Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT ON FORM 8-K - James River Coal CO | jrcc_8k-030611.htm |

| EX-2.1 - PURCHASE AGREEMENT - James River Coal CO | jrcc_8k-ex201.htm |

| EX-99.1 - PRESS RELEASE - James River Coal CO | jrcc_8k-ex9901.htm |

| EX-10.2 - CONSENT AND THIRD AMENDMENT TO AMENDED AND RESTATED REVOLVING CREDIT AGREEMENT - James River Coal CO | jrcc_8k-ex1002.htm |

| EX-10.1 - SENIOR BRIDGE FACILITY COMMITMENT LETTER - James River Coal CO | jrcc_8k-ex1001.htm |

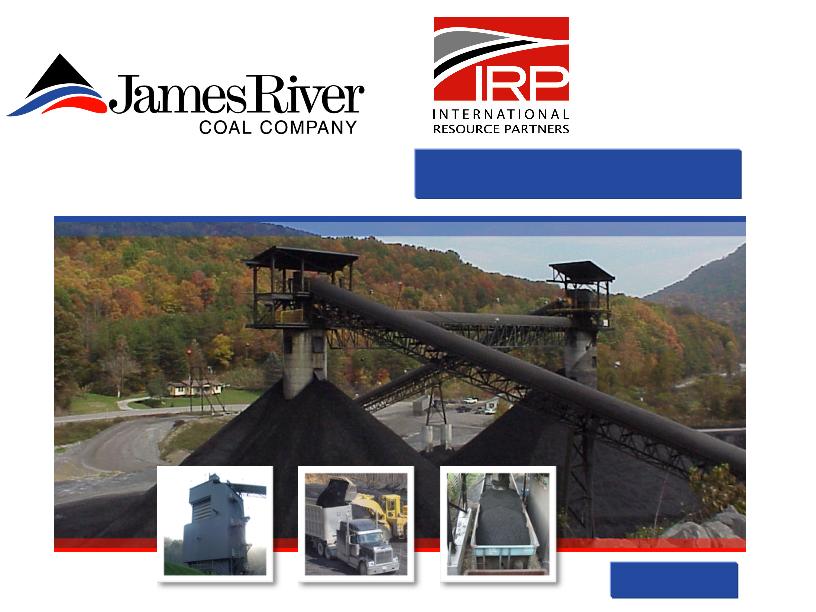

Exhibit 99.2

Transaction Overview

Logan and Kanawha

Logan and Kanawha

March 2011

2

Forward-Looking Statements

Certain statements in this Shareholder Update, and other written or oral statements made by or on behalf of us are

"forward-looking statements" within the meaning of the federal securities laws. Statements regarding future events

and developments and our future performance, as well as management's expectations, beliefs, plans, estimates or

projections relating to the future, are forward-looking statements within the meaning of these laws. Forward looking

statements include, without limitation, statements regarding future contract mine production, market improvements,

industry demand, inventory and purchasing patterns. These forward-looking statements are subject to a number of

risks and uncertainties. These risks and uncertainties include, but are not limited to, the following: the risk that the

business of International Resource Partners L.P. will not be integrated successfully with our businesses or such

integration may be more difficult, time-consuming or costly than expected; uncertainty of our expected financial

performance following completion of the proposed transaction; our ability to achieve the cost savings and synergies

contemplated by the proposed transaction within the expected time frame; disruption from the proposed transaction

making it more difficult to maintain relationships with customers, employees or suppliers; change in the demand for

coal by electric utility customers, as well as the perceived benefits of alternative sources of energy; the loss of one or

more of our largest customers; inability to secure new coal supply agreements or to extend existing coal supply

agreements at market prices; our dependency on one railroad for transportation of a large percentage of our

productions; failure to exploit additional coal reserves; the risk that reserve estimates and pension and post-retirement

benefit liabilities are inaccurate; failure to diversify our operations; increased capital expenditures; encountering

difficult mining conditions; inherent complexities associated with mining in Central Appalachia including special

dangers and risks of underground mining; increased costs of complying with mine health and safety regulations;

bottlenecks or other difficulties in transporting coal to our customers; delays in the development of new mining

projects; increased costs of raw materials; the effects of litigation, regulation and competition; lack of availability of

financing sources; our compliance with debt covenants; the risk that we are unable to successfully integrate acquired

asset into our business; and the other risks detailed in our reports filed with the Securities and Exchange Commission

(SEC).

"forward-looking statements" within the meaning of the federal securities laws. Statements regarding future events

and developments and our future performance, as well as management's expectations, beliefs, plans, estimates or

projections relating to the future, are forward-looking statements within the meaning of these laws. Forward looking

statements include, without limitation, statements regarding future contract mine production, market improvements,

industry demand, inventory and purchasing patterns. These forward-looking statements are subject to a number of

risks and uncertainties. These risks and uncertainties include, but are not limited to, the following: the risk that the

business of International Resource Partners L.P. will not be integrated successfully with our businesses or such

integration may be more difficult, time-consuming or costly than expected; uncertainty of our expected financial

performance following completion of the proposed transaction; our ability to achieve the cost savings and synergies

contemplated by the proposed transaction within the expected time frame; disruption from the proposed transaction

making it more difficult to maintain relationships with customers, employees or suppliers; change in the demand for

coal by electric utility customers, as well as the perceived benefits of alternative sources of energy; the loss of one or

more of our largest customers; inability to secure new coal supply agreements or to extend existing coal supply

agreements at market prices; our dependency on one railroad for transportation of a large percentage of our

productions; failure to exploit additional coal reserves; the risk that reserve estimates and pension and post-retirement

benefit liabilities are inaccurate; failure to diversify our operations; increased capital expenditures; encountering

difficult mining conditions; inherent complexities associated with mining in Central Appalachia including special

dangers and risks of underground mining; increased costs of complying with mine health and safety regulations;

bottlenecks or other difficulties in transporting coal to our customers; delays in the development of new mining

projects; increased costs of raw materials; the effects of litigation, regulation and competition; lack of availability of

financing sources; our compliance with debt covenants; the risk that we are unable to successfully integrate acquired

asset into our business; and the other risks detailed in our reports filed with the Securities and Exchange Commission

(SEC).

─ $475 million on a cash-free, debt-free basis

─ 100% cash consideration

Consideration

Synergies

Approvals

Capital

structure

structure

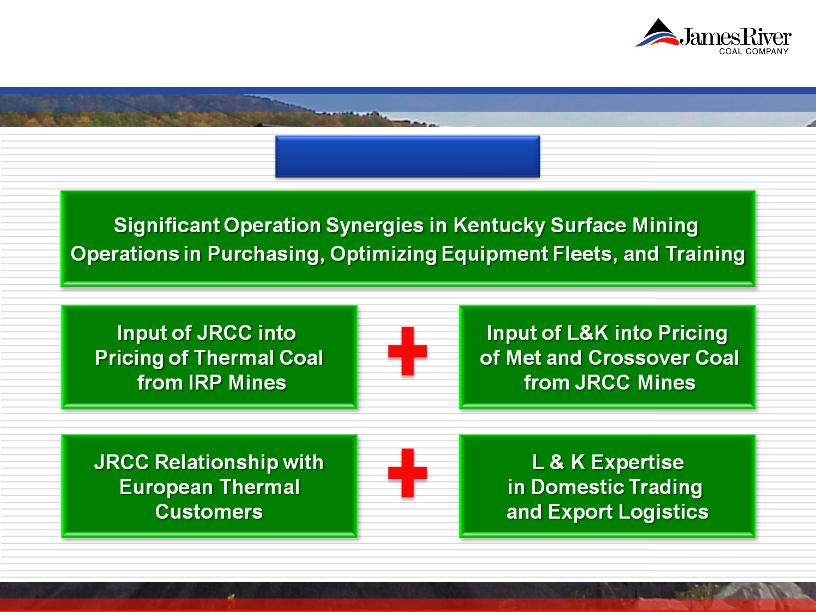

─ Synergies expected through complementary marketing strengths

─ $375 million in committed financing plus existing cash balances

─ Plan to access capital markets in place of the committed

financing

financing

─ Expect to maintain a conservative capital structure

─ Approved by the boards of James River and IRP

─ No significant regulatory issues expected

Closing

─ Transaction expected to close in the first half of 2011

IRP and L&K Overview

Accretive

─ Expected to be Accretive to Earnings Per Share and Cash Flow

Per Share in Year 1, Without Synergies

Per Share in Year 1, Without Synergies

4

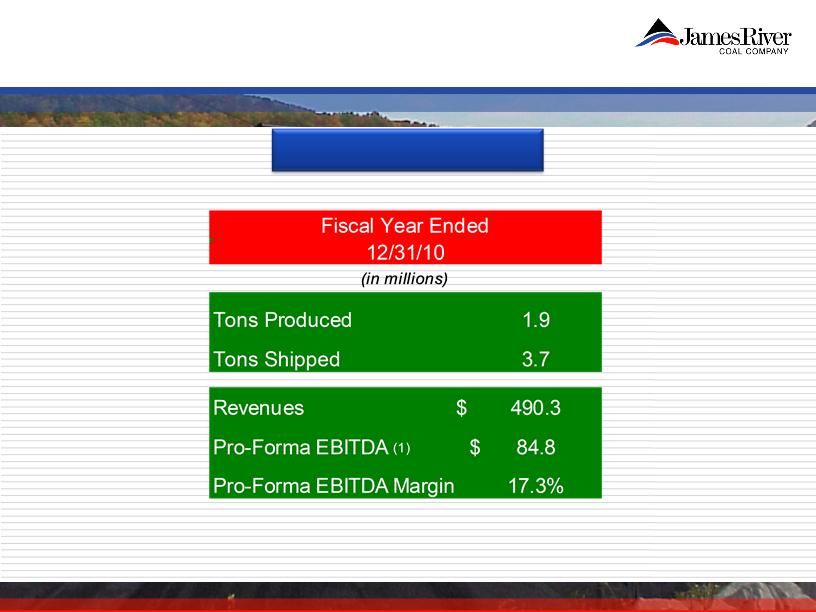

IRP and L&K Overview

Financial Summary

(1) Pro-Forma Adjustments Contained in Press Release

(1) Pro-Forma Adjustments Contained in Press Release

─ 9 Operating Mines and 136 Million Tons of Reserves and

Resources in Central Appalachia

Resources in Central Appalachia

Adds Size and Scale

Broadens

product base

product base

Solid

credit profile

credit profile

IRP Focus on

Operating Margins

Operating Margins

─ Adds High Quality Metallurgical Coal Shipments

─ IRP 2010 Pro-Forma EBITDA Margins of 17.3%

─ Union-free workforce and minimal legacy liabilities

5

Global Coal

Marketing Group

Marketing Group

─ Substantial Presence in Global Seaborne Coal Markets

─ Opportunity to Optimize a Broader Base of Coal Sales Contracts

IRP and L&K Overview

New Orleans, LA

Mobile, AL

Norfolk, VA

Newport News, VA

Port

Ohio

Kentucky

W. Virginia

IRP and L&K Overview

Laurel Mountain Resources

Prestonsburg, Kentucky

Active Surface Mines: 3

2010 Production: 0.5 MM

Rail Loadout Facility: 1

6

IRP Operations Map

Hampden Coal Company

Gilbert, WV

Active Underground Mines: 5

Active Surface Mines: 1

2010 Production: 1.4 MM

Rail Loadout Facilities: 3

7

JRCC Combined Operations

Indiana

Indiana

Kentucky

Kentucky

West

West

Virginia

Virginia

Hampden Coal

Hampden Coal

Laurel Mt.

Laurel Mt.

McCoy

McCoy

Leeco

Leeco

Blue Diamond

Blue Diamond

Bledsoe

Bledsoe

Bell

Bell

Triad

Triad

36 Mines

23 Underground

13 Surface

4 High Wall Miner

11 Preparation Plants

2,500 Employees

IRP and L&K Overview

8

IRP and L&K Overview

IRP Reserves and Resources

Thermal Coal

75 Million Tons

Met Coal

61 Million Tons

Source: Marshall Miller SEC Guide 7 Reserve Report Dated 12/31/10

Source: Marshall Miller SEC Guide 7 Reserve Report Dated 12/31/10

9

Rail Loadout Facilities

§ 1 NS Unit Train Rail Loadout Facility in

West Virginia

West Virginia

§ 2 CSX Unit Train Rail Loadout Facilities

in West Virginia and Kentucky

in West Virginia and Kentucky

§ 1 CSX Rail Loadout Facility in West

Virginia

Virginia

Big Sandy River Transportation

§ Long-term relationships with storage

and transportation companies to ship

coal via the Big Sandy River in Eastern

Kentucky

and transportation companies to ship

coal via the Big Sandy River in Eastern

Kentucky

IRP and L&K Overview

IRP

Transportation

Transportation

10

IRP and L&K Overview

Logan & Kanawha Overview

● Markets Metallurgical and Steam Coal Produced on IRP Properties

● Markets Metallurgical and Steam Coal Produced on IRP Properties

● Purchases and Resells Blended Coal Under the L&K Brand Name

● Purchases and Resells Blended Coal Under the L&K Brand Name

● Oldest Independent Coal Marketing Company in the United States,

Founded in 1915

Founded in 1915

● Oldest Independent Coal Marketing Company in the United States,

Founded in 1915

Founded in 1915

● 24 Active Customers in 8 Countries

● 24 Active Customers in 8 Countries

● One of Three U.S. Sales Companies that Sell Directly to State-Owned

Indian Steel Producers

Indian Steel Producers

● One of Three U.S. Sales Companies that Sell Directly to State-Owned

Indian Steel Producers

Indian Steel Producers

● One of the Largest Suppliers of U.S. Coal to the Indian Market

● One of the Largest Suppliers of U.S. Coal to the Indian Market

● Real-Time Expertise and Knowledge of Global Coal Markets

● Real-Time Expertise and Knowledge of Global Coal Markets

Logan & Kanawha Global Sales

11

IRP and L&K Overview

IRP and L&K Overview

Logan and Kanawha Contract Position

A Solid History and a Bright Future

13

IRP and L&K Overview

Possible Synergies

14

Addition of

high-quality

high-quality

metallurgical coal

reserves and

production

production

Substantial

presence in

global seaborne

global seaborne

coal markets

Opportunity to

optimize broader

base of coal

sales contracts

sales contracts

Focus on

operating margin

Union-free

workforce with

minimal legacy

liabilities

Increase in size

and scale in

Central Appalachia

IRP and L&K Overview

Accretive to EPS

and CFPS

15

Question and Answer

Session

Session