UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (date of earliest event reported): March 8, 2011

K-V PHARMACEUTICAL COMPANY

(Exact name of registrant as specified in its charter)

Commission File Number 1-9601

| Delaware | 1-9601 | 43-0618919 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

| One Corporate Woods Drive Bridgeton, MO | 63044 | |

| (Address of principal executive offices) | (Zip Code) |

(314) 645-6600

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act. |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act. |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. |

Explanatory Note

This Current Report on Form 8-K is being filed by the Registrant solely for the purpose of fulfilling the Registrant’s obligations under the Second Amended and Restated Registration Rights Agreement described below to disclose certain information provided to the Registrants’s Lenders that has not previously been publicly disclosed and which the Registrant reasonably believes constitutes material non-public information.

| Item 2.02 | Results of Operations and Financial Condition |

Item 7.01 below discloses results of operations and financial condition of the Company for prior periods that were previously unreported. Item 7.01 is hereby incorporated by reference.

| Item 7.01 | Regulation FD Disclosure |

As previously disclosed, K-V Pharmaceutical Company (the “Company” or the “Registrant”), certain of the Company’s subsidiaries, and each of U.S. Healthcare I, L.L.C. and U.S. Healthcare II, L.L.C. (collectively, the “Lenders”), are parties to a Credit and Guaranty Agreement, dated November 17, 2010, as amended by that certain Amended and Restated Amendment No. 1 to Credit Agreement dated as of January 6, 2011, as amended by that Amendment No. 2 to Credit Agreement dated as of March 2, 2011 (as amended, the “Credit Agreement”). Pursuant to the Credit Agreement, at various times prior to the date hereof the Company has provided to the Lenders certain information regarding the Company and its business, including various consolidated financial projections and liquidity forecasts and internal financial information and results (collectively, the “Provided Information”). The Company and the Lenders are also parties to that certain Second Amended and Restated Registration Rights Agreement, dated as of March 2, 2011 (the “Second Amended RRA”), pursuant to which the Company has agreed to register for resale under the Securities Act of 1933, as amended, shares of the Company’s Class A Common Stock which are issuable upon the exercise of warrants issued by the Company to the Lenders in connection with the Credit Agreement. Under the Second Amended RRA, the Company is obligated under certain circumstances to publicly disclose all of the previously publicly undisclosed confidential information provided to the Lender or its affiliates that, in the Company’s reasonable judgment, constitutes material non-public information. This Current Report on Form 8-K is being filed by the Company solely for the purpose of fulfilling the Company’s obligation under the Second Amended RRA to disclose the portions of the Provided Information that have not previously been publicly disclosed and which the Company reasonably believes constitute material non-public information.

The Provided Information includes certain consolidated financial projections and liquidity forecasts for the Company set forth below in this Current Report on Form 8-K (collectively, the “Projections”). The Projections set forth below reflect information that was prepared at various times in connection with the Company’s exploration of potential financing alternatives, and were not prepared with a view toward public disclosure or compliance with the published guidelines of the Securities and Exchange Commission (the “SEC”) or with the standards for projections promulgated by the American Institute of Certified Public Accountants or the Financial Accounting Standards Board. The Projections do not purport to present financial condition in accordance with accounting principles generally accepted in the United States (“GAAP”). The Company’s independent accountants have not audited, examined, reviewed, compiled or otherwise applied procedures to the Projections and, accordingly, do not express an opinion or any other form of assurance with respect to the Projections.

The Projections also were prepared by the Company’s management solely for internal use, capital budgeting, discussions with financing sources under confidentiality agreements, and other management decisions and are subjective in many respects. The Projections reflect numerous assumptions made by management of the Company with respect to financial condition, business and industry performance, general economic, market and financial conditions, regulatory matters, loan compliance, and other matters. Some of the assumptions used have not been achieved to date and may not be realized in the future, and are subject to significant business, litigation, economic, regulatory and competitive uncertainties and contingencies, many of which are beyond the control of the Company. The Projections also contain information that is, in many cases, obsolete, superseded or no longer applicable due to subsequent developments and events occurring since the Projections were made. Unanticipated events and circumstances may also affect the actual financial results of the Company in the future.

Principal assumptions underlying the Projections include those relating to the launch of our recently approved product Makena™. In addition to the various material assumptions to the Projections set forth below, the following information is material to an understanding of uncertainties regarding the launch of Makena™ and could cause actual results to vary materially from the forecasts reflected in the Projections:

| • | The Projections assume that the average course of treatment will involve three vials (each vial consisting of five doses) of Makena™ per patient. The actual per patient usage of Makena™ could vary significantly from this assumption based on a variety of factors. |

| • | The Projections have been prepared on the basis of certain assumptions regarding gross and net pricing to be recognized from sales of Makena™, including estimates of adjustments to net sales reflecting discounts, rebates and other customary allowances. The Company’s ability to achieve these assumptions regarding gross and net pricing is subject to substantial uncertainty. |

| • | Although Makena™ is the first and only FDA-approved treatment indicated to reduce the risk of preterm birth in women with a singleton pregnancy that have a history of singleton spontaneous preterm birth, the Company’s sales of Makena™ could be negatively affected by treatment of this condition by unapproved drug therapies. |

| • | Subsequent to the preparation of the Projections, the Company received preliminary initial orders from distributors for approximately 6,000 vials of Makena™. The amount of these orders reflects various factors such as special discounts made available by the Company in connection with the product launch and should not be considered as indicative of expectations for future sales of Makena™. Actual sales volumes for Makena™ will depend on a number of factors, including market acceptance. |

With respect to the Company’s efforts to secure approval for additional products, in February 2011, the FDA conducted an inspection with respect to the Company’s Clindesse® product and issued a Form 483 with certain observations. Also in February 2011, the Company filed its responses with the FDA with respect to such observations

In view of the foregoing, the Projections should not be regarded as a representation or warranty by the Company, or any other person or entity, that the Projections will be realized. It is expected that there will be differences between actual and projected results, and the differences may be material. The inclusion of the Projections herein should not be regarded as an indication that the Company or its affiliates or representatives consider the Projections to be a reliable prediction of future events, and the Projections should not be relied upon as such. Neither the Company nor any of its affiliates or representatives make any representation or warranty regarding the accuracy, completeness, current relevance or applicability of any data or computations contained in the Projections, and neither the Company nor any of its affiliates or representatives undertake any obligation to publicly update the Projections or the information reflected in them to reflect circumstances or factual information existing or arising after the date when the Projections were made or to reflect the occurrence of future events, even in the event that any or all of the assumptions underlying the Projections are shown to be in error. The Projections should be read in conjunction with the information set forth in the Company’s Annual Report on Form 10-K for the fiscal year ended March 31, 2010 (the “2010 Form 10-K”), including the risk factors that are included under the caption “Item 1A—“Risk Factors”” in the 2010 Form 10-K, as supplemented by the Company’s subsequent SEC filings.

The Provided Information also included certain consolidated internal financial information and results derived from the Company’s internally prepared financial statements (collectively, “Internal Financial Results”). Internal Financial Results included in the materials set forth below that relate to periods for which the Company has not yet filed a Quarterly Report on Form 10-Q or an Annual Report on Form 10-K are identified by columns marked “Preliminary.” The Company’s independent accountants have not audited, examined, reviewed, compiled or otherwise applied procedures to the Internal Financial Information and, accordingly, do not express an opinion or any other form of assurance with respect to the Internal Financial Information. The Internal Financial Information is subject to adjustment in connection with the preparation of the Company’s periodic reports for the applicable periods, and such adjustments may be material. The Company’s actual financial results reported in its future filings with the SEC or otherwise publicly disclosed may vary from the Internal Financial Information presented below, and such variances may be material. Accordingly, neither the Company nor any of its affiliates or representatives make any representation or warranty regarding the accuracy of any data or computations contained in the Internal Financial Information, and the Internal Financial Information should not be regarded as a representation or warranty by the Company, or any other person or entity, that the Internal Financial Information set forth below is accurate or will be realized.

The Internal Financial Information should be read in conjunction with the consolidated financial statements and other information contained in the 2010 Form 10-K. As previously disclosed, the Company has not filed with the SEC its Quarterly Reports on

Form 10-Q for the quarters ended June 30, 2010, September 30, 2010 or December 31, 2010. Certain of the information contained in the Internal Financial Information may differ materially from the information in these reports when filed by the Company with the SEC. As discussed in the 2010 Form 10-K, the Company believes that there is substantial doubt regarding its ability to continue as a going concern and, as a result, the report of its independent registered public accounting firm accompanying its annual consolidated financial statements for the fiscal year ended March 31, 2010, included an explanatory paragraph disclosing the existence of substantial doubt regarding the Company’s ability to continue as a going concern. The Company does not expect that the substantial doubt will be resolved as of the end of the period covered by the Form 10-Q for the quarters ended June 30, 2010, September 30, 2010, December 31, 2010 or possibly the year ended March 31, 2011. The Internal Financial Information has been prepared using GAAP applicable to a going concern, which contemplates the realization of assets and liquidation of liabilities in the normal course of business. The historical consolidated financial statements included in the Internal Financial Information does not include any adjustments that might be necessary if the Company was unable to continue as a going concern.

On March 1, 2011, the Company announced that it intends to offer $200 million of senior secured notes due 2015 (the “Notes”) in a private placement, subject to market conditions, and that the Company intends to use the net proceeds from the private placement of the Notes to repay in full its obligations under the Credit Agreement with the Lenders (including the payment of related premiums) and terminate the related future loan commitments, to establish an escrow reserve for one year of interest payments on the Notes and for general corporate purposes. The information regarding the Projections and the Internal Financial Information included below does not include any adjustment for the issuance of the Notes or the application of the proceeds from the sale of the Notes. The information regarding the Projections and the Internal Financial Information also assumes the obligation of the Company to comply with the covenants contained in the Credit Facility, which covenants would no longer be applicable in the event that the Company completes the sale of the Notes.

CONFIDENTIAL

CONFIDENTIAL

Makena™

Revenue Assumptions

1

The Projections included herein represent the Company’s projections provided

to the Lenders in connection with negotiating the amendment to the

Company’s Bridge Loan and the related Multi-draw Facility and have not been

updated

to

reflect

the

recently

announced

efforts

by

the

Company

to

refinance

the Credit Facility with secured debt.

•

Financing Case

–

This scenario was prepared for purposes of negotiating the Credit

Agreement and related covenants with the Lenders. Assumes ~47% of Research

Case by March 2012 and ~82% by March 2013

•

Internal Case –

This scenario was developed by the Company to be utilized for

financial and business planning purposes. Assumes ~71% of Research Case by

March 2012 and ~94% by March 2013

•

Research Case

–

Estimate of Makena™

market and potential penetration based on

a Company proprietary market study

•

List Price -

Makena™

list price per vial at launch in March 2011 $7,500

The information set forth herein is not intended to be relied upon by

investors. Please see the important explanatory information set forth

above in this Current Report on Form 8-K |

CONFIDENTIAL

CONFIDENTIAL

Makena™

Revenue Assumptions

(Continued)

2

The information set forth herein is not intended to be relied upon by

investors. Please see the important explanatory information set forth

above in this Current Report on Form 8-K

Market

Quarter

Quarter End

Market Penetration at Quarter End

Estimated Quarterly Unit

2

Sales (000s)

End

(Patients)

1

Financing

Internal

Research

Financing

Internal

Research

Mar-11

8,755

0.6%

1.4%

2.1%

2.5

2.5

5.0

Jun-11

8,773

2.7%

6.3%

9.0%

0.0

1.0

0.0

Sep-11

8,791

6.1%

12.6%

18.0%

1.3

4.6

6.6

Dec-11

8,809

10.4%

19.8%

28.2%

4.7

9.7

13.5

Mar-12

8,827

16.0%

23.9%

34.1%

8.3

14.4

20.5

Market

Fiscal Year

Fiscal Year 2013

Market Penetration at Fiscal Year End

Estimated Fiscal Year Unit

2

Sales (000s)

End

(Patients)

1

Financing

Internal

Research

Financing

Internal

Research

Mar-13

105,000

29.6%

33.8%

36.2%

69.0

84.4

104.6

Notes:

2) One unit = 5 injections

1) Company's estimate of insured (or covered) lives who receive

prenatal care. Company assumes

that approximately 15% of market is uninsured. |

CONFIDENTIAL

CONFIDENTIAL

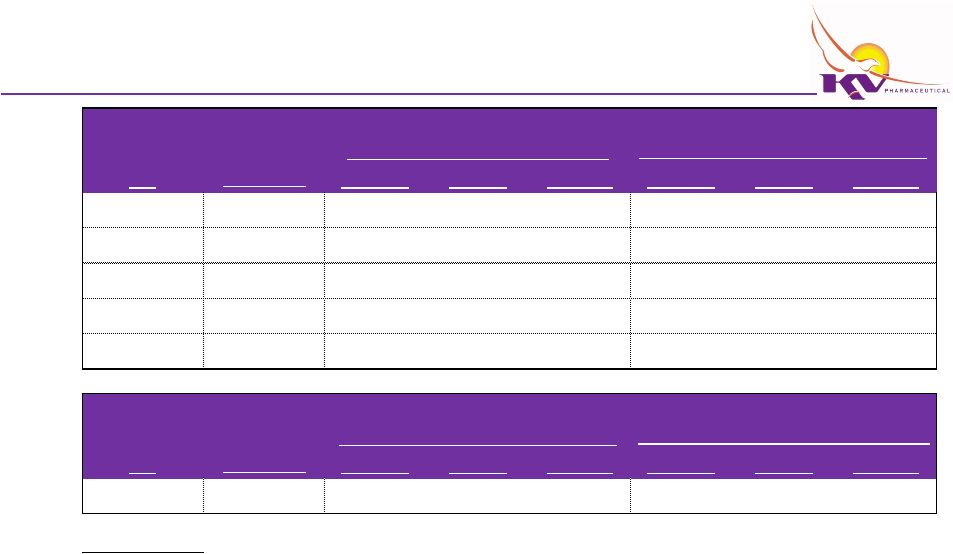

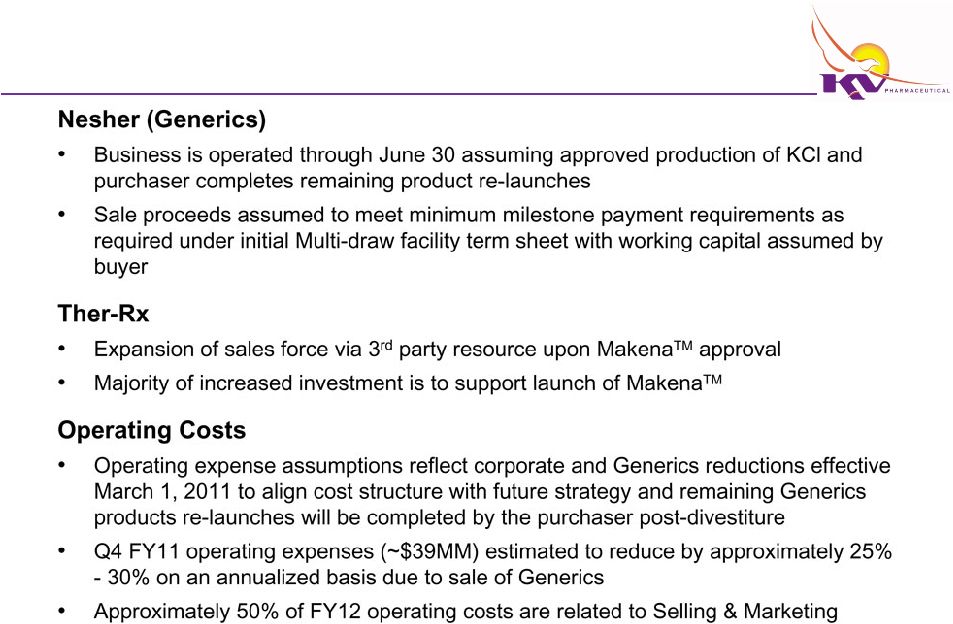

Financing Case Key Assumptions

3

•

Expand to 150 sales force footprint upon approval of Makena™

•

Advertising & Promotion spend will increase in FY 2012 and

beyond, predominantly supporting Makena™

•

Evamist was assumed to be divested in March 2011 and Generics in

June 2011 (per requirements of existing loan with the Lenders)

The information set forth herein is not intended to be relied upon by investors. Please see the

important explanatory information set forth above in this Current Report on Form 8-K

$000s

Branded

Anti-Infectives

1

Generics

Grand

Description

Makena

& Evamist

Total

KCl

Total

Approval Date

Q4 FY2011

N/A

N/A

Q3 FY2011

N/A

Q4 FY 2011 Net Revenues

15,469

$

2,826

$

18,295

$

5,829

$

24,124

$

FY 2012 Net Revenues

92,892

$

26,626

$

119,518

$

8,967

$

128,485

$

FY 2013 Net Revenues

420,405

$

32,359

$

452,764

$

-

$

452,764

$

Notes:

1) Assumes Anti-Infectives are approved prior to June 30, 2011

Company is not required to divest Evamist or Generics if the Mutli-draw

facility is not closed and will evaluate strategic alternatives with Evamist and

Generics |

CONFIDENTIAL

CONFIDENTIAL

Financing Case Key Assumptions

(Continued)

4

The information set forth herein is not intended to be relied upon by

investors. Please see the important explanatory information set forth

above in this Current Report on Form 8-K |

CONFIDENTIAL

CONFIDENTIAL

5

The information set forth herein is not intended to be relied upon by

investors. Please see the important explanatory information set forth

above in this Current Report on Form 8-K |

CONFIDENTIAL

CONFIDENTIAL

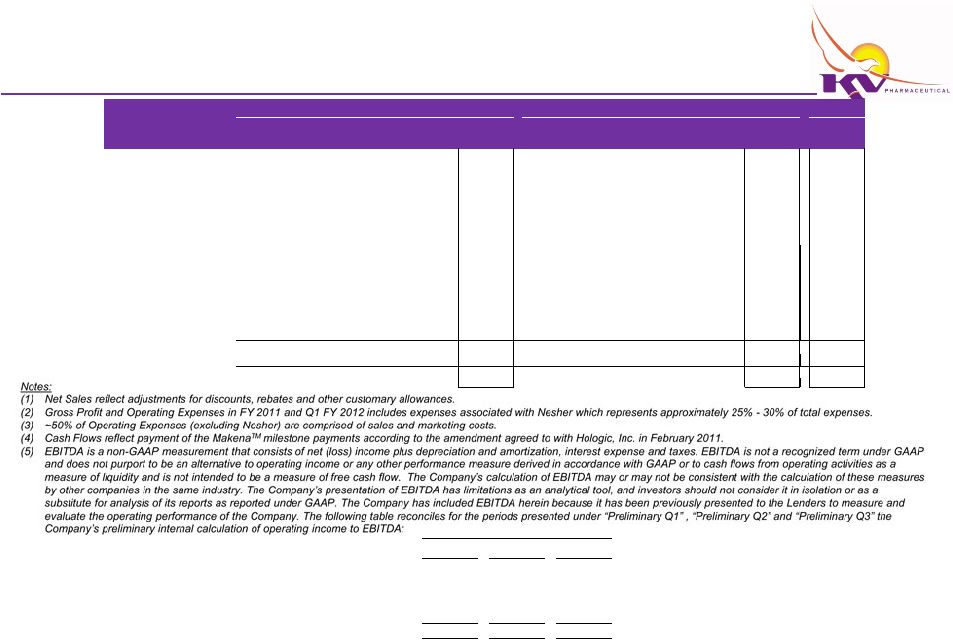

Financing Case Financial Projections

FY 2011 –

FY 2013

6

The information set forth herein is not intended to be relied upon by

investors. Please see the important explanatory information set forth

above in this Current Report on Form 8-K

Q1

Q2

Q3

Net Loss from continuing operations

(40,451)

$

(34,518)

$

(38,397)

$

Amortization and Depreciation

5,085

4,100

3,924

Interest expense, net

1,848

2,014

3,931

Taxes

(679)

1,923

2,560

EBITDA from continuing operations

(34,197)

$

(26,481)

$

(27,982)

$

Preliminary

$000s

FY 2011

FY 2012

FY 2013

Preliminary

Preliminary

Preliminary

Projected

Projected

Projected

Projected

Projected

Projected

Projected

Projected

Q1

Q2

Q3

Q4

Total

Q1

Q2

Q3

Q4

Total

Total

Income Statement

Net Sales

(1)

3,376

$

3,307

$

5,566

$

24,124

$

36,373

$

14,010

$

13,017

$

38,646

$

62,813

$

128,485

$

452,764

$

Gross Profit

(2)

(6,732)

(5,520)

(1,748)

14,686

686

5,129

10,055

35,518

59,662

110,363

441,158

Gross Margin

-199.4%

-166.9%

-31.4%

60.9%

1.9%

36.6%

77.2%

91.9%

95.0%

85.9%

97.4%

Operating Expenses

(2) (3)

32,003

25,069

31,668

38,553

127,293

30,974

27,680

26,888

25,912

111,453

117,921

EBITDA

(5)

(34,197)

$

(26,481)

$

(27,982)

$

(20,244)

$

(108,904)

$

(22,271)

$

(14,689)

$

13,330

$

34,627

$

10,997

$

329,517

$

-1012.9%

-800.8%

-502.7%

-83.9%

-299.4%

-159.0%

-112.8%

34.5%

55.1%

8.6%

72.8%

Cash Flows

(4)

Operating Activities

(50,874)

$

(37,276)

$

(32,564)

$

(72,597)

$

(193,311)

$

(30,932)

$

(31,681)

$

(7,001)

$

12,440

$

(57,174)

$

190,577

$

Investing Activities

33,212

2,150

144

2,939

38,445

60,019

306

306

306

60,937

-

Financing Activities

(1,508)

19,265

38,560

45,791

102,108

(33,358)

30,058

10,400

436

7,536

1,811

Net Increase (Decrease)

(19,170)

$

(15,861)

$

6,140

$

(23,866)

$

(52,757)

$

(4,270)

$

(1,318)

$

3,705

$

13,182

$

11,299

$

192,387

$

Beginning Cash

60,693

41,523

25,662

31,802

60,693

7,936

3,666

2,348

6,053

7,936

19,235

Ending Cash

41,523

$

25,662

$

31,802

$

7,936

$

7,936

$

3,666

$

2,348

$

6,053

$

19,235

$

19,235

$

211,623

$

6 |

CONFIDENTIAL

CONFIDENTIAL

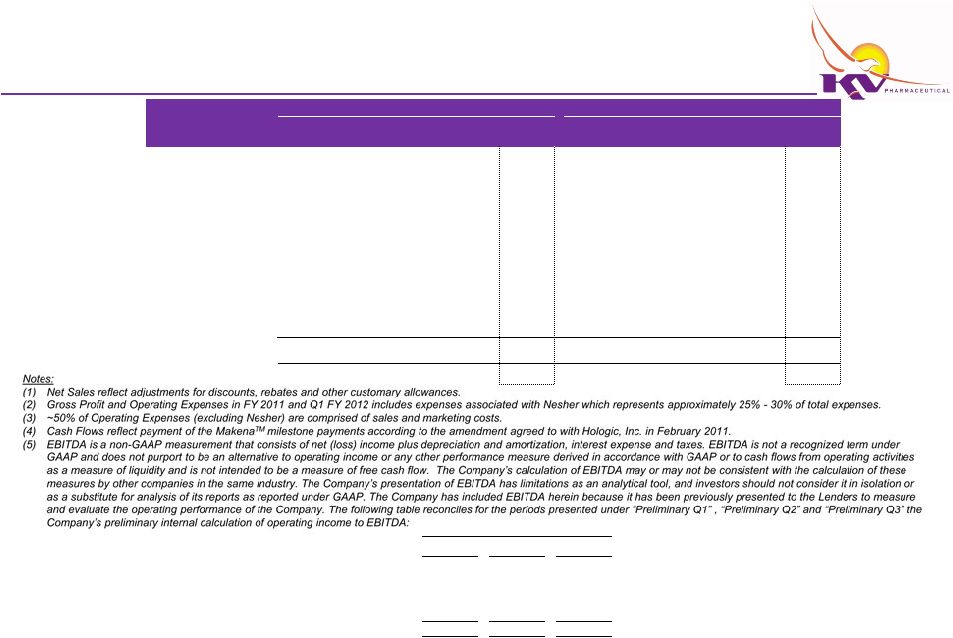

Internal Case Financial Projections

FY 2011 –

FY 2012

7

The information set forth herein is not intended to be relied upon by

investors. Please see the important explanatory information set forth

above in this Current Report on Form 8-K

Q1

Q2

Q3

Net Loss from continuing operations

(40,451)

$

(34,518)

$

(38,397)

$

Amortization and Depreciation

5,085

4,100

3,924

Interest expense, net

1,848

2,014

3,931

Taxes

(679)

1,923

2,560

EBITDA from continuing operations

(34,197)

$

(26,481)

$

(27,982)

$

Preliminary

$000s

FY 2011

FY 2012

Preliminary

Preliminary

Preliminary

Projected

Projected

Projected

Projected

Projected

Projected

Projected

Q1

Q2

Q3

Q4

Total

Q1

Q2

Q3

Q4

Total

Income Statement

Net Sales

(1)

3,376

$

3,307

$

5,566

$

24,124

$

36,373

$

20,657

$

34,462

$

70,572

$

102,546

$

228,236

$

Gross Profit

(2)

(6,732)

(5,520)

(1,748)

14,686

686

11,775

31,500

67,444

99,395

210,115

Gross Margin

-199.4%

-166.9%

-31.4%

60.9%

1.9%

57.0%

91.4%

95.6%

96.9%

92.1%

Operating Expenses

(2) (3)

32,003

25,069

31,668

38,553

127,293

30,974

27,681

26,889

25,913

111,457

EBITDA

(5)

(34,197)

$

(26,481)

$

(27,982)

$

(20,244)

$

(108,904)

$

(15,625)

$

6,755

$

45,255

$

72,981

$

109,366

$

-1012.9%

-800.8%

-502.7%

-83.9%

-299.4%

-75.6%

19.6%

64.1%

71.2%

47.9%

Cash Flows

(4)

Operating Activities

(50,874)

$

(37,276)

$

(32,564)

$

(72,597)

$

(193,311)

$

(29,166)

$

(15,026)

$

22,765

$

50,819

$

29,392

$

Investing Activities

33,212

2,150

144

2,939

38,445

60,019

306

306

306

60,937

Financing Activities

(1,508)

19,265

38,560

45,791

102,108

(33,358)

30,058

10,400

436

7,536

Net Increase (Decrease)

(19,170)

$

(15,861)

$

6,140

$

(23,866)

$

(52,757)

$

(2,505)

$

15,337

$

33,471

$

51,561

$

97,865

$

Beginning Cash

60,693

41,523

25,662

31,802

60,693

7,936

5,431

20,768

54,239

7,936

Ending Cash

41,523

$

25,662

$

31,802

$

7,936

$

7,936

$

5,431

$

20,768

$

54,239

$

105,801

$

105,801

$ |

CONFIDENTIAL

CONFIDENTIAL

Financing Case

Selected Balance Sheet Information

8

The information set forth herein is not intended to be relied upon by

investors. Please see the important explanatory information set forth

above in this Current Report on Form 8-K

Audited

(1)

($ in thousands)

31-Mar-2010

30-Jun-2010

30-Sep-2010

31-Dec-2010

31-Mar-2011

31-Mar-2012

31-Mar-2013

Cash and cash equivalents

$60,693

$41,523

$25,662

$31,802

$7,936

$19,235

$211,623

Other current assets

(4)

31,020

20,813

21,627

28,577

60,596

88,082

121,043

Property and equipment, net

(5)

122,910

117,661

112,755

110,182

105,266

53,299

41,625

Total Assets

(6)

358,557

315,480

294,209

303,447

357,210

322,804

535,253

Current liabilities

(7)

172,794

152,527

166,521

206,223

271,415

267,171

187,087

Long-term debt

(8)

233,174

232,441

231,828

231,219

230,350

227,454

224,981

Notes:

(7)

Current

liabilities

includes

the

remaining

scheduled

Makena

TM

milestone

payments

and

remaining

outstanding

amounts

owed

under

the

Company's

loan

obligations to the Lenders.

(6)

The

increase

in

total

assets

beginning

in

March

2011

is

primarily

due

to

the

capitalization

of

$120,000

of

future

Makena

TM

milestone payments due uopn FDA

approval offset by a planned liquidation of the Company's remaining basis in its Auction Rate

Securities. (8) Long term debt is comprised primarily of $200,000 of convertible

notes, which have a next scheduled put date of May 2013, and the remaining balance of a

mortgage on four of the Company's properties. The long term debt balances shown do not

include a proposed $200,000 senior secured financing announced by the Company on March

1, 2011. Preliminary

(2)

Projected

(3)

(1) Per the Company's Form 10-K for Fiscal Year Ended March 31, 2010.

(2) Based on the Company's internally prepared financial statements, as provided to the

Lenders and required to be disclosed pursuant to covenants with the Lenders, and may

differ materially from actual results reported in Form 10-Q for each of the periods presented.

(3) Based on the Company's internal projections, as provided the

Lenders, and required to be disclosed pursuant to covenants with the Lenders and may

differ materially from actual results reported in future SEC filings for each of the

periods presented. (4)

Increase

in

current

assets

beginning

in

March

2011

is

primarily

due

to

receivables

associated

with

sales

launch

of

Makena

TM

.

(5) Decrease in property and equipment, net is primarily due to

the planned divestiture of the generics business in June 2011. |

CONFIDENTIAL

CONFIDENTIAL

Internal Case

Selected Balance Sheet Information

9

The information set forth herein is not intended to be relied upon by

investors. Please see the important explanatory information set forth

above in this Current Report on Form 8-K

Audited

(1)

($ in thousands)

31-Mar-2010

30-Jun-2010

30-Sep-2010

31-Dec-2010

31-Mar-2011

31-Mar-2012

Cash and cash equivalents

$60,693

$41,523

$25,662

$31,802

$7,936

105,801

Other current assets

(4)

31,020

20,813

21,627

28,577

60,596

109,645

Property and equipment, net

(5)

122,910

117,661

112,755

110,182

105,266

53,299

Total Assets

(6)

358,557

315,480

294,209

303,447

357,210

430,931

Current liabilities

(7)

172,794

152,527

166,521

206,223

271,415

276,930

Long-term debt

(8)

233,174

232,441

231,828

231,219

230,350

227,454

Notes:

Preliminary

(2)

Projected

(3)

(1)

Per

the

Company's

Form

10-K

for

Fiscal

Year

Ended

March

31,

2010.

(2)

Based

on

the

Company's

internally

prepared

financial

statements,

as

provided

to

the

Lenders

and

required

to

be

disclosed

pursuant

to

covenants

with

the

Lenders,

and

may

differ

materially

from

actual

results

reported

in

Form

10-Q

for

each

of

the

periods

presented.

(3)

Based

on

the

Company's

internal

projections,

as

provided

to

the

Lenders,

and

required

to

be

disclosed

pursuant

to

covenants

with

the

Lenders

and

may

differ

materially

from

actual

results

reported

in

future

SEC

filings

for

each

of

the

periods

presented.

(4)

Increase

in

current

assets

beginning

in

March

2011

is

primarily

due

to

receivables

associated

with

sales

launch

of

Makena

TM

.

(

5)

Decrease

in

property

and

equipment,

net

is

primarily

due

to

the

planned

divestiture

of

the

generics

business

in

June

2011.

(6)

The

increase

in

total

assets

beginning

in

March

2011

is

primarily

due

to

the

capitalization

of

$120,000

of

future

Makena

TM

milestone

payments

due

upon

FDA

approval

offset

by

a

planned

liquidation

of

the

Company's

remaining

basis

in

its

Auction

Rate

Securities.

(7)

Current

liabilities

includes

the

remaining

scheduled

Makena

TM

milestone

payments

and

remaining

outstanding

amounts

owed

under

the

Company's loan obligations to the Lenders.

(8)

Long

term

debt

is

comprised

primarily

of

$200,000

of

convertible

notes,

which

have

a

next

scheduled

put

date

of

May

2013,

and

the

remaining

balance

of

a

mortgage

on

four

of

the

Company's

properties.

The

long

term

debt

balances

shown

do

not

include

a

proposed

$200,000

senior

secured

financing

announced

by

the

Company

on

March

1,

2011. |

The information contained herein shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall they be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

The information contained in this Current Report on Form 8-K includes forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995. All statements (other than statements of historical facts) that address projected or estimated results, or events, developments or results that we intend, expect, believe, anticipate, plan, forecast or project, will or may occur in the future are forward-looking statements. The words “possible,” “propose,” “might,” “could,” “would,” “projects,” “plan,” “forecasts,” “anticipates,” “expect,” “intend,” “believe,” “seek” or “may,” and similar expressions, are intended to identify forward-looking statements, but are not the exclusive means of identifying them. Forward-looking statements are subject to a number of risks, contingencies and uncertainties, some of which our management has not yet identified. Forward-looking statements are not guarantees of future performance; subsequent developments may cause forward-looking statements to become outdated; and actual results, developments and business decisions may differ materially from those contemplated by such forward-looking statements as a result of various factors, certain (but not all) of which are discussed in the risk factors included in the Company’s reports filed with the SEC including, but not limited to, their Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q. Important factors that could cause actual results to differ from those contemplated by forward-looking statements include, but are not limited to, the terms of the restructuring or reorganization plan ultimately implemented, the timing thereof, the related costs and expenses, and the ability of the Company to maintain normal relationships with their vendors, service providers and customers. The Company undertakes no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or circumstances, or otherwise.

The Company will post this Form 8-K on its Internet website at www.kvpharmaceutical.com. References to the Company’s website address are included in this Form 8-K only as inactive textual references and the Company does not intend them to be active links to its website. Information contained on the Company’s website does not constitute part of this Form 8-K.

* * *

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: March 8, 2011

| K-V PHARMACEUTICAL COMPANY | ||

| By: | /s/ GREGORY J. DIVIS, JR. | |

| Gregory J. Divis, Jr. | ||

| President and Chief Executive Officer | ||