Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SAFEWAY INC | d8k.htm |

| EX-99.1 - PRESS RELEASE - SAFEWAY INC | dex991.htm |

Reconciliations and Financial Slides

from the Safeway Investor Conference

March 8, 2011

Exhibit 99.2 |

2

This presentation may contain forward-looking statements. Such statements may

relate to topics such as sales, margins, earnings estimates, guidance, free

cash flow, cash flow available for return to shareholders / debt paydown,

capital spending, and other related subjects.

These statements are based on Safeway’s current plans and expectations and

are subject to risks and uncertainties that could cause actual events and

results to vary significantly from those implied by such statements.

We ask you to refer

to Safeway’s reports and filings with the SEC for a further discussion of

these risks and uncertainties.

Safe Harbor Language |

3

Reconciliation of Diluted EPS

Low

High

Diluted earnings per share

$ 1.45

$ 1.65

Net interest expense

(0.01)

(0.01)

Share repurchase

(0.06)

(0.06)

Tax effect of Canadian dividend

0.22

0.22

Diluted earnings per share, before Canadian dividend

$ 1.60

$ 1.80

2011G |

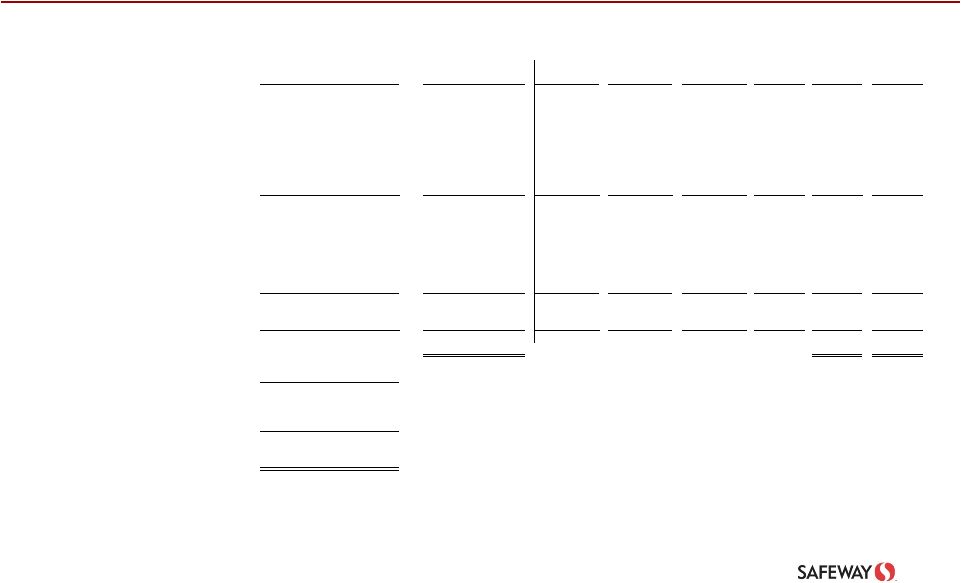

4

$ Millions

Reconciliation of GAAP Cash Flow

Measure to Free Cash Flow*

(1)

Without repatriation

Low

High

Low

High

2010

2009

2008

2007

2006

2005

Net cash flow from operating activities

1,850

$

1,950

$

1,950

$

2,050

$

1,850

$

2,549

$

2,251

$

2,190

$

2,175

$

1,881

$

Decrease (increase) in payables related to

third party gift cards, net of receivables

-

-

-

-

7

(170)

(24)

(84)

(71)

(48)

Interest earned on favorable income tax

settlement, net of tax

-

-

-

-

-

-

-

-

(63)

-

Net cash flow from operating activities,

as adjusted

1,850

1,950

1,950

2,050

1,857

2,379

2,227

2,106

2,041

1,833

Net cash flow used by investing activities

(1,000)

(1,000)

(1,050)

(950)

(799)

(889)

(1,546)

(1,686)

(1,735)

(1,314)

Cash used to acquire businesses/stores,

net of tax benefits

-

-

-

-

50

-

Net cash flow used by investing activities,

as adjusted

(1,000)

(1,000)

(1,050)

(950)

(799)

(889)

(1,546)

(1,686)

(1,685)

(1,314)

Free cash flow

850

(1)

950

(1)

900

$

1,100

$

1,058

$

1,490

$

681

$

420

$

356

$

519

$

Tax effect of Canadian dividend

(95)

(95)

41,050

40,851

44,104

42,286

2.6%

3.6%

1.5%

1.0%

Free cash flow with repatriation

755

855

Cash in Canada

600

600

Cash flow available to return to shareholders/

debt paydown

1,355

$

1,455

$

2010

Original Guidance

2011G

Sales and other revenue

Cash flow yield

*Excludes cash flow from payables related to third-party gift cards, net of receivables.

Cash from the sale of third-party gift cards is held for a short period of time and

then remitted, less Safeway's commission, to card partner. Because this cash flow is temporary, it is not available for other uses and

therefore is excluded from the company’s calculation of free cash flow. No forecast was made for

this item. |

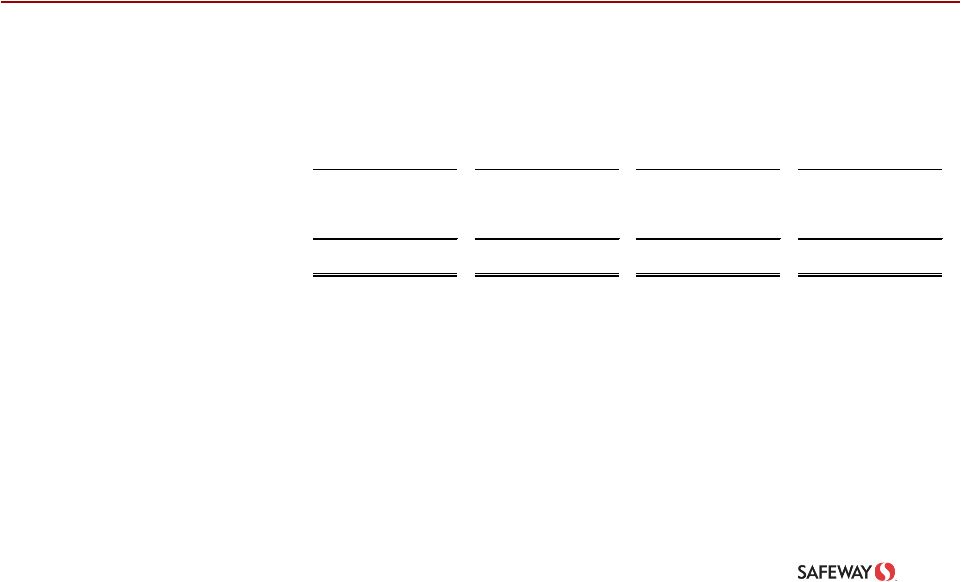

5

$ Millions

Reconciliation of GAAP Cash Flow

Measure to Free Cash Flow

Low

High

Low

High

Low

High

Low

High

Net cash flow from operating activities

2,000

$

2,200

$

2,200

$

2,400

$

2,300

$

2,500

$

2,400

$

2,600

$

Net cash flow used by investing activities

(1,000)

(1,000)

(1,100)

(1,100)

(1,100)

(1,100)

(1,100)

(1,100)

Free cash flow

1,000

$

1,200

$

1,100

$

1,300

$

1,200

$

1,400

$

1,300

$

1,500

$

2014F

2015F

2012F

2013F |

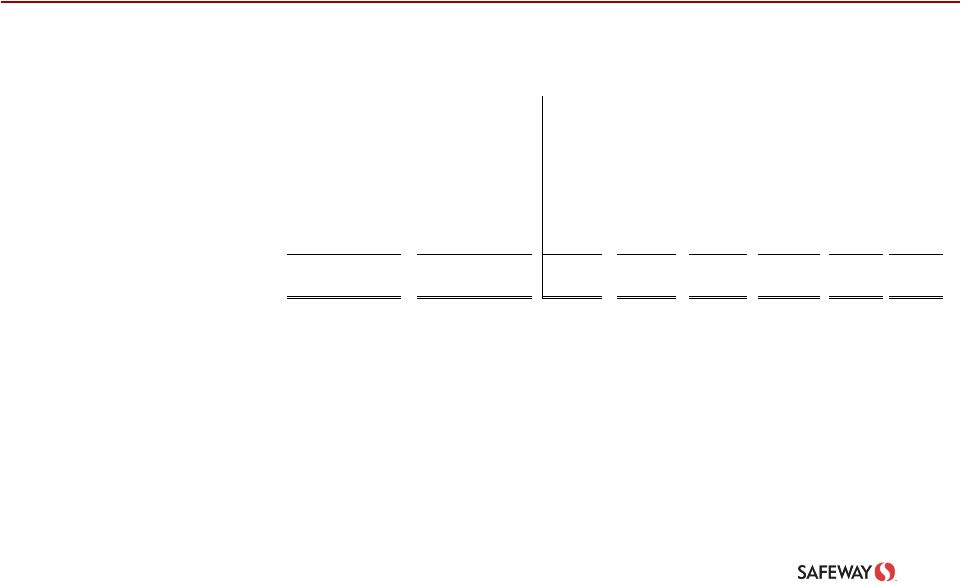

6

Reconciliation of Operating Profit Margin Basis Point

Change Excluding Fuel & Unusual Items

2010

2009

2008

2007

2006

2005

Low

High *

Low

High

3

NM

(5)

10

436

(574)

1

21

82

(11)

Unusual items:

Texas store closures

(29)

29

Goodwill impairment charges

(483)

483

Impairment charges (incl. Dominick's)

(13)

Labor buyout and health and welfare contributions

(15)

7

Stock option expense

15

Fuel impact

(3)

(3)

(5)

(5)

(3)

(4)

(1)

4

15

6

-

NM

(10)

5

(50)

(95)

-

25

53

33

* Basis point change not specified.

Basis point change in operating profit margin

Basis point change in operating profit margin, excluding

fuel and unusual items

2010G

2011G |

7

$ Millions

Reconciliation of Net (Loss) Income to

Adjusted

EBITDA (Interest Coverage)

2010

2009

2008

2007

2006

2005

2004

2003

Net income (loss) attributable to Safeway Inc.

$589.8

($1,097.5)

$965.3

$888.4

$870.6

$561.1

$560.2

($169.8)

Add (subtract):

Income taxes

290.6

144.2

539.3

515.2

369.4

287.9

233.7

310.9

Interest expense

298.5

331.7

358.7

388.9

396.1

402.6

411.2

442.4

Depreciation expense

1,162.4

1,171.2

1,141.1

1,071.2

991.4

932.7

894.6

863.6

LIFO (income) expense

(28.0)

(35.2)

34.9

13.9

1.2

(0.2)

(15.2)

(1.3)

Share-based employee compensation

55.5

61.7

64.3

48.4

51.2

59.7

-

-

Property impairment charges

71.7

73.7

40.3

27.1

39.2

78.9

39.4

344.9

Miscellaneous equity investment impairment charge

-

-

-

-

-

-

-

10.6

Goodwill impairment charges

-

1,974.2

-

-

-

-

-

729.1

Equity in (earnings) losses of unconsolidated affiliate

(15.3)

(8.5)

2.5

(8.7)

(21.1)

(15.8)

(12.6)

7.1

Dividend received from unconsolidated affiliate

-

5.8

-

8.9

9.0

-

-

-

Total Adjusted EBITDA

$2,425.2

$2,621.3

$3,146.4

$2,953.3

$2,707.0

$2,306.9

$2,111.3

$2,537.5

Adjusted EBITDA as a multiple of interest expense

8.1x

7.9x

8.8x

7.6x

6.8x

5.7x

5.1x

5.7x |

8

Reconciliation of Net Cash Flow from Operating Activities

to Adjusted EBITDA

$ Millions

2010

2009

2008

2007

2006

2005

2004

2003

Net cash flow from operating activities

$1,849.7

$2,549.7

$2,250.9

$2,190.5

$2,175.0

$1,881.0

$2,226.4

$1,609.6

Add (subtract):

Income taxes

290.6

144.2

539.3

515.2

369.4

287.9

233.7

310.9

Interest expense

298.5

331.7

358.7

388.9

396.1

402.6

411.2

442.4

Amortization of deferred finance costs

(4.8)

(4.8)

(5.1)

(5.3)

-

-

-

-

Excess tax benefit from exercise of stock options

1.6

0.1

1.5

38.3

-

-

-

-

Deferred income taxes

31.3

142.1

(171.7)

(130.8)

(1.1)

215.9

29.2

77.9

Net pension and post-retirement benefits expense

(125.2)

(140.1)

(96.7)

(72.1)

(83.1)

(115.6)

(112.9)

(130.9)

Contributions to pension and post-retirement benefit plans

17.7

24.4

42.5

33.0

29.2

18.1

15.1

12.1

(Increase) decrease in accrued claims and other liabilities

(36.2)

34.3

(21.1)

5.8

(10.8)

(44.1)

(118.1)

(52.7)

Gain (loss) on property dispositions and lease exit activities

27.5

(12.7)

19.0

42.3

17.8

(13.6)

(20.6)

13.4

Changes in working capital items

67.9

(426.7)

226.0

(45.6)

(181.4)

(310.9)

(538.2)

263.0

Other

6.6

(20.9)

3.1

(6.9)

(4.1)

(14.4)

(14.5)

(8.2)

Total Adjusted EBITDA

$2,425.2

$2,621.3

$3,146.4

$2,953.3

$2,707.0

$2,306.9

$2,111.3

$2,537.5 |

9

Reconciliation of Gross Margin BP Change

Excluding Fuel

Basis point (decrease) increase over prior year:

2010

2009

2008

2007

2006

Basis point change in gross margin

(34)

24

(36)

(8)

(11)

Fuel

27

(59)

10

20

28

Basis point change in gross margin, excluding fuel

(7)

(35)

(26)

12

17

|

10

Reconciliation of Gross Margin BP Change

Excluding Fuel

Basis point (decrease) increase over prior year:

Q1

Q2

Q3

Q4

Basis point change in gross margin

(31)

(32)

(13)

(56)

Fuel

26

1

13

60

Basis point change in gross margin, excluding fuel

(5)

(31)

-

4

Burnaby warehouse closure

14

7

Basis point change in gross margin, excluding fuel and

Burnaby warehouse closure

14

11

2010 |

11

Reconciliation of Operating and Administrative

Expense Margin BP Change

Excluding Fuel

Basis point increase (decrease) over prior year:

Q1

Q2

Q3

Q4

Basis point change in operating and administrative expense margin

44

46

23

(44)

Fuel

39

31

14

36

Basis point change in operating and administrative expense margin, excluding

fuel 83

77

37

(8)

2010 |

12

Excluding Fuel and Unusual Items

Reconciliation of Operating

&

Administrative Expense BP Change

Basis point (decrease) increase over prior year:

2010

2009

2008

2007

2006

2005

12

116

(38)

(29)

(93)

(53)

Unusual items:

Texas store closures

29

(29)

Impairment charges (incl. Dominick's)

13

Labor buyout and health and welfare contributions

15

(7)

Stock option expense

(15)

Fuel impact

31

(56)

11

16

13

32

43

60

(27)

(13)

(36)

(59)

Basis point change in operating & administrative

expense

Basis point change in operating & administrative

expense, excluding fuel and unusual items |

13

2011 Guidance –

Before Canadian Dividend

Earnings

per

Share

$1.60 –

$1.80

ID

Sales

1.0% –

1.5%

Operating Profit Margin Change

1,2

flat to

slightly positive

Cash Capital Expenditures

~$1.0B

Free Cash Flow

1,3

$0.85B –

$0.95B

¹

See website for reconciliation

²

X-Fuel

³

Excludes Blackhawk gift card payables, net of receivables

1

2 |

14

2011 Guidance –

Post Repatriation

EPS

Without repatriation

$1.60 -

$1.80

With repatriation

$1.45 -

$1.65

Free Cash Flow

2

Without repatriation

$0.85B -

$0.95B

With repatriation

$0.75B -

$0.85B

Cash Flow Available for

Return

to Shareholders / Debt Paydown

Without repatriation

$0.85B -

$0.95B

With repatriation

$1.35B -

$1.45B

1

Repatriation benefit post 2011 equals $0.10+ / share

2

Excludes Blackhawk gift card payables, net of receivables

See website for reconciliation

¹ |

15

2010 Results

Original

Revised

Actual

ID Sales X-Fuel

0.0% -

1.0%

(1.0)% -

(1.5)%

(2.0)%

Inflation / (Deflation)

0.4%

NA

(1.2)%

Operating Profit Margin

Change (X-Fuel)

(10) –

5bps

NA

(50)bps

Capital Expenditures

$0.9 -

$1.0B

~ $0.9B

$838M

Free Cash Flow

$0.09 -

$1.1B

NC

$1,058

Earnings Per Share

$1.65 -

$1.85

$1.50 -

$1.70

$1.55

1

Excludes Blackhawk gift card payables, net of receivables

See website for reconciliations

1 |

16

Consistent Sales Improvement

0.3

(0.8)

(2.0)

(2.5)

(3.1)

(4.1)

(0.7)

(1.5)

(3.0)

-5.0

-4.0

-3.0

-2.0

-1.0

0.0

1.0

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

8 weeks

ID Sales X-Fuel –

Total Company |

17

Lifestyle Stores Completed

20

14

26

82

60

30

8

232

2008

2009

2010

2011F

New

Remodel

90

74

56

252 |

18

Capital Spending as a % of Sales

3.4%

3.6%

4.2%

4.2%

3.6%

2.1%

2.0%

2.4%

2.3%

2.4%

2.3%

2.2%

2.3%

'04

'05

'06

'07

'08

'09

'10

'11F

'12F

'13F

'14F

'15F

'10-

'15

$1.2

$1.4

$1.7

$1.8

$1.6

$0.9

$0.8

$1.0

$1.0

$1.1

$1.1

$1.1

$ Billions

12 year average = 2.9% |

19

0.5

0.4

0.4

0.7

1.5

1.0

1.3 -

1.5

1.2 -

1.4

1.1 -

1.3

1.0 -

1.2

0.75 -

0.85*

2005

2006

2007

2008

2009

2010

2011F

2012F

2013F

2014F

2015F

Free Cash Flow

$ Billions

1.4

1.7

1.7

1.6

0.9

0.8

1.0

1.0

1.1

1.1

1.1

Capital Spending

See website for reconciliation

*Includes tax on Canada dividend

Excludes Blackhawk gift card payables, net of receivables

|

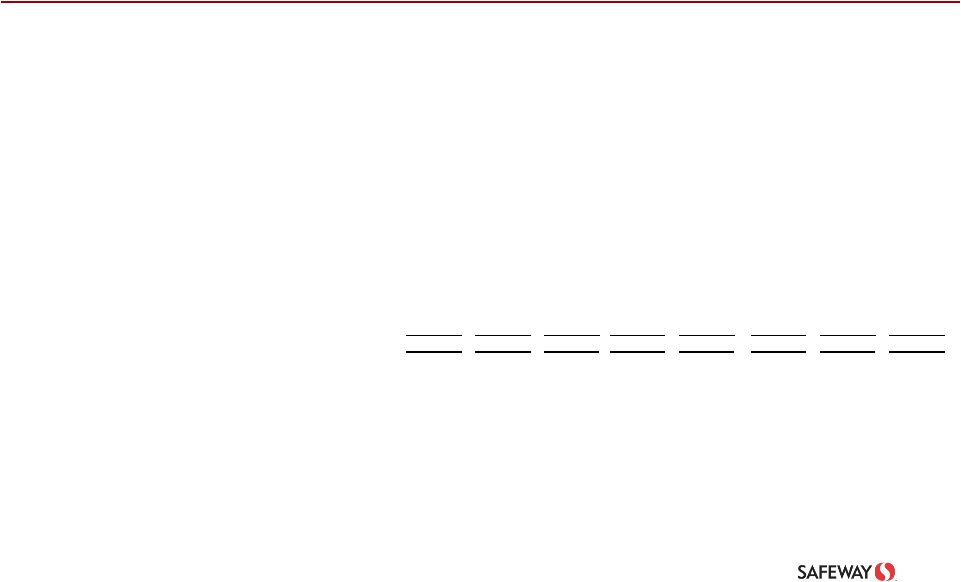

Adjusting

4

th

Quarter

Earnings

Per

Share

–

2010

Proper Adjustment To

Item

Analyst

Normal

Last Year

Comments

Tax Rate

(3) ¢

(3) ¢

(5) ¢

Property Gain

(5)

(3)

(4)

Integral to business

Property Impairment

-

1

(1)

LIFO

(5)

(3)

1

Unprecedented deflation

Currency

(2)

(1)

(1)

Casa Ley

(2)

-

(1)

Subtotal

(17) ¢

(9) ¢

(11) ¢

D.C. Closure

-

1

1

Fuel Margins

-

2

3

Workers Comp

-

3

7

Subtotal

(17) ¢

(3) ¢

0 ¢

Exclude LIFO

-

3

(1)

P&L already contains an 18¢

reduction from deflation

Total Adjustments

(17) ¢

0 ¢

(1) ¢

Reported EPS

62 ¢

62 ¢

62 ¢

Adjusted EPS

45 ¢

62 ¢

61 ¢ |

|