Attached files

| file | filename |

|---|---|

| EX-23 - CONSENT OF PARENTEBEARD LLC - YORK WATER CO | exhibit23-123110.htm |

| EX-31.2 - YWC CERTIFICATION OF CFO - YORK WATER CO | exhibit312-123110.htm |

| EX-10.19 - YWC FORM OF DEFERRED COMPENSATION AGREEMENT - YORK WATER CO | exhibit1019-123110.htm |

| EX-10.17 - YWC FORM OF CHANGE IN CONTROL AGREEMENT - YORK WATER CO | exhibit1017-123110.htm |

| EX-10.18 - YWC FORM OF SUPPLEMENTAL RETIREMENT PLAN - YORK WATER CO | exhibit1018-123110.htm |

| 10-K - THE YORK WATER COMPANY 10K 12-31-10 - YORK WATER CO | form10k123110.htm |

| EX-32.1 - YWC SECTION 906 CERTIFICATION OF CEO - YORK WATER CO | exhibit321-123110.htm |

| EX-32.2 - YWC SECTION 906 CERTIFICATION OF CFO - YORK WATER CO | exhibit322-123110.htm |

| EX-31.1 - YWC CERTIFICATION OF CEO - YORK WATER CO | exhibit311-123110.htm |

EXHIBIT 13

| 1 | |

| 2 | |

| 4 | |

| 15 | |

| 16 | |

| 17 | |

| 18 | |

| 20 | |

| 21 | |

| 22 |

Highlights of Our 195th Year

(In thousands of dollars, except per share amounts)

|

Summary of Operations

|

|||||

|

For the Year

|

2010

|

2009

|

2008

|

2007

|

2006

|

|

Water operating revenues

|

$39,005

|

$37,043

|

$32,838

|

$31,433

|

$28,658

|

|

Operating expenses

|

19,238

|

19,655

|

18,158

|

17,333

|

15,754

|

|

Operating income

|

19,767

|

17,388

|

14,680

|

14,100

|

12,904

|

|

Interest expense

|

4,795

|

4,780

|

4,112

|

3,916

|

3,727

|

|

Other income (expenses), net

|

(465)

|

(517)

|

(509)

|

(78)

|

110

|

|

Income before income taxes

|

14,507

|

12,091

|

10,059

|

10,106

|

9,287

|

|

Income taxes

|

5,578

|

4,579

|

3,628

|

3,692

|

3,196

|

|

Net income

|

$ 8,929

|

$ 7,512

|

$ 6,431

|

$ 6,414

|

$ 6,091

|

|

Per Share of Common Stock

|

|||||

|

Book value

|

$7.19

|

$6.92

|

$6.14

|

$5.97

|

$5.84

|

|

Basic earnings per share

|

0.71

|

0.64

|

0.57

|

0.57

|

0.58

|

|

Cash dividends declared per share

|

0.515

|

0.506

|

0.489

|

0.475

|

0.454

|

|

Weighted average number of shares

|

|||||

|

outstanding during the year

|

12,626,660

|

11,695,155

|

11,298,215

|

11,225,822

|

10,475,173

|

|

Utility Plant

|

|||||

|

Original cost,

|

|||||

|

net of acquisition adjustments

|

$269,856

|

$259,839

|

$245,249

|

$222,354

|

$202,020

|

|

Construction expenditures

|

10,541

|

12,535

|

24,438

|

18,154

|

20,678

|

|

Other

|

|||||

|

Total assets

|

$259,931

|

$248,837

|

$240,442

|

$210,969

|

$196,064

|

|

Long-term debt

|

|||||

|

including current portion

|

85,173

|

77,568

|

86,353

|

70,505

|

62,335

|

For Management's Discussion and Analysis of Financial Condition and Results of Operations, please refer to page 4.

Market for Common Stock and Dividends

The common stock of The York Water Company is traded on the NASDAQ Global Select Market (Symbol “YORW”). Quarterly price ranges and cash dividends per share for the last two years follow:

|

2010

|

2009

|

|||||

|

High

|

Low

|

Dividend*

|

High

|

Low

|

Dividend*

|

|

|

1st Quarter

|

$15.00

|

$13.04

|

$0.128

|

$13.50

|

$9.74

|

$0.126

|

|

2nd Quarter

|

15.60

|

12.83

|

0.128

|

16.26

|

11.75

|

0.126

|

|

3rd Quarter

|

16.40

|

13.42

|

0.128

|

17.95

|

13.75

|

0.126

|

|

4th Quarter

|

18.00

|

15.52

|

0.131

|

15.24

|

13.65

|

0.128

|

*Cash dividends per share reflect dividends declared at each dividend date.

Prices listed in the above table are sales prices as listed on the NASDAQ Global Select Market. Shareholders of record (excluding individual participants in securities positions listings) as of December 31, 2010 numbered approximately 1,649.

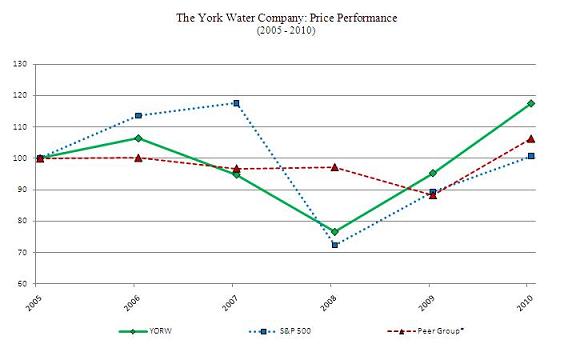

Performance Graph

The following line graph presents the annual and cumulative total shareholder return for The York Water Company Common Stock over a five-year period from 2005 through 2010, based on the market price of the Common Stock and assuming reinvestment of dividends, compared with the cumulative total shareholder return of companies in the S&P 500 Index and a peer group made up of publicly traded water utilities, also assuming reinvestment of dividends. The peer group companies include: American States, Aqua America, Artesian Resources, California Water Service, Connecticut Water Service, Middlesex Water, Pennichuck Corporation and San Jose Water.

|

2005

|

2006

|

2007

|

2008

|

2009

|

2010

|

|

|

The York Water Company

|

100.00

|

106.37

|

94.84

|

76.67

|

95.34

|

117.43

|

|

S&P 500 Index

|

100.00

|

113.62

|

117.63

|

72.36

|

89.33

|

100.75

|

|

Peer Group*

|

100.00

|

100.19

|

96.79

|

97.25

|

88.32

|

106.26

|

*ARTNA, AWR, CTWS, CWT, MSEX, PNNW, SJW, WTR

Source: FactSet Research Systems Inc.

Dividend Policy

Dividends on the Company's common stock are declared by the Board of Directors and are normally paid in January, April, July and October. Dividends are paid based on shares outstanding as of the stated record date, which is ordinarily the last day of the calendar month immediately preceding the dividend payment.

The dividend paid on the Company’s common stock on January 14, 2011 was the 560th consecutive dividend paid by the Company. The Company has paid consecutive dividends for its entire history, since 1816. The policy of our Board of Directors is currently to pay cash dividends on a quarterly basis. The dividend rate has been increased annually for fourteen consecutive years. The Company’s Board of Directors declared dividend number 561 in the amount of $0.131 per share at its January 2011 meeting. The dividend is payable on April 15, 2011 to shareholders of record as of February 28, 2011. Future cash dividends will be dependent upon the Company’s earnings, financial condition, capital demands and other factors and will be determined by the Company’s Board of Directors. See Note 4 to the Company’s financial statements included herein for restrictions on dividend payments.

Financial Reports and Investor Relations

Shareholders may request, without charge, copies of the Company’s financial reports, including Annual Reports, and Forms 8-K, 10-K and 10-Q filed with the Securities and Exchange Commission (SEC). Such requests, as well as other investor relations inquiries, should be addressed to:

|

Kathleen M. Miller

|

The York Water Company

|

(717) 845-3601

|

|

Chief Financial Officer

|

P. O. Box 15089

|

(800) 750-5561

|

|

York, PA 17405-7089

|

kathym@yorkwater.com

|

The Annual Report as well as reports filed with the SEC and other information about the Company can also be found on the Company's website at: www.yorkwater.com.

of Financial Condition and Results of Operations

(In thousands of dollars, except per share amounts)

Forward-looking Statements

This Annual Report contains certain matters which are not historical facts, but which are forward-looking statements. Words such as "may," "should," "believe," "anticipate," "estimate," "expect," "intend," "plan" and similar expressions are intended to identify forward-looking statements. The Company intends these forward-looking statements to qualify for safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. These forward-looking statements include certain information relating to the Company’s business strategy; statements including, but not limited to:

|

|

·

|

expected profitability and results of operations;

|

|

|

·

|

goals, priorities and plans for, and cost of, growth and expansion;

|

|

|

·

|

strategic initiatives;

|

|

|

·

|

availability of water supply;

|

|

|

·

|

water usage by customers; and

|

|

|

·

|

ability to pay dividends on common stock and the rate of those dividends.

|

The forward-looking statements in this Annual Report reflect what the Company currently anticipates will happen. What actually happens could differ materially from what it currently anticipates will happen. The Company does not intend to make a public announcement when forward-looking statements in this Annual Report are no longer accurate, whether as a result of new information, what actually happens in the future or for any other reason. Important matters that may affect what will actually happen include, but are not limited to:

|

|

·

|

changes in weather, including drought conditions;

|

|

|

·

|

levels of rate relief granted;

|

|

|

·

|

the level of commercial and industrial business activity within the Company's service territory;

|

|

|

·

|

construction of new housing within the Company's service territory and increases in population;

|

|

|

·

|

changes in government policies or regulations;

|

|

|

·

|

the ability to obtain permits for expansion projects;

|

|

|

·

|

material changes in demand from customers, including the impact of conservation efforts which may impact the demand of customers for water;

|

|

|

·

|

changes in economic and business conditions, including interest rates, which are less favorable than expected;

|

|

|

·

|

changes in, or unanticipated, capital requirements;

|

|

|

·

|

changes in accounting pronouncements;

|

|

|

·

|

changes in our credit rating or the market price of our common stock;

|

|

|

·

|

the ability to obtain financing; and

|

|

|

·

|

other matters set forth in Item 1A, “Risk Factors,” of the Company’s Annual Report on Form 10-K for the year ended December 31, 2010.

|

Overview

The Company is the oldest investor-owned water utility in the United States and is duly organized under the laws of the Commonwealth of Pennsylvania. The Company has operated continuously since 1816. The business of the Company is to impound, purify to meet or exceed safe drinking water standards and distribute water. The Company operates within its franchised territory, which covers 39 municipalities within York County, Pennsylvania and seven municipalities within Adams County, Pennsylvania. The Company is regulated by the Pennsylvania Public Utility Commission, or PPUC, in the areas of billing, payment procedures, dispute processing, terminations, service territory, debt and equity financing and rate setting. The Company must obtain PPUC approval before changing any practices associated with the aforementioned areas. Water service is supplied through the Company's own distribution system. The Company obtains its water supply from both the South Branch and East Branch of the Codorus Creek, which together have an average daily flow of 73.0 million gallons per day. This combined watershed area is approximately 117 square miles. The Company has two reservoirs, Lake Williams and Lake Redman, which together hold up to approximately 2.2 billion gallons of water. The Company has a 15-mile pipeline from the Susquehanna River to Lake Redman which provides access to an additional supply of 12.0 million gallons of untreated water per day. As of December 31, 2010, the Company's average daily availability was 35.0 million gallons, and daily consumption was approximately 18.9 million gallons. The Company's service territory had an estimated population of 182,000 as of December 31, 2010. Industry within the Company’s service territory is diversified, manufacturing such items as fixtures and furniture, electrical machinery, food products, paper, ordnance units, textile products, air conditioning systems, laundry detergent, barbells and motorcycles.

The Company's business is somewhat dependent on weather conditions, particularly the amount of rainfall. Revenues are particularly vulnerable to weather conditions in the summer months. Prolonged periods of hot and dry weather generally cause increased water usage for watering lawns, washing cars, and keeping golf courses and sports fields irrigated. Conversely, prolonged periods of dry weather could lead to drought restrictions from governmental authorities. Despite the Company’s adequate water supply, customers may be required to cut back water usage under such drought restrictions which would negatively impact our revenues. The Company has addressed some of this vulnerability by instituting minimum customer charges which are intended to cover fixed costs of operations under all likely weather conditions. In 2010, per capita consumption by industrial and commercial customers showed a modest increase over prior year while residential customer use decreased slightly. Total per capita consumption for the year was approximately 0.3% higher compared to 2009.

The Company’s business does not require large amounts of working capital and is not dependent on any single customer or a very few customers for a material portion of its business. In 2010, operating revenue was derived from the following sources and in the following percentages: residential, 63%; commercial and industrial, 29%; and other, 8%, which is primarily from the provision for fire service. Increases in revenues are generally dependent on the Company’s ability to obtain rate increases from regulatory authorities in a timely manner and in adequate amounts and to increase volumes of water sold through increased consumption and increases in the number of customers served. The Company continuously looks for acquisition and expansion opportunities both within and outside its current service territory. The Company also looks for additional opportunities to enter into bulk water contracts with municipalities and other entities to supply water.

During the five-year period ended December 31, 2010, the Company has maintained growth in the number of customers and distribution facilities as demonstrated by the following chart:

|

2010

|

2009

|

2008

|

2007

|

2006

|

|

|

Average daily consumption (gallons per day)

|

18,875,000

|

18,233,000

|

18,298,000

|

19,058,000

|

18,769,000

|

|

Miles of mains at year-end

|

925

|

922

|

884

|

845

|

817

|

|

Additional distribution

mains installed/acquired (ft.)

|

19,886

|

200,439

|

206,140

|

147,803

|

159,330

|

|

Number of customers at year-end

|

62,505

|

62,186

|

61,527

|

58,890

|

57,578

|

|

Population served at year-end

|

182,000

|

180,000

|

176,000

|

171,000

|

166,000

|

Performance Measures

Company management uses financial measures including operating revenues, net income, earnings per share and return on equity to evaluate its financial performance. Additional statistical measures including number of customers, customer complaint rate, annual customer rates and the efficiency ratio are used to evaluate performance quality. These measures are calculated on a regular basis and compared with historical information, budget and the other publicly-traded water companies.

The Company’s 2010 performance was strong under the above measures. Increases in the number of customers and per capita water usage by the customers, increased rates from a rate filing and a higher distribution system improvement charge (DSIC) resulted in higher revenue. The DSIC allows the Company to add a charge to customers’ bills for qualified replacement costs of certain infrastructure without submitting a rate filing. In addition, the Company incurred lower operating and maintenance expenses in 2010. The overall effect was an increase in net income in 2010 over 2009 of 18.9% and a return on year end common equity at its highest level in five years.

The efficiency ratio, which is calculated as net income divided by revenues, is used by management to evaluate its ability to keep expenses in line. Over the five previous years, our ratio averaged 20.7%. In 2010, the ratio increased to 22.9% due to the higher net income resulting from higher revenue and reduced expenses. Management is confident that our ratio will again exceed that of our peers. Management continues to look for ways to decrease expenses and increase efficiency as well as to file for rate increases promptly when needed. Effective November 4, 2010, the PPUC authorized an increase in rates which will allow for recovery of some of the expected increases in expense.

Results of Operations

2010 Compared with 2009

Net income for 2010 was $8,929, an increase of $1,417, or 18.9%, from net income of $7,512 for 2009. The primary contributing factors to the increase in net income were higher water revenues and reduced expenses for salary and wages, distribution system maintenance and employee retirement. Higher capitalized overhead and lower interest expense added to the reduction in expenses which were partially offset by higher depreciation expense, a reduced allowance for funds used during construction, higher power costs and increased capital stock tax.

Water operating revenues for the year increased $1,962, or 5.3%, from $37,043 for 2009 to $39,005 for 2010. The primary reasons for the increase in revenues were an increased DSIC, a rate increase effective November 4, 2010 and growth in the customer base. The average number of customers served in 2010 increased as compared to 2009 by 577 customers, from 61,897 to 62,474 customers. The total per capita volume of water sold in 2010 increased compared to 2009 by approximately 0.3%. Per capita consumption by industrial and commercial customers showed a modest increase over prior year and was partially offset by a slight decrease in use by residential customers. The Company expects revenues to continue to increase in 2011 as a result of the full year’s impact of the rate increase granted in November 2010. Drought warnings or restrictions as well as regulatory actions and weather patterns could impact results.

Operating expenses for the year decreased $417, or 2.1%, from $19,655 for 2009 to $19,238 for 2010. The decrease was primarily due to lower salary and wage expense of approximately $177. This was mainly a result of the vacation accrual recorded in 2009 as discussed in Note 1 (Reclassifications) to the Company’s financial statements included herein. Lower distribution system maintenance expense of approximately $158, increased capitalized overhead of approximately $152, and reduced pension cost and other expenses aggregating approximately $275 added to the reduction of expenses. Higher depreciation expense due to increased plant investment, increased power costs and higher capital stock tax aggregating approximately $345 partially offset the decrease. Depreciation expenses are expected to continue to rise due to investment in utility plant, pension expense is expected to rise due to an expected increase in contributions to be made to the plans and other operating expenses are expected to increase at a moderate rate as costs to serve customers and to extend our distribution system continue to rise.

Interest on debt for 2010 decreased $84, or 1.7%, from $4,990 for 2009 to $4,906 for 2010. The primary reasons for the decrease were lower interest payments of $131 due to the retirement of the 3.60% Industrial Development Authority Revenue Refunding Bonds, Series 1994, in May of 2009 and the 3.75% Industrial Development Authority Revenue Refunding Bonds, Series 1995, in June of 2010, lower interest of $81 on the Company’s lines of credit due to reduced borrowings and lower interest of $47 on the $12,000 variable rate bonds due to reduced interest rates. The decrease in expense was partially offset by higher interest of $175 primarily for the newly issued 5.00% Senior Notes, Series 2010A, in October of 2010. The average interest rate on the lines of credit was 1.54% for 2010 compared to 1.41% for 2009. The average debt outstanding under the lines of credit was $7,191 for 2010 and $16,848 for 2009. Interest expense is expected to increase due to the long-term debt issued in October.

Allowance for funds used during construction decreased $99, from $210 for 2009 to $111 in 2010, due to a lower volume of eligible construction. Eligible 2009 construction expenditures included a main extension to West Manheim Township. Allowance for funds used during construction is expected to remain consistent in 2011 with the 2010 level based on a projected comparable amount of construction expenditures.

Other income (expenses), net for 2010 reflects decreased expenses of $52 as compared to 2009. The decrease was primarily due to lower employee retirement expense.

Income taxes for 2010 increased by $999, or 21.8%, compared to 2009, primarily due to an increase in taxable income. The Company’s effective tax rate was 38.5% in 2010 and 37.9% in 2009.

2009 Compared with 2008

Net income for 2009 was $7,512, an increase of $1,081, or 16.8%, from net income of $6,431 for 2008. The primary contributing factors to the increase in net income were higher water revenues which were partially offset by increased depreciation, higher pension cost, reduced interest capitalized, increased interest expense on debt and higher salary and wage expense.

Water operating revenues for the year increased $4,205, or 12.8%, from $32,838 for 2008 to $37,043 for 2009. The primary reasons for the increase in revenues were a rate increase of 17.9% effective October 9, 2008 and growth in the customer base. The average number of customers served in 2009 increased as compared to 2008 by 2,414 customers, from 59,483 to 61,897 customers. Approximately 2,050 of the additional customers were due to the Asbury Pointe and West Manheim acquisitions. Despite this increase in customers, the total per capita volume of water sold in 2009 decreased compared to 2008 by approximately 5.7%. The largest decline occurred in the industrial category followed by the commercial and residential categories.

Operating expenses for the year increased $1,497, or 8.2%, from $18,158 for 2008 to $19,655 for 2009. The increase was primarily due to higher depreciation of $790 due to increased plant investment, increased pension expense of $487, higher salary and wage expense of $229 due mainly to the increased vacation accrual discussed in Note 1 (Reclassifications) to the Company’s financial statements included herein and higher distribution system maintenance expense, chemical expense, power costs, rate case expense, provision for doubtful accounts, banking fees, realty taxes and other expenses aggregating approximately $482. The increase was partially offset by reduced health insurance costs, increased capitalized overhead, lower transportation expenses and reduced software support and legal expenses aggregating approximately $491.

Interest on debt for 2009 increased $231, or 4.9%, from $4,759 for 2008 to $4,990 for 2009. Interest on the Company’s long-term debt increased by $706 due to an increase in the amount of long-term debt outstanding from new debt issued on October 15, 2008 in the aggregate principal amount of $15,000 at an interest rate of 6%. The increased expenses were partially offset by lower interest on the $12,000 variable rate bonds of approximately $69 due to lower variable interest rates. Interest on the Company’s lines of credit decreased by $346 due to lower interest rates. The average interest rate on the lines of credit was 1.41% for 2009 compared to 3.61% for 2008. The average debt outstanding under the lines of credit was $16,848 for 2009 and $16,128 for 2008. Other long-term interest decreased $60.

Allowance for funds used during construction decreased $437, from $647 for 2008 to $210 in 2009, due to a lower volume of eligible construction. Eligible 2008 construction expenditures included an investment in a large water treatment replacement and expansion project and a main extension to West Manheim Township that was placed in service in December, 2008.

Other income (expenses), net for 2009 reflects increased expenses of $8 as compared to 2008. The increase was primarily due to increased charitable contributions, higher debt cost amortization and other expenses which were partially offset by reduced retirement expenses.

Income taxes for 2009 increased by $951, or 26.2%, compared to 2008, primarily due to an increase in taxable income. The Company’s effective tax rate was 37.9% in 2009 and 36.1% in 2008. The increase in the effective tax rate was due to taxable gains on the surrender of life insurance policies and bonus depreciation initially being taxable for state tax purposes.

Rate Developments

From time to time, the Company files applications for rate increases with the PPUC and is granted rate relief as a result of such requests. These rate increases are designed to cover operating expenses, taxes, interest on debt used to finance capital investments and a return on equity. The most recent rate request was filed by the Company on May 14, 2010 and sought an increase of $6,220, which would have represented a 15.9% increase in rates. Effective November 4, 2010, the PPUC authorized an average increase of 8.7% in rates designed to produce approximately $3,400 in additional annual revenues. The Company does not expect to file a base rate increase request in 2011.

Acquisitions

See Note 2 to the Company’s financial statements included herein for a discussion of our acquisitions.

Capital Expenditures

During 2010, the Company invested $10,541 in construction expenditures including routine items, upgrades to its water treatment facilities, backup generators at various booster stations, reinforcing water mains, and various replacements of aging infrastructure. The Company replaced and relined over 37,000 feet of main in 2010. The Company was able to fund operating activities and construction expenditures using internally-generated funds, borrowings against the Company’s lines of credit, proceeds from a long-term debt issue, proceeds from its stock purchase plans (see Note 5 to the Company’s financial statements included herein), customer advances and the DSIC allowed by the PPUC.

The Company anticipates construction and acquisition expenditures for 2011 and 2012 of approximately $12,800 and $13,415, respectively. In addition to routine transmission and distribution projects, a portion of the anticipated 2011 and 2012 expenditures will be for additional main extensions, further upgrades to water treatment facilities, reinforcement of one of our dams, and various replacements of aging infrastructure including a standpipe. The Company intends to use internally-generated funds for at least half of our anticipated 2011 and 2012 construction and fund the remainder through line of credit borrowings, proceeds from our stock purchase plans, potential debt and equity offerings, the DSIC and customer advances and contributions (see Note 1 to the Company’s financial statements included herein). Customer advances and contributions are expected to account for approximately 8% of funding requirements in 2011 and 15% of funding requirements in 2012. We believe we will have adequate access to the capital markets, if necessary during 2011, to fund anticipated construction and acquisition expenditures.

Liquidity and Capital Resources

Cash

Although the Company is able to generate funds internally through customer bill payments, we have not historically maintained cash on the balance sheet. The Company manages its cash through a cash management account that is directly connected to a line of credit. Excess cash generated automatically pays down outstanding borrowings under the line of credit arrangement. If there are no outstanding borrowings, the cash is automatically invested in an interest-bearing account overnight. Likewise, if additional funds are needed, besides what is generated internally, for payroll, to pay suppliers, or to pay debt service, funds are automatically borrowed under the line of credit. The cash management facility has historically provided the necessary liquidity and funding for our operations and we expect that to continue to be the case for the foreseeable future. The cash balance of $1,327 at December 31, 2010 represents the proceeds of the October long-term debt issue that were not utilized until 2011.

Accounts Receivable

Historically the Company has seen an upward trend in its accounts receivable balance. This trend is generally a result of increased revenues. Increases in accounts receivable have corresponded with increases in revenue. Recently the Company has noticed a decline in the timeliness of payments by its customers resulting in an increase in accounts receivable in excess of the increase in revenues. Despite this trend of slower payments, the Company has not seen a dramatic deterioration of its accounts receivable aging or the amount of uncollectible accounts written off. The Company has increased its allowance for doubtful accounts in consideration of this trend. If this trend continues, the Company may incur additional expenses for uncollectible accounts and see a reduction in its internally-generated funds.

Internally-generated Funds

The amount of internally-generated funds available for operations and construction depends on our ability to obtain timely and adequate rate relief, our customers’ water usage, weather conditions, customer growth and controlled expenses. In 2010, we generated $14,755 internally as compared to $15,801 in 2009 and $11,527 in 2008. An increase in net income was offset by higher accounts receivable and an increase in income taxes paid resulting in lower cash flow from operating activities during 2010. In addition to internally-generated funds, we used our bank lines of credit and proceeds from a long-term debt issue to help fund operations and construction.

Credit Lines

Historically, the Company has borrowed $15,000 to $20,000 under its lines of credit before refinancing with long-term debt or equity capital. As of December 31, 2010, the Company maintained unsecured lines of credit aggregating $33,000 with three banks. One line of credit includes a $4,000 portion which is payable upon demand and carries an interest rate of LIBOR plus 2.00%, and a $13,000 committed portion with a revolving 2-year maturity (currently May 2012), which carries an interest rate of LIBOR plus 2.00%. The Company had no outstanding borrowings under the committed portion and no on-demand borrowings under this line of credit as of December 31, 2010. The second line of credit, in the amount of $11,000, is a committed line of credit, which matures in May 2012 and carries an interest rate of LIBOR plus 1.50%. This line of credit has a compensating balance requirement of $500. The Company had no outstanding borrowings under this line of credit as of December 31, 2010. The third line of credit, in the amount of $5,000, is a committed line of credit, which matures in June 2011 and carries an interest rate of LIBOR plus 2.00%. The Company had no outstanding borrowings under this line of credit as of December 31, 2010. The Company plans to renew the line of credit that expires in 2011 under similar terms and conditions.

The credit and liquidity crisis which began in 2008 has caused substantial volatility and uncertainty in the capital markets and in the banking industry resulting in increased borrowing costs and reduced credit availability. While actual interest rates are currently low, one of our banks increased the interest rate on our line of credit from LIBOR plus 70 basis points to LIBOR plus 200 basis points in 2009. The higher interest rate remains in effect. One of the lines of credit also carries a commitment fee. Although we have taken steps to manage the risk of reduced credit availability such as maintaining primarily committed lines of credit that cannot be called on demand and obtaining a 2-year revolving maturity, there is no guarantee that we will be able to obtain sufficient lines of credit with favorable terms in the future. In addition, if the Company is unable to refinance our line of credit borrowings with long-term debt or equity when necessary, we may have to eliminate or postpone capital expenditures. The Company was able to pay off its line of credit borrowings by issuing long-term debt in October 2010. We believe we will have adequate capacity under our current lines of credit to meet our financing needs throughout 2011.

Long-term Debt

The Company’s loan agreements contain various covenants and restrictions. We believe we are currently in compliance with all of these restrictions. See Note 4 to the Company’s financial statements included herein for additional information regarding these restrictions.

The 3.75% Industrial Development Authority Revenue Refunding Bonds, Series 1995, had a mandatory tender date of June 1, 2010. The Company retired the $4,300 bonds using funds available under its lines of credit.

On October 8, 2010, the Company issued $15,000 aggregate principal amount of 5.00% Monthly Senior Notes Series 2010A due October 1, 2040 (the “Senior Notes”) pursuant to the terms of an indenture, as supplemented by a first supplemental indenture, each dated as of October 1, 2010, between the Company and Manufacturers and Traders Trust Company, as trustee. The Senior Notes bear interest at a rate of 5.00% payable monthly with a maturity date of October 1, 2040. The Senior Notes are direct, unsecured and unsubordinated obligations of the Company. The Company received net proceeds, after deducting issuance costs, of approximately $14,300. The net proceeds were used to pay off the Company’s line of credit borrowings incurred for capital expenditures and acquisitions, to retire maturing long-term debt issues, and for general corporate purposes. The Senior Notes are subject to redemption at the direction of the Company, in whole or in part, at any time on or after October 1, 2015.

The Company’s debt (long-term debt plus current portion of long-term debt) as a percentage of the total capitalization, defined as total common stockholders’ equity plus long-term debt (including current portion of long-term debt), was 48.3% as of December 31, 2010, compared with 47.2% as of December 31, 2009. As our debt load trends upward in the future, we will likely match increasing debt with increasing equity so that our debt to total capitalization ratio remains at nearly fifty percent. This capital structure has historically been acceptable to the PPUC in that prudent debt costs and a fair return have been granted by the PPUC in rate filings. See Note 4 to the Company’s financial statements included herein for the details of our long-term debt outstanding as of December 31, 2010.

The Company has an effective “shelf” Registration Statement on Form S-3 on file with the Securities and Exchange Commission (SEC), pursuant to which the Company may offer an aggregate remaining amount of up to $25,000 of its common stock or debt securities subject to market conditions at the time of any such offering.

Deferred Income Taxes

The Company has seen an increase in its deferred income tax liability amounts over the last several years. This is primarily a result of the accelerated and bonus depreciation deduction available for federal tax purposes which creates differences between book and tax depreciation expense. We expect this trend to continue as we make significant investments in capital expenditures and as the tax code continues to extend bonus depreciation. Despite having a significant deferred income tax asset balance, the Company does not believe a valuation allowance is required due to the expected generation of future taxable income during the periods in which those temporary differences become deductible. The Company has determined there are no uncertain tax positions that require recognition as of December 31, 2010.

Common Stock

Common stockholders’ equity as a percent of the total capitalization was 51.7% as of December 31, 2010, compared with 52.8% as of December 31, 2009. It is the Company’s intent to maintain a ratio near fifty percent. The 2009 common stock offering improved our ratio substantially. Under the Registration Statement previously mentioned, we have the ability to issue additional shares of the Company’s common stock, subject to market conditions at the time of any such offering.

Credit Rating

Our ability to maintain our credit rating depends, among other things, on adequate and timely rate relief, which we have been successful in obtaining, and our ability to fund capital expenditures in a balanced manner using both debt and equity. In 2011, our objectives will be to continue to maximize our funds provided by operations and maintain the equity component of total capitalization.

Dividends

During 2010, the Company's dividend payout ratios relative to net income and cash provided by operating activities were 72.9% and 43.8%, respectively. During 2009, the Company’s dividend payout ratios relative to net income and cash provided by operating activities were 80.5% and 37.0%, respectively. During the fourth quarter of 2010, the Board of Directors increased the dividend by 2.3% from $0.128 per share to $0.131 per share per quarter. This was the fourteenth consecutive annual dividend increase and the 195th consecutive year of paying dividends.

The Company’s Board of Directors declared a dividend in the amount of $0.131 per share at its January 2011 meeting. The dividend is payable on April 15, 2011 to shareholders of record as of February 28, 2011. While the Company expects to maintain this dividend amount in 2011, future dividends will be dependent upon the Company’s earnings, financial condition, capital demands and other factors and will be determined by the Company’s Board of Directors. See Note 4 to the Company’s financial statements included herein for restrictions on dividend payments.

Inflation

The Company is affected by inflation, most notably by the continually increasing costs incurred to maintain and expand its service capacity. The cumulative effect of inflation results in significantly higher facility replacement costs which must be recovered from future cash flows. The ability of the Company to recover this increased investment in facilities is dependent upon future rate increases, which are subject to approval by the PPUC. The Company can provide no assurances that its rate increases will be approved by the PPUC; and, if approved, the Company cannot guarantee that these rate increases will be granted in a timely or sufficient manner to cover the investments and expenses for which the rate increase was sought.

Contractual Obligations

The following summarizes the Company’s contractual obligations by period as of December 31, 2010:

|

Payments due by period

|

|||||||

|

Total

|

2011

|

2012

|

2013

|

2014

|

2015

|

Thereafter

|

|

|

Long-term debt obligations (a)

|

$85,173

|

$41

|

$12,042

|

$42

|

$43

|

$43

|

$72,962

|

|

Interest on long-term debt (b)

|

84,863

|

4,871

|

4,870

|

4,870

|

4,869

|

4,869

|

60,514

|

|

Purchase obligations (c)

|

1,053

|

1,053

|

-

|

-

|

-

|

-

|

-

|

|

Defined benefit obligations (d)

|

3,186

|

1,593

|

1,593

|

-

|

-

|

-

|

-

|

|

Deferred employee benefits (e)

|

4,629

|

225

|

239

|

230

|

241

|

240

|

3,454

|

|

Other deferred credits (f)

|

1,601

|

351

|

307

|

226

|

157

|

103

|

457

|

|

Total

|

$180,505

|

$8,134

|

$19,051

|

$5,368

|

$5,310

|

$5,255

|

$137,387

|

|

(a)

|

Represents debt maturities including current maturities. Included in the table is a payment of $12,000 in 2012 on the variable rate bonds which would only be due if the bonds were unable to be remarketed. There is currently no such indication of this happening.

|

|

(b)

|

Excludes interest on the $12,000 variable rate debt as these payments cannot be reasonably estimated. The interest rate on this issue is reset weekly by the remarketing agent based on then current market conditions. Also excludes interest on the committed line of credit due to the variability of both the outstanding amount and the interest rate.

|

|

(c)

|

Represents an approximation of open purchase orders at year end.

|

|

(d)

|

Represents contributions expected to be made to qualified defined benefit plans. The contribution may increase if the minimum required contribution as calculated under Employee Retirement Income Security Act (ERISA) standards is higher than these amounts but in no case will the amount be less. The amount of required contributions in 2013 and thereafter is not currently determinable.

|

|

(e)

|

Represents the obligations under the Company’s Supplemental Retirement and Deferred Compensation Plans for executives.

|

|

(f)

|

Represents the estimated settlement payments to be made under the Company’s interest rate swap contract.

|

In addition to these obligations, the Company makes refunds on Customers’ Advances for Construction over a specific period of time based on operating revenues related to developer-installed water mains or as new customers are connected to and take service from such mains. The refund amounts are not included in the above table because the timing cannot be accurately estimated. Portions of these refund amounts are payable annually through 2021 and amounts not paid by the contract expiration dates become non-refundable and are transferred to Contributions in Aid of Construction.

See Note 9 to the Company’s financial statements included herein for a discussion of our commitments.

Critical Accounting Estimates

The methods, estimates and judgments we use in applying our accounting policies have a significant impact on the results we report in our financial statements. Our accounting policies require us to make subjective judgments because of the need to make estimates of matters that are inherently uncertain. Our most critical accounting estimates include: regulatory assets and liabilities, revenue recognition and accounting for our pension plans.

Regulatory Assets and Liabilities

Generally accepted accounting principles define professional standards for companies whose rates are established by or are subject to approval by an independent third-party regulator. In accordance with the professional standards, the Company defers costs and credits on its balance sheet as regulatory assets and liabilities when it is probable that these costs and credits will be recognized in the rate-making process in a period different from when the costs and credits were incurred. These deferred amounts are then recognized in the statement of income in the period in which they are reflected in customer rates. If the Company later finds that these assets and liabilities cannot be included in rate-making, they are adjusted appropriately. See Note 1 for additional details regarding regulatory assets and liabilities.

Revenue Recognition

Revenues include amounts billed to metered customers on a cycle basis and unbilled amounts based on both actual and estimated usage from the latest meter reading to the end of the accounting period. Estimates are based on average daily usage for those particular customers. The unbilled revenue amount is recorded as a current asset on the balance sheet. Actual results could differ from these estimates and would result in operating revenues being adjusted in the period in which the actual usage is known. Based on historical experience, the Company believes its estimate of unbilled revenues is reasonable.

Pension Accounting

Accounting for defined benefit pension plans requires estimates of future compensation increases, mortality, the discount rate, and expected return on plan assets as well as other variables. These variables are reviewed annually with the Company’s pension actuary. The Company selected its December 31, 2010 and 2009 discount rates based on the Citigroup Pension Liability Index. This index uses the Citigroup spot rates for durations out to 30 years and matches them to expected disbursements from the plan over the long term. The Company believes this index most appropriately matches its pension obligations. The present values of the Company’s future pension obligations were determined using a discount rate of 5.35% at December 31, 2010 and 6.0% at December 31, 2009.

Choosing a lower discount rate normally increases the amount of pension expense and the corresponding liability. In the case of the Company, a reduction in the discount rate would increase its liability, but would not have an impact on its pension expense. The PPUC, in a previous rate settlement, agreed to grant recovery of the Company’s contribution to the pension plans in customer rates. As a result, under the professional standards, expense in excess of the Company’s pension plan contribution is deferred as a regulatory asset and will be expensed as contributions are made to the plans and the contributions are recovered in customer rates. Therefore, changes in the discount rate affect regulatory assets rather than pension expense.

The Company’s estimate of the expected return on plan assets is primarily based on the historic returns and projected future returns of the asset classes represented in its plans. The target allocation of pension assets is 50% to 70% equity securities, 30% to 50% debt securities, and 0% to 10% cash reserves. The Company used 7% as its estimate of expected return on assets in both 2010 and 2009. If the Company were to reduce the expected return, its liability would increase, but its expense would again remain unchanged because the expense is equal to the Company’s contribution to the plans. The additional expense would instead be recorded as an increase to regulatory assets.

Other critical accounting estimates are discussed in the Significant Accounting Policies Note to the Financial Statements.

Off-Balance Sheet Transactions

The Company does not use off-balance sheet transactions, arrangements or obligations that may have a material current or future effect on financial condition, results of operations, liquidity, capital expenditures, capital resources or significant components of revenues or expenses. The Company does not use securitization of receivables or unconsolidated entities. The Company uses a derivative financial instrument, an interest rate swap agreement discussed in Note 4 to the financial statements included herein, for risk management purposes. The Company does not engage in trading or other risk management activities, does not use other derivative financial instruments for any purpose, has no lease obligations, no guarantees and does not have material transactions involving related parties.

Impact of Recent Accounting Pronouncements

See Note 1 to the Company’s financial statements included herein for a discussion on the effect of new accounting pronouncements.

Management’s Report on Internal Control Over Financial Reporting

Management of The York Water Company (the “Company”) is responsible for establishing and maintaining adequate internal control over financial reporting. Internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company’s internal control over financial reporting includes those policies and procedures that pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Management evaluated the Company’s internal control over financial reporting as of December 31, 2010. In making this assessment, management used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission in Internal Control-Integrated Framework (COSO). As a result of this assessment and based on the criteria in the COSO framework, management has concluded that, as of December 31, 2010, the Company’s internal control over financial reporting was effective.

The Company’s independent auditors, ParenteBeard LLC, have audited the Company’s internal control over financial reporting. Their opinions on the Company’s internal control over financial reporting and on the Company’s financial statements appear on the following pages of this annual report.

|

/s/Jeffery R. Hines

|

/s/Kathleen M. Miller

|

||

|

Jeffrey R. Hines

|

Kathleen M. Miller

|

||

|

President, Chief Executive Officer

|

Chief Financial Officer

|

March 8, 2011

Report of Independent Registered Public Accounting Firm

To the Board of Directors and

Stockholders of The York Water Company

We have audited The York Water Company’s (the “Company”) internal control over financial reporting as of December 31, 2010, based on criteria established in Internal Control—Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). The York Water Company’s management is responsible for maintaining effective internal control over financial reporting, and for its assessment of the effectiveness of internal control over financial reporting, included in the accompanying Management’s Report on Internal Control over Financial Reporting. Our responsibility is to express an opinion on the Company’s internal control over financial reporting based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects. Our audit of internal control over financial reporting included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, and testing and evaluating the design and operating effectiveness of internal control based on the assessed risk. Our audit also included performing such other procedures as we considered necessary in the circumstances. We believe that our audit provides a reasonable basis for our opinion.

A company’s internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with accounting principles generally accepted in the United States of America. A company’s internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

In our opinion, The York Water Company maintained, in all material respects, effective internal control over financial reporting as of December 31, 2010, based on criteria established in Internal Control—Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO).

We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the balance sheets and the related statements of income, common stockholders’ equity and comprehensive income, and cash flows of The York Water Company, and our report dated March 8, 2011 expressed an unqualified opinion.

/s/ParenteBeard LLC

ParenteBeard LLC

York, Pennsylvania

March 8, 2011

Report of Independent Registered Public Accounting Firm

To the Board of Directors and

Stockholders of The York Water Company

We have audited the accompanying balance sheets of The York Water Company (the “Company”) as of December 31, 2010 and 2009, and the related statements of income, common stockholders’ equity and comprehensive income, and cash flows for each of the years in the three-year period ended December 31, 2010. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of The York Water Company as of December 31, 2010 and 2009, and the results of its operations and its cash flows for each of the years in the three-year period ended December 31, 2010 in conformity with accounting principles generally accepted in the United States of America.

We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), The York Water Company’s internal control over financial reporting as of December 31, 2010, based on criteria established in Internal Control—Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO), and our report dated March 8, 2011 expressed an unqualified opinion.

/s/ParenteBeard LLC

ParenteBeard LLC

York, Pennsylvania

March 8, 2011

|

Balance Sheets

|

||||||||

|

(In thousands of dollars, except per share amounts)

|

||||||||

|

Dec. 31, 2010

|

Dec. 31, 2009

|

|||||||

|

ASSETS

|

||||||||

|

UTILITY PLANT, at original cost

|

$ | 272,565 | $ | 262,598 | ||||

|

Plant acquisition adjustments

|

(2,709 | ) | (2,759 | ) | ||||

|

Accumulated depreciation

|

(42,179 | ) | (38,364 | ) | ||||

|

Net utility plant

|

227,677 | 221,475 | ||||||

|

OTHER PHYSICAL PROPERTY:

|

||||||||

|

Net of accumulated depreciation of $190 in 2010

|

||||||||

|

and $175 in 2009

|

712 | 554 | ||||||

|

CURRENT ASSETS:

|

||||||||

|

Cash and cash equivalents

|

1,327 | - | ||||||

|

Restricted cash-compensating balance

|

- | 500 | ||||||

|

Accounts receivable, net of reserves of $245 in 2010

|

||||||||

|

and $225 in 2009

|

3,769 | 2,938 | ||||||

|

Unbilled revenues

|

2,503 | 2,451 | ||||||

|

Recoverable income taxes

|

21 | - | ||||||

|

Materials and supplies inventories, at cost

|

608 | 716 | ||||||

|

Prepaid expenses

|

398 | 387 | ||||||

|

Deferred income taxes

|

167 | 154 | ||||||

|

Total current assets

|

8,793 | 7,146 | ||||||

|

OTHER LONG-TERM ASSETS:

|

||||||||

|

Deferred debt expense

|

2,501 | 1,906 | ||||||

|

Notes receivable

|

407 | 476 | ||||||

|

Deferred regulatory assets

|

15,821 | 14,010 | ||||||

|

Restricted cash-compensating balance

|

500 | - | ||||||

|

Other assets

|

3,520 | 3,270 | ||||||

|

Total other long-term assets

|

22,749 | 19,662 | ||||||

|

Total Assets

|

$ | 259,931 | $ | 248,837 | ||||

|

The accompanying notes are an integral part of these statements.

|

||||||||

|

THE YORK WATER COMPANY

|

||||||||

|

Balance Sheets

|

||||||||

|

(In thousands of dollars, except per share amounts)

|

||||||||

|

Dec. 31, 2010

|

Dec. 31, 2009

|

|||||||

|

STOCKHOLDERS' EQUITY AND LIABILITIES

|

||||||||

|

COMMON STOCKHOLDERS' EQUITY:

|

||||||||

|

Common stock, no par value, authorized 46,500,000 shares,

|

$ | 75,481 | $ | 73,569 | ||||

|

issued and outstanding 12,692,054 shares in 2010

|

||||||||

|

and 12,558,724 shares in 2009

|

||||||||

|

Retained earnings

|

15,776 | 13,353 | ||||||

|

Total common stockholders' equity

|

91,257 | 86,922 | ||||||

|

PREFERRED STOCK, authorized 500,000 shares, no shares issued

|

- | - | ||||||

|

LONG-TERM DEBT, excluding current portion

|

85,132 | 73,227 | ||||||

|

COMMITMENTS

|

- | - | ||||||

|

CURRENT LIABILITIES:

|

||||||||

|

Short-term borrowings

|

- | 5,000 | ||||||

|

Current portion of long-term debt

|

41 | 4,341 | ||||||

|

Accounts payable

|

1,245 | 892 | ||||||

|

Dividends payable

|

1,440 | 1,393 | ||||||

|

Accrued taxes

|

19 | 488 | ||||||

|

Accrued interest

|

1,068 | 1,019 | ||||||

|

Other accrued expenses

|

1,518 | 1,472 | ||||||

|

Total current liabilities

|

5,331 | 14,605 | ||||||

|

DEFERRED CREDITS:

|

||||||||

|

Customers' advances for construction

|

15,031 | 16,188 | ||||||

|

Deferred income taxes

|

25,437 | 22,507 | ||||||

|

Deferred employee benefits

|

9,814 | 8,765 | ||||||

|

Other deferred credits

|

2,003 | 1,679 | ||||||

|

Total deferred credits

|

52,285 | 49,139 | ||||||

|

Contributions in aid of construction

|

25,926 | 24,944 | ||||||

|

Total Stockholders' Equity and Liabilities

|

$ | 259,931 | $ | 248,837 | ||||

|

The accompanying notes are an integral part of these statements.

|

||||||||

|

Statements of Income

|

||||||||||||

|

(In thousands of dollars, except per share amounts)

|

||||||||||||

|

Year Ended December 31

|

||||||||||||

|

2010

|

2009

|

2008

|

||||||||||

|

WATER OPERATING REVENUES:

|

||||||||||||

|

Residential

|

$ | 24,478 | $ | 23,299 | $ | 20,572 | ||||||

|

Commercial and industrial

|

11,440 | 10,734 | 9,671 | |||||||||

|

Other

|

3,087 | 3,010 | 2,595 | |||||||||

| 39,005 | 37,043 | 32,838 | ||||||||||

|

OPERATING EXPENSES:

|

||||||||||||

|

Operation and maintenance

|

6,760 | 7,067 | 6,749 | |||||||||

|

Administrative and general

|

6,725 | 7,101 | 6,685 | |||||||||

|

Depreciation and amortization

|

4,592 | 4,412 | 3,622 | |||||||||

|

Taxes other than income taxes

|

1,161 | 1,075 | 1,102 | |||||||||

| 19,238 | 19,655 | 18,158 | ||||||||||

|

Operating income

|

19,767 | 17,388 | 14,680 | |||||||||

|

OTHER INCOME (EXPENSES):

|

||||||||||||

|

Interest on debt

|

(4,906 | ) | (4,990 | ) | (4,759 | ) | ||||||

|

Allowance for funds used during construction

|

111 | 210 | 647 | |||||||||

|

Other income (expenses), net

|

(465 | ) | (517 | ) | (509 | ) | ||||||

| (5,260 | ) | (5,297 | ) | (4,621 | ) | |||||||

|

Income before income taxes

|

14,507 | 12,091 | 10,059 | |||||||||

|

Income taxes

|

5,578 | 4,579 | 3,628 | |||||||||

|

Net Income

|

$ | 8,929 | $ | 7,512 | $ | 6,431 | ||||||

|

Basic Earnings Per Share

|

$ | 0.71 | $ | 0.64 | $ | 0.57 | ||||||

|

Cash Dividends Declared Per Share

|

$ | 0.515 | $ | 0.506 | $ | 0.489 | ||||||

|

The accompanying notes are an integral part of these statements.

|

||||||||||||

|

Statements of Common Stockholders' Equity and Comprehensive Income

|

||||||||||||||||

|

(In thousands of dollars, except per share amounts)

|

||||||||||||||||

|

For the Years Ended December 31, 2010, 2009 and 2008

|

||||||||||||||||

|

Accumulated

|

||||||||||||||||

|

Other

|

||||||||||||||||

|

Common

|

Retained

|

Comprehensive

|

||||||||||||||

|

Stock

|

Earnings

|

Income (Loss)

|

Total

|

|||||||||||||

|

Balance, December 31, 2007

|

$ | 56,566 | $ | 10,986 | $ | (280 | ) | $ | 67,272 | |||||||

|

Net income

|

- | 6,431 | - | 6,431 | ||||||||||||

|

Other comprehensive income:

|

||||||||||||||||

|

Reclassification adjustment for unrealized loss

|

||||||||||||||||

|

on interest rate swap to regulatory asset,

|

||||||||||||||||

|

net of $191 income tax

|

- | - | 280 | 280 | ||||||||||||

|

Comprehensive income

|

6,711 | |||||||||||||||

|

Dividends ($0.489 per share)

|

- | (5,526 | ) | - | (5,526 | ) | ||||||||||

|

Issuance of common stock under

|

||||||||||||||||

|

dividend reinvestment, direct stock and

|

||||||||||||||||

|

employee stock purchase plans

|

1,309 | - | - | 1,309 | ||||||||||||

|

Balance, December 31, 2008

|

57,875 | 11,891 | - | 69,766 | ||||||||||||

|

Net income

|

- | 7,512 | - | 7,512 | ||||||||||||

|

Dividends ($0.506 per share)

|

- | (6,050 | ) | - | (6,050 | ) | ||||||||||

|

Issuance of 1,070,000 shares of common stock

|

14,094 | - | - | 14,094 | ||||||||||||

|

Issuance of common stock under

|

||||||||||||||||

|

dividend reinvestment, direct stock and

|

||||||||||||||||

|

employee stock purchase plans

|

1,600 | - | - | 1,600 | ||||||||||||

|

Balance, December 31, 2009

|

73,569 | 13,353 | - | 86,922 | ||||||||||||

|

Net income

|

- | 8,929 | - | 8,929 | ||||||||||||

|

Dividends ($0.515 per share)

|

- | (6,506 | ) | - | (6,506 | ) | ||||||||||

|

Issuance of common stock under

|

||||||||||||||||

|

dividend reinvestment, direct stock and

|

||||||||||||||||

|

employee stock purchase plans

|

1,912 | - | - | 1,912 | ||||||||||||

|

Balance, December 31, 2010

|

$ | 75,481 | $ | 15,776 | $ | - | $ | 91,257 | ||||||||

|

The accompanying notes are an integral part of these statements.

|

||||||||||||||||

|

Statements of Cash Flows

|

|||||||||||||

|

(In thousands of dollars, except per share amounts)

|

|||||||||||||

|

Year Ended December 31

|

|||||||||||||

|

2010

|

2009

|

2008

|

|||||||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

|||||||||||||

|

Net income

|

$ | 8,929 | $ | 7,512 | $ | 6,431 | |||||||

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

|||||||||||||

|

Depreciation and amortization

|

4,592 | 4,412 | 3,622 | ||||||||||

|

Increase in deferred income taxes

|

2,591 | 2,515 | 1,911 | ||||||||||

|

Other

|

99 | 39 | (166 | ) | |||||||||

|

Changes in assets and liabilities:

|

|||||||||||||

|

(Increase) decrease in accounts receivable, unbilled revenues and recoverable income taxes

|

(1,127 | ) | 440 | (816 | ) | ||||||||

|

Decrease in materials and supplies and prepaid expenses

|

97 | 50 | 105 | ||||||||||

|

Increase in accounts payable, accrued expenses, regulatory

|

|||||||||||||

|

and other liabilities, and deferred employee benefits and credits

|

705 | 666 | 870 | ||||||||||

|

Increase (decrease) in accrued interest and taxes

|

(420 | ) | 352 | 221 | |||||||||

|

Increase in regulatory and other assets

|

(711 | ) | (185 | ) | (651 | ) | |||||||

|

Net cash provided by operating activities

|

14,755 | 15,801 | 11,527 | ||||||||||

|

CASH FLOWS FROM INVESTING ACTIVITIES:

|

|||||||||||||

|

Utility plant additions, including debt portion of allowance for funds used

|

|||||||||||||

|

during construction of $62 in 2010, $117 in 2009 and $427 in 2008

|

(10,541 | ) | (12,535 | ) | (24,438 | ) | |||||||

|

Acquisitions of water systems

|

- | (2,236 | ) | (259 | ) | ||||||||

|

Increase in compensating balance

|

- | (500 | ) | - | |||||||||

|

Decrease in notes receivable

|

69 | 60 | 74 | ||||||||||

|

Net cash used in investing activities

|

(10,472 | ) | (15,211 | ) | (24,623 | ) | |||||||

|

CASH FLOWS FROM FINANCING ACTIVITIES:

|

|||||||||||||

|

Customers' advances for construction and contributions in aid of construction

|

428 | 443 | 804 | ||||||||||

|

Repayments of customer advances

|

(544 | ) | (926 | ) | (1,489 | ) | |||||||

|

Proceeds of long-term debt issues

|

39,491 | 23,659 | 52,308 | ||||||||||

|

Debt issuance costs

|

(703 | ) | - | (950 | ) | ||||||||

|

Repayments of long-term debt

|

(34,886 | ) | (32,444 | ) | (36,460 | ) | |||||||

|

Borrowings (repayments) under short-term line of credit agreements

|

(2,000 | ) | (1,000 | ) | 3,000 | ||||||||

|

Changes in cash overdraft position

|

(195 | ) | (167 | ) | 34 | ||||||||

|

Issuance of common stock

|

1,912 | 15,694 | 1,309 | ||||||||||

|

Dividends paid

|

(6,459 | ) | (5,849 | ) | (5,460 | ) | |||||||

|

Net cash (used in) provided by financing activities

|

(2,956 | ) | (590 | ) | 13,096 | ||||||||

|

Net change in cash and cash equivalents

|

1,327 | - | - | ||||||||||

|

Cash and cash equivalents at beginning of year

|

- | - | - | ||||||||||

|

Cash and cash equivalents at end of year

|

$ | 1,327 | $ | - | $ | - | |||||||

|

Supplemental disclosures of cash flow information:

|

|||||||||||||

|

Cash paid during the year for:

|

|||||||||||||

|

Interest, net of amounts capitalized

|

$ | 4,797 | $ | 4,911 | $ | 4,200 | |||||||

|

Income taxes

|

3,513 | 1,284 | 1,611 | ||||||||||

|

Supplemental schedule of non-cash investing and financing activities:

|

|||||||||||||

|

Accounts payable includes $726 in 2010, $292 in 2009 and $950 in 2008 for the construction of utility plant.

|

|||||||||||||

|

Accounts payable and other deferred credits includes $19 in 2009 and $93 in 2008 for the acquisition of water systems.

|

|||||||||||||

|

Contributions in aid of construction includes $51 of contributed land in 2008.

|

|||||||||||||

|

Short-term line of credit borrowings amounting to $3,000 were reclassified as long-term borrowings in 2010.

|

|||||||||||||

|

The accompanying notes are an integral part of these statements.

|

|||||||||||||

(In thousands of dollars, except per share amounts)

|

1.

|

Significant Accounting Policies

|

The business of The York Water Company is to impound, purify and distribute water. The Company operates within its franchised territory located in York and Adams Counties, Pennsylvania, and is subject to regulation by the Pennsylvania Public Utility Commission, or PPUC.

The following summarizes the significant accounting policies employed by The York Water Company.

Utility Plant and Depreciation

The cost of additions includes contracted cost, direct labor and fringe benefits, materials, overhead and, for certain utility plant, allowance for funds used during construction. In accordance with regulatory accounting requirements, water systems acquired are recorded at estimated original cost of utility plant when first devoted to utility service and the applicable depreciation is recorded to accumulated depreciation. The difference between the estimated original cost less applicable accumulated depreciation, and the purchase price is recorded as an acquisition adjustment within utility plant. At December 31, 2010 and 2009, utility plant includes a credit acquisition adjustment of $2,709 and $2,759, respectively. The net acquisition adjustment is being amortized over the remaining life of the respective assets. Amortization amounted to $50 in 2010, $49 in 2009, and $27 in 2008.

Upon normal retirement of depreciable property, the estimated or actual cost of the asset is credited to the utility plant account, and such amounts, together with the cost of removal less salvage value, are charged to the reserve for depreciation. To the extent the Company recovers cost of removal or other retirement costs through rates after the retirement costs are incurred, a regulatory asset is reported. Gains or losses from abnormal retirements are reflected in income currently.

The Company charges to maintenance expense the cost of repairs and replacements and renewals of minor items of property. Maintenance of transportation equipment is charged to clearing accounts and apportioned therefrom in a manner similar to depreciation. The cost of replacements, renewals and betterments of units of property is capitalized to the utility plant accounts.

The straight-line remaining life method is used to compute depreciation on utility plant cost, exclusive of land and land rights. Annual provisions for depreciation of transportation and mechanical equipment included in utility plant are computed on a straight-line basis over the estimated service lives. Such provisions are charged to clearing accounts and apportioned therefrom to operating expenses and other accounts in accordance with the Uniform System of Accounts as prescribed by the PPUC.

The following remaining lives are used for financial reporting purposes:

|

December 31,

|

Approximate range

|

|||||

|

Utility Plant Asset Category

|

2010

|

2009

|

of remaining lives

|

|||

|

Mains and accessories

|

$142,162

|

$138,738

|

12 – 85 years

|

|||

|

Services, meters and hydrants

|

54,970

|

53,195

|

21 – 53 years

|

|||

|

Operations structures, reservoirs and

|

||||||

|

water tanks

|

40,387

|

39,928

|

8 – 64 years

|

|||

|

Pumping and purification equipment

|

20,563

|

16,167

|

6 – 25 years

|

|||

|

Office, transportation and

|

||||||

|

operating equipment

|

9,424

|

9,212

|

3- 23 years

|

|||

|

Land and other non-depreciable assets

|

2,973

|

2,963

|

-

|

|||

|

Utility plant in service

|

270,479

|

260,203

|

||||

|

Construction work in progress

|

2,086

|

2,395

|

-

|

|||

|