Attached files

| file | filename |

|---|---|

| EX-23 - CONSENT - CASS INFORMATION SYSTEMS INC | v214144_ex23.htm |

| EX-21 - SUBSIDIARIES - CASS INFORMATION SYSTEMS INC | v214144_ex21.htm |

| EX-31.2 - CERTIFICATION - CASS INFORMATION SYSTEMS INC | v214144_ex31-2.htm |

| EX-32.1 - CERTIFICATION - CASS INFORMATION SYSTEMS INC | v214144_ex32-1.htm |

| EX-32.2 - CERTIFICATION - CASS INFORMATION SYSTEMS INC | v214144_ex32-2.htm |

| EX-31.1 - CERTIFICATION - CASS INFORMATION SYSTEMS INC | v214144_ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2010

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from to

Commission file number 000-20827

|

CASS INFORMATION SYSTEMS, INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

Missouri

|

43-1265338

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

13001 Hollenberg Drive, Bridgeton, Missouri

|

63044

|

(314) 506-5500

|

||

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

(Telephone Number, incl. area code)

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each Class

|

Name of each exchange on which registered

|

|

|

Common Stock, par value $.50

|

|

The Nasdaq Global Select Market

|

Securities registered pursuant to Section 12(g) of the Act:

|

Title of each Class

|

|

None

|

Indicate by checkmark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

Indicate by checkmark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by checkmark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one) Large accelerated filer: o Accelerated filer: x Non-accelerated filer: o

Smaller reporting company: o

Indicate by checkmark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No x

The aggregate market value of the common stock held by non-affiliates of the Registrant was approximately $297,540,000 based on the closing price of the common stock of $34.25 on June 30, 2010, as reported by The Nasdaq Global Select Market. As of March 4, 2011, the Registrant had 9,407,294 shares outstanding of common stock.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information required for Part III of this report is incorporated by reference from the Registrant’s Proxy Statement for the 2011 Annual Meeting of Shareholders.

CASS INFORMATION SYSTEMS, INC.

FORM 10-K ANNUAL REPORT

TABLE OF CONTENTS

|

PART I.

|

|||

|

Item 1.

|

BUSINESS

|

1

|

|

|

Item 1A.

|

RISK FACTORS

|

3

|

|

|

Item 1B.

|

UNRESOLVED STAFF COMMENTS

|

7

|

|

|

Item 2.

|

PROPERTIES

|

7

|

|

|

Item 3.

|

LEGAL PROCEEDINGS

|

7

|

|

|

Item 4.

|

REMOVED AND RESERVED

|

7

|

|

|

PART II.

|

|||

|

Item 5.

|

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

8

|

|

|

Item 6.

|

SELECTED FINANCIAL DATA

|

9

|

|

|

Item 7.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

9

|

|

|

Item 7A.

|

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

23

|

|

|

Item 8.

|

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

|

26

|

|

|

Item 9.

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

|

51

|

|

|

Item 9A.

|

CONTROLS AND PROCEDURES

|

51

|

|

|

Item 9B.

|

OTHER INFORMATION

|

53

|

|

|

PART III.

|

|||

|

Item 10.

|

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

|

53

|

|

|

Item 11.

|

EXECUTIVE COMPENSATION

|

53

|

|

|

Item 12.

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

||

|

AND RELATED STOCKHOLDER MATTERS

|

53

|

||

|

Item 13.

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

|

54 | |

|

Item 14.

|

PRINCIPAL ACCOUNTANT FEES AND SERVICES

|

54

|

|

|

PART IV.

|

|||

|

Item 15.

|

EXHIBITS AND FINANCIAL STATEMENT SCHEDULES

|

54

|

|

|

SIGNATURES

|

56

|

Forward-looking Statements - Factors That May Affect Future Results

This report may contain or incorporate by reference forward-looking statements made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Although we believe that, in making any such statements, our expectations are based on reasonable assumptions, forward-looking statements are not guarantees of future performance and involve risks, uncertainties, and other factors beyond our control, which may cause future performance to be materially different from expected performance summarized in the forward-looking statements. These risks, uncertainties and other factors are discussed in the section Part I, Item 1A, “Risk Factors”. We undertake no obligation to

publicly update or revise any forward-looking statements to reflect changed assumptions, the occurrence of anticipated or unanticipated events, or changes to future results over time.

PART I.

ITEM 1. BUSINESS

Description of Business

Cass Information Systems, Inc. (“Cass” or “the Company”) is a leading provider of payment and information processing services to large manufacturing, distribution and retail enterprises across the United States. The Company provides transportation invoice rating, payment, audit, accounting and transportation information to many of the nation’s largest companies. It is also a processor and payer of utility invoices, including electricity, gas, and other facility related expenses. Additionally, Cass competes in the telecommunications expense management market which includes bill processing, audit and payment services for telephone, data line, cellular and communication equipment expense. Also the Company, through its wholly owned bank

subsidiary, Cass Commercial Bank (“the Bank”), provides commercial banking services. The Bank’s primary focus is to support the Company’s payment operations and provide banking services to its target markets, which include privately owned businesses and churches and church-related ministries. Services include commercial and commercial real estate loans, checking, savings and time deposit accounts and other cash management services. The principal offices of the Company are at 13001 Hollenberg Drive, Bridgeton, Missouri 63044. Other operating locations are in Columbus, Ohio, Boston, Massachusetts, Greenville, South Carolina and Wellington, Kansas. The Bank’s headquarters are also located at the Bridgeton location, and the Bank operates five other branches, four in the St. Louis metropolitan area and one in southern California.

Company Strategy and Core Competencies

Cass is an information services company with a primary focus on processing payables and payables-related transactions for large corporations located in the United States. Cass possesses four core competencies that encompass most of its processing services.

Data acquisition – This refers to the gathering of data elements from diverse, heterogeneous sources and the building of complete databases for our customers. Data is the raw material of the information economy. Cass gathers vital data from complex and diverse input documents, electronic media, proprietary databases and data feeds, including data acquired from vendor invoices as well as customer procurement and sales systems. Through its numerous methods of obtaining streams and pieces of raw data, Cass is able to assemble vital data into centralized data management systems and warehouses, thus producing an engine to create the power of information for managing critical corporate functions and processing systems.

Data management – Once data is assembled, Cass is able to utilize the power from derived information to produce significant savings and benefits for its clients. This information is integrated into customers’ unique financial and accounting systems, eliminating the need for internal accounting processing and providing internal and external support for these critical systems. Information is also used to produce management and exception reporting for operational control, feedback, planning assistance and performance measurement.

Business Intelligence – Receiving information in the right place at the right time and in the required format is paramount for business survival. Cass’ information delivery solutions provide reports, digital images, data files and retrieval capabilities through the Internet or directly into customer internal systems. Cass’ proprietary Internet management delivery system is the foundation for driving these critical functions. Transaction, operational, control, status and processing exception information are all delivered through this system creating an efficient, accessible and highly reliable asset for Cass customers.

Financial exchange – Since Cass is unique among its competition in that it owns a commercial bank, it is also able to manage the movement of funds from its customers to their suppliers. This is a distinguishing factor, which clearly requires the processing capability, operating systems and financial integrity of a banking organization. Cass provides immediate, accurate, controlled and protected funds management and transfer system capabilities for all of its customers. Old and costly check processing and delivery mechanisms are replaced with more efficient electronic cash management and funds transfer systems.

Cass’ core competencies allow it to perform the highest levels of transaction processing in an integrated, efficient and systematic approach. Not only is Cass able to process the transaction, it is also able to collect the data defining the transaction and effect the financial payment governing its terms.

Cass’ shared business processes – Accounting, Human Resources and Technology – support its core competencies. Cass’ accounting function provides the internal control systems to ensure the highest levels of accountability and protection for customers. Cass’ human resources department provides experienced people dedicated to streamlining business procedures and reducing expenses. Cass’ technology is proven and reliable. The need to safeguard data and secure the efficiency, speed and timeliness that govern its business is a priority within the organization. The ability to

1

leverage technology over its strategic units allows Cass the advantage of deploying technology in a proven and reliable manner without hindering clients’ strategic business and system requirements.

These core competencies, enhanced through shared business processes, drive Cass’ strategic business units. Building upon these foundations, Cass continues to explore new business opportunities that leverage these competencies and processes.

Marketing, Customers and Competition

The Company, through its Transportation Information Services business unit, is one of the largest firms in the transportation bill processing and payment industry in the United States based on the total dollars of transportation bills paid and items processed. Competition consists of a few primary competitors and numerous small transportation bill audit firms located throughout the United States. While offering transportation payment services, few of these audit firms compete on a national basis. These competitors compete mainly on price, functionality and service levels. The Company, through its Utility Information Services business unit, also competes with other companies, located throughout the United States, that pay utility bills and provide management

reporting. Available data indicates that the Company is one of the largest providers of utility information processing and payment services. Cass’ Utility Information Services is unique among these competitors in that it is not exclusively affiliated with any one energy service provider (“ESP”). The ESPs market the Company’s services adding value with their unique auditing, consulting and technological capabilities. Many of Cass’ services are customized for the ESPs, providing a full-featured solution without any development costs to the ESP. Also the Company, through its Telecom Information Services business unit, is a leader in the growing telecom expense management market, and competes with other companies located throughout the United States in this market.

The Bank is organized as a Missouri trust company with banking powers and was founded in 1906. Due to its ownership of a federally insured commercial bank, the Company is a bank holding corporation and was originally organized in 1982 as Cass Commercial Corporation under the laws of Missouri. It was approved by the Board of Governors of the Federal Reserve System (the “Federal Reserve”) in February 1983. The Company changed its name to Cass Information Systems, Inc. in January 2001. The Company’s bank subsidiary encounters competition from numerous banks and financial institutions located throughout the St. Louis, Missouri metropolitan area and other areas in which the Bank competes. The Bank’s principal competitors, however, are large

bank holding companies that are able to offer a wide range of banking and related services through extensive branch networks. The Bank targets its services to privately held businesses located in the St. Louis, Missouri area and church and church-related institutions located in St. Louis, Missouri, Orange County, California and other selected cities located throughout the United States.

The Company holds several trademarks for the payment and rating services it provides. These include: FreightPayÒ, TransdataÒ, TransInqÒ, RatemakerÒ, Rate AdviceÒ, First RateÒ, Best RateÒ, Rate ExchangeÒ and CassPortÒ. The

Company and its subsidiaries are not dependent on any one customer for a significant portion of their businesses. The Company and its subsidiaries have a varied client base with no individual client exceeding 10% of total revenue.

Employees

The Company and its subsidiaries had 671 full-time and 247 part-time employees as of March 4, 2011. Of these employees, the Bank had 60 full-time and one part-time employee.

Supervision and Regulation

The Company and its bank subsidiary are extensively regulated under federal and state law. These laws and regulations are intended to protect depositors, not shareholders. These laws also include the recently enacted Dodd-Frank Wall Street Reform and Consumer Protection Act (The Dodd-Frank Act). The regulations related to the Dodd-Frank Act are currently being written, and accordingly, the full implication of this new law will not be known for some time. The Bank is subject to regulation and supervision by the Missouri Division of Finance, the Federal Reserve Bank (the “FRB”) and the Federal Deposit Insurance Corporation (the “FDIC”). The Company is a bank holding company within the meaning of the Bank Holding Company Act of 1956, as amended, and

as such, it is subject to regulation, supervision and examination by the FRB. The Company is required to file quarterly and annual reports with the FRB and to provide to the FRB such additional information as the FRB may require, and it is subject to regular inspections by the FRB. Bank regulatory agencies use Capital Adequacy Guidelines in their examination and regulation of bank holding companies and banks. If the capital falls below the minimum levels established by these guidelines, the agencies may force certain remedial action to be taken. The Capital Adequacy Guidelines are of several types and include risk-based capital guidelines, which are designed to make capital requirements more sensitive to various risk profiles and account for off-balance sheet exposure; guidelines that consider market risk, which is the risk of loss due to change in value of assets and liabilities due to changes in interest rates; and guidelines that use a

leverage ratio which places a constraint on the maximum degree of risk to which a bank holding company may leverage its equity capital base. For further discussion of the capital adequacy guidelines and ratios, please refer

2

to Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Item 8, Note 2 of this report.

The FRB also has extensive enforcement authority over bank holding companies, including, among other things, the ability to assess civil money penalties, to issue cease and desist or removal orders and to require that a holding company divest subsidiaries (including its bank subsidiaries). In general, enforcement actions may be initiated for violations of law or regulations or for unsafe or unsound practices. Both the FRB and Missouri Division of Finance also have restrictions on the amount of dividends that banks and bank holding companies may pay.

As a bank holding company, the Company must obtain prior approval from the FRB before acquiring ownership or control of more than 10% of the voting shares of another bank or bank holding company or acquiring all or substantially all of the assets of such a company. In many cases, prior approval is also required for the Company to engage in similar acquisitions involving a non-bank company or to engage in new non-bank activities. Any change in applicable laws or regulations may have a material effect on the business and prospects of the Company.

Website Availability of SEC Reports

Cass files annual, quarterly and current reports with the Securities and Exchange Commission (the “SEC”). Cass will, as soon as reasonably practicable after they are electronically filed with or furnished to the SEC, make available free of charge on its website each of its Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, all amendments to those reports, and its definitive proxy statements. The address of Cass’ website is: www.cassinfo.com. All reports filed with the SEC are available for reading and copying at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549-0213 or for more information call the Public Reference Room at 1-800-SEC-0330. The SEC also makes all filed reports, proxy

statements and information statements available on its website at www.sec.gov.

The reference to our website address does not constitute incorporation by reference of the information contained on the website and should not be considered part of this report.

Financial Information about Segments

The services provided by the Company are classified in two reportable segments: Information Services and Banking Services. The revenues from external customers, net income and total assets by segment as of and for the three years ended December 31, 2010, are set forth in Item 8, Note 16 of this report.

Statistical Disclosure by Bank Holding Companies

For the statistical disclosure by bank holding companies refer to Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

ITEM 1A. RISK FACTORS

This section highlights specific risks that could affect the Company’s business. Although this section attempts to highlight key factors, please be aware that other risks may prove to be important in the future. New risks may emerge at any time, and Cass cannot predict such risks or estimate the extent to which they may affect the Company’s financial performance. In addition to the factors discussed elsewhere or incorporated by reference in this report, the identified risks that could cause actual results to differ materially include the following:

General political, economic or industry conditions may be less favorable than expected.

Local, domestic, and international economic, political and industry-specific conditions and governmental monetary and fiscal policies affect the industries in which the Company competes, directly and indirectly. Conditions such as inflation, recession, unemployment, volatile interest rates, tight money supply, real estate values, international conflicts and other factors outside of Cass’ control may adversely affect the Company. Economic downturns could result in the delinquency of outstanding loans, which could have a material adverse impact on Cass’ earnings.

Unfavorable developments concerning customer credit quality could affect Cass’ financial results.

Although the Company regularly reviews credit exposure related to its customers and various industry sectors in which it has business relationships, default risk may arise from events or circumstances that are difficult to detect or foresee. Under such circumstances, the Company could experience an increase in the level of provision for credit losses, delinquencies, nonperforming assets, net charge-offs and allowance for credit losses.

3

The Company has lending concentrations, including, but not limited to, churches and church-related entities located in selected cities and privately-held businesses located in or near St. Louis, Missouri, that could suffer a significant decline which could adversely affect the Company.

Cass’ customer base consists, in part, of lending concentrations in several segments and geographical areas. If any of these segments or areas is significantly affected by weak economic conditions, the Company could experience increased credit losses, and its business could be adversely affected.

Fluctuations in interest rates could affect Cass’ net interest income and balance sheet.

The operations of financial institutions such as the Company are dependent to a large degree on net interest income, which is the difference between interest income from loans and investments and interest expense on deposits and borrowings. Prevailing economic conditions, the fiscal and monetary policies of the federal government and the policies of various regulatory agencies all affect market rates of interest, which in turn significantly affect financial institutions’ net interest income. Fluctuations in interest rates affect Cass’ financial statements, as they do for all financial institutions. Volatility in interest rates can also result in disintermediation, which is the flow of funds away from financial institutions into direct investments, such as federal

government and corporate securities and other investment vehicles, which, because of the absence of federal insurance premiums and reserve requirements, generally pay higher rates of return than financial institutions. As discussed in greater detail in Item 7A, “Quantitative and Qualitative Disclosures about Market Risk,” a continuation of the current low level of interest rates would have a negative impact on the Company’s net interest income.

Methods of reducing risk exposures might not be effective.

Instruments, systems and strategies used to hedge or otherwise manage exposure to various types of credit, interest rate, market and liquidity, operational, regulatory/compliance, business risks and enterprise-wide risks could be less effective than anticipated. As a result, the Company may not be able to effectively mitigate its risk exposures in particular market environments or against particular types of risk.

Customer borrowing, repayment, investment, deposit, and payable processing practices may be different than anticipated.

The Company uses a variety of financial tools, models and other methods to anticipate customer behavior as part of its strategic and financial planning and to meet certain regulatory requirements. Individual, economic, political, industry-specific conditions and other factors outside of Cass’ control could alter predicted customer borrowing, repayment, investment, deposit, and payable processing practices. Such a change in these practices could adversely affect Cass’ ability to anticipate business needs, including cash flow and its impact on liquidity, and to meet regulatory requirements.

Cass must respond to rapid technological changes and these changes may be more difficult or expensive than anticipated.

If competitors introduce new products and services embodying new technologies, or if new industry standards and practices emerge, the Company’s existing product and service offerings, technology and systems may become obsolete. Further, if Cass fails to adopt or develop new technologies or to adapt its products and services to emerging industry standards, Cass may lose current and future customers, which could have a material adverse effect on its business, financial condition and results of operations. The payment processing and financial services industries are changing rapidly and in order to remain competitive, Cass must continue to enhance and improve the functionality and features of its products, services and technologies. These changes may be more difficult or

expensive than the Company anticipates.

Operational difficulties or security problems could damage Cass’ reputation and business.

The Company depends on the reliable operation of its computer operations and network connections from its clients to its systems. Any operational problems or outages in these systems would cause Cass to be unable to process transactions for its clients, resulting in decreased revenues. In addition, any system delays, failures or loss of data, whatever the cause, could reduce client satisfaction with the Company’s products and services and harm Cass’ financial results. Cass also depends on the security of its systems. Company networks may be vulnerable to unauthorized access, computer viruses and other disruptive problems. A material security problem affecting Cass could damage its reputation, deter prospects from purchasing its products, deter

customers from using its products or result in liability to Cass.

4

Cass’ stock price can become volatile and fluctuate widely in response to a variety of factors.

The Company’s stock price can fluctuate based on factors that can include actual or anticipated variations in Cass’ quarterly results; new technology or services by competitors; unanticipated losses or gains due to unexpected events, including losses or gains on securities held for investment purposes; significant acquisitions or business combinations, strategic partnerships, joint ventures or capital commitments by or involving the Company or its competitors; changes in accounting policies or practices; failure to integrate acquisitions or realize anticipated benefits from acquisitions; or changes in government regulations.

General market fluctuations, industry factors and general economic and political conditions, such as economic slowdowns or recessions, governmental intervention, interest rate changes, credit loss trends, low trading volume or currency fluctuations also could cause Cass’ stock price to decrease regardless of the Company’s operating results.

Competitive product and pricing pressure within Cass’ markets may change.

The Company operates in a very competitive environment, which is characterized by competition from a number of other vendors and financial institutions in each market in which it operates. The Company competes with large payment processors and national and regional financial institutions and also smaller auditing companies and banks in terms of products and pricing. If the Company is unable to compete effectively in products and pricing in its markets, business could decline.

Management’s ability to maintain and expand customer relationships may differ from expectations.

The industries in which the Company operates are very competitive. The Company not only competes for business opportunities with new customers, but also competes to maintain and expand the relationships it has with its existing customers. The Company continues to experience pressures to maintain these relationships as its competitors attempt to capture its customers.

The introductions, withdrawal, success and timing of business initiatives and strategies, including, but not limited to, the expansion of payment and processing activities to new markets, the expansion of products and services to existing markets and opening of new bank branches, may be less successful or may be different than anticipated. Such a result could adversely affect Cass’ business.

The Company makes certain projections as a basis for developing plans and strategies for its payment processing and banking products. If the Company does not accurately determine demand for its products and services, it could result in the Company incurring significant expenses without the anticipated increases in revenue, which could result in an adverse effect on its earnings.

Management’s ability to retain key officers and employees may change.

Cass’ future operating results depend substantially upon the continued service of Cass’ executive officers and key personnel. Cass’ future operating results also depend in significant part upon Cass’ ability to attract and retain qualified management, financial, technical, marketing, sales, and support personnel. Competition for qualified personnel is intense, and the Company cannot ensure success in attracting or retaining qualified personnel. There may be only a limited number of persons with the requisite skills to serve in these positions, and it may be increasingly difficult for the Company to hire personnel over time. Cass’ business, financial condition and results of operations could be materially adversely affected by the loss of

any of its key employees, by the failure of any key employee to perform in his or her current position, or by Cass’ inability to attract and retain skilled employees.

Changes in regulation or oversight may have a material adverse impact on Cass’ operations.

The Company is subject to extensive regulation, supervision and examination by the Missouri Division of Finance, the FDIC, the FRB, the SEC and other regulatory bodies. Such regulation and supervision governs the activities in which the Company may engage. Regulatory authorities have extensive discretion in their supervisory and enforcement activities, including the imposition of restrictions on Cass’ operations, investigations and limitations related to Cass’ securities, the classification of Cass’ assets and determination of the level of Cass’ allowance for loan losses. Any change in such regulation and oversight, whether in the form of regulatory policy, regulations, legislation or supervisory action, may have a material adverse impact on Cass’

operations.

Legal and regulatory proceedings and related matters with respect to the financial services industry, including those directly involving the Company and its subsidiaries, could adversely affect Cass or the financial services industry in general.

5

The Company is subject to various legal and regulatory proceedings. It is inherently difficult to assess the outcome of these matters, and there can be no assurance that the Company will prevail in any proceeding or litigation. Any such matter could result in substantial cost and diversion of Cass’ efforts, which by itself could have a material adverse effect on Cass’ financial condition and operating results. Further, adverse determinations in such matters could result in actions by Cass’ regulators that could materially adversely affect Cass’ business, financial condition or results of operations. Please refer to Item 3, “Legal Proceedings.”

The Company’s accounting policies and methods are the basis of how Cass reports its financial condition and results of operations, and they require management to make estimates about matters that are inherently uncertain. In addition, changes in accounting policies and practices, as may be adopted by the regulatory agencies, the Financial Accounting Standards Board, or other authoritative bodies, could materially impact Cass’ financial statements.

The Company’s accounting policies and methods are fundamental to how Cass records and reports its financial condition and results of operations. Management must exercise judgment in selecting and applying many of these accounting policies and methods in order to ensure that they comply with generally accepted accounting principles and reflect management’s judgment as to the most appropriate manner in which to record and report Cass’ financial condition and results of operations. In some cases, management must select the accounting policy or method to apply from two or more alternatives, any of which might be reasonable under the circumstances yet might result in the Company reporting materially different amounts than would have been reported under a different

alternative.

Cass has identified four accounting policies as being “critical” to the presentation of its financial condition and results of operations because they require management to make particularly subjective and/or complex judgments about matters that are inherently uncertain and because of the likelihood that materially different amounts would be reported under different conditions or using different assumptions. More information on Cass’ critical accounting policies is contained in Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

From time to time, the regulatory agencies, the Financial Accounting Standards Board (“FASB”), and other authoritative bodies change the financial accounting and reporting standards that govern the preparation of the Company’s financial statements. These changes can be hard to predict and can materially impact how management records and reports the Company’s financial condition and results of operations.

Cass is subject to examinations and challenges by tax authorities, which, if not resolved in the Company’s favor, could adversely affect the Company’s financial condition and results of operations.

In the normal course of business, Cass and its affiliates are routinely subject to examinations and challenges from federal and state tax authorities regarding the amount of taxes due in connection with investments it has made and the businesses in which it is engaged. Recently, federal and state taxing authorities have become increasingly aggressive in challenging tax positions taken by financial institutions. These tax positions may relate to tax compliance, sales and use, franchise, gross receipts, payroll, property and income tax issues, including tax base, apportionment and tax credit planning. The challenges made by tax authorities may result in adjustments to the timing or amount of taxable income or deductions or the allocation of income among tax

jurisdictions. If any such challenges are made and are not resolved in the Company’s favor, they could have an adverse effect on Cass’ financial condition and results of operations.

There could be terrorist activities or other hostilities, which may adversely affect the general economy, financial and capital markets, specific industries, and the Company.

The terrorist attacks in September 2001 in the United States and ensuing events, as well as the resulting decline in consumer confidence, had a material adverse effect on the economy. Any similar future events may disrupt Cass’ operations or those of its customers. In addition, these events had and may continue to have an adverse impact on the U.S. and world economy in general and consumer confidence and spending in particular, which could harm Cass’ operations. Any of these events could increase volatility in the U.S. and world financial markets, which could harm Cass’ stock price and may limit the capital resources available to its customers and the Company. This could have a significant impact on Cass’ operating results, revenues and costs and

may result in increased volatility in the market price of Cass’ common stock.

There could be natural disasters, including, but not limited to, hurricanes, tornadoes, earthquakes, fires and floods, which may adversely affect the general economy, financial and capital markets, specific industries, and the Company.

The Company has significant operations and customer base in Missouri, California, Ohio, Massachusetts, South Carolina, and other regions where natural disasters may occur. These regions are known for being vulnerable to

6

natural disasters and other risks, such as tornadoes, hurricanes, earthquakes, fires and floods. These types of natural disasters at times have disrupted the local economy, Cass’ business and customers and have posed physical risks to Cass’ property. A significant natural disaster could materially affect Cass’ operating results.

|

ITEM 1B.

|

UNRESOLVED STAFF COMMENTS

|

None.

|

ITEM 2.

|

PROPERTIES

|

The Company’s headquarters are located at 13001 Hollenberg Drive, Bridgeton, Missouri. This location is owned by the Company, and includes a building with approximately 61,500 square feet of office space. The Company also owns a production facility of approximately 45,500 square feet located at 2675 Corporate Exchange Drive, Columbus, Ohio. Additional facilities are located in Lowell, Massachusetts where approximately 25,800 square feet of office space is leased through March 2011, Greenville, South Carolina where approximately 8,500 square feet of office space is leased through November 2013, Wellington, Kansas where approximately 2,000 square feet of office space is leased through July 2011 and Columbus, Ohio where approximately 8,500 square feet of office space is leased

through March 2013. During January 2011, the Company opened an office in Breda, Netherlands to help service its multinational customers in the future. Total space leased is less than 200 square feet and it is leased through December 2011.

The Bank’s headquarters are also located at 13001 Hollenberg Drive, Bridgeton, Missouri. The Bank occupies approximately 20,500 square feet of the 61,500 square foot building. In addition, the Bank owns a banking facility near downtown St. Louis, Missouri that consists of approximately 1,750 square feet with adjoining drive-up facilities. The Bank has additional leased facilities in Maryland Heights, Missouri (2,500 square feet), Fenton, Missouri (2,000 square feet), Chesterfield, Missouri (2,850 square feet) and Santa Ana, California (3,400 square feet).

Management believes that these facilities are suitable and adequate for the Company’s operations.

|

ITEM 3.

|

LEGAL PROCEEDINGS

|

The Company is the defendant in a proceeding pending in the United States Bankruptcy Court for the District of Delaware, which proceeding was initiated by Chapter 11 debtor LNT Services, Inc. ("LNT"), an affiliate of Linens N' Things, on December 19, 2009. The LNT Chapter 11 bankruptcy proceeding was subsequently converted to a Chapter 7 proceeding. Pursuant to Section 547 of the United States Bankruptcy Code, the LNT bankruptcy trustee, on behalf of LNT, seeks to avoid and recover $33,825,773.71 in allegedly preferential payments (the "Payments") made to the Company. The Payments were received by the Company in the normal course of providing services to Linens N' Things. The Company had been engaged under contract with Linens N' Things to audit, process and pay its freight carrier

invoices. Accordingly, the Payments made to the Company were subsequently paid to the appropriate Linens N' Things freight carriers as specified in the contract.

On September 28, 2010, Asentinel LLC ("Asentinel") filed a lawsuit in the United States District Court for the Western District of Tennessee against the Company, AnchorPoint, Inc. ("AnchorPoint") and Veramark Technologies, Inc. ("Veramark"). The suit alleges infringement of two Asentinel patents by the Company, AnchorPoint and Veramark. Cass vigorously denies infringing any valid claim of either patent. Asentinel has requested an order enjoining the Company from infringing the two patents at issue, damages for the alleged infringement, interest and costs, treble damages for willful infringement, and attorneys' fees.

While there is some uncertainty relating to any litigation, management is of the opinion that the Company has valid defenses to both these claims. All other legal proceedings and actions involving the Company are of an ordinary and routine nature and are incidental to the operations of the Company. Management believes the outcome of these proceedings, including the LNT and Asentinel proceedings, will not have a material effect on the businesses or financial conditions of the Company or its subsidiaries.

|

ITEM 4.

|

(REMOVED AND RESERVED)

|

7

PART II.

|

ITEM 5.

|

MARKET FOR REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

|

The Company’s common stock is quoted on The Nasdaq Global Select MarketÒ under the symbol “CASS.” As of March 1, 2011, there were 158 holders of record of the Company’s common stock. High and low sale prices, as reported by The Nasdaq Global Select Market for each quarter of 2010 and 2009 were as follows:

|

2010

|

2009

|

|||||||||||||||

|

High

|

Low

|

High

|

Low

|

|||||||||||||

|

1st Quarter

|

$ | 31.70 | $ | 29.15 | $ | 33.60 | $ | 23.20 | ||||||||

|

2nd Quarter

|

35.00 | 30.11 | 35.35 | 29.75 | ||||||||||||

|

3rd Quarter

|

35.29 | 31.62 | 36.19 | 29.51 | ||||||||||||

|

4th Quarter

|

40.49 | 33.51 | 31.39 | 27.46 | ||||||||||||

The Company has continuously paid regularly scheduled cash dividends since 1934 and expects to continue to pay quarterly cash dividends in the future. Cash dividends paid per share by the Company during the two most recent fiscal years were as follows:

|

2010

|

2009

|

|||||||

|

March

|

$ | .14 | $ | .13 | ||||

|

June

|

.14 | .13 | ||||||

|

September

|

.14 | .13 | ||||||

|

December

|

.16 | .14 | ||||||

The Company maintains a treasury stock buyback program pursuant to which the Board of Directors has authorized the repurchase of up to 300,000 shares of the Company’s common stock. The Company repurchased 12,000 shares for an aggregate purchase price of $467,000 in 2010 and 0 shares in 2009. As of December 31, 2010, 168,000 shares remained available for repurchase under the program. A portion of the repurchased shares may be used for the Company's employee benefit plans, and the balance will be available for other general corporate purposes. The stock repurchase authorization does not have an expiration date and the pace of repurchase activity will depend on factors such as levels of cash generation from operations, cash requirements for investments, repayment of debt,

current stock price, and other factors. The Company may repurchase shares from time to time on the open market or in private transactions, including structured transactions. The stock repurchase program may be modified or discontinued at any time.

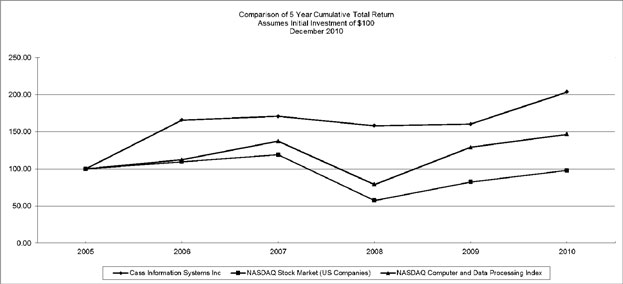

Performance Quoted on The Nasdaq Stock Market for the Last Five Fiscal Years

The following graph compares the cumulative total returns over the last five fiscal years of a hypothetical investment of $100 in shares of common stock of the Company with a hypothetical investment of $100 in The Nasdaq Stock Market (US) (“Nasdaq”) and in the index of Nasdaq computer and data processing stocks. The graph assumes $100 was invested on December 31, 2005, with dividends reinvested. Returns are based on period end prices.

8

|

ITEM 6.

|

SELECTED FINANCIAL DATA

|

The following table presents selected financial information for each of the five years ended December 31. The selected financial data should be read in conjunction with the Company’s consolidated financial statements and accompanying notes included in Item 8 of this report.

|

(Dollars in thousands except per share data)

|

2010

|

2009

|

2008

|

2007

|

2006

|

|||||||||||||||

|

Fee revenue and other income

|

$ | 56,146 | $ | 51,238 | $ | 53,170 | $ | 48,200 | $ | 42,821 | ||||||||||

|

Interest income on loans

|

39,785 | 36,003 | 34,204 | 36,288 | 36,164 | |||||||||||||||

|

Interest income on debt and equity securities

|

8,747 | 7,611 | 7,716 | 5,531 | 3,627 | |||||||||||||||

|

Other interest income

|

514 | 170 | 2,218 | 7,527 | 7,262 | |||||||||||||||

|

Total interest income

|

49,046 | 43,784 | 44,138 | 49,346 | 47,053 | |||||||||||||||

|

Interest expense on deposits

|

4,875 | 4,924 | 3,179 | 7,728 | 6,414 | |||||||||||||||

|

Interest expense on short-term borrowings

|

0 | 23 | 12 | 6 | 7 | |||||||||||||||

|

Interest on debentures and other

|

0 | 106 | 187 | 230 | 198 | |||||||||||||||

|

Total interest expense

|

4,875 | 5,053 | 3,378 | 7,964 | 6,619 | |||||||||||||||

|

Net interest income

|

44,171 | 38,731 | 40,760 | 41,382 | 40,434 | |||||||||||||||

|

Provision for loan losses

|

4,100 | 2,050 | 2,200 | 900 | 1,150 | |||||||||||||||

|

Net interest income after provision

|

40,071 | 36,681 | 38,560 | 40,482 | 39,284 | |||||||||||||||

|

Operating expense

|

68,284 | 66,385 | 65,564 | 62,739 | 58,277 | |||||||||||||||

|

Income before income tax expense

|

27,933 | 21,534 | 26,166 | 25,943 | 23,828 | |||||||||||||||

|

Income tax expense

|

7,623 | 5,405 | 7,160 | 8,148 | 8,367 | |||||||||||||||

|

Income from continuing operations

|

$ | 20,310 | $ | 16,129 | $ | 19,006 | $ | 17,795 | $ | 15,461 | ||||||||||

|

Net loss from discontinued operations

|

— | — | — | — | (395 | ) | ||||||||||||||

|

Net income

|

20,310 | 16,129 | 19,006 | 17,795 | 15,066 | |||||||||||||||

|

Diluted earnings per share from continuing operations

|

$ | 2.15 | $ | 1.73 | $ | 2.03 | $ | 1.90 | $ | 1.65 | ||||||||||

|

Diluted earnings per share

|

2.15 | 1.73 | 2.03 | 1.90 | 1.61 | |||||||||||||||

|

Dividends per share

|

.580 | .530 | .490 | .447 | .400 | |||||||||||||||

|

Dividend payout ratio

|

26.82 | % | 30.54 | % | 24.14 | % | 23.53 | % | 24.84 | % | ||||||||||

|

Average total assets

|

$ | 1,157,257 | $ | 978,171 | $ | 922,471 | $ | 891,734 | $ | 839,208 | ||||||||||

|

Average net loans

|

666,202 | 606,304 | 546,110 | 508,621 | 516,164 | |||||||||||||||

|

Average debt and equity securities

|

222,249 | 193,393 | 197,273 | 141,363 | 91,555 | |||||||||||||||

|

Average total deposits

|

470,096 | 375,572 | 241,844 | 279,831 | 278,546 | |||||||||||||||

|

Average subordinated convertible debentures

|

— | 1,984 | 3,669 | 3,699 | 3,700 | |||||||||||||||

|

Average total shareholders’ equity

|

137,748 | 117,663 | 104,185 | 89,427 | 79,736 | |||||||||||||||

|

Return on average total assets

|

1.76 | % | 1.65 | % | 2.06 | % | 2.00 | % | 1.80 | % | ||||||||||

|

Return on average equity

|

14.74 | 13.71 | 18.24 | 19.90 | 18.89 | |||||||||||||||

|

Average equity to assets ratio

|

11.90 | 12.03 | 11.29 | 10.03 | 9.50 | |||||||||||||||

|

Equity to assets ratio at year-end

|

11.96 | 12.79 | 12.00 | 11.01 | 9.78 | |||||||||||||||

|

Net interest margin

|

4.61 | 4.79 | 5.34 | 5.45 | 5.50 | |||||||||||||||

|

Allowance for loan losses to loans at year-end

|

1.68 | 1.29 | 1.09 | 1.26 | 1.31 | |||||||||||||||

|

Nonperforming assets to loans and foreclosed assets

|

.35 | .55 | .57 | .77 | .16 | |||||||||||||||

|

Net loan charge-offs to average loans outstanding

|

.07 | .04 | .37 | .24 | .16 | |||||||||||||||

|

ITEM 7.

|

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

The following discussion and analysis provides information about the financial condition and results of operations of the Company for the years ended December 31, 2010, 2009 and 2008. This discussion and analysis should be read in conjunction with the Company’s consolidated financial statements and accompanying notes and other selected financial data presented elsewhere in this report.

Executive Overview

Cass provides payment and information processing services to large manufacturing, distribution and retail enterprises from its offices/locations in St. Louis, Missouri, Columbus, Ohio, Boston, Massachusetts, Greenville, South Carolina and Wellington, Kansas. The Company’s services include freight invoice rating, payment processing, auditing, and the generation of accounting and transportation information. Cass also processes and pays utility invoices, which

9

include electricity, gas and telecommunications expenses, and is a provider of telecom expense management solutions. Cass extracts, stores, and presents information from freight, utility and telecommunication invoices, assisting its customers’ transportation, energy, and information technology managers in making decisions that will enable them to improve operating performance. The Company receives data from multiple sources, electronic and otherwise, and processes the data to accomplish the specific operating requirements of its customers. It then provides the data in a central repository for access and archiving. The data is finally transformed into information through the Company’s databases that allow client interaction as required and provide

Internet-based tools for analytical processing. The Company also, through Cass Commercial Bank, its St. Louis, Missouri based bank subsidiary (the “Bank”), provides banking services in the St. Louis metropolitan area, Orange County, California, and other selected cities in the United States. In addition to supporting the Company’s payment operations, the Bank provides banking services to its target markets, which include privately-owned businesses and churches and church-related ministries.

The specific payment and information processing services provided to each customer are developed individually to meet each customer’s requirements, which can vary greatly. In addition, the degree of automation such as electronic data interchange, imaging, and web-based solutions varies greatly among customers and industries. These factors combine so that pricing varies greatly among the customer base. In general, however, Cass is compensated for its processing services through service fees and investment of account balances generated during the payment process. The amount, type, and calculation of service fees vary greatly by service offering, but generally follow the volume of transactions processed. Interest income from the balances generated during

the payment processing cycle is affected by the amount of time Cass holds the funds prior to payment and the dollar volume processed. Both the number of transactions processed and the dollar volume processed are therefore key metrics followed by management. Other factors will also influence revenue and profitability, such as changes in the general level of interest rates, which have a significant effect on net interest income. The funds generated by these processing activities are invested in overnight investments, investment grade securities, and loans generated by the Bank. The Bank earns most of its revenue from net interest income, or the difference between the interest earned on its loans and investments and the interest paid on its deposits and other borrowings. The Bank also assesses fees on other services such as cash management services.

Industry-wide factors that impact the Company include the willingness of large corporations to outsource key business functions such as freight, utility, and telecommunication payment and audit. The benefits that can be achieved by outsourcing transaction processing and the management information generated by Cass’ systems can be influenced by factors such as the competitive pressures within industries to improve profitability, the general level of transportation costs, deregulation of energy costs, and consolidation of telecommunication providers. Economic factors that impact the Company include the general level of economic activity that can affect the volume and size of invoices processed, the ability to hire and retain qualified staff, and the growth and quality of the loan

portfolio. As lower levels of economic activity are encountered, such as those experienced in 2009, the number and total dollar amount of transactions processed by the Company may decline, thereby reducing fee revenue, interest income, and possibly liquidity. Conversely, improving economic conditions, such as those experienced in 2010, will tend to increase fee revenue, interest income, and liquidity. The general level of interest rates also has a significant effect on the revenue of the Company. As discussed in greater detail in Item 7A, “Quantitative and Qualitative Disclosures about Market Risk,” a decline in the general level of interest rates can have a negative impact on net interest income.

In 2010, total fee revenue and other income increased $4,908,000, or 10%, net interest income after provision for loan losses increased $3,390,000, or 9%, and total operating expenses increased $1,899,000, or 3%. These results were driven by a 3,916,000, or 11%, increase in items processed and $3,708,885,000, or 16%, increase in dollars processed. The asset quality of the Company’s loans and investments as of December 31, 2010 appeared strong.

Currently, management views Cass’ major opportunity as the continued expansion of its payment and information processing service offerings and customer base. Management intends to accomplish this by maintaining the Company’s lead in applied technology, which when combined with the security and processing controls of the Bank, makes Cass unique in the industry.

Impact of New and Not Yet Adopted Accounting Pronouncements

In July 2010, the FASB issued Accounting Standards Update (ASU) “Disclosures about the Credit Quality of Financing Receivables and the Allowance for Credit Losses.” This guidance requires a greater level of disaggregated information about the credit quality of financing receivables and reserves for credit losses, including increased disclosure of credit quality indicators, past due information, and modifications of financing receivables. Disclosures regarding activity during a reporting period are effective for interim and annual reporting periods beginning on or after December 15, 2010. Adoption of this ASU is not expected to have a material impact on the Company’s consolidated financial position or results of operations.

10

Critical Accounting Policies

The Company has prepared the consolidated financial statements in this report in accordance with the FASB Accounting Standards Codification (“ASC”). In preparing the consolidated financial statements, management makes estimates and assumptions that affect the reported amount of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenue and expenses during the reporting period. These estimates have been generally accurate in the past, have been consistent and have not required any material changes. There can be no assurances that actual results will not differ from those estimates. Certain accounting policies that require significant management estimates and are deemed

critical to our results of operations or financial position have been discussed with the Audit Committee of the Board of Directors and are described below.

Allowance for Loan Losses. The Company performs periodic and systematic detailed reviews of its loan portfolio to assess overall collectability. The level of the allowance for loan losses reflects management’s estimate of the collectability of the loan portfolio. Although these estimates are based on established methodologies for determining allowance requirements, actual results can differ significantly from estimated results. These policies affect both segments of the Company. The impact and associated risks related to these policies on the Company’s business operations are discussed in the “Provision and Allowance for Loan Losses” section of this report. The

Company’s estimates have been materially accurate in the past, and accordingly, the Company expects to continue to utilize the present processes.

Impairment of Assets. The Company periodically evaluates certain long-term assets such as intangible assets including goodwill, foreclosed assets and assets held for sale for impairment. Generally, these assets are initially recorded at cost, and recognition of impairment is required when events and circumstances indicate that the carrying amounts of these assets will not be recoverable in the future. If impairment occurs, various methods of measuring impairment may be called for depending on the circumstances and type of asset, including quoted market prices, estimates based on similar assets, and estimates based on valuation techniques such as discounted projected cash flows. The Company had no impairment of

goodwill and intangible assets for fiscal years ended December 31, 2010, 2009 and 2008 and management does not anticipate any future impairment loss. Investment securities available-for-sale are measured at fair value as calculated by an independent research firm. The market evaluation utilizes several sources which include “observable inputs” rather than “significant unobservable inputs.” These policies affect both segments of the Company and require significant management assumptions and estimates that could result in materially different results if conditions or underlying circumstances change.

Income Taxes. The objectives of accounting for income taxes are to recognize the amount of taxes payable or refundable for the current year and deferred tax liabilities and assets for the future tax consequences of events that have been recognized in an entity's financial statements or tax returns. Judgment is required in addressing the future tax consequences of events that have been recognized in the Company’s financial statements or tax returns such as the realization of deferred tax assets or changes in tax laws or interpretations thereof. In addition, the Company is subject to the continuous examination of its income tax returns by the Internal Revenue Service and other taxing authorities. In accordance

with FASB ASC 740, “Income Taxes,” the Company has unrecognized tax benefits related to tax positions taken or expected to be taken. See Note 13 to the consolidated financial statements. The audit of the Company’s federal consolidated tax returns conducted by the Internal Revenue Service for fiscal years 2004 and 2005 resulted in no significant material adjustments.

Pension Plans. The amounts recognized in the consolidated financial statements related to pension plans are determined from actuarial valuations. Inherent in these valuations are assumptions including expected return on plan assets, discount rates at which the liabilities could be settled at December 31, 2010, rate of increase in future compensation levels and mortality rates. These assumptions are updated annually and are disclosed in Note 10 to the consolidated financial statements. There have been no significant changes in the Company’s long-term rate of return assumptions for the past three fiscal years ended December 31 and management believes they are not reasonably likely to change in the

future. Pursuant to FASB ASC 715, “Compensation – Retirement Benefits,” the Company has recognized the funded status of its defined benefit postretirement plan in its consolidated balance sheet and has recognized changes in that funded status through comprehensive income. The funded status is measured as the difference between the fair value of the plan assets and the projected benefit obligation as of the date of its fiscal year-end.

Summary of Results

|

For the Years Ended December 31,

|

% Change

|

|||||||||||||||||||

|

(In thousands except per share data)

|

2010

|

2009

|

2008

|

2010 v. 2009 | 2009 v. 2008 | |||||||||||||||

|

Total processing volume

|

38,534 | 34,619 | 36,416 | 11.3 | % | (4.9 | )% | |||||||||||||

|

Total processing dollars

|

$ | 27,426,336 | $ | 23,717,451 | $ | 26,900,535 | 15.6 | (11.8 | ) | |||||||||||

|

Payment and processing fees

|

$ | 54,183 | $ | 48,665 | $ | 50,721 | 11.3 | (4.1 | ) | |||||||||||

|

Net interest income after provision for loan losses

|

$ | 40,071 | $ | 36,681 | $ | 38,560 | 9.2 | (4.9 | ) | |||||||||||

|

Total net revenue

|

$ | 96,217 | $ | 87,919 | $ | 91,730 | 9.4 | (4.2 | ) | |||||||||||

|

Average earning assets

|

$ | 1,060,559 | $ | 894,951 | $ | 841,367 | 18.5 | 6.4 | ||||||||||||

|

Net interest margin*

|

4.61 | % | 4.79 | % | 5.34 | % | ||||||||||||||

|

Net income

|

$ | 20,310 | $ | 16,129 | $ | 19,006 | 25.9 | (15.1 | ) | |||||||||||

|

Diluted earnings per share

|

$ | 2.15 | $ | 1.73 | $ | 2.03 | 24.3 | (14.8 | ) | |||||||||||

|

Return on average assets

|

1.76 | % | 1.65 | % | 2.06 | % | ||||||||||||||

|

Return on average equity

|

14.74 | % | 13.71 | % | 18.24 | % | ||||||||||||||

*Presented on a tax-equivalent basis

11

The results of 2010 compared to 2009 include the following significant items:

Payment and processing fee revenue increased as the number of transactions processed increased. This increase was due to increased activity from both base and new customers.

Net interest income after provision for loan losses increased $3,390,000, or 9%, primarily due to the 18% growth in average earning assets. The net interest margin on a tax equivalent basis was 4.61% in 2010 compared to 4.79% in 2009. The growth in average earning assets was funded mainly by the increase in deposits.

Gains from the sale of securities were $0 in 2010 and $697,000 in 2009. Bank service fees were up $86,000, or 6%, and other income was approximately the same in 2010 and 2009. Operating expenses increased $1,899,000, or 3%, primarily in response to the increase in business volume, as well as higher professional fees as the Company invests for future growth.

The results of 2009 compared to 2008 include the following significant items:

Payment and processing fee revenue decreased as the number of transactions processed decreased. This decrease was driven mainly by the decline in the transportation base customer volumes as the global economic slowdown continued.

Net interest income after provision for loan losses decreased $1,879,000 primarily due to a decline in the general level of interest rates and a less favorable mix of funding sources. The net interest margin on a tax equivalent basis was 4.79% in 2009, compared to 5.34% in 2008. The growth in average earning assets was funded mainly by the increase in deposits.

Gains from the sale of securities were $697,000 in 2009 and $552,000 in 2008. Bank service fees and other income were approximately the same in 2009 and 2008. Operating expenses increased $821,000, or 1%.

Fee Revenue and Other Income

The Company’s fee revenue is derived mainly from transportation and utility payment and processing fees. As the Company provides its processing and payment services, it is compensated by service fees which are typically calculated on a per-item basis and by the accounts and drafts payable balances generated in the payment process which can be used to generate interest income. Processing volumes, fee revenue and other income were as follows:

|

December 31,

|

% Change

|

|||||||||||||||||||

|

(In thousands)

|

2010

|

2009

|

2008

|

2010 v. 2009 | 2009 v. 2008 | |||||||||||||||

|

Transportation invoice transaction volume

|

26,287 | 23,137 | 25,854 | 13.6 | % | (10.5 | )% | |||||||||||||

|

Transportation invoice dollar volume

|

$ | 16,966,003 | $ | 14,047,342 | $ | 17,482,520 | 20.8 | (19.6 | ) | |||||||||||

|

Utility transaction volume

|

12,247 | 11,482 | 10,562 | 6.7 | 8.7 | |||||||||||||||

|

Utility transaction dollar volume

|

$ | 10,460,333 | $ | 9,670,109 | $ | 9,418,015 | 8.2 | 2.7 | ||||||||||||

|

Payment and processing revenue

|

$ | 54,183 | $ | 48,665 | $ | 50,721 | 11.3 | (4.1 | ) | |||||||||||

|

Bank service fees

|

$ | 1,410 | $ | 1,324 | $ | 1,330 | 6.5 | (0.5 | ) | |||||||||||

|

Gains on sales of investment securities

|

$ | 0 | $ | 697 | $ | 552 | (100.0 | ) | 26.3 | |||||||||||

|

Other

|

$ | 553 | $ | 552 | $ | 567 | 0.2 | (2.6 | ) | |||||||||||

Fee revenue and other income in 2010 compared to 2009 include the following significant pre-tax components:

Transportation dollar volume increased by 21% during the past year. This increase was due to the increased activity from both base and new customers. Utility transaction dollar volume was up a solid 8%. Overall, revenues for the year were up 11%.

Fee revenue and other income in 2009 compared to 2008 include the following significant pre-tax components:

12

Transportation volume decreased by 2,717,000 transactions during the past year. This decrease was due mainly to the impact of the general economic slow-down on existing customer processing activity. Utility volume experienced solid growth, adding more than 920,000 transactions in 2009. This growth was due mainly to new business. The reduction in transportation transaction volume drove the $2,056,000 decrease in payment and processing revenue.

Net Interest Income

Net interest income is the difference between interest earned on loans, investments, and other earning assets and interest expense on deposits and other interest-bearing liabilities. Net interest income is a significant source of the Company’s revenues. The following table summarizes the changes in tax-equivalent net interest income and related factors:

|

December 31,

|

% Change

|

|||||||||||||||||||

|

(In thousands)

|

2010

|

2009

|

2008

|

2010 v. 2009 | 2009 v. 2008 | |||||||||||||||

|

Average earning assets

|

$ | 1,060,559 | $ | 894,951 | $ | 841,366 | 18.5 | % | 6.4 | % | ||||||||||

|

Net interest income*

|

$ | 48,891 | $ | 42,869 | $ | 44,966 | 14.0 | (4.7 | ) | |||||||||||

|

Net interest margin*

|

4.61 | % | 4.79 | % | 5.34 | % | ||||||||||||||

|

Yield on earning assets*

|

5.07 | % | 5.35 | % | 5.75 | % | ||||||||||||||

|

Rate on interest bearing liabilities

|

1.37 | % | 1.81 | % | 2.16 | % | ||||||||||||||

*Presented on a tax-equivalent basis using a tax rate of 35% in 2010, 34% in 2009, and 35% in 2008.

Net interest income in 2010 compared to 2009:

The increase in net interest income was caused by the increase in average earning assets, partially offset by a decrease in net interest margin. The increase in earning assets was funded mainly by the increase in deposits and accounts and drafts payable. The decrease in net interest margin was due to the continued low interest rate environment. More information is contained in the tables below and in Item 7A of this report.

Total average loans increased $62,642,000, or 10%, to $675,901,000. Loans have a positive effect on interest income and the net interest margin due to the fact that loans are one of the Company’s highest yielding earning assets for any given maturity.

Total average investment in securities increased $28,856,000, or 15%, to $222,249,000. The investment portfolio will expand and contract over time as the interest rate environment changes and the Company manages its liquidity and interest rate position. All purchases were made in accordance with the Company’s investment policy. Total average federal funds sold and other short-term investments increased $68,280,000, or 117%.

The Bank’s average interest-bearing deposits increased $83,063,000, or 30%, compared to the prior year. This increase in deposits, along with the $73,729,000, or 16% increase in accounts and drafts payable, funded the increase in earning assets. Average rates paid on interest-bearing liabilities decreased from 1.81% to 1.37% as a result of the continued low interest rate environment experienced during 2010.

Net interest income in 2009 compared to 2008:

The decrease in net interest income was caused by the decrease in net interest margin, partially offset by an increase in average earning assets. The increase in earning assets was funded mainly by the increase in deposits. The decrease in net interest margin was due mainly to the reduction in the general level of interest rates and a less favorable mix of funding sources.

Total average loans increased $60,926,000, or 11%, to $613,259,000. Loans have a positive effect on interest income and the net interest margin due to the fact that loans are one of the Company’s highest yielding earning assets for any given maturity.

Total average investment in securities decreased $3,880,000, or 2%, to $193,393,000. The investment portfolio will expand and contract over time as the interest rate environment changes and the Company manages its liquidity and interest rate position. All purchases were made in accordance with the Company’s investment policy. Total average federal funds sold and other short-term investments decreased $16,090,000, or 22%. This decrease offset the previously mentioned increase in loans.

The Bank’s average interest-bearing deposits increased $121,362,000, or 80%, compared to the prior year. The increase in deposits was required to offset the $99,342,000, or 18%, decrease in accounts and drafts

13

payable that resulted from a lower level of transportation invoice dollar volume. Average rates paid on interest-bearing liabilities decreased from 2.16% to 1.81% as a result of an overall decline in the interest rate environment during 2009.

Distribution of Assets, Liabilities and Shareholders' Equity; Interest Rate and Interest Differential

The following table contains condensed average balance sheets for each of the periods reported, the tax-equivalent interest income and expense on each category of interest-earning assets and interest-bearing liabilities, and the average yield on such categories of interest-earning assets and the average rates paid on such categories of interest-bearing liabilities for each of the periods reported:

|

2010

|

2009

|

2008

|

||||||||||||||||||||||||||||||||||

|

(In thousands)

|

Average

Balance

|

Interest

Income/

Expense

|

Yield/

Rate

|

Average

Balance

|

Interest

Income/

Expense

|

Yield/

Rate

|

Average

Balance

|

Interest

Income/

Expense

|

Yield/

Rate

|

|||||||||||||||||||||||||||

|

Assets1

|

||||||||||||||||||||||||||||||||||||

|

Earning assets

|

||||||||||||||||||||||||||||||||||||

|

Loans2, 3:

|

||||||||||||||||||||||||||||||||||||

|

Taxable

|

$ | 674,026 | $ | 39,723 | 5.89 | % | $ | 610,171 | $ | 35,872 | 5.88 | % | $ | 548,500 | $ | 34,030 | 6.20 | % | ||||||||||||||||||

|

Tax-exempt4

|

1,875 | 95 | 5.07 | 3,088 | 202 | 6.54 | 3,833 | 268 | 6.97 | |||||||||||||||||||||||||||

|

Debt and equity securities5:

|

||||||||||||||||||||||||||||||||||||

|

Taxable

|

885 | 43 | 4.86 | 3,373 | 58 | 1.72 | 2,758 | 78 | 2.83 | |||||||||||||||||||||||||||

|

Tax-exempt4

|

221,364 | 13,391 | 6.05 | 190,020 | 11,620 | 6.12 | 194,515 | 11,750 | 6.04 | |||||||||||||||||||||||||||

|

Interest-bearing deposits in other financial institutions

|

35,655 | 139 | .39 | 29,825 | 72 | 0.24 | 17,196 | 375 | 2.18 | |||||||||||||||||||||||||||

|

Federal funds sold and other short-term investments

|

126,754 | 375 | .30 | 58,474 | 98 | 0.17 | 74,564 | 1,843 | 2.47 | |||||||||||||||||||||||||||

|

Total earning assets

|

1,060,559 | 53,766 | 5.07 | 894,951 | 47,922 | 5.35 | 841,366 | 48,344 | 5.75 | |||||||||||||||||||||||||||

|

Non-earning assets

|

||||||||||||||||||||||||||||||||||||

|

Cash and due from banks

|

10,794 | 9,541 | 11,607 | |||||||||||||||||||||||||||||||||

|

Premise and equipment, net

|

9,979 | 11,171 | 12,393 | |||||||||||||||||||||||||||||||||

|

Bank owned life insurance

|

13,924 | 13,376 | 12,802 | |||||||||||||||||||||||||||||||||

|

Goodwill and other intangibles

|

7,795 | 7,942 | 8,216 | |||||||||||||||||||||||||||||||||

|

Other assets

|

63,905 | 48,145 | 42,310 | |||||||||||||||||||||||||||||||||

|

Allowance for loan losses

|

(9,699 | ) | (6,955 | ) | (6,223 | ) | ||||||||||||||||||||||||||||||

|

Total assets

|

$ | 1,157,257 | $ | 978,171 | $ | 922,471 | ||||||||||||||||||||||||||||||

|

Liabilities and Shareholders’ Equity1

|

||||||||||||||||||||||||||||||||||||

|

Interest-bearing liabilities

|

||||||||||||||||||||||||||||||||||||

|

Interest-bearing demand deposits

|

$ | 182,869 | $ | 2,082 | 1.14 | % | $ | 127,952 | $ | 1,798 | 1.41 | % | $ | 77,835 | $ | 1,086 | 1.40 | % | ||||||||||||||||||

|

Savings deposits

|

28,137 | 321 | 1.14 | 25,268 | 334 | 1.32 | 21,434 | 290 | 1.35 | |||||||||||||||||||||||||||

|

Time deposits >=$100

|

52,510 | 814 | 1.55 | 43,590 | 1,063 | 2.44 | 32,052 | 1,102 | 3.44 | |||||||||||||||||||||||||||

|

Other time deposits

|

92,942 | 1,658 | 1.78 | 76,585 | 1,729 | 2.26 | 20,712 | 701 | 3.38 | |||||||||||||||||||||||||||

|

Total interest-bearing deposits

|

356,458 | 4,875 | 1.37 | 273,395 | 4,924 | 1.80 | 152,033 | 3,179 | 2.09 | |||||||||||||||||||||||||||

|

Short-term borrowings

|

33 | — | — | 3,759 | 23 | 0.61 | 876 | 12 | 1.37 | |||||||||||||||||||||||||||

|

Subordinated debentures

|

— | — | — | 1,984 | 106 | 5.34 | 3,669 | 187 | 5.10 | |||||||||||||||||||||||||||

|

Total interest bearing liabilities

|

356,491 | 4,875 | 1.37 | 279,138 | 5,053 | 1.81 | 156,578 | 3,378 | 2.16 | |||||||||||||||||||||||||||

|

Non-interest bearing liabilities

|

||||||||||||||||||||||||||||||||||||