Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - KEMPER Corp | d8k.htm |

1

Exhibit 99.1 |

Donald G. Southwell

Chairman, President & Chief Executive Officer

Dennis R. Vigneau

Senior Vice President & Chief Financial Officer

RAYMOND JAMES

32nd Annual Institutional Investor Conference

March 9, 2011

Orlando, Florida |

| 2

Safe Harbor Statement:

This presentation may contain or incorporate by reference information that includes

or is based on forward-looking statements within the meaning of Section

27A of the Securities Act of 1933 and Section 21E of the Securities Exchange

Act of 1934. Forward-looking statements give expectations or forecasts

of future events. These statements can be indentified by the fact that they do not relate strictly to historical or

current

facts.

They

use

words

such

as

“believe(s),”

“goal(s),”

“target(s),”

“estimate(s),”

“anticipate(s),”

“forecast(s),”

“project(s),”

“plan(s),”

“intend(s),”

“expect(s),”

“might,”

“may”

and

other

words

and

terms

of

similar

meaning

in

connection

with

a

discussion

of

future

operating

financial performance or financial condition. Forward-looking statements, in

particular, include statements relating to future actions, prospective

services or products, future performance or results of current and anticipated services or products, sales efforts, expenses, the

outcome of contingencies such as legal proceedings, trends in operations and

financial results. These statements are based on current expectations and the

current economic environment. They involve a number of risks and

uncertainties that are difficult to predict. These statements are not guarantees of

future performance; actual results could differ materially from those

expressed or implied in the forward-looking statements. Forward-looking statements can be affected by inaccurate assumptions

or by known or unknown risks and uncertainties. No assurances can be given

that the results contemplated in any forward-looking statements will be

achieved or will be achieved in any particular timetable. The Company assumes no obligation to publicly correct or

update any forward-looking statements as a result of events or developments

subsequent to the date of this presentation. The reader is advised, however,

to consult any further disclosures Unitrin makes on related subjects in its filings with the SEC.

Kemper®:

Kemper®

is a registered service mark of Unitrin, Inc.

iMingle™, iMingle Network

and Insuring The i Generation™, and logos containing such terms, are service

marks or trademarks of Unitrin Direct Insurance Company.

Presentation Note:

Unless otherwise noted, numbers are as of December 31, 2010 and dollars are in

millions. Non-GAAP Measures:

Non-GAAP Measures are discussed and reconciled at the end of this

presentation. |

3

Unitrin Highlights

A diversified P&C and Life business with a national footprint

-

20

largest

personal

lines

writer

and

17

largest

auto

insurer

in

the

United

States

(1)

-

Strong regional presence providing basic protection product

Multi-channel distribution network

History of opportunistic acquisitions and successful integration

Conservative balance sheet with strong holding company liquidity

-

$8.4

billion

assets,

$2.1

billion

shareholders’

equity,

22.4%

basic

debt

to

capital

ratio

-

94% of fixed maturity investment portfolio rated investment grade

Experienced management team with long-term association with the Company

th

th |

4

-

Flagship operating companies have been conducting business for more than 80

years Independently managed businesses, leveraging key common platforms

Over 6 million policyholders served by 7,000 associates

Company Overview

Kemper

Unitrin

Specialty

(Non-Standard)

Unitrin Direct

Property & Casualty Insurance

$900 statutory surplus

Career Agency

Fireside Bank

(In Run-off)

$249

Life & Health Insurance

$405 statutory surplus

Reserve

National

Earned Premiums

Policies in Force

$888

$475

$282

$514

$130

721K

342K

175K

5,000K

80K

Multi-line insurance holding company incorporated in 1990 and based in Chicago, IL (Ticker:

UTR) |

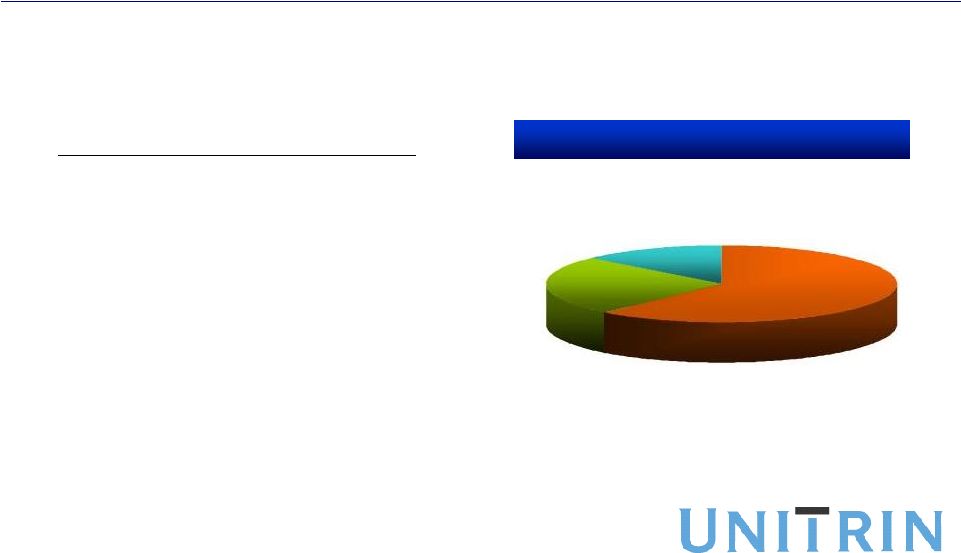

Life 17%

Other 6%

Homeowners

13%

A&H 7%

Commercial

Auto 2%

$44

Earned Premiums

by Line of Business

Earned Premiums $2,289

Standard & Preferred

Personal Auto 36%

Non-Standard

Personal Auto 19%

Total

Personal

Auto

$1,250

55%

5

Total Revenues $2,743

$137

$162

$299

$397

$431

$891 |

History of Successful Transactions

Multiple acquisitions since spin-off

Launched Unitrin Direct as a start-up

6

Disciplined capital management to

create shareholder value

-

Tax-free spin-off of Curtiss Wright

-

Structured tax efficient sale of Litton to

Northrop Grumman

-

Exited several non-core businesses

(e.g. Fireside, Pyramid Life and Unitrin

Business Insurance |

Business Lines |

8

Property & Casualty Insurance Segment

54%

17%

29% |

Personal Lines Insurance

Headquartered in Jacksonville, Florida

Personal auto (61% sales) & homeowners/other (39% sales)

2,600 independent agents in 38 states

Lead product is Package Plus

Net Written Premium:

$872

Top 4 premium states: NY, CA, NC & TX

9 |

Competitive Advantages

Strong brand name recognized by agents and target market

Package policies specifically designed for target market

Proprietary pricing engine

-

Multi-variant capabilities

-

Leveraged across Unitrin

Automation and service built for agency convenience

Claims handling focused on high quality customer service,

supported by a shared services group

10 |

Headquartered in Dallas, Texas

Non Standard Auto (NSA) -

personal and

commercial

8,000 independent agents in 21 states

Target market is top tier of insureds not eligible

for Preferred and/or Standard offerings

Non Standard Auto Insurance

11

Business model focused on automation and agent convenience

Net Written Premium: $457

Top 2 premium states: CA & TX |

Competitive Advantages

Recognized carrier in the NSA market for over 60 years

Strong regional presence expandable to more states

Point of sale systems designed for ease of placement

12

Proprietary pricing engine leveraged across Unitrin

Claims handling designed for the unique challenges of NSA,

supported by a shared claims organization |

Headquartered in Chicago, Illinois

Built through several key acquisitions

Recent enhancements:

-

Re-designed Customer Website

-

New proprietary product (now active in 12 states)

-

Focused on margin improvement in 2011

Direct to Consumer

13

Launched

iMingle

, a social networking insurance platform

TM |

Experienced foothold in the direct marketplace

Complete on-line life cycle capabilities for ease of doing business

Product suite includes Homeowners coverage

Multi-channel approach targeting standard & preferred customers

-

Customizable product offerings

-

Integrated customer experience

-

Flexible payment options

Leveraging claims and other back office infrastructure

Building Competitive

Advantages

14 |

Life

and Health Insurance Segment 80%

20%

Career Agency Companies |

16

Life and Health Insurance Business

-

3,800 associates and career agents

-

Targets modest income consumers

-

Basic protection for individuals and families

-

Leading product is ordinary life insurance,

including permanent and term insurance

-

No exposure to variable annuities

-

Operates in 25 states

Career Agency Companies

-

275 exclusive independent agents and 150

home office employees, targeting under-

served rural markets

-

Key products include limited benefit hospital

expense and surgical benefit plan, Medicare

Supplement and other supplemental A&H

insurance |

17

Life and Health Insurance Business

Career

Agency

Competitive

Advantages

-

Leader in moderate income segment

-

Significant scale

-

Business not sensitive to interest rate or

stock market volatility

-

Products are simple with stable, predictable

cash flows

-

Over 5 million policyholders

Life

Property

Total Earned Premiums = $644

Accident &

Health

Earned Premiums by Product

Predominately a career agency-driven business with modest amounts of

A&H business through Reserve National

25%

13%

62% |

Reserves By Product Line

Life and Health

Whole Life

$2,666

Term Life

$225

A&H

$54 2%

Total $ 3,064

Interest Sensitive Life

$119

18

87%

4%

7% |

Financial Overview |

20

Financial Trends

Earned Premiums

Stable earned premiums over the

past several years

Income from continuing operations

has rebounded from low in 2008

-

Portfolio losses

-

Catastrophe losses

Post 2008 catastrophe exposure

significantly reduced in both P&C

and Career Agency businesses

$2,291

$2,287

$2,377

$2,456

$2,289

Catastrophes

& GW Write-off

2006

2007

2008

2009

2010

$259

$192

$137

$222

$230

Net Income

26

(39)

(22)

(5)

15

$248

$127

$21

$189

$179

Note:

P&C

and

Life

Net

Income

excluding

Catastrophe

Losses

and

a

Goodwill

Write-off

is

a

Non-GAAP

measure.

See

the

discussion

and

a

detailed

reconciliation

at

the

end

of

this

presentation.

2006

2007

2008

2009

2010

$(37)

$(26)

$(94)

$(28)

$(66)

Fireside

Reported

Segment

Net Income

P&C / Life

(ex. Cats &

2010 GW

Write-off) |

21

P&C Insurance Financial Results

Earned Premiums

Underlying Combined Ratios*

$945

$926

$931

$932

$888

2006

2007

2008

2009

2010

Kemper

$444

$449

$494

$528

$475

2006

2007

2008

2009

2010

Unitrin Specialty

$226

$258

$291

$346

$282

2006

2007

2008

2009

2010

Unitrin Direct

2006

2007

2008

2009

2010

Kemper

93.7%

96.7%

96.7%

93.6%

96.9%

2006

2007

2008

2009

2010

Unitrin Specialty

97.9%

98.9%

100.3%

98.7%

99.8%

2006

2007

2008

2009

2010

Unitrin Direct

106.1%

111.9%

119.8%

111.9%

117.3%

Cats / Loss Development (Favorable)/Unfavorable:

(2.4%)

(1.6%)

4.6%

(1.4%)

5.2%

(1.7%)

(3.3%)

(0.5%)

(0.7%)

1.4%

2.5%

2.3%

0.0%

(2.6%)

(1.8%)

GAAP Reported Combined Ratios:

91.3%

95.3%

101.3%

95.3%

98.8%

96.2%

96.5%

99.8%

98.2%

100.1%

108.6%

119.6%

119.8%

109.3%

110.1%

*Underlying

Combined Ratio is a Non-GAAP measure discussed at the end of

this presentation. |

22

Life and Health Insurance Financial Results

2006

2007

2008

2009

2010

$651

$654

$676

$661

$644

2006

2007

2008

2009

2010

Earned Premiums

Segment Net Income

Catastrophes

& GW Write-off

$102

$97

$52

$112

$95

$109

$104

$80

$116

$115

$(7)

$(7)

$(27)

$(4)

$(20) |

23

Auto only subprime lender

-

30+ year history with strong lifetime ROE

Run-off plan commenced March 2009

-

All deposits mature by Q3 2012

-

No new deposits since March 2009

-

No deposit rollovers since October 2009

Strong

balance

sheet

–

Tier

One

Capital

37%

(2)

$250 million expected to be returned to Unitrin

Run-off Asset: Fireside Bank

Loans 30 or More Days Delinquent

$19

$103

91%

44%

3/31/2009

12/31/2010

Loans 30 or more days

delinquent

Loans 30 or more days delinquent

as a % of reserves for loan losses

Net Automobile Loan Receivables Outstanding

$1,125

$381

3/31/2009

12/31/2010

Tier One Capital

(2)

16%

37%

3/31/2009

12/31/2010 |

Investment Portfolio |

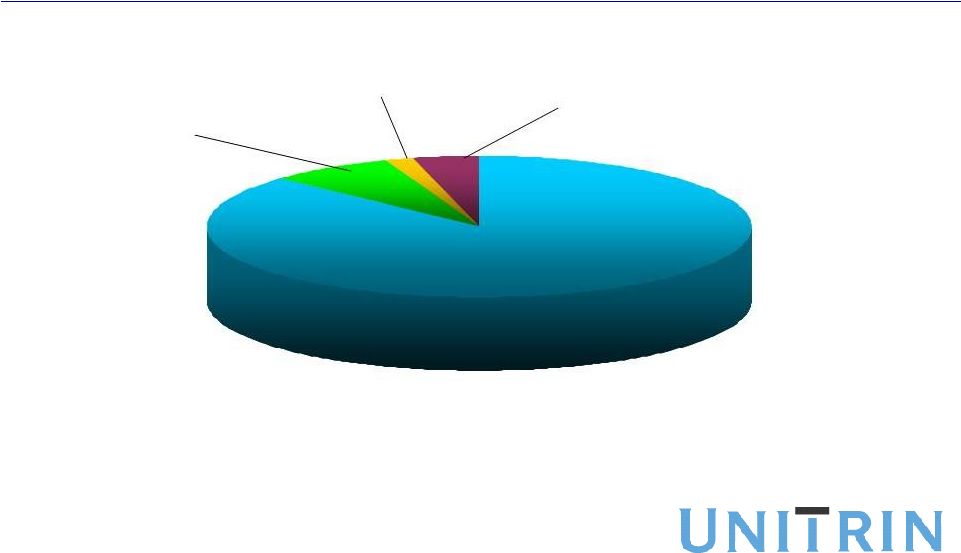

25

Investment Portfolio Overview

Total return investment strategy with an

emphasis on yield

No direct exposure to:

-

Enhanced Money Market Funds

-

Commercial Paper Investments

-

Sovereign Governments

-

Securities Lending

-

Credit or Other Derivatives

Minimal exposure to non-governmental

RMBS, CMBS, and CDO

Centralized investment function

Equities

$550

Real

Estate

$250

Other (3)

$245

LP

LLC

$328

Short

Term

$403

Fixed Maturities

$4,475

72%

6%

9%

5%

4%

4%

$6,251 million |

26

Fixed Income Portfolio

40%

$4,475 million

95% investment grade municipal, corporate & agency bonds

-

40% of portfolio relates to states, municipal entities and political subdivisions;

No state represents more than 4% of total fixed maturity investments

12%

48%

46%

State

G.O.’s

Revenue

Bonds

Local

Government

G. O.’s

24%

Pre-Refunded

20%

10%

States & Political

Subs

$1,793

U.S. Gov’t &

Agencies

$537

Corporate

$2,049 |

27

LP’s & LLC’s / Equities

-

Diversified across 30+ funds

-

Performed well during financial crisis

Secondary

Funds

$68

Private Equity /

LBO Funds

$31

Other Funds

$8

Mezzanine /

Senior Debt

$74

Distressed Debt

$206

51%

18%

17%

8%

2%

$403 million

(4)

4%

Equity

Co-Investments

$16

LP & LLC’s

Fair

value

%

Intermec

138

$

2.2%

Barclays Bank (Pfd.)

22

0.3%

Deutsche Bank (Pfd.)

20

0.3%

HSBC Holdings (Pfd.)

16

0.3%

Bank of America (Pfd.)

16

0.3%

Total

211

$

3.4%

Top 5 Holdings

33%

23%

7%

10%

8%

2%

Equities

$475 million

(5)

17%

Industrial

$158

Technology

$12

Other

$37

Consumer,

Non-cyclical

$47

Energy

$33

ETF

$79

Financial

$109 |

Capital and Liquidity |

Sound Balance Sheet

Strong liquidity at the holding company

Simple

capital

structure

–

no converts or hybrids

Low debt to total capitalization ratio of 22%

High quality investment portfolio

Highly rated reinsurance partners

Shareholders’

equity

of

$2.1B

/

$2.0B

ex.

AOCI

(6)

29 |

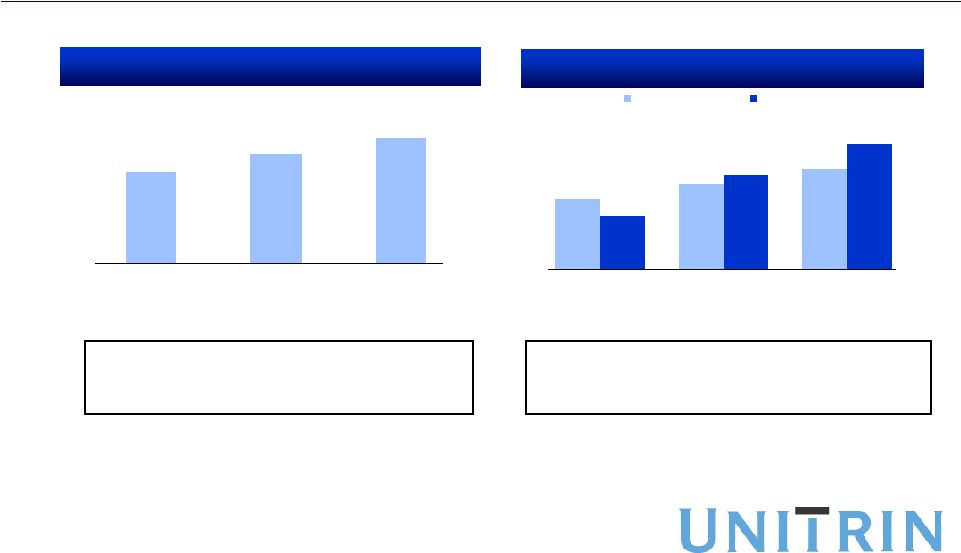

30

Strong Liquidity Profile

Operating Company Dividend Capacity

$170

$147

$123

$1,757

$1,859

$1,956

$1,649

$1,918

$2,113

Excl. AOCI

Incl. AOCI

U.S. GAAP Shareholders’

Equity

(6)

Growing Statutory Earnings

and Dividend Capacity

(6)

Improved Operating Results

and Asset Valuations

2008

2009

2010

2008

2009

2010 |

31

Earnings per Share

Book Value per Share

Delivered 13% Growth in Earnings

& Book Value per Share in 2010

Creating Shareholder Value

($0.47)

$2.64

$2.98

2008

2009

2010

2008

2009

2010

$26.46

$30.75

$34.61 |

Capital Deployment Priorities

1.

Fund Organic Growth

-

Maintain or improve margins in all lines

-

Build growth capital for improved pricing environment

2.

Acquisitions

-

Bolt-on Standard & Preferred opportunities

-

Geographic expansion in Non-standard

-

Leverage scale in Life operations

-

$300 million program announced February 2011

-

Maintain a flexible, measured approach

3.

Dividends

-

Remain competitive

-

Target around 1/3 of earnings

32

4.

Share Repurchase |

Investor Considerations

Unitrin is well positioned across personal lines market

-

Preferred, Standard & Non Standard product auto product suite &

homeowners -

Broad distribution capabilities; direct channel in place today to capture evolving

consumer buying preferences

Life & Health business is stable & accretive with potential for

upside A disciplined approach to capital management

-

Competitive, 3%+ dividend yield

-

$300 million repurchase program

-

Fireside Bank on track to free-up $250 million

-

Acquisition focus

33

Delivering Shareholder Value |

|

Non-GAAP

Measures Underlying Combined Ratio is a non-GAAP measure, which

is computed as the difference between the GAAP combined ratio, the effect of

catastrophes (excluding development of prior year catastrophes) on the combined ratio

and the effect of prior year reserve development (including development on prior year

catastrophes) on the combined ratio. The most directly comparable GAAP measure is the

combined ratio. We believe the underlying combined ratio is useful to investors and is

used by management to reveal the trends in our Property and Casualty business that may

be obscured by catastrophe losses and prior year reserve development. These

catastrophe losses cause our loss trends to vary significantly between periods as a

result of their incidence of occurrence and magnitude, and can have a significant impact on

the combined ratio. Prior year reserve developments are caused by unexpected loss development

on historical reserves. We believe it is useful for investors to evaluate these

components separately and in the aggregate when reviewing our underwriting

performance. The underlying combined ratio should not be considered a substitute for

the combined ratio and does not reflect the overall underwriting profitability of our

business. The P&C and Life Net Income excluding Catastrophe Losses / and a

Goodwill Write-off is a non-GAAP measure, which is computed

as reported Segment Net Income (Loss) from Kemper, Unitrin Specialty,

Unitrin Direct and Life and Health Insurance, excluding Catastrophe Losses

and a 2010 Reserve National Goodwill write-off. A detailed

reconciliation is on the following slide. The most directly comparable GAAP

measure is the Total Segment Net Income. We believe the P&C and Life

net income excluding catastrophe losses / and a Goodwill write-off is useful to investors

and is used by management to reveal the trends in business.

|

Reconciliation of Non-GAAP Measure

2006

2007

2008

2009

2010

P&C and Life Net Income excluding

Catastrophe Losses and a 2010 Goodwill Write-off

259

$

192

$

137

$

222

$

230

$

Catastrophe Losses

(37)

(26)

(94)

(28)

(51)

Reserve National Goodwill Write-off

-

-

-

-

(15)

Fireside Bank (In Run-off)

26

(39)

(22)

(5)

15

Total Segment Net Income as Reported

248

$

127

$

21

$

189

$

179

$ |

Footnotes

(1)

Source: SNL Financial based on 2009 Direct Premium Written

(2)

Ratio of Tier 1 Capital to total average assets

(3)

Primarily loans to policyholders

(4)

Includes $75 million of LP & LLC’s accounted under the Fair Value Method and

reported as Equity Securities

(5)

Excludes $75 million of LP & LLC’s accounted under the Fair Value Method and

reported as Equity Securities; includes $125 million of Preferred Stock

(6)

AOCI represents Accumulated Other Comprehensive Income reported in the company’s 10K

filings |