Attached files

| file | filename |

|---|---|

| EX-5.1 - EX-5.1 - GNC HOLDINGS, INC. | a2202611zex-5_1.htm |

| EX-23.1 - EXHIBIT 23.1 - GNC HOLDINGS, INC. | a2202611zex-23_1.htm |

| EX-10.33 - EXHIBIT 10.33 - GNC HOLDINGS, INC. | a2202611zex-10_33.htm |

| EX-10.32 - EXHIBIT 10.32 - GNC HOLDINGS, INC. | a2202611zex-10_32.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on March 11, 2011.

Registration Statement No. 333-169618

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 5

TO

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

GNC Acquisition Holdings Inc.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

5400 (Primary Standard Industrial Classification Code Number) |

20-8536244 (I.R.S. Employer Identification Number) |

300 Sixth Avenue

Pittsburgh, Pennsylvania 15222

(412) 288-4600

(Address, including zip code, and telephone number,

including area code, of registrant's principal executive offices)

Gerald J. Stubenhofer, Jr.

Senior Vice President, Chief Legal Officer and Secretary

GNC Acquisition Holdings Inc.

300 Sixth Avenue

Pittsburgh, Pennsylvania 15222

(412) 288-4600

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies of all communications to: | ||

Philippa M. Bond, Esq. |

Robert E. Buckholz, Jr., Esq. |

|

| Proskauer Rose LLP | Sullivan & Cromwell LLP | |

| 2049 Century Park East, Suite 3200 | 125 Broad Street | |

| Los Angeles, California 90067 | New York, New York 10004 | |

| (310) 557-2900/(310) 557-2193 (Facsimile) | (212) 558-4000/(212) 558-3588 (Facsimile) | |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If the securities being registered on this Form are being offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer", "accelerated filer", and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Commission, acting pursuant to Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, Dated March 11, 2011

PROSPECTUS

Shares

GNC Holdings, Inc.

Class A Common Stock

This is an initial public offering of Class A common stock of GNC Holdings, Inc. (formerly GNC Acquisition Holdings Inc.).

We are selling 16,000,000 shares and 6,500,000 shares are being sold by certain of our stockholders, some of whom are our affiliates. We will not receive any proceeds from the sale of our Class A common stock by the selling stockholders.

No public market currently exists for our Class A common stock. We will apply to list our Class A common stock on the New York Stock Exchange under the symbol "GNC". We anticipate that the initial public offering price of our Class A common stock will be between $ and $ per share.

Investing in our Class A common stock involves risk. See "Risk Factors" beginning on page 16 of this prospectus.

|

Per Share |

Total |

|||

Public offering price |

$ | $ | |||

Underwriting discount and commissions |

$ | $ | |||

Proceeds, before expenses, to GNC Holdings, Inc. |

$ | $ | |||

Proceeds, before expenses, to the selling stockholders |

$ | $ |

The selling stockholders have granted the underwriters a 30-day option to purchase up to 3,375,000 additional shares of Class A common stock at the public offering price, less the underwriting discount. We will not receive any proceeds from the exercise of the option to purchase additional shares.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Delivery of the shares of Class A common stock will be made on or about , 2011.

| Goldman, Sachs & Co. | J.P. Morgan | |

| Deutsche Bank Securities | Morgan Stanley |

| Barclays Capital William Blair & Company |

Credit Suisse BMO Capital Markets |

The date of this prospectus is , 2011.

i

This summary highlights the information contained in this prospectus. Because this is only a summary, it does not contain all of the information that may be important to you. For a more complete understanding of the information that you may consider important in making your investment decision, we encourage you to read this entire prospectus. Before making an investment decision, you should carefully consider the information under the heading "Risk Factors" and our consolidated financial statements and their notes in this prospectus. Prior to the consummation of this offering, GNC Acquisition Holdings Inc. will be renamed GNC Holdings, Inc. ("Holdings"). Unless the context requires otherwise, "we", "us", "our", and "GNC" refer to Holdings and its subsidiaries and, for periods prior to March 16, 2007, our predecessor. See "Business — Corporate History". References to "our stores" refer to our company-owned stores and our franchise stores. References to "our locations" refer to our stores and our "store-within-a-store" locations at Rite Aid.

Our Company

Based on our worldwide network of more than 7,200 locations and our GNC.com website, we believe we are the leading global specialty retailer of health and wellness products, including vitamins, minerals and herbal supplements ("VMHS") products, sports nutrition products and diet products. Our diversified, multi-channel business model derives revenue from product sales through domestic company-owned retail stores, domestic and international franchise activities, third-party contract manufacturing, e-commerce and corporate partnerships. We believe that the strength of our GNC brand, which is distinctively associated with health and wellness, combined with our stores and website, give us broad access to consumers and uniquely position us to benefit from the favorable trends driving growth in the nutritional supplements industry and the broader health and wellness sector. Our broad and deep product mix, which is focused on high-margin, premium, value-added nutritional products, is sold under our GNC proprietary brands, including Mega Men®, Ultra Mega®, GNC WELLbeING®, Pro Performance®, Pro Performance® AMP and Longevity Factors™, and under nationally recognized third-party brands.

Based on the information we compiled from the public securities filings of our primary competitors, our network of domestic retail locations is approximately twelve times larger than the next largest U.S. specialty retailer of nutritional supplements and provides a leading platform for our vendors to distribute their products to their target consumer. Our close relationship with our vendor partners has enabled us to negotiate first-to-market opportunities. In addition, our in-house product development capabilities enable us to offer our customers proprietary merchandise that can only be purchased through our locations or on our website. Since the nutritional supplement consumer often requires knowledgeable customer service, we also differentiate ourselves from mass and drug retailers with our well-trained sales associates who are aided by in-store technology. We believe that our expansive retail network, differentiated merchandise offering and quality customer service result in a unique shopping experience that is distinct from our competitors.

Recent Transformation of GNC

Beginning in 2006, we executed a series of strategic initiatives to enhance our existing business and growth profile. Specifically, we:

- •

- Assembled a world-class management team. We made key senior management upgrades with talented and seasoned executives who have significant retail, international and consumer packaged-goods expertise to complement the existing leadership of GNC and to establish a foundation for growth and innovation.

1

- •

- Adopted a comprehensive approach to brand building and the retail

experience. We have modernized GNC's brand image, product packaging and media campaigns, and enhanced the in-store shopping

experience for our customers.

- •

- Increased focus on proprietary product development and innovation to drive growth in retail

sales. We have increased revenue contribution from new product lines through a series of successful GNC-branded product launches

(Vitapak®, Pro Performance® AMP and GNC WELLbeING®), as well as recent launches of preferred third-party product offerings.

- •

- Restaged e-commerce business. We executed an

overall site redesign in September 2009 in an effort to increase traffic and conversion rates, while enhancing overall functionality of the site. We believe this redesign has positioned GNC.com

to continue capturing market share within one of the fastest growing channels of distribution in the U.S. nutritional supplements industry.

- •

- Invested capital to support future growth. During 2008 and

2009, we upgraded our point-of-sale systems to improve retail business processes, customer data collection and associate training, and to enhance the customer experience. In

2008, we also invested in our Greenville, South Carolina manufacturing facility to add capacity with respect to our soft gelatin capsule production and vitamin production and enhanced our packaging

capabilities.

- •

- Launched partnership programs designed to leverage GNC's brand strength. In 2010, we partnered with PepsiCo to support its launch of Gatorade G Series Pro and to develop a new brand of fortified coconut water called Phenom, which we expect to be available to consumers in 2011, and with PetSmart to launch an exclusive line of GNC-branded pet supplements.

Industry Overview

We operate within the large and growing U.S. nutritional supplements industry. According to Nutrition Business Journal's Supplement Business Report 2010, our industry generated $26.9 billion in sales in 2009 and an estimated $28.7 billion in 2010, and is projected to grow at an average annual rate of approximately 5.3% through 2015. Our industry is highly fragmented, and we believe this fragmentation provides large operators, like us, the ability to compete more effectively due to scale advantages.

We expect several key demographic, healthcare and lifestyle trends to drive the continued growth of our industry. These trends include:

- •

- increasing awareness of nutritional supplements across major age and lifestyle segments of the U.S. population;

and

- •

- increased focus on fitness and healthy living.

Competitive Strengths

We believe we are well-positioned to capitalize on favorable industry trends as a result of the following competitive strengths:

- •

- Highly-valued and iconic brand. According to a Beanstalk Marketing and LJS & Associates research study commissioned by us, we hold an 87% brand awareness rate with consumers, which we believe is significantly higher than our direct competitors. We believe our recently modernized brand image, communicated through enhanced advertising campaigns, in-store signage and product packaging, reinforces GNC's credibility as a leader in the industry. Our large customer base includes approximately 4.9 million active Gold Card

2

- •

- Commanding market position in an attractive and growing

industry. With a global footprint of more than 7,200 locations in the United States and 46 international countries (including

distribution centers where retail sales are made), and on GNC.com, we believe we are the leading global specialty retailer of health and wellness products.

- •

- Unique product offerings and robust innovation

capabilities. Product innovation is critical to our growth, brand image superiority and competitive advantage. We have internal product

development teams located in our corporate headquarters in Pittsburgh, Pennsylvania and our manufacturing facility in Greenville, South Carolina, which collaborate on the development and formulation

of proprietary nutritional supplements with a focus on high growth categories. In 2010, we believe GNC-branded products generated more than $850 million of retail sales across company-owned and

domestic franchise stores, GNC.com and Rite Aid store-within-a-store locations. In addition, our strong vendor relationships and large retail footprint ensure our stores

frequently benefit from preferred distribution rights on certain new third-party products.

- •

- Diversified business model. Our multi-channel approach is

unlike many other specialty retailers as we derive revenues across a number of distribution channels, including retail sales from company-owned retail stores, retail sales from GNC.com, royalties,

wholesale sales and fees from both domestic and international franchisees, revenue from third-party contract manufacturing and wholesale revenue and fees from our Rite Aid

store-within-a-store locations. Our business is further diversified by our broad merchandise assortment.

- •

- Vertically integrated operations that underpin our business

strategy. To support our company-owned and franchise global store base, we have developed sophisticated manufacturing, warehousing and

distribution facilities. Our vertically integrated business model allows us to control the production and timing of new product introductions, control costs, maintain high standards of product

quality, monitor delivery times, manage inventory levels and enhance profitability. In addition, combined with our broad retail footprint, this model enables us to respond quickly to changes in

consumer preferences and maintain a high pace of product innovation.

- •

- Differentiated service model that fosters a "selling" culture and an exceptional customer

experience. We believe we distinguish ourselves from mass and drug retailers with our well-trained sales associates, who

offer educated service and trusted advice. We believe that our expansive retail network, differentiated merchandise offering and quality customer service result in a unique shopping experience.

- •

- World-class management team with a proven track record. Our highly experienced and talented management team has a unique combination of leadership and experience across the retail and consumer packaged-goods industries.

members in the United States and Canada who account for over 50% of company-owned retail sales.

As a result of our competitive strengths, we have maintained consistent earnings growth through the recent economic cycle. The fourth quarter of 2010 marked the 22nd consecutive quarter of positive domestic company-owned same store sales growth. This consistent growth in company-owned retail sales, the positive operating leverage generated by our retail operations, cost containment initiatives, as well as growth in our other channels of distribution, have allowed us to expand our EBITDA margin by 560 basis points since 2005.

3

Our Growth Strategy

We plan to execute several strategies in the future to promote growth in revenue and operating income, and capture market share, including:

- •

- Growing company-owned domestic retail earnings. We believe

growth in our domestic retail business will be supported by continued same store sales growth and positive operating leverage. The fourth quarter of 2010 marked our 22nd consecutive quarter of

positive domestic company-owned same store sales growth. We believe our continued positive same store sales growth will be supported by the forecasted industry growth, our brand building initiatives,

future proprietary product introductions and potential improvements in mall traffic trends. Our existing store base and the supporting infrastructure provide us the ability to convert a high

percentage of our incremental sales volume into operating income, providing the opportunity to further expand our company-owned retail operating income margin.

- •

- Growing domestic company-owned retail square footage. For

2011, we expect to grow domestic company-owned retail square footage by approximately 3% to 4%. Based upon our operating experience and research commissioned by us and conducted by The Buxton Company,

a customer analytics research firm, we believe that (i) the expansion of our store base and roll out of new store formats will allow us to increase our market share as we enter new markets and

grow within existing markets to increase our appeal to a wider range of consumers, and (ii) the U.S. market can support a significant number of additional GNC stores, with at least 4,500 total

potential domestic company-owned and franchise stores (excluding Rite Aid store-within-a-store locations).

- •

- Growing our international footprint. Our international

business has been a key driver of growth in recent years. We expect to continue capitalizing on international revenue growth opportunities through additions of franchise stores, direct investment in

high growth markets and expansion of product distribution in both existing and new markets. For example, we believe China's nutritional supplements market represents a significant growth opportunity,

and in 2010, one of our subsidiaries commenced the process of registering products and initiating wholesale sales and distribution in China.

- •

- Expanding our e-commerce business. We believe

GNC.com is positioned to continue capturing market share online, which represents one of the fastest growing channels of distribution in the U.S. nutritional supplements industry.

- •

- Further leveraging of the GNC brand. As with our Rite Aid partnership, we believe we have the opportunity to create incremental streams of revenue and grow our customer base by leveraging the GNC brand outside of our existing distribution channels through corporate partnerships. We expect these partnerships to include relationships with well-known national specialty retailers and club stores in addition to partnerships with leading consumer brand companies to sell our proprietary products.

The Sponsors

Currently, Ares Corporate Opportunities Fund II, L.P. ("Ares"), Ontario Teachers' Pension Plan Board ("OTPP") and members of management hold substantially all of our outstanding common stock. Ares and OTPP are collectively referred to in this prospectus as the "Sponsors". After giving effect to this offering, the Sponsors will collectively hold 54,767,565 shares of our Class A common stock, representing approximately 63% of our outstanding Class A common stock, and OTPP will hold 16,103,245 shares of our Class B common stock, representing 100% of our outstanding Class B common stock, and the Sponsors will have the power to control our affairs and policies,

4

including with respect to the election of directors (and through the election of directors the appointment of management), the entering into of mergers, sales of substantially all of our assets and other significant transactions. The Class A common stock and Class B common stock vote together as a single class on all matters and are substantially identical in all respects, including with respect to voting, dividends and conversion, except that the Class B common stock does not entitle its holder to vote for the election or removal of directors. In addition, a holder of Class B common stock may, at any time, elect to convert shares of Class B common stock into an equal number of shares of Class A common stock or, under certain circumstances, convert shares of Class A common stock into an equal number of shares of Class B common stock.

All of our current directors were designated by the Sponsors and elected pursuant to the existing amended and restated stockholders agreement, which requires each of Ares and OTPP to vote all the shares of Class A common stock held by them in favor of the directors designated by each of them. Under a new stockholders agreement to be entered into among the Sponsors and us (the "New Stockholders Agreement"), effective upon completion of this offering, the Sponsors will have the right to nominate to our board of directors, subject to their election by our stockholders, for so long as the Sponsors collectively own more than 50% of the then outstanding shares of our common stock, the greater of up to nine directors and the number of directors comprising a majority of our board and, subject to certain exceptions, for so long as the Sponsors collectively own 50% or less of the then outstanding shares of our common stock, that number of directors (rounded up to the nearest whole number or, if such rounding would cause the Sponsors to have the right to elect a majority of our board of directors, rounded to the nearest whole number) that is the same percentage of the total number of directors comprising our board as the collective percentage of common stock owned by the Sponsors. Under the New Stockholders Agreement, each Sponsor will also agree to vote in favor of the other Sponsor's nominees. Because our board of directors will be divided into three staggered classes, the Sponsors may be able to influence or control our affairs and policies even after they cease to collectively own a majority of our then outstanding common stock during the period in which the Sponsors' designated directors finish their terms as members of our board. The New Stockholders Agreement will also provide that, so long as the Sponsors collectively own more than one-third of our outstanding common stock, certain significant corporate actions will require the approval of at least one of the Sponsors. See "Certain Relationships and Related Transactions — Stockholders Agreements".

Pursuant to the ACOF Management Services Agreement described under the heading "Certain Relationships and Related Transactions — ACOF Management Services Agreement", upon consummation of this offering, we intend to terminate the agreement by paying ACOF Operating Manager II, L.P. (an affiliate of Ares) a fee equal to the net present value of the aggregate annual management fee that would have been payable to ACOF Operating Manager II during the remainder of the term of the fee agreement. Pursuant to the obligations under our Class B common stock, as described under the heading "Certain Relationships and Related Transactions — Special Dividend", OTPP will receive, in lieu of quarterly special dividend payments that would have been payable during the remainder of the Special Dividend Period (as defined below), an automatic payment in the amount equal to the net present value of the aggregate annual special dividend amount that would have been payable to OTPP. We expect that our aggregate payment to each of ACOF Operating Manager II and OTPP in connection with the termination of the ACOF Management Services Agreement and the special dividend payments, respectively, will be approximately $5.1 million.

In connection with the consummation of this offering, OTPP will convert 12,065,316 shares of Class B common stock into an equal number of shares of Class A common stock. As a result of such conversion and after giving effect to this offering, OTPP will hold 23,610,082 shares of our Class A common stock representing approximately 27% of our outstanding Class A common stock

5

and will hold 16,103,245 shares of our Class B common stock representing 100% of our outstanding Class B common stock.

Together with our wholly owned subsidiary, GNC Acquisition Inc., we entered into an Agreement and Plan of Merger (the "Merger Agreement") with GNC Parent Corporation on February 8, 2007. Pursuant to the Merger Agreement and on March 16, 2007, GNC Acquisition Inc. was merged with and into GNC Parent Corporation, with GNC Parent Corporation as the surviving corporation and our wholly owned subsidiary (the "Merger"). In connection with the Merger, the Sponsors made equity contributions in GNC Parent Corporation in exchange for all of their shares of our common stock that they currently own.

Payments in Connection with This Offering

The table below sets forth information concerning the payments that we expect to make to the Sponsors and our directors, director nominees and executive officers in connection with this offering.

| |

Payments in connection with redemption of Series A preferred stock(1) |

Payments in connection with the ACOF Management Services Agreement and the Special Dividend |

Proceeds from the sale of Class A common stock(2) |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

(in thousands) |

|||||||||

Directors and Executive Officers: |

||||||||||

Norman Axelrod(3) |

$ | 227.7 | $ | — | $ | |||||

David P. Berg |

35.4 | — | ||||||||

Jeffrey P. Berger* |

— | — | — | |||||||

Andrew Claerhout |

— | — | — | |||||||

Thomas Dowd |

131.7 | — | ||||||||

Joseph Fortunato |

632.6 | — | ||||||||

Jeffrey Hennion |

— | — | — | |||||||

Michael Hines |

— | — | — | |||||||

Beth J. Kaplan |

— | — | ||||||||

David B. Kaplan |

— | — | — | |||||||

Brian Klos |

— | — | — | |||||||

Johann O. Koss* |

— | — | — | |||||||

Romeo Leemrijse |

— | — | — | |||||||

Michael Locke |

105.5 | — | ||||||||

Michael M. Nuzzo |

— | — | — | |||||||

Guru Ramanathan |

63.5 | — | ||||||||

Gerald J. Stubenhofer |

— | — | ||||||||

Richard J. Wallace |

— | — | — | |||||||

Sponsors: |

||||||||||

Ares |

85,377.8 | 5,098.0 | ||||||||

OTPP |

108,822.5 | 5,098.0 | ||||||||

- *

- Director nominee

- (1)

- The accrued and unpaid dividends per share of our Series A preferred stock will be $2.45, assuming this offering is consummated on March 31, 2011.

6

- (2)

- The

proceeds from the sale of Class A common stock are based on the midpoint of the price range set forth on the front cover of this prospectus, less

the underwriting discount, and do not take into account the sale of up to 3,375,000 shares of our Class A common stock that the underwriters have the option to purchase from the selling

stockholders.

- (3)

- Includes amounts that will be paid to AS Skip LLC of which Mr. Axelrod is the managing member.

Risks Related to Our Business and Strategy

Despite the competitive strengths described above, our ability to successfully operate our business is subject to numerous risks, including those that are generally associated with operating in the nutritional supplements industry. Any of the factors set forth under "Risk Factors" may limit our ability to successfully execute our business strategy. You should carefully consider all of the information set forth in this prospectus and, in particular, you should evaluate the specific factors set forth under "Risk Factors" in deciding whether to invest in our Class A common stock. Risks relating to our business and our ability to execute our business strategy include:

- •

- we may not effectively manage our growth;

- •

- we operate in a highly competitive industry and our failure to compete effectively could adversely affect our market

share, revenues and growth prospects;

- •

- unfavorable publicity or consumer perception of our products could adversely affect our reputation and the demand for our

products;

- •

- if the products we sell do not comply with applicable regulatory and legislative requirements, we may be required to

recall or remove these products from the market;

- •

- if we do not introduce new products or make enhancements to meet the changing needs of our customers in a timely manner,

some of our products could become obsolete;

- •

- our substantial debt could place us at a competitive disadvantage compared to our competitors that have less debt or that

have greater capacity to service or refinance their debt;

- •

- we may not anticipate all of the challenges imposed by the expansion of our operations and, as a result, may not meet our

targets for opening new stores, remodeling or relocating stores or expanding profitably; and

- •

- changes in our management team could adversely affect our business strategy and adversely impact our performance.

Recent Developments

On March 4, 2011, our indirect operating subsidiary, General Nutrition Centers, Inc. ("Centers") entered into a $1.2 billion term loan facility with a term of seven years (the "Term Loan Facility") and an $80.0 million revolving credit facility with a term of five years (the "Revolving Credit Facility" and, together with the Term Loan Facility, the "Senior Credit Facility"). Centers used a portion of the proceeds from the Term Loan Facility to refinance its former indebtedness, including all outstanding indebtedness under the Old Senior Credit Facility, the Senior Notes and the Senior Subordinated Notes (each as defined in this prospectus), and to pay related fees and expenses. Centers used the remaining proceeds, together with cash on hand, to pay a dividend to Holdings of $185 million and contribute $85 million to its wholly owned subsidiary, GNC Funding, Inc. ("GNC Funding"), which amount GNC Funding then loaned to Holdings. In connection with the foregoing, Centers terminated all swap arrangements related to its prior indebtedness at an aggregate cost of

7

$8.7 million. As of the date hereof, the Revolving Credit Facility remains undrawn, and we expect that the Revolving Credit Facility will remain undrawn as of the date this offering is consummated. We refer to these transactions and the use of proceeds therefrom collectively as the "Refinancing". For information about our use of the proceeds from the Refinancing and this offering please refer to "Use of Proceeds".

Corporate Information

We are a Delaware corporation. Our principal executive office is located at 300 Sixth Avenue, Pittsburgh, Pennsylvania 15222, and our telephone number is (412) 288-4600. We also maintain a website at GNC.com. The information contained on, or that can be accessed through, our website is not part of, and is not incorporated into, this prospectus. We own or have rights to trademarks or trade names that we use in conjunction with the operation of our business. Our service marks and trademarks include the GNC® name. Each trademark, trade name, or service mark of any other company appearing in this prospectus belongs to its holder. Use or display by us of other parties' trademarks, trade names, or service marks is not intended to and does not imply a relationship with, or endorsement or sponsorship by us of, the trademark, trade name, or service mark owner.

We have not authorized anyone to provide any information or make any representations other than the information and representations in this prospectus or any free writing prospectus that we have authorized to be delivered to you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is not an offer to sell or a solicitation of an offer to buy shares in any jurisdiction where an offer or sale of shares would be unlawful. The information in this prospectus is complete and accurate only as of the date on the front cover regardless of the time of delivery of this prospectus or of any sale of shares of our Class A common stock.

Throughout this prospectus, we use market data and industry forecasts and projections that were obtained from surveys and studies conducted by third parties, including the Nutrition Business Journal, Beanstalk Marketing and LJS & Associates, and The Buxton Company, and from publicly available industry and general publications. Although we believe that the sources are reliable, and that the information contained in such surveys and studies conducted by third parties is accurate and reliable, we have not independently verified the information contained therein. We note that estimates, in particular as they relate to general expectations concerning our industry, involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading "Risk Factors" in this prospectus.

8

Class A common stock offered by us |

16,000,000 shares | |

|

||

Class A common stock offered by the selling stockholders, some of whom are our affiliates |

6,500,000 shares | |

|

||

Underwriters' option to purchase additional shares of Class A common stock from the selling stockholders in this offering |

3,375,000 shares | |

|

||

Class A common stock outstanding after this offering |

87,444,748 shares | |

|

||

Class B common stock outstanding after this offering |

16,103,245 shares | |

|

||

Voting rights |

Each share of our Class A common stock entitles its holder to one vote per share on all matters to be voted upon by our stockholders. Each share of our Class B common stock entitles its holder to one vote per share on all matters to be voted upon by our stockholders, except with respect to the election or removal of directors on which the holders of shares of our Class B common stock are not entitled to vote. As discussed above under "— The Sponsors", Ares and OTPP will be parties to the New Stockholders Agreement pursuant to which they will have the ability to initially appoint all of the directors to our board. | |

|

||

Conversion rights |

The shares of Class A common stock are convertible into shares of Class B common stock, in whole or in part, at any time and from time to time at the option of the holder so long as such holder holds Class B common stock, on the basis of one share of Class B common stock for each share of Class A common stock that it wishes to convert. The shares of Class B common stock are convertible into shares of Class A common stock, in whole or in part, at any time and from time to time at the option of the holder, on the basis of one share of Class A common stock for each share of Class B common stock that it wishes to convert. | |

|

9

Use of proceeds |

We estimate that the net proceeds to us from this offering will be approximately $ million (based on the midpoint of the price range set forth on the front cover of this prospectus), after deducting underwriting discounts and commissions and estimated offering expenses payable by us. In connection with the Refinancing, Centers used a portion of the net proceeds of the Term Loan Facility, together with cash on hand, to pay a dividend to Holdings of $185 million and to make a contribution to GNC Funding of $85 million, which amount GNC Funding then loaned to Holdings. We expect to use such amounts, together with the net proceeds we receive from this offering and $ million of cash on hand, to redeem all of our outstanding shares of Series A preferred stock immediately following completion of this offering, to contribute $ million to Centers to repay outstanding borrowings under its Senior Credit Facility, to satisfy our obligations under the ACOF Management Services Agreement and the Class B common stock, and to pay related expenses. We will not receive any proceeds from the sale of any shares of Class A common stock by the selling stockholders. See "Use of Proceeds". | |

|

||

|

Ares, OTPP and members of our management hold substantially all of our outstanding Series A preferred stock and funds affiliated with Ares hold approximately 10% of the outstanding loans under the Senior Credit Facility. | |

|

||

Dividend policy |

Although the holders of our common stock will be entitled to receive dividends when and as declared by our board of directors from legally available sources, subject to the prior rights of the holders of our preferred stock, if any, we do not anticipate paying any dividends on our common stock in the foreseeable future. See "Dividend Policy." Any future determination relating to dividend policy will be made at the discretion of our board of directors and will depend on a number of factors, including restrictions in our debt instruments, our future earnings, capital requirements, financial condition, future prospects, and applicable Delaware law, which provides that dividends are only payable out of surplus or current net profits. | |

|

||

Proposed New York Stock Exchange trading symbol |

"GNC" | |

|

||

Risk factors |

For a discussion of risks relating to our business and an investment in our Class A common stock, see "Risk Factors" beginning on page 16. |

The number of shares of Class A common stock to be outstanding after completion of this offering is based on 22,500,000 shares of our Class A common stock to be sold in this offering

10

and, except where we state otherwise, the Class A common stock information we present in this prospectus:

- •

- includes the shares of Class A common stock to be issued by us upon the closing of this offering;

- •

- assumes that, prior to this offering, 12,065,316 shares of Class B common stock are converted into in an

equal number of shares of Class A common stock;

- •

- assumes an initial public offering price of $ per share of Class A common stock, the midpoint of

the

range on the cover of this prospectus;

- •

- excludes 9,651,444 shares of Class A common stock subject to outstanding stock options with a weighted average

exercise price of $ per share; and

- •

- excludes 7,930,000 shares of Class A common stock available for future grant or issuance under our stock plans.

Unless we specifically state otherwise, the information in this prospectus does not take into account the sale of up to 3,375,000 shares of our Class A common stock that the underwriters have the option to purchase from the selling stockholders.

11

Summary Consolidated Financial Data

The summary consolidated financial data presented below as of December 31, 2010 and for the years ended December 31, 2010, 2009 and 2008 are derived from our audited consolidated financial statements and footnotes included in this prospectus.

The summary consolidated financial data is presented on an actual basis for and as of the periods indicated and on an as adjusted basis giving effect to 1) the completion of this offering, 2) the application of the estimated net proceeds from this offering, as described under "Use of Proceeds", including the redemption of all outstanding shares of our Series A preferred stock immediately following completion of this offering, 3) the Refinancing, including the application of the net proceeds therefrom as described under "Use of Proceeds" and "Prospectus Summary — Recent Developments", 4) prior to the consummation of this offering, the conversion of 12,065,316 shares of Class B common stock into an equal number of shares of Class A common stock, and 5) our use of cash on hand to satisfy our obligations under the ACOF Management Services Agreement and our Class B common stock (see "Certain Relationships and Related Transactions — ACOF Management Services Agreement" and "— Special Dividend").

Our results for interim periods are not necessarily indicative of our results for a full year of operations. The following summary consolidated financial data should be read in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and footnotes included elsewhere in this prospectus.

| |

Year Ended December 31, 2010 |

Year Ended December 31, 2009 |

Year Ended December 31, 2008 |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

(dollars in millions, except share data and as noted) |

|||||||||||

Statement of Income Data: |

||||||||||||

Total revenues |

$ | 1,822.2 | $ | 1,707.0 | $ | 1,656.7 | ||||||

Gross profit |

642.3 | 590.6 | 574.1 | |||||||||

Operating income |

212.4 | 181.0 | 169.6 | |||||||||

Interest expense, net |

65.4 | 69.9 | 83.0 | |||||||||

Net income |

96.6 | 69.5 | 54.6 | |||||||||

Earnings per share(1): |

||||||||||||

Basic |

$ | 0.87 | $ | 0.58 | $ | 0.43 | ||||||

Diluted |

$ | 0.85 | $ | 0.58 | $ | 0.43 | ||||||

Other Data: |

||||||||||||

Net cash provided by operating activities |

141.5 | 114.0 | 77.4 | |||||||||

Net cash used in investing activities |

(36.1 | ) | (42.2 | ) | (60.4 | ) | ||||||

Net cash used in financing activities |

(1.5 | ) | (26.4 | ) | (1.4 | ) | ||||||

EBITDA(2) |

259.4 | 227.7 | 212.1 | |||||||||

Capital expenditures(3) |

32.5 | 28.7 | 48.7 | |||||||||

Number of Stores (at end of period): |

||||||||||||

Company-owned stores(4) |

2,917 | 2,832 | 2,774 | |||||||||

Franchise stores(4) |

2,340 | 2,216 | 2,144 | |||||||||

Store-within-a-store franchise locations(4) |

2,003 | 1,869 | 1,712 | |||||||||

Same Store Sales Growth:(5) |

||||||||||||

Domestic company-owned, including web |

5.6 | % | 2.8 | % | 2.7 | % | ||||||

Domestic franchise |

2.9 | % | 0.9 | % | 0.7 | % | ||||||

Average revenue per domestic company-owned store (dollars in thousands) |

$ | 438.2 | $ | 422.4 | $ | 418.1 | ||||||

12

| |

Year ended December 31, 2010 |

|||||||

|---|---|---|---|---|---|---|---|---|

| |

Actual

|

As Adjusted(6)

|

||||||

Income (loss) Per Share — Basic & Diluted (in thousands): |

||||||||

Net income |

$ | 96,567 | $ | |||||

Preferred stock dividends |

(20,606 | ) | — | |||||

Net income available to common stockholders |

$ | 75,961 | $ | |||||

Earnings per share: |

||||||||

Basic |

$ | 0.87 | $ | |||||

Diluted |

$ | 0.85 | $ | |||||

Weighted average common shares outstanding (in thousands): |

||||||||

Basic |

87,339 | |||||||

Diluted |

88,917 | |||||||

| |

As of December 31, 2010 | ||||||

|---|---|---|---|---|---|---|---|

| |

Actual

|

As Adjusted(6)

|

|||||

| |

(Dollars in millions) |

||||||

Balance Sheet Data: |

|||||||

Cash and cash equivalents |

$ | 193.9 | |||||

Working capital(7) |

484.5 | ||||||

Total assets |

2,425.1 | ||||||

Total current and non-current long-term debt |

1,058.5 | ||||||

Preferred stock |

218.4 | — | |||||

Total stockholders' equity |

619.5 | ||||||

- (1)

- Includes

impact of dividends on our Series A preferred stock.

- (2)

- We

define EBITDA as net income before interest expense (net), income tax expense, depreciation and amortization. Management uses EBITDA as a tool to measure

operating performance of the business. EBITDA is not a measurement of our financial performance under U.S. GAAP and should not be considered as an alternative to net income, operating income,

or any other performance measures derived in accordance with U.S. GAAP, or as an alternative to U.S. GAAP cash flow from operating activities, as a measure of our profitability or

liquidity.

The following table reconciles EBITDA to net income as determined in accordance with GAAP for the periods indicated:

| |

Year Ended December 31, 2010 |

Year Ended December 31, 2009 |

Year Ended December 31, 2008 |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

(dollars in millions) |

|||||||||

Net income |

$ | 96.6 | $ | 69.5 | $ | 54.6 | ||||

Interest expense, net |

65.4 | 69.9 | 83.0 | |||||||

Income tax expense |

50.4 | 41.6 | 32.0 | |||||||

Depreciation and amortization |

47.0 | 46.7 | 42.5 | |||||||

EBITDA |

$ | 259.4 | (a) | $ | 227.7 | (b) | $ | 212.1 | (b) | |

- (a)

- For the year ended December 31, 2010, EBITDA includes the following expenses: $1.5 million related to payments to the Sponsors under the ACOF Management Services Agreement and Class B common stock, which payments will cease following this offering, and $4.0 million of non-recurring expenses principally related to the exploration of strategic alternatives.

13

- (b)

- For each of the years ended December 31, 2010, 2009 and 2008, EBITDA includes $1.5 million related to payments to the Sponsors under the ACOF Management Services Agreement and Class B common stock, which payments will cease following this offering.

- (3)

- Capital

expenditures for the year ended December 31, 2008 includes approximately $10.1 million incurred in conjunction with our store register

upgrade program.

- (4)

- The following table summarizes our locations for the periods indicated:

| |

Year Ended December 31, 2010 |

Year Ended December 31, 2009 |

Year Ended December 31, 2008 |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Company-Owned Stores |

|||||||||||

Beginning of period |

2,832 | 2,774 | 2,745 | ||||||||

Store openings |

101 | 45 | 71 | ||||||||

Franchise conversions(a) |

24 | 53 | 33 | ||||||||

Store closings(b) |

(40 | ) | (40 | ) | (75 | ) | |||||

End of period balance |

2,917 | 2,832 | 2,774 | ||||||||

Franchise Stores |

|||||||||||

Domestic |

|||||||||||

Beginning of period |

909 | 954 | 978 | ||||||||

Store openings(b) |

42 | 31 | 41 | ||||||||

Store closings(c) |

(48 | ) | (76 | ) | (65 | ) | |||||

End of period balance |

903 | 909 | 954 | ||||||||

International |

|||||||||||

Beginning of period |

1,307 | 1,190 | 1,078 | ||||||||

Store openings |

232 | 187 | 198 | ||||||||

Store closings |

(102 | ) | (70 | ) | (86 | ) | |||||

End of period balance |

1,437 | 1,307 | 1,190 | ||||||||

Store-within-a-Store (Rite Aid) |

|||||||||||

Beginning of period |

1,869 | 1,712 | 1,358 | ||||||||

Store openings |

150 | 177 | 401 | ||||||||

Store closings |

(16 | ) | (20 | ) | (47 | ) | |||||

End of period balance |

2,003 | 1,869 | 1,712 | ||||||||

Total stores |

7,260 | 6,917 | 6,630 | ||||||||

- (a)

- Stores

that were acquired from franchisees and subsequently converted into company-owned stores.

- (b)

- Includes

corporate store locations acquired by franchisees.

- (c)

- Includes franchise stores closed and acquired by us.

- (5)

- Same store sales growth reflects the percentage change in same store sales in the period presented compared to the prior year period. Same store sales are calculated on a daily basis for each store and exclude the net sales of a store for any period if the store was not open during the same period of the prior year. Beginning in the first quarter of 2006, we also included our internet sales, as generated through GNC.com and www.drugstore.com, in our domestic company-owned same store sales calculation. When a store's square footage has been changed as a result of reconfiguration or relocation in the same mall or shopping center, the store continues to be treated as a same store. If, during the period presented, a store was closed, relocated to a different mall or shopping center, or converted to a franchise store or a company-owned store, sales from that store up to and including the closing day or the day immediately preceding the relocation or conversion are included as same store sales as long as the store was open during the same period of the

14

prior year. We exclude from the calculation sales during the period presented that occurred on or after the date of relocation to a different mall or shopping center or the date of a conversion.

- (6)

- The

unaudited pro forma income statement information for the year ended December 31, 2010 gives effect to an adjustment to interest expense and

related income taxes due to the Refinancing, including certain adjustments resulting from the termination of the swap agreements as described under "Management's Discussion and Analysis of Financial

Condition and Results of Operations — Qualitative and Quantitative Disclosures About Market Risk".

- (7)

- Working capital represents current assets less current liabilities.

15

You should carefully consider the risks described below and all other information contained in this prospectus before making an investment decision. If any of the following risks actually occur, our business, financial condition and results of operations could be materially and adversely affected. In that event, the trading price of our Class A common stock could decline, and you may lose part or all of your investment.

Risks Relating to Our Business and Industry

We may not effectively manage our growth, which could materially harm our business.

We expect that our business will continue to grow, which may place a significant strain on our management, personnel, systems and resources. We must continue to improve our operational and financial systems and managerial controls and procedures, and we will need to continue to expand, train and manage our technology and workforce. We must also maintain close coordination among our technology, compliance, accounting, finance, marketing and sales organizations. We cannot assure you that we will manage our growth effectively. If we fail to do so, our business could be materially harmed.

Our continued growth will require an increased investment by us in technology, facilities, personnel, and financial and management systems and controls. It also will require expansion of our procedures for monitoring and assuring our compliance with applicable regulations, and we will need to integrate, train and manage a growing employee base. The expansion of our existing businesses, any expansion into new businesses and the resulting growth of our employee base will increase our need for internal audit and monitoring processes that are more extensive and broader in scope than those we have historically required. We may not be successful in identifying or implementing all of the processes that are necessary. Further, unless our growth results in an increase in our revenues that is proportionate to the increase in our costs associated with this growth, our operating margins and profitability will be adversely affected.

We operate in a highly competitive industry. Our failure to compete effectively could adversely affect our market share, revenues, and growth prospects.

The U.S. nutritional supplements retail industry is large and highly fragmented. Participants include specialty retailers, supermarkets, drugstores, mass merchants, multi-level marketing organizations, on-line merchants, mail-order companies and a variety of other smaller participants. We believe that the market is also highly sensitive to the introduction of new products, which may rapidly capture a significant share of the market. In the United States, we also compete for sales with heavily advertised national brands manufactured by large pharmaceutical and food companies, as well as other retailers. In addition, as some products become more mainstream, we experience increased price competition for those products as more participants enter the market. Our international competitors include large international pharmacy chains, major international supermarket chains, and other large U.S.-based companies with international operations. Our wholesale and manufacturing operations compete with other wholesalers and manufacturers of third-party nutritional supplements. We may not be able to compete effectively and our attempt to do so may require us to reduce our prices, which may result in lower margins. Failure to effectively compete could adversely affect our market share, revenues, and growth prospects.

16

Unfavorable publicity or consumer perception of our products and any similar products distributed by other companies could cause fluctuations in our operating results and could have a material adverse effect on our reputation, the demand for our products, and our ability to generate revenues.

We are highly dependent upon consumer perception of the safety and quality of our products, as well as similar products distributed by other companies. Consumer perception of products can be significantly influenced by scientific research or findings, national media attention, and other publicity about product use. A product may be received favorably, resulting in high sales associated with that product that may not be sustainable as consumer preferences change. Future scientific research or publicity could be unfavorable to our industry or any of our particular products and may not be consistent with earlier favorable research or publicity. A future research report or publicity that is perceived by our consumers as less favorable or that questions earlier research or publicity could have a material adverse effect on our ability to generate revenues. For example, sales of some of our products, such as those containing ephedra, were initially strong, but decreased as a result of negative publicity and an ultimate ban of such products by the Food and Drug Administration (the "FDA"). As such, period-to-period comparisons of our results should not be relied upon as a measure of our future performance. Adverse publicity in the form of published scientific research or otherwise, whether or not accurate, that associates consumption of our products or any other similar products with illness or other adverse effects, that questions the benefits of our or similar products, or that claims that such products are ineffective could have a material adverse effect on our reputation, the demand for our products, and our ability to generate revenues.

Our failure to appropriately respond to changing consumer preferences and demand for new products could significantly harm our customer relationships and product sales.

Our business is particularly subject to changing consumer trends and preferences. Our continued success depends in part on our ability to anticipate and respond to these changes, and we may not be able to respond in a timely or commercially appropriate manner to these changes. If we are unable to do so, our customer relationships and product sales could be harmed significantly.

Furthermore, the nutritional supplements industry is characterized by rapid and frequent changes in demand for products and new product introductions. Our failure to accurately predict these trends could negatively impact consumer opinion of our stores as a source for the latest products. This could harm our customer relationships and cause losses to our market share. The success of our new product offerings depends upon a number of factors, including our ability to accurately anticipate customer needs; innovate and develop new products; successfully commercialize new products in a timely manner; price our products competitively; manufacture and deliver our products in sufficient volumes and in a timely manner; and differentiate our product offerings from those of our competitors.

If we do not introduce new products or make enhancements to meet the changing needs of our customers in a timely manner, some of our products could become obsolete, which could have a material adverse effect on our revenues and operating results.

Our substantial debt could adversely affect our results of operations and financial condition and otherwise adversely impact our operating income and growth prospects.

As of December 31, 2010, after giving effect to the Refinancing and this offering (including the use of proceeds), our total consolidated long-term debt (including current portion) would have been

17

approximately $ million, and we would have had an additional $71.2 million available under the Revolving Credit Facility after giving effect to $8.8 million utilized to secure letters of credit.

All of the debt under the Senior Credit Facility bears interest at variable rates. Our unhedged debt is subject to additional interest expense if these rates increase significantly, which could also reduce our ability to borrow additional funds.

Our substantial debt could have material consequences on our financial condition. For example, it could:

- •

- increase our vulnerability to general adverse economic and industry conditions;

- •

- require us to use all or a large portion of our cash flow from operations to pay principal and interest on our debt,

thereby reducing the availability of our cash flow to fund working capital, capital expenditures, and other business activities;

- •

- limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate;

- •

- restrict us from making strategic acquisitions or exploiting business opportunities;

- •

- place us at a competitive disadvantage compared to our competitors that have less debt; and

- •

- limit our ability to borrow additional funds or pay cash dividends.

For additional information regarding the interest rates and maturity dates of our existing debt, see "Management's Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources".

We and our subsidiaries may be able to incur additional debt in the future, including collateralized debt. Although the Senior Credit Facility contains restrictions on the incurrence of additional debt, these restrictions are subject to a number of qualifications and exceptions. If additional debt is added to our current level of debt, the risks described above would increase.

Our ability to continue to access credit on the terms previously obtained for the funding of our operations and capital projects may be limited due to changes in credit markets.

In recent periods, the credit markets and the financial services industry have experienced disruption characterized by the bankruptcy, failure, collapse or sale of various financial institutions, increased volatility in securities prices, diminished liquidity and credit availability and intervention from the United States and other governments. Continued concerns about the systemic impact of potential long-term or widespread downturn, energy costs, geopolitical issues, the availability and cost of credit, the global commercial and residential real estate markets and related mortgage markets and reduced consumer confidence have contributed to increased market volatility. The cost and availability of credit has been and may continue to be adversely affected by these conditions. We cannot be certain that funding for our capital needs will be available from our existing financial institutions and the credit markets if needed, and if available, to the extent required, and on acceptable terms. The Revolving Credit Facility matures in March 2016. If we cannot renew or refinance this facility upon its maturity or, more generally, obtain funding when needed, in each case on acceptable terms, we may be unable to continue our current rate of growth and store expansion, which may have an adverse effect on our revenues and results of operations.

18

We require a significant amount of cash to service our debt. Our ability to generate cash depends on many factors beyond our control and, as a result, we may not be able to make payments on our debt obligations.

We may be unable to generate sufficient cash flow from operations or to obtain future borrowings under our credit facilities or otherwise in an amount sufficient to enable us to pay our debt or to fund our other liquidity needs. In addition, because we conduct our operations through our operating subsidiaries, we depend on those entities for dividends and other payments to generate the funds necessary to meet our financial obligations, including payments on our debt. Under certain circumstances, legal and contractual restrictions, as well as the financial condition and operating requirements of our subsidiaries, may limit our ability to obtain cash from our subsidiaries. If we do not have sufficient liquidity, we may need to refinance or restructure all or a portion of our debt on or before maturity, sell assets, or borrow more money, which we may not be able to do on terms satisfactory to us or at all. In addition, any refinancing could be at higher interest rates and may require us to comply with more onerous covenants which could further restrict our business operations.

If we are unable to meet our obligations with respect to our debt, we could be forced to restructure or refinance our debt, seek equity financing, or sell assets. A default on any of our debt obligations could trigger certain acceleration clauses and cause those and our other obligations to become immediately due and payable. Upon an acceleration of any of our debt, we may not be able to make payments under our other outstanding debt.

Restrictions in the agreements governing our existing and future indebtedness may prevent us from taking actions that we believe would be in the best interest of our business.

The agreements governing our existing indebtedness contain and the agreements governing our future indebtedness will likely contain customary restrictions on us or our subsidiaries, including covenants that restrict us or our subsidiaries, as the case may be, from:

- •

- incurring additional indebtedness and issuing preferred stock;

- •

- granting liens on our assets;

- •

- making investments;

- •

- consolidating or merging with, or acquiring, another business;

- •

- selling or otherwise disposing of our assets;

- •

- paying dividends and making other distributions to our stockholders;

- •

- entering into transactions with our affiliates; and

- •

- incurring capital expenditures in excess of limitations set within the agreement.

The Revolving Credit Facility also requires that, to the extent borrowings thereunder exceed $25 million, we meet a senior secured debt ratio of consolidated senior secured debt to consolidated EBITDA. See "Description of Certain Debt — Senior Credit Facility" for additional information. If we fail to satisfy such ratio, then we will be restricted from drawing the remaining $55 million of available borrowings under the Revolving Credit Facility, which may impair our liquidity.

Our ability to comply with these covenants and other provisions of the Senior Credit Facility may be affected by changes in our operating and financial performance, changes in general business and economic conditions, adverse regulatory developments, or other events beyond our control. The breach of any of these covenants could result in a default under our debt, which could

19

cause those and other obligations to become immediately due and payable. In addition, these restrictions may prevent us from taking actions that we believe would be in the best interest of our business and may make it difficult for us to successfully execute our business strategy or effectively compete with companies that are not similarly restricted.

We depend on the services of key executives and changes in our management team could affect our business strategy and adversely impact our performance and results of operations.

Our senior executives are important to our success because they have been instrumental in setting our strategic direction, operating our business, identifying, recruiting and training key personnel, identifying opportunities and arranging necessary financing. Losing the services of any of these individuals could adversely affect our business until a suitable replacement is hired. We believe that our senior executives could not be replaced quickly with executives of equal experience and capabilities. We do not maintain key person life insurance policies on any of our executives.

If our risk management methods are not effective, our business, reputation and financial results may be adversely affected.

We have methods to identify, monitor and manage our risks; however, these methods may not be fully effective. Some of our risk management methods may depend upon evaluation of information regarding markets, customers or other matters that are publicly available or otherwise accessible by us. That information may not in all cases be accurate, complete, up-to-date or properly evaluated. If our methods are not fully effective or we are not successful in monitoring or evaluating the risks to which we are or may be exposed, our business, reputation, financial condition and operating results could be materially and adversely affected. In addition, our insurance policies may not provide adequate coverage.

Compliance with new and existing governmental regulations could increase our costs significantly and adversely affect our results of operations.

The processing, formulation, manufacturing, packaging, labeling, advertising, and distribution of our products are subject to federal laws and regulation by one or more federal agencies, including the FDA, the Federal Trade Commission (the "FTC"), the Consumer Product Safety Commission, the United States Department of Agriculture, and the Environmental Protection Agency. These activities are also regulated by various state, local, and international laws and agencies of the states and localities in which our products are sold. Government regulations may prevent or delay the introduction, or require the reformulation, of our products, which could result in lost revenues and increased costs to us. For instance, the FDA regulates, among other things, the composition, safety, labeling, and marketing of dietary supplements (including vitamins, minerals, herbs, and other dietary ingredients for human use). The FDA may not accept the evidence of safety for any new dietary ingredient that we may wish to market, may determine that a particular dietary supplement or ingredient presents an unacceptable health risk, and may determine that a particular claim or statement of nutritional value that we use to support the marketing of a dietary supplement is an impermissible drug claim, is not substantiated, or is an unauthorized version of a "health claim". See "Business — Government Regulation — Product Regulation" for additional information. Any of these actions could prevent us from marketing particular dietary supplement products or making certain claims or statements with respect to those products. The FDA could also require us to remove a particular product from the market. Any future recall or removal would result in additional costs to us, including lost revenues from any products that we are required to remove from the market, any of which could be material. Any product recalls or removals could also lead to liability, substantial costs, and reduced growth prospects. For more information, see

20

"— We may experience product recalls, which could reduce our sales and margin and adversely affect our results of operations".

Additional or more stringent regulations of dietary supplements and other products have been considered from time to time. These developments could require reformulation of some products to meet new standards, recalls or discontinuance of some products not able to be reformulated, additional record-keeping requirements, increased documentation of the properties of some products, additional or different labeling, additional scientific substantiation, adverse event reporting, or other new requirements. Any of these developments could increase our costs significantly. The FDA has announced that it plans to publish a guidance governing the notification of new dietary ingredients. Although FDA guidance is not mandatory, it is a strong indication of the FDA's current views on the topic discussed in the guidance, including its position on enforcement. Depending on its recommendations, particularly those relating to animal or human testing, such guidance could also raise our costs and negatively impact our business in several ways, including the potential that the FDA might seek to enjoin the manufacturing of our products because of violation of the Good Manufacturing Practice ("GMP") regulations until the FDA determines that we are in compliance and can resume manufacturing. We may not be able to comply with the new rules without incurring additional expenses, which could be significant. For example, the Dietary Supplement Safety Act (S3002) was introduced in February 2010 and contains many restrictive provisions on the sale of dietary supplements, including, but not limited to, provisions that limit the dietary ingredients acceptable for use in dietary supplements, increased fines for violations of the Dietary Supplement Health and Education Act of 1994 ("DSHEA"), and increased registration and reporting requirements with the FDA. If reintroduced and enacted, this bill could severely restrict the number of dietary supplements available for sale and increase our costs and potential penalties associated with selling dietary supplements.

Our failure to comply with FTC regulations and existing consent decrees imposed on us by the FTC could result in substantial monetary penalties and could adversely affect our operating results.

The FTC exercises jurisdiction over the advertising of dietary supplements and has instituted numerous enforcement actions against dietary supplement companies, including us, for failure to have adequate substantiation for claims made in advertising or for the use of false or misleading advertising claims. As a result of these enforcement actions, we are currently subject to three consent decrees that limit our ability to make certain claims with respect to our products and required us in the past to pay civil penalties and other amounts in the aggregate amount of $3.0 million. See "Business — Government Regulation — Product Regulation" for more information. Failure by us or our franchisees to comply with the consent decrees and applicable regulations could occur from time to time. Violations of these orders could result in substantial monetary penalties, which could have a material adverse effect on our financial condition or results of operations.

We may incur material product liability claims, which could increase our costs and adversely affect our reputation, revenues, and operating income.

As a retailer, distributor, and manufacturer of products designed for human consumption, we are subject to product liability claims if the use of our products is alleged to have resulted in injury. Our products consist of vitamins, minerals, herbs and other ingredients that are classified as foods or dietary supplements and are not subject to pre-market regulatory approval in the United States. Our products could contain contaminated substances, and some of our products contain ingredients that do not have long histories of human consumption. Previously unknown adverse reactions resulting from human consumption of these ingredients could occur.

21

In addition, third-party manufacturers produce many of the products we sell. As a distributor of products manufactured by third parties, we may also be liable for various product liability claims for products we do not manufacture. Although our purchase agreements with our third-party vendors typically require the vendor to indemnify us to the extent of any such claims, any such indemnification is limited by its terms. Moreover, as a practical matter, any such indemnification is dependent on the creditworthiness of the indemnifying party and its insurer, and the absence of significant defenses by the insurers. We may be unable to obtain full recovery from the insurer or any indemnifying third party in respect of any claims against us in connection with products manufactured by such third party.

We have been and may be subject to various product liability claims, including, among others, that our products include inadequate instructions for use or inadequate warnings concerning possible side effects and interactions with other substances. For example, as of December 31, 2010, there were 50 pending lawsuits related to Hydroxycut in which GNC had been named, including 44 individual, largely personal injury claims and six putative class action cases. See "Business — Legal Proceedings".

Even with adequate insurance and indemnification, product liability claims could significantly damage our reputation and consumer confidence in our products. Our litigation expenses could increase as well, which also could have a materially negative impact on our results of operations even if a product liability claim is unsuccessful or is not fully pursued.

We may experience product recalls, which could reduce our sales and margin and adversely affect our results of operations.

We may be subject to product recalls, withdrawals or seizures if any of the products we formulate, manufacture or sell are believed to cause injury or illness or if we are alleged to have violated governmental regulations in the manufacturing, labeling, promotion, sale or distribution of such products. For example, in May 2009, the FDA warned consumers to stop using Hydroxycut diet products, which are produced by Iovate Health Sciences, Inc. ("Iovate") and were sold in our stores. Iovate issued a voluntary recall, with which we fully complied. Sales of the recalled Hydroxycut products amounted to approximately $57.8 million, or 4.7% of our retail sales in 2008, and $18.8 million, or 4.2% of our retail sales in the first four months of 2009. We provided refunds or gift cards to consumers who returned these products to our stores. In the second quarter of 2009, we experienced a reduction in sales and margin due to this recall as a result of accepting returns of products from customers and a loss of sales as a replacement product was not available. Through December 31, 2010, we estimate that we have refunded approximately $3.5 million to our retail customers and approximately $1.6 million to our wholesale customers for Hydroxycut product returns. Our results of operations may continue to be affected by the Hydroxycut recall. Any additional recall, withdrawal or seizure of any of the products we formulate, manufacture or sell would require significant management attention, would likely result in substantial and unexpected expenditures and could materially and adversely affect our business, financial condition or results of operations. Furthermore, a recall, withdrawal or seizure of any of our products could materially and adversely affect consumer confidence in our brands and decrease demand for our products.

As is common in our industry, we rely on our third-party vendors to ensure that the products they manufacture and sell to us comply with all applicable regulatory and legislative requirements. In general, we seek representations and warranties, indemnification and/or insurance from our vendors. However, even with adequate insurance and indemnification, any claims of non-compliance could significantly damage our reputation and consumer confidence in our products. In addition, the failure of such products to comply with applicable regulatory and legislative requirements could prevent us from marketing the products or require us to recall or remove such products from the market, which in certain cases could materially and adversely affect our

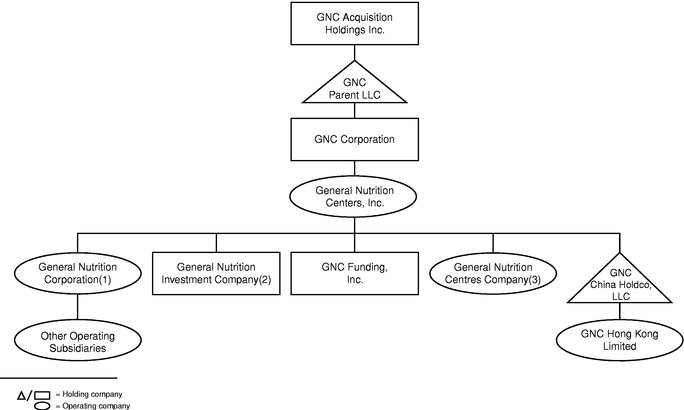

22