Attached files

| file | filename |

|---|---|

| 8-K - TRUSTMARK CORP 8-K 3-7-2011 - TRUSTMARK CORP | form8k.htm |

Raymond James Annual Investors Conference

Orlando, Florida

March 7, 2011

Orlando, Florida

March 7, 2011

Forward-Looking Statements

Certain statements contained in this document constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of

1995. You can identify forward-looking statements by words such as “may,” “hope,” “will,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,”

“estimate,” “predict,” “potential,” “continue,” “could,” “future” or the negative of those terms or other words of similar meaning. You should read statements

that contain these words carefully because they discuss our future expectations or state other “forward-looking” information. These forward-looking

statements include, but are not limited to, statements relating to anticipated future operating and financial performance measures, including net interest

margin, credit quality, business initiatives, growth opportunities and growth rates, among other things, and encompass any estimate, prediction,

expectation, projection, opinion, anticipation, outlook or statement of belief included therein as well as the management assumptions underlying these

forward-looking statements. (You should be aware that the occurrence of the events described under the caption “Risk Factors” in Trustmark’s filings with

the Securities and Exchange Commission could have an adverse effect on our business, results of operations and financial condition.) Should one or

more of these risks materialize, or should any such underlying assumptions prove to be significantly different, actual results may vary significantly from

those anticipated, estimated, projected or expected.

1995. You can identify forward-looking statements by words such as “may,” “hope,” “will,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,”

“estimate,” “predict,” “potential,” “continue,” “could,” “future” or the negative of those terms or other words of similar meaning. You should read statements

that contain these words carefully because they discuss our future expectations or state other “forward-looking” information. These forward-looking

statements include, but are not limited to, statements relating to anticipated future operating and financial performance measures, including net interest

margin, credit quality, business initiatives, growth opportunities and growth rates, among other things, and encompass any estimate, prediction,

expectation, projection, opinion, anticipation, outlook or statement of belief included therein as well as the management assumptions underlying these

forward-looking statements. (You should be aware that the occurrence of the events described under the caption “Risk Factors” in Trustmark’s filings with

the Securities and Exchange Commission could have an adverse effect on our business, results of operations and financial condition.) Should one or

more of these risks materialize, or should any such underlying assumptions prove to be significantly different, actual results may vary significantly from

those anticipated, estimated, projected or expected.

Risks that could cause actual results to differ materially from current expectations of Management include, but are not limited to, changes in the level of

nonperforming assets and charge-offs, local, state and national economic and market conditions, including the extent and duration of the current volatility

in the credit and financial markets, changes in our ability to measure the fair value of assets in our portfolio, material changes in the level and/or volatility

of market interest rates, the performance and demand for the products and services we offer, including the level and timing of withdrawals from our

deposit accounts, the costs and effects of litigation and of unexpected or adverse outcomes in such litigation, our ability to attract noninterest-bearing

deposits and other low cost funds, competition in loan and deposit pricing, as well as the entry of new competitors into our markets through de novo

expansion and acquisitions, economic conditions and monetary and other governmental actions designed to address the level and volatility of interest

rates and the volatility of securities, currency and other markets, the enactment of legislation and changes in existing regulations, or enforcement

practices, or the adoption of new regulations, changes in accounting standards and practices, including changes in the interpretation of existing

standards, that affect our consolidated financial statements, changes in consumer spending, borrowings and savings habits, technological changes,

changes in the financial performance or condition of our borrowers, changes in our ability to control expenses, changes in our compensation and benefit

plans, greater than expected costs or difficulties related to the integration of new products and lines of business, natural disasters, environmental

disasters, acts of war or terrorism and other risks described in our filings with the Securities and Exchange Commission.

nonperforming assets and charge-offs, local, state and national economic and market conditions, including the extent and duration of the current volatility

in the credit and financial markets, changes in our ability to measure the fair value of assets in our portfolio, material changes in the level and/or volatility

of market interest rates, the performance and demand for the products and services we offer, including the level and timing of withdrawals from our

deposit accounts, the costs and effects of litigation and of unexpected or adverse outcomes in such litigation, our ability to attract noninterest-bearing

deposits and other low cost funds, competition in loan and deposit pricing, as well as the entry of new competitors into our markets through de novo

expansion and acquisitions, economic conditions and monetary and other governmental actions designed to address the level and volatility of interest

rates and the volatility of securities, currency and other markets, the enactment of legislation and changes in existing regulations, or enforcement

practices, or the adoption of new regulations, changes in accounting standards and practices, including changes in the interpretation of existing

standards, that affect our consolidated financial statements, changes in consumer spending, borrowings and savings habits, technological changes,

changes in the financial performance or condition of our borrowers, changes in our ability to control expenses, changes in our compensation and benefit

plans, greater than expected costs or difficulties related to the integration of new products and lines of business, natural disasters, environmental

disasters, acts of war or terrorism and other risks described in our filings with the Securities and Exchange Commission.

Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations

will prove to be correct. Except as required by law, we undertake no obligation to update or revise any of this information, whether as the result of new

information, future events or developments or otherwise.

will prove to be correct. Except as required by law, we undertake no obligation to update or revise any of this information, whether as the result of new

information, future events or developments or otherwise.

2

3

ü Strong market share in legacy markets with growth potential

in Houston and Memphis

in Houston and Memphis

ü Diversified and stable business mix

ü Proven ability to generate superior profitability through the

cycle

cycle

ü Solid credit quality as a result of diligent credit risk

management

management

ü Robust capital position provides strategic flexibility

Investment Thesis

Trustmark is Uniquely Positioned to Capitalize

on Market Opportunities

on Market Opportunities

4

Strong Market Share in Legacy Markets

Growth Opportunities in Houston and Memphis

Growth Opportunities in Houston and Memphis

Strong Market Share

2010 Financial Highlights

Total Assets $9.6 billion

Total Loans HFI $6.1 billion

Total Deposits $7.0 billion

TCE/TA 9.11%

Risk-based Capital Ratio 15.77%

Net Income $100.6 million

ROAA 1.08%

Return on Average Tangible

Common Equity 12.31%

Integrated Provider of Financial Solutions

• 150 Retail Banking Centers

• Commercial Banking and Treasury Services

• Mortgage Banking

• Wealth Management

• Insurance

Total Shareholder Return (as of 12/31/2010)

One Year 14.97%

Three Year 12.36%

Five Year 10.10%

5

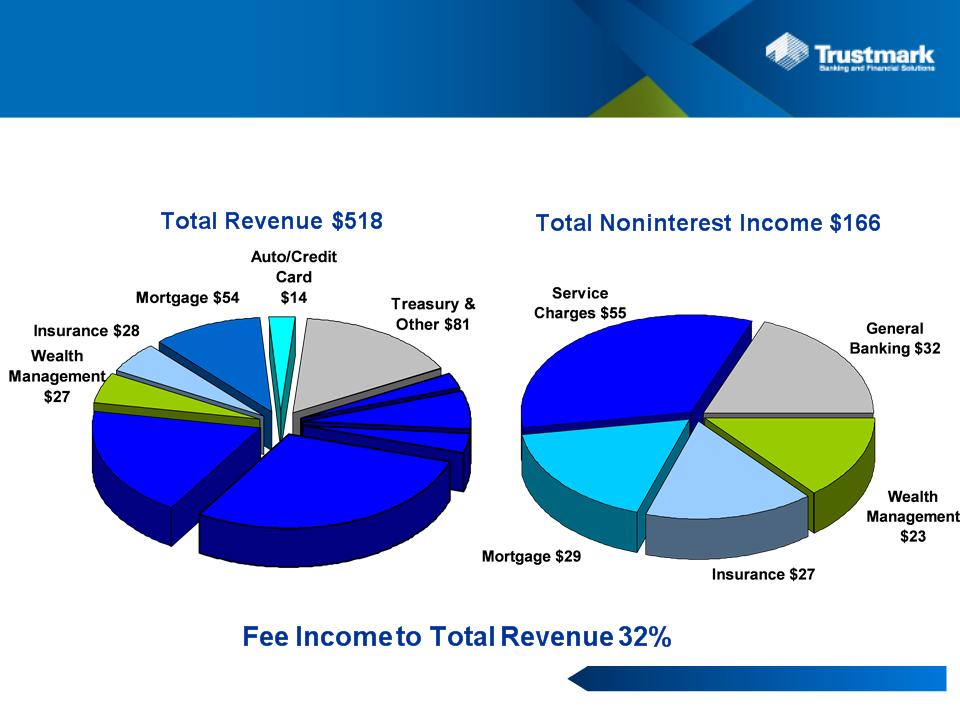

Diversified and Stable Business Mix

($ in millions)

18%

33%

14%

16%

19%

11%

5%

5%

3%

16%

Jackson 29%

FL Panhandle 2%

Houston, TX 7%

Memphis, TN 3%

Commercial -

Retail Banking

$313

MS-Other 19%

For The Year Ended December 31, 2010

Diversified Revenue Base

6

Proven Ability to Generate Superior Profitability

($ in millions)

Superior Profitability

|

Profitability and Key Ratios

|

2009

|

Q1-10

|

Q2-10

|

Q3-10

|

Q4-10

|

2010

|

|

Net Income Available to Common Shareholders

|

$73.0(1) |

$23.5

|

$26.2

|

$25.9

|

$25.2

|

$100.6

|

|

Return on Average Assets

|

0.98%

|

1.02%

|

1.13%

|

1.11%

|

1.07%

|

1.08%

|

|

Return on Average Tangible Common Equity

|

10.80%(1)

|

11.98%

|

12.92%

|

12.38%

|

11.96%

|

12.31%

|

(1) TRMK net income available to common shareholders includes $20 million of dividends and discount

accretion on $215 million of TARP Preferred Stock redeemed in the fourth quarter of 2009.

accretion on $215 million of TARP Preferred Stock redeemed in the fourth quarter of 2009.

(2) Metric not available for STI

Source: SNL Financial

2010 Return on Average Assets

2010 Return on Average Tangible Common Equity (2)

ü Best in class margin resulting from disciplined loan and deposit pricing and prudent investment

portfolio management

portfolio management

ü Management’s focus on expense initiatives has translated into a top tier operating platform

... Driven by Best in Class Net Interest Margin

and Efficiency Ratio

and Efficiency Ratio

Core Earnings Strength

(1) Efficiency ratio calculated as noninterest expense before foreclosed property expense, amortization of intangibles, and goodwill impairments as a percent of net interest income (fully taxable

equivalent, if applicable) and noninterest revenues, excluding only gains from securities transactions and nonrecurring items.

equivalent, if applicable) and noninterest revenues, excluding only gains from securities transactions and nonrecurring items.

Source: SNL Financial

Balanced Loan Portfolio

Consumer Loans $2,070

Commercial Loans $3,990

2%

37%

2%

10%

49%

13%

19%

27%

19%

8%

14%

Total Loans Held for Investment $6,060

Balanced Loan Portfolio

ü Total loans held for investment decreased $259.6 million from the prior year to $6.1 billion

• Construction and land development loans declined $246.8 million

• Indirect auto portfolio declined $192.2 million

• Loans in other business lines expanded $179.4 million

December 31, 2010

($ in millions)

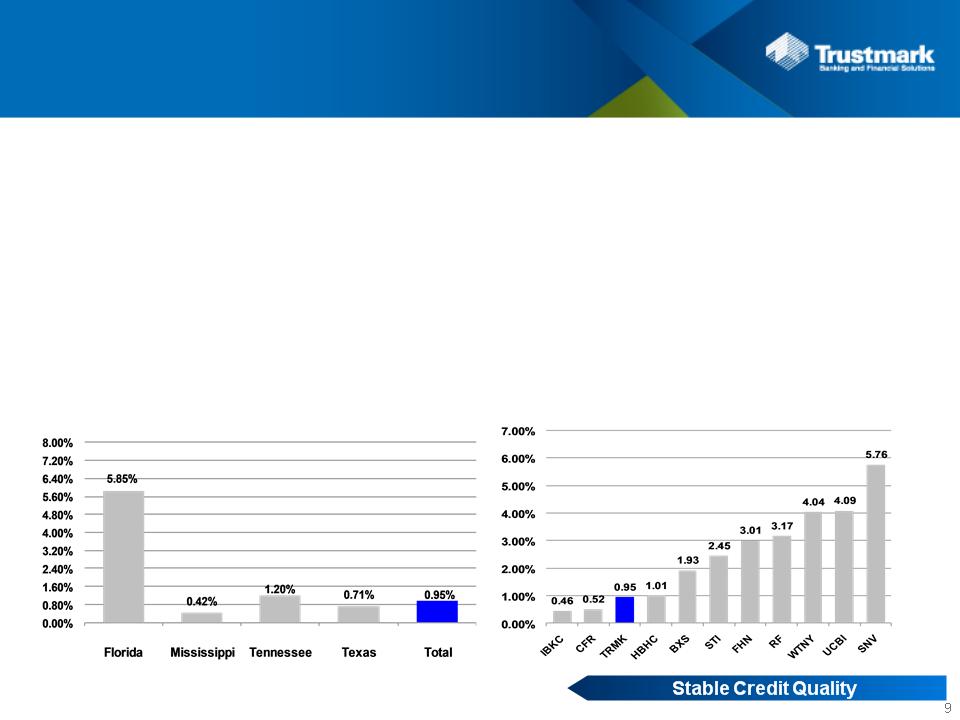

Prudent Credit Risk Management

ü During 2010, the Florida construction and land development portfolio was reduced by 33.6% to $132.0 million. At

year end 2010, the associated reserve on this portfolio was $16.4 million, or 12.41%.

year end 2010, the associated reserve on this portfolio was $16.4 million, or 12.41%.

ü Allocation of $93.5 million allowance for loan losses represented 1.94% of commercial loans and 0.78% of consumer

and home mortgage loans, resulting in an allowance to total loans of 1.54%

and home mortgage loans, resulting in an allowance to total loans of 1.54%

|

|

Florida

|

Mississippi (1)

|

Tennessee (2)

|

Texas

|

Total

|

|

Total Loans (including HFS)

|

$444.4

|

$4,449.0

|

$533.2

|

$786.6

|

$6,213.3

|

|

Nonaccrual Loans

|

$53.8

|

$39.8

|

$14.7

|

$34.6

|

$142.9

|

|

Other Real Estate

|

$32.4

|

$24.2

|

$16.4

|

$13.7

|

$86.7

|

|

Nonperforming Assets

|

$86.1

|

$64.0

|

$31.1

|

$48.4

|

$229.6

|

|

Nonperforming Assets/Total Loans + ORE

|

18.06%

|

1.43%

|

5.66%

|

6.05%

|

3.64%

|

|

Provision for Loan Losses

|

$19.9

|

$14.2

|

$5.6

|

$9.8

|

$49.5

|

|

Net Charge-offs

|

$28.7

|

$19.0

|

$6.6

|

$5.5

|

$59.7

|

(1) Mississippi includes Central and Southern Mississippi regions.

(2) Tennessee includes Memphis, Tennessee and Northern Mississippi regions.

Source: SNL Financial

Peer 2010 NCOs/Average Loans

December 31, 2010

($ in millions)

TRMK 2010 NCOs/Average Loans

Dependable, Low Cost Core Funding Base

Total Deposits $7,045

Source: SNL Financial and company reports

Loans HFI / Deposits

26%

4%

16%

30%

23%

December 31, 2010

($ in millions)

Robust Capital Position

Provides Strategic Flexibility

Provides Strategic Flexibility

|

|

Q4-09

|

Q1-10

|

Q2-10

|

Q3-10

|

Q4-10

|

|

Tangible Common Equity / Tangible Assets

|

8.67%

|

9.11%

|

9.32%

|

9.34%

|

9.11%

|

|

Tier 1 Risk-Based Capital Ratio

|

12.61%

|

13.15%

|

13.53%

|

13.75%

|

13.77%

|

|

Total Risk-Based Capital Ratio

|

14.58%

|

15.15%

|

15.53%

|

15.75%

|

15.77%

|

ü Optimized capital structure; continued leadership position in capital strength among mid-cap peers

ü Existing capital base could support $2 billion to $3 billion in additional assets while maintaining appropriate capital

ratios.

ratios.

Robust Capital Position

($ in millions)

Robust Capital Position and Attractive Dividend

Tangible Common Equity /

Tangible Assets (3)

Tangible Assets (3)

ü Given quality and stability of earnings, Trustmark has increased its dividend over time and maintained it through

the cycle

the cycle

ü Trustmark is one of the 28 largest banks (1) in the U.S. that maintained its dividend since September 2007

Trustmark’s Annual

Dividend - Last 20 Years

Dividend - Last 20 Years

Dividend Yield (2)

(3) Metric not available for STI

Source: SNL Financial

Well Positioned for Continued Success

|

|

Industry

|

TRMK

|

|

Economy

|

ü Slow recovery with continued uncertainty

|

ü Trustmark’s core franchise provides stability and profitability

ü Growth opportunities in Houston and Memphis (and

throughout the franchise) when economy normalizes |

|

Interest Rates

|

ü Exceptionally low interest rates

|

ü Maintain net interest income

|

|

Credit

|

ü Continued elevation in credit costs

|

ü Anticipate additional reductions in problem assets and

provisioning |

|

Regulatory

Reform |

ü Reg E and Durbin Amendment provide

revenue headwinds |

ü Evaluating products and services structure to mitigate

potential impact of regulatory reform ü Reg E - Opt in 72% response rate, 79% accepted OD

protection; • Potential revenue reduction of Opt-in estimated at $3 to

$4 million in 2011

• Potential revenue reduction of additional regulatory

guidance estimated at $3 to $5 million in 2011

ü Durbin Amendment - potential revenue reduction of $4 to $6

million in 2011 if implemented as written and in the estimated time frame |

|

|

ü Anticipate higher regulatory capital

requirements |

ü Robust capital position provides significant flexibility;

capacity to increase assets by $2 to $3 billion and maintain capital at appropriate levels |

|

Consolidation

|

ü Sluggish economic environment coupled with

increased credit costs and reduced revenue from regulatory reform will likely result in increased consolidation |

ü Ability to leverage existing capital base

ü Proven capabilities to successfully acquire and integrate

financial services firms |

13

Strategic Priorities

ü Continue to manage through challenging business cycle

ü Aggressively work to dispose of ORE

ü Maintain fortress balance sheet and appropriate capital ratios

ü Position organization for success in new regulatory reform environment

ü Prudent investments to support revenue growth

ü Seek strategic opportunities to enhance long-term shareholder value

Priorities in 2011

16

Supplemental Information

17

Jackson Metro

Ø Trustmark has $2.1 billion in loans

and $3.4 billion in deposits+

and $3.4 billion in deposits+

Ø Maintain market dominance

through cross-selling and

retention

through cross-selling and

retention

|

County

|

2010

Population

|

2010-15

Projected

Population Growth |

Deposit

Market Share++ |

TRMK

Banking Centers |

|

Hinds

|

250,044

|

-0.67%

|

40.58%

|

21

|

|

Rankin

|

146,177

|

9.82%

|

33.09%

|

11

|

|

Madison

|

97,343

|

11.41%

|

21.54%

|

8

|

|

TOTAL

|

493,564

|

4.82%

|

35.05%

|

40

|

+ As of 12/31/2010

++ As of 6/30/2010

Source: SNL Financial and ESRI

Banking center

18

Houston MSA

Ø Trustmark has $787 million in loans and $456

million in deposits+

million in deposits+

Ø Building stronger Commercial, Retail, and

Wealth Management platforms

Wealth Management platforms

|

Market

|

2010

Population

|

2010-15

Projected Population Growth

|

Deposit

Market Share++ |

TRMK

Banking Centers |

|

Houston MSA

|

6,017,013

|

10.46%

|

0.37%

|

16

|

+ As of 12/31/2010

++ As of 6/30/2010

Source: SNL Financial and ESRI

Banking center

19

Memphis MSA

Ø Trustmark has $399 million in

loans and $637 million in deposits+

loans and $637 million in deposits+

Ø Focus on middle market

commercial and real estate lending

commercial and real estate lending

|

Market

|

2010

Population

|

2010-15

Projected

Population Growth |

Deposit

Market Share++ |

TRMK

Banking Centers |

|

Memphis MSA

|

1,325,833

|

4.28%

|

2.83%

|

22

|

Banking center

+ As of 12/31/2010

++ As of 6/30/2010

Source: SNL Financial and ESRI

20

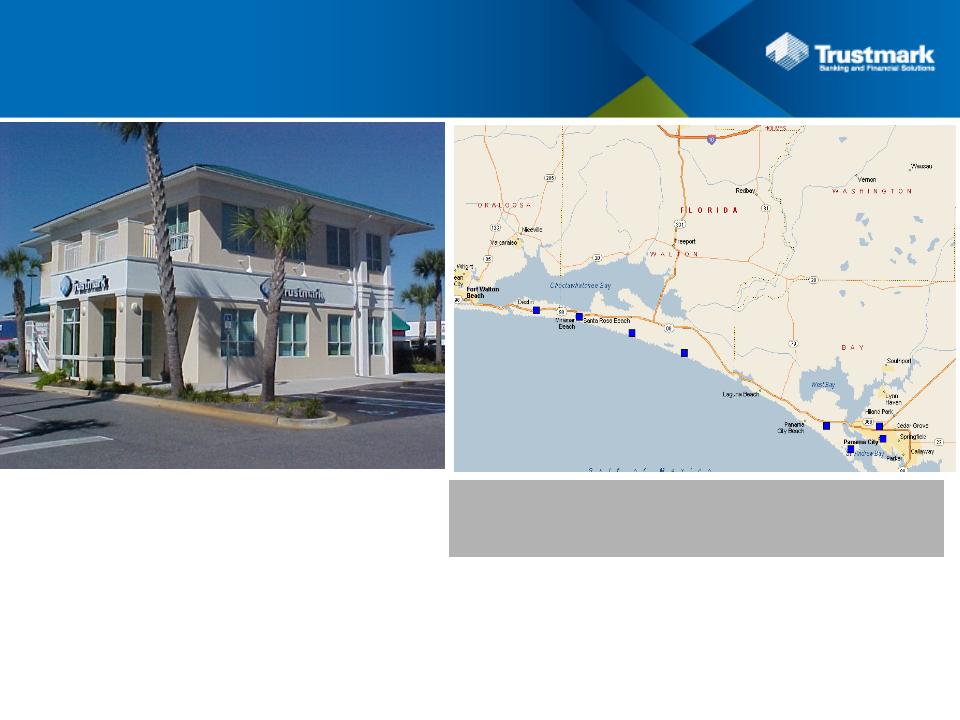

Florida Panhandle

Ø Trustmark has $444 million in loans

and $218 million in deposits+

and $218 million in deposits+

Ø Cross-sell to Fisher-Brown’s

commercial insurance customers

commercial insurance customers

Ø Focus on commercial lending and

expansion of wealth management

expansion of wealth management

|

County

|

2010

Population

|

2010-15

Projected

Population Growth |

Deposit

Market Share++ |

TRMK

Banking Centers |

|

Bay

|

170,196

|

2.72%

|

4.57%

|

4

|

|

Okaloosa

|

191,856

|

3.29%

|

1.32%

|

1

|

|

Walton

|

57,960

|

9.34%

|

7.67%

|

3

|

|

Total

|

420,012

|

3.89%

|

3.27%

|

8

|

+ As of 12/31/2010

++ As of 6/30/2010

Source: SNL Financial and ESRI

Owner-Occupied CRE

December 31, 2010

December 31, 2010

($ in thousands)

(1) Mississippi includes Central and Southern Mississippi regions.

(2) Tennessee includes Memphis, Tennessee and Northern Mississippi regions.

21

Income Producing CRE

December 31, 2010

December 31, 2010

($ in thousands)

(1) Mississippi includes Central and Southern Mississippi regions.

(2) Tennessee includes Memphis, Tennessee and Northern Mississippi regions.

22

($ in thousands)

(2) Tennessee includes Memphis, Tennessee and Northern Mississippi regions.

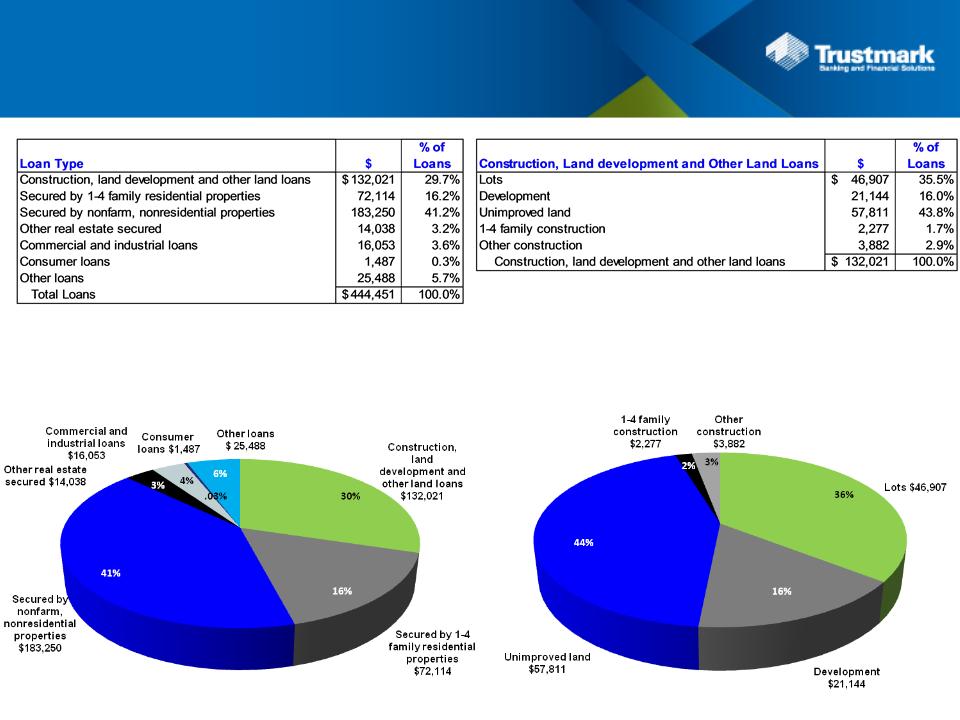

Construction, Land Development and Other Land Loans

December 31, 2010

December 31, 2010

23

Florida Loans

December 31, 2010

December 31, 2010

($ in thousands)

By Loan Type

$444 million

Construction, Land Development and

Other Land Loans

Other Land Loans

$132 million

24

Florida Loans

December 31, 2010

December 31, 2010

($ in thousands)

1) Criticized loans equal all special mention and classified loans.

2) Special mention loans exhibit potential credit weaknesses that, if not resolved, may ultimately result in a more severe classification.

3) Classified loans include those loans identified by management as exhibiting well-defined credit weaknesses that may jeopardize repayment in full of the debt.

4) All nonaccrual loans over $500 thousand are individually assessed for impairment. Impaired loans have been determined to be collateral dependent and assessed using a

fair value approach. Fair value estimates begin with appraised values, normally from recently received and reviewed appraisals. Appraised values are adjusted down for

costs associated with asset disposal. At the time a loan is deemed to be impaired, the full difference between book value and the most likely estimate of the asset’s net

realizable value is charged off. However, as subsequent events dictate and estimated net realizable values decline, required reserves are established.

fair value approach. Fair value estimates begin with appraised values, normally from recently received and reviewed appraisals. Appraised values are adjusted down for

costs associated with asset disposal. At the time a loan is deemed to be impaired, the full difference between book value and the most likely estimate of the asset’s net

realizable value is charged off. However, as subsequent events dictate and estimated net realizable values decline, required reserves are established.

25

26

Contact Information

Trustmark Corporation’s common stock is listed on the NASDAQ National Market System and is traded under the

symbol TRMK. Additional information is available at www.trustmark.com.

symbol TRMK. Additional information is available at www.trustmark.com.

Investor Inquiries:

Louis E. Greer

Treasurer and Principal Financial Officer

601-208-2310

lgreer@trustmark.com

F. Joseph Rein, Jr.

Senior Vice President

601-208-6898

jrein@trustmark.com

Shareholder Services

Trustmark’s shareholder services are provided by American Stock Transfer & Trust Company, LLC .

Trustmark Corporation

c/o American Stock Transfer & Trust Co.

Operations Center

6201 15th Avenue

Brooklyn, NY 11219

(877) 476-4393

info@amstock.com

www.amstock.com