Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ENERGEN CORP | d8k.htm |

Focusing on Oil & Liquids

Wells Fargo Securities 2

nd

Annual E&P Forum

March 15, 2011

Exhibit 99.1 |

This presentation contains statements expressing expectations

of future plans, objectives, and performance that constitute

forward-looking statements made pursuant to the Safe Harbor

Provision of the Private Securities Litigation Reform Act of

1995. Unless noted, these statements do not reflect possible or

pending acquisitions, divestitures, or restructurings.

Statements based on expectations

are forward-looking

statements

that are dependent on certain events, risks, and

uncertainties that could cause actual results to differ materially

from those anticipated. A discussion of risks and uncertainties

is included in the Company’s periodic reports filed with the

SEC.

2 |

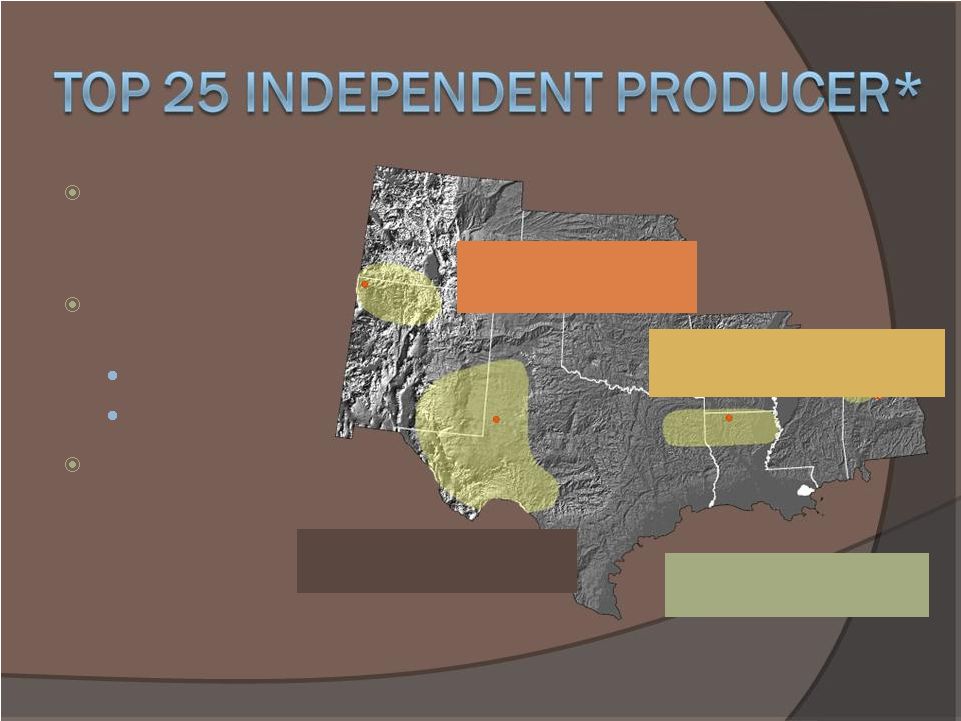

Energen

is a top 25

independent producer

of domestic natural gas,

oil, & natural gas

liquids and the largest

distributor of natural

gas in Alabama.

3 |

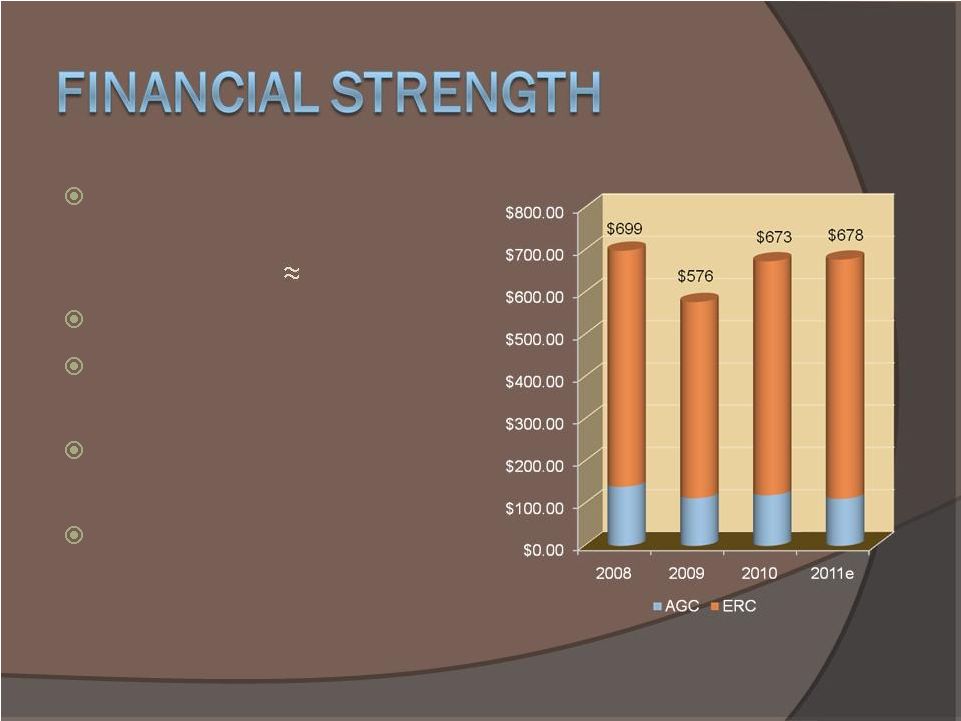

Excellent balance sheet

(debt-to-total cap at YE11

estimated at 25%)

Significant ATCF

$1.0 B syndicated credit

facility

Oil/NGLs comprise 47%

of 2010 proved reserves

Hedging strategy

4

ATCF ($MM)

(2011e ATCF reflects mid-point of guidance range)

|

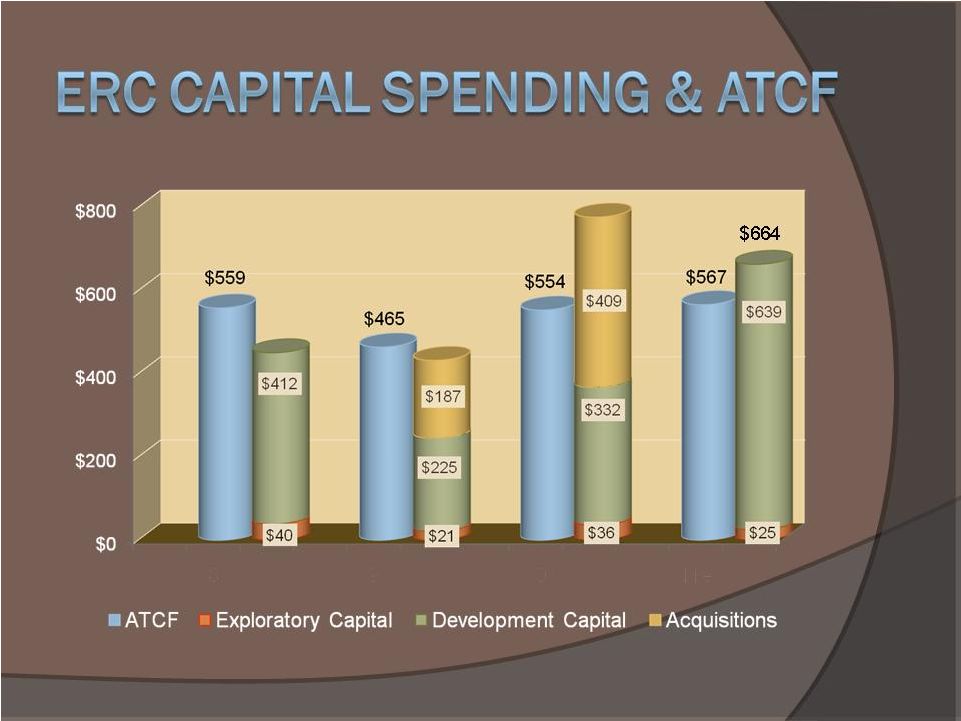

5

2008

2010

2011e

2009

$451

$433

$777

($MM)

(Energen Resources’

2011e ATCF reflects mid-point of guidance range)

|

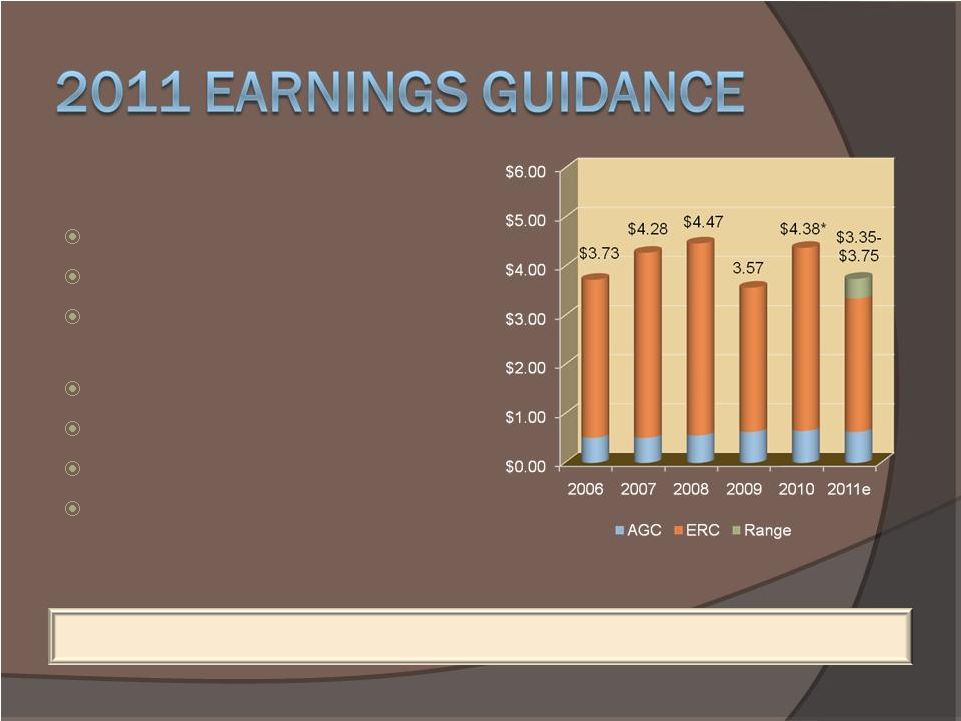

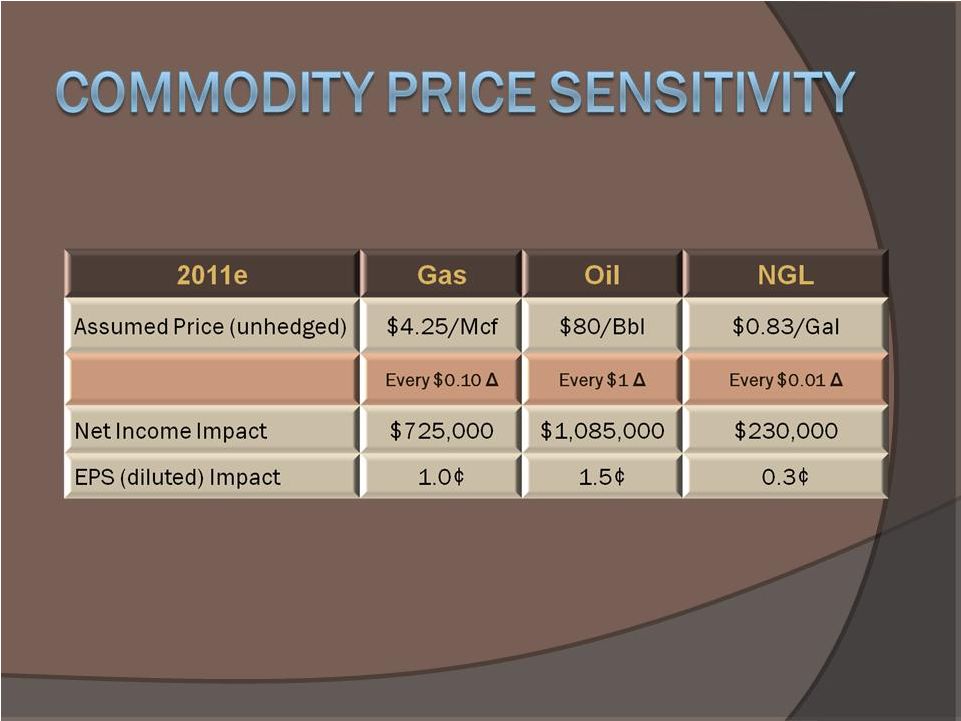

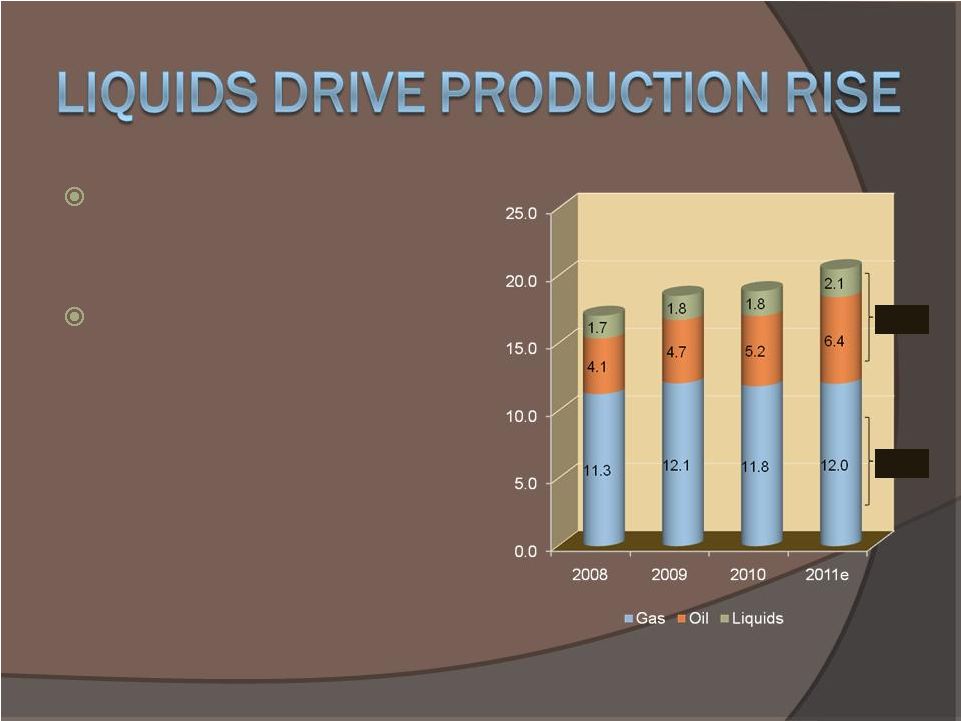

Liquids Production Growth: 20%

2011 Assumptions

69% of est. production hedged

9% production growth

Unhedged price assumptions:

$4.25 gas, $80 oil, $0.83 NGL

LOE: $12.18/BOE

DD&A: $11.46/BOE

G&A: $2.94/BOE

AGC average equity of $346

MM

6

EPS diluted

* Excludes $0.34

non-cash write-off of Alabama shale acreage |

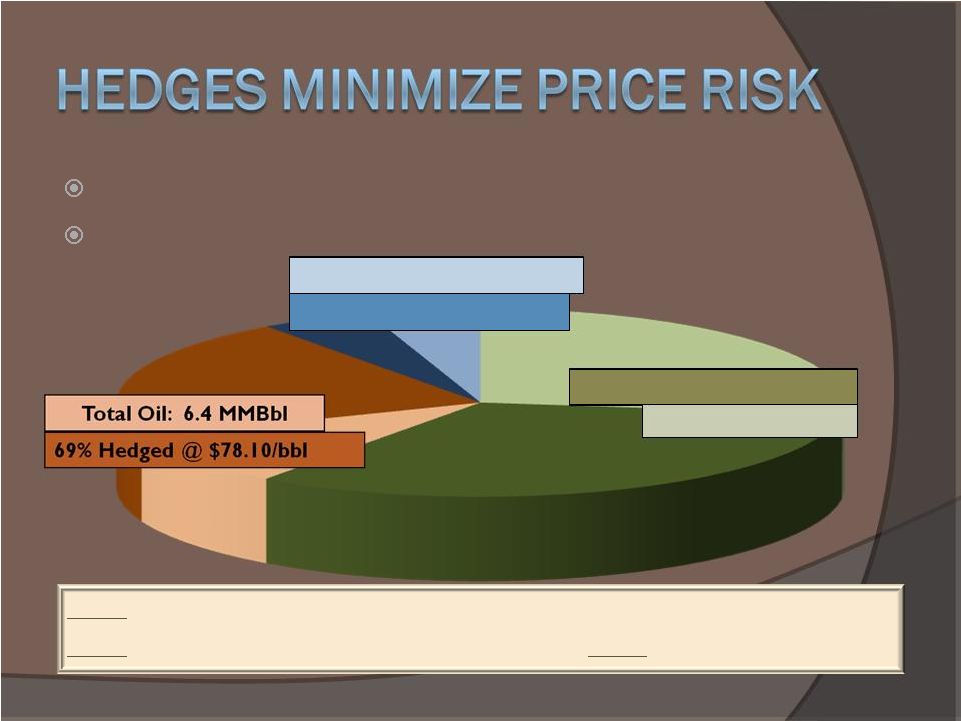

69% of 2011(e) production hedged

2011(e) cash costs: $15.06/BOE

49% Hedged @ $0.90/gal

Total NGL: 86.7 MMgal

2012:

3.7

MMBbl

at

$82.34,

40.5

Bcf

at

$5.02,

39.9

MMgal

at

$0.86

2013: 3.2 MMBbl

at

$85.32,

28.0

Bcf

at

$5.30;

2014:

2.7

MMBbl

at

$87.44

73% Hedged @ $6.20/Mcf

Total Gas: 72.1Bcf

7 |

8 |

303 MMBOE of

proved reserves @

YE2010

2011e production

mix:

59% gas

41% oil/NGL

Major presence in

3 largest areas of

operation

* Based on U.S. Proved Reserves

TX

Black Warrior Basin:

154 Bcf

(8%)

N. LA/E. TX/Other:

51 Bcfe

(3%)

San Juan Basin:

815 Bcfe

(45%)

Permian Basin: 133

MMBOE (44%)

Farmington

Midland

Arcadia

Birmingham

NM

CO

LA

AL

9 |

Estimated Probable & Possible Reserves: 315+ MMBOE

10

(MMBOE)

264

303

264

303

(MMBOE) |

Oil/NGL comprise 41% of

estimated production in 2011.

Based on pace of drilling and

risking incorporated into

acquisition models, oil and NGL

production could increase

approximately 60% from 2010

to 2013.

11

Production (MMBOE)

41%

59%

20.5

18.8

18.6

17.1 |

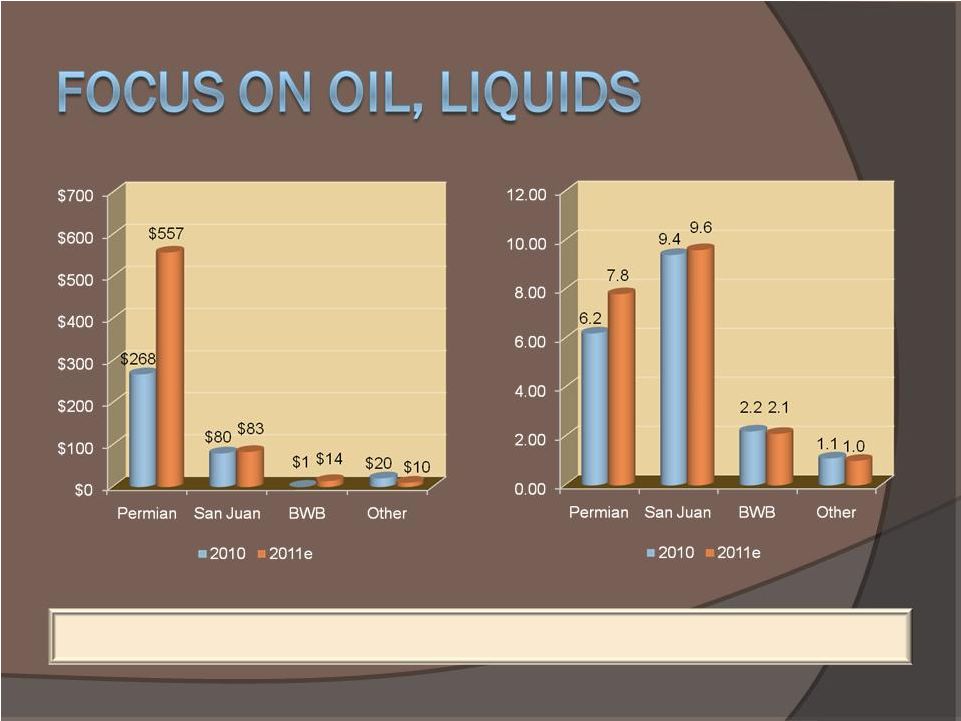

>80% of 2011 capital spending in Permian Basin

12

Production by Basin (MBOE)

Capital Spending by Basin ($MM) |

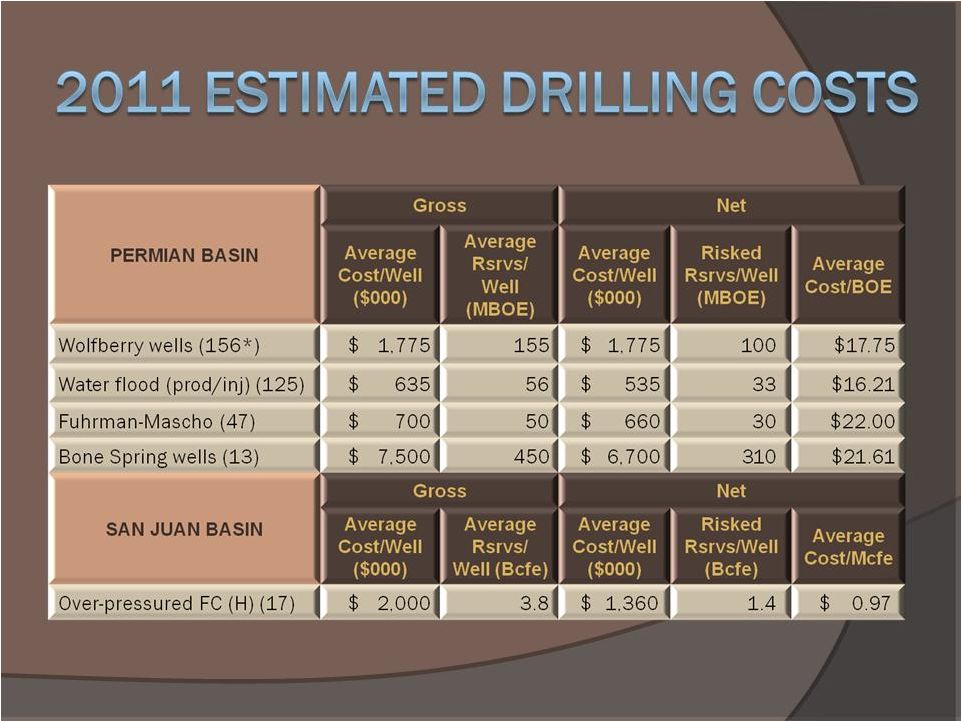

13

* Net wells to be drilled |

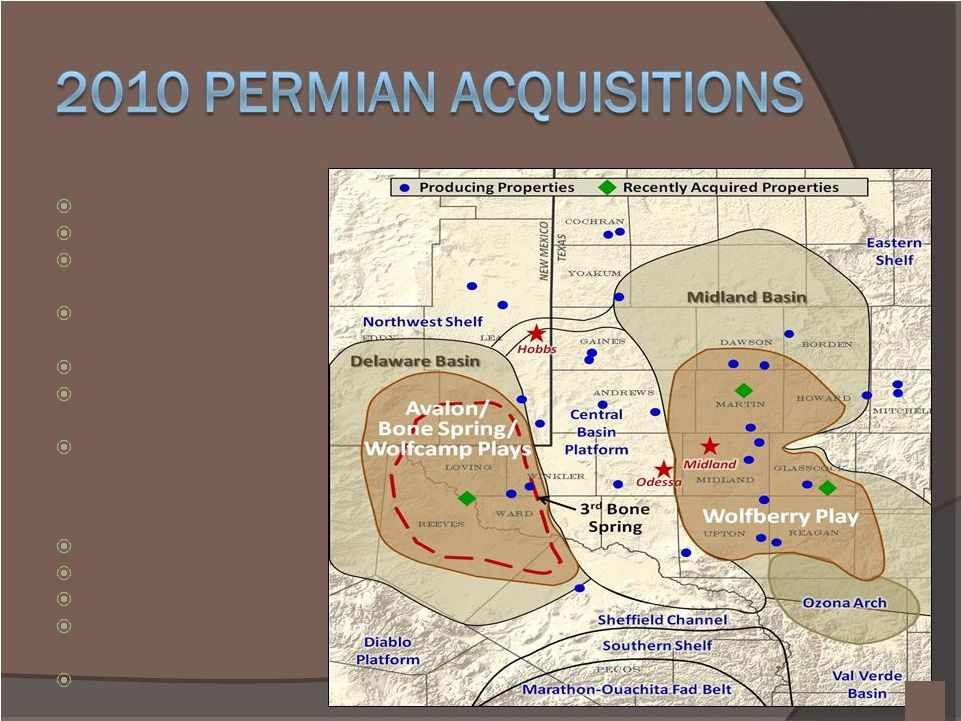

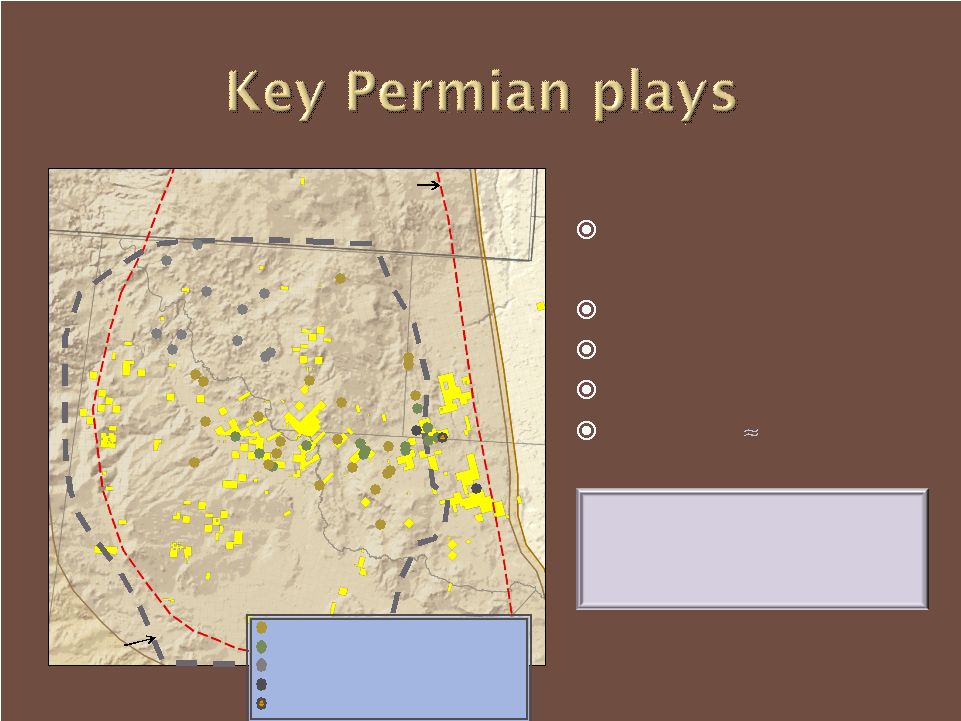

Bone Spring/Avalon

Seller: SandRidge

Energy

40,000

net

acres

-

Avalon

21,300

net

acres

-

Bone

Spring

21 MMBOE unproved

reserves (net unrisked)

$110 MM + closing adj.

Future cost to develop Bone

Spring potential: $465 MM

Potential drilling locations:

62 Bone Spring, 125 Avalon

Wolfberry

Private sellers

19,060 net acres

$260 MM + closing adj.

Future cost to develop: $755

MM

Future drilling locations:

205 PUD, 219 probable

14 |

3rd Bone Spring

Vertical depth:

11,000’

–

11,300’

Horizontal wells

Multi-stage fracs (8-10)

EUR:

400

–

500

MBOE

Well cost:

$7.5 Million

Rigs in 2011: 4-5

15

NEW MEXICO

TEXAS

Loving

Winkler

Reeves

Ward

Avalon ERC

Area of Interest

3

Bone Spring

ERC Area of

Interest

50,000 net undeveloped acres;

150 potential locations on

320-acre spacing

Recently Drilled Bone Spring Wells

ERC 3

Bone Spring Wells

rd

rd |

Avalon Shale

Vertical depth:

8,500’

-

9,000’

Horizontal wells

Multi-stage fracs (8-10)

EUR: 300 –

350 MBOE

Well cost:

$5.5 Million

16

NEW MEXICO

TEXAS

Loving

Winkler

Reeves

Ward

Avalon ERC

Area of Interest

3

rd

Bone Spring ERC

Area of Interest

80,000

net

undeveloped

acres;

250

potential

locations

on 320-

acre

spacing

Recently Drilled Bone Spring Wells

ERC 3

rd

Bone Spring Wells

Recently Drilled Avalon Wells

Avalon Test Wells (vertical)

ERC Avalon Well |

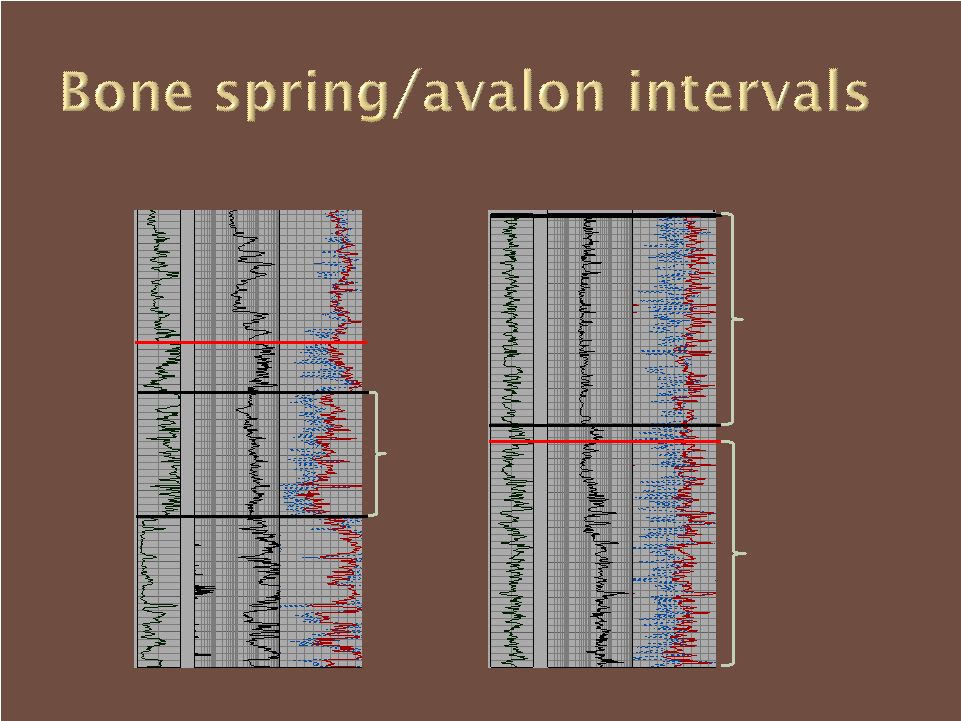

0.2

2000

0.3

17

11,000’

8,750’

11,900’

3

rd

Bone

Spring

Sands

Avalon

Avalon

Shale

Shale

Top of

Top of

Bone

Bone

Spring

Spring

Interval

Interval

Top of

Top of

Wolfcamp

Wolfcamp

8,500’

11,300’

8,550’

Upper

Upper

Wolfcamp

Wolfcamp |

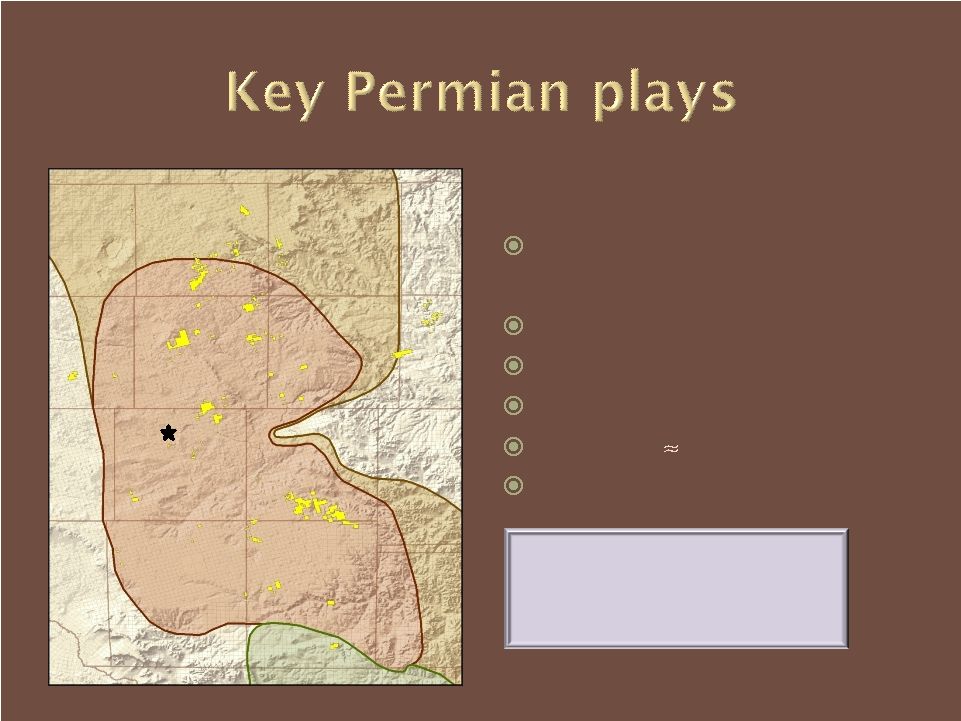

26,300

net

undeveloped

acres;

650

potential

locations

on

40-

acre

spacing

Wolfberry

Completion

interval:

7,500’

–

10,500’

Vertical wells

Multi-stage fracs (6-8)

EUR: 125 –

175MBOE

Well

cost:

$1.8

Million

Rigs in 2011: 7

18

Gaines

Dawson

Borden

Andrews

Martin

Howard

Glasscock

Midland

Ector

Crane

Upton

Reagan

Sterling

Irion

Midland |

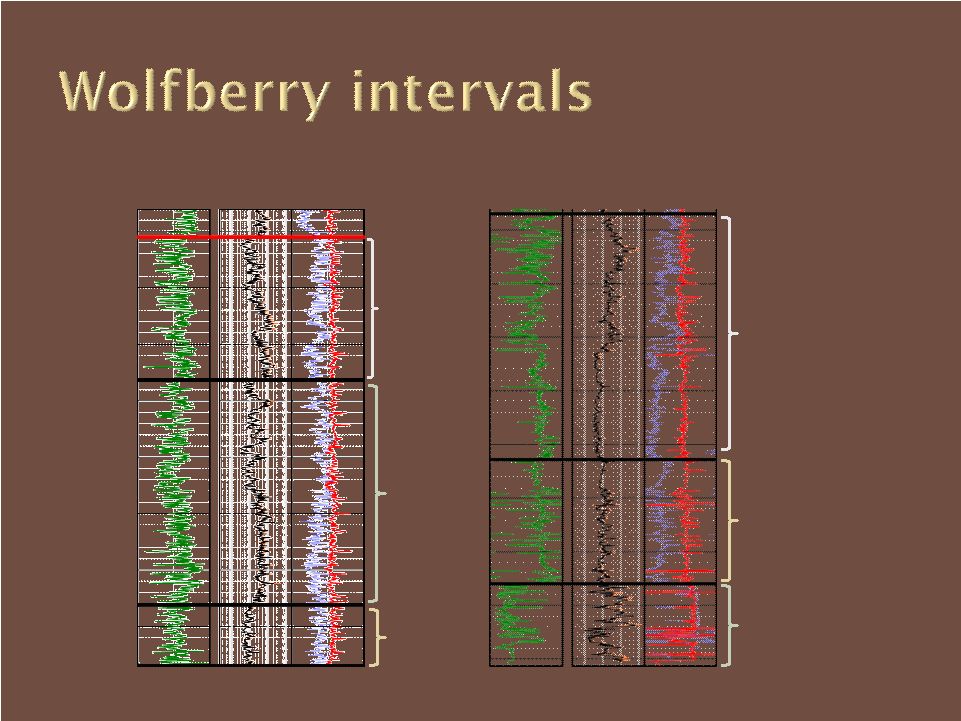

19

7,500’

9,000’

9,000’

10,600’

Wolfcamp

Wolfcamp

Lower

Lower

Spraberry

Spraberry

Cline

Cline

Upper

Upper

Spraberry

Spraberry

Dean

Dean

Strawn

Strawn

8,000’

8,750’

9,900’

10,400’ |

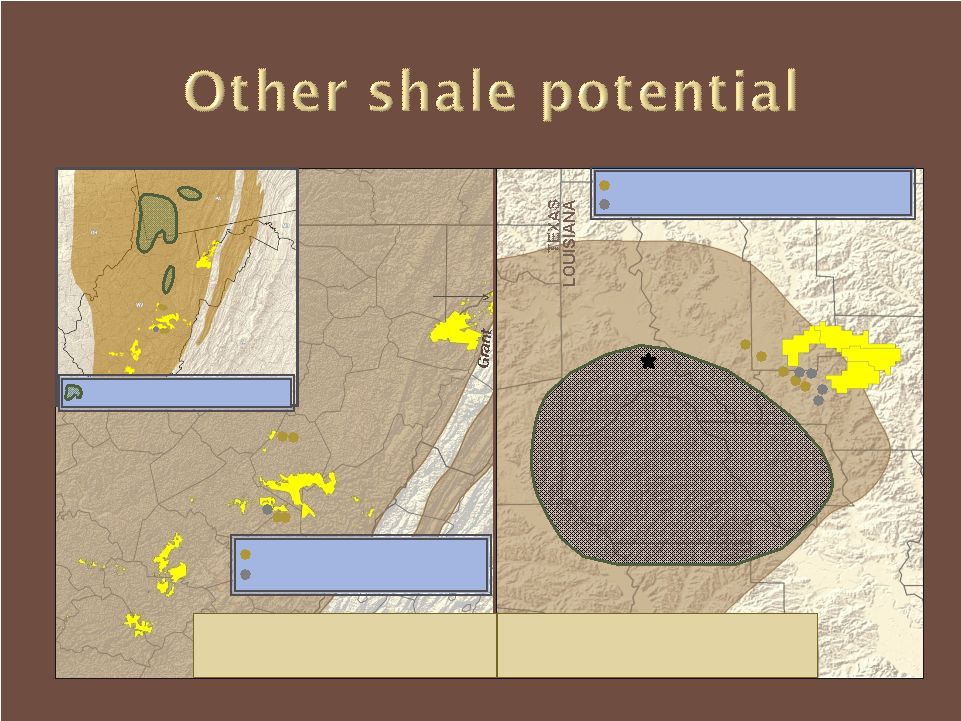

20

Haynesville Shale

12,000 acres

Lewis Shale

55,500 acres

Mancos/Niobrara Shale -

Gas

55,500 acres

Mancos/Niobrara Shale -

Oil

54,000 acres

Marcellus Shale

200,000 acres

Net

Net

Undeveloped

Undeveloped

Acres

Acres |

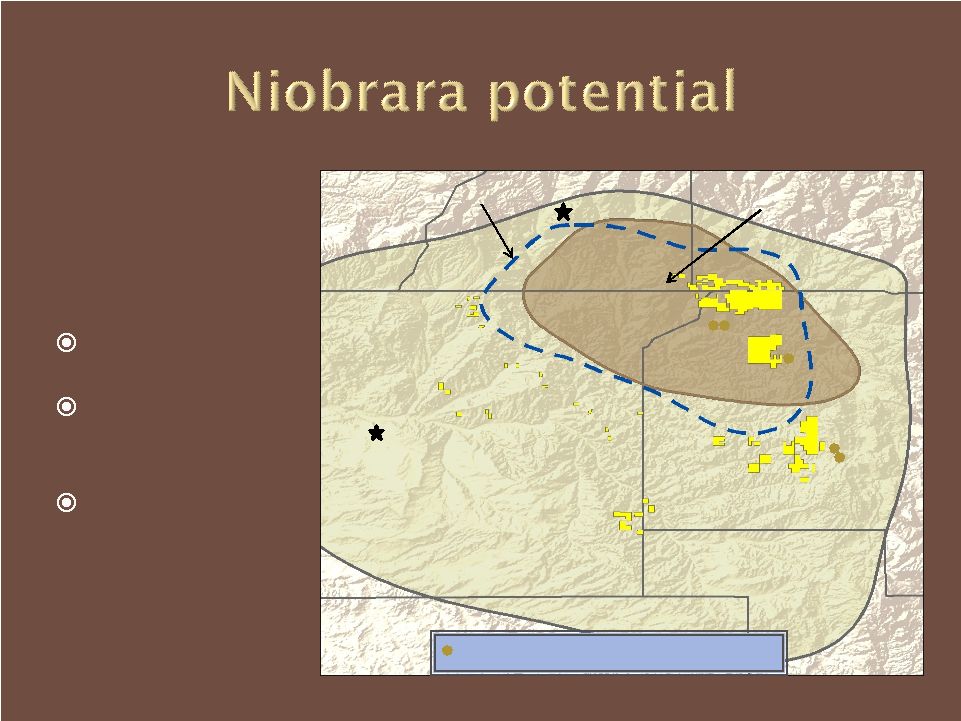

Net

Undeveloped

Acres

Lewis Shale: 55,500

Niobrara

Shale

Gas:

55,500

Niobrara

Shale

Oil: 54,000

21

Niobrara Shale Oil

Lewis Shale

Farmington

Durango

San Juan

Rio Arriba

Sandoval

La Plata

Archuleta

Niobrara Shale Gas

Recently

Drilled

Niobrara

Shale

Wells

(horizontal) |

22

OHIO

Shreveport

Bienville

Webster

PENN.

W. VIRGINIA

MD

Pocahontas

Nicholas

Webster

Fayette

Raleigh

Wyoming

Boone

Tucker

Mineral

Haynesville

12,000 Net Undeveloped Acres

Area of Major

Haynesville

Development

Recently

Completed

Haynesville

Wells

Recently

Drilled

Haynesville

Wells

Permitted

Marcellus

Wells

(hrzntl)

6

Completed

Marcellus

Wells

(vert)

Marcellus –

Appalachia

200,000 Net Undeveloped Acres

Areas

of

Major

Marcellus

Activity

Garrett |

Complementary business

Excellent rate of return

Primary source of dividend

23 |

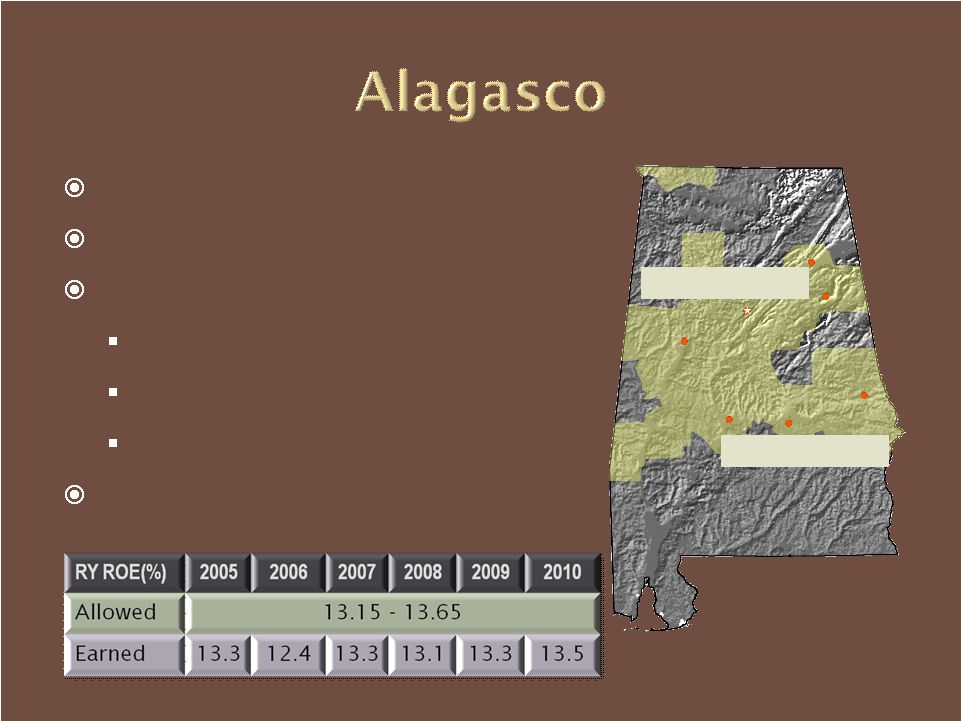

Single-state utility

More than 437,000 customers

Progressive regulation

RSE through rate-year 2015

Allowed ROE: 13.15%-13.65%

Forward-looking test year

Temperature adjustment

Birmingham

Montgomery

24 |

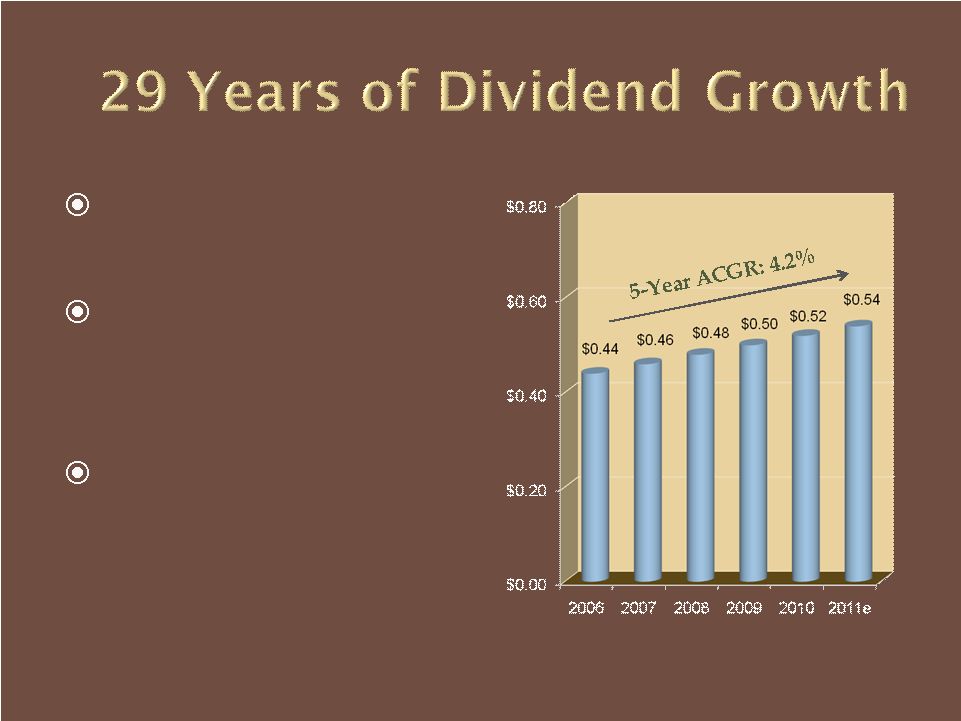

2011 dividend raised 3.8%

Alagasco funds dividend

at utility payout over 65%

ERC may make small

payout contribution

25

Annual Dividend Rate |

Liquids-focused

Significant Hedges

Strong Cash Flows

Excellent

Fundamentals

Proven Track Record

26 |

Julie S. Ryland

Vice President –

Investor Relations

205-326-8421

jryland@energen.com

www.energen.com

27 |

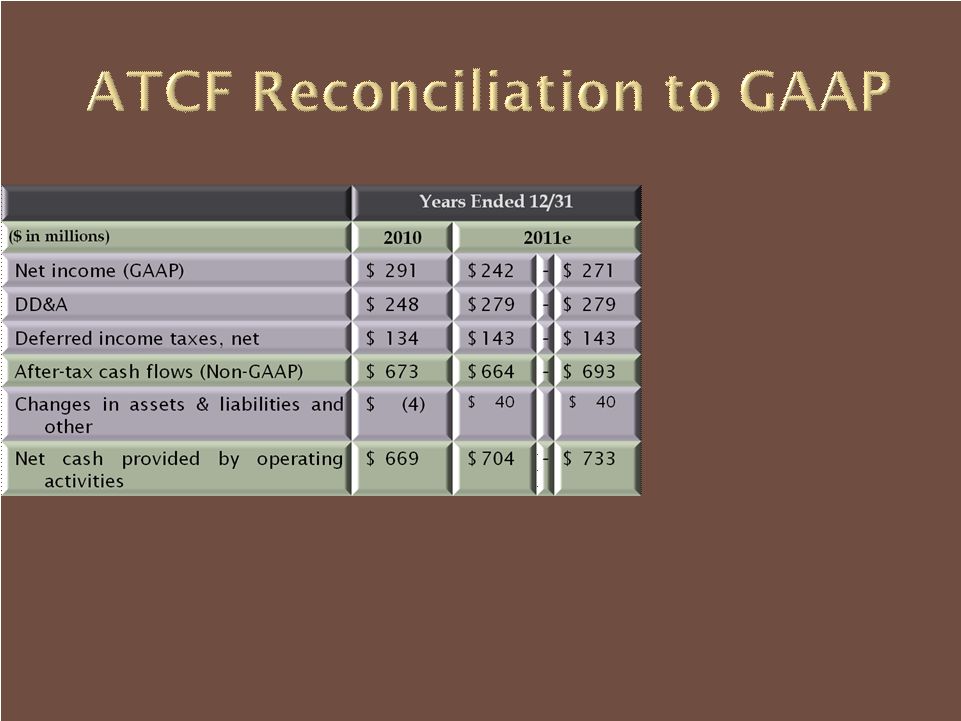

Note: 2011e data constitute forward-looking statements

The

U.S.

Securities

and

Exchange

Commission

(SEC)

requires

public

companies

to

reconcile

Non-

GAAP

financial

measures

to

related

GAAP

measures.

GAAP

refers

to

generally

accepted

accounting

principles.

After-tax

Cash

Flow

(ATCF)

is

a

Non-GAAP

financial

measure.

Energen

believes

ATCF

is

relevant

as

a

measure

of

cash

available

to

fund

its

capital

expenditures,

dividends,

debt

reduction,

and

other

investments.

28 |

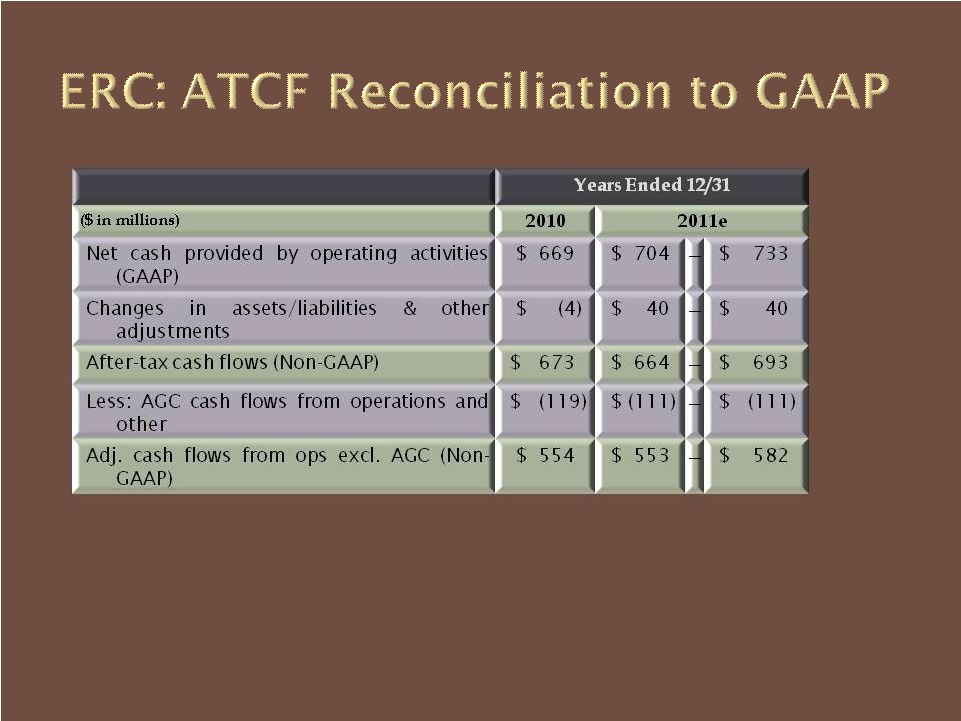

29

After-tax

Cash

Flow

(ATCF)

is

a

Non-GAAP

financial

measure.

Energen

believes

ATCF

is

relevant

as

a

measure

of

cash

available

to

fund

its

capital

expenditures,

dividends,

debt

reduction,

and

other

investments.

Adjusted

Cash

Flows

from

Operations

Excluding

Alagasco

reflect

information

specific

to

Energen’s

non-regulated

activities. |

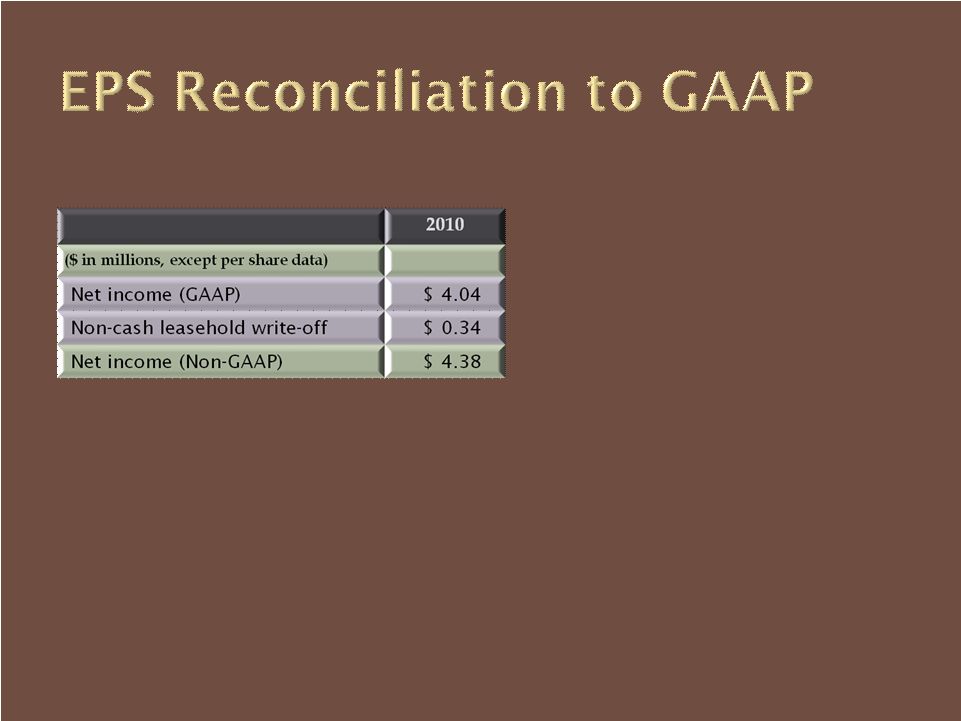

30

The

U.S.

Securities

and

Exchange

Commission

(SEC)

requires

public

companies

to

reconcile

Non-

GAAP

financial

measures

to

related

GAAP

measures.

GAAP

refers

to

generally

accepted

accounting

principles.

Net

Income

excluding

the

non-cash,

after-tax

unproved

leasehold

write-

off is

a

Non-

GAAP

financial

measure.

Energen

believes

that

excluding

it

for

comparative

purposes

better

reflects

financial

performance

of

the

company’s

on-going

operations. |

March 15, 2011

Wells

Fargo

Securities

2

nd

Annual

E&P

Forum

Focusing on Oil & Liquids |