Attached files

EXHIBIT 10.2

Esterline Technologies Corporation

2004 Equity Incentive Plan

LONG TERM INCENTIVE PLAN

1. Purpose. Esterline Technologies Corporation (the “Company”) has designed this Long Term Incentive Plan (“LTIP”) to reward its officers and selected senior executives for their contributions to the long-term performance of the Company. The LTIP rewards effective use of the Company’s resources to achieve expected and superior performance.

2. Participation.

(a) The Company’s officers and other senior executive employees are eligible to participate in this LTIP, subject to selection and appointment by the Company’s Board of Directors (“the Board”) at the beginning of each performance period. Appointment as a participant in one or more performance periods does not entitle employees to continued participation for subsequent periods. Each participant in this LTIP for a particular performance period will receive an appointment in the form attached.

(b) The Board may also appoint new participants during any current performance period. They will receive a pro-rata award based on the remaining portion of the performance period.

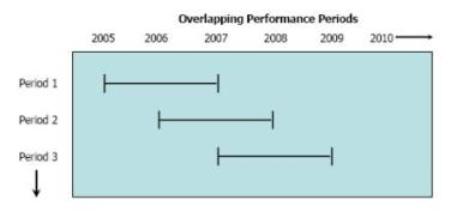

3. Performance Periods. The LTIP performance periods will be three years in duration, beginning on the first day of the Company’s fiscal year and ending on the last day of the third fiscal year thereafter, except for an initial implementation phase. A new three-year performance period will start with each new fiscal year, such that when the LTIP is fully-implemented, there will be three overlapping LTIP performance periods at any given time, as illustrated below. The Board may establish shorter performance periods as it determines are reasonable to implement this LTIP.

4. Performance Measures & Goals. The LTIP has two performance measures: average return on invested capital (“ROIC”); and cumulative compound earnings per share growth (“EPSG”). At the beginning of each performance period the Board will set ROIC and EPSG goals combined on a matrix to show their relative relationship and importance (“LTIP Matrix”). A sample LTIP matrix is attached.

5. Target and Actual Awards. The Board will establish a target cash award for each participant. Participants’ actual awards will equal their target awards if the Company fully achieves the target LTIP goals. Participants’ actual awards will vary from their target awards if the Company performs above or below target LTIP goals. Participants will receive no award for performance less than the minimum LTIP goals. Actual awards for superior performance are subject to a maximum of 400% of a participant’s target award.

6. Calculations. The Board will use the following formulas to determine Company performance and actual awards:

(a) Average Return on Invested Capital (ROIC) — Fiscal year end net income (before extraordinary items), divided by the monthly average invested capital during the corresponding fiscal year, averaged over the applicable performance period, and expressed as a percentage.

(b) Cumulative Compound Earnings Per Share Growth (EPSG) — Cumulative growth in fully diluted EPS (net income before extraordinary items, divided by the monthly average of total common shares outstanding), measured as the annualized percentage compound growth over the applicable performance period.

(c) Pro-rata participants — For participants appointed during a performance period under section 2c above, the Company will calculate a pro forma amount as though the participant had been appointed for the full performance period, and then reduce that amount by an appropriate factor, based on the participant’s appointment date.

7. Adjustments. In rare circumstances, the Board may exercise its discretion, consistent with the 2004 Plan, to either: (a) subtract from or add to a participant’s actual award; or (b) adjust the LTIP’s performance goals. This would occur only if unusual events or business conditions develop after the beginning of a performance period, such as significant acquisitions or divestitures that materially alter earnings or returns. Provided, however, the Board may not adjust awards for any participant who is a covered employee for purposes of Section 162(m) of the Internal Revenue Code of 1986 in such a manner as would increase the amount of compensation otherwise payable to that employee.

8. Payments. The Company will pay LTIP awards no later than two-and-a-half months following approval by the Board’s Audit Committee of the Company’s financial reports for the pertinent fiscal periods.

9. Continuous Employment. Except as provided below, to receive an LTIP award payment participants must be actively employed by the Company throughout the entire performance period and through the date on which the Company pays LTIP awards for that performance period. Appointments will end automatically for participants who do not satisfy this employment condition and no LTIP award payments will be earned or due. The Company considers approved leaves of absence to be active employment, provided they do not exceed the amount of leave to which a participant might be entitled under applicable Company policies, and under disability, family and medical leave laws. For approved leaves that exceed such limits, payment of LTIP awards, if any, is subject to Board discretion.

Long Term Incentive Plan

Page 2

10. End of Employment.

(a) Suspension, Resignation, or Discharge. All a participant’s rights under this plan will be suspended during any period of suspension from employment. A participant’s appointment will automatically end when s/he leaves employment with the Company for any reason other than Retirement, Disability, or death.

(b) Retirement, Disability, or Death. If a participant leaves employment with the Company due to Retirement, Disability, or death, the Company will pay the participant’s actual award for the full performance period in the normal course, provided the participant completed at least one year of continuous, active employment during the performance period. If a participant does not complete this minimum employment period, his/her appointment will automatically end, and no LTIP award will be earned or due.

(c) Other. The Board may immediately cancel a participant’s appointment and recover any payments made if it discovers facts that, if known earlier, would have constituted grounds for termination of employment for Cause.

11. LTIP Terms. The Company established this LTIP pursuant to its 2004 Equity Incentive Plan (“2004 Plan”). The terms of a participant’s appointment, this LTIP document, and the 2004 Plan together constitute the “LTIP terms.”

12. Employment Terms. The LTIP terms do not affect participants’ terms of employment, except as specifically provided in the LTIP terms. They do not guarantee continued employment. Participants remain subject to usual Company policies and practices, and to any other employment agreements, service terms, appointments, or mandates to which they are otherwise subject.

13. Plan Administration. The Board has delegated administrative authority to its Compensation Committee (“Committee”), which will consider any issues arising under the LTIP terms, oversee award calculations, and make recommendations to the Board for final approval. The Board has sole and final authority to determine Plan achievement and actual awards.

14. Plan Interpretation. All references to the “Company” include a “Related Company”, as that term is defined in the 2004 Plan. Definitions in the 2004 Plan apply to terms used in this LTIP unless otherwise defined here. On any issues of interpretation, the Committee’s decisions will be final and binding.

15. Modification. The Board may modify or terminate this LTIP at any time.

Approved by the Board December 9, 2010.

/s/ R. Bradley Lawrence

R. Bradley Lawrence

President & CEO

| Attachments: | Sample LTIP Matrix LTIP Appointment form |

Long Term Incentive Plan

Page 3