Attached files

| file | filename |

|---|---|

| 8-K - STERLING BANCORP | i00100_sterling-8k.htm |

Common Stock Offering

March 2011

© Sterling Bancorp, March 2011

Certain statements contained or incorporated by reference in this presentation, including but not limited to, statements

concerning future results of operations or financial position, borrowing

capacity and future liquidity, future investment

results, future credit exposure, future loan losses and plans and objectives for future operations, economic environment and

other statements contained herein regarding matters that are not historical

facts, are “forward-looking statements” as

defined in the Securities Exchange Act of 1934. These statements are not historical facts but instead are subject to

numerous assumptions, risks and uncertainties, and represent only our belief regarding

future events, many of which, by

their nature, are inherently uncertain and outside our control. Any forward-looking statements the Company may make

speak only as of the date on which such statements are made. The Company’s actual results

and financial position may

differ materially from the anticipated results and financial condition indicated in or implied by these forward-looking

statements, and the Company makes no commitment to update or revise forward-looking statements in order

to reflect new

information or subsequent events or changes in expectations.

Factors that could cause the Company’s actual results to differ materially from those in the forward-looking statements

include, but are not limited to, the following: inflation, interest

rates, market and monetary fluctuations; geopolitical

developments including acts of war and terrorism and their impact on economic conditions; the effects of, and changes in,

trade, monetary and fiscal policies and laws, including interest rate policies

of the Federal Reserve Board; changes,

particularly declines, in general economic conditions and in the local economies in which the Company operates; the

financial condition of the Company’s borrowers; competitive pressures on loan and deposit

pricing and demand; changes in

technology and their impact on the marketing of new products and services and the acceptance of these products and

services by new and existing customers; the willingness of customers to substitute competitors’ products

and services for

the Company’s products and services; the impact of changes in financial services laws and regulations (including laws

concerning taxes, banking, securities and insurance); changes in accounting principles, policies and guidelines;

the risks

and uncertainties described in ITEM 1A. RISK FACTORS on pages 17–27 of the Company’s Form 10-K for the year

ended December 31, 2010; other risks and uncertainties

described from time to time in press releases and other public

filings; and the Company’s performance in managing the risks involved in any of the foregoing. The foregoing list of

important

factors is not exclusive, and the Company will not update any forward-looking statement, whether written or

oral, that may be made from time to time.

Safe Harbor Statement

This presentation is for informational purposes only and does not constitute an offer to sell securities. The

Company has filed a preliminary prospectus supplement and a registration statement

(including a base prospectus)

with the Securities and Exchange Commission (“SEC”) for the offering to which this communication relates.

Before you invest, you should read the preliminary prospectus supplement and the base prospectus, and other

documents the Company has filed with the SEC for more complete information about the Company and this

offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov.

Alternatively, copies of the preliminary prospectus

supplement and the base prospectus may also be obtained from

the Company or any underwriter participating in the offering if you request it by calling toll-free 1-866-699-6332.

Rule 433 Legend

3

Offering Terms

Issuer: Sterling Bancorp

Symbol: NYSE: STL

Security Offered: Common Shares, par value $1.00 per share

Offering Size: $35 Million (approximately)

Over-allotment Option: 15%

Use of Proceeds: The repurchase of the Issuer’s TARP CPP preferred shares,

separately or together with the

warrant for Common Shares held by

the U.S. Department of the Treasury, subject to the receipt of

regulatory approval, the financing of possible acquisitions or

the extension of credit to, or the funding of investments in, our

subsidiaries and for general corporate purposes

Book-Running Manager: Stifel Nicolaus Weisel

Co-Manager: Keefe, Bruyette & Woods, Inc.

4

Unique New York Metro Community Bank Franchise

Investment Merits

Current Market Environment Presents a Unique Opportunity to Deploy Capital Toward both

Organic Growth and Acquisitions at Advantageous Pricing Levels

Proven Management Team with Extensive NYC Banking Experience

High Quality Deposit Franchise with a Stable Core Deposit Base;

33% Non-Interest Bearing Demand Deposits Exceed Peer Levels

Solid Non-Interest Income Generation through Diversified Sources of Fee Income;

35% of Operating Revenue

Disciplined Credit Culture and Rigorous Underwriting Standards Lead to Superb Asset Quality

(NPAs 0.29% of assets)

Attractively Priced Relative to Historical Multiples of Tangible Book Value

Attractive Dividend Yield of 3.6%

5

Operating data as of December 31, 2010

Sterling At a Glance

Stability:

Founded in 1932 as a Finance and Factoring Company; performance across

over 80 years of business cycles

Sterling National Bank Acquired in 1968, founded in 1929

Strong reputation and brand recognition

Focus:

Built to serve small to midsized businesses and their owners, managers and

employees

Emphasis on low cost core deposit generation

33% non-interest bearing demand deposits

Opportunity:

NY-metro area is a vast market whose small to midsized businesses are

underserved by competing institutions

Loan demand picking up from existing customers and new relationships given

economic recovery in market area

Unique opportunity for growth on both an organic and acquisition basis

Resources:

Total assets of $2.4 billion, strong capital and liquidity, 12 bank offices

6

Focus on deepening customer relationships and winning new business

Continue disciplined underwriting practices while pursuing quality loan

growth

Maintain cost-effective funding base and tight expense control

Preserve strong capital and liquidity position

Selectively consider value-enhancing acquisitions (complementary businesses,

portfolios, whole bank transactions)

Strategic Priorities

7

Offering Objectives

Reinforces strong capital position

Repayment of the Company’s $42.0 million of TARP Preferred and the related warrant,

subject to required regulatory approvals

Enhances earnings to common shareholders

Provides greater strategic flexibility

Increases tangible common equity base to support franchise growth through:

Pursuit of potential attractive M&A opportunities (both whole bank and selective

business opportunities); and

Organic growth as market disruptions and dwindling capital levels have forced

competitors to maintain a defensive posture

Enables Sterling to capitalize on its favorable position and further penetrate the market

Leverage management’s extensive New York City banking experience through several

economic cycles and Sterling’s business development efforts to meaningfully expand the

balance sheet

8

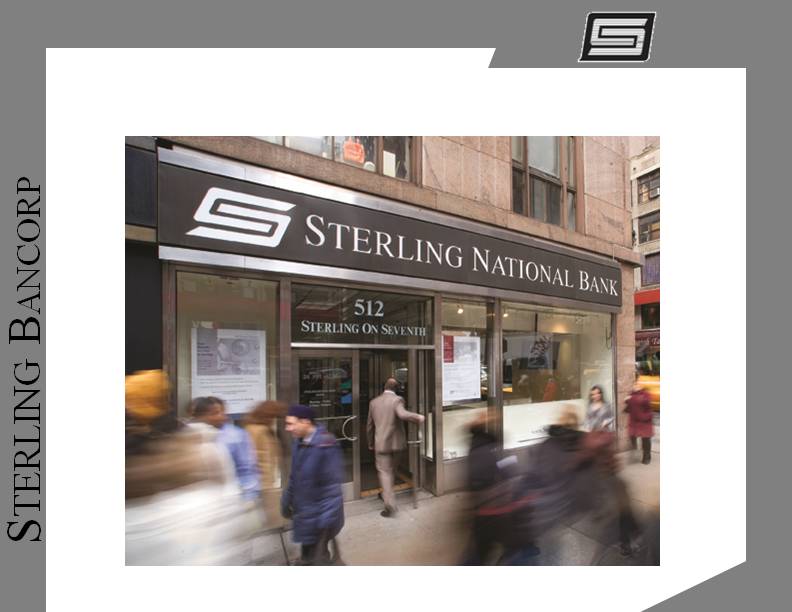

Unique NY-Metro Franchise

9

9

Founded and headquartered in New York city, Sterling has served the Greater

New York market for over 80 years

Region characterized by large concentration of small and middle-market

businesses

Sterling focuses primarily on companies with credit needs up to $15 million

Exceptionally diverse range of industries and market sectors

Sterling customer profile:

Privately Owned, Entrepreneurial Firms; Manufacturers and Distributers; Importers; Wholesalers; Service

Companies; Professional Firms

New York’s role as an international gateway provides global opportunities

Unique NY-Metro Franchise

10

Branch Footprint

Headquarters & Main Office

650 Fifth Avenue, New York, NY 10019

Sterling National Bank Branches

425 Park Ave 138-21

Queens Blvd

New York, NY 10022 Briarwood,

NY 11435

512 7th Ave 42 Broadway

New York, NY 10018 New York, NY 10004

98 Cutter Mill Rd 30-30 47th Ave

Great Neck, NY 11021 Long

Island City, NY 11101

622 3rd Ave 89-04 Sutphin Blvd

New York, NY 10017 Jamaica,

NY 11435

108-01 Queens Blvd 1 Executive Blvd

Forest Hills, NY 11375 Yonkers, NY 10701

650 5th Ave 177 Crossways Park Dr

New York, NY 10022 Woodbury,

NY 11797

11

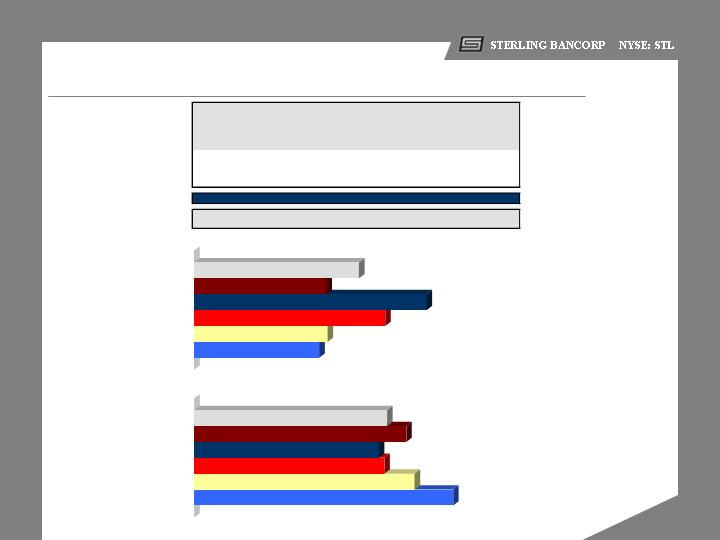

Attractive Market Demographics

MEDIAN HOUSEHOLD INCOME

New York

Queens

Nassau

Westchester

State of New York

United States

UNEMPLOYMENT RATE

Source: SNL Financial and BLS; unemployment data is as of December 2010 and is seasonally unadjusted

New York

Queens

Nassau

Westchester

State of New York

United States

12

County

Total

Population

2010

Population

Change

2000-2010

(%)

Projected

Population

Change

2010-2015

(%)

New York

1,643,382

6.91

2.33

Queens

2,306,637

3.47

1.69

Nassau

1,337,619

0.23

0.48

Westchester

956,959

3.63

0.96

Weighted Average Franchise*

6,244,597

5.81

2.04

New York

19,543,731

2.99

0.99

National

311,212,863

10.59

3.85

*Figures are weighted by deposits in each county, except total population which is the summation of each county

$54,442

$58,128

$83,123

$101,176

$57,589

$71,770

9.4%

8.0%

6.9%

6.7%

7.7%

7.0%

Significant Market Share Opportunity

Sterling has a significant opportunity to gain market share given the weakness and capital constraints of certain in-market competitors

Source: SNL Financial. Deposit data as of June 30, 2010

New York, NY

Queens, NY

2010

Rank

Institution (ST)

Number of

Branches

Total

Deposits in

Market

($000)

Total

Market

Share

(%)

2010

Rank

Institution (ST)

Number of

Branches

Total

Deposits in

Market

($000)

Total

Market

Share

(%)

1

JPMorgan Chase & Co. (NY)

159

234,446,127

49.07

1

JPMorgan Chase & Co. (NY)

91

7,830,369

18.92

2

Bank of New York Mellon Corp. (NY)

5

59,288,402

12.41

2

Citigroup Inc. (NY)

29

6,006,347

14.51

3

Bank of America Corp. (NC)

62

40,578,557

8.49

3

Capital One Financial Corp. (VA)

47

4,926,914

11.90

4

Citigroup Inc. (NY)

76

35,242,112

7.38

4

Astoria Financial Corp. (NY)

17

2,836,591

6.85

5

HSBC Holdings Plc

54

29,030,742

6.08

5

HSBC Holdings Plc

23

2,770,126

6.69

6

Wells Fargo & Co. (CA)

24

9,520,942

1.99

6

New York Community Bancorp (NY)

43

2,584,157

6.24

7

Capital One Financial Corp. (VA)

51

8,703,371

1.82

7

Ridgewood Savings Bank (NY)

11

1,709,650

4.13

8

Toronto-Dominion Bank

37

6,158,308

1.29

8

Toronto-Dominion Bank

21

1,587,442

3.84

9

Signature Bank (NY)

8

4,632,838

0.97

9

Flushing Financial Corp. (NY)

9

1,261,186

3.05

10

Israel Discount Bank Limited

2

3,836,705

0.80

10

Maspeth FS&LA (NY)

5

1,077,465

2.60

25

Sterling Bancorp (NY)

5

1,285,792

0.27

30

Sterling Bancorp (NY)

4

179,717

0.43

Total For Institutions In Market

680

477,747,218

Total For Institutions In Market

437

41,386,740

Nassau, NY

Westchester, NY

2010

Rank

Institution (ST)

Number of

Branches

Total

Deposits in

Market

($000)

Total

Market

Share

(%)

2010

Rank

Institution (ST)

Number of

Branches

Total

Deposits in

Market

($000)

Total

Market

Share

(%)

1

JPMorgan Chase & Co. (NY)

98

10,592,458

19.44

1

JPMorgan Chase & Co. (NY)

99

8,648,144

20.35

2

Citigroup Inc. (NY)

57

8,037,493

14.75

2

NY Private Bank & Trust Corp. (NY)

6

7,623,060

17.94

3

Capital One Financial Corp. (VA)

59

7,353,090

13.49

3

Citigroup Inc. (NY)

24

6,214,847

14.62

4

Astoria Financial Corp. (NY)

28

4,833,131

8.87

4

Wells Fargo & Co. (CA)

35

5,790,444

13.62

5

New York Community Bancorp (NY)

38

4,085,861

7.50

5

HSBC Holdings Plc

25

2,356,139

5.54

6

Bank of America Corp. (NC)

44

3,247,196

5.96

6

Hudson Valley Holding Corp. (NY)

18

1,752,351

4.12

7

Toronto-Dominion Bank

27

3,149,676

5.78

7

Hudson City Bancorp Inc. (NJ)

10

1,433,890

3.37

8

HSBC Holdings Plc

20

2,041,619

3.75

8

Bank of America Corp. (NC)

24

1,391,812

3.27

9

Flushing Financial Corp. (NY)

5

1,800,180

3.30

9

Toronto-Dominion Bank

14

1,135,421

2.67

10

Signature Bank (NY)

5

1,484,988

2.72

10

Capital One Financial Corp. (VA)

11

1,085,776

2.55

23

Sterling Bancorp (NY)

2

159,918

0.29

31

Sterling Bancorp (NY)

1

46,569

0.11

Total For Institutions In Market

498

54,496,160

Total For Institutions In Market

370

42,499,897

Increase in market share since 2009: 3 bps

Increase in market share since 2009: 7 bps

Increase in market share since 2009: 4 bps

Market share remained constant since 2009

13

Market Opportunity

Sterling’s target customer base are small to midsized businesses in the New

York metropolitan area, which the Company views as underserved

Opportunities to provide credit to quality borrowers has increased given the

New York metropolitan market’s recovery from the economic

downturn

Evidence of increased loan demand

Merger and consolidation activity has increased customer displacement

The needs of small/midsized businesses require personalized attention,

flexibility and customized loan, cash management and deposit products

14

Business Overview - Full Range of Products that Support Core Growth

Sterling is well known for its focus on business customers and a high-touch,

hands-on approach to customer service

15

Extensive Product Portfolio includes:

Commercial Lending

Asset-Based Finance

Trade Finance/Factoring /

Accounts Receivable Management

Payroll Finance & Processing

Depository & Cash Management

Residential Mortgages

Mortgage Warehouse Financing

Equipment Financing

Financial Highlights

16

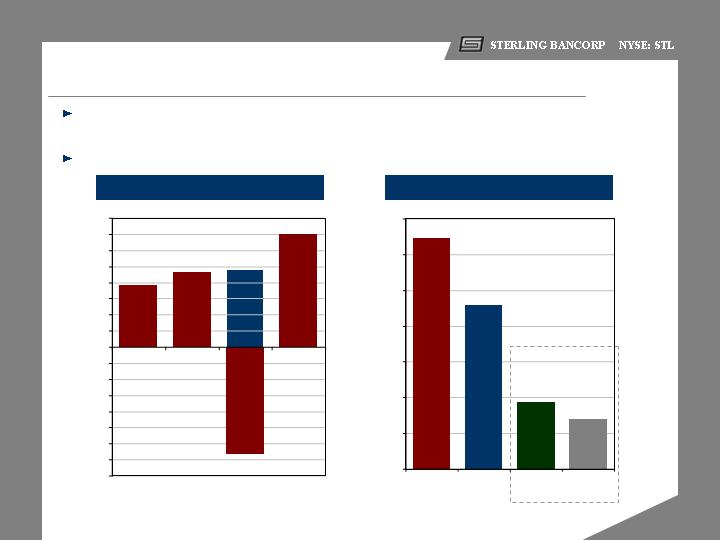

Recent Highlights – 4Q 2010

17

Total Deposits

TCE / Assets*

Highest quarterly profit in the past 2 years

- Earnings stream becoming increasingly

diversified

with particular growth in fee

related products

- NIM of 3.98% in the 4Q

- Lower quarterly provision of $3.0 million

(greater

than net charge-offs of $2.9 million)

as credit quality continued to improve

Net Income to Common

$3.5 million

EPS

$0.13

Loan Loss Reserves

$18.2 million

Nonperforming Assets

0.29% of assets

At 12/31 - 6.81%

Pro Forma – 8.39%

$1.75 billion

Continued growth and superior levels of non-interest bearing demand deposits, at 33% of total deposits. Overall cost of deposits of only 0.51% in 4Q

Demand Deposits

$570.3 million

Savings, NOW & MM

$562.2 million

Represents 1.39% of loans and 274.5% coverage of nonaccrual loans

Continued positive credit trends following the 3Q

accelerated resolution of equipment financing

receivables

Ample capital for opportunistic deployment in areas that have the potential to drive long-term sustainable growth and shareholder value

* See appendix for non-GAAP reconciliation of TCE / Assets ratio

(1) Pro forma information based on a $40.2 million offering ($35.0 million offering plus 15% overallotment) and the repayment of outstanding TARP preferred

(1)

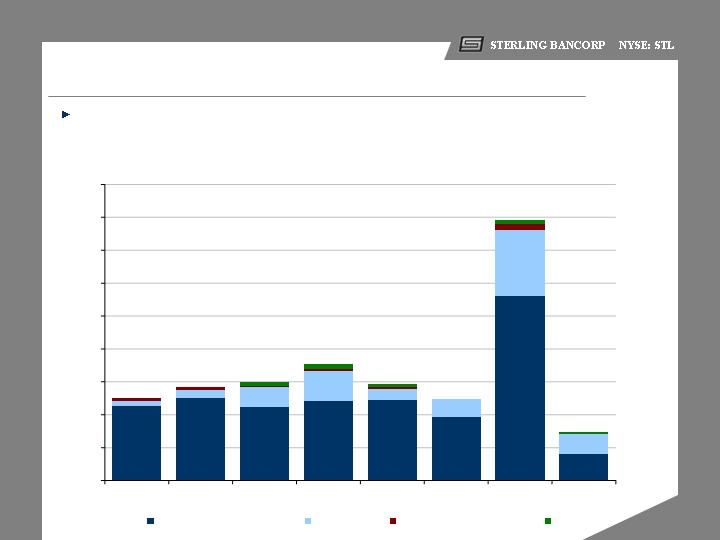

5%

6%

19%

16%

54%

$0

$20,000

$40,000

$60,000

$80,000

$100,000

$120,000

$140,000

2008

2009

2010

Other

Net Interest Income

Non-Interest Income

71%

66%

4%

29%

30%

34%

63%

3%

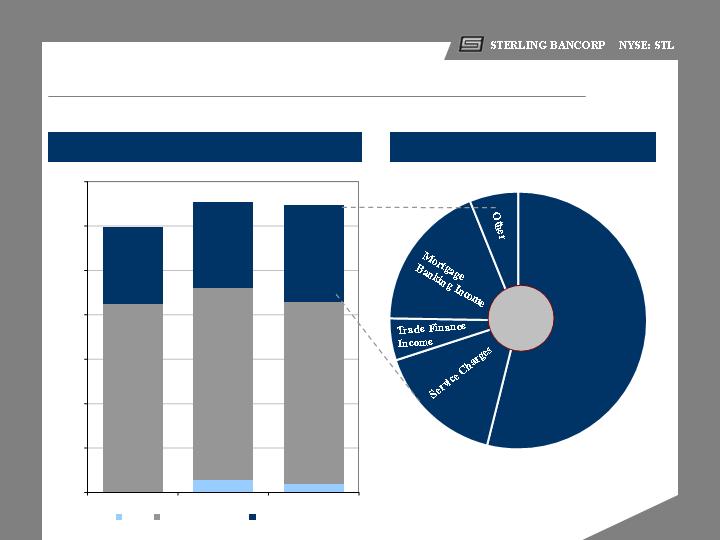

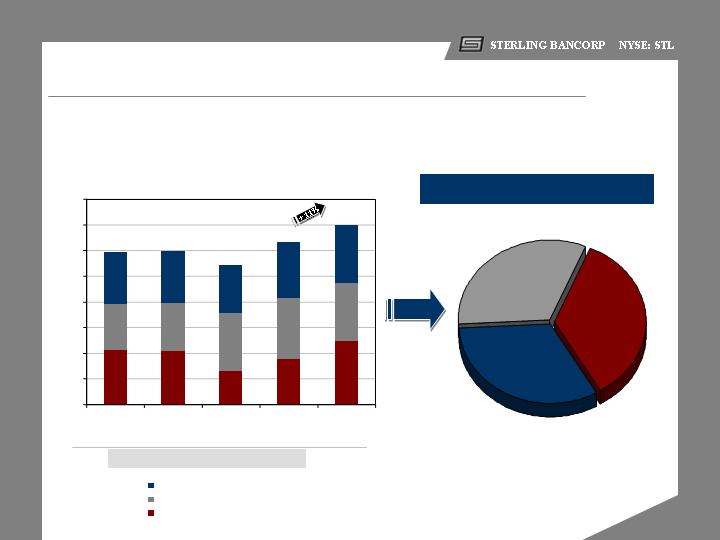

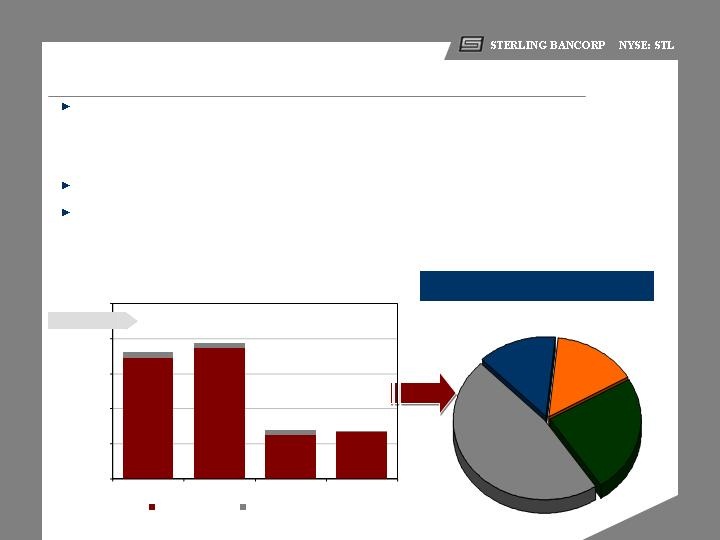

High Quality Business Lines, Diverse Revenue Streams

2008-2010 Revenue Comparison

($ Thousands)

Full Year 2010

* Other income includes securities gains and losses

18

Accounts

Receivable

Management /

Factoring

Commissions

Noninterest

Income

$43.7 Million

$117,983

$130,775

$129,240

$34,984

$38,589

$43,705

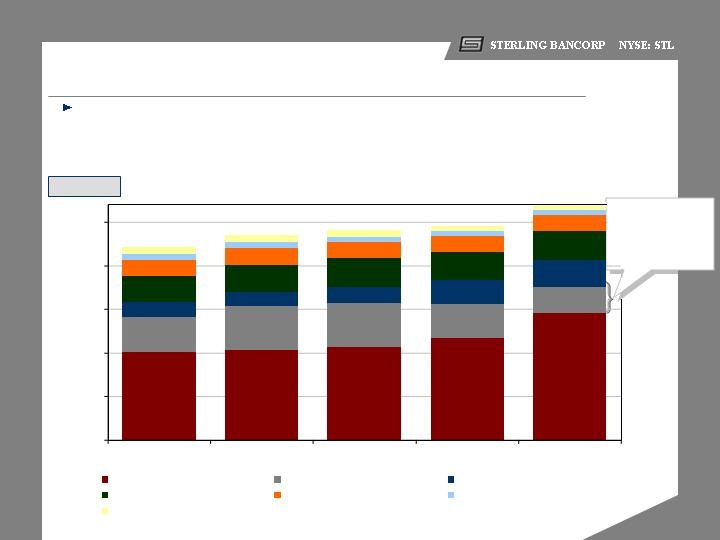

Total Loans

$1,105.4

$1,176.6

$1,208.0

$1,229.3

$1,346.3

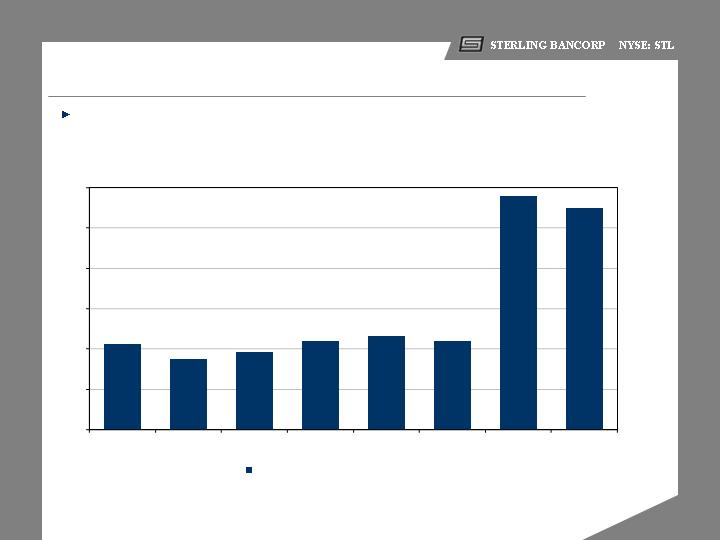

Loan Portfolio Growth

($ Million)

Residential mortgages include both loans held for sale and loans held in portfolio

Recovering economy coupled with Sterling’s “high touch” customer

service has increased opportunities for quality lending relationships.

19

Equipment financing

balance down 31%

since 2006 as part of a

planned shift toward

core commercial

lending products.

501.9

518.3

531.5

585.9

731.1

207.8

249.7

255.7

195.1

144.2

79.7

80.0

89.1

139.9

161.8

153.4

153.2

165.5

158.6

159.7

93.2

99.1

96.9

92.6

97.0

$0

$250

$500

$750

$1,000

$1,250

2006

2007

2008

2009

2010

Commercial and Industrial

Equipment Financing

Factored Receivables

Residential Mortgages

Commercial Mortgages

Construction & Land Development

Other

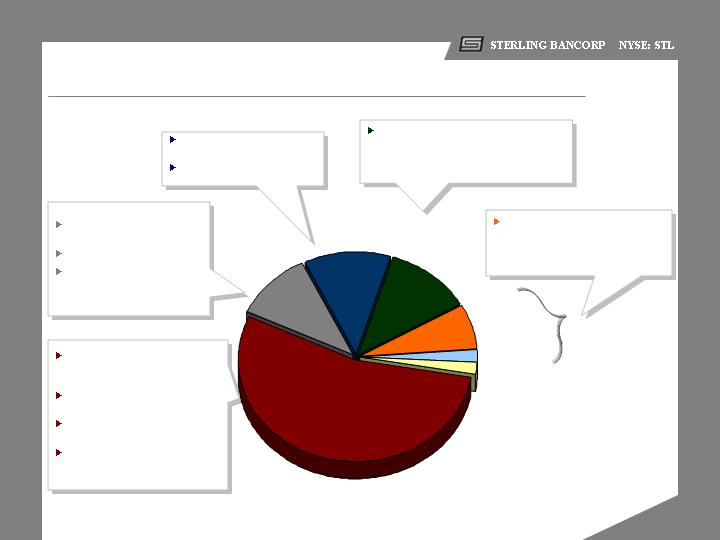

At December 31, 2010

(% of total loans, $ in millions)

75.1%

3.2%

11.1%

Loan Composition

Average yield on loans: 5.98%

20

Loans to small & medium-sized

businesses. 69% of loans are to

borrowers in NY metro area.

Range in size from $250,000 to $15

million.

No industry concentration that

exceeds 10% of gross loans.

Often collateralized by accounts

receivable, inventory, marketable

securities, equipment and other assets.

Full payout leases with terms

ranging from 24 to 60 months.

Loans written on recourse basis.

Outstanding balance down 26%

year over year due to planned

reduction of portfolio.

Provide accounts receivable

management services.

Clients primarily engaged in the

apparel and textile industries.

Residential loans represent approximately

12% of total loans and are primarily secured

by mortgages on real property located in New

York, New Jersey, Connecticut, Virginia and

North

Carolina.

Commercial real estate, including

Construction, represents approximately

9% of the portfolio and are primarily

secured by properties located in the NY

metro area

Residential

Mortgage

12%

Other

2%

Construction

2%

Commercial

Mortgage

7%

Equipment

Financing

Receivables

11%

Commercial and

Industrial

54%

Factored

Receivables

12%

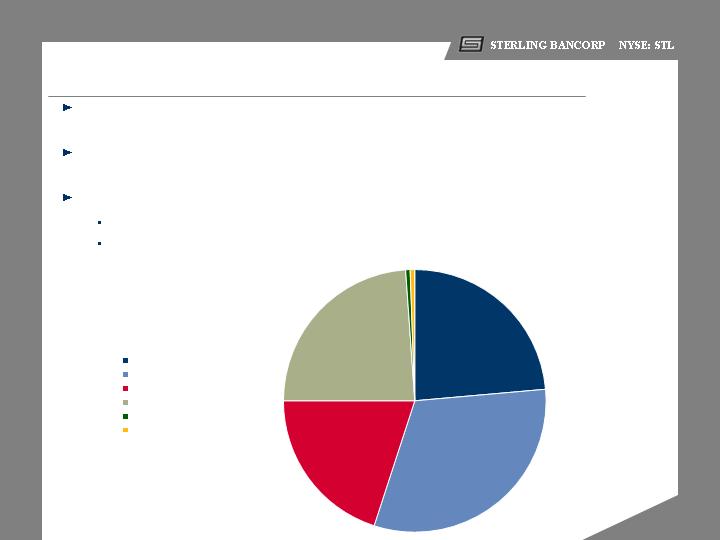

Low Risk Investment Portfolio

21

High level of short term securities currently being maintained in order to

retain flexibility to respond to loan demand

At December 31, 2010 approximately 55% of the portfolio was

comprised of US government and GSE obligations

Municipal bond portfolio characteristics:

G.O.’s are 100% of total

All A-rated or better at purchase and

a purchase limitation of $2 million per issuer

24%

30%

20%

24%

1%

1%

Agency Mortgage-backed Securities

Agency Notes

Municipal Securities

Corporate Debt Securities

Trust Preferred

Other

Attractive Deposit Base

22

Stable, Cost-Effective Funding

Demand deposits are traditionally a high percentage of total

deposits ($570.3mm at 12/31/10, 4% growth over year-end

2009)

Demand deposit accounts required as part of substantially all

lending relationships

Aggressive cross-selling strategy – significant percentage of

deposits generated by lending units

Cost-effective funding contributed to a 4.25% NIM (tax-

equivalent basis) for 2010

23

Low Cost Deposit Mix

Deposits by Type

($ Million)

Deposit

Detail

$1,581

$1,358

$1,493

$1,481

December 31, 2010

Average cost of deposits: 0.59%

$1,748

24

Weighted Average Cost of Deposits

2.62%

2.11%

1.54%

0.86%

0.59%

528.0

524.2

329.0

442.3

615.3

447.6

467.4

564.2

592.0

562.2

505.9

501.0

464.6

546.3

570.3

$0

$250

$500

$750

$1,000

$1,250

$1,500

$1,750

$2,000

2006

2007

2008

2009

2010

Non-Interest Bearing Demand

Savings, NOW & Money Mkt

Time Deposits

Non-Interest Bearing

Demand

33%

Savings, NOW &

Money Mkt

32%

Time

Deposits

35%

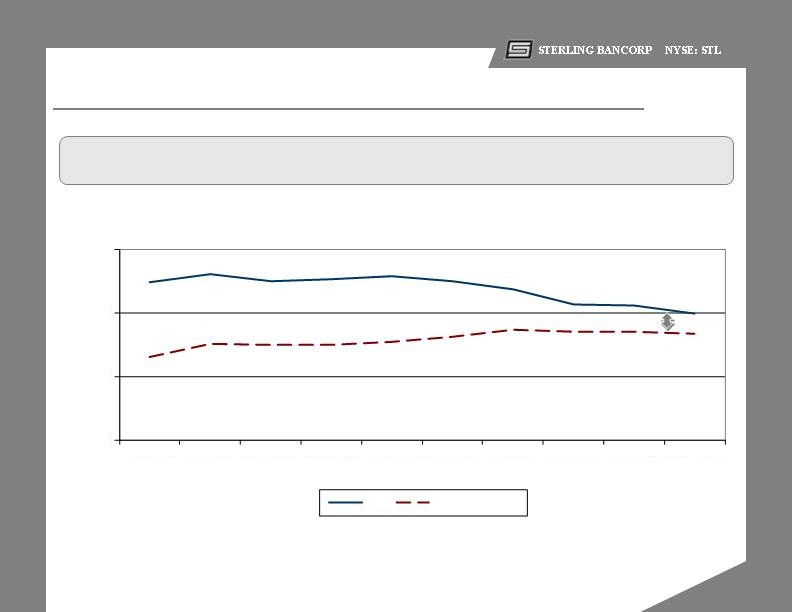

Net Interest Margin

Stable funding base consisting of primarily core deposits has historically resulted in an above average net interest margin.

As a result of actions taken during 2010, Sterling’s balance sheet is well-positioned for a rising interest rate environment.

5.00%

4.00%

3.00%

2007Y 2008Y 2009Q1 2009Q2 2009Q3 2009Q4 2010Q1 2010Q2 2010Q3 2010Q4

STL STL Per Average

2.00%

STL Peers include: VLY, SBNY, FFIC, DCOM, PBNY, LBAI, HUVL, SUBK, FLIC, STBC & CNBC

Source: SNL Financial, operating data as of 12/31/10 or most recent available quarter

Average Spread Since 2007 + 80 bps

25

Track Record of Profitability & Growth

26

Sterling has a longstanding history of producing returns for shareholders, despite

earnings having come under pressure in recent years

Core franchise has retained the capacity for significant internal capital generation

Longstanding History of Profitability

Return on Average Assets

27

* See appendix for non-GAAP reconciliation of 2010 Core Return on Average Assets

0.31%

0.58%

0.70%

1.42%

1.42%

1.53%

1.50%

1.45%

1.36%

1.30%

1.14%

0.82%

0.77%

0.45%

0.00%

0.25%

0.50%

0.75%

1.00%

1.25%

1.50%

1.75%

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2010

Core*

4Q

2010

Earnings Trends

Despite the loss in Q3 2010 due to the Company’s accelerated charge-

offs, the Company exhibited positive trending profits

Core earnings capacity intact, substantially exceeding credit costs

2010 Net Income(1) by Quarter

($ Thousands)

(1) Net income displayed is net income available to common shareholders

(2) Prior to 2010 the five year average annual loan loss provision was approximately $10.4 million which, on average, represented 114% of net charge-offs

* Represents non-GAAP statistic

** See appendix for non-GAAP reconciliation of Pretax Pre-provision Earnings

Full Year 2010

($ Thousands)

28

Core

Earnings

(Ex. $8.5

million

equipment

financing

provision)

$2,622*

$3,500

($3,328)

$2,338

$1,927

($4,000)

($3,500)

($3,000)

($2,500)

($2,000)

($1,500)

($1,000)

($500)

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

$4,000

1Q 2010

2Q 2010

3Q 2010

4Q 2010

$28,500

$37,684

$91,556

$129,240

$0

$20,000

$40,000

$60,000

$80,000

$100,000

$120,000

$140,000

Total

Revenue

Non-Interest

Expense

Pretax Pre-

provision

earnings**

Loan Loss

Provision(2)

Fourth Quarter Overview

Net interest income

Noninterest income

Noninterest expenses

Provision for loan losses

Provision for income taxes

Net income

Dividends on preferred shares & accretion

Net Income avail. to common shareholders

12/31/10

$20,299

12,112

24,328

3,000

928

4,155

655

$3,500

Quarter Ended

(dollars in thousands)

12/31/09

$21,975

10,813

21,173

7,950

1,028

2,637

648

$1,989

29

Proven, Capable Management Team

30

Continuity and experience

Top executives have been with Sterling for decades

Business unit leaders average 20+ years of experience

Hands-on approach

Senior management meets daily

Our culture encourages and values personal service

Aligned with shareholders’ interests

Directors and executive officers own approximately 6.10% of STL common

shares

Proven, Capable Management Team

31

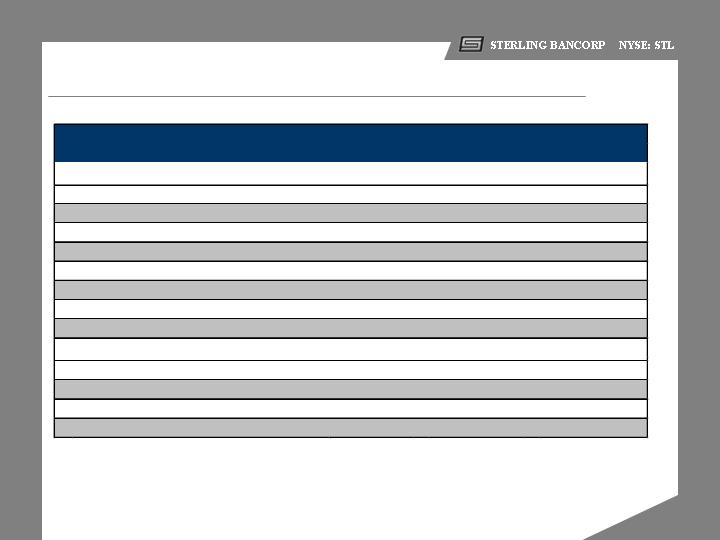

Key Statistics Relative To Peers

Sterling vs. Peers

National Peers comprised of Public Banks in U.S. with assets between $1 billion and $5 billion

STL Peers include: VLY, SBNY, FFIC, DCOM, PBNY, LBAI, HUVL, SUBK, FLIC, STBC & CNBC

Source: SNL Financial, operating data as of 12/31/10 or most recent available quarter.

Texas Ratio = (Nonaccrual + Renegotiated + 90 day PD + OREO) / (Tangible Equity + Reserves)

NPAs defined as Nonaccruals + OREO

(1)

Represents loans held in portfolio

(2)

Excludes securities gains

* See appendix for non-GAAP reconciliation of TCE / Assets ratio

** See appendix for non-GAAP reconciliation of PTPP ROAA

32

Sterling

National

New York MSA

Bancorp

Peer Average

Peer Average

Balance Sheet

Total Assets ($MM)

2,360

$

2,206

$

4,438

$

Tier 1 Capital Ratio

13.6%

12.1%

13.0%

TCE / Assets

6.81%

*

6.78%

8.06%

NPAs/Assets

0.29%

3.28%

1.25%

Reserves/Nonaccruals

275%

114%

109%

Texas Ratio

7.8%

69.1%

17.8%

Loans

(1)

/Deposits

75.2%

85.9%

87.9%

Non-interest Bearing Deposits/ Deposits

32.6%

16.5%

18.5%

LTM Performance

NIM

4.25%

3.64%

3.86%

Cost of Deposits

0.59%

1.39%

0.86%

Non-Interest Income

(2)

/Operating Revenue

34.9%

22.2%

11.0%

PTPP ROAA

1.68%

**

1.25%

1.73%

Market Statistics

Sterling vs. Peers

* Denotes non-GAAP metric

** Earnings estimate based solely on mean consensus estimates as provided by Thomson Financial

*** Most recent quarter dividend figures annualized

National Peers comprised of Public Banks in U.S. with assets between $1 billion and $5 billion

STL Peers include: VLY, SBNY, FFIC, DCOM, PBNY, LBAI, HUVL, SUBK, FLIC, STBC & CNBC

Source: SNL Financial, operating data as of 12/31/10 or most recent available quarter, market data as of 2/28/11

33

Sterling

National

New York MSA

Bancorp

Peer Average

Peer Average

Price

as of 2/28/11

10.04

$

N/A

N/A

Market Cap ($MM)

269

$

206

$

643

$

Price/Tangible Book Value

*

169%

121%

161%

Price/ Consensus 2011 EPS Est.

**

16.7x

17.5x

14.3x

Dividend Yield

***

3.59%

1.44%

2.69%

Payout as % of Consensus 2011 EPS Est.

**

60.0%

23.8%

40.4%

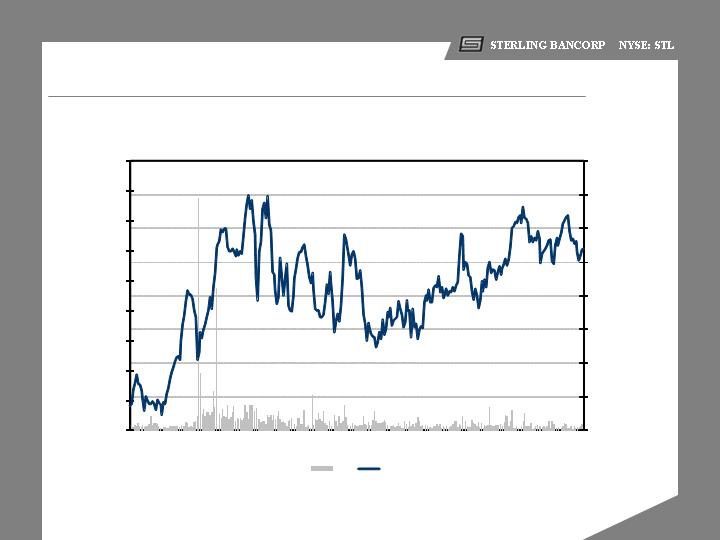

Stock Price Performance

Source: SNL Financial, market data as of 2/28/11

34

Since January 1, 2010

$

7

.

00

$

7

.

50

$

8

.

00

$

8

.

50

$

9

.

00

$

9

.

50

$

10

.

00

$

10

.

50

$

11

.

00

$

11

.

50

500

1

,

000

1

,

500

2

,

000

2

,

500

3

,

000

3

,

500

4

,

000

2

/

28

/

11

12

/

30

/

10

11

/

2

/

10

9

/

7

/

10

7

/

12

/

10

5

/

13

/

10

3

/

17

/

10

1

/

19

/

10

Price ($)

Volume (shares

000

's)

Vol

Price

Strong Asset Quality & Capital Base

35

Q4 2010

$3.00 million

$2.92 million

$6.64 million

$182 thousand

0.49%

0.29%

1.39%

275%

Asset Quality Overview

Provision for Loan Losses

Net charge-offs

Nonaccrual loans

Other real estate owned

Nonaccrual loans/loans

Nonperforming assets/assets

Allowance for loan losses/loans

Reserves/nonaccrual loans

Q2 2010

$5.50 million

$4.95 million

$18.69 million

$761 thousand

1.46%

0.85%

1.66%

110%

Q3 2010

$14.00 million

$15.86 million

$6.27 million

$744 thousand

0.47%

0.30%

1.40%

290%

Prior 5 Year Annual Average

$10.36 million

$9.95 million

$8.35 million

$1.54 million

0.71%

0.48%

1.46%

247%

36

In light of recent economic developments, in 3Q 2010 the Company decided to

implement an accelerated resolution of certain categories of nonaccrual loans,

including charging off $11.4 million

of equipment financing receivables. As a

result, asset quality has improved significantly.

Non-Performing Asset Trends

Quality of loan portfolio has continued to compare favorably to peers in the

current economic environment primarily as a result of rigorous underwriting

standards coupled with a regular evaluation

of the creditworthiness of each

borrower

Senior management actively involved in monitoring credit risk

During Q3 2010, the Company accelerated the charge-off of a significant portion

of its nonaccruals, the majority of which were related to the equipment financing

portfolio. This action, in

addition to intensified collection activities, has resulted in

a significant decline in non-performing assets

($ Thousands)

0.83%

NPAs / Assets (%)

0.85%

0.30%

0.29%

Nonaccrual Loan Composition

Nonaccrual

Detail

$0.9 million

16 leases

$3.1 million

2 loans

$1.0 million

6 loans

37

$1.6 million

12 loans

Commercial

Mortgage

47%

Equipment Financing

14%

Commercial &

Industrial

15%

Residential

Mortgages

24%

17,239

18,688

6,270

6,644

874

761

744

182

$0

$5,000

$10,000

$15,000

$20,000

$25,000

1Q 2010

2Q 2010

3Q 2010

4Q 2010

Nonaccrual Loans

Other Real Estate Owned

Strong Coverage of Non-Performing Assets

38

While Sterling has historically operated with reserve coverage in excess of its

nonaccruals, as of year end 2010 its coverage of nonaccrual loans was 2.75x

96%

111%

116%

110%

275%

290%

88%

106%

0%

50%

100%

150%

200%

250%

300%

1Q 2009

2Q 2009

3Q 2009

4Q 2009

1Q 2010

2Q 2010

3Q 2010

4Q 2010

Allowance for Loan Losses / Nonaccrual Loans

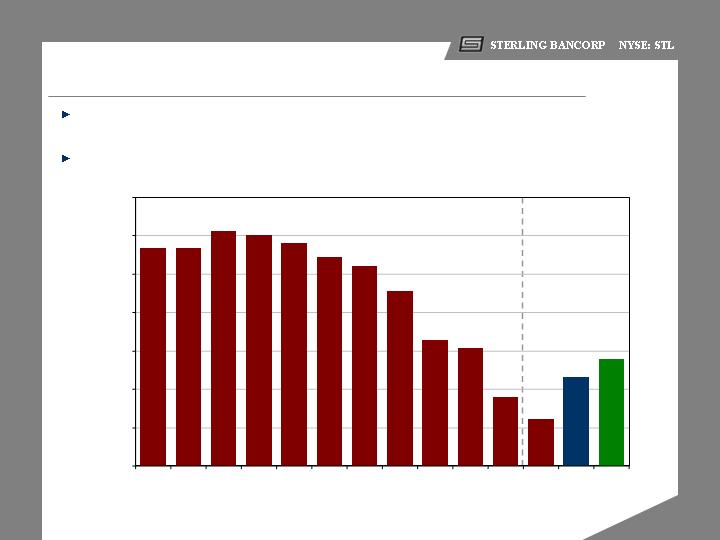

Net-Charge-off History

39

Historically, Sterling has incurred low levels of net charge-offs. In Q3 2010,

Sterling accelerated the resolution of certain categories of nonaccrual loans and

recognized charge-offs

of $11.4 million in the equipment financing portfolio

($ in Thousands)

$4,997

$5,654

$5,965

$7,048

$5,870

$4,951

$15,861

$2,915

$0

$2,000

$4,000

$6,000

$8,000

$10,000

$12,000

$14,000

$16,000

$18,000

1Q 2009

2Q 2009

3Q 2009

4Q 2009

1Q 2010

2Q 2010

3Q 2010

4Q 2010

Equipment Financing

C&I

Factored Receivables

Other

Sterling

13.61%

14.68%

10.15%

6.81%*

Strong Capital Base

Tier 1 Risk-Based

Total Risk Based

Leverage

TCE / Assets

Well-Capitalized

Requirement

6.00%

10.00%

5.00%

40

Pro Forma

Offering

& TARP

Repayment

13.11%

14.18%

9.79%

8.19%

(As of December 31, 2010)

In addition, repayment of TARP would result in the elimination of $2.6

million of preferred dividend payments which would further enhance the

Company’s internal capital

generation

* See appendix for non-GAAP reconciliation of TCE / Assets ratio

Pro Forma

Offering (with

Overallotment)

& TARP

Repayment

13.39%

14.46%

9.99%

8.39%

Continued growth in earnings

with a persistent diversity of

revenue leading to continued

shareholder value creation

Sterling is Very Well Positioned

41

2010

2011 +

Strengthened

capital position

Redemption of TARP

Balance sheet

expansion through

building new loan and

deposit relationships

Pay down of

higher cost

borrowings with

low cost deposit

funding

Higher & more

diversified

sources of non-

interest income

Ample liquidity

with loans held in

portfolio to

deposits at 75%

Increasingly asset

sensitive balance

sheet

Significantly

improved

credit quality

A firm foundation is in place for continued future growth and profitability.

Actions taken in 2010 pave the way for a positive 2011 outlook

Improving NIM as cash

flows from securities are

redeployed into loans

Focus on pursuing

quality growth

opportunities

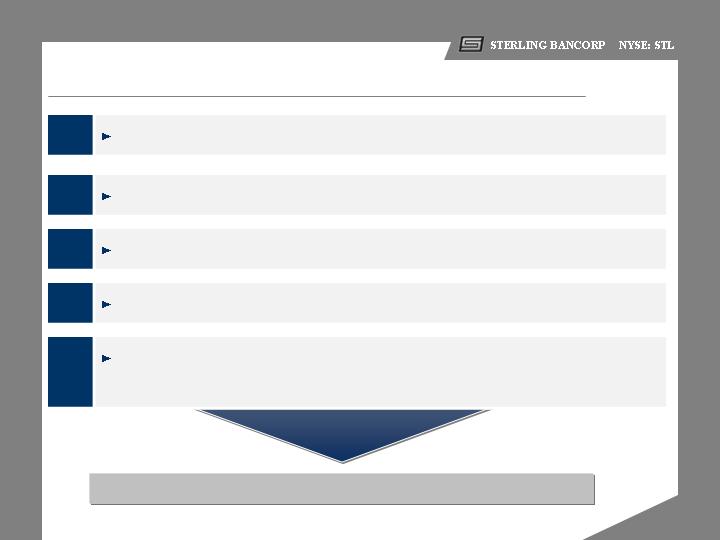

The Sterling Opportunity

Focused on Shareholder Returns

1.

Management team with extensive in-market experience

2.

Attractive near-term growth opportunities for deployment of capital

3.

Core funded franchise

4.

Significant franchise value

5.

Attractive valuation relative to historical tangible book value

multiple, forward EPS and dividend yield

42

43

Appendix

This presentation contains certain financial information determined by methods other than

U.S. GAAP. Management believes that these non-GAAP financial measures provide

useful supplemental information.

Non-GAAP financial measures are not standardized,

and, therefore, it may not be possible to compare these financial measures with other

companies’ non-GAAP financial measures that may have

the same or similar names.

Reconciliation tables relating to the non-GAAP financial measures used in this

presentation are displayed on the following page.

(Dollars in thousands)

(Dollars in thousands)

Reconciliation of Tangible Common Equity Ratio (TCE / Assets)

Reconciliation of Pretax Pre-provision Earnings

Tangible Common Equity as of December 31, 2010

Net Income for the 12 Months Ended December 31, 2010

$7,026

Total shareholders’ equity

$222,742

Add:

Subtract:

Provision for income taxes

2,158

Preferred Equity

(40,602)

Provision for loan losses

28,500

Goodwill and other intangible assets

(23,039)

Pretax Pre-provision Earnings

$37,684

Total Tangible Common Equity

$159,101

Tangible Assets as of December 31, 2010

Average Assets for the 12 Months Ended December 31, 2010

$2,244,569

Total Assets

$2,360,457

PTPP ROAA

1.68%

Subtract:

Goodwill and other intangible assets

(23,039)

Total Tangible Assets

$2,337,418

TCE / Assets (non-GAAP)

6.81%

Shareholders’ Equity / Assets (GAAP)

9.44%

(Dollars in thousands)

Reconciliation of Core Return on Average Assets (ROAA)

Net Income for the 12 Months Ended December 31, 2010

$7,026

Add:

Addition provision for loan losses in 3Q 2010

8,500

Subtract:

Tax effect

(2,550)

Non-GAAP Net Income

$12,976

Average Assets for the 12 Months Ended December 31, 2010

$2,244,569

Core Return on Average Assets (non-GAAP)

0.58%

Return on Average Assets (GAAP)

0.31%

(

1

)

44

Non-GAAP Financial Measures

Common Stock Offering

March 2011

STERLING BANCORP

STERLING NATIONAL BANK