Attached files

| file | filename |

|---|---|

| 8-K - ALLIANCEBERNSTEIN L.P. 8-K 3-10-2011 - ALLIANCEBERNSTEIN L.P. | form8k.htm |

| EX-99.01 - EXHIBIT 99.01 - ALLIANCEBERNSTEIN L.P. | ex99_01.htm |

| EX-99.03 - EXHIBIT 99.03 - ALLIANCEBERNSTEIN L.P. | ex99_03.htm |

EXHIBIT 99.02

AllianceBernstein: Tradition and Change

Citigroup Financial Services Conference

March 10, 2011

David A. Steyn

Chief Operating Officer

1

AllianceBernstein.com

Certain statements provided by management in this news release are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act

of 1995. Such forward-looking statements are subject to risks, uncertainties, and other factors that could cause actual results to differ materially from future results

expressed or implied by such forward-looking statements. The most significant of these factors include, but are not limited to, the following: the performance of

financial markets, the investment performance of sponsored investment products and separately-managed accounts, general economic conditions, industry trends,

future acquisitions, competitive conditions, and current and proposed government regulations, including changes in tax regulations and rates and the manner in

which the earnings of publicly-traded partnerships are taxed. AllianceBernstein cautions readers to carefully consider such factors. Further, such forward-looking

statements speak only as of the date on which such statements are made; AllianceBernstein undertakes no obligation to update any forward-looking statements to

reflect events or circumstances after the date of such statements. For further information regarding these forward-looking statements and the factors that could

cause actual results to differ, see “Risk Factors” and “Cautions Regarding Forward-Looking Statements” in AllianceBernstein’s Form 10-K for the year ended

December 31, 2010. Any or all of the forward-looking statements made in this news release, Form 10-K, other documents AllianceBernstein files with or furnishes to

the SEC, and any other public statements issued by AllianceBernstein, may turn out to be wrong. It is important to remember that other factors besides those listed

in “Risk Factors” and “Cautions Regarding Forward-Looking Statements”, and those listed below, could also adversely affect AllianceBernstein’s financial condition,

results of operations and business prospects.

of 1995. Such forward-looking statements are subject to risks, uncertainties, and other factors that could cause actual results to differ materially from future results

expressed or implied by such forward-looking statements. The most significant of these factors include, but are not limited to, the following: the performance of

financial markets, the investment performance of sponsored investment products and separately-managed accounts, general economic conditions, industry trends,

future acquisitions, competitive conditions, and current and proposed government regulations, including changes in tax regulations and rates and the manner in

which the earnings of publicly-traded partnerships are taxed. AllianceBernstein cautions readers to carefully consider such factors. Further, such forward-looking

statements speak only as of the date on which such statements are made; AllianceBernstein undertakes no obligation to update any forward-looking statements to

reflect events or circumstances after the date of such statements. For further information regarding these forward-looking statements and the factors that could

cause actual results to differ, see “Risk Factors” and “Cautions Regarding Forward-Looking Statements” in AllianceBernstein’s Form 10-K for the year ended

December 31, 2010. Any or all of the forward-looking statements made in this news release, Form 10-K, other documents AllianceBernstein files with or furnishes to

the SEC, and any other public statements issued by AllianceBernstein, may turn out to be wrong. It is important to remember that other factors besides those listed

in “Risk Factors” and “Cautions Regarding Forward-Looking Statements”, and those listed below, could also adversely affect AllianceBernstein’s financial condition,

results of operations and business prospects.

The forward-looking statements referred to in the preceding paragraph include statements regarding:

<The pipeline of new institutional mandates not yet funded: Before they are funded, institutional mandates do not represent legally binding commitments to fund

and, accordingly, the possibility exists that not all mandates will be funded in the amounts and at the times currently anticipated.

and, accordingly, the possibility exists that not all mandates will be funded in the amounts and at the times currently anticipated.

<Our confidence that we will outperform in equities in the months ahead which, combined with an improved risk appetite on the part of investors, will lead

to improved flows: We cannot predict the timing or degree of global market growth, nor our absolute or relative investment performance for our clients. The actual

performance of the capital markets and other factors beyond our control will affect our investment success for clients and asset flows. Furthermore, improved flows

depend on a number of factors, including our ability to deliver consistent, competitive investment performance, which cannot be assured, conditions of financial

markets, changes and volatility in political, economic, capital market or industry conditions, consultant recommendations, and changes in our clients’ investment

preferences, risk tolerances and liquidity needs.

to improved flows: We cannot predict the timing or degree of global market growth, nor our absolute or relative investment performance for our clients. The actual

performance of the capital markets and other factors beyond our control will affect our investment success for clients and asset flows. Furthermore, improved flows

depend on a number of factors, including our ability to deliver consistent, competitive investment performance, which cannot be assured, conditions of financial

markets, changes and volatility in political, economic, capital market or industry conditions, consultant recommendations, and changes in our clients’ investment

preferences, risk tolerances and liquidity needs.

<The degree to which the $89.6 million real estate charge we recorded during the third quarter of 2010 will reduce occupancy costs on existing real estate

in 2011 and subsequent years: The charge we recorded during the third quarter and our estimates of reduced occupancy costs in future years are based on

existing sub-leases, as well as our current assumptions of when we can sub-lease the remaining space and current market rental rates, which are factors largely

beyond our control. If our assumptions prove to be incorrect, we may be forced to take an additional charge and/or our estimated occupancy cost reductions may be

less than we currently anticipate.

in 2011 and subsequent years: The charge we recorded during the third quarter and our estimates of reduced occupancy costs in future years are based on

existing sub-leases, as well as our current assumptions of when we can sub-lease the remaining space and current market rental rates, which are factors largely

beyond our control. If our assumptions prove to be incorrect, we may be forced to take an additional charge and/or our estimated occupancy cost reductions may be

less than we currently anticipate.

<Our intention to continue to engage in open market purchases of Holding Units, from time to time, to help fund anticipated obligations under our

incentive compensation award program: The number of Holding Units needed in future periods to make incentive compensation awards is dependent upon

various factors, some of which are beyond our control, including fluctuation in the price of a Holding Unit.

incentive compensation award program: The number of Holding Units needed in future periods to make incentive compensation awards is dependent upon

various factors, some of which are beyond our control, including fluctuation in the price of a Holding Unit.

<Our confidence that we will deliver consistent, long-term value to all of our stakeholders: Changes and volatility in political, economic, capital market or

industry conditions can result in changes in demand for our products and services or impact the value of our assets under management, all of which may

significantly hinder our ability to execute on our strategy.

industry conditions can result in changes in demand for our products and services or impact the value of our assets under management, all of which may

significantly hinder our ability to execute on our strategy.

Cautions Regarding Forward-Looking Statements

2

AllianceBernstein.com

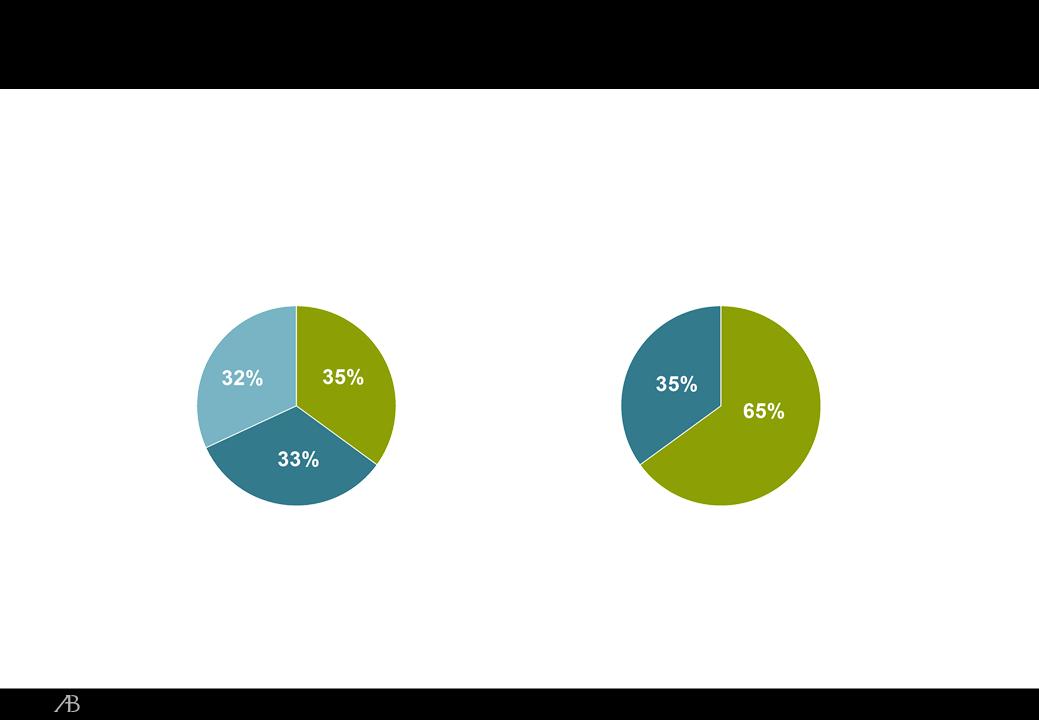

By Client Domicile

Firm-Wide Diversification

On Annualized Fee Base of $2.1 Billion

US

Non-US

By Channel

Institutions

Retail

Private

Client

As of December 31, 2010

Source: AllianceBernstein

December 31, 2010 AUM: $478 Billion

Breadth and Balance Across Channel and Geography

3

AllianceBernstein.com

Institutional AUM

$272 Billion

Value

As of December 31, 2010

Source: AllianceBernstein

32%

12%

10%

45%

Growth

Fixed

Income

Income

Index

The Institutions Channel:

Significant Share of Global Institutional Assets

Significant Share of Global Institutional Assets

4

AllianceBernstein.com

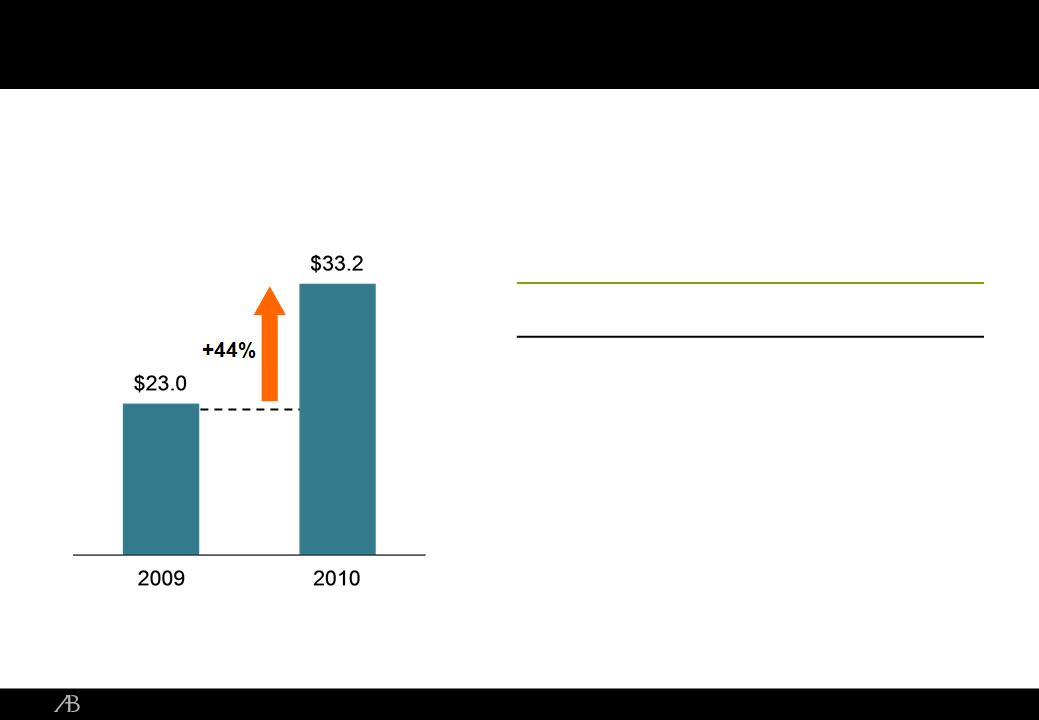

Retail Sales Growth in 2010

In US$ Billions

Retail Fixed Income

Global High Yield $7.3 $11.1 52%

American Income 1.7 3.3 94

US Municipal

Bond Funds 0.8 1.8 125

Bond Funds 0.8 1.8 125

Emerging Markets

Debt 0.0 0.5 —

Debt 0.0 0.5 —

Breadth and Velocity of Sales Momentum

2009 2010 % Change

As of December 31, 2010

Source: AllianceBernstein

The Retail Business:

Sales Growth and Product Momentum

Sales Growth and Product Momentum

5

AllianceBernstein.com

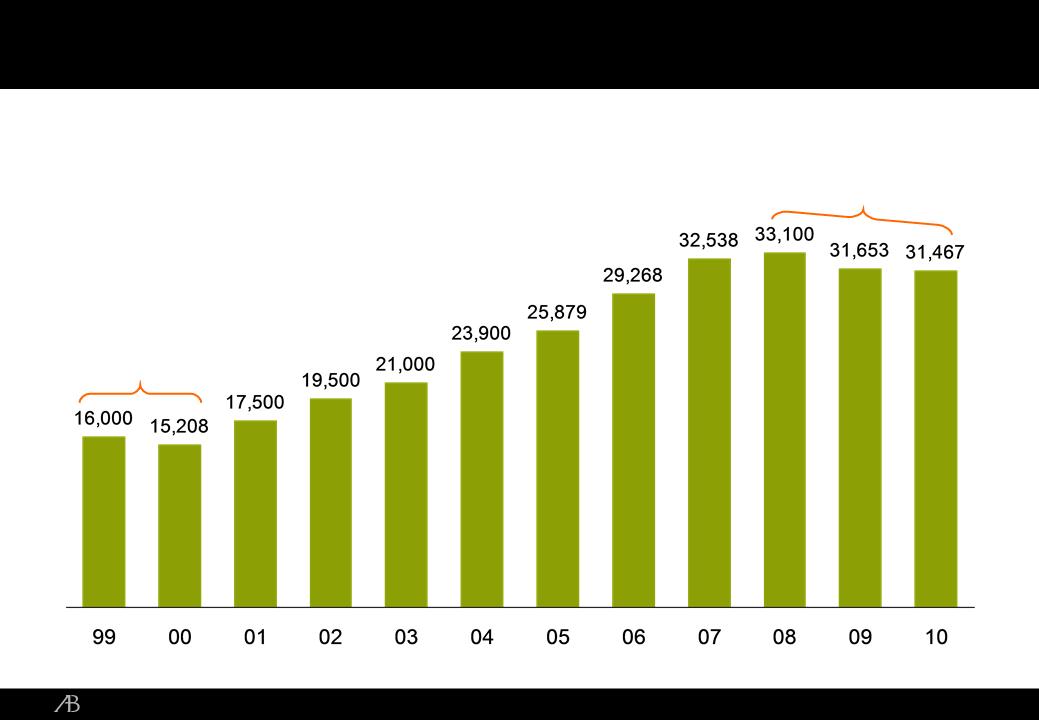

Private Client Relationships

Source: AllianceBernstein

(5)%

(5)%

Private Client:

A History of Growing Long-Term Relationships

A History of Growing Long-Term Relationships

6

AllianceBernstein.com

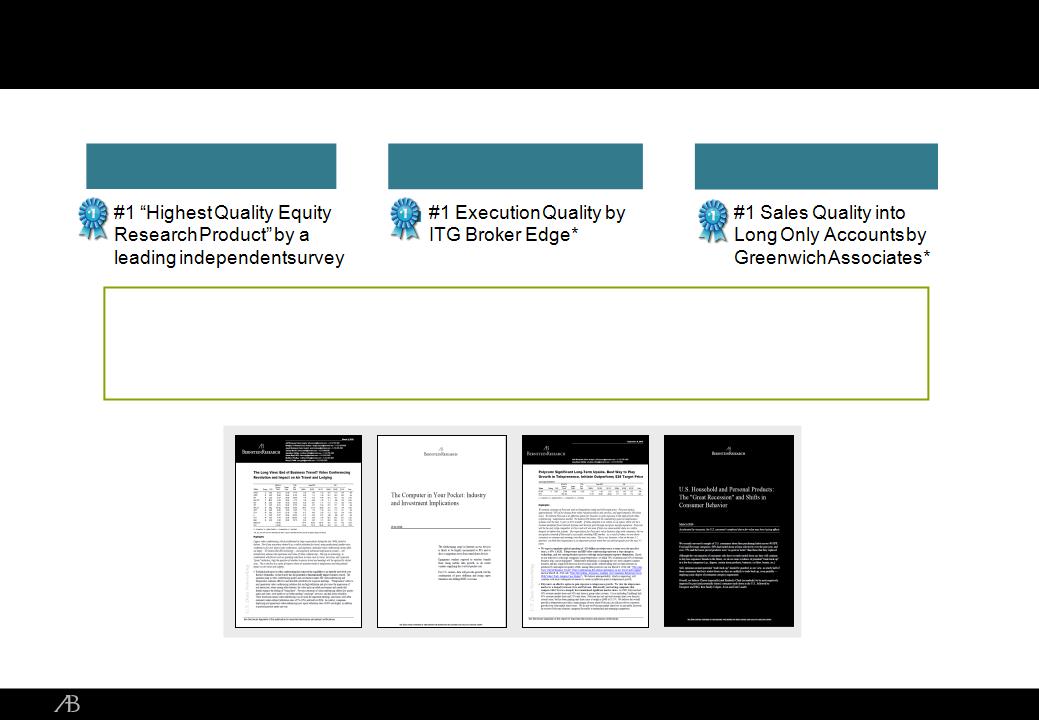

Sanford C. Bernstein:

Industry Leading Research and Trading Platform

Industry Leading Research and Trading Platform

Research

Trading

Sales

< A leader in research for nearly 40 years; known for insight, independence, integrity

< Today, 375 employees with seven offices in the US, Europe and Asia

< Growth driven by expansion of geographic footprint, trading capabilities, research product suite

*ITG Survey as of 2009; Greenwich Associates ranking as of 2010.

Source: AllianceBernstein

7

AllianceBernstein.com

üSolving the DB/DC Dilemma

üRisk Reduction Strategies (volatility and inflation risk)

üHolistic Exposure to Liquid and Illiquid Alternatives

üAppetite for Emerging Market Services

üUnconstrained, Cross-Sector Investing

üThe Move to Passive

üThe Rise of the Global Investor

AllianceBernstein and the Future of Money Management

8

Integrated

Multi-Insurer

Guarantees

Guarantees

Auto-Enrollment

and Participant

Communications

and Participant

Communications

Research-

Driven

Driven

Target-Date

Construction

Open-

Architecture

Target-Date

Fund Structure

Architecture

Target-Date

Fund Structure

DB Plan Benefits

AUM: Over $30 Billion*

*Includes won but not yet funded mandates as of December 31, 2010.

Bringing the Best of DB to DC:

ABDC Innovation in the Retirement Space

ABDC Innovation in the Retirement Space

9

AllianceBernstein.com

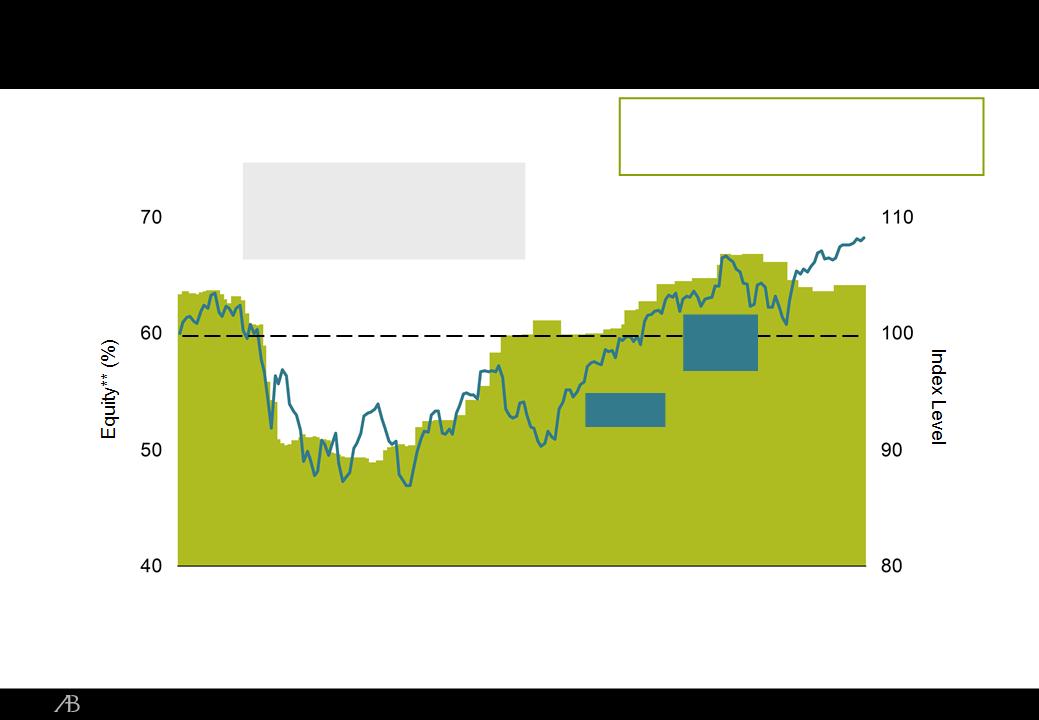

Strategic Allocation

Equity Weight

MSCI World Index

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

*Includes eligible private client assets serviced with an overlay of Dynamic Asset Allocation, as of December 31, 2010.

**“Equity” here refers to a 70% US equity and 30% international-equity allocation. The index is the Morgan Stanley Capital International (MSCI) World Index indexed to 100 on March 31, 2010.

MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further

redistributed or used as a basis for other indexes or any securities or financial products. This document is not approved, reviewed or produced by MSCI.

Source: MSCI and AllianceBernstein

MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further

redistributed or used as a basis for other indexes or any securities or financial products. This document is not approved, reviewed or produced by MSCI.

Source: MSCI and AllianceBernstein

Greek Debt Crisis

“QE2”

Irish

Crisis

Crisis

Benefit of DAA:

1.3% Return Enhancement

90 bps Lower Volatility

AUM: Over $19 Billion*

üRisk Reduction Strategies

(Volatility)

(Volatility)

Smoothing the Investment Ride:

A Year in the Life of Dynamic Asset Allocation

A Year in the Life of Dynamic Asset Allocation

10

AllianceBernstein.com

Cash

Diversified

Bonds

Diversified

Stocks

Stocks

Cash

Diversified

Stocks

Stocks

Real Cash

Real

Assets

Assets

“Traditional” vs. Inflation-Protected Allocation

Diversified

Bonds

Real Assets represents the total return of a real asset portfolio (comprising one-third Commodity Stocks, one-third REITs, and one-third Commodity Futures fully collateralized by 10-year TIPS).

10-year Treasury Inflation-Protected Securities (TIPS) are calculated from synthetic AllianceBernstein real yields estimated from actual inflation and nominal yield curve variables before 1999 and

from Federal Reserve real yields thereafter. REITs (Real Estate) are sourced from the Ken French Data Library prior to 1972; they are represented by the NAREIT Equity REIT Index thereafter.

Commodity Stocks are sourced from the Ken French Data Library and are weighted by market-capitalization. Commodity Futures and Precious Metals Futures prior to 1990 are on a US

consumption-weighted basis and are sourced from AllianceBernstein series prior to 1970 and from the MJK Commodity Futures Database between 1970 and 1990; they are represented by the

Dow Jones-UBS Commodity Futures Index (DJ-UBS) thereafter. All futures returns are fully collateralized by T-bills unless otherwise indicated.

from Federal Reserve real yields thereafter. REITs (Real Estate) are sourced from the Ken French Data Library prior to 1972; they are represented by the NAREIT Equity REIT Index thereafter.

Commodity Stocks are sourced from the Ken French Data Library and are weighted by market-capitalization. Commodity Futures and Precious Metals Futures prior to 1990 are on a US

consumption-weighted basis and are sourced from AllianceBernstein series prior to 1970 and from the MJK Commodity Futures Database between 1970 and 1990; they are represented by the

Dow Jones-UBS Commodity Futures Index (DJ-UBS) thereafter. All futures returns are fully collateralized by T-bills unless otherwise indicated.

Source: AllianceBernstein

Commodity

Futures (incl.

TIPS and

Precious Metals),

Commodity

Stocks, REITs

Futures (incl.

TIPS and

Precious Metals),

Commodity

Stocks, REITs

Intermediate-Term

Inflation-Linked

Bonds (Taxable

and Muni)

Inflation-Linked

Bonds (Taxable

and Muni)

Short-Term

Inflation-Linked

Bonds

Inflation-Linked

Bonds

Real

Bonds

üRisk Reduction Strategies

(Inflation)

(Inflation)

A Comprehensive Inflation Suite:

Real Investments Complement Traditional Portfolio

Real Investments Complement Traditional Portfolio

11

AllianceBernstein.com

Comprehensive

< Single solution for gaining alternatives exposure through a strategic blend of third-party and proprietary

hedge fund strategies and private capital opportunities with diversification across strategy, manager

and vintage***

hedge fund strategies and private capital opportunities with diversification across strategy, manager

and vintage***

Integrated

< Allocation to alternatives customized to align with your traditional portfolio and risk tolerance; ability to

maintain appropriate mix of alternatives based on target allocations; cash flow management

maintain appropriate mix of alternatives based on target allocations; cash flow management

Transparent

< Capital markets and wealth management research; reporting on performance attribution and portfolio

exposures; manager commentary; risk analysis; consolidated tax reporting

exposures; manager commentary; risk analysis; consolidated tax reporting

Bernstein Alternative Investment Strategies

Fund of Funds

Fund of Funds

Hedge Fund Strategies

Private Capital**

*Includes SunAmerica acquisition and proprietary AllianceBernstein alternative funds.

**Private capital investments are expected to be available by 2012.

***Diversification by vintage will require a client to invest in a new Private Capital series year by year.

Source: AllianceBernstein

AUM: Over $12 Billion*

üHolistic Exposure

to Liquid and Illiquid Alts

to Liquid and Illiquid Alts

Integrated Approach to Alternative Investments:

Leading Research Influences Innovative Product Design

Leading Research Influences Innovative Product Design

12

AllianceBernstein.com

As of June 30, 2010

Source: AllianceBernstein

US$ Denominated 88%

Local Currency 12%

Growth 29%

Blend 30%

AUM: Over $40 Billion

üAppetite for Emerging Markets

Dedicated

Multisector

49%

51%

Dedicated

Global/

International

37%

63%

Emerging Strengths:

Significant Emerging Market Investment Focus

Significant Emerging Market Investment Focus

13

AllianceBernstein.com

Global

Cross-

Sector

Sector

Disruptive

Thematic

Alpha

Generation

Alpha

Generation

Web 2.0

Energy

Transformation

Transformation

(re) Emerging

Middle Class

Middle Class

Genomic Age

Financial Reformation

ü Unconstrained, Cross-Sector Investing

As of December 31, 2010

Source: AllianceBernstein

Unconstrained, “Thematic” Investing:

Catching the Next Wave

Catching the Next Wave

14

AllianceBernstein.com

Objectives

What Are the Client’s Needs?

< Standard indices

< Customized indices (i.e.; Fundamental, SRI, Green Indices)

< Restricted securities

Implementation

How Do We Meet Those Needs?

< Index replication

< Stratified sampling

< Derivatives

How Do We Execute Those Strategies?

< Global trading platform

< Integrated trade analytics

< Constituent change management

Execution

Over $30 Billion*

*As of December 31, 2010

üThe Move to Passive

AB Index Strategies:

Customized to Client Objectives

Customized to Client Objectives

15

AllianceBernstein.com

Countries and Regions with AUM Over $1 Billion

As of December 31, 2010

Source: AllianceBernstein

üThe Rise of the Global Investor

Growing Abroad:

Non-US Domiciled AUM of Almost $170 Billion

Non-US Domiciled AUM of Almost $170 Billion

16

AllianceBernstein.com

Market Direction

Long

Equities

Equities

Fixed

Income

Income

Alternatives

DAA

Target

Date/DC

Date/DC

Inflation

Services

Services

Thematic

Investing

Investing

Source: AllianceBernstein

Emerging

Index

Building an All-Weather Firm

17

AllianceBernstein.com

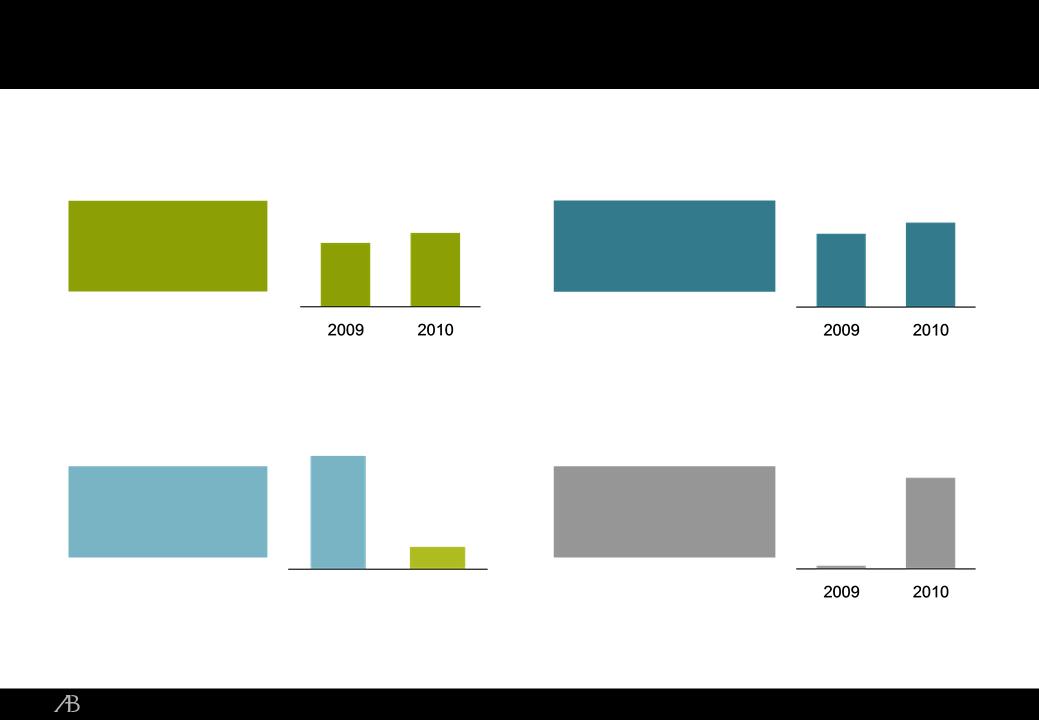

Adjusted

EPU

EPU

18.4%

21.3%

5%

1%

Adjusted

Revenues

Revenues

Adjusted

Expenses

Expenses

% Change

2010 vs. 2009

2010 vs. 2009

$1.38

$1.60

Adjusted

Operating Margins

Operating Margins

Adjusted Revenue/

Expense Trends

Expense Trends

7.0

226.4

Share Repurchases

($ Millions)

($ Millions)

Source: AllianceBernstein

February 28, 2011 AUM: $487 Billion

Financial Highlights: Progress in 2010

18

AllianceBernstein.com

Q & A

19

AllianceBernstein.com

Appendix

20

AllianceBernstein.com

AllianceBernstein L.P.

Notes to Condensed Consolidated Statements of Income and Supplemental Information

(Unaudited)

Adjusted Net Revenues

Adjusted net revenues exclude investment gains and losses and dividends and interest on deferred compensation-related investments, and 90% of the investment gains and

losses of our consolidated venture capital fund attributable to non-controlling interests. In addition, adjusted net revenues offset distribution-related payments to third parties as well

as amortization of deferred sales commissions against distribution revenues. We believe the offset of distribution-related payments from net revenues is useful for our investors

and other users of our financial statements because such presentation appropriately reflects the nature of these costs as pass-through payments to third parties who perform

functions on behalf of our sponsored mutual funds and/or shareholders of these funds. Amortization of deferred sales commissions is offset against net revenues because such

costs, over time, offset distribution revenues earned by the company.

losses of our consolidated venture capital fund attributable to non-controlling interests. In addition, adjusted net revenues offset distribution-related payments to third parties as well

as amortization of deferred sales commissions against distribution revenues. We believe the offset of distribution-related payments from net revenues is useful for our investors

and other users of our financial statements because such presentation appropriately reflects the nature of these costs as pass-through payments to third parties who perform

functions on behalf of our sponsored mutual funds and/or shareholders of these funds. Amortization of deferred sales commissions is offset against net revenues because such

costs, over time, offset distribution revenues earned by the company.

Adjusted Operating Income

Adjusted operating income represents operating income on a GAAP basis (1) excluding the impact on net revenues and compensation expense of the mark-to-market gains and

losses (as well as the dividends and interest) associated with employee deferred compensation-related investments, (2) excluding real estate charges, and (3) including the net

loss or income of consolidated entities attributable to non-controlling interests.

losses (as well as the dividends and interest) associated with employee deferred compensation-related investments, (2) excluding real estate charges, and (3) including the net

loss or income of consolidated entities attributable to non-controlling interests.

(1) Prior to 2009, a large proportion of employee compensation was in the form of deferred awards that were notionally invested in AllianceBernstein investment services and

generally vested over a period of four years. AllianceBernstein has economically hedged the exposure to market movements by purchasing and holding these investments on its

balance sheet. The full value of the investments’ appreciation (depreciation) is recorded within investment gains and losses on the income statement in the current period. US

GAAP requires the appreciation (depreciation) in the compensation liability to be expensed over the award vesting period in proportion to the vested amount of the award as part of

compensation expense. This creates a timing difference between the recognition of the compensation expense and the investment gain or loss impacting operating income, which

will fluctuate over the life of the award and net to zero at the end of the multi-year vesting period. Although during periods of high market volatility these timing differences have an

impact on operating income and operating margin, over the life of the award any impact is ultimately offset. Because these plans are economically hedged, management believes

it is useful to reflect the offset ultimately achieved from hedging the investments’ market exposure in the calculation of adjusted operating income, adjusted operating margin and

adjusted diluted net income per Holding Unit, which will produce core operating results from period to period. The non-GAAP measures exclude gains and losses and dividends

and interest on deferred compensation-related investments included in revenues and compensation expense, thus eliminating the timing differences created by different treatment

under US GAAP of the market movement on the expense and the investments.

generally vested over a period of four years. AllianceBernstein has economically hedged the exposure to market movements by purchasing and holding these investments on its

balance sheet. The full value of the investments’ appreciation (depreciation) is recorded within investment gains and losses on the income statement in the current period. US

GAAP requires the appreciation (depreciation) in the compensation liability to be expensed over the award vesting period in proportion to the vested amount of the award as part of

compensation expense. This creates a timing difference between the recognition of the compensation expense and the investment gain or loss impacting operating income, which

will fluctuate over the life of the award and net to zero at the end of the multi-year vesting period. Although during periods of high market volatility these timing differences have an

impact on operating income and operating margin, over the life of the award any impact is ultimately offset. Because these plans are economically hedged, management believes

it is useful to reflect the offset ultimately achieved from hedging the investments’ market exposure in the calculation of adjusted operating income, adjusted operating margin and

adjusted diluted net income per Holding Unit, which will produce core operating results from period to period. The non-GAAP measures exclude gains and losses and dividends

and interest on deferred compensation-related investments included in revenues and compensation expense, thus eliminating the timing differences created by different treatment

under US GAAP of the market movement on the expense and the investments.

(2) Real estate charges have been excluded because they are not considered part of our core operating results when comparing financial results from period to period and to

industry peers.

industry peers.

(3) Most of the net income or loss of consolidated entities attributable to non-controlling interests relates to the 90% limited partner interests held by third parties in our

consolidated venture capital fund. We own a 10% limited partner interest in the fund. Because we are the general partner of the venture capital fund and are deemed to have a

controlling interest, US GAAP requires us to consolidate the financial results of the fund. However, recognizing 100% of the gains or losses in operating income while only retaining

10% is not reflective of our underlying financial results at the operating income level. As a result, we are excluding the 90% limited partner interests we do not own from our

adjusted operating income. Similarly, net income of joint ventures attributable to non-controlling interests, although not significant, is excluded because it does not reflect the

economic interest attributable to AllianceBernstein.

consolidated venture capital fund. We own a 10% limited partner interest in the fund. Because we are the general partner of the venture capital fund and are deemed to have a

controlling interest, US GAAP requires us to consolidate the financial results of the fund. However, recognizing 100% of the gains or losses in operating income while only retaining

10% is not reflective of our underlying financial results at the operating income level. As a result, we are excluding the 90% limited partner interests we do not own from our

adjusted operating income. Similarly, net income of joint ventures attributable to non-controlling interests, although not significant, is excluded because it does not reflect the

economic interest attributable to AllianceBernstein.

Adjusted Operating Margin

Adjusted operating margin allows us to monitor our financial performance and efficiency from period to period and to compare our performance to industry peers without the

volatility noted above in our discussion of adjusted operating income. Adjusted operating margin is derived by dividing adjusted operating income by adjusted net revenues.

volatility noted above in our discussion of adjusted operating income. Adjusted operating margin is derived by dividing adjusted operating income by adjusted net revenues.

AllianceBernstein Adjusted Financial Results Reconciliation