Attached files

| file | filename |

|---|---|

| EX-23 - EXHIBIT 23 - NATIONAL BANKSHARES INC | ex23.htm |

| EX-32.1 - EXHIBIT 32.1 - NATIONAL BANKSHARES INC | ex32i.htm |

| EX-31.1 - EXHIBIT 31.1 - NATIONAL BANKSHARES INC | ex31i.htm |

| EX-31.2 - EXHIBIT 31.2 - NATIONAL BANKSHARES INC | ex31ii.htm |

| EX-32.2 - EXHIBIT 32.2 - NATIONAL BANKSHARES INC | ex32ii.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

[x] Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

For the Fiscal Year Ended December 31, 2010

|

|

[ ] Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

For the transition period from ________ to ________.

Commission File Number: 0-15204

NATIONAL BANKSHARES, INC.

(Exact name of registrant as specified in its charter)

|

Virginia

(State of incorporation)

|

54-1375874

(I.R.S. Employer Identification No.)

|

101 Hubbard Street

P.O. Box 90002

Blacksburg, VA 24062-9002

(540) 951-6300

(Address and telephone number of principal executive offices)

|

Securities registered pursuant to Section 12(b) of the Act:

None

|

Securities registered Pursuant to Section 12(g) of the Act:

Common Stock, Par Value $1.25 per share

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [x]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [x]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [x] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T(§232.405 of this chapter) during the preceding 12 months (or for such period that the registrant was required to submit and post files). Yes [x] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [x]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “accelerated filer, large accelerated filer, and smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer [ ] Accelerated filer [x] Non-accelerated filer [ ] Smaller reporting company [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [x]

The aggregate market value of the voting common stock of the registrant held by stockholders (not including voting common stock held by Directors, Executive Officers and Corporate Governance) on June 30, 2010 (the last business day of the most recently completed second fiscal quarter) was approximately $157,991,618. As of February 23, 2011, the registrant had 6,933,474 shares of voting common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the following documents are incorporated herein by reference into the Part of the Form 10-K indicated.

|

Document

|

Part of Form 10-K into which incorporated

|

|

National Bankshares, Inc. 2010 Annual Report to Stockholders

|

Part II

|

|

National Bankshares, Inc. Proxy Statement for the 2011 Annual Meeting of Stockholders

|

Part III

|

Form 10-K

Index

|

Page

|

||

|

Item 1.

|

3

|

|

|

Item 1A.

|

8

|

|

|

Item 1B.

|

8

|

|

|

Item 2.

|

9

|

|

|

Item 3.

|

9

|

|

|

Item 4.

|

9

|

|

|

Item 5.

|

9

|

|

|

Item 6.

|

11

|

|

|

Item 7.

|

12

|

|

|

Item 7A.

|

30

|

|

|

Item 8.

|

31

|

|

|

Item 9.

|

67

|

|

|

Item 9A.

|

67

|

|

|

Item 9B.

|

68

|

|

|

Item 10.

|

68

|

|

|

Item 11.

|

68

|

|

|

Item 12.

|

69

|

|

|

Item 13.

|

69

|

|

|

Item 14.

|

69

|

|

|

Item 15.

|

70

|

|

|

71

|

||

|

76

|

2

$ in thousands, except per share data

History and Business

National Bankshares, Inc. (the Company or NBI) is a financial holding company that was organized in 1986 under the laws of Virginia and is registered under the Bank Holding Company Act of 1956. It conducts most of its operations through its wholly-owned community bank subsidiary, the National Bank of Blacksburg (NBB). It also owns National Bankshares Financial Services, Inc. (NBFS), which does business as National Bankshares Insurance Services and National Bankshares Investment Services.

The National Bank of Blacksburg

The National Bank of Blacksburg, which does business as National Bank, was originally chartered in 1891 as the Bank of Blacksburg. Its state charter was converted to a national charter in 1922 and it became the National Bank of Blacksburg. In 2004, NBB purchased Community National Bank of Pulaski, Virginia. In May, 2006, Bank of Tazewell County, a Virginia bank which since 1996 had also been a wholly-owned subsidiary of NBI, was merged with and into NBB.

NBB is community-oriented, and it offers a full range of retail and commercial banking services to individuals, businesses, non-profits and local governments from its headquarters in Blacksburg, Virginia and its twenty-four branch offices throughout southwest Virginia. NBB has telephone and internet banking and it operates twenty-five automated teller machines in its service area. Lending is focused at small and mid-sized businesses and at individuals. Loan types include commercial, agricultural, real estate, home equity and consumer. Merchant credit card services and business and consumer debit and credit cards are available. Deposit accounts offered include demand deposit accounts, money market deposit accounts, savings accounts and certificates of deposit. NBB offers other miscellaneous services normally provided by commercial banks, such as letters of credit, night depository, safe deposit boxes, travelers checks, utility payment services and automatic funds transfer. NBB conducts a general trust business that has wealth management and trust and estate services for individual and business customers.

At December 31, 2010, NBB had total assets of $1,018,622 and total deposits of $884,658. NBB’s net income for 2010 was $15,935, which produced a return on average assets of 1.62% and a return on average equity of 12.65%. Refer to Note 12 of the Notes to Consolidated Financial Statements for NBB’s risk-based capital ratios.

National Bankshares Financial Services, Inc.

In 2001, National Bankshares Financial Services, Inc. was formed in Virginia as a wholly-owned subsidiary of NBI. NBFS offers non-deposit investment products and insurance products for sale to the public. NBFS works cooperatively with Infinex Investments, Inc. to provide investments and with Bankers Insurance, LLC for insurance products. NBFS does not significantly contribute to NBI’s net income.

Operating Revenue

The percentage of total operating revenue attributable to each class of similar service that contributed 15% or more of the Company’s total operating revenue for the years ended December 31, 2010, 2009 and 2008 is set out in the following table.

|

Period

|

Class of Service

|

Percentage of

Total Revenues

|

|||

|

December 31, 2010

|

Interest and Fees on Loans

|

64.22

|

%

|

||

|

Interest on Investments

|

21.03

|

%

|

|||

|

December 31, 2009

|

Interest and Fees on Loans

|

63.38

|

%

|

||

|

Interest on Investments

|

21.62

|

%

|

|||

|

December 31, 2008

|

Interest and Fees on Loans

|

62.68

|

%

|

||

|

Interest on Investments

|

21.21

|

%

|

3

Market Area

The Company’s market area in southwest Virginia is made up of the counties of Montgomery, Giles, Pulaski, Tazewell, Wythe, Smyth and Washington. It includes the independent cities of Radford and Galax, and the portions of Carroll and Grayson Counties that are adjacent to Galax. The Company also serves those portions of Mercer County and McDowell County, West Virginia that are contiguous with Tazewell County, Virginia. Although largely rural, the market area is home to two major universities, Virginia Tech and Radford University, and to three community colleges. Virginia Tech, located in Blacksburg, Virginia, is the area’s largest employer and is the Commonwealth’s second largest university. A second state supported university, Radford University, is located nearby. State support for public colleges and universities, like Virginia Tech and Radford University, has been adversely affected by the recession and State budget considerations. As a result, the normally stable base of university employment is likely to be reduced. In recent years, Virginia Tech’s Corporate Research Center has brought a number of technology related companies to Montgomery County. However, the recession has slowed the growth of new jobs in the Center.

In addition to education, the market area has a diverse economic base, with manufacturing, agriculture, tourism, healthcare, retail and service industries all represented. Large manufacturing facilities in the region include Celanese Acetate, the largest employer in Giles County, and Volvo Heavy Trucks, the largest company in Pulaski County. Both of these firms have experienced layoffs within the past several years. During the past year, Volvo Heavy Trucks has begun to slowly re-hire some employees whose jobs were cut in the previous year in response to a rapid decline in the demand for trucks because of the economic downturn. Pulaski and Galax have in the past been centers for furniture manufacturing. However, this industry has been declining because of growing furniture imports and the loss of demand. Several furniture companies have gone out of business in the recent past. Tazewell County is largely dependent on the coal mining industry and on agriculture for its economic base. Coal production is a cyclical industry that was negatively affected by the economic decline. Montgomery County, Bluefield in Tazewell County and Abingdon in Washington County are regional retail centers and have facilities to provide basic health care for the region.

NBI’s market area offers the advantages of a good quality of life, scenic beauty, moderate climate and historical and cultural attractions. The region has some recent success attracting retirees, particularly from the Northeast and urban northern Virginia.

Because NBI’s market area is economically diverse and includes large public employers, it has historically avoided the most extreme effects of past economic downturns. However, because the current national and state economic problems have been severe and prolonged, most the Company’s market area is experiencing higher levels of unemployment and very slow economic growth. For the Company, the result is a higher number of loan defaults than its historical average and a lower loan demand.

Competition

The banking and financial services industry in NBI’s market area is highly competitive. The competitive business environment is a result of changes in regulation, changes in technology and product delivery systems and competition from other financial institutions as well as non-traditional financial services. NBB competes for loans and deposits with other commercial banks, credit unions, securities and brokerage companies, mortgage companies, insurance companies, retailers, automobile companies and other nonbank financial service providers. Many of these competitors are much larger in total assets and capitalization, have greater access to capital markets and offer a broader array of financial services than NBB. In order to compete, NBB relies upon a deep knowledge of its markets, a service-based business philosophy, personal relationships with customers, specialized services tailored to meet customers’ needs and the convenience of office locations. In addition, the bank is generally competitive with other financial institutions in its market area with respect to interest rates paid on deposit accounts, interest rates charged on loans and other service charges on loans and deposit accounts.

Organization and Employment

NBI, NBB and NBFS are organized in a holding company/subsidiary structure. Functions that serve both subsidiaries, including audit, compliance, loan review and human resources, are at the holding company level, and fees are charged to the respective subsidiary for those services.

At December 31, 2010, NBI employed 18 full time employees, NBB had 199 full time equivalent employees and NBFS had 3 full time employees.

Regulation, Supervision and Government Policy

NBI and NBB are subject to state and federal banking laws and regulations that provide for general regulatory oversight of all aspects of their operations. As a result of substantial regulatory burdens on banking, financial institutions like NBI and NBB are at a disadvantage to other competitors who are not as highly regulated, and NBI and NBB’s costs of doing business are accordingly higher. Legislative efforts to prevent a repeat of the 2008 financial crisis culminated in the Dodd-Frank Wall Street Reform Act of 2010. This legislation, together with existing and planned implementing regulations, has dramatically increased the regulatory burden on commercial banks. The burden falls disproportionately on community banks like NBB, which must devote a higher proportion of their human and other resources to compliance than do their larger competitors. The financial crisis has also heightened the examination focus by banking regulators, particularly on real estate related assets and commercial loans. In the current environment, the potential for additional laws and regulations that will impact the Company, as well as heightened examination standards with regard to asset quality, cannot be ruled out. The following is a brief summary of certain laws, rules and regulations that affect NBI and NBB.

4

National Bankshares, Inc.

NBI is a bank holding company qualified as a financial holding company under the Federal Bank Holding Company Act (BHCA), which is administered by the Board of Governors of the Federal Reserve System (the Federal Reserve). NBI is required to file an annual report with the Federal Reserve and may be required to furnish additional information pursuant to the BHCA. The Federal Reserve is authorized to examine NBI and its subsidiaries. With some limited exceptions, the BHCA requires a bank holding company to obtain prior approval from the Federal Reserve before acquiring or merging with a bank or before acquiring more than 5% of the voting shares of a bank unless it already controls a majority of shares.

The Bank Holding Company Act. Under the BHCA, a bank holding company is generally prohibited from engaging in nonbanking activities unless the Federal Reserve has found those activities to be incidental to banking. Bank holding companies also may not acquire more than 5% of the voting shares of any company engaged in nonbanking activities. Amendments to the BHCA that were included in the Gramm-Leach-Bliley Act of 1999 (see below) permitted any bank holding company with bank subsidiaries that are well-capitalized, well-managed and which have a satisfactory or better rating under the Community Reinvestment Act (see below) to file an election with the Federal Reserve to become a financial holding company. A financial holding company may engage in any activity that is (i) financial in nature (ii) incidental to a financial activity or (iii) complementary to a financial activity. Financial activities include insurance underwriting, securities dealing and underwriting and providing financial, investment or economic advising services. NBI is a financial holding company.

The Virginia Banking Act. The Virginia Banking Act requires all Virginia bank holding companies to register with the Virginia State Corporation Commission (the Commission). NBI is required to report to the Commission with respect to financial condition, operations and management. The Commission may also make examinations of any bank holding company and its subsidiaries and must approve the acquisition of ownership or control of more than 5% of the voting shares of any Virginia bank or bank holding company.

The Gramm-Leach-Bliley Act. The Gramm-Leach-Bliley Act (GLBA) permits significant combinations among different sectors of the financial services industry, allows for expansion of financial service activities by bank holding companies and offers financial privacy protections to consumers. GLBA preempts most state laws that prohibit financial holding companies from engaging in insurance activities. GBLA permits affiliations between banks and securities firms in the same holding company structure, and it permits financial holding companies to directly engage in a broad range of securities and merchant banking activities.

The Sarbanes-Oxley Act. The Sarbanes-Oxley Act (SOX) enacted major reforms of the federal securities laws intended to protect investors by improving the accuracy and reliability of corporate disclosures. It impacts all companies with securities registered under the Securities Exchange Act of 1934, including NBI. SOX creates increased responsibility for chief executive officers and chief financial officers with respect to the content of filings with the Securities and Exchange Commission. Section 404 of SOX and related Securities and Exchange Commission rules focused increased scrutiny by internal and external auditors on NBI’s systems of internal controls over financial reporting, which is designed to insure that those internal controls are effective in both design and operation. SOX sets out enhanced requirements for audit committees, including independence and expertise, and it includes stronger requirements for auditor independence and limits the types of non-audit services that auditors can provide. Finally, SOX contains additional and increased civil and criminal penalties for violations of securities laws.

Capital Requirements. The Federal Reserve has adopted risk-based capital guidelines that are applicable to NBI. The guidelines provide that the Company must maintain a minimum ratio of 8% of qualified total capital to risk-weighted assets (including certain off-balance sheet items, such as standby letters of credit). At least half of total capital must be comprised of Tier 1 capital, for a minimum ratio of Tier 1 capital to risk-weighted assets of 4%. In addition, the Federal Reserve has established minimum leverage ratio guidelines of 4% for banks that meet certain specified criteria. The leverage ratio is the ratio of Tier 1 capital to total average assets, less intangibles. NBI is expected to be a source of capital strength for its subsidiary bank, and regulators can undertake a number of enforcement actions against NBI if its subsidiary bank becomes undercapitalized. NBI’s bank subsidiary is well capitalized and fully in compliance with capital guidelines.

Bank regulators could choose to raise capital requirements for banking organizations beyond current levels. NBI is unable to predict if higher capital levels may be mandated in the future.

Emergency Economic Stabilization Act of 2008. On October 14, 2008, the U.S. Treasury announced the Troubled Asset Relief Program (TARP) under the Emergency Economic Stabilization Act of 2008. In the program, the Treasury was authorized to purchase up to $250 billion of senior preferred shares in qualifying U.S. banks, saving and loan associations and bank and savings and loan holding companies. The amount of TARP funds was later increased to $350 billion. The minimum subscription amount was 1% of risk-weighted assets and the maximum amount was the lesser of $25 billion or 3% of risk-weighted assets. NBI did not participate in TARP.

5

American Recovery and Reinvestment Act of 2009. The ARRA was enacted in 2009 and includes a wide range of programs to stimulate economic recovery. In addition, it also imposed new executive compensation and corporate governance obligations on TARP Capital Purchase Program recipients. Because NBI did not participate in TARP, it is not affected by these requirements.

Dodd-Frank Wall Street Reform and Consumer Protection Act. The Dodd-Frank Act was signed into law on July 21, 2010. Its wide ranging provisions affect all federal financial regulatory agencies and nearly every aspect of the American financial services industry. Among the provisions of the Dodd-Frank Act that directly impact the Company is the creation of an independent Consumer Financial Protection Bureau (CFPB), which has the ability to write rules for consumer protections governing all financial institutions. All consumer protection responsibility formerly handled by other banking regulators is consolidated in the CFPB. It will also oversee the enforcement of all federal laws intended to ensure fair access to credit. For smaller financial institutions such as NBI and NBB, the CFPB will coordinate its examination activities through their primary regulators.

The Dodd-Frank Act contains provisions designed to reform mortgage lending, which includes the requirement of additional disclosures for consumer mortgages. In addition, the Federal Reserve must issue new rules that will have the effect of limiting the fees charged to merchants by credit card companies for debit card transactions. The result of these rules will be to limit the amount of interchange fee income available to the Company. The Dodd-Frank Act also contains provisions that affect corporate governance and executive compensation.

Although the Dodd-Frank Act provisions themselves are extensive, the ultimate impact on the Company of this massive legislation is unknown. The Act provides that several federal agencies, including the Federal Reserve and the Securities and Exchange Commission, shall issue regulations implementing major portions of the legislation, and this process is ongoing.

The National Bank of Blacksburg

NBB is a national banking association incorporated under the laws of the United States, and the bank is subject to regulation and examination by the Office of the Comptroller of the Currency (OCC). NBB’s deposits are insured by the Federal Deposit Insurance Corporation (FDIC) up to the limits of applicable law. The OCC, as the primary regulator, and the FDIC regulate and monitor all areas of NBB’s operation. These areas include adequacy of capitalization and loss reserves, loans, deposits, business practices related to the charging and payment of interest, investments, borrowings, payment of dividends, security devices and procedures, establishment of branches, corporate reorganizations and maintenance of books and records. NBB is required to maintain certain capital ratios. It must also prepare quarterly reports on its financial condition for the OCC and conduct an annual audit of its financial affairs. OCC requires NBB to adopt internal control structures and procedures designed to safeguard assets and monitor and reduce risk exposure. While appropriate for the safety and soundness of banks, these requirements add to overhead expense for NBB and other banks.

The Community Reinvestment Act. NBB is subject to the provisions of the Community Reinvestment Act (CRA), which imposes an affirmative obligation on financial institutions to meet the credit needs of the communities they serve, including low and moderate income neighborhoods. The OCC monitors NBB’s compliance with the CRA and assigns public ratings based upon the bank’s performance in meeting stated assessment goals. Unsatisfactory CRA ratings can result in restrictions on bank operations or expansion. NBB received a “satisfactory” rating in its last CRA examination by the OCC.

The Gramm-Leach-Bliley Act. In addition to other consumer privacy provisions, the Gramm-Leach-Bliley Act (GLBA) restricts the use by financial institutions of customers’ nonpublic personal information. At the inception of the customer relationship and annually thereafter, NBB is required to provide its customers with information regarding its policies and procedures with respect to handling of customers’ nonpublic personal information. GLBA generally prohibits a financial institution from providing a customer’s nonpublic personal information to unaffiliated third parties without prior notice and approval by the customer.

The USA Patriot Act. The USA Patriot Act (Patriot Act) facilitates the sharing of information among government entities and financial institutions to combat terrorism and money laundering. The Patriot Act imposes an obligation on NBB to establish and maintain anti-money laundering policies and procedures, including a customer identification program. The bank is also required to screen all customers against government lists of known or suspected terrorists. There is additional regulatory oversight to insure compliance with the Patriot Act.

Consumer Laws and Regulations. There are a number of laws and regulations that regulate banks’ consumer loan and deposit transactions. Among these are the Truth in Lending Act, the Truth in Savings Act, the Expedited Funds Availability Act, the Equal Credit Opportunity Act, the Fair Housing Act, the Fair Credit Reporting Act, the Electronic Funds Transfer Act and the Fair Debt Collections Practices Act. NBB is required to comply with these laws and regulations in its dealings with customers. There are numerous disclosure and other compliance requirements associated with the consumer laws and regulations.

6

Deposit Insurance. NBB has deposits that are insured by the Federal Deposit Insurance Corporation (FDIC). FDIC maintains a Deposit Insurance Fund (DIF) that is funded by risk-based insurance premium assessments on insured depository institutions. Assessments are determined based upon several factors, including the level of regulatory capital and the results of regulatory examinations. FDIC may adjust assessments if the insured institution’s risk profile changes or if the size of the DIF declines in relation to the total amount of insured deposits. In 2009, because of the troubled economy and the number of failed banks nationwide, there was pressure on the reserve ratio of the DIF. In order to rebuild the Fund and to help maintain public confidence in the banking system, on June 30, 2009, the FDIC imposed a special assessment of five basis points of NBB’s FDIC insured assets, minus Tier 1 capital. The special assessment, which was in addition to regular DIF assessments was payable on September 30, 2009. In an effort to further strengthen the Fund, on November 12, 2009 the FDIC adopted a rule requiring insured depository institutions (including NBB) to prepay their estimated quarterly regular risk-based assessments for the fourth quarter of 2009, and for all of 2010, 2011 and 2012 on December 30, 2009. These changes in FDIC assessments have resulted in significant increased costs to NBB.

On May 20, 2009, the FDIC announced that the increase in deposit insurance to at least $250,000 from $100,000, which became effective in October 2008, would be extended to December 31, 2013.

FDIC announced its Transaction Account Guarantee Program on October 14, 2008. On July 21, 2010, the Dodd-Frank Act made the increase permanent and made it retroactive to January 1, 2008. The Transaction Account Guarantee Program, which was a part of the Temporary Liquidity Guarantee Program, provided unlimited coverage for noninterest bearing deposit accounts for FDIC-insured institutions that elected to participate. NBB elected to participate in this program, and its DIF assessments increased to reflect the additional FDIC coverage. The Dodd-Frank Act expanded the program to all FDIC insured depository institutions and extended it until December 31, 2012.

After giving primary regulators an opportunity to first take action, FDIC may initiate an enforcement action against any depository institution it determines is engaging in unsafe or unsound actions or which is in an unsound condition, and the FDIC may terminate that institution’s deposit insurance. NBB has no knowledge of any matter that would threaten its FDIC insurance coverage.

Capital Requirements. The same capital requirements that are discussed above with relation to NBI are applied to NBB by the OCC. The OCC guidelines provide that banks experiencing internal growth or making acquisitions are expected to maintain strong capital positions well above minimum levels, without reliance on intangible assets.

Limits on Dividend Payments. A significant portion of NBI’s income is derived from dividends paid by NBB. As a national bank, NBB may not pay dividends from its capital, and it may not pay dividends if the bank would become undercapitalized, as defined by regulation, after paying the dividend. Without prior OCC approval, NBB’s dividend payments in any calendar year are restricted to the bank’s retained net income for that year, as that term is defined by the laws and regulations, combined with retained net income from the preceding two years, less any required transfer to surplus.

The OCC and FDIC have authority to limit dividends paid by NBB if the payments are determined to be an unsafe and unsound banking practice. Any payment of dividends that depletes the bank’s capital base could be deemed to be an unsafe and unsound banking practice.

Branching. As a national bank, NBB is required to comply with the state branch banking laws of Virginia, the state in which the bank is located. NBB must also have the prior approval of OCC to establish a branch or acquire an existing banking operation. Under Virginia law, NBB may open branch offices or acquire existing banks or bank branches anywhere in the state. Virginia law also permits banks domiciled in the state to establish a branch or to acquire an existing bank or branch in another state. The Dodd-Frank Act permits the OCC to approve applications by national banks like NBB to establish de novo branches in any state in which a bank located in that state is permitted to establish a branch.

Monetary Policy

The monetary and interest rate policies of the Federal Reserve, as well as general economic conditions, affect the business and earnings of NBI. NBB and other banks are particularly sensitive to interest rate fluctuations. The spread between the interest paid on deposits and that which is charged on loans is the most important component of the bank’s earnings. In addition, interest earned on investments held by NBI and NBB has a significant effect on earnings. As conditions change in the national and international economy and in the money markets, the Federal Reserve’s actions, particularly with regard to interest rates, can impact loan demand, deposit levels and earnings at NBB. It is not possible to accurately predict the effects on NBI of economic and interest rate changes.

Other Legislative and Regulatory Concerns

Particularly because of uncertain economic conditions and the current political environment, federal and state laws and regulations are regularly proposed that could affect the regulation of financial institutions. New regulations could add to the regulatory burden on banks and other financial service providers and increase the costs of compliance, or they could change the products that can be offered and the manner in which financial institutions do business. We cannot foresee how regulation of financial institutions may change in the future and how those changes might affect NBI.

7

Company Website

NBI maintains a website at www.nationalbankshares.com. The Company’s annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports are made available on its website as soon as is practical after the material is electronically filed with the Securities and Exchange Commission. The Company’s proxy materials for the 2011 annual meeting of stockholders are also posted on a separate website at www.nationalbanksharesproxy.com.

If recovery from the economic downturn is delayed, our credit risk will increase and there could be greater loan losses.

A slow economic recovery is likely to result in a higher rate of business closures and increased job losses in the region in which we do business. In addition, reduced State funding for the public colleges and universities that are large employers in our market area could have an adverse effect on employment levels and on the area’s economy. These factors would increase the likelihood that more of our customers would become delinquent or default on their loans. A higher level of loan defaults could result in higher loan losses, which could adversely affect our performance.

An extended economic recovery could increase the risk of losses in our investment portfolio.

We hold both corporate and municipal bonds in our investment portfolio. A slow recovery could increase the actual or perceived risk of default by both corporate and government issuers and, in either case, could adversely affect the value of these investments.

If the real estate market remains depressed for an extended period, our business could be negatively affected.

A depressed real estate market can impact us in several ways. First, the demand for new real estate loans will decline, and existing loans may become delinquent. In addition, if there is a general devaluation in real estate, loan collateral values will decline.

Market interest rates are currently low. If market interest rates rise, our net interest income can be negatively affected in the short term.

The direction and speed of interest rate changes affect our net interest margin and net interest income. In the short term, rising interest rates may negatively affect our net interest income, because our interest-bearing liabilities (generally deposits) reprice sooner than our interest-earning assets (generally loans).

A large number of bank failures nationwide could significantly increase the cost of FDIC insurance.

Since insured depositary institutions, including our bank, bear the full cost of deposit insurance provided by FDIC, a high number of bank failures could put additional pressure on a stressed Deposit Insurance Fund. This possibility could in turn lead to higher assessments that could negatively impact our earnings.

If more competitors come into our market area, our business could suffer.

The financial services industry in our market area is highly competitive, with a number of commercial banks, credit unions, insurance companies and stockbrokers seeking to do business with our customers. If there is additional competition from new business or if our existing competitors focus more attention on our market, we could lose customers and our business could suffer.

Additional laws and regulations could lead to a significant increase in our regulatory burden.

The Dodd-Frank Act and its implementing regulations will result in greater compliance costs and may reduce the profitability of some of our products and services. Both federal and state governments could enact new laws affecting financial institutions that would increase our regulatory burden and could negatively affect our profits.

New laws and regulations could limit our sources of noninterest income.

New laws and regulations could limit our ability to offer certain profitable products and services or require that we offer unprofitable products and services. This could have a negative effect on the level of noninterest income.

Intense oversight by regulators could result in stricter requirements and higher overhead costs.

The regulatory environment could cause financial industry regulators to impose additional requirements, such as higher capital limits, which would impact the Company’s earnings.

There are none.

8

NBB owns and has a branch bank in NBI’s headquarters building located at 101 Hubbard Street, Blacksburg, Virginia. The bank’s main office is at 100 South Main Street, Blacksburg, Virginia. NBB owns an additional nineteen branch offices and it leases four. NBI owns a building in Pulaski, Virginia that is rented. We believe that existing facilities are adequate for current needs and to meet anticipated growth.

NBI, NBB, and NBFS are not currently involved in any material pending legal proceedings.

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Common Stock Information and Dividends

National Bankshares, Inc.’s common stock is traded on the NASDAQ Capital Market under the symbol “NKSH”. As of December 31, 2010, there were 837 record stockholders of NBI common stock. The following is a summary of the market price per share and cash dividend per share of the common stock of National Bankshares, Inc. for 2010 and 2009.

Common Stock Market Prices

|

2010

|

2009

|

Dividends per share

|

||||||||||||||||||||||

|

High

|

Low

|

High

|

Low

|

2010

|

2009

|

|||||||||||||||||||

|

First Quarter

|

$ | 29.15 | 23.01 | $ | 20.50 | 17.91 | $ | --- | $ | --- | ||||||||||||||

|

Second Quarter

|

28.50 | 22.96 | 25.80 | 18.51 | 0.44 | 0.41 | ||||||||||||||||||

|

Third Quarter

|

25.88 | 21.76 | 26.90 | 24.27 | --- | --- | ||||||||||||||||||

|

Fourth Quarter

|

32.28 | 25.39 | 29.21 | 25.08 | 0.47 | 0.43 | ||||||||||||||||||

NBI’s primary source of funds for dividend payments is dividends from its bank subsidiary, NBB. Bank dividend payments are restricted by regulators, as more fully disclosed in Note 11 of Notes to Consolidated Financial Statements.

On May 12, 2010, NBI’s Board of Directors approved the repurchase of up to 100,000 shares of equity securities that are registered by the Company pursuant to Section 12 of the Securities Exchange Act of 1934. During the fourth quarter of 2010 there were no shares repurchased, and 100,000 shares may yet be purchased under the program.

9

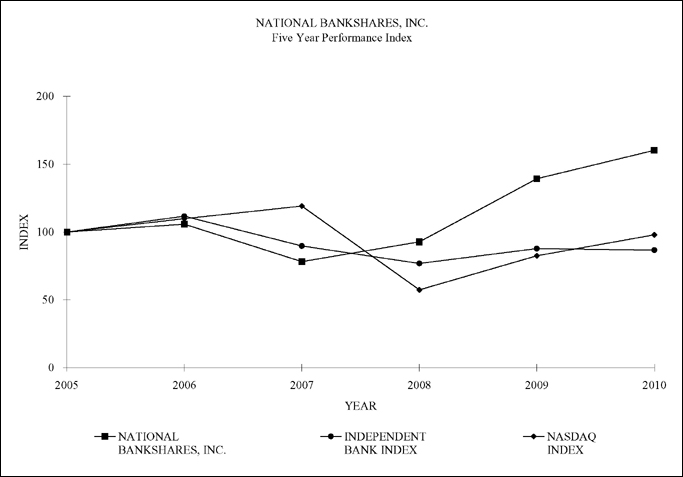

Stock Performance Graph

The following graph compares the yearly percentage change in the cumulative total of stockholder return on NBI common stock with the cumulative return on the NASDAQ Index and a peer group index comprised of southeastern independent community banks and bank holding companies for the five-year period commencing on December 31, 2005. These comparisons assume the investment of $100 in National Bankshares, Inc. common stock in each of the indices on December 31, 2005, and the reinvestment of dividends.

|

2005

|

2006

|

2007

|

2008

|

2009

|

2010

|

||||||||

|

NATIONAL BANKSHARES, INC.

|

100

|

106

|

78

|

93

|

139

|

160

|

|||||||

|

INDEPENDENT BANK INDEX

|

100

|

112

|

90

|

77

|

88

|

87

|

|||||||

|

NASDAQ INDEX

|

100

|

110

|

119

|

57

|

83

|

98

|

The peer group Independent Bank Index is the compilation of the total return to stockholders over the past five years of the following group of 23 independent community banks and bank holding companies located in the southeastern states of Alabama, Florida, Georgia, North Carolina, South Carolina, Tennessee, Virginia and West Virginia. The banks and bank holding companies are: American National Bankshares, Inc., Auburn National Bancorporations, Inc., BNC Bancorp, C&F Financial Corporation, Carolina Trust Bank, Central Virginia Bankshares, Inc., Community First, CNB Corporation, Fidelity Southern Corporation, First Century Bankshares, Inc., First Community Bank Corporation of America, First Pulaski National Corporation, Four Oaks Fincorp, Inc., Geer Bancshares Incorporated, Monarch Financial Holdings, Inc., National Bankshares, Inc., New Bridge Bancorp, Peoples Bancorporation, Inc., Savannah Bancorp, Inc., Southeastern Banking Corporation, Southwest Georgia Financial Corp., United Security Bancshares, Inc. and Uwharrie Capital Corp.

10

National Bankshares, Inc. and Subsidiaries

Selected Consolidated Financial Data

|

$ in thousands, except per share data

|

Years ended December 31,

|

|||||||||||||||||||

|

2010

|

2009

|

2008

|

2007

|

2006

|

||||||||||||||||

|

Selected Income Statement Data:

|

||||||||||||||||||||

|

Interest income

|

$ | 49,139 | $ | 50,487 | $ | 50,111 | $ | 50,769 | $ | 47,901 | ||||||||||

|

Interest expense

|

11,158 | 15,825 | 18,818 | 21,745 | 18,564 | |||||||||||||||

|

Net interest income

|

37,981 | 34,662 | 31,293 | 29,024 | 29,337 | |||||||||||||||

|

Provision for loan losses

|

3,409 | 1,634 | 1,119 | 423 | 49 | |||||||||||||||

|

Noninterest income

|

8,347 | 8,804 | 9,087 | 8,760 | 8,802 | |||||||||||||||

|

Noninterest expense

|

23,127 | 23,853 | 22,023 | 20,956 | 21,670 | |||||||||||||||

|

Income taxes

|

4,223 | 3,660 | 3,645 | 3,730 | 3,788 | |||||||||||||||

|

Net income

|

15,569 | 14,319 | 13,593 | 12,675 | 12,632 | |||||||||||||||

|

Per Share Data:

|

||||||||||||||||||||

|

Basic net income

|

2.25 | 2.07 | 1.96 | 1.82 | 1.80 | |||||||||||||||

|

Diluted net income

|

2.24 | 2.06 | 1.96 | 1.82 | 1.80 | |||||||||||||||

|

Cash dividends declared

|

0.91 | 0.84 | 0.80 | 0.76 | 0.73 | |||||||||||||||

|

Book value

|

18.63 | 17.61 | 15.89 | 15.07 | 13.86 | |||||||||||||||

|

Selected Balance Sheet Data at End of Year:

|

||||||||||||||||||||

|

Loans, net

|

568,779 | 583,021 | 569,699 | 518,435 | 495,486 | |||||||||||||||

|

Total securities

|

315,907 | 297,417 | 264,999 | 273,343 | 285,489 | |||||||||||||||

|

Total assets

|

1,022,238 | 982,367 | 935,374 | 887,647 | 868,203 | |||||||||||||||

|

Total deposits

|

884,583 | 852,112 | 817,848 | 776,339 | 764,692 | |||||||||||||||

|

Stockholders’ equity

|

129,187 | 122,076 | 110,108 | 104,800 | 96,755 | |||||||||||||||

|

Selected Balance Sheet Daily Averages:

|

||||||||||||||||||||

|

Loans, net

|

577,210 | 572,438 | 533,190 | 505,070 | 488,624 | |||||||||||||||

|

Total securities

|

289,532 | 298,237 | 281,367 | 282,734 | 271,066 | |||||||||||||||

|

Total assets

|

989,952 | 971,538 | 899,462 | 867,061 | 840,080 | |||||||||||||||

|

Total deposits

|

852,953 | 846,637 | 783,774 | 758,657 | 741,071 | |||||||||||||||

|

Stockholders’ equity

|

129,003 | 117,086 | 108,585 | 100,597 | 94,194 | |||||||||||||||

|

Selected Ratios:

|

||||||||||||||||||||

|

Return on average assets

|

1.57 | % | 1.47 | % | 1.51 | % | 1.46 | % | 1.50 | % | ||||||||||

|

Return on average equity

|

12.07 | % | 12.23 | % | 12.52 | % | 12.60 | % | 13.41 | % | ||||||||||

|

Dividend payout ratio

|

40.52 | % | 40.67 | % | 40.78 | % | 41.80 | % | 40.44 | % | ||||||||||

|

Average equity to average assets

|

13.03 | % | 12.05 | % | 12.07 | % | 11.60 | % | 11.21 | % | ||||||||||

11

$ in thousands, except per share data

The purpose of this discussion and analysis is to provide information about the results of operations, financial condition, liquidity and capital resources of National Bankshares, Inc. and its subsidiaries (the Company). The discussion should be read in conjunction with the material presented in Item 8, “Financial Statements and Supplementary Data”, of this Form 10-K.

Per share data has been adjusted to reflect a 2-for-1 stock split effective March 31, 2006.

Subsequent events have been considered through the date on which the Form 10-K was issued.

Cautionary Statement Regarding Forward-Looking Statements

We make forward-looking statements in this Form 10-K that are subject to significant risks and uncertainties. These forward-looking statements include statements regarding our profitability, liquidity, allowance for loan losses, interest rate sensitivity, market risk, growth strategy, and financial and other goals, and are based upon our management’s views and assumptions as of the date of this report. The words “believes,” “expects,” “may,” “will,” “should,” “projects,” “contemplates,” “anticipates,” “forecasts,” “intends,” or other similar words or terms are intended to identify forward-looking statements.

These forward-looking statements are based upon or are affected by factors that could cause our actual results to differ materially from historical results or from any results expressed or implied by such forward-looking statements. These factors include, but are not limited to, changes in:

|

·

|

interest rates,

|

|

·

|

general economic conditions,

|

|

·

|

the legislative/regulatory climate,

|

|

·

|

monetary and fiscal policies of the U.S. Government, including policies of the U.S. Treasury, the Office of the Comptroller of the Currency, the Federal Reserve Board and the Federal Deposit Insurance Corporation, and the impact of any policies or programs implemented pursuant to the Emergency Economic Stabilization Act of 2008 (EESA) the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the Dodd-Frank Act) and other financial reform legislation,

|

|

·

|

unanticipated increases in the level of unemployment in the Company’s trade area,

|

|

·

|

the quality or composition of the loan and/or investment portfolios,

|

|

·

|

demand for loan products,

|

|

·

|

deposit flows,

|

|

·

|

competition,

|

|

·

|

demand for financial services in the Company’s trade area,

|

|

·

|

the real estate market in the Company’s trade area,

|

|

·

|

the Company’s technology initiatives, and

|

|

·

|

applicable accounting principles, policies and guidelines.

|

These risks and uncertainties should be considered in evaluating the forward-looking statements contained in this report. We caution readers not to place undue reliance on those statements, which speak only as of the date of this report. This discussion and analysis should be read in conjunction with the description of our “Risk Factors” in Item 1A. of this Form 10-K.

The Company was not negatively impacted during the initial phases of the economic slowdown in late 2008. Its markets did not experience the dramatic declines in real estate values seen in some other areas of the country. In addition, the diverse economy of the Company’s market area, including several large employers that are public colleges or universities, helped to insulate the Company from the worst effects of the recession. As the recession continued into 2009, real estate values in the Company’s trade area declined moderately. In 2010, the Company experienced an increasing level of nonperforming assets, including nonperforming loans and other real estate owned. If the economic recovery progresses slowly or is reversed, it is likely that unemployment will continue to rise in the Company’s trade area. Because of the importance to the Company’s markets of state-funded universities, cutbacks in the funding provided by the State as a result of the recession could also negatively impact employment. This could lead to an even higher rate of delinquent loans and a greater number of real estate foreclosures. Higher unemployment and the fear of layoffs causes reduced consumer demand for goods and services, which negatively impacts the Company’s business and professional customers. In conclusion, a slow economic recovery could have an adverse effect on all financial institutions, including the Company.

Critical Accounting Policies

General

The Company’s financial statements are prepared in accordance with accounting principles generally accepted in the United States (GAAP). The financial information contained within our statements is, to a significant extent, financial information that is based on measures of the financial effects of transactions and events that have already occurred. A variety of factors could affect the ultimate value that is obtained when earning income, recognizing an expense, recovering an asset or relieving a liability. The Company uses historical loss factors as one factor in determining the inherent loss that may be present in the loan portfolio. Actual losses could differ significantly from one previously acceptable method to another method. Although the economics of the Company’s transactions would be the same, the timing of events that would impact the transactions could change.

12

Allowance for Loan Losses

The allowance for loan losses is an accrual of estimated losses that have been sustained in our loan portfolio. The allowance is reduced by charge-offs of loans and increased by the provision for loan losses and recoveries of previously charged-off loans. The determination of the allowance is based on two accounting principles, FASB Topic 450-20 (Contingencies) which requires that losses be accrued when occurrence is probable and the loss is reasonably estimable, and FASB Topic 310-10 (Receivables) which requires accrual of losses on impaired loans if the recorded investment exceeds fair value.

Probable losses are accrued through two calculations, individual evaluation of impaired loans and evaluation on a group basis of the remainder of the portfolio. Impaired loans are larger nonhomogeneous loans for which there is a probability that collection will not occur according to the loan terms, as well as loans whose terms have been modified in a troubled debt restructuring. Impaired loans are individually evaluated for potential loss. Impaired loans with an estimated impairment loss are placed on nonaccrual status.

Estimated loss for an impaired loan is the amount of recorded investment that exceeds the loan’s fair value. Fair value of an impaired loan is measured by one of three methods, the fair value (less cost to sell) of collateral, the present value of future cash flows, or observable market price. For loans that are not collateral dependent, the potential loss is accrued in the allowance. For collateral-dependent loans, the potential loss is charged off against the allowance, instead of being accrued. Impaired loans with partial charge-offs are maintained as impaired until it becomes evident that the borrower can repay the remaining balance of the loan according to the terms.

For impaired loans for which the collateral method is elected, the Company requires a current third-party appraisal of “as is” value. If an existing appraisal is older than 12 months, a new appraisal is ordered immediately after the date of impairment designation. If a current appraisal cannot be obtained prior to reporting deadlines, the existing appraisal is discounted according to published independent indices. The Company believes this serves as a conservative estimate of fair value until the updated appraisal can be obtained.

Impaired loans are measured for impairment at least quarterly. Loss reserves and nonaccrual designation, or partial charge-off for estimated losses on impaired loans are recorded at the first measurement date and at each measurement date thereafter.

In the third quarter of 2010, the Company revised its policy for evaluation of nonimpaired loans. The policy formalized criteria used to group loans for purposes of estimating losses; provided for analysis of trends and current levels of risk indicators; and designated loans that the Company determines to have inherently higher risk.

Nonimpaired loans are grouped according to risk characteristic into portfolio segments and loan classes. Loans within a segment or class have similar risk characteristics. Each segment and class is evaluated for probable loss by applying quantitative and qualitative factors, including net charge-off trends, delinquency rates, concentration trends and economic trends. Net charge-off trends are evaluated by segment within a two to three year time frame. The Company accrues additional reserves for criticized loans within each class and for loans designated high risk. High risk loans are defined as junior lien mortgages, loans with high loan-to-value ratios and loans with payments of interest-only required. Both classified loans and high risk loans are included in the base risk analysis for each class and are allocated additional reserves.

The change in methodology did not materially affect the total estimated accrual; however, previously unallocated amounts became allocated with the new methodology.

The estimation of the accrual involves analysis of internal and external variables, methodologies, assumptions and our judgment and experience. Key judgments used in determining the allowance for loan losses include internal risk ratings, market and collateral values, discount rates, loss rates, and our view of current economic conditions. The inherent subjectivity of these judgments, as well as the lagging of credit quality measurements relative to the performance of the loan portfolio, create a degree of imprecision. Our actual losses could be greater or less than the estimate. Future estimates of the allowance could increase or decrease based on changes in the financial condition of individual borrowers, concentrations of various types of loans, economic conditions or the markets in which collateral may be sold. The estimate of the allowance accrual determines the amount of provision expense and directly affects our financial results.

During 2009 and 2010, the Company experienced increases in delinquencies and net charge-offs due to deterioration of the real estate market and the economy as a whole. The estimate of the allowance incorporated these market conditions in determining the accrual. However, given the continued economic difficulties, the ultimate amount of loss could vary from that estimate. For additional discussion of the allowance, see Note 5 of the Notes to Consolidated Financial Statements and “Asset Quality”, and “Provision and Allowance for Loan Losses”.

Goodwill and Core Deposit Intangibles

Goodwill is subject to at least an annual assessment for impairment by applying a fair value based test. The Company performs impairment testing in the fourth quarter. The Company’s goodwill impairment analysis considered three valuation techniques appropriate to the measurement. The first technique uses the Company’s market capitalization as an estimate of fair value; the second technique estimates fair value using current market pricing multiples for companies comparable to NBI; while the third technique uses current market pricing multiples for change-of-control transactions involving companies comparable to NBI. Each measure indicated that the Company’s fair value exceeded its book value, validating that goodwill is not impaired.

13

Certain key judgments were used in the valuation measurement. Goodwill is held by the Company’s bank subsidiary. The bank subsidiary is 100% owned by the Company, and no market capitalization is available. Because most of the Company’s assets are comprised of the subsidiary bank’s equity, the Company’s market capitalization was used to estimate the Bank’s. Other judgments include the assumption that the companies and transactions used as comparables for the second and third technique were appropriate to the estimate of the Company’s fair value, and that the comparable multiples are appropriate indicators of fair value, and compliant with accounting guidance.

Acquired intangible assets (such as core deposit intangibles) are recognized separately from goodwill if the benefit of the asset can be sold, transferred, licensed, rented, or exchanged, and amortized over its useful life. The Company amortizes intangible assets arising from branch transactions over their useful life. Core deposit intangibles are subject to a recoverability test based on undiscounted cash flows, and to the impairment recognition and measurement provisions required for other long-lived assets held and used. The impairment testing showed that the expected cash flows of the intangible assets exceeded the carrying value.

Overview

National Bankshares, Inc. is a financial holding company incorporated under the laws of Virginia. Located in southwest Virginia, NBI has two wholly-owned subsidiaries, the National Bank of Blacksburg and National Bankshares Financial Services, Inc. The National Bank of Blacksburg, which does business as National Bank from twenty-five office locations, is a community bank. NBB is the source of nearly all of the Company’s revenue. National Bankshares Financial Services, Inc. does business as National Bankshares Investment Services and National Bankshares Insurance Services. Income from NBFS is not significant at this time, nor is it expected to be so in the near future.

National Bankshares, Inc. common stock is listed on the NASDAQ Capital Market and is traded under the symbol “NKSH.” National Bankshares, Inc. has been included in the Russell Investments Russell 3000 and Russell 2000 Indexes since June 29, 2009.

Performance Summary

The following table presents NBI’s key performance ratios for the years ending December 31, 2010 and December 31, 2009:

|

12/31/10

|

12/31/09

|

|||||||

|

Return on average assets

|

1.57 | % | 1.47 | % | ||||

|

Return on average equity

|

12.07 | % | 12.23 | % | ||||

|

Basic net earnings per share

|

$ | 2.25 | $ | 2.07 | ||||

|

Fully diluted net earnings per share

|

$ | 2.24 | $ | 2.06 | ||||

|

Net interest margin (1)

|

4.52 | % | 4.23 | % | ||||

|

Noninterest margin (2)

|

1.49 | % | 1.55 | % | ||||

|

|

(1)

|

Net Interest Margin – Year-to-date tax equivalent net interest income divided by year-to-date average earning assets.

|

|

|

(2)

|

Noninterest Margin – Noninterest income (excluding securities gains and losses) less noninterest expense (excluding the provision for bad debts and income taxes) divided by average year-to-date assets.

|

The return on average assets for the year ended December 31, 2010 was 1.57%, an increase of 10 basis points from the 1.47% for the year ended December 31, 2009. The return on average equity declined from 12.23% for the year ended December 31, 2009 to 12.07% for the year ended December 31, 2010. Earnings benefited from reduced assessments for Federal Deposit Insurance Corporation Deposit Insurance Fund. The total FDIC assessments for the year ended December 31, 2010 were $1,080, as compared with $1,727 for 2009. Please refer to the discussion of “Noninterest Expense” for additional details about FDIC assessments. Reflecting both the effects of the low interest rate environment throughout 2010 on NBI’s funding costs and the Company’s asset/liability management practices, the net interest margin increased from 4.23% at year-end 2009 to 4.52% at December 31, 2010. The noninterest margin decreased from 1.55% to 1.49% over the same period due to decreases in both FDIC assessment and salaries and benefits expense.

The higher net interest margin, together with decreases in FDIC assessments and controllable noninterest expenses, are largely responsible for the increase in basic net earnings per share, from $2.07 for the year ended December 31, 2009 to $2.25 for the year ended December 31, 2010.

14

Growth

NBI’s key growth indicators are shown in the following table:

|

12/31/10

|

12/31/09

|

|||||||

|

Securities

|

$ | 315,907 | $ | 297,417 | ||||

|

Loans, net

|

568,779 | 583,021 | ||||||

|

Deposits

|

884,583 | 852,112 | ||||||

|

Total assets

|

1,022,238 | 982,367 | ||||||

Securities, deposits and total assets all experienced growth, while loans declined when December 31, 2010 and 2009 are compared. Deposits grew $32,471, or 3.81%, from December 31, 2009, with increases mainly from municipal deposits and individuals seeking to safeguard principal by avoiding more volatile investments in financial markets. Net loans at year-end 2010 were $568,779, a decrease of $14,242, or 2.44%, when compared to $583,021 at December 31, 2009. The excess liquidity from increased deposits and decreased loans was held in interest-bearing deposits and securities, which grew by $18,490, or 6.22%, from December 31, 2009 to December 31, 2010. The Company’s total assets at December 31, 2010 were $1,022,238, an increase of $39,871, or 4.06%, when compared with total assets of $982,367 at December 31, 2009.

In both 2009 and 2010, the Company’s growth was internally generated and was not the result of acquisitions.

Asset Quality

Key indicators of NBI’s asset quality are presented in the following table:

|

12/31/10

|

12/31/09

|

|||||||

|

Nonperforming loans

|

$ | 8,421 | $ | 6,750 | ||||

|

Loans past due 90 days or more

|

1,336 | 1,697 | ||||||

|

Other real estate owned

|

1,723 | 2,126 | ||||||

|

Allowance for loan losses to loans

|

1.33 | % | 1.17 | % | ||||

|

Net charge-off ratio

|

0.46 | % | 0.10 | % | ||||

Nonperforming loans at December 31, 2010 were $8,421, or 1.46% of loans net of unearned income and deferred fees, plus other real estate owned. This compares with $6,750 in nonperforming loans reported at year-end 2009. Of the nonperforming loans reported at December 31, 2010, all are nonaccrual loans, with the exception of one restructured loan.

Loans designated as troubled debt restructurings totaled $6,483. Loans past due 90 days or more and still accruing at year-end 2010 totaled $1,336, a decrease of $361, or 21.27%, from $1,697 at December 31, 2009.

The increase in nonperforming loans from 2009 to 2010 has pushed the ratio of nonperforming loans to net loans to a level that is higher than it has been for the Company in the recent past. However, the level of nonperforming loans remains manageable and below that of peers. Sufficient resources have been dedicated to working out problem assets, and exposure to loss is somewhat mitigated because most of the non-performing loans are collateralized. In addition, the Company’s conservative loan underwriting policies help to limit potential loss. More information about nonaccrual and past due loans is provided in “Balance Sheet – Loans – Risk Elements”. Management also dedicates sufficient resources to monitoring loan portfolio quality on an ongoing basis.

In response to an increase in problem loans, the ratio of the allowance for loan losses to loans grew from 1.17% at December 31, 2009 to 1.33% at the same period in 2010. For more information see “Allowance for Loan Losses”.

The net charge-off ratio was 0.10% at year-end 2009 and 0.46% at December 31, 2010. Other real estate owned declined from $2,126 at December 31, 2009 to $1,723 at the same period in 2010, a decrease of $403, or 18.96%. Management anticipates that the level of other real estate owned may still increase as a consequence of the process of working through loan delinquencies.

Net Interest Income

Net interest income for the period ended December 31, 2010 was $37,981, an increase of $3,319, or 9.58%, when compared to the prior year. Net interest income for the period ended December 31, 2009 was $34,662, an increase of $3,369, or 10.71%, from 2008. The net interest margin for 2010 was 4.52%, compared to 4.23% for 2009. Total interest income for the period ended December 31, 2010 was $49,139, a decrease of $1,348 from the period ended December 31, 2009. Interest expense was down by $4,667 during the same time frame, from $15,825 for 2009 to $11,158 for the year ended December 31, 2010. The decline in interest expense came about because higher priced certificates of deposit renewed at a lower interest rate and noninterest-bearing deposits grew at a faster rate than interest-bearing deposits. In summary, the rates paid on the Company’s deposit liabilities declined at a more rapid pace than the interest rates on its interest-earning assets.

15

The amount of net interest income earned is affected by various factors, including changes in market interest rates due to the Federal Reserve Board’s monetary policy, the level and composition of the earning assets, and the composition of interest-bearing liabilities. The Company has the ability to respond over time to interest rate movements and reduce volatility in the net interest margin. However, the frequency and/or magnitude of changes in market interest rates are difficult to predict and may have a greater impact on net interest income than adjustments by management.

During 2010, interest rates continued at historic lows, and low and stable interest rates benefited the Company. Offsetting the positive effect of low interest rates is the fact that some higher yielding securities in the Company’s investment portfolio were called and were replaced with securities yielding at the lower market rate. Another negative effect of the low interest rate environment is the level of interest earned on overnight funds. These assets are used primarily to provide liquidity. The yield on these assets in 2010 was 0.23%, while the cost to fund them was 1.21% in the same period.

The primary source of funds used to support the Company’s interest-earning assets is deposits. Deposits are obtained in the Company’s trade area through traditional marketing techniques. Other funding sources, such as the Federal Home Loan Bank, while available, are only used occasionally. The cost of funds is dependent on interest rate levels and competitive factors. This limits the ability of the Company to react to interest rate movements.

If interest rates remain low and stable, management does not anticipate any further improvement in the net interest margin. If interest rates rise quickly, the net interest margin would narrow, because deposit rates would increase at a faster rate than loan rates. If interest rates rise more slowly, the negative effect on the net interest margin would be less pronounced.

Because interest rates are at historic lows, interest rates can only trend up in the future. Management cannot predict the timing and level of interest rate increases.

Analysis of Net Interest Earnings

The following table shows the major categories of interest-earning assets and interest-bearing liabilities, the interest earned or paid, the average yield or rate on the daily average balance outstanding, net interest income and net yield on average interest-earning assets for the years indicated.

|

December 31, 2010

|

December 31, 2009

|

December 31, 2008

|

||||||||||||||||||||||||||||||||||

|

Average

Balance

|

Interest

|

Average

Yield/

Rate

|

Average

Balance

|

Interest

|

Average

Yield/

Rate

|

Average

Balance

|

Interest

|

Average

Yield/

Rate

|

||||||||||||||||||||||||||||

|

Interest-earning assets:

|

||||||||||||||||||||||||||||||||||||

|

Loans, net (1)(2)(3)

|

$ | 585,933 | $ | 37,282 | 6.36 | % | $ | 579,581 | $ | 37,903 | 6.54 | % | $ | 538,868 | $ | 37,356 | 6.93 | % | ||||||||||||||||||

|

Taxable securities

|

123,920 | 5,588 | 4.51 | % | 134,607 | 6,273 | 4.66 | % | 137,497 | 6,817 | 4.96 | % | ||||||||||||||||||||||||

|

Nontaxable securities (1)(4)

|

161,571 | 10,074 | 6.24 | % | 162,889 | 10,154 | 6.23 | % | 144,137 | 8,911 | 6.18 | % | ||||||||||||||||||||||||

|

Interest-bearing deposits

|

55,477 | 128 | 0.23 | % | 35,841 | 90 | 0.25 | % | 21,440 | 449 | 2.09 | % | ||||||||||||||||||||||||

|

Total interest-earning assets

|

$ | 926,901 | $ | 53,072 | 5.73 | % | $ | 912,918 | $ | 54,420 | 5.96 | % | $ | 841,942 | $ | 53,533 | 6.36 | % | ||||||||||||||||||

|

Interest-bearing liabilities:

|

||||||||||||||||||||||||||||||||||||

|

Interest-bearing demand deposits

|

$ | 322,705 | $ | 3,332 | 1.03 | % | $ | 282,532 | $ | 3,076 | 1.09 | % | $ | 243,409 | $ | 3,486 | 1.43 | % | ||||||||||||||||||

|

Savings deposits

|

54,543 | 51 | 0.09 | % | 48,992 | 52 | 0.11 | % | 45,796 | 132 | 0.29 | % | ||||||||||||||||||||||||

|

Time deposits

|

352,887 | 7,775 | 2.20 | % | 399,873 | 12,694 | 3.17 | % | 381,961 | 15,188 | 3.98 | % | ||||||||||||||||||||||||

|

Short-term borrowings

|

--- | --- | --- | % | 49 | 3 | 6.12 | % | 297 | 12 | 4.04 | % | ||||||||||||||||||||||||

|

Total interest-bearing liabilities

|

$ | 730,135 | $ | 11,158 | 1.53 | % | $ | 731,446 | $ | 15,825 | 2.16 | % | $ | 671,463 | $ | 18,818 | 2.80 | % | ||||||||||||||||||

|

Net interest income and interest rate spread

|

$ | 41,914 | 4.20 | % | $ | 38,595 | 3.80 | % | $ | 34,715 | 3.56 | % | ||||||||||||||||||||||||

|

Net yield on average interest-earning assets

|

4.52 | % | 4.23 | % | 4.12 | % | ||||||||||||||||||||||||||||||

|

(1)

|

Interest on nontaxable loans and securities is computed on a fully taxable equivalent basis using a Federal income tax rate of 35% in the three years presented.

|

|

(2)

|

Loan fees of $863 in 2010, $956 in 2009 and $859 in 2008 are included in total interest income.

|

|

(3)

|

Nonaccrual loans are included in average balances for yield computations.

|

|

(4)

|

Daily averages are shown at amortized cost.

|

16

Analysis of Changes in Interest Income and Interest Expense

The Company’s primary source of revenue is net interest income, which is the difference between the interest and fees earned on loans and investments and the interest paid on deposits and other funds. The Company’s net interest income is affected by changes in the amount and mix of interest-earning assets and interest-bearing liabilities and by changes in yields earned on interest-earning assets and rates paid on interest-bearing liabilities. The following table sets forth, for the years indicated, a summary of the changes in interest income and interest expense resulting from changes in average asset and liability balances (volume) and changes in average interest rates (rate).

|

2010 Over 2009

|

2009 Over 2008

|

|||||||||||||||||||||||

|

Changes Due To

|

Changes Due To

|

|||||||||||||||||||||||

|

Rates(2)

|

Volume(2)

|

Net Dollar

Change

|

Rates(2)

|

Volume(2)

|

Net Dollar Change

|

|||||||||||||||||||

|

Interest income: (1)

|

|

|

|

|

|

|

||||||||||||||||||

|

Loans

|

$ | (1,033 | ) | $ | 412 | $ | (621 | ) | $ | (2,184 | ) | $ | 2,731 | $ | 547 | |||||||||

|

Taxable securities

|

(198 | ) | (487 | ) | (685 | ) | (403 | ) | (141 | ) | (544 | ) | ||||||||||||

|

Nontaxable securities

|

2 | (82 | ) | (80 | ) | 75 | 1,168 | 1,243 | ||||||||||||||||

|

Interest-bearing deposits

|

(8 | ) | 46 | 38 | (651 | ) | 292 | (359 | ) | |||||||||||||||

|

Increase (decrease) in income on interest-earning assets

|

$ | (1,237 | ) | $ | (111 | ) | $ | (1,348 | ) | $ | (3,163 | ) | $ | 4,050 | $ | 887 | ||||||||

|

Interest expense:

|

||||||||||||||||||||||||

|

Interest-bearing demand deposits

|

$ | (165 | ) | $ | 421 | $ | 256 | $ | (916 | ) | $ | 506 | $ | (410 | ) | |||||||||

|

Savings deposits

|

(7 | ) | 6 | (1 | ) | (89 | ) | 9 | (80 | ) | ||||||||||||||

|

Time deposits

|

(3,553 | ) | (1,366 | ) | (4,919 | ) | (3,179 | ) | 685 | (2,494 | ) | |||||||||||||

|

Short-term borrowings

|

--- | (3 | ) | (3 | ) | 4 | (13 | ) | (9 | ) | ||||||||||||||

|

Increase (decrease) in expense of interest-bearing liabilities

|

$ | (3,725 | ) | $ | (942 | ) | $ | (4,667 | ) | $ | (4,180 | ) | $ | 1,187 | $ | (2,993 | ) | |||||||

|

Increase in net interest income

|

$ | 2,488 | $ | 831 | $ | 3,319 | $ | 1,017 | $ | 2,863 | $ | 3,880 | ||||||||||||

|

|

(1) Taxable equivalent basis using a Federal income tax rate of 35% in 2010, 2009 and 2008.

|

|

(2)

|

Variances caused by the change in rate times the change in volume have been allocated to rate and volume changes proportional to the relationship of the absolute dollar amounts of the change in each.

|

With interest rates remaining at historic lows throughout 2010, interest expense declined by $4,667 when 2010 and 2009 are compared. For the same period, there was a decrease of $1,348 in interest income. The result was an increase of $3,319 in net interest income in 2010 over 2009. Of this increase, $2,488 was attributable to rates, and $831 came from higher volume.

The lower interest rate environment led to a decline of $1,033 in interest income from loans. This was partially offset by interest on a higher volume of loans. The average balance of loans increased from $579,581 in 2009 to $585,933 in 2010, causing an increase in interest income of $412. The net decrease in loan interest income was $621.

Interest income on taxable securities decreased $198 due to rates and $487 because of average volume, for a total decrease of $685 compared to 2009. The low interest rate environment increased the number of called securities in 2010 and reduced the opportunity to reinvest the proceeds in securities with more attractive yields. Because of low yields in the securities markets and flat loan demand, the Company did not aggressively pursue deposit growth.

Interest on time deposits declined $4,919 from 2009 to 2010, with a decline of $3,553 due to rates and $1,366 attributable to volume. See “Net Interest Income” for additional information related to the decline in interest expense.

If the volume of interest bearing liabilities remains at December 31, 2010 levels and interest rates remain low and stable, management does not anticipate any further improvement in the net interest margin. However, any interest rate increases would have a negative effect on net interest income. The negative effect would be more pronounced if rates were to rise rapidly.

Interest rates began to fall in 2008. As compared with 2008, there was a $2,993 decline in interest expense associated with time deposits in 2009. Of the total decline, $4,180 was due to rates, offset by $1,187 from higher deposit volume. Management focused on deposit pricing in 2009 and took advantage of falling rates to lower interest expense.

From 2008 to 2009 interest on loans increased by $547. Loan interest income attributable to rates was $2,184 lower, offset to a large degree to an increase of $2,731 because of volume. As compared with 2008, there was an increase of $3,880 in net interest income in 2009, $1,017 of the increase was due to rates and $2,863 due to volume.

17

Interest Rate Sensitivity