Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - NZCH Corp | c13030exv31w1.htm |

| EX-32.2 - EXHIBIT 32.2 - NZCH Corp | c13030exv32w2.htm |

| EX-31.2 - EXHIBIT 31.2 - NZCH Corp | c13030exv31w2.htm |

| EX-32.1 - EXHIBIT 32.1 - NZCH Corp | c13030exv32w1.htm |

| EX-10.6 - EXHIBIT 10.6 - NZCH Corp | c13030exv10w6.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2010

OR

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 000-27729

Zap.Com Corporation

(Exact name of Registrant as specified in its charter)

| Nevada | 76-0571159 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| 450 Park Avenue, 27th Floor | ||

| New York, NY | 10022 | |

| (Address of principal executive offices) | (Zip Code) |

REGISTRANT’S TELEPHONE NUMBER, INCLUDING AREA CODE

(212) 906-8555

(212) 906-8555

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

None.

None.

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT:

TITLE OF EACH CLASS: Common Stock, $0.001 par value

TITLE OF EACH CLASS: Common Stock, $0.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule

405 of the Securities Act. Yes o or No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or

Section 15(d) of the Act. Yes o or No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by

Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for

such shorter period that the Registrant was required to file such reports), and (2) has been

subject to such filing requirements for the past 90 days. Yes þ or No o.

Indicate by check mark whether the registrant has submitted electronically and posted on its

corporate Web site, if any, every Interactive Data File required to be submitted and posted

pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period

that the registrant was required to submit and post such files). Yes o or No o.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is

not contained herein, and will not be contained, to the best of Registrant’s knowledge, in

definitive proxy or information statements incorporated by reference in Part III of this Form 10-K

or any amendment to this Form 10-K.o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a

non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated

filer” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer þ | Smaller reporting company o | |||

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the

Act). Yes þ or No o

The aggregate market value of the voting stock held by non-affiliates of the registrant as of June

30, 2010 (the last business day of the registrant’s most recently completed second fiscal quarter)

was $20,644. For the sole purpose of making this calculation, the term “non-affiliate” has been

interpreted to exclude directors, corporate officers and holders of 10% or more of the Company’s

common stock.

As of March 8, the Registrant had outstanding 50,004,474 shares of common stock, $0.001

par value.

Documents Incorporated By Reference: The information required by Part III of this Form 10-K, to the

extent not set forth herein, is incorporated by reference from the registrant’s information

statement to be filed with the Securities and Exchange Commission pursuant to Regulation 14C on or

prior to May 2, 2011.

TABLE OF CONTENTS

| Page | ||||||||

| PART I |

||||||||

| 3 | ||||||||

| 4 | ||||||||

| 8 | ||||||||

| 8 | ||||||||

| 8 | ||||||||

| 8 | ||||||||

| PART II |

||||||||

| 9 | ||||||||

| 10 | ||||||||

| 11 | ||||||||

| 11 | ||||||||

| 11 | ||||||||

| 11 | ||||||||

| 12 | ||||||||

| 12 | ||||||||

| 12 | ||||||||

| 12 | ||||||||

| 13 | ||||||||

| 13 | ||||||||

| 13 | ||||||||

| 13 | ||||||||

| 13 | ||||||||

| 14 | ||||||||

| PART III |

||||||||

| 15 | ||||||||

| 15 | ||||||||

| 15 | ||||||||

| 15 | ||||||||

| 15 | ||||||||

| PART IV |

||||||||

| 16 | ||||||||

| Exhibit 10.6 | ||||||||

| Exhibit 31.1 | ||||||||

| Exhibit 31.2 | ||||||||

| Exhibit 32.1 | ||||||||

| Exhibit 32.2 | ||||||||

1

Table of Contents

FORWARD-LOOKING STATEMENTS

CAUTIONARY STATEMENT FOR PURPOSES OF THE “SAFE HARBOR” PROVISIONS OF THE PRIVATE SECURITIES

LITIGATION REFORM ACT OF 1995.

Zap.Com

Corporation (referred to as the “Company,” “Zap.Com,” “we,” “us,” or “our”) has made forward-looking

statements in this Annual Report on Form 10-K that are subject to risks and uncertainties. These

statements are based on the beliefs and assumptions of our management. Generally, forward-looking

statements include information concerning possible or assumed future actions, events or results of

operations of our company. Forward-looking statements include, without limitation, the information

regarding our assets and operations and management’s plan for the Company.

Forward-looking statements may be preceded by, followed by or include the words “may,” “will,”

“believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “could,” “might,” or “continue” or

the negative or other variations thereof or comparable terminology. We claim the protection of the

safe harbor for forward-looking statements contained in the Private Securities Litigation Reform

Act of 1995 for all forward-looking statements.

Forward-looking statements are not guarantees of performance. You should understand that the

following important factors, in addition to those discussed in Item 1A of Part I of this report,

could affect our future results and could cause those results or other outcomes to differ

materially from those expressed or implied in the forward-looking statements.

Important factors that could affect our future results include, without limitation, the following:

| • | The impact of our limited assets and no source of revenue; |

||

| • | The controlling effect of Harbinger Group Inc. (our “Principal Stockholder”) whose

interests may conflict with interests of our stockholders; |

||

| • | The impact of a determination that we are an investment company; |

||

| • | The impact of our not selecting a specific industry or industries in which to acquire or

develop a business; |

||

| • | The impact of insubstantial disclosure relating to prospective new businesses; |

||

| • | The impact of the structure of an acquisition or business combination on our

stockholders; |

||

| • | The impact of management devoting insignificant time to our activities; |

||

| • | The impact of significant competition for acquisition candidates; |

||

| • | The impact of our categorization as a “shell company” as that term is used in the

Securities and Exchange Commission’s (the “Commission” or “SEC”) rules; |

||

| • | The effect of a limited public market for our common stock on the trading activity and

market value of our stock; |

||

| • | The potential liabilities from being a member of our Principal Stockholder’s

consolidated tax group; |

||

| • | The effect of our intention not to pay any cash dividends on our common stock; |

||

| • | The effect of the anti-takeover provisions in our corporate documents on the market

price of our common stock; |

||

| • | The effect of a substantial amount of our common stock being eligible for sale into the

market on our stock price; and |

||

| • | The impact of delays or difficulty in satisfying the requirements of Section 404 of the

Sarbanes-Oxley Act of 2002 or negative reports concerning our internal. |

2

Table of Contents

PART I

| Item 1. | Business |

General

The Company was incorporated in Nevada in 1999 for the purpose of creating and operating a global

network of independently owned web sites. Our Principal Stockholder, Harbinger Group Inc., owns

approximately 98% of our outstanding common stock. Other than complying with our reporting

requirements under the Securities Exchange Act of 1934 (the “Exchange Act”), we have no business

operations. We may search for assets or businesses to acquire so we can become an operating

company.

We have broad discretion in identifying and selecting both the industries and the possible

acquisition or business combination opportunities. We have not identified a specific industry to

focus on and have no present plans, proposals, arrangements or understandings with respect to a

business combination or acquisition of any specific business. There can be no assurance that we

will be able to identify or successfully complete any such transactions. As of the date of this

report, we are not a party to any agreements providing for a business combination or other

acquisition of assets. We may pay acquisition consideration in the form of cash, debt or equity

securities or a combination thereof. In addition, as a part of our acquisition strategy we may

consider raising additional capital through the issuance of equity or debt securities, including

the issuance of preferred stock.

Available Information

We file annual, quarterly and current reports and other information with the SEC. Our annual

reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to

these reports filed under the Exchange Act, as well as Section 16 filings by officers and

directors, are available free of charge at www.sec.gov. We will provide a copy of these documents

to stockholders upon request. We do not maintain a website.

In addition, the public may read and copy any materials filed by the Company with the SEC at the

SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain

information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

The SEC maintains an Internet site that contains reports, proxy and information statements, and

other information regarding issuers that file electronically with the SEC.

We have adopted a Code of Ethics and Business Conduct that applies to all of our directors and key

employees, including our principal executive officer, principal financial officer, principal

accounting officer and persons performing similar functions. We will provide without charge, upon

request, a copy of the Code of Ethics and Business Conduct. Anyone wishing to obtain a copy should

write to Zap.Com Corporation, Investor Relations, 450 Park Avenue, 27th Floor, New York,

New York 10022.

Financial Information about Industry Segments

We follow the accounting guidance which establishes standards for the way companies report

information about operating segments in annual financial statements and for related disclosures

about products and services, geographic areas and major customers. We have determined that we do

not have any separately reportable operating segments.

Employees

At December 31, 2010, we employed four executive personnel. These employees are also employees of

our Principal Stockholder and do not receive a salary or bonus from the Company. In the normal

course of business, we use contract personnel to supplement our employee base to meet our business

needs. We believe that our employee relations are generally satisfactory.

3

Table of Contents

| Item 1A. | Risk Factors |

In examining an investment in our common stock, you should be aware that there are various risks

which could negatively impact our results of operations, cash flows and financial condition,

including those described below. We urge you to carefully consider these risk factors, together

with all of the other information included in this filing and other risks and uncertainties

identified in our filings made with the Commission, press releases and public statements made by

our authorized officers, before you decide to purchase or make an investment decision regarding our

common stock.

We have limited assets and no source of revenue.

We have limited assets and have had no significant revenue since inception, nor will we receive any

operating revenues until we complete an acquisition or business combination, or we successfully

develop a new business. We can provide no assurance that any acquired business will produce any

material revenues for the Company or that any such business will operate on a profitable basis.

Our Principal Stockholder controls us and the Harbinger Parties hold a majority of the outstanding

common stock of our Principal Stockholder; the presence of interlocking directors and officers

creates potential conflicts of interest and could prevent a change of control.

As of the date of this report, our Principal Stockholder owns approximately 98% of our outstanding

common stock, and entities affiliated with Harbinger Capital Partners LLC (the “Harbinger Parties’)

own approximately 93.3% of our Principal Stockholder’s outstanding common stock. As a result, the

directors and officers of our Principal Stockholder, and, indirectly, the directors and officers of

the Harbinger Parties, will be able to control the outcome of substantially all matters submitted

to our stockholders for approval, including the election of directors and any proposed merger,

liquidation, transfer or encumbrance of a substantial portion of our assets, or amendment to our

charter to change our authorized capitalization. This concentration of ownership may also have the

effect of delaying or preventing a change in control of the Company even if it would be beneficial

to our other stockholders.

Our directors and executive officers also are directors and executive officers of our Principal

Stockholder and two of our executive officers and all of our directors are affiliated with or

employed by the Harbinger Parties or their affiliates. The Harbinger Parties could cause corporate

actions to be taken even if the interests of these entities conflict with or are not aligned with

interests of our other stockholders.

Our officers are also officers of our Principal Stockholder and our officers and our Principal

Stockholder may have conflicts of interest.

Although we have not identified any potential acquisition target or new business opportunities, the

possibility exists that we may acquire or merge with a business or company in which our executive

officers, directors or their affiliates, including the Harbinger Parties, may have an ownership

interest. A transaction of this nature would present a conflict of interest for those parties with

a managerial position and/or an ownership interest in both the Company and the acquired entity. An

independent appraisal of the acquired company may or may not be obtained in the event a related

party transaction is contemplated. Moreover, our Principal Stockholder is also currently seeking

potential acquisition candidates and new business opportunities. Our executive officers could

identify a potential acquisition target or business opportunity that is suitable for us as well as

our Principal Stockholder, thereby creating a conflict of interest for our officers.

We may suffer adverse consequences if we are deemed an investment company under the Investment

Company Act and we may be required to incur significant costs, and our activities and investments

will be restricted, to avoid investment company status.

We believe we are not an investment company as defined by the Investment Company Act of 1940 (the

“Investment Company Act”). The Investment Company Act contains substantive legal requirements that

regulate the manner in which investment companies are permitted to conduct their business

activities. If the Commission or a court were to disagree with us, we could be required to register

as an investment company. This would negatively affect our ability to consummate an acquisition of

an operating company; subject us to disclosure and accounting guidance

geared toward investment, rather than operating, companies; limit our ability to borrow money,

issue options, issue multiple classes of stock and debt, and engage in transactions with

affiliates; and require us to undertake significant costs and expenses to meet the disclosure and

regulatory requirements to which we would be subject as a registered investment company. To avoid

investment company status, we may be required to incur significant costs and our activities and

investments will be restricted.

4

Table of Contents

We have not selected a specific industry in which to acquire or develop a business.

To date, we have not identified any particular industry or business in which to concentrate our

acquisition efforts. Accordingly, our current stockholders and prospective investors have no basis

to evaluate the comparative risks and merits of investing in the industry of any business we may

acquire or develop. If we acquire a business in a high risk industry, we will become subject to

those risks. Similarly, if we acquire a financially unstable business or a business that is in the

early stages of development, we will become subject to the numerous risks to which such businesses

are subject. Although management intends to consider the risks inherent in any industry and

business in which we may become involved, there can be no assurance that it will correctly assess

such risks.

We have made no substantive disclosure relating to prospective new businesses.

Because we have not yet identified any assets, property or business that we may acquire or develop,

our current stockholders and potential investors in the Company have no substantive information

about any such new business upon which to base a decision whether to invest in the Company. We can

provide no assurance that any investment in the Company will ultimately prove to be favorable. In

any event, stockholders and potential investors will likely not have access to any information

about any new business until a transaction is completed and we have filed a report with the

Commission disclosing the nature of the transaction and/or business.

If we consummate an acquisition or business combination, our stockholders will likely not know its

structure in advance and will likely suffer dilution.

Our management has had no contact or discussions regarding, and there are no present plans,

proposals or arrangements to acquire, any specific assets, property or business. Accordingly, it is

unclear whether such an acquisition or business combination would take the form of an exchange of

capital stock, a merger or an asset acquisition. However, because we have limited resources, an

acquisition or business combination is likely to involve the issuance of our capital stock.

We currently have 1,500,000,000 authorized shares of common stock and 150,000,000 authorized shares

of preferred stock. As of the date of this report, we have 50,004,474 shares of common stock

outstanding and no outstanding preferred stock. We will be able to issue significant amounts of

additional shares of common stock without obtaining stockholder approval, provided we comply with

the rules and regulations of any exchange or national market system on which our shares are then

listed. As of the date of this report, we are not subject to the rules of any exchange that would

require stockholder approval. To the extent we issue additional common stock in the future,

existing stockholders will experience dilution in percentage ownership.

As of the date of this report, we have reserved 3,000,000 shares for options issued or to be issued

pursuant to our 1999 Long-Term Incentive Plan. There are no outstanding options as of the date of

this report. The issuance of shares upon the exercise of the above securities may have a dilutive

effect in the future on our common stock, which may adversely affect the price of our common stock.

Management devotes insignificant time to our activities.

Members of our management are not required to and do not devote their full time to our affairs.

Because of their time commitments to our Principal Stockholder, and the fact that we have no

business operations, we do not anticipate that our management will devote any significant amount of

time to the activities of the Company.

5

Table of Contents

There is significant competition for acquisition candidates.

Our management believes there are numerous companies, including our Principal Stockholder, that are

also seeking merger or acquisition transactions, most of which have greater resources than we do.

These entities will present competition to us in our search for a suitable transaction candidate,

and we can make no assurance that we will be successful in our search.

We are categorized as a “shell company” under the Commission’s rules.

The Commission’s rules prohibit the use of Form S-8 by a shell company, and require a shell company

to file a Form 8-K to report the same type of information that would be required if it were filing

to register a class of securities under the Exchange Act when the shell company reports the event

that caused it to cease being a shell company. Being a shell company may adversely impact our

ability to offer our stock to officers, directors and consultants, and thereby make it more

difficult to attract and retain qualified individuals to perform services for the Company, and will

likely increase the costs of registration compliance following the completion of a business

combination.

There is no assurance of a continued public trading market for our stock and being a low priced

security may affect the trading activity and market value of our stock.

To date, there has been only a limited public market for our common stock. Our common stock is

currently quoted on the National Association of Securities Dealers Over-the-Counter Electronic

Bulletin Board, under the symbol “ZPCM”, and an investor may find it difficult to obtain accurate

quotations as to the market value of our stock. Our stock is subject to the low-priced security

(less than $5.00), or so-called “penny stock”, rules of the Commission that impose additional sales

practice requirements on broker/dealers who sell such securities. Some of these requirements are

discussed below.

A broker/dealer selling penny stocks must, at least two business days before effecting a customer’s

first transaction in a penny stock, provide the customer with a document containing information

mandated by the Commission regarding the risks of investing in such stock, and the broker/dealer

must receive a signed and dated written acknowledgement of the customer’s receipt of that document

before effecting a customer’s first transaction in a penny stock.

If the customer is someone other than an accredited investor (as defined in the Securities Act of

1933 (the “Securities Act”)) or an established customer of the broker/dealer, the broker/dealer

must approve the potential customer’s account by obtaining information from the customer concerning

the customer’s financial situation, investment experience and investment objectives. Based on this

information and any other information known by the broker/dealer, the broker/dealer must reasonably

determine that transactions in penny stocks are suitable for the customer and that the customer has

sufficient knowledge and experience in financial matters to reasonably be expected to be capable of

evaluating the risks of transactions in penny stocks. A broker/dealer must, before effecting a

customer’s first purchase of a penny stock, send a written statement of this determination,

together with other disclosures required by the Commission, to the customer, and the broker/dealer

must receive a signed and dated copy of the statement before effecting the customer’s first

purchase of a penny stock. In such situations, a broker/dealer must also, before effecting a

customer’s purchase of a penny stock, deliver to the customer an agreement to the transaction that

sets forth the identity and quantity of the penny stock to be purchased, and the broker/dealer must

receive the customer’s agreement to the transaction before effecting the transaction.

A broker/dealer must also, orally or in writing, disclose before effecting a customer’s transaction

in a penny stock (and thereafter confirm in writing):

| • | the bid and offer price quotes in and for the penny stock, and the number of shares

to which the quoted prices apply, |

||

| • | the brokerage firm’s compensation for the trade, and |

||

| • | the compensation received by the brokerage firm’s sales person for the trade. |

6

Table of Contents

In addition, subject to limited exceptions, a brokerage firm must send to its customers trading in

penny stocks a monthly account statement that provides the identity and number of shares of each

penny stock in the customer’s account and the current estimated market value of such stock, to the

extent such market value may be determined. The Commission’s rules may have the effect of reducing trading activity of our common stock in the

secondary market and, consequently, may limit your ability to resell any shares you may purchase.

We cannot assure you that there will be market makers in our stock. If the number of market makers

in our stock declines, the liquidity of our common stock could be impaired. This could affect the

number of shares of common stock which can be bought and sold, and could also result in delays in

the timing of transactions and lower prices for the common stock than might otherwise prevail.

Further, the lack of market makers could result in persons being unable to buy or sell shares of

our common stock on any secondary market.

We may have liabilities as a member of our Principal Stockholder’s consolidated tax group.

We are a member of our Principal Stockholder’s consolidated tax group under the Federal income tax

laws and will continue to be a member until the securities held by our Principal Stockholder no

longer constitute 80 percent or more of either the voting power or the market value of our

outstanding stock. Each member of a consolidated group for Federal income tax purposes is jointly

and severally liable for the Federal income tax liability of each other member of the consolidated

group. Similar rules may apply under state income tax laws. Although we have a tax sharing and

indemnity agreement with our Principal Stockholder, if our Principal Stockholder or members of its

consolidated tax group (other than us) fail to pay tax liabilities arising prior to the time we are

no longer a member of our Principal Stockholder’s consolidated tax group, we could be required to

make payments in respect of these tax liabilities and these payments could materially adversely

affect our financial condition.

Because we do not intend to pay any cash dividends on our common stock, holders of our common stock

will not be able to receive a return on their shares unless they sell their shares.

We have paid no dividends on our common stock. We do not anticipate paying any cash dividends on

our common stock in the foreseeable future. Unless we pay dividends, holders of our common stock

will not be able to receive a return on their shares unless they sell them, which could be

difficult unless a more active market develops in our stock.

The anti-takeover provisions in our corporate documents may have an adverse effect on the market

price of our common stock.

Provisions in our charter and by-laws could make it more difficult for a third party to gain

control of us, even if a change in control might be beneficial to our stockholders. This could

adversely affect the market price of our common stock. These provisions include:

| • | the elimination of the right to act by written consent by stockholders after our

Principal Stockholder no longer holds a controlling interest in us; |

||

| • | the elimination of the right to call special meetings of the stockholders by

stockholders except that our Principal Stockholder may do so as long as it holds a

controlling interest in us; |

||

| • | the existence of a staggered board of directors; and |

||

| • | the ability of our board of directors to designate, determine the rights and

preferences of, and to issue preferred stock, without stockholder consent, which could

adversely affect the rights of our common stockholders. |

7

Table of Contents

A substantial amount of our common stock is eligible for sale into the market and this could

depress our stock price.

Sales of a substantial number of shares of our common stock in the future could cause the market

price of our common stock to decline. As of the date of this report, we have outstanding 50,004,474

shares of common stock, of which our Principal Stockholder owns 48,972,258 shares and the Harbinger

Parties own 758,647 shares, with the remainder owned by public stockholders. Additionally, we have

3,000,000 shares of common stock reserved for issuance under our 1999 Long-Term Incentive Plan. As

of February 21, 2011, we had no stock options outstanding and 3,000,000 shares available for

issuance under the plan.

All of our shares distributed to stockholders on November 12, 1999 are freely tradable without

restriction or further registration under the Federal securities laws unless acquired by our

“affiliates,” as that term is defined in Rule 144 under the Securities Act. All of the shares held

by our Principal Stockholder are “restricted securities” under the Securities Act and are subject

to restrictions on resale. All of the shares held by the Harbinger Parties that were purchased on

July 9, 2009 are “restricted securities” under the Securities Act and are subject to restrictions

on resale.

We have registered 1,000,000 shares of our common stock for resale by our Principal Stockholder

from time to time under a separate registration statement. We have also granted our Principal

Stockholder registration rights with respect to all of its shares. These registration rights

effectively allow our Principal Stockholder to register and publicly sell all of its shares at any

time and to participate as a selling stockholder in future public offerings by the Company.

Section 404 of the Sarbanes-Oxley Act of 2002 requires us to document and test our internal

controls over financial reporting and to report on our assessment as to the effectiveness of these

controls. Any delays or difficulty in satisfying these requirements or negative reports concerning

our internal controls could adversely affect our future results of operations and our stock price.

We may in the future discover areas of our internal controls that need improvement, particularly

with respect to businesses that we may acquire in the future. We cannot be certain that any

remedial measures we take will ensure that we implement and maintain adequate internal controls

over our financial reporting processes and reporting in the future. Any failure to implement

required new or improved controls, or difficulties encountered in their implementation, could harm

our operating results or cause us to fail to meet our reporting obligations. If we are unable to

conclude that we have effective internal controls over financial reporting, investors could lose

confidence in the reliability of our financial statements, which could result in a decrease in the

market price of our common stock. Failure to comply with Section 404 could potentially subject us

to sanctions or investigations by the Commission, or other regulatory authorities, which could also

result in a decrease in the market price of our common stock.

| Item 1B. | Unresolved Staff Comments |

None.

| Item 2. | Properties |

The Company’s headquarters are located in New York, New York, in space we share with our Principal

Stockholder. Our Principal Stockholder has advised the Company that it has waived its rights to

collect rent until future notice.

| Item 3. | Legal Proceedings |

None.

| Item 4. | (Removed and Reserved) |

8

Table of Contents

PART II

| Item 5. | Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities |

Market Information and Dividends

Our common stock began trading on November 30, 1999 on the OTCBB under the symbol “ZPCM.” The

OTCBB is a regulated quotation service that displays real-time quotes, last-sale prices and volume

information in over-the-counter equity securities. The OTCBB market quotations reflect

inter-dealer prices, without retail mark up, mark down or commission, and are not necessarily

representative of actual transactions, and may not be indicative of the value of the common stock

or the existence of an active market. Historically, the level of trading in our common stock has

been sporadic and limited and there is no assurance that an active trading market will develop

which will provide liquidity for the Company’s stockholders.

The following table presents quarterly high and low bid and sale prices for the Company’s common

stock reported by the OTCBB for the three months ended:

| Bid Information(1) | Sales Price(1) | |||||||||||||||

| High Bid | Low Bid | High Price | Low Price | |||||||||||||

12/31/10 |

$ | — | $ | — | $ | 0.20 | $ | 0.07 | ||||||||

09/30/10 |

0.00 | 0.00 | 0.13 | 0.00 | ||||||||||||

06/30/10 |

— | — | 0.20 | 0.02 | ||||||||||||

03/31/10 |

0.11 | 0.00 | 0.15 | 0.00 | ||||||||||||

12/31/09 |

0.26 | 0.10 | 0.26 | 0.10 | ||||||||||||

09/30/09 |

0.10 | 0.00 | 0.35 | 0.00 | ||||||||||||

06/30/09 |

0.05 | 0.04 | 0.25 | 0.04 | ||||||||||||

03/31/09 |

0.04 | 0.04 | 0.04 | 0.04 | ||||||||||||

| (1) | As reflected in the ZPCM-Zap.Com Corp OTC Bulletin Board® Quarterly Trade and Quote Summary

Reports for the years ending December 31, 2010 and December 31, 2009. |

As of March 8, 2011, there were approximately 1,188 holders of record of our common stock.

This number does not include the stockholders for whom shares are held in a “nominee” or “street”

name.

We have never declared or paid cash dividends on our common stock and we do not anticipate paying

any cash dividends in the foreseeable future. The payment of any future dividends will be at the

discretion of our board of directors and will depend upon a number of factors including future

earnings, the success of our business activities, capital requirements, the general financial

condition and future prospects of any business that we acquire, general business conditions and

such other factors as our board of directors may deem relevant.

9

Table of Contents

Securities Authorized for Issuance under Equity Compensation Plans

The following table sets forth information with respect to compensation plans under which our

equity securities are authorized for issuance as of December 31, 2010:

| Number of Securities to | Weighted-Average | Number of Securities Remaining | ||||||||||

| be Issued Upon Exercise | Exercise Price of | Available for Future Issuance Under | ||||||||||

| of Outstanding Options, | Outstanding Options, | Equity Compensation Plans (Excluding | ||||||||||

| Plan category | Warrants and Rights | Warrants and Rights | Securities Reflected in Column (a)) | |||||||||

| (a) | (b) | (c) | ||||||||||

Equity compensation

plans approved by

securities holders |

— | $ | — | 3,000,000 | ||||||||

Equity compensation

plans not approved

by security holders |

— | — | — | |||||||||

Total |

— | $ | — | 3,000,000 | ||||||||

Performance Graph

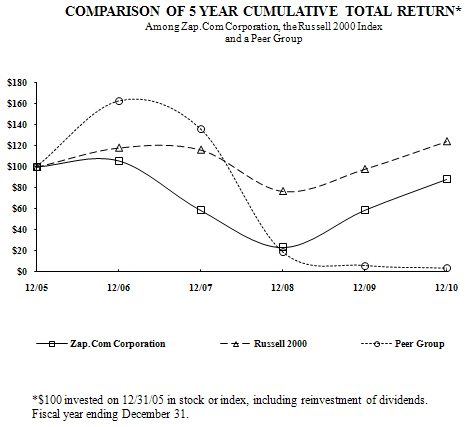

Set forth below is a line-graph presentation comparing the cumulative stockholder return on our common stock against cumulative

total returns of the following: (a) the Russell 2000 and (b) a peer group of companies compiled from the SIC Code 6726

(Unit Trust & C E Investments) with small market capitalizations. The performance graph shows total return on investment for the

period beginning December 31, 2005 and ending December 31, 2010.

The Company was not able to identify a published industry or line-of-business index that it thinks is comparable to both the Company's

business and assets and its limited market capitalization. Instead, the Company selected a peer group, in good faith, consisting of

the following companies: Navios Maritime Acquisition Corp., Black Diamond Inc., Ameriwest Petroleum Corp., 57th Saint General

Acquisition Corp., Motors Liquidation Company, Comdisco Holding Company Inc., Omni Ventures Inc., Arete Industries Inc., National

Patent Development Corp. and Fifth Season International Inc. Zap.Com chose these companies because their market capitalizations

are small and they are identified by third parties with the SIC Code 6726 (Unit Trust & C E Investments). The Company believes

that unit trusts, which are fixed portfolios of income-producing securities, most closely resemble Zap.Com's operations.

The Company believes that this group of companies provides a reasonable basis for comparing total stockholder returns.

The stockholder return shown on the graph below is not necessarily indicative of future performance, and we will not make or endorse any predictions as to future stockholder returns. The graph and related data were furnished by Research Data Group, Inc.

| Item 6. | Selected Financial Data |

The following table sets forth certain selected financial data derived from our financial

statements for the periods and as of the dates presented. The following information should be read

in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of

Operations” and the financial statements and notes thereto included in Item 7 and referenced in Item 8 of this

report, respectively.

| Year Ended December 31, | ||||||||||||||||||||

| 2010 | 2009 | 2008 | 2007 | 2006 | ||||||||||||||||

Income Statement Data: |

||||||||||||||||||||

Revenues |

$ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||

Operating loss |

(146,200 | ) | (180,385 | ) | (84,147 | ) | (160,451 | ) | (133,135 | ) | ||||||||||

Interest income |

223 | 576 | 29,743 | 84,902 | 83,947 | |||||||||||||||

Net loss |

(145,977 | ) | (179,809 | ) | (48,207 | ) | (75,549 | ) | (49,188 | ) | ||||||||||

Net loss per share-basic and

diluted |

(0.00 | ) | (0.00 | ) | (0.00 | ) | (0.00 | ) | (0.00 | ) | ||||||||||

Weighted average common

shares outstanding |

50,004,474 | 50,004,474 | 50,004,474 | 50,004,474 | 50,004,474 | |||||||||||||||

Balance Sheet Data (as of year end): |

||||||||||||||||||||

Cash and cash equivalents |

$ | 546,407 | $ | 1,441,166 | $ | 1,597,007 | $ | 1,686,624 | $ | 1,724,351 | ||||||||||

Total assets |

1,296,032 | 1,441,166 | 1,597,007 | 1,689,460 | 1,728,350 | |||||||||||||||

Total liabilities |

886 | 15,968 | 3,018 | 60,988 | 52,618 | |||||||||||||||

Total stockholders’ equity |

1,295,146 | 1,425,198 | 1,593,989 | 1,628,472 | 1,675,732 | |||||||||||||||

10

Table of Contents

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operation |

Overview

The Company was formed for the purpose of creating and operating a global network of independently

owned web sites. Our Principal Stockholder, Harbinger Group Inc., holds approximately 98% of our

outstanding common stock. Currently, we have no business operations, other than complying with

reporting requirements under the Exchange Act. We may search for assets or businesses that we can

acquire so we can become an operating company.

We have broad discretion in identifying and selecting both the industries and the possible

acquisition or business combination opportunities. We have not identified a specific industry to

focus on and have no present plans, proposals, arrangements or understandings with respect to a

business combination or acquisition of any specific business. There can be no assurance that we

will be able to identify or successfully complete any such transactions. As of the date of this

report, we are not a party to any agreements providing for a business combination or other

acquisition of assets. We may pay acquisition consideration in the form of cash, debt or equity

securities or a combination thereof. In addition, as a part of our acquisition strategy we may

consider raising additional capital through the issuance of equity or debt securities, including

the issuance of preferred stock.

The following discussion of the financial condition and results of operations of the Company should

be read in conjunction with the financial statements and notes thereto included elsewhere in this

report. This discussion contains forward-looking statements which involve risks and uncertainties.

The Company’s actual results may differ materially from those anticipated in these forward-looking

statements as a result of certain factors, including, but not limited to, those set forth under

“Part 1—Item 1A. Risk Factors”.

Results of Operations

For the years ended December 31, 2010, 2009, and 2008, our operations consisted of the following:

Revenues. We had no revenues for the years ended December 31, 2010, 2009

and 2008, and we do not presently have any revenue-generating business.

Cost of revenues. We had no cost of revenues for the years ended December 31, 2010, 2009 and 2008.

General and administrative expenses. General and administrative expenses consist primarily of

legal and accounting professional services, printing and filing costs, expenses allocated by our

Principal Stockholder under a services agreement, and various other costs. General and

administrative expenses for the year ended December 31, 2010 were $146,000 compared to $180,000 and

$84,000 for the years ended December 31, 2009 and 2008, respectively. The $34,000 decrease in

general and administrative expenses for the year ended December 31, 2010 compared to the year ended

December 31, 2009 is due primarily to a decrease in professional fees. The $96,000 increase in

general and administrative expenses for the year ended December 31, 2009 compared to the year ended

December 31, 2008 was due primarily to an increase in professional fees and printing and filing

costs associated with our Exchange Act filings.

Interest income. Interest income was $200, $600 and $30,000 for the years ended December 31, 2010, 2009 and 2008, respectively. Our interest income will continue to be negligible

while our cash is maintained in bank accounts or invested in U.S. Government instruments with

nominal interest rates.

Liquidity and Capital Resources

We have not generated any significant revenue since inception. As a result, our primary source of

liquidity has been from our initial capitalization and, to a lesser extent, the interest income

generated on our cash equivalents and short-term investments. As we limit our investments

principally to U.S. Government instruments, we do not expect to earn significant interest income in

the near term. As of December 31, 2010, our cash and cash equivalents were $546,000 and we held

$750,000 in short-term investments.

11

Table of Contents

Since our inception, we have utilized services of the management and staff and occupied office

space of our Principal Stockholder under a shared services agreement that allocated these costs.

Since May 1, 2000, our Principal Stockholder has waived its rights under the services agreement to

be reimbursed these costs. For each of the years ended December 31, 2010, 2009 and 2008, we

recorded approximately $16,000, $11,000 and $14,000, respectively, as contributed capital for these

services.

We believe that we have sufficient resources to satisfy our existing liabilities and our

anticipated operating expenses for the next twelve months. Until such time as we actively pursue a

business combination or asset acquisition, we expect these expenses to consist mainly of general

and administrative expenses incurred in connection with maintaining our status as a publicly traded

company. We have no commitments for capital expenditures and foresee none, except for possible

future business combinations or asset acquisitions. In order to effect a business combination or

asset acquisition, however, we may need additional financing. There is no assurance that any such

financing will be available or available on terms favorable or acceptable to us.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements as of December 31, 2010 that have or are

reasonably likely to have a current or future material effect on our financial position, results of

operations or cash flows.

Summary of Cash Flows

Cash used in operating activities was $145,000 for the year ended December 31, 2010 compared to

$156,000 for the year ended December 31, 2009. The $11,000 decrease in cash used in operating

activities resulted primarily from a decrease in general and administrative payments.

Cash used in operating activities was $156,000 for the year ended December 31, 2009 compared to

$90,000 for the year ended December 31, 2008. The $66,000 increase in cash used in operating

activities resulted primarily from increased general and administrative payments and lower interest

income in 2009 compared to 2008.

Cash used in investing activities for the year ended December 31, 2010 of $750,000 represents the

purchase of a short-term investment that is classified as held-to-maturity. We had no cash flows

from investing activities for the year ended December 31, 2009. Cash flows from investing

activities for the year ended December 31, 2008, which netted to zero, were the result of purchases

and maturities of short-term investments that were held-to-maturity. All highly liquid

investments with original maturities of three months or less are considered to be cash equivalents

and all investments with original maturities greater than three months are classified as either

short-term or long-term investments.

We had no cash flows from financing activities for the years ended December 31, 2010, 2009 or 2008.

Recent Accounting Pronouncements Not Yet Adopted

As of the date of this report, there are no recent accounting pronouncements that have not yet been

adopted that we believe may have a material impact on our financial statements.

Critical Accounting Policies

The discussion and analysis of our financial condition, liquidity and results of operations are

based upon our financial statements, which have been prepared in accordance with accounting

principles generally accepted in the United States of America. The preparation of these financial

statements requires management to make estimates and assumptions that affect amounts reported

therein. The following lists our current accounting policies involving significant management

judgment and provides a brief description of these policies:

Valuation allowance for deferred income taxes. We reduce our deferred tax assets to an amount that

we believe is more likely than not to be realized. In so doing, we estimate future taxable income

in determining if any valuation allowance is necessary. As a result, we had a full valuation

allowance against our deferred tax assets, totaling $87,000, as of December 31, 2010.

12

Table of Contents

We also apply the accounting guidance for uncertain tax positions which prescribes a minimum

recognition threshold a tax position is required to meet before being recognized in the financial

statements. It also provides information on derecognition, measurement, classification, interest

and penalties, accounting in interim periods, disclosure and transition. We believe that we had no

uncertain tax positions as of December 31, 2010 which would be required to be recognized in our

financial statements.

Contractual Obligations

The Company does not have any long-term debt obligations, capital lease obligations, operating

lease obligations or purchase obligations.

| Item 7A. | Quantitative and Qualitative Disclosures about Market Risk |

We do not have any market risk exposure to changes in interest rates, foreign currency exchange

rates, equity prices or commodity prices at December 31, 2010. At that date, our investments

consist entirely of U.S Treasury securities with maturities of less than one year that are being

held to maturity. We had no outstanding derivative instruments or long-term debt at December 31, 2010.

| Item 8. | Financial Statements and Supplementary Data |

The Reports of Independent Registered Public Independent Accounting Firms, the Company’s financial

statements and notes to the Company’s financial statements appear in a separate section of this

Form 10-K (beginning on Page F-2 following Part IV). The index to the Company’s financial

statements appears on Page F-1.

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

None.

| Item 9A. | Controls and Procedures |

Evaluation of Disclosure Controls and Procedures

An evaluation was performed under the supervision of the Company’s management, including the Chief

Executive Officer (“CEO”) and Chief Financial Officer (“CFO”), of the effectiveness of the design

and operation of the Company’s disclosure controls and procedures (as defined in the Exchange Act

Rules 13a-15(e) and 15d-15(e)) as of the end of the period covered by this report. Based on that

evaluation, the Company’s management, including the CEO and CFO, concluded that, as of December 31,

2010, the Company’s disclosure controls and procedures were effective to ensure that information we

are required to disclose in reports that we file or submit under the Exchange Act is recorded,

processed, summarized and reported within the time periods specified in the SEC’s rules and

forms, and is accumulated and communicated to the Company’s management, including the Company’s CEO and

CFO, as appropriate to allow timely decisions regarding required disclosure.

Notwithstanding the foregoing, there can be no assurance that the Company’s disclosure controls and

procedures will detect or uncover all failures of persons within the Company to disclose material

information otherwise required to be set forth in the Company’s periodic reports. There are

inherent limitations to the effectiveness of any system of disclosure controls and procedures,

including the possibility of human error and the circumvention or overriding of the controls and

procedures. Accordingly, even effective disclosure controls and procedures can only provide

reasonable, not absolute, assurance of achieving their control objectives.

Management’s Report on Internal Control Over Financial Reporting

The Company’s management is responsible for establishing and maintaining adequate internal control

over financial reporting for the Company, as such term is defined in Exchange Act Rule 13a-15(f).

Internal control over financial reporting is a process designed to provide reasonable assurance

regarding the reliability of financial reporting and the preparation of financial statements for

external purposes in accordance with generally accepted accounting principles. Internal control

over financial reporting includes those policies and procedures that (1) pertain to the maintenance

of records that, in reasonable detail, accurately and fairly reflect the transactions and

dispositions of the

Company’s assets; (2) provide reasonable assurance that transactions are recorded as necessary to

permit preparation of the financial statements in accordance with generally accepted accounting

principles, and that receipts and expenditures are being made only with proper authorizations; and

(3) provide reasonable assurance regarding prevention or timely detection of unauthorized

acquisition, use or disposition of the Company’s assets that could have a material effect on the

financial statements.

13

Table of Contents

Because of its inherent limitations, internal control over financial reporting may not prevent or

detect misstatements. These inherent limitations are an intrinsic part of the financial reporting

process. Therefore, although the Company’s management is unable to eliminate this risk, it is

possible to develop safeguards to reduce it. Also, projections of any evaluation of effectiveness

to future periods are subject to the risk that controls may become inadequate because of changes in

conditions, or that the degree of compliance with the policies or procedures may deteriorate.

The Company’s management, under the supervision of and with the participation of the Chief

Executive Officer and the Chief Financial Officer, assessed the effectiveness of the Company’s

internal control over financial reporting as of December 31, 2010 based on criteria for effective

control over financial reporting described in Internal Control — Integrated Framework issued by

the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”). Based on this

assessment, the Company’s management concluded that its internal control over financial reporting

was effective as of December 31, 2010 in accordance with the COSO criteria.

Changes in Internal Controls Over Financial Reporting

An evaluation was performed under the supervision of the Company’s management, including the CEO

and CFO, of whether any change in the Company’s internal control over financial reporting (as

defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) occurred during quarter ended December 31,

2010. Based on that evaluation, the Company’s management, including the CEO and CFO, concluded that

no significant changes in the Company’s internal controls over financial reporting occurred during

the quarter ended December 31, 2010 that has materially affected or is reasonably likely to

materially affect, the Company’s internal control over financial reporting.

| Item 9B. | Other Information |

None.

14

Table of Contents

PART III

| Item 10. | Directors, Executive Officers and Corporate Governance, Item 11. Executive Compensation,

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder

Matters, Item 13. Certain Relationships and Related Transactions, and Director Independence and

Item 14. Principal Accounting Fees and Services. |

The information required by Items 10, 11, 12, 13 and 14 will be furnished on or prior to May 2,

2011 (and is hereby incorporated by reference) by an amendment hereto or pursuant to the Company’s

information statement relating to the election of directors pursuant to Regulation 14C that will

contain such information. Notwithstanding the foregoing, information appearing in the section

“Report of the Board of Directors” shall not be deemed to be incorporated by reference in this Form

10-K.

15

Table of Contents

PART IV

| Item 15. | Exhibits, Financial Statements and Schedules. |

| (a) | List of Documents Filed: |

| (1) | Financial Statements |

|

See Index to Financial Statements on Page F-1 following this Part IV. |

||

| (2) | Financial Statement Schedules |

|

All schedules have been omitted since they are either not applicable or the information is

contained within the accompanying financial statements. |

| (b) | Exhibits: |

| Exhibit No. | Description of Exhibits | |||

| 3.1 | Restated Articles of Incorporation of Zap.Com Corporation (“Zap.Com”) (Incorporated

herein by reference to Exhibit No. 3.1 to Zap.Com’s Registration Statement on Form S-1 (File

No. 333-76135) originally filed with the Securities and Exchange Commission on April 13, 1999,

as amended.) |

|||

| 3.2 | Amended and Restated By-laws of Zap.Com (Incorporated herein by reference to Exhibit No. 3.1

to Zap.Com’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2009 filed

November 4, 2009 (File No. 0-27729.)) |

|||

| 4.1 | Specimen Stock Certificate (Incorporated herein by reference to Exhibit No. 4.1 to Zap.Com’s

Registration Statement on Form S-1 (File No. 333-76135) originally filed with the Securities

and Exchange Commission on April 13, 1999, as amended.) |

|||

| 4.2 | Registration Rights Agreement between Zap.Com and Zapata Corporation (Incorporated herein by

reference to Exhibit No. 10.4 to Zap.Com’s Registration Statement on Form S-1 (File No.

333-76135) originally filed with the Securities and Exchange Commission on April 13, 1999, as

amended.) |

|||

| 10.1 | Investment and Distribution Agreement between Zap.Com and Zapata Corporation (Incorporated

herein by reference to Exhibit No. 10.1 to Zap.Com’s Registration Statement on Form S-1 (File

No. 333-76135) originally filed with the Securities and Exchange Commission on April 13, 1999,

as amended.) |

|||

| 10.2 | Services Agreement between Zap.Com and Zapata Corporation (Incorporated herein by reference

to Exhibit No. 10.2 to Zap.Com’s Registration Statement on Form S-1 (File No. 333-76135)

originally filed with the Securities and Exchange Commission on April 13, 1999, as amended.) |

|||

| 10.3 | Amended and Restated Tax Sharing and Indemnity Agreement between Zap.Com and Zapata

Corporation (Incorporated herein by reference to Exhibit 10.3 to Zap.Com’s Annual Report on

Form 10-K for the Year Ended December 31, 2007 as filed with the Securities and Exchange

Commission on March 7, 2008 (File No. 000-27729.) |

|||

| 10.4 | Form of Indemnification Agreement by and among Zapata Corporation and Zap.Com and

the Directors or Officers of Zapata Corporation and Zap.Com (Incorporated herein by reference

to Exhibit 10.1 to Zap.Com’s Quarterly Report on Form 10-Q for the quarter ended September 30,

2009 filed November 4, 2009 (File No. 0-27729.) |

|||

| 10.5 | Amended and Restated 1999 Long-Term Incentive Plan of Zap.Com (Incorporated herein by

reference to Exhibit 4.2 to Zap.Com’s Annual Report on Form 10-K for the Year Ended December

31, 2005 as filed with the Securities and Exchange Commission on March 14, 2006 (File No.

000-27729.)) |

|||

16

Table of Contents

| Exhibit No. | Description of Exhibits | |||

| 10.6 | * | Indemnification Agreement by and between Zap.Com and Richard H. Hagerup, dated

as of December 1, 2010. |

||

| 31.1 | * | Certification of CEO Pursuant to Rule 13a-14(a) or 15d-14(a) of the Securities Exchange Act

of 1934, as Adopted Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

||

| 31.2 | * | Certification of CFO Pursuant to Rule 13a-14(a) or 15d-14(a) of the Securities Exchange Act

of 1934, as Adopted Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

||

| 32.1 | ** | Certification of CEO Pursuant to 18 U.S.C. Section 1350, as Adopted Pursuant to Section 906

of the Sarbanes-Oxley Act of 2002. |

||

| 32.2 | ** | Certification of CFO Pursuant to 18 U.S.C. Section 1350, as Adopted Pursuant to Section 906

of the Sarbanes-Oxley Act of 2002. |

||

| * | Filed herewith |

|

| ** | Furnished herewith |

17

Table of Contents

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the

Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| Zap.Com Corporation (Registrant) |

||||

| March 11, 2011 | By: | /s/ FRANCIS T. McCARRON | ||

| (Francis T. McCarron) | ||||

| Executive Vice President and Chief Financial Officer | ||||

| (on behalf of the Registrant and as Principal Financial Officer) | ||||

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed

below by the following persons on behalf of the registrant and in the capacities and on the dates

indicated.

| Signature | Title | Date | ||

/s/ PHILIP A. FALCONE

|

President and Chief Executive Officer (Principal Executive Officer) and Chairman of the Board of Directors | March 11, 2011 | ||

/s/ FRANCIS T. McCARRON

|

Executive Vice President and Chief Financial Officer (Principal Financial Officer) | March 11, 2011 | ||

/s/ RICHARD H. HAGERUP

|

Interim Chief Accounting Officer (Principal Accounting Officer) |

March 11, 2011 | ||

/s/ PETER A. JENSON

|

Director | March 11, 2011 | ||

/s/ KEITH M. HLADEK

|

Director | March 11, 2011 |

18

Table of Contents

ZAP.COM CORPORATION

INDEX TO FINANCIAL STATEMENTS

| F-2 | ||||

| F-4 | ||||

| F-5 | ||||

| F-6 | ||||

| F-7 | ||||

| F-8 | ||||

| F-8 | ||||

| F-8 | ||||

| F-9 | ||||

| F-10 | ||||

| F-10 | ||||

| F-11 | ||||

| F-11 | ||||

| F-11 | ||||

| F-12 |

F-1

Table of Contents

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders of

Zap.Com Corporation:

Zap.Com Corporation:

We have audited the accompanying balance sheet of

Zap.Com Corporation (the “Company”) as of December 31, 2010, and the related statements of

operations, changes in stockholders’ equity, and cash flows for the year then ended. These financial

statements are the responsibility of the Company’s management. Our responsibility is to express an opinion

on these financial statements based on our audit.

We conducted our audit in accordance

with the standards of the Public Company Accounting Oversight Board (United States). Those standards require

that we plan and perform the audit to obtain reasonable assurance about whether the financial

statements are free of material misstatement. An audit includes examining, on a test basis, evidence

supporting the amounts and disclosures in the financial statements. An audit also includes assessing the

accounting principles used and significant estimates made by management, as well as evaluating the

overall financial statement presentation. We believe that our audit provides a reasonable basis for

our opinion.

In our opinion, the financial statements

referred to above present fairly, in all material respects, the financial position of the Company as of

December 31, 2010, and the results of its operations and its cash flows for the year then ended, in

conformity with U.S. generally accepted accounting principles.

/s/ KPMG

New York, NY

March 11, 2011

New York, NY

March 11, 2011

F-2

Table of Contents

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders of

Zap.Com Corporation

Rochester, NY

Zap.Com Corporation

Rochester, NY

We have audited the accompanying balance sheet of Zap.com Corporation (the “Company”) as of

December 31, 2009 and the related statements of operations, changes in stockholders’ equity, and

cash flows for each of the two years in the period ended December 31, 2009. These financial

statements are the responsibility of the Company’s management. Our responsibility is to express an

opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight

Board (United States). Those standards require that we plan and perform the audit to obtain

reasonable assurance about whether the financial statements are free of material misstatement. The

Company is not required to have, nor were we engaged to perform, an audit of its internal control

over financial reporting. Our audits included consideration of internal control over financial

reporting as a basis for designing audit procedures that are appropriate in the circumstances, but

not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control

over financial reporting. Accordingly, we express no such opinion. An audit also includes

examining, on a test basis, evidence supporting the amounts and disclosures in the financial

statements, assessing the accounting principles used and significant estimates made by management,

as well as evaluating the overall financial statement presentation. We believe that our audits

provide a reasonable basis for our opinion.

In our opinion, such financial statements present fairly, in all material respects, the financial

position of Zap.Com Corporation as of December 31, 2009, and the results of its operations and its

cash flows for each of the two years in the period ended December 31, 2009, in conformity with

accounting principles generally accepted in the United States of America.

/s/ Deloitte & Touche LLP

Rochester, NY

February 26, 2010

Rochester, NY

February 26, 2010

F-3

Table of Contents

ZAP.COM CORPORATION

BALANCE SHEETS

| December 31, | December 31, | |||||||

| 2010 | 2009 | |||||||

ASSETS: |

||||||||

Current assets: |

||||||||

Cash and cash equivalents (Note 3) |

$ | 546,407 | $ | 1,441,166 | ||||

Short-term investments (Note 3) |

749,450 | — | ||||||

Interest receivable |

175 | — | ||||||

Total assets |

$ | 1,296,032 | $ | 1,441,166 | ||||

LIABILITIES AND STOCKHOLDERS’ EQUITY: |

||||||||

Current liabilities: |

||||||||

Accounts payable |

$ | 886 | $ | 6,119 | ||||

Accrued liabilities |

— | 9,849 | ||||||

Total liabilities |

886 | 15,968 | ||||||

Commitments and contingencies (Note 7) |

||||||||

Stockholders’ equity (Note 5): |

||||||||

Preferred stock, $0.01 par value, 150,000,000 shares authorized, none

issued or outstanding |

— | — | ||||||

Common stock, $0.001 par value, 1,500,000,000 shares authorized;

50,004,474 shares issued and outstanding |

50,004 | 50,004 | ||||||

Additional paid in capital |

10,941,471 | 10,925,546 | ||||||

Accumulated deficit |

(9,696,329 | ) | (9,550,352 | ) | ||||

Total stockholders’ equity |

1,295,146 | 1,425,198 | ||||||

Total liabilities and stockholders’ equity |

$ | 1,296,032 | $ | 1,441,166 | ||||

See accompanying notes to financial statements.

F-4

Table of Contents

ZAP.COM CORPORATION

STATEMENTS OF OPERATIONS

| Years Ended December 31, | ||||||||||||

| 2010 | 2009 | 2008 | ||||||||||

Revenues |

$ | — | $ | — | $ | — | ||||||

Cost of revenues |

— | — | — | |||||||||

Gross profit |

— | — | — | |||||||||

Operating expenses: |

||||||||||||

General and administrative (Note 8) |

146,200 | 180,385 | 84,147 | |||||||||

Operating loss |

(146,200 | ) | (180,385 | ) | (84,147 | ) | ||||||

Other income: |

||||||||||||

Interest income |

223 | 576 | 29,743 | |||||||||

Other, net |

— | — | 6,197 | |||||||||

| 223 | 576 | 35,940 | ||||||||||

Loss before income taxes |

(145,977 | ) | (179,809 | ) | (48,207 | ) | ||||||

Income taxes (Note 4) |

— | — | — | |||||||||

Net loss |

$ | (145,977 | ) | $ | (179,809 | ) | $ | (48,207 | ) | |||

Net loss per share —basic and diluted (Note 6) |

$ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | |||

Weighted average common shares outstanding |

50,004,474 | 50,004,474 | 50,004,474 | |||||||||

See accompanying notes to financial statements.

F-5

Table of Contents

ZAP.COM CORPORATION

STATEMENTS OF CASH FLOWS

| Years Ended December 31, | ||||||||||||

| 2010 | 2009 | 2008 | ||||||||||

Cash flows from operating activities: |

||||||||||||

Net loss |

$ | (145,977 | ) | $ | (179,809 | ) | $ | (48,207 | ) | |||

Adjustments to reconcile net loss to net cash used in

operating activities: |

||||||||||||

Contributed capital from Harbinger Group Inc. for

unreimbursed management services and rent |

15,925 | 11,018 | 13,724 | |||||||||

Changes in assets and liabilities |

||||||||||||

Interest receivable |

(175 | ) | — | 2,836 | ||||||||

Accounts payable |

(5,233 | ) | 3,251 | (20,370 | ) | |||||||

Accrued liabilities |

(9,849 | ) | 9,699 | (37,600 | ) | |||||||

Net cash used in operating activities |

(145,309 | ) | (155,841 | ) | (89,617 | ) | ||||||

Cash flows from investing activities: |

||||||||||||

Purchases of investments |

(749,450 | ) | — | (3,245,284 | ) | |||||||

Maturities of investments |

— | — | 3,245,284 | |||||||||

Net cash used in investing activities |

(749,450 | ) | — | — | ||||||||

Net decrease in cash and cash equivalents |

(894,759 | ) | (155,841 | ) | (89,617 | ) | ||||||

Cash and cash equivalents at beginning of year |

1,441,166 | 1,597,007 | 1,686,624 | |||||||||

Cash and cash equivalents at end of year |

$ | 546,407 | $ | 1,441,166 | $ | 1,597,007 | ||||||

See accompanying notes to financial statements.

F-6

Table of Contents

ZAP.COM CORPORATION

STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

| Additional | Total | |||||||||||||||||||

| Common Stock | Paid In | Accumulated | Stockholders’ | |||||||||||||||||

| Shares | Amount | Capital | Deficit | Equity | ||||||||||||||||

Balance, January 1, 2008 |

50,004,474 | $ | 50,004 | $ | 10,900,804 | $ | (9,322,336 | ) | $ | 1,628,472 | ||||||||||

Contributed capital from Harbinger Group Inc. for

unreimbursed management

services and rent (Note 8) |

— | — | 13,724 | — | 13,724 | |||||||||||||||

Net loss and comprehensive loss |

— | — | — | (48,207 | ) | (48,207 | ) | |||||||||||||

Balance, December 31, 2008 |

50,004,474 | 50,004 | 10,914,528 | (9,370,543 | ) | 1,593,989 | ||||||||||||||

Contributed capital from Harbinger Group Inc. for

unreimbursed management

services and rent (Note 8) |

— | — | 11,018 | — | 11,018 | |||||||||||||||

Net loss and comprehensive loss |

— | — | — | (179,809 | ) | (179,809 | ) | |||||||||||||

Balance, December 31, 2009 |

50,004,474 | 50,004 | 10,925,546 | (9,550,352 | ) | 1,425,198 | ||||||||||||||

Contributed capital from Harbinger Group Inc. for

unreimbursed management

services and rent (Note 8) |

— | — | 15,925 | — | 15,925 | |||||||||||||||

Net loss and comprehensive loss |

— | — | — | (145,977 | ) | (145,977 | ) | |||||||||||||

Balance, December 31, 2010 |

50,004,474 | $ | 50,004 | $ | 10,941,471 | $ | (9,696,329 | ) | $ | 1,295,146 | ||||||||||

See accompanying notes to financial statements.

F-7

Table of Contents

ZAP.COM CORPORATION

NOTES TO FINANCIAL STATEMENTS

Note 1. Business and Organization

Zap.Com Corporation (“Zap.Com” or the “Company”) was formed for the purpose of creating and

operating a global network of independently owned web sites. Harbinger Group Inc. (the Company’s

“Principal Stockholder”) is the holder of approximately 98% of Zap.Com’s outstanding common stock

and, prior to its reincorporation in December 2009, was named Zapata Corporation. Other than

complying with its reporting requirements under the Securities Exchange Act of 1934, Zap.Com has no

business operations. Zap.Com may seek assets or businesses to acquire so that it can become an

operating company.

On July 9, 2009, Harbinger Capital Partners Master Fund I, Ltd. (“Master Fund”), Global

Opportunities Breakaway Ltd. (“Global Fund”) and Harbinger Capital Partners Special Situations

Fund, L.P. (“Special Situations Fund” and, together with the Master Fund and Global Fund, the

“Harbinger Parties”) purchased 9,937,962 shares, or 51.6%, of the Principal Stockholder’s common

stock and 757,907 shares, or 1.5%, of Zap.Com’s common stock. This transaction is referred to as

the “2009 Change of Control.” The Harbinger Parties subsequently purchased 740 additional shares of

Zap.Com’s common stock and 12,099 additional shares of the Principal Stockholder’s common stock

during 2009.

On January 7, 2011, the Principal Stockholder acquired a controlling financial interest in Spectrum

Brands Holdings, Inc., a global consumer products company, from the Harbinger Parties. In

exchange, the Principal Stockholder issued 119,909,829 shares of its common stock to the Harbinger

Parties. After completing this transaction, the Harbinger Parties hold approximately 93.3% of the

outstanding common stock of the Principal Stockholder.

Management believes that Zap.Com has sufficient resources to satisfy its existing and contingent

liabilities and its anticipated operating expenses for at least the next twelve months.

Note 2. Significant Accounting Policies

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted

in the United States of America (“GAAP”) requires management to make estimates and assumptions that

affect the reported amounts of assets and liabilities at the date of the financial statements and

the reported amounts of revenues and expenses during the reporting period. Actual results reported

in future periods could differ from these estimates. The Company’s significant estimates relate to

the valuation allowance for its deferred income tax assets (see Note 4).

Cash and Cash Equivalents

The Company principally invests its excess cash in U.S. Government instruments. All highly liquid

investments with original maturities of three months or less are considered to be cash equivalents.

The Company had no cash equivalents at December 31, 2010.

Investments

The Company also invests in U.S. Government instruments with maturities greater than three months.

As the Company has both the intent and the ability to hold these securities to maturity, they are

considered held-to-maturity investments. These investments are recorded at original cost plus

accrued interest, which is included in “Interest receivable” in the accompanying balance sheets.

F-8

Table of Contents

Income Taxes

The Company recognizes deferred income tax assets and liabilities for the expected future tax

consequences of existing temporary differences between the financial reporting and tax-reporting