Attached files

| file | filename |

|---|---|

| EX-3.1 - EXHIBIT 3.1 - THESTREET, INC. | exhibit3_1.htm |

| EX-32.2 - EXHIBIT 32.2 - THESTREET, INC. | exhibit32_2.htm |

| EX-23.2 - EXHIBIT 23.2 - THESTREET, INC. | exhibit23_2.htm |

| EX-31.2 - EXHIBIT 31.2 - THESTREET, INC. | exhibit31_2.htm |

| EX-21.1 - EXHIBIT 21.1 - THESTREET, INC. | exhibit21_1.htm |

| EX-31.1 - EXHIBIT 31.1 - THESTREET, INC. | exhibit31_1.htm |

| EX-32.1 - EXHIBIT 32.1 - THESTREET, INC. | exhibit32_1.htm |

| EX-23.1 - EXHIBIT 23.1 - THESTREET, INC. | exhibit23_1.htm |

| EX-10.36 - EXHIBIT 10.36 - THESTREET, INC. | exhibit10_36.htm |

| EX-10.37 - EXHIBIT 10.37 - THESTREET, INC. | exhibit10_37.htm |

| EX-10.38 - EXHIBIT 10.38 - THESTREET, INC. | exhibit10_38.htm |

| EX-10.34 - EXHIBIT 10.34 - THESTREET, INC. | exhibit10_34.htm |

| EX-10.35 - EXHIBIT 10.35 - THESTREET, INC. | exhibit10_35.htm |

| EX-10.33 - EXHIBIT 10.33 - THESTREET, INC. | exhibit10_33.htm |

|

|

|

UNITED STATES

|

|

SECURITIES AND EXCHANGE COMMISSION

|

|

Washington, D.C. 20549

|

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2010

COMMISSION FILE NUMBER 0-25779

|

THESTREET.COM, INC.

|

||||||||

|

(Exact name of Registrant as specified in its charter)

|

||||||||

|

Delaware

|

06-1515824

|

|||||||

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|||||||

|

14 Wall Street, 15th Floor

New York, New York

|

10005

|

|||||||

|

(Address of principal executive offices)

|

(Zip code)

|

|||||||

|

Registrant’s telephone number, including area code: (212) 321-5000

|

||||||||

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

Name of Each Exchange on Which the Securities are Registered

|

|

|

Common Stock, par value $0.01 per share

|

Nasdaq Global Market

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes □ Nox

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes □ No x

Indicate by a check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No □

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant as required to submit and post such files). Yes x No □

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. □

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer □

|

Accelerated filer x

|

Non-accelerated filer □

|

Smaller reporting company □

|

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes No x

The aggregate market value of the Registrant’s common stock held by non-affiliates of the Registrant (assuming, for the sole purpose of this calculation, that all directors and executive officers of the Registrant are “affiliates”), based upon the closing price of the Registrant’s common stock on June 30, 2010 as reported by Nasdaq, was approximately $74million.

Indicate the number of shares outstanding of each of the Registrant’s classes of common stock, as of the latest practicable date.

|

Title of Each Class

|

Number of Shares Outstanding as of March 9, 2011

|

|

Common Stock, par value $0.01 par value

|

31,933,893

|

Documents Incorporated By Reference

|

Part III of this Form 10-K incorporates by reference certain information from the Registrant’s Definitive Proxy Statement for its Annual Meeting of Stockholders to be held on May 26, 2011, to be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year covered by this Report.

|

i

THESTREET.COM, INC.

2010 ANNUAL REPORT ON FORM 10-K

|

Page

|

|||

ii

THESTREET.COM, INC.

2010 ANNUAL REPORT ON FORM 10-K

Special Note Regarding Forward-Looking Statements – all statements contained in this Report that are not descriptions of historical facts are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements are inherently subject to risks and uncertainties, and actual results could differ materially from those reflected in the forward-looking statements due to a number of factors, which include, but are not limited to, the factors set forth under the heading “Risk Factors” and elsewhere in this Report, and in other documents we file with the Securities and Exchange Commission from time to time. Certain forward-looking statements may be identified by terms such as “may,” “will,” “should,” “could,” “expects,” “plans,” “intends,” “anticipates,” “believes,” “estimates,” “predicts,” “forecasts,” “potential,” or “continue” or similar terms or the negative of these terms. All statements relating to our plans, strategies and objectives are deemed forward-looking statements. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. We have no obligation to update these forward-looking statements, whether as a result of new information, future developments or otherwise.

Overview

TheStreet.com, Inc., together with its wholly owned subsidiaries (“we”, “us” or the “Company”), is a digital financial media company. Our goal is to be the primary independent online-only source of reliable and actionable investing ideas, news and analysis, markets and rate data and analytical tools for a large audience of active self-directed investors, as well as to assist advertisers desiring to connect with our affluent audience. We distribute our fee-based premium content and advertising-supported content through a network of proprietary electronic services including: Web sites, blogs, widgets, email services, mobile devices, podcasts and online video channels. We also syndicate our content for distribution by financial institutions and other media organizations.

We pioneered online publishing of business and investment information through our creation of TheStreet, which launched in 1996 as a paid subscription financial news and commentary Web site. Today, TheStreet is our flagship advertising-supported property, a leading site in its category and a major source of subscribers to a variety of our premium subscription products. Our subscription products, which include paid Web sites such as, RealMoney, RealMoney Silver, Options Profits, Actions Alerts PLUS, and Stocks Under $10 – are designed to address the needs of investors with various areas of interest and increasing levels of financial sophistication. The majority of our subscription revenue derives from annual subscriptions, although products also are offered on a monthly subscription basis.

We believe we are one of the first companies to successfully create a large scale, consumer-focused, digital premium services content business. We believe we have been able to successfully build our premium services business because we have established a track record for almost 15 years of providing high quality, independent investing ideas that have produced financial value for our readers. We believe our track record provides us with a competitive advantage and we will seek to enhance the value of our leading brand and our ability to monetize that value. Steps we intend to take in this regard include the following: first, we will focus on creating additional subscription products, at various price points, to more precisely target the needs of investors willing to pay for high quality, actionable investing ideas, analysis, data and tools. Second, we will continue to refine our marketing strategy, seeking to identify cost-effective promotional opportunities with a variety of third-party media providers, improving our efficiency in promoting our offerings in our own expanding collection of properties and expanding direct sales efforts by a growing internal sales force. Third, we will seek continually to ensure and enhance the quality and competitiveness of our products and to make them available on the widest choice of digital platforms.

In addition to our consumer-focused subscription products, our premium services business also includes information services revenue from our RateWatch business, which maintains a constantly-updated database of financial rate and fee data collected from more than 80,000 financial institutions (at the branch level), including certificate of deposit, money market account, savings account, checking account, home mortgage, home equity loan, credit card and auto loan rates. This information is sold to banks and financial institutions on a subscription basis, in the form of standard and custom reports that outline the competitive landscape for our clients, and also serves as the foundation for the data available on BankingMyWay, a free advertising-supported Web site that enables consumers to search for the most competitive local and national rates from the RateWatch data. Our premium services revenue also includes revenue generated from syndication and licensing of certain of our content, including data from TheStreet Ratings (“Ratings”), which tracks the risk-adjusted performance of more than 16,000 mutual funds and exchange-traded funds (ETFs) and more than 5,000 stocks. We intend to expand our licensing arrangements to make some of our proprietary content available in channels we do not presently serve. Premium services contributed 67% of our total revenue in 2010, as compared to 63% in 2009 and 58% in 2008.

Our advertising-supported properties, which include TheStreet, Stockpickr, MainStreet and BankingMyWay, attract one of the largest and most affluent audiences of any digital publisher in our content vertical. We believe our flagship site, TheStreet, with its enviable track record as a leading and distinctive digital voice in the financial category since the early days of the consumer Internet, is regarded as a must-buy for our core online brokerage advertisers and a highly effective means for other financial services companies and non-endemic advertisers to communicate with our active, affluent audience. We believe we are able to command pricing for our advertising inventory that is strong relative to most Web sites. We sell banner, tile and sponsorship advertising exclusively through our experienced internal sales force and also generate revenue from contextual and search-based advertising provided by third party technology providers.

We generate advertising revenue from our content through the sale of the following types of advertising placements:

|

|

·

|

banner, tile, contextual, performance-based and interactive advertisement and sponsorship placements in our advertising-supported Web sites, as well as on select paid subscription sites;

|

|

|

·

|

advertisement placements in our free email newsletters and stand-alone emails sent on behalf of our advertisers to our registered users; and

|

|

|

·

|

advertisements in TheStreet TV, TheStreet services for mobile and tablet devices, RSS feeds, blogs and in our podcasts.

|

During the years ended December 31, 2009 and 2008, we also generated interactive marketing services revenue from our former Promotions.com subsidiary, which we acquired in August 2007 and sold in December 2009. Promotions.com implemented online and mobile interactive promotions – including sweepstakes, instant win games and customer loyalty programs – for some of the world’s largest brands. Including Promotions.com, advertising and marketing services contributed 33% of our total revenue in 2010, as compared to 37% in 2009 and 42% in 2008.

We will seek to increase the traffic to our network of Web sites both by expanding the range of content we offer (which may include repurposing content from one site to address the needs of another site) and by expanding our relationships with third parties having larger or complimentary audiences. We believe our expertise at monetizing our content offerings through a variety of sources, and the value we have built in our brand over the past 15 years as a leading voice in our content vertical – as well as our independence from any larger media organization – enables us to successfully partner with a variety of high-traffic Web sites and portals, providing expertise in our content category under arrangements that provide benefits to both our partners and ourselves.

Marketing

We pursue a variety of sales and marketing initiatives to sell subscriptions to our premium services, increase traffic to our sites, license our content, expose our brands, and build our customer databases. These initiatives include promoting our services through online, email, radio and television marketing, telemarketing and establishing content syndication and subscription distribution relationships with leading companies. Our in-house online marketing and creative design teams create a variety of marketing campaigns, which are then implemented by our technical and operations team and by third-party service providers. We also have a reporting and analysis group that analyzes traffic and subscription data to determine the effectiveness of the campaigns.

We use content syndication and subscription distribution arrangements to capitalize on the cost efficiencies of online delivery and create additional value from content we already have produced for our own properties. By syndicating our content to other leading Web sites to host on their own sites, we expose our brands and top-quality writing to millions of potential users. In one type of syndication arrangement, we provide leading Web sites, including Yahoo! Finance, MSN Money and CNN Money, with article headlines that these partners display on their stock quote result pages, providing links back to our site. This type of arrangement exposes new audiences to our brands and content and generates additional traffic to our sites, creating the opportunity for us to increase our advertising revenue and subscription sales.

We are intensely focused on generating additional visitors to our sites through search engine optimization efforts, in order to increase the visibility of our content on search engines such as Google Search and Microsoft’s Bing, and through efforts to increase our presence on a variety of social media platforms, such as Facebook and Twitter. In addition, we are focused on increasing the engagement our visitors have with our sites, measured by visits per visitor, page views per visit and by time spent on site, and we continuously seek to improve the experience our sites offer.

We also use subscription distribution arrangements with online financial services firms and other companies. These agreements allow their customers to receive discounts on certain of our premium subscription services or to access our free and premium content, thereby exposing our brands and content to new audiences.

In addition, we obtain exposure through other media outlets who cite our writers and our stories or who invite our writers to appear on segments. In 2010, we were mentioned or featured in numerous reports by major news outlets, including The Wall Street Journal, Bloomberg, Newsweek and The New York Times; and some of our writers appeared on various television and radio stations, including CNBC, CNN, ABC, PBS and MSNBC.

Competition

Our services face intense competition from other providers of business, personal finance, investing and ratings content, including:

|

|

·

|

online services or Web sites focused on business, personal finance, or investing, such as The Wall Street Journal Digital Network, CNN Money, Reuters.com, Bloomberg.com and CNBC.com, as well as financial portals such as Yahoo! Finance, AOL Money & Finance and MSN Money;

|

|

|

·

|

publishers and distributors of traditional media focused on business, personal finance or investing, including print and radio, such as The Wall Street Journal and financial talk radio programs, and business television networks such as CNBC and the Fox Business Channel;

|

|

|

·

|

investment newsletter publishers; and

|

|

|

·

|

established ratings services, such as Standard & Poor’s, Morningstar and Lipper, with respect to our Ratings products, and rate database providers such as Informa, with respect to our RateWatch products.

|

Many of these competitors have significantly greater scale and resources than we do. Additionally, advances in technology have reduced the cost of production and online distribution of written, audio and video content, which has resulted in the proliferation of small, often self-published providers of free content, such as bloggers.

According to comScore, Inc., an independent Web measurement company (“comScore”), based upon average monthly numbers for the three months ending December 31, 2010, our network of sites had the following ranking among the top 15 sites, as measured by total unique visitors among the 139 listed competitors in the Business/Finance – News/Research category: our sites were second in terms of average minutes per visit; ninth in terms of average visits per visitor; tenth in terms of total minutes spent on site; eleventh in terms of average daily visitors, total pages viewed and total visits; and twelfth in terms of total unique visitors.

While we believe that comScore significantly undercounts our site traffic as measured by our own servers, we believe that advertisers and agencies often look to independent measurement data such as that provided by comScore in order to gain a sense of the performance of various sites, in relation to their peer category, when determining where to allocate advertising dollars. We believe that advertisers and agencies also look to demographic data provided by independent parties such as Nielsen @Plan, which routinely ranks our network of sites as having one of the highest concentrations of affluent, self-directed investors among measured sites.

We compete with these other content providers for customers, including subscribers, readers and viewers of our video content, for advertising revenue, and for employees and contributors to our services. Our ability to compete successfully depends on many factors, including the quality, originality, timeliness, insightfulness and trustworthiness of our content and that of our competitors, the reputations of our contributors and our brands, the success of our recommendations and research, our ability to introduce products and services that keep pace with new investing trends, the experience we and our competitors offer our users and the effectiveness of our sales and marketing efforts.

Infrastructure, Operations and Technology

Our main technological infrastructure consists of proprietary and Drupal-based content management, subscription management, Ratings models, and e-commerce systems, which are hosted primarily at a third-party facility. Our operations are dependent in part on our ability, and that of our various hosting facilities, to protect our systems against damage from fire, earthquakes, power loss, telecommunications failure, break-ins, computer viruses, hacker attacks, terrorist attacks and other events beyond our control.

Our content-management systems are based on proprietary software and the Drupal Content Management System. They allow our stories, videos and data to be prepared for distribution online to a large audience. These systems enable us to distribute and syndicate our content economically and efficiently to multiple destinations in a variety of technical formats.

Our subscription-management system is based on proprietary software and allows us to communicate automatically with readers during their free-trial and subscription periods. The system is capable of yielding a wide variety of customized subscription offers to potential subscribers, using various communication methods and platforms.

Our e-commerce system is based on proprietary software and controls user access to a wide array of service offerings. The system automatically controls all aspects of online daily credit card billing, based upon user-selected billing terms. All financial revenue-recognition reports are automatically generated, providing detailed reporting on all account subscriptions. This generally allows a user to sign up and pay for an online service for his or her selected subscription term (annual or monthly). We are currently migrating this system to a customized off-the-shelf system.

Our Ratings business is based on a set of proprietary statistical models that use key financial metrics and indicators to rate stocks, mutual funds and ETFs. The data and output from these models are managed and stored within a content management system and updated daily based on changes in markets. The system is capable of search-based syndication of customized ratings data that can be distributed in a variety of technical formats.

Intellectual Property

To protect our rights to intellectual property, we rely on a combination of trademarks, copyrights, trade secret protection, confidentiality agreements and other contractual arrangements with our employees, affiliates, customers, strategic partners and others. We have registered certain of our trademarks in the United States and we have pending U.S. applications for other trademarks. Additionally, we police Internet message boards and other Web sites for copyrighted content of ours that has been republished without our permission and we will aggressively pursue the poster, the site hosting the content and any Internet service provider in order to protect our copyright. To protect our intellectual property rights as well as protect against infringement claims in our relationships with business partners, we generally look to incorporate contractual provisions protecting our intellectual property and seeking indemnification for any third-party infringement claims. However, the protective steps we have taken may be inadequate to deter misappropriation of our proprietary information. We may be unable to detect the unauthorized use of, or take appropriate steps to enforce, our intellectual property rights. Failure to adequately protect our intellectual property could harm our brand, devalue our proprietary content and affect our ability to compete effectively.

Some of our services incorporate licensed third-party technology. In these license agreements, the licensors have generally agreed to defend, indemnify and hold us harmless with respect to any claim by a third party that the licensed technology infringes any patent or other proprietary right. We cannot provide assurance that the foregoing provisions will be adequate to protect us from infringement claims. In addition, we may be accused of violating the intellectual property rights of others for reasons unrelated to any third-party technology we use. Any infringement claims, even if not meritorious, could result in the expenditure of significant financial and managerial resources on our part, which could materially adversely affect our business, results of operations and financial condition.

Customers; Seasonality

In 2010, no customer accounted for 10% or more of our consolidated revenue. There does not tend to be significant seasonality to our premium services revenue. Advertising spending by our customers generally tends to be higher in the fourth calendar quarter as compared to other quarters, and the first and third calendar quarters often are lower than the other quarters.

Working Capital

Our current assets at December 31, 2010 consisted primarily of marketable securities, cash and cash equivalents, and accounts receivable. We do not hold inventory. Our current liabilities at December 31, 2010 consisted primarily of deferred revenue, accrued expenses and accounts payable. At December 31, 2010, our current assets were approximately $55.7 million, 1.97 times greater than our current liabilities. With respect to most of our annual subscription products, we offer the ability to receive a refund during the first 30 days but none thereafter. We do not as a general matter offer any other refunds for any premium services products or offer refunds for advertising that has run.

Geography

During 2010, 2009 and 2008, all of our long-lived assets were located in the United States. Substantially all of our revenue in 2010, 2009 and 2008 was generated from customers in the United States.

Employees

As of December 31, 2010, the Company had 291employees. The Company has never had a work stoppage and none of its employees are represented under collective bargaining agreements. The Company considers its relations with its employees to be good.

Government Regulation

We are subject to government regulation in connection with securities laws and regulations applicable to all publicly-owned companies, as well as laws and regulations applicable to businesses generally. We are also increasingly subject to government regulation and legislation specifically targeting Internet companies, such as privacy regulations adopted at the local, state, national and international levels and taxes levied at the state level. Due to the increasing popularity and use of the Internet, enforcement of existing laws, such as consumer protection regulations, in connection with Web-based activities has become more aggressive, and we expect that new laws and regulations will continue to be enacted at the local, state, national and international levels. Such new legislation, alone or combined with increasingly aggressive enforcement of existing laws, could decrease the demand for our services or otherwise have a material adverse effect on our future operating performance and business.

Available Information

We were founded in 1996 as a limited liability company, and reorganized as a C corporation in 1998. We consummated our initial public offering in 1999 and we file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission (“SEC”). Our CorporateWeb site is located at http://www.t.st. We make available free of charge, on or through our Web site, our annual, quarterly and current reports, and any amendments to those reports, as soon as reasonably practicable after electronically filing such reports with the SEC. Information contained on our Web site is not part of this Report or any other report filed with the SEC.

You may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NW, Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site (http://www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC.

Note – investing in our Common Stock involves a high degree of risk. You should carefully consider the following risk factors, as well as the other information in this Report, before deciding whether to invest in our Common Stock. Our business, prospects, financial condition or operating results could be materially adversely affected by any of these risks, as well as other risks not currently known to us or that we currently consider immaterial. The trading price of our Common Stock could decline as a result of any of these risks, and you could lose part or all of your investment in our Common Stock. When deciding whether to invest in our Common Stock, you should also refer to the other information in this Report, including our consolidated financial statements and related notes and the information contained in Part II, Item 7 of this Report entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” You should carefully consider the following material risks we face. If any of the following risks occur, our business, results of operations or financial condition could be materially adversely affected. Please also refer to the Special Note Regarding Forward-Looking Statements appearing in Part I, Item 1 of this Report.

Our Quarterly Financial Results May Fluctuate and our Future Revenue Is Difficult to Forecast

Our quarterly operating results may fluctuate significantly in the future as a result of a variety of factors, many of which are outside our control, including:

|

|

·

|

the level of interest and investment in the stock market by both individual and institutional investors;

|

|

|

·

|

the willingness of investors to pay for content distributed over the Internet, where a large quantity of content is available for free;

|

|

|

·

|

demand and pricing for advertising on our Web sites, which is affected by advertising budget cycles of our customers, general economic conditions, demand for advertising on the Internet generally, the supply of advertising inventory in the market and actions by our competitors;

|

|

|

·

|

subscription price reductions attributable to decreased demand or increased competition;

|

|

|

·

|

new products or services introduced by our competitors;

|

|

|

·

|

content distribution fees or other costs;

|

|

|

·

|

costs or lost revenue associated with system downtime affecting the Internet generally or our Web sites in particular; and

|

|

|

·

|

general economic and market conditions.

|

We had a large net loss in fiscal year 2009 and have incurred net losses for most years of our history. We may not be cash-flow positive or generate net income in future periods. We forecast our current and future expense levels based on expected revenue and our operating plans. Because of the above factors, as well as other material risks we face, as described elsewhere in this Report, our operating results may be below the expectations of public market analysts and investors in some future quarters. In such an event, the price of our Common Stock is likely to decline.

Key Writers, Particularly James J. Cramer, are Essential Sources of Revenue

Some of our products, particularly our editorial subscription products, reflect the talents, efforts, personalities and reputations of their respective writers. As a result, the services of these key writers, including our co-founder James J. Cramer, form an essential element of our subscription revenue. In addition, Mr. Cramer’s popularity and visibility have provided public awareness of our services and introduced our content to new audiences. Accordingly, we seek to compensate and provide incentives for these key writers through competitive salaries, stock ownership and bonus plans and/or royalty arrangements, and we have entered into employment or contributor agreements with certain of them, including Mr. Cramer. Mr. Cramer has a three-year employment agreement, which will expire on December 31, 2013. We can give no assurances that we will be able to retain key writers, or, should we lose the services of one or more of our key writers to death, disability, loss of reputation or other reason, to attract new writers acceptable to readers of our network of Web sites and editorial subscription products. The loss of services of one or more of our key writers could have a material adverse effect on our business, results of operations and financial condition.

The Loss of the Services of Other Key Employees Could Affect Our Business

Our ability to compete in the marketplace depends upon the retention of other key employees, including executives to operate our business, technology personnel to run our publishing, commerce, communications, video and other systems, and salespersons to sell our advertising inventory. Several, but not all, of our key employees are bound by agreements containing non-competition provisions. There can be no assurances that these arrangements with key employees will provide adequate protections to us or will not result in management changes that would have material adverse impact on us. In addition, we may incur increased costs to continue to compensate our key executives, as well as other employees, through competitive salaries, stock ownership and bonus plans. Nevertheless, we can make no assurances that these programs will allow us to retain key employees or hire new employees. The loss of one or more of our key employees, or our inability to attract experienced and qualified replacements, could materially adversely affect our business, results of operations and financial condition.

We May Have Difficulty Maintaining or Increasing Our Advertising Revenue, a Significant Portion of Which Is Concentrated Among Our Top Advertisers and Subject to Industry and Other Factors

Our ability to maintain or increase our advertising revenue depends on a variety of factors. Such factors include: general market conditions; seasonal fluctuations in financial news consumption and overall online usage; our ability to maintain or increase our unique visitors, page view inventory and user engagement; our ability to attract audiences possessing demographic characteristics most desired by our advertisers; and our ability to win advertisers from other Web sites, television, newspapers, magazines, newsletters or other new media. Advertising revenue could decline if the relationships we have with portals and other high-traffic Web sites is adversely affected. In addition, our advertising revenue may decline as a result of pricing pressures on Internet advertising rates due to industry developments, changes in consumer interest in the financial media and other factors in and outside of our control, including in particular as a result of any significant or prolonged downturn in, or periods of extreme volatility of, the financial markets. In addition, any advertising revenue that is performance-based may be adversely impacted by the foregoing and other factors. If our advertising revenue significantly decreases, our business, results of operations and financial condition could be materially adversely affected.

In 2010, our top five advertisers accounted for approximately 29% of our total advertising revenue, a decrease from 36% for 2009. Furthermore, although we have advertisers from outside the financial services industry, such as travel, automotive and technology, a large proportion of our top advertisers are concentrated in financial services, particularly in the online brokerage business. Recent consolidation of financial institutions and other factors could cause us to lose a number of our top advertisers, which could have a material adverse affect on our business, results of operations and financial condition. As is typical in the advertising industry, our advertising contracts have short notice cancellation provisions.

Investment of Our Cash Carries Risks

Financial instruments that subject us to concentrations of credit risk consist primarily of cash, cash equivalents, debt securities available for sale and restricted cash. We maintain all of our cash, cash equivalents, marketable securities and restricted cash in seven financial institutions, although substantially all of the balance is within one institution. We perform periodic evaluations of the relative credit standing of the seven institutions. No assurances can be made that the third-party institutions will retain acceptable credit ratings or investment practices. Investment decisions of third parties and market conditions may adversely affect our cash balances and financial condition.

We Have Recorded Impairments of Goodwill and Intangible Assets and There Can be No Assurances that We Will Not Have to Record Additional Impairments in the Future

In 2009 and 2008, we recorded impairments of goodwill and intangible assets that totaled $22.6 million and $2.3 million, respectively. The recorded impairments were the primarily the result of a reduction in our revenue, cash flows and enterprise value. In addition, we reduced the carrying value of a long-term investment, in the amount of $0.6 million in 2010 and $1.5 million in 2009. We may have to record additional impairments in the future which may materially adversely affect our results of operations and financial condition.

We Face Intense Competition

Our services face intense competition from other providers of business, personal finance, investing and ratings content, including:

|

|

·

|

online services or Web sites focused on business, personal finance, or investing, such as The Wall Street Journal digital network, CNN Money, Reuters.com, Bloomberg.com and CNBC.com, as well as financial portals such as Yahoo! Finance, AOL Money & Finance and MSN Money;

|

|

|

·

|

publishers and distributors of traditional media focused on business, personal finance or investing, including print and radio, such as The Wall Street Journal and financial talk radio programs, and business television networks such as CNBC and the Fox Business Channel;

|

|

|

·

|

investment newsletter publishers; and

|

|

|

·

|

established ratings services, such as Standard & Poor’s, Morningstar and Lipper, with respect to our Ratings products, and rate database providers such as Informa, with respect to our RateWatch products.

|

Additionally, advances in technology have reduced the cost of production and online distribution of print, audio and video content, which has resulted in the proliferation of small, often self-published providers of free content, such as bloggers. We compete with these other publications and services for customers, including subscribers, readers and viewers of our video content, for advertising revenue, and for employees and contributors to our services. Our ability to compete successfully depends on many factors, including the quality, originality, timeliness, insightfulness and trustworthiness of our content and that of our competitors, the success of our recommendations and research, our ability to introduce products and services that keep pace with new investing trends, the ease of use of services developed either by us or our competitors and the effectiveness of our sales and marketing efforts.

Many of our competitors have longer operating histories, greater name recognition, larger customer bases and significantly greater financial, technical and marketing resources than we have. Increased competition could result in price reductions, reduced margins or loss of market share, any of which could materially adversely affect our business, results of operations and financial condition. Accordingly, we cannot guarantee that we will be able to compete effectively with our current or future competitors or that this competition will not significantly harm our business.

Risks Associated with Our Strategic Acquisitions Could Adversely Affect Our Business

We have completed several acquisitions within recent years, and we expect to make additional acquisitions and strategic investments in the future. Acquisitions involve numerous risks, including difficulties in the assimilation of the operations and services of the acquired companies as well as the diversion of management's attention from other business concerns. In addition, there may be expenses incurred in connection with the acquisition and subsequent assimilation of operations and services and the potential loss of key employees of the acquired company. There can be no assurance that our acquisitions will be successfully integrated into our operations. In addition, there can be no assurance that we will complete any future acquisitions or that acquisitions will contribute favorably to our operations and financial condition.

Although due diligence and detailed analysis were conducted before these acquisitions, there can be no assurance that these can fully expose all hidden problems that the acquired company may have. In addition, our valuations and analyses are based on numerous assumptions, and there can be no assurance that those assumptions will be proven correct or appropriate. Relevant facts and circumstances of our analyses could have changed over time, and new facts and circumstances may come to light as to render the previous assumptions and the valuations and analyses based thereon incorrect. Further, we may not necessarily be able to successfully integrate the acquired companies, may not be able to derive any synergy from the acquisitions and may not realize the benefits intended in such acquisitions.

System Failure or Interruption May Result in Reduced Traffic, Reduced Revenue and Harm to Our Reputation

Our ability to provide timely, updated information depends on the efficient and uninterrupted operation of our computer and communications hardware and software systems. Similarly, our ability to track, measure and report the delivery of advertisements on our Web sites depends on the efficient and uninterrupted operation of a third-party system. Our operations depend in part on the protection of our data systems and those of our third-party providers against damage from human error, natural disasters, fire, power loss, water damage, telecommunications failure, computer viruses, terrorist acts, vandalism, sabotage, and other adverse events. Although we utilize the services of third-party data-center hosts with both physical and procedural security systems and have put in place certain other disaster recovery measures, including offsite storage of backup data, these disaster recovery measures currently may not be comprehensive enough and there is no guarantee that our Internet access and other data operations will be uninterrupted, error-free or secure. Any system failure, including network, software or hardware failure, that causes an interruption in our service or a decrease in responsiveness of our Web sites could result in reduced traffic, reduced revenue and harm to our reputation, brand and relations with our advertisers and strategic partners. Our insurance policies may not adequately compensate us for such losses. In such event, our business, results of operations and financial condition could be materially adversely affected.

Our Ratings models, purchased from a third party, were written in legacy technologies that do not have robust backup or recovery provisions. The ongoing production of valid ratings data is based upon the successful continued migration of these legacy systems to more robust and current systems. The hardware platforms upon which these applications run have been migrated to more modern equipment within our multi-redundant hosting facilities; however, many of the core application code remains in production. Migration of such complex applications is time consuming, resource intensive and can pose considerable risk.

Difficulties in New Product Development Could Harm Our Business

In the past few years, we have introduced several new products and services, and expect to continue to do so. However, we may experience difficulties that could delay or prevent us from introducing new products and services in the future, or cause our costs to be higher than anticipated, which could materially adversely affect our business, results of operations and financial condition.

Failure to Establish and Maintain Successful Strategic Relationships with Other Companies Could Decrease our Subscriber and User Base

We rely in part on establishing and maintaining successful strategic relationships with other companies to attract and retain a portion of our current subscriber and reader base and to enhance public awareness of our brands. In particular, our relationships with Yahoo! Finance, MSN Money and CNN Money, which index our headlines and/or hosts our content including our video offerings, have been important components of our effort to enhance public awareness of our brands, which awareness we believe also is enhanced by the public appearances of James J. Cramer, in particular on his “Mad Money” television program telecast by CNBC. There is intense competition for relationships with these firms and for content placement on their Web sites and for distribution of our audio and video content, and we may have to pay significant fees, or be unable, to establish additional relationships with large, high-traffic partners or maintain existing relationships in the future. From time to time, we enter into agreements with advertisers that require us to exclusively feature these parties in sections of our Web sites. Existing and future exclusivity arrangements may prevent us from entering into other advertising or sponsorship arrangements or other strategic relationships. If we do not successfully establish and maintain our strategic relationships on commercially reasonable terms or if these relationships do not attract significant revenue, our business, results of operations and financial condition could be materially adversely affected.

Difficulties Associated With Our Brand Development May Harm Our Ability to Attract Subscribers to Our Paid Services and Users to Our Advertising-Supported Services

We believe that maintaining and growing awareness about our services is an important aspect of our efforts to continue to attract users. Our new services do not have widely recognized brands, and we will need to increase awareness of these brands among potential users. Our efforts to build brand awareness may not be cost effective or successful in reaching potential users, and some potential users may not be receptive to our marketing efforts or advertising campaigns. Accordingly, we can make no assurances that such efforts will be successful in raising awareness of our brands or in persuading potential users to subscribe to or use our services.

Failure to Maintain Our Reputation for Trustworthiness May Harm Our Business

Our brand is based upon the integrity of our editorial content. We are proud of the trust and reputation for quality we have developed in our 15 years and we seek to renew and deepen that trust continually. We require all of our writers, whether employees or outside contributors, to adhere to strict standards of integrity, including standards that are designed to prevent any actual or potential conflict of interest, and to comply with all applicable laws, including securities laws.The occurrence of events such as our misreporting a news story, the non-disclosure of a stock ownership position by one or more of our writers, or the manipulation of a security by one or more of our writers, or any other breach of our compliance policies, could harm our reputation for trustworthiness and reduce readership. In addition, in the event the reputation of any of our directors, officers or key contributors was harmed for any other reason, we could suffer as result of our association with the individual, and also could suffer if the quantity or value of future services we received from the individual was diminished. These events could materially adversely affect our business, results of operations and financial condition.

We May Face Liability for, or Incur Costs to Defend, Information Published in Our Services

We may be subject to claims for defamation, libel, copyright or trademark infringement, fraud or negligence, or based on other theories of liability, in each case relating to the articles, commentary, investment recommendations, ratings, or other information we publish in our services. These types of claims have been brought, sometimes successfully, against media companies in the past, and we presently are defending against two suits alleging libel, both of which suits we believe are without merit and in both of which we are vigorously defending ourselves. We could also be subject to claims based upon the content that is accessible from our Web sites through links to other Web sites. While we maintain insurance to provide coverage with respect to many such claims, our insurance may not adequately protect us against these claims.

We May Not Adequately Protect Our Own Intellectual Property and May Incur Costs to Defend Against, or Face Liability for, Intellectual Property Infringement Claims of Others

To protect our rights to our intellectual property, we rely on a combination of trademark and copyright law, trade secret protection, confidentiality agreements and other contractual arrangements with our employees, affiliates, customers, strategic partners and others. We have registered certain of our trademarks in the United States and we have pending U.S. applications for other trademarks. Additionally, we police Internet message boards and other Web sites for copyrighted content of ours that has been republished without our permission and we will aggressively pursue the poster, the site hosting the content and any Internet service provider in order to protect our copyright. To protect our intellectual property rights as well as protect against infringement claims in our relationships with business partners, we generally look to incorporate contractual provisions protecting our intellectual property and seeking indemnification for any third-party infringement claims. Some of our services incorporate licensed third-party technology. In these license agreements, the licensors have generally agreed to defend, indemnify and hold us harmless with respect to any claim by a third party that the licensed technology infringes any patent or other proprietary right.

The protective steps we have taken may be inadequate to deter misappropriation of our proprietary information. We may be unable to detect the unauthorized use of, or take appropriate steps to enforce, our intellectual property rights. Failure to adequately protect our intellectual property could harm our brand, devalue our proprietary content and affect our ability to compete effectively. In addition, other parties may assert infringement claims against us or claim that we have violated a patent or infringed a copyright, trademark or other proprietary right belonging to them, whether on our own or by virtue of our use of certain third-party technology. We cannot assure you that the steps we have taken will be adequate to protect us from infringement claims. Protecting our intellectual property rights, or defending against infringement claims, even if not meritorious, could result in the expenditure of significant financial and managerial resources on our part, which could materially adversely affect our business, results of operations and financial condition.

We Face Government Regulation and Legal Uncertainties

Internet Communications, Commerce and Privacy Regulation. The growth and development of the market for Internet commerce and communications has prompted both federal and state laws and regulations concerning the collection and use of personally identifiable information (including consumer credit and financial information under the Gramm-Leach-Bliley Act), consumer protection, the content of online publications, the taxation of online transactions and the transmission of unsolicited commercial email, popularly known as “spam.” More laws and regulations are under consideration by various governments, agencies and industry self-regulatory groups. Although our compliance with applicable federal and state laws, regulations and industry guidelines has not had a material adverse effect on us, new laws and regulations may be introduced and modifications to existing laws may be enacted that require us to make changes to our business practices. Although we believe that our practices are in compliance with applicable laws, regulations and policies, if we were required to defend our practices against investigations of state or federal agencies or if our practices were deemed to be violative of applicable laws, regulations or policies, we could be penalized and our activities enjoined. Any of the foregoing could increase the cost of conducting online activities, decrease demand for our services, lessen our ability to effectively market our services, or otherwise materially adversely affect our business, financial condition and results of operations.

Securities Industry Regulation. Our activities include, among other things, the offering of stand-alone services providing stock recommendations and analysis to subscribers. The securities industry in the United States is subject to extensive regulation under both federal and state laws. A failure to comply with regulations applicable to securities industry participants could materially and adversely affect our business, results of operations and financial condition.

New regulation, changes in existing regulation, or changes in the interpretation or enforcement of existing laws and rules could have a material adverse effect on our business, results of operations and financial condition.

Regulation of Sweepstakes and Promotions. Our activities have included and from time to time may include, conducting online sweepstakes and contests for clients. We use best efforts to comply with all sweepstakes, contest and bonding requirements as specified under various state laws. In the event, however, that we were later determined to have violated any applicable law or regulation, we could suffer a material adverse effect on our business, results of operations and financial condition.

Foreign Regulation. Although we do not actively seek customers and have no property outside the United States, regulatory entities of foreign governments could seek to exercise jurisdiction over our activities. If we were required to defend our practices against investigations of foreign regulatory agencies or if our practices were deemed to be violative of the laws, regulations or policies of such jurisdictions, we could be penalized and our activities enjoined. Any of the foregoing could materially adversely affect our business, financial condition and results of operations.

Any Failure of Our Internal Security Measures or Breach of Our Privacy Protections Could Cause Us to Lose Users and Subject Us to Liability

Users who subscribe to our paid subscription services are required to furnish certain personal information (including name, mailing address, phone number, email address and credit card information), which we use to administer our services. We also require users of some of our free services and features to provide us with some personal information during the membership registration process. Additionally, we rely on security and authentication technology licensed from third parties to perform real-time credit card authorization and verification, and at times rely on third parties, including technology consulting firms, to help protect our infrastructure from security threats. We may have to continue to expend capital and other resources on the hardware and software infrastructure that provides security for our processing, storage and transmission of personal information.

In this regard, our users depend on us to keep their personal information safe and private and not to disclose it to third parties or permit our security to be breached. However, advances in computer capabilities, new discoveries in the field of cryptography or other events or developments, including improper acts by third parties, may result in a compromise or breach of the security measures we use to protect the personal information of our users. If a party were to compromise or breach our information security measures or those of our agents, such party could misappropriate the personal information of our users, cause interruptions in our operations, expose us to significant liabilities and reporting obligations, damage our reputation and discourage potential users from registering to use our Web sites or other services, any of which could have a material adverse effect on our business, results of operations and financial condition.

We utilize various third parties to assist with various aspects of our business. Some of these partnerships require the exchange of user information. This is required because some features of our Web sites may be hosted by these third parties. While we take significant measures to guarantee the security of our customer data and require such third parties to comply with our privacy and security policies as well as be contractually bound to defend, indemnify and hold us harmless with respect to any claim by a thirdparty related to any breach of relevant privacy laws, we are still at risk if any of these third-party systems are breached or compromised and may in such event suffer a material adverse effect to business, results of operations and financial condition.

Control by Principal Stockholders, Officers and Directors Could Adversely Affect Our Stockholders, and the Terms of Our Series B Preferred Stock Include Significant Control Rights

Our officers, directors and greater-than-five-percent stockholders (and their affiliates), acting together, may have the ability to control our management and affairs, and substantially all matters submitted to stockholders for approval (including the election and removal of directors and any merger, consolidation or sale of all or substantially all of our assets). Some of these persons acting individually or together, even in the absence of control, may be able to exert a significant degree of influence over such matters. The interests of persons having this concentration of ownership may not always coincide with our interests or the interests of other stockholders. This concentration of ownership, for example, may have the effect of delaying, deferring or preventing a change in control of the Company, impeding a merger, consolidation, takeover or other business combination involving the Company or discouraging a potential acquirer from making a tender offer or otherwise attempting to obtain control of the Company, which in turn could materially adversely affect the market price of the Common Stock.

In November 2007, we issued to and sold to TCV VI, L.P. and TCV Member Fund, L.P., for an aggregate purchase price of approximately $55 million, a total of 5,500 shares of our Series B preferred stock, par value $0.01 per share (“Series B Preferred Stock”), which are convertible into an aggregate of 3,856,942 shares of our Common Stock, at a conversion price of $14.26 per share and warrants to purchase 1,157,083 shares of Common Stock at an exercise price of $15.69 per share. The holders of the Series B Preferred Stock have the right to vote on any matter submitted to a vote of the stockholders of the Company and are entitled to vote that number of votes equal to the aggregate number of shares of Common Stock issuable upon the conversion of such holders’ shares of Series B Preferred Stock. In addition, so long as 2,200 shares of Series B Preferred Stock remain outstanding, the holders of a majority of such shares will have the right to appoint one person to our board of directors.

So long as 30% of the shares of the currently-outstanding Series B Preferred Stock remain outstanding, the affirmative vote of the holders of a majority of such shares will be necessary to take any of the following actions: (i) authorize, create or issue any class or classes of our capital stock ranking senior to, or on a parity with (as to dividends or upon a liquidation event) the Series B Preferred Stock or any securities exercisable or exchangeable for, or convertible into, any now or hereafter authorized capital stock ranking senior to, or on a parity with (as to dividends or upon a liquidation event) the Series B Preferred Stock (including, without limitation, the issuance of any shares of Series B Preferred Stock (other than shares of Series B Preferred Stock issued as a stock dividend or in a stock split)); (ii) any increase or decrease in the authorized number of shares of Series B Preferred Stock; (iii) any amendment, waiver, alteration or repeal of our certificate of incorporation or bylaws in a way that adversely affects the rights, preferences or privileges of the Series B Preferred Stock; (iv) the payment of any dividends (other than dividends paid in our capital stock or any of our subsidiaries) in excess of $0.10 per share per annum on the Common Stock unless after the payment of such dividends we have unrestricted cash (net of all indebtedness for borrowed money, purchase money obligations, promissory notes or bonds) in an amount equal to at least two times the product obtained by multiplying the number of shares of Series B Preferred Stock outstanding at the time such dividend is paid by the liquidation preference; and (v) the purchase or redemption of: (A) any Common Stock (except for the purchase or redemption from employee, directors and consultants pursuant to agreements providing us with repurchase rights upon termination of their service with us) unless after such purchase or redemption we have unrestricted cash (net of all indebtedness for borrowed money, purchase money obligations, promissory notes or bonds) equal to at least two times the product obtained by multiplying the number of shares of Series B Preferred Stock outstanding at the time such dividend is paid by the liquidation preference; or (B) any class or series of now or hereafter of our authorized stock that ranks junior to (upon a liquidation event) the Series B Preferred Stock.

As a result of the foregoing, the requisite holders of the Series B Preferred Stock may be able to block the proposed approval of any of the above actions, which blockage may prevent us from achieving strategic or other goals dependent on such actions, including without limitation additional capital raising, certain dividend increases, and the redemption of outstanding Common Stock. All of the foregoing rights may limit our ability to take certain actions deemed in the interests of all of our stockholders but as to which the holders of the Series B Preferred Stock have control rights.

Our Staggered Board and Certain Other Provisions in Our Certificate of Incorporation, By-Laws or Delaware Law Could Prevent or Delay a Change of Control

Provisions of our restated certificate of incorporation and amended and restated bylaws and Delaware law – including without limitation the fact that we have a staggered board, with only approximately one-third of our directors standing for re-election each year – could make it more difficult for a third party to acquire the Company, even if doing so would be beneficial to our stockholders.

Our Revenue Could Be Adversely Affected if the Securities Markets Decline, are Stagnant or Experience Extreme Volatility

Our results of operations, particularly related to subscription revenue, are affected by certain economic factors, including the performance of the securities markets. While we believe investors are seeking more information related to the financial markets from trusted sources, the existence of adverse or stagnant securities markets conditions and lack of investor confidence could result in investors decreasing their interest in investor-related publications, which could adversely affect the subscription revenue we derive from our subscription based Web sites and newsletters.

The Utilization of Tax Operating Loss Carryforwards Depends Upon Future Income

We have net operating loss carryforwards of approximately $139 million as of December 31, 2010, available to offset future taxable income through 2030. Our ability to fully utilize these net operating loss carryforwards is dependent upon the generation of future taxable income before the expiration of the carryforward period attributable to these net operating losses.

We Had Material Weaknesses in Internal Controls at December 31, 2008 and December 31, 2009

We determined that we had material weaknesses in our internal control over financial reporting as of December 31, 2008 and as of December 31, 2009. While we remediated those material weaknesses, there can be no assurance that a material weakness will not arise in the future. As a result, current and potential stockholders could lose confidence in our financial reporting, which would harm our business and the trading price of our Common Stock.

Not applicable.

We do not own any real property and we lease all of our facilities. Our principal administrative, sales, marketing, and editorial facilities currently reside in a facility encompassing approximately 35,000 square feet of office space on one floor in an office building at 14 Wall Street in New York, New York. Bankers Financial Products Corporation (d/b/a RateWatch) occupies approximately 15,000 square feet of office space in Fort Atkinson, Wisconsin. We also remain responsible for a sublease of approximately 6,500 square feet of office space in an office building at 29 West 38th Street in New York, New York, which we sublease. Regional locations of certain of our operations include 2,500 square feet of office space in Boston, Massachusetts primarily related to editorial staff. We also lease small satellite office space for our West Coast bureau in Los Angeles, California and our Midwest bureau in Chicago, Illinois as well as TheStreet Ratings in Jupiter, Florida.

Our main technological infrastructure consists of proprietary content-management, subscription management, Ratings models, and e-commerce systems, which are hosted primarily at a facility of Equinix, Inc. in New Jersey. We have certain backup systems at a facility in Nebraska and RateWatch systems in Wisconsin.

As previously disclosed, in 2001, the Company, certain of its current or former officers and directors and certain underwriters were named in a securities class action related to the Company’s initial public offering (“IPO”). Similar suits were filed against approximately 300 other issuers and their underwriters, all of which are included in a single coordinated proceeding in the district court (the “IPO Litigations”). The complaints allege that the prospectus and the registration statement for the IPO failed to disclose that the underwriters allegedly solicited and received “excessive” commissions from investors and that some investors in the IPO allegedly agreed with the underwriters to buy additional shares in the aftermarket in order to inflate the price of the Company’s stock. The complaints seek unspecified damages, attorney and expert fees, and other unspecified litigation costs. In 2003, the district court granted the Company’s motion to dismiss the claims against it under Rule 10b-5 but motions to dismiss the claims under Section 11 of the Securities Act of 1933 were denied as to virtually all of the defendants in the consolidated cases, including the Company. In addition, some of the individual defendants in the IPO Litigations, including Mr. Cramer, signed a tolling agreement and were dismissed from the action without prejudice on October 9, 2002. In 2003, a proposed collective partial settlement of this litigation was structured between the plaintiffs, the issuer defendants in the consolidated actions, the issuer officers and directors named as defendants, and the issuers’ insurance companies. The court granted preliminary approval of the settlement in 2005 but in 2007 the settlement was terminated, in light of a ruling by the appellate court in related litigation in 2006 that reversed the trial court’s certification of classes in that related litigation. In 2009, another settlement was entered into and approved by the trial court. Under the settlement, the Company’s obligation of approximately $339,000 would be paid by the issuers’ insurance companies. The settlement has been appealed. There can be no assurance that the approval of the settlement will not be reversed on appeal and that the settlement will be implemented in its current form, or at all. Due to the inherent uncertainties of litigation, the ultimate outcome of the matter is uncertain.

As previously disclosed, we conducted a review of the accounting in our former Promotions.com subsidiary, which subsidiary we sold in December 2009. As a result of this review, in February 2010 we filed a Form 10-K/A for the year ended December 31, 2008 and a Form 10-Q/A for the quarter ended March 31, 2009, respectively, to restate and correct certain previously-reported financial information as well as filed Forms 10-Q for the quarters ended June 30, 2009 and September 30, 2009, respectively. The SEC commenced an investigation in March 2010 into the facts surrounding our restatement of previously issued financial statements and related matters. We are cooperating fully with the SEC. The investigation could result in the SEC seeking various penalties and relief including, without limitation, civil injunctive relief and/or civil monetary penalties or administrative relief. The nature of the relief or remedies the SEC may seek, if any, cannot be predicted at this time.

As previously disclosed, in April 2010, we and one of our reporters were named in a lawsuit captioned Generex Biotechnology Corporation v. Feuerstein et al. (N.Y. Supreme Court, County of New York, Index No. 10104433), in which plaintiff alleges that certain articles we published concerning plaintiff were libelous. In May 2010 we filed an answer denying all claims. We intend to vigorously defend ourselves in this matter and believe we have meritorious defenses. Due to the preliminary stage of this matter and the inherent uncertainties of litigation, the ultimate outcome of the matter is uncertain.

In December 2010, the Company was named as one of several defendants in a lawsuit captioned EIT Holdings LLC v. WebMD, LLC et al., (U.S.D.C., D. Del.), on the same day that plaintiff filed a substantially identical suit against a different group of defendants in a lawsuit captioned EIT Holdings LLC v. Yelp!, Inc. et al., (U.S.D.C., N. D. Cal.). The complaints allege that defendants infringe U.S. Patent No. 5,828,837, putatively owned plaintiff, related to a certain method of displaying information to an Internet-accessible device. In February 2011, by agreement of plaintiff and the Company, the Company was dismissed from the Delaware action without prejudice and named as a defendant in the California action. The Company intends to vigorously defend itself and believes it has meritorious defenses. Due to the early stage of this matter and the inherent uncertainties of litigation, the ultimate outcome of this matter is uncertain.

The Company is party to other legal proceedings arising in the ordinary course of business or otherwise, none of which other proceedings is deemed material.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

|

We have been a Nasdaq-listed company since May 11, 1999 and our Common Stock currently is quoted on the Nasdaq Global Market under the symbol TST. The following table sets forth, for the periods indicated, the high and low closing sales prices per share of the Common Stock as reported on the Nasdaq Global Market.

|

Low

|

High

|

|||||||

|

2009

|

||||||||

|

First quarter

|

$ | 1.70 | $ | 3.49 | ||||

|

Second quarter

|

$ | 1.85 | $ | 2.47 | ||||

|

Third quarter

|

$ | 1.94 | $ | 2.90 | ||||

|

Fourth quarter

|

$ | 2.12 | $ | 3.08 | ||||

|

2010

|

||||||||

|

First quarter

|

$ | 2.22 | $ | 3.76 | ||||

|

Second quarter

|

$ | 2.79 | $ | 3.93 | ||||

|

Third quarter

|

$ | 2.63 | $ | 3.15 | ||||

|

Fourth quarter

|

$ | 2.55 | $ | 3.14 | ||||

On March 9, 2011, the last reported sale price for our Common Stock was $3.29 per share.

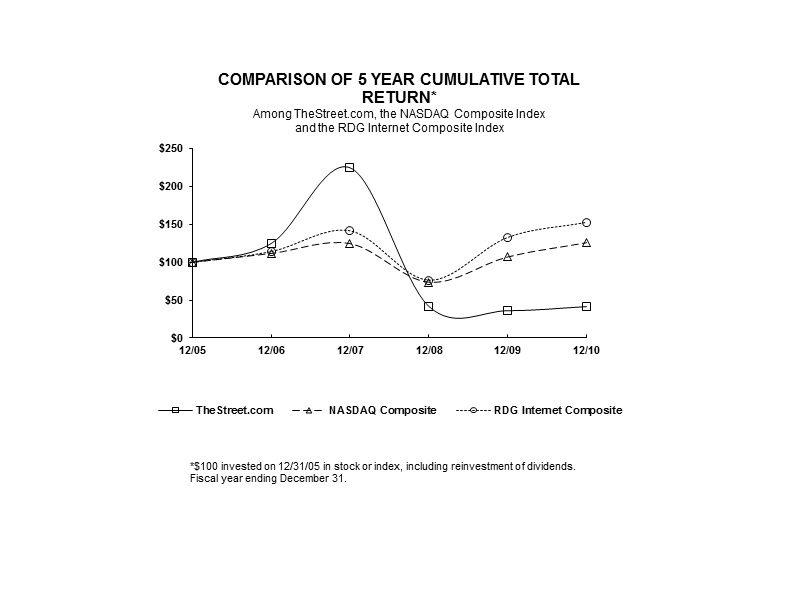

Set forth below is a graph comparing the cumulative total stockholder return on the Company’s Common Stock from December 31, 2005 through December 31, 2010 with the cumulative total return on the Nasdaq Composite Index and the Research Data Group (RDG) Internet Composite Index. The RDG Internet Composite Index is included as the Company believes that this index adequately represents its industry. The performance graph is based upon closing prices on December 31st of each year other than 2006, which is based on the closing price on December 29,2006, the last trading day before December 31, 2006. The comparison assumes $100 was invested on December 31, 2005 in the Company’s Common Stock and in each of the foregoing indices and assumes reinvestment of dividends. The closing price of our Common Stock on December 31, 2005 was $7.21.

|

December 31,

|

||||||||||||||||||||||||

|

2005

|

2006

|

2007

|

2008

|

2009

|

2010

|

|||||||||||||||||||

|

TheStreet.com

|

100.00 | 124.72 | 224.61 | 41.73 | 36.12 | 41.55 | ||||||||||||||||||

|

NASDAQ Composite

|

100.00 | 111.74 | 124.67 | 73.77 | 107.12 | 125.93 | ||||||||||||||||||

|

RDG Internet Composite

|

100.00 | 114.13 | 141.53 | 76.47 | 132.93 | 152.77 | ||||||||||||||||||

Holders

The number of holders of record of our Common Stock on March 9, 2011 was 243, which does not include beneficial owners of our Common Stock whose shares are held in the names of various dealers, clearing agencies, banks, brokers and other fiduciaries.

Dividends

During the years ended December 31, 2010 and December 31, 2009, the Company paid four quarterly cash dividends of $0.025 per share on its Common Stock and its Series B Preferred Stock on a converted common share basis. For the year ended December 31, 2010, dividends paid totaled approximately $3.7million, as compared to approximately $3.6 million for the year ended December 31, 2009. The Company’s Board of Directors reviews the dividend payment each quarter and there can be no assurance that we will continue to pay this cash dividend in the future.

Issuer Purchases of Equity Securities

The following table presents information related to repurchases of its Common Stock made by the Company during the three months ended December 31, 2010.

|

Period

|

(a)

Total Number of Shares(or Units)Purchased

|

(b)

Average Price Paid per Share (or Unit)

|

(c)

Total Number of Shares (or Units)Purchased as Part of Publicly Announced Plans or Programs

|

(d)

Maximum Number(or Approximate Dollar Value) of Shares (or Units) that May Yet Be Purchased Under the Plans or Programs*

|

|||||||||||||

|

October 1 - 31, 2010

|

—

|

$

|

—

|

—

|

$

|

2,678,878

|

|||||||||||

|

November 1 - 30, 2010

|

—

|

$

|

—

|

—

|

$

|

2,678,878

|

|||||||||||

|

December 1 - 31, 2010

|

—

|

$

|

—

|

—

|

$

|

2,678,878

|

|||||||||||

|

Total

|

—

|

$

|

—

|

—

|

$

|

2,678,878

|

|||||||||||

_____________

|

*

|

In December 2000, the Company’s Board of Directors authorized the repurchase of up to $10 million worth of the Company’s Common Stock, from time to time, in private purchases or in the open market. In February 2004, the Company’s Board approved the resumption of this program under new price and volume parameters, leaving unchanged the maximum amount available for repurchase under the program. The program does not have a specified expiration date and is subject to certain limitations. See “Risk Factors — Control by principal stockholders, officers and directors could adversely affect our stockholders, and the terms of our Series B preferred stock include significant control rights.”

|