Attached files

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2010

Commission file number 0-12820

AMERICAN NATIONAL BANKSHARES INC.

(Exact name of registrant as specified in its charter)

|

Virginia

|

54-1284688

|

|

|

(State of incorporation)

|

(I.R.S. Employer Identification No.)

|

|

|

628 Main Street, Danville, VA

|

24541

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

434-792-5111

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

Name of Exchange on Which Registered

|

|

|

Common Stock, $1 par value

|

NASDAQ Global Select Market

|

|

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o Accelerated filer þ Non-accelerated filer o Smaller reporting company o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act.) Yes o No þ

The aggregate market value of the voting stock held by non-affiliates of the registrant at June 30, 2010, based on the closing price, was $115,300,466.

The number of shares of the registrant’s common stock outstanding on March 10, 2011 was 6,153,337.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement of the Registrant for the Annual Meeting of Shareholders to be held on May 17, 2011, are incorporated by reference in Part III of this report.

|

PAGE

|

||

|

ITEM 1

|

3

|

|

|

ITEM 1A

|

10

|

|

|

ITEM 1B

|

Unresolved Staff Comments

|

None

|

|

ITEM 2

|

15

|

|

|

ITEM 3

|

15

|

|

|

ITEM 4

|

15

|

|

|

|

||

|

ITEM 5

|

16

|

|

|

ITEM 6

|

19

|

|

|

ITEM 7

|

20

|

|

|

ITEM 7A

|

26

|

|

|

ITEM 8

|

Financial Statements and Supplementary Data

|

|

|

40

|

||

|

43

|

||

|

44

|

||

|

45

|

||

|

46

|

||

|

47

|

||

|

ITEM 9

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

None

|

|

ITEM 9A

|

80

|

|

|

80

|

||

|

ITEM 9B

|

Other Information

|

None

|

|

|

||

|

PART III

|

||

|

ITEM 10

|

Directors, Executive Officers and Corporate Governance

|

*

|

|

ITEM 11

|

Executive Compensation

|

*

|

|

ITEM 12

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

*

|

|

ITEM 13

|

Certain Relationships and Related Transactions, and Director Independence

|

*

|

|

ITEM 14

|

Principal Accountant Fees and Services

|

*

|

|

|

||

|

ITEM 15

|

81

|

|

_______________________________

*Certain information required by Item 10 is incorporated herein by reference to the information that appears under the headings “Election of Directors,” “Election of Directors – Board Members Serving on Other Publicly Traded Company Boards of Directors,” “Election of Directors – Board of Directors and Committees - The Audit and Compliance Committee,” “Section 16(a) Beneficial Ownership Reporting Compliance,” “Report of the Audit and Compliance Committee,” and “Code of Conduct” in the Registrant’s Proxy Statement for the 2011 Annual Meeting of Shareholders. The information required by Item 401 of regulation S-K on executive officers is disclosed herein.

The information required by Item 11 is incorporated herein by reference to the information that appears under the headings “Compensation Discussion and Analysis,” “Compensation Committee Interlocks and Insider Participation,” and “Compensation Committee Report” in the Registrant’s Proxy Statement for the 2011 Annual Meeting of Shareholders.

The information required by Item 12 is incorporated herein by reference to the information that appears under the heading “Security Ownership” in the Registrant’s Proxy Statement for the 2011 Annual Meeting of Shareholders. The information required by Item 201(d) of Regulation S-K is disclosed herein. See Item 5, “Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.”

The information required by Item 13 is incorporated herein by reference to the information that appears under the headings “Related Party Transactions” and “Election of Directors – Board Independence” in the Registrant’s Proxy Statement for the 2011 Annual Meeting of Shareholders.

The information required by Item 14 is incorporated herein by reference to the information that appears under the heading “Independent Public Accountants” in the Registrant’s Proxy Statement for the 2011 Annual Meeting of Shareholders.

Forward-Looking Statements

This report contains forward-looking statements with respect to the financial condition, results of operations and business of American National Bankshares Inc. and its wholly owned subsidiary, American National Bank and Trust Company (collectively referred to as the “Company”). These forward-looking statements involve risks and uncertainties and are based on the beliefs and assumptions of management of the Company and on information available to management at the time these statements and disclosures were prepared. Forward-looking statements are subject to numerous assumptions, estimates, risks, and uncertainties that could cause actual conditions, events, or results to differ materially from those stated or implied by such forward-looking statements.

A variety of factors, some of which are discussed in more detail in Item 1A – Risk Factors, may affect the operations, performance, business strategy, and results of the Company. Those factors include but are not limited to the following:

|

·

|

Financial market volatility including the level of interest rates could affect the values of financial instruments and the amount of net interest income earned;

|

|

·

|

General economic or business conditions, either nationally or in the market areas in which the Company does business, may be less favorable than expected, resulting in deteriorating credit quality, reduced demand for credit, or a weakened ability to generate deposits;

|

|

·

|

Competition among financial institutions may increase and competitors may have greater financial resources and develop products and technology that enable those competitors to compete more successfully than the Company;

|

|

·

|

Businesses that the Company is engaged in may be adversely affected by legislative or regulatory changes, including changes in accounting standards;

|

|

·

|

The ability to retain key personnel;

|

|

·

|

The failure of assumptions underlying the allowance for loan losses; and

|

|

·

|

Risks associated with legal, regulatory and operational aspects of the proposed merger with MidCarolina Financial Corporation.

|

American National Bankshares Inc. is a one-bank holding company organized under the laws of the Commonwealth of Virginia in 1984. On September 1, 1984, American National Bankshares Inc. acquired all of the outstanding capital stock of American National Bank and Trust Company (“American National Bank”), a national banking association chartered in 1909 under the laws of the United States. American National Bank and Trust Company is the only banking subsidiary of American National Bankshares Inc. In April 2006, AMNB Statutory Trust I, a Delaware statutory trust (the “Trust”) and a wholly owned subsidiary of American National Bankshares Inc., was formed for the purpose of issuing preferred securities (the “Trust Preferred Securities”) in a private placement pursuant to an applicable exemption from registration. Proceeds from the securities were used to fund the acquisition of Community First Financial Corporation (“Community First”). In April 2006, the Company finalized the acquisition of Community First and acquired 100% of its preferred and common stock through a merger transaction. Community First was a bank holding company headquartered in Lynchburg, Virginia, and through its subsidiary, Community First Bank, operated four banking offices serving the city of Lynchburg and Bedford, Nelson, and Amherst Counties.

The operations of the Company are conducted at eighteen banking offices and one loan production office serving Southern and Central Virginia and the northern portion of Central North Carolina. American National Bank provides a full array of financial products and services, including commercial, mortgage, and consumer banking; trust and investment services; and insurance. Services are also provided through twenty-six ATMs, “AmeriLink” Internet banking, and 24-hour “Access American” telephone banking.

On December 16, 2010, American National Bankshares Inc. announced that it had entered into an Agreement and Plan of Reorganization, dated December 15, 2010 (the “Merger Agreement”), with MidCarolina Financial Corporation (“MidCarolina”), pursuant to which it will acquire MidCarolina in a business combination transaction (the “Merger”). MidCarolina is headquartered in Burlington, North Carolina and the transaction will expand the Company’s footprint in North Carolina, adding eight branches in Alamance and Guilford Counties. The Company expects that it will have approximately $1.4 billion in assets upon completion of the Merger.

Pursuant to and subject to the terms of the Merger Agreement, as a result of the Merger, the holders of shares of MidCarolina common stock will receive 0.33 shares of American National Bankshares Inc. common stock for each share of MidCarolina common stock held immediately prior to the effective date of the Merger. Each share of American National Bankshares Inc. common stock outstanding immediately prior to the Merger will continue to be outstanding after the Merger. Each option to purchase a share of MidCarolina common stock outstanding immediately prior to the effective date of the Merger will be converted into an option to purchase shares of American National Bankshares Inc. common stock, adjusted for the 0.33 exchange ratio. Additionally, the holders of shares of noncumulative perpetual Series A preferred stock of MidCarolina will receive one share of a newly authorized noncumulative perpetual Series A preferred stock of American National Bankshares Inc. which will have terms, preferences, rights and limitations that are identical in all material respects to the MidCarolina Series A preferred stock.

Subject to customary closing conditions, including regulatory and shareholder approvals, the Company expects the Merger to close in the second quarter of 2011. Following completion of the Merger, MidCarolina's subsidiary bank, MidCarolina Bank, will be merged into American National Bank.

Competition and Markets

Vigorous competition exists in the Company’s service area. The Company competes not only with national, regional, and community banks, but also with many other types of financial institutions, including without limitation, savings banks, finance companies, mutual and money market fund providers, brokerage firms, insurance companies, credit unions, and mortgage companies. The Company has the largest deposit market share in the City of Danville, as well as in the City of Danville and Pittsylvania County, combined.

The Southern Virginia market, in which the Company has a significant presence, is under economic pressure. The region’s economic base has historically been weighted toward the manufacturing sector. Increased global competition has negatively impacted the textile industry and several manufacturers have closed plants due to competitive pressures or the relocation of some operations to foreign countries. Other important industries include farming, tobacco processing and sales, food processing, furniture manufacturing and sales, specialty glass manufacturing, and packaging tape production. Companies within these industries, especially furniture manufacturing, have also closed plants for reasons similar to those noted above. Additional declines in manufacturing production and unemployment could negatively impact the ability of certain borrowers to repay loans. Also, the current economic and credit crisis, which is resulting in rising unemployment and increasing bankruptcies, foreclosures and bank failures nationally, may further intensify the economic pressure in our markets.

Supervision and Regulation

The Company is extensively regulated under both federal and state law. The following information describes certain aspects of that regulation applicable to the Company and does not purport to be complete. Proposals to change the laws and regulations governing the banking industry are frequently raised in Congress, in state legislatures, and before the various bank regulatory agencies. The likelihood and timing of any changes and the impact such changes might have on the Company are impossible to determine with any certainty. A change in applicable laws or regulations, or a change in the way such laws or regulations are interpreted by regulatory agencies or courts, may have a material impact on the business, operations, and earnings of the Company.

American National Bankshares Inc.

American National Bankshares Inc. is qualified as a bank holding company (“BHC”) within the meaning of the Bank Holding Company Act of 1956, as amended (the “BHC Act”), and is registered as such with the Board of Governors of the Federal Reserve System (the “FRB”). As a bank holding company, American National Bankshares Inc. is required to file various reports and additional information with the FRB and is also subject to examinations by the FRB.

The BHC Act prohibits, with certain exceptions, a BHC from acquiring beneficial ownership or control of more than 5% of the voting shares of any company, including a bank, without the FRB’s prior approval and from engaging in any activity other than those of banking, managing or controlling banks or other subsidiaries authorized under the BHC Act, or furnishing services to or performing services for its subsidiaries. Among the permitted activities is the ownership of shares of any company the activities of which the FRB determines to be so closely related to banking or managing or controlling banks as to be proper incident thereto.

Under FRB policy, a BHC is expected to serve as a source of financial and managerial strength to its subsidiary banks and to commit resources to support those banks. This support may be required at times when the BHC may not have the resources to provide it. Under this policy, a BHC is expected to stand ready to use available resources to provide adequate capital funds to its subsidiary banks during periods of financial adversity and to maintain the financial flexibility and capital-raising capacity to obtain additional resources for assisting its subsidiary banks.

Under the Gramm-Leach-Bliley Act, a BHC may elect to become a financial holding company and thereby engage in a broader range of financial and other activities than are permissible for traditional BHC’s. In order to qualify for the election, all of the depository institution subsidiaries of the BHC must be well capitalized, well managed, and have achieved a rating of “satisfactory” or better under the Community Reinvestment Act (the “CRA”). Financial holding companies are permitted to engage in activities that are “financial in nature” or incidental or complementary thereto as determined by the FRB. The Gramm-Leach-Bliley Act identifies several activities as “financial in nature,” including insurance underwriting and sales, investment advisory services, merchant banking and underwriting, and dealing or making a market in securities. American National Bankshares Inc. has not elected to become a financial holding company.

American National Bank and Trust Company

American National Bank and Trust Company is a federally chartered national bank and is a member of the Federal Reserve System. It is subject to federal regulation by the Office of the Comptroller of the Currency (the “OCC”), the FRB, and the Federal Deposit Insurance Corporation (“FDIC”).

Depository institutions, including American National Bank, are subject to extensive federal and state regulations that significantly affect their business and activities. Regulatory bodies have broad authority to implement standards and initiate proceedings designed to prohibit deposit institutions from engaging in unsafe and unsound banking practices. The standards relate generally to operations and management, asset quality, interest rate exposure, and capital. The agencies are authorized to take action against institutions that fail to meet such standards.

As with other financial institutions, the earnings of American National Bank are affected by general economic conditions and by the monetary policies of the FRB. The FRB exerts a substantial influence on interest rates and credit conditions, primarily through open market operations in U.S. Government securities, setting the reserve requirements of member banks, and establishing the discount rate on member bank borrowings. The policies of the FRB have a direct impact on loan and deposit growth and the interest rates charged and paid thereon. They also impact the source and cost of funds and the rates of return on investments. Changes in the FRB’s monetary policies have had a significant impact on the operating results of American National Bank and other financial institutions and are expected to continue to do so in the future; however, the exact impact of such conditions and policies upon the future business and earnings cannot accurately be predicted.

FDIC Insurance

American National Bank pays deposit insurance assessments to the FDIC’s Deposit Insurance Fund (“DIF”) which are determined through a risk-based assessment system. Deposit accounts are currently insured by the DIF generally up to a maximum of $250,000 per separately insured depositor

The Dodd-Frank Act

On July 21, 2010, President Obama signed into law the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”). The Dodd-Frank Act will have a significant impact on financial institutions, with increased regulatory and compliance changes. A summary of certain provisions of the Dodd-Frank Act is set forth below:

Increased Capital Standards. The federal banking agencies are required to establish minimum leverage and risk-based capital requirements for banks and bank holding companies. These new standards will be no lower than current regulatory capital and leverage standards and may, in fact, be higher when established by the agencies. The act requires the OCC to seek to make the capital requirements for national banks, like American National Bank, countercyclical.

Deposit Insurance. The Dodd-Frank Act makes permanent the $250,000 deposit insurance limit for insured deposits. Amendments to the Federal Deposit Insurance Act also revise the assessment base against which an insured depository institution’s deposit insurance premiums paid to the Deposit Insurance Fund will be calculated. Under the amendments, the assessment base will no longer be the institution’s deposit base, but rather its average consolidated total assets less its average tangible equity during the assessment period. Additionally, the Dodd-Frank Act makes changes to the minimum designated reserve ratio of the DIF, increasing the minimum from 1.15% to 1.35% of the estimated amount of total insured deposits and eliminating the requirement that the FDIC pay dividends to depository institutions when the reserve ratio exceeds certain thresholds. In December 2010, the FDIC increased the reserve ratio to 2.0%. The Dodd-Frank Act also provides that, effective one year after the date of enactment, depository institutions may pay interest on demand deposits.

Enhanced Lending Limits. The Dodd-Frank Act strengthens the existing limits on a depository institution’s credit exposure to one borrower. Current banking law limits a depository institution’s ability to extend credit to one person (or group of related persons) in an amount exceeding certain thresholds.

The Consumer Financial Protection Bureau (“Bureau”). The Dodd-Frank Act creates the Bureau within the Federal Reserve. The Bureau will establish rules and regulations under certain federal consumer protection laws with respect to the conduct of providers of certain consumer financial products and services.

Compensation Practices. The Dodd-Frank Act provides that the appropriate federal regulators must establish standards prohibiting as an unsafe and unsound practice any compensation plan of a bank holding company or bank that provides an insider or other employee with “excessive compensation” or could lead to a material financial loss to such firm. In June 2010, prior to the Dodd-Frank Act, the bank regulatory agencies promulgated the Interagency Guidance on Sound Incentive Compensation Policies, which requires that financial institutions establish metrics for measuring the impact of activities to achieve incentive compensation with the related risk to the financial institution of such behavior.

The requirements of the Dodd-Frank Act will significantly affect banks and other financial institutions. However, because much of these requirements will be phased in over time and will not become effective until federal agency rulemaking initiatives are completed, the Company cannot fully assess the impact of Dodd-Frank Act on the Company. The Company does believe, however, that short- and long-term compliance costs for the Company will be greater because of the Dodd-Frank Act.

Capital Requirements

The Federal Reserve, the OCC and the FDIC have issued substantially similar risk-based and leverage capital guidelines applicable to all banks and bank holding companies. In addition, those regulatory agencies may from time to time require that a banking organization maintain capital above the minimum levels because of its financial condition or actual or anticipated growth. Under the risk-based capital requirements of these federal bank regulatory agencies, American National Bankshares Inc. and American National Bank are required to maintain a minimum ratio of total capital to risk-weighted assets of at least 8.0%. At least half of the total capital is required to be “Tier 1 capital,” which consists principally of common and certain qualifying preferred shareholders’ equity (including trust preferred securities), less certain intangibles and other adjustments. The remainder (“Tier 2 capital”) consists of a limited amount of subordinated and other qualifying debt (including certain hybrid capital instruments) and a limited amount of the general loan loss allowance. The Tier 1 and total capital to risk-weighted asset ratios of the American National Bankshares Inc. were 18.38% and 19.64%, respectively, as of December 31, 2010, thus exceeding the minimum requirements. The Tier 1 and total capital to risk-weighted asset ratios of American National Bank were 16.79% and 17.88%, respectively, as of December 31, 2010, thus exceeding the minimum requirements.

Each of the federal regulatory agencies has established a minimum leverage capital ratio of Tier 1 capital to average adjusted assets (“Tier 1 leverage ratio”). These guidelines provide for a minimum Tier 1 leverage ratio of 4% for banks and bank holding companies that meet certain specified criteria, including having the highest regulatory examination rating and are not contemplating significant growth or expansion. The Tier 1 leverage ratio of American National Bankshares Inc. as of December 31, 2010 was 12.74%, which is above the minimum requirements. The guidelines also provide that banking organizations experiencing internal growth or making acquisitions will be expected to maintain strong capital positions substantially above the minimum supervisory levels without significant reliance on intangible assets.

Dividends

American National Bankshares Inc.’s principal source of cash flow, including cash flow to pay dividends to its shareholders, is dividends it receives from American National Bank. Statutory and regulatory limitations apply to American National Bank’s payment of dividends to American National Bankshares Inc. As a general rule, the amount of a dividend may not exceed, without prior regulatory approval, the sum of net income in the calendar year to date and the retained net earnings of the immediately preceding two calendar years. A depository institution may not pay any dividend if payment would cause the institution to become “undercapitalized” or if it already is “undercapitalized.” The OCC may prevent the payment of a dividend if it determines that the payment would be an unsafe and unsound banking practice. The OCC also has advised that a national bank should generally pay dividends only out of current operating earnings.

In November 2008, the FDIC issued a final rule under its Transaction Account Guarantee Program (“TAGP”), pursuant to which the FDIC fully guaranteed all non-interest bearing transaction deposit accounts, including all personal and business checking deposit accounts that do not earn interest, lawyer trust accounts where interest does not accrue to the account owner (IOLTA), and NOW accounts with interest rates no higher than 0.50% until June 30, 2010 and 0.25% beginning July 1, 2010. Thus, under TAGP, all money in these accounts were fully insured by the FDIC regardless of dollar amount. This second increase to coverage was originally in effect through December 31, 2009, but was extended until June 30, 2010 and then again until December 31, 2010, unless the Company elected to “opt out” of participating, which we did not do. The Dodd-Frank Act extended full deposit coverage for non-interest bearing transaction deposit accounts for two years beginning on December 31, 2010, and all financial institutions are required to participate in this extended program.

Under the current assessment system, the FDIC assigns an institution to one of four risk categories, with the first category having two sub-categories based on the institution’s most recent supervisory and capital evaluations, designed to measure risk. Total base assessment rates currently range from 0.07% of deposits for an institution in the highest sub-category of the highest category to 0.775% of deposits for an institution in the lowest category. On May 22, 2009, the FDIC imposed a special assessment of five basis points on each FDIC-insured depository institution’s assets, minus its Tier 1 capital, as of June 30, 2009. This special assessment was collected on September 30, 2009. Finally, on November 12, 2009, the FDIC adopted a new rule requiring insured institutions to prepay on December 30, 2009, estimated quarterly risk-based assessments for the fourth quarter of 2009 and for all of 2010, 2011, and 2012. The Company prepaid an assessment of $2.9 million, which incorporated a uniform 3.00 basis point increase effective January 1, 2011 and assumed 5% annual deposit growth.

In addition, all FDIC insured institutions are required to pay assessments to the FDIC at an annual rate of approximately one basis point of insured deposits to fund interest payments on bonds issued by the Financing Corporation, an agency of the federal government established to recapitalize the predecessor to the Savings Association Insurance Fund. These assessments will continue until the Financing Corporation bonds mature in 2017 through 2019.

The Federal Deposit Insurance Corporation Improvement Act

Under the Federal Deposit Insurance Corporation Improvement Act of 1991 (“FDICIA”), the federal banking agencies possess broad powers to take prompt corrective action to resolve problems of insured depository institutions. The extent of these powers depends upon whether the institution is “well capitalized,” “adequately capitalized,” “undercapitalized,” “significantly undercapitalized,” or “critically undercapitalized,” as defined by the law. Under regulations established by the federal banking agencies a “well capitalized” institution must have a Tier 1 capital ratio of at least 6%, a total capital ratio of at least 10%, and a leverage ratio of at least 5%, and not be subject to a capital directive order. An “adequately capitalized” institution must have a Tier 1 capital ratio of a least 4%, a total capital ratio of at least 8%, and a leverage ratio of at least 4%, or 3% in some cases. Management believes, as of December 31, 2010 and 2009, that the Company met the requirements for being classified as “well capitalized.”

As required by FDICIA, the federal banking agencies also have adopted guidelines prescribing safety and soundness standards relating to, among other things, internal controls and information systems, internal audit systems, loan documentation, credit underwriting, and interest rate exposure. In general, the guidelines require appropriate systems and practices to identify and manage the risks and exposures specified in the guidelines. In addition, the agencies adopted regulations that authorize, but do not require, an institution which has been notified that it is not in compliance with safety and soundness standard to submit a compliance plan. If, after being so notified, an institution fails to submit an acceptable compliance plan, the agency must issue an order directing action to correct the deficiency and may issue an order directing other actions of the types to which an undercapitalized institution is subject under the prompt corrective action provisions described above.

Branching

National banks are required by the National Bank Act to adhere to branch office banking laws applicable to state banks in the states in which they are located. In addition, with prior regulatory approval, American National Bank is able to acquire existing banking operations in North Carolina. Furthermore, federal legislation permits interstate branching, including out-of-state acquisitions by bank holding companies, interstate branching by banks if allowed by state law, and interstate merging by banks. Virginia and North Carolina each adopted “opt in” legislation that allows interstate bank mergers, branch acquisitions and de novo branching across their respective borders.

Community Reinvestment and Consumer Protection Laws

In connection with its lending activities, the Company is subject to a number of federal laws designed to protect borrowers and promote lending to various sectors of the economy and population. These include the Equal Credit Opportunity Act, the Truth-in-Lending Act, the Home Mortgage Disclosure Act, the Real Estate Settlement Procedures Act, and the Community Reinvestment Act.

The CRA requires the appropriate federal banking agency, in connection with its examination of a bank, to assess the bank’s record in meeting the credit needs of the communities served by the bank, including low and moderate income neighborhoods. Furthermore, such assessment is also required of banks that have applied, among other things, to merge or consolidate with or acquire the assets or assume the liabilities of an insured depository institution, or to open or relocate a branch. In the case of a BHC applying for approval to acquire a bank or BHC, the record of each subsidiary bank of the applicant BHC is subject to assessment in considering the application. Under the CRA, institutions are assigned a rating of “outstanding,” “satisfactory,” “needs to improve,” or “substantial non-compliance.” The Company was rated “outstanding” in its most recent CRA evaluation.

Anti-Money Laundering Legislation

The Company is subject to the Bank Secrecy Act and other anti-money laundering laws and regulations, including the USA Patriot Act of 2001. Among other things, these laws and regulations require the Company to take steps to prevent the use of the Company for facilitating the flow of illegal or illicit money, to report large currency transactions, and to file suspicious activity reports. The Company is also required to carry out a comprehensive anti-money laundering compliance program. Violations can result in substantial civil and criminal sanctions. In addition, provisions of the USA Patriot Act require the federal financial institution regulatory agencies to consider the effectiveness of a financial institution’s anti-money laundering activities when reviewing bank mergers and BHC acquisitions.

Emergency Economic Stabilization Act of 2008

Deteriorating market conditions in 2008 led to the enactment of the Emergency Economic Stabilization Act of 2008 (the “EESA”) on October 3, 2008. The EESA authorized the Troubled Asset Relief Plan (“TARP”) with an objective to ease the downturn in the credit cycle. The TARP provided up to $700 billion to the U.S. Department of the Treasury (“UST”) to buy mortgages and other troubled assets, to provide guarantees and to inject capital into financial institutions. As part of the $700 billion TARP, a capital purchase program was established by UST which allowed it to purchase up to $250 billion of senior preferred shares issued by U.S. financial institutions. The EESA also temporarily raised the basic limit on federal deposit insurance coverage from $100,000 to $250,000 per depositor (which has since been made permanent pursuant to the Dodd-Frank Act).

After considering the appropriateness of applying under UST’s capital purchase program under TARP, the Company elected not to participate.

Effect of Governmental Monetary Policies

The Company’s operations are affected not only by general economic conditions, but also by the policies of various regulatory authorities. In particular, the Federal Reserve regulates money and credit conditions and interest rates to influence general economic conditions. These policies have a significant impact on overall growth and distribution of loans, investments and deposits; they affect interest rates charged on loans or paid for time and savings deposits. Federal Reserve monetary policies have had a significant effect on the operating results of commercial banks, including the Company, in the past and are expected to do so in the future. As a result, the Company is unable to predict the effects of possible changes in monetary policies upon its future operating results.

Employees

At December 31, 2010, the Company employed 242 full-time equivalent persons. The relationship with employees is considered to be good.

Internet Access to Company Documents

The Company provides access to its Securities and Exchange Commission (the “SEC”) filings through a link on the Investor Relations page of the Company’s website at www.amnb.com. Reports available include the annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports as soon as reasonably practicable after the reports are filed electronically with the SEC. The information on the Company’s website is not incorporated into this Annual Report on Form 10-K or any other filing the Company makes with the SEC. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at www.sec.gov.

Executive Officers of the Registrant

The following lists, as of December 31, 2010, the named executive officers of the registrant, their ages, and their positions.

|

Name

|

Age

|

Position

|

||

|

Charles H. Majors

|

65

|

President and Chief Executive Officer of American National Bankshares Inc.; Chairman and Chief Executive Officer of American National Bank and Trust Company since June 2010; prior thereto, President of American National Bank and Trust Company.

|

||

|

Jeffrey V. Haley

|

50

|

Executive Vice President of American National Bankshares Inc. since June 2010; prior thereto, Senior Vice President of American National Bankshares Inc. since July 2008; President of American National Bank and Trust Company since June 2010; prior thereto, Executive Vice President of American National Bank and Trust Company, as well as President of Trust and Financial Services since July 2008; prior thereto, Executive Vice President and Chief Operating Officer of American National Bank and Trust Company since November 2005.

|

||

|

William W. Traynham

|

55

|

Senior Vice President, Chief Financial Officer, Treasurer and Secretary of American National Bankshares Inc. since April 2009; Executive Vice President, Chief Financial Officer, and Cashier of American National Bank and Trust Company since April 2009; prior thereto, President and Chief Financial Officer of Community Bankshares Inc. and Chief Financial Officer of Community Resource Bank, NA from 1992 until the sale of the company in 2008.

|

||

|

R. Helm Dobbins

|

59

|

Senior Vice President of American National Bankshares Inc. since December 2008; Executive Vice President and Chief Credit Officer of American National Bank and Trust Company since November 2005.

|

||

|

S. Cabell Dudley, Jr.

|

65

|

Senior Vice President of American National Bankshares Inc. since December 2008; Executive Vice President and Chief Lending Officer of American National Bank and Trust Company since July 2008; prior thereto, Senior Vice President and Commercial Relationship Manager since March 2006.

|

||

|

Dabney T. P. Gilliam, Jr.

|

56

|

Senior Vice President of American National Bankshares Inc. since December 2008; Executive Vice President and Chief Administrative Officer of American National Bank and Trust Company since July 2008; prior thereto, Senior Vice President of American National Bank and Trust Company since February 2007; prior thereto, Chief Financial Officer of RACO, Inc. from January 2006 to February 2007; prior thereto, Senior Vice President, Senior Loan Officer and Chief Banking Officer of American National Bank and Trust Company.

|

ITEM 1A – RISK FACTORS

The Company’s business is subject to interest rate risk and variations in interest rates may negatively affect financial performance.

Changes in the interest rate environment may reduce the Company’s profits. It is expected that the Company will continue to realize income from the differential or “spread” between the interest earned on loans, securities, and other interest earning assets, and interest paid on deposits, borrowings and other interest bearing liabilities. Net interest spreads are affected by the difference between the maturities and repricing characteristics of interest earning assets and interest bearing liabilities. In addition, loan volume and yields are affected by market interest rates on loans, and rising interest rates generally are associated with a lower volume of loan originations. Management cannot ensure that it can minimize the Company’s interest rate risk. While an increase in the general level of interest rates may increase the loan yield and the net interest margin, it may adversely affect the ability of certain borrowers with variable rate loans to pay the interest and principal of their obligations. Accordingly, changes in levels of market interest rates could materially and adversely affect the net interest spread, asset quality, loan origination volume, and overall profitability of the Company.

The Company faces strong competition from financial services companies and other companies that offer banking services which could negatively affect the Company’s business.

Increased competition may result in reduced business for the Company. Ultimately, the Company may not be able to compete successfully against current and future competitors. Many competitors offer the same banking services that the Company offers in its service area. These competitors include national, regional, and community banks. The Company also faces competition from many other types of financial institutions, including without limitation, savings banks, finance companies, mutual and money market fund providers, brokerage firms, insurance companies, credit unions, financial subsidiaries of certain industrial corporations, and mortgage companies. In particular, competitors include several major financial companies whose greater resources may afford them a marketplace advantage by enabling them to maintain numerous banking locations and ATMs and conduct extensive promotional and advertising campaigns.

Additionally, banks and other financial institutions with larger capitalization and financial intermediaries not subject to bank regulatory restrictions have larger lending limits and are thereby able to serve the credit needs of larger customers. Areas of competition include interest rates for loans and deposits, efforts to obtain loans and deposits, and range and quality of products and services provided, including new technology-driven products and services. Technological innovation continues to contribute to greater competition in domestic and international financial services markets as technological advances enable more companies to provide financial services. If the Company is unable to attract and retain banking customers, it may be unable to continue to grow loan and deposit portfolios and its results of operations and financial condition may otherwise be adversely affected.

Changes in economic conditions could materially and negatively affect the Company’s business.

The Company’s business is directly impacted by economic, political, and market conditions, broad trends in industry and finance, legislative and regulatory changes, changes in government monetary and fiscal policies, and inflation, all of which are beyond the Company’s control. A deterioration in economic conditions, whether caused by global, national or local concerns, especially within the Company’s market area, could result in the following potentially material consequences: loan delinquencies increasing; problem assets and foreclosures increasing; demand for products and services decreasing; low cost or noninterest bearing deposits decreasing; and collateral for loans, especially real estate, declining in value, in turn reducing customers’ borrowing power, and reducing the value of assets and collateral associated with existing loans.

Trust division income is a major source of non-interest income for the Company. Trust and Investment Services fee revenue is largely dependent on the fair market value of assets under management and on trading volumes in the brokerage business. General economic conditions and their subsequent effect on the securities markets tend to act in correlation. When general economic conditions deteriorate, securities markets generally decline in value, and the Company’s Trust and Investment Service revenues are negatively impacted as asset values and trading volumes decrease.

A continued downturn in the real estate market could materially and negatively affect the Company’s business.

A continued downturn in the real estate market could negatively affect the Company’s business because significant portions of its loans are secured by real estate. The ability to recover on defaulted loans by selling the real estate collateral could then be diminished and the Company would be more likely to suffer losses.

Substantially all of the Company’s real property collateral is located in its market area. If there is a continued decline in real estate values, especially in our market area, the collateral for loans would provide significantly less security. Real estate values could be affected by, among other things, a continued economic slowdown and an increase in interest rates.

The Company’s credit standards and its on-going credit assessment processes might not protect it from significant credit losses.

The Company takes credit risk by virtue of making loans and extending loan commitments and letters of credit. The Company manages credit risk through a program of underwriting standards, the review of certain credit decisions and an on-going process of assessment of the quality of the credit already extended. The Company’s exposure to credit risk is managed through the use of consistent underwriting standards that emphasize local lending while avoiding highly leveraged transactions as well as excessive industry and other concentrations. The Company’s credit administration function employs risk management techniques to help ensure that problem loans and leases are promptly identified. While these procedures are designed to provide the Company with the information needed to implement policy adjustments where necessary and to take appropriate corrective actions, and have proven to be reasonably effective to date, there can be no assurance that such measures will be effective in avoiding future undue credit risk.

The Company relies upon independent appraisals to determine the value of the real estate which secures a significant portion of its loans, and the values indicated by such appraisals may not be realizable if the Company is forced to foreclose upon such loans.

A significant portion of the Company’s loan portfolio consists of loans secured by real estate. The Company relies upon independent appraisers to estimate the value of such real estate. Appraisals are only estimates of value and the independent appraisers may make mistakes of fact or judgment which adversely affect the reliability of their appraisals. In addition, events occurring after the initial appraisal may cause the value of the real estate to increase or decrease. As a result of any of these factors, the real estate securing some of the Company’s loans may be more or less valuable than anticipated at the time the loans were made. If a default occurs on a loan secured by real estate that is less valuable than originally estimated, the Company may not be able recover the outstanding balance of the loan.

The Company is dependent on key personnel and the loss of one or more of those key personnel may materially and adversely affect the Company’s prospects.

The Company currently depends heavily on the services of a number of key management personnel. The loss of key personnel could materially and adversely affect the results of operations and financial condition. The Company’s success also depends in part on the ability to attract and retain additional qualified management personnel. Competition for such personnel is strong in the banking industry and the Company may not be successful in attracting or retaining the personnel it requires.

The allowance for loan losses may not be adequate to cover actual losses.

In accordance with accounting principles generally accepted in the United States, an allowance for loan losses is maintained to provide for loan losses. The allowance for loan losses may not be adequate to cover actual credit losses, and future provisions for credit losses could materially and adversely affect operating results. The allowance for loan losses is based on prior experience, as well as an evaluation of the risks in the current portfolio. The amount of future losses is susceptible to changes in economic, operating, and other conditions, including changes in interest rates, all of which are beyond the Company’s control; and these losses may exceed current estimates. Federal regulatory agencies, as an integral part of their examination process, review the Company’s loans and allowance for loan losses. While management believes that the allowance for loan losses is adequate to cover current losses, it cannot make assurances that it will not further increase the allowance for loan losses or that regulators will not require it to increase this allowance. Either of these occurrences could adversely affect earnings.

The allowance for loan losses requires management to make significant estimates that affect the financial statements. Due to the inherent nature of this estimate, management cannot provide assurance that it will not significantly increase the allowance for loan losses, which could materially and adversely affect earnings.

The Company is subject to extensive regulation which could adversely affect its business.

The Company’s operations as a publicly traded corporation and an insured depository institution are subject to extensive regulation by federal, state, and local governmental authorities and are subject to various laws and judicial and administrative decisions imposing requirements and restrictions on part or all of the Company’s operations. Because the Company’s business is highly regulated, the laws, rules, and regulations applicable to it are subject to frequent and sometimes extensive change. For instance, the recently enacted Dodd-Frank Act financial reform legislation will likely (i) make regulatory compliance much more difficult and expensive, (ii) restrict the ability to originate, broker or sell loans, or accept certain deposits, (iii) further limit or restrict the amount of commissions, interest, or other charges earned on loans originated by the Company, and (iv) otherwise adversely affect the Company’s business or prospects for business. Any future changes in the laws, rules or regulations applicable to the Company may negatively affect the Company’s business and results of operations.

Increases in FDIC insurance premiums may adversely affect the Company’s earnings.

During 2009 and 2010, higher levels of bank failures dramatically increased resolution costs of the FDIC and depleted the Depository Insurance Fund. In addition, the FDIC instituted two temporary programs, now permanent, to further insure customer deposits at FDIC insured banks: deposit accounts are insured up to $250,000 per customer (up from $100,000) and non-interest bearing transactional accounts are currently fully insured (unlimited coverage). These programs have placed additional stress on the DIF.

In order to maintain a strong funding position and restore reserve ratios of the Deposit Insurance Fund, the FDIC has increased assessment rates of insured institutions and in 2009 required banks to prepay three years’ worth of premiums to replenish the DIF.

The FDIC’s new assessment calculation redefines the deposit insurance assessment base as average consolidated total assets less average tangible equity plus adjustments for unsecured debt, brokered deposits, other debt and secured liability adjustments. If the plan to restore the DIF to required levels falls short or additional losses in the future due to bank failures further deplete the DIF, there can be no assurance that there will not be additional significant deposit insurance premium increases in order to restore the insurance fund’s reserve ratio.

The primary source of the Company’s income from which it pays cash dividends is the receipt of dividends from its subsidiary bank.

The availability of dividends from the Company is limited by various statutes and regulations. It is possible, depending upon the financial condition of the subsidiary bank and other factors, that the Office of the Comptroller of the Currency could assert that payment of dividends or other payments is an unsafe or unsound practice. In the event American National Bank was unable to pay dividends to American National Bankshares Inc., or be limited in the payment of such dividends, the holding company would likely have to reduce or stop paying common stock dividends. The Company’s reduction, limitation or failure to pay such dividends on its common stock could have a material adverse effect on the market price of the common stock.

A limited trading market exists for the Company’s common stock which could lead to price volatility.

The Company’s common stock is listed on the NASDAQ Global Select Market, but the historical trading volume has generally been modest. The limited trading market for the common stock may cause fluctuations in the stock’s market value to be exaggerated, leading to price volatility in excess of that which would occur in a more active trading market. In addition, even if a more active market in the Company’s common stock develops, management cannot ensure that such a market will continue or that shareholders will be able to sell their shares.

The Company is exposed to operational risk.

The Company is exposed to many types of operational risks, including reputation, legal, and compliance risk, the risk of fraud or theft by employees or outsiders, unauthorized transactions by employees or operational errors, clerical or record-keeping errors, and errors resulting from faulty or disabled computer or telecommunications systems.

Negative public opinion can result from the actual or alleged conduct in any number of activities, including lending practices, corporate governance, and acquisitions, and from actions taken by government regulators and community organizations in response to those activities. Negative public opinion can adversely affect the Company’s ability to attract and retain customers and can expose it to litigation and regulatory action.

Certain errors may be repeated or compounded before they are discovered and successfully rectified. The Company’s necessary dependence upon automated systems to record and process its transactions may further increase the risk that technical system flaws or employee tampering or manipulation of those systems will result in losses that are difficult to detect. The Company may also be subject to disruptions of its operating systems arising from events that are wholly or partially beyond its control (for example, computer viruses or electrical or telecommunications outages), which may give rise to disruption of service to customers and to financial loss or liability. The Company is further exposed to the risk that its external vendors may be unable to fulfill their contractual obligations (or will be subject to the same risk of fraud or operational errors by their respective employees as is the Company) and to the risk that the Company’s (or its vendors’) business continuity and data security systems prove to be inadequate.

Changes in accounting standards could impact reported earnings.

From time to time there are changes in the financial accounting and reporting standards that govern the preparation of the Company’s financial statements. These changes can materially impact how the Company records and reports its financial condition and results of operations. In some instances, the Company could be required to apply a new or revised standard retroactively, resulting in the restatement of prior period financial statements.

The Company may need to raise additional capital in the future to continue to grow, but may be unable to obtain additional capital on favorable terms or at all.

Federal and state banking regulators and safe and sound banking practices require the Company to maintain adequate levels of capital to support its operations. Although the Company currently has no definitive plans for additional offices, other than in connection with the MidCarolina merger, its business strategy calls for it to continue to grow in its existing banking markets (internally and through additional offices) and to expand into new markets as appropriate opportunities arise. Continued growth in the Company’s earning assets, which may result from internal expansion and new branch offices, at rates in excess of the rate at which its capital is increased through retained earnings, will reduce the Company’s capital ratios. If the Company’s capital ratios fell below “well capitalized” levels, the FDIC deposit insurance assessment rate would increase until capital was restored and maintained at a “well capitalized” level. A higher assessment rate would cause an increase in the assessments the Company pays for federal deposit insurance, which would have an adverse effect on the Company’s operating results.

Management of the Company believes that its current and projected capital position is sufficient to maintain capital ratios significantly in excess of regulatory requirements for the next several years and allow the Company flexibility in the timing of any possible future efforts to raise additional capital. However, if, in the future, the Company needs to increase its capital to fund additional growth or satisfy regulatory requirements, its ability to raise that additional capital will depend on conditions at that time in the capital markets, economic conditions, the Company’s financial performance and condition, and other factors, many of which are outside its control. There is no assurance that the Company will be able to raise additional capital on terms favorable to it or at all. Any future inability to raise additional capital on terms acceptable to the Company may have a material adverse effect on its ability to expand operations, and on its financial condition, results of operations and future prospects.

The Company’s information systems may experience an interruption or breach in security.

The Company relies heavily on communications and information systems to conduct business. Any failure, interruption, or breach in security of these systems could result in failures or disruptions in the Company’s relationship management, general ledger, deposit, loan, and other systems. While the Company has policies and procedures designed to prevent or limit the effect of such failure, interruption, or security breach, there can be no assurance that they will not occur or, if they do occur, that they will be adequately addressed. Any such occurrences could damage the Company’s reputation, result in a loss of customer business, subject the Company to additional regulatory scrutiny, or expose the Company to civil litigation and possible financial liability, any of which could have a material adverse affect on the Company’s financial condition and results of operations.

The Company relies on other companies to provide key components of our business infrastructure.

Third parties provide key component of our business operations such as data processing, recording and monitoring transactions, online banking interfaces and services, Internet connections and network access. While we have selected these third party vendors carefully, we do not control their actions. Any problem caused by these third parties, including those resulting from disruptions in communication services proved by a vendor, failure of a vendor to handle current or higher volumes, failures of a vendor to provide services for any reason or poor performance of services, could adversely affect our ability to deliver products and services to our customers and otherwise conduct our business. Financial or operational difficulties of a third party vendor could also hurt our operations if those difficulties interface with the vendor’s ability to serve us. Replacing these third party vendors could also create significant delay and expense. Accordingly, use of such third parties creates an unavoidable inherent risk to our business operations.

Risks Related to the Pending Merger with MidCarolina

The Company’s ability to complete the MidCarolina merger is subject to shareholder approvals, certain closing conditions and the receipt of approvals from government agencies.

The Merger Agreement contains certain closing conditions including approval of the Merger Agreement by MidCarolina’s shareholders, approval of the issuance of the Company’s common stock to MidCarolina shareholders by American’s shareholders, the absence of injunctions or other legal restrictions and generally that no material adverse change shall have occurred to either company. In addition, we will be unable to complete the Merger until we receive approvals from the Federal Reserve, the Virginia State Corporation Commission and the North Carolina Commissioner of Banks. Regulatory entities may impose certain requirements or obligations as conditions for their approval. The Company can provide no assurance that it or MidCarolina will satisfy the various closing conditions and obtain the necessary approvals or that any required conditions will not materially adversely affect the Company following the Merger. In addition, we can provide no assurance that these conditions will not result in the abandonment or delay of the Merger. Failure to complete the Merger could negatively impact us.

The Merger may distract management of the Company from its other responsibilities.

The Merger could cause members of the Company’s management group to focus their time and energies on matters related to the transaction that otherwise would be directed to the Company’s business and operations. Any such distraction on the part of management, if significant, could affect the Company’s ability to service existing business and develop new business and adversely affect the business and earnings of the Company before the Merger, or the business and earnings of the Company after the Merger.

If the Company and MidCarolina do not successfully integrate, the combined company may not realize the expected benefits from the Merger.

Integration in connection with a merger is sometimes difficult, and there is a risk that integrating the Company and MidCarolina may take more time and resources than the Company expects. The Company’s ability to integrate MidCarolina and its future success depend in large part on the ability of members of its Board of Directors and executive officers to work together effectively. After the Merger, the Company’s Board of Directors and executive management will include certain former directors and an officer of MidCarolina. Disagreements among board members and executive management could arise in connection with integration issues, strategic considerations and other matters. As a result, there is a risk that the Company’s Board of Directors and executive management may not be able to operate effectively, which would affect adversely the Company’s ability to integrate the operations of the Company and MidCarolina successfully and the Company’s future operating results.

Combining the Company and MidCarolina may be more difficult, costly or time-consuming than the Company expects.

The Company and MidCarolina have operated, and, until the completion of the Merger, will continue to operate, independently. The integration process in connection with the Merger could result in the loss of key employees, the disruption of each party’s ongoing business, inconsistencies in standards, controls, procedures and policies that affect adversely either party’s ability to maintain relationships with customers and employees or achieve the anticipated benefits of the Merger. As with any merger of financial institutions, there also may be disruptions that cause the Company and MidCarolina to lose customers or cause customers to withdraw their deposits from MidCarolina or the Company, or other unintended consequences that could have a material adverse effect on the Company’s results of operations or financial condition after the Merger.

The Company may not be able to effectively integrate the operations of MidCarolina Bank and American National Bank.

The future operating performance of the Company will depend, in part, on the success of the merger of MidCarolina Bank and American National Bank. The success of the merger of the banks will, in turn, depend on a number of factors, including: the Company’s ability to (i) integrate the operations and branches of MidCarolina Bank and American National Bank; (ii) retain the deposits and customers of MidCarolina Bank and American National Bank; (iii) control the incremental increase in noninterest expense arising from the merger in a manner that enables the combined bank to improve its overall operating efficiencies; and (iv) retain and integrate the appropriate personnel of MidCarolina Bank into the operations of American National Bank, as well as reducing overlapping bank personnel. The integration of MidCarolina Bank and American National Bank following the merger will require the dedication of the time and resources of the banks’ management, and may temporarily distract managements’ attention from the day-to-day business of the banks. If American National Bank is unable to successfully integrate MidCarolina Bank, American National Bank may not be able to realize expected operating efficiencies and eliminate redundant costs, which would have an adverse effect on the Company.

As of December 31, 2010, the Company maintained eighteen banking offices located in Danville, Pittsylvania County, Martinsville, Henry County, Halifax County, Lynchburg, Bedford County, Campbell County, and Nelson County in Virginia and Caswell County in North Carolina. The Company also operates one loan production office.

The principal executive offices of the Company are located at 628 Main Street in the business district of Danville, Virginia. This building, owned by the Company, was originally constructed in 1973 and has three floors totaling approximately 27,000 square feet.

The Company owns a building located at 103 Tower Drive in Danville, Virginia. This three-story facility serves as an operations center for data processing and deposit operations.

The Company has an office at 445 Mount Cross Road in Danville, Virginia where it consolidated two banking offices in January 2009 and gained additional administrative space.

The Company owns eleven other retail offices and two closed offices, for a total of fifteen owned buildings. There are no mortgages or liens against any of the properties owned by the Company. The Company operates twenty-six Automated Teller Machines (“ATMs”) on owned or leased facilities. The Company leases five of the retail office locations and two storage warehouses.

There are no material pending legal proceedings to which the Company is a party or to which the property of the Company is subject.

No matters were submitted during the fourth quarter of the fiscal year covered by this report to a vote of security holders of the Company through a solicitation of proxies or otherwise.

|

ITEM 5 – MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

The Company’s common stock is traded on the NASDAQ Global Select Market under the symbol “AMNB.” At December 31, 2010, the Company had 1,597 shareholders of record. The following table presents the high and low sales prices for the Company’s common stock and dividends declared for the past two years.

|

Market Price of the Company's Common Stock

|

||||||||||||

|

Sales Price

|

Dividends

|

|||||||||||

|

2010

|

High

|

Low

|

Per Share

|

|||||||||

|

1st quarter

|

$ | 22.51 | $ | 17.04 | $ | 0.23 | ||||||

|

2nd quarter

|

23.00 | 18.11 | 0.23 | |||||||||

|

3rd quarter

|

22.30 | 18.00 | 0.23 | |||||||||

|

4th quarter

|

24.42 | 21.32 | 0.23 | |||||||||

| $ | 0.92 | |||||||||||

|

Sales Price

|

Dividends

|

|||||||||||

|

2009

|

High

|

Low

|

Per Share

|

|||||||||

|

1st quarter

|

$ | 17.95 | $ | 14.25 | $ | 0.23 | ||||||

|

2nd quarter

|

22.00 | 14.99 | 0.23 | |||||||||

|

3rd quarter

|

23.50 | 19.10 | 0.23 | |||||||||

|

4th quarter

|

22.84 | 19.01 | 0.23 | |||||||||

| $ | 0.92 | |||||||||||

Stock Compensation Plans

The Company maintains the 2008 Stock Incentive Plan (“2008 Plan”), which is designed to attract and retain qualified personnel in key positions, provide employees with an equity interest in the Company as an incentive to contribute to the success of the Company, and reward employees for outstanding performance and the attainment of targeted goals. The 2008 Plan was adopted by the Board of Directors of the Company on February 19, 2008 and approved by the stockholders on April 22, 2008 at the Company’s 2008 Annual Meeting. The 2008 Plan provides for the granting of restricted stock awards and incentive and non-statutory options to employees and directors on a periodic basis, at the discretion of the Board or a Board designated committee. The 2008 Plan authorized the issuance of up to 500,000 shares of common stock.

The 2008 Plan is administered by a committee of the Board of Directors of the Company comprised of independent directors. Under the 2008 Plan, the committee determines which employees will be granted restricted stock awards and options, whether such options will be incentive or non-statutory options, the number of shares subject to each option, whether such options may be exercised by delivering other shares of common stock, and when such options become exercisable. The per share exercise price of an incentive stock option must be at least equal to the fair market value of a share of common stock on the date the option is granted. Restricted stock would be granted under terms and conditions established by the committee.

Stock Options

Stock options become vested and exercisable in the manner specified by the committee. Each stock option or portion thereof shall be exercisable at any time on or after it vests and is exercisable until ten years after its date of grant. As of December 31, 2010, options for 103,999 shares remain exercisable under the 1997 Option Plan and options for 42,250 shares are vested and exercisable under the 2008 Plan. There were 6,000 stock options awarded in 2009 and none in 2010. The options granted in 2009 vest one third each year at December 31, 2009, 2010, and 2011.

The December 31, 2010 position of the Company’s equity investment compensation plan is summarized below:

|

December 31, 2010

|

|||||

|

Number of Shares

to be Issued Upon Exercise

of Outstanding Options

|

Weighted-Average Per Share Exercise Price of Outstanding Options

|

Number of Shares Remaining Available

for Future

Issuance Under

Stock Compensation Plans

|

|||

|

Equity compensation plans

approved by shareholders

|

159,499

|

$21.41

|

441,000

|

||

|

Equity compensation plans not

approved by shareholders

|

-

|

-

|

-

|

||

|

Total

|

159,499

|

$21.41

|

441,000

|

||

Restricted Stock

The Company from time-to-time grants shares of restricted stock to key employees and non-employee directors. These awards help align the interests of these employees and directors with the interests of the shareholders of the Company by providing economic value directly related to increases in the value of the Company’s stock. The value of the stock awarded is established as the fair market value of the stock at the time of the grant. The Company recognizes expense, equal to the total value of such awards, ratably over the vesting period of the stock grants.

The Company made its first restricted grant to executive officers in the first quarter 2010. These grants cliff vest over a 24-month period. On January 19, 2010, the Company issued 8,712 shares of restricted stock to its six executive officers and three regional executives.

Nonvested restricted stock for the twelve months ended December 31, 2010 is summarized in the following table.

|

Restricted Stock

|

Shares

|

Grant date fair value

|

||

|

Nonvested at January 1, 2010

|

-

|

-

|

||

|

Granted

|

8,712

|

$21.36

|

||

|

Vested

|

-

|

-

|

||

|

Forfeited

|

-

|

-

|

||

|

Nonvested at December 31, 2010

|

8,712

|

$21.36

|

||

As of December 31, 2010, there was $93,000 of total unrecognized compensation cost related to nonvested restricted stock granted under the 2008 Plan. This cost is expected to be recognized over the next 12 months.

Starting in 2010, the Company has begun offering its directors an option on director compensation. Their regular monthly retainer could be received as $1,000 per month in cash or $1,250 in immediately vested, but restricted stock. Eight of twelve directors elected to receive stock in lieu of cash for their retainer fees. Only outside directors receive board fees. The Company issued 5,784 shares and recognized share based compensation expense of $120,000 during the year ended December 31, 2010.

Comparative Stock Performance

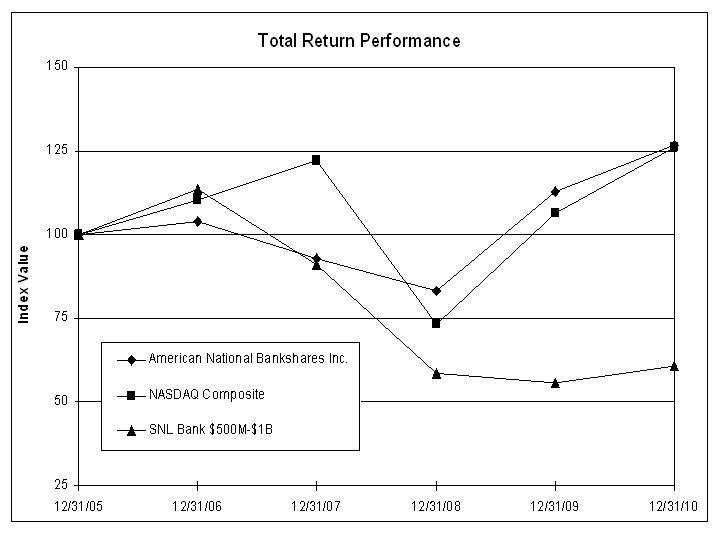

The following graph compares the Company’s cumulative total return to its shareholders with the returns of two indexes for the five-year period ended December 31, 2010. The cumulative total return was calculated taking into consideration changes in stock price, cash dividends, stock dividends, and stock splits since December 31, 2005. The indexes are the NASDAQ Composite Index; the SNL Bank $500 Million-$1Billlion Index, which includes bank holding companies with assets of $500 million to $1 billion and is published by SNL Financial, LC.

American National Bankshares Inc.

|

Period Ending

|

||||||||||||||||||||||||

|

Index

|

12/31/05

|

12/31/06

|

12/31/07

|

12/31/08

|

12/31/09

|

12/31/10

|

||||||||||||||||||

|

American National Bankshares Inc.

|

$ | 100.00 | $ | 104.09 | $ | 92.93 | $ | 83.29 | $ | 112.77 | $ | 126.70 | ||||||||||||

|

NASDAQ Composite

|

100.00 | 110.39 | 122.15 | 73.32 | 106.57 | 125.91 | ||||||||||||||||||

|

SNL Bank $500M-$1B

|

100.00 | 113.73 | 91.14 | 58.40 | 55.62 | 60.72 | ||||||||||||||||||

Russell 2000

The Company was added to the Russell 3000 Index and the Russell 2000 Index on June 29, 2009 when Russell Investments reconstituted its comprehensive set of U. S. and Global equity indexes. The Russell indexes are widely used by investment managers as index funds and performance benchmarks for investment strategies. The indexes are reconstituted annually and are comprised of the 3,000 largest U. S. stocks by market capitalization. The largest 1,000 companies comprise the Russell 1000 and the next 2,000 companies comprise the Russell 2000.

The following table sets forth selected financial data for the Company for the last five years:

|

(Amounts in thousands, except per share information)

|

December 31,

|

|||||||||||||||||||

|

2010

|

2009

|

2008

|

2007

|

2006

|

||||||||||||||||

|

Results of Operations:

|

||||||||||||||||||||

|

Interest income

|

$ | 35,933 | $ | 38,061 | $ | 42,872 | $ | 48,597 | $ | 45,070 | ||||||||||

|

Interest expense

|

8,719 | 10,789 | 15,839 | 19,370 | 16,661 | |||||||||||||||

|

Net interest income

|

27,214 | 27,272 | 27,033 | 29,227 | 28,409 | |||||||||||||||

|

Provision for loan losses

|

1,490 | 1,662 | 1,620 | 403 | 58 | |||||||||||||||

|

Noninterest income

|

8,531 | 7,043 | 7,913 | 8,822 | 8,458 | |||||||||||||||

|

Noninterest expense

|

22,796 | 23,318 | 22,124 | 21,326 | 20,264 | |||||||||||||||

|

Income before income tax provision

|

11,459 | 9,335 | 11,202 | 16,320 | 16,545 | |||||||||||||||

|

Income tax provision

|

3,181 | 2,525 | 3,181 | 4,876 | 5,119 | |||||||||||||||

|

Net income

|