Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TEXAS INDUSTRIES INC | f8k_030311.htm |

1

TEXAS INDUSTRIES, INC.

DAVENPORT & COMPANY

INFRASTRUCTURE AND BASIC INDUSTRY CONFERENCE

MARCH 3, 2011

2

FORWARD-LOOKING STATEMENT

Certain statements contained in this presentation are “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act of 1995. Such

statements are subject to risks, uncertainties and other factors, which could cause

actual results to differ materially from future results expressed or implied by such

forward-looking statements. Potential risks and uncertainties include, but are not

limited to, the impact of competitive pressures and changing economic and financial

conditions on Texas Industries’ business; changes in economic conditions specific to

any one or more of Texas Industries’ markets; the cyclical and seasonal nature of

Texas Industries’ business; the level of construction activity in Texas Industries’

markets; changes in demand; abnormal periods of inclement weather; unexpected

periods of equipment downtime; changes in costs of raw materials, fuel and energy;

changes in the cost or availability of transportation; unexpected operational

difficulties; changes in interest rates; the timing and amount of federal, state and local

funding for infrastructure; delays in announced capacity expansions; ongoing volatility

and uncertainty in the capital or credit markets; the impact of environmental laws,

regulations and claims, and changes in governmental and public policy; and other

risks and uncertainties described in Texas Industries’ reports on SEC Forms 10-K, 10-

Q and 8-K. Forward-looking statements speak only as of the date hereof, and Texas

Industries assumes no obligation to publicly update such statements.

within the meaning of the Private Securities Litigation Reform Act of 1995. Such

statements are subject to risks, uncertainties and other factors, which could cause

actual results to differ materially from future results expressed or implied by such

forward-looking statements. Potential risks and uncertainties include, but are not

limited to, the impact of competitive pressures and changing economic and financial

conditions on Texas Industries’ business; changes in economic conditions specific to

any one or more of Texas Industries’ markets; the cyclical and seasonal nature of

Texas Industries’ business; the level of construction activity in Texas Industries’

markets; changes in demand; abnormal periods of inclement weather; unexpected

periods of equipment downtime; changes in costs of raw materials, fuel and energy;

changes in the cost or availability of transportation; unexpected operational

difficulties; changes in interest rates; the timing and amount of federal, state and local

funding for infrastructure; delays in announced capacity expansions; ongoing volatility

and uncertainty in the capital or credit markets; the impact of environmental laws,

regulations and claims, and changes in governmental and public policy; and other

risks and uncertainties described in Texas Industries’ reports on SEC Forms 10-K, 10-

Q and 8-K. Forward-looking statements speak only as of the date hereof, and Texas

Industries assumes no obligation to publicly update such statements.

3

A BUILDING MATERIALS COMPANY

¨ Cement, Aggregate and Concrete

¨ Used in all types of construction

¨ Cement accounts for approximately 75% of

operating earnings over time

operating earnings over time

4

SUMMARY

¨ Cement Capacity (millions of tons)

North Texas 2.2

Central Texas 0.9

California 2.3

TOTAL CEMENT CAPACITY 5.4

Central Texas Expansion 1.4

North Texas Expansion 0.8

TOTAL TARGETED CAPACITY 7.6

¨ Shipment Recovery/Expansion

◊ with construction recovery

◊ with completion and utilization of new capacity

¨ Margin Expansion

◊ with improving shipments

◊ with recovery of prices

◊ with positive impact of new capacity

¨ TXI’s Strategy Remains Intact

5

LONG TERM DRIVERS OF CEMENT

DEMAND

DEMAND

6

PUBLIC WORKS - 50%

7

RESIDENTIAL - 25%

NON-RESIDENTIAL - 25%

9

FAVORABLE INDUSTRY STRUCTURE

10

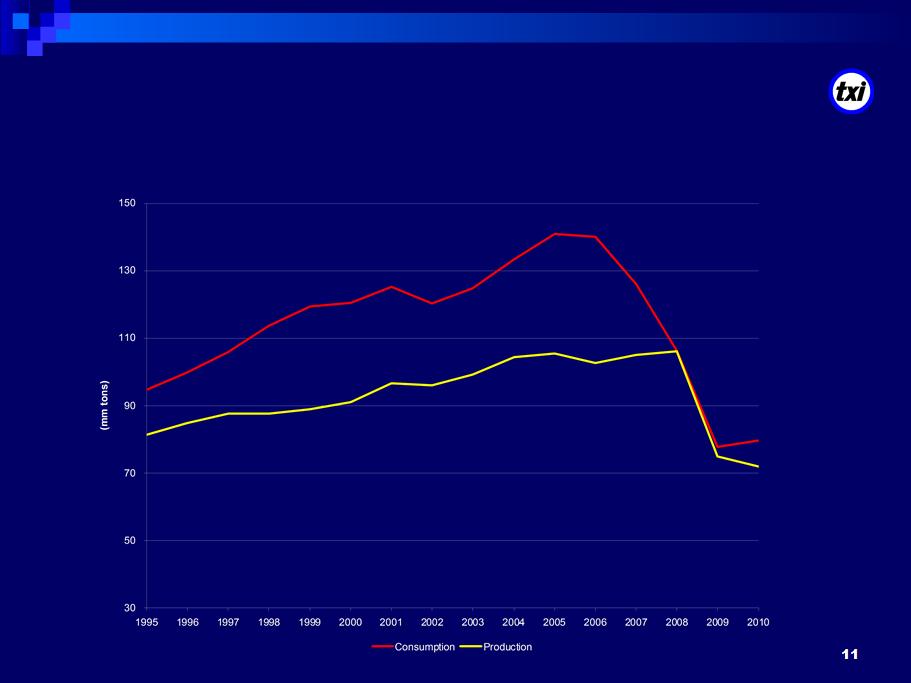

FAVORABLE INDUSTRY STRUCTURE

¨ U. S. cement consumption has historically exceeded

domestic production capacity

U.S. CEMENT CONSUMPTION AND PRODUCTION

1995 - 2010

1995 - 2010

12

FAVORABLE INDUSTRY STRUCTURE

¨ U. S. cement consumption has historically exceeded

domestic production capacity

¨ U.S. cement capacity and import terminals are largely owned

or controlled by international producers

¨ Significant barriers to entry exist for new cement capacity

¨ Significant transportation costs lead to regional markets

13

TEXAS AND CALIFORNIA

ATTRACTIVE LONG-TERM MARKETS

ATTRACTIVE LONG-TERM MARKETS

14

TEXAS AND CALIFORNIA

ATTRACTIVE LONG-TERM MARKETS

ATTRACTIVE LONG-TERM MARKETS

¨ The two largest cement markets in the U.S.

¨ Account for almost 25% of cement consumption

¨ Receive the largest shares of federal transportation

funding

funding

¨ Favorable demographics

◊ Large populations

◊ Above average population growth rates

TEXAS CEMENT

CONSUMPTION AND CAPACITY

CONSUMPTION AND CAPACITY

TEXAS CONSTRUCTION

RESIDENTIAL AND NON-RESIDENTIAL

RESIDENTIAL AND NON-RESIDENTIAL

CALIFORNIA CEMENT

CONSUMPTION AND CAPACITY

CONSUMPTION AND CAPACITY

19

20

CALIFORNIA CONSTRUCTION

NON-BUILDING AND HIGHWAY CONTRACT AWARDS

NON-BUILDING AND HIGHWAY CONTRACT AWARDS

21

TEXAS MARKET - 1980, 2000 AND 2020

Sources: U. S. Census Bureau, Portland Cement Association (PCA), USGS

22

Sources: U.S. Census Bureau, Portland Cement Association (PCA), USGS

23

STRONG COMPETITIVE POSITION

24

STRONG COMPETITIVE POSITIONS

¨ Texas

◊ Accounts for approximately 80% of TXI sales

◊ TXI is the largest cement supplier in the state

◊ TXI is a low cost cement supplier

◊ Aggregate and ready mix operations are concentrated in Texas

◊ Largest expanded shale and clay supplier in Texas

¨ California

◊ Cement plant expansion makes TXI one of the largest competitors in

southern California

southern California

◊ Expansion gives TXI low cost cement capacity

25

LOW COST OPERATIONS ARE KEY

Notes:

1 North Texas productivity from the dry kiln for the twelve months ended May 31, 2008

1 North Texas productivity from the dry kiln for the twelve months ended May 31, 2008

2 Old California productivity for the twelve months ended May 31, 2007

3 Expected California productivity for the new kiln at full capacity

4 Current Central Texas productivity for the twelve months ended May 31, 2008

5 Values reflect the expected combined operations of the current and new kilns at TXI’s Central Texas plant

6 U.S. and Canadian Labor - Energy Input Survey, Portland Cement Association

North

Texas

1

Old

California

2

New

California

3

Current

Texas

5

PCA

Comps

6

Labor Productivity

Tons per man hour

6.0

2.6

6.1

2.8

3.6

Energy Efficiency

Mmbtu / ton

3.2

5.0

3.7

2.6

3.3

Kwh / ton

118.6

164.6

115.0

124.6

136.0

High Productivity and Efficiency

2.5

Central

New Central

Current and

Texas

6.4

110.0

4

PCA

Best

6

5.8

2.0

115.0

26

OVERVIEW OF OPERATIONS

27

NORTH TEXAS CEMENT PLANT

28

CENTRAL TEXAS CEMENT PLANT

29

NEW CALIFORNIA CEMENT PLANT

30

STONE PLANT IN OKLAHOMA

31

READY-MIX CONCRETE

32

CURRENT MARKET CONDITIONS

33

CURRENT ECONOMIC CONDITIONS

¨ The Texas economy continues to be one of the better economies in

the nation

the nation

¨ California economic activity continues to be weak

¨ Energy costs have been volatile in recent years

¨ Credit markets have begun to heal

34

INFRASTRUCTURE DEVELOPMENT

¨ The current federal stimulus program calls for approximately $27 -

30 billion to be invested in highways and bridges

30 billion to be invested in highways and bridges

¨ Total recent annual U.S. investment (all sources) in highways and

bridges has approximated $75 billion

bridges has approximated $75 billion

¨ Roadbuilding:

◊ Creates jobs

◊ Creates a foundation for further growth and development

¨ Texas and California have received stimulus funding for

infrastructure projects of $2.25 billion and $2.6 billion, respectively

infrastructure projects of $2.25 billion and $2.6 billion, respectively

¨ Approximately 50% of the highway stimulus funding remains to be

invested

invested

¨ Several large highway projects in North Texas have begun

35

FOCUS ON LIQUIDITY

¨ CASH BALANCE OF $140 MILLION AT NOVEMBER 30, 2010

¨ $200 MILLION BANK CREDIT LINE

◊ Matures August 2012

◊ Utilization at May 31, 2010 - $31.1 million of letters of credit

¨ $650 MILLION 9.25% NOTES

◊ Mature August 2020

◊ Refinancing of existing bonds was executed in July 2010

¨ CAPITAL EXPENDITURES HAVE DECLINED DRAMATICALLY

36

EARNINGS POTENTIAL AND STRATEGY

37

EARNINGS POTENTIAL

|

($, tons and cubic yards in millions)

|

Shipments

|

Sales

|

Normalized

Margin |

Potential

Operating

Profit

|

|

|

|

|

|

|

|

Cement (tons)

|

7.6

|

$722

|

30%

|

$217

|

|

Aggregates (tons)

|

25.0

|

200

|

20

|

40

|

|

Ready-mix (cubic yards)

|

4.5

|

405

|

9

|

37

|

|

Other

|

|

130

|

20

|

26

|

|

Combined Operating Profit

|

|

|

|

320

|

|

Corporate Expenses, Net

|

|

|

|

(30)

|

|

Depreciation

|

|

|

|

85

|

|

EBITDA

|

|

|

|

375

|

|

FY10 EBITDA

|

|

|

|

54

|

|

Note: Potential values assume a recovery in construction activity, cement consumption equal to or greater than cement capacity

in Texas and California, normalized industry margins, and expected performance from new cement operations. |

||||

38

TXI’S STRATEGY REMAINS INTACT

¨ Expand TXI’s most important business line - Cement

◊ All projects are at existing sites

s They utilize infrastructure already in place

s Growth is organic rather than through acquisitions

◊ All projects are in attractive long-term markets

◊ All projects should improve production efficiencies

◊ All projects should reduce per ton emissions

¨ Expand and improve efficiencies in TXI’s other business lines

39

TXI MANAGEMENT TEAM

n Mel G. Brekhus, CEO

n Kenneth R. Allen, CFO

n J. Lynn Davis, VP-CEMENT

n Stephen D. Mayfield, VP-AGGREGATES

n Ronnie A. Pruitt, VP-CEMENT AND AGGREGATE MARKETING AND

SALES

SALES

n James B. Rogers, VP-CONSUMER PRODUCTS

n Barry M. Bone, VP-REAL ESTATE

n Lyndon Zielke, VP-Purchasing

Average Company / Industry Experience 29 Years

40

41

ADDENDUM - RECONCILIATION

EBITDA TO NET INCOME

EBITDA TO NET INCOME

42

RECONCILIATION OF EBITDA TO NET INCOME

IN $ MILLIONS

IN $ MILLIONS

FY 2010

EBITDA Reconciled

Net loss from Continuing Operations (39)

Plus (minus):

Interest 52

Income Taxes (23)

Depreciation, Depletion & Amortization 64

EBITDA 54

EBITDA represents income from continuing operations before interest, income taxes, depreciation and amortization

EBITDA is presented because we believe it is a useful indicator of our performance and our ability to meet debt service and capital expenditure requirements. It is not, however,

intended as an alternative measure of operating results or cash flow from operations as determined in accordance with generally accepted accounting principles.

intended as an alternative measure of operating results or cash flow from operations as determined in accordance with generally accepted accounting principles.

EBITDA is not necessarily comparable to similarly titled measures used by other companies.

43

COMPANY COLORS

Blue:

R = 0

G = 0

B = 255

Beige:

R = 251

G = 248

B = 216

TEXAS INDUSTRIES, INC.

DAVENPORT & COMPANY

INFRASTRUCTURE AND BASIC INDUSTRY CONFERENCE

MARCH 3, 2011

DRAFT