70 stores at the end of 2009. In addition, our same store sales increased 9.6% as we introduced a strategy to offer new styles regularly in our retail stores. In 2011, we expect to open approximately15 branded retail stores in the United States.

U.S. Wholesale net sales decreased 14.9% to $104.9 million. Net sales to major accounts, which include Nordstrom, Bloomingdale's, Saks Fifth Avenue and Neiman Marcus, decreased as we continue to be impacted by the overall sales decline in the women's premium denim category at the major department stores. In addition, we reduced our sales to off-price retailers to maintain our premium brand positioning. Partially offsetting these decreases was an increase in our net sales to specialty retailers.

International net sales increased 18.3% to $64.4 million primarily due to increased sales to the Europe, Middle East and Africa ("EMEA") and Asia Pacific regions. The increase in net sales to the EMEA region was driven by the addition of our German joint venture in August 2010 and the opening of a retail store in London, England in May 2010. The increase in net sales in the Asia Pacific region was driven by the additional of our Hong Kong-based Asia Pacific team beginning in late 2009. During 2010, we opened three international branded retail stores: one in Toronto, Canada, one in London, England and one in Tokyo, Japan. Our Store in Cologne, Germany was opened in March 2010, shortly before we acquired it in August 2010. In 2011, we expect to open eight international branded retail stores.

Core services net sales increased 23.6% to $5.3 million in 2010 from $4.3 million in 2009, due to increases in royalties due under existing licensing contracts.

Gross Profit

The following table summarizes gross profit by segment (dollar amounts in thousands):

| |

Years Ended December 31, | Change | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2010 | 2009 | Amount | % | |||||||||

U.S. Consumer Direct |

$ | 136,915 | $ | 95,276 | $ | 41,639 | 43.7 | % | |||||

U.S. Wholesale |

53,362 | 65,882 | (12,520 | ) | (19.0 | )% | |||||||

International |

34,402 | 30,115 | 4,287 | 14.2 | % | ||||||||

Core Services |

5,300 | 4,289 | 1,011 | 23.6 | % | ||||||||

Total gross profit |

$ | 229,979 | $ | 195,562 | $ | 34,417 | 17.6 | % | |||||

20

The following table summarizes gross profit as a percentage of net sales ("gross margin") by segment:

| |

December 31, | Change | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

2010 | 2009 | % | |||||||

U.S. Consumer Direct |

72.4 | % | 73.8 | % | (1.4 | )% | ||||

U.S. Wholesale |

50.9 | 53.5 | (2.6 | )% | ||||||

International |

53.4 | 55.3 | (1.9 | )% | ||||||

Core Services |

100.0 | 100.0 | 0.0 | % | ||||||

Total gross margin |

63.2 | % | 62.9 | % | 0.3 | % | ||||

Overall gross margin improved from 62.9% of net sales in 2009 to 63.2% of net sales in 2010, primarily reflecting the ongoing net sales mix shift towards the higher-margin U.S. Consumer Direct business.

The U.S. Consumer Direct gross margin decreased to 72.4% in 2010 from 73.8% in 2009 as a higher percentage of the segment's net sales came from the lower margin outlet stores as compared to the full price stores and an increase in sales of the lower margin sportswear.

U.S. Wholesale gross profit decreased to 50.9% in 2010 from 53.5% in 2009 primarily due to additional sales discounts that we offered to spur sales of merchandise on hand.

International gross margin decreased to 53.4% in 2010 from 55.3% in 2009 primarily because the gross margin earned on sales in the third quarter by our new German joint venture was driven by merchandise that was acquired from our former distributor at a higher cost.

Selling, General and Administrative Expenses

The following table presents the components of selling, general & administrative expenses ("SG&A") by segment (dollar amounts in thousands):

| |

Years Ended December 31, | Change | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2010 | 2009 | Amount | % | |||||||||

U.S. Consumer Direct |

$ | 72,274 | $ | 50,510 | $ | 21,764 | 43.1 | % | |||||

U.S. Wholesale |

7,097 | 5,775 | 1,322 | 22.9 | % | ||||||||

International |

16,915 | 4,948 | 11,967 | 241.9 | % | ||||||||

Core Services |

63,771 | 56,732 | 7,039 | 12.4 | % | ||||||||

Total selling, general and administrative expenses |

$ | 160,057 | $ | 117,965 | $ | 42,092 | 35.7 | % | |||||

The following table summarizes SG&A as a percentage of segment net sales ("SG&A rate"), by segment:

| |

December 31, | Change | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

2010 | 2009 | % | |||||||

U.S. Consumer Direct |

38.2 | % | 39.1 | % | (0.9 | )% | ||||

U.S. Wholesale |

6.8 | 4.7 | 2.1 | % | ||||||

International |

26.2 | 9.1 | 17.1 | % | ||||||

Core Services |

NM | NM | NM | |||||||

Total SG&A rate |

44.0 | % | 37.9 | % | 6.1 | % | ||||

21

The U.S. Consumer Direct SG&A increase of $21.8 million or 43.1% is directly related to the growth in the number of stores over the prior year, from 70 at the end of 2009 to 94 at the end of 2010. As a percentage of net sales, the U.S. Consumer Direct SG&A rate decreased from 39.1% in 2009 to 38.2% in 2010 primarily due to the segment's same store sales increase producing leverage on fixed costs.

U.S. Wholesale SG&A increased $1.3 million, or 22.9%, primarily as a result of the costs incurred over the first half of 2010 in connection with the transition from a sales agent to an in-house sales team.

International SG&A increased $12.0 million, or 241.9%, primarily due to the new wholesale sales teams in Asia Pacific and Germany, the opening of four new retail stores, and the costs to set up a European regional office in Switzerland.

Core Services SG&A increased $7.0 million or 12.4% primarily due to $4.3 million in separation costs associated with the termination of our former president in May 2010. In addition, our advertising costs increased as well as depreciation expense in 2010 as we installed a new wholesale and financial information technology system in the second half of 2009.

Operating Income

The following table summarizes operating income by segment (dollar amounts in thousands):

| |

Years Ended December 31, | Change | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2010 | 2009 | Amount | % | |||||||||

U.S. Consumer Direct |

$ | 64,641 | $ | 44,766 | $ | 19,875 | 44.4 | % | |||||

U.S. Wholesale |

46,265 | 60,107 | (13,842 | ) | (23.0 | )% | |||||||

International |

17,487 | 25,167 | (7,680 | ) | (30.5 | )% | |||||||

Core Services |

(58,471 | ) | (52,443 | ) | (6,028 | ) | 11.5 | % | |||||

Total operating income |

$ | 69,922 | $ | 77,597 | $ | (7,675 | ) | (9.9 | )% | ||||

The following table summarizes operating income as a percentage of net sales ("operating margin"), by segment:

| |

December 31, | Change | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

2010 | 2009 | % | |||||||